UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

Amendment No. 1

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended August 31, 2005

or

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-15649

EAGLE BROADBAND, INC.

(Exact name of registrant as specified in its charter)

| TEXAS | 76-0494995 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

101 COURAGEOUS DRIVE

LEAGUE CITY, TEXAS 77573

(Address of principal executive offices) (Zip Code)

(281) 538-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | | Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share | | American Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes o No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is an accelerated filer (as defined in Rule 12b-2 of the Act). x Yes o No

The aggregate market value of the voting stock held by non-affiliates of the registrant on February 28, 2005, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing price on that date of $0.37 per share on the American Stock Exchange, was $90,957,612.

As of November 23, 2005, the registrant had 303,086,275 shares of common stock outstanding.

EAGLE BROADBAND, INC.

FORM 10-K/A

FOR THE FISCAL YEAR ENDED AUGUST 31, 2005

TABLE OF CONTENTS

EXPLANATORY NOTE

Eagle Broadband, Inc. (the “Company,” “we,” “us,” or “our”) is filing this Amendment No. 1 on Form 10-K/A to our Annual Report on Form 10-K for the fiscal year ended August 31, 2005, as filed with the Securities and Exchange Commission on November 29, 2005 (the “Report”), for the purpose of including information that was to be incorporated by reference from our definitive proxy statement. We will not file our proxy statement within 120 days of the end of our fiscal year and are, therefore, amending Items 10, 11, 12, 13 and 14 of Part III of our Report, to add the information contained herein.

As required by Rule 12b-15 under the Securities Exchange Act of 1934, as amended, new certifications by the Company’s principal executive officer and principal financial officer are being filed as exhibits to this Form 10-K/A under Item 15.

Except as describe above, no other amendments are being made to the Report. This Form 10-K/A does not reflect events occurring after the November 29, 2005, filing of our Report.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers, and persons who own more than ten percent of a registered class of our equity securities to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent stockholders are required by Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of the reports furnished to us and written representations that no other reports were required, during the fiscal year ended August 31, 2005, all Section 16(a) filing requirements applicable to our officers, directors and greater than ten percent beneficial owners were complied with and no reports or transactions were filed late except for the following: Messrs. Eric Blachno, Lorne Persons, C. J. Reinhartsen, James Yarbrough, Glenn Goerke and H. Dean Cubley failed to timely report transactions on Form 4 for the issuance of stock options, each of which were subsequently reported on Form 5 in November 2005. Messrs. Micek, Blachno, Yarbrough and Goerke failed to timely file Form 3 reports, which were subsequently filed in November and December 2005. Messrs. A. L. Clifford and Christopher W. Futer, directors of the Company until April 2005 and October 2005, respectively, failed to file a Form 4 for the issuance of stock options.

The following table contains compensation data for our named executive officers for the fiscal years ended August 31, 2005, 2004 and 2003.

SUMMARY COMPENSATION TABLE

| | | | | Annual Compensation | | Long-Term Compensation | | |

Name and Principal Position | | Fiscal Year | | Salary ($) | | Bonus ($) | | Other Annual Compensation ($) | | Restricted Stock Awards ($) | | Securities Underlying Options (#) | | All Other Compensation ($) |

David Micek (1) President & CEO | | 2005 2004 2003 | | 178,154 — — | | — — — | | — — — | | — — — | | 7,200,000 — — | | — — — |

Eric Blachno (2) Chief Financial Officer | | 2005 2004 2003 | | 163,857 — — | | — — — | | — — — | | — — — | | 500,000 — — | | 77,562 (3) — — |

