Note 1. Description of the Business and Significant Accounting Policies

Description of the Business

Steel Dynamics, Inc. (SDI), together with its subsidiaries (the company), is one of the largest and most diversified domestic steel producers and metals recycler. The company has 3 reportable segments: steel operations, metals recycling operations, and steel fabrication operations.

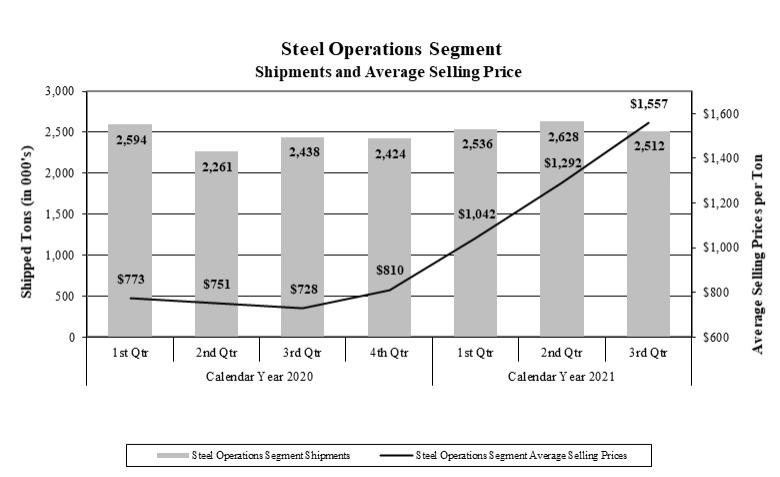

Steel Operations Segment. Steel operations include the company’s 6 operating electric arc furnace steel mills, including Butler Flat Roll Division, Columbus Flat Roll Division, Structural and Rail Division, Engineered Bar Products Division, Roanoke Bar Division, and Steel of West Virginia, and the under construction Southwest-Sinton Flat Roll Division; and steel coating and processing operations at The Techs galvanizing lines, Heartland Flat Roll Division, United Steel Supply (USS), and Vulcan Threaded Products, Inc. Steel operations accounted for 72% and 73% of the company’s consolidated net sales during the three-month periods ended September 30, 2021 and 2020, respectively, and 72% and 75% of the company’s consolidated net sales during the nine-month periods ended September 30, 2021 and 2020, respectively.

Metals Recycling Operations Segment. Metals recycling operations include the company’s OmniSource ferrous and nonferrous processing, transportation, marketing, brokerage, and scrap management services primarily throughout the United States and in Central and Northern Mexico. Metals recycling operations accounted for 12% of the company’s consolidated net sales during the three-month periods ended September 30, 2021 and 2020, and 12% and 10% of the company’s consolidated net sales during the nine-month periods ended September 30, 2021 and 2020, respectively.

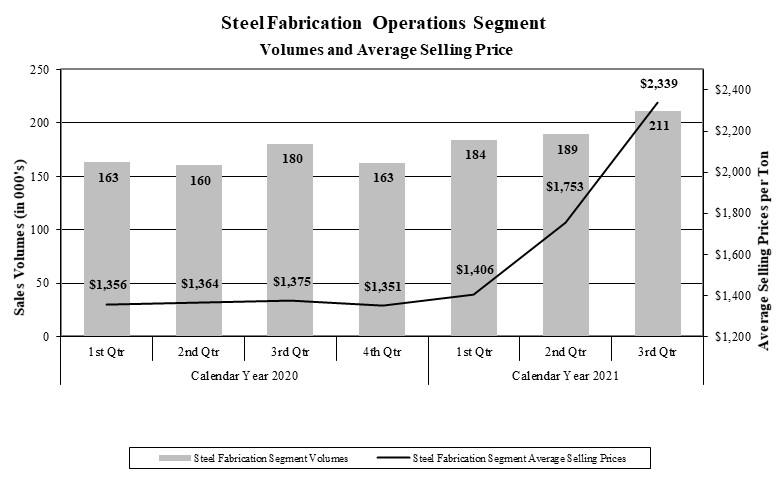

Steel Fabrication Operations Segment. Steel fabrication operations include the company’s New Millennium Building Systems joist and deck plants located throughout the United States, and in Northern Mexico. Revenues from these plants are generated from the fabrication of trusses, girders, steel joists and steel deck used within the non-residential construction industry. Steel fabrication operations accounted for 10% of the company’s consolidated net sales during the three-month periods ended September 30, 2021 and 2020, and 8% and 10% of the company’s consolidated net sales during the nine-month periods ended September 30, 2021 and 2020, respectively.

Other. Other operations consist of subsidiary operations that are below the quantitative thresholds required for reportable segments and primarily consist of joint ventures, and our idle Minnesota ironmaking operations. Also included in “Other” are certain unallocated corporate accounts, such as the company’s senior unsecured credit facility, senior notes, certain other investments and certain profit sharing expenses.

Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the accounts of SDI, together with its wholly- and majority-owned or controlled subsidiaries, after elimination of intercompany accounts and transactions. Noncontrolling and redeemable noncontrolling interests represent the noncontrolling owner’s proportionate share in the equity, income, or losses of the company’s majority-owned or controlled consolidated subsidiaries. Redeemable noncontrolling interests related to USS (owned 75% by SDI) are $75.6 million at September 30, 2021 and $47.4 million at December 31, 2020. Redeemable noncontrolling interests related to Mesabi Nugget (owned 84% by SDI) are $111.2 million at September 30, 2021, and December 31, 2020.