UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

oPreliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

EAGLE BROADBAND, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

o Fee paid previously with preliminary materials.

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

101 Courageous Drive

League City, Texas 77573

Annual Meeting of Shareholders

December 18, 2006

Dear Eagle Shareholder:

You are cordially invited to attend the 2007 Annual Meeting of Shareholders of Eagle Broadband, Inc., which will be held at 1:30 p.m. Central Time on January 23, 2007, at the South Shore Harbour Resort & Conference Center, 2500 South Shore Blvd., League City, Texas 77573. I look forward to your attendance either in person or by proxy.

Information about the Annual Meeting, including matters on which shareholders will act, may be found in the Notice of Annual Meeting and Proxy Statement accompanying this letter.

Whether or not you plan to attend the meeting, please vote as soon as possible. You can vote by returning the enclosed proxy card, you can vote on the Internet at www.proxyvote.com, or you can vote by telephone according to the instructions on the enclosed proxy card.

The Annual Meeting agenda includes the election of Class I directors, approval of the 2007 Employee Stock Option and Stock Bonus Plan, and ratification of our independent registered public accounting firm. The Board of Directors recommends that you vote FOR election of the Class I director nominees, FOR approval of the 2007 Employee Stock Option and Stock Bonus Plan, and FOR ratification of appointment of our independent registered public accounting firm. Please refer to the proxy statement for detailed information on each of the proposals and the Annual Meeting.

This meeting is for Eagle Broadband shareholders. Only shareholders of record or their designated proxy are entitled to attend the meeting. All shareholders who attend the meeting will be required to show proof of ownership of Eagle Broadband stock such as a brokerage account statement and valid photo identification such as a current driver’s license or passport.

If you have any questions concerning the Annual Meeting or the matters to be voted on, please contact our Investor Relations department at (281) 538-6023 or send an email to InvestorRelations@eaglebroadband.com. For questions regarding your stock ownership or questions related to voting procedures, you may contact our transfer agent, Registrar and Transfer Company, via email through their web site at www.rtco.com or by phone at (800) 368-5948.

Very truly yours,

C. J. Reinhartsen

Chairman of the Board

———————————————————

Notice of Annual Meeting of Shareholders

January 23, 2007

1:30 p.m. Central Time

———————————————————

Notice is hereby given that the 2007 Annual Meeting of Shareholders of Eagle Broadband, Inc., will be held at 1:30 p.m. Central Time on January 23, 2007, at the South Shore Harbour Resort & Conference Center, 2500 South Shore Blvd., League City, Texas 77573. We are holding the Annual Meeting for the following purposes:

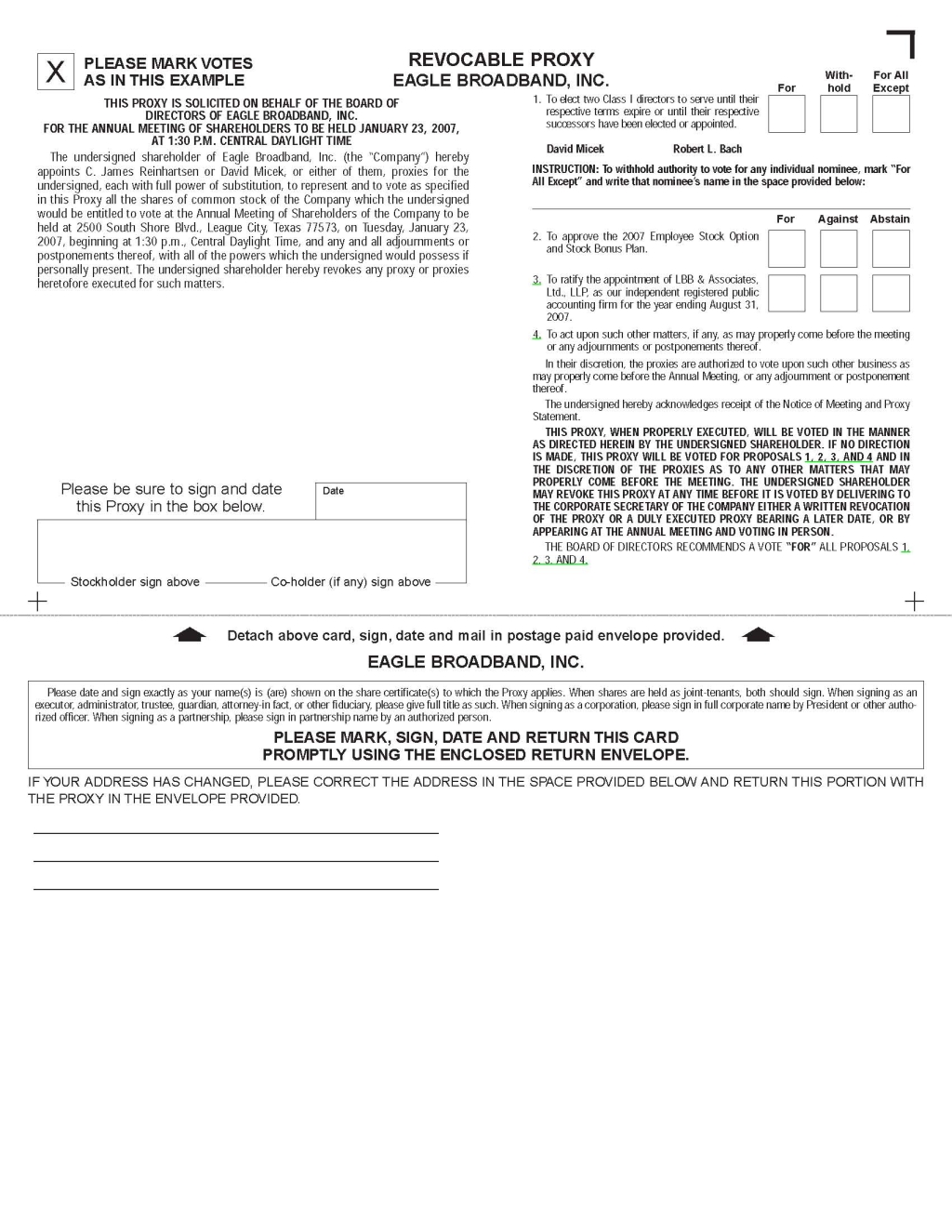

1) To elect two Class I directors to serve until their respective terms expire or until their respective successors have been elected or appointed.

2) To approve the 2007 Employee Stock Option and Stock Bonus Plan.

3) To ratify the appointment of LBB & Associates, Ltd., LLP, as our independent registered public accounting firm for the year ending August 31, 2007.

4) To act upon such other matters, if any, as may properly come before the meeting or any adjournments or postponements thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. We have not received notice of other matters that may be properly presented at the Annual Meeting.

Only shareholders of record at the close of business on November 24, 2006, will be entitled to vote at the Annual Meeting and any adjournments that may take place. All shareholders are requested to be present in person or by proxy. For the convenience of those shareholders who do not expect to attend the Annual Meeting in person and desire to have their shares voted, a form of proxy and an envelope, for which no postage is required, are enclosed. You may also vote by the Internet or telephone. Any shareholder may revoke the proxy for any reason and at any time before it is voted.

Registration will begin at 12:30 p.m. and seating will begin at 1:00 p.m. Each shareholder may be asked to present valid picture identification, such as a driver’s license or passport. Shareholders holding stock in brokerage accounts must bring a copy of a brokerage statement reflecting stock ownership as of the record date. Cameras, recording devices and other electronic devices will not be permitted at the meeting. Any shareholder attending the meeting may vote in person even if he or she has previously returned a proxy.

Please complete, sign, date and mail the accompanying proxy card in the return envelope furnished for that purpose, whether or not you plan to attend the annual meeting. Voting by the Internet or telephone is fast, convenient and your vote is immediately confirmed and tabulated. By using the Internet or telephone you help the company reduce postage and proxy tabulation costs.

