UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantþ

Filed by a Party other than the Registranto

| | | |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| o | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| þ | | Soliciting Material Pursuant to §240.14a-12 |

| | | |

| TXU Corp. |

| |

| (Name of Registrant as Specified In Its Charter) |

| | | |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| þ | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | | |

|

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | | |

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

|

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

|

| | | (5) | | Total fee paid: |

| | | | |

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid: |

| | | | |

|

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | | |

|

| | | (3) | | Filing Party: |

| | | | |

|

| | | (4) | | Date Filed: |

| | | | |

|

| | | | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Explanatory Note

TXU Corp. is filing this Amendment No. 1 to Schedule 14A, to correct certain typographical errors in the “TXU Corp. Conference Call” previously filed by the Registrant on February 26, 2007. In addition, this Amendment consolidates the previously filed soliciting materials in one filing, adds a Table of Contents and adds the Employee Town Hall Meeting Transcript, which had not been used by the Registrant to date. Accordingly, the soliciting material that was previously filed by the Registrant on February 26, 2007, is hereby amended and restated in its entirety as provided in this Amendment No. 1 to Schedule 14A.

TABLE OF CONTENTS

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

Key Talking Points

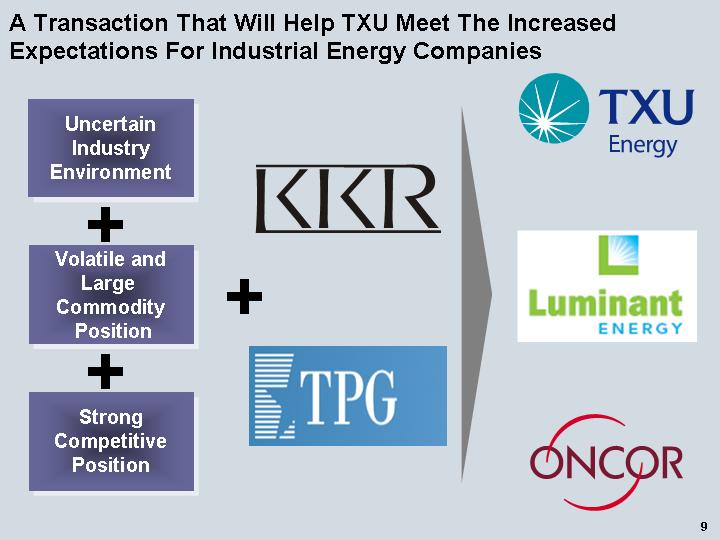

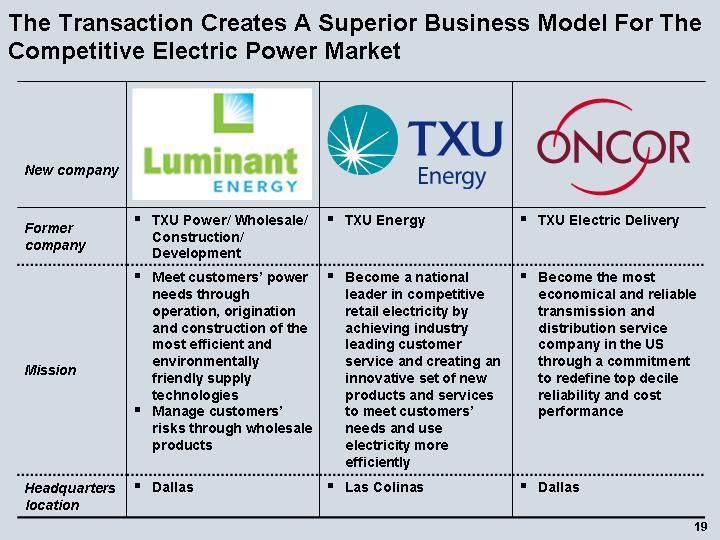

Transformation Enables Each Business to Meet Its Unique Objectives and Customer Needs

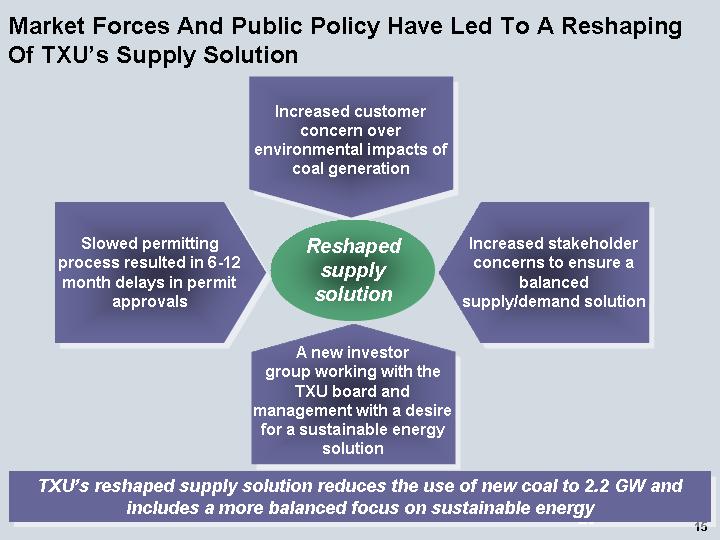

| | • | | Due to a balance of factors (Texas’ move to a fully competitive electric market, policy-maker and stakeholder feedback, new supplies announced by others, uncertainty in permitting process, evolving global climate debate), TXU re-visited its strategy with a new mindset. |

| |

| | • | | The investor group approached the TXU Board with a proposal enabling TXU’s transformation — investing new capital in customer-focused, long-term innovation. |

| |

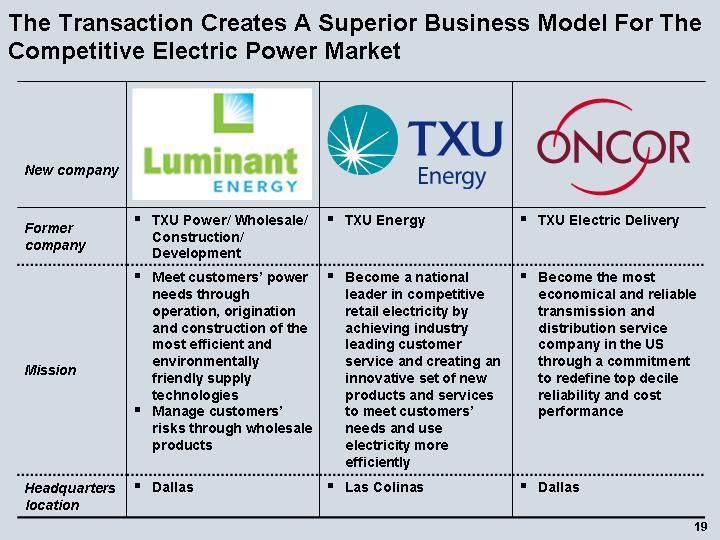

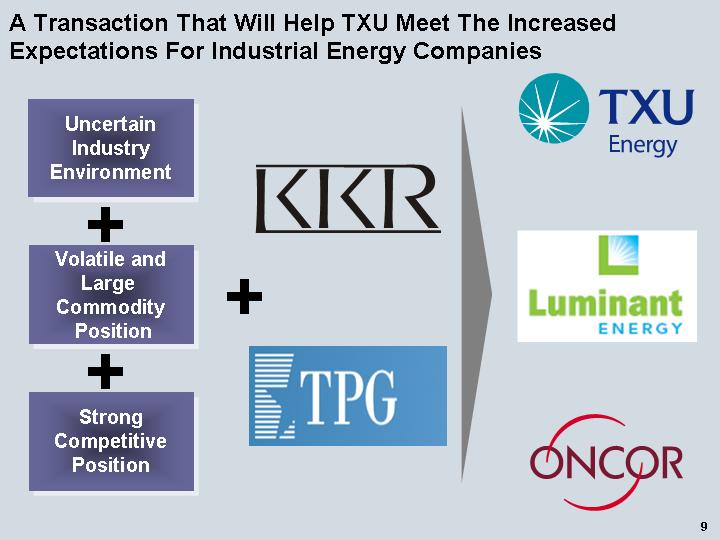

| | • | | Unbundle three separate businesses to focus on distinct roles and customer needs (Oncor Electric Delivery, TXU Energy and Luminant Energy) — each with own management team and headquarters. |

