SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

|

| | | |

|

Filed by the Registrant x | | |

|

Filed by a Party other than the Registrant ¨ | | |

|

| Check the appropriate box: | | |

|

¨ Preliminary Proxy Statement | | ¨ Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

|

x Definitive Proxy Statement | | |

|

¨ Definitive Additional Materials | | |

|

¨ Soliciting Material Pursuant to §240.14a-11(c) or §240.14a-12 |

Consolidated Freightways Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | | Fee computed on table below per Exchange Act Rules 14a(6)(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

¨ | | Fee paid previously with preliminary materials. |

¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

Notes:

Notice of Annual Meeting

and

Proxy Statement

Annual Meeting of Shareholders

June 17, 2002

16400 S.E. CF Way Vancouver, WA 98683 | | Telephone: 360/448-4000 |

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Dear CF Shareholder:

On June 17, 2002, Consolidated Freightways Corporation will hold its 2002 Annual Meeting of Shareholders at the Company’s Corporate Headquarters, 16400 S.E. CF Way, Vancouver, Washington. The meeting will begin at 10:00 am. Only shareholders of record at the close of business on April 19, 2002 may vote at the meeting.

At the meeting, we will:

| | 1. | | Elect two group 3 directors for a three-year term; |

| | 2. | | Approve the 2002 Stock Plan; and |

| | 3. | | Transact any other business properly presented at the meeting. |

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND, PLEASE SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED, SO THAT YOUR SHARES WILL BE REPRESENTED AT THE MEETING. No postage is required. If you attend the meeting and prefer to vote in person, your vote at the meeting will revoke any proxy you submit. If you receive more than one proxy because your shares are held in various names or accounts, each proxy should be completed and returned.

| | Vic | e President and Secretary |

April 30, 2002

CONSOLIDATED FREIGHTWAYS CORPORATION

16400 S.E. CF Way

Vancouver, Washington 98683

Telephone: 360/448-4000

PROXY STATEMENT

The Annual Meeting

The Annual Meeting of Shareholders of Consolidated Freightways Corporation will be held on June 17, 2002, at the Company’s corporate headquarters, 16400 S.E. CF Way, Vancouver, Washington. Shareholders will be asked to elect directors, to approve the 2002 Stock Plan and to transact such other business as may properly come before the meeting. Shareholders of record at the close of business on April 19, 2002 will be entitled to notice of and to vote at the meeting or any adjournment or postponement of the meeting. This proxy statement, accompanying proxy and the 2001 Annual Report of the Company are first being sent to shareholders on or about May 7, 2002. The Annual Report is not part of this proxy soliciting material.

Board of Directors’ Recommendation

The Board of Directors of the Company is soliciting your proxy for use at the meeting and any adjournment or postponement of the meeting. The Board recommends a vote for the election of the two nominees for directors, and for the approval of the 2002 Stock Plan.

Proxy Voting Procedures

To be effective, properly signed proxies must be returned to the Company prior to the meeting. The shares represented by your proxy will be voted in accordance with your instructions. However, if no instructions are given, your shares will be voted in favor of the two directors nominated, and for approval of the 2002 Stock Plan. The Board of Directors does not know of any other matters to be presented at the meeting. If any other matters are properly presented, the persons named on the accompanying proxy will vote according to their best judgment.

Voting Requirements

The holders of a majority of the outstanding shares of common stock of the Company must be represented in person or by proxy at the meeting to establish a quorum for action at the meeting. The two nominees who receive the greatest number of votes cast for election of directors at the meeting will be elected directors for a three-year term. The affirmative vote of a majority of the votes cast at the meeting is required to approve the 2002 Stock Plan. If a proxy or ballot indicates that a shareholder, broker or other nominee abstains from voting or that shares are not to be voted, the shares will be counted for purposes of establishing a quorum, but will not be counted as votes cast in determining the outcome. Therefore, abstentions and “non-votes” will not affect the outcome of any vote. Votes will be counted by employees of American Stock Transfer & Trust Company which has been engaged to act as inspector of elections.

Voting Shares Outstanding

At the close of business on April 19, 2002, the record date for the Annual Meeting, 22,431,481 shares of common stock were outstanding and entitled to vote. Each share of common stock has the right to one vote.

1

Proxy Voting Convenience

You are encouraged to exercise your right to vote by returning to the Company a properly executed proxy in the enclosed envelope, whether or not you plan to attend the meeting. This will ensure that your votes are cast.

Revocability of Proxies

You may revoke or change your proxy at any time prior to its use at the meeting. There are three ways you may do so: (1) give a written direction to revoke your proxy to the Corporate Secretary of the Company at the Company’s principal office, 16400 S.E. CF Way, Vancouver, Washington, 98683; (2) submit a later dated proxy to the Corporate Secretary; or (3) attend the meeting and vote in person. Please note, however, that if a broker, bank or other nominee holds your shares of record and you wish to vote at the meeting, you must obtain a proxy issued in your name from the record holder.

PROPOSAL 1

ELECTION OF DIRECTORS

The Board of Directors Recommends a Vote “For” Both Nominees

Pursuant to the Certificate of Incorporation, the Board of Directors of the Company has set the number of directors of the Company at seven. The Company has three groups of directors, each of whom is elected for a three-year term. Group 1 directors will be elected in 2003 and group 2 directors will be elected in 2004. The remaining directors may fill vacancies that occur prior to the expiration of a three-year term.

The following persons are the nominees of the Board of Directors for election as group 3 directors to serve for a three-year term until the Annual Meeting of Shareholders to be held in the year 2005 and until their successors are duly elected and qualified:

Robert W. Hatch

Henry C. Montgomery

If a nominee becomes unable or unwilling to serve, proxy holders are authorized to vote for election of such person or persons as shall be designated by the Board of Directors. The Board of Directors knows of no reason why any of the nominees would be unable or unwilling to serve.

Nominees for Terms Expiring in 2005

Robert W. Hatch —age 63

Chairman and Chief Executive Officer of Cereal Ingredients, Inc. (a specialty ingredient manufacturer, providing fat-free and high fiber products) since 1991. He also served as Chairman of the Board of Chromcraft Revington (a diversified furniture manufacturer) from 1992 to 1993, and Chairman, President, and Chief Executive Officer of Mohasco (a manufacturer of upholstered and case goods furniture) from 1989 to 1992. Mr. Hatch is Chairman of the Company’s Compensation Committee. Director of the Company since 1996.

Henry C. Montgomery —age 66

Chairman of Montgomery Financial Services Corporation (a management consulting and financial services firm); Executive Vice President, Finance and Administration and Chief Financial Officer, Indus

2

International, Inc. (enterprise asset management systems) from January 2000 to March 2001; interim Executive Vice President, Finance and Administration (1999) and now a director of Spectrian Corporation (a manufacturer of cellular base station power amplifiers and power transistors); Executive Vice President of SyQuest Technology, Inc. (develops, manufactures and sells computer hard drives), from November 1996 through July 1997; President and Chief Executive Officer of New Media Corporation (privately held company engaged in developing, manufacturing and selling PCMCIA cards for the computer industry) from March 1995 until November 1996. Also a director of Catalyst Semiconductor and Swift Energy Company. Mr. Montgomery is Chairman of the Company’s Audit Committee. Director of the Company since 2001.

Directors with Terms Expiring in 2004

Patrick H. Blake —age 52

President and Chief Executive Officer of the Company since May 2000. Mr. Blake previously was Executive Vice President and Chief Operating Officer of the Company. He joined the Company in 1969 as a dockman and moved into a series of supervisory and management positions beginning in 1975. He was named Executive Vice President in 1994. Director of the Company since 2000.