YOUR VOTE IS IMPORTANT

IN ORDER TO ASSURE YOUR REPRESENTATION AT THE MEETING AND ENSURE THAT YOUR VOTE IS RECORDED PROMPTLY, YOU ARE REQUESTED TO COMPLETE, SIGN, AND DATE THE ENCLOSED PROXY AND RETURN IT IN THE ENCLOSED ENVELOPE AS SOON AS POSSIBLE, EVEN IF YOU PLAN TO ATTEND THE MEETING.

By Order of the Board of Directors,

/s/Richard H. Sanger, Jr.

Richard H. Sanger, Jr.

Corporate Secretary

December 18, 2006

TABLE OF CONTENTS

———————————————————

———————————————————

Our Board of Directors (the “Board”) solicits your proxy for the 2007 Annual Meeting of Shareholders to be held at 1:30 p.m. Central Time on Tuesday, January 23, 2007 at the South Shore Harbour Resort & Conference Center, 2500 South Shore Blvd., League City, Texas 77573, and at any postponement or adjournment of the meeting, for the purposes set forth in the Notice of Annual Meeting of Shareholders.

Record Date and Share Ownership

Only shareholders of record at the close of business on November 24, 2006 will be entitled to vote at the Annual Meeting. The majority of the shares of common stock outstanding on the record date must be present in person or by proxy to have a quorum. As of the close of business on November 24, 2006, we had 18,103,204 outstanding shares of common stock. We made copies of this proxy statement available to shareholders beginning on or about December 18, 2006.

Submitting and Revoking Your Proxy

If you complete and submit your proxy, the persons named as proxies will vote the shares represented by your proxy in accordance with your instructions. If you submit a proxy card but do not fill out the voting instructions on the proxy card, the persons named as proxies will vote the shares represented by your proxy as follows:

| · | FOR the election of the Class I director nominees set forth in “Proposal 1: Election of Class I Directors.” |

| · | FOR approval of the 2007 Employee Stock Option and Stock Bonus Plan set forth in “Proposal 2: Approval of the 2007 Employee Stock Option and Stock Bonus Plan.” |

| · | FOR ratification of the independent registered public accounting firm set forth in “Proposal 4: Ratification of Selection of Independent Registered Public Accounting Firm.” |

In addition, if other matters are properly presented for voting at the Annual Meeting, the persons named as proxies will vote on such matters in accordance with their best judgment. We have not received notice of other matters that may properly be presented for voting at the Annual Meeting.

To ensure that your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Annual Meeting in person. Most shareholders have three options for submitting their votes: (1) via the Internet, (2) by phone or (3) by mail. If you have Internet access, we encourage you to record your vote on the Internet. It is convenient, and it saves the company significant postage and processing costs. In addition, when you vote via the Internet or by phone prior to the meeting date, your vote is recorded immediately and there is no risk that postal delays will cause your vote to arrive late and therefore not be counted. If you attend the Annual Meeting and are a registered holder, you may also submit your vote in person, and any previous votes that you submitted, whether by Internet, phone or mail, will be superseded by the vote that you cast at the Annual Meeting prior to the close of the polls, and no further votes will be accepted after that time. We intend to announce preliminary results at the Annual Meeting and publish final results in our quarterly report on Form 10-Q for the second quarter of fiscal 2007. If you have any questions about submitting your vote, call our Investor Relations department at (281) 538-6023.

You may revoke your proxy at any time prior to the close of the polls by: (1) submitting a later-dated vote, in person at the Annual Meeting, via the Internet, by telephone or by mail, or (2) delivering instructions to our Corporate Secretary prior to the Annual Meeting via fax to (281) 538-1578 or by mail to Richard Sanger, Jr., Corporate Secretary, Eagle Broadband, Inc., at 101 Courageous Drive, League City, Texas 77573. If you hold shares through a bank or brokerage firm, you must contact that firm to revoke any prior voting instructions.

Votes Required to Adopt Proposals

Each share of our common stock outstanding on the record date will be entitled to one vote on each matter. The two nominees for election as Class I directors who receive the most votes “for” election will be elected. Approval of the 2007 Employee Stock Option and Stock Bonus Plan, and ratification of the appointment of our independent registered public accounting firm requires an affirmative vote of the majority of the shares of common stock present or represented at the Annual Meeting.

For the election of directors, withheld votes do not affect whether a nominee has received sufficient votes to be elected. For the purpose of determining whether the shareholders have approved matters other than the election of directors, abstentions are treated as shares present or represented and voting, so abstaining has the same effect as a negative vote. Shares held by brokers that do not have discretionary authority to vote on a particular matter and that have not received voting instructions from their customers are not counted or deemed to be present or represented for the purpose of determining whether stockholders have approved that matter, but they are counted as present for the purpose of determining the existence of a quorum at the Annual Meeting. Please note that banks and brokers that have not received voting instructions from their clients cannot vote on their clients’ behalf on “non-routine” proposals, such as approval of the 2007 Employee Stock Option and Stock Bonus Plan, but may vote their clients’ shares on the election of directors and the ratification of LBB & Associates, Ltd., LLP, as our independent registered public accounting firm.

Board Meetings and Committees

The Board held ten meetings during the year ended August 31, 2006. Each Board member attended at least 75% or more of the Board meetings held during the fiscal ended August 31, 2006. As of the date of this Proxy Statement, the Board has four standing committees: the Executive Committee, the Compensation Committee, the Audit Committee and the Nominating Committee.

Director Independence

The Board of Directors has determined that each of Messrs. Bach, Goerke, Persons, Reinhartsen and Yarbrough are independent directors as defined in the listing standards of the American Stock Exchange. As part of its analysis, the Board of Directors determined that none of these independent directors has a direct or indirect material relationship with the company that would interfere with the exercise of independent judgment.

Executive Committee

The Executive Committee of the Board consists of the Chairman of the Board, the Chairman of the Audit Committee, and the Chief Executive Officer of the company. The Executive Committee has the authority to consider and make decisions on all matters requiring Board approval that arise between scheduled meetings of the Board, including the authority to authorize the sale and issuance of shares of the company. However, the Executive Committee has no authority with respect to matters where action of the entire Board is required to be taken by Article 2.36B of the Texas Business Corporation Act.

Compensation Committee

The Compensation Committee of the Board reviews and approves salaries and incentive compensation for the company’s executive officers. The Compensation Committee consists of four, non-employee directors: Messrs. Bach, Goerke, Persons and Reinhartsen (Compensation Committee Chair). Messrs. Bach, Goerke, Persons and Reinhartsen are independent as defined in the listing standards of the American Stock Exchange. The Compensation Committee held six meetings in the year ended August 31, 2006. Each Compensation Committee member with the exception of Mr. Bach, who became a member in April 2006, attended at least 75% or more of the Compensation Committee meetings held during the year ended August 31, 2006. The Report of the Compensation Committee is included in this Proxy Statement. In addition, the Board has adopted a written charter for the Compensation Committee, which is available on the company’s website at www.eaglebroadband.com.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee has been or is an officer or employee of the company. None of the company’s executive officers serves on the Board of Directors or compensation committee of a company that has an executive officer that serves on the company’s Board or Compensation Committee. No member of the company’s Board is an executive officer of a company in which one of the company’s executive officers serves as a member of the Board of Directors or Compensation Committee of that company.

Audit Committee

The Audit Committee of the Board consists of three non-employee directors: Messrs. Goerke, Bach and Yarbrough (Audit Committee Chair). Each of Messrs. Goerke, Bach and Yarbrough are independent as defined in the listing standards of the American Stock Exchange. The Audit Committee engages the company’s independent auditors, reviews the company’s financial controls, evaluates the scope of the annual audit, reviews audit results, consults with management and the company’s independent auditors prior to the presentation of financial statements to shareholders and, as appropriate, initiates inquiries into aspects of the company’s internal accounting controls and financial affairs. The Audit Committee met six times in the year ended August 31, 2006. Each Audit Committee member attended at least 75% or more of the Audit Committee meetings held during the year ended August 31, 2006.

The Board has determined that Mr. Yarbrough qualifies as an “audit committee financial expert” as defined by Item 401(h) of Regulation S-K of the Exchange Act. The Report of the Audit Committee is included in this Proxy Statement. In addition, the Board has adopted a written charter for the Audit Committee, which is available on the company’s website at www.eaglebroadband.com.