Different, More Responsive Approach to Meeting Near- and Long-Term Energy Challenges

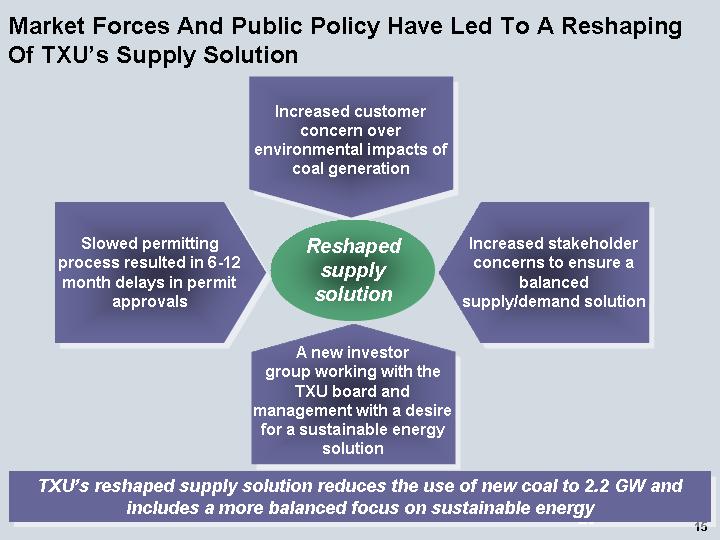

| | • | | Re-shape Generation Development Program |

| | • | | Meet near-term power needs with investments in energy conservation and efficiency programs, and construction of two units at Oak Grove and one unit at Sandow. |

| |

| | • | | Suspend permitting on the eight coal-fueled reference plant units that were intended to address longer term needs; withdraw the reference plant permits upon closing of transaction. |

| |

| | • | | Strategy provides opportunity for renewable/alternative energy sources and next-generation technologies to mature in order to help meet longer-term challenges. |

| | • | | Environmental Issues, Global Climate Change and New Technologies |

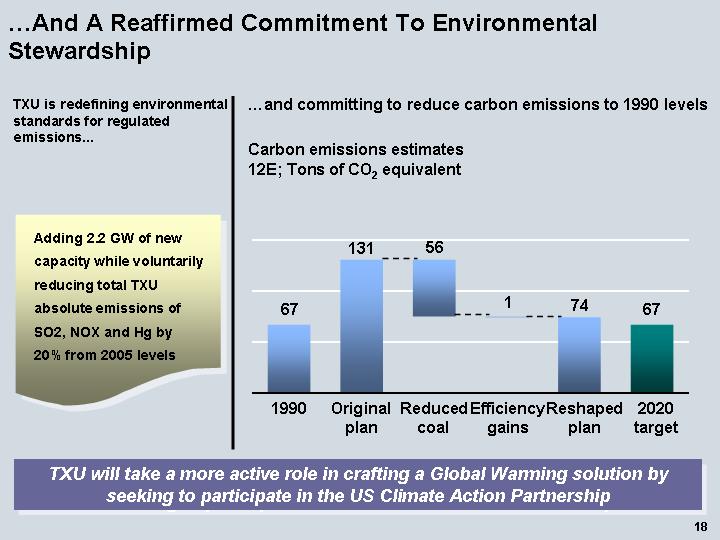

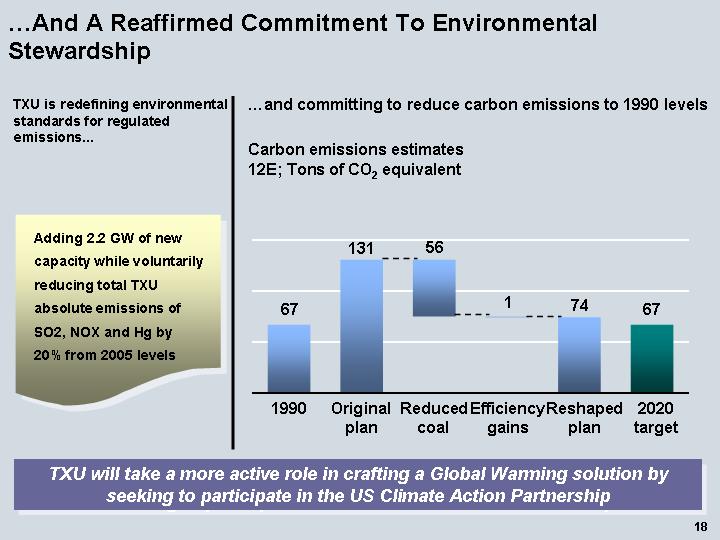

| | • | | Air quality: TXU remains committed to 20% reductions on key pollutants. |

| |

| | • | | Substantial new investments in research, demand-side management: Expanded $400 million conservation and energy efficiency program, maintain program to double renewable wind power, IGCC evaluation, join Future Gen, and continued development of next-generation clean energy technology. |

| |

| | • | | Significance of addressing global climate change: given evolution of this issue in recent months, acknowledge it must be addressed aggressively (including through conservation, energy efficiency, renewable wind and solar, nuclear, new technologies and alternative energy). |

| |

| | • | | Transaction endorsed by Environmental Defense and Natural Resources Defense Council. |

Immediate and Longer-Term Benefits to Customers and Other Stakeholders

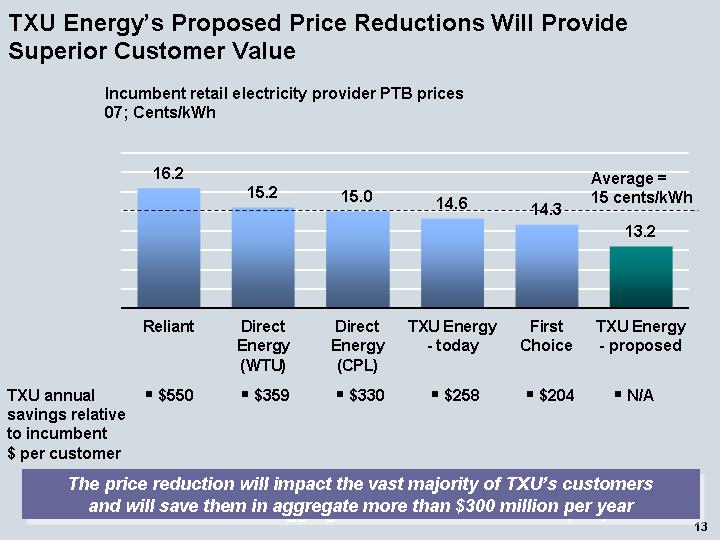

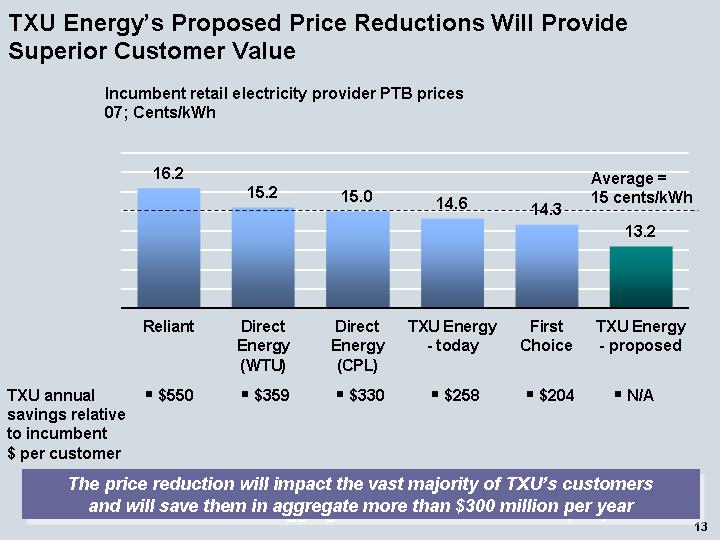

| | • | | Customer price reduction and price protection: 10% price cut (6% in approximately 30 days and 4% at closing of the transaction) — resulting in more than $300 million of annual savings for residential customers who haven’t already selected one of our lower-priced offers, and price protection through September 2008. |

| |

| | • | | Demand-side management: Give customers tools to manage their own electric use through innovative new energy efficiency & conservation offerings. |

| |

| | • | | Ongoing commitment to Texas and employees: Businesses remain headquartered in D/FW area. |

| |

| | • | | Shareholder value: Investors receive a 25% premium. |

Investor Group and Private Ownership Provide “Patient” Capital and World Class Capabilities

| | • | | Investor group led by KKR and TPG provide patient capital, long-term vision, experience partnering with management teams to build great companies, and global relationships needed to drive long-term success. |

| |

| | • | | Private ownership helps free TXU from short-term financial pressures affecting public companies |

| | • | | Notable Texans to advise and help govern company, including former Secretary of State James Baker and former EPA Administrator William Reilly |

