Exhibit 99.1 LENDER PRESENTATION September 10, 2018 Exhibit 99.1 LENDER PRESENTATION September 10, 2018

Disclaimer The Securities and Exchange Commission (the “SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible oil and gas reserves that meet the SEC’s definitions for such terms. In this presentation, because none of the estimates we present meet the SEC’s definitions for such terms, none of such estimates would be permitted to be disclosed in SEC filings, including the items designated herein as “Adjusted PDP Reserves” and “Total Adjusted 1P Reserves” and “Adjusted PV-10” and/or that bear similar or related descriptions. In all cases, the estimates presented herein: (i) do not represent and are not intended to represent “proved oil and gas reserves” or any other category of reserves based on SEC definitions; (ii) do not comply with guidelines established by the American Institute of Certified Public Accountants regarding forecasts of oil and gas reserve estimates; and (iii) are more speculative, by their nature, than estimates of proved, probable and possible reserves disclosed in SEC filings and, accordingly, are subject to substantially greater uncertainty of being actually realized. In addition, items in this presentation that reference an “Adjusted PV-10” value and/or that bear similar or related descriptions attributable to the estimates regarding the Company’s oil and gas properties disclosed herein were calculated or determined using forward-looking prices for crude oil, natural gas liquids and natural gas as reflected in the Price Deck table set forth in the Reserves Details slide in this presentation and do not represent and are not intended to represent the “PV-10” value that would be attributable to such items if such items were calculated based on applicable SEC requirements, which are based on backward-looking, historical pricing. In addition, the information disclosed in this presentation does not present and does not purport to present the estimated value of any of Ultra Resources, Inc. or of any of its subsidiaries or of any of the oil and gas properties owned by Ultra Resources, Inc. or any of its subsidiaries, whether in accordance with U.S. generally accepted accounting principles or otherwise. The information disclosed in this presentation should not be relied upon as presenting any such value. Neither Ultra Resources, Inc. nor any of its subsidiaries nor any of its or their representatives undertakes any obligation to update or correct any of the projections, forecasts, estimates or other information included in this presentation, whether publicly or otherwise, even if any or all of the assumptions underlying such projections, forecasts, estimates or other information prove to have been incorrect. Disclaimer The Securities and Exchange Commission (the “SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible oil and gas reserves that meet the SEC’s definitions for such terms. In this presentation, because none of the estimates we present meet the SEC’s definitions for such terms, none of such estimates would be permitted to be disclosed in SEC filings, including the items designated herein as “Adjusted PDP Reserves” and “Total Adjusted 1P Reserves” and “Adjusted PV-10” and/or that bear similar or related descriptions. In all cases, the estimates presented herein: (i) do not represent and are not intended to represent “proved oil and gas reserves” or any other category of reserves based on SEC definitions; (ii) do not comply with guidelines established by the American Institute of Certified Public Accountants regarding forecasts of oil and gas reserve estimates; and (iii) are more speculative, by their nature, than estimates of proved, probable and possible reserves disclosed in SEC filings and, accordingly, are subject to substantially greater uncertainty of being actually realized. In addition, items in this presentation that reference an “Adjusted PV-10” value and/or that bear similar or related descriptions attributable to the estimates regarding the Company’s oil and gas properties disclosed herein were calculated or determined using forward-looking prices for crude oil, natural gas liquids and natural gas as reflected in the Price Deck table set forth in the Reserves Details slide in this presentation and do not represent and are not intended to represent the “PV-10” value that would be attributable to such items if such items were calculated based on applicable SEC requirements, which are based on backward-looking, historical pricing. In addition, the information disclosed in this presentation does not present and does not purport to present the estimated value of any of Ultra Resources, Inc. or of any of its subsidiaries or of any of the oil and gas properties owned by Ultra Resources, Inc. or any of its subsidiaries, whether in accordance with U.S. generally accepted accounting principles or otherwise. The information disclosed in this presentation should not be relied upon as presenting any such value. Neither Ultra Resources, Inc. nor any of its subsidiaries nor any of its or their representatives undertakes any obligation to update or correct any of the projections, forecasts, estimates or other information included in this presentation, whether publicly or otherwise, even if any or all of the assumptions underlying such projections, forecasts, estimates or other information prove to have been incorrect.

