UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-07851

Franklin Fund Allocator Series

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Alison Baur,

One Franklin Parkway,

San Mateo, CA

94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area code:

(650) 312-2000

Date of fiscal year end: 12/31

Date of reporting period: 06/30/24

| Item 1. Reports to Stockholders. |

| | |

| a.) | The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1). |

| | |

| b.) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

| Not Applicable. |

| | |

Franklin Conservative Allocation Fund | |

| Class A [FTCIX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Conservative Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class A1 | $31 | 0.62% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $878,426,710 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.65% |

| * | Does not include derivatives, except purchased options, if any. |

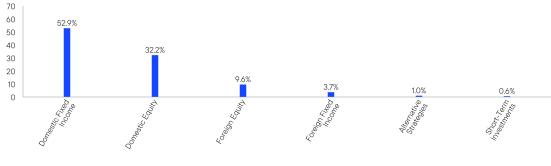

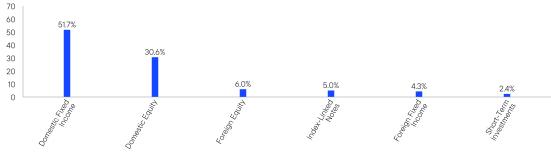

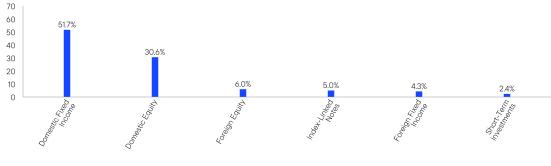

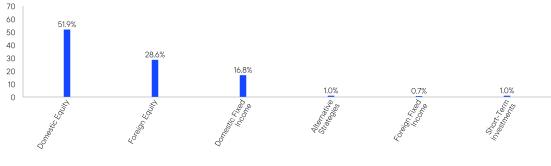

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

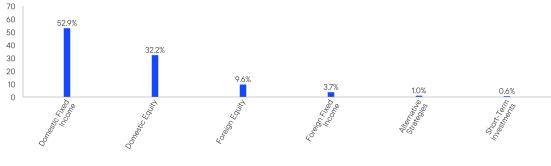

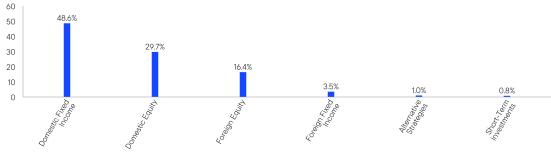

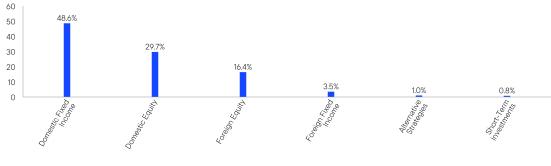

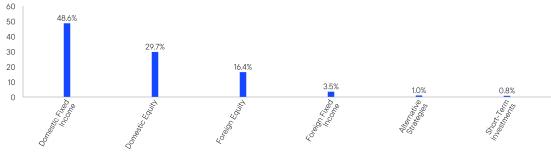

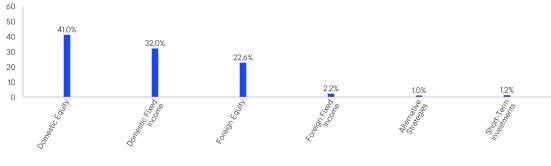

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Conservative Allocation Fund | PAGE 1 | 484-STSR-0824 |

52.932.29.63.71.00.6

| | |

Franklin Conservative Allocation Fund | |

| Class C [FTCCX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Conservative Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class C1 | $69 | 1.36% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $878,426,710 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.65% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Conservative Allocation Fund | PAGE 1 | 584-STSR-0824 |

52.932.29.63.71.00.6

| | |

Franklin Conservative Allocation Fund | |

| Class R [FTCRX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Conservative Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R1 | $44 | 0.87% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $878,426,710 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.65% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Conservative Allocation Fund | PAGE 1 | 884-STSR-0824 |

52.932.29.63.71.00.6

| | |

Franklin Conservative Allocation Fund | |

| Class R6 [FTCMX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Conservative Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R61 | $16 | 0.31% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $878,426,710 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.65% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Conservative Allocation Fund | PAGE 1 | 384-STSR-0824 |

