QuickLinks -- Click here to rapidly navigate through this documentFILING PURSUANT TO RULE 425

OF THE SECURITIES ACT OF 1933, AS AMENDED

AND DEEMED FILED PURSUANT TO RULE 14(a)-12

OF THE SECURITIES EXCHANGE ACT OF 1934

FILED BY: STERLING FINANCIAL CORPORATION

SUBJECT COMPANY: EMPIRE FEDERAL BANCORP, INC.

COMMISSION FILE NO. 0-28934

SEPTEMBER 19, 2002

Except for historical information, all other information in this filing consists of forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the merger between Sterling Financial Corporation ("Sterling") and Empire Federal Bancorp, Inc. ("Empire"), including future financial and operating results, cost savings enhancements to revenue and accretion to reported earnings that may be realized from the merger; (ii) Sterling's and Empire's plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (iii) other statements identified by words such as "expects" "anticipates," "intends," "plans," "believes," "seeks," "estimates," or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations of the management of Sterling and Empire and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of numerous possible uncertainties.

The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of Sterling and Empire may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer losses and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of Empire may fail to approve the merger; (6) adverse governmental or regulatory policies may be enacted; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (9) competition from other financial services companies in Sterling's and Empire's markets could adversely affect operations; and (10) an economic slowdown could adversely affect credit quality and loan originations. Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Sterling's and Empire's reports (such as Annual Reports on Form 10-K and 10-KSB, Quarterly Reports on Form 10-Q and 10-QSB and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available on the SEC's Internet site (http://www.sec.gov).

Sterling and Empire caution that the foregoing list of factors is not exclusive. All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Sterling or Empire or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Sterling and Empire do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

The proposed transaction will be submitted to Empire's shareholders for their consideration. Sterling and Empire will file a registration statement, a joint prospectus/proxy statement and other relevant documents concerning the proposed transaction with the SEC.

SHAREHOLDERS OF EMPIRE ARE URGED TO READ THE REGISTRATION STATEMENT AND THE PROSPECTUS/PROXY STATEMENT WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a free copy of the prospectus/proxy statement and other documents containing information about Sterling and Empire when they become available on the SEC's Internet site at (http://www.sec.gov).

Empire and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Empire in connection with the Merger. Information about the directors and executive officers of Empire and their ownership of Empire common stock is set forth in Empire's proxy statement, dated April 18, 2002, for Empire's 2002 annual meeting of stockholders, as filed with the SEC on Schedule 14A. Additional information regarding the interests of these participants may be obtained by reading the joint prospectus/proxy statement regarding this transaction when it becomes available.

THE FOLLOWING IS A JOINT PRESS RELEASE ISSUED BY STERLING AND EMPIRE ON SEPTEMBER 19, 2002.

For Release September 19, 2002—1:30 p.m. PDT

STERLING FINANCIAL CORPORATION

OF SPOKANE, WASHINGTON, TO ACQUIRE

EMPIRE FEDERAL BANCORP FOR $29.8 MILLION

Spokane, Washington—September 19, 2002—Sterling Financial Corporation (NASDAQ: STSA) today announced the signing of a definitive agreement to acquire Empire Federal Bancorp, Inc. (NASDAQ: EFBC).

Under the terms of the definitive agreement, each share of Empire common stock will be converted into shares of Sterling common stock at a price of $19.25 per share, subject to adjustment in certain circumstances. The exchange of shares is expected to be tax-free to the Empire shareholders. It is anticipated that the transaction will close in the first quarter of 2003, subject to regulatory approvals and the approval of the shareholders of Empire. The transaction is currently valued at approximately $29.8 million and has been unanimously approved by the boards of directors of both companies. This transaction is expected to be accretive to Sterling's earnings per share in 2003.

Sterling's Chairman and Chief Executive Officer, Harold B. Gilkey, commented, "We are very pleased to welcome the employees, customers and investors of Empire into the Sterling family. This agreement allows us the opportunity to extend our Pacific Northwest community bank franchise into the attractive Montana markets and to increase lending opportunities while also keeping capital here in the Pacific Northwest. We believe the transaction will strengthen Sterling's capital base and is beneficial to the shareholders of both Sterling and Empire."