Nominating Committee

The Nominating Committee consists of five non-employee directors: Messrs. Goerke (Nominating Committee Chair), Persons, Bach, Reinhartsen and Yarbrough. Each of Messrs. Goerke, Persons, Bach, Reinhartsen and Yarbrough are independent as defined in the listing standards of the American Stock Exchange. The Nominating Committee met six times in the year ended August 31, 2006. Each Nominating Committee member attended at least 75% or more of the Nominating Committee meetings held during the year ended August 31, 2006. The Board has adopted a written charter for the Nominating Committee, which is available on the company’s website at www.eaglebroadband.com.

Director Qualifications

In discharging its responsibilities to nominate candidates for election to the Board, the Nominating Committee has not specified any minimum qualifications for serving on the Board. However, the Nominating Committee endeavors to evaluate, propose and approve candidates with business experience and personal skills in finance, marketing, financial reporting and other areas that may be expected to contribute to an effective Board. The Nominating Committee seeks to assure that the Board is composed of individuals who have experience relevant to the needs of the company and who have the highest professional and personal ethics, consistent with the company’s values and standards. Candidates should be committed to enhancing stockholder value and should have sufficient time to carry out their duties and to provide insight and practical wisdom based on experience. Each director must represent the interests of all shareholders.

Identifying and Evaluating Nominees for Directors

The Nominating Committee will utilize a variety of methods for identifying and evaluating nominees for director. Candidates may come to the attention of the Nominating Committee through current Board members, professional search firms, shareholders or other persons. These candidates will be evaluated at regular or special meetings of the Nominating Committee, and may be considered at any point during the year. The Nominating Committee will also review materials provided by professional search firms or other parties in connection with a nominee who is not proposed by a shareholder.

Director Nominations made by Shareholders

The Nominating Committee will consider properly submitted shareholder nominations for candidates for the Board. Following verification of the shareholder status of persons proposing candidates, recommendations will be aggregated and considered by the Nominating Committee. If any materials are provided by a shareholder in connection with the nomination of a director candidate, such materials will be forwarded to the Nominating Committee. Section 3.5 of our Bylaws set forth the procedures to submit director nominations. These procedures provide that a shareholder who desires to submit a nominee for the Board must be a shareholder on (i) the date such shareholder submits the nomination and (ii) on the record date for the determination of shareholders entitled to vote at the meeting at which such nominee will stand for election. To be considered timely submitted, the nomination must be received at the company’s principal executive offices no later than 120 days prior to the anniversary date of the immediately preceding annual meeting. However, if the annual meeting is called for a date that is not within 30 days before or after such anniversary date, the nomination must be received no later than the close of business on the tenth (10th) day following the day on which the notice of such annual meeting was mailed or publicly disclosed, whichever occurs first.

Attendance at Annual Meetings

Members of the Board of Directors are encouraged to attend the company’s Annual Meeting; however, attendance is not mandatory.

Compensation of Directors

Directors receive an annual fee of $20,000, paid in $5,000 quarterly payments. The Chairman of the Board receives an additional fee of $55,000 annually, which is paid on a monthly basis. Committee chairmen receive an annual fee of $5,000, with the exception of the Audit Committee chairman, who receives an annual fee of $10,000, all of which are paid quarterly. Directors receive $1,500 for each regular meeting attended each year and $1,000 for each regularly scheduled committee meeting attended. In December 2006, each director received restricted stock grant of 50,000 shares of common stock, which vests in increments of 25,000 shares at the end of each of our second and third fiscal quarters. Directors are also eligible to receive grants of restricted stock based on the attainment of certain objectives by the company. company employees that also serve as directors do not receive the abovementioned fees, stock options or restricted stock.

Communications with the Board

The Board has adopted the following policy for shareholders who wish to communicate any concern directly with the Board. Shareholders may mail or deliver their communication to the company’s principal executive offices, addressed as follows:

Addressee (*)

c/o Corporate Secretary

Eagle Broadband, Inc.

101 Courageous Drive

League City, Texas 77573

*Addressees: Board of Directors; Audit Committee of the Board of Directors; Nominating Committee of the Board of Directors; Compensation Committee of the Board of Directors; name of individual director. Copies of written communications received at such address will be forwarded to the addressee as soon as practicable.

Certain Relationships and Related Transactions

In June 2006, the company entered into a short-term promissory note with Ron Persons, the brother of Lorne Persons, Jr., a director of the company, pursuant to which Mr. Persons loaned the company $250,000. The note was paid in full on September 2, 2006.

ELECTION OF DIRECTORS

The company has a classified board currently consisting of two Class I directors (David Micek and Robert Bach), two Class II directors (Glenn Goerke and Lorne Persons) and two Class III directors (C. James Reinhartsen and James Yarbrough). At each annual meeting of shareholders, directors are duly elected for a full term of three years to succeed those whose terms are expiring. The Class I directors currently serve until the Annual Meeting, and the Class II and Class III directors currently serve until the annual meetings of shareholders to be held in 2008 and 2009, respectively.

At the Annual Meeting, two nominees will be elected to serve as Class I directors until the 2010 annual meeting. The Nominating Committee of the Board of Directors has unanimously nominated David Micek and Robert Bach to stand for election as Class I directors. Each of these nominees presently serves as a Class I director.

The persons named as proxies in the accompanying proxy have been designated by the Board of Directors and, unless authority is withheld, will vote for the election of the nominees to the Board of Directors. If any director nominee is unable or unwilling to serve as a nominee at the time of the Annual Meeting, the persons named as proxies may vote either (1) for a substitute nominee designated by the present Board to fill the vacancy or (2) for the balance of the nominees, leaving a vacancy. Alternatively, the Board may reduce the size of the Board. The Board has no reason to believe that any of the following nominees will be unwilling or unable to serve if elected as a director. All of the nominees have been previously elected as directors by the shareholders. This section contains the names and biographical information for each of the nominees.

David Micek (age 53) has served as President and Chief Executive Officer since April 2005 and as a Director since October 2005. From November 2004 to April 2005, Mr. Micek served as Chief Operating Officer of the company. From 2002 to 2003, Mr. Micek was president at Internet search company AltaVista Software. From 2000 to 2001, Mr. Micek was president and CEO of wireless networking company Zeus Wireless. From 1999 to 2000, he was president and CEO of broadband video applications company iKnowledge. From 1995 to 1997, Mr. Micek was vice president and general manager at Texas Instruments Software. He holds an MBA from the University of Southern California.

Robert L. Bach (age 58) has served as a Director since October 2005. Mr. Bach is an attorney with the Minneapolis, Minnesota law firm of Felhaber, Larson, Fenlon & Vogt, P.A., where he has practiced for 29 years. Mr. Bach is a civil trial specialist certified by the Minnesota State Bar Association. He received his J.D. from the University of Minnesota Law School and his B.A. from the University of Iowa.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR”

THE ELECTION OF EACH OF THE NOMINEES ABOVE

Continuing Directors

The following persons are the Class II and Class III Directors of the company, with terms expiring as set forth below.

Class II Directors - Term expires at the 2008 annual meeting

Glenn A. Goerke (age 74) has served as a Director since March 2000. Dr. Goerke is president emeritus of the University of Houston and currently serves as a director of The Institute for the Future of Higher Education. He has served as vice president of Edusafe Systems, Inc. since 1996. From 1995 to 1997, Dr. Goerke served as president of the University of Houston. From 1991 to 1995, he served as president of the University of Houston - Clear Lake. Dr. Goerke holds a Ph.D. in Adult and Higher Education from Michigan State University and M.A. and B.A. degrees from Eastern Michigan University.

Lorne E. Persons, Jr. (age 59) has served as Director since March 2003. He has been a sales executive in the insurance industry since 1975. Since 1995, Mr. Persons has served as President of National Insurance Marketing Corporation, Aurora, Colorado, and is currently contracted to National States Insurance Company as a regional sales and recruiting director in a five-state area.