52.932.29.63.71.00.6

| | |

Franklin Conservative Allocation Fund | |

| Advisor Class [FTCZX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Conservative Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Advisor Class1 | $19 | 0.37% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $878,426,710 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.65% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Conservative Allocation Fund | PAGE 1 | 641-STSR-0824 |

52.932.29.63.71.00.6

| | |

Franklin Moderate Allocation Fund | |

| Class A [FMTIX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Moderate Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class A1 | $31 | 0.61% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $1,666,208,354 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.87% |

| * | Does not include derivatives, except purchased options, if any. |

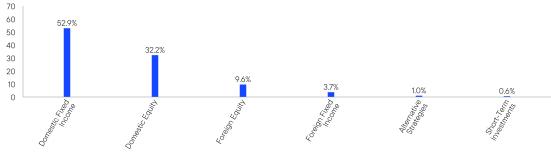

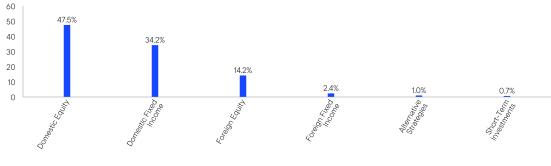

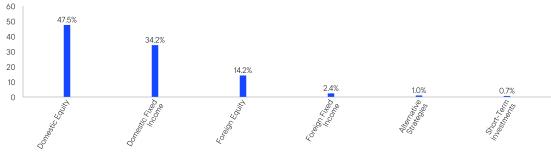

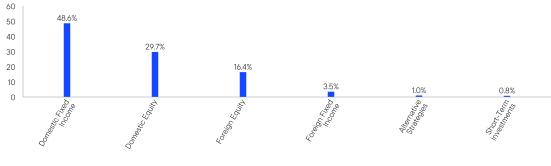

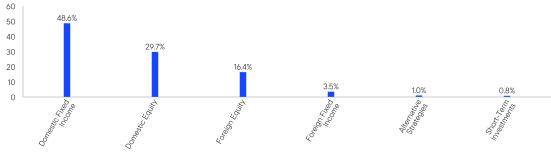

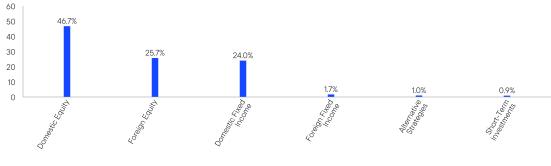

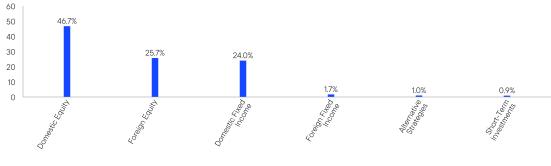

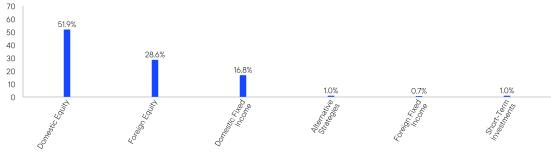

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

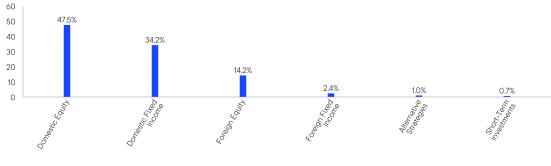

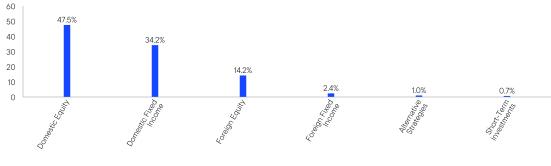

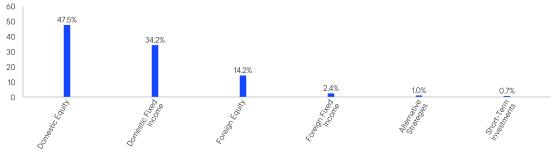

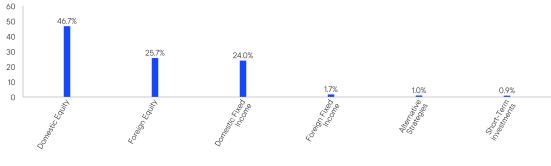

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Moderate Allocation Fund | PAGE 1 | 485-STSR-0824 |

