UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N–CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811–07851

Franklin Fund Allocator Series

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403–1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403–1906

(Name and address of agent for service)

Registrant’s telephone number, including area code: (650) 312–2000

Date of fiscal year end: 5/31

Date of reporting period: 5/31/18

Item 1. Reports to Stockholders.

Franklin Templeton Investments

Why choose Franklin Templeton Investments?

Successful investing begins with ambition. And achievement only comes when you reach for it. That’s why we continually strive to deliver better outcomes for investors. No matter what your goals are, our deep, global investment expertise allows us to offer solutions that can help.

During our more than 70 years of experience, we’ve managed through all kinds of markets—up, down and those in between. We’re always preparing for what may come next. It’s because of this, combined with our strength as one of the world’s largest asset managers that we’ve earned the trust of millions of investors around the world.

Contents

| | | | | | | | |

| Not FDIC Insured | | | | | May Lose Value | | | | | No Bank Guarantee |

| | | | | | |

| | | Not part of the annual report | | | 1 | |

Annual Report

Economic and Market Overview

The US economy grew during the 12 months under review. The economy strengthened in 2017’s third quarter but moderated in the next two quarters. The slower growth in 2018’s first quarter reflected a slowdown in consumer spending, exports, and state and local government spending, as well as a decline in residential fixed investment. The manufacturing and services sectors expanded during the period. The unemployment rate declined from 4.3% in May 2017, as reported at the beginning of the 12-month period, to an 18-year low of 3.8% at period-end.1 Annual inflation, as measured by the Consumer Price Index, increased from 1.9% in May 2017, as reported at the beginning of the period, to 2.8% at period-end.1

The US Federal Reserve (Fed) raised its target range for the federal funds rate 0.25% at its June and December 2017 meetings and began reducing its balance sheet in October as part of its ongoing effort to normalize monetary policy. In February 2018, new Fed Chair Jerome Powell spoke before Congress and indicated the Fed saw signs of a continued strong labor market and economic growth. He reiterated the Fed’s intention to gradually raise interest rates in an effort to keep the economy from overheating and as inflation increases toward the Fed’s target. However, he noted there was no evidence of the economy overheating and he had yet to see a clear upward move in wages. At its March meeting, the Fed raised its target range for the federal funds rate 0.25% to 1.50%–1.75%. At its May meeting, the Fed kept its target rate unchanged, while expressing more confidence about inflation hitting its target and indicating it may be comfortable with a modest overshoot of inflation.

The 10-year Treasury yield, which moves inversely to its price, shifted throughout the period. The yield rose in June 2017 amid renewed optimism for faster economic growth and was supported in July by hawkish comments from key central bankers around the world. Easing concerns about Hurricane Irma’s economic impact, the Fed’s balance sheet normalization beginning in October, the passage of the tax reform bill in December and indications of higher inflation, especially in 2018, also pushed the yield higher. However, some factors weighed on the Treasury yield at certain points during the period, including concerns about political uncertainties in the US, tensions between the US and North Korea, the Trump administration’s protectionist trade policies and uncertainty surrounding the trade relationship between the US and China. In April and May, trade tensions and expectations for higher inflation and stronger economic growth led the 10-year yield to reach multi-year highs. However, political turmoil in Italy near period-end weighed on the yield. Overall, the 10-year Treasury yield rose from 2.21% at the beginning of the period to 2.83% at period-end.

The foregoing information reflects our analysis and opinions as of May 31, 2018. The information is not a complete analysis of every aspect of any market, country, industry, security or fund. Statements of fact are from sources considered reliable.

1. Source: Bureau of Labor Statistics.

Franklin Payout 2018 Fund

This annual report for Franklin Payout 2018 Fund covers the fiscal year ended May 31, 2018.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in US dollar-denominated investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares delivered a +0.92% cumulative total return for the 12 months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays US Government/Credit 2018 Maturity Index, returned +1.21%.1 The index includes investment-grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2018. You can find more of the Fund’s performance data in the Performance Summary beginning on page 5.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a significant portion of the Fund’s assets in US dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use a top-down analysis of macroeconomic trends, combined with a bottom-up fundamental analysis of market sectors,

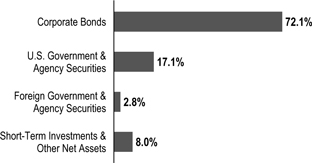

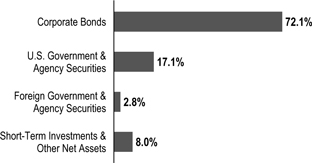

Portfolio Composition

Based on Total Net Assets as of 5/31/18

industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2018. Over time, the Fund’s duration and weighted average maturity declined as 2018 approached. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2018, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is designed for investors who seek an investment with a payout schedule to help meet their retirement spending needs, particularly those who are nearing retirement or are in retirement. There is no guarantee the Fund will meet an investor’s retirement spending needs.

|

What is duration? Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration. |

| | | | |

Maturity 5/31/18 | | | |

| | | % of Total

Market Value | |

0 to 1 Year | | | 100.0% | |

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 34.