According to Bill Ruegamer, President and CEO of Empire, "The merger with Sterling will provide a number of benefits to our existing customers, including an expanded product line which will continue to be delivered by our dedicated staff of local bankers. It will also allow us to serve a broader segment of the Montana market. Our shareholders are receiving a premium on their investment and a more liquid stock."

According to Gilkey, "Sterling will continue local decision-making in Montana, which will allow us to continue to deliver on our promise to customers of prompt, professional responses to their banking needs and continue our history of community involvement in this extended Montana region. Sterling

intends to form a Montana-area advisory board comprised of some of the current Empire board members and others to facilitate Sterling's further expansion into Montana."

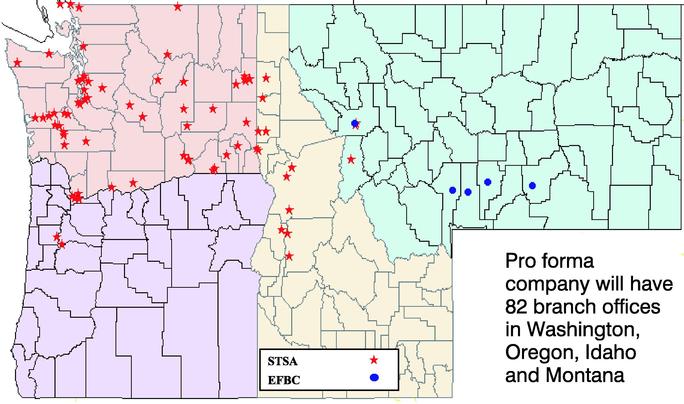

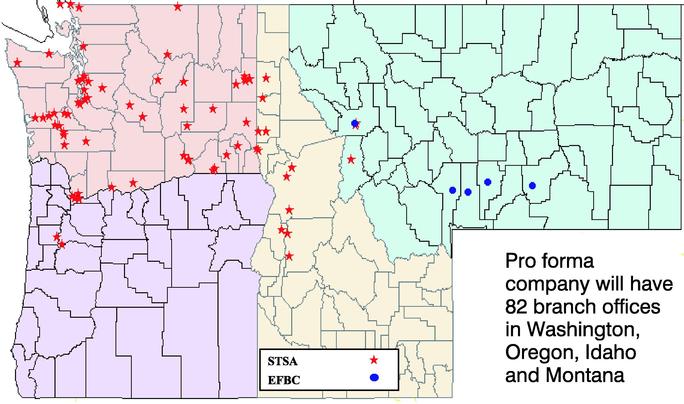

Commenting further, Mr. Gilkey, stated, "This transaction is a win-win for the shareholders of both companies. The access to capital and other resources gives Sterling the opportunity to continue its regional growth. Additionally, the transaction reflects Sterling's long-term strategy of concentrating on its core businesses, including our ability to diversify loan portfolio opportunities across the region. Sterling welcomes and looks forward to a long-term opportunity for achievement and success with the Empire team. This transaction will bring Sterling to a total of 82 branches in Washington, Oregon, Idaho and Montana."

Sterling will host a conference call for investors, analysts and other interested parties on September 20, 2002 at 11:00 a.m. EDT.

Participants will include:

- •

- Harold Gilkey, Chairman and CEO of Sterling

- •

- Bill Ruegamer, President and CEO of Empire

- •

- Heidi Stanley, EVP—Corporate Administration of Sterling

- •

- Daniel Byrne, SVP and CFO of Sterling

Investors, analysts and other interested parties may access the teleconference at 712-271-3411 and use the password "STERLING-EMPIRE." A replay will be available from approximately 11:00 a.m. PDT on September 24, 2002 until October 15, 2002 at 5:00 p.m. PDT. The replay number is 402-220-9676. In addition, Sterling has prepared an Investor Presentation to accompany the audio call. The presentation is available in PDF format via the Internet at www.sterlingsavingsbank.com. The Investor Relations site contains the investor presentation in PDF format, as well as the link to the audio webcast for the Friday morning conference call.

Empire is being advised in this transaction by the investment bank of D.A. Davidson & Co. Sterling is being advised by Sandler O'Neill & Partners, L.P.

