Exhibit 99.1

EEI Conference

C. John Wilder Chief Executive Officer

November 8, 2005

Safe Harbor Statement

This presentation contains forward-looking statements, which are subject to various risks and uncertainties. Discussion of risks and uncertainties that could cause actual results to differ materially from management’s current projections, forecasts, estimates and expectations is contained in the company’s SEC filings. In addition to the risks and uncertainties set forth in the company’s SEC filings, the forward-looking statements in this release could be affected by the ability of the company to implement the initiatives that are part of its operational improvement and cost reduction program and financial and growth strategies, and the terms under which the company executes those initiatives, the ability of the company to execute its share repurchase program and the actions of its board of directors with respect to future dividends and other cash distributions to shareholders, which will be based upon a number of factors, including the company’s profit levels, operating cash flow levels and capital requirements as well as financial and other business conditions existing at the time.

Regulation G

This presentation includes certain non-GAAP financial measures. A reconciliation of these measures to the most directly comparable GAAP measure is included in the appendix of the printed version of the slides and the version included on the company’s website at www.txucorp.com under Investor Resources/Presentations.

Today’s Agenda

TXU Today

The TXU Turnaround Core Strategic Principles

Business Unit Strategies

TXU Power

TXU Retail/Wholesale TXU Electric Delivery

Risk/Market Outlook

Natural Gas Heat Rate

Capital Allocation Principles

Financial Principles

Financial Outlook And Growth Financial Sensitivities

Long-Term Sources And Uses Of Cash

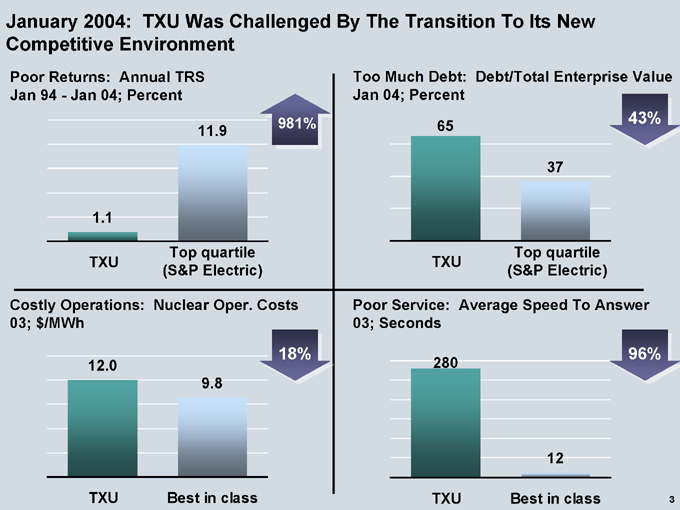

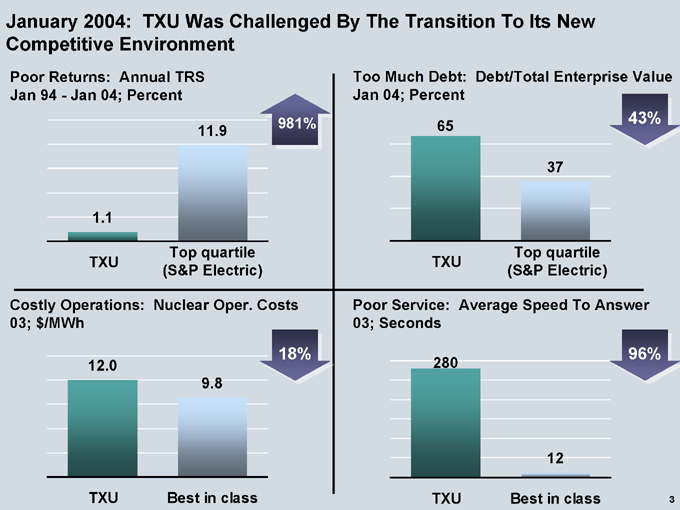

January 2004: TXU Was Challenged By The Transition To Its New Competitive Environment

Poor Returns: Annual TRS Jan 94—Jan 04; Percent

1.1

TXU

11.9

Top quartile (S&P Electric)

981%

Costly Operations: Nuclear Oper. Costs 03; $/MWh

12.0

TXU

9.8

Best in class

18%

Too Much Debt: Debt/Total Enterprise Value Jan 04; Percent

65

TXU

37

Top quartile (S&P Electric)

43%

Poor Service: Average Speed To Answer 03; Seconds

280

TXU

12

Best in class

96%

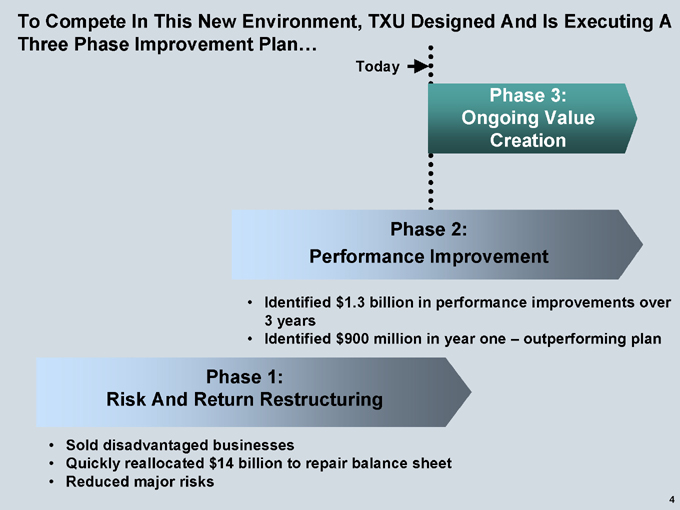

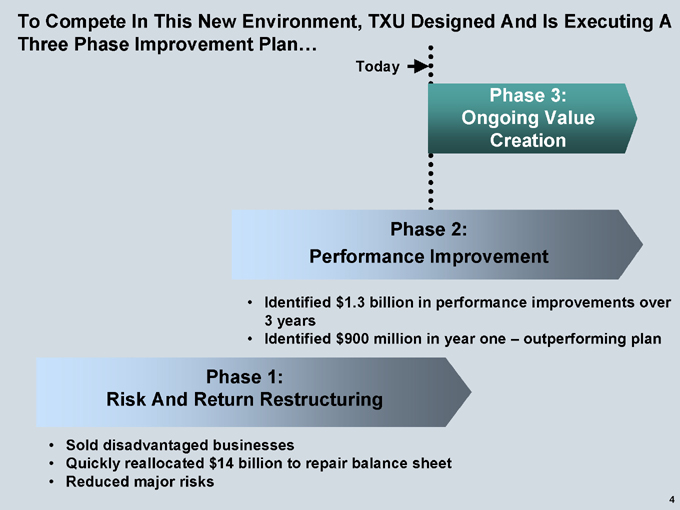

To Compete In This New Environment, TXU Designed And Is Executing A Three Phase Improvement Plan…

Today

Phase 3: Ongoing Value Creation

Phase 2:

Performance Improvement

Identified $1.3 billion in performance improvements over 3 years Identified $900 million in year one – outperforming plan

Phase 1:

Risk And Return Restructuring

Sold disadvantaged businesses

Quickly reallocated $14 billion to repair balance sheet Reduced major risks

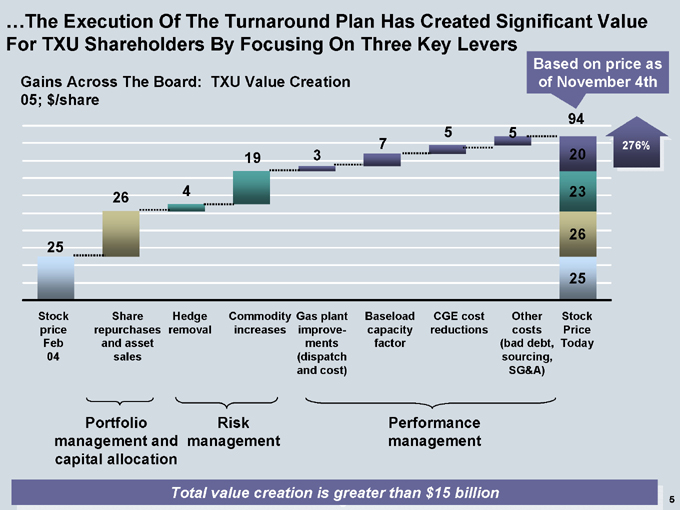

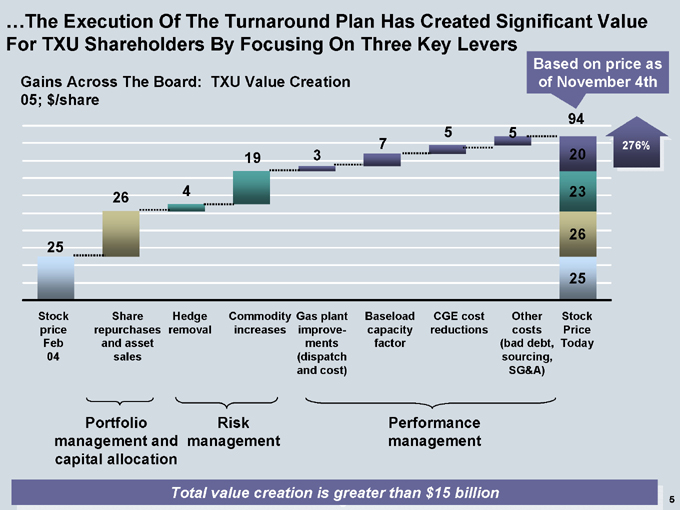

…The Execution Of The Turnaround Plan Has Created Significant Value For TXU Shareholders By Focusing On Three Key Levers

Based on price as of November 4th

Gains Across The Board: TXU Value Creation 05; $/share

25

26

19

94

20

23

26

25

276%

Stock Share Hedge Commodity Gas plant Baseload CGE cost Other Stock price repurchases removal increases improvements capacity reductions costs Price Feb and asset factor (bad debt, Today 04 sales (dispatch sourcing, and cost) SG&A)

Portfolio Risk Performance management and management management capital allocation

Total value creation is greater than $ 15 billion

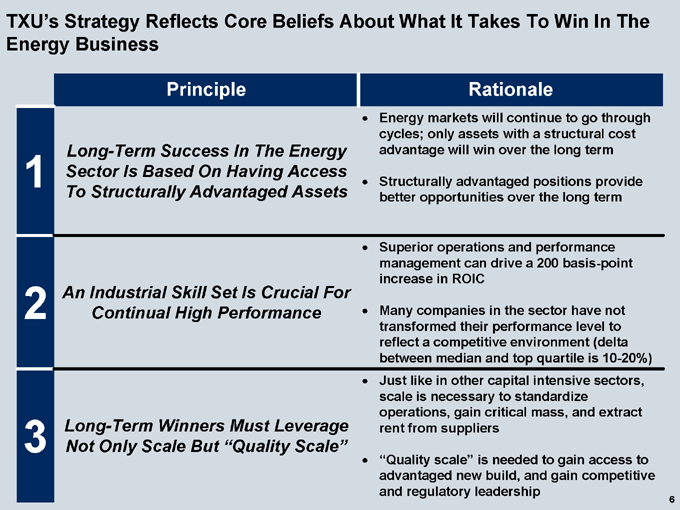

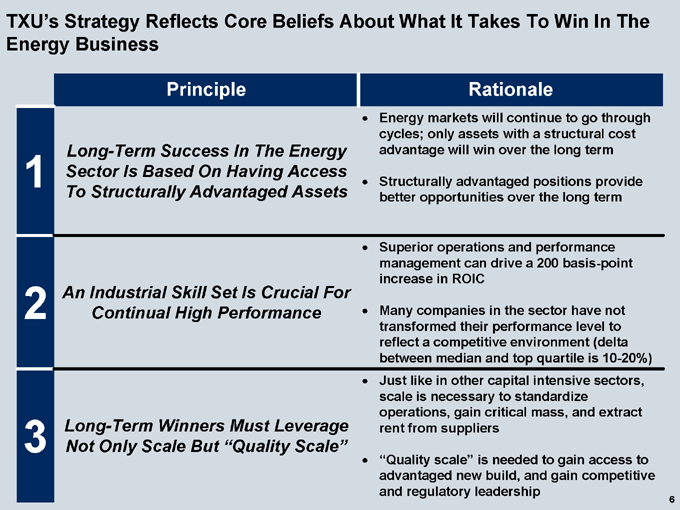

TXU’s Strategy Reflects Core Beliefs About What It Takes To Win In The Energy Business

Principle

Long-Term Success In The Energy

1 | | Sector Is Based On Having Access To Structurally Advantaged Assets |

An Industrial Skill Set Is Crucial For

2 | | Continual High Performance |

Long-Term Winners Must Leverage

3 | | Not Only Scale But “Quality Scale” |

Rationale

Energy markets will continue to go through cycles; only assets with a structural cost advantage will win over the long term

Structurally advantaged positions provide better opportunities over the long term

Superior operations and performance management can drive a 200 basis-point increase in ROIC

Many companies in the sector have not transformed their performance level to reflect a competitive environment (delta between median and top quartile is 10-20%)

Just like in other capital intensive sectors, scale is necessary to standardize operations, gain critical mass, and extract rent from suppliers

“Quality scale” is needed to gain access to advantaged new build, and gain competitive and regulatory leadership

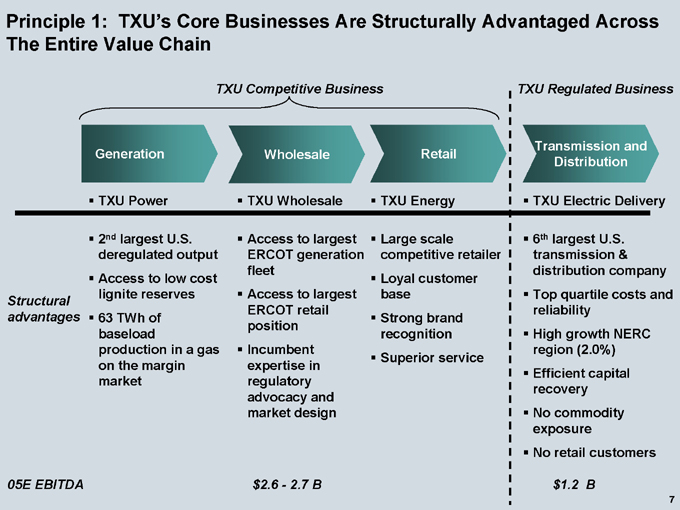

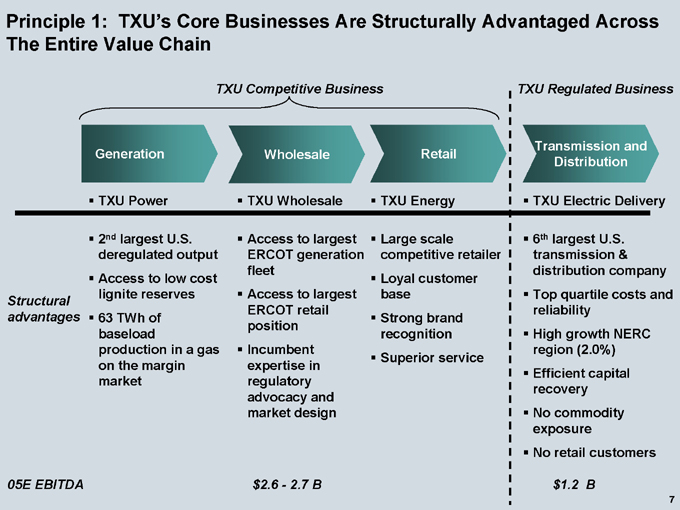

Principle 1: TXU’s Core Businesses Are Structurally Advantaged Across The Entire Value Chain

TXU Competitive Business

Generation

TXU Power

Wholesale

TXU Wholesale

Retail

TXU Energy

Transmission and Distribution

TXU Electric Delivery

Structural advantages

2nd largest U.S. deregulated output Access to low cost lignite reserves 63 TWh of baseload production in a gas on the margin market

Access to largest ERCOT generation fleet Access to largest ERCOT retail position Incumbent expertise in regulatory advocacy and market design

Large scale competitive retailer Loyal customer base Strong brand recognition Superior service

6th largest U.S. transmission & distribution company Top quartile costs and reliability High growth NERC region (2.0%) Efficient capital recovery No commodity exposure No retail customers

05E EBITDA $2.6—2.7 B $1.2 B

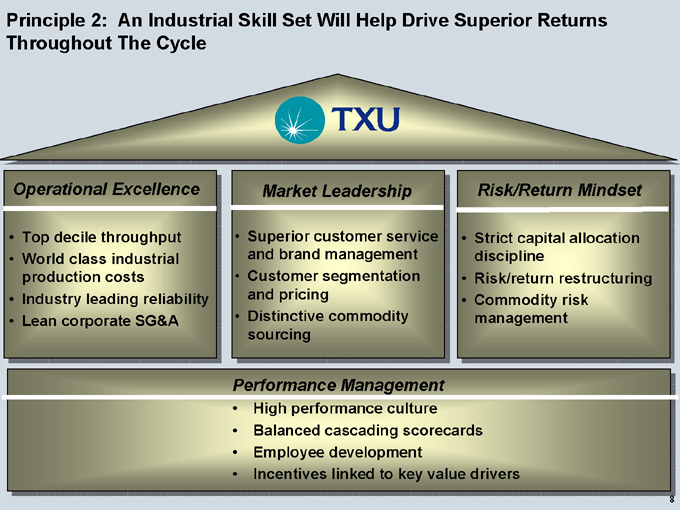

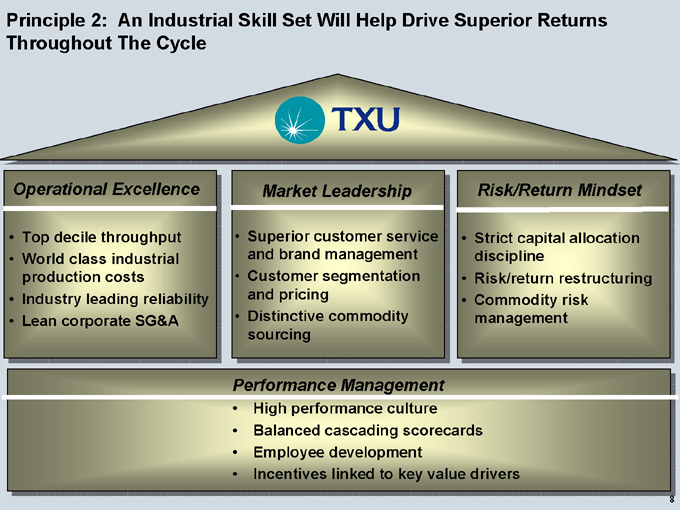

Principle 2: An Industrial Skill Set Will Help Drive Superior Returns Throughout The Cycle

Operational Excellence

Top decile throughput World class industrial production costs Industry leading reliability Lean corporate SG&A

Market Leadership

Superior customer service and brand management Customer segmentation and pricing Distinctive commodity sourcing

Risk/Return Mindset

Strict capital allocation discipline Risk/return restructuring Commodity risk management

Performance Management

High performance culture Balanced cascading scorecards Employee development Incentives linked to key value drivers

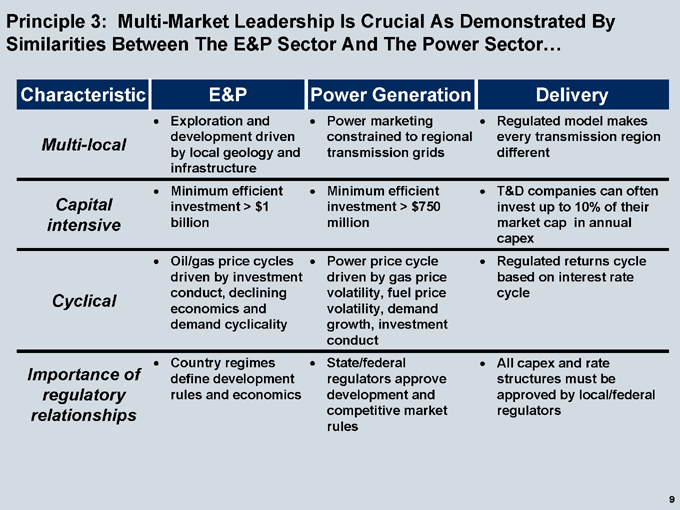

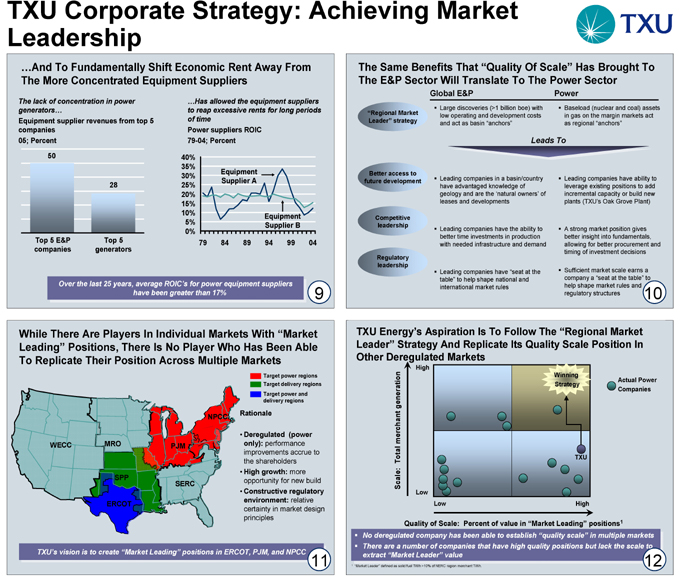

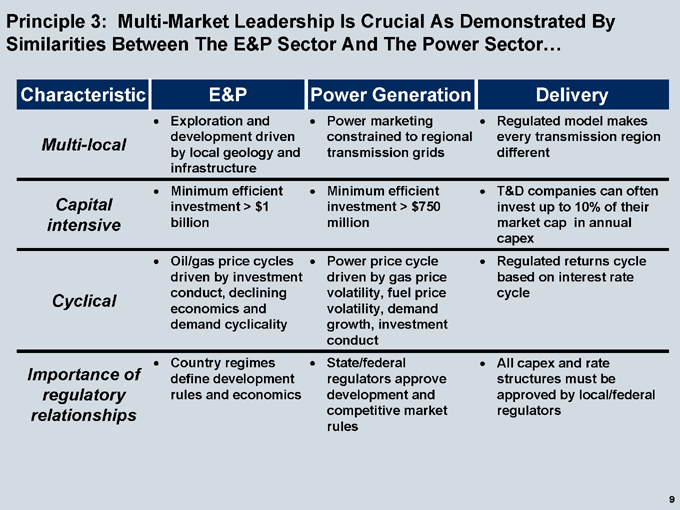

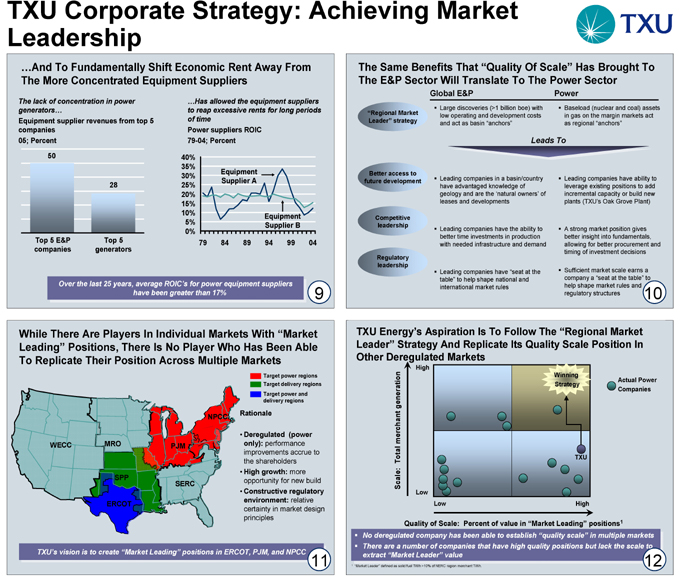

Principle 3: Multi-Market Leadership Is Crucial As Demonstrated By Similarities Between The E&P Sector And The Power Sector…