Paul B. Guenther —age 61

Retired President of PaineWebber Group, Inc. (a full-service securities firm) from 1994 to 1995 and President of PaineWebber Incorporated (a full-service securities firm) from 1988 to 1995. Mr. Guenther is a director of Gabelli Asset Management Inc., (a mutual fund management company) and a volunteer executive or director of a number of not-for-profit organizations. He is a member of the Company’s Audit Committee. Director of the Company since 1996.

William D. Walsh —age 71

Chairman of Sequoia Associates, LLC (a private investment firm) since 1982. He is Chairman of the Board of privately held Clayton Group, Inc. and Newell Industrial Corporation; and a director of privately held Ameriscape, Inc. and Bemiss-Jason Corp., and publicly held Crown Vantage, Inc., Unova, Inc., and URS Corporation. Mr. Walsh is Chairman of the Board of the Company and a member of the Company’s Audit and Compensation Committees. Director of the Company since 1996.

Directors with Terms Expiring in 2003

G. Robert Evans —age 70

Retired Chairman of Material Sciences Corporation (continuously processed, coated materials technologies) from 1991 to 1998. He remains a director of Material Sciences Corporation and is a director of Swift Energy Company. Mr. Evans was elected Vice Chairman and Chief Executive Officer of the Company on January 24, 2000, and relinquished the position of Chief Executive Officer and Vice Chairman on May 8, 2000. Director of the Company since 1996.

James B. Malloy —age 74

Retired Chairman of Smurfit Packaging Company from 1993 to 1998 and President and Chief Executive Officer of Jefferson Smurfit Corporation and its affiliate, Container Corporation of America (integrated multinational paper and packaging manufacturers) from 1980 to 1993. Mr. Malloy is a director of The Jefferson Smurfit Group PLC. He is a member of the Company’s Compensation Committee. Director of the Company since 1996.

3

PROPOSAL 2

APPROVAL OF 2002 STOCK PLAN

The Board of Directors Recommends a Vote “For” the Plan

In February 2002, the Board of Directors adopted the Consolidated Freightways Corporation 2002 Stock Plan, subject to shareholder approval. The Plan provides for the grant of stock options, stock appreciation rights, restricted stock awards and stock bonuses (“Stock Awards” or “Awards”).

The total number of shares authorized for Stock Awards is 900,000 shares of common stock. Restricted stock and stock bonus awards are limited to 400,000 shares. In addition, a participant may not be granted Stock Awards for more than 400,000 shares during any calendar year. If an Award expires or is cancelled without having been exercised or vested, the unvested or canceled shares will again be available for grants under the Plan.

The purpose of the Plan is to attract and retain employees, directors and consultants and motivate them to use their best efforts for the success of the Company. The Plan is also intended to encourage participants to think like shareholders, thereby aligning their interests more closely with the Company’s shareholders.

Administration

The Board has delegated the administration of the Plan to the Compensation Committee of the Board of Directors. Subject to the provisions of the Plan, the Committee has the power to construe and interpret the Plan in its sole discretion. It also has the sole discretion to determine the persons who will receive Awards, the size and types of such Stock Awards, and the terms and conditions. Notwithstanding, Awards may not be amended to lower the aggregate consideration payable, nor may they be canceled and reissued, unless approved by shareholders of the Company.

The Board intends to limit the directors who may grant Stock Awards to “outside directors” under Section 162(m) of the Internal Revenue Code. This is one of the requirements to assure the deductibility for federal income tax purposes of compensation from Stock Awards earned by the chief executive officer and the other four most highly compensated officers.

Eligibility

Employees, directors and consultants of the Company are eligible to be selected to receive Stock Awards. The actual number of employees, directors and consultants who will receive Awards cannot be determined because selection for participation in the Plan is at the discretion of the Committee. It is currently expected that Awards will be limited to key management employees and directors. To date, no Stock Awards have been granted under the Plan.

Options

The Committee may grant non-qualified stock options, incentive stock options or a combination of the two. The number of shares covered by an option will be determined by the Committee. However, no participant may be granted Stock Awards for more than 400,000 shares in any one calendar year.

Incentive options may only be granted to employees. In addition, the aggregate fair market value, determined at the time of the grant, of the shares of common stock with respect to which incentive stock options are exercisable for the first time by a participant during any calendar year may not exceed $100,000.

4

The exercise price of incentive and non-qualified stock options may not be less than 100% of the fair market value of the stock subject to the option on the date of the grant (110% for anyone who owns 10% of the voting power of the Company). The closing price of the Company’s Common Stock as reported on the NASDAQ National Market on April 1, 2002 was $5.11 per share.

The exercise price of options must be paid with cash or the receipt of irrevocable instructions to pay the exercise price from sales proceeds. The Committee may also permit payment of the exercise price through tender of shares of the Company’s common stock, deferred payment arrangements or other legal consideration acceptable to the Committee.

Options become exercisable at the times and on the terms established by the Committee. In general, the maximum term of options under the Plan is 10 years, although it has been the Committee’s practice in the past to have a shorter term. In the event of termination of service because of involuntary termination, disability, death or retirement, an option may be exercised at any time within 3 months (or such shorter or longer period as specified in this stock option agreement approved by the Committee), 12 months, 18 months and 36 months, respectively. In no case may the exercise period extend beyond its term. If a participant’s service terminates for cause, the option will terminate immediately.

Stock Bonuses and Restricted Stock

Stock bonus and restricted stock awards represent shares of the Company’s common stock, which vest in accordance with the terms established by the Committee. The number of shares subject to these Stock Awards will be determined by the Committee, but may not exceed 400,000 in total.

Stock bonus and restricted stock awards may be subject to such restrictions on transferability, other restrictions, if any, and/or conditions to vesting as the Committee may impose at the date of grant or thereafter, which restrictions may lapse separately or in combination at such times, under such circumstances, in such installments, or otherwise, as the Committee may determine. Such restrictions or conditions may include factors relating to the increase in the value of the stock, or individual or Company performance such as the attainment of certain specified individual, divisional or Company-wide performance levels. The performance measures may include: operating profits, operating profits before incentives, revenue, revenue increases, earnings per share, net income, increase in net income, pre-tax earnings, pre-tax earnings before interest, return on designated assets, return on sales, cash flow, return on capital, return on equity, return on investment, economic value added, pre-tax operating earnings after interest and before incentives, operating income before incentives, a combination of any of these criteria or any other measurable performance objective. The Committee may also impose additional restrictions pursuant to which a participant may elect to defer the receipt (or constructive receipt) of a stock bonus or restricted stock award beyond the date the base restrictions may lapse.

Stock Appreciation Rights

Stock appreciation rights represent the right of a participant to receive the excess of the fair market value of a share of common stock on the date of exercise over the grant price, which may not be less than the fair market price on the date of grant. There are three types of stock appreciation rights.

Tandem stock appreciation rights are tied to an underlying option and require the participant to elect whether to exercise the underlying option or to surrender the option for a cash appreciation distribution. Concurrent stock appreciation rights are tied to an underlying option and are exercised automatically at the same time the underlying option is exercised. The participant receives a cash

5

appreciation distribution equal to the fair market value of the vested shares purchased under the option less the aggregate exercise price payable for such shares. Independent stock appreciation rights are granted independently of any option and entitle the participant to receive upon exercise an appreciation distribution in cash and/or shares, at the Committee’s discretion.

Adjustment Provisions

Transactions not involving receipt of consideration by the Company, such as a merger, consolidation, reorganization, recapitalization, re-incorporation, stock dividend in property other than cash, stock split, liquidating dividend, combination of shares, exchange of shares, change in corporate structure or other transaction not involving the receipt of consideration by the Company, may change the class and number of shares of common stock subject to the Plan and outstanding Stock Awards. In that event, the Plan will be appropriately adjusted as to the type of security and the maximum number of shares of common stock subject to the Plan, and outstanding Awards will be adjusted as to the type of security, number of shares and price per share of common stock subject to such Awards.