Additional Information and Where to Find It

In connection with the proposed merger of TXU Corp. with Texas Energy Future Merger Sub Corp., a wholly-owned subsidiary of Texas Energy Future Holdings Limited Partnership(the “Merger”), the Company will prepare a proxy statement to be filed with the Securities Exchange Commission (SEC). When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website athttp://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to TXU Corp., Energy Plaza, 1601 Bryan, Dallas, Texas 75201, telephone: (214) 812-4600, or from the Company’s website,http:www.txucorp.com.

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the Merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2006 Annual Meeting of Shareholders, which was filed with the SEC on April 5, 2006. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the Merger, when filed with the SEC.

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

TXU Talking Points for Managers

| | • | | TXU is being acquired by a group of investors led by two of the nation’s leading private equity firms, Kohlberg Kravis Roberts & Co. (KKR) and Texas Pacific Group (TPG). This is a momentous event for our Company. |

| |

| | • | | We are only now talking to you about this news due to public disclosure requirements. As the deal was not yet finalized, TXU was prohibited from discussing it until we made the public announcement this morning. |

| |

| | • | | Today at 11 a.m., CEO John Wilder and other members of senior management will brief all employees on the transaction at a Town Hall meeting at Energy Plaza which will be webcast for all employees. |

Why are we doing this?

| | • | | The capital and resources of the private investor group will enable us to transform TXU into a more customer-centered, innovative company that can better meet the growing and diverse energy needs of Texas. |

| |

| | • | | Our new owners have committed to making greater investments in technology and innovation, which will allow us to provide more meaningful price cuts and protection to customers; expand our product and service offerings; take a different, more responsive approach to meeting the state’s energy challenges—including staying the permitting process for 8 of the proposed 11 new coal-fueled units; focusing more on energy efficiency and conservation programs and alternative energy sources to meet Texas’ near-term energy needs; and better organizing our businesses to be more focused on each business’s customers. |

How did this transaction come about?

| | • | | TXU’s Board of Directors and the TXU leadership team have been evaluating how best to re-visit our strategy in light of Texas’ new competitive marketplace, our state’s growing and diverse energy needs, taking into account input from our many concerned stakeholders. |

| |

| | • | | TXU was approached by the investor group with a strong proposal that provides us the resources and tools to achieve our strategic objectives — and is good for TXU. |

| |

| | • | | The investor group shares a common vision: to transform TXU into the most customer-centered, technology-led, environmentally-responsible innovator in the industry. |

| |

| | • | | The capital and resources of this private investor group will provide us access to world-class capabilities, scale and long-term capital. |

What does this mean for employees?

| | • | | We believe this is a very exciting development for employees. The investor group has a history of working with management teams to build great companies. |

| |

| | • | | In the short term, we do not expect this transaction will have much impact on employees’ day-to-day jobs. In fact, the transaction will take several months to close and it will be business as usual until that time. |

| |

| | • | | We will continue to focus on running our operations safely and achieving the goals we have set in place for 2007. 2006 annual incentive payouts will remain unchanged and will be paid out in early March as planned. |

| |

| | • | | TXU’s current pay, health benefits, and retirement programs will remain in place. |

| |

| | • | | The transition for customers will be seamless—customer service and billing processes will all remain the same and the same employee teams will be serving the same customers. |

| |

| | • | | Over the long term, we believe the transformation will create exciting growth opportunities for employees as we create new technologies to meet our state’s energy needs and develop innovative products and services for our customers. |

| |

| | • | | Our goal is nothing short of making Texas the most innovative, environmentally-responsible, state-of-the-art electric market in the nation. We will rely on employees to help us realize this vision. |

How will our new company operate?

| | • | | TXU will separate into three distinct businesses with distinct names and headquarters — a critical step in the transition from a regulated market to a customer-centered, innovative competitor. |

| |

| | • | | This separation enables quicker reaction to changing market conditions and wiser deployment of technology and capital investment. |

| |

| | • | | TXU Electric Delivery’s name will be changed to Oncor Electric Delivery and will remain headquartered downtown Dallas. |

| |

| | • | | Luminant Energy (TXU Power, TXU Wholesale, TXU Development and TXU Construction) will remain in downtown Dallas. |

| |

| | • | | TXU Energy will retain its current name and will relocate to its customer contact site in Irving, TX. |

Why are we changing TXU Development’s coal build strategy?

| | • | | Our previously proposed 11 unit generation expansion program was designed to meet Texas’ energy needs through 2014. |

| |

| | • | | We’ve listened to what many Texans and elected officials have said, and with this transaction, TXU will approach Texas’ power challenges differently so we can meet the needs of our changing marketplace. |

| |

| | • | | Our new approach focuses on meeting Texas’ near-term energy needs through 2011. We will continue with plans for two new units at Oak Grove and one at Sandow, but we will suspend pursuing the remaining eight permits immediately and will withdraw them altogether upon completion of the transaction. |

| | • | | We will focus on the development of new technology advancements, alternative and renewable energy sources and strategies focusing on conservation and energy efficiency programs to meet Texas’ long-term energy needs for cleaner, reliable, and affordable power. |

Please know we are committed to keeping you informed about throughout this transition.

You will be hearing more information later today at the town hall and there is a great deal of information posted on Connect.

| | • | | Additional information will be posted on Connect as it becomes available. In addition, there will be an area to submit questions, and we urge employees to post questions. |

| |

| | • | | We know that this is big news and can be distracting. Nevertheless, we ask that you stay focused on performing your responsibilities safely and completely and we thank you for your hard work and support. We think this is a very exciting time for TXU. |

Additional Information and Where to Find It

In connection with the proposed merger of TXU Corp. with Texas Energy Future Merger Sub Corp., a wholly-owned subsidiary of Texas Energy Future Holdings Limited Partnership(the “Merger”), the Company will prepare a proxy statement to be filed with the Securities Exchange Commission (SEC). When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website athttp://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to TXU Corp., Energy Plaza, 1601 Bryan, Dallas, Texas 75201, telephone: (214) 812-4600, or from the Company’s website,http:www.txucorp.com.

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the Merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2006 Annual Meeting of Shareholders, which was filed with the SEC on April 5, 2006. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the Merger, when filed with the SEC.

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

Employee Email Message from John Wilder

February 26, 2007

To All TXU Employees:

TXU has grown over the years as a public company, responding to the changing energy needs of Texas. Now, we are at a point in our development where the company has the opportunity to transform its businesses through private ownership. This will allow us to better respond to the new competitive marketplace and the changing and diverse needs of our customers. To that end, I’m pleased to announce that we have reached an agreement to be acquired by a group of investors led by two of the nation’s leading private equity firms. This is very exciting news for TXU, our employees and our customers.

Before I explain the details of the transaction, I want to first reassure you that our new partners have a long history of working with management teams and employees to build great companies. We do not expect this transaction will have a meaningful impact on employees’ day-to-day jobs and, over the long term, we believe the transformation will create exciting opportunities for employees. Our goal is nothing short of making Texas the most innovative, environmentally-responsible, state-of-the-art electric market in the nation. And, we will be counting on our employees to help us realize that vision.

Let me explain how this opportunity came about. TXU’s Board of Directors and our management team have been evaluating how best to shape our strategy in light of Texas’ new competitive marketplace and our state’s growing and diverse energy needs. As we were going through this process, we were approached by the investor groups with a proposal that would provide us with the resources and tools to achieve our strategic objectives. It soon became clear that TXU’s Board of Directors and the investor group share a common vision to transform TXU into the most customer-centered, technology-led, environmentally-responsible innovator in the industry.