FRANKLIN PAYOUT 2018 FUND

| | | | |

Top 10 Holdings* | | | | |

| 5/31/18 | | | | |

| Issue/Issuer | | % of Total

Net Assets | |

| |

| U.S. Treasury Note | | | 8.6% | |

| |

| Federal National Mortgage Association (FNMA) | | | 5.0% | |

| |

| Federal Home Loan Bank (FHLB) | | | 3.6% | |

| |

| Duke Energy Carolinas LLC | | | 2.9% | |

| |

| Bank of America Corp. | | | 2.9% | |

| |

| HSBC USA Inc. | | | 2.8% | |

| |

| Citigroup Inc. | | | 2.8% | |

| |

| BNP Paribas/BNP Paribas U.S. Medium-Term Note | | | | |

| |

| Program LLC | | | 2.8% | |

| |

| Bank of Nova Scotia | | | 2.8% | |

| |

| John Deere Capital Corp. | | | 2.8% | |

| * | Securities are listed by issuer, which may appear by another name in the SOI. |

Manager’s Discussion

During the period under review, the Fund’s performance relative to the Bloomberg Barclays US Government/Credit 2018 Maturity Index was enhanced primarily by our overweighted allocation to the investment-grade corporate credit sector, as well as security selection within the sector. In contrast, longer duration positioning compared with the index was the primary detractor from performance.

At period-end, we remained focused on investment-grade corporate credit exposures in the portfolio and maintained an overweighting in the sector compared with the index. We focused on the sector based on our belief that valuations remained relatively attractive on a longer term basis and that the sector has potential for higher earnings. Conversely, we maintained an underweighted allocation to the US Treasury sector as valuations and income levels remain unattractive to us. Additionally, we maintained a slightly underweighted allocation to the agency sector. Finally, we maintained a slightly longer duration in the portfolio compared with the index, driven largely by our focus on bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2018 Fund. We look forward to serving your future investment needs.

| | | | |

| | | |

Roger A. Bayston, CFA |

| | |

| | | |

David Yuen, CFA, FRM |

| | | | Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN PAYOUT 2018 FUND

Performance Summary as of May 31, 2018

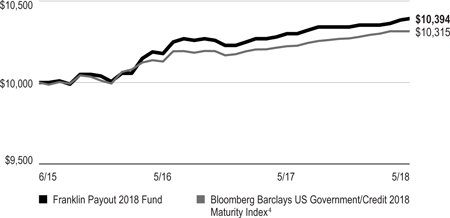

The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 5/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%. Advisor Class: no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

| | | | | | | | |

| Share Class | | Cumulative

Total Return2 | | | Average Annual

Total Return3 | |

| | |

Advisor | | | | | | | | |

| | |

1-Year | | | +0.92% | | | | +0.92% | |

| | |

Since Inception (6/1/15) | | | +3.94% | | | | +1.30% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 7 for Performance Summary footnotes.