Effect Of Certain Corporate Events

The Plan provides that, in the event of a dissolution, liquidation or sale of all or substantially all of the assets of the Company, specified types of merger, or other corporate reorganization (“change in control”), any surviving or acquiring corporation shall assume Stock Awards outstanding under the Plan or substitute similar Stock Awards for those outstanding under the Plan. If a surviving or acquiring corporation declines to assume outstanding Stock Awards, or to substitute similar Stock Awards, then, the vesting of such Awards will be accelerated. The acceleration of an Award may be viewed as an anti-takeover provision, which may have the effect of discouraging a proposal to acquire or otherwise obtain control of the Company. If a participant’s service is terminated involuntarily without cause within 24 months after the occurrence of a change in control, then any Stock Awards held by such participant shall immediately become fully vested and exercisable.

Duration, Amendment and Termination

The Board may amend or terminate the Plan without shareholder approval at any time for any reason, except that, as required by Section 162(m) of the Internal Revenue Code, certain material amendments must be approved by shareholders. In no event may Stock Awards be amended to lower the consideration payable, nor may such Awards be cancelled and reissued, unless approved by the shareholders. Unless sooner terminated, the Plan will terminate on February 12, 2012.

Federal Income Tax Information

A recipient of a stock option or stock appreciation right will not have taxable income on the date of grant. Upon the exercise of non-qualified options and stock appreciation rights, the participant will recognize ordinary income equal to the difference between the fair market value of the shares on the date of exercise and the exercise price. Any gain or loss recognized upon any later disposition of the shares generally would be a capital gain or loss.

Purchase of shares upon exercise of an incentive stock option will not result in any taxable income to the participant, except for purposes of the alternative minimum tax. Gain or loss recognized by the participant on a later sale or other disposition will either be capital gain or loss or ordinary income, depending upon how long the participant holds the shares. Any ordinary income will be in the amount, if any, by which the lesser of (i) the fair market value of such shares on the date of exercise or (ii) the amount realized from the sale, exceeds the exercise price.

6

Upon receipt of a stock bonus or restricted stock award, the participant will not have taxable income unless he/she elects to be taxed on its then fair market value. Absent such election, upon vesting the participant will recognize ordinary income equal to the fair market value of the shares or units at such time.

The Committee may permit participants to satisfy tax withholding requirements in connection with the exercise or receipt of an Award by electing to have the Company withhold otherwise deliverable shares, or delivering to the Company already-owned shares having a value equal to the amount required to be withheld.

The Company generally will be entitled to a tax deduction for a Stock Award in an amount equal to the ordinary income realized by the participant at the time the participant recognizes such income. Internal Revenue Code section 162(m) contains special rules regarding the federal income tax deductibility of compensation paid to the Company’s chief executive officer and to each of the other four most highly compensated executive officers. The general rule is that annual compensation paid to any of these specified executives will be deductible only to the extent that it does not exceed $1 million. However, the Company can preserve the deductibility of certain compensation in excess of $1 million if it complies with conditions imposed by section 162(m). The Plan has been designed to permit the Committee to grant Stock Awards which qualify as performance-based compensation.

Other Stock Plans of the Company

The Company’s 1996 Stock Option and Incentive Plan (the “1996 Plan”) terminated by its terms in 2001, and no new grants may be made under the 1996 Plan. However, stock options for 232,752 shares are still outstanding. Options must be exercised before their expiration dates ranging from August 13, 2006 to February 5, 2008. Expired options may not be re-used.

The Company’s 1999 Equity Incentive Plan (the “1999 Plan”) has awards of restricted stock, subject to forfeiture, and stock options outstanding for 1,859,232 shares as of April 1, 2002. Stock awards for an additional 64,083 shares may be issued under the 1999 Plan. Shares for forfeited restricted stock awards and expired or forfeited stock options may be re-used. The 1999 Plan terminates on February 16, 2009 and no further awards may be issued thereafter. The 1999 Plan is the same as the 2002 Stock Plan except for the number of shares for which awards may be made and the termination date.

The Non-Employee Directors’ Equity Plan (the “Directors’ Plan”) was approved by shareholders in 1999. Outstanding stock options for 185,812 shares were granted under a formula to non-employee directors. Options for an additional 64,188 shares may be awarded in the future according to a formula established in the Directors’ Plan to new directors or a new Chairman of the Board. The Directors’ Plan terminates on December 31, 2003, and no grants may be made after that date.

Information about the Company’s common stock that may be issued under the 1996 Plan, the 1999 Plan and the Directors’ Plan is shown below under “Equity Compensation Plan Information”. It does not include information on the 2002 Stock Plan, which is subject to shareholder approval. The total potential dilution to shareholders for stock awards issued and that may be issued under the 1996 Plan, the 1999 Plan and the Directors’ Plan, together with stock awards that may be issued under the 2002 Stock Plan, if approved by shareholders, is 3,306,067 shares, representing 14.81% of the shares of common stock outstanding on April 1, 2002.

7

EQUITY COMPENSATION PLAN INFORMATION

Plan category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | | Weighted-average exercise price of outstanding options, warrants and rights

| | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in the first column)

| |

| Equity compensation plans approved by security holders | | 2,277,796 | (1) | | $ | 7.53 | (2) | | 128,271 | (3) |

| Equity compensation plans not approved by security holders | | — | | | | — | | | — | |

| Total | | 2,277,796 | | | | | | | 128,271 | |

| (1) | | Includes 67,750 shares and 15,000 shares of restricted stock that will be issued if the Company’s common stock price reaches $20 per share and $10.03, respectively, on or prior to May 12, 2002. If those prices are not attained, the restricted stock awards would be forfeited, and those shares would again become available for future stock incentives under the 1999 Plan. |

| (2) | | Restricted stock awards are included in the weighted-average at a value of $0 since no cash consideration is payable upon attainment of the required stock price. |

| (3) | | Includes 64,188 shares available under the Directors’ Plan and 64,083 shares available under the 1999 Plan. Shares in the 1999 Plan may be issued in the form of stock bonuses and restricted stock awards in addition to options or stock appreciation rights. |

APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee and the Board of Directors have not yet appointed independent auditors for the year ending December 31, 2002 due to the uncertainties surrounding the Company’s current independent auditors, Arthur Andersen LLP. However, a representative of Arthur Andersen LLP for the Company will attend the Annual Meeting to respond to appropriate questions, and will have an opportunity to make a statement if he so desires.

8

STOCK OWNERSHIP BY DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth information regarding beneficial ownership of the Company’s common stock by the directors (including the two nominees), the Named Executives (as defined in the Summary Compensation Table below), and by all directors and executive officers as a group, as of April 1, 2002.