Randall Shapiro (4) Vice President, Marketing | | 2005 2004 2003 | | 190,000 166,931 — | | — — — | | — — — | | — — — | | 200,000 810,000 — | | — — — |

| David Weisman (5) | | 2005 2004 2003 | | 179,806 345,120 — | (6) | — — — | | — — — | | — — — | | — 1,237,500 — | | (7) — — |

| H. Dean Cubley (8) | | 2005 2004 2003 | | 74,716 275,558 275,000 | | — — — | | — — — | | — — — | | 50,000 2,037,500 300,000 | | (9) — — |

| (1) | Mr. Micek was named Chief Operating Officer in November 2004 and President and Chief Executive Officer in April 2005. |

| | |

| (2) | Mr. Blachno was named Chief Financial Officer in November 2004. |

| | |

| (3) | Pursuant to his employment agreement, the Company reimbursed Mr. Blachno for his relocation expenses. |

| | |

| (4) | Mr. Shapiro’s employment agreement expired on November 30, 2005 and was not renewed. Under the terms of that agreement, a bonus in the amount of $146,000 is owed to Mr. Shapiro. |

| | |

| (5) | Mr. Weisman served as Chief Executive Officer from October 2003 to April 2005. |

| | |

| (6) | Mr. Weisman’s total compensation for the fiscal year ending August 31, 2004, includes salary and consulting fees. |

| (7) | In December 2003, Mr. Weisman agreed to cancel options to purchase an aggregate of 3,200,000 shares of common stock with exercise prices ranging from $0.41 to $0.75 per share, in exchange for an exchangeable promissory note in the amount of $1,362,000, representing the difference between the market price and exercise prices on the date of cancellation of the vested options and to include any amount that became vested subsequent thereto (“Guaranteed Value”). Pursuant to the terms of the note, the Company reissued options to Mr. Weisman in 2004 to purchase 1,200,000 shares at the same exercise prices and continued to guarantee Mr. Weisman the Guaranteed Value, less any profit obtained from the sale of the vested options. In January 2005, Mr. Weisman exercised options to purchase 1,200,000 shares (representing all of the options then owned by Mr. Weisman), obligating the Company under the guarantee obligation in the note to pay Mr. Weisman. In June 2005, Mr. Weisman entered into a note exchange agreement with the Company pursuant to which the Company issued 3,377,778 shares of Company common stock to Mr. Weisman to fully satisfy the Company’s outstanding guarantee obligation under the note. (See “Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values” below.) |

| | |

| (8) | Dr. Cubley served as Chief Executive Officer from March 1996 until October 2003. |

| | |

| (9) | In December 2003, Dr. Cubley agreed to cancel options to purchase an aggregate of 9,975,000 shares of common stock at an exercise price of $0.41 per share, in exchange for an exchangeable promissory note in the amount of $2,680,000, representing the difference between the market price and exercise price on the date of cancellation of the vested options and to include any amount that became vested subsequent thereto (“Guaranteed Value”). Pursuant to the terms of the note, the Company reissued options to Dr. Cubley in 2004 to purchase 2,000,000 shares at an exercise price of $0.41 per share and continued to guarantee Dr. Cubley the Guaranteed Value, less any profit obtained from the sale of the vested options. In December 2004 and January 2005, Dr. Cubley exercised options to purchase 2,000,000 shares (representing all of the options then owned by Dr. Cubley, except for the right to purchase 37,500 shares at $1.00 per share), obligating the Company under the Guarantee obligation in the note to pay Dr. Cubley. (See “Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values” below.) |

The following table sets forth information concerning individual grants of stock options made during the fiscal year ended August 31, 2005, to our named executive officers. No stock appreciation rights were issued during the fiscal year.

Options Grants in Last Fiscal Year

| | | Individual Grants | | | | |

| Name | | Number of Securities Underlying Options Granted (#) | | Percentage of Total Options Granted to

Employees in Fiscal Year (1) | | Exercise or Base Price($/Share) | | Expiration Date | | Potential Realizable Value at Assumed Annual Rates of