FRANKLIN PAYOUT 2018 FUND

PERFORMANCE SUMMARY

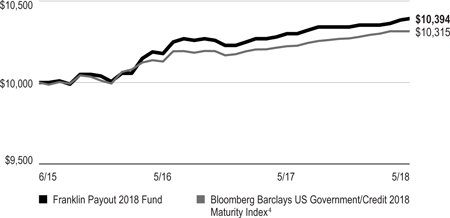

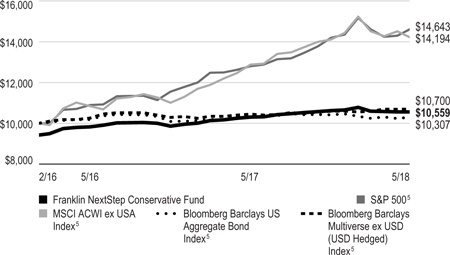

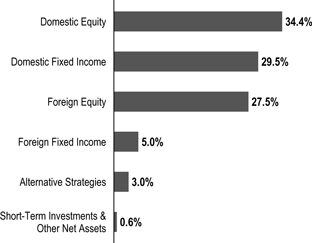

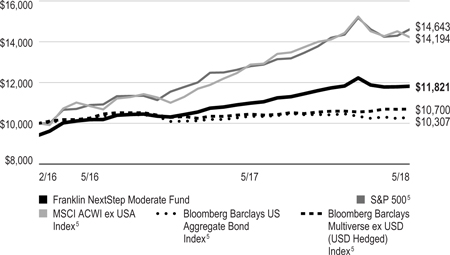

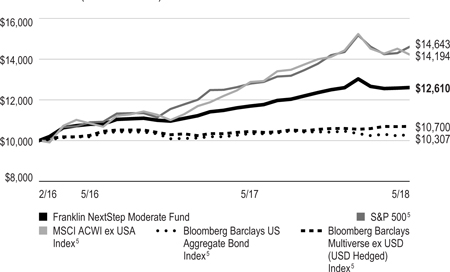

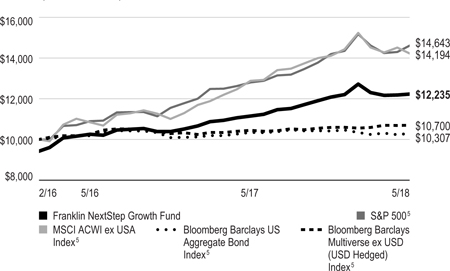

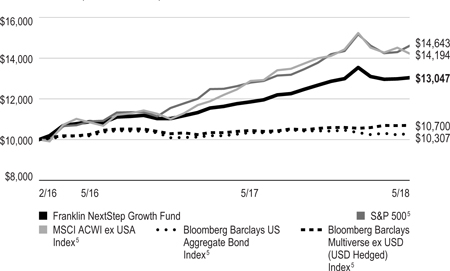

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Advisor Class (6/1/15–5/31/18)

See page 7 for Performance Summary footnotes.

FRANKLIN PAYOUT 2018 FUND

PERFORMANCE SUMMARY

Distributions (6/1/17–5/31/18)

| | | | | | | | | | | | |

| Share Class | | Net Investment

Income | | | Long-Term

Capital Gain | | | Total | |

| |

| | | |

R6 | | | $0.1398 | | | | $0.0027 | | | | $0.1425 | |

| |

| | | |

Advisor | | | $0.1388 | | | | $0.0027 | | | | $0.1415 | |

| |

|

Total Annual Operating Expenses5 | |

| Share Class | | With Waiver | | | Without Waiver | | | | |

| | | | | |

| | | |

Advisor | | | 0.45% | | | | 3.17% | | | | | |

| | | | | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will achieve the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 9/30/18. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Source: Morningstar. The Bloomberg Barclays US Government/Credit 2018 Maturity Index includes investment-grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2018.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

FRANKLIN PAYOUT 2018 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | | | |

Share

Class | | Beginning

Account

Value 12/1/17 | | | | Ending

Account

Value 5/31/18 | | Expenses Paid During

Period 12/1/17–5/31/181,2 | | | | Ending

Account

Value 5/31/18 | | Expenses Paid During

Period 12/1/17–5/31/181,2 | | | | Net

Annualized

Expense

Ratio2 |

| | | | | | | | | |

R6 | | $1,000 | | | | $1,006.30 | | $1.50 | | | | $1,023.44 | | $1.51 | | | | 0.30% |

Advisor | | $1,000 | | | | $1,005.20 | | $1.60 | | | | $1,023.34 | | $1.61 | | | | 0.32% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

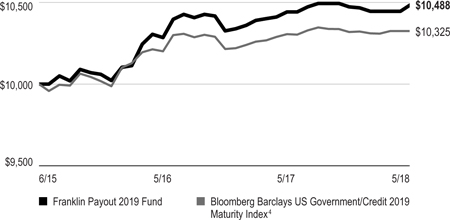

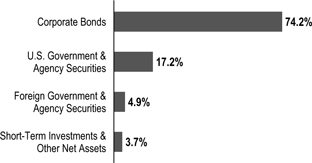

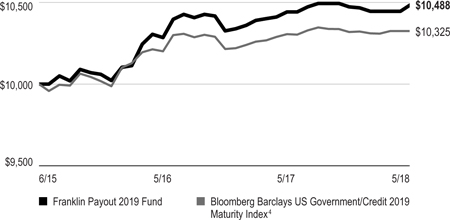

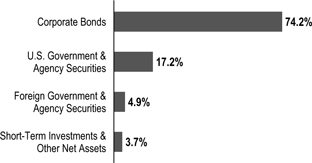

Franklin Payout 2019 Fund

This annual report for Franklin Payout 2019 Fund covers the fiscal year ended May 31, 2018.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in US dollar-denominated investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares delivered a +0.44% cumulative total return for the 12 months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays US Government/Credit 2019 Maturity Index, returned +0.50%.1 The index includes investment-grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2019. You can find more of the Fund’s performance data in the Performance Summary beginning on page 11.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a significant portion of the Fund’s assets in US dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use a top-down analysis of macroeconomic trends, combined with a bottom-up fundamental analysis of market sectors,

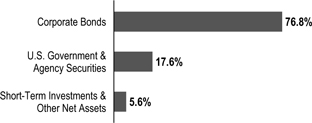

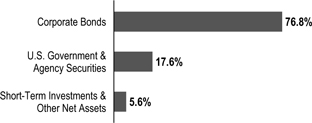

Portfolio Composition

Based on Total Net Assets as of 5/31/18

industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2019. Over time, the Fund’s duration and weighted average maturity will decline as 2019 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2019, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is designed for investors who seek an investment with a payout schedule to help meet their retirement spending needs, particularly those who are nearing retirement or are in retirement. There is no guarantee the Fund will meet an investor’s retirement spending needs.

|

What is duration? Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration. |

Maturity

5/31/18

| | |

| | | % of Total

Market Value |

| |

0 to 1 Year | | 4.9% |

| |

1 to 2 Years | | 95.1% |

1. Source: FactSet

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 38.

