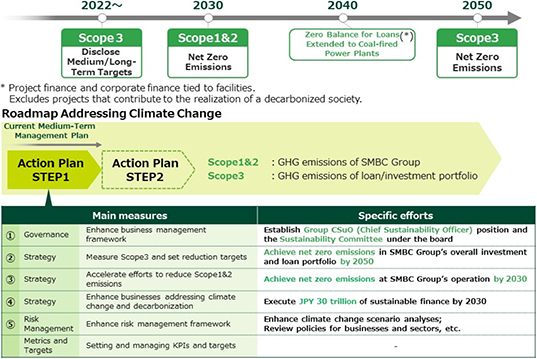

SMBC Group, including the Company, has been earnestly working on measures to address climate change issues, which it positions as one of our most important management issues, and is already promoting initiatives related to what this shareholder proposal seeks (implementation of loans and investments aligned with the goals of the Paris Agreement) as part of its management policy. Furthermore, SMBC Group continuously engages in open dialogues with environmental NGOs and institutional investors, including these proposing shareholders, on measures to address climate change. Since the adoption of the Paris Agreement, measures to address climate change issues have accelerated worldwide, and in October 2020, the Japanese government announced “2050 Carbon Neutrality,” a declaration aiming to realize a carbon-neutral society by reducing overall greenhouse gas (“GHG”) emissions to zero by 2050. Under these circumstances, while supporting the Japanese government’s policy, SMBC Group, as a financial group that conducts business globally in a wide range of fields, work earnestly to reduce GHG emissions in line with the goals of the Paris Agreement, and supports customers’ efforts contributing to the transition to and realization of a carbon-neutral society. Meanwhile, the Articles of Incorporation stipulate fundamental policies in the operation of a company, and therefore is inappropriate to stipulate matters concerning individual and specific business execution. The proposal seeks to stipulate in the Articles of Incorporation the setting and disclosure of business plans, including GHG emissions reduction targets aligned with the Paris Agreement, which is a case of individual and specific business execution. The Company will continue to review flexibly and implement swiftly its GHG emissions reduction targets and business plans in light of the ever-changing situation. Changes to the Articles of Incorporation require a special resolution at the General Meeting of Shareholders, therefore, if this proposal is approved, it will make it difficult for the Company to respond and adjust flexibly. SMBC Group, within the framework of the current Articles of Incorporation, has already committed to the following in August 2021: to achieve net zero GHG emissions across our overall loan and investment portfolio by 2050, as well as net zero in our groupwide operations by 2030. In October 2021, SMBC Group participated in the “Net-Zero Banking Alliance*,” an international initiative. Positioning concrete measures to be implemented over the short-to-medium term (around three years) as its “Action Plan,” the entire group is currently working on measures to address climate change issues. In May 2021, we announced the measures to be implemented by April 2023 in “Action Plan STEP1.” One of the major measures of “Action Plan STEP1” is to calculate the GHG Financed Emissions (FE) in our loan and investment portfolio and to set reduction targets. In terms of concrete results of this measure, we disclosed the amounts of FE of the power sector, including current corporate financing, in the “SMBC Group TCFD Report 2021” released in August 2021. In May 2022, we announced a FE reduction target for the power sector and calculated FE of the oil and gas sector, for strengthening measures to address climate change issues. Accordingly, through the “Action Plan,” and other materials which have already been released, the Board of Directors has made commitments regarding the contents requested in this proposal and the Company has announced such information in a timely manner. In addition, the Japan’s Corporate Governance Code (the “CG Code”), revised in June 2021, requires active responses to issues related to sustainability. SMBC Group has taken the following measures and complies with all matters required by the CG Code. |

indicates Chairman

indicates Chairman