Stock Price Appreciation for Option Term ($) (2) |

5% | | 10% |

David Micek | | 500,000 6,700,000 | | 5.5% 74.1% | | 0.61 0.19 | | 10/31/09 10/31/09 | | 83,474 310,302 | | 184,255 676,357 |

| Eric Blachno | | 500,000 | | 5.5% | | 0.61 | | 10/31/09 | | 83,837 | | 185,149 |

| Randall Shapiro | | 200,000 | | 2.2% | | 0.78 | | 09/01/08 | | 31,028 | | 66,343 |

| David Weisman | | — | | — | | — | | — | | — | | — |

| H. Dean Cubley | | 50,000 | | * | | 0.78 | | 09/30/09 | | 10,607 | | 23,397 |

* Less than 1%

| (1) | Percentages are based on a total of 9,037,618 shares subject to options granted to employees during fiscal 2005. |

| | |

| (2) | In accordance with SEC rules, these columns show gains that could accrue for the respective options, assuming that the market price of our common stock appreciates from the date of grant until the expiration date at an annualized rate of 5% and 10%, respectively. If the stock price does not increase above the exercise price at the time of exercise, realized value to the named executives from these options will be zero. |

The following table sets forth information concerning option exercises during the fiscal year ended August 31, 2005, and option holdings as of August 31, 2005, with respect to our named executive officers. No stock appreciation rights were outstanding at the end of the fiscal year.

| | | | | | Number of Securities Underlying Unexercised Options at Fiscal Year-End | | Value of Unexercised In-the-Money Options at Fiscal Year-End ($) |

| Name | | Shares Acquired on Exercise (#) | | Value Realized ($) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

| David Micek | | — | | — | | 883,334 | | 6,316,666 | | — | | — |

| Eric Blachno | | — | | — | | 208,330 | | 291,670 | | — | | — |

| Randall Shapiro | | — | | — | | 710,000 | | 300,000 | | — | | — |

| David Weisman | | 1,200,000 | | 1,362,000 | | 37,500 | | — | | — | | — |

| H. Dean Cubley | | 2,000,000 | | 2,680,000 | | 117,756 | | 75,000 | | — | | — |

Employment Contracts

Mr. Micek’s amended employment agreement provides for an annual salary of $275,000, and is effective through May 2008, which shall be extended until May 2010, if agreed by both parties. Under the terms of his original employment agreement, Mr. Micek was granted the right to purchase 500,000 shares of Company common stock at a price per share of $0.61, which vests over 36 months. In May 2005, Mr. Micek's employment agreement was amended and he was granted the right to (i) receive an option to purchase 6,700,000 shares at an exercise price of $0.19 per share, vesting over a 36-month term, which vesting accelerates upon a change of control or termination of employee without cause, and (ii) receive 2,000,000 shares of restricted stock (which have not yet been issued), which vest upon Mr. Micek’s or the Company’s attainment of certain objectives and/or Company milestones, which to date have not been satisfied. Mr. Micek receives customary fringe benefits.

Mr. Blachno’s employment agreement provides for an annual salary of $200,000, and is effective through November 2008, which shall be extended until November 2010, if agreed by both parties. Under the terms of his employment agreement, Mr. Blachno was granted the right to purchase 500,000 shares of Company common stock exercisable at a price per share of $0.61, which vests over 24 months. Additionally, Mr. Blachno has a right to receive 200,000 shares of Company common stock upon the satisfaction of certain objectives and/or Company milestones.

Report of the Compensation Committee on Executive Compensation

Decisions on compensation of the Company’s executive officers are made by the Compensation Committee of the Board. The Compensation Committee is composed solely of independent, non-employee directors. The Compensation Committee is responsible for all elements of executive compensation including base salary and other benefit programs for key executives.

The goals of the Company’s executive compensation program are to (i) pay competitively to attract, retain and motivate executives who must operate in a highly competitive and technologically specialized environment, (ii) relate total compensation for each executive to overall Company performance as well as individual performance, and (iii) align executives’ performances and financial interests with shareholder value.

Base Salary

Base salary ranges are developed after considering the recommendations of professional compensation consultants who conduct annual compensation surveys of similar companies. Base salaries within these ranges are targeted to be competitive in relation to salaries paid for similar positions in comparable companies. On an annual basis, the Compensation Committee reviews management recommendations for executives’ salaries utilizing the results of survey data for comparable executive positions. Individual salary determinations within the established ranges are made based on position accountabilities, experience, sustained individual performance, overall Company performance, and peer comparisons inside and outside the Company, with each factor being weighed reasonably in relation to other factors.

