UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-Q

| | | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: 001-14733

Lithia Motors, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Oregon | | 93-0572810 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| 150 N. Bartlett Street | Medford, | Oregon | 97501 |

| (Address of principal executive offices) | (Zip Code) |

(541) 776-6401

Registrant’s telephone number, including area code

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock without par value | | LAD | | The New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | Non-accelerated filer | Accelerated filer | Smaller reporting company | Emerging growth company |

| ☒ | ☐ | ☐ | ☐ | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of October 25, 2024, there were 26,637,156 shares of the registrant’s common stock outstanding.

LITHIA MOTORS, INC.

FORM 10-Q QUARTERLY REPORT

TABLE OF CONTENTS

| | | | | | | | |

| Item Number | Item | Page |

| GLOSSARY | |

| | |

| PART I | FINANCIAL INFORMATION | |

| | |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | OTHER INFORMATION | |

| | |

| Item 1. | Legal Proceedings | |

| Item 1A. | | |

| Item 2. | | |

| Item 5. | Other Information | |

| Item 6. | | |

| | |

| SIGNATURE | |

GLOSSARY OF DEFINITIONS

The following are abbreviations and definitions of terms used within this report:

| | | | | | | | |

| Terms | | Definitions |

| AFS | | Available-for-sale |

| ASC | | Accounting Standards Codification |

| ASU | | Accounting standards update |

| BOA | | Bank of America |

| Board | | Board of directors |

| BNS | | The Bank of Nova Scotia |

| BPS | | Basis points |

| CAD | | Canadian Dollar ($) |

| CORRA | | Canadian Overnight Repo Rate Average |

| CPO | | Certified pre-owned |

| DFC | | Driveway Finance Corporation |

| EBITDA | | Earnings before interest, taxes, depreciation, and amortization |

| EPS | | Earnings per share |

| FASB | | Financial Accounting Standards Board |

| GAAP | | Generally accepted accounting principles |

| GBP | | Great Britain Pound (£) |

| JPM | | JPMorgan Chase Bank, N.A. |

| LAD | | Lithia and Driveway |

| LMMH | | Lithia Marubeni Mobility Holdings |

| MD&A | | Management’s discussion and analysis |

| Mizuho | | Mizuho Bank, Ltd. |

| NCI | | Non-controlling interest |

| NM | | Not meaningful |

| NYSE | | New York Stock Exchange |

| PINE.L | | Pinewood Technologies Group PLC |

| PPA | | Purchase price allocation |

| QTD | | Quarter-to-date |

| RSU | | Restricted stock units |

| SEC | | Securities and Exchange Commission |

| SG&A | | Selling, general, and administrative |

| SOFR | | Secured Overnight Financing Rate |

| SONIA | | Sterling Overnight Index Average |

| U.K. | | United Kingdom |

| U.S. | | United States of America |

| USB | | US Bank National Association |

| USD | | United States Dollar ($) |

| | |

| YTD | | Year-to-date |

| | | | | | | | | | | |

| CONSOLIDATED BALANCE SHEETS |

| (In millions; Unaudited) | September 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash, restricted cash, and cash equivalents | $ | 359.5 | | | $ | 941.4 | |

| Accounts receivable, net of allowance for doubtful accounts of $3.1 and $7.1 | 1,209.4 | | | 1,123.1 | |

| Inventories, net | 6,100.2 | | | 4,753.9 | |

| Other current assets | 224.0 | | | 136.8 | |

| Total current assets | 7,893.1 | | | 6,955.2 | |

| | | |

| Property and equipment, net of accumulated depreciation of $773.8 and $646.7 | 4,664.0 | | | 3,981.4 | |

| Operating lease right-of-use assets | 722.5 | | | 478.8 | |

| Finance receivables, net of allowance for estimated losses of $120.5 and $106.4 | 3,765.5 | | | 3,242.3 | |

| Goodwill | 2,126.2 | | | 1,930.6 | |

| Franchise value | 2,575.3 | | | 2,402.2 | |

| Other non-current assets | 1,514.9 | | | 642.0 | |

| Total assets | $ | 23,261.5 | | | $ | 19,632.5 | |

| | | |

| Liabilities and equity | | | |

| Current liabilities: | | | |

| Floor plan notes payable | $ | 2,602.9 | | | $ | 1,347.0 | |

| Floor plan notes payable: non-trade | 2,516.7 | | | 2,288.5 | |

| Current maturities of long-term debt | 113.2 | | | 75.7 | |

| Current maturities of non-recourse notes payable | 10.3 | | | 33.9 | |

| Trade payables | 301.3 | | | 288.0 | |

| Accrued liabilities | 1,119.7 | | | 899.1 | |

| Total current liabilities | 6,664.1 | | | 4,932.2 | |

| | | |

| Long-term debt, less current maturities | 6,399.8 | | | 5,483.7 | |

| Non-recourse notes payable, less current maturities | 1,772.7 | | | 1,671.7 | |

| Deferred revenue | 400.5 | | | 264.1 | |

| Deferred income taxes | 455.8 | | | 349.3 | |

| Non-current operating lease liabilities | 636.1 | | | 427.9 | |

| Other long-term liabilities | 304.3 | | | 220.7 | |

| Total liabilities | 16,633.3 | | | 13,349.6 | |

| | | |

| Redeemable non-controlling interest | — | | | 44.0 | |

| | | |

| Equity: | | | |

| Preferred stock - no par value; authorized 15.0 shares; none outstanding | — | | | — | |

| Common stock - no par value; authorized 125.0 shares; issued and outstanding 26.6 and 27.4 | 878.3 | | | 1,100.6 | |

| Additional paid-in capital | 94.3 | | | 79.9 | |

| Accumulated other comprehensive income | 75.4 | | | 20.1 | |

| Retained earnings | 5,556.7 | | | 5,013.3 | |

| Total stockholders’ equity - Lithia Motors, Inc. | 6,604.7 | | | 6,213.9 | |

| Non-controlling interest | 23.5 | | | 25.0 | |

| Total equity | 6,628.2 | | | 6,238.9 | |

| Total liabilities, redeemable non-controlling interest, and equity | $ | 23,261.5 | | | $ | 19,632.5 | |

See accompanying condensed notes to consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF OPERATIONS |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In millions, except per share amounts; Unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

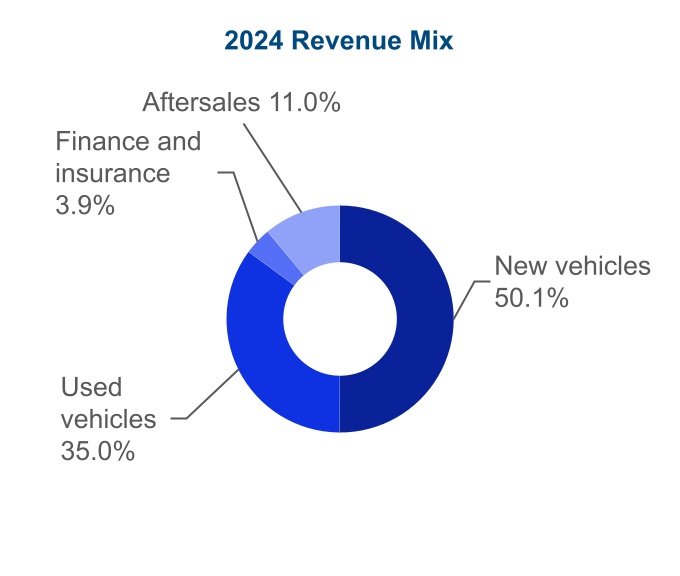

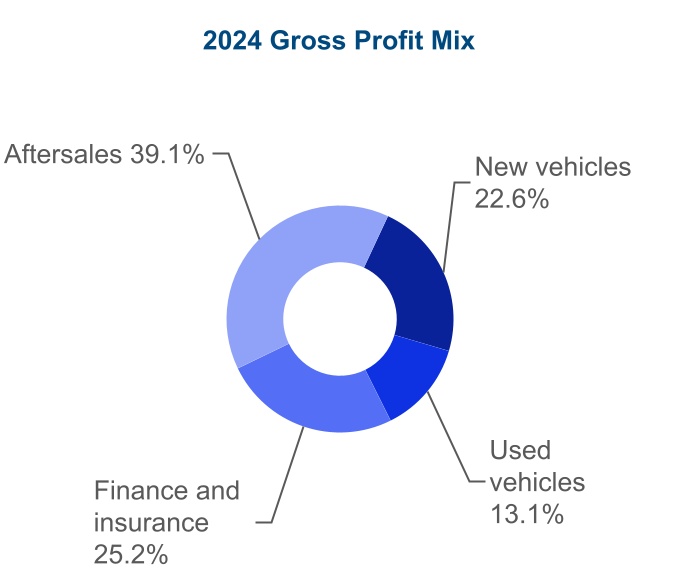

| New vehicle retail | $ | 4,430.0 | | | $ | 3,885.8 | | | $ | 12,847.9 | | | $ | 11,179.5 | |