Characteristic

Multi-local

Capital intensive

Cyclical

Importance of regulatory relationships

E&P

Exploration and development driven by local geology and infrastructure Minimum efficient investment > $1 billion

Oil/gas price cycles driven by investment conduct, declining economics and demand cyclicality

Country regimes define development rules and economics

Power Generation

Power marketing constrained to regional transmission grids

Minimum efficient investment > $750 million

Power price cycle driven by gas price volatility, fuel price volatility, demand growth, investment conduct State/federal regulators approve development and competitive market rules

Delivery

Regulated model makes every transmission region different

T&D companies can often invest up to 10% of their market cap in annual capex Regulated returns cycle based on interest rate cycle

All capex and rate structures must be approved by local/federal regulators

9

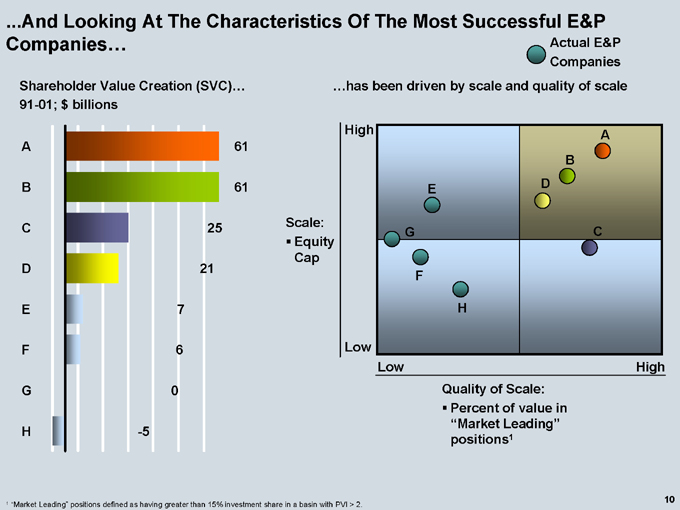

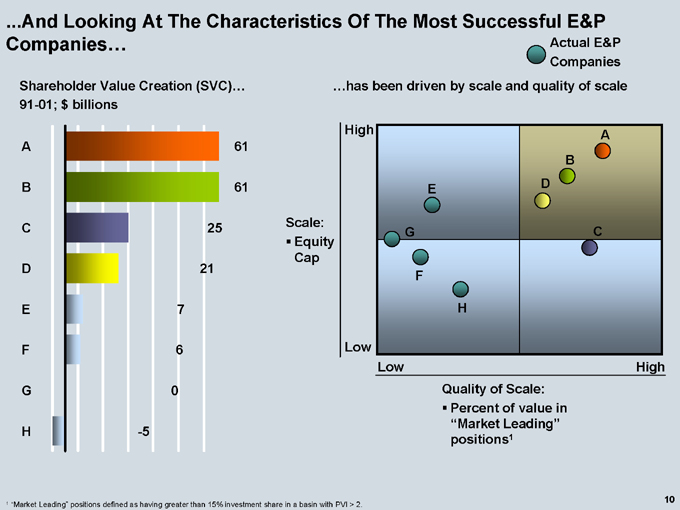

.And Looking At The Characteristics Of The Most Successful E&P Companies… Actual E&P

Companies

Shareholder Value Creation (SVC)… 91-01; $ billions

A B C D E F G H

-5

0

21

25

61

61

…has been driven by scale and quality of scale

High

Low

Low

High

Quality of Scale: Percent of value in “Market Leading” positions1

1 | | “Market Leading” positions defined as having greater than 15% investment share in a basin with PVI > 2. |

E

G

F

H

A

B

D

C

10

…The Winning Strategy In The Power Sector Will Require The Combination Of Scale And Quality Of Scale

Key Principle

Scale

Competitive Advantages

Standardization of operating practices

Ability to take part in needed large capital investments

Ability to extract excess rents from equipment suppliers

TXU Application

Applying TXU Operating System across larger portfolio of assets

Taking part in infrastructure build out without “betting the company”

Leveraging bulk purchases to reduce equipment supplier costs and increase returns

Quality of scale

Better access to future development opportunities

Providing competitive leadership and capital discipline

Providing regulatory leadership

Taking advantage of sites like Oak Grove for new build

Ensuring capital is invested appropriately in needed infrastructure

Advocating that market rules (e.g., Nodal) develop to ensure fair competition

In the E&P sector, the combination of both factors was needed to drive significant value creation over time

11

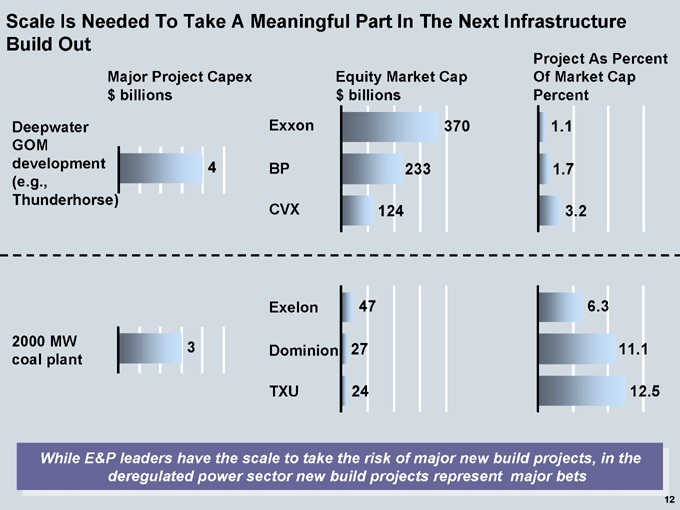

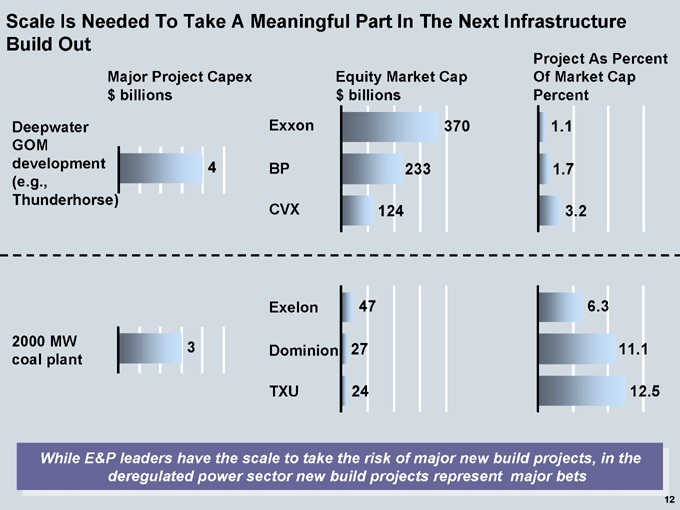

Scale Is Needed To Take A Meaningful Part In The Next Infrastructure Build Out

Major Project Capex $ billions

Deepwater GOM development (e.g., Thunderhorse)

Equity Market Cap $ billions

Exxon

BP

CVX

370

233

124

Project As Percent Of Market Cap Percent

1.1

1.7

3.2

2000 MW coal plant

Exelon

Dominion

TXU

47

27

24

6.3

11.1

12.5

While E&P leaders have the scale to take the risk of major new build projects, in the deregulated power sector new build projects represent major bets

12

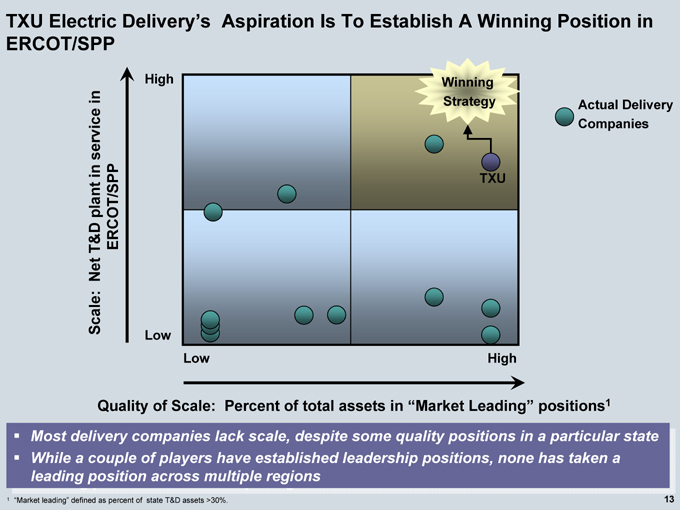

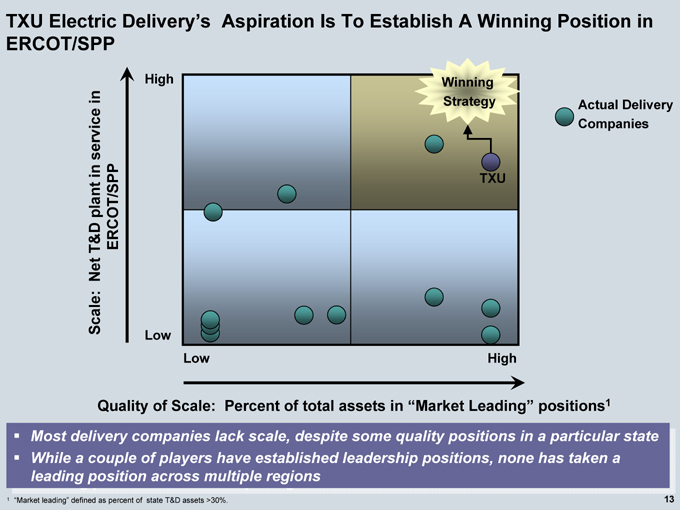

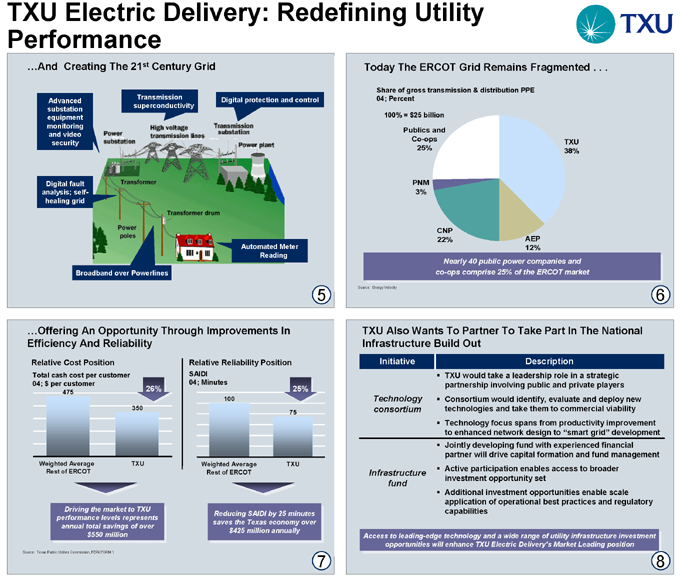

TXU Electric Delivery’s Aspiration Is To Establish A Winning Position in ERCOT/SPP

Scale: Net T&D plant in service in ERCOT/SPP

High

Low

Winning Strategy

TXU

Low

High

Actual Delivery Companies

Quality of Scale: Percent of total assets in “Market Leading” positions1

Most delivery companies lack scale, despite some quality positions in a particular state While a couple of players have established leadership positions, none has taken anone has taken a leading position across multiple regions

1 | | “Market leading” defined as percent of state T&D assets >30%. |

13

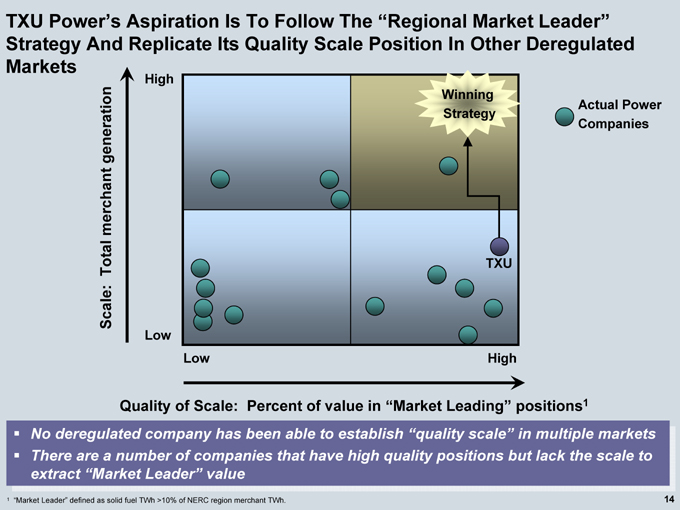

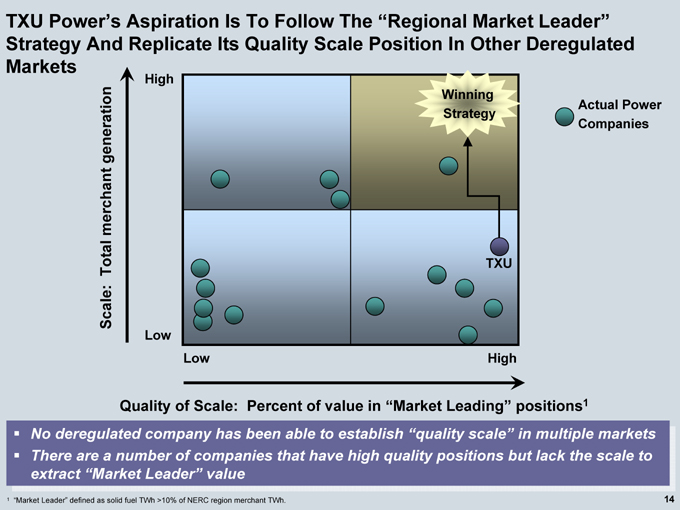

TXU Power’s Aspiration Is To Follow The “Regional Market Leader” Strategy And Replicate Its Quality Scale Position In Other Deregulated

Markets

Scale: Total merchant generation

High

Low

TXU

Winning Strategy

Actual Power Companies

Low

High

Quality of Scale: Percent of value in “Market Leading” positions1

No deregulated company has been able to establish “quality scale” in multiple markets There are a number of companies that have high quality positions but lack the scale to extract “Market Leader” value

1 | | “Market Leader” defined as solid fuel TWh >10% of NERC region merchant TWh. |

14

Today’s Agenda

TXU Today

The TXU Turnaround

Core Strategic Principles

Business Unit Strategies

TXU Power

TXU Retail/Wholesale

TXU Electric Delivery

Risk/Market Outlook

Natural Gas

Heat Rate

Capital Allocation Principles

Financial Principles

Financial Outlook And Growth

Financial Sensitivities

Long-Term Sources And Uses Of Cash

15

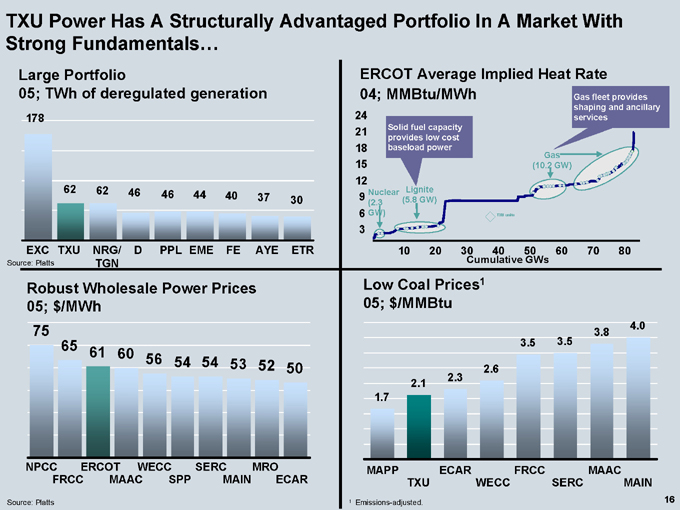

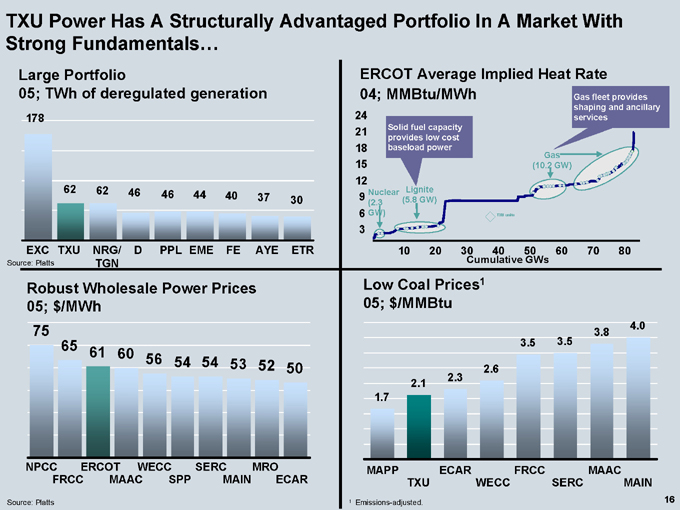

TXU Power Has A Structurally Advantaged Portfolio In A Market With Strong Fundamentals…

Large Portfolio

05; TWh of deregulated generation

178

62

62

46

46

44

40

37

30

EXC

TXU

NRG/ TGN

D

PPL

EME

FE

AYE

ETR

ERCOT Average Implied Heat Rate

04; MMBtu/MWh

24 21 18 15 12 9 6 3

Solid fuel capacity provides low cost baseload power

Gas fleet provides shaping and ancillary services

Nuclear 2.3 GW)

Lignite (5.8 GW)

Gas (10.2 GW)

TXU units

10 20 30 40 50 60 70 80

Robust Wholesale Power Prices 05; $/MWh

75

65

61

60

56

54

54

53

52

50

NPCC

FRCC

ERCOT

MAAC

WECC

SPP

SERC

MAIN

MRO

Source: Platts

Low Coal Prices1 05; $/MMBtu

1.7

2.1

2.3

2.6

3.5

3.5

3.8

4.0

MAPP

TXU

ECAR

WECC

FRCC

SERC

MAAC

MAIN

16

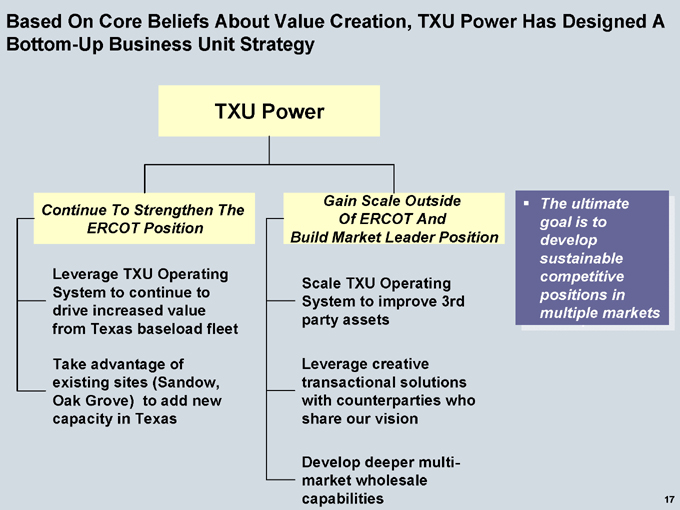

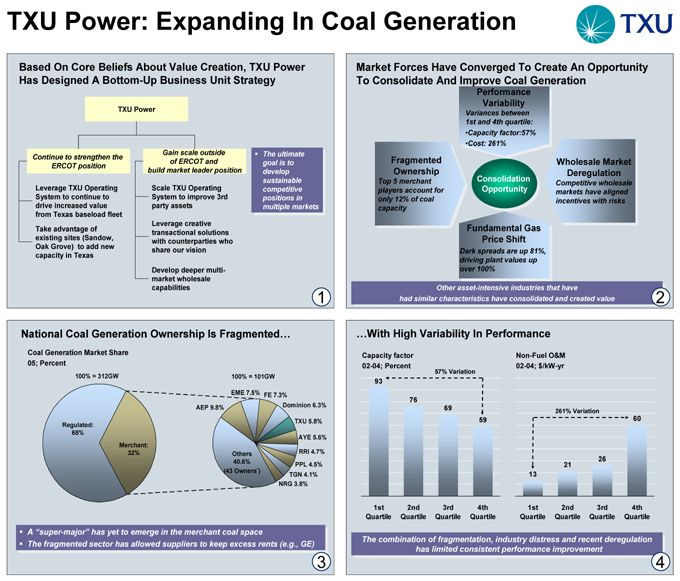

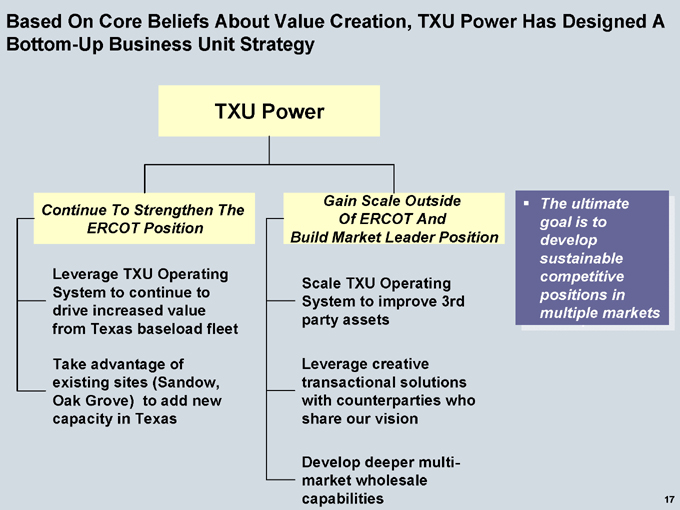

Based On Core Beliefs About Value Creation, TXU Power Has Designed A Bottom-Up Business Unit Strategy

TXU Power

Continue To Strengthen The ERCOT Position

Leverage TXU Operating System to continue to drive increased value from Texas baseload fleet

Take advantage of existing sites (Sandow, Oak Grove) to add new capacity in Texas

Gain Scale Outside Of ERCOT And Build Market Leader Position

Scale TXU Operating System to improve 3rd party assets

Leverage creative transactional solutions with counterparties who share our vision

Develop deeper multi-market wholesale capabilities

The ultimate goal is to develop sustainable competitive positions in multiple markets

17

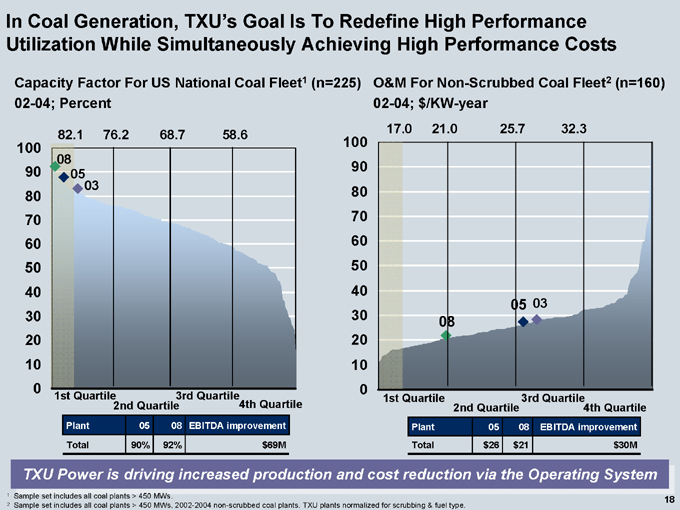

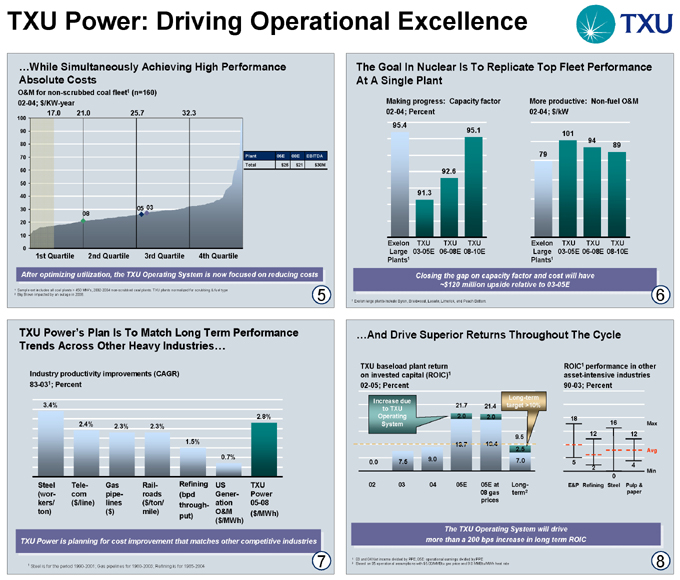

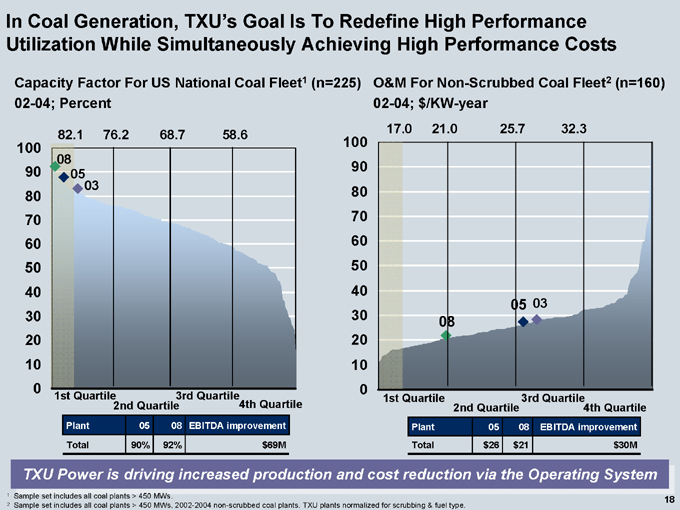

In Coal Generation, TXU’s Goal Is To Redefine High Performance Utilization While Simultaneously Achieving High Performance Costs

Capacity Factor For US National Coal Fleet1 (n=225) 02-04; Percent

82.1 76.2 68.7 58.6

100 90 80 70 60 50 40 30 20 10 0

08 05 03

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

Plant

Total

05

90%

08

92%

EBITDA improvement $69M

O&M For Non-Scrubbed Coal Fleet2 (n=160) 02-04; $/KW-year

17.0 21.0 25.7 32.3

100 90 80 70 60 50 40 30 20 10 0

08

05 03

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

Plant

Total

05 $26

08 $21

EBITDA improvement $30M

TXU Power is driving increased production and cost reduction via the Operating System

1 | | Sample set includes all coal plants > 450 MWs. |

2 Sample set includes all coal plants > 450 MWs, 2002-2004 non-scrubbed coal plants. TXU plants normalized for scrubbing & fuel type.