47.534.214.22.41.00.7

| | |

Franklin Moderate Allocation Fund | |

| Class C [FTMTX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Moderate Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class C1 | $70 | 1.36% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $1,666,208,354 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.87% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Moderate Allocation Fund | PAGE 1 | 585-STSR-0824 |

47.534.214.22.41.00.7

| | |

Franklin Moderate Allocation Fund | |

| Class R [FTMRX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Moderate Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R1 | $44 | 0.86% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $1,666,208,354 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.87% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Moderate Allocation Fund | PAGE 1 | 885-STSR-0824 |

47.534.214.22.41.00.7

| | |

Franklin Moderate Allocation Fund | |

| Class R6 [FTMLX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Moderate Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R61 | $15 | 0.30% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $1,666,208,354 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.87% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Moderate Allocation Fund | PAGE 1 | 385-STSR-0824 |

47.534.214.22.41.00.7

| | |

Franklin Moderate Allocation Fund | |

| Advisor Class [FMTZX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Moderate Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Advisor Class1 | $19 | 0.36% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $1,666,208,354 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.87% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Moderate Allocation Fund | PAGE 1 | 642-STSR-0824 |

47.534.214.22.41.00.7

| | |

Franklin Growth Allocation Fund | |

| Class A [FGTIX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Growth Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class A1 | $33 | 0.63% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $1,347,285,070 |