ABOUT STERLING

Sterling of Spokane, Washington, is a unitary savings and loan holding company, which owns Sterling Savings Bank. Sterling Savings Bank is a Washington State-chartered, federally insured stock savings association, which opened in April 1983. Sterling Savings Bank, based in Spokane, Washington, has branches throughout Washington, Idaho, Oregon and western Montana. Through Sterling's wholly owned subsidiaries Action Mortgage Company and INTERVEST-Mortgage Investment Company, it operates loan production offices in Washington, Oregon, Idaho and western Montana. Sterling's subsidiary Harbor Financial Services provides non-bank investments, including mutual funds, variable annuities, and tax-deferred annuities, through regional representatives throughout Sterling Saving's branch network.

ABOUT EMPIRE

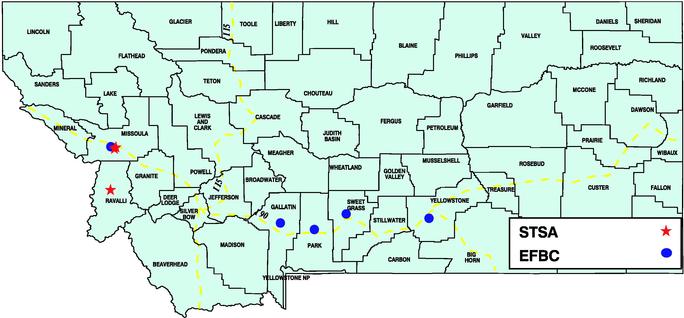

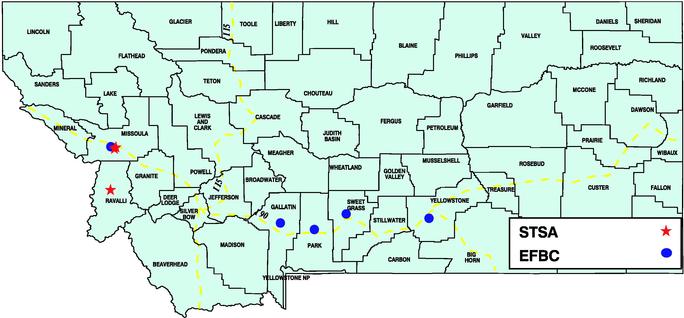

Empire Federal Bancorp, Inc. is the holding company for Empire Bank. The Bank is a community-oriented financial institution that has traditionally offered a variety of savings products to its retail customers, while concentrating its lending activities on the origination of loans secured by one- to four-family residential dwellings. The Bank considers Gallatin, Missoula, Park and Sweet Grass counties in south central Montana as its primary market area. Lending activities also have included the origination of multi-family, commercial, business, commercial real estate and home equity loans. The Bank's primary business has been that of a traditional financial institution, originating loans in its primary market area for its portfolio. In addition, it has maintained a significant portion of its assets in investment and mortgage-backed securities.

ADDITIONAL INFORMATION

The proposed transaction will be submitted to Empire's shareholders for their consideration. Sterling and Empire will file a registration statement, a joint prospectus/proxy statement and other relevant documents concerning the proposed transaction with the SEC. Shareholders of Empire are urged to read the Prospectus/Proxy Statement when it becomes available and any other relevant documents filed with the SEC as well as any amendments or supplements to those documents, because they will contain important information. Shareholders may obtain a free copy of the prospectus/proxy statement and other documents containing information about Sterling and Empire when they become available on the SEC's Internet site at (http://www.sec.gov).

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the merger between Sterling Financial Corporation ("Sterling") and Empire Federal Bancorp, Inc. ("Empire"), including future financial and operating results, cost savings enhancements to revenue and accretion to reported earnings that may be realized from the merger; (ii) Sterling's and Empire's plans, objectives, expectations and intentions and other statements contained in this presentation that are not historical facts; and (iii) other statements identified by words such as "expects," "anticipates," "intends," "plans," "believes," "seeks," "estimates," or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations of the management of Sterling and Empire and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of numerous possible uncertainties.