The new investor group will provide access to world-class capabilities, scale and the “patient” capital that will drive sustainable success in each of our businesses. By transitioning to private ownership, we will team up with a group of investors committed to making long-term, patient investments for lasting gains while maintaining our commitment to transparency.

What does today’s announcement mean?

| | • | | TXU will separate into three distinct businesses with distinct names and headquarters: |

| | • | | TXU Electric Delivery’s name will be changed to Oncor Electric Delivery and will remain headquartered in downtown Dallas. |

| |

| | • | | Luminant Energy (TXU Power, TXU Wholesale, TXU Development and TXU Construction) will remain in downtown Dallas. |

| |

| | • | | TXU Energy will retain its current name and will relocate to its customer contact site in Irving, Texas. |

| | • | | We will be able to deliver immediate and long-term benefits to customers: |

| | • | | As part of the transaction, TXU will provide more than $300 million in annual savings through an immediate 6 percent price reduction (and an additional 4 percent price reduction upon completion of the merger) for residential customers in its traditional service areas that haven’t already selected one of TXU’s other lower price offers. |

| | • | | We will reshape our coal build strategy to address Texas’ future energy needs while being responsive to Texas policymakers and other key stakeholders: |

| | • | | Our strategy will adopt a timed approach to construction that will allow for the best use of new technology and conservation. The Sandow 5 unit and the Oak Grove units will move forward as planned. Permitting plans for the eight reference plant units will be immediately suspended and will then be withdrawn when the merger is consummated. |

| • | | TXU will continue to operate each of the businesses with the same level of commitment to transparency and accountability to public regulatory bodies. |

We want you to have all available information. This morning at 11 a.m. we will brief all employees at a Town Hall meeting originating at Energy Plaza. The meeting also will be Web cast. Please visit Connect for information on how you can participate.

TXU is a proud company with a strong heritage that has served Texas for more than 100 years. You have played a critical role in achieving TXU’s current success and I thank you for your continued commitment and dedication to this company. I hope you share in our excitement about this new and exciting phase in our company’s history, and I look forward to working with you to make our vision a reality.

Sincerely,

John Wilder

Additional Information and Where to Find It

In connection with the proposed merger of TXU Corp. with Texas Energy Future Merger Sub Corp., a wholly-owned subsidiary of Texas Energy Future Holdings Limited Partnership (the “Merger”), the Company will prepare a proxy statement to be filed with the Securities Exchange Commission (SEC). When completed, a

definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website athttp://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to TXU Corp., Energy Plaza, 1601 Bryan, Dallas, Texas 75201, telephone: (214) 812-4600, or from the Company’s website,http:www.txucorp.com.

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the Merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2006 Annual Meeting of Shareholders, which was filed with the SEC on April 5, 2006. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the Merger, when filed with the SEC.

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

Customer Frequently Asked Questions

(to be used at Call Centers)

| | • | | Why is this transaction good for customers? |

| |

| | | | This transaction is based on transforming TXU to become more customer-centered, more innovative and more technology-driven to better serve our customers. Customers will benefit from, among other things: |

| | • | | Price cuts and “price protection”— residential customers in traditional service areas that haven’t already selected one of TXU’s other lower-price offers will benefit from a 10 percent price discount; |

| |

| | • | | New customer offerings, including energy conservation and efficiency; and |

| |

| | • | | Expanded use of new energy technologies and alternative energy sources for new products like smart appliances and demand-side management programs. |

| | | | This will all be seamless to customers. Customer service and billing processes will remain the same. Payment locations and online services will remain the same. And we’ll remain committed to providing our customers reliable, affordable and clean power. |

| |

| | • | | Will my electric bill increase as a result of this transaction? |

| |

| | | | No prices will increase as a result of the transaction. In fact, many customers will receive price cuts now with “price protection” against any price increases through September 2008. |

| |

| | | | Specifically, residential customers in traditional service areas that haven’t already selected one of TXU Energy’s other lower-price offers will benefit from a 10 percent price discount — a 6 percent reduction that will begin within 30 days, and an additional 4 percent reduction at the close of the transaction, which we expect to occur before the end of 2007. These customers will also receive price protection through September 2008, ensuring customers receive the benefits of these savings through two summer seasons of peak energy usage. Furthermore, TXU Energy expects to aggressively compete state-wide to deliver benefits across all customer segments. |

| |

| | | | Other customers will continue to receive the remainder of the $100 in quarterly bill credits. |

| |

| | • | | I am on a certain plan and I don’t know if my plan benefits from the price cuts. Does it? |

| |

| | | | Customers on TXU Energy FlexProtectSM and the TXU Energy Freedom PlanSM, will benefit from the price cuts announced in the press release. Customers who are |

| | | | currently enjoying lower rates on our existing term service plans will continue to enjoy these savings. |

| | • | | Will my current plan change? |

| |

| | | | For current TXU Energy FlexProtectSM and TXU Energy Freedom PlanSM customers, your plan will change to the lower rate. Customers who prefer to stay on the current plan at the higher price with the three-year price protection through 2009 will have that opportunity. Instructions on how to remain on these plans will be provided in the next few weeks and will be provided to your home. TXU Energy will continue to honor all other service plans and discounts. |

| |

| | • | | What if I want to change my plan? |

| |

| | | | You may do so. Customers on the Flex Protect plan may do so, and customers whose current plan permits them to do so retain their ability to switch plans or providerswithout penalty. |

| |

| | • | | Will the look of my electric bill change? |

| |

| | | | No, not as a result of the transaction. The materials you receive from TXU Energy will appear the same. |

| |

| | • | | Will TXU continue contributing to Energy Aid? |

| |

| | | | Absolutely. We will remain committed to our industry-leading Energy Aid program that provides bill payment assistance to customers in need. This includes a commitment of $5 million in 2007. |

| |

| | • | | What impact will this have on the proposed 11 coal-fired power plants? |

| |

| | | | You should also know that TXU has listened to comments from many Texans and your elected representatives and is taking a new approach to how to address Texas’ energy needs. |

| |

| | | | TXU will still meet the state’s near-term power needs, but we will scale back our proposals for addressing the state’s future need. This will allow us to develop, test and incorporate emerging new technology that will help produce cleaner power to more efficiently meet Texas’ long-term energy needs. This means TXU will be building 3 units of the 11 proposed coal-fired plants and suspending the others. |

| |

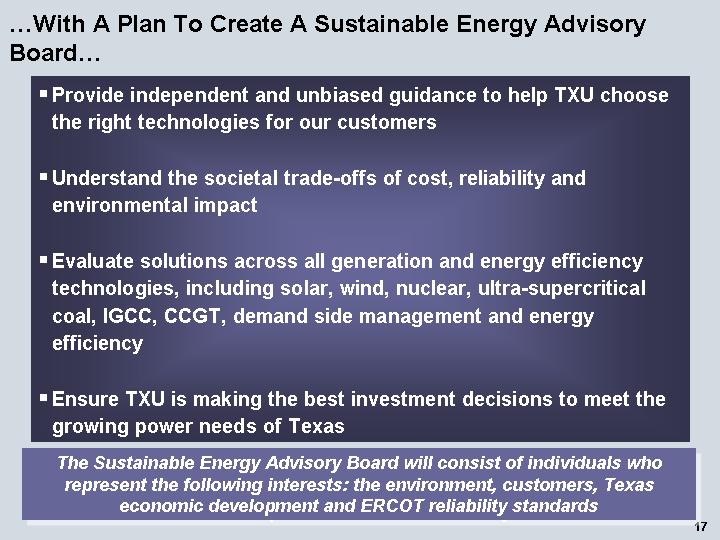

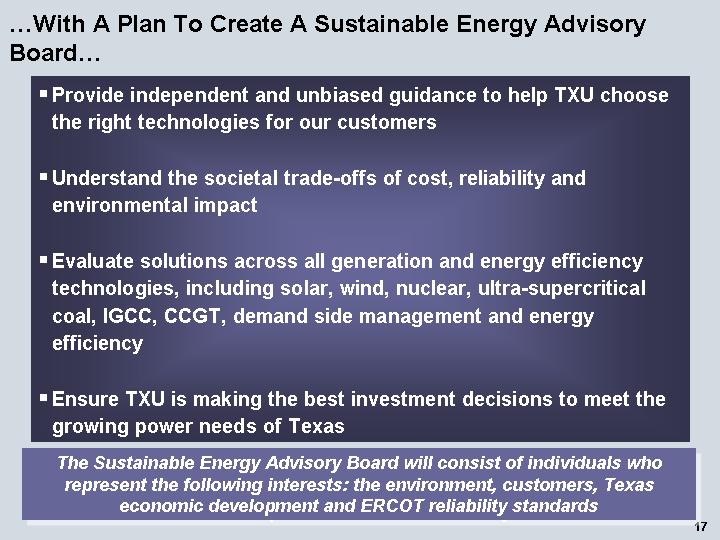

| | | | In terms of Texas’ long-term energy needs, we will create an advisory board composed of environmental, reliability and technology experts to help us determine how we can meet the state’s energy needs in the effective and environmentally responsible manner possible. |