Name of Beneficial Owner

| | Amount and Nature of Beneficial Ownership (1)

| | | Percent of Class (2)

| |

|

| Patrick H. Blake | | 239,045 | | | 1.07 | % |

|

| G. Robert Evans | | 95,872 | | | * | |

|

| Paul B. Guenther | | 36,773 | | | * | |

|

| Robert W. Hatch | | 22,876 | | | * | |

|

| Martin W. Larson | | 24,074 | | | * | |

|

| James B. Malloy | | 22,290 | | | * | |

|

| Henry C. Montgomery | | 12,480 | | | * | |

|

| Thomas A. Paulsen | | 131,641 | (3) | | * | |

|

| Stephen D. Richards | | 153,466 | | | * | |

|

| William D. Walsh | | 253,829 | | | 1.14 | % |

|

| Robert E. Wrightson | | 169,868 | | | * | |

|

All directors and executive officers as a group (12 persons) | | 1,162,214 | | | 5.21 | % |

| * | | Less than one percent of the Company’s outstanding shares of common stock. |

| (1) | | Includes options that are exercisable within 60 days of April 1, 2002 and restricted shares as shown below. Restricted shares are not issued until restrictions lapse, at which time the holders will have the right to vote and dispose of such stock, unless receipt of the shares is deferred. |

Name

| | Options Exercisable within 60 Days

| | Restricted Shares

|

| Patrick H. Blake | | 140,620 | | 19,000 |

| G. Robert Evans | | 66,771 | | 15,000 |

| Paul B. Guenther | | 16,771 | | — |

| Robert W. Hatch | | 16,771 | | — |

| Martin W. Larson | | 24,074 | | — |

| James B. Malloy | | 16,771 | | — |

| Henry C. Montgomery | | 12,480 | | — |

| Thomas A. Paulsen | | 81,725 | | 6,000 |

| Stephen D. Richards | | 71,133 | | 13,000 |

| William D. Walsh | | 31,875 | | — |

| Robert E. Wrightson | | 71,991 | | 13,000 |

| All directors and executive officers | | | | |

| as a group (12 persons) | | 590,750 | | 66,000 |

Restricted shares will be forfeited on May 12, 2002 if the price of the Company’s common stock does not reach $20 per share by then ($10.03 for Mr. Evans).

9

| (2) | | The percent is calculated based on shares of common stock outstanding on April 1, 2002, except that a particular person’s options (to the extent exercisable within 60 days of April 1, 2002) and restricted stock subject to forfeiture are deemed outstanding for the purpose of calculating the percentage of outstanding securities owned by that person, but are not deemed outstanding for calculating the percentage owned by another person. |

| (3) | | Mr. Paulsen disclaims beneficial ownership of 30 shares that are held by his spouse. |

PRINCIPAL SHAREHOLDERS

As of April 1, 2002, based solely on the Company’s review of the most recent filings with the Securities and Exchange Commission and information provided by T. Rowe Price Trust Company, the trustee of the Company’s 401(k) plans, the only persons known to the Company to own beneficially an interest in 5% or more of the shares of the Company’s common stock are set forth below.

Name and Address of Beneficial Owner

| | Amount and Nature of Beneficial Ownership

| | | Percent of Class

| |

| T. Rowe Price Trust Company | | 4,652,290 | (1) | | 20.84 | % |

| 100 East Pratt Street | | | | | | |

| Baltimore, MD 21202 | | | | | | |

|

| Ironwood Capital Management, LLC | | 2,263,150 | (2) | | 10.14 | % |

| 21 Custom House Street, Suite 240 | | | | | | |

| Boston, MA 02110 | | | | | | |

|

| Dimensional Fund Advisors Inc. | | 1,848,350 | (3) | | 8.28 | % |

| 1299 Ocean Avenue, 11th Floor | | | | | | |

| Santa Monica, CA 90401 | | | | | | |

|

| Willow Creek Capital Management | | 1,636,000 | (4) | | 7.33 | % |

| 17 East Sir Francis Drake Blvd., Suite 100 | | | | | | |

| San Rafael, CA 94939 | | | | | | |

|

| Four Partners | | 1,300,150 | (5) | | 5.82 | % |

| 667 Madison Avenue | | | | | | |

| New York, NY 10021 | | | | | | |

|

| Kevin Douglas and Cynthia Douglas | | 1,098,000 | (6) | | 4.92 | % |

| 4040 Civic Center Drive, Suite 530 | | | | | | |

| San Rafael, CA 94903 | | | | | | |

| (1) | | T. Rowe Price Trust Company, the directed trustee under the Company’s 401(k) plans (the “Trust Company”), has sole voting power over 0 shares, non-discretionary voting power over 4,652,290 shares, sole dispositive power over 0 shares, and non-discretionary dispositive power over 4,652,290 shares. Under the terms of the Company’s agreements with the Trust Company and the 401(k) plans, the Trust Company will vote the Company’s shares in accordance with the direction of the participants in the Company’s 401(k) plans or, if no instructions are received, in the same proportion as for all other shares of the same plan for which instructions are received. For purposes of the reporting requirements of the Securities Exchange Act of 1934, as amended, the Trust Company is deemed to be the beneficial owner of 4,652,290 shares of the Company’s common stock. However, the Trust Company disclaims beneficial ownership of such shares. |

| (2) | | Ironwood Capital Management, LLC has shared power to vote 1,558,750 shares and shared dispositive power over 2,263,150 shares. |

10

| (3) | | Dimensional Fund Advisors Inc. has sole voting power and sole dispositive power over 1,848,350 shares. |

| (4) | | Willow Creek Capital Management has shared voting power and shared dispositive power over 1,636,000 shares. |

| (5) | | Four Partners has sole voting power and sole dispositive power over 1,300,150 shares. By virtue of their status as managing trustees of the trusts that are the general partners of Four Partners, Andrew H. Tisch, Daniel R. Tisch, James S. Tisch and Thomas J. Tisch may be deemed to have shared beneficial ownership of shares owned by Four Partners and shared power to vote or direct the vote of and to dispose or direct the disposition of the 1,300,150 shares owned by Four Partners. By virtue of his status as manager of Four Partners, Thomas J. Tisch may be deemed to have power to vote or direct the vote of the shares owned by Four Partners and power to dispose of or direct the disposition of the shares. |

| (6) | | Kevin Douglas and Cynthia Douglas have shared voting power and shared dispositive power over 1,098,000 shares. |

11

INFORMATION ABOUT THE BOARD OF DIRECTORS AND BOARD COMMITTEES

During 2001, the Board of Directors held five regular meetings and twelve telephonic meetings. Each director attended at least 75% of the meetings of the Board and the Committees of the Board on which he served. The Board of Directors has standing Audit and Compensation Committees. The Board does not have a standing Nominating Committee. The Audit Committee held three meetings and the Compensation Committee held four meetings in 2001.

Audit Committee: The Audit Committee recommends to the Board of Directors the appointment of independent public accountants to perform the audit of the Company’s accounting records and authorizes the performance of services by the accountants so appointed. The Committee reviews the annual audit of the Company by the independent public accountants, and annually reviews the results of the examinations of accounting procedures and controls performed by the Company’s internal auditors. The Committee’s functions are described in more detail in the Audit Committee Charter, which was adopted by the Board of Directors and attached to the 2001 Proxy Statement. The Audit Committee is now comprised of Henry C. Montgomery—Chairman, Paul B. Guenther and William D. Walsh. Mr. John M. Lillie resigned from the Board and as Chairman of the Audit Committee on February 1, 2001. Henry C. Montgomery was elected to the Board and the Audit Committee on February 6, 2001.

Compensation Committee: The Compensation Committee approves the salaries and other compensation of the officers of the Company. The Committee determines the compensation policies and programs for officers and key personnel, including incentive compensation. It oversees the administration of the Company’s short-term and long-term incentive compensation plans and grants awards under the Company’s stock plans. The Committee also oversees the administration of the retirement and benefit plans of the Company and its domestic subsidiaries for non-contractual employees. The members of the Compensation Committee are currently Robert W. Hatch—Chairman, James B. Malloy and William D. Walsh. Mr. Raymond F. O’Brien resigned from the Board and as a member of the Compensation Committee on May 24, 2001.

COMPENSATION OF DIRECTORS

Directors’ fees are paid to non-employee directors. In 2001, each non-employee director was paid an annual retainer of $12,000, $2,000 per Board meeting attended, $1,000 per Committee meeting attended, and $500 per telephonic meeting attended.