The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of Sterling and Empire may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the merger may not be fully realized or may take longer to realize than expected; (3) operating costs, customer losses and business disruption following the merger, including adverse effects on relationships with employees, may be greater than expected; (4) governmental approvals of the merger may not be obtained, or adverse regulatory conditions may be imposed in connection with governmental approvals of the merger; (5) the stockholders of Empire may fail to approve the merger; (6) adverse governmental or regulatory policies may be enacted; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (9) competition from other financial services companies in Sterling's and Empire's markets could adversely affect operations; and (10) an economic slowdown could adversely affect credit quality and loan originations. Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Sterling's and Empire's reports (such as Annual Reports on Form 10-K and 10-KSB, Quarterly Reports on Form 10-Q and 10-QSB

and Current Reports on Form 8-K) filed with the Securities and Exchange Commission and available on the SEC's Internet site (http://www.sec.gov).

| Media Contact: | | Sterling Financial Corporation

Heidi B. Stanley

EVP, Corporate Administration

509-358-6160 | | Empire Federal Bancorp

William Ruegamer

President and CEO

406-222-1981 |

Investor Contacts: |

|

Sterling Financial Corporation

Heidi B. Stanley

509-358-6160 |

|

Empire Federal Bancorp

William Ruegamer

406-222-1981 |

or |

|

Daniel G. Byrne

SVP, Chief Financial Officer

509-363-5731 |

|

|

* * * * *

THE FOLLOWING ARE MATERIALS TO BE USED IN CONNECTION WITH THE TELECONFERENCE TO BE HELD ON SEPTEMBER 20, 2002 AT 11:00 A.M. EDT.

announces the acquisition of:

Empire Federal Bancorp, Inc.

Investor Presentation

September 20, 2002

Safe Harbor Statement

In the course of our presentation, executive officers and other key employees of the company may discuss matters that are deemed to be forward-looking statements (1) under the law. While we always do our best to give accurate and balanced presentations of the Company's business and prospects, actual results may differ from management's view. Additional information about risks of the Company achieving the results suggested by any forward-looking statements may be found under the heading "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the Company's Annual 10-K.

(1) The Reform Act defines the term "forward-looking statement" to include: statements of management plans and objectives, statements regarding future economic performance, and projections of revenues and other financial data, among others. The Reform Act precludes liability for an oral or written forward-looking statement if the statement is identified as such and accompanied by "meaningful cautionary statements identifying important factors that could cause actual results to differ materially from those" made in the forward-looking statements.

2

Transaction Rationale

- •

- Attractive Financial Results

- —

- Immediately 3% accretive to earnings per share

- —

- Purchase price is a negligible premium to Empire's book value

- —

- Increases tangible equity-to-total assets ratio by approximately 0.35% from 4.62% to 4.96%

- •

- Expands Pacific Northwest Community Bank Franchise

- —

- Opportunity to extend additional loan and deposit products to Empire customers

- —

- Solid foundation for growth in most attractive Montana markets

- —

- Franchise overlap in Missoula allows for branch consolidation

- •

- Low Risk Integration

- —

- Sterling has successfully integrated 12 acquisitions since 1983, including Big Sky Bancorp of Missoula, Montana

- —

- Reasonable cost savings validated through due diligence

- —

- Achievable cost of funding improvements validated through due diligence

- —

- Asset quality issues reviewed during due diligence

3

Franchise Enhancing

4

Why Montana?

- •

- Combined Montana franchise is strategically poised to increase market share along the I-90 corridor where the majority of Montana's business takes place

- •

- Proven success in integrating Big Sky Bancorp of Missoula, Montana

5

Why Empire Federal Bancorp?

- •

- Significant opportunities to expand product offerings within Empire's branch network

- —

- Business Lines of Credit and Term Loans

- —

- Commercial Checking & Sweep Accounts

- —

- Cash Management, On-line Bill Pay and other Internet Banking services

- —

- Direct Deposit, ACH & 24 hour Anytime Line Access

- —

- Business Visa, Merchant Account & International LOC

- •

- Acquiring Empire provides Sterling with additional capital to be deployed in asset growth within its Pacific Northwest footprint

- •

- The services of Empire's subsidiary Dime Insurance Agency provide additional products for Sterling customers