| |

| | • | | You are restructuring the company. What does that mean for me? |

| |

| | | | We believe that this transaction will be good for customers. Let’s be clear about what we’re doing. We are organizing into three businesses — TXU Energy, Oncor Electric |

| | | | Delivery and Luminant Energy — such that each one is better organized to serve its distinct customer base. Each of these businesses will have its own management team, board of directors and headquarters location. |

| | | | That means that each one will focus even more on their own customers — providing the kind of pricing, service and products that customers want and need. |

| |

| | • | | You’re going to be purchased by out-of-state investors and they’re going to take the company private — how is that good for customers? |

| |

| | | | This is good for customers. This investor group will be providing access to capital and resources that are expected to generate long-term benefits — price cuts, new products and services, enhanced energy conservation and efficiency programs, and development of new clean energy technologies. |

| |

| | | | Texas Pacific Group, a Fort Worth-based firm, and KKR have excellent track records of partnering with management teams to build great companies. |

| |

| | • | | Who are KKR, Texas Pacific Group and the other Texas investors? |

| |

| | | | Texas Pacific Group is a private investment partnership, based in Fort Worth, Texas, that manages more than $15 billion in assets. Texas Pacific Group seeks to invest in world-class franchises across a range of industries. For more information on Texas Pacific Group, please go to www.texaspacificgroup.com. |

| |

| | | | KKR, established in 1976, is one of the world’s largest and most successful private equity firms and it has completed buyout transactions that are among the most complex in history. However, the firm’s investment approach is fundamentally simple. It acquires industry-leading companies and works with management to grow and improve them. KKR has completed more than 140 transactions. For more information on KKR, go to: www.KKR.com. |

| |

| | • | | When will the transaction take effect? |

| |

| | | | We expect the transaction to be completed before the end of 2007. |

| |

| | • | | Will TXU remain subject to regulatory oversight? |

| |

| | | | Yes. TXU Energy (as well Oncor Electric Delivery and Luminant Energy) will all remain subject to the same Texas regulatory authorities. |

Additional Information and Where to Find It

In connection with the proposed merger of TXU Corp. with Texas Energy Future Merger Sub Corp., a wholly-owned subsidiary of Texas Energy Future Holdings Limited Partnership(the “Merger”), the Company will prepare a proxy

statement to be filed with the Securities Exchange Commission (SEC). When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMIPRORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website athttp://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to TXU Corp., Energy Plaza, 1601 Bryan, Dallas, Texas 75201, telephone: (214) 812-4600, or from the Company’s website,http:www.txucorp.com.

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the Merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2006 Annual Meeting of Shareholders, which was filed with the SEC on April 5, 2006. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the Merger, when filed with the SEC.

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

Talking Points for Customers

What Is Happening

| | • | | TXU has signed a merger agreement with an investor group led by Kohlberg, Kravis Roberts & Co. (KKR) and Texas Pacific Group (TPG), two of the nation’s leading private equity firms. |

| |

| | • | | As a result of the transaction, we will transform the company to become more customer-centered, innovative and technology-driven. |

| |

| | • | | We will cut prices for many consumers, including all month-to-month customers on our TXU Energy FlexProtectplan (formerly known as the “price to beat” rate) and the TXU Energy Freedom Plan. These customers will receive a 10% price cut (6% in approximately 30 days and 4% at closing of the transaction) resulting in more than $300 million of annual savings for residential customers who haven’t selected one of our lower-priced offers, and price protection through September 2008. |

| |

| | • | | We will expand our product and service offerings; |

| |

| | • | | We will suspend permitting on the eight coal-fueled reference plant units that are intended to address longer term needs and withdraw the reference plant permits upon closing of the transaction. |

| |

| | • | | We will focus more on energy efficiency and conservation programs and alternative energy sources to meet Texas’ near-term energy needs; and better organize the company to focus on our customers. |

| |

| | • | | This transition will be seamless to our customers — current employees will continue to operate the company, customer service and billing processes will remain the same, and the company’s businesses will maintain headquarters in the Dallas/Fort Worth area. |

What It Means for TXU Energy Customers

Price Cuts and Price Protection

This transaction will result in the opportunity for lower prices for many TXU Energy customers. We will be notifying customers in the near future about our lower prices.

Seamless Service

| • | | While the benefits of the transaction will be obvious, the changes will all be seamless to customers. |

| • | | For example, customer service, billing and emergency service contact information will all remain the same. Payment locations and online services will remain the same. |

| • | | While the company will divide into three separate businesses better focused on their distinctive customers, TXU Energy will retain its name and be operated by the same team of employees. |

Offering new products and services

| | • | | As a result of the transaction, we will significantly increase our investment in new technology and innovation to improve customer offerings. Building on TXU Energy’s track record of product innovation, the company will seek to increase its offering of industry-leading technology solutions for consumers in areas like energy efficiency and conservation. We will seek to partner with leading retailers to provide smart device solutions and real-time price signals to help customers manage peak load. |

| |

| | • | | We also will invest in new technology and customer service platforms to support new product development and innovation. |

New, more responsive approach to energy challenges, focused on environmental stewardship.

| | • | | We’ve listened to what Texans have said and we will approach Texas’ power challenges differently. We plan to move forward with three of the 11 coal-fueled plants. This new approach focuses on meeting Texas’ near-term energy needs, allowing for incorporation of new technology advancements, alternative energy sources and strategies to reduce the growth in overall demand through conservation and energy efficiency programs. |

| |

| | • | | TXU Energy will invest $400 million in an aggressive pursuit of conservation and energy efficiency programs. |

| |

| | • | | TXU will un-bundle its segments into three separate businesses to focus on their distinct roles and customer needs — TXU Energy (retail), Oncor Electric Delivery, and Luminant Energy (power). |

| |

| | • | | A new vision is driving this journey of transformation. This process will give us a stronger position for meeting the complex energy challenges of Texas now and for the future. |

Additional Information and Where to Find It

In connection with the proposed merger of TXU Corp. with Texas Energy Future Merger Sub Corp., a wholly-owned subsidiary of Texas Energy Future Holdings Limited Partnership(the “Merger”), the Company will prepare a proxy statement to be filed with the Securities Exchange Commission (SEC). When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMIPRORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website athttp://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to TXU Corp., Energy Plaza, 1601 Bryan, Dallas, Texas 75201, telephone: (214) 812-4600, or from the Company’s website,http:www.txucorp.com.

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the Merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2006 Annual Meeting of Shareholders, which was filed with the SEC on April 5, 2006. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the Merger, when filed with the SEC.