| Used vehicle retail | 2,843.3 | | | 2,620.2 | | | 8,630.1 | | | 7,302.8 | |

| Used vehicle wholesale | 390.9 | | | 316.1 | | | 1,018.1 | | | 1,082.4 | |

| Finance and insurance | 360.4 | | | 349.4 | | | 1,061.9 | | | 1,005.6 | |

| Aftersales | 1,012.8 | | | 838.0 | | | 2,876.3 | | | 2,378.8 | |

| Fleet and other | 183.6 | | | 267.5 | | | 580.4 | | | 418.9 | |

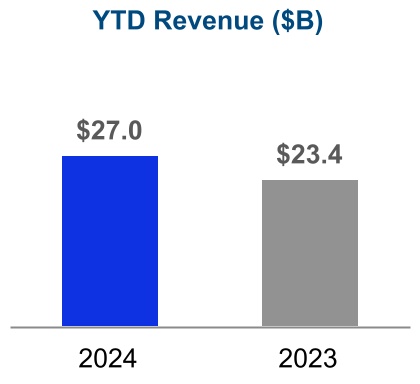

| Total revenues | 9,221.0 | | | 8,277.0 | | | 27,014.7 | | | 23,368.0 | |

| Cost of sales: | | | | | | | |

| New vehicle retail | 4,123.6 | | | 3,526.9 | | | 11,925.4 | | | 10,099.6 | |

| Used vehicle retail | 2,654.4 | | | 2,431.2 | | | 8,062.9 | | | 6,735.4 | |

| Used vehicle wholesale | 393.0 | | | 322.1 | | | 1,020.7 | | | 1,091.9 | |

| Aftersales | 453.0 | | | 375.2 | | | 1,285.1 | | | 1,077.7 | |

| Fleet and other | 166.6 | | | 250.3 | | | 531.1 | | | 395.2 | |

| Total cost of sales | 7,790.6 | | | 6,905.7 | | | 22,825.2 | | | 19,399.8 | |

| Gross profit | 1,430.4 | | | 1,371.3 | | | 4,189.5 | | | 3,968.2 | |

| | | | | | | |

| Finance operations income (loss) | 0.9 | | | (4.4) | | | 6.4 | | | (43.8) | |

| | | | | | | |

| | | | | | | |

| Selling, general and administrative | 943.6 | | | 850.8 | | | 2,853.0 | | | 2,458.1 | |

| Depreciation and amortization | 63.5 | | | 50.8 | | | 183.6 | | | 146.4 | |

| Operating profit | 424.2 | | | 465.3 | | | 1,159.3 | | | 1,319.9 | |

| Floor plan interest expense | (76.6) | | | (40.2) | | | (214.0) | | | (102.6) | |

| Other interest expense, net | (64.5) | | | (58.5) | | | (189.3) | | | (141.5) | |

| Other income (expense),net | 5.1 | | | (5.3) | | | 35.4 | | | 6.8 | |

| Income before income taxes | 288.2 | | | 361.3 | | | 791.4 | | | 1,082.6 | |

| Income tax provision | (65.3) | | | (96.4) | | | (187.0) | | | (287.0) | |

| Net income | 222.9 | | | 264.9 | | | 604.4 | | | 795.6 | |

| Net income attributable to non-controlling interest | (1.2) | | | (2.1) | | | (3.8) | | | (4.7) | |

| Net income attributable to redeemable non-controlling interest | (12.6) | | | (1.3) | | | (14.8) | | | (3.6) | |

| Net income attributable to Lithia Motors, Inc. | $ | 209.1 | | | $ | 261.5 | | | $ | 585.8 | | | $ | 787.3 | |

| | | | | | | |

| Basic earnings per share attributable to Lithia Motors, Inc. common stockholders | $ | 7.82 | | | $ | 9.49 | | | $ | 21.57 | | | $ | 28.60 | |

| Shares used in basic per share calculations | 26.7 | | | 27.6 | | | 27.2 | | | 27.5 | |

| | | | | | | |

| Diluted earnings per share attributable to Lithia Motors, Inc. common stockholders | $ | 7.80 | | | $ | 9.46 | | | $ | 21.54 | | | $ | 28.54 | |

| Shares used in diluted per share calculations | 26.8 | | | 27.6 | | | 27.2 | | | 27.6 | |

| | | | | | | |

| Cash dividends paid per share | $ | 0.53 | | | $ | 0.50 | | | $ | 1.56 | | | $ | 1.42 | |

See accompanying condensed notes to consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In millions; Unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Net income | $ | 222.9 | | | $ | 264.9 | | | $ | 604.4 | | | $ | 795.6 | |

| Other comprehensive (loss) income, net of tax: | | | | | | | |

| Foreign currency translation adjustment | 71.6 | | | (25.9) | | | 54.6 | | | 3.3 | |

| | | | | | | |

| Unrealized gain on debt securities, net of tax provision of $(0.3), $0.0, $(0.2) and $0.0, respectively | 1.2 | | | — | | | 0.7 | | | — | |

| | | | | | | |

| Total other comprehensive income (loss), net of tax | 72.8 | | | (25.9) | | | 55.3 | | | 3.3 | |

| Comprehensive income | 295.7 | | | 239.0 | | | 659.7 | | | 798.9 | |

| | | | | | | |

| Comprehensive income attributable to non-controlling interest | (1.2) | | | (2.1) | | | (3.8) | | | (4.7) | |

| Comprehensive income attributable to redeemable non-controlling interest | (12.6) | | | (1.3) | | | (14.8) | | | (3.6) | |

| Comprehensive income attributable to Lithia Motors, Inc. | $ | 281.9 | | | $ | 235.6 | | | $ | 641.1 | | | $ | 790.6 | |

See accompanying condensed notes to consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF EQUITY AND REDEEMABLE NON-CONTROLLING INTEREST |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (In millions; Unaudited) | 2024 | | 2023 | | 2024 | | 2023 |

| Total equity, beginning balances | $ | 6,392.4 | | | $ | 5,759.7 | | | $ | 6,238.9 | | | $ | 5,210.4 | |

| | | | | | | |

| Common stock, beginning balances | 924.0 | | | 1,116.1 | | | 1,100.6 | | | 1,082.1 | |

| Stock-based compensation | 1.5 | | | 2.5 | | | 29.7 | | | 36.1 | |

| Issuance of stock in connection with employee stock purchase plans | 7.4 | | | 7.9 | | | 21.2 | | | 22.8 | |

| | | | | | | |

| Repurchase of common stock, including excise tax | (54.6) | | | — | | | (273.2) | | | (14.5) | |

| | | | | | | |

| Common stock, ending balances | 878.3 | | | 1,126.5 | | | 878.3 | | | 1,126.5 | |

| | | | | | | |

| Additional paid-in capital, beginning balances | 79.5 | | | 62.5 | | | 79.9 | | | 76.8 | |

| Stock-based compensation | 14.8 | | | 8.6 | | | 14.4 | | | (5.7) | |

| | | | | | | |

| | | | | | | |

| Additional paid-in capital, ending balances | 94.3 | | | 71.1 | | | 94.3 | | | 71.1 | |

| | | | | | | |

| Accumulated other comprehensive income (loss), beginning balances | 2.6 | | | 11.2 | | | 20.1 | | | (18.0) | |

| Foreign currency translation adjustment | 71.6 | | | (25.9) | | | 54.6 | | | 3.3 | |

| | | | | | | |

| Unrealized gain on debt securities, net of tax provision of $(0.3), $0.0, $(0.2), and $0.0, respectively | 1.2 | | | — | | | 0.7 | | | — | |

| | | | | | | |

| Accumulated other comprehensive income (loss), ending balances | 75.4 | | | (14.7) | | | 75.4 | | | (14.7) | |

| | | | | | | |

| Retained earnings, beginning balances | 5,361.8 | | | 4,565.8 | | | 5,013.3 | | | 4,065.3 | |

| | | | | | | |

| Net income attributable to Lithia Motors, Inc. | 209.1 | | | 261.5 | | | 585.8 | | | 787.3 | |

| Dividends paid | (14.2) | | | (13.8) | | | (42.4) | | | (39.1) | |

| | | | | | | |

| Retained earnings, ending balances | 5,556.7 | | | 4,813.5 | | | 5,556.7 | | | 4,813.5 | |

| | | | | | | |

| Non-controlling interest, beginning balances | 24.5 | | | 4.1 | | | 25.0 | | | 4.2 | |

| (Distribution) contribution of non-controlling interest | (2.2) | | | 19.9 | | | (5.3) | | | 17.2 | |

| Net income attributable to non-controlling interest | 1.2 | | | 2.1 | | | 3.8 | | | 4.7 | |

| Non-controlling interest, ending balances | 23.5 | | | 26.1 | | | 23.5 | | | 26.1 | |

| | | | | | | |

| Total equity, ending balances | $ | 6,628.2 | | | $ | 6,022.5 | | | $ | 6,628.2 | | | $ | 6,022.5 | |

| | | | | | | |

| Redeemable non-controlling interest, beginning balances | $ | 46.2 | | | $ | 43.0 | | | $ | 44.0 | | | $ | 40.7 | |

| Distribution of redeemable non-controlling interest | (0.1) | | | — | | | (0.1) | | | — | |

| Net income attributable to redeemable non-controlling interest | 12.6 | | | 1.3 | | | 14.8 | | | 3.6 | |

| Redemption of redeemable non-controlling interest | (58.7) | | | — | | | (58.7) | | | — | |

| Redeemable non-controlling interest, ending balances | $ | — | | | $ | 44.3 | | | $ | — | | | $ | 44.3 | |

See accompanying condensed notes to consolidated financial statements.

| | | | | | | | | | | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS |

| | Nine Months Ended September 30, |

| (In millions; Unaudited) | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 604.4 | | | $ | 795.6 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | |

| | | |

| Depreciation and amortization | 219.7 | | | 154.9 | |

| Stock-based compensation | 44.1 | | | 30.4 | |

| | | |

| Net loss on disposal of other assets | 3.8 | | | 0.1 | |

| Net gain on disposal of stores | (0.3) | | | (31.4) | |

| Unrealized investment gain, net | (27.6) | | | (0.1) | |

| Deferred income taxes | 86.9 | | | 47.2 | |

| Amortization of operating lease right-of-use assets | 70.6 | | | 49.1 | |

| Decrease (increase) (net of acquisitions and dispositions): | | | |

| Accounts receivable, net | 44.7 | | | (110.6) | |

| Inventories | (324.3) | | | (498.2) | |

| Finance receivables | (526.5) | | | (907.0) | |

| Other assets | (114.7) | | | 5.8 | |

| Increase (decrease) (net of acquisitions and dispositions): | | | |

| Floor plan notes payable | 325.0 | | | 292.0 | |

| Trade payables | (26.7) | | | (34.1) | |

| Accrued liabilities | (6.2) | | | 9.7 | |

| Other long-term liabilities and deferred revenue | (9.6) | | | 19.4 | |

| Net cash provided by (used in) operating activities | 363.3 | | | (177.2) | |

| Cash flows from investing activities: | | | |

| | | |

| | | |

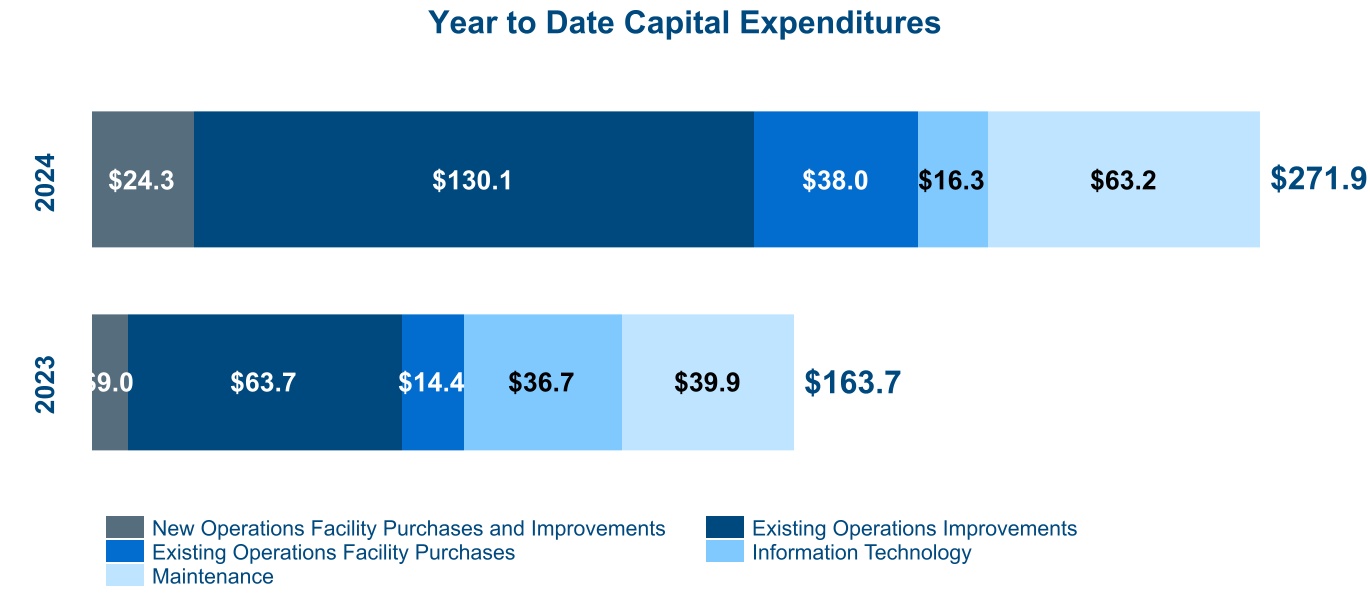

| Capital expenditures | (271.9) | | | (163.7) | |

| Proceeds from sales of assets | 5.3 | | | 3.1 | |

| Cash paid for other investments | (329.1) | | | (11.1) | |

| Cash paid for acquisitions, net of cash acquired | (1,247.0) | | | (1,204.7) | |

| Proceeds from sales of stores | 21.9 | | | 136.1 | |

| Net cash used in investing activities | (1,820.8) | | | (1,240.3) | |

| Cash flows from financing activities: | | | |

| Borrowings on floor plan notes payable, net: non-trade | 280.1 | | | 426.7 | |

| Borrowings on lines of credit | 10,325.4 | | | 9,625.1 | |

| Repayments on lines of credit | (9,627.0) | | | (9,681.0) | |

| Principal payments on long-term debt and finance lease liabilities, scheduled | (29.0) | | | (26.2) | |

| Principal payments on long-term debt and finance lease liabilities, other | (48.2) | | | (3.4) | |

| Proceeds from issuance of long-term debt | 279.5 | | | 79.8 | |

| Principal payments on non-recourse notes payable | (661.6) | | | (404.0) | |

| Proceeds from issuance of non-recourse notes payable | 739.0 | | | 1,451.7 | |

| Payment of debt issuance costs | (7.6) | | | (14.3) | |

| Proceeds from issuance of common stock | 21.2 | | | 23.0 | |

| Repurchase of common stock | (273.2) | | | (14.5) | |

| Dividends paid | (42.4) | | | (39.1) | |

| Payment of contingent consideration related to acquisitions | (12.0) | | | (14.0) | |

| Other financing activity | (64.0) | | | 17.2 | |

| Net cash provided by financing activities | 880.2 | | | 1,427.0 | |

| Effect of exchange rate changes on cash, restricted cash, and cash equivalents | 3.9 | | | 5.7 | |

| (Decrease) increase in cash, restricted cash, and cash equivalents | (573.4) | | | 15.2 | |

| Cash, restricted cash, and cash equivalents at beginning of year | 972.0 | | | 271.5 | |

| Cash, restricted cash, and cash equivalents at end of period | $ | 398.6 | | | $ | 286.7 | |

See accompanying condensed notes to consolidated financial statements.

| | | | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION |

| Nine Months Ended September 30, |

| (In millions) | 2024 | | 2023 |

| Reconciliation of cash, restricted cash, and cash equivalents to the consolidated balance sheets |

| Cash and cash equivalents | $ | 209.8 | | | $ | 146.9 | |

| Restricted cash from collections on auto loans receivable and customer deposits | 149.7 | | | 109.3 | |

| Cash, restricted cash, and cash equivalents | 359.5 | | | 256.2 | |

| Restricted cash on deposit in reserve accounts, included in other non-current assets | 39.1 | | | 30.5 | |

| Total cash, restricted cash, and cash equivalents reported in the Consolidated Statements of Cash Flows | $ | 398.6 | | | $ | 286.7 | |

| | | |

| Supplemental cash flow information: | | | |

| Cash paid during the period for interest | $ | 546.5 | | | $ | 359.3 | |

| Cash paid during the period for income taxes, net | 149.8 | | | 203.5 | |

| Debt paid in connection with store disposals | 13.1 | | | 13.2 | |

| | | |

| Non-cash activities: | | | |

| | | |

| | | |

| Contingent consideration in connection with acquisitions | $ | — | | | $ | 7.3 | |

| Debt assumed in connection with acquisitions | 868.1 | | | 401.6 | |

| Acquisition of finance leases in connection with acquisitions | 22.7 | | | 45.0 | |

| | | |

| Right-of-use assets obtained in exchange for lease liabilities | 310.7 | | | 139.1 | |

| | | |

See accompanying condensed notes to consolidated financial statements.

CONDENSED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. INTERIM FINANCIAL STATEMENTS

Basis of Presentation

These condensed Consolidated Financial Statements contain unaudited information as of September 30, 2024, and for the three and nine months ended September 30, 2024 and 2023. The unaudited interim financial statements have been prepared pursuant to the rules and regulations for reporting on Form 10-Q. Accordingly, certain disclosures required by accounting principles generally accepted in the United States of America for annual financial statements are not included herein. In management’s opinion, these unaudited financial statements reflect all adjustments (which include only normal recurring adjustments) necessary for a fair presentation of the information when read in conjunction with our 2023 audited Consolidated Financial Statements and the related notes thereto. The financial information as of December 31, 2023, is derived from our Annual Report on Form 10-K filed with the SEC on February 23, 2024. The results of operations for the interim periods presented are not necessarily indicative of the results to be expected for the full year.

Reclassifications

Certain reclassifications of amounts previously reported have been made to the accompanying Consolidated Financial Statements to maintain consistency and comparability between periods presented. Within our financing operations income, we disaggregated our “lease income” out of our previously reported “interest, fee, and lease income” to be its own separately presented line item, as well as revised the related “lease depreciation and amortization” to now be reported as “lease costs,” reclassifying amounts previously reported net within “lease income.”

NOTE 2. ACCOUNTS RECEIVABLE

Accounts receivable consisted of the following:

| | | | | | | | | | | |

| (in millions) | September 30, 2024 | | December 31, 2023 |

| Contracts in transit | $ | 451.4 | | | $ | 559.7 | |

| Trade receivables | 190.2 | | | 153.3 | |

| Vehicle receivables | 278.3 | | | 191.4 | |

| Manufacturer receivables | 280.5 | | | 216.5 | |

| Other receivables, current | 12.1 | | | 9.3 | |

| | 1,212.5 | | | 1,130.2 | |

| Less: Allowance for doubtful accounts | (3.1) | | | (7.1) | |

| Total accounts receivable, net | $ | 1,209.4 | | | $ | 1,123.1 | |

The long-term portion of accounts receivable was included as a component of other non-current assets in the Consolidated Balance Sheets.

NOTE 3. INVENTORIES AND FLOOR PLAN NOTES PAYABLE

The components of inventories, net, consisted of the following:

| | | | | | | | | | | |

| (in millions) | September 30, 2024 | | December 31, 2023 |

| New vehicles | $ | 3,631.8 | | | $ | 2,886.3 | |

| Used vehicles | 2,188.0 | | | 1,637.5 | |

| Parts and accessories | 280.4 | | | 230.1 | |

| Total inventories | $ | 6,100.2 | | | $ | 4,753.9 | |

Vehicle inventory costs are generally reduced by manufacturer holdbacks and incentives, while the related floor plan notes payable are reflective of the gross cost of the vehicle.

| | | | | | | | | | | |

| (in millions) | September 30, 2024 | | December 31, 2023 |

| Floor plan notes payable | $ | 2,602.9 | | | $ | 1,347.0 | |

| Floor plan notes payable: non-trade | 2,516.7 | | | 2,288.5 | |

| Total floor plan debt | $ | 5,119.6 | | | $ | 3,635.5 | |

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 8 |

NOTE 4. FINANCE RECEIVABLES

Interest income on finance receivables is recognized based on the contractual terms of each receivable and is accrued until repayment, reaching non-accrual status, charge-off, or repossession. Direct costs associated with originations are capitalized and expensed as an offset to interest income when recognized on the receivables.