Stock Options

Stock option plans are used to align the long-term financial interests of executives with those of shareholders. On October 18, 2005, the Company’s shareholders approved the 2005 Employee Stock Option Plan (“2005 Plan”), which provides for the grant of options that may be “Incentive Stock Options” within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended, or non-qualified stock options, or a combination of both, as determined by the Compensation Committee. The 2005 Plan covers a total of 30,000,000 shares of the Company’s common stock, and is administered by the Compensation Committee.

In April 2005, the Board of Directors named then Chief Operating Officer, David Micek, as the Company’s President and Chief Executive Officer. Mr. Micek’s employment contract was subsequently amended in May 2005 providing, among other things, Mr. Micek the right to receive an option to purchase 6.7 million shares of the Company’s common stock. The stock option was issued in December 2005, subsequent to shareholder approval of the 2005 Plan.

Restricted Stock

The 2005 Plan also provides that the Compensation Committee may issue shares of restricted stock to persons eligible under the plan. Mr. Micek’s amended employment agreement provides him the right to receive 2,000,000 shares of restricted stock, which vest upon his or the Company’s attainment of certain objectives and/or Company milestones, which to date have not been satisfied. These shares of restricted stock will be issued upon the Company’s receipt of listing approval from the American Stock Exchange.

Compensation of the Chief Executive Officer

The Compensation Committee determines the Chief Executive Officer’s salary and other compensation elements based on performance. The CEO’s salary is established within a salary range recommended by an independent compensation consulting firm. The Compensation Committee believes that the stock options and restricted stock granted to Mr. Micek provide the necessary long-term incentives, and align Mr. Micek’s performance and financial interests with shareholder value. Mr. Micek’s efforts during his limited time as CEO have not only resulted in improved Company performance, but have also positioned the Company for continued success in the future.

The Compensation Committee believes that its actions in fiscal 2005 have been consistent with and have effectively implemented the Company’s overall executive compensation policies.

C. J. Reinhartsen

Glenn A. Goerke

Lorne E. Persons

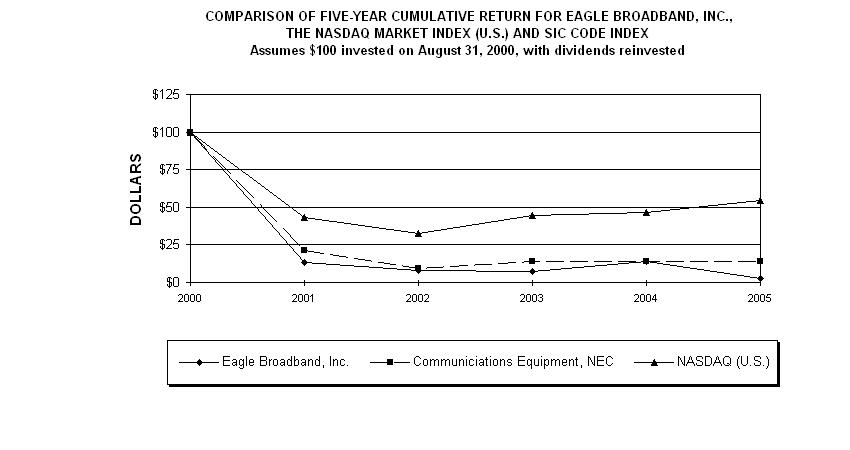

Stock Price Performance Graph

Below is a comparison of the cumulative total shareholder return on the Company’s common stock against the cumulative total return of the NASDAQ (U.S.) Index and the communications equipment peer group for the period of five fiscal years commencing August 31, 2000, and ending August 31, 2005. The graph and table assume that $100 was invested on August 31, 2000, in each of the Company’s common stock, the NADAQ Index and the peer group, and that all dividends were reinvested. The comparison shown is based upon historical data. The stock price performance shown below is not necessarily indicative of, nor intended to forecast, the potential future performance of the Company’s common stock.

| | August 31, |

| 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 |

| Eagle Broadband, Inc. | $100 | | $13 | | $8 | | $7 | | $14 | | $3 |

| Communications Equipment, NEC | $100 | | $21 | | $9 | | $14 | | $14 | | $14 |

| NASDAQ (U.S.) | $100 | | $43 | | $33 | | $45 | | $46 | | $54 |

As of December 16, 2005, a total of 303,086,275 shares of our common stock were outstanding. The following table sets forth, as of the date of this prospectus, certain information with respect to shares beneficially owned by: (a) each person who is known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock, (b) each of our current directors, (c) the executive officers named in the Summary Compensation Table above (as of August 31, 2005), and (d) all current directors and executive officers as a group.