Total Number of Portfolio Holdings* | 25 |

Portfolio Turnover Rate | 10.22% |

| * | Does not include derivatives, except purchased options, if any. |

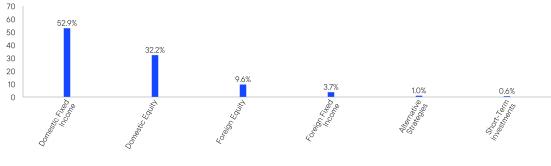

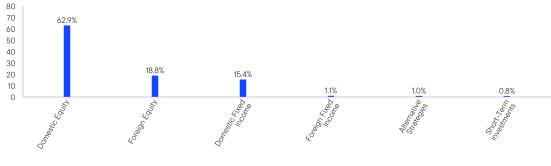

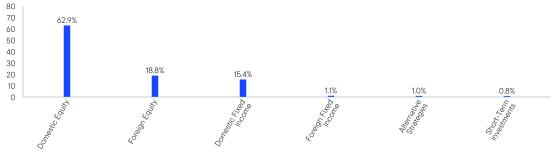

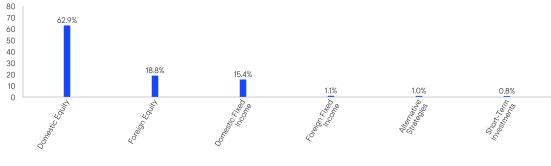

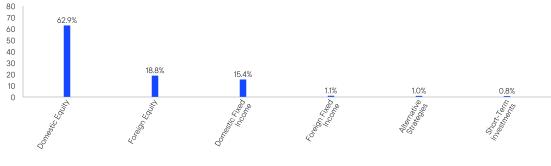

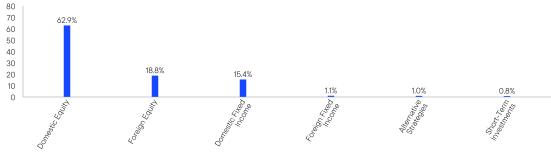

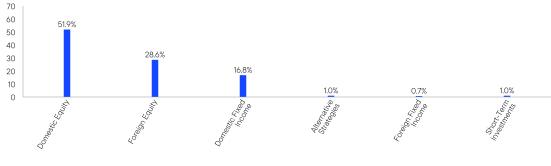

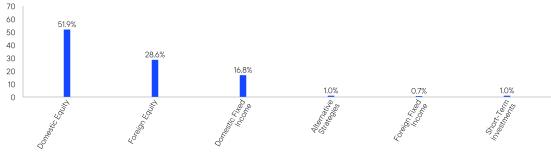

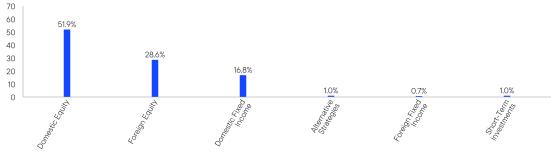

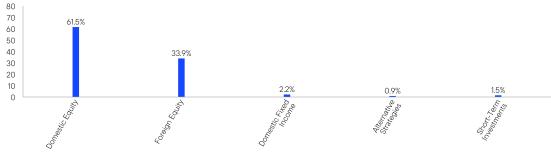

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

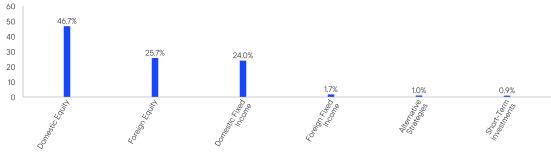

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Growth Allocation Fund | PAGE 1 | 486-STSR-0824 |

62.918.815.41.11.00.8

| | |

Franklin Growth Allocation Fund | |

| Class C [FTGTX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Growth Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class C1 | $72 | 1.38% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $1,347,285,070 |

Total Number of Portfolio Holdings* | 25 |

Portfolio Turnover Rate | 10.22% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Growth Allocation Fund | PAGE 1 | 586-STSR-0824 |

62.918.815.41.11.00.8

| | |

Franklin Growth Allocation Fund | |

| Class R [FGTRX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Growth Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R1 | $46 | 0.88% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $1,347,285,070 |

Total Number of Portfolio Holdings* | 25 |

Portfolio Turnover Rate | 10.22% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Growth Allocation Fund | PAGE 1 | 886-STSR-0824 |

62.918.815.41.11.00.8

| | |

Franklin Growth Allocation Fund | |

| Class R6 [FTGMX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Growth Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R61 | $16 | 0.30% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $1,347,285,070 |

Total Number of Portfolio Holdings* | 25 |

Portfolio Turnover Rate | 10.22% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Growth Allocation Fund | PAGE 1 | 386-STSR-0824 |

62.918.815.41.11.00.8

| | |

Franklin Growth Allocation Fund | |

| Advisor Class [FGTZX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Growth Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Advisor Class1 | $20 | 0.38% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $1,347,285,070 |

Total Number of Portfolio Holdings* | 25 |

Portfolio Turnover Rate | 10.22% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Growth Allocation Fund | PAGE 1 | 643-STSR-0824 |

62.918.815.41.11.00.8

| | |

Franklin Corefolio Allocation Fund | |

| Class A [FTCOX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Corefolio Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class A1 | $20 | 0.38% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $988,247,534 |

Total Number of Portfolio Holdings* | 5 |

Portfolio Turnover Rate | 3.47% |

| * | Does not include derivatives, except purchased options, if any. |

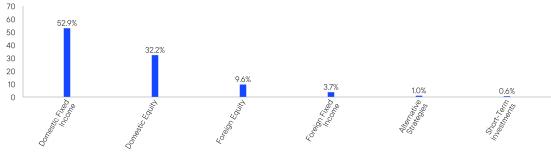

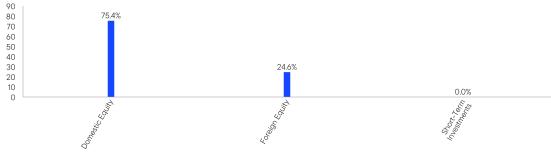

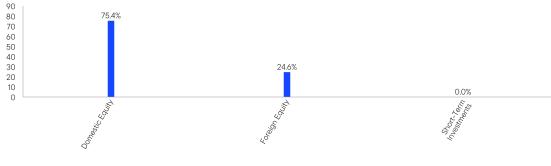

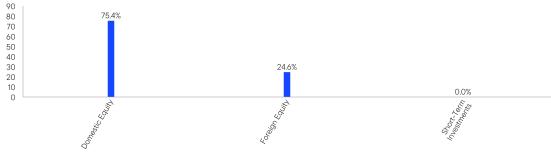

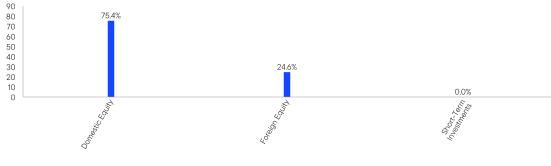

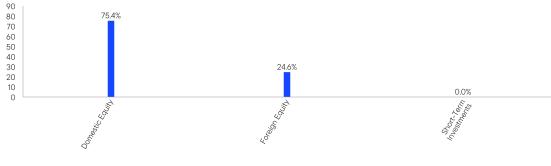

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Corefolio Allocation Fund | PAGE 1 | 470-STSR-0824 |