Class III Directors - Term expires at the 2009 annual meeting

C. J. (Jim) Reinhartsen (age 64) has served as a Director since November 2002 and as Chairman since April 2005. Since 1993, Mr. Reinhartsen has served as President of the Bay Area Houston Economic Partnership, formerly known as the Clear Lake Area Economic Development Foundation (CLAEDF). From 1988 to 1993, when he retired with 30 years service at Grumman, Mr. Reinhartsen was General Manager for the Grumman Houston Corporation headquartered in Houston, Texas.

James D. Yarbrough (age 50) has served as a Director of Eagle since October 2004. Since 1995, Judge Yarbrough has served as Chief Executive Officer and County Judge of Galveston County. From 1989 to 1994, Judge Yarbrough was the founder and President of James D. Yarbrough & Company. He also serves as a Director at American National Insurance Company, where he is Chairman of its Compensation Committee, and a member and financial expert for its Audit Committee.

APPROVAL OF THE 2007 EMPLOYEE STOCK OPTION AND STOCK BONUS PLAN

Introduction

The Eagle Broadband, Inc. 2007 Employee Stock Option and Stock Bonus Plan (the “Plan”) is intended to attract and retain directors, officers and employees of the company and to motivate these persons to achieve performance objectives related to the company’s overall goal of increasing shareholder value. The Board of Directors unanimously approved and adopted the Plan on November 1, 2006, and the Plan is being submitted to the shareholders of the company for approval. If a quorum is present at the Annual Meeting, the approval of the Plan must receive the affirmative vote of a majority of the votes cast at the Annual Meeting.

The Board of Directors believes approval of the Plan by shareholders is in the company’s best interest. The principal reason for adopting the Plan is to ensure that the company has a mechanism for long-term, equity-based incentive compensation to directors, officers and employees. The Plan is designed to comply with Rule 16b-3 under the Securities and Exchange Act of 1934, as amended, and, to the extent applicable, with the provisions of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”).

Summary of the Plan

The full text of the Plan is set forth at Appendix A to this Proxy Statement, and the following summary is qualified in its entirety by reference to Appendix A.

General. Awards granted under the Plan may be in the form of stock option awards or stock bonus awards. The Plan provides that awards may be made for ten years, and the Plan will remain in effect thereafter until all matters relating to the payment of awards and administration of the Plan have been settled.

Administration. The Plan, if approved by the shareholders of the company, will be administered by the board of directors or the compensation committee of the board of directors (the “Committee”). The Committee has sole authority to administer and interpret the Plan. The Committee, within the terms of the Plan, selects eligible employees and non-employee directors, consultants and vendors to participate in the Plan and determines the type, amount and duration of individual awards.

Shares Available. The Plan provides that the aggregate number of shares of common stock that may be subject to award may not exceed 2,000,000 shares, subject to adjustment in certain circumstances to prevent dilution. The common stock to be delivered under the Plan will be authorized and unissued shares. Shares underlying awards that are canceled, expired, forfeited or terminated shall, in most circumstances, again be available for the grant of additional awards within the limits provided by the Plan.

Eligibility. The Plan provides for awards to eligible employees of the company and to non-employee directors, consultants and vendors of the company. Because it is generally within the discretion of the Committee to determine which participants receive awards and the amount and type of award received, it is not possible at the present time to determine the amount of awards or the number of individuals to whom awards will be made under the Plan. The executive officers of the company named in the table under the caption “Executive Compensation” herein are among the employees who would be eligible to receive awards under the Plan.

Stock Option Awards. Subject to the terms and provisions of the Plan, options to purchase the common stock of the company may be granted to participants at any time and from time to time as shall be determined by the Committee. Such options may be “incentive stock options,” as defined in Section 422 of the Code, or “non-qualified options” under the Code. Incentive stock options may only be granted to eligible employees and not to non-employee directors. The Committee will have discretion in determining the number of shares of common stock to be covered by each option granted to the recipient. Each grant of options under the Plan will be evidenced by an option agreement that will specify the exercise price, the duration of the option, the number of shares to which the option pertains, the percentage of the option that becomes exercisable on specified dates in the future, and such other provisions as the Committee may determine.

The initial exercise price for each option granted under the Plan will be determined by the Committee in its discretion, provided that the exercise price of any option may not be less than the fair market value of the common stock (as determined pursuant to the Plan) on the date of grant of the option and, in the case of any optionee who owns stock possessing more than 10% of the total combined voting power of all classes of the capital stock of the company (within the meaning of Section 422(b)(6) of the Code), 110% of such fair market value with respect to any option intended to qualify as an incentive stock option.

All options granted under the Plan will expire no later than ten years from the date of grant. Subject to the limitations set forth in the Plan, any option may be exercised by payment to the company of cash or, at the discretion of the Committee, by surrender of shares of the company’s common stock owned by the participant (including, if the Committee so permits, a portion of the shares as to which the option is then being exercised) or a combination of cash and such shares.

The Plan places limitations on the exercise of options that constitute incentive stock options under certain circumstances upon or after termination of employment, and also provides the Committee with the discretion to place similar limitations on the exercise of any non-qualified options. Options are nontransferable except by will or in accordance with applicable laws of descent and distribution. The granting of an option does not provide the recipient the rights of a shareholder, and such rights accrue only after the exercise of an option and the payment in full of the exercise price by the optionee for the shares being purchased.

Stock Bonus Awards. The Plan provides for the award of shares of common stock, the issuance of which may be subject to restrictions determined by the Committee. Stock bonus awards pursuant to the Plan will be evidenced by a grant agreement between the company and the recipient. The grant agreement will set forth the forfeiture provisions, if any, regarding the recipient’s right to receive the shares, as determined by the Committee in its discretion. A recipient of a stock bonus award will have no rights as a shareholder of the company with respect to any shares until the distribution of such shares in connection therewith.

New Plan Benefits. No benefits have been granted or will be granted under the Plan prior to the approval of the Plan by the shareholders of the company.

Effect of Change in Control. Awards under the Plan are generally subject to special provisions upon the occurrence of a “change in control” (as defined in the Plan) transaction with respect to the company. Under the Plan, upon the occurrence of a change in control any outstanding stock options or stock bonus awards under the Plan will generally become fully vested and exercisable and, in certain cases, paid to the participant, unless the agreement entered into with respect to such equity award provides otherwise. Payments under awards that become subject to the excess parachute tax rules may be reduced under certain circumstances.

Amendment and Termination. The board of directors may, at any time and from time to time, terminate, amend, or modify some or all of the provisions of the Plan. However, without the approval of the shareholders of the company (as may be required by the Code, by Section 16 of the Securities Exchange Act of 1934, as amended, by any national securities exchange or system on which the shares are then listed or reported, or by a regulatory body having jurisdiction with respect hereto) no such termination, amendment, or modification may: (i) materially increase the total number of shares which may be granted under the Plan, (ii) materially modify the requirements as to eligibility for participation in the Plan or (iii) materially increase the benefits accruing to participants under the Plan. No termination, amendment or modification of the Plan may in any manner adversely affect any award previously granted under the Plan, without the written consent of the recipient.

Federal Income Tax Consequences

The following description of federal income tax consequences is based on current statutes, regulations and interpretations. The description does not address state or local income tax consequences. In addition, the description is not intended to address specific tax consequences applicable to an individual participant who receives an award under the Plan.

Incentive Options. There will not be any federal income tax consequences to either the optionee or the company as a result of the grant of an incentive stock option under the Plan. The exercise by an optionee of an incentive stock option also will not result in any federal income tax consequences to the company or the optionee, except that (i) an amount equal to the excess of the fair market value of the shares acquired upon exercise of the incentive stock option, determined at the time of exercise, over the amount paid for the shares by the optionee will be includable in the optionee’s alternative minimum taxable income for purposes of the alternative minimum tax and (ii) the optionee may be subject to an additional excise tax if any amounts are treated as excess parachute payments, as discussed below. Special rules will apply if previously acquired shares of common stock are permitted to be tendered in payment of an option exercise price or if shares otherwise to be received pursuant to the exercise of such option are used for such purpose.

