As filed with the Securities and Exchange Commission on August 25, 2006

Registration No. 333-

Investment Company Act File No. 811-07811

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

o PRE-EFFECTIVE AMENDMENT NO.

o POST-EFFECTIVE AMENDMENT NO.

JENNISON U.S. EMERGING GROWTH FUND, INC.

(Exact Name of Registrant as Specified in Charter)

Gateway Center Three, 100 Mulberry Street, Newark, New Jersey 07102-4077

(Address of Principal Executive Offices)

(973) 367-7521

(Registrant’s Telephone Number)

Deborah A. Docs, Esq.

Gateway Center Three

100 Mulberry Street

Newark, New Jersey 07102-4077

(Name and Address of Agent for Service)

with a copy to :

William G. Farrar, Esq.

Sullivan & Cromwell LLP

125 Broad Street

New York, New York 10004

(212) 558-4000

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective under the Securities Act of 1933.

Title of the securities being registered: Shares of common stock, par value $0.001 per share of Jennison U.S. Emerging Growth Fund, Inc.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

It is proposed that this filing become effective on September [6], 2006, pursuant to Rule 488(a) under the Securities Act of 1933.

No filing fee is due because the Registrant has previously registered an indefinite number of shares of common stock under the Securities Act of 1933.

STRATEGIC PARTNERS MID-CAP GROWTH FUND,

A SERIES OF STRATEGIC PARTNERS MUTUAL FUNDS, INC.

STRATEGIC PARTNERS NEW ERA GROWTH FUND,

A SERIES OF STRATEGIC PARTNERS OPPORTUNITY FUNDS

Gateway Center Three

100 Mulberry Street

Newark, New Jersey 07102

IMPORTANT PROXY MATERIALS

PLEASE VOTE NOW

September , 2006

Dear Shareholder:

I am writing to ask you to vote on one or both of the important proposals whereby the assets of each of the following funds:

• Strategic Partners Mid-Cap Growth Fund (Mid-Cap Growth Fund), a series of Strategic Partners Mutual Funds, Inc. (SP Mutual Funds); and

• Strategic Partners New Era Growth Fund (New Era Growth Fund, and together with Mid-Cap Growth Fund, the Target Funds), a series of Strategic Partners Opportunity Funds (SP Opportunity Funds)

would be acquired in separate transactions by Jennison U.S. Emerging Growth Fund, Inc. (Emerging Growth Fund, and together with the Target Funds, the Funds), and Emerging Growth Fund would acquire all of the assets and assume all of the liabilities of each of Mid-Cap Growth Fund and New Era Growth Fund (each, a Reorganization and together, the Reorganizations). Emerging Growth Fund and SP Mutual Funds are Maryland corporations. SP Opportunity Funds is a Delaware statutory trust.

Shareholder meetings (each, a Meeting) are scheduled on Thursday December 7, 2006 as follows: 5:00 p.m. Eastern time for Mid-Cap Growth Fund and 5:00 p.m. Eastern time for New Era Growth Fund. Only shareholders of Mid-Cap Growth Fund will vote on the acquisition of Mid-Cap Growth Fund's assets and the assumption of Mid-Cap Growth Fund's liabilities by Emerging Growth Fund. Only shareholders of New Era Growth Fund will vote on the acquisition of New Era Growth Fund's assets and the assumption of New Era Growth Fund's liabilities by Emerging Growth Fund. Shareholder approval of one Reorganization is not contingent upon, and will not affect, shareholder approval of the other Reorganization. In addition, completion of one Reorganization is not contingent upon, and will not affect, completion of the other Reorganization.

This package contains important information about the proposals and includes materials you will need in order to vote. The Board of Directors of SP Mutual Funds and the Board of Trustees of SP Opportunity Funds have reviewed and approved the proposals and recommended that they be presented to shareholders of the relevant Target Fund for their consideration. Although the relevant directors have determined that each proposal is in the best interests of each Fund's shareholders, the final decision is up to you.

If a Reorganization is approved, shareholders of the relevant Target Fund would have the opportunity to participate in a single mutual fund with virtually identical investment objectives and substantially similar investment policies. Combining both Mid-Cap Growth Fund and New Era Growth Fund or either Target Fund alone with Emerging Growth Fund will allow shareholders of the participating Funds to enjoy a larger asset base over which certain expenses may be spread. In addition, shareholders of each Target Fund are expected to realize a reduction in both the net and gross annual operating expenses borne by such shareholders, including a reduction in investment management fee rates, as a result of the consummation of the relevant Reorganization.

The accompanying combined joint proxy statement and prospectus includes a detailed description of the proposals. Please read the enclosed materials carefully and cast your vote.

Remember, your vote is extremely important, no matter how large or small your holdings. By voting now, you can help avoid additional costs that would be incurred with follow-up letters and calls.

To vote, you may use any of the following methods:

• By Mail. Please complete, date and sign your proxy card before mailing it in the enclosed postage paid envelope. Proxy cards must be received by 11:59 p.m. Eastern time on the day prior to the relevant Meeting to be counted.

• By Internet. Have your proxy card available. Go to the web site: www.proxyvote.com. Enter your 12-digit control number from your proxy card. Follow the simple instructions found on the web site. Votes must be entered by 11:59 p.m. Eastern time on the day prior to the Meeting to be counted.

• By Telephone. If your fund shares are held in your own name, call 1-800-690-6903 toll-free. If your fund shares are held on your behalf in a brokerage account, call 1-800-454-8683 toll-free. Enter your 12-digit control number from your proxy card. Follow the simple instructions. Votes must be entered by 11:59 p.m. Eastern time on the day prior to the relevant Meeting to be counted.

• Attend the relevant Meeting in person.

Special Note for Systematic Investment Plans (e.g., Automatic Investment Plan, Systematic Exchange, etc.). Shareholders in systematic investment plans must contact their financial adviser or call our customer service division, toll free, at 1-800-225-1852 to change their investment options. Otherwise, if a proposed transaction is approved, starting on the day following the closing of the proposed transaction (which is expected to occur after the relevant Meeting as reasonably practicable), future purchases will automatically be made in shares of Emerging Growth Fund.

If you have any questions before you vote, please call MIS, an ADP Company, at 1-888-684-2435 toll-free. They will be happy to help you understand the proposals and assist you in voting.

Judy A. Rice

President

STRATEGIC PARTNERS MID-CAP GROWTH FUND,

A SERIES OF STRATEGIC PARTNERS MUTUAL FUNDS, INC.

STRATEGIC PARTNERS NEW ERA GROWTH FUND,

A SERIES OF STRATEGIC PARTNERS OPPORTUNITY FUNDS

Gateway Center Three

100 Mulberry Street

Newark, New Jersey 07102

NOTICE OF SPECIAL MEETINGS OF SHAREHOLDERS

To Our Shareholders:

Notice is hereby given that Special Meetings of Shareholders (each, a Meeting) of each of the following funds:

• Strategic Partners Mid-Cap Growth Fund (Mid-Cap Growth Fund), a series of Strategic Partners Mutual Funds, Inc. (SP Mutual Funds), a Maryland corporation; and

• Strategic Partners New Era Growth Fund (New Era Growth Fund, and together with Mid-Cap Growth Fund, the Target Funds), a series of Strategic Partners Opportunity Funds (SP Opportunity Funds), a Delaware statutory trust

will be held at Gateway Center Three, 100 Mulberry Street, 14th Floor, Newark, New Jersey 07102, on Thursday, December 7, 2006, at 5:00 p.m. Eastern time for Mid-Cap Growth Fund and 5:00 p.m. Eastern time for New Era Growth Fund, for the following purposes, as applicable:

1. For shareholders of Mid-Cap Growth Fund to approve or disapprove a Plan of Reorganization and the reorganization it contemplates, under which Mid-Cap Growth Fund will transfer all of its assets to, and all of its liabilities will be assumed by, Jennison U.S. Emerging Growth Fund, Inc. (Emerging Growth Fund and, together with the Target Funds, the Funds). In connection with this proposed reorganization, each whole and fractional share of each class of Mid-Cap Growth Fund will be exchanged for whole and fractional shares of equal dollar value of the corresponding class of Emerging Growth Fund, outstanding shares of Mid-Cap Growth Fund will be cancelled, and Mid-Cap Growth Fund will be liquidated and terminated.