75.424.60.0

| | |

Franklin Corefolio Allocation Fund | |

| Class C [FTCLX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Corefolio Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class C1 | $59 | 1.13% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $988,247,534 |

Total Number of Portfolio Holdings* | 5 |

Portfolio Turnover Rate | 3.47% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Corefolio Allocation Fund | PAGE 1 | 570-STSR-0824 |

75.424.60.0

| | |

Franklin Corefolio Allocation Fund | |

| Class R [FFAYX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Corefolio Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R1 | $33 | 0.63% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $988,247,534 |

Total Number of Portfolio Holdings* | 5 |

Portfolio Turnover Rate | 3.47% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Corefolio Allocation Fund | PAGE 1 | 870-STSR-0824 |

75.424.60.0

| | |

Franklin Corefolio Allocation Fund | |

| Class R6 [FTLQX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Corefolio Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R61 | $4 | 0.08% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $988,247,534 |

Total Number of Portfolio Holdings* | 5 |

Portfolio Turnover Rate | 3.47% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Corefolio Allocation Fund | PAGE 1 | 8470-STSR-0824 |

75.424.60.0

| | |

Franklin Corefolio Allocation Fund | |

| Advisor Class [FCAZX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Corefolio Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Advisor Class1 | $7 | 0.13% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $988,247,534 |

Total Number of Portfolio Holdings* | 5 |

Portfolio Turnover Rate | 3.47% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition*,† (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| † | Certain categories may represent less than 0.1%. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Corefolio Allocation Fund | PAGE 1 | 670-STSR-0824 |

75.424.60.0

| | |

Franklin Global Allocation Fund | |

| Class A [FFALX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Global Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class A | $48 | 0.92% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $2,749,438,874 |

Total Number of Portfolio Holdings* | 253 |

Portfolio Turnover Rate | 28.69% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

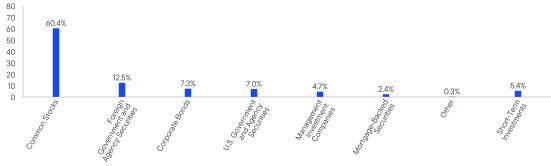

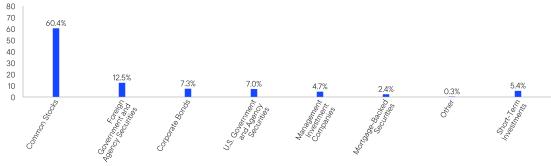

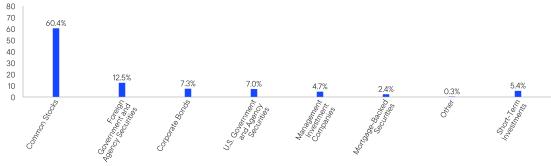

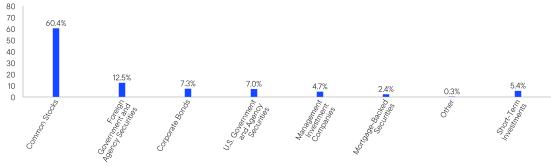

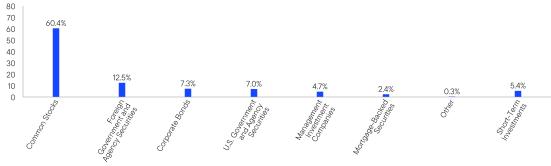

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Global Allocation Fund | PAGE 1 | 481-STSR-0824 |

60.412.57.37.04.72.40.35.4

| | |

Franklin Global Allocation Fund | |

| Class C [FFACX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Global Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class C | $87 | 1.67% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $2,749,438,874 |

Total Number of Portfolio Holdings* | 253 |

Portfolio Turnover Rate | 28.69% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Global Allocation Fund | PAGE 1 | 282-STSR-0824 |

60.412.57.37.04.72.40.35.4

| | |

Franklin Global Allocation Fund | |

| Class R [FFARX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Global Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R | $61 | 1.17% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $2,749,438,874 |

Total Number of Portfolio Holdings* | 253 |

Portfolio Turnover Rate | 28.69% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Global Allocation Fund | PAGE 1 | 871-STSR-0824 |