If the optionee disposes of the shares of common stock acquired upon exercise of the incentive stock option, the federal income tax consequences will depend upon how long the optionee has held the shares. If the optionee does not dispose of the shares within two years after the incentive stock option was granted, nor within one year after the incentive stock option was exercised and the shares were transferred to the optionee, then the optionee will recognize a long-term capital gain or loss. The amount of the long-term capital gain or loss will be equal to the difference between (i) the amount the optionee realized on disposition of the shares and (ii) the option price at which the optionee acquired the shares. The company would not be entitled to any compensation expense deduction under these circumstances.

If the optionee does not satisfy both of the above holding period requirements (a “disqualifying disposition”), then the optionee will be required to report as ordinary income, in the year the shares are disposed of, the amount by which (A) the lesser of (i) the fair market value of the shares at the time of exercise of the incentive stock option (or, for directors, officers or greater than 10% stockholders of the company, generally the fair market value of the shares six months after the date of exercise, unless such persons file an election under Section 83(b) of the Code within 30 days of exercise) or (ii) the amount realized on the disposition of the shares, exceeds (B) the option price for the shares. The company will be entitled to a compensation expense deduction in an amount equal to the ordinary income includable in the taxable income of the optionee (as such deduction may be limited by certain provisions of the Code). The remainder of the gain recognized on the disposition, if any, or any loss recognized on the disposition, will be treated as long-term or short-term capital gain or loss, depending on the holding period.

Non-qualified Options. Neither the optionee nor the company incurs any federal income tax consequences as a result of the grant of a non-qualified option. Upon exercise of a non-qualified option, an optionee will recognize ordinary income, subject, in the case of employees, to payroll tax withholding and reporting requirements, on the “includability date” in an amount equal to the difference between (i) the fair market value of the shares purchased, determined on the includability date and (ii) the consideration paid for the shares. The includability date generally will be the date of exercise of the non-qualified option. However, the includability date for participants who are officers, directors or greater than 10% stockholders of the company will generally occur six months later, unless such persons file an election under Section 83(b) of the Code within 30 days of the date of exercise to include as ordinary income the amount realized upon exercise of the non-qualified option. The optionee may be subject to an additional excise tax if any amounts are treated as excess parachute payments, as discussed below. Special rules will apply if previously acquired shares of common stock are permitted to be tendered in payment of an option exercise price or if shares otherwise to be received pursuant to the exercise of such option are used for such purpose.

At the time of a subsequent sale or disposition of any shares of common stock obtained upon exercise of a non-qualified option, any gain or loss will be a capital gain or loss. Such capital gain or loss will be long-term capital gain or loss if the sale or disposition occurs more than one year after the includability date and short-term capital gain or loss if the sale or disposition occurs one year or less after the includability date.

In general, the company will be entitled to a compensation expense deduction in connection with the exercise of a non-qualified option for any amounts includable in the taxable income of the optionee as ordinary income (as such deduction may be limited by certain provisions of the Code).

Stock Bonus Awards. Neither the grantee nor the company incurs any federal income tax consequences as a result of the grant of a stock bonus award. With respect to shares issued pursuant to a stock bonus award, a holder will recognize ordinary income, subject, in the case of employees, to payroll tax withholding and reporting requirements, in the year of receipt an amount equal to the fair market value of the shares received on the date of receipt. The company will receive a corresponding tax deduction for any amounts includable in the taxable income of the holder as ordinary income (as such deduction may be limited by certain provisions of the Code). At the time any such shares are sold or disposed of, any gain or loss will be treated as long-term or short-term capital gain or loss, depending on the holding period from the date of receipt of the stock bonus award.

Excise Tax on Parachute Payments. Section 4999 of the Code imposes an excise tax on “excess parachute payments,” as defined in Section 280G of the Code. Generally, parachute payments are payments in the nature of compensation to employees or independent contractors who are also officers, shareholders or highly-compensated individuals, where such payments are contingent on a change in ownership or control of the stock or assets of the paying corporation. In addition, the payments generally must be substantially greater in amount than the recipient’s regular annual compensation. Under Treasury Regulations finalized by the Internal Revenue Service in 2003, under certain circumstances the grant, vesting, acceleration or exercise of awards pursuant to the Plan could be treated as contingent on a change in ownership or control for purposes of determining the amount of a participant’s parachute payments.

In general, the amount of a parachute payment (some portion of which may be deemed to be an “excess parachute payment”) would be the cash or the fair market value of the property received (or to be received) less the amount paid for such property. If a participant were found to have received an excess parachute payment, he or she would be subject to a special nondeductible 20% excise tax on the amount thereof, and the company would not be allowed to claim any deduction with respect thereto.

Excise Tax on Deferred Compensation. Section 409A of the Code provides for the imposition of an excise tax and interest on service providers in the case of certain deferrals of compensation that do not comply with the statute’s requirements. The company intends and anticipates that awards under the Plan will not be subject to the requirements of Section 409A because awards generally will be payable as soon as administratively practicable after the award becomes vested, thus avoiding a deferral of compensation, or otherwise will not provide for compensation deferral. However, to the extent that Section 409A does apply to an award, the Plan will be interpreted, operated and administered consistent with the company’s intent that participants not be subject to the imposition of excise tax and interest, and any inconsistent provision of an award agreement will be deemed to be modified as the Committee determines in its sole discretion and without further consent of the affected participant.

Required Vote

The affirmative vote of a majority of the shares of common stock present in person or represented by proxy and voting at the meeting will be required to approve this proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

A VOTE “FOR” THE ADOPTION OF THIS PROPOSAL

PROPOSAL 3

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected LBB & Associates, Ltd., LLP (formerly Lopez, Blevins, Bork & Associates, LLP) (“LBB & Associates”) as our independent auditors for the fiscal year ending August 31, 2007, subject to shareholder ratification. In the event this ratification is not approved by our shareholders, the Audit Committee will review their future selection of auditors.

We expect that a representative of LBB & Associates will attend the Annual Meeting, and the representative will have an opportunity to make a statement if she or he so desires. The representative will also be available to respond to appropriate questions from shareholders.

Required Vote

The affirmative vote of a majority of the shares of common stock present in person or represented by proxy and voting at the meeting will be required to approve this proposal.

Principal Accounting Fees and Services.

Fees for services provided by LBB & Associates for the years ended August 31, 2006 and 2005, were as follows:

Audit Fees

The aggregate fees billed to the company by LBB & Associates for the audit of the company’s annual financial statements and for the review of the financial statements included in the company’s quarterly reports on Form 10-Q totaled $138,922 and $164,625 in the years ended August 31, 2006 and 2005, respectively.

Audit-Related Fees

The aggregate fees billed to the company by LBB & Associates for assurance and related services totaled $4,800 and $3,300 in the fiscal years ended August 31, 2006 and 2005, respectively, which were for audits of our employee benefit plans.

Tax Fees

There were no fees billed to the company by LBB & Associates for tax compliance, tax advice or tax planning services in the years ended August 31, 2006 and 2005.

All Other Fees

There were no fees billed to the company by LBB & Associates, other than the services described above, for the years ended August 31, 2006 and 2005.

Policy on Audit Committee Pre-Approval and Permissible Non-Audit Services of Independent Auditors

The Audit Committee is directly responsible for the appointment, compensation and oversight of the independent public accounting firm engaged to prepare or issue an audit report on the financial statements of the company or perform other audit, review or attestation services for the company, and each such public accounting firm reports directly to the Audit Committee. The Audit Committee has established a policy requiring its pre-approval of all audit and permissible non-audit services provided by the independent public accounting firm. The Audit Committee considers whether such services are consistent with the rules of the SEC on auditor independence as well as whether the independent public accounting firm is best positioned to provide the most effective and efficient service, for reasons such as familiarity with the company’s business, people, culture, accounting systems, risk profile and other factors and input from the company’s management. The policy prohibits the Audit Committee from delegating to management the Audit Committee’s responsibility to pre-approve permitted services of the independent public accounting firm. During the year ended August 31, 2006, all of the services related to the audit or other fees described above were pre-approved by the Audit Committee and none were provided pursuant to any waiver of the pre-approval requirement.