Forward Looking Statement Forward-Looking Statements and Estimates This presentation contains “forward-looking statements” within the meaning of the federal securities laws, including statements about our business strategies and plans, plans for future drilling and resource development, prospective levels of capital expenditures and production and operating costs, and estimates of future results. Any statement in this presentation, including any opinions, forecasts, projections or other statements, other than statements of historical fact, are forward-looking statements. Although we believe the expectations reflected in such forward-looking statements are reasonable, we can give no assurance such expectations are correct, and actual results may differ materially from those projected. The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible oil and gas reserves that meet the SEC’s definitions for such terms. As discussed in the Reserves Details slide in this presentation also includes information about oil and gas quantity estimates that are not permitted to be disclosed in SEC filings, including terms or designations such as “estimated ultimate recovery” or “EUR” or “resource” or “resource potential” or other terms bearing similar or related descriptions. These types of estimates do not represent and are not intended to represent any category of reserves based on SEC definitions, do not comply with guidelines established by the American Institute of Certified Public Accountants regarding forecasts of oil and gas reserves estimates, are, by their nature, more speculative than estimates of proved, probable and possible reserves disclosed in SEC filings, and, accordingly, are subject to substantially greater uncertainty of being actually realized. Actual volumes or quantities of oil and gas that may be ultimately recovered will likely differ substantially from such estimates. Factors affecting such ultimate recovery include the scope of our actual drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices, availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, and actual drilling, completion and production results as well as other factors. These estimates may change significantly as the development of properties provides additional data. The estimates of value set forth in this presentation were calculated based on the assumptions and methodologies set forth in this presentation, which differ materially from the assumptions and methodologies oil and gas companies are required to use in calculating PV-10 values of proved reserves disclosed in SEC filings. As a result, the estimates of values included in this presentation do not represent and are not intended to represent the “PV-10” value that would be attributable to such items if such items were calculated based on applicable SEC requirements. Risk Factors Certain risks and uncertainties inherent in our operating businesses as well as certain on-going risks related to our operational and financial results are set forth in our filings with the SEC, particularly in the section entitled “Risk Factors” included in our most recently-filed Annual Report on Form 10-K, our most recently-filed Quarterly Reports on Form 10-Q, and from time to time in other filings we make with the SEC. Some of the risk and uncertainties related to our business include, but are not limited to, increased competition, the timing and extent of changes in prices for oil and gas, particularly in the areas where we own properties, conduct operations, and market our production, as well as the timing and extent of our success in discovering, developing, producing and estimating oil and gas reserves, including from any horizontal wells we drill in the future, the timing and cost of our future production and development activities, our ability to successfully monetize the properties we are marketing, weather and government regulation, and the availability and cost of oil field services, personnel and equipment. Investors are encouraged to review and consider the risk factors set forth in our historical and future SEC filings, as well as any set forth in this presentation, in connection with a review and consideration of