18

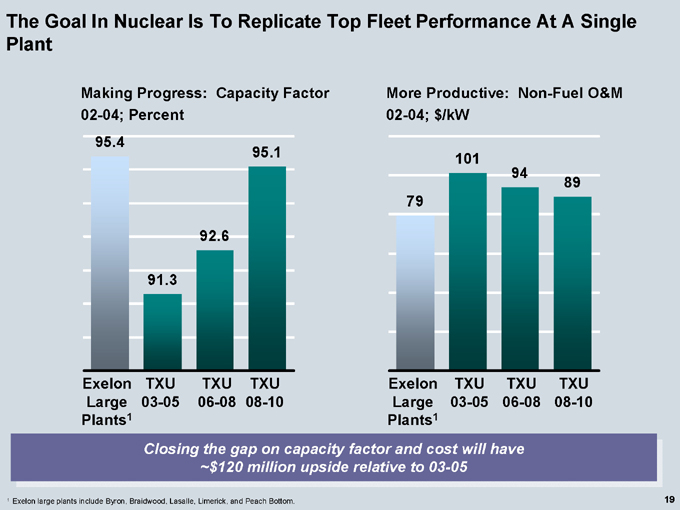

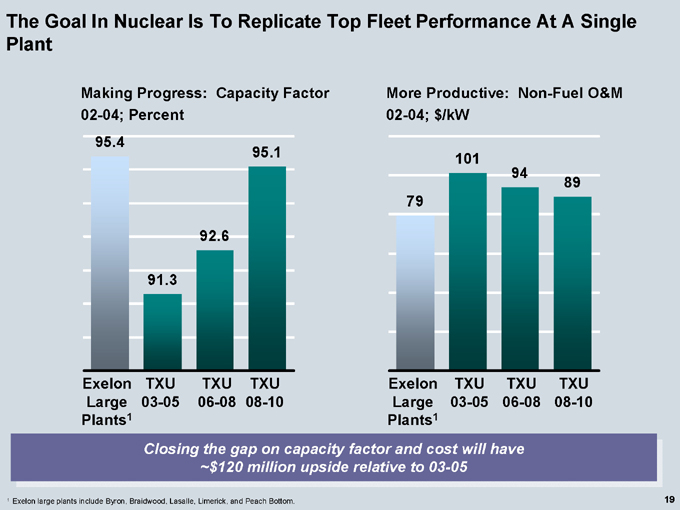

The Goal In Nuclear Is To Replicate Top Fleet Performance At A Single Plant

Making Progress: Capacity Factor 02-04; Percent

95.4

91.3

92.6

95.1

Exelon TXU TXU TXU Large 03-05 06-08 08-10 Plants1

More Productive: Non-Fuel O&M 02-04; $/kW

79

101

94

89

Exelon TXU TXU TXU Large 03-05 06-08 08-10 Plants1

Closing the gap on capacity factor and cost will have ~$120 million upside relative to 03-05

1 | | Exelon large plants include Byron, Braidwood, Lasalle, Limerick, and Peach Bottom. |

19

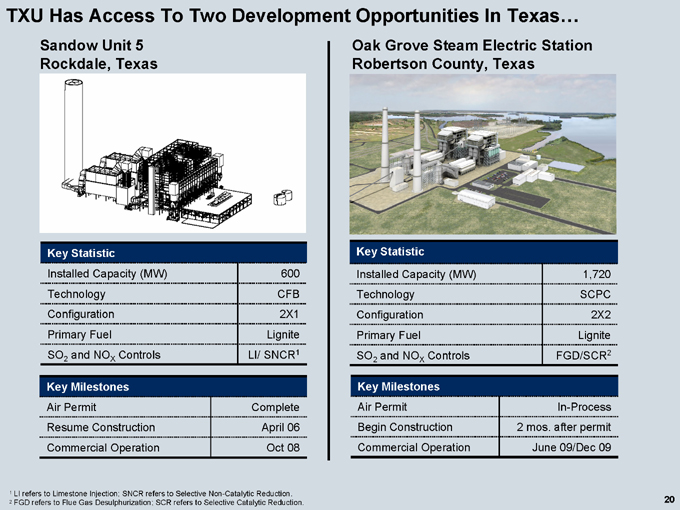

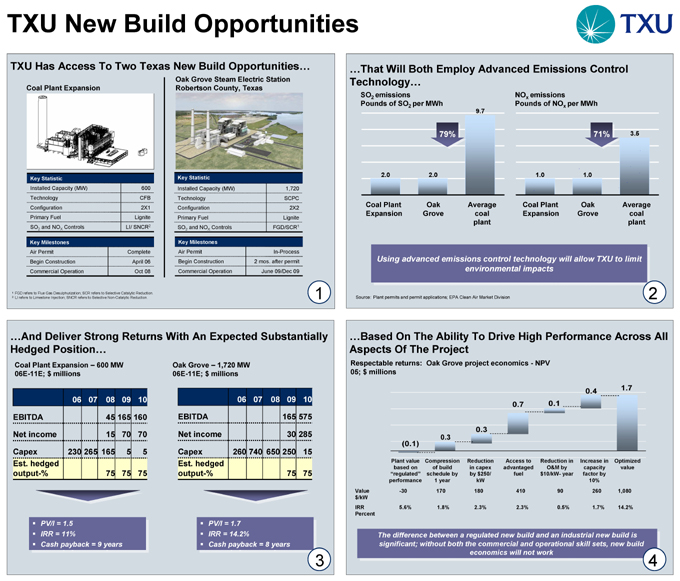

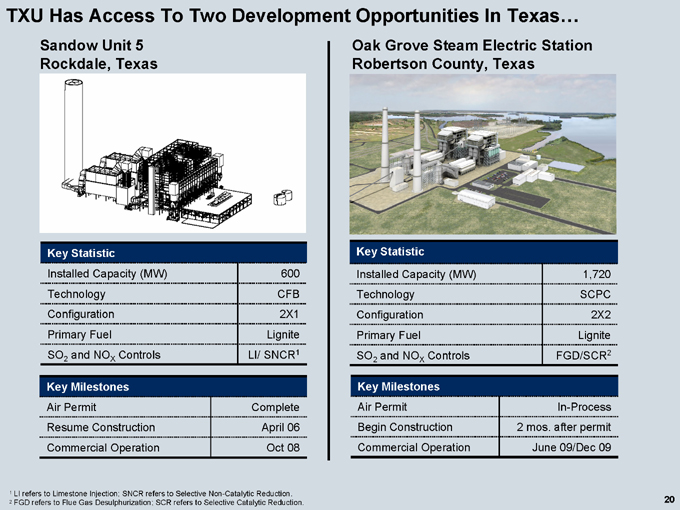

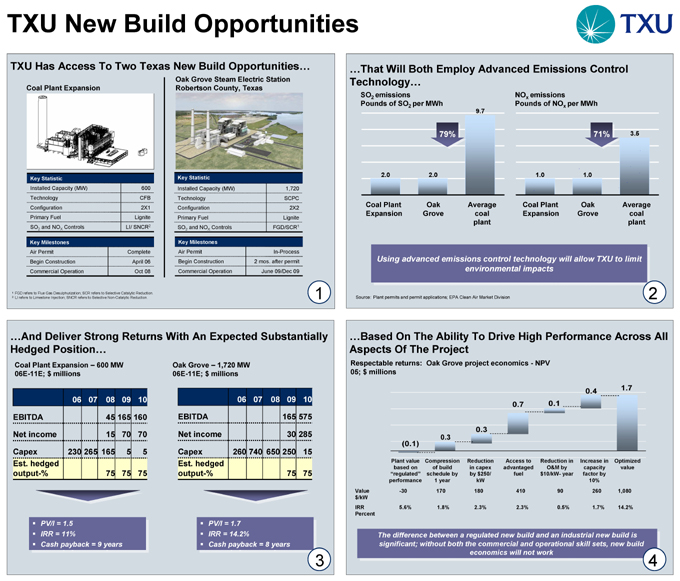

TXU Has Access To Two Development Opportunities In Texas…

Sandow Unit 5 Rockdale, Texas

Key Statistic

Installed Capacity (MW) 600

Technology CFB

Configuration 2X1

Primary Fuel Lignite

SO2 and NOX Controls LI/ SNCR1

Key Milestones

Air Permit Complete

Resume Construction April 06

Commercial Operation Oct 08

Oak Grove Steam Electric Station Robertson County, Texas

Key Statistic

Installed Capacity (MW) 1,720

Technology SCPC

Configuration 2X2

Primary Fuel Lignite

SO2 and NOX Controls FGD/SCR2

Key Milestones

Air Permit In-Process

Begin Construction 2 mos. after permit

Commercial Operation June 09/Dec 09

1 | | LI refers to Limestone Injection; SNCR refers to Selective Non-Catalytic Reduction. |

2 | | FGD refers to Flue Gas Desulphurization; SCR refers to Selective Catalytic Reduction. |

20

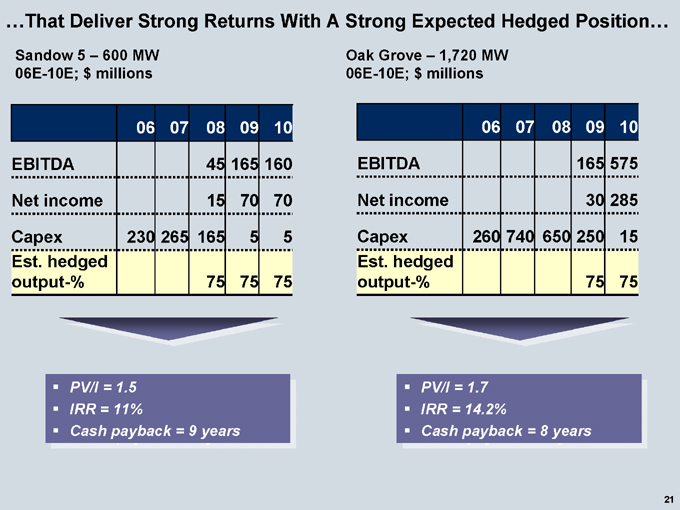

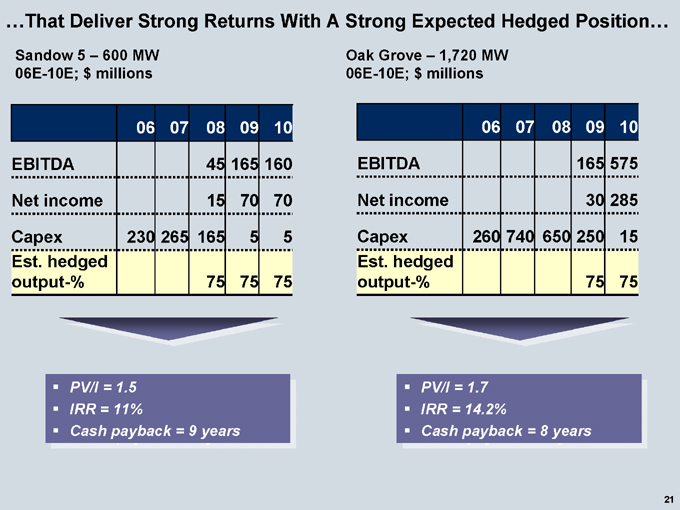

…That Deliver Strong Returns With A Strong Expected Hedged Position…

Sandow 5 – 600 MW 06E-10E; $ millions

06 07 08 09 10

EBITDA 45 165 160

Net income 15 70 70

Capex 230 265 165 5 5

Est. hedged

output-% 75 75 75

PV/I = 1.5 IRR = 11%

Cash payback = 9 years

Oak Grove – 1,720 MW 06E-10E; $ millions

06 07 08 09 10

EBITDA 165 575

Net income 30 285

Capex 260 740 650 250 15

Est. hedged

output-% 75 75

PV/I = 1.7 IRR = 14.2%

Cash payback = 8 years

21

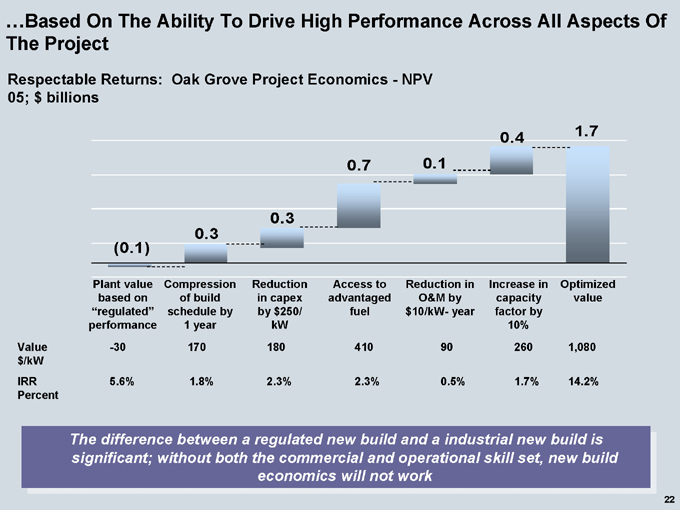

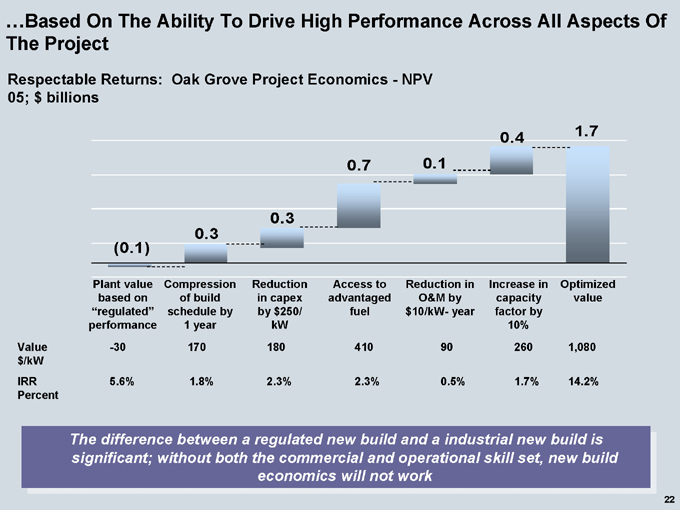

…Based On The Ability To Drive High Performance Across All Aspects Of The Project

Respectable Returns: Oak Grove Project Economics—NPV 05; $ billions

(0.1)

0.3

0.3

0.7

0.1

0.4

1.7

Plant value based on “regulated” performance

Compression of build schedule by 1 year

Reduction in capex by $250/ kW

Access to advantaged fuel

Reduction in O&M by $10/kW- year

Increase in capacity factor by 10%

Optimized value

Value -30 170 180 410 90 260 1,080

$/kW

IRR 5.6% 1.8% 2.3% 2.3% 0.5% 1.7% 14.2%

Percent

The difference between a regulated new build and a industrial new build is significant; without both the commercial and operational skill set, new build economics will not work

22

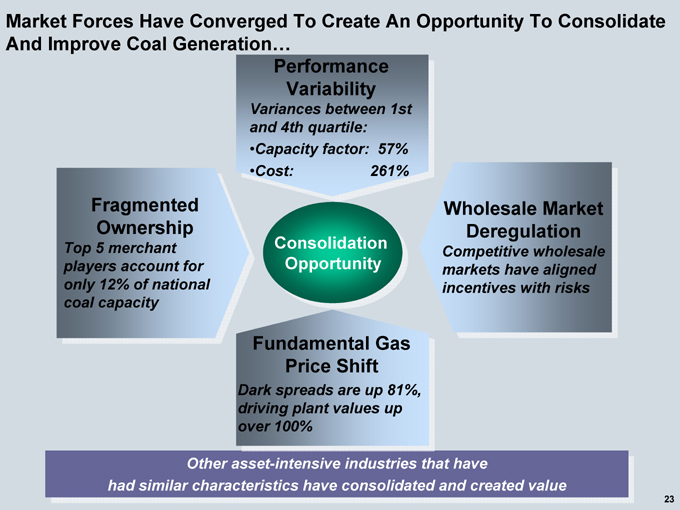

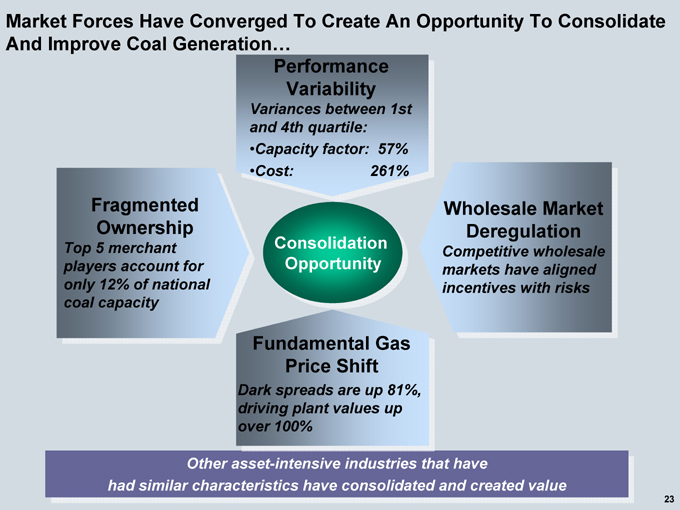

Market Forces Have Converged To Create An Opportunity To Consolidate And Improve Coal Generation…

Performance Variability

Variances between 1st and 4th quartile: Capacity factor: 57% Cost: 261%

Fragmented Ownership

Top 5 merchant players account for only 12% of national coal capacity

Consolidation Opportunity

Fundamental Gas Price Shift

Dark spreads are up 81%, driving plant values up over 100%

Wholesale Market Deregulation

Competitive wholesale markets have aligned incentives with risks

Other asset-intensive industries that have had similar characteristics have consolidated and created value

23

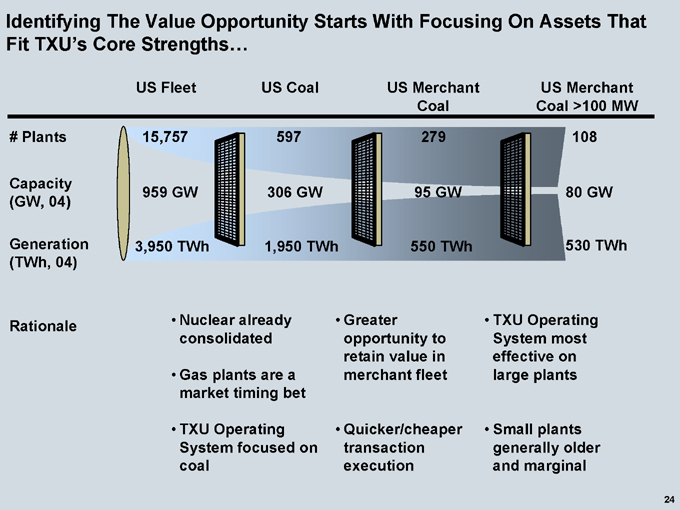

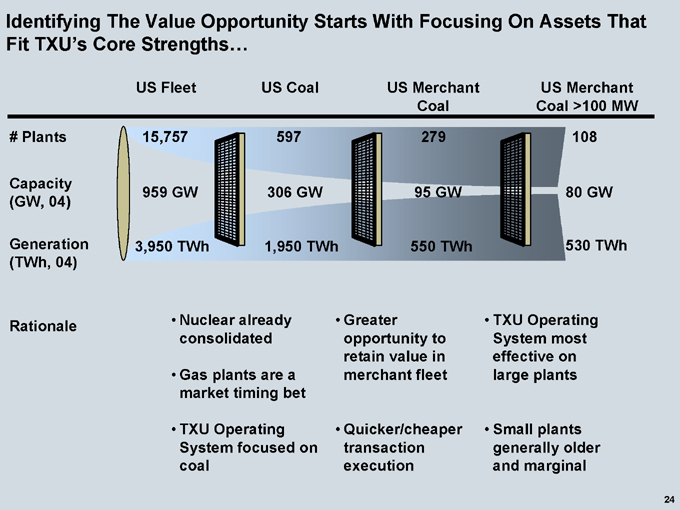

Identifying The Value Opportunity Starts With Focusing On Assets That Fit TXU’s Core Strengths…

US Fleet US Coal US Merchant US Merchant Coal Coal >100 MW

# Plants

Capacity (GW, 04)

Generation (TWh, 04)

959 GW 15,757

3,950 TWh

597 306 GW 1,950 TWh

279 95 GW 550 TWh

108 80 GW 530 TWh

Rationale Nuclear already Greater TXU Operating consolidated opportunity to System most retain value in effective on Gas plants are a merchant fleet large plants market timing bet