FRANKLIN PAYOUT 2019 FUND

Top 10 Holdings*

5/31/18

| | | | |

| Issue/Issuer | | % of Total

Net Assets | |

| |

| Federal Home Loan Bank (FHLB) | | | 9.1% | |

| |

| Federal National Mortgage Association (FNMA) | | | 4.9% | |

| |

| Federal Farm Credit Bank (FFCB) | | | 3.7% | |

| |

| Anheuser-Busch InBev Worldwide Inc. | | | 2.6% | |

| |

| Morgan Stanley | | | 2.6% | |

| |

| Boeing Capital Corp. | | | 2.6% | |

| |

| Emerson Electric Co. | | | 2.5% | |

| |

| Westpac Banking Corp. | | | 2.5% | |

| |

| Lockheed Martin Corp. | | | 2.5% | |

| |

| Deere & Co. | | | 2.5% | |

*Securities are listed by issuer, which may appear by another name in the SOI.

Manager’s Discussion

During the period under review, the Fund’s performance relative to the Bloomberg Barclays US Government/Credit 2019 Maturity Index was enhanced primarily by overweighted allocation to the investment-grade and high-yield corporate credit sectors, although security selection within the high-yield corporate credit sector detracted from returns. In contrast, longer duration positioning compared with the index was the primary detractor from relative performance during the period.

At period-end, we remained focused on investment-grade corporate credit exposures in the portfolio and maintained an overweighting in the sector compared with the index. We focused on the sector based on our belief that valuations remain relatively attractive on a longer term basis and that the sector has potential for higher earnings. Conversely, we maintained an underweighted allocation to the US Treasury sector as valuations and income levels remain unattractive to us. Additionally, we maintained an overweighted position to the agency sector. Finally, we maintained a slightly longer duration in the portfolio compared with the index, driven largely by our focus on bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2019 Fund. We look forward to serving your future investment needs.

| | |

| |  |

| | Roger A. Bayston, CFA |

| | |

| |  |

| | David Yuen, CFA, FRM |

| |

| | Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN PAYOUT 2019 FUND

Performance Summary as of May 31, 2018

The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 5/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%. Advisor Class: no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

| | | | |

| Share Class | | Cumulative Total Return2 | | Average Annual Total Return3 |

| | |

Advisor | | | | |

1-Year | | +0.44% | | +0.44% |

| | |

Since Inception (6/1/15) | | +4.88% | | +1.60% |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 13 for Performance Summary footnotes.

FRANKLIN PAYOUT 2019 FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Advisor Class (6/1/15–5/31/18)

See page 13 for Performance Summary footnotes.

FRANKLIN PAYOUT 2019 FUND

PERFORMANCE SUMMARY

Distributions (6/1/17–5/31/18)

| | | | | | | | | | | | |

Share Class | | Net Investment

Income | | | Long-Term

Capital Gain | | | Total | |

| |

| | | |

R6 | | | $0.1823 | | | | $0.0031 | | | | $0.1854 | |

| |

| | | |

Advisor | | | $0.1814 | | | | $0.0031 | | | | $0.1845 | |

| |

Total Annual Operating Expenses5

| | | | | | | | | | | | |

| Share Class | | With Waiver | | | Without Waiver | | | | |

| | | | | |

| | | |

Advisor | | | 0.45% | | | | 2.81% | | | | | |

| | | | | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will achieve the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 9/30/18. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Source: Morningstar. The Bloomberg Barclays US Government/Credit 2019 Maturity Index includes investment-grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2019.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

FRANKLIN PAYOUT 2019 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | | | |

Share Class | | Beginning

Account

Value 12/1/17 | | | | Ending

Account

Value 5/31/18 | | Expenses Paid During

Period 12/1/17–5/31/181,2 | | | | Ending

Account

Value 5/31/18 | | Expenses Paid During

Period 12/1/17–5/31/181,2 | | | | Net

Annualized

Expense

Ratio2 |

R6 | | $1,000 | | | | $1,001.60 | | $1.50 | | | | $1,023.44 | | $1.51 | | | | 0.30% |

Advisor | | $1,000 | | | | $1,001.50 | | $1.60 | | | | $1,023.34 | | $1.61 | | | | 0.32% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