The balances of finance receivables are made up of loans and finance leases secured by the related vehicles. More than 98% of the portfolio is aged less than 60 days past due with less than 2% on non-accrual status.

Finance Receivables, net

| | | | | | | | | | | |

| (in millions) | September 30, 2024 | | December 31, 2023 |

| Asset-backed term funding | $ | 2,267.8 | | | $ | 2,146.5 | |

| Warehouse facilities | 1,332.5 | | | 749.3 | |

| Other managed receivables | 285.7 | | | 452.9 | |

| Total finance receivables | 3,886.0 | | | 3,348.7 | |

| Less: Allowance for finance receivable losses | (120.5) | | | (106.4) | |

| Finance receivables, net | $ | 3,765.5 | | | $ | 3,242.3 | |

Finance Receivables by FICO Score

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2024 |

| Year of Origination |

| ($ in millions) | 2024 | | 2023 | | 2022 | | 2021 | | 2020 | | | | | | Total |

| <599 | $ | 44.4 | | | $ | 45.3 | | | $ | 26.1 | | | $ | 11.9 | | | $ | 1.6 | | | | | | | $ | 129.3 | |

| 600-699 | 428.7 | | | 452.6 | | | 338.2 | | | 103.9 | | | 10.0 | | | | | | | 1,333.4 | |

| 700-774 | 434.4 | | | 444.4 | | | 317.9 | | | 44.8 | | | 3.8 | | | | | | | 1,245.3 | |

| 775+ | 418.9 | | | 364.0 | | | 197.4 | | | 10.4 | | | 1.6 | | | | | | | 992.3 | |

| Total auto loan receivables | $ | 1,326.4 | | | $ | 1,306.3 | | | $ | 879.6 | | | $ | 171.0 | | | $ | 17.0 | | | | | | | 3,700.3 | |

Other finance receivables 1 | | | | | | | | | | | | | | | 185.7 | |

| Total finance receivables | | | | | | | | | | | | | | | $ | 3,886.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, 2023 |

| | | Year of Origination |

| ($ in millions) | 2023 | | 2022 | | 2021 | | 2020 | | | | | | | | Total |

| <599 | $ | 62.2 | | | $ | 39.0 | | | $ | 17.6 | | | $ | 2.4 | | | | | | | | | $ | 121.2 | |

| 600-699 | 586.6 | | | 463.6 | | | 152.7 | | | 16.1 | | | | | | | | | 1,219.0 | |

| 700-774 | 568.1 | | | 422.5 | | | 63.9 | | | 5.9 | | | | | | | | | 1,060.4 | |

| 775+ | 490.3 | | | 263.5 | | | 14.7 | | | 2.7 | | | | | | | | | 771.2 | |

| Total auto loan receivables | $ | 1,707.2 | | | $ | 1,188.6 | | | $ | 248.9 | | | $ | 27.1 | | | | | | | | | 3,171.8 | |

Other finance receivables 1 | | | | | | | | | | | | | | | 176.9 | |

| Total finance receivables | | | | | | | | | | | | | | | $ | 3,348.7 | |

1Includes legacy portfolio, loans that are originated with no FICO score available, lease receivables, and deferred origination fees.

In accordance with ASC Topic 326, the allowance for finance receivable losses is estimated based on our historical write-off experience, current conditions and forecasts, as well as the value of any underlying assets securing these receivables. Consideration is given to recent delinquency trends and recovery rates. Account balances are charged against the allowance upon reaching 120 days past due status.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 9 |

Rollforward of Allowance for Finance Receivable Losses

Our allowance for finance receivable losses represents the net credit losses expected over the remaining contractual life of our managed receivables. The allowances for credit losses related to finance receivables consisted of the following changes during the period:

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| (in millions) | 2024 | | 2023 |

| Allowance at beginning of period | $ | 106.4 | | | $ | 69.3 | |

| Charge-offs | (106.8) | | | (79.1) | |

| Recoveries | 44.2 | | | 35.5 | |

| Sold loans | (0.3) | | | — | |

| Initial allowance for credit-deteriorated receivables | — | | | 2.3 | |

| Provision expense | 77.0 | | | 75.0 | |

| Allowance at end of period | $ | 120.5 | | | $ | 103.0 | |

Charge-off Activity by Year of Origination

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| (in millions) | 2024 | | 2023 |

| 2024 | $ | 5.3 | | | $ | — | |

| 2023 | 45.4 | | | 5.0 | |

| 2022 | 39.5 | | | 47.1 | |

| 2021 | 13.6 | | | 23.0 | |

| 2020 | 1.2 | | | 2.3 | |

Other finance receivables 1 | 1.8 | | | 1.7 | |

| Total charge-offs | $ | 106.8 | | | $ | 79.1 | |

1Includes legacy portfolio, loans that are originated with no FICO score available, and finance lease receivables.

NOTE 5. GOODWILL AND FRANCHISE VALUE

The changes in the carrying amounts of goodwill are as follows:

| | | | | | | | | | | | | | | | | |

| (in millions) | Vehicle Operations | | Financing Operations | | Consolidated |

| Balance as of December 31, 2022 | $ | 1,443.5 | | | $ | 17.2 | | | $ | 1,460.7 | |

| | | | | |

Additions through acquisitions 1 | 519.1 | | | — | | | 519.1 | |

| Reductions through disposals | (51.1) | | | — | | | (51.1) | |

| | | | | |

| Currency translation | 1.5 | | | 0.4 | | | 1.9 | |

| Balance as of December 31, 2023 | 1,913.0 | | | 17.6 | | | 1,930.6 | |

Adjustments to purchase price allocations2 | 47.6 | | | — | | | 47.6 | |

Additions through acquisitions3 | 142.7 | | | — | | | 142.7 | |

| Reductions through disposals | (0.6) | | | — | | | (0.6) | |

| | | | | |

| Currency translation | 6.3 | | | (0.4) | | | 5.9 | |

| Balance as of September 30, 2024 | $ | 2,109.0 | | | $ | 17.2 | | | $ | 2,126.2 | |

1Our purchase price allocation (PPA) for the 2022 acquisitions were finalized in 2023. As a result, we added $285.9 million of goodwill. Preliminary PPA for a portion of our 2023 acquisitions resulted in adding $233.2 million of goodwill. Our PPA for the remaining 2023 acquisitions are preliminary and goodwill is not yet allocated to our segments. These amounts are included in other non-current assets until we finalize our purchase accounting. See Note 13 – Acquisitions.

2Our PPA for a portion of the 2023 acquisitions recognized in 2023 was adjusted and finalized in 2024 upon the completion of our fair value adjustments for assumed contract liabilities, acquired loan portfolio, and contingent consideration, adding $47.6 million of goodwill.

3Our PPA for the remainder of the 2023 acquisitions were finalized in 2024. As a result, we added $142.7 million of goodwill. Our PPA for the 2024 acquisitions are preliminary and goodwill is not yet allocated to our segments. These amounts are included in other non-current assets until we finalize our purchase accounting. See Note 13 – Acquisitions.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 10 |

The changes in the carrying amounts of franchise value are as follows:

| | | | | |

| (in millions) | Franchise Value |

| Balance as of December 31, 2022 | $ | 1,856.2 | |

| |

Additions through acquisitions 1 | 556.5 | |

| Reductions through divestitures | (14.5) | |

| |

| Currency translation | 4.0 | |

| Balance as of December 31, 2023 | 2,402.2 | |

| |

Additions through acquisitions 2 | 172.5 | |

| Reductions through divestitures | (5.3) | |

| |

| Currency translation | 5.9 | |

| Balance as of September 30, 2024 | $ | 2,575.3 | |

1Our PPA for the 2022 acquisitions were finalized in 2023. As a result, we added $363.1 million of franchise value. Preliminary PPA for a portion of our 2023 acquisitions resulted in adding $193.4 million of franchise value. Our PPA for the remaining 2023 acquisitions is preliminary and franchise value is not yet allocated to our reporting units. These amounts are included in other non-current assets until we finalize our purchase accounting. See Note 13 – Acquisitions.

2Our PPA for the remainder of the 2023 acquisitions were finalized in 2024. As a result, we added $172.5 million of franchise value. Our PPA for the 2024 acquisitions are preliminary and franchise value is not yet allocated to our reporting units. These amounts are included in other non-current assets until we finalize our purchase accounting. See Note 13 – Acquisitions.

NOTE 6. INVESTMENTS

Marketable Securities

In 2024, our captive insurance subsidiary began investing cash in excess of current needs in marketable securities. The marketable securities are recorded within other current assets in the Consolidated Balance Sheets and consist of debt securities accounted for as available-for-sale (AFS) and equity securities measured at fair value. Changes in the fair value of equity securities are recognized as a component of other income (expense), net in the Consolidated Statements of Operations and unrealized gains (losses) on AFS debt securities are recorded as a component of other comprehensive income (loss), net of tax until the security is sold. See Note 12 – Fair Value Measurements.

As of September 30, 2024, equity securities recorded within other current assets in the Consolidated Balance Sheets were $2.2 million. Net unrealized gains recognized during the three and nine-months ended September 30, 2024 on equity securities held at the reporting date were $0.1 million and $0.3 million, respectively.