• TXU Operating Quicker/cheaper Small plants System focused on transaction generally older coal execution and marginal

24

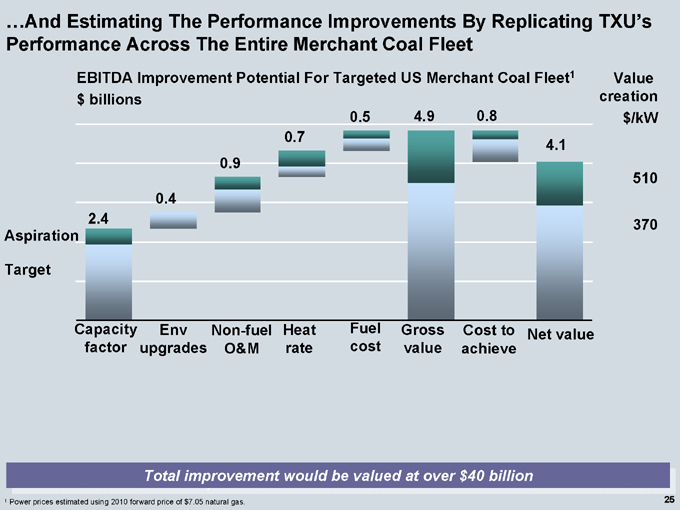

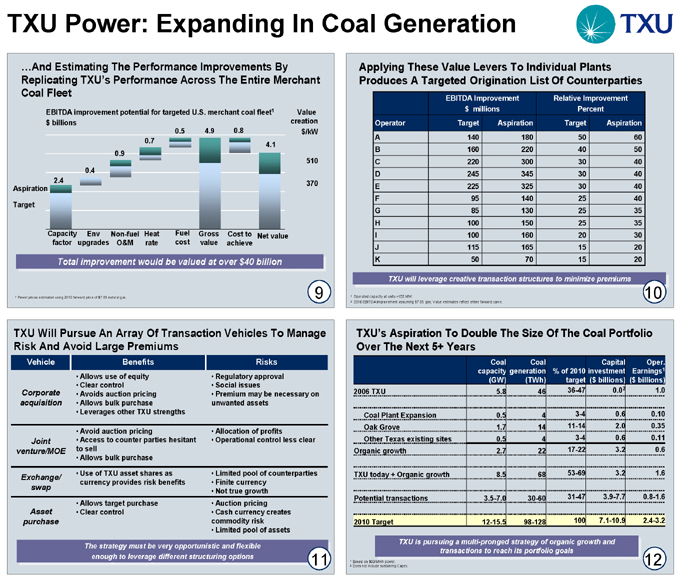

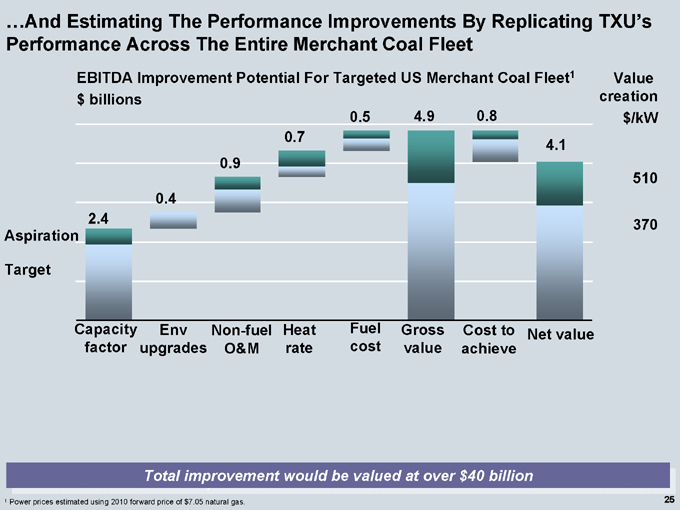

…And Estimating The Performance Improvements By Replicating TXU’s Performance Across The Entire Merchant Coal Fleet

EBITDA Improvement Potential For Targeted US Merchant Coal Fleet1 $ billions

Aspiration

Target

2.4

0.4

0.9

0.7

0.5

4.9

0.8

4.1

Value creation $/kW

510

370

Capacity Env Non-fuel Heat Fuel Gross Cost to Net value factor upgrades O&M rate cost value achieve

Total improvement would be valued at over $40 billion

1 | | Power prices estimated using 2010 forward price of $7.05 natural gas. |

25

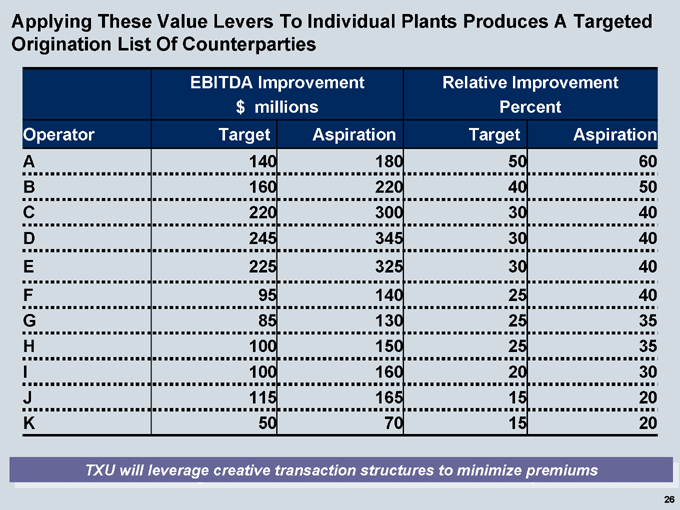

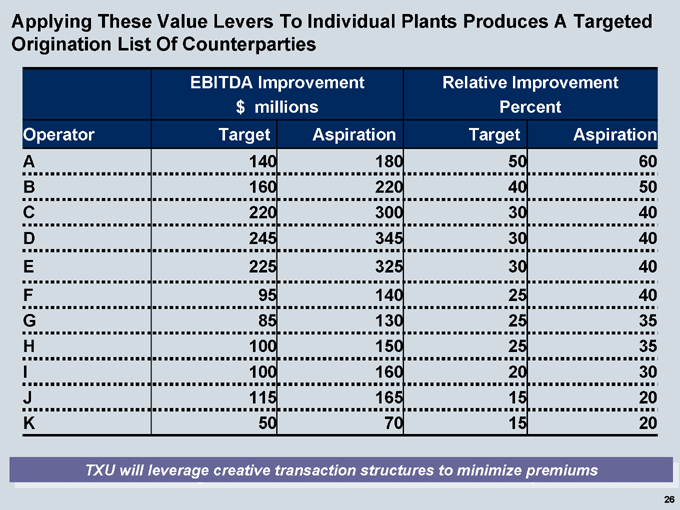

Applying These Value Levers To Individual Plants Produces A Targeted Origination List Of Counterparties

EBITDA Improvement Relative Improvement

$ millions Percent

Operator Target Aspiration Target Aspiration

A 140 180 50 60

B 160 220 40 50

C 220 300 30 40

D 245 345 30 40

E 225 325 30 40

F 95 140 25 40

G 85 130 25 35

H 100 150 25 35

I 100 160 20 30

J 115 165 15 20

K 50 70 15 20

TXU will leverage creative transaction structures to minimize premiums

26

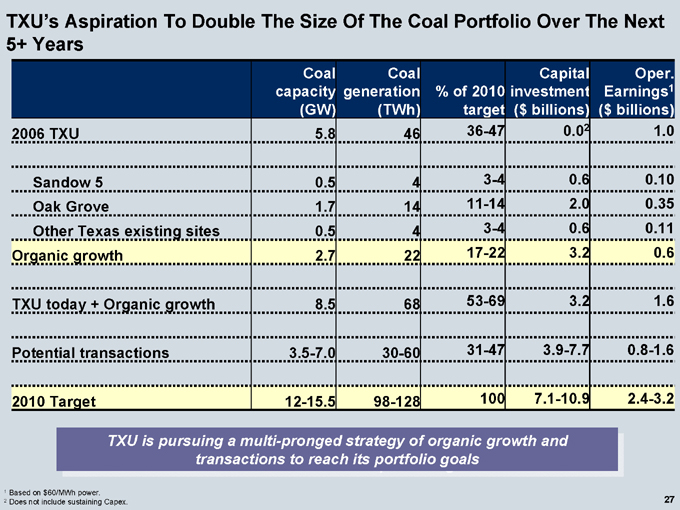

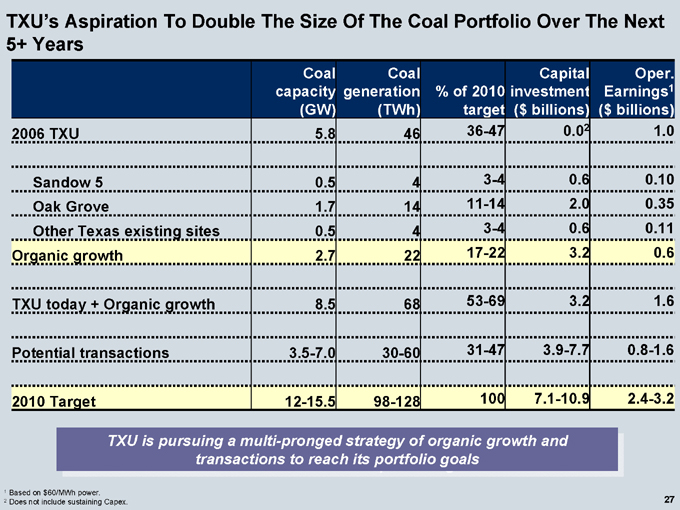

TXU’s Aspiration To Double The Size Of The Coal Portfolio Over The Next 5+ Years

Coal Coal Capital Oper.

capacity generation % of 2010 investment Earnings1

(GW) (TWh) target ($ billions) ($ billions)

2006 TXU 5.8 46 36-47 0.02 1.0

Sandow 5 0.5 4 3-4 0.6 0.10

Oak Grove 1.7 14 11-14 2.0 0.35

Other Texas existing sites 0.5 4 3-4 0.6 0.11

Organic growth 2.7 22 17-22 3.2 0.6

TXU today + Organic growth 8.5 68 53-69 3.2 1.6

Potential transactions 3.5-7.0 30-60 31-47 3.9-7.7 0.8-1.6

2010 Target 12-15.5 98-128 100 7.1-10.9 2.4-3.2

TXU is pursuing a multi-pronged strategy of organic growth and transactions to reach its portfolio goals

1 | | Based on $60/MWh power. |

2 | | Does not include sustaining Capex. |

27

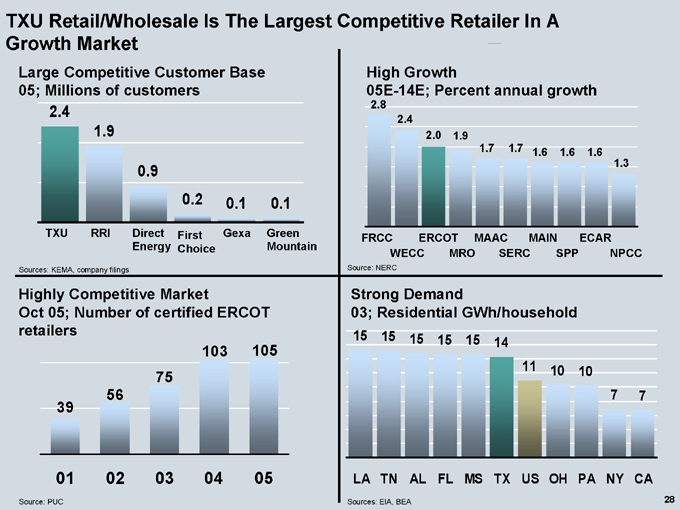

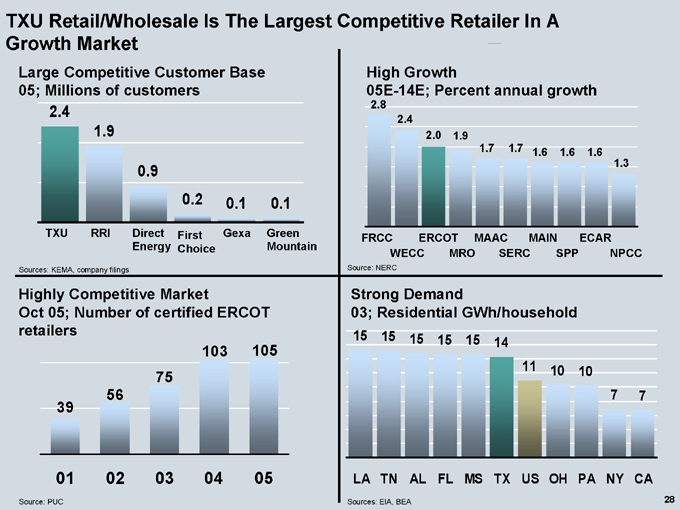

TXU Retail/Wholesale Is The Largest Competitive Retailer In A Growth Market

Large Competitive Customer Base 05; Millions of customers

2.4

1.9

0.9

0.2

0.1

0.1

TXU RRI Direct First Gexa Green Energy Choice Mountain

Sources: KEMA, company filings

Highly Competitive Market

Oct 05; Number of certified ERCOT retailers

39

56

75

103

105

01 02 03 04 05

Source: PUC

High Growth

05E-14E; Percent annual growth

2.8

2.4

2.0 1.9

1.7

1.7

1.6 1.6 1.6

1.3

FRCC ERCOT MAAC MAIN ECAR

WECC MRO SERC SPP NPCC

Source: NERC

Strong Demand

03; Residential GWh/household

15 15 15 15 15 14

11 10 10

LA TN AL FL MS TX US OH PA NY CA

Sources: EIA, BEA

28

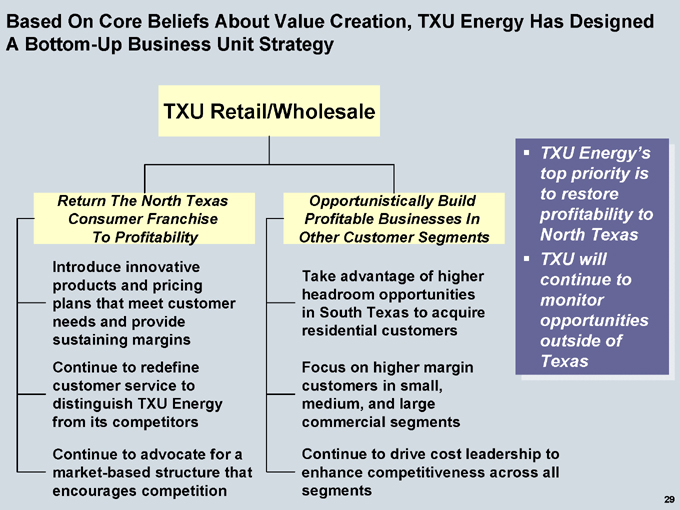

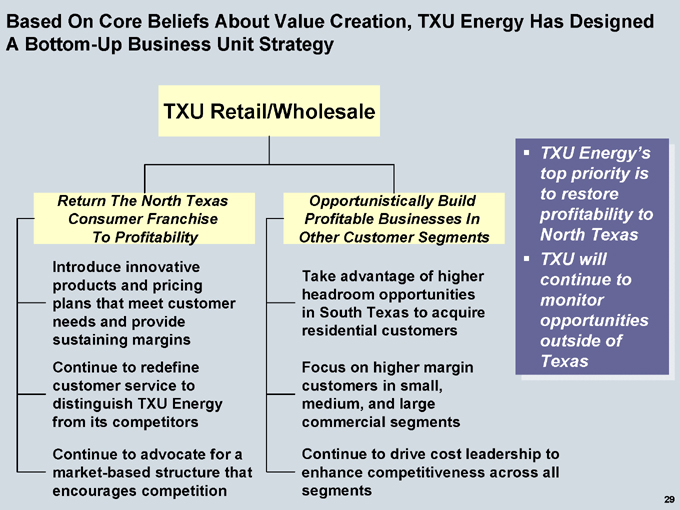

Based On Core Beliefs About Value Creation, TXU Energy Has Designed A Bottom-Up Business Unit Strategy

TXU Retail/Wholesale

Return The North Texas Consumer Franchise To Profitability

Introduce innovative products and pricing plans that meet customer needs and provide sustaining margins

Continue to redefine customer service to distinguish TXU Energy from its competitors

Continue to advocate for a market-based structure that encourages competition

Opportunistically Build Profitable Businesses In Other Customer Segments

Take advantage of higher headroom opportunities in South Texas to acquire residential customers

Focus on higher margin customers in small, medium, and large commercial segments

Continue to drive cost leadership to enhance competitiveness across all segments

TXU Energy’s top priority is to restore profitability to North Texas TXU will continue to monitor opportunities outside of Texas

29

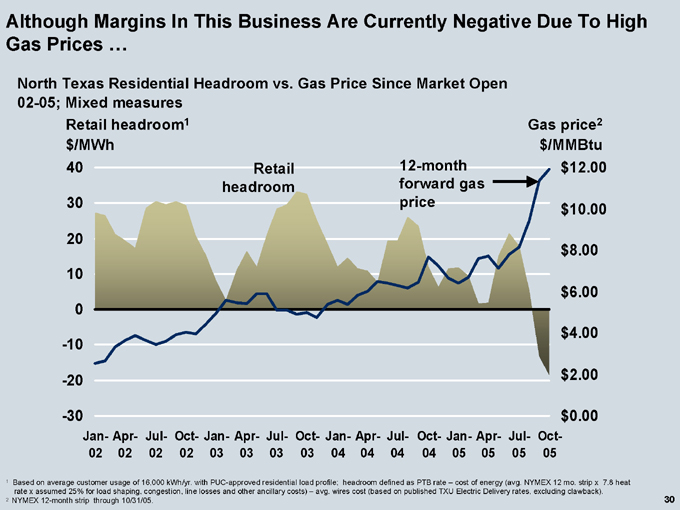

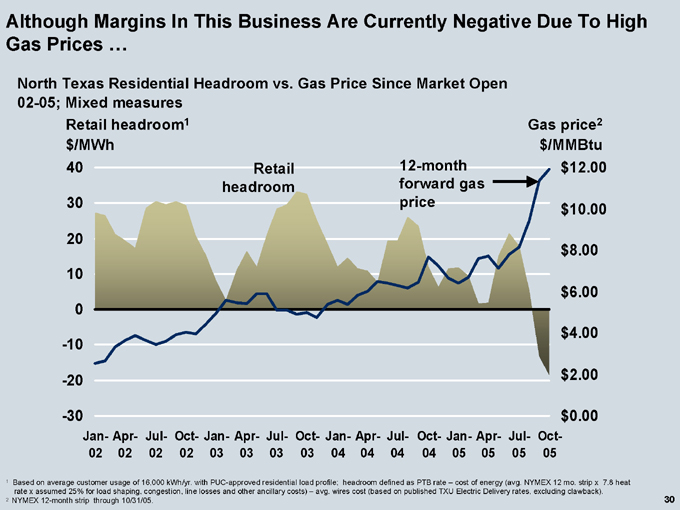

Although Margins In This Business Are Currently Negative Due To High Gas Prices …

North Texas Residential Headroom vs. Gas Price Since Market Open 02-05; Mixed measures

Retail headroom1 $/MWh

40 30 20 10 0 -10 -20 -30

Retail headroom

12-month forward gas price

Gas price2 $/MMBtu $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $0.00

Jan- Apr- Jul- Oct- Jan- Apr- Jul- Oct- Jan- Apr- Jul- Oct- Jan- Apr- Jul- Oct-

02 02 02 02 03 03 03 03 04 04 04 04 05 05 05 05

1 Based on average customer usage of 16,000 kWh/yr. with PUC-approved residential load profile; headroom defined as PTB rate – cost of energy (avg. NYMEX 12 mo. strip x 7.8 heat rate x assumed 25% for load shaping, congestion, line losses and other ancillary costs) – avg. wires cost (based on published TXU Electric Delivery rates, excluding clawback).

2 | | NYMEX 12-month strip through 10/31/05. |

30

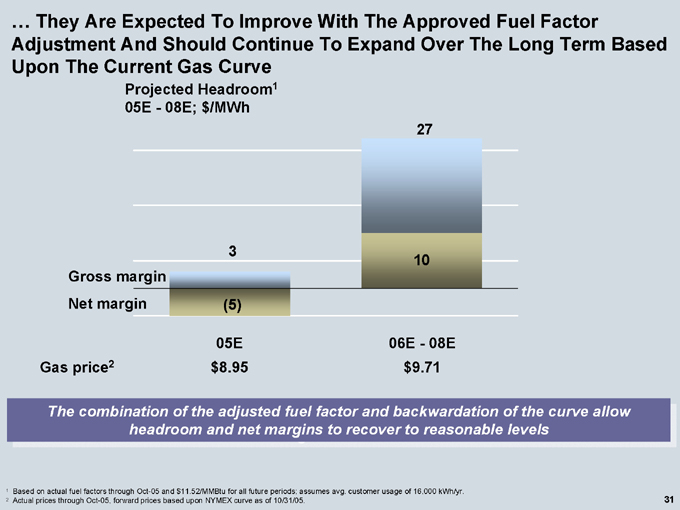

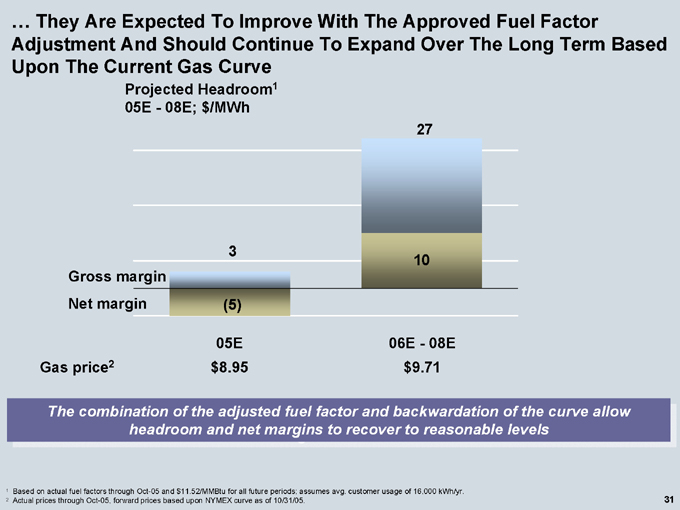

… They Are Expected To Improve With The Approved Fuel Factor Adjustment And Should Continue To Expand Over The Long Term Based Upon The Current Gas Curve

Projected Headroom1 05E—08E; $/MWh

Gross margin Net margin

27

10

Gas price2

05E $8.95

06E—08E $9.71

The combination of the adjusted fuel factor and backwardation of the curve allow headroom and net margins to recover to reasonable levels

1 Based on actual fuel factors through Oct-05 and $11.52/MMBtu for all future periods; assumes avg. customer usage of 16,000 kWh/yr.