this presentation. Our SEC filings are available directly from the company – please send any requests to Ultra Petroleum Corp. at 400 North Sam Houston Parkway East, Suite 1200, Houston, Texas 77060 (Attention: Investor Relations). Our SEC filings are also available from the SEC on their website at www.sec.gov or by telephone request at 1-800-SEC-0330. Non-GAAP Measures Adjusted EBITDA, Net Debt and EBITDA Cash Costs are financial measures not presented in accordance with generally accepted accounting principles (“GAAP”). The reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures can be found in the appendix to this presentation. Forward Looking Statement Forward-Looking Statements and Estimates This presentation contains “forward-looking statements” within the meaning of the federal securities laws, including statements about our business strategies and plans, plans for future drilling and resource development, prospective levels of capital expenditures and production and operating costs, and estimates of future results. Any statement in this presentation, including any opinions, forecasts, projections or other statements, other than statements of historical fact, are forward-looking statements. Although we believe the expectations reflected in such forward-looking statements are reasonable, we can give no assurance such expectations are correct, and actual results may differ materially from those projected. The Securities and Exchange Commission (“SEC”) permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible oil and gas reserves that meet the SEC’s definitions for such terms. As discussed in the Reserves Details slide in this presentation also includes information about oil and gas quantity estimates that are not permitted to be disclosed in SEC filings, including terms or designations such as “estimated ultimate recovery” or “EUR” or “resource” or “resource potential” or other terms bearing similar or related descriptions. These types of estimates do not represent and are not intended to represent any category of reserves based on SEC definitions, do not comply with guidelines established by the American Institute of Certified Public Accountants regarding forecasts of oil and gas reserves estimates, are, by their nature, more speculative than estimates of proved, probable and possible reserves disclosed in SEC filings, and, accordingly, are subject to substantially greater uncertainty of being actually realized. Actual volumes or quantities of oil and gas that may be ultimately recovered will likely differ substantially from such estimates. Factors affecting such ultimate recovery include the scope of our actual drilling program, which will be directly affected by the availability of capital, drilling and production costs, commodity prices, availability of drilling services and equipment, lease expirations, transportation constraints, regulatory approvals, field spacing rules, and actual drilling, completion and production results as well as other factors. These estimates may change significantly as the development of properties provides additional data. The estimates of value set forth in this presentation were calculated based on the assumptions and methodologies set forth in this presentation, which differ materially from the assumptions and methodologies oil and gas companies are required to use in calculating PV-10 values of proved reserves disclosed in SEC filings. As a result, the estimates of values included in this presentation do not represent and are not intended to represent the “PV-10” value that would be attributable to such items if such items were calculated based on applicable SEC requirements. Risk Factors Certain risks and uncertainties inherent in our operating businesses as well as certain on-going risks related to our operational and financial results are set forth in our filings with the SEC, particularly in the section entitled “Risk Factors” included in our most recently-filed Annual Report on Form 10-K, our most recently-filed Quarterly Reports on Form 10-Q, and from time to time in other filings we make with the SEC. Some of the risk and uncertainties related to our business include, but are not limited