Marketable debt securities accounted for as AFS were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2024 |

| | | | | | | | | Fair Value of Securities with Contractual Maturities |

| (in millions) | Amortized Cost | | Total Gains1 | | Total Losses1 | | Fair Value | | Within 1 Year | | | | | | After 1 Year through 5 Years | | After 5 Years |

| U.S. Treasury | $ | 20.2 | | | $ | 0.3 | | | $ | — | | | $ | 20.5 | | | $ | 3.4 | | | | | | | $ | 13.9 | | | $ | 3.2 | |

| Municipal securities | 10.0 | | | 0.2 | | | — | | | 10.2 | | | 1.5 | | | | | | | 3.8 | | | 4.9 | |

| Corporate debt | 20.6 | | | 0.4 | | | — | | | 21.0 | | | 1.9 | | | | | | | 14.1 | | | 5.0 | |

| Total | $ | 50.8 | | | $ | 0.9 | | | $ | — | | | $ | 51.7 | | | $ | 6.8 | | | | | | | $ | 31.8 | | | $ | 13.1 | |

1Represents total unrealized gains (losses) for securities with net gains (losses) in accumulated other comprehensive income as of September 30, 2024.

There were no sales of AFS securities during the three and nine-months ended September 30, 2024.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 11 |

Equity Method Investments

Our investment in Pinewood Technologies, PLC (PINE.L), U.K. based automotive dealership management system provider, consists of 25.5% common stock voting interests accounted for as an equity method investment. The investment is measured at fair value based on quoted market prices, and all fair market value changes in the investment are recorded as unrealized gains as a component of other income (expense), net in the Consolidated Statements of Operations. The fair value of our investment was $105.4 million as of September 30, 2024. See Note 12 – Fair Value Measurements.

Our investment in Wheels, Inc., automotive fleet management provider, through LMMH consists of 26.5% common stock voting interests accounted for as an equity method investment. The investment is measured at cost plus or minus our share of equity method investee income or loss as a component of other non-current assets in the Consolidated Balance Sheets. The book value of our investment was $208.0 million as of September 30, 2024.

We reported unrealized gains on equity method investments of $0.7 million and $30.5 million for the three and nine months ended September 30, 2024, respectively. Comparatively, we recorded a loss of $0.7 million and gain of $0.1 million in the same periods of 2023, respectively.

NOTE 7. NET INVESTMENT IN OPERATING LEASES

Net investment in operating leases consists primarily of lease contracts for vehicles with individuals and business entities. Assets subject to operating leases are depreciated using the straight-line method over the term of the lease to reduce the asset to its estimated residual value. Estimated residual values are based on assumptions for used vehicle prices at lease termination and the number of vehicles that are expected to be returned.

Net investment in operating leases was as follows:

| | | | | | | | | | | |

| (in millions) | September 30, 2024 | | December 31, 2023 |

Vehicles, at cost 1 | $ | 323.3 | | | $ | 102.7 | |

Accumulated depreciation 1 | (20.2) | | | (11.2) | |

| Net investment in operating leases | $ | 303.1 | | | $ | 91.5 | |

1Vehicles, at cost and accumulated depreciation are recorded in other non-current assets on the Consolidated Balance Sheets.

NOTE 8. COMMITMENTS AND CONTINGENCIES

Contract Liabilities

We are the obligor on our lifetime oil and at home valet contracts. Revenue is allocated to these performance obligations and is recognized over time as services are provided to the customer. The amount of revenue recognized is calculated, net of cancellations, using an input method, which most closely depicts performance of the contracts. Our contract liability balances were $402.3 million and $317.0 million as of September 30, 2024, and December 31, 2023, respectively; and we recognized $17.7 million and $54.2 million of revenue in the three and nine months ended September 30, 2024 related to our contract liability balance at December 31, 2023. Our contract liability balance is included in accrued liabilities and deferred revenue.

Litigation

We are party to numerous legal proceedings arising in the normal course of our business. Although we do not anticipate that the resolution of legal proceedings arising in the normal course of business will have a material adverse effect on our business, results of operations, financial condition, or cash flows, we cannot predict this with certainty.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 12 |

NOTE 9. DEBT

Credit Facilities

US Bank Syndicated Credit Facility

On February 23, 2024, we amended our existing syndicated credit facility (USB credit facility), comprised of 21 financial institutions, including eight manufacturer-affiliated finance companies, maturing February 23, 2029. The amendment increased the total financing commitment and the amount to which the commitment could be further expanded.

This USB credit facility provides for a total financing commitment of $6.0 billion, which may be further expanded, subject to lender approval and the satisfaction of other conditions, up to a total of $6.5 billion. The allocation of the financing commitment is for up to $2.8 billion in new vehicle inventory floorplan financing, up to $900 million in used vehicle inventory floorplan financing, up to $100 million in service loaner vehicle floorplan financing, and up to $2.2 billion in revolving financing for general corporate purposes, including acquisitions and working capital. We have the option to reallocate the commitments under this USB credit facility, provided that the aggregate revolving loan commitment may not be more than 40% of the amount of the aggregate commitment, and the aggregate service loaner vehicle floorplan commitment may not be more than the 3% of the amount of the aggregate commitment. All borrowings from, and repayments to, our lending group are presented in the Consolidated Statements of Cash Flows as financing activities.

Our obligations under our USB credit facility are secured by a substantial amount of our assets, including our inventory (including new and used vehicles, parts and accessories), equipment, accounts receivable (and other rights to payment), real property, and our equity interests in certain of our subsidiaries. Under our USB credit facility, our obligations relating to new vehicle floor plan loans are secured only by collateral owned by Lithia and its dealerships borrowing under the new vehicle floor plan portion of the USB credit facility.

The interest rate on the USB credit facility varies based on the type of debt, with the rate of one-day SOFR plus a credit spread adjustment of 0.10% plus a margin of 1.10% for new vehicle floor plan financing, 1.40% for used vehicle floor plan financing, 1.20% for service loaner floor plan financing, and a variable interest rate on the revolving financing ranging from 1.00% to 2.00% depending on our leverage ratio. The annual interest rates associated with our floor plan commitments are as follows:

| | | | | |

| Commitment | Annual Interest Rate at September 30, 2024 |

| New vehicle floor plan | 6.16% |

| Used vehicle floor plan | 6.46% |

| Service loaner floor plan | 6.26% |

| Revolving line of credit | 6.31% |

JPM Warehouse Facility

On August 15, 2024, we amended our securitization facility for our auto loan portfolio (JPM warehouse facility) with JPMorgan Chase Bank, as administrative agent and account bank, providing initial commitments for borrowings of up to $1.0 billion. The JPM warehouse facility matures on November 16, 2026. The interest rate on the JPM warehouse facility varies based on the Daily Simple SOFR rate plus 1.00% to 1.70%.

Mizuho Warehouse Facility

On February 16, 2024, we amended our securitization facility for our auto loan portfolio (Mizuho warehouse facility), with Mizuho Bank Ltd. as administrative agent and account bank, providing initial commitments for borrowings of up to $750 million. The Mizuho warehouse facility matures on July 20, 2026. The interest rate on the Mizuho warehouse facility varies based on the Daily Simple SOFR rate plus 1.20%.

Bank of Nova Scotia Syndicated Credit Facility

On May 14, 2024, we amended our syndicated credit agreement with The Bank of Nova Scotia as agent (BNS credit facility), comprised of six financing institutions, including two manufacturer-affiliated finance companies, to extend the maturity date.

The BNS credit facility provides for a total financing commitment of approximately $1.1 billion CAD, including a working capital revolving credit facility of up to $100 million CAD, a wholesale flooring facility for new vehicles up to $500 million CAD, used vehicle flooring facility of up to $100 million CAD, wholesale leasing facility of up to $400 million CAD, and daily rental vehicle facility up to $25 million CAD.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 13 |

The interest rate on the BNS credit facility varies based on the type of debt, with the daily compound rate of the Canadian Overnight Repo Rate Average (CORRA) plus a margin of 1.00-1.30%. The annual interest rates associated with our floor plan commitments are as follows:

| | | | | |

| Commitment | Annual Interest Rate at September 30, 2024 |

| Wholesale flooring facility | 5.30% |

| Used vehicle flooring facility | 5.55% |

| Daily rental facility | 5.50% |

| Wholesale leasing facility | 5.60% |

| Working capital revolving facility | 5.55% |

All Canadian facilities other than the wholesale flooring facility, which is a demand facility, mature on March 18, 2027. The credit agreement includes various financial and other covenants typical of such agreements.

Bank of America UK Revolving Credit Facility

On July 9, 2024 we amended our revolving credit facility agreement with BOA. The amendment extended the maturity date to February 22, 2029 and increased the commitment to £100.0 million GBP. The interest rate on the working capital line of credit is measured based on the Sterling Overnight Index Average (SONIA) plus 1.45%.