2. For shareholders of New Era Growth Fund to approve or disapprove a Plan of Reorganization and the reorganization it contemplates, under which New Era Growth Fund will transfer all of its assets to, and all of its liabilities will be assumed by, Emerging Growth Fund. In connection with this proposed reorganization, each whole and fractional share of each class of New Era Growth Fund will be exchanged for whole and fractional shares of equal dollar value of the corresponding class of Emerging Growth Fund, outstanding shares of New Era Growth Fund will be cancelled, and New Era Growth Fund will be liquidated and terminated.

3. To transact such other business as may properly come before each Meeting or any adjournments or postponements of each Meeting.

There will be one Plan of Reorganization (the Plan) that covers both reorganization transactions. The Plan provides that shareholder approval of one reorganization transaction is not contingent upon, and will not affect, shareholder approval of the other reorganization transaction. In addition, completion of one reorganization transaction is not contingent upon, and will not affect, completion of the other reorganization transaction.

The Board of Directors of SP Mutual Funds, on behalf of Mid-Cap Growth Fund, and the Board of Trustees of SP Opportunity Funds, on behalf of New Era Growth Fund, have each fixed the close of business on September 8, 2006 as the record date for the determination of the shareholders of the relevant Target Fund entitled to notice of, and to vote at, the relevant Meeting and any adjournments of the relevant Meeting.

Deborah A. Docs

Secretary

Dated: September __, 2006

A proxy card is enclosed along with this combined joint Prospectus and Proxy Statement for each proposal that is applicable to you. Please vote your shares today by signing and returning the enclosed proxy card(s) in the postage prepaid envelope provided. You may also vote by telephone or via the Internet as described in the enclosed materials. The Board of Directors of SP Mutual Funds and the Board of Trustees of SP Opportunity Funds recommend that you vote FOR the Mid-Cap Growth Fund proposal and the New Era Growth Fund proposal, respectively.

Your vote is important.

Please return your proxy card promptly

or vote by telephone or over the internet.

Shareholders are invited to attend the relevant Meeting in person. Any shareholder who does not expect to attend the relevant Meeting is urged to complete the enclosed proxy card, date and sign it, and return it in the envelope provided, which needs no postage if mailed in the United States. You may also vote by telephone or over the Internet as described in the materials provided to you. In order to avoid unnecessary expense, we ask for your cooperation in mailing your proxy card promptly, no matter how large or small your holdings may be.

INSTRUCTIONS FOR EXECUTING YOUR PROXY CARD

The following general rules for executing proxy cards may be of assistance to you and may help avoid the time and expense involved in validating your vote if you fail to execute your proxy card properly.

1. INDIVIDUAL ACCOUNTS: Your name should be signed exactly as it appears on the account registration shown on the proxy card.

2. JOINT ACCOUNTS: Both owners must sign and the signatures should conform exactly to the names shown on the account registration.

3. ALL OTHER ACCOUNTS should show the capacity of the individual signing. This can be shown either in the form of account registration or by the individual executing the proxy card. For example:

| REGISTRATION | | VALID SIGNATURE | |

| A. | | | 1. | | | XYZ Corporation | | John Smith, President | |

|

| | | | 2. | | | XYZ Corporation | | John Smith, President | |

|

| | | | | | | c/o John Smith, President | | | |

|

| B. | | | 1. | | | ABC Company Profit Sharing Plan | | Jane Doe, Trustee | |

|

| | | | 2. | | | Jones Family Trust | | Charles Jones, Trustee | |

|

| | | | 3. | | | Sarah Clark, Trustee | | Sarah Clark, Trustee | |

|

| | | | | | | u/t/d 7/1/85 | | | |

|

| C. | | | 1. | | | Thomas Wilson, Custodian | | Thomas Wilson, Custodian | |

|

| | | | | | | f/b/o Jessica Wilson UTMA | | | |

|

| | | | | | | New Jersey | | | |

|

PROXY STATEMENT

for

STRATEGIC PARTNERS MID-CAP GROWTH FUND,

A SERIES OF STRATEGIC PARTNERS MUTUAL FUNDS, INC.

and

STRATEGIC PARTNERS NEW ERA GROWTH FUND,

A SERIES OF STRATEGIC PARTNERS OPPORTUNITY FUNDS

and

PROSPECTUS

for

JENNISON U.S. EMERGING GROWTH FUND, INC.

Gateway Center Three

100 Mulberry Street

Newark, New Jersey 07102

(973) 367-7521

Dated September , 2006

Acquisition of the Assets of Strategic Partners Mid-Cap Growth Fund

and

Acquisition of the Assets of Strategic Partners New Era Growth Fund

By and in exchange for shares of Jennison U.S. Emerging Growth Fund, Inc.

This combined joint Proxy Statement and Prospectus (Prospectus/Proxy Statement) is being furnished to the shareholders of each of the following funds:

• Strategic Partners Mid-Cap Growth Fund (Mid-Cap Growth Fund), a series of Strategic Partners Mutual Funds, Inc. (SP Mutual Funds), a Maryland corporation; and

• Strategic Partners New Era Growth Fund (New Era Growth Fund, and together with Mid-Cap Growth Fund, the Target Funds), a series of Strategic Partners Opportunity Funds (SP Opportunity Funds), a Delaware statutory trust

in connection with the solicitation of proxies by the Board of Directors of SP Mutual Funds and the Board of Trustees of SP Opportunity Funds for use at special meetings of shareholders of Mid-Cap Growth Fund and New Era Growth Fund, respectively, and at any adjournments or postponements thereof (each, a Meeting and together, the Meetings).

The Meetings will be held at Gateway Center Three, 100 Mulberry Street, 14th Floor, Newark, New Jersey 07102 on Thursday, December 7, 2006 as follows: 5:00 p.m. Eastern time for Mid-Cap Growth Fund, and 5:00 p.m. Eastern time for New Era Growth Fund. This Prospectus/Proxy Statement will first be sent to shareholders on or about September 29, 2006.

The purpose of the Meetings is for shareholders of Mid-Cap Growth Fund and New Era Growth Fund, as applicable, to vote on the Plan of Reorganization (the Plan), under which a Target Fund will transfer all of its assets to, and all of its liabilities will be assumed by, Jennison U.S. Emerging Growth Fund, Inc. (Emerging Growth Fund, and together with the Target Funds, the Funds), a Maryland corporation, solely in exchange for shares of Emerging Growth Fund, which will be distributed to shareholders of the relevant Target Fund, and the subsequent cancellation of shares of such Target Fund and its liquidation and termination (each, a Reorganization and together, the Reorganizations). If the Plan receives the required approval from the relevant Target Fund shareholders, each whole and fractional share of each class of the relevant Target Fund will be exchanged for whole and fractional shares of equal dollar value of the corresponding class of Em erging Growth Fund subsequent to the relevant Meeting or any adjournment thereof, the relevant Target Fund subsequently will be liquidated and terminated, and Emerging Growth

1

Fund will be the surviving fund. The Plan provides that shareholder approval of one Reorganization is not contingent upon, and will not affect, shareholder approval of the other Reorganization. In addition, completion of one Reorganization is not contingent upon, and will not affect, completion of the other Reorganization.

The investment objectives of the Funds are virtually identical. The investment objective of each Target Fund is to seek long-term growth of capital while the investment objective of Emerging Growth Fund is long-term capital appreciation. In short, each Fund seeks investments whose price will increase over several years. No assurance can be given that any Fund will achieve its investment objective.

The investment policies of the Funds are substantially similar. Each Fund invests primarily in the equity securities of companies with the potential for above-average growth. Each Fund has a slightly different focus with respect to market capitalization. While Emerging Growth Fund currently focuses primarily on small and medium-sized U.S. companies, Mid-Cap Growth Fund focuses primarily on medium-sized companies and New Era Growth Fund invests in companies of any size. Each Fund generally uses a "growth" investment style. Effective March 15, 2007, Emerging Growth Fund will focus primarily on the equity and equity-related securities of medium-sized companies with the potential for above-average growth and the name of the Fund will be changed to Jennison Mid-Cap Growth Fund.