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

Talking Points for Business Customers

What Is Happening

| | • | | TXU has signed a merger agreement with an investment group led by Kohlberg Kravis Roberts & Co. (KKR) and Texas Pacific Group (TPG), two of the nation’s leading private equity firms. |

| |

| | • | | As part of the transaction, TXU will reorganize into three separate businesses to focus on distinct roles and customer needs (Oncor Electric Delivery, TXU Energy and Luminant Energy) — each with its own management team and headquarters. |

| |

| | • | | We will expand our product and service offerings; plan to build three of the 11 proposed coal-fueled plants; focus more on energy efficiency and conservation programs and alternative energy sources to meet Texas’ near-term energy needs; and better organize the company to focus on our customers. |

| |

| | • | | This will be seamless to our customers. All customer service, billing and contact information will remain the same. |

Customer Benefits

| | • | | As a result of the transaction, we will significantly increase our investment in new technology and innovation to improve customer offerings. Building on TXU’s track record of product innovation, the company will seek to increase its offering of industry-leading technology solutions for commercial customers in areas like energy efficiency and conservation. |

| |

| | • | | We have listened to what our customers and other stakeholders have had to say about how best to meet the state’s growing need for power. |

| |

| | • | | In response, we are adopting a new approach to meeting Texas’ near-term energy needs that will involve seeking to build three new coal-fueled plants to meet the state’s energy needs through 2011, but suspend permitting on the eight coal-fueled reference plants that were intended to address longer-term needs. We intend to withdraw the reference plant permits upon closing of transaction. This strategy provides opportunity for renewable/alternative energy sources and next-generation technologies to mature in order to help meet longer-term challenges. |

| |

| | • | | We’re committed to clean air. TXU remains committed to 20% reductions on key pollutants. |

| | • | | We also will make substantial new investments in research, demand-side management including an expanded $400 million conservation and energy efficiency program, join Future Gen, and continued development of next-generation clean energy technology. |

| |

| | • | | We expect to aggressively address global climate change (including through conservation, energy efficiency, renewable wind and solar, nuclear, new technologies and alternative energy). |

Additional Information and Where to Find It

In connection with the proposed merger of TXU Corp. with Texas Energy Future Merger Sub Corp., a wholly-owned subsidiary of Texas Energy Future Holdings Limited Partnership(the “Merger”), the Company will prepare a proxy statement to be filed with the Securities Exchange Commission (SEC). When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website athttp://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to TXU Corp., Energy Plaza, 1601 Bryan, Dallas, Texas 75201, telephone: (214) 812-4600, or from the Company’s website,http:www.txucorp.com.

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the Merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2006 Annual Meeting of Shareholders, which was filed with the SEC on April 5, 2006. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the Merger, when filed with the SEC.

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

Customer Letter/Talking Points For TXU Business Customers

Letter to Business Customers

Dear Valued Customer,

On February 26, 2007, we announced that TXU signed a merger agreement with an investment group led by Kohlberg Kravis Roberts & Co. (KKR) and Texas Pacific Group (TPG), two of the nation’s leading private equity firms. The proposed transaction will give us new financial and strategic resources to transform our business so we can better meet the energy needs of our customers now and in the future.

While our company is changing, our commitment to providing quality service to our customers is not. We expect this transition to be seamless for all of our customers. All customer service, billing and contact information will remain the same.

A key change in our strategy will be to take a new, more responsive approach to meeting Texas’ energy challenges. We have listened to what our customers and other stakeholders have had to say about how to best meet the state’s growing need for power. In response, we are adopting a new approach to meeting Texas’ near-term energy needs that will involve seeking to build three new coal-fueled plants to meet the state’s energy needs through 2011, but suspend permitting on the eight coal-fueled reference plants that were intended to address longer-term needs. We intend to withdraw the reference plant permits upon closing of the transaction. This strategy provides opportunity for renewable/alternative energy sources and next-generation technologies to mature in order to help meet longer-term challenges.

We are proud of our long heritage serving Texas and we are confident that our new strategy will best enable us to provide our customers with reliable, affordable and clean power now and in the future.

Thank you.

Sincerely,

Don Smith

Additional Information and Where to Find It

In connection with the proposed merger of TXU Corp. with Texas Energy Future Merger Sub Corp., a wholly-owned subsidiary of Texas Energy Future Holdings Limited Partnership(the “Merger”), the Company will prepare a proxy statement to be filed with the Securities Exchange Commission (SEC). When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website athttp://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to TXU Corp., Energy Plaza, 1601 Bryan, Dallas, Texas 75201, telephone: (214) 812-4600, or from the Company’s website,http:www.txucorp.com.

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the Merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2006 Annual Meeting of Shareholders, which was filed with the SEC on April 5, 2006. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the Merger, when filed with the SEC.

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

Community-Issue FAQ

Overview

Can you describe the transaction?

TXU and an investor group led by KKR and Texas Pacific Group have entered into a definitive merger agreement.

TXU shareholders will receive $69.25 in cash for each share of TXU common stock held. This represents a 24.6% premium. The total value of the transaction is $45 billion.

The transaction is subject to customary conditions, including approval of TXU shareholders and various regulatory agencies, including the Federal Energy Regulatory Commission (FERC), the Nuclear Regulatory Commission (NRC) and the Federal Communications Commission (FCC). We expect that the transaction will close in the second half of 2007.

We believe this transaction will enable us to become more customer-centered, technology-driven and environmentally focused. This means:

| • | | First, this means we can provide a 10% price reductions for residential customers in its traditional service area who haven’t already selected one of TXU Energy’s other lower-priced offers (6% within approximately 30 days and an additional 4% at the closing of the transaction) and protect those prices through September 2008. This will ensure that these customers receive the benefits of these savings through two summer seasons of peak energy usage. |

| |

| • | | Second, we can take a new, more “patient” approach to solving Texas’ long-term, complex power challenges. We will continue our plans to meet Texas’ near-term power demand, however, we will scale back the size and scope of our original new build strategy. This will allow us to take advantage of — and incorporate — new technology advancements, alternative energy sources and conservation and energy efficiency efforts, for the longer-term power needs. |

| |

| • | | Third, we will re-organize our corporate structure, creating three distinct businesses so we can better and more quickly meet the needs of the customers of each of these businesses. This will include name changes, separate boards, management teams, and headquarters. |

| |

| • | | Fourth, we expect to make significant investments in energy efficiency and conservation programs, R&D and alternative/renewable energy sources and |

| | | technologies to bring our customers new and innovative products and to drive longer-term value through technological advancements with a commitment to environmental stewardship. |

Who are the members of the buyer group?

KKR is one of the world’s largest and most successful private equity firms and has completed buyout transactions that are among the most complex in history. However, the firm’s investment approach is fundamentally simple. It acquires industry-leading companies and works with management to grow and improve them. Established in 1976, it has completed over 140 transactions.

Texas Pacific Group is a private investment partnership managing over $15 billion in assets. It is based in Fort Worth, with additional offices in San Francisco and London. TPG seeks to invest in world-class franchises across a range of industries.

Additionally, there are a number of other financial institutions that intend to be equity investors at closing.

The investor group has indicated they look forward to working with TXU’s management team and talented employees in the years ahead.

In addition, former U.S. Secretary of State James A. Baker, III will serve as Advisory Chairman to the investment group. Following the closing of the transaction, former EPA Administrator William Reilly will join Board of Directors and lead effort making climate stewardship central to corporate policies. Donald L. Evans, former U.S. Secretary of Commerce; James R. Huffines, Chairman of the University of Texas Board of Regents; and Lyndon L. Olson Jr., former Texas State Representative and former U.S. Ambassador to Sweden, will join the Board of Directors. TXU will create an independent Sustainable Energy Advisory Board to guide energy investments. This board is expected be comprised of individuals who represent the following interests: the environment, customers, Texas economic development and ERCOT reliability standards.

Why are you taking TXU private? How did this come about? What are these private investors offering that couldn’t be accomplished independently as a public company?

The TXU board and management team have been strategically evaluating how to best reshape TXU’s strategy, in light of various factors including input from stakeholders, the new competitive marketplace, the growing and diverse energy needs of Texas, growing concerns around climate change, and other issues. As we were going through this process, we were approached by the investor group with a proposal that addressed our key strategic objectives. It became clear that the TXU board, TXU management team and the investor group had a shared vision to transform TXU into the most customer-centered, technology-led, environmentally responsible innovator in the industry.

After carefully evaluating various options in terms of the company’s structure, we determined that private ownership with these partners was the best solution to effectively and efficiently enable this critical transformation in a timely manner. By transitioning to private ownership, we will free ourselves from the short-term financial pressures affecting public companies and team up with a group of investors committed to making investments through technological innovation and business transformation.