On May 11, 1999, each non-employee director of the Company was automatically granted an option to purchase 25,000 shares of the Company’s common stock under the Company’s Non-Employee Directors’ Stock Option Plan, except the Chairman of the Board, who was granted an option for 50,000 shares in recognition of the extra services he performs for the Company. The exercise price of the options is $13.00 per share, the closing price of the Company’s common stock on May 10, 1999, the last trading day prior to the date of grant. Each of these options vests monthly over 48 months, beginning January 31, 2000. Options for one-fourth of the shares vested in 2001.

On May 16, 2001, Mr. Henry C. Montgomery was automatically granted an option for 20,709 shares with an exercise price of $7.17 per share, the closing price of the Company’s common stock on May 15, 2001. In 2001, the option to purchase 4,167 shares vested. The options for 4,042 vest on May 16, 2002 and the remainder vests at the rate of 521 shares per month through 2003.

On February 5, 2001, each director was granted an option to purchase 5,000 shares of the Company’s common stock. The exercise price for those shares is $6.4375 per share, the most recent closing price prior to the grant. The options vest at the rate of 1/48th per month beginning February 28, 2001.

12

COMPENSATION OF EXECUTIVE OFFICERS

I. SUMMARY COMPENSATION TABLE

The following table sets forth information concerning compensation of the Company’s Chief Executive Officer and the next four most highly compensated executive officers (the “Named Executives”) for the three years ended December 31, 2001.

| | | | | | | | | Long Term Compensation

| | |

| | | | | Annual Compensation

| | Restricted Stock Awards ($)(1)

| | Securities Underlying Options/ SARs (#)

| | All Other Compensation ($)(2)

|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | | |

| P. H. Blake | | 2001 | | $ | 331,168 | | | — | | | — | | 26,320 | | $ | 3,194 |

President, Chief Executive Officer and Director | | 2000 1999 | | | 328,561 291,287 | | $ | 400,000 — | | $ | — 267,188 | | 126,000 60,000 | | | 9,001 9,882 |

|

| T. A. Paulsen | | 2001 | | $ | 279,120 | | | — | | | — | | 16,600 | | $ | 5,924 |

Executive Vice President & Chief Operating Officer | | 2000 1999 | | | 268,871 228,499 | | | — — | | $ | — 84,375 | | 76,500 30,000 | | | 15,464 13,622 |

|

| R. E. Wrightson | | 2001 | | $ | 282,832 | | | — | | | — | | 14,310 | | $ | 2,838 |

Executive Vice President & Chief Financial Officer | | 2000 1999 | | | 270,666 249,013 | | | — — | | $ | — 182,813 | | 55,000 42,000 | | | 16,405 16,338 |

|

| M.W. Larson | | 2001 | | $ | 169,200 | | | — | | | — | | 22,020 | | $ | 2,939 |

Senior Vice President— Sales | | 2000 1999 | | | 140,857 95,915 | | | — — | | | — — | | 20,000 1,350 | | | 2,550 2,400 |

|

| S. D. Richards | | 2001 | | $ | 210,524 | | | — | | | — | | 12,020 | | $ | 4,461 |

Senior Vice President & General Counsel | | 2000 1999 | | | 222,508 227,442 | | | — — | | $ | — 182,813 | | 55,000 42,000 | | | 9,303 9,667 |

| (1) | | In 1999, the Named Executives were granted restricted stock awards as follows: Mr. Blake—19,000 shares; Mr. Paulsen—6,000 shares; and Messrs. Wrightson and Richards—13,000 shares each. These awards are contingent on the closing price of the Company’s stock averaging $20 or more per share over ten consecutive trading days on or prior to May 12, 2002. The value of the awards was calculated using the $14.0625 closing stock price on the date of the award. The dollar value of the unvested restricted stock awards held by the Named Executives as of December 31, 2001, based on the $5.09 closing price of the Company’s stock on that date, was: Mr. Blake—$96,710; Mr. Paulsen—$30,540; Mr. Wrightson—$66,170 and Mr. Richards—$66,170. |

| (2) | | For 2001, All Other Compensation consisted of the following: |

| | (a) | | 401(k) Match: matching contributions in the Company’s common stock under the Company’s Stock and Savings Plan: $2,550 for Messrs. Blake, Paulsen, Wrightson, Larson and Richards. |

| | (b) | | Deferred Compensation: above market interest credited on deferred compensation: Mr. Blake—$424; Mr. Paulsen—$3,110; Mr. Larson—$208 and Mr. Richards—$1,695. |

| | (c) | | Split Dollar Life Insurance: compensation attributable to split dollar life insurance represents the present value of the interest (compounded annually) projected to accrue on the portion of the current year’s insurance premium paid by the Company: Mr. Blake—$220; Mr. Paulsen—$264; Mr. Wrightson—$288; Mr. Larson—$181; and Mr. Richards—$216. The program was terminated on January 1, 2002 and the portion of the premium payments paid by the Company was recovered by the Company from the cash value of the policies. |

13

II. 2001 OPTION GRANTS TABLE

Option/SAR Grants in Last Fiscal Year

Name

| | Number of Securities Underlying Options/SARs Granted(#)(1)

| | Percent of Total Options/SARs Granted to Employees in Fiscal Year

| | | Exercise or Base Price ($/Share)(2)

| | Expiration Date

| | Grant Date Present Value $(3)

|

| P. H. Blake | | 26,320 | | 6.63 | % | | $ | 5.95 | | 8/13/2006 | | $ | 88,709 |

|

| T. A. Paulsen | | 16,600 | | 4.18 | % | | $ | 5.95 | | 8/13/2006 | | $ | 55,949 |

|

| R. E. Wrightson | | 14,310 | | 3.60 | % | | $ | 5.95 | | 8/13/2006 | | $ | 48,230 |

|

| M. W. Larson | | 22,020 | | 5.55 | % | | $ | 5.95 | | 8/13/2006 | | $ | 74,216 |

|

| S. D. Richards | | 12,020 | | 3.03 | % | | $ | 5.95 | | 8/13/2006 | | $ | 40,512 |

| (1) | | No Stock Appreciation Rights (SARs) were granted in 2001. Options vest at the rate of 1/24th per month beginning on September 14, 2001. Options may be exercised by payment of cash, delivery of shares with a value equal to the exercise price or payment of the exercise price from the proceeds of the sale of shares acquired upon exercise. |

| (2) | | Equal to the most recent closing price of the stock at the time of the grant. |

| (3) | | The grant date present value is based upon the Black-Scholes option pricing model using the following assumptions: option exercise price equals the fair market value on the date of the grant; risk-free interest rate, 3.94%; expected life, 5 years; expected volatility, 63.1%; and expected dividend, 0%. The use of this model should not be construed as an endorsement of its accuracy in valuing options. Stock options are not transferable so the “present value” shown cannot be realized by the executive. Future compensation resulting from the option grants will ultimately depend on the amount (if any) by which the market price of the stock exceeds the exercise price on the date of exercise. |

III. 2001 OPTION EXERCISES AND YEAR-END VALUE TABLE

Aggregated Option/SAR Exercises in Last Fiscal Year

and Fiscal Year-End Option/SAR Values (1)