to, increased competition, the timing and extent of changes in prices for oil and gas, particularly in the areas where we own properties, conduct operations, and market our production, as well as the timing and extent of our success in discovering, developing, producing and estimating oil and gas reserves, including from any horizontal wells we drill in the future, the timing and cost of our future production and development activities, our ability to successfully monetize the properties we are marketing, weather and government regulation, and the availability and cost of oil field services, personnel and equipment. Investors are encouraged to review and consider the risk factors set forth in our historical and future SEC filings, as well as any set forth in this presentation, in connection with a review and consideration of this presentation. Our SEC filings are available directly from the company – please send any requests to Ultra Petroleum Corp. at 400 North Sam Houston Parkway East, Suite 1200, Houston, Texas 77060 (Attention: Investor Relations). Our SEC filings are also available from the SEC on their website at www.sec.gov or by telephone request at 1-800-SEC-0330. Non-GAAP Measures Adjusted EBITDA, Net Debt and EBITDA Cash Costs are financial measures not presented in accordance with generally accepted accounting principles (“GAAP”). The reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures can be found in the appendix to this presentation.

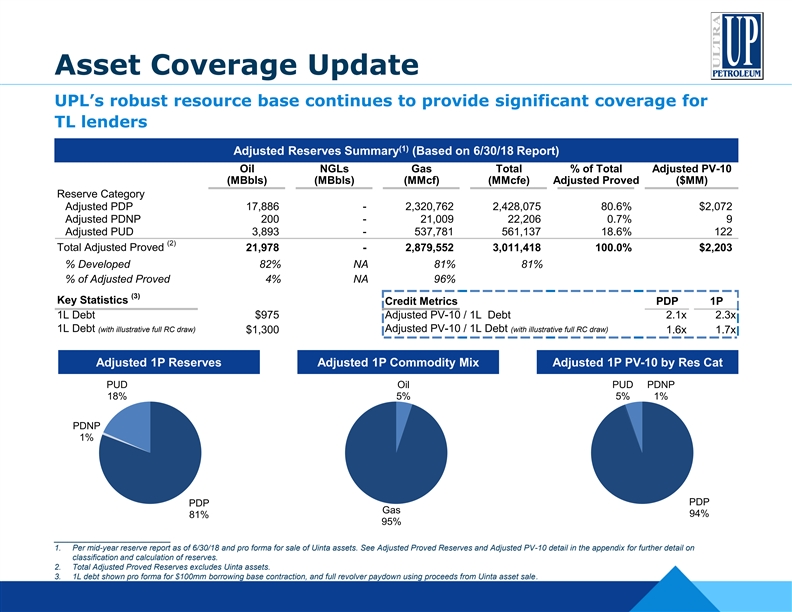

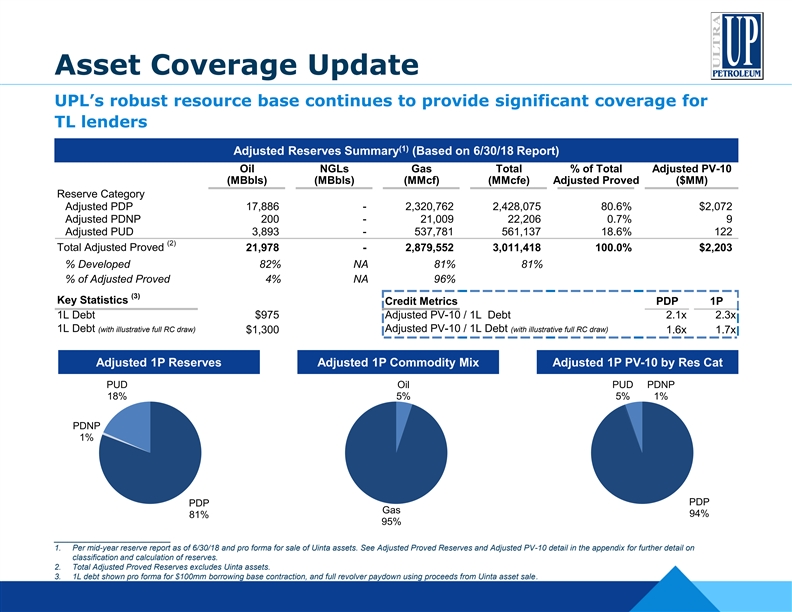

Asset Coverage Update UPL’s robust resource base continues to provide significant coverage for TL lenders (1) Adjusted Reserves Summary (Based on 6/30/18 Report) Oil NGLs Gas Total % of Total Adjusted PV-10 (MBbls) (MBbls) (MMcf) (MMcfe) Adjusted Proved ($MM) Reserve Category Adjusted PDP 17,886 - 2,320,762 2,428,075 80.6% $2,072 Adjusted PDNP 200 - 21,009 22,206 0.7% 9 Adjusted PUD 3,893 - 537,781 561,137 18.6% 122 (2) Total Adjusted Proved 21,978 - 2,879,552 3,011,418 100.0% $2,203 % Developed 82% NA 81% 81% % of Adjusted Proved 4% NA 96% (3) Key Statistics Credit Metrics PDP 1P 1L Debt $975 Adjusted PV-10 / 1L Debt 2.1x 2.3x 1L Debt (with illustrative full RC draw) Adjusted PV-10 / 1L Debt (with illustrative full RC draw) $1,300 1.6x 1.7x Adjusted 1P Reserves Adjusted 1P Commodity Mix Adjusted 1P PV-10 by Res Cat PUD Oil PUD PDNP 18% 5% 5% 1% PDNP 1% PDP PDP Gas 94% 81% 95% __________________________ 1. Per mid-year reserve report as of 6/30/18 and pro forma for sale of Uinta assets. See Adjusted Proved Reserves and Adjusted PV-10 detail in the appendix for further detail on classification and calculation of reserves. 2. Total Adjusted Proved Reserves excludes Uinta assets. 3. 1L debt shown pro forma for $100mm borrowing base contraction, and full revolver paydown using proceeds from Uinta asset sale.Asset Coverage Update UPL’s robust resource base continues to provide significant coverage for TL lenders (1) Adjusted Reserves Summary (Based on 6/30/18 Report) Oil NGLs Gas Total % of Total Adjusted PV-10 (MBbls) (MBbls) (MMcf) (MMcfe) Adjusted Proved ($MM) Reserve Category Adjusted PDP 17,886 - 2,320,762 2,428,075 80.6% $2,072 Adjusted PDNP 200 - 21,009 22,206 0.7% 9 Adjusted PUD 3,893 - 537,781 561,137 18.6% 122 (2) Total Adjusted Proved 21,978 - 2,879,552 3,011,418 100.0% $2,203 % Developed 82% NA 81% 81% % of Adjusted Proved 4% NA 96% (3) Key Statistics Credit Metrics PDP 1P 1L Debt $975 Adjusted PV-10 / 1L Debt 2.1x 2.3x 1L Debt (with illustrative full RC draw) Adjusted PV-10 / 1L Debt (with illustrative full RC draw) $1,300 1.6x 1.7x Adjusted 1P Reserves Adjusted 1P Commodity Mix Adjusted 1P PV-10 by Res Cat PUD Oil PUD PDNP 18% 5% 5% 1% PDNP 1% PDP PDP Gas 94% 81% 95% __________________________ 1. Per mid-year reserve report as of 6/30/18 and pro forma for sale of Uinta assets. See Adjusted Proved Reserves and Adjusted PV-10 detail in the appendix for further detail on classification and calculation of reserves. 2. Total Adjusted Proved Reserves excludes Uinta assets. 3. 1L debt shown pro forma for $100mm borrowing base contraction, and full revolver paydown using proceeds from Uinta asset sale.