Non-Recourse Notes Payable

In 2024, we issued $739.0 million in non-recourse notes payable related to asset-backed term funding transactions. Below is a summary of outstanding non-recourse notes payable issued:

| | | | | | | | | | | | | | | | | |

| ($ in millions) | Balance as of September 30, 2024 | Initial Principal Amount | Issuance Date | Interest Rate Range | Final Distribution Date |

| LAD Auto Receivables Trust 2021-1 Class A-D | $ | 56.5 | | $ | 344.4 | | 11/24/21 | 1.94% to 3.99% | Various dates through Nov 2029 |

| LAD Auto Receivables Trust 2022-1 Class A-C | 96.4 | | 298.1 | | 08/17/22 | 5.21% to 6.85% | Various dates through Apr 2030 |

| LAD Auto Receivables Trust 2023-1 Class A-D | 208.9 | | 479.7 | | 02/14/23 | 5.48% to 7.30% | Various dates through Jun 2030 |

| LAD Auto Receivables Trust 2023-2 Class A-D | 283.3 | | 556.7 | | 05/24/23 | 5.42% to 6.30% | Various dates through Feb 2031 |

| LAD Auto Receivables Trust 2023-3 Class A-D | 251.8 | | 415.4 | | 08/23/23 | 5.95% to 6.92% | Various dates through Dec 2030 |

| LAD Auto Receivables Trust 2023-4 Class A-D | 281.4 | | 421.2 | | 11/15/23 | 6.10% to 7.37% | Various dates through Apr 2031 |

| LAD Auto Receivables Trust 2024-1 Class A-D | 248.4 | | 329.4 | | 02/14/24 | 5.17% to 6.15% | Various dates through Jun 2031 |

| LAD Auto Receivables Trust 2024-2 Class A-D | 356.3 | | $ | 409.6 | | 06/20/24 | 5.46% to 6.37% | Various dates through Oct 2031 |

| Total non-recourse notes payable | $ | 1,783.0 | | $ | 3,254.5 | | | | |

NOTE 10. RETIREMENT PLANS AND POSTRETIREMENT BENEFITS

Company-Sponsored Defined Benefit Pension Plan

In 2024, we acquired Pendragon PLC’s Fleet Management and UK Motor Divisions in the United Kingdom, which included the assumption of its company-sponsored defined benefit plan applicable to a portion of the salaried present and past employees, closed to future accrual. At the time of acquisition, these balances increased our defined benefit obligations by $465.7 million and increased our fair value of plan assets by $466.4 million.

Net Periodic (Benefit) Cost

Interest cost represents the increase in the projected benefit obligation, which is a discounted amount, due to the passage of time. The expected return on plan assets reflects the computed amount of current-year earnings from the investment of plan assets using an estimated long-term rate of return.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 14 |

| | | | | | | | | | | | | |

| ($ in millions) | Three Months Ended September 30, 2024 | | Nine Months Ended September 30, 2024 | | |

| | | | | |

| Interest cost | $ | 7.8 | | | $ | 21.5 | | | |

| Expected return on plan assets | (8.5) | | | (23.4) | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net periodic benefit | $ | (0.7) | | | $ | (1.9) | | | |

During the nine months ended September 30, 2024, funding of pension plans was $16.6 million. For the remainder of 2024, we estimate approximately $1.2 million of cash contributions.

NOTE 11. EQUITY AND REDEEMABLE NON-CONTROLLING INTEREST

Repurchases of Common Stock

Repurchases of our common stock occurred under a repurchase authorization granted by our Board and related to shares withheld as part of the vesting of RSUs.

On June 4, 2024, our Board approved an additional $350 million repurchase authorization of our common stock. This authorization is in addition to the amount previously authorized by the Board for repurchase. Share repurchases under our authorization were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Repurchases Occurring in 2024 | | Cumulative Repurchases as of September 30, 2024 |

| | Shares | | Average Price1 | | Shares | | Average Price |

| Share Repurchase Authorization | 986,032 | | | $ | 259.76 | | | 8,033,542 | | | $ | 185.36 | |

1Price excludes excise taxes imposed under the Inflation Reduction Act of $2.0 million for the nine months ended September 30, 2024.

As of September 30, 2024, we had $560.9 million available for repurchases pursuant to our share repurchase authorizations from our Board in 2024 and prior years.

In addition, during 2024, we repurchased 45,903 shares at an average price of $328.62 per share, for a total of $15.1 million, related to tax withholding associated with the vesting of RSUs. The repurchase of shares related to tax withholding associated with stock awards does not reduce the number of shares available for repurchase as approved by our Board.

Redeemable Non-Controlling Interest

In 2021, we expanded into Canada through a partnership with Toronto-based Pfaff Automotive Partners. As part of the partnership, we were granted the right to purchase (Call Option), and granted Pfaff Automotive a right to sell (Put Option), the remaining ownership interest in the partnership after a three-year period. As a result of this redemption feature, we recorded redeemable NCI that is classified as mezzanine equity in the accompanying Consolidated Balance Sheets.

In August 2024, we completed the acquisition of the remaining 10.1% interest in our redeemable non-controlling interest (NCI), resulting in us now owning 100% of our operations in Canada. Prior to this transaction, the acquired entities were fully consolidated in our financial statements due to our majority ownership; however, this acquisition eliminates the redeemable NCI. The transaction was executed for total consideration of $58.8 million, which included an additional premium of $11.6 million recognized as a component of “Net income attributable to redeemable non-controlling interest” in our Consolidated Statements of Operations.

NOTE 12. FAIR VALUE MEASUREMENTS

Factors used in determining the fair value of our financial assets and liabilities are summarized into three broad categories:

•Level 1 - quoted prices in active markets for identical securities;

•Level 2 - other significant observable inputs, including quoted prices for similar securities, interest rates, prepayment spreads, credit risk; and

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 15 |

•Level 3 - significant unobservable inputs, including our own assumptions in determining fair value.

We determined the carrying value of cash equivalents, accounts receivable, trade payables, accrued liabilities, finance receivables, and short-term borrowings approximate their fair values because of the nature of their terms and current market rates of these instruments. We believe the carrying value of our variable rate debt approximates fair value. We have measured the carrying value of our equity method investments without a fair value election at cost plus or minus our proportionate share of earnings or losses in the investee.

We have investments consisting of equity securities, available for sale debt securities, and equity method investments with a fair value election. We calculated the estimated fair value of the equity securities, equity method investments, and U.S. Treasury debt securities using quoted market prices (Level 1). The fair value of corporate and municipal debt securities are measured using observable Level 2 market expectations at each measurement date. See Note 6 – Investments.

We have fixed rate debt primarily consisting of amounts outstanding under our senior notes, non-recourse notes payable, and real estate mortgages. We calculated the estimated fair value of the senior notes using quoted prices for the identical liability (Level 1). The fair value of non-recourse notes payable are measured using observable Level 2 market expectations at each measurement date. The calculated estimated fair values of the fixed rate real estate mortgages and finance lease liabilities use a discounted cash flow methodology with estimated current interest rates based on a similar risk profile and duration (Level 2). The fixed cash flows are discounted and summed to compute the fair value of the debt.

We have derivative instruments consisting of an offsetting set of interest rate caps. The fair value of derivative assets and liabilities are measured using observable Level 2 market expectations at each measurement date and is recorded as other current assets, current liabilities and other long-term liabilities in the Consolidated Balance Sheets.

Nonfinancial assets such as goodwill, franchise value, or other long-lived assets are measured and recorded at fair value during a business combination or when there is an indicator of impairment. We evaluate our goodwill and franchise value using a qualitative assessment process. If the qualitative factors determine that it is more likely than not that the carrying value exceeds the fair value, we would further evaluate for potential impairment using a quantitative assessment. The quantitative assessment estimates fair values using unobservable (Level 3) inputs by discounting expected future cash flows of the store for franchise value, or reporting unit for goodwill. The forecasted cash flows contain inherent uncertainties, including significant estimates and assumptions related to growth rates, margins, working capital requirements, and cost of capital, for which we utilize certain market participant-based assumptions we believe to be reasonable. We estimate the value of other long-lived assets that are recorded at fair value on a non-recurring basis on a market valuation approach. We use prices and other relevant information generated primarily by recent market transactions involving similar or comparable assets, as well as our historical experience in divestitures, acquisitions and real estate transactions. Additionally, we may use a cost valuation approach to value long-lived assets when a market valuation approach is unavailable. Under this approach, we determine the cost to replace the service capacity of an asset, adjusted for physical and economic obsolescence. When available, we use valuation inputs from independent valuation experts, such as real estate appraisers and brokers, to corroborate our estimates of fair value. Real estate appraisers’ and brokers’ valuations are typically developed using one or more valuation techniques including market, income and replacement cost approaches. Because these valuations contain unobservable inputs, we classified the measurement of fair value of long-lived assets as Level 3.

There were no changes to our valuation techniques during the nine-month period ended September 30, 2024.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 16 |

Below are our assets and liabilities that are measured at fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of September 30, 2024 | | As of December 31, 2023 |

| ($ in millions) | Carrying Value | | Level 1 | | Level 2 | | Level 3 | | Carrying Value | | Level 1 | | Level 2 | | Level 3 |

| Recorded at fair value | | | | | | | | | | | | | | | |

| Marketable securities | | | | | | | | | | | | | | | |

| Equity securities | $ | 2.2 | | | $ | 2.2 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | |

| U.S. Treasury | $ | 20.5 | | | $ | 20.5 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| Municipal debt | 10.2 | | | — | | | 10.2 | | | — | | | — | | | — | | | — | | | — | |

| Corporate debt | 21.0 | | | — | | | 21.0 | | | — | | | — | | | — | | | — | | | — | |

| Total debt securities | $ | 51.7 | | | $ | 20.5 | | | $ | 31.2 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | |

| Equity Method Investment | | | | | | | | | | | | | | | |

| PINE.L | $ | 105.4 | | | $ | 105.4 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | |

| Derivatives | | | | | | | | | | | | | | | |

| Derivative assets | $ | 5.6 | | | $ | — | | | $ | 5.6 | | | $ | — | | | $ | 12.3 | | | $ | — | | | $ | 12.3 | | | $ | — | |

| Derivative liabilities | 5.6 | | | — | | | 5.6 | | | — | | | 12.3 | | | — | | | 12.3 | | | — | |

| | | | | | | | | | | | | | | |

| Recorded at historical value | | | | | | | | | | | | | | | |

Fixed rate debt 1 | | | | | | | | | | | | | | | |

| 4.625% Senior notes due 2027 | $ | 400.0 | | | $ | 390.0 | | | $ | — | | | $ | — | | | $ | 400.0 | | | $ | 380.0 | | | $ | — | | | $ | — | |

| 4.375% Senior notes due 2031 | 550.0 | | | 510.8 | | | — | | | — | | | 550.0 | | | 492.3 | | | — | | | — | |

| 3.875% Senior notes due 2029 | 800.0 | | | 744.0 | | | — | | | — | | | 800.0 | | | 716.0 | | | — | | | — | |

| Non-recourse notes payable | 1,783.0 | | | — | | | 1,801.9 | | | — | | | 1,705.6 | | | — | | | 1,705.1 | | | — | |

| Real estate mortgages and other debt | 740.7 | | | — | | | 750.8 | | | — | | | 603.5 | | | — | | | 644.5 | | | — | |

1Excluding unamortized debt issuance costs

NOTE 13. ACQUISITIONS

In the first nine months of 2024, we completed the following acquisitions:

•In January 2024, Pendragon PLC’s Fleet Management and UK Motor Divisions in the United Kingdom.