Name

| | Shares Acquired on Exercise (#)

| | Value Realized ($)

| | Number of Securities Underlying Unexercised Options/SARs at Fiscal Year End (#) Unexercisable/ Exercisable (1)

| | Value of Unexercised In-the-Money Options/SARs at Fiscal Year End ($) Unexercisable/ Exercisable(2)

|

| P. H. Blake | | — | | — | | 114,933 / 97,387 | | $23,389 /$23,389 |

|

| T. A. Paulsen | | — | | — | | 67,083 / 56,017 | | 14,200 /14,200 |

|

| R. E. Wrightson | | — | | — | | 60,425 / 50,885 | | 10,209 /10,209 |

|

| M. W. Larson | | — | | — | | 29,025 / 14,345 | | 3,713 / 3,713 |

|

| S. D. Richards | | — | | — | | 58,517 / 50,503 | | 10,209 /10,209 |

| (1) | | No SARs have been granted or are outstanding. |

| (2) | | Based upon the closing price of $5.09 on December 31, 2001. |

14

IV. PENSION PLAN TABLE

The following shows the estimated annual retirement benefits payable to the highest paid employees, assuming retirement at age 65 as of January 1, 2002.

| | | Years of Service

| |

Remuneration(1)

| | 15

| | | 20

| | | 25

| | | 30

| | | 35

| |

| $200,000 | | $ | 42,210 | | | $ | 61,050 | | | $ | 79,900 | | | $ | 98,750 | | | $ | 118,800 | |

| $300,000 | | | 65,540 | | | | 94,560 | | | | 123,570 | | | | 152,590 | | | | 183,300 | |

| $400,000 | | | 89,090 | | | | 128,340 | | | | 167,590 | | | | 206,850 | | | | 247,800 | |

| $500,000 | | | 112,640 | | | | 162,130 | | | | 211,620 | | | | 261,110 | | | | 312,300 | |

| $600,000 | | | 136,180 | | | | 195,910 | | | | 255,640 | | | | 315,370 | | | | 376,800 | |

| $700,000 | | | 159,730 | | | | 229,700 | | | | 299,660 | | | | 369,630 | | | | 441,300 | |

| $800,000 | | | 183,280 | | | | 263,480 | | | | 343,690 | | | | 423,890 | | | | 505,800 | |

| (1) | | Compensation covered for the Named Executives is the highest annual average of Salary and Bonus as shown in the Summary Compensation Table over five consecutive years of the last ten years of employment. The formula for this annual benefit is 1.1% of the average annual compensation up to an individual’s social security covered compensation, plus 1.4% of such compensation in excess of the social security covered compensation, multiplied by years of service. Retirement benefits shown are payable at or after age 65 in the form of a straight life annuity. Certain benefits of an individual will be reduced by a Social Security offset formula no longer in effect, depending on when the individual joined the Pension Plan. |

Federal law places certain limitations on the amount of compensation that may be taken into account in calculating pension benefits and on the amount of pension payments that may be paid under federal income tax qualified plans. The Company has adopted a non-qualified plan to provide for payment out of the Company’s general funds for benefits not covered by the qualified plan. The table above represents total retirement benefits, which may be paid from a combination of the qualified and non-qualified plans.

As of December 31, 2001, Messrs. Blake, Larson, Paulsen, Richards and Wrightson had approximately 26, 18, 33, 10 and 34 years of plan participation, respectively.

EMPLOYMENT AGREEMENTS AND CHANGE-IN-CONTROL ARRANGEMENTS

The Company entered into employment agreements with Messrs. Blake, Larson, Paulsen, Richards and Wrightson that provide for continued salary and benefits and the opportunity to earn short-term and long-term incentive compensation at not less than current levels.

Mr. Blake’s agreement provides for a three-year term ending December 31, 2004. The agreements for the other executives provide for two-year terms ending December 31, 2003. The agreements automatically renew for one more year on January 1 of each year unless such renewal provision is terminated by the executive or the Company. All agreements automatically terminate when the executive reaches age 65. They terminate sooner upon termination for cause, voluntary termination of employment, death or disability.

In the event of termination of employment by death or disability, the executive will be entitled to a lump sum payment of six months base salary and target bonus, plus health benefits and age and service credits under the Company’s retirement plans. In the event of termination of employment by the Company without cause or if the executive resigns due to a constructive termination of employment by the Company, the executive will be entitled to a lump sum payment of salary and target bonus and

15

continued benefits for the remainder of the term of his employment agreement. The executive will also be entitled to (i)pro-rata short-term and long-term incentives based upon performance of the Company to date of termination; (ii) additional age and service credits under the Company’s pension and supplemental retirement plans for the remainder of the term of the employment agreement with benefits determined as if the executive had continued employment for that period at current salary and target bonus; and (iii) acceleration of the vesting of any stock awards.

In the event of a change-in-control, the terms of the employment agreements will automatically be extended for one additional year. If an executive’s employment is terminated without cause or by constructive termination within 24 months of a change-in-control, the executive will be paid, in a lump sum, base salary, target bonus and automobile allowance for the remainder of the term of the agreement, plus be given three years age and service credit under the Company’s retirement plans with benefits determined as if the executive had continued employment for that period at current salary and target bonus, and be entitled to continued health care without premiums for the executive and his spouse until eligible for Medicare, or ten years, whichever is shorter. In addition to these severance payments, the executive would be entitled to receive an additional payment, net of taxes, to compensate for any excise tax required on those or other payments to the extent required under the Internal Revenue Code for excess severance payments. The executive has the right to voluntarily resign in the thirteenth calendar month following a change-in-control and receive twelve months of base salary, target bonus and benefits in lieu of the more extensive severance compensation under the employment agreement.

Constructive termination includes a reduction in base salary, target bonus or long-term incentive opportunity, material reduction of benefits, material changes in responsibilities, and, in the event of a change-in-control, relocation. “Change-in-control” generally includes: (i) a merger, consolidation or reorganization where less than 50% of the voting power is retained by the Company’s shareholders; (ii) the sale of at least 50% of the Company’s assets in a 12 month period and thereafter less than 50% of the voting power is retained by the Company’s shareholders; (iii) the acquisition of beneficial ownership of 25% or more of the Company’s voting power by any person as the term “person” is used under the Securities Exchange Act of 1934; (iv) the current directors ceasing to be a majority of the directors of the Company during any two-year period unless approved by two-thirds of the incumbent directors; and (v) the Company filing a report with the Securities and Exchange Commission under applicable law that a change-in-control of the Company has or may have occurred or will or may occur in the future pursuant to a then-existing control or transition; or (vi) a liquidation or dissolution of the Company.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

One of the Compensation Committee’s responsibilities is to determine the compensation of officers, including the chief executive officer and the other most highly compensation executive officers shown earlier in the “Summary Compensation Table” (the “Named Executives”). The Committee is composed of three non-employee directors: Robert W. Hatch, Chairman, James B. Malloy and William D. Walsh. Mr. Raymond F. O’Brien also served on this Committee until his resignation as a director on May 24, 2001.

Policies

The Committee has established “pay-for-performance” as the guiding principle of compensation, with a major portion of total compensation “at risk” through short-term and long-term incentives. The greater the executive’s responsibilities, the higher the percentage of total potential compensation should be “at risk.”

16

The Committee has also determined that the Company should pay competitive base salaries and above average incentive compensation for achievement of objectives for the long-term success and competitiveness of the Company. Short-term incentives should be tied to measurable performance goals established at the beginning of the year. However, the Committee has reserved the discretion to increase or award bonuses for significant corporate accomplishments, superior performance relative to comparable companies, and to take into account external factors that may adversely affect performance such as general economic conditions. Long-term incentives should closely align the interests of executives with the long-term interests of the Company and its shareholders.

The Committee believes that compensation, including salary, should be measured and evaluated against a peer compensation group. Salaries should also take into account compensation outside the peer group where the Company may compete for executive talent, and subjective factors, such as experience, responsibilities, performance and value to the Company. The peer compensation group is not the same as the companies included in the S&P SmallCap Trucking Index used later in the “Performance Graph,” but rather a broader group of transportation companies selected by the Committee which it believes is representative of the market in which the Company may compete for executive talent.