2 | | Actual prices through Oct-05, forward prices based upon NYMEX curve as of 10/31/05. |

31

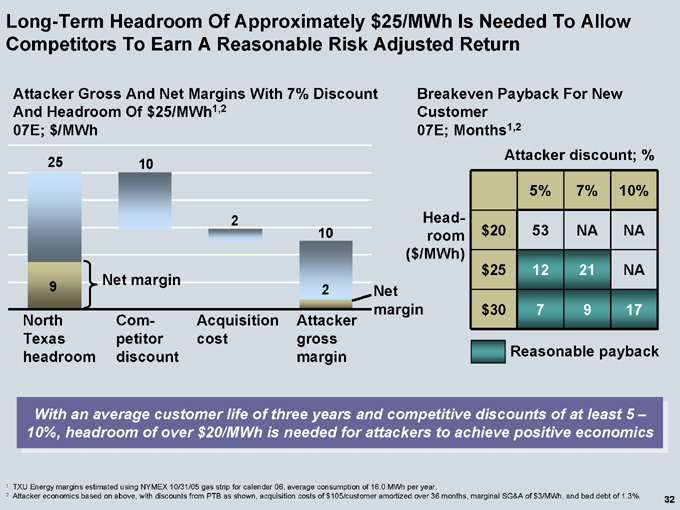

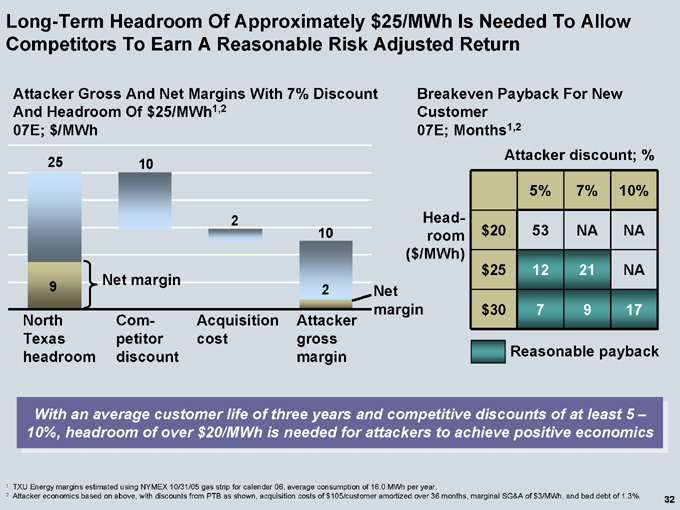

Long-Term Headroom Of Approximately $25/MWh Is Needed To Allow Competitors To Earn A Reasonable Risk Adjusted Return

Attacker Gross And Net Margins With 7% Discount And Headroom Of $25/MWh1,2 07E; $/MWh

25

9

10

10

Net margin

Net margin

North Com- Acquisition Attacker Texas petitor cost gross headroom discount margin

With an average customer life of three years and competitive discounts of at least 5 – 10%, headroom of over $20/MWh is needed for attackers to achieve positive economics

Breakeven Payback For New Customer 07E; Months1,2

Attacker discount; %

Headroom

($ /MWh)

5% 7% 10%

$20 53 NA NA

$25 12 21 NA

$30 7 9 17

Reasonable payback

1 TXU Energy margins estimated using NYMEX 10/31/05 gas strip for calendar 06, average consumption of 16.0 MWh per year.

2 Attacker economics based on above, with discounts from PTB as shown, acquisition costs of $105/customer amortized over 36 months, marginal SG&A of $3/MWh, and bad debt of 1.3%.

32

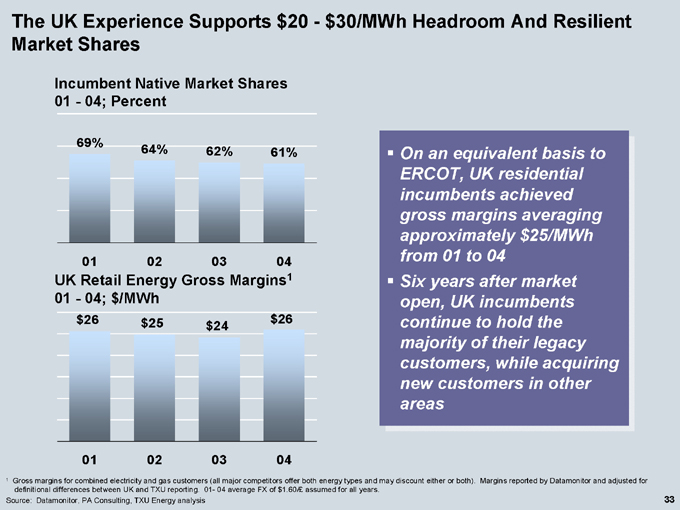

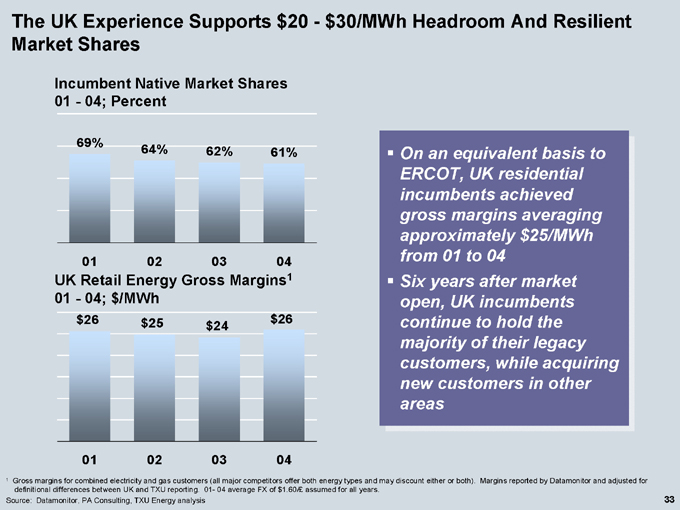

The UK Experience Supports $20—$30/MWh Headroom And Resilient Market Shares

Incumbent Native Market Shares 01—04; Percent

69%

64%

62%

61%

01 02 03 04

UK Retail Energy Gross Margins1 01—04; $/MWh

$26$ 25 $26 $24

01 02 03 04

On an equivalent basis to ERCOT, UK residential incumbents achieved gross margins averaging approximately$25/MWh from 01 to 04

Six years after market open, UK incumbent continue to hold the majority of their legacy customers, while acquiring new customers in other areas

1 Gross margins for combined electricity and gas customers (all major competitors offer both energy types and may discount either or both). Margins reported by Datamonitor and adjusted for definitional differences between UK and TXU reporting. 01- 04 average FX of $1.60/£ assumed for all years.

Source: Datamonitor, PA Consulting, TXU Energy analysis

33

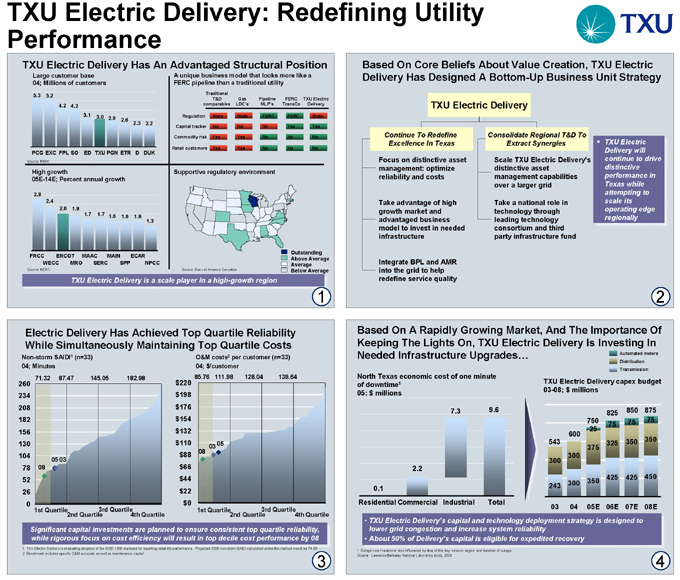

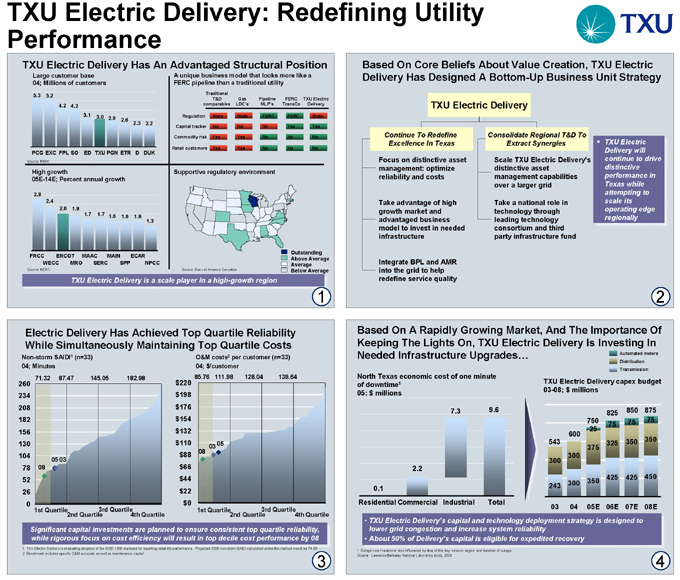

TXU Electric Delivery Has An Advantaged Structural Position…

Size: Large Customer Base 04; Millions of customers

5.3

5.2

4.2

4.2

3.1

3.0

2.9

2.6

2.3

2.2

PCG EXC FPL SO ED TXU PGN ETR D DUK

Source: FERC

Scope: Large Infrastructure

04; Thousands of miles of primary distribution lines

146

105

87

87

69

69

65

63

59

54

TXU

Source: Proprietary benchmarking study

Demand: High Growth

05E-14E; Percent annual growth

2.8

2.4

2.0

1.9

1.7

1.7

1.6

1.6

1.6

1.3

FRCC ERCOT MAAC MAIN ECAR

WECC MRO SERC SPP NPCC

Source: NERC

Supportive Regulatory Environment

Source: Banc of America Securities Research

Outstanding Above Average Average Below Average

TXU Electric Delivery is a scale player in a high-growth region

34

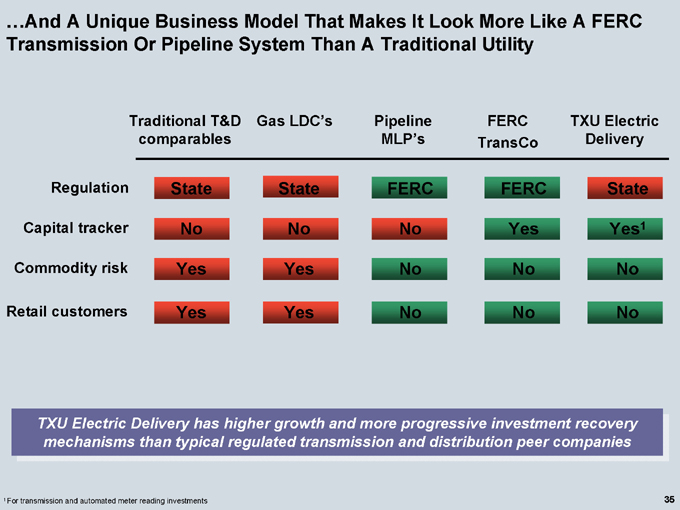

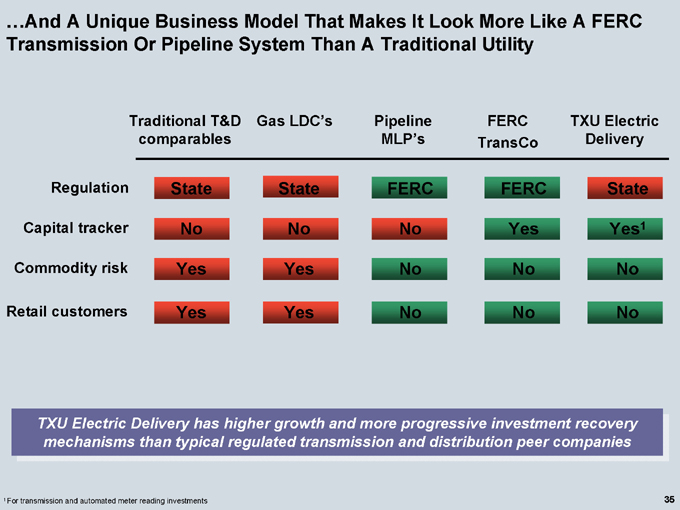

…And A Unique Business Model That Makes It Look More Like A FERC Transmission Or Pipeline System Than A Traditional Utility

Traditional T&D Gas LDC’s Pipeline FERC TXU Electric comparables MLP’s TransCo Delivery

Regulation Capital tracker Commodity risk

Retail customers

State State FERC FERC State

No No No Yes Yes1

Yes Yes No No No

Yes Yes No No No

TXU Electric Delivery has higher growth and more progressive investment recovery mechanisms than typical regulated transmission and distribution peer companies

1 | | For transmission and automated meter reading investments |

35

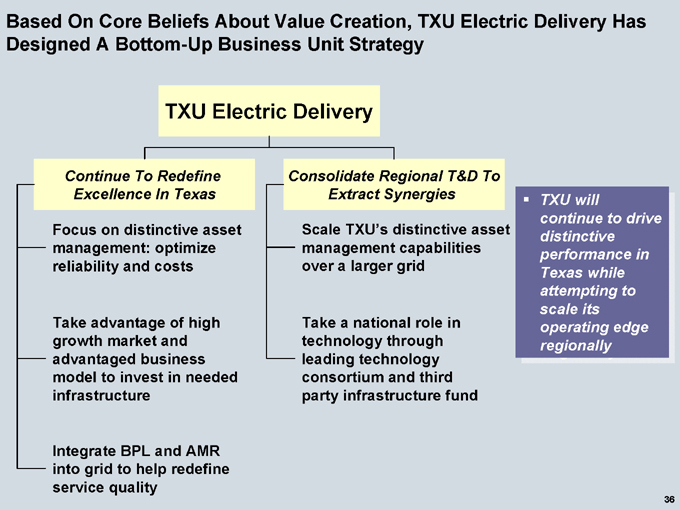

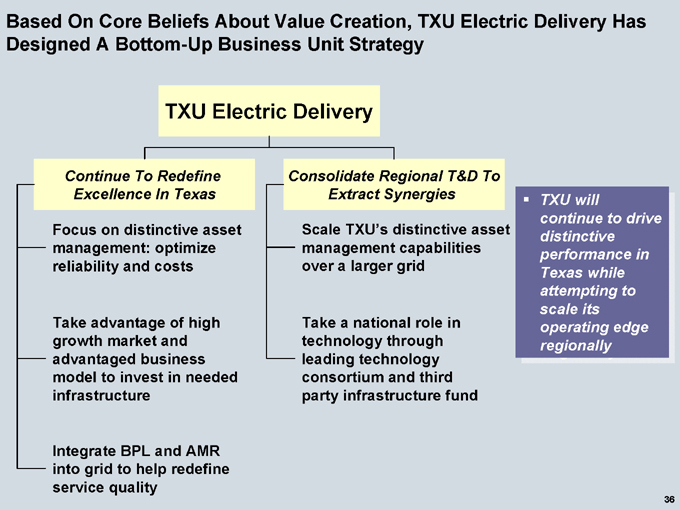

Based On Core Beliefs About Value Creation, TXU Electric Delivery Has Designed A Bottom-Up Business Unit Strategy

TXU Electric Delivery

Continue To Redefine Excellence In Texas

Focus on distinctive asset management: optimize reliability and costs

Take advantage of high growth market and advantaged business model to invest in needed infrastructure

Integrate BPL and AMR into grid to help redefine service quality

Consolidate Regional T&D To Extract Synergies

Scale TXU’s distinctive asset management capabilities over a larger grid

Take a national role in technology through leading technology consortium and third party infrastructure fund

TXU will continue to drive distinctive performance in Texas while attempting to scale its operating edge regionally

36

TXU Electric Delivery Has Achieved Top Quartile Reliability While Simultaneously Maintaining Top Quartile Costs

Non-Storm SAIDI1 (n=33) 04; Minutes

260 234 208 182 156 130 104 78 52 26 0

71.3 87.5 145.1 183.0

08

05 03

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

O&M Costs2 Per Customer (n=33) 04; $/customer $220 $198 $176 $154 $132 $110 $88 $66 $44 $22 $0

85.8 112.0 128.0 139.6

08

03 05

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

Significant capital investments are planned to ensure consistent top quartile reliability, while rigorous focus on cost efficiency will result in top decile cost performance by 08

1 TXU Electric Delivery is evaluating adoption of the IEEE 1366 standard for reporting reliability performance. Projected 2008 non-storm SAIDI calculated under this method would be 74.59.2.

2 | | Benchmark includes specific O&M accounts as well as maintenance capital. |

37

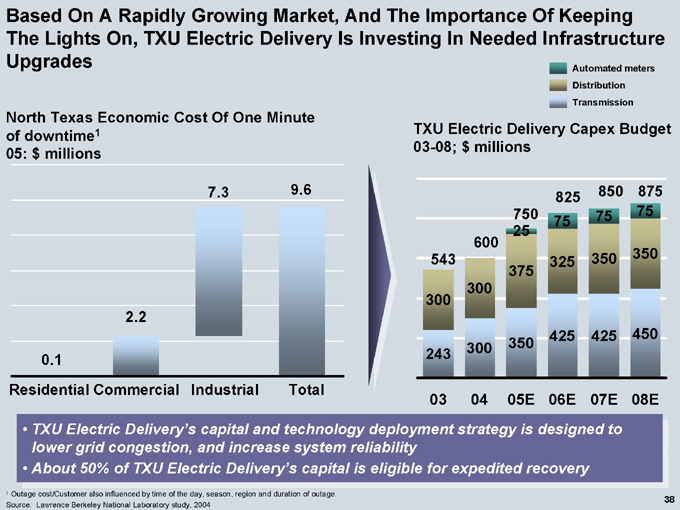

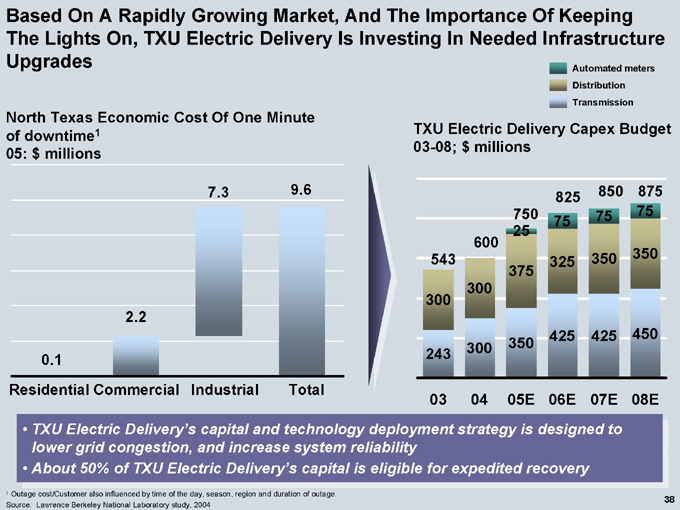

Based On A Rapidly Growing Market, And The Importance Of Keeping The Lights On, TXU Electric Delivery Is Investing In Needed Infrastructure

Upgrades

Automated meters Distribution Transmission

North Texas Economic Cost Of One Minute of downtime1 05: $ millions

0.1

2.2

7.3

9.6

Residential Commercial Industrial Total

TXU Electric Delivery Capex Budget 03-08; $ millions

543

300

243

600

300

300

750 25

375

350

825

75

325

425

850

75

350

425

875

75

350

450

03 04 05E 06E 07E 08E

TXU Electric Delivery’s capital and technology deployment strategy is designed to lower grid congestion, and increase system reliability lower grid congestion, and increase system reliability About 50% of TXU Electric Delivery’s capital is eligible for expedited recovery

1 | | Outage cost/Customer also influenced by time of the day, season, region and duration of outage. |

Source: Lawrence Berkeley National Laboratory study, 2004

38

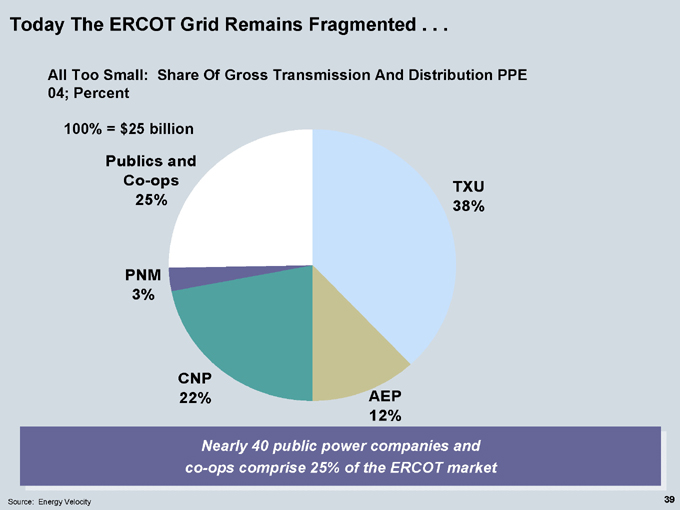

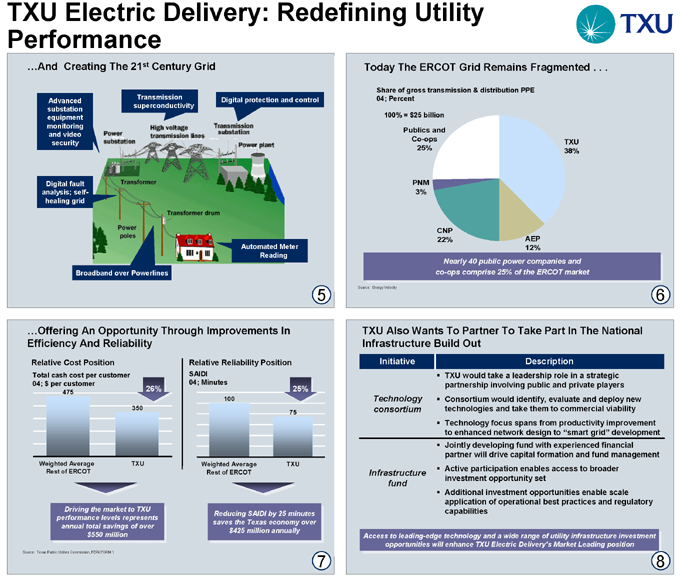

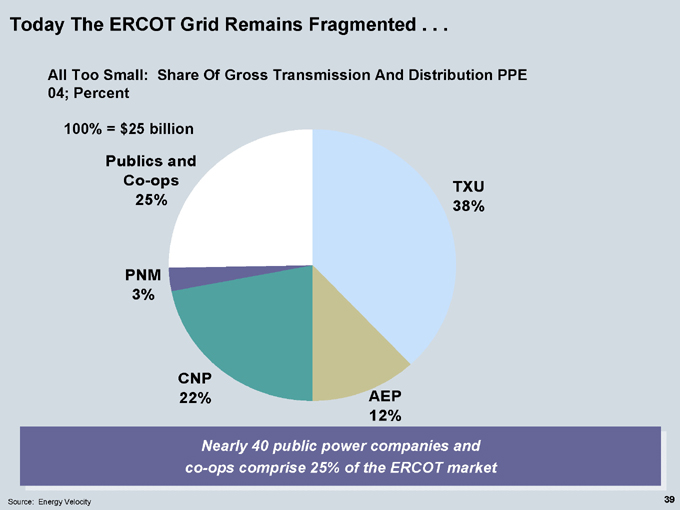

Today The ERCOT Grid Remains Fragmented . . .