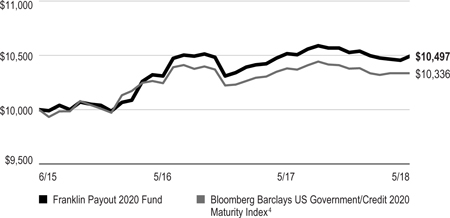

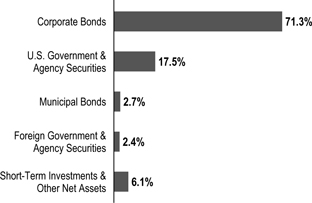

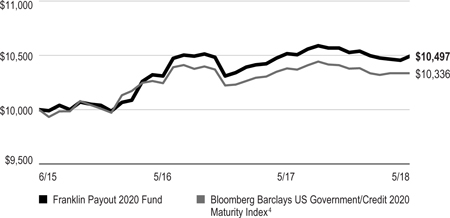

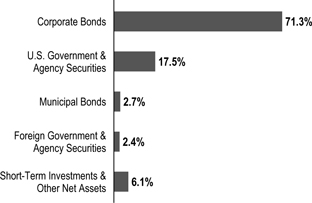

Franklin Payout 2020 Fund

This annual report for Franklin Payout 2020 Fund covers the fiscal year ended May 31, 2018.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in US dollar-denominated investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares delivered a -0.18% cumulative total return for the 12 months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays US Government/Credit 2020 Maturity Index, returned -0.16%.1 The index includes investment-grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2020. You can find more of the Fund’s performance data in the Performance Summary beginning on page 17.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a significant portion of the Fund’s assets in US dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use a top-down analysis of macroeconomic trends, combined with a bottom-up fundamental analysis of market sectors,

Portfolio Composition

Based on Total Net Assets as of 5/31/18

industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2020. Over time, the Fund’s duration and weighted average maturity will decline as 2020 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2020, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is designed for investors who seek an investment with a payout schedule to help meet their retirement spending needs, particularly those who are nearing retirement or are in retirement. There is no guarantee the Fund will meet an investor’s retirement spending needs.

|

What is duration? Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration. |

Maturity

5/31/18

| | |

| | | % of Total

Market Value |

| |

0 to 1 Year | | 3.1% |

| |

2 to 3 Years | | 96.9% |

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI). The SOI begins on page 43.

FRANKLIN PAYOUT 2020 FUND

Top 10 Holdings*

5/31/18

| | | | |

| Issue/Issuer | | % of Total

Net Assets | |

| U.S. Treasury Note | | | 12.2% | |

| |

| Federal Home Loan Bank (FHLB) | | | 5.0% | |

| |

| AEGON Funding Co. LLC | | | 2.6% | |

| |

| Morgan Stanley | | | 2.6% | |

| |

| Hershey Co. | | | 2.6% | |

| |

| Emerson Electric Co. | | | 2.6% | |

| |

| JPMorgan Chase & Co. | | | 2.5% | |

| |

| UnitedHealth Group Inc. | | | 2.5% | |

| |

| Travelers Cos. Inc. | | | 2.5% | |

| |

| TransCanada PipeLines Ltd. | | | 2.5% | |

| * | Securities are listed by issuer, which may appear by another name in the SOI. |

Manager’s Discussion

During the period under review, the Fund’s performance relative to the Bloomberg Barclays US Government/Credit 2020 Maturity Index was enhanced primarily by overweighted allocation to investment-grade and high-yield corporate credit sectors, while security selection within both sectors also contributed to returns. In contrast, longer duration positioning compared with the index was the primary detractor from relative performance during the period.

At period-end, we remained focused on investment-grade corporate credit exposures in the portfolio and maintained an overweighting in the sector compared with the index. We focused on the sector based on our belief that valuations remain relatively attractive on a longer term basis and that the sector has potential for higher earnings. Conversely, we maintained an underweighted allocation to the US Treasury sector as valuations and income levels remain unattractive to us. Additionally, we maintained an overweighted position to the agency sector. Finally, we maintained a slightly longer duration in the portfolio compared with the index, driven largely by our focus on bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2020 Fund. We look forward to serving your future investment needs.

| | |

| |  |

| | Roger A. Bayston, CFA |

| | |

| |  |

| | David Yuen, CFA, FRM |

| |

| | Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN PAYOUT 2020 FUND

Performance Summary as of May 31, 2018

The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 5/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%. Advisor Class: no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

| | | | | | | | |

| Share Class | | Cumulative

Total Return2 | | | Average Annual

Total Return3 | |

| | |

Advisor | | | | | | | | |

1-Year | | | -0.18% | | | | -0.18% | |

| | |

Since Inception (6/1/15) | | | +4.97% | | | | +1.63% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 19 for Performance Summary footnotes.

FRANKLIN PAYOUT 2020 FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Advisor Class (6/1/15–5/31/18)

See page 19 for Performance Summary footnotes.