This Prospectus/Proxy Statement sets forth concisely the information about the Plan and the issuance of shares of Emerging Growth Fund that you should know before voting. You should retain it for future reference. Additional information about Emerging Growth Fund has been filed with the Securities and Exchange Commission (SEC) and can be found in the following documents:

• The Prospectus for Emerging Growth Fund, dated February 27, 2006, which is enclosed and incorporated by reference into this Prospectus/Proxy Statement;

• The Statement of Additional Information (SAI) for Emerging Growth Fund, dated February 27, 2006, which is incorporated by reference into this Prospectus/Proxy Statement;

• An SAI, dated September , 2006, relating to this Prospectus/Proxy Statement, which is incorporated by reference into this Prospectus/Proxy Statement;

• An Annual Report to Shareholders of Emerging Growth Fund for the fiscal year ended October 31, 2005, which is enclosed and is incorporated by reference into this Prospectus/Proxy Statement; and

• A Semi-Annual Report to Shareholders of Emerging Growth Fund for the fiscal period ended April 30, 2006, which is enclosed and is incorporated by reference into this Prospectus/Proxy Statement.

You may request a free copy of these documents by calling 1-800-225-1852 or by writing to Emerging Growth Fund at the above address.

The SEC has not approved or disapproved these securities or passed upon the adequacy of this Prospectus/Proxy Statement. Any representation to the contrary is a criminal offense.

Mutual fund shares are not deposits or obligations of, or guaranteed or endorsed by, any bank, and are not insured by the Federal Deposit Insurance Corporation or any other U.S. government agency. Mutual fund shares involve investment risks, including the possible loss of principal.

SUMMARY

The following is a summary of certain information contained elsewhere in this Prospectus/Proxy Statement, including the Plan. You should read the more complete information in the rest of this Prospectus/Proxy Statement, including the form of Plan (attached as Exhibit A), the Prospectus for Emerging Growth Fund, dated February 27, 2006 (enclosed as Exhibit B), the Annual Report to Shareholders of Emerging Growth Fund for the fiscal year ended October 31, 2005 (enclosed as Exhibit C), and the Semi-Annual Report to Shareholders of Emerging Growth Fund for the fiscal period ended April 30, 2006 (enclosed as Exhibit D). You should also review the SAI relating to this Prospectus/Proxy Statement. This Prospectus/Proxy Statement is qualified in its entirety by reference to these documents. You should read these materials for more complete information.

2

The Proposals

Shareholders of each Target Fund are being asked to consider and approve the Plan, which will have the effect of combining their respective Target Fund and Emerging Growth Fund into a single mutual fund. Mid-Cap Growth Fund is a series of an open-end investment company that is organized as a Maryland corporation. New Era Growth Fund is a series of an open-end investment company that is organized as a Delaware statutory trust. Emerging Growth Fund is an open-end investment company that is organized as a Maryland corporation.

If the Reorganization with respect to your Target Fund receives the required shareholder approval and is completed, the assets of that Target Fund will be transferred to, and all of the liabilities of that Target Fund will be assumed by, Emerging Growth Fund in exchange for an equal value of shares of Emerging Growth Fund. Shareholders of that Target Fund will have their class of shares exchanged for the same class of shares of Emerging Growth Fund of equal dollar value based upon the value of the shares at the time that Target Fund's assets are transferred to Emerging Growth Fund. After the transfer of assets, assumption of liabilities, and exchange of shares have been completed, the Target Fund will be liquidated and terminated and you will cease to be a shareholder of that Target Fund and will become a shareholder of Emerging Growth Fund.

There will be one Plan for both Reorganizations. The Plan provides that shareholder approval of one Reorganization is not contingent upon, and will not affect, shareholder approval of the other Reorganization. In addition, completion of one Reorganization is not contingent upon, and will not affect, the completion of the other Reorganization.

For the reasons set forth below, the Boards of Directors of SP Mutual Funds and Emerging Growth Fund and the Board of Trustees of SP Opportunity Funds have determined that the proposed Reorganization of each Target Fund into Emerging Growth Fund is in the best interests of Fund shareholders and that the interests of Fund shareholders would not be subject to any dilution as a result of the consummation of the relevant Reorganization:

• The Funds have virtually identical investment objectives;

• The Funds have substantially similar investment policies and restrictions;

• Shareholders of the Target Funds are expected to realize a reduction in net and gross operating expenses as a result of the consummation of one or both of the Reorganizations;

• Shareholders of the Target Funds are expected to realize a reduction in investment management fee rates as a result of the consummation of one or both of the Reorganizations;

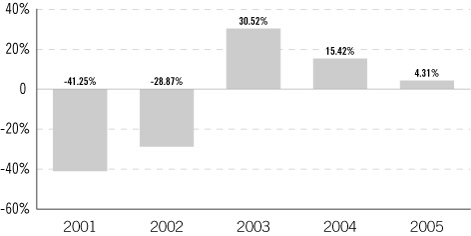

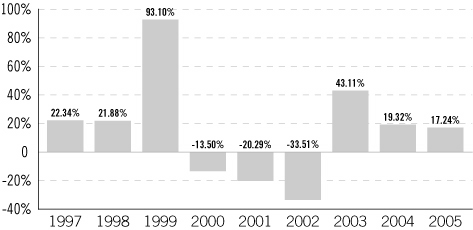

• Emerging Growth Fund has outperformed Mid-Cap Growth Fund and New Era Growth Fund over the past three month, 1-year, 3- year and 5-year time periods;

• Emerging Growth Fund has substantially more assets than either Target Fund; and

• Shareholders of each Fund could benefit from the long-term economies of scale that may result from consummation of one or both of the Reorganizations.

See the section entitled "Reasons for the Reorganizations" for a more detailed discussion.

The Board of Directors of SP Mutual Funds, on behalf of Mid-Cap Growth Fund, and the Board of Trustees of SP Opportunity Funds, on behalf of New Era Growth Fund, have approved the Plan and unanimously recommend that you vote to approve the Plan.

Shareholder Voting

Shareholders who own shares of a Target Fund as of the close of business on September 8, 2006 (the Record Date) will be entitled to vote at the relevant Meeting, and will be entitled to one vote for each full share and a fractional vote for each fractional share that they hold of that Target Fund. Shareholder approval of the Plan with respect to a Target Fund requires the affirmative vote of the holders of a "majority of the outstanding voting securities" of the relevant Target Fund as defined under the Investment Company Act of 1940 Act (the 1940 Act).

3

A majority of the outstanding voting securities for these purposes means the lesser of: (i) 67% or more of the voting shares of a Target Fund represented at a meeting at which more than 50% of the outstanding voting shares of the Target Fund are present in person or represented by proxy; or (ii) more than 50% of the outstanding voting shares of a Target Fund.

Please vote your shares as soon as you receive this Prospectus/Proxy Statement. You may vote by completing and signing the enclosed ballot (proxy card) or over the Internet or by phone. If you vote by any of these methods, your votes will be officially cast at the relevant Meeting by persons appointed as proxies. If you own shares in both Target Funds or in multiple accounts, you will receive multiple proxy cards. Each proxy card must be voted for all of your shares to be voted.

You can revoke or change your voting instructions at any time until the vote is taken at a Meeting. For more details about shareholder voting, see the "Voting Information" section of this Prospectus/Proxy Statement.

COMPARISON OF IMPORTANT FEATURES

Investment Objectives and Principal Investment Policies of the Funds

This section describes the investment objective and policies of the Funds and the differences between them. For a complete description of the investment policies and risks for Emerging Growth Fund, you should read the Prospectus for Emerging Growth Fund (enclosed as Exhibit B and incorporated by reference into this Prospectus/Proxy Statement) and the Statement of Additional Information for Emerging Growth Fund, dated February 27, 2006 (incorporated by reference into this Prospectus/Proxy Statement).