•In February 2024, Carousel Motor Group in Minnesota and Wisconsin.

•In May 2024, Pine View Hyundai Store in Ontario, Canada.

•In June 2024, Sunrise Chevrolet Buick GMC at Collierville and Sunrise Buick GMC at Wolfchase in Tennessee.

•In September 2024, Duval Honda, Duval Acura and Gainesville Subaru in Florida.

Revenue and operating income contributed by the 2024 acquisitions subsequent to the date of acquisition were as follows (in millions):

| | | | | |

| Nine Months Ended September 30, | 2024 |

| Revenue | $ | 3,863.7 | |

| Operating income | 35.1 | |

In the first nine months of 2023, we completed the following acquisitions:

•In February 2023, Thornhill Acura in Canada.

•In March 2023, Jardine Motors Group UK Limited in the United Kingdom.

•In June 2023, Priority Auto Group in Virginia.

•In June 2023, Wade Ford in Georgia.

•In July 2023, Hill Country Honda in Texas.

•In August 2023, Arden Auto Group in the United Kingdom.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 17 |

All acquisitions were accounted for as business combinations under the acquisition method of accounting. The results of operations of the acquired stores are included in our Consolidated Financial Statements from the date of acquisition.

The following tables summarize the consideration paid for the 2024 acquisitions and the PPA for identified assets acquired and liabilities assumed as of the acquisition date:

| | | | | |

| (in millions) | Consideration |

| Cash paid, net of cash acquired | $ | 1,247.0 | |

| |

| |

| |

| |

| |

| |

| Total consideration transferred | $ | 1,247.0 | |

| | | | | |

| (in millions) | Assets Acquired and Liabilities Assumed |

| Accounts receivables, net | $ | 119.0 | |

| Inventories, net | 1,016.3 | |

| Property and equipment | 559.3 | |

| Operating lease right-of-use assets | 289.8 | |

| |

| |

| |

| Net investment in operating leases | 181.5 | |

| Deferred taxes, net | 20.5 | |

| Other assets | 586.4 | |

| Floor plan notes payable assumed | (868.1) | |

| Trade payables | (39.6) | |

| Debt and finance lease obligations assumed | (22.7) | |

| Operating lease liabilities | (283.9) | |

| Other liabilities and deferred revenue | (311.5) | |

| Total net assets acquired and liabilities assumed | $ | 1,247.0 | |

The PPA for the 2024 acquisitions are preliminary, as we have not obtained and evaluated all of the detailed information necessary to finalize the opening balance sheet amounts in all respects. We recorded the PPA based upon information that is currently available and recorded unallocated items as a component of other non-current assets in the Consolidated Balance Sheets.

We expect all of the goodwill related to North American acquisitions completed in 2023 and 2024 to be deductible for US federal income tax purposes. Due to local country laws, we do not expect goodwill related to UK acquisitions completed in 2023 and 2024 to be deductible for UK income tax purposes.

In the three and nine-month periods ended September 30, 2024, we recorded $0.2 million and $9.7 million in acquisition-related expenses as a component of selling, general and administrative expense. Comparatively, we recorded $4.8 million and $10.5 million of acquisition-related expenses in the same periods of 2023.

The following unaudited pro forma summary presents consolidated information as if all acquisitions in the three and nine-month periods ended September 30, 2024 and 2023 had occurred on January 1, 2023:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in millions, except per share amounts) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 9,263.1 | | | $ | 9,775.6 | | | $ | 27,723.4 | | | $ | 27,625.3 | |

| Net income attributable to Lithia Motors, Inc. | 223.8 | | | 286.3 | | | 617.3 | | | 860.9 | |

| Basic EPS attributable to Lithia Motors, Inc. common stockholders | 8.37 | | | 10.39 | | | 22.73 | | | 31.27 | |

| Diluted EPS attributable to Lithia Motors, Inc. common stockholders | 8.35 | | | 10.36 | | | 22.70 | | | 31.21 | |

These amounts have been calculated by applying our accounting policies and estimates. The results of the acquired stores have been adjusted to reflect the following: depreciation on a straight-line basis over the expected lives for property and equipment, accounting for inventory on a specific identification method, and recognition of interest expense for real estate financing related to stores where we purchased the facility. No nonrecurring proforma adjustments directly attributable to the acquisitions are included in the reported proforma revenues and earnings.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 18 |

NOTE 14. EARNINGS PER SHARE

We calculate basic EPS by dividing net income attributable to Lithia Motors, Inc. by the weighted average number of common shares outstanding for the period, including vested RSU awards. Diluted EPS is calculated by dividing net income attributable to Lithia Motors, Inc. by the weighted average number of shares outstanding, adjusted for the dilutive effect of unvested RSU awards and employee stock purchases.

The following is a reconciliation of net income attributable to Lithia Motors, Inc. and weighted average shares used for our basic EPS and diluted EPS:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in millions, except per share amounts) | 2024 | | 2023 | | 2024 | | 2023 |

| Net income attributable to Lithia Motors, Inc. | $ | 209.1 | | | $ | 261.5 | | | $ | 585.8 | | | $ | 787.3 | |

| | | | | | | |

| Weighted average common shares outstanding – basic | 26.7 | | | 27.6 | | | 27.2 | | | 27.5 | |

| Effect of employee stock purchases and restricted stock units on weighted average common shares outstanding | 0.1 | | | — | | | — | | | 0.1 | |

| Weighted average common shares outstanding – diluted | 26.8 | | | 27.6 | | | 27.2 | | | 27.6 | |

| | | | | | | |

| Basic EPS attributable to Lithia Motors, Inc. common stockholders | $ | 7.82 | | | $ | 9.49 | | | $ | 21.57 | | | $ | 28.60 | |

| Diluted EPS attributable to Lithia Motors, Inc. common stockholders | $ | 7.80 | | | $ | 9.46 | | | $ | 21.54 | | | $ | 28.54 | |

The effect of antidilutive securities on common stock was evaluated for the three and nine-month periods ended September 30, 2024 and 2023 and was determined to be immaterial.

NOTE 15. SEGMENTS

We operate in two reportable segments: Vehicle Operations and Financing Operations. Our Vehicle Operations consists of all aspects of our auto merchandising and aftersales operations, excluding financing provided by our Financing Operations. Our Financing Operations segment provides financing to customers buying and leasing retail vehicles from our Vehicle Operations, as well as leasing vehicles from our fleet management services provider.

All other remaining unallocated corporate overhead expenses and internal charges are reported under “Corporate and Other.” Asset information by segment is not utilized for purposes of assessing performance or allocating resources and, as a result, such information has not been presented.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 19 |

Certain financial information on a segment basis is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (in millions) | 2024 | | 2023 | | 2024 | | 2023 |

| Vehicle operations revenue | $ | 9,221.0 | | | $ | 8,277.0 | | | $ | 27,014.7 | | | $ | 23,368.0 | |

| | | | | | | |

| Vehicle operations gross profit | 1,430.4 | | | 1,371.3 | | | 4,189.5 | | | 3,968.2 | |

| Floor plan interest expense | (76.6) | | | (40.2) | | | (214.0) | | | (102.6) | |

| Vehicle operations SG&A | (1,024.0) | | | (915.5) | | | (3,066.6) | | | (2,587.6) | |

| Vehicle operations income | 329.8 | | | 415.6 | | | 908.9 | | | 1,278.1 | |

| | | | | | | |

| Financing operations interest margin: | | | | | | | |

| Interest and fee income | 91.1 | | | 67.5 | | | 252.2 | | | 176.2 | |

| Interest expense | (51.2) | | | (42.5) | | | (146.0) | | | (125.5) | |

| Total interest margin | 39.9 | | | 25.0 | | | 106.2 | | | 50.7 | |

| Lease income | 25.6 | | | 4.9 | | | 61.2 | | | 14.1 | |

| Lease costs | (21.6) | | | (2.0) | | | (51.0) | | | (6.3) | |

| Lease income, net | 4.0 | | | 2.9 | | | 10.2 | | | 7.8 | |

| Financing operations SG&A | (11.2) | | | (9.2) | | | (33.0) | | | (27.3) | |

| Provision expense | (31.8) | | | (23.1) | | | (77.0) | | | (75.0) | |

| Financing operations income (loss) | 0.9 | | | (4.4) | | | 6.4 | | | (43.8) | |

| | | | | | | |

| Total segment income for reportable segments | 330.7 | | | 411.2 | | | 915.3 | | | 1,234.2 | |

| | | | | | | |

| Corporate and other | 80.4 | | | 64.7 | | | 213.6 | | | 129.5 | |

| Depreciation and amortization | (63.5) | | | (50.8) | | | (183.6) | | | (146.4) | |

| Other interest expense | (64.5) | | | (58.5) | | | (189.3) | | | (141.5) | |

| Other income (expense), net | 5.1 | | | (5.3) | | | 35.4 | | | 6.8 | |

| Income before income taxes | $ | 288.2 | | | $ | 361.3 | | | $ | 791.4 | | | $ | 1,082.6 | |

NOTE 16. RECENT ACCOUNTING PRONOUNCEMENTS

In November 2023, the FASB issued ASU 2023-07 related to improvements to reportable segment disclosures. The amendments in this update require additional disclosure of significant expenses related to our reportable segments, additional segment disclosures on an interim basis, and qualitative disclosures regarding the decision making process for segment resources. The amendments in this update are effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024. We have adopted this pronouncement and plan to make the necessary updates to our segment disclosures for the year ending December 31, 2024, and, aside from these disclosure changes, we do not expect the amendments to have a material effect on our financial statements.