FRANKLIN PAYOUT 2020 FUND

PERFORMANCE SUMMARY

Distributions (6/1/17–5/31/18)

| | | | | | | | | | | | |

Share Class | | Net Investment Income | | | | | | | |

R6 | | | $0.2029 | | | | | | | | | |

Advisor | | | $0.2020 | | | | | | | | | |

|

Total Annual Operating Expenses5 | |

Share Class | | With Waiver | | | Without Waiver | | | | |

Advisor | | | 0.45% | | | | 2.87% | | | | | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will achieve the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 9/30/18. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Source: Morningstar. The Bloomberg Barclays US Government/Credit 2020 Maturity Index includes investment-grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2020.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

FRANKLIN PAYOUT 2020 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual

(actual return after expenses) | | | | Hypothetical

(5% annual return before expenses) | | | | |

Share Class | | Beginning

Account

Value 12/1/17 | | | | Ending

Account

Value 5/31/18 | | Expenses Paid During Period 12/1/17–5/31/181,2 | | | | Ending

Account

Value 5/31/18 | | Expenses Paid During

Period 12/1/17–5/31/181,2 | | | | Net

Annualized

Expense

Ratio2 |

| | | | | | | | | | | | |

R6 | | $1,000 | | | | $997.30 | | $1.49 | | | | $1,023.44 | | $1.51 | | | | 0.30% |

Advisor | | $1,000 | | | | $997.20 | | $1.59 | | | | $1,023.34 | | $1.61 | | | | 0.32% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

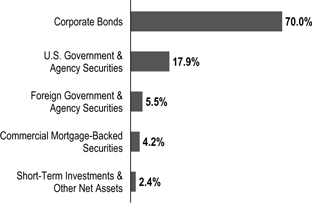

Franklin Payout 2021 Fund

This annual report for Franklin Payout 2021 Fund covers the fiscal year ended May 31, 2018.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in US dollar-denominated investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

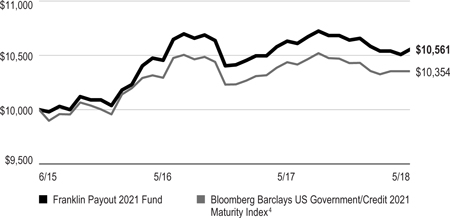

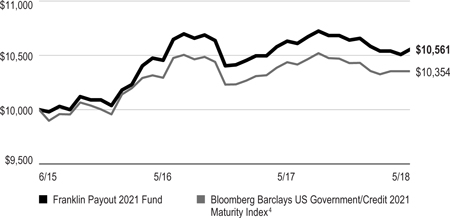

Performance Overview

The Fund’s Advisor Class shares had a -0.65% cumulative total return for the 12 months under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays US Government/ Credit 2021 Maturity Index, had a -0.65%.1 The index includes investment-grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2021. You can find more of the Fund’s performance data in the Performance Summary beginning on page 23.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at

(800) 321-8563.

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a significant portion of the Fund’s assets in US dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use a top-down analysis of macroeconomic trends, combined with a bottom-up fundamental analysis of market sectors,

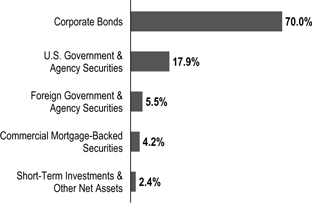

Portfolio Composition

Based on Total Net Assets as of 5/31/18

industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2021. Over time, the Fund’s duration and weighted average maturity will decline as 2021 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2021, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is designed for investors who seek an investment with a payout schedule to help meet their retirement spending needs, particularly those who are nearing retirement or are in retirement. There is no guarantee the Fund will meet an investor’s retirement spending needs.

|

What is duration? Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration. |

Manager’s Discussion

During the period under review, the Fund’s performance relative to the Bloomberg Barclays US Government/Credit

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 48.

FRANKLIN PAYOUT 2021 FUND

Maturity

5/31/18

| | | | |

| | | % of Total

Market Value | |

| |

| 0 to 1 Year | | | 5.5% | |

| |

| 3 to 4 Years | | | 94.5% | |

Top 10 Holdings* 5/31/18 | | | | |

| Issue/Issuer | | % of Total

Net Assets | |

| U.S. Treasury Note | | | 7.8% | |

| |

| Federal Home Loan Bank (FHLB) | | | 4.9% | |

| |

| Federal Farm Credit Bank (FFCB) | | | 4.8% | |

| |

| California State GO | | | 2.7% | |

| |

| Thomas & Betts Corp. | | | 2.7% | |

| |

| Telstra Corp. Ltd. | | | 2.6% | |

| |

| General Electric Co. | | | 2.6% | |

| |

| Total Capital SA | | | 2.6% | |

| |

| Gilead Sciences Inc. | | | 2.6% | |

| |

| Simon Property Group LP | | | 2.5% | |

| *Securities | are listed by issuer, which may appear by another name in the SOI. |

2021 Maturity Index was enhanced primarily by our overweighted allocations to the investment-grade and high-yield corporate credit sectors, although security selection within both sectors detracted from returns. Our allocation to taxable municipal bonds also contributed to performance, although this effect was partially offset by security selection within the sector. In contrast, our overweighted duration positioning was the primary detractor from performance.