60.412.57.37.04.72.40.35.4

| | |

Franklin Global Allocation Fund | |

| Class R6 [FFAQX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Global Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Class R6 | $32 | 0.62% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $2,749,438,874 |

Total Number of Portfolio Holdings* | 253 |

Portfolio Turnover Rate | 28.69% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Global Allocation Fund | PAGE 1 | 8481-STSR-0824 |

60.412.57.37.04.72.40.35.4

| | |

Franklin Global Allocation Fund | |

| Advisor Class [FFAAX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin Global Allocation Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

| Advisor Class | $35 | 0.68% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $2,749,438,874 |

Total Number of Portfolio Holdings* | 253 |

Portfolio Turnover Rate | 28.69% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin Global Allocation Fund | PAGE 1 | 671-STSR-0824 |

60.412.57.37.04.72.40.35.4

| | |

Franklin LifeSmart Retirement Income Fund | |

| Class A [FTRAX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart Retirement Income Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class A1 | $15 | 0.30% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $44,562,884 |

Total Number of Portfolio Holdings* | 16 |

Portfolio Turnover Rate | 7.14% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

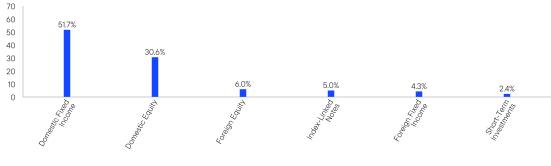

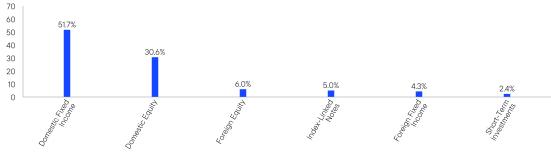

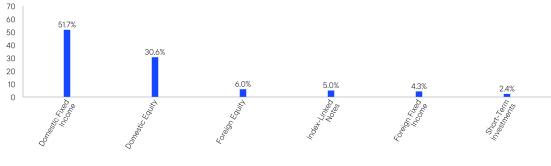

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart Retirement Income Fund | PAGE 1 | 427-STSR-0824 |

51.730.66.05.04.32.4

| | |

Franklin LifeSmart Retirement Income Fund | |

| Class C [FRTCX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart Retirement Income Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class C1 | $53 | 1.05% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $44,562,884 |

Total Number of Portfolio Holdings* | 16 |

Portfolio Turnover Rate | 7.14% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart Retirement Income Fund | PAGE 1 | 527-STSR-0824 |

51.730.66.05.04.32.4

| | |

Franklin LifeSmart Retirement Income Fund | |

| Class R [FBRLX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart Retirement Income Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R1 | $28 | 0.55% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $44,562,884 |

Total Number of Portfolio Holdings* | 16 |

Portfolio Turnover Rate | 7.14% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart Retirement Income Fund | PAGE 1 | 827-STSR-0824 |

51.730.66.05.04.32.4

| | |

Franklin LifeSmart Retirement Income Fund | |

| Class R6 [FLMTX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart Retirement Income Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R61 | $0 | 0.00% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $44,562,884 |

Total Number of Portfolio Holdings* | 16 |

Portfolio Turnover Rate | 7.14% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart Retirement Income Fund | PAGE 1 | 327-STSR-0824 |

51.730.66.05.04.32.4

| | |

Franklin LifeSmart Retirement Income Fund | |

| Advisor Class [FLRDX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart Retirement Income Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Advisor Class1 | $3 | 0.05% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $44,562,884 |

Total Number of Portfolio Holdings* | 16 |

Portfolio Turnover Rate | 7.14% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart Retirement Income Fund | PAGE 1 | 627-STSR-0824 |

51.730.66.05.04.32.4

| | |

Franklin LifeSmart 2020 Retirement Target Fund | |

| Class A [FLRMX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2020 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class A1 | $25 | 0.49% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $27,488,400 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 12.96% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2020 Retirement Target Fund | PAGE 1 | 52-STSR-0824 |

48.629.716.43.51.00.8

| | |

Franklin LifeSmart 2020 Retirement Target Fund | |

| Class C [FLRQX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2020 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class C1 | $63 | 1.24% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $27,488,400 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 12.96% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2020 Retirement Target Fund | PAGE 1 | 552-STSR-0824 |