6

Transaction Terms and Pricing

7

Transaction Summary

| Transaction Price Per Share: | | $19.25 / Share |

Aggregate Transaction Value: |

|

$29.8 Million(1) |

| | Stock Component to Shareholders: | | $29.0 Million(1) |

| | Value Paid to Optionholders: | | $0.8 Million(1) |

Consideration to Common: |

|

100% Sterling Common Stock |

Transaction Structure: |

|

Tax-free exchange of stock |

Advisory Board: |

|

Current Empire board members will continue to have a regional advisory role |

Due Diligence: |

|

Completed |

Anticipated Closing: |

|

First Quarter 2003 |

- (1)

- Based upon 1.51 million Empire common shares outstanding and 234,628 options with an average strike price of $16.04.

8

Transaction Summary

| Pricing Mechanism: | | Holders of Empire common stock receive a consideration equal to $19.25 in Sterling shares if Sterling's stock price is between $17.01 and $22.68. |

|

|

If Sterling's stock price is less than $17.01, each common share of Empire receives 1.132 Sterling shares. |

|

|

If Sterling's stock price is greater than $22.68, each common share of Empire receives 0.849 Sterling shares. |

|

|

Sterling's stock price will be defined as the average price for Sterling during a ten-day determination period prior to closing. |

9

Deal Pricing

| Purchase Price Per Share: | | $ | 19.25 / Share | |

|

|

Sterling/

Empire

|

|

Nationwide

Median(1)

|

|

|---|

| Price / Book Value:(2) | | | 102.0 | % | 150.5 | % |

| Price / Tangible Book Value:(2) | | | 102.0 | % | 151.1 | % |

| Tangible Book Premium / Core Deposits:(3) | | | 0.9 | % | 9.5 | % |

| Premium to Market:(4) | | | 41.2 | % | 33.3 | % |

| Fully Phased-in Return on Equity | | | over 15 | % | | |

- (1)

- Reflects median multiples for 42 nationwide savings institution transactions announced since January 1, 2001 with a deal value greater than $15 million.

- (2)

- Based upon Empire's stated book value and tangible book value of$18.88 as of June 30, 2002.

- (3)

- Core deposits exclude jumbo time deposits

- (4)

- Based upon Empire's closing stock price of $13.63 on September 18, 2002

10

Pro Forma Financial Impact

11

Pro Forma Earnings Impact

Earnings Projections

| | Projected for

Fiscal Year 2003

| |

|---|

| | ($ in millions)

| |

|---|

| Sterling Earnings(1) | | $ | 25.8 | |

| Empire Earnings(2) | | | 1.0 | |

| Anticipated Expense Savings(3) | | | 0.8 | |

| Anticipated Reduction in Deposit Cost(4) | | | 0.4 | |

| Anticipated Additional Growth(5) | | | 2.3 | |

| CDI Amortization Expense(6) | | | (0.4 | ) |

| | |

| |

| Pro Forma Net Income | | $ | 29.9 | |

| | |

| |

- (1)

- Based on I/B/E/S mean EPS Estimate for 2003 of $2.06 as of September 18, 2002 and assuming 12.5 million fully diluted shares for Sterling.

- (2)

- Management estimates

- (3)

- Assumes cost savings equivalent to 28% of Empire's non-interest expense and includes the consolidation of a branch in Missoula

- (4)

- Assumes Empire's cost of deposits can be reduced approximately 0.35% while operated by Sterling

- (5)

- The additional capital created facilitates earnings contribution of $150 million in additional asset growth at an average pre-tax spread of 2.50%

- (6)

- The core deposit intangible equal to 4% of Empire's core deposits is assumed to be amortized straight-line over 10 years

12

Accretive to GAAP and Cash Earnings

Earnings per Share Projections

| | Projected for

Fiscal Year 2003

| |

|---|

| Current Sterling GAAP EPS Estimate(1) | | $ | 2.06 | |

| Pro Forma Sterling GAAP EPS(2) | | | 2.13 | |

|

|

| GAAP Accretion to Sterling ($) | | $ | 0.07 | |

| GAAP Accretion to Sterling (%) | | | 3.2 | % |

| |

Stand-Alone Sterling Cash EPS Estimate |

|

$ |

2.06 |

|

| Pro Forma Sterling Cash EPS(2) | | | 2.15 | |

|

|

| Cash Accretion to Sterling ($) | | $ | 0.09 | |

| Cash Accretion to Sterling (%) | | | 4.5 | % |

| |

- (1)

- Based on Sterling's mean I/B/E/S EPS Estimate for 2003 as of September 18, 2002.