The investment objectives of the Funds are virtually identical. The investment objective of each Target Fund is to seek long-term growth of capital while the investment objective of Emerging Growth Fund is long-term capital appreciation. In short, each Fund seeks investments whose price will increase over several years. The investment objectives of Emerging Growth Fund and New Era Growth Fund are fundamental policies that cannot be changed by the relevant Board of Directors/Trustees without shareholder approval. The investment objective of Mid-Cap Growth Fund is a non-fundamental policy that may be changed by the Board of Directors of SP Mutual Funds without shareholder approval. No assurance can be given that any Fund will achieve its investment objective.

Each Fund invests primarily in the equity securities of companies with the potential for above-average growth. Each Fund pursues its investment objective through various investment strategies that are employed by that Fund's respective subadviser(s) as follows:

• Emerging Growth Fund normally invests at least 80% of its investable assets in equity securities of small and medium-sized U.S. companies with the potential for above-average growth. The term "investable assets" in this Prospectus/Proxy Statement refers to a Fund's net assets plus any borrowings for investment purposes. A Fund's investable assets will be less than its total assets to the extent that it has borrowed money for non-investment purposes, such as to meet anticipated redemptions. Effective March 15, 2007, Emerging Growth Fund will normally invest at least 80% of its investable assets in equity and equity-related securities of medium-sized companies with the potential for above-average growth and the name of the Fund will be changed to Jennison Mid-Cap Growth Fund. Emerging Growth Fund will provide 60 days' prior written notice to shareholders of a change in its non-fundamental policy of investing at least 80% of i ts investable assets in the type of investment suggested by its name. Emerging Growth Fund currently considers small and medium-sized companies to be those with market capitalizations (measured at the time of investment) that are generally less than the largest capitalization of the Russell Mid Cap Index. As of June 30, 2006, the largest market capitalization of a company represented in the Russell Mid Cap Index was approximately $____ billion. Effective March 15, 2007, Emerging Growth Fund will consider medium-sized companies to be those whose market capitalizations (measured at the time of investment) fall within the range of companies in the Russell Mid Cap Growth Index. The market capitalizations within the Russell Mid Cap Growth Index will vary, but as of June 30, 2006, they ranged from approximately $___ [million/billion] to $____ billion. Emerging

4

Growth Fund's subadviser, Jennison Associates LLC (Jennison), currently looks for small and medium-sized companies that have growth in sales and earnings driven by products or services. These companies usually have a unique market niche, a strong new product profile or superior management. Jennison analyzes companies using fundamental techniques. Emerging Growth Fund also may invest up to 20% of its investable assets in the equity securities of large capitalization companies. Effective March 15, 2007, Emerging Growth Fund may invest up to 35% of its investable assets in foreign securities, excluding American Depositary Receipts (ADRs) or similar receipts and shares traded in U.S. markets.

In addition to buying common stocks, Emerging Growth Fund may invest in other equity-related securities. Equity-related securities include ADRs; American Depositary Shares (ADSs); common stocks; non-convertible preferred stocks; warrants and rights that can be exercised to obtain stock; investments in various types of business ventures, including partnerships and joint ventures; securities of real estate investment trusts (REITs); and similar securities. Emerging Growth Fund also may buy convertible securities. These are securities – like bonds, corporate notes and preferred stocks – that it can convert into a company's common stock or some other equity related security. Emerging Growth Fund will only invest in investment-grade convertible securities. Emerging Growth Fund also may participate in the initial public offering (IPO) market. Generally, Emerging Growth Fund considers selling a security when, in the opinion of Jennison, t he security has experienced a fundamental disappointment in earnings; it has reached an intermediate-term price objective and its outlook no longer seems sufficiently promising; a relatively more attractive security emerges; or the security has experienced adverse price movements.

• Mid-Cap Growth Fund has a non-fundamental policy to invest, under normal circumstances, at least 80% of the value of its assets in medium capitalization companies. The 80% investment requirement applies at the time Mid-Cap Growth Fund invests its assets. Mid-Cap Growth Fund will provide 60 days' prior written notice to shareholders of a change in this non-fundamental policy. Mid-Cap Growth Fund pursues its investment objective by investing primarily in equity securities selected for their growth potential. Equity securities include common stocks, preferred stocks, warrants and securities convertible into or exchangeable for common or preferred stocks. For purposes of Mid-Cap Growth Fund, medium-sized companies are those whose market capitalizations (measured at the time of investment) fall within the range of companies in the Russell Mid Cap Growth Index. The market capitalizations within the Russell Mid Cap Growth Index wi ll vary, but as of June 30, 2006, they ranged from approximately $___ [million/billion] to $____ billion. Mid-Cap Growth Fund's subadviser, Goldman Sachs Asset Management, L.P. (GSAM), generally takes a "bottom up" approach to choosing investments for the Fund. In other words, GSAM seeks to identify individual companies with earnings growth potential that may not be recognized by the market at large.

• New Era Growth Fund's strategy is to invest in the favorite stock selection ideas of Calamos Advisors LLC (Calamos) and TCW Investment Management Company, its two subadvisers. Each subadviser builds a portfolio with stocks in which it has the highest confidence and may invest more than 5% of New Era Growth Fund's assets in any one issuer. New Era Growth Fund normally invests at least 65% of its total assets in equity-related securities of emerging U.S. companies that are believed to have strong capital appreciation potential. Emerging companies, however, may be of any size (i.e., small-, medium-, and large-capitalization companies). These companies are expected to have products, technologies, management, markets and opportunities that will help achieve an earnings growth over time that is well above the growth rate of the overall U.S. economy. The primary equity-related securities in which the Fund invests are common stocks .

In deciding which stocks to buy, each subadviser uses what is known as a growth investment style. This means that a subadviser will invest in stocks that it believes could experience superior sales or earnings growth. Calamos employs a top-down, bottom-up process focusing on stocks. The portfolio managers focus on long-term earnings sustainability and return on capital, along with a valuation overlay. The top-down view is used to set sector weights, which are influenced by macroeconomic themes such as the phase of the economic cycle, political factors, or the inflationary environment. The entire investment process is highly dependent on a number of proprietary research and pricing models. TCW Investment Management Company takes a bottom-up, fundamental research-based approach to stock selection. TCW Investment Management Company

5

is a long-term investor and believes that over the long-term, stock prices follow earnings growth. TCW Investment Management Company's strategy seeks to purchase securities of profitable, growing companies whose business prospects are believed to be improperly estimated by consensus research.

In addition to common stocks in which New Era Growth Fund primarily invests, equity-related securities include nonconvertible preferred stocks; convertible securities; ADRs; warrants and rights that can be exercised to obtain stock; investments in various types of business ventures, including partnerships and joint ventures; REITs; and similar securities. Convertible securities are securities – like bonds, corporate notes and preferred stocks – that can be converted into the company's common stock or some other equity security. REITs invest primarily in real estate or real estate mortgages and distribute almost all of their income – most of which comes from rents, mortgages and gains on sales of property – to shareholders. New Era Growth Fund may invest up to 25% of its investable assets in REITs as a secondary strategy. In addition, New Era Growth Fund also may participate in the IPO market. New Era Growth Fund intends t o be fully invested, holding less than 5% of its total assets in cash under normal market conditions.

Each of Emerging Growth Fund and Mid-Cap Growth Fund is a "diversified" investment company under the 1940 Act while New Era Growth Fund is a "non-diversified" investment company under the 1940 Act. See "Comparison of Other Policies – Diversification" and "Investment Restrictions" below.

The Funds typically distribute annually all or substantially all of their ordinary income and net realized capital gains.

After one or both Reorganizations are completed, it is expected that the combined, surviving fund will be managed according to the investment objective and policies of Emerging Growth Fund.

Comparison of Other Investment Policies

Diversification

Each of Emerging Growth Fund and Mid-Cap Growth Fund is a "diversified" investment company under the 1940 Act. As diversified investment companies, with respect to 75% of their assets, Emerging Growth Fund and Mid-Cap Growth Fund cannot invest more than 5% of their respective assets in the securities of any one issuer (except U.S. Government obligations) or cannot hold more than 10% of the outstanding voting securities of any one issuer. New Era Growth Fund is a "non-diversified" investment company under the 1940 Act, which means that the 5% and 10% limitations are computed with respect to 50% of its assets.