48.629.716.43.51.00.8

| | |

Franklin LifeSmart 2020 Retirement Target Fund | |

| Class R [FLRVX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2020 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R1 | $38 | 0.74% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $27,488,400 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 12.96% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2020 Retirement Target Fund | PAGE 1 | 852-STSR-0824 |

48.629.716.43.51.00.8

| | |

Franklin LifeSmart 2020 Retirement Target Fund | |

| Class R6 [FRTSX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2020 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R61 | $10 | 0.19% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $27,488,400 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 12.96% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2020 Retirement Target Fund | PAGE 1 | 892-STSR-0824 |

48.629.716.43.51.00.8

| | |

Franklin LifeSmart 2020 Retirement Target Fund | |

| Advisor Class [FLROX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2020 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Advisor Class1 | $12 | 0.24% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $27,488,400 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 12.96% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2020 Retirement Target Fund | PAGE 1 | 82-STSR-0824 |

48.629.716.43.51.00.8

| | |

Franklin LifeSmart 2025 Retirement Target Fund | |

| Class A [FTRTX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2025 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class A1 | $25 | 0.50% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $112,922,227 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.87% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

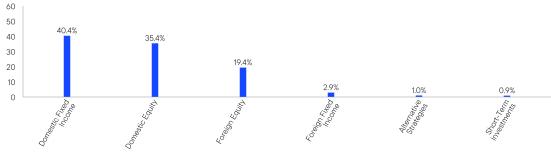

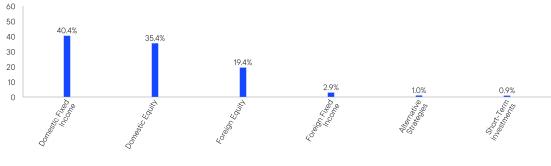

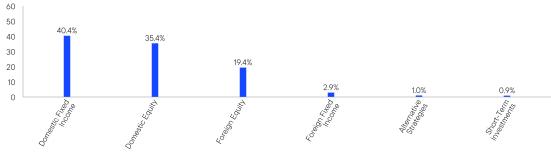

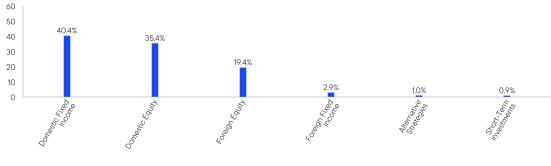

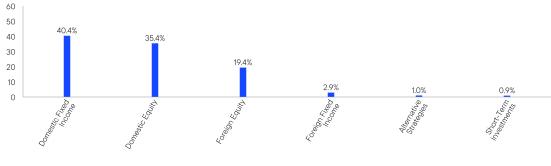

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2025 Retirement Target Fund | PAGE 1 | 445-STSR-0824 |

40.435.419.42.91.00.9

| | |

Franklin LifeSmart 2025 Retirement Target Fund | |

| Class C [FTTCX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2025 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class C1 | $64 | 1.25% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $112,922,227 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.87% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2025 Retirement Target Fund | PAGE 1 | 545-STSR-0824 |

40.435.419.42.91.00.9

| | |

Franklin LifeSmart 2025 Retirement Target Fund | |

| Class R [FRELX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2025 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R1 | $38 | 0.74% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $112,922,227 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.87% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2025 Retirement Target Fund | PAGE 1 | 845-STSR-0824 |

40.435.419.42.91.00.9

| | |

Franklin LifeSmart 2025 Retirement Target Fund | |

| Class R6 [FTLMX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2025 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R61 | $9 | 0.18% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $112,922,227 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.87% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2025 Retirement Target Fund | PAGE 1 | 345-STSR-0824 |

40.435.419.42.91.00.9

| | |

Franklin LifeSmart 2025 Retirement Target Fund | |

| Advisor Class [FLRFX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2025 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Advisor Class1 | $13 | 0.25% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $112,922,227 |

Total Number of Portfolio Holdings* | 24 |

Portfolio Turnover Rate | 11.87% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2025 Retirement Target Fund | PAGE 1 | 645-STSR-0824 |

40.435.419.42.91.00.9

| | |

Franklin LifeSmart 2030 Retirement Target Fund | |

| Class A [FLRSX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2030 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class A1 | $26 | 0.51% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $71,948,365 |