Name Changes

Why are you changing the name of the Holding Company?

We believe the name Luminant better reflects the company’s transformation and focus on customer-centered innovation.

Why are you changing the names of TXU Electric Delivery and TXU Power?

Our subsidiaries have fundamentally different missions, strategies and customers. We have listened to concerns from the PUC and from market participants that there may be some customer confusion that arises from “TXU” being in both the name of the competitive retail company and the regulated delivery company. Changing the names of the companies allows customers, employees and communities to better distinguish the contributions, capabilities and focus. Symbolically, the new name communicates our new vision of the company as one highly focused on customer-centered innovation that will drive our success and the transformation of our businesses and the Texas energy marketplace.

The Oncor Electric Delivery name also works well for our delivery business and was used briefly several years ago. In fact, many investors still use the name.

Different, More Responsive Approach to Meeting Near- and Long-Term Energy Challenges

What has changed to make management rethink its generation development strategy? If coal is the right technology for Texas, why are we cancelling our reference plants?

TXU still considers coal to be a key part of meeting the Texas power challenge. A number of factors have caused TXU to shift its strategy away from current pulverized coal technologies. Both TXU’s board and its management team as well as the investor group are keenly aware of a balance of factors that have evolved since the April announcement, including the move to a fully competitive energy market, stakeholder feedback, new supplies announced by other generators, uncertainty in the permitting process, and the evolving global warming debate.

This has driven our focus on ensuring the near-term needs are met. In the short term, TXU will continue pursuit of its Oak Grove permits and resolution of the Sandow consent decree—coal facilities that leverage Texas lignite. TXU believes that future environmental technologies may allow TXU to produce energy, cheaply and environmentally efficiently while ensuring energy security and growth for the Texas economy.

By suspending the permit applications for the eight reference plant units, we will be able to best take advantage of — and incorporate — new technology advancements, alternative energy sources and conservation and energy efficiency efforts into future development opportunities.

What impact will this have on your plans for 11 coal-fired units?

Under the guidance of an independent Sustainable Energy Advisory Board that will be created upon the closing of the merger, we will assess demand and capacity needs.

We’ll scale back the size and scope of our planned coal-fired generation to best take advantage of — and incorporate — new technology advancements, alternative energy sources and conservation efforts.

Re-shape New Build

| • | | Meet near-term power needs with investments in energy conservation and efficiency programs, and construction of Oak Grove and Sandow units. |

| |

| • | | Provides opportunity for renewable/alternative energy sources and next-generation technologies to mature in order to solve long-term challenges. |

| |

| • | | Suspend permitting on the eight coal-fueled reference plant units that were intended to address future needs — giving new energy solutions time to mature. |

| |

| • | | Withdraw the reference plant permits, upon closing of transaction. |

Environmental Stewardship and New Technology

| • | | Remain committed to reducing sulfur dioxide, nitrogen oxides and mercury by 20% from 2005 levels. |

| |

| • | | Address environmental issues through substantial new investments in research, demand-side management: substantially expanded $400 million conservation and energy efficiency program, new renewable wind power program, IGCC evaluation, and accelerated investments in next-generation clean technology. |

Under your new plan, how will you adequately address the electricity needs of Texas in the coming years?

Our plan, in conjunction with anticipated actions by other developers and generators, should provide sufficient power for Texas over the near-term. We remain committed to enhancing Texas’ energy supply to meet future needs and will work collaboratively with Texas leaders to address this generation development in a manner that allows for incorporation of new technology advancements and alternative energy sources. We will continue to evaluate, along with ERCOT, the longer-term issues as we make progress.

In retrospect, was it a mistake to file for 8 reference plant permits all at once?

No. At the time, we believed that we had a solution that would have addressed Texas’ energy challenge. Now, there is a balance of factors that have fundamentally altered the environment, including stakeholder feedback, new energy supplies announced by other generators, uncertainty in the permitting process, the evolving global warming debate, and changes in the competitive landscape.

Have you been ‘surprised’ by the opposition?

In this day and age, we assumed there would be opposition.Certain opponents will never be satisfied with any growth plans no matter how environmentally benign— we expected that. We do acknowledge that the carbon debate has escalated more rapidly since April than anyone anticipated. We recognize this growing concern, and feel like we are responding in an appropriate way.

Did you ever really think you would be able to build all those units or was this your plan all along?

At the time it was announced, we believed we could and should permit and construct all the plants to meet the near-term energy needs of Texas. With changing circumstances, including the opportunity presented by this transaction to accelerate our concepts in this regard, we have the opportunity to revise and improve that plan to allow for incorporation

of new technology advancements, alternative energy sources, conservation, and energy efficiency.

Will you still deliver on your 20% fleet-wide reduction of key pollutants?

TXU remains committed to its pollution reduction program, reducing total emissions of sulfur dioxide (SO2) nitrogen oxides (NOx) and mercury to 20% below 2005 levels.

Why not retrofit mothballed gas plants?

Theses plants have been mothballed for a reason. They are old and inefficient and therefore more expensive to operate. It would not make economic, nor environmental sense to retrofit these old units.

Will all of your existing plants remain in operation?

Yes, our existing plants will continue to operate although some of the older gas-fueled units may go off-line over time if not needed to meet reliability needs. We continue to take very seriously our responsibility to supply energy to the state of Texas.

Under the new owners, how much will you commit to renewables?

We will reaffirm our commitment to more than double our wind power purchases to 1.5 GW over the next five years. Additionally, we expect to make significant investment in advancing new technologies, including renewable resources.

Will IGCC technologies be used at any of your locations?

We cannot speculate as to whether IGCC technology will be used in the future at any of our present facilities or locations. However, TXU is committed to the development and deployment of advance technologies with a commitment to exploring IGCC’s potential to meet Texas’ reliability requirements.

Immediate and Longer-Term Benefits to Customers and Other Stakeholders

Why is this transaction good for customers? How will the separation of businesses be good for customers?

We expect that the transaction will enable TXU to be a more customer-centered, innovative company. That means that we expect to execute on a streamlined plan to provide more reliable, more affordable and cleaner electricity. TXU Energy will provide annual savings through a 10% price reduction for residential customers in its traditional service area who haven’t already selected one of TXU Energy’s lower-priced offers. Customers will begin receiving a 6% reduction in approximately 30 days, and an additional 4% reduction at the close of the transaction. TXU Energy will also offer price protection through September 2008, ensuring customers receive benefits through two summer seasons of peak energy use. We’ll continue to develop a broader and more innovative array of products and services, like smart appliances and other demand-side management programs. And we’re going to use next-generation technologies from every part of the business to drive better prices, service and environmental performance.

Establishing independently run businesses will allow us to better focus on the unique customers that each business serves. This is a critical next step in the transition from a regulated market to a customer-centered, innovative competitor. We believe it will allow us to react more quickly to changing market conditions, deploy technology wisely and

invest our capital more effectively. Together with the worldwide network and capabilities of our strategic partners, we will be in a better position to grow our independent businesses.

Furthermore, this will all be seamless to customers. Customer service and billing processes will remain the same. Payment locations and online services will remain the same. And we’ll remain committed to providing our customers reliable, affordable and clean power.

Where will you be headquartered?

We’ll stay in the Dallas/Fort Worth area.

Community Questions

What do you have to say to the communities that were counting on these new coal-fueled units?

We appreciate the support of these communities and the strong partnerships we have forged. Even though the original proposal may have been scaled back in some of these communities, we remain committed to meet the state’s near-term and future energy needs. We will be constantly reevaluating the opportunities in and needs of Texas.

How will this transaction impact the economy of Texas?

TXU remains committed to reinvestment in the Texas economy. TXU expects to invest billions of dollars in the Oak Grove and Sandow 5 facilities. This program is expected to create thousands of temporary and full-time jobs and significantly contribute to the gross state product. TXU Electric Delivery (to be renamed Oncor Electric Delivery) is expected to spend an additional $3.6 billion over the next five years improving the Texas power delivery infrastructure.

How will this change our commitment to Energy Aid?