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within sixty days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person's actual voting power at any particular date.

To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. Unless otherwise indicated, the business address of the individuals listed is Eagle Broadband, Inc., 101 Courageous Drive, League City, Texas 77573.

SHARES BENEFICIALLY OWNED AS OF DECEMBER 16, 2005

| Name and Address of Beneficial Owner | | Shares Owned | | Shares Covered by Exercisable Options (1) | | Total (1) | | Percent of Class (1) |

Frorer Partners, L.P. 15 North Balch Street, Hanover, NH 03755 | | 22,222,222 | | — | | 22,222,222 | | 7.2% |

| David Micek | | — | | 2,083,334 | | 2,083,334 | | * |

| H. Dean Cubley | | 1,117,333 | | 142,756 | | 1,260,089 | | * |

| Randall Shapiro (2) | | 79,600 | | 710,000 | | 789,600 | | * |

| Robert Bach | | 618,179 | (3) | 50,000 | | 668,179 | | * |

| Lorne Persons | | 297,993 | | 150,000 | | 447,993 | | * |

| Eric Blachno | | — | | 333,328 | | 333,328 | | * |

| Glenn Goerke | | 158,656 | | 150,000 | | 308,656 | | * |

| C. J. Reinhartsen | | 106,597 | | 150,000 | | 256,597 | | * |

David Weisman 390 Interlocken Crescent, Suite 900 Broomfield, CO 80021 | | 120,478 | | 37,500 | | 157,978 | | * |

| James Yarbrough | | — | | 100,000 | | 100,000 | | * |

All current directors and executive officers as a group (8 persons) | | 2,298,758 | | 3,159,418 | | 5,458,176 | | 1.8% |

—————————

* Less than 1%

| (1) | Includes options exercisable within 60 days of December 16, 2005. |

| (2) | Mr. Shapiro served as Vice President, Marketing, until November 30, 2005. |

| (3) | Includes 20,000 shares held in a trust of which Mr. Bach is a trustee. |

Equity Compensation Plan Information

| | | As of August 31, 2005 |

| Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance |

Equity compensation plans approved by security holders | | 11,737,968 | | $ 0.43 | | 18,262,032 |

Equity compensation plans not approved by security holders | | — | | — | | — |

| Total | | 11,737,968 | | $ 0.43 | | 18,262,032 |

In June 2005, the Company entered into a note exchange agreement with David Weisman, pursuant to which the Company issued 3,377,778 shares of Company common stock to Mr. Weisman to fully satisfy the Company’s outstanding obligation under the note. (See Note 7 to the Summary Compensation Table above and Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values above.)

Fees for services provided by our principal accountant, Lopez, Blevins, Bork & Associates, LLP (Lopez & Associates), for the fiscal years ended August 31, 2005 and 2004, and by Malone & Bailey for the fiscal year ended August 31, 2004, were as follows:

Audit Fees

The aggregate fees billed to the Company by Lopez & Associates for the audit of the Company’s annual financial statements and for the review of the financial statements included in the Company’s quarterly reports on Form 10-Q totaled $164,625 and $9,420 in the fiscal years ended August 31, 2005 and 2004, respectively. The aggregate fees billed to the Company by Malone & Bailey for the audit of the Company’s financial statements and for the review of the financial statements included in the Company’s quarterly reports on Form 10-Q totaled $137,717 in the fiscal year ended August 31, 2004.