All Too Small: Share Of Gross Transmission And Distribution PPE 04; Percent

100% = $25 billion

Publics and Co-ops 25%

PNM 3%

CNP 22%

TXU 38%

AEP 12%

Nearly 40 public power companies and co-ops comprise 25% of the ERCOT market

Source: Energy Velocity

39

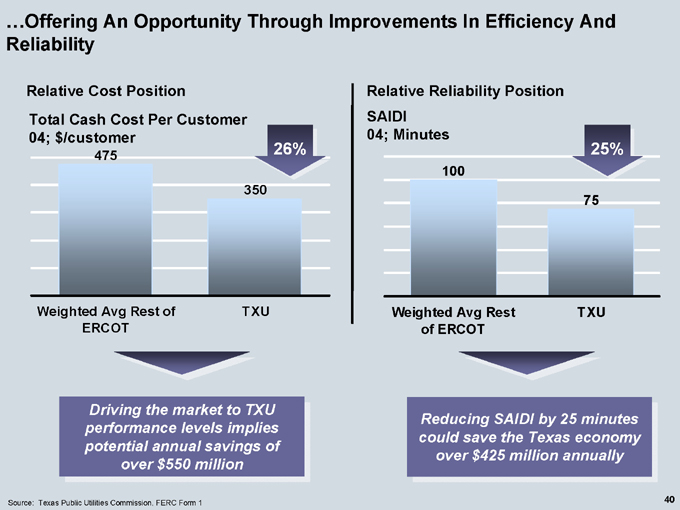

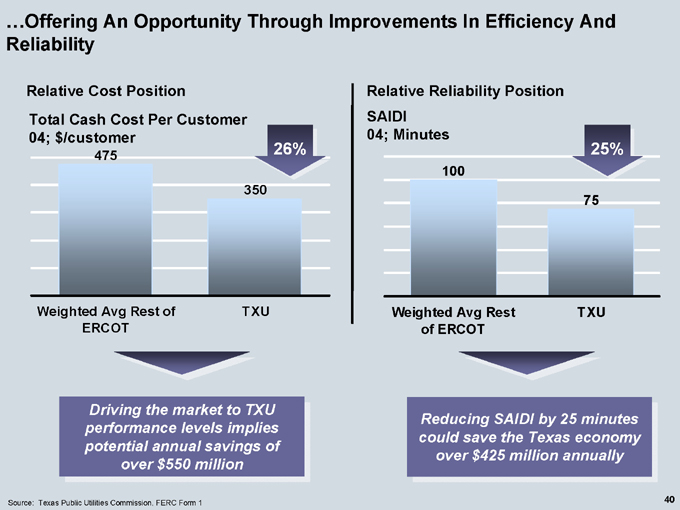

…Offering An Opportunity Through Improvements In Efficiency And Reliability

Relative Cost Position

Total Cash Cost Per Customer 04; $/customer

475

350

26%

Weighted Avg Rest of ERCOT

TXU

Driving the market to TXU performance levels implies potential annual savings of$550 million

Source: Texas Public Utilities Commission, FERC Form 1

Relative Reliability Position

SAIDI 04; Minutes

100

75

25%

Weighted Avg Rest of ERCOT

TXU

Reducing SAIDI by 25 minutes could save the Texas economy over$425 million annually

40

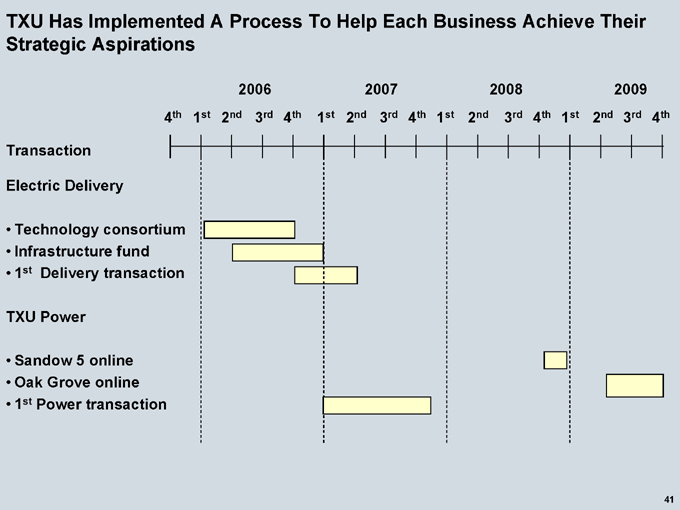

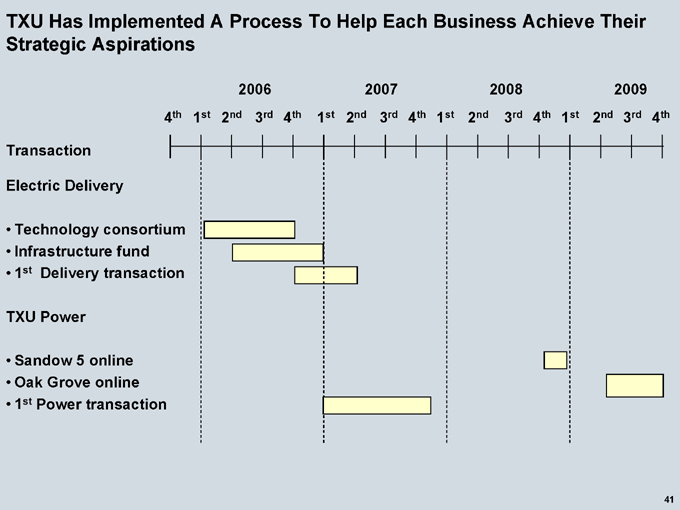

TXU Has Implemented A Process To Help Each Business Achieve Their Strategic Aspirations

2006

2007

2008

2009

4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th 1st 2nd 3rd 4th

Transaction

Electric Delivery

Technology consortium Infrastructure fund 1st Delivery transaction

TXU Power

Sandow 5 online Oak Grove online 1st Power transaction

41

Today’s Agenda

TXU Today

Business Unit Strategies

Risk/Market Outlook

Financial Principles

The TXU Turnaround Core Strategic Principles

TXU Power

TXU Retail/Wholesale TXU Electric Delivery

Natural Gas Heat Rate

Capital Allocation Principles

Financial Outlook And Growth Financial Sensitivities

Long-Term Sources And Uses Of Cash

42

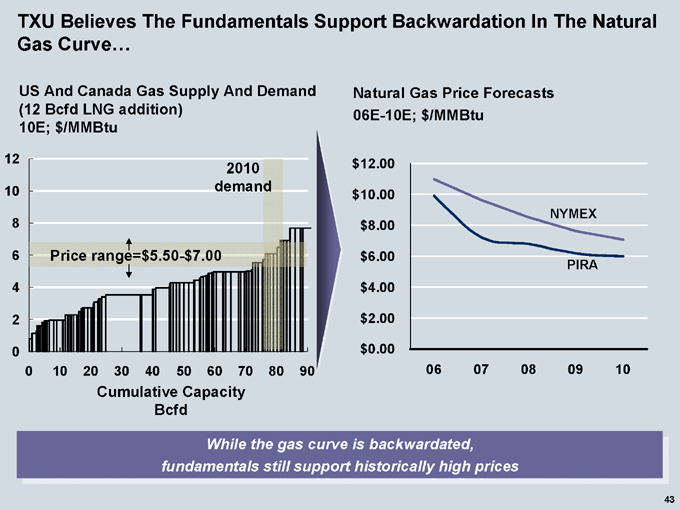

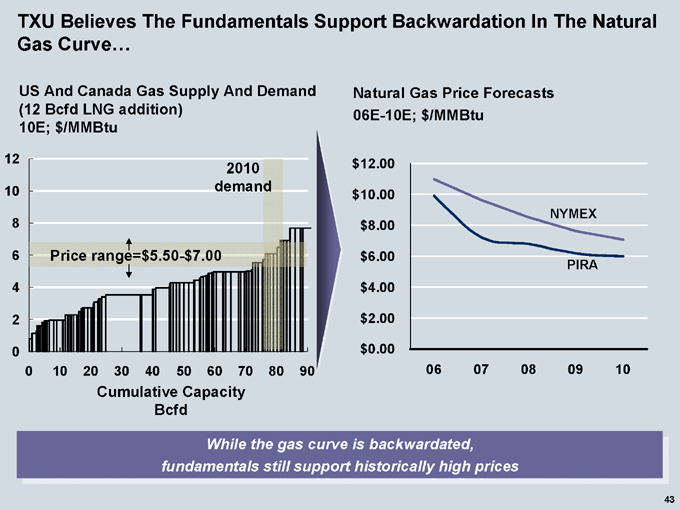

TXU Believes The Fundamentals Support Backwardation In The Natural Gas Curve…

US And Canada Gas Supply And Demand (12 Bcfd LNG addition) 10E; $/MMBtu

12 10 8 6 4 2 0

2010 demand

Price range=$5.50-$7.00

0 10 20 30 40 50 60 70 80 90

Cumulative Capacity Bcfd

Natural Gas Price Forecasts 06E-10E; $/MMBtu $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $0.00

06 07 08 09 10

NYMEX

PIRA

While the gas curve is backwardated, fundamentals still support historically high prices

43

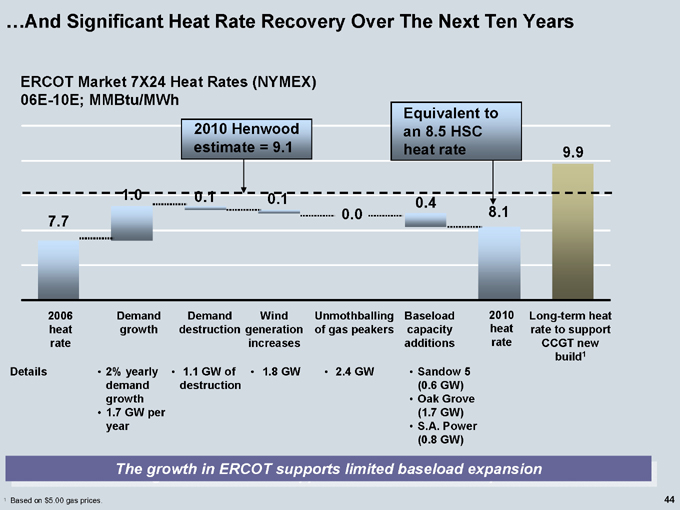

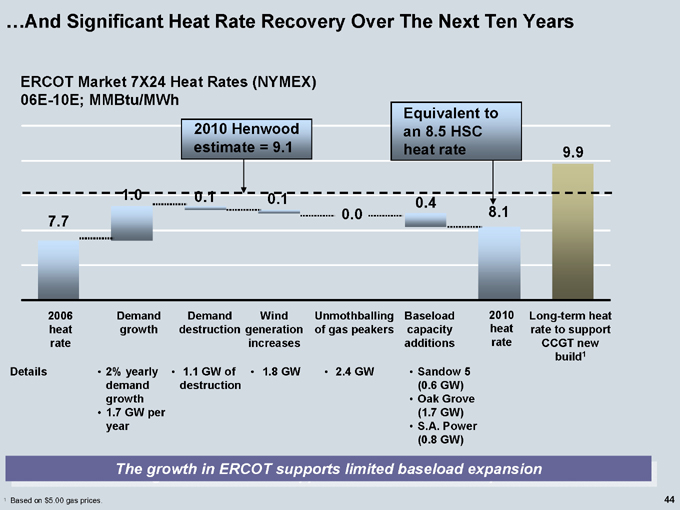

…And Significant Heat Rate Recovery Over The Next Ten Years

ERCOT Market 7X24 Heat Rates (NYMEX) 06E-10E; MMBtu/MWh

2010 Henwood estimate = 9.1

Equivalent to an 8.5 HSC heat rate

7.7

1.0

0.1

0.1

0.0

0.4

8.1

9.9

2006 heat rate

Demand growth

Demand destruction

Wind generation increases

Unmothballing of gas peakers

Baseload capacity additions

2010 heat rate

Long-term heat rate to support CCGT new build1

Details

2% yearly demand growth 1.7 GW per year

1.1 GW of destruction

1.8 GW

2.4 GW

Sandow 5 (0.6 GW) Oak Grove (1.7 GW) S.A. Power (0.8 GW)

The growth in ERCOT supports limited baseload expansion

1 | | Based on $5.00 gas prices. |

44

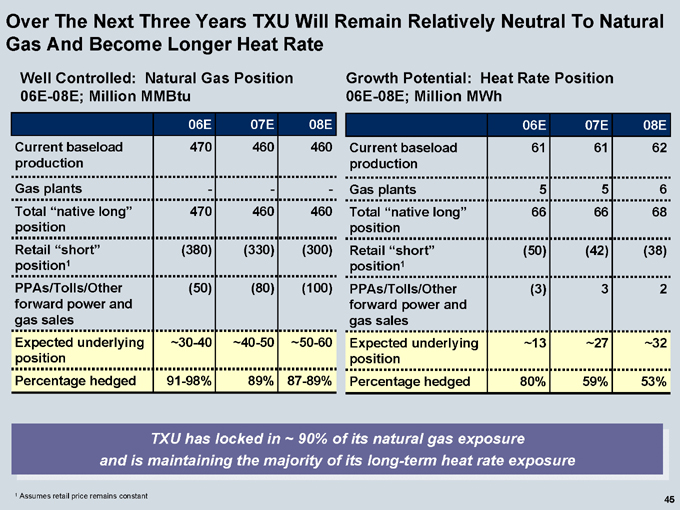

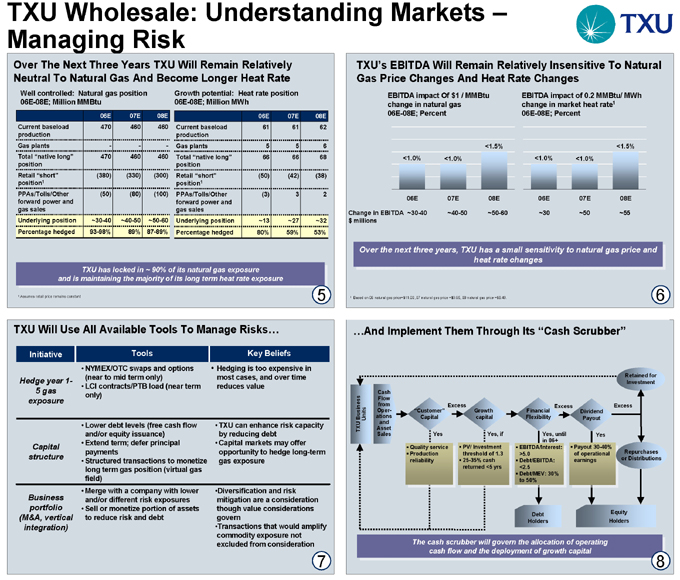

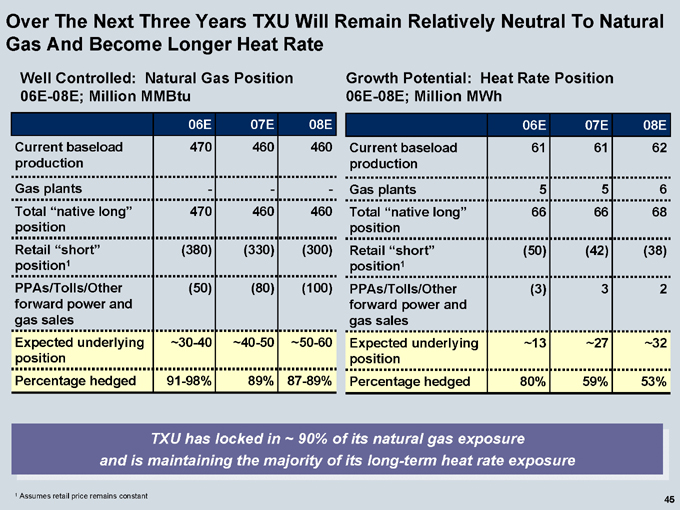

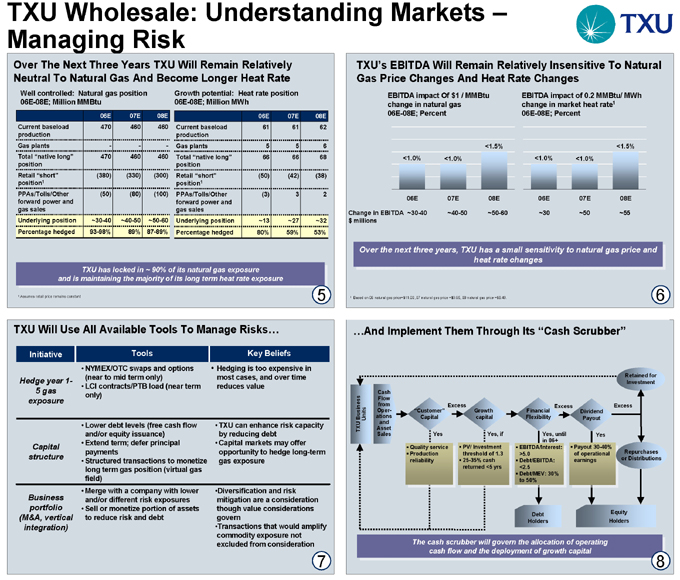

Over The Next Three Years TXU Will Remain Relatively Neutral To Natural Gas And Become Longer Heat Rate

Well Controlled: Natural Gas Position 06E-08E; Million MMBtu

Growth Potential: Heat Rate Position 06E-08E; Million MWh

06E 07E 08E 06E 07E 08E

Current baseload production 470 460 460 Current baseload production 61 61 62

Gas plants ——— Gas plants 5 5 6

Total “native long” position 470 460 460 Total “native long” position 66 66 68

Retail “short” position1 (380) (330) (300) Retail “short” position1 (50) (42) (38)

PPAs/Tolls/Other forward power and gas sales (50) (80) (100) PPAs/Tolls/Other forward power and gas sales (3) 3 2

Expected underlying position ~30-40 ~40-50 ~50-60 Expected underlying position ~13 ~27 ~32

Percentage hedged 91-98% 89% 87-89% Percentage hedged 80% 59% 53%

TXU has locked in ~ 90% of its natural gas exposure and is maintaining the majority of its long-term heat rate exposure

1 | | Assumes retail price remains constant |

45

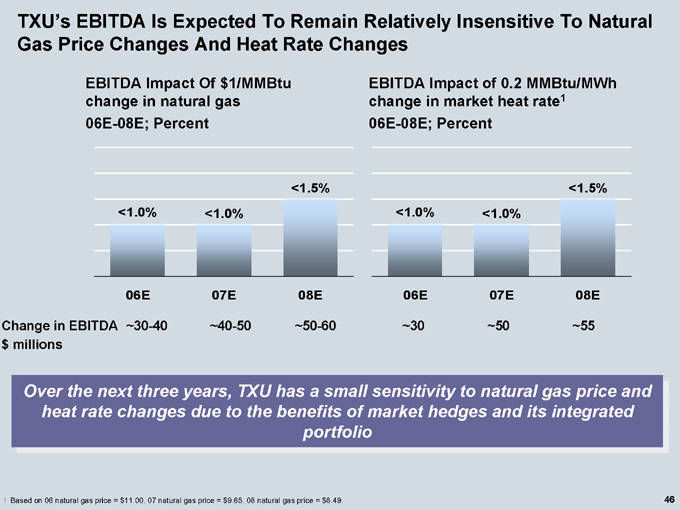

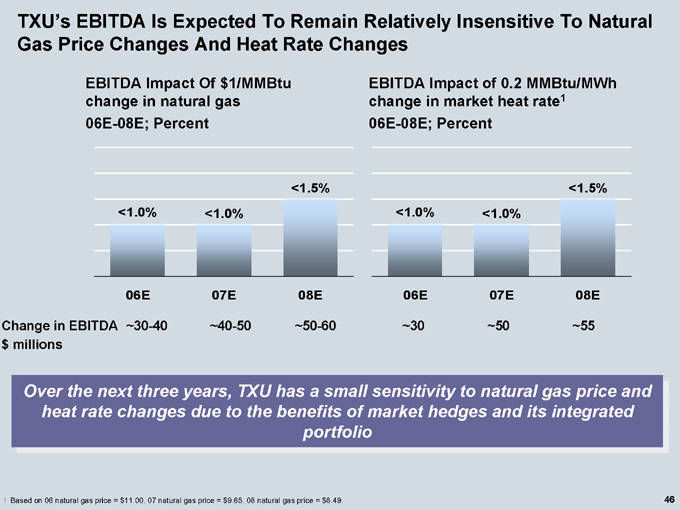

TXU’s EBITDA Is Expected To Remain Relatively Insensitive To Natural Gas Price Changes And Heat Rate Changes

EBITDA Impact Of $1/MMBtu change in natural gas 06E-08E; Percent

EBITDA Impact of 0.2 MMBtu/MWh change in market heat rate1 06E-08E; Percent

<1.0%

<1.0%

<1.5%

<1.0%

<1.0%

<1.5%

06E 07E 08E 06E 07E 08E

Change in EBITDA ~30-40 ~40-50 ~50-60 ~30 ~50 ~55 $ millions

Over the next three years, TXU has a small sensitivity to natural gas price and heat rate changes due to the benefits of market hedges and its integrated portfolio

1 | | Based on 06 natural gas price = $11.00, 07 natural gas price = $9.65, 08 natural gas price = $8.49. |

46

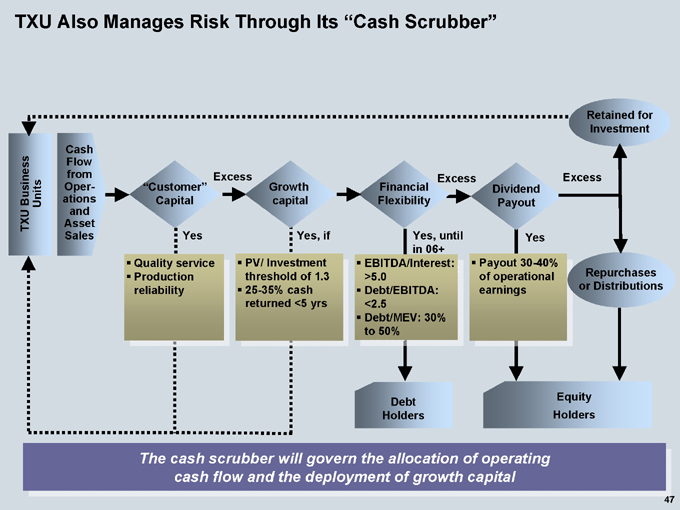

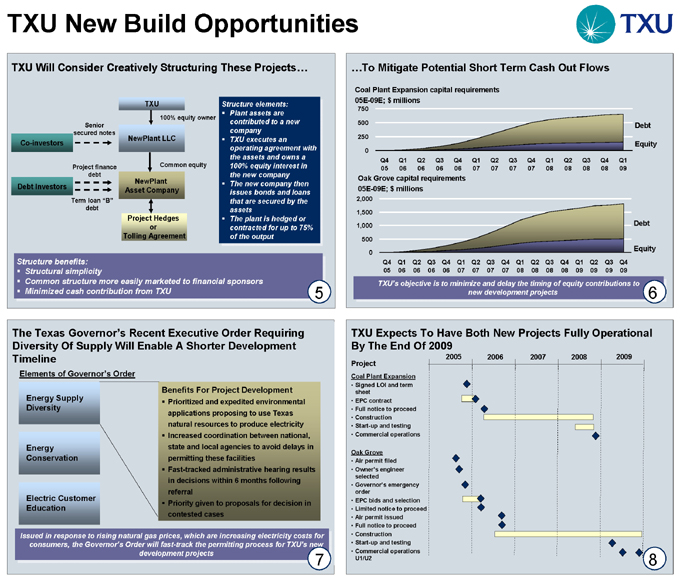

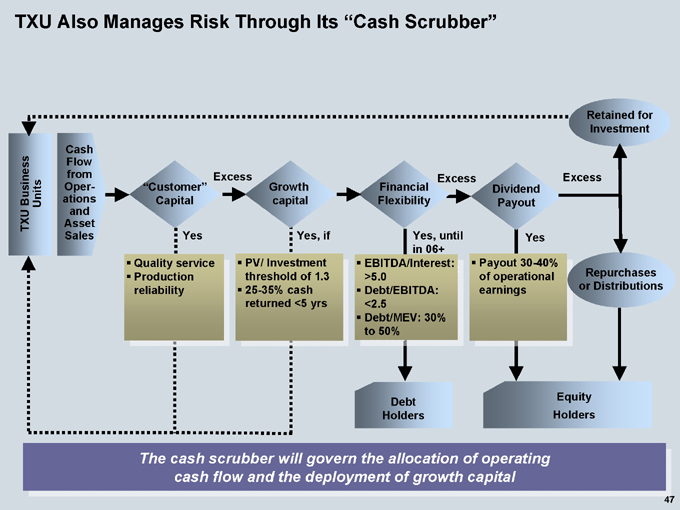

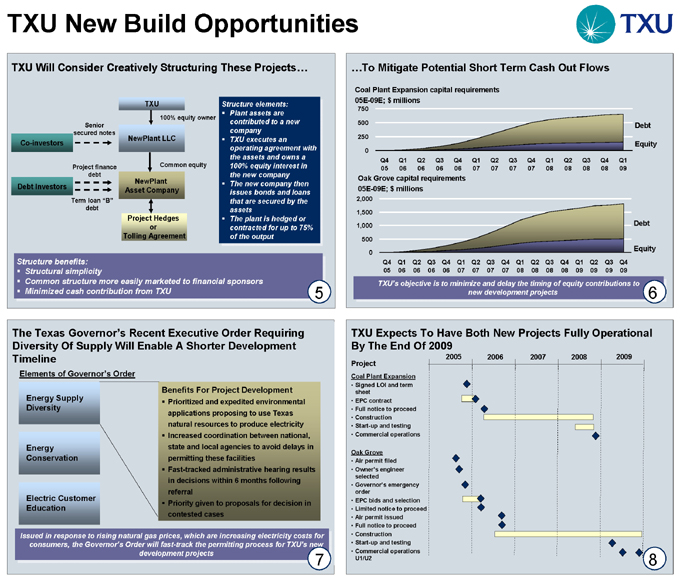

TXU Also Manages Risk Through Its “Cash Scrubber”