Foreign Securities

Each Fund may invest in securities of foreign issuers. Emerging Growth Fund and New Era Growth Fund may invest up to 20% and 35% of their respective investable assets in foreign securities, including stocks and other equity-related securities, money market instruments and other investment-grade fixed income securities of foreign issuers including securities of issuers in emerging markets. Effective March 15, 2007, Emerging Growth Fund may invest up to 35% of its investable assets in foreign securities. Neither of these Funds considers ADRs, ADSs and other similar receipts or shares traded in U.S. markets to be foreign securities. Mid-Cap Growth Fund may invest up to 25% of its net assets in foreign securities denominated in foreign currencies and not publicly traded in the United States. Mid-Cap Growth Fund may also invest in foreign companies through depository receipts or passive foreign investment companies.

Fixed-Income Obligations

Fixed-income obligations include bonds and notes. Emerging Growth Fund may invest up to 20% of its investable assets in fixed-income obligations. Emerging Growth may invest only in investment-grade corporate or government obligations. Investment-grade obligations are rated in one of the top four long-term quality ratings by a major rating service (such as Baa/BBB or better by Moody's Investors Service, Inc. or Standard & Poor's Ratings Services, respectively). Emerging Growth Fund also may invest in obligations that are not rated, but that are believed

6

to be of comparable quality. Obligations rated in the fourth category (Baa/BBB) have speculative characteristics. Although GSAM expects to invest primarily in domestic and foreign equity securities, Mid-Cap Growth Fund may also invest to a lesser degree in debt securities (i.e., up to 20% under normal circumstances). These debt securities may include bonds rated below investment-grade (sometimes referred to as junk bonds), mortgage-backed securities, asset-backed securities, and zero coupon bonds. Junk bonds are regarded as having predominantly speculative characteristics with respect to capacity to pay interest income and repay principal. New Era Growth Fund may invest up to 35% of its investable assets in securities issued or guaranteed by the U.S. government or by an agency or instrumentality of the U.S. government. Some U.S. government securities are backed by the full faith and credit of the United States, which means that payment of pr incipal and interest are guaranteed but market value is not. Some are supported only by the credit of the issuing agency and depend entirely on their own resources to repay their debt and are subject to the risk of default like private issuers.

Derivative Instruments

Each Fund may use various derivative strategies to try to improve its returns. Each Fund may also use hedging techniques to try to protect its assets. The use of derivatives – such as futures, foreign currency forward contracts, options on futures and various types of swaps – involves costs and can be volatile. With derivatives, the relevant subadviser tries to predict if the underlying investment – a security, market index, currency, interest rate, or some other benchmark, will go up or down at some future date. The relevant subadviser may use derivatives to try to reduce risk or to increase return consistent with the Fund's overall investment objectives. The relevant subadviser will consider other factors (such as cost) in deciding whether to employ any particular strategy or technique, or use any particular instrument. Any derivatives used may not match or offset a Fund's underlying positions and this could result in losses to the Fund that would not otherwise have occurred. Derivatives that involve leverage could magnify losses. When a Fund uses derivative strategies, the Fund designates certain assets as segregated or otherwise covers its exposure, as required by the rules of the SEC. Emerging Growth Fund and New Era Growth Fund usually invest less than 10% of their respective investable assets in derivatives. The Funds cannot guarantee these derivative strategies will work, that the instruments necessary to implement these strategies will be available or that the Funds will not lose money.

Short Sales

Emerging Growth Fund and New Era Growth Fund may make short sales of securites. This means that Emerging Growth Fund and New Era Growth Fund may sell a security that they do not own, which they may do, for example, when the relevant subadviser thinks the value of the security will decline. Emerging Growth Fund and New Era Growth Fund generally borrow the security to deliver to the buyer in a short sale. Emerging Growth Fund and New Era Growth Fund must then replace the borrowed security by purchasing it at the market price at the time of replacement. Short sales involve costs and risks. Mid-Cap Growth Fund has a non-fundamental policy that it will not engage in short sales.

Each Fund also may make short sales "against the box". In a short sale against the box, at the time of sale, the Fund owns or has the right to acquire the identical security at no additional cost. When selling short against the box, a Fund gives up the opportunity for capital appreciation in the security. No more than 25% of the respective net assets of Emerging Growth Fund and New Era Growth Fund, and usually no more than 10% of their respective total assets, will be subject to short sales. Short sales against the box are not subject to this limitation for Emerging Growth Fund.

Illiquid Securities

Each Fund may invest up to 15% of its net assets in illiquid securities, including securities with legal or contractual restrictions on resale, those without a readily available market, and repurchase agreements with maturities longer than seven days. Certain derivative instruments held by the Funds may also be considered illiquid.

7

Borrowing

Each Fund may borrow up to 33 1/3% of the value of its total assets calculated when the loan is made. If a Fund's asset coverage for borrowing falls below 300%, the Fund will take action to reduce its borrowings in accordance with applicable law. If the 300% asset coverage should decline, the Fund may be required to sell portfolio securities to reduce the debt and restore the 300% asset coverage, even though it may be disadvantageous from an investment standpoint to sell securities at that time. Emerging Growth Fund and New Era Growth will not purchase portfolio securities when borrowings exceed 5% of the value of their respective total assets. Mid-Cap Growth Fund does not have such a policy. Additionally, Emerging Growth Fund will take prompt action to reduce its borrowing if it holds more than 15% of its net assets in illiquid securities.

Lending of Portfolio Securities

Consistent with the applicable regulatory requirements, each Fund may lend its portfolio securities to brokers, dealers and financial institutions, if outstanding loans do not exceed 33 1/3% of the value of such Fund's assets and the loans are callable at any time by the Fund.

Temporary Defensive Investments

In response to adverse market, economic or political conditions, each Fund may take a temporary defensive position and invest up to 100% of the Fund's assets in money market instruments, including short-term obligations of, or securities guaranteed by, the U.S. Government, its agencies or instrumentalities or in high-quality obligations of banks and corporations, and may hold up to 100% of the Fund's assets in cash or cash equivalents. Investing heavily in these securities limits the Fund's ability to achieve its investment objectives, but can help to preserve the Fund's assets.

Investments in Affiliated and Non-affiliated Funds

The Funds may invest up to 25% of their respective total assets in shares of affiliated money-market funds or open-ended short-term bond funds with a portfolio maturity of three years or less. The Funds may invest up to 10% of their respective total assets in other non-affiliated investment companies, subject to additional restrictions under the 1940 Act.

Investment Restrictions

Each Fund has adopted fundamental investment restrictions, which limit its ability to: (i) issue senior securities; (ii) borrow money (except for non-leveraging, temporary, or emergency purposes); (iii) underwrite securities; (iv) purchase or sell real estate; (v) purchase or sell physical commodities; (vi) make loans (except for certain securities lending transactions); and (vi) invest more than 25% of its assets in any one industry. In addition, Emerging Growth Fund and Mid-Cap Growth Fund have adopted fundamental investment restrictions to diversify their respective investments. Accordingly, Emerging Growth Fund and Mid-Cap Growth Fund are diversified funds under the 1940 Act. This means that they may not, with respect to 75% of the value of their respective total assets, purchase a security of any issuer (other than U.S. Government securities) or securities of other investment companies) if, as a result (i) more than 5% of the value of t he Fund's total assets would be invested in the securities of such issuer, or (ii) more than 10% of the outstanding voting securities of such issuer would be held by the Fund. Under the 1940 Act, a fundamental policy may not be changed without the approval of the holders of a majority of the Fund's outstanding voting securities. For these purposes, a "majority of the outstanding voting securities" of a Fund means the lesser of: (i) 67% or more of the voting shares of a Fund represented at a meeting at which more than 50% of the outstanding voting shares of the Fund are present in person or represented by proxy; or (ii) more than 50% of the outstanding voting shares of a Fund.