- (2)

- Assumes 1,573,868 shares will be issued to Empire based upon an Sterling stock price of $18.44, the ten-day average ending September 18, 2002.

13

Estimated Cost Savings

Sources of Cost Savings

| | Savings Projected for

Fiscal Year 2003

| | Percent of

Empire Expense

| |

|---|

| | ($ in millions)

| |

|---|

| Compensation & Benefits | | $ | 0.43 | | 20 | % |

| ESOP/MRDP | | | 0.38 | | 100 | % |

| Missoula Branch Consolidation | | | 0.33 | | 80 | % |

| Other Operating | | | 0.20 | | 10 | % |

|

|

| Total Cost Savings (Pre-tax) | | $ | 1.33 | | 28 | % |

| |

|

|

| Total Cost Savings (After-tax)(1) | | $ | 0.82 | | | |

| |

- (1)

- Assumes an effective tax rate of 38%.

14

Estimated Restructuring Costs

- •

- estimates pre-tax merger costs of approximately $1.4 million

| | Cost

|

|---|

| | ($ in millions)

|

|---|

| Transaction Costs | | $ | 0.8 |

| Conversion / Integration Costs | | | 0.4 |

| Employee-Related Costs(1) | | | 0.5 |

| | |

|

|

| Total Merger Costs (Pre-tax) | | $ | 1.8 |

|

Taxes |

|

|

0.4 |

|

| Total Merger Costs (After-tax)(2) | | $ | 1.4 |

|

- (1)

- Does not include the termination of ESOP and MRDP plans, which are reflected in the transaction value

- (2)

- Assumes Employee-Related Costs and Conversion/Integration Costs are fully tax-deductible at a tax rate of 38%.

15

Summary Financial Impact

| | Sterling

| | Empire

| | Pro Forma(1)

|

|---|

| | ($ in millions)

|

|---|

| Assets | | $ | 3,088 | | $ | 213 | | $ | 3,301 |

| Loans | | | 2,184 | | | 90 | | | 2,274 |

| Deposits | | | 1,979 | | | 170 | | | 2,149 |

| Borrowings | | | 797 | | | 13 | | | 810 |

| Equity | | | 187 | | | 28 | | | 215 |

| Market Cap.(2) | | | 221 | | | 21 | | | 250 |

| Branches | | | 77 | | | 5 | | | 82 |

Data as of June 30, 2002. Source: SNL Financial. Market data as of September 18, 2002.

- (1)

- Every pro forma number except for equity excludes purchase accounting adjustments.

- (2)

- The calculation of pro forma market capitalization assume that Empire shareholders receive stock consideration equal to $29M

16

Appendix

17

Empire's Historical Balance Sheet

| | As of December 31,

| | As of June 30,

| |

|---|

| | 1999

| | 2000

| | 2001

| | 2002

| |

|---|

| | ($ in thousands)

| |

|---|

| Assets | | | | | | | | | | | | | |

| Cash and Equivalents | | $ | 2,372 | | $ | 2,648 | | $ | 46,536 | | $ | 52,049 | |

| Securities | | | 48,961 | | | 35,959 | | | 37,616 | | | 78,367 | |

| | |

| |

| |

| |

| |

| | Total Cash and Securities | | $ | 51,333 | | $ | 38,607 | | $ | 84,152 | | $ | 130,416 | |

| Gross Loans | | $ | 59,796 | | $ | 82,196 | | $ | 85,832 | | $ | 77,742 | |

| Loan Loss Reserves | | | (226 | ) | | (336 | ) | | (591 | ) | | (1,266 | ) |

| | |

| |

| |

| |

| |

| | Total Net Loans | | $ | 59,570 | | $ | 81,860 | | $ | 85,241 | | $ | 76,476 | |

