The information in this preliminary prospectus supplement and the accompanying prospectus is not complete and may be changed. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-261754

SUBJECT TO COMPLETION, DATED JANUARY 5, 2022

PRELIMINARY PROSPECTUS SUPPLEMENT

(To prospectus dated December 20, 2021)

Sumitomo Mitsui Financial Group, Inc.

(incorporated under the laws of Japan with limited liability)

U.S.$ Senior Floating Rate Notes due 2027

U.S.$ % Senior Notes due 2027

U.S.$ % Senior Notes due 2029

U.S.$ % Senior Notes due 2042

We expect to issue an aggregate principal amount of U.S.$ of senior notes due 2027, or the 5-year notes, an aggregate principal amount of U.S.$ of senior notes due 2029, or the 7-year notes, and an aggregate principal amount of U.S.$ of senior notes due 2042, or the 20-year notes, and together with the 5-year notes and the 7-year notes, the fixed rate notes. The 5-year notes, the 7-year notes and the 20-year notes will bear interest commencing , 2022, at an annual rate of %, % and %, respectively, payable semiannually in arrears on and of each year, beginning on , 2022.

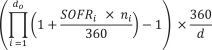

We also expect to issue an aggregate principal amount of U.S.$ of senior floating rate notes due 2027, or the floating rate notes, and together with the fixed rate notes, the notes. The floating rate notes will bear interest commencing , 2022 at a floating rate per annum, equal to Compounded Daily SOFR (determined as provided under “Description of the Notes”), plus % payable quarterly in arrears on , , and of each year, beginning on , 2022, subject to adjustments.

We intend to use the net proceeds from the sale of the notes to extend unsecured loans, intended to qualify as internal TLAC (defined herein), to Sumitomo Mitsui Banking Corporation, or SMBC. For the 7-year notes, SMBC intends to use the proceeds of the loans to finance, in whole or in part, existing and future qualifying environmentally-related projects, which we refer to as “Eligible Green Projects,” defined under the Green Bond Framework adopted by us and SMBC. See “Use of Proceeds—Use of Proceeds for the 7-year Notes.”

The notes will not be redeemable prior to maturity, except as set forth under “Description of the Notes—Redemption for Taxation Reasons,” and will not be subject to any sinking fund. The notes will be issued only in registered form in minimum denominations of U.S.$200,000 and integral multiples of U.S.$1,000 in excess thereof.

We have made an application to the Luxembourg Stock Exchange to list the notes on the official list of the Luxembourg Stock Exchange and for such notes to be admitted to trading on the Luxembourg Stock Exchange’s Euro MTF Market. The Luxembourg Stock Exchange’s Euro MTF Market is not a regulated market for the purposes of Directive 2014/65/EU. This prospectus supplement constitutes a prospectus for purposes of Part IV of the Luxembourg law on prospectus securities dated July 16, 2019.

This prospectus supplement does not constitute a prospectus for the purposes of Regulation (EU) 2017/1129 (the “Prospectus Regulation”) as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (the “EUWA”).

Investing in the notes involves risks. You should carefully consider the risk factors set forth in “Item 3. Key Information—Risk Factors” of our most recent annual report on Form 20-F filed with the U.S. Securities and Exchange Commission, or the SEC, and in the “Risk Factors” section beginning on page S-13 of this prospectus supplement before making any decision to invest in the notes.

| | | | | | | | | | | | | | | | | | | | |

| | | Per floating

rate note | | | Per 5-year

note | | | Per 7-year

note | | | Per 20-year

note | | | Total | |

Public offering price(1) | | | | % | | | | % | | | | % | | | | % | | U.S.$ | | |

Underwriting commissions(2) | | | | % | | | | % | | | | % | | | | % | | U.S.$ | | |

Proceeds, before expenses, to SMFG(1) | | | | % | | | | % | | | | % | | | | % | | U.S.$ | | |

| (1) | Plus accrued interest from , 2022, if settlement occurs after that date. |

| (2) | For additional underwriting compensation information, see “Underwriting (Conflicts of Interest).” |

Neither the SEC nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the related prospectus. Any representation to the contrary is a criminal offense.

The notes of each series will be represented by one or more global certificates deposited with a custodian for, and registered in the name of a nominee of, The Depository Trust Company, or DTC. Beneficial interests in these global certificates will be shown on, and transfers thereof will be effected through, records maintained by DTC and its direct and indirect participants, including Euroclear Bank SA/NV, or Euroclear, and Clearstream Banking S.A., or Clearstream. Except as described in this prospectus supplement or the accompanying prospectus, notes in definitive certificated form will not be issued in exchange for global certificates.

It is expected that the notes will be delivered in book-entry form only, through the facilities of DTC and its participants, including Euroclear and Clearstream, on or about , 2022.

Floating Rate Notes, 5-year Notes and 20-year Notes

Joint Lead Managers and Joint Bookrunners

| | |

| SMBC NIKKO | | Goldman Sachs & Co. LLC |

| BofA Securities | | Citigroup |

7-year Notes

Joint Lead Managers and Joint Bookrunners

| | | | |

SMBC NIKKO (Joint Green Structuring Agent) | | BofA Securities (Joint Green Structuring Agent) | | Barclays |

| | |

Credit Agricole CIB (Joint Green Structuring Agent) | | ING |

Prospectus Supplement dated , 2022