Total Number of Portfolio Holdings* | 25 |

Portfolio Turnover Rate | 13.11% |

| * | Does not include derivatives, except purchased options, if any. |

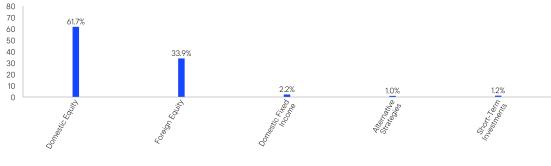

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

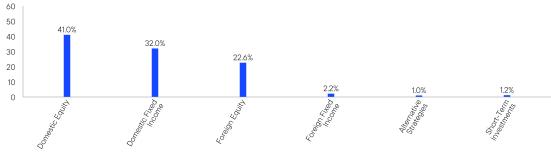

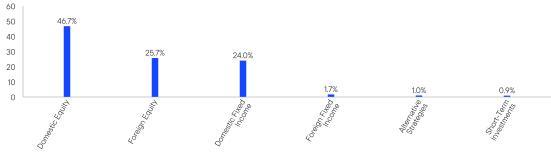

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2030 Retirement Target Fund | PAGE 1 | 47-STSR-0824 |

41.032.022.62.21.01.2

| | |

Franklin LifeSmart 2030 Retirement Target Fund | |

| Class C [FLRTX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2030 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class C1 | $65 | 1.26% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $71,948,365 |

Total Number of Portfolio Holdings* | 25 |

Portfolio Turnover Rate | 13.11% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

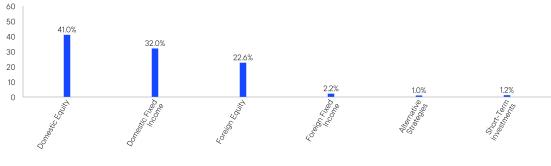

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2030 Retirement Target Fund | PAGE 1 | 553-STSR-0824 |

41.032.022.62.21.01.2

| | |

Franklin LifeSmart 2030 Retirement Target Fund | |

| Class R [FLRWX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

This semi-annual shareholder report contains important information about Franklin LifeSmart 2030 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.

You can find additional information about the Fund at https://www.franklintempleton.com/regulatory-fund-documents. You can also request this information by contacting us at (800) DIAL BEN/342-5236.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment*,† |

Class R1 | $39 | 0.76% |

| * | Reflects fee waivers and/or expense reimbursements, without which expenses would have been higher. |

| 1 | Excludes the fees and expenses of the underlying Funds. |

KEY FUND STATISTICS (as of June 30, 2024)

| |

Total Net Assets | $71,948,365 |

Total Number of Portfolio Holdings* | 25 |

Portfolio Turnover Rate | 13.11% |

| * | Does not include derivatives, except purchased options, if any. |

WHAT DID THE FUND INVEST IN? (as of June 30, 2024)

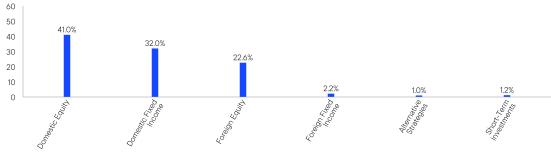

Portfolio Composition* (% of Total Investments)

| * | Does not include derivatives, except purchased options, if any. |

| |

| WHERE CAN I FIND ADDITIONAL INFORMATION ABOUT THE FUND? |

Additional information is available on https://www.franklintempleton.com/regulatory-fund-documents, including its: |

| • prospectus • proxy voting information • financial information • holdings • tax information |

| Franklin LifeSmart 2030 Retirement Target Fund | PAGE 1 | 853-STSR-0824 |

41.032.022.62.21.01.2

| | |

Franklin LifeSmart 2030 Retirement Target Fund | |

| Class R6 [FLERX] |

| Semi-Annual Shareholder Report | June 30, 2024 |

|

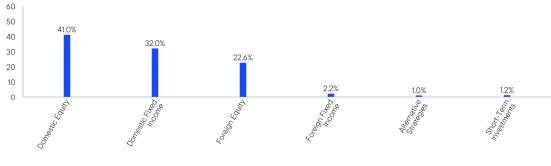

This semi-annual shareholder report contains important information about Franklin LifeSmart 2030 Retirement Target Fund for the period January 1, 2024, to June 30, 2024.