Audit-Related Fees

The aggregate fees billed to the Company by Lopez & Associates for assurance and related services totaled $3,300 and $-0- in the fiscal years ended August 31, 2005 and 2004, respectively, which were for audits of our employee benefit plans.

Tax Fees

There were no fees billed to the Company by Lopez & Associates for tax compliance, tax advice or tax planning services in the fiscal years ended August 31, 2005 and 2004.

All Other Fees

There were no fees billed to the Company by Lopez & Associates, other than the services described above, for the fiscal years ended August 31, 2005 and 2004.

Policy on Audit Committee Pre-Approval and Permissible Non-Audit Services of Independent Auditors

The Audit Committee is directly responsible for the appointment, compensation and oversight of the independent public accounting firm engaged to prepare or issue an audit report on the financial statements of the Company or perform other audit, review or attestation services for the Company, and each such public accounting firm reports directly to the Audit Committee. The Audit Committee has established a policy requiring its pre-approval of all audit and permissible non-audit services provided by the independent public accounting firm. The Audit Committee considers whether such services are consistent with the rules of the SEC on auditor independence as well as whether the independent public accounting firm is best positioned to provide the most effective and efficient service, for reasons such as familiarity with the Company’s business, people, culture, accounting systems, risk profile and other factors and input from the Company’s management. The policy prohibits the Audit Committee from delegating to management the Audit Committee’s responsibility to pre-approve permitted services of the independent public accounting firm. During the fiscal year ended August 31, 2005, all of the services related to the audit or other fees described above were pre-approved by the Audit Committee and none were provided pursuant to any waiver of the pre-approval requirement.

| Item 15. | Exhibits, Financial Statement Schedules. |

| | |

| 3. | Exhibits: The exhibits listed in the accompanying Index to Exhibits are filed or incorporated by reference as part of this Form 10-K. |

Exhibit Number | | Description |

| | | |

| 3.1† | | Restated Articles of Incorporation. |

| | | |

| 3.2 | | Amended and Restated Bylaws (Incorporated by reference to Exhibit 3.2 of Form 10-KSB for the fiscal year ended August 31, 2001, filed November 16, 2001). |

| | | |

| 4.1 | | Purchase Agreement by and between Eagle Broadband, Inc. and Investors dated October 2, 2003, including registration rights and security agreement attached as an exhibit thereto (Incorporated by reference to Exhibit 10.1 of Form S-3, file no. 333-109481, filed October 3, 2003). |

| | | |

| 4.2 | | Q-Series Bond Agreement (Incorporated by reference to Exhibit 10.3 of Form S-3, file no. 333-106074, filed June 12, 2003). |

| | | |

| 4.3 | | Addendum to Q-Series Bond Agreement (Incorporated by reference to Exhibit 10.4 of Form S-3, file no. 333-106074, filed June 12, 2003). |

| | | |

| 4.4 | | Form of Subscription Agreement for Q Series Bond, between Eagle Broadband and certain investors (Incorporated by reference to Exhibit 10.5 of Form S-3, file no. 333- 106074, filed June 12, 2003). |

| | | |

| 10.1 | | Securities Purchase Agreement between Eagle Broadband, Inc., and the Purchasers identified on the signature pages thereto, dated August 2005 (Incorporated by reference to Exhibit 10.1 of Form 8-K, filed August 18, 2005). |

| | | |

| 10.2 | | Registration Rights Agreement between Eagle Broadband, Inc., and the Purchasers identified on the signature pages thereto (Incorporated by reference to Exhibit 10.2 of Form 8-K, filed August 18, 2005). |

| | | |

| 10.3 | | Securities Purchase Agreement between Eagle Broadband, Inc., and the Purchasers identified on the signature pages thereto (Incorporated by reference to Exhibit 10.1 of Form 8-K, filed February 18, 2005). |

| | | |

| 10.4 | | 1996 Incentive Stock Option Plan (Incorporated by reference to Exhibit 10.1 of Form S-8, file no. 333-72645, filed February 19, 1999). |

| | | |

| 10.5 | | 2002 Stock Incentive Plan (Incorporated by reference to Exhibit 10.1 of Form S-8, file no. 333-97901, filed August 9, 2002). |