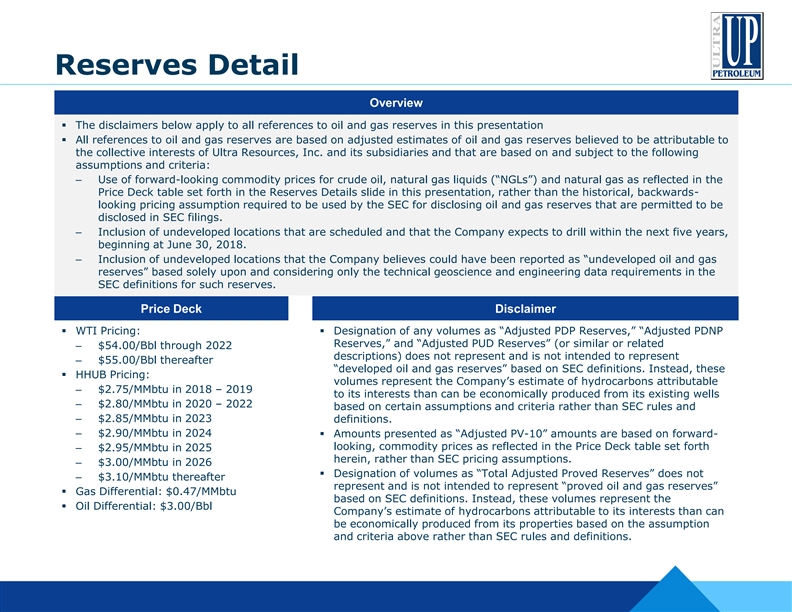

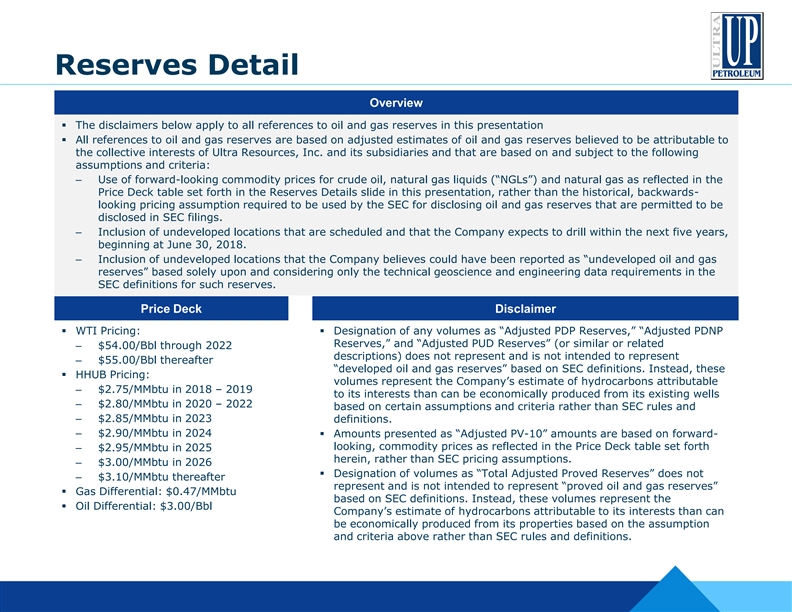

Reserves Detail Overview § The disclaimers below apply to all references to oil and gas reserves in this presentation § All references to oil and gas reserves are based on adjusted estimates of oil and gas reserves believed to be attributable to the collective interests of Ultra Resources, Inc. and its subsidiaries and that are based on and subject to the following assumptions and criteria: – Use of forward-looking commodity prices for crude oil, natural gas liquids (“NGLs”) and natural gas as reflected in the Price Deck table set forth in the Reserves Details slide in this presentation, rather than the historical, backwards- looking pricing assumption required to be used by the SEC for disclosing oil and gas reserves that are permitted to be disclosed in SEC filings. – Inclusion of undeveloped locations that are scheduled and that the Company expects to drill within the next five years, beginning at June 30, 2018. – Inclusion of undeveloped locations that the Company believes could have been reported as “undeveloped oil and gas reserves” based solely upon and considering only the technical geoscience and engineering data requirements in the SEC definitions for such reserves. Price Deck Disclaimer § WTI Pricing:§ Designation of any volumes as “Adjusted PDP Reserves,” “Adjusted PDNP Reserves,” and “Adjusted PUD Reserves” (or similar or related – $54.00/Bbl through 2022 descriptions) does not represent and is not intended to represent – $55.00/Bbl thereafter “developed oil and gas reserves” based on SEC definitions. Instead, these § HHUB Pricing: volumes represent the Company’s estimate of hydrocarbons attributable – $2.75/MMbtu in 2018 – 2019 to its interests than can be economically produced from its existing wells – $2.80/MMbtu in 2020 – 2022 based on certain assumptions and criteria rather than SEC rules and – $2.85/MMbtu in 2023 definitions. – $2.90/MMbtu in 2024§ Amounts presented as “Adjusted PV-10” amounts are based on forward- looking, commodity prices as reflected in the Price Deck table set forth – $2.95/MMbtu in 2025 herein, rather than SEC pricing assumptions. – $3.00/MMbtu in 2026 § Designation of volumes as “Total Adjusted Proved Reserves” does not – $3.10/MMbtu thereafter represent and is not intended to represent “proved oil and gas reserves” § Gas Differential: $0.47/MMbtu based on SEC definitions. Instead, these volumes represent the § Oil Differential: $3.00/Bbl Company’s estimate of hydrocarbons attributable to its interests than can be economically produced from its properties based on the assumption and criteria