Each Fund also has certain non-fundamental restrictions. These non-fundamental investment restrictions may be changed by the relevant Board without shareholder approval. Under its non-fundamental investment restrictions, Emerging Growth Fund may not: (i) purchase securities on margin (but the Fund may obtain such short-term credits as may be necessary for the clearance of transactions); provided that the deposit or payment by the Fund of initial

8

or maintenance margin in connection with futures or options is not considered the purchase of a security on margin; (ii) make short sales of securities or maintain a short position if, when added together, more than 25% of the value of the Fund's net assets would be (a) deposited as collateral for the obligation to replace securities borrowed to effect short sales and (b) allocated to segregated accounts in connection with short sales; provided, however, that short sales "against-the-box" are not subject to this limitation; (iii) make investments for the purpose of exercising control or management; (iv) invest in securities of other non-affiliated investment companies, except by purchases in the open market involving only customary brokerage commissions and as a result of which the Fund will not hold more than 3% of the outstanding voting securities of any one investment company, will not have invested more than 5% of its total assets in any one investment company and will not have invested more than 10% of its total assets (determined at the time of investment) in such securities of one or more investment companies, or except as part of a merger, consolidation or other acquisition; (v) purchase more than 10% of all outstanding voting securities of any one issuer; and (vi) change its policy of investing at least 80% of its investable assets in the type of investments suggested by the Fund's name. In addition, Emerging Growth Fund may not acquire securities of other investment companies or registered unit investment trusts in reliance on subparagraph (F) or (G) of Section 12(d)(1) of the 1940 Act so long as it is a fund in which one or more of the JennisonDryden Allocation Funds (which are series of The Prudential Investment Portfolios, Inc., Registration Nos. 33-61997, 811-7343) may invest. Under its non-fundamental investment restrictions, Mid-Cap Growth Fund may not: (i) change its policy to invest at least 80% of the value of its assets in m edium capitalization companies unless it provides 60 days prior written notice to its shareholders; (ii) sell securities short, unless it owns or has the right to obtain securities equivalent in kind and amount to the securities sold short without the payment of any additional consideration therefor, and provided that transactions in futures, options, swaps and forward contracts are not deemed to constitute selling securities short; (iii) purchase securities on margin, except that Mid-Cap Growth Fund may obtain such short-term credits as are necessary for the clearance of transactions, and provided that margin payments and other deposits in connection with transactions in futures, options, swaps and forward contracts shall not be deemed to constitute purchasing securities on margin; (iv) mortgage or pledge any securities owned or held by it in amounts that exceed, in the aggregate, 15% of its net asset value, provided that this limitation does not apply to reverse repurchase agreements, margin and other depo sits in connection with transactions in futures, options, swaps or forward contracts, or the segregation of assets in connection with such contracts; (v) purchase any security or enter into a repurchase agreement if, as a result, more than 15% of its net assets would be invested in repurchase agreements not entitling the holder to payment of principal and interest within seven days and in securities that are illiquid by virtue of legal or contractual restrictions on resale or the absence of a readily available market; and (vi) invest in companies for the purpose of exercising control of management. Under its non-fundamental investment restrictions, New Era Growth Fund may not: (i) make investments for the purpose of exercising control or management; (ii) invest in securities of other investment companies, except as permitted under the 1940 Act and the rules thereunder, as amended from time to time, or by any exemptive relief granted by the SEC, including investing up to 25% of its assets in shares of affilia ted mutual funds; and (iii) purchase portfolio securities when borrowings exceed 5% of the value of its total assets.

Risks of Investing in the Funds

As set forth below, the principal investment risks associated with an investment in both Target Funds are substantially similar to the principal investment risks associated with an investment in Emerging Growth Fund.

General. Like all investments, an investment in any of the Funds involves risk. An investment in a Fund is not a bank deposit and is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. No assurance can be given that the Funds will meet their respective investment objectives. The Funds invest primarily in equity or equity-related securities. As with any mutual fund investing primarily in equity securities, there is the risk that the price of particular equities the Funds own could go down, or the value of the equity markets or a sector of them could go down and that such declines could be substantial. Stock markets are volatile. Generally, the stock prices of small and medium-sized companies vary more than the prices of large company stocks and may present above-average risks. This means that when stock pri ces decline overall, a Fund may decline more than the Standard & Poor's 500 Composite Stock Price Index. This is particularly true for Emerging Growth Fund and Mid-Cap Growth Fund. In addition, different parts of a market can react differently to adverse issuer,

9

market, regulatory, political and economic developments. Since each Fund's investment objective involves long-term capital appreciation/long-term capital growth, the companies that the Funds invest in generally reinvest their earnings rather than distribute them to shareholders. As a result, each Fund is not likely to receive significant dividend income on its portfolio securities.

Initial Public Offerings. Emerging Growth Fund and New Era Growth Fund may participate in the initial public offering (IPO) market. The volume of IPOs and the levels at which the newly issued stocks trade in the secondary market are affected by the performance of the stock market overall. If IPOs are bought to the market, availability may be limited and if a Fund desired to acquire shares in such an offering, it may not be able to buy any shares at the offering price, or if it is able to buy shares, it may not be able to buy as many shares at the offering price as it would like. The prices of securities involved in IPOs are often subject to greater and more unpredictable price changes than more established stocks. Such unpredictability can have a dramatic impact on a Fund's performance (higher or lower) and any assumptions by investors based on the impacted perfo rmance may be unwarranted. In addition, as a Fund's assets grow, the impact of their IPO investments on performance will decline, which could reduce total returns.

Non-Diversification. New Era Growth Fund is a non-diversified fund under the 1940 Act and, as a result, can invest more than 5% of its assets in the securities of any one issuer. Investing in a non-diversified fund involves greater risk than investing in a diversified fund because a loss resulting from the decline in volume of securities issued by one issuer may represent a greater portion of the total assets of a non-diversified fund.

Growth Investing Style Risk. Each Fund follows an investing style that favors growth investments. Historically, growth investments, have performed best during the later stages of economic expansion. Therefore, the aggressive growth investing style may over time go in and out of favor. At times when growth investing styles used are out of favor, each Fund may underperform other equity funds that use different investing styles.

Derivatives. Each Fund may use investment strategies, such as derivatives, that involve risk. The Funds use these risk management techniques to try to preserve assets or enhance return. Derivatives may not fully offset the underlying positions and this could result in losses to the Funds that would not otherwise have occurred. Derivatives can increase share price volatility and those that involve leverage could magnify losses.

Foreign Securities. Investing in foreign securities subjects the Funds to additional risks. Foreign markets, economies and political systems may not be as stable as those in the U.S. and may involve additional risk. Foreign markets tend to be more volatile than U.S. markets and generally are not subject to regulatory requirements comparable to those in the U.S. Additionally, adverse changes in the value of foreign currencies can cause losses. These securities may also be less liquid than U.S. stocks and bonds. Also, differences in foreign laws, accounting standards, public information, custody and settlement practices may result in less reliable information.

Emerging Markets. Investments in securities of emerging markets involve additional risks. The securities markets of developing countries are less liquid, are subject to greater price volatility, have smaller market capitalizations, and have less government regulation than the securities markets of more developed countries and are not subject to such extensive and frequent accounting, financial and other reporting requirements as the securities markets of more developed countries. These risks are not normally associated with investments in more developed countries.

Fixed-Income Obligations. To the extent the Funds invest in fixed-income obligations, the investments are subject to the credit risk of the issuer, market risk with respect to the value of the investment, interest rate risk, and call and redemption risk. Credit risk is the risk that the borrower will not make timely payments of principal and interest. The degree of credit risk depends on the issuer's financial condition and on the terms of the debt securities. Market risk is the risk that the debt markets will go down in value, including the possibility that such market will go down sharply and unpredictably. Interest rate risk is the risk that prices of debt securities generally increase when interest rates decline and decrease when interest rates increase. Stated otherwise, bond prices and, to the extent a Fund has invested in fixed-income obligations, the net asset value per share (NAV) for each Fund generally move in the opposite direction from interest rates. Prices of longer-term securities generally change more (i.e., decline) in response

10

to interest rate changes than prices of shorter-term securities. The Funds may lose money if short-term or long-term interest rates rise sharply or otherwise change in a manner not anticipated by the relevant subadviser. Each Fund also faces call and redemption risk. A bond's issuer may call a bond for redemption before it matures. If this happens to a bond a Fund holds, the Fund may lose income and may have to invest the proceeds in bonds with lower yields.