| | | |

| 10.6 | | Amendment to the 2002 Stock Incentive Plan (Incorporated by reference to Exhibit 10.2 of Form S-8, file no. 333-102506, filed January 14, 2003). |

| | | |

| 10.7 | | 2003 Stock Incentive and Compensation Plan (Incorporated by reference to Exhibit 10.1 of Form S-8, file no. 333-103829, filed March 14, 2003). |

| | | |

| 10.8 | | Amendment to the 2003 Stock Incentive and Compensation Plan (Incorporated by reference to Exhibit 10.2 of Form S-8, file no. 333-105074, filed May 8, 2003). |

| | | |

| 10.9 | | Amendment No. 2 to the 2003 Stock Incentive and Compensation Plan (Incorporated by reference to Exhibit 10.2 of Form S-8, file no. 333-109339, filed October 1, 2003). |

| | | |

| 10.10 | | 2004 Stock Incentive Plan (Incorporated by reference to Exhibit 10.1 of Form S-8, file no. 333-110309, filed November 6, 2003). |

| | | |

| 10.11 | | June 2004 Compensatory Stock Option Plan (Incorporated by reference to Exhibit 10.1 of Form S-8, file no. 333-117690, filed July 27, 2004). |

| | | |

| 10.12 | | 2005 Employee Stock Option Plan (Incorporated by reference to Exhibit 10.10 of Form S-1/A, file no. 333-127895, filed October 28, 2005). |

| | | |

| 10.13 | | Employment Agreement between Eagle Broadband, Inc. and Eric Blachno (Incorporated by reference to Exhibit 10.13 of Form 10-K/A for the fiscal year ended August 31, 2004, filed December 29, 2004). |

| | | |

| 10.14 | | Amended and Restated Employment Agreement between Eagle Broadband, Inc. and David Micek (Incorporated by reference to Exhibit 10.12 of Form S-1/A, file no. 333-127895, filed October 28, 2005). |

| | | |

| 21.1 | | List of Subsidiaries (Incorporated by reference to Exhibit 21.1 of Form S-1/A, file no. 333-127895, filed October 28, 2005). |

| | | |

| 23.1† | | Consent of Lopez, Blevins, Bork and Associates, LLP, Independent Registered Public Accounting Firm |

| | | |

| 31.1* | | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| | | |

| 31.2* | | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002. |

| | �� | |

| 32.1* | | Certification of Chief Executive Officer and Chief Financial Officer pursuant to Section 906 of the Sarbanes-Oxley Act of 2002. |

† Previously filed

* Filed herewith

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | EAGLE BROADBAND, INC. |

| | (Registrant) |

| | |

| | |

| | By: /s/ DAVID MICEK |

| | David Micek President and Chief Executive Officer |

| | Date: December 16, 2005 |

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

Signature | | Title | | Date |

| | | | | |

| /s/ DAVID MICEK | | Chief Executive Officer and Director | | December 16, 2005 |

| David Micek | | Principal Executive Officer | | |

| | | | | |

| /s/ ERIC BLACHNO | | Chief Financial Officer | | December 16, 2005 |

| Eric Blachno | | Principal Financial Officer | | |

| | | | | |

| /s/ JULIET MARKOVICH | | Corporate Controller & Principal Accounting Officer | | December 16, 2005 |

| Juliet Markovich | | Principal Accounting Officer | | |

| | | | | |

| /s/ ROBERT BACH | | Director | | December 16, 2005 |

| Robert Bach | | | | |

| /s/ GLENN GOERKE | | Director | | December 16, 2005 |

| Glenn Goerke | | | | |

| | | | | |

| /s/ LORNE PERSONS | | Director | | December 16, 2005 |

| Lorne Persons | | | | |

| | | | | |

| /s/ C. J. REINHARTSEN | | Director | | December 16, 2005 |

| C. J. Reinhartsen | | | | |

| | | | | |

| /s/ JAMES YARBROUGH | | Director | | December 16, 2005 |

| James Yarbrough | | | | |