above rather than SEC rules and definitions.Reserves Detail Overview § The disclaimers below apply to all references to oil and gas reserves in this presentation § All references to oil and gas reserves are based on adjusted estimates of oil and gas reserves believed to be attributable to the collective interests of Ultra Resources, Inc. and its subsidiaries and that are based on and subject to the following assumptions and criteria: – Use of forward-looking commodity prices for crude oil, natural gas liquids (“NGLs”) and natural gas as reflected in the Price Deck table set forth in the Reserves Details slide in this presentation, rather than the historical, backwards- looking pricing assumption required to be used by the SEC for disclosing oil and gas reserves that are permitted to be disclosed in SEC filings. – Inclusion of undeveloped locations that are scheduled and that the Company expects to drill within the next five years, beginning at June 30, 2018. – Inclusion of undeveloped locations that the Company believes could have been reported as “undeveloped oil and gas reserves” based solely upon and considering only the technical geoscience and engineering data requirements in the SEC definitions for such reserves. Price Deck Disclaimer § WTI Pricing:§ Designation of any volumes as “Adjusted PDP Reserves,” “Adjusted PDNP Reserves,” and “Adjusted PUD Reserves” (or similar or related – $54.00/Bbl through 2022 descriptions) does not represent and is not intended to represent – $55.00/Bbl thereafter “developed oil and gas reserves” based on SEC definitions. Instead, these § HHUB Pricing: volumes represent the Company’s estimate of hydrocarbons attributable – $2.75/MMbtu in 2018 – 2019 to its interests than can be economically produced from its existing wells – $2.80/MMbtu in 2020 – 2022 based on certain assumptions and criteria rather than SEC rules and – $2.85/MMbtu in 2023 definitions. – $2.90/MMbtu in 2024§ Amounts presented as “Adjusted PV-10” amounts are based on forward- looking, commodity prices as reflected in the Price Deck table set forth – $2.95/MMbtu in 2025 herein, rather than SEC pricing assumptions. – $3.00/MMbtu in 2026 § Designation of volumes as “Total Adjusted Proved Reserves” does not – $3.10/MMbtu thereafter represent and is not intended to represent “proved oil and gas reserves” § Gas Differential: $0.47/MMbtu based on SEC definitions. Instead, these volumes represent the § Oil Differential: $3.00/Bbl Company’s estimate of hydrocarbons attributable to its interests than can be economically produced from its properties based on the assumption and criteria above rather than SEC rules and definitions.