We will remain committed to our industry-leading Energy Aid program that provides bill payment assistance to customers in need.

Additional Information and Where to Find It

In connection with the proposed merger of TXU Corp. with Texas Energy Future Merger Sub Corp., a wholly-owned subsidiary of Texas Energy Future Holdings Limited Partnership(the “Merger”), the Company will prepare a proxy statement to be filed with the Securities Exchange Commission (SEC). When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMIPRORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website athttp://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to TXU Corp., Energy Plaza, 1601 Bryan, Dallas, Texas 75201, telephone: (214) 812-4600, or from the Company’s website,http:www.txucorp.com.

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the Merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2006 Annual Meeting of Shareholders, which was filed with the SEC on April 5, 2006. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the Merger, when filed with the SEC.

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

CJW Letter to Retirees

Dear [Salutation] [Last Name]:

We wanted to write to you regarding a new development at TXU. The company is being acquired by a group of investors led by two of the nation’s leading private equity firms — Kohlberg Kravis Roberts & Co. (KKR) and Texas Pacific Group (TPG). As a result of the transaction, we will transform the company to become more customer-centered, innovative and technology-driven to better meet the growing and diverse energy needs of Texas.

We believe this is very exciting news for TXU and, as a retiree, we wanted to keep you informed about what this means for the company and how it will benefit our customers and the State of Texas.

In summary, what this transaction means is that we will be able to:

| | • | | provide meaningful price cuts and protection to customers; |

| |

| | • | | expand our product and service offerings; |

| |

| | • | | take a different, more responsive approach to meeting the state’s energy challenges, including suspending the permitting process for 8 of the proposed 11 new coal-fueled units and developing, testing and incorporating emerging new technology that will help us produce power cleaner and more efficiently to meet long-term energy needs; |

| |

| | • | | focus more on energy efficiency and conservation programs and alternative energy sources to meet Texas’ near-term energy needs; |

| |

| | • | | better organize our businesses to be more focused on each business’s customers; and |

| |

| | • | | provide our customers with the reliability and service they have come to expect. |

Our new partners have a history of working with management teams to build great companies. They will give us new financial and strategic resources to meet the energy needs of our customers now and in the future. The transformation will help us solve Texas’ power challenge and enable long-term investments in research and technology to provide clean, reliable and affordable power.

Under the new corporate banner ofLuminant,we will separate into three distinct businesses to better meet the needs of our unique customers. TXU Electric Delivery’s name will be changed to Oncor. TXU Power, TXU Wholesale, TXU Development and TXU Construction will be called Luminant Energy and TXU Energy’s name will remain the same.

As a TXU retiree, we want you to have full information about this transaction so we urge you to visit a Web site that provides key information regarding the transaction at www.TransformingTXU.com. We want to assure you that your TXU retirement and other benefits are expected to be unaffected by the changes to our ownership.

TXU is a proud company that has served Texas for more than 100 years. You have played a critical role in achieving TXU’s current success and I hope you share in our excitement about the next promising phase for our Company.

Sincerely,

John Wilder

Additional Information and Where to Find It

In connection with the proposed merger of TXU Corp. with Texas Energy Future Merger Sub Corp., a wholly-owned subsidiary of Texas Energy Future Holdings Limited Partnership(the “Merger”), the Company will prepare a proxy statement to be filed with the Securities Exchange Commission (SEC). When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website athttp://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to TXU Corp., Energy Plaza, 1601 Bryan, Dallas, Texas 75201, telephone: (214) 812-4600, or from the Company’s website,http:www.txucorp.com.

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the Merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2006 Annual Meeting of Shareholders, which was filed with the SEC on April 5, 2006. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the Merger, when filed with the SEC.

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

John Wilder Letter to Vendors and Suppliers

February XX, 2007

Dear [Salutation] [First Name]:

As a valued partner, I wanted to personally share with you some exciting news about our company. TXU is being acquired by a group of investors led by Kohlberg Kravis Roberts & Co. (KKR) and Texas Pacific Group (TPG), two of the nation’s leading private equity firms. This transaction will give us new financial and strategic resources to transform our business so we can better meet the energy needs of our customers now and in the future.

In summary, what this transaction means is that we will be able to:

| | • | | provide more meaningful price cuts and protection to customers; |

| |

| | • | | expand our product and service offerings; |

| |

| | • | | take a different, more responsive approach to meeting the state’s energy challenges; including suspending the permitting process for 8 of the proposed 11 new coal-fueled units and developing, testing, and incorporating emerging new technology that will help us produce power cleaner and more efficiently to meet long-term energy needs. |

| |

| | • | | focus more on energy efficiency and conservation programs and alternative energy sources to meet Texas’ near-term energy needs; and |

| |

| | • | | better organize our businesses to be more focused on each business’s customers. |

Under the new corporate banner ofLuminant,we will separate into three distinct businesses to better meet the needs of our unique customers. TXU Electric Delivery’s name will be changed to Oncor. TXU Power, TXU Wholesale, TXU Development and TXU Construction will be called Luminant Energy and TXU Energy’s name will remain the same.

We want to assure that the transition will be seamless and advise you that we are looking forward to entering into a new phase of our relationship.

If you have any questions about the transaction, you can visit www.TransformingTXU.com or call your TXU contact.

Sincerely,

John Wilder

Additional Information and Where to Find It

In connection with the proposed merger of TXU Corp. with Texas Energy Future Merger Sub Corp., a wholly-owned subsidiary of Texas Energy Future Holdings Limited Partnership(the “Merger”), the Company will prepare a proxy statement to be filed with the Securities Exchange Commission (SEC). When completed, a definitive proxy statement and a form of proxy will be mailed to the shareholders of the Company. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT REGARDING THE MERGER CAREFULLY AND IN ITS ENTIRETY BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The Company’s shareholders will be able to obtain, without charge, a copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website athttp://www.sec.gov. The Company’s shareholders will also be able to obtain, without charge, a copy of the proxy statement and other relevant documents (when available) by directing a request by mail or telephone to TXU Corp., Energy Plaza, 1601 Bryan, Dallas, Texas 75201, telephone: (214) 812-4600, or from the Company’s website,http:www.txucorp.com.

Participants in the Solicitation

The Company and its directors and officers may be deemed to be participants in the solicitation of proxies from the Company’s shareholders with respect to the Merger. Information about the Company’s directors and executive officers and their ownership of the Company’s common stock is set forth in the proxy statement for the Company’s 2006 Annual Meeting of Shareholders, which was filed with the SEC on April 5, 2006. Shareholders may obtain additional information regarding the interests of the Company and its directors and executive officers in the merger, which may be different than those of the Company’s shareholders generally, by reading the proxy statement and other relevant documents regarding the Merger, when filed with the SEC.

Filed by TXU Corp.

Pursuant to Rule 14a-12 under the Securities Exchange Act of 1934

Subject Company: TXU Corp.

Commission File No.: 1-12833

| | | |

| Legislative Goal | | Accomplished by the Transaction |

| | | |

| Reduce retail electricity prices | | 10 percent retail price reduction for most TXU Energy residential customers |

| | | • 6% in approximately 30 days (to 14.1 c/kwh for 1,000 kwh/mo user) |

| | | • 4% additional at closing (to 13.5 c/kwh for 1,000 kwh/mo user) |

| | | |

| Ensure no retail price hikes after “141st Day” | | Provide price protection at the reduced price through September 2008 — with no term contract required |

| | | |

| Encourage energy efficiency and conservation | | Invest $400 million over 5 years in demand-side management |

| | | |

| Separate TXU Corp subsidiaries | | Creates three separate and distinct businesses: |

| | | • T&D utility |

| | | • Wholesale/Generation business |

| | | • Retail business |

| | | |

| | | Separate Boards of Directors and management teams for each business. |

| | | |

| | | Separate headquarters locations for each of those three businesses |

| | | |

| | | Intent to attract unique Texas investors for T&D utility |

| | | |

| Prohibit use of same name/logo by utility and | | Use three distinct names/logos: |

| competitive affiliate | | • Oncor Electric Delivery Company (T&D utility) |

| | | • Luminant Energy (Wholesale/Generation) |

| | | • TXU Energy (Retail) |

| | | |