Using the peer compensation group as a general guideline, the Committee targets salaries between the 50th and 75th percentile of that group. Short-term and long-term incentives are targeted to be competitive with the peer group, based on the performance of management.

The compensation program for officers includes three principal components.

Base Salary

Salaries are reviewed annually by the Compensation Committee. The Committee exercises subjective judgment based upon a variety of factors. These include, from time to time: (i) advice and information provided by an independent compensation consultant; (ii) recommendations from the chief executive officer for officers other than himself; (iii) salaries for comparable executives at other transportation companies; (iv) responsibilities, performance, knowledge, experience and value of the services of the executives considered; and (v) performance of the Company. The Committee does not assign a relative importance to any one factor. Rather, the Committee reaches a consensus based on the weighing of these factors by each member of the Committee based on his individual views and experience.

For 2001, no increases in salaries were awarded to the Named Executives, except Mr. Larson. Mr. Larson received a raise in August 2001 upon his promotion to Senior Vice President, Sales and Marketing. In deciding to freeze salaries of the other Named Executives, the key factor in the Committee’s decision was the performance of the Company in 2000. On June 17, 2001, the Named Executives, other than Mr. Larson, implemented a voluntary salary reduction for themselves of 10%. As a result, salaries are now generally below the target range of the 50th to 75th percentile of peer group salaries.

Short-Term Incentive Compensation

The Committee approved a 2001 cash incentive plan for all regular, full-time, non-contractual employees based upon measurable performance objectives. The plan included the opportunity to surpass that target for exceeding performance objectives. Bonuses were targeted at 35% of salary for officers, 50% for senior officers, 55% for the President and 65% for the Chief Executive Officer.

2001 target bonuses for all officers were based upon pre-tax, pre-incentive profits of the Company as a whole or its principal U.S. operating subsidiary. The target bonus for the officer managing

17

Canadian operations was based on the profits of the Canadian operations. In 2001, performance criteria established at the beginning of the year for the Company, as a whole and its principal U.S. operating subsidiary, were not met. As a result, neither the chief executive officer nor any of the other Named Executives earned any bonuses for 2001.

Long-Term Incentive Compensation

On August 13, 2001, the Compensation Committee approved grants of non-qualified stock options to officers and senior management, at an exercise price of $5.95 per share, the closing price on the date of grant. The options vest at a rate of 1/24th per month beginning September 14, 2001, and expire, if not exercised, on August 13, 2006.

The stock option grants were deemed to be consistent with the objective of aligning the interests of officers with the long-term interests of the Company’s shareholders. The grants were also in keeping with the general policy of pay-for-performance and the policy that an even greater portion of the total potential compensation for officers generally, and even more so for the Named Executives, should be tied to performance.

The option grants were based upon the principle that the officers are the key executives who can increase the Company’s profits, thereby benefiting the Company’s shareholders. In making its decision to grant options in 2001, the Committee considered the terms and amount of options and restricted stock awards already held by the Named Executives and then made a subjective decision on the amount of the grants to accelerate the turnaround of the Company.

In addition, the Committee took into consideration that voluntary salary reductions were taken and salaries were generally below the 50th percentile of the peer group. Allocation among officers was based upon a subjective judgment of the relative contribution that would be made by the individual executives, except that a larger grant was awarded to Mr. Larson in recognition of his promotion to Senior Vice President, Sales and Marketing. The awards to the Named Executives are disclosed in the preceding “Option Grants Table”.

CEO Compensation

On May 8, 2000, Mr. Patrick H. Blake was elected as CEO. Mr. Blake was given a salary of $350,000, which was recognized as substantially below the median compensation paid by peer companies for the position. Mr. Blake subsequently requested that his salary be lowered 10% to $315,000 consistent with salary reductions taken by other senior officers.

The chief executive officer participates in the same programs and receives compensation based on the same factors as other executive officers. However, his overall compensation reflects his greater degree of decision-making authority and higher level of responsibility for strategic planning and financial and operational results. As a result, the Committee believes he should receive compensation consistent with that responsibility and CEO’s in the peer group. In addition, the Committee believes the CEO should be more at risk through having a larger part of his total compensation at risk through incentive compensation. While aware that Mr. Blake’s salary is substantially below the 50th percentile of the peer group, the Committee has not increased that salary because of the disappointing performance of the Company.

Policy on Deductibility of Compensation

Section 162(m) of the Internal Revenue Code generally limits the deductibility of certain compensation paid to the chief executive officer or any of the four other most highly compensated

18

executives as of the end of the fiscal year in excess of $1 million annually. There is an exception for certain performance-based compensation established and administered by “outside directors” defined in Section 162(m).

The Compensation Committee has adopted the general policy that compensation paid to the officers subject to the deductibility limitation should be structured so as to maximize the deductibility of such compensation for federal income tax purposes. Currently, the Committee expects that all compensation paid to executive officers will be deductible. The Committee, however, reserves the discretion to pay compensation to executive officers that may not be deductible.

THE COMPENSATION COMMITTEE

| Robert W. Hatch, Chairman | | James B. Malloy | | William D. Walsh |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Members of the Compensation Committee have been independent directors of the Company and have had no other relationships with the Company and its subsidiaries.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee of the Company consists of three directors who are responsible for engaging the independent auditors and assuring that management fulfills its responsibilities in the preparation of the financial statements. All members of the Audit Committee are independent as required by the National Association of Securities Dealers listing requirements. The Audit Committee has fulfilled its responsibilities, outlined in the formal written charter.

The Audit Committee has:

| | • | | Reviewed and discussed the audited financial statements as of and for the year ended December 31, 2001 with management. |

| | • | | Discussed with Arthur Andersen LLP, the Company’s independent auditors, the matters required to be discussed by Statement of Auditing Standards 61, “Communication with Audit Committees.” |

| | • | | Received and reviewed the written disclosures and the letter from Arthur Andersen LLP required by Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees.” |

| | • | | Has discussed with Arthur Andersen LLP its independence from the Company and its management. |

Based upon the Audit Committee’s review of the financial statements as of and for the year ended December 31, 2001 and discussions with both management and Arthur Andersen LLP, the Audit Committee has recommended to the Board of Directors that the financial statements be included in the Company’s Annual Report on Form 10-K.

19

The following is a summary of fees paid to Arthur Andersen LLP for the year ended December 31, 2001:

| Audit | | $ | 346,518 |

| Financial Systems Design and Implementation | | | — |

| All Other | | | |

| Audit Related | | $ | 324,947 |

| Non-Audit Related | | $ | 168,713 |

| Total Fees | | $ | 840,178 |

The Audit Committee has considered and determined that the fees for services other than the audit are compatible with maintaining the accountants’ independence.

THE AUDIT COMMITTEE

Henry C. Montgomery, Chairman

Paul B. Guenther

William D. Walsh

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

With the exception of Mr. Montgomery, the Company believes that during 2001 its executive officers and directors timely complied with all filing requirements of Section 16(a) of the Securities and Exchange Act of 1934. The report on the automatic grant of stock options to Mr. Montgomery under the Non-Employee Directors’ Equity Plan was inadvertently filed late.