Audit Committee Report

In accordance with its written charter adopted by the Board of Directors, the Audit Committee assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing, and financial reporting practices of the company. The Audit Committee recommends to the Board of Directors, subject to shareholder approval, the selection of the company’s independent accountants. The Audit Committee is comprised of Messrs. Goerke, Bach and Yarbrough (Audit Committee Chair). Messrs. Goerke, Bach and Yarbrough are independent directors, as defined by the American Stock Exchange’s listing standards.

Management is responsible for our internal controls. Our independent auditors, LBB& Associates, are responsible for performing an independent audit of the company’s consolidated financial statements in accordance with generally accepted auditing standards and to issue a report thereon. The Audit Committee has general oversight responsibility with respect to financial reporting, and reviews the results and scope of the audit and other services provided by LBB & Associates.

The Audit Committee members are not professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and LBB & Associates, nor can the Audit Committee certify that LBB & Associates is “independent” under applicable rules. The Audit Committee serves a board-level oversight role, in which it provides advice, counsel, and direction to management and the auditors on the basis of the information it receives, discussions with management and the auditors and the experience of the Audit Committee members in business, financial, and accounting matters.

In this context, the Audit Committee has met and held discussions with management and LBB & Associates. Management represented to the Audit Committee that our consolidated financial statements were prepared in accordance with generally accepted accounting principles, and the Audit Committee has reviewed and discussed the consolidated financial statements with management and LBB & Associates. The Audit Committee discussed with LBB & Associates matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees).

LBB & Associates also provided to the Audit Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with LBB & Associates their independence.

Based upon the Audit Committee’s discussion with management and LBB & Associates and the Audit Committee’s review of the representations of management and the report of LBB & Associates to the Audit Committee, the Audit Committee recommended that the Board of Directors include the company’s audited consolidated financial statements in the Eagle Broadband, Inc. Annual Report on Form 10-K for the year ended August 31, 2006 filed with the Securities and Exchange Commission.

MEMBERS OF THE AUDIT COMMITTEE

James D. Yarbrough, Chairman

Robert L. Bach

Glenn A. Goerke

Please see Proposal 1 for biographical information with respect to our President and Chief Executive Officer, David Micek.

Brian Morrow (age 55) has served as Chief Operating Officer since April 2006. Mr. Morrow joined the company in December 2005 as General Manager of the IPTV Solutions division. From June 2005 until joining the company, Mr. Morrow served as President and Chief Operating Officer for Analytical Surveys, Inc. From January 2003 to June 2005, Mr. Morrow served as a certified management consultant to various companies, including Eagle Broadband. From March 2001 to March 2002, he served as chairman of the 50-company Peer-To-Peer Working Group, an international industry association that included businesses such as Intel, HP, Cisco, and NTT. From July 2000 to December 2002, he served as President and Chief Operating Officer of Endeavors Technology, a Java and .NET Web Services start-up company that developed Web collaboration and application delivery enterprise software, and was acquired by U.K.-based Tadpole Technology. He holds a BS degree from Dalhousie University and an MBA in Finance from the University of Ottawa.

Richard Sanger, Jr. (age 62) joined the company in July 2004 as Chief Board Administrative Officer, was appointed Corporate Secretary in October 2005, and was promoted to Vice President of Administration in December 2005. From 2003 to 2004, Mr. Sanger was President of the Performance Technology Division of Pro Technik, Inc., the largest independent Porsche racing and repair facility in the southwest United States. From 1997 to 2003, Mr. Sanger served as Chief Financial and Development Officer and then as Vice President and General Manager of the Diversified Programs Group of GB Tech, Inc., an engineering and scientific services company based in Houston, Texas. Mr. Sanger holds a B.A. in History from Trinity College and an M.B.A. from the University of Virginia Darden Graduate School of Business.

The following table contains compensation data for our named executive officers for the years ended August 31, 2006, 2005 and 2004.

SUMMARY COMPENSATION TABLE

| | | | | Annual Compensation | | Long-Term Compensation | | |

Name and Principal Position | | Fiscal Year | | Salary ($) | | Bonus ($) | | Other Annual Compensation ($) | | Restricted Stock Awards ($) | | Securities Underlying Options (#) (1) | | All Other Compensation ($) (2) |

David Micek (3) President & CEO | | 2006 2005 2004 | | 275,000 178,154 — | | — — — | | — — — | | — — — | | — 205,715 — | | 75,184 2,625 — |

Brian Morrow (4) Chief Operating Officer | | 2006 2005 2004 | | 142,326 — — | | 25,000 — — | | — — — | | — — — | | 21,429 — — | | 2,343 — — |

Richard Sanger, Jr. (5) Vice President of Administration | | 2006 2005 2004 | | 167,512 150,000 13,269 | | 5,000 — — | | — — — | | — — — | | 17,143 — 6,429 | | — — — |

Juliet Markovich (6) Corporate Controller and Principal Accounting Officer | | 2006 2005 2004 | | 115,769 9,135 — | | — — — | | — — — | | — — — | | 5,715 — — | | — — — |

Eric Blachno (7) Chief Financial Officer | | 2006 2005 2004 | | 74,628 163,857 — | | — — — | | — — — | | — — — | | — 14,286 (8) — | | 100,000 77,562 — |

Randall Shapiro (9) Vice President, Marketing | | 2006 2005 2004 | | 53,346 190,000 166,931 | | — — — | | — — — | | — — — | | — 5,714 23,143 | | 254,231 — — |

(1) The number of securities underlying stock options have been adjusted to reflect the 1-for-35 reverse stock split effected on May 12, 2006.

(2) Amounts for fiscal year 2006 include payments made to (i) Mr. Micek for moving expenses ($66,184) and car allowance ($9,000), (ii) Mr. Morrow for temporary living expenses, (iii) Mr. Blachno for severance payments and (iv) Mr. Shapiro for a negotiated settlement of a disputed bonus amount due ($225,000) and accrued vacation ($29,231). Amounts for fiscal year 2005 include payments made to (i) Mr. Micek for car allowance and (ii) Mr. Blachno for relocation expenses.

(3) Mr. Micek was named Chief Operating Officer in November 2004 and was promoted to President and Chief Executive Officer in April 2005.

(4) Mr. Morrow joined the company in December 2005 as General Manager of the IPTV Solutions division and was promoted to Chief Operating Officer in April 2006.

(5) Mr. Sanger joined the company in July 2004 as Chief Board Administrative Officer and was promoted to Vice President of Administration in December 2005.

(6) Ms. Markovich joined the company in July 2005 as Corporate Controller and was named Principal Accounting Officer in December 2005. In November 2006, Ms. Markovich resigned as Corporate Controller and Principal Accounting Officer.

(7) Mr. Blachno was named Chief Financial Officer in November 2004. In January 2006, the company entered into an agreement with Mr. Blachno, pursuant to which he resigned effective as of January 3, 2006. Under the agreement, Mr. Blachno received severance payments over a six-month period equal to six months salary. In connection with entering into the agreement, the Employment Agreement between Mr. Blachno and the company dated November 4, 2004, was terminated.

(8) Pursuant to the Employment Resignation Agreement with Mr. Blachno, these options have been canceled.

(9) Mr. Shapiro’s employment agreement expired on November 30, 2005 and was not renewed.

The following table sets forth information concerning individual grants of stock options made during the fiscal year ended August 31, 2006, to our named executive officers. No stock appreciation rights were issued during the year.

Options Grants in Last Fiscal Year

| | | Individual Grants | | | | |

Name | | Number of Securities Underlying Options Granted (#) | | Percentage of Total Options Granted to Employees in Fiscal Year (1) | | Exercise or Base Price ($/Share) | | Expiration Date | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term ($) (2) |

| David Micek | | — | | — | | — | | — | | — | | — |

| Brian Morrow | | 21,429 | | 9.4% | | $4.725 | | (3) | | — | | — |

| Richard Sanger, Jr. | | 17,143 | | 7.4% | | $4.725 | | (3) | | — | | — |

| Juliet Markovich | | 1,429 4,286 | | 0.6% 1.9% | | $5.775 $4.725 | | 10/18/2010 (3) | | $2,280 — | | $5,038 — |

* Less than 1%

(1) Percentages are based on a total of 229,163 shares subject to options granted to employees during the year ended August 31, 2006.