In December 2023, the FASB issued ASU 2023-09 related to improvements to income tax disclosures. The amendments in this update require enhanced jurisdictional and other disaggregated disclosures for the effective tax rate reconciliation and income taxes paid. The amendments in this update are effective for fiscal years beginning after December 15, 2024. We plan to adopt this pronouncement and make the necessary updates to our disclosures for the year ending December 31, 2025, and, aside from these disclosure changes, we do not expect the amendments to have a material effect on our financial statements.

| | | | | | | | | | | | | | |

| | NOTES TO FINANCIAL STATEMENTS | | 20 |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Forward-Looking Statements and Risk Factors

Certain statements under the sections entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Risk Factors” and elsewhere in this Form 10-Q constitute forward-looking statements within the meaning of the “Safe Harbor” provisions of the Private Securities Litigation Reform Act of 1995. Generally, you can identify forward-looking statements by terms such as “project,” “outlook,” “target,” “may,” “will,” “would,” “should,” “seek,” “expect,” “plan,” “intend,” “forecast,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “likely,” “goal,” “strategy,” “future,” “maintain,” and “continue” or the negative of these terms or other comparable terms. Examples of forward-looking statements in this Form 10-Q include, among others, statements we make regarding:

•Future market conditions, including anticipated car and other sales levels and the supply of inventory

•Our business strategy and plans, including our achieving our long-term financial targets

•The growth, expansion, make-up and success of our network, including our finding accretive acquisitions that meet our target valuations and acquiring additional stores

•Annualized revenues from acquired stores or achieving target returns

•The growth and performance of our Driveway e-commerce home solution and DFC, their synergies and other impacts on our business and our ability to meet Driveway and DFC-related targets

•The impact of sustainable vehicles and other market and regulatory changes on our business

•Our capital allocations and uses and levels of capital expenditures in the future

•Expected operating results, such as improved store performance, continued improvement of SG&A as a percentage of gross profit and any projections

•Our anticipated financial condition and liquidity, including from our cash and the future availability of our credit facilities, unfinanced real estate and other financing sources

•Our continuing to purchase shares under our share repurchase program

•Our compliance with financial and restrictive covenants in our credit facilities and other debt agreements

•Our programs and initiatives for employee recruitment, training, and retention

•Our strategies and targets for customer retention, growth, market position, operations, financial results and risk management

The forward-looking statements contained in this Form 10-Q involve known and unknown risks, uncertainties and situations that may cause our actual results to materially differ from the results expressed or implied by these statements. Certain important factors that could cause actual results to differ from our expectations are discussed in the Risk Factors section of our 2023 Annual Report on Form 10-K, as supplemented and amended from time to time in Quarterly Reports on Form 10-Q and our other filings with the SEC.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events that depend on circumstances that may or may not occur in the future. You should not place undue reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. We assume no obligation to update or revise any forward-looking statement.

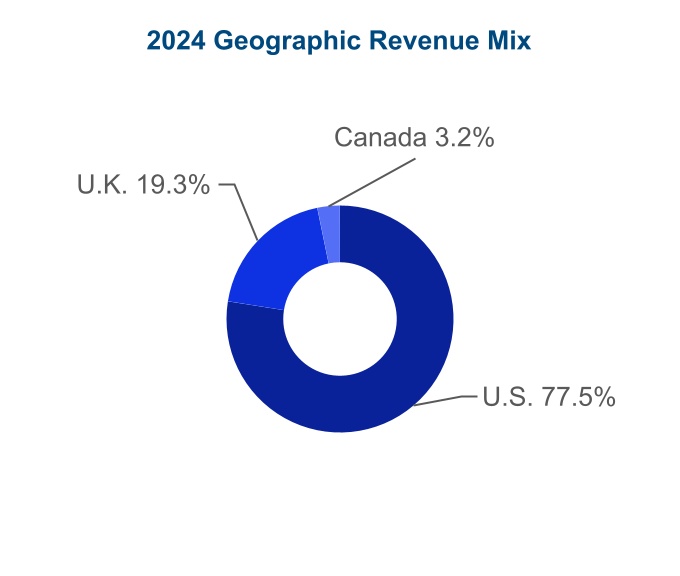

Overview

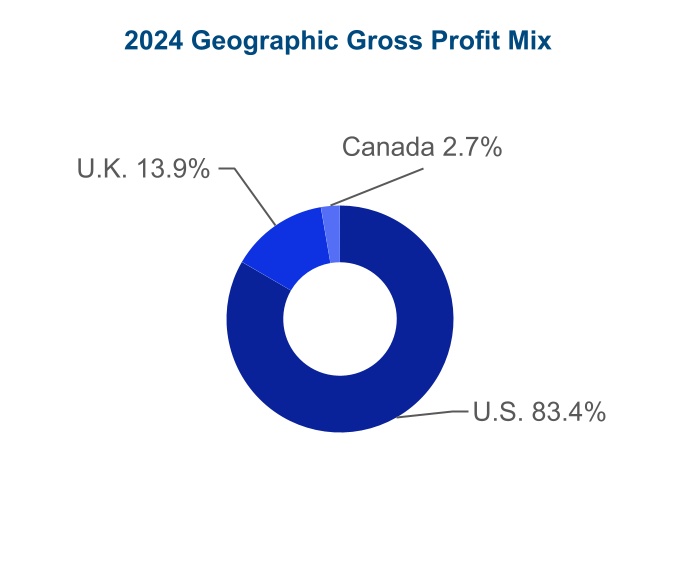

Lithia and Driveway (NYSE: LAD) is one of the largest global automotive retailers providing an array of products and services throughout the vehicle ownership lifecycle. Simple, convenient and transparent experiences are offered through our comprehensive network of physical locations, e-commerce platforms, captive finance solutions, fleet management offerings, and other synergistic adjacencies. We have delivered consistent profitable growth in a massive and unconsolidated industry. Our highly diversified and competitively differentiated design provides us the flexibility and scale to pursue our vision to modernize personal transportation solutions wherever, whenever and however consumers desire. As of September 30, 2024, we operated 467 locations representing 52 brands in the U.S., the U.K., and Canada.

We offer a wide array of products and services fulfilling the entire vehicle ownership lifecycle including new and used vehicles, financing and insurance products and automotive repair and maintenance aftersales. We strive for diversification in our products, services, brands and geographic locations to reduce dependence on any one manufacturer, reduce susceptibility to changing consumer preferences, manage market risk and maintain profitability. Our diversification, along with our operating structure, provides a resilient and nimble business model.

| | | | | | | | | | | | | | |

| | MANAGEMENT’S DISCUSSION AND ANALYSIS | | 21 |

We seek to provide customers with a seamless, blended online and physical retail experience, broad selection and access to specialized expertise and knowledge. Our comprehensive network enables us to provide convenient touch points for customers and provides services throughout the vehicle life cycle. We seek to increase market share and optimize profitability by focusing on the consumer experience and applying proprietary performance measurement systems fueled by data science. Our Driveway and GreenCars brands complement our in-store experiences in the U.S. and provide convenient, simple and transparent platforms that serve as our e-commerce home solutions and allow us to deliver differentiated, proprietary digital experiences. Enhancing our business, our captive auto financing division allows us to provide financing solutions for customers and diversify our business model with adjacent products.

Our long-term strategy to create value for our customers, employees and shareholders includes the following elements:

Driving operational excellence, innovation and diversification

LAD builds magnetic brand loyalty in our 467 stores and with Driveway, our e-commerce home delivery experience, and GreenCars, our electric vehicle learning resource and marketplace. Operational excellence is achieved by focusing the business on convenient and transparent consumer experiences supported by proprietary data science to improve market share, consumer loyalty, and profitability. By promoting an entrepreneurial model with our in-store experiences, we build strong businesses responsive to each of our local markets. Utilizing performance-based action plans, we develop high-performing teams and foster manufacturer relationships.

In response to evolving consumer preferences, we invest in modernization that supports and expands our core business. These digital strategies combine our experienced, knowledgeable workforce with our owned inventory and physical network of stores, enabling us to be agile and adapt to consumer preferences and market specific conditions. Additionally, we systematically explore transformative adjacencies, which are identified to be synergistic and complementary to our existing business, such as our captive auto finance division and our fleet funding and management division.

Our investments in modernization are well under way and are taking hold with our teams as they provide digital shopping experiences including finance, contactless test drives and home delivery or curbside pickup for vehicle purchases. Our people and these solutions power our national brands, overlaying our physical footprint in a way that we believe attracts a larger population of digital consumers seeking transparent, empowered, flexible and simple buying and servicing experiences.

Our performance-based culture is geared toward an incentive-based compensation structure for a majority of our personnel. We develop pay plans that are measured based upon various factors such as customer satisfaction, profitability and individual performance metrics. These plans serve to reward team members for creating customer loyalty, achieving store potential, developing high-performing talent, meeting and exceeding manufacturer requirements and living our core values.

We have centralized many administrative functions to drive efficiencies and streamline store-level operations. The reduction of administrative functions at our stores allows our local managers to focus on customer-facing opportunities to increase revenues and gross profit. Our operations are supported by regional and corporate management, as well as dedicated training and personnel development programs which allow us to share best practices across our network and develop management talent.

Growth through acquisition and network optimization