At period-end, we remained focused on investment-grade corporate credit exposures in the portfolio and maintained an overweighting to the sector compared with the index. We focused on the sector based on our belief that valuations remain relatively attractive on a longer term basis and that the sector has potential for higher earnings. Conversely, we maintained an underweighted allocation to the US Treasury sector as valuations and income levels remain unattractive to us. Additionally, we maintained an overweighted position to the agency sector. Finally, we maintained a slightly longer duration in the portfolio compared with the index, driven largely by our focus on bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2021 Fund. We look forward to serving your future investment needs.

| | | | |

| | | |

|

| | | | Roger A. Bayston, CFA |

| | |

| | | |

|

| | | | David Yuen, CFA, FRM |

| | |

| | | | Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN PAYOUT 2021 FUND

Performance Summary as of May 31, 2018

The performance table and graph do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 5/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%. Advisor Class: no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

| | | | | | | | |

| Share Class | | Cumulative

Total Return2 | | | Average Annual

Total Return3 | |

| | |

Advisor | | | | | | | | |

1-Year | | | -0.65% | | | | -0.65% | |

| | |

Since Inception (6/1/15) | | | +5.61% | | | | +1.84% | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

See page 25 for Performance Summary footnotes.

FRANKLIN PAYOUT 2021 FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

Advisor Class (6/1/15–5/31/18)

See page 25 for Performance Summary footnotes.

FRANKLIN PAYOUT 2021 FUND

PERFORMANCE SUMMARY

Distributions (6/1/17–5/31/18)

| | | | | | | | | | |

Share Class | | Net Investment

Income | | | | | | |

R6 | | | $0.2259 | | | | | | | |

Advisor | | | $0.2250 | | | | | | | |

|

Total Annual Operating Expenses5 | |

Share Class | | With Waiver | | | Without Waiver | | | |

Advisor | | | 0.45% | | | 3.00% | | | | |

Each class of shares is available to certain eligible investors and has different annual fees and expenses, as described in the prospectus.

All investments involve risks, including possible loss of principal. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Interest rate movements will affect the Fund’s share price and yield. Bond prices generally move in the opposite direction of interest rates. As the prices of bonds in the Fund adjust to a rise in interest rates, the Fund’s share price may decline. Because the Fund can only distribute what it earns, the Fund’s distributions to shareholders may decline when prevailing interest rates fall or when the Fund experiences defaults on debt securities it holds. Interest earned on floating rate loans varies with changes in prevailing interest rates. Therefore, while floating rate loans offer higher interest income when interest rates rise, they will also generate less income when interest rates decline. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will achieve the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. The Fund has an expense reduction and a fee waiver associated with any investments it makes in a Franklin Templeton money fund and/or other Franklin Templeton fund, contractually guaranteed through 9/30/18. Fund investment results reflect the expense reduction and fee waiver; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the change in value of an investment over the periods indicated. Return for less than one year, if any, has not been annualized.

4. Source: Morningstar. The Bloomberg Barclays US Government/Credit 2021 Maturity Index includes investment-grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2021.

5. Figures are as stated in the Fund’s current prospectus and may differ from the expense ratios disclosed in the Your Fund’s Expenses and Financial Highlights sections in this report. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to become higher than the figures shown.

See www.franklintempletondatasources.com for additional data provider information.

FRANKLIN PAYOUT 2021 FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions, if applicable; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, if applicable, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value” for each class of shares. You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | | | | | | | | |

| | | | | | | Actual (actual return after expenses) | | | | Hypothetical (5% annual return before expenses) | | |

Share

Class | | Beginning

Account

Value 12/1/17 | | | | Ending

Account

Value 5/31/18 | | Expenses Paid During

Period 12/1/17–5/31/181,2

| | | | Ending

Account

Value 5/31/18 | | Expenses Paid During

Period 12/1/17–5/31/181,2 | | | | Net

Annualized

Expense

Ratio2 |

R6 | | $1,000 | | | | $992.60 | | $1.49 | | | | $1,023.44 | | $1.51 | | | | 0.30% |

Advisor | | $1,000 | | | | $992.50 | | $1.59 | | | | $1,023.34 | | $1.61 | | | | 0.32% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 182/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

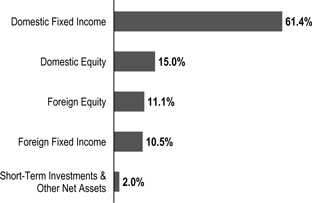

Franklin Payout 2022 Fund

This inaugural annual report for Franklin Payout 2022 Fund covers the period since the Fund’s inception on January 23, 2018, through May 31, 2018.

Your Fund’s Goals and Main Investments

The Fund seeks capital preservation and income with a predetermined maturity date. Under normal market conditions, the Fund invests predominantly in US dollar-denominated investment-grade debt securities and investments, including government and corporate debt securities and asset-backed securities and municipal securities.