(2) In accordance with SEC rules, these columns show gains that could accrue for the respective options, assuming that the market price of our common stock appreciates from the date of grant until the expiration date at an annualized rate of 5% and 10%, respectively. If the stock price does not increase above the exercise price at the time of exercise, realized value to the named executives from these options will be zero.

(3) These options were granted with five-year terms expiring December 5, 2010. However, pursuant to the vesting terms of these options, these options would only vest if the company achieved revenues of at least $10 million in fiscal year 2006, which the company did not. Thus, these options expired on August 31, 2006.

The following table sets forth information concerning option exercises during the year ended August 31, 2006, and option holdings as of August 31, 2006, with respect to our named executive officers. No stock appreciation rights were outstanding at the end of the fiscal year.

Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

| Name | | Shares Acquired on Exercise (#) | | Value Realized ($) | | Number of Securities Underlying Unexercised Options at Fiscal Year-End | | Value of Unexercised In-the-Money Options at Fiscal Year-End ($) |

| Exercisable | | Unexercisable | Exercisable | | Unexercisable |

| David Micek | | — | | — | | 93,806 | | 111,909 | | — | | — |

| Brian Morrow | | — | | — | | — | | — | | — | | — |

| Richard Sanger, Jr. | | — | | — | | 6,429 | | — | | — | | — |

| Juliet Markovich | | — | | — | | 387 | | 1,042 | | — | | — |

Mr. Micek’s amended employment agreement provides for an annual salary of $275,000 and is effective through May 2008. Under the terms of his original employment agreement, Mr. Micek was granted the right to purchase 14,286 shares (after adjustment for the reverse split) of company common stock at a price per share of $21.35 per share (after adjustment for the reverse split), which vests over 36 months. In May 2005, Mr. Micek’ employment agreement was amended and he was granted the right to (i) receive an option to purchase 191,429 shares (after adjustment for the reverse split) at an exercise price of $6.65 per share (after adjustment for the reverse split) per share, vesting over a 36-month term, which vesting accelerates upon a change of control or termination of employee without cause, and (ii) receive 57,143 shares (after adjustment for the reverse split) of restricted stock (which have not yet been issued), which vest upon Mr. Micek’s or the company’s attainment of certain objectives and/or company milestones, which to date have not been satisfied. If Mr. Micek’s employment is terminated for reasons other than cause or “good reason” (as defined in the employment agreement), Mr. Micek will be entitled to his salary for 18 months. Mr. Micek receives customary fringe benefits.

Mr. Morrow’s employment agreement provides for an annual salary of $200,000.00 and is effective through October 2010. Mr. Morrow is eligible to receive bonuses up to a total of $100,000 based upon the attainment of certain objectives during his first year of employment. If Mr. Morrow’s employment is terminated for reasons other than cause, Mr. Morrow will be entitled to his salary for six months. Mr. Morrow receives customary fringe benefits.

Mr. Sanger’s amended employment agreement provides for an annual salary of $175,000 and is effective through July 2010. Mr. Sanger was granted an option to purchase 6,429 shares (after adjustment for the reverse split) of company common stock at a price per share of $27.30 per share (after adjustment for the reverse split), which are fully vested. Mr. Sanger also has the right to receive 1,429 shares (after adjustment for the reverse split) of company common stock upon the attainment of certain company milestones. If Mr. Sanger’s employment is terminated for reasons other than cause, Mr. Sanger will be entitled to his salary for one year. Mr. Sanger receives customary fringe benefits.

Decisions on compensation of the company’s executive officers are made by the Compensation Committee of the Board. The Compensation Committee is composed solely of independent, non-employee directors. The Compensation Committee is responsible for all elements of executive compensation including base salary and other benefit programs for key executives.

The goals of the company’s executive compensation program are to (i) pay competitively to attract, retain and motivate executives who must operate in a highly competitive and technologically specialized environment, (ii) relate total compensation for each executive to overall company performance as well as individual performance and (iii) align executives’ performances and financial interests with shareholder value.

Base Salary

Base salary ranges are developed after considering the recommendations of professional compensation consultants who conduct annual compensation surveys of similar companies. Base salaries within these ranges are targeted to be competitive in relation to salaries paid for similar positions in comparable companies. On a regular basis, the Compensation Committee reviews executives’ salaries utilizing the results of survey data for comparable executive positions. Individual salary determinations within the established ranges are made based on position accountabilities, experience, sustained individual performance, overall company performance, and peer comparisons inside and outside the company, with each factor being weighed reasonably in relation to other factors.

Incentives Compensation

Bonus incentives for the company’s executives are tied to specific performance goals including, but not limited to, attainment of IPTVComplete customers, sales of set-top boxes, and revenue and profit thresholds.

Equity Incentives

Stock option plans are used to align the long-term financial interests of executives with those of shareholders. On October 18, 2005, the company’s shareholders approved the 2005 Employee Stock Option Plan (“2005 Plan”), which provides for the grant of options that may be “Incentive Stock Options” within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended, or non-qualified stock options, or a combination of both, as determined by the Compensation Committee. The 2005 Plan also provides that the Compensation Committee may issue shares of restricted stock to persons eligible under the plan. The 2005 Plan, as amended, provides for a total of 571,429 shares of the company’s common stock, and is administered by the Compensation Committee.

Included in this Proxy Statement is a proposal (Proposal 2) to approve the 2007 Employee Stock Option and Stock Bonus Plan (“2007 Plan), which, if approved by the shareholders, will provide for the grant of options that may be “Incentive Stock Options” within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended, or non-qualified stock options, or a combination of both, as determined by the Compensation Committee. If approved, the 2007 Plan will also provide for the grant of stock bonus awards as determined by the Compensation Committee. The 2007 Plan, if approved, will provide for 2,000,000 shares of the company’s common stock, and will be administered by the Compensation Committee.

Compensation of the Chief Executive Officer

The Compensation Committee determines the Chief Executive Officer’s salary and other compensation elements based on performance. The CEO’s salary is established within a salary range recommended by an independent compensation consulting firm. The Compensation Committee believes that the equity incentives granted to Mr. Micek provide the necessary long-term incentives, and align Mr. Micek’s performance and financial interests with shareholder value. The Compensation Committee believes that Mr. Micek’s efforts during his time as CEO have positioned the company for success in the future.

The Compensation Committee believes that its actions in fiscal 2006 have been consistent with and have effectively implemented the company’s overall executive compensation policies.

MEMBERS OF THE COMPENSATION COMMITTEE

C. J. Reinhartsen, Chairman

Robert L. Bach

Glenn A. Goerke

Lorne E. Persons

Below is a comparison of the cumulative total shareholder return on the company’s common stock against the cumulative total return of the NASDAQ Composite Index and the communications equipment peer group for the period of five fiscal years commencing August 31, 2001, and ending August 31, 2006. The graph and table assume that $100 was invested on August 31, 2001, in each of the company’s common stock, the NASDAQ Index and the peer group, and that all dividends were reinvested. The comparison shown is based upon historical data. The stock price performance shown below is not necessarily indicative of, nor intended to forecast, the potential future performance of the company’s common stock.

| | August 31, |

| | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 |

| Eagle Broadband, Inc. | $100 | | $59 | | $55 | | $102 | | $18 | | $2 |

| Communications Equipment, NEC | $100 | | $31 | | $66 | | $62 | | $60 | | $64 |

| NASDAQ (U.S.) | $100 | | $75 | | $101 | | $105 | | $123 | | $128 |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors, executive officers, and persons who own more than ten percent of a registered class of our equity securities to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent stockholders are required by Securities and Exchange Commission regulations to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of the reports furnished to us and written representations that no other reports were required, during the year ended August 31, 2006, all Section 16(a) filing requirements applicable to our officers, directors and greater than 10% beneficial owners were complied with and no reports or transactions were filed late except for the following: Messrs. Bach, Goerke, Persons, Reinhartsen and Yarbrough failed to timely report transactions on Form 4 for the October 2005 issuance of stock options, each of which were subsequently reported on Form 4 in November 2005. Richard Sanger, Jr. and Juliet Markovich failed to timely report transactions on Form 4 for the December 2005 issuance of stock options, each of which were subsequently reported on Form 4 in May 2006. Brian Morrow failed to timely file Form 3 upon being named Chief Operating Officer in April 2006, which was subsequently filed in May 2006. Messrs. Bach and Reinhartsen failed to timely report transactions on Form 4 for the June 2006 issuance of restricted stock, each of which were subsequently reported on Form 4 in July 2006. Mr. Persons failed to timely report a transaction on Form 4 for the June 2006 issuance of restricted stock, which was subsequently reported on Form 4 in July 2006. Mr. Morrow failed to timely report a transaction on Form 4 for the September 2006 issuance of restricted stock, which was subsequently reported on Form 4 in October 2006.