TXU Business Units

Cash Flow from Operations and Asset Sales

“Customer” Capital

Excess

Growth capital

Financial Flexibility

Excess

Dividend Payout

Excess

Retained for Investment

Yes

Yes, if

Yes, until in 06+

Yes

Quality service Production reliability

PV/ Investment threshold of 1.3 25-35% cash returned <5 yrs

EBITDA/Interest: >5.0 Debt/EBITDA: <2.5 Debt/MEV: 30% to 50%

Payout 30-40% of operational earnings

Repurchases or Distributions

Debt Holders

Equity Holders

The cash scrubber will govern the allocation of operating cash flow and the deployment of growth capital

47

Today’s Agenda

TXU Today

Business Unit Strategies

Risk/Market Outlook

Financial Principles

The TXU Turnaround Core Strategic Principles

TXU Power

TXU Retail/Wholesale TXU Electric Delivery

Natural Gas Heat Rate

Capital Allocation Principles

Financial Outlook And Growth Financial Sensitivities

Long-Term Sources And Uses Of Cash

48

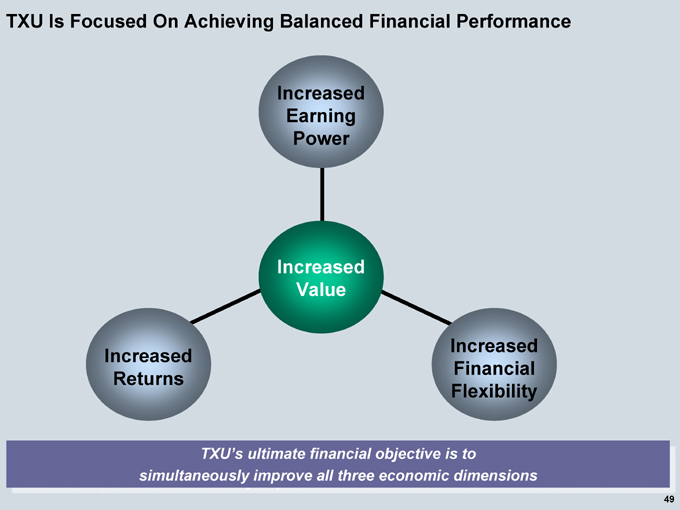

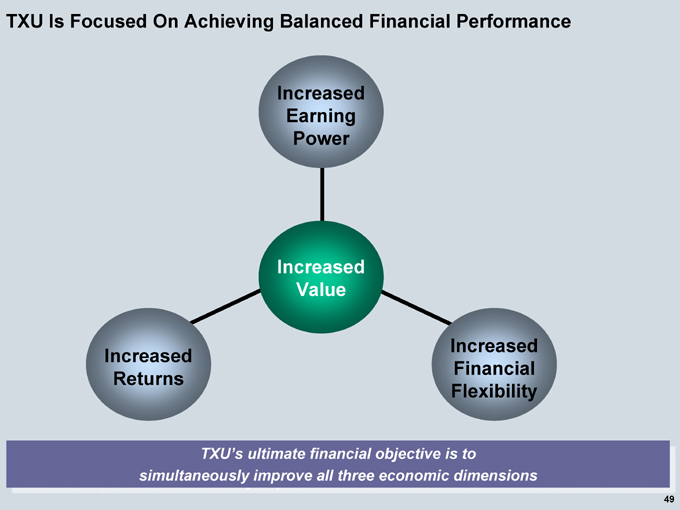

TXU Is Focused On Achieving Balanced Financial Performance

Increased Earning Power

Increased Value

Increased Returns

Increased Financial Flexibility

TXU’s ultimate financial objective is to simultaneously improve all three economic dimensions

49

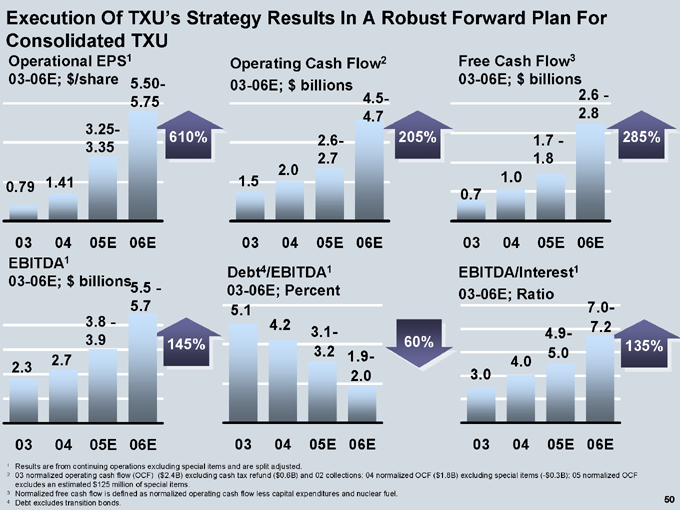

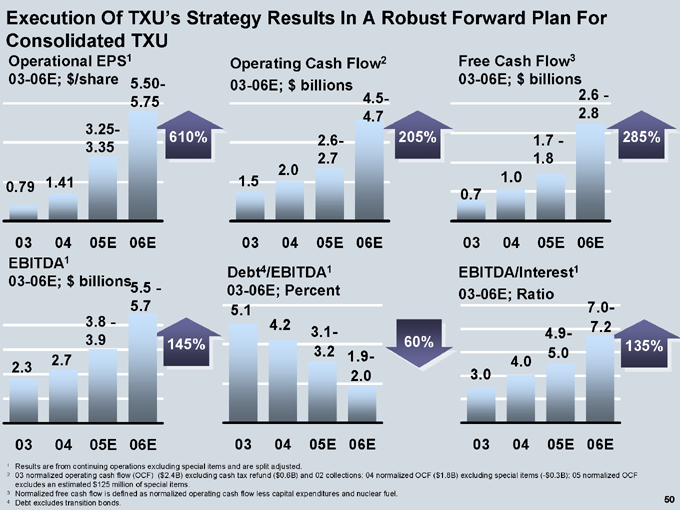

Execution Of TXU’s Strategy Results In A Robust Forward Plan For

Consolidated TXU

Operational EPS1

03-06E; $/share

5.50-5.75

0.79

1.41

3.25-3.35

610%

03 04 05E 06E

EBITDA1

03-06E; $ billions 5.5 -5.7

3.8 -3.9

2.7

2.3

145%

03 04 05E 06E

Operating Cash Flow2

03-06E; $ billions

4.5-4.7

2.6-2.7

2.0

1.5

205%

Free Cash Flow3 03-06E; $ billions

2.6 -2.8

1.7 -1.8

1.0

0.7

285%

03 04 05E 06E

03 04 05E 06E

Debt4/EBITDA1 03-06E; Percent

5.1

4.2

3.1-3.2

1.9-2.0

60%

03 04 05E 06E

EBITDA/Interest1 03-06E; Ratio

7.0-7.2

4.9-5.0

4.0

3.0

135%

03 04 05E 06E

1 | | Results are from continuing operations excluding special items and are split adjusted. |

2 03 normalized operating cash flow (OCF) ($2.4B) excluding cash tax refund ($0.6B) and 02 collections; 04 normalized OCF ($1.8B) excluding special items (-$0.3B); 05 normalized OCF excludes an estimated $125 million of special items.

3 | | Normalized free cash flow is defined as normalized operating cash flow less capital expenditures and nuclear fuel. |

4 | | Debt excludes transition bonds. |

50

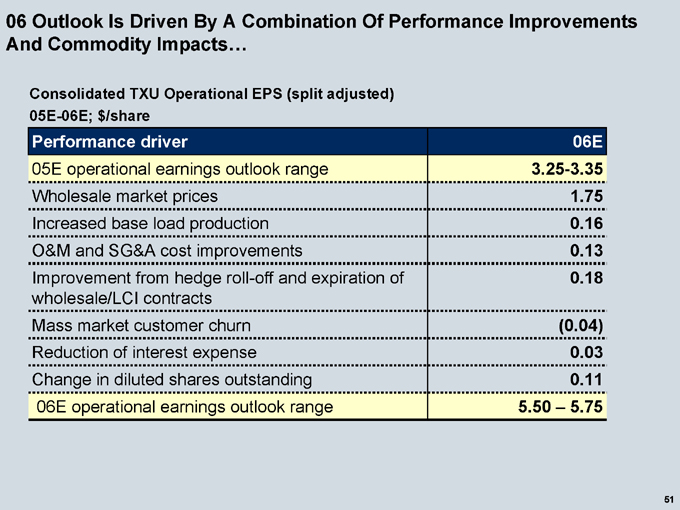

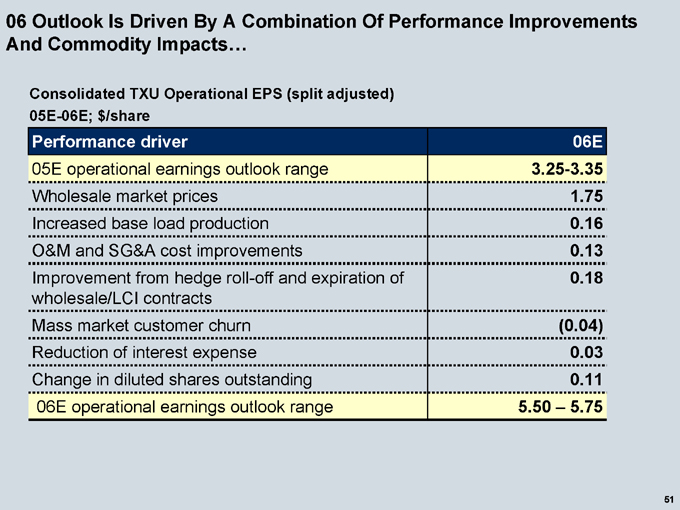

06 Outlook Is Driven By A Combination Of Performance Improvements And Commodity Impacts…

Consolidated TXU Operational EPS (split adjusted) 05E-06E; $/share

Performance driver 06E

05E operational earnings outlook range 3.25-3.35

Wholesale market prices 1.75

Increased base load production 0.16

O&M and SG&A cost improvements 0.13

Improvement from hedge roll-off and expiration of 0.18

wholesale/LCI contracts

Mass market customer churn (0.04)

Reduction of interest expense 0.03

Change in diluted shares outstanding 0.11

06E operational earnings outlook range 5.50 – 5.75

51

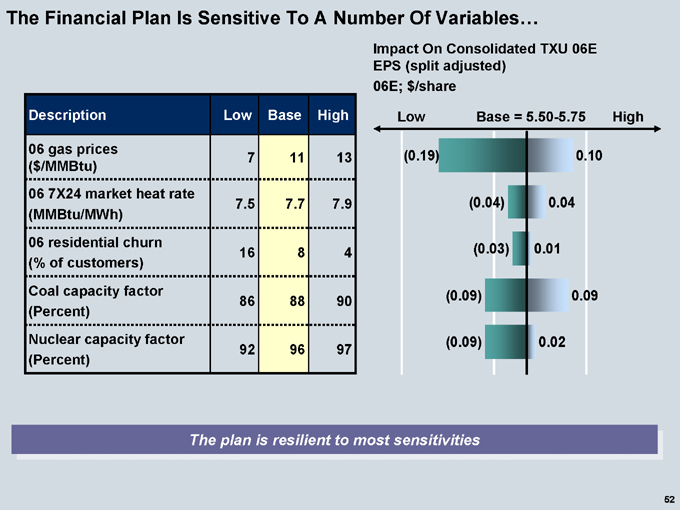

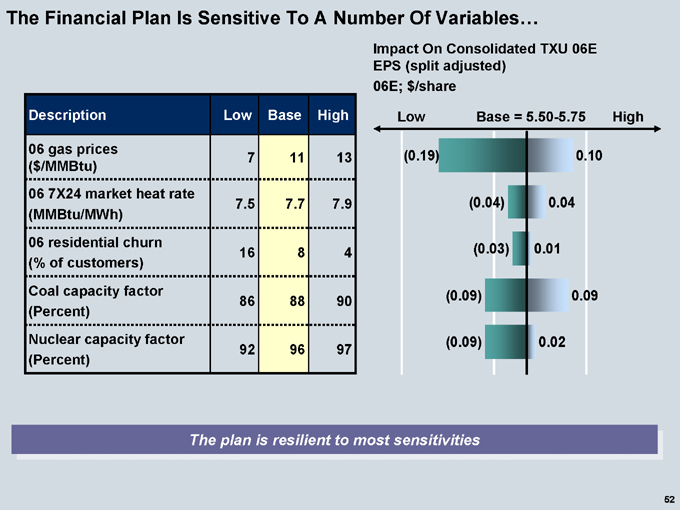

The Financial Plan Is Sensitive To A Number Of Variables…

Description Low Base High

06 gas prices ($/MMBtu) 7 11 13

06 7X24 market heat rate (MMBtu/MWh) 7.5 7.7 7.9

06 residential churn (% of customers) 16 8 4

Coal capacity factor (Percent) 86 88 90

Nuclear capacity factor (Percent) 92 96 97

Impact On Consolidated TXU 06E EPS (split adjusted) 06E; $/share

Low

Base = 5.50-5.75

High

(0.19)

(0.04)

(0.03)

(0.09)

(0.09)

0.10

0.04

0.01

0.09

0.02

The plan is resilient to most sensitivities

52

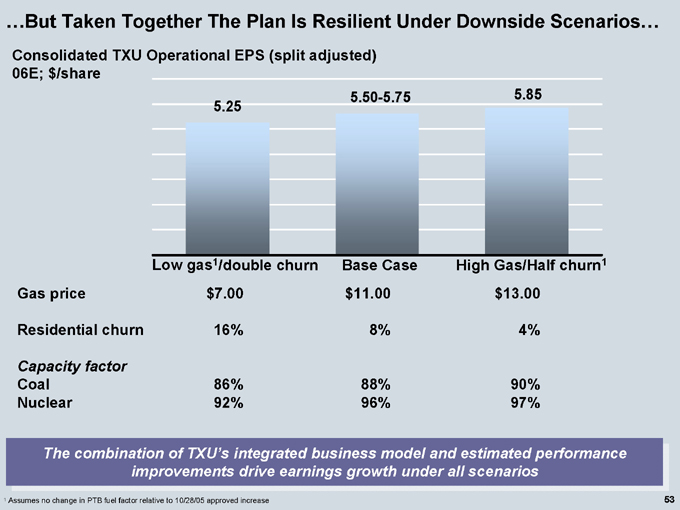

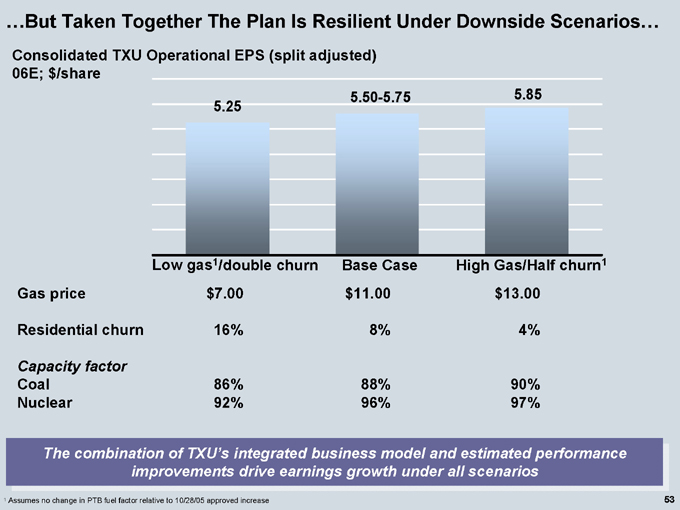

…But Taken Together The Plan Is Resilient Under Downside Scenarios…

Consolidated TXU Operational EPS (split adjusted) 06E; $/share

5.25

5.50-5.75

5.85

Low gas1/double churn Base Case High Gas/Half churn1

Gas price $7.00 $11.00 $13.00

Residential churn 16% 8% 4%

Capacity factor

Coal 86% 88% 90%

Nuclear 92% 96% 97%

The combination of TXU’s integrated business model and estimated performance improvements drive earnings growth under all scenarios

1 | | Assumes no change in PTB fuel factor relative to 10/28/05 approved increase |

53

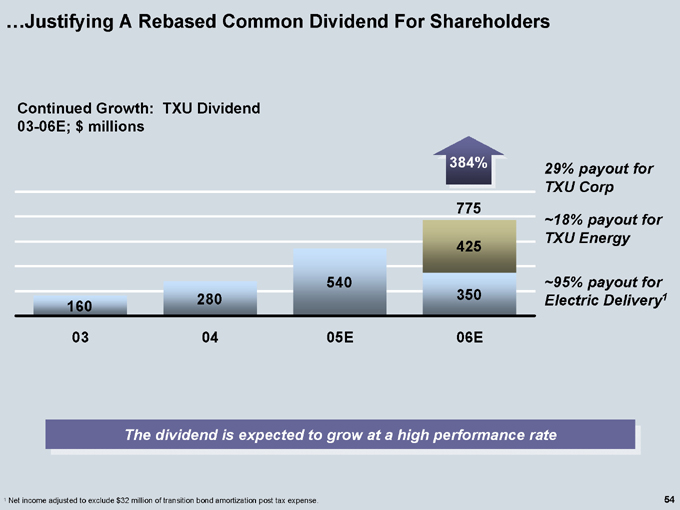

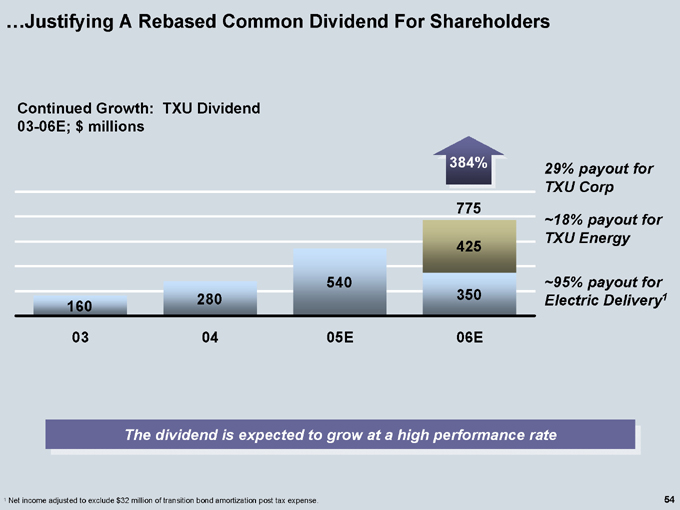

…Justifying A Rebased Common Dividend For Shareholders

Continued Growth: TXU Dividend 03-06E; $ millions

160

280

540

384%

775

425

350

03 04 05E 06E

29% payout for TXU Corp

~18% payout for TXU Energy

~95% payout for Electric Delivery1

The dividend is expected to grow at a high performance rate

1 | | Net income adjusted to exclude $32 million of transition bond amortization post tax expense. |

54

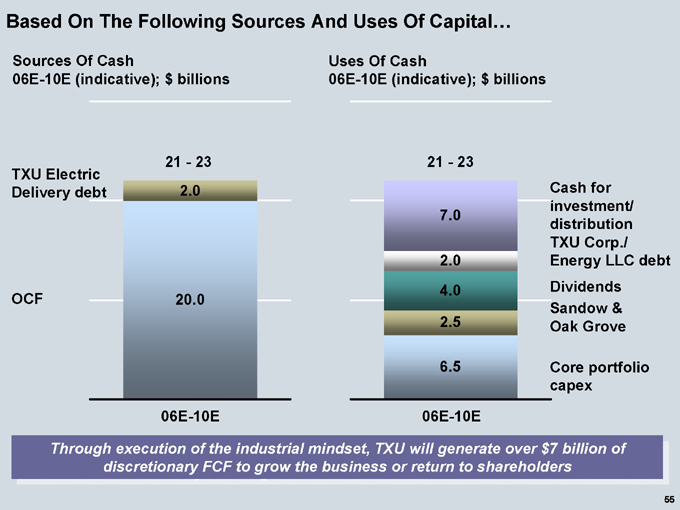

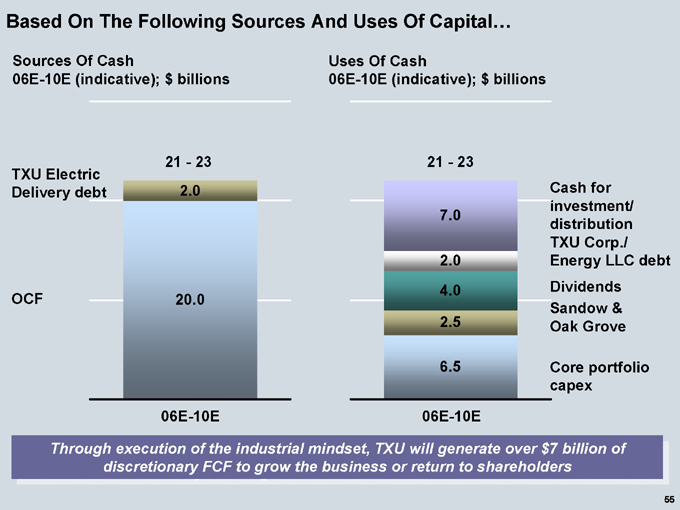

Based On The Following Sources And Uses Of Capital…

Sources Of Cash

06E-10E (indicative); $ billions

TXU Electric Delivery debt

OCF

21—23

2.0

20.0

06E-10E

Uses Of Cash

06E-10E (indicative); $ billions

21—23

7.0

2.0

4.0

2.5

6.5

06E-10E

Cash for investment/ distribution TXU Corp./ Energy LLC debt Dividends Sandow & Oak Grove

Core portfolio capex

Through execution of the industrial mindset, TXU will generate over $ 7 billion of discretionary FCF to grow the business or return to shareholders