Performance Overview

The Fund’s Advisor Class shares had a -0.60% cumulative total return for the period under review. In comparison, the Fund’s benchmark, the Bloomberg Barclays US Government/Credit 2022 Maturity Index, had a -0.31%.1 The index includes investment-grade, US dollar-denominated, fixed-rate Treasuries, government-related and corporate securities and foreign debt maturing in 2022. You can find more of the Fund’s performance data in the Performance Summary beginning on page 29.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. For most recent month-end performance, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

Investment Strategy

We focus on investment-grade securities and investments or in unrated securities and investments we determine are of comparable quality. Our focus on the portfolio’s credit quality is intended to reduce credit risk and help to preserve capital. We may invest a significant portion of the Fund’s assets in US dollar-denominated foreign securities, including debt issued by supranational entities. In choosing investments, we select securities in various market sectors based on our assessment of changing economic, market, industry and issuer conditions. We use a top-down analysis of macroeconomic trends, combined with a bottom-up fundamental analysis of market sectors,

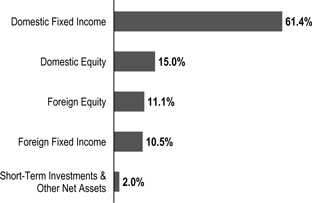

Portfolio Composition

Based on Total Net Assets as of 5/31/18

industries and issuers, to try to take advantage of varying sector reactions to economic events.

Although the Fund may invest in individual securities of any maturity, the Fund is a term fund and is managed to mature in 2022. Over time, the Fund’s duration and weighted average maturity will decline as 2022 approaches. In the later months of operation, when the debt securities held by the Fund mature, the proceeds from such securities will be held in cash, cash equivalents and money market instruments, including affiliated money market funds, or invested in short-term bonds. In early December 2022, the Fund is expected to consist almost entirely of cash, cash equivalents and money market instruments. The Fund is designed for investors who seek an investment with a payout schedule to help meet their retirement spending needs, particularly those who are nearing retirement or are in retirement. There is no guarantee the Fund will meet an investor’s retirement spending needs.

|

What is duration? Duration is a measure of a bond’s price sensitivity to interest-rate changes. In general, a portfolio of securities with a lower duration can be expected to be less sensitive to interest-rate changes than a portfolio with a higher duration. |

Manager’s Discussion

During the period under review, the Fund’s performance relative to the Bloomberg Barclays US Government/Credit

1. Source: FactSet.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 53.

FRANKLIN PAYOUT 2022 FUND

Maturity

5/31/18

| | | | |

| | | % of Total

Market Value | |

| |

| 0 to 1 Year | | | 2.0% | |

| |

| 4 to 5 Years | | | 93.8% | |

| |

| 6 to 7 Years | | | 2.8% | |

| |

| 7 to 8 Years | | | 1.4% | |

Top 10 Holdings*

5/31/18

| | | | |

| Issue/Issuer | | % of Total

Net Assets | |

| |

| U.S. Treasury Note | | | 9.4% | |

| |

| Federal Home Loan Bank (FHLB) | | | 8.5% | |

| |

| JPMorgan Chase & Co. | | | 2.9% | |

| |

| International Business Machines Corp. | | | 2.8% | |

| |

| Metlife Inc. | | | 2.8% | |

| |

| Swiss Re Treasury U.S. Corp. | | | 2.8% | |

| |

| American Express Credit Account Master Trust | | | 2.8% | |

| |

| United Parcel Service Inc. | | | 2.8% | |

| |

| Walmart Inc. | | | 2.8% | |

| |

| Caterpillar Financial Services Corp. | | | 2.8% | |

*Securities are listed by issuer, which may appear by another name in the SOI.

2022 Maturity Index was hindered primarily by our overweighted allocations to the investment-grade corporate credit sector, as well as security selection within the sector. In contrast, our overweighted duration positioning contributed to performance.

At period-end, we remained focused on investment-grade corporate credit exposures in the portfolio and maintained an overweighting in the sector compared with the index. We focused on the sector based on our belief that valuations remain relatively attractive on a longer term basis and that the sector has the potential for higher earnings. Conversely, we maintained an underweighted allocation to the US Treasury sector as valuations and income levels remain unattractive to us. Additionally, we maintained an overweighted position to the agency sector. Finally, we maintained a slightly longer

duration in the portfolio compared with the index, driven largely by our focus bonds with final maturity dates closer to the Fund’s predetermined maturity date.

Thank you for your participation in Franklin Payout 2022 Fund. We look forward to serving your future investment needs.

| | | | |

| | | |

|

| | | | Roger A. Bayston, CFA |

| | |

| | | |

|

| | | | David Yuen, CFA, FRM |

| | |

| | | | Portfolio Management Team |

The foregoing information reflects our analysis, opinions and portfolio holdings as of May 31, 2018, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

FRANKLIN PAYOUT 2022 FUND

Performance Summary as of May 31, 2018

The performance table does not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses. Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities.

Performance as of 5/31/181

Cumulative total return excludes sales charges. Average annual total return includes maximum sales charges. Sales charges will vary depending on the size of the investment and the class of share purchased. The maximum and minimum is 0%. Advisor Class: no sales charges. For other share classes, call a Franklin Templeton Institutional Services representative at (800) 321-8563.

| | | | | | | | |

| Share Class | | Cumulative

Total Return2 | | | Average Annual

Total Return3 | |

| | |

Advisor | | | | | | | | |

Since Inception (1/23/18) | | | -0.60% | | | | -0.60% | |