As of October 31, 2006, a total of 17,656,797 shares of our common stock were outstanding. The following table sets forth, as of October 31, 2006, certain information with respect to shares beneficially owned by: (a) each person who is known by us to be the beneficial owner of more than 5% of our outstanding shares of common stock, (b) each of our current directors, (c) each of the current the executive officers named in the Summary Compensation Table above and (d) all current directors and executive officers as a group.

Beneficial ownership has been determined in accordance with Rule 13d-3 under the Exchange Act. Under this rule, certain shares may be deemed to be beneficially owned by more than one person (if, for example, persons share the power to vote or the power to dispose of the shares). In addition, shares are deemed to be beneficially owned by a person if the person has the right to acquire shares (for example, upon exercise of an option or warrant) within sixty days of the date as of which the information is provided. In computing the percentage ownership of any person, the amount of shares is deemed to include the amount of shares beneficially owned by such person by reason of such acquisition rights. As a result, the percentage of outstanding shares of any person as shown in the following table does not necessarily reflect the person's actual voting power at any particular date.

To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. Unless otherwise indicated, the business address of the individuals listed is Eagle Broadband, Inc., 101 Courageous Drive, League City, Texas 77573.

SHARES BENEFICIALLY OWNED AS OF OCTOBER 31, 2006

| Name and Address of Beneficial Owner | | Shares Owned | | Shares Covered by Convertible Instruments (1) | | Total | | Percent of Class (2) |

The Tail Wind Fund Ltd. 77 Long Acre London, England | | 324,819 (3) | | 1,250,000 (4) | | 1,574,819 | | 8.1% |

| David Micek | | — | | 116,662 | | 116,662 | | * |

| Brian Morrow | | 75,000 | | — | | 75,000 | | * |

| Lorne Persons, Jr. | | 41,126 | | 5,715 | | 46,841 | | * |

| Robert Bach | | 29,001 (5) | | 2,857 | | 31,858 | | * |

| C. J. Reinhartsen | | 11,351 | | 5,715 | | 17,066 | | * |

| Glenn Goerke | | 5,604 | | 5,715 | | 11,319 | | * |

| Richard Sanger, Jr. | | — | | 6,429 | | 6,429 | | * |

| James Yarbrough | | 1,099 | | 4,286 | | 5,385 | | * |

| Juliet Markovich | | — | | 507 | | 507 | | * |

All current directors and executive officers as a group (9 persons) | | 163,181 | | 147,886 | | 311,067 | | 1.6% |

* Less than 1%

(1) Unless otherwise indicated, represents shares underlying options exercisable as of October 31, 2006 and within 60 days thereof.

(2) The denominator used in this calculation includes options, warrants and other instruments convertible into Eagle common stock as of October 31, 2006 and within 60 days thereof.

(3) Based on information provided to the company by The Tail Wind Fund Ltd.

(4) Represents shares issuable upon conversion of a convertible note with a $1,000,000 principle balance. The number of shares into which the convertible note is convertible at any time is limited to the number of shares that would result in Tail Wind owning no more than 9.9% of the total issued and outstanding shares of Eagle common stock.

(5) Includes 571 shares held in a trust of which Mr. Bach is a trustee.

| | | As of August 31, 2006 |

| Plan Category | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | Weighted average exercise price of outstanding options, warrants and rights | | Number of securities remaining available for future issuance |

Equity compensation plans approved by security holders | | 322,551 | | $ 10.37 | | 248,878 |

Equity compensation plans not approved by security holders | | — | | — | | — |

| Total | | 322,551 | | $ 10.37 | | 248,878 |

DEADLINE FOR SUBMISSION OF SHAREHOLDER PROPOSALS

Proposals of shareholders intended to be included in the company’s Proxy Statement and form of proxy relating to the company’s 2008 Annual Meeting of Shareholders must be received by the Corporate Secretary, Eagle Broadband, Inc., 101 Courageous Drive, League City, Texas 77573, no later than August 10, 2007. Proof of ownership of Eagle common stock must accompany any such proposal. We strongly encourage any shareholder interested in submitting a proposal to contact our Corporate Secretary in advance of this deadline to discuss the proposal, and shareholders may want to consult knowledgeable counsel with regard to the detailed requirements of applicable securities laws. Submitting a shareholder proposal does not guarantee that we will include it in our proxy statement.

OTHER MATTERS

All shareholders of record at the close of business on November 24, 2006, the record date for the determination of shareholders entitled to vote at the Annual Meeting, are concurrently being sent a copy of the company’s Annual Report on Form 10-K, including financial statements for the year ended August 31, 2006.

In some cases, we have multiple shareholders of record at a single address. We are sending a single Annual Report and Proxy Statement to that address unless we received instructions to the contrary. Each shareholder of record, however, will continue to receive a separate proxy card. This practice, known as “householding,” is designed to reduce our printing and postage costs. If you wish to receive separate copies of the Annual Report and Proxy Statement now or in the future, or to discontinue householding entirely, you may call our transfer agent, Registrar and Transfer Company, at (800) 368-5948, contact it by e-mail at info@rtco.com, or provide written instructions to Registrar and Transfer Company, 10 Commerce Drive, Cranford, New Jersey 07016-3572.

If you receive multiple copies of the Annual Report and Proxy Statement, you also may contact our transfer agent at the telephone number or address above to request householding. If your shares are held in street name through a bank, broker or other holder of record, you may request householding by contacting that bank, broker or other holder of record.

The expense of preparing, printing and mailing the Notice of Meeting and proxy material and all other expenses of soliciting proxies will be borne by the company. In addition to the solicitation of proxies by use of the mails, the directors, officers and regular employees of the company, who will receive no compensation in addition to their regular salary, if any, may solicit proxies by mail, telegraph, telephone, or personal interview. The company will also reimburse brokerage firms, banks, trustees, nominees and other persons for their expenses in forwarding proxy material to the beneficial owners of shares held by them of record.

Management knows of no business which will be presented for consideration at the Annual Meeting other than that stated in the Notice of Meeting. However, if any such matter shall properly come before the meeting, the persons named in the enclosed proxy form will vote the same in accordance with their best judgment.

By Order of the Board of Directors

Richard Sanger, Jr.

Corporate Secretary

December 18, 2006

2007 STOCK OPTION AND STOCK BONUS PLAN

OF

EAGLE BROADBAND, INC.

SECTION 1

PURPOSE; DEFINITIONS

1.1 The purpose of the Plan is to retain, attract, motivate and compensate selected key employees, consultants and directors of the Company and its Affiliates and to provide them with an opportunity to benefit from ownership of and/or increases in the value of the stock of the Company.

1.2 For purposes of the Plan, the following terms are defined as set forth below:

A. “Affiliate” means a corporation or other entity controlled by the Company.

B. “Award” means a Stock Option or a Stock Bonus.

C. “Board” means the Board of Directors of the Company.

D. “Cause” has the meaning set forth in Subsection 5.4.E.

E. “Committee” means the Committee referred to in Section 2.

F. “Company” means Eagle Broadband, Inc., a Texas corporation.