Illiquid Securities. Investments in illiquid securities involve additional risks. Illiquid securities may be difficult to value precisely and the Funds may have difficultly selling the securities at the time or price desired.

Short Sales. Each of Emerging Growth Fund and New Era Growth Fund may engage in short sales of securities. Short sales may magnify underlying investment losses. Share price volatility can increase losses because the underlying security must be replaced at a specific time. Investment costs may exceed potential investment gains. Short sales against the box, which all the Funds may engage in, may cause a Fund to give up the opportunity for capital appreciation in the security.

U.S. Government Securities. Not all U.S. government securities are issued or guaranteed by the U.S. government, but are only insured or guaranteed by the issuing agency, which must rely on its own resources to repay the debt and are subject to the risk of default. Investing in U.S. government securities also limits the potential for capital appreciation.

Money Market Instruments. Investing in money market instruments limits the Funds' ability to achieve their respective investment objectives of capital appreciation. Such investments also involve credit and market risk as described under Fixed Income Securities.

High Yield-High Risk Securities. Mid-Cap Growth Fund may invest in high yield securities also known as "junk bonds". High yield securities are subject to higher risk of loss, greater volatility and are considered speculative by traditional investment standards. The most significant risk associated with high yield securities is credit risk: the risk that the company issuing a high yield security may have difficulty in meeting its principal and/or interest payments on a timely basis. As a result, extensive credit research and diversification are essential factors in managing risk in the high yield arena. To a lesser extent, high yield bonds are also subject to interest rate risk: when interest rates increase, the value of fixed income securities tends to decline.

Federal Income Tax Considerations

Each Fund is treated as a separate entity for federal income tax purposes. Each Fund has qualified and elected to be treated as a "regulated investment company" under Subchapter M of the Internal Revenue Code of 1986, as amended (the Code), and intends to continue to so qualify in the future. As a regulated investment company, a Fund must, among other things, (a) derive at least 90% of its gross income from dividends, interest, payments with respect to certain loans of stock and securities, gains from the sale or other disposition of stock, securities or foreign currency and other income (including but not limited to gains from options, futures, and forward contracts) derived with respect to its business of investing in such stock, securities or foreign currency and (b) diversify its holdings so that, at the end of each quarter of its taxable year, (i) at least 50% of the value of the Fund's total assets is represented by cash, cash items, U .S. Government securities, securities of other regulated investment companies, and other securities limited, in respect of any one issuer, to an amount not greater than 5% of the Fund's total assets, and not more than 10% of the outstanding voting securities of such issuer, and (ii) not more than 25% of the value of its total assets is invested in the securities of any one issuer (other than U.S. Government securities or securities of other regulated investment companies), two or more issuers that are controlled by the Fund and are determined, pursuant to Department of Treasury regulations, to be in the same, similar or related trades or businesses. As a regulated investment company, a Fund (as opposed to its shareholders) will not be subject to federal income taxes on the net investment income and capital gain that it distributes to its shareholders, provided that at least 90% of its net investment income and realized net short-term capital gain in excess of net long-term capital loss for the taxable year i s distributed in accordance with the Code's distribution requirements.

Each Reorganization may lead to various tax consequences, which are discussed under the caption "Tax Consequences of the Reorganizations."

11

Forms of Organization

Mid-Cap Growth Fund is a series of SP Mutual Funds, which is an open-end management investment company, organized as a Maryland corporation. SP Mutual Funds is authorized to issue 5.5 billion shares of capital stock, par value $0.001 per share, 150,000,000 of which are designated as shares of Mid-Cap Growth Fund, which are further divided into Class A, Class B, Class C, Class L, Class M, Class X and New Class X shares. The rights and terms of Class X and New Class X shares are almost identical, so for ease of reference, SP Mutual Funds sometimes provides combined expenses, capitalization, financial and other information for "New Class X" and "Class X" and refers to all such shares as "Class X." The principal difference between outstanding shares of the two classes is that Class X shares issued prior to August 17, 1998 are subject to automatic conversion to Class A approximately 8 years after purchase, while New Class X shares, meaning Class X shares issued on or after August 17, 1998, are subject to automatic conversion to Class A shares approximately 10 years after purchase. You should be aware that if you hold shares referred to as "Class X," your conversion rights are determined by the date you purchased your shares.

New Era Growth Fund is a series of SP Opportunity Funds, which is an open-end management investment company, organized as a Delaware statutory trust. SP Opportunity Funds is authorized to issue an unlimited number of shares of beneficial interest, $0.001 par value per share, currently divided into four series and four classes, designated Class A, Class B, Class C and Class Z shares.

Emerging Growth Fund is an open-end management investment company, organized as a Maryland corporation. Emerging Growth Fund is authorized to issue 2 billion shares of common stock, $0.001 par value per share, divided into nine classes, designated Class A, Class B, Class C, Class L, Class M, Class X, New Class X, Class Z and Class R common stock. Of the authorized shares of common stock of Emerging Growth Fund, 800 million shares consist of Class A common stock, 400 million shares consist of Class B common stock, 300 million shares consist of Class C common stock, 100 million shares consist of Class L common stock, 100 million shares consist of Class M common stock, 50 million shares consist of Class X common stock, 50 million shares consist of New Class X common stock, 100 million shares consist of Class Z common stock and 100 million shares consist of Class R common stock. The rights and terms of Class X and New Class X shares are almost i dentical, so for ease of reference, Emerging Growth Fund sometimes provides combined expenses, capitalization, financial and other information for "New Class X" and "Class X" and refers to all such shares as "Class X." The principal difference between outstanding shares of the two classes is that Class X shares issued prior to August 17, 1998 are subject to automatic conversion to Class A approximately 8 years after purchase, while New Class X shares, meaning Class X shares issued on or after August 17, 1998, are subject to automatic conversion to Class A shares approximately 10 years after purchase. You should be aware that if you hold shares referred to as "Class X," your conversion rights are determined by the date you purchased your shares.

SP Mutual Funds and Emerging Growth Fund (together, the Companies) operate pursuant to charters, which include their Articles of Incorporation and supplements, corrections and amendments thereto, and by-laws. SP Opportunity Funds operates pursuant to an Agreement and Declaration of Trust (the Declaration) and by-laws. Each Company is governed by a Board of Directors. SP Opportunity Funds is governed by a Board of Trustees. For ease of reference and clarity of presentation, the Trustees of SP Opportunity Funds and the Directors of SP Mutual Funds and Emerging Growth Fund are referred to herein as "Directors" and the Board of Trustees of SP Opportunity Funds and the Boards of Directors of SP Mutual Funds and Emerging Growth Fund are each referred to herein as a "Board" and collectively as the "Boards."

Due to differences in Maryland law and Delaware law and the governing documents of the Companies and SP Opportunity Funds, we have summarized certain rights of shareholders of the Companies and SP Opportunity Funds below. The following is only a summary and is not a complete description of the respective governing documents or applicable state law. You should refer to the governing documents of the Companies and SP Opportunity Funds for more complete information.

12

Forms of Ownership

Ownership interests in the Companies and their series, if applicable, are represented by shares of common stock of a corporation. The par value of SP Mutual Funds' common stock is $0.001 per share. The par value of Emerging Growth Fund's common stock is $0.001 per share. Ownership interests in SP Opportunity Funds and its series are represented by shares of beneficial interest of a statutory trust. The par value of SP Opportunity Funds shares of beneficial interest is $0.001 per share. For ease of reference and clarity of presentation, shares of common stock of Mid-Cap Growth Fund and Emerging Growth Fund and shares of beneficial interest of New Era Growth Fund are referred to herein as "shares" and holders of shares are referred to herein as "shareholders."