55

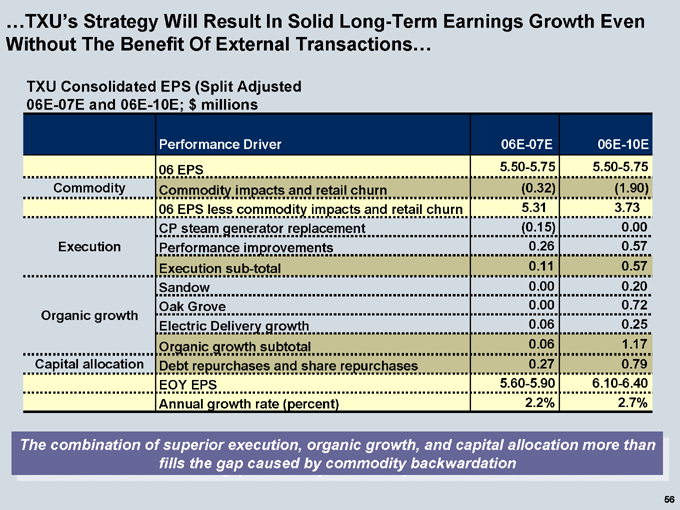

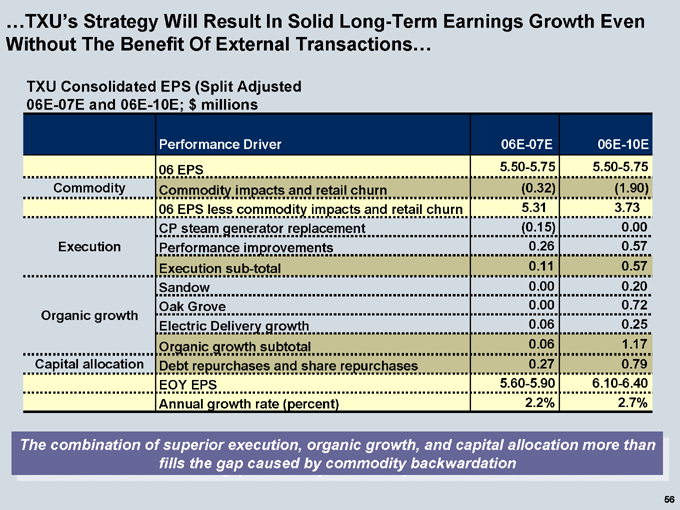

…TXU’s Strategy Will Result In Solid Long-Term Earnings Growth Even Without The Benefit Of External Transactions…

TXU Consolidated EPS (Split Adjusted 06E-07E and 06E-10E; $ millions

Performance Driver 06E-07E 06E-10E

06 EPS 5.50-5.75 5.50-5.75

Commodity Commodity impacts and retail churn (0.32) (1.90)

06 EPS less commodity impacts and retail churn 5.31 3.73

CP steam generator replacement (0.15) 0.00

Execution Performance improvements 0.26 0.57

Execution sub-total 0.11 0.57

Sandow 0.00 0.20

Oak Grove 0.00 0.72

Organic growth

Electric Delivery growth 0.06 0.25

Organic growth subtotal 0.06 1.17

Capital allocation Debt repurchases and share repurchases 0.27 0.79

EOY EPS 5.60-5.90 6.10-6.40

Annual growth rate (percent) 2.2% 2.7%

The combination of superior execution, organic growth, and capital allocation more than fills the gap caused by commodity backwardation

56

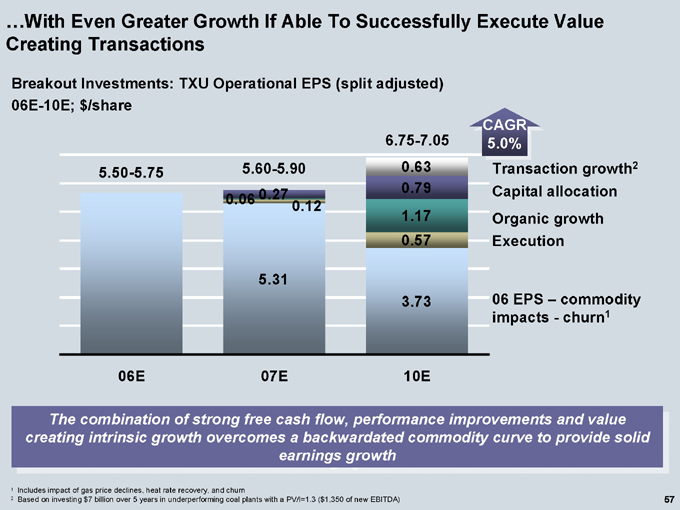

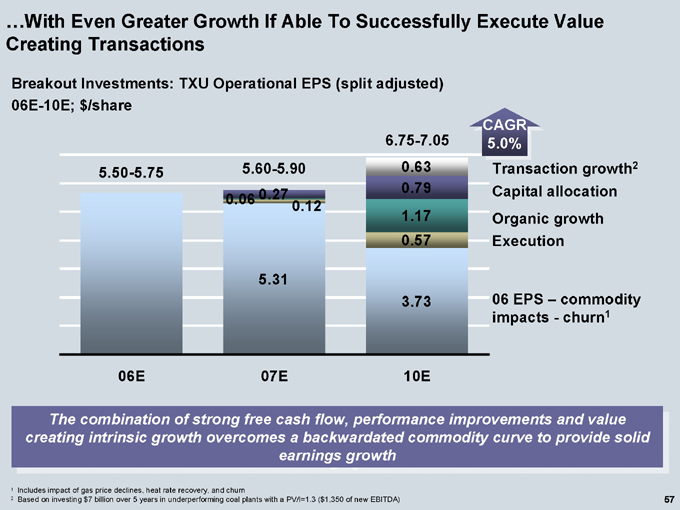

…With Even Greater Growth If Able To Successfully Execute Value Creating Transactions

Breakout Investments: TXU Operational EPS (split adjusted) 06E-10E; $/share

5.50-5.75

5.60-5.90

0.06 0.27 0.12

5.31

6.75-7.05

0.63

0.79

1.17

0.57

3.73

CAGR 5.0%

06E 07E 10E

Transaction growth2 Capital allocation Organic growth Execution

06 EPS – commodity impacts—churn1

The combination of strong free cash flow, performance improvements and value creating intrinsic growth overcomes a backwardated commodity curve to provide solid earnings

1 | | Includes impact of gas price declines, heat rate recovery, and churn |

2 | | Based on investing $7 billion over 5 years in underperforming coal plants with a PV/I=1.3 ($1,350 of new EBITDA) |

57

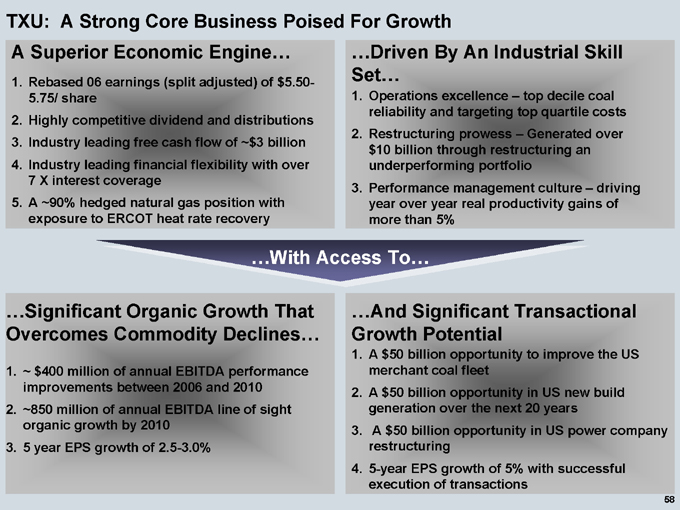

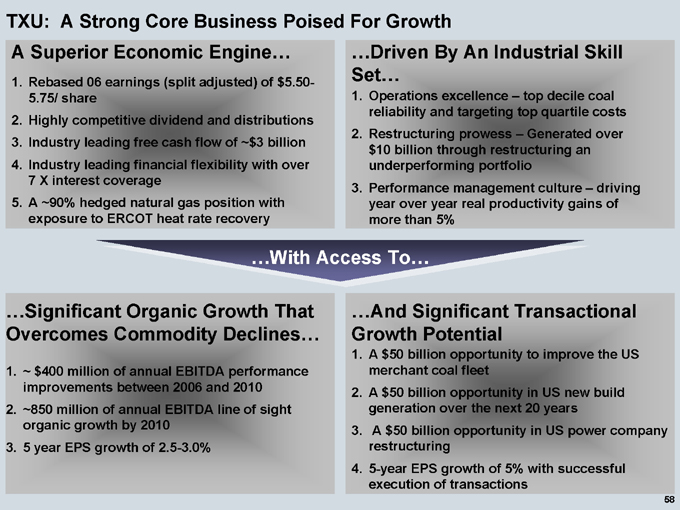

TXU: A Strong Core Business Poised For Growth

A Superior Economic Engine…

1. Rebased 06 earnings (split adjusted) of $5.50-5.75/ share

2. Highly competitive dividend and distributions

3. Industry leading free cash flow of ~$3 billion

4. Industry leading financial flexibility with over 7 X interest coverage

5. A ~90% hedged natural gas position with exposure to ERCOT heat rate recovery

…Driven By An Industrial Skill Set…

1. Operations excellence – top decile coal reliability and targeting top quartile costs

2. Restructuring prowess – Generated over $10 billion through restructuring an underperforming portfolio

3. Performance management culture – driving year over year real productivity gains of more than 5%

…With Access To…

…Significant Organic Growth That Overcomes Commodity Declines…

1. ~ $400 million of annual EBITDA performance improvements between 2006 and 2010

2. ~850 million of annual EBITDA line of sight organic growth by 2010

3. 5 year EPS growth of 2.5-3.0%

…And Significant Transactional Growth Potential

1. A $50 billion opportunity to improve the US merchant coal fleet

2. A $50 billion opportunity in US new build generation over the next 20 years

3. A $50 billion opportunity in US power company restructuring

4. 5-year EPS growth of 5% with successful execution of transactions

58

Regulation G Reconciliations

For future periods, TXU is currently unable to estimate the impact of special items or changes in accounting principles or policies on free cash flow, return on invested capital, total debt to capitalization or interest coverage. TXU is therefore currently unable to reconcile the most directly comparable GAAP measures to these items for forecasted periods.

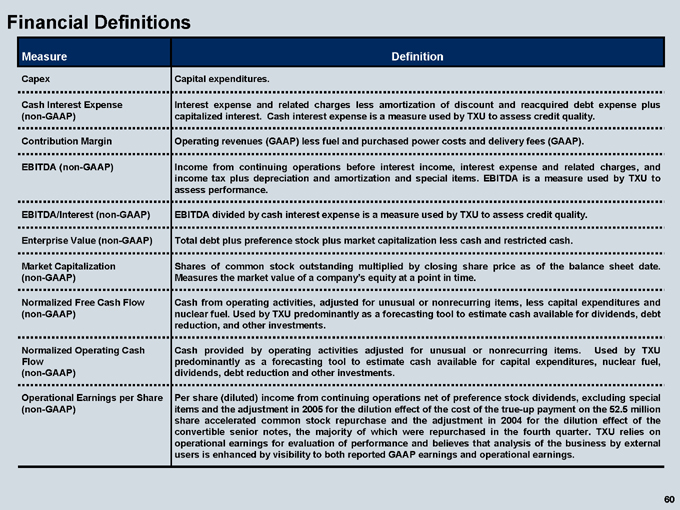

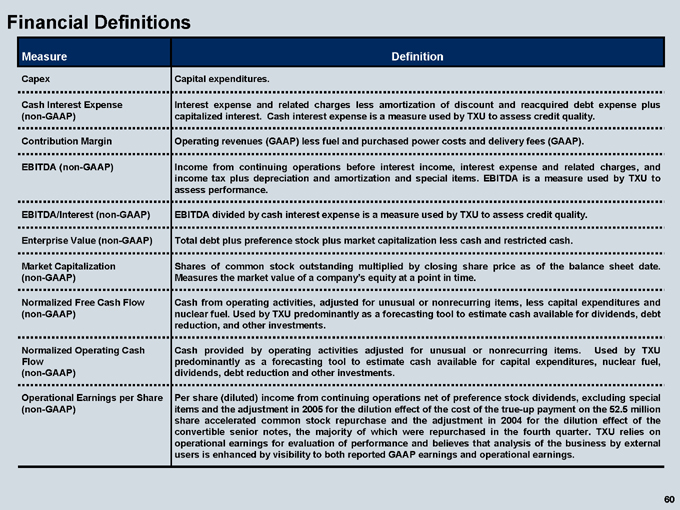

Financial Definitions

Measure Definition

Capex Capital expenditures.

Cash Interest Expense (non-GAAP) Interest expense and related charges less amortization of discount and reacquired debt expense plus capitalized interest. Cash interest expense is a measure used by TXU to assess credit quality.

Contribution Margin Operating revenues (GAAP) less fuel and purchased power costs and delivery fees (GAAP).

EBITDA (non-GAAP) Income from continuing operations before interest income, interest expense and related charges, and income tax plus depreciation and amortization and special items. EBITDA is a measure used by TXU to assess performance.

EBITDA/Interest (non-GAAP) EBITDA divided by cash interest expense is a measure used by TXU to assess credit quality.

Enterprise Value (non-GAAP) Total debt plus preference stock plus market capitalization less cash and restricted cash.

Market Capitalization (non-GAAP) Shares of common stock outstanding multiplied by closing share price as of the balance sheet date Measures the market value of a company’s equity at a point in time.

Normalized Free Cash Flow (non-GAAP) Cash from operating activities, adjusted for unusual or nonrecurring items, less capital expenditures and nuclear fuel. Used by TXU predominantly as a forecasting tool toestimate cash available for dividends, debt reduction, and other investments.

Normalized Operating Cash Flow (non-GAAP) Cash provided by operating activities adjusted for unusual or nonrecurring items. Used by TXU predominantly as a forecasting tool to estimate cash available for capital expenditures, nuclear fuel, dividends, debt reduction and other investments.

Operational Earnings per Share (non-GAAP) Per share (diluted) income from continuing operations net of preference stock dividends, excluding special items and the adjustment in 2005 for the dilution effect of the cost of the true-up payment on the 52.5 million share accelerated common stock repurchase and the adjustment in 2004 for the dilution effect of the convertible senior notes, the majority of which were repurchased in the fourth quarter. TXU relies on operational earnings for evaluation of performance and believes that analysis of the business by external users is enhanced by visibility to both reported GAAP earnings and operational earnings.

60

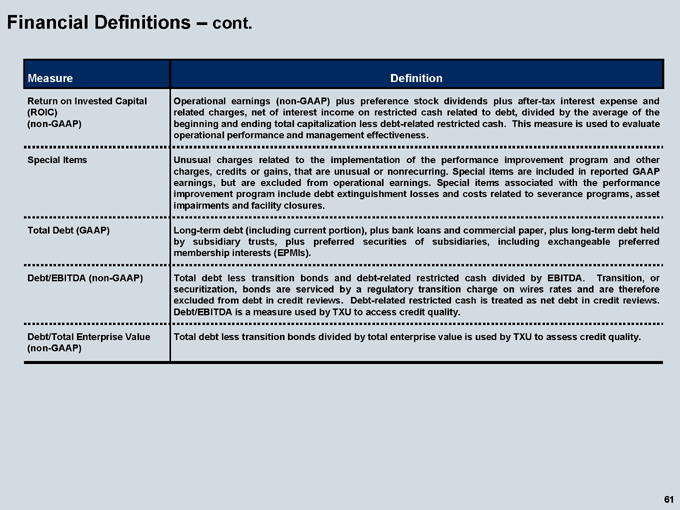

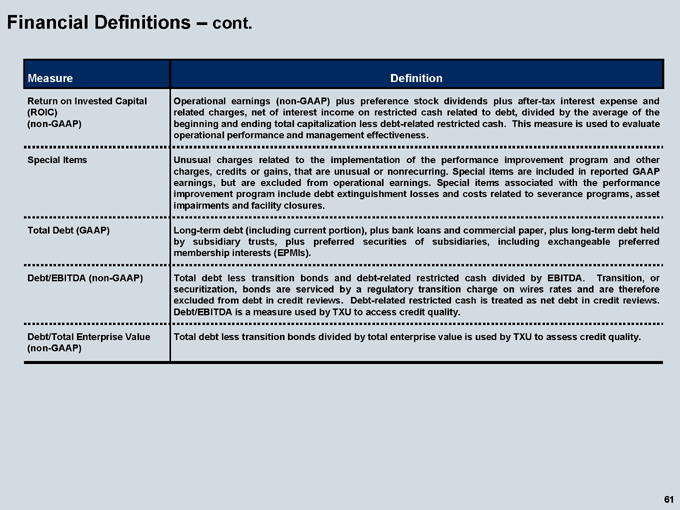

Financial Definitions – cont.

Measure Definition

Return on Invested Capital (ROIC) (non-GAAP) Operational earnings (non-GAAP) plus preference stock dividends plus after-tax interest expense and related charges, net of interest income on restricted cash related to debt, divided by the average of the beginning and ending total capitalization less debt-related restricted cash. This measure is used to evaluate operational performance and management effectiveness.

Special Items Unusual charges related to the implementation of the performance improvement program and other charges, credits or gains, that are unusual or nonrecurring. Special items are included in reported GAAP earnings, but are excluded from operational earnings. Special items associated with the performance improvement program include debt extinguishment losses and costs related to severance programs, asset impairments and facility closures.

Total Debt (GAAP) Long-term debt (including current portion), plus bank loans and commercial paper, plus long-term debt held by subsidiary trusts, plus preferred securities of subsidiaries, including exchangeable preferred membership interests (EPMIs).

Debt/EBITDA (non-GAAP) Total debt less transition bonds and debt-related restricted cash divided by EBITDA. Transition, or securitization, bonds are serviced by a regulatory transition charge on wires rates and are therefore excluded from debt in credit reviews. Debt-related restricted cash is treated as net debt in credit reviews. Debt/EBITDA is a measure used by TXU to access credit quality.

Debt/Total Enterprise Value (non-GAAP) Total debt less transition bonds divided by total enterprise value is used by TXU to assess credit quality.

61

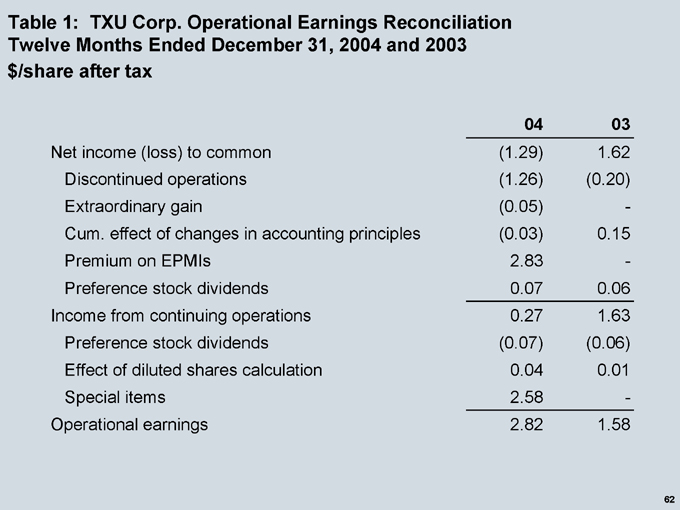

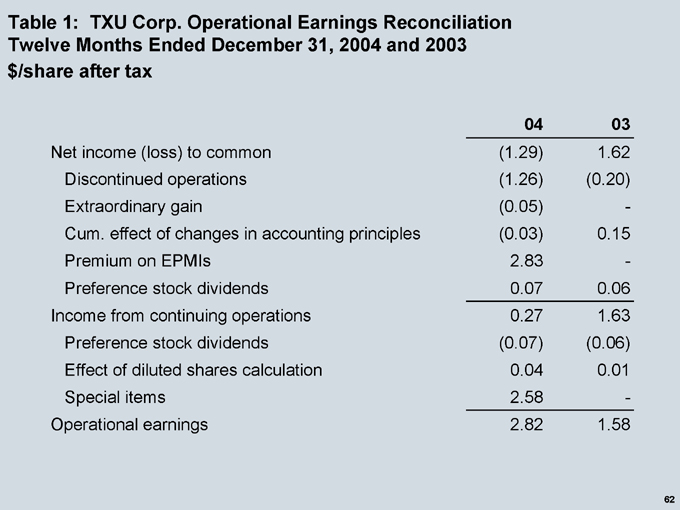

Table 1: TXU Corp. Operational Earnings Reconciliation Twelve Months Ended December 31, 2004 and 2003 $/share after tax

04 03

Net income (loss) to common (1.29) 1.62

Discontinued operations (1.26) (0.20)

Extraordinary gain (0.05) -

Cum. effect of changes in accounting principles (0.03) 0.15

Premium on EPMIs 2.83 -

Preference stock dividends 0.07 0.06

Income from continuing operations 0.27 1.63

Preference stock dividends (0.07) (0.06)

Effect of diluted shares calculation 0.04 0.01

Special items 2.58 -

Operational earnings 2.82 1.58

62

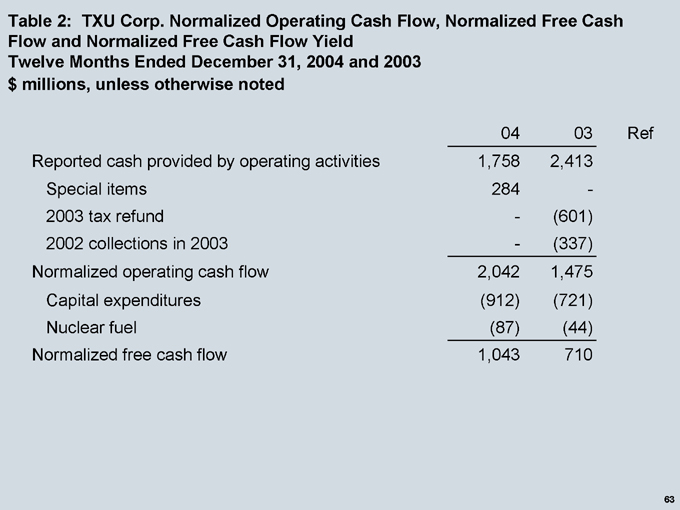

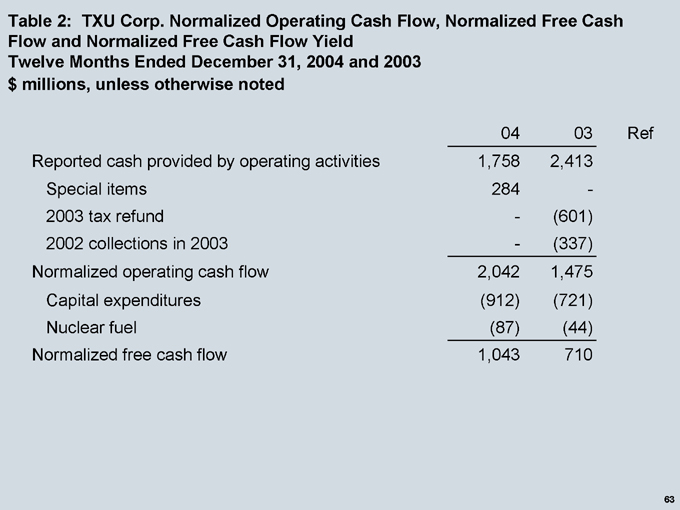

Table 2: TXU Corp. Normalized Operating Cash Flow, Normalized Free Cash Flow and Normalized Free Cash Flow Yield Twelve Months Ended December 31, 2004 and 2003 $ millions, unless otherwise noted

04 03 Ref

Reported cash provided by operating activities 1,758 2,413

Special items 284 —

2003 tax refund — (601)

2002 collections in 2003 — (337)

Normalized operating cash flow 2,042 1,475

Capital expenditures (912) (721)

Nuclear fuel (87) (44)

Normalized free cash flow 1,043 710

63