| Real Estate Owned | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 0 | |

| Total Intangibles | | | 0 | | | 0 | | | 0 | | | 0 | |

| Other Assets | | | 3,624 | | | 4,600 | | | 5,519 | | | 6,411 | |

| | |

| |

| |

| |

| |

| | Total Assets | | $ | 114,527 | | $ | 125,067 | | $ | 174,912 | | $ | 213,303 | |

| | |

| |

| |

| |

| |

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Deposits | | $ | 71,353 | | $ | 77,667 | | $ | 126,940 | | $ | 170,226 | |

| Total Borrowings | | | 9,392 | | | 16,731 | | | 17,464 | | | 13,000 | |

| Other Liabilities | | | 1,027 | | | 1,754 | | | 1,635 | | | 1,606 | |

| | |

| |

| |

| |

| |

| | Total Liabilities | | $ | 81,772 | | $ | 96,152 | | $ | 146,039 | | $ | 184,832 | |

| | |

| |

| |

| |

| |

| Equity | | $ | 32,755 | | $ | 28,915 | | $ | 28,873 | | $ | 28,471 | |

| | |

| |

| |

| |

| |

| | Total Liabilities & Equity | | $ | 114,527 | | $ | 125,067 | | $ | 174,912 | | $ | 213,303 | |

| | |

| |

| |

| |

| |

Source: SNL Financial.

18

Empire's Historical Income Statement

| | For the Year Ended December 31,

| | For the Six Mos Ended June 30,

| |

|---|

| | 1999

| | 2000

| | 2001

| | 2001

| | 2002

| |

|---|

| | ($ in thousands)

| |

|---|

| Total Interest Inc | | $ | 7,592 | | $ | 8,702 | | $ | 9,538 | | $ | 4,781 | | $ | 4,646 | |

| Total Interest Exp | | | 3,208 | | | 4,070 | | | 5,103 | | | 2,330 | | | 3,219 | |

| | |

| |

| |

| |

| |

| |

| | Net Interest Inc | | $ | 4,384 | | $ | 4,632 | | $ | 4,435 | | $ | 2,451 | | $ | 1,427 | |

Loan Loss Provision |

|

$ |

18 |

|

$ |

110 |

|

$ |

255 |

|

$ |

50 |

|

$ |

720 |

|

Service Charges |

|

$ |

229 |

|

$ |

250 |

|

$ |

301 |

|

$ |

140 |

|

$ |

139 |

|

| Other Non-intIncome | | | 600 | | | 583 | | | 606 | | | 276 | | | 264 | |

| | |

| |

| |

| |

| |

| |

| | Non-int Income | | $ | 829 | | $ | 833 | | $ | 907 | | $ | 416 | | $ | 403 | |

Gain on Sale of Securities |

|

$ |

0 |

|

$ |

185 |

|

$ |

386 |

|

$ |

0 |

|

$ |

446 |

|

| Gain on Sale of Loans | | $ | 0 | | $ | 58 | | $ | 552 | | $ | 144 | | $ | 210 | |

Comp and Benefits |

|

$ |

1,839 |

|

$ |

2,033 |

|

$ |

2,326 |

|

$ |

1,134 |

|

$ |

1,159 |

|

| Occupancy and Equip | | | 409 | | | 565 | | | 645 | | | 322 | | | 335 | |

| Other Non-interest Exp | | | 874 | | | 1,008 | | | 1,039 | | | 544 | | | 688 | |

| | |

| |

| |

| |

| |

| |

| | Non-int Exp | | $ | 3,122 | | $ | 3,606 | | $ | 4,010 | | $ | 2,000 | | $ | 2,182 | |

Net Income Before Taxes |

|

$ |

2,073 |

|

$ |

1,991 |

|

$ |

2,016 |

|

$ |

961 |

|

$ |

(416 |

) |

| Income Taxes | | | 808 | | | 775 | | | 875 | | | 402 | | | (145 | ) |

| | |

| |

| |

| |

| |

| |

| | Net Income | | $ | 1,265 | | $ | 1,217 | | $ | 1,141 | | $ | 559 | | $ | (271 | ) |

| | |

| |

| |

| |

| |

| |

Source: SNL Financial.

19

QuickLinks

Safe Harbor StatementTransaction Terms and PricingPro Forma Financial ImpactAppendix