Extraordinary Transactions

As registered open-end investment companies, the Companies are authorized under Maryland law to transfer all of their respective assets (or the assets of any class or series of their shares) without shareholder approval, but pursuant to Maryland law and their charters, most other extraordinary transactions, including mergers, consolidations, share exchanges and dissolutions, must be approved by a majority vote of the shares entitled to vote on the matter. The Declaration permits the Board of SP Opportunity Funds, without shareholder approval (unless such approval is otherwise required by the 1940 Act) to (a) cause SP Opportunity Funds to convert or merge, reorganize or consolidate with or into one or more business entities (or a series thereof to the extent permitted by law) so long as the surviving or resulting entity is an open-end management investment company (or a series thereof to the extent permitted by law) formed, organized or exist ing under the laws of a U.S. jurisdiction and that, in the case of any business entity created by the Board to accomplish such conversion, merger, reorganization or consolidation, may succeed to or assume SP Opportunity Funds' registration under the 1940 Act, (b) cause shares to be exchanged under or pursuant to any state or federal statute to the extent permitted by law, (c) cause SP Opportunity Funds to incorporate under the laws of a U.S. jurisdiction, (d) sell or convey all or substantially all of the assets of SP Opportunity Funds or any series or class thereof to another series or class thereof or to another business entity (or a series thereof to the extent permitted by law) organized under the laws of a U.S. jurisdiction so long as such business entity is an open-end management investment company and, in the case of any business entity created by the Board to accomplish such sale and conveyance, may succeed to or assume SP Opportunity Funds' registration under the 1940 Act or (e) at any time sell or convert into money all or any part of the assets of SP Opportunity Funds or any series or class thereof.

Shareholder Meetings

Place of Meeting. The Companies may hold shareholder meetings at any place set by the Board, except that in the case of SP Mutual Funds, that place is required to be within the United States. SP Opportunity Funds is required to hold shareholder meetings at the principal executive offices of SP Opportunity Funds or at such other place within the United States as the Trustees shall designate.

Shareholder Voting Rights. Each share of a Company's common stock entitles its holder to one vote and fractional shares are entitled to pro rata voting rights. In all elections for directors, each share of a Company's stock may be voted for as many individuals as there are directors to be elected and for whose election the share is entitled to be voted. SP Opportunity Funds' Board is entitled to determine, without the vote or consent of shareholders (except as required by the 1940 Act) with respect to any matter submitted for a shareholder vote whether each share shall be entitled to one vote as to any matter on which it is entitled to vote and each fractional share shall be entitled to a proportionate fractional share, or whether each dollar of net asset value shall be entitled to one vote on any matter on which such shares are entitled to vote and each fraction al dollar amount shall be entitled to a proportionate fractional vote. In addition, shareholders of SP Opportunity Funds are entitled to vote only (1) for the election or removal of Trustees and (2) with respect to such additional matters relating to SP Opportunity Funds as may be required by the 1940 Act, the Declaration, the By-Laws or any registration of SP Opportunity Funds with the SEC (or any successor agency) or any state, or as the Board may consider necessary or desirable.

Record Date. The Companies' Boards have the sole power to set a record date, which must be at or after close of business on the day the record date is fixed, and may not be more than 90 or fewer than 10 days prior to the

13

applicable meeting of shareholders. SP Opportunity Funds' Board may fix a record date falling not more than 120 days prior to the meeting.

Annual Meetings. Neither Company is required to hold annual meetings of its respective shareholders in any year in which the election of directors is not required to be acted upon under the 1940 Act. There are no requirements regarding annual shareholder meetings set forth in SP Opportunity Funds' Declaration or By-Laws.

Special Meetings. Each Company must call a special meeting of shareholders if so requested by the chairman or the president or by a majority of the Directors. In addition, SP Mutual Funds must call a special meeting, in the discretion of the Board, or on the written request of shareholders holding at least 10% of the outstanding shares of a series. In the case of Emerging Growth Fund, a special meeting will be held on the written request of shareholders representing a majority of the votes entitled to be cast at the meeting. Each Company's Board has sole power to fix the date and time of any special meeting of shareholders. SP Opportunity Funds is required to call a meeting of shareholders upon order of the Board, or, for the purpose of voting on the removal of any Trustee, upon the request of shareholders holding at least 10% of the outstanding shares entitled t o vote. If the Secretary of SP Opportunity Funds refuses or neglects to call such meeting for more than 10 days, the Board or shareholders so requesting may call the meeting themselves by giving notice thereof in the manner required by the By-Laws.

Inspector of Elections. SP Mutual Funds is required to appoint one or more inspectors of election to conduct the voting at any meeting, if so ordered by the chairman of the meeting or upon the request of shareholders entitled to cast at least 10% of the votes entitled to be cast at the meeting. Emerging Growth Fund's Board may appoint one or three inspectors before a shareholder meeting. In addition, the chairman may make such appointment and must do so upon the request of at least 10% of the shareholders. There are no requirements regarding inspectors set forth in SP Opportunity Funds' Declaration or By-Laws or the Delaware Statutory Trust Act.

Advance Notice of Shareholder Proposals. The by-laws of Emerging Growth Fund provides that in order for a shareholder to nominate a director for election or propose business to be considered at an annual meeting of shareholders, such shareholder must give notice of such nomination or proposal to Emerging Growth Fund's Secretary not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year's annual meeting. However, if no annual meeting was held in the preceding year, any such shareholder must give notice to the Secretary not earlier than the 90th day prior to such meeting and not later than either the 60th day prior to such meeting or the 10th day after public announcement of such meeting is made. Although the charter of SP Mutual Funds provides that its by-laws may delineate requirements for presenting matters at annual meetin gs, its by-laws do not currently do so. This generally means that shareholders of SP Mutual Funds may submit proposals from the floor of an annual meeting. Under Maryland law, the purpose of any special meeting must be described in the notice of such meeting so only items included in the notice may be considered at special meetings of shareholders of the Companies. There are no requirements regarding advance notice for shareholder proposals set forth in SP Opportunity Funds' Declaration or By-Laws or the Delaware Statutory Trust Act. Under the by-laws of SP Opportunity Funds, only the business stated in the notice of the meeting shall be considered at such meeting.

Quorum. The presence, in person or by proxy, of shareholders entitled to cast a majority of all votes entitled to be cast on a matter with respect to one or more series or classes of SP Mutual Funds shall constitute a quorum for the transaction of business at a meeting of such shareholders. Emerging Growth Fund's charter reduces this requirement from a majority of votes entitled to be cast to one-third of votes entitled to be cast. For SP Opportunity Funds, a quorum is one-third of the shares entitled to vote, except when a larger quorum is required by federal law, including the 1940 Act, the By-Laws or the Declaration.

Adjournments. Whether or not a quorum is present, Emerging Growth Fund may adjourn a meeting of shareholders convened on the date for which it was called, by action of the chairman of the meeting, to a date not more than 120 days after the original record date. For SP Mutual Funds, a majority vote of the shareholders present is needed to achieve such an adjournment. SP Opportunity Funds can adjourn a meeting of shareholders without notice thereof if the time and date of the meeting are announced at the meeting and the adjourned meeting is held within a reasonable time after the date of the original meeting. Any meeting of shareholders of SP Opportunity Funds

14

may be adjourned one or more times to another time or place by shareholders holding a majority of the outstanding shares present and entitled to vote on a proposal to adjourn at such meeting, whether or not a quorum is present.

Shareholder Action Without a Meeting. Shareholders of the Companies are not entitled to act by written consent unless such consent is unanimous. Shareholders of SP Opportunity Funds can act by written consent if such consent is signed by the holders of outstanding shares having enough votes to authorize the action at a meeting at which all shares entitled to vote on that action were present and voted, except that in the case of shareholder proposals and any matter subject to a proxy contest or proxy solicitation or any proposal in opposition to a proposal by the Officers or Trustees of SP Opportunity Funds, shares may be voted only in person or by written proxy at a meeting.

Amendments to Charter

Amendments to each Company's charter generally require the approval of the Board and at least a majority of the votes entitled to be cast. However, the Board may amend the charter to change the name of the company, or change the designation or par value of shares, without shareholder approval. Under Maryland law, each Company's Board is also authorized to increase or decrease authorized capital stock, and classify and reclassify shares without shareholder approval. The Board of SP Opportunity Funds is entitled to amend the Declaration without shareholder approval, except that shareholders have the right to vote on (1) any amendment that is required to be approved by shareholders pursuant to the 1940 Act, and (2) any amendment submitted to the shareholders by the Board at its discretion.

Amendment of By-Laws