20

PERFORMANCE GRAPH

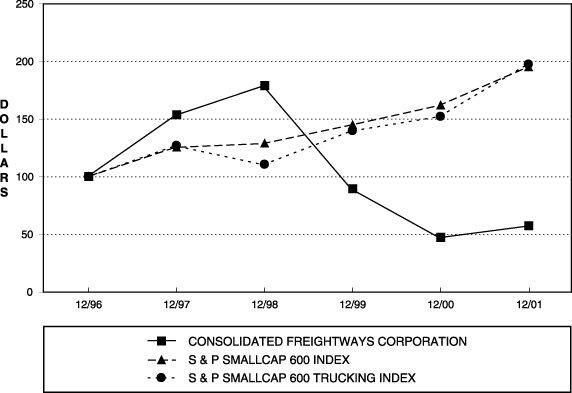

The following graph shows a comparison of the five-year cumulative total return through December 31, 2001 for the Company’s common stock (“CFWY”), the S & P SmallCap 600 Index and the S & P SmallCap Trucking Index. The graph assumes $100 was invested on December 31, 1996 and that dividends in the two indexes were reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Consolidated Freightways Corporation, the S & P Smallcap 600 Index

and the S & P Smallcap 600 Trucking Index

21

CONFIDENTIAL VOTING

The Board of Directors has adopted a confidential voting policy. Under this policy, all proxies, ballots and voting materials that identify the votes of specific shareholders will be kept confidential from the Company except as may be required by law or to assist in the pursuit or defense of claims or judicial actions, and except in the event of a contested proxy solicitation. In addition, comments written on proxies, ballots, or other voting materials, together with the name and address of the commenting shareholder, will be made available to the Company without reference to the vote of the shareholder, except where such vote is included in the comment or disclosure is necessary to understand the comment. Certain vote tabulation information may also be made available to the Company, provided that the Company is unable to determine how any particular shareholder voted.

Access to proxies, ballots and other shareholder voting records will be limited to inspectors of election who are not employees of the Company and to certain Company employees and agents engaged in the receipt, count and tabulation of proxies.

SUBMISSION OF SHAREHOLDER PROPOSALS

Under the rules of the Securities and Exchange Commission, shareholder proposals intended for inclusion in next year’s proxy statement must be directed to the Corporate Secretary, Consolidated Freightways Corporation, at 16400 S.E. CF Way, Vancouver, Washington, 98683 and must be received by December 31, 2002. With respect to shareholder proposals not intended to be included in the proxy statement or nominations of persons for election to the Board, the Company’s Bylaws require that advance notice of such proposals and nominations be given to the Corporate Secretary no later than the close of business on the 45th day and no earlier than the close of business on the 75th day prior to the first anniversary of the day on which proxy materials for the prior year’s annual meeting were first mailed to shareholders. Proposals and nominations received outside of this period will not be eligible to be raised or voted upon at the meeting. Any notice of a proposal or nomination must include certain information about the shareholder, the proposal and nominee as well as the written consent of any nominee, all as required by the Bylaws of the Company. A copy of these Bylaw provisions may be obtained without charge by writing to the Corporate Secretary.

OTHER MATTERS

The Company will furnish to interested shareholders, free of charge, a copy of its 2001 Annual Report on Form 10-K that is filed with the Securities and Exchange Commission. Please direct your written request to the Corporate Secretary, Consolidated Freightways Corporation, P.O. Box 871570, Vancouver, Washington, 98687-1570.

The Company will pay the expense of proxy solicitation. The solicitation is being made by mail and may also be made by telephone, facsimile, e-mail, or personally by directors, officers, and regular employees of the Company who will receive no extra compensation for their services. The Company has engaged Innisfree M&A Incorporated to assist in the solicitation of proxies, for which the Company will pay a fee of $7,500. The Company will also reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy material to beneficial owners of the Company’s common stock.

22

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED AT THE MEETING. PLEASE SIGN, DATE AND RETURN THE ACCOMPANYING PROXY CARD AS SOON AS POSSIBLE WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING.

| | BY | ORDER OF THE BOARD OF DIRECTORS |

| | Vic | e President and Secretary |

April 30, 2002

23

CONSOLIDATED FREIGHTWAYS CORPORATION

16400 S.E. CF Way

Vancouver, Washington 98683

This Proxy is Solicited on Behalf of the Board of Directors of

Consolidated Freightways Corporation

The undersigned appoints Thomas A. Paulsen, Stephen D. Richards, Robert E. Wrightson and each of them, the proxies of the undersigned, with full power of substitution, to vote the stock of CONSOLIDATED FREIGHTWAYS CORPORATION, which the undersigned may be entitled to vote at the Annual Meeting of Shareholders to be held on Monday, June 17, 2002 at 10:00 A.M. or at any adjournments or postponements thereof. The proxies are authorized to vote in their discretion upon such other business as may properly come before the meeting and any and all adjournments or postponements thereof.

You are encouraged to specify your choice by marking the appropriate box, SEE REVERSE SIDE, but you need not mark any boxes if you wish to vote in accordance with the Board of Directors’ recommendations.

This proxy when properly executed, will be voted in the manner directed herein. If no direction is made, this proxy will be voted FOR the election of directors set forth on the reverse side of this card and FOR the approval of the 2002 Stock Plan.

For participants in the Company’s 401k Plan, Stock and Savings Plan and CF AirFreight Savings Plan, any shares held in the share owner’s account on the record date will be voted by the applicable trustee of the applicable plan in accordance with the participant’s instructions or if no instructions are given, such shares will be voted in the same proportion as all other shares in the plan for which instructions are received. The trustees will vote in their discretion upon other business as may properly come before the meeting.

(Continued and to be signed on the other side)

Consolidated Freightways Corporation

16400 S.E. CF Way

Vancouver, Washington 98683

DEAR SHAREHOLDER:

The Annual Meeting of Shareholders of Consolidated Freightways Corporation (the “Company”) will be held at 10:00 A.M., Pacific Daylight Time, on Monday, June 17, 2002, at the Company’s Corporate Headquarters, 16400 S.E. CF Way, Vancouver, Washington to:

| | 1. | | Elect two group 3 directors for a three-year term; |

| | 2. | | Approve the 2002 Stock Plan; and |

| | 3. | | Transact any other business properly brought before the meeting and any adjournment or postponement thereof. |

Shareholders of record at the close of business on April 19, 2002 are entitled to notice of and to vote at the meeting.

Your vote is important. Whether or not you plan to attend, I urge you to SIGN, DATE AND RETURN THE ATTACHED PROXY CARD IN THE ENVELOPE PROVIDED, in order that as many shares as possible will be represented at the meeting. If you attend the meeting and prefer to vote in person, you will be able to do so and your vote at the meeting will revoke any proxy you may submit.

Sincerely,

MARYLA R. FITCH

Vice President and Secretary

April 30, 2002

¯ Please Detach and Mail in the Envelope Provided ¯

A | | x | | Please mark your votes as indicated in this example. |

| | | FOR all nominees listed below (except as marked to the contrary below) | | WITHHOLD AUTHORITY to vote for all nominees listed below | | The Board of Directors recommends a vote FOR the directors and FOR the approval of the 2002 Stock Plan. |

| 1. Election of two group 3 directors for a three-year term. | | ¨ | | ¨ | | Nominees: | | Robert W. Hatch Henry C. Montgomery |

(INSTRUCTIONS: To withhold authority to vote for any individual nominee, mark the “FOR” box and strike a line through that nominee’s name.)

| | | FOR | | AGAINST | | ABSTAIN |

| 2. Approve the 2002 Stock Plan | | ¨ | | ¨ | | ¨ |

The proxies are hereby authorized to vote in their discretion upon such other matters as may properly come before the meeting and any adjournments or postponements thereof.

| Change of Address and/or Comments Mark Here | | ¨ |

Please Mark, Sign, Date and Return the Proxy Card Promptly Using the Enclosed Envelope.

Signature: __________________________________ Date: ___________ Signature: __________________________________ Date: ___________

| Important: | | Please sign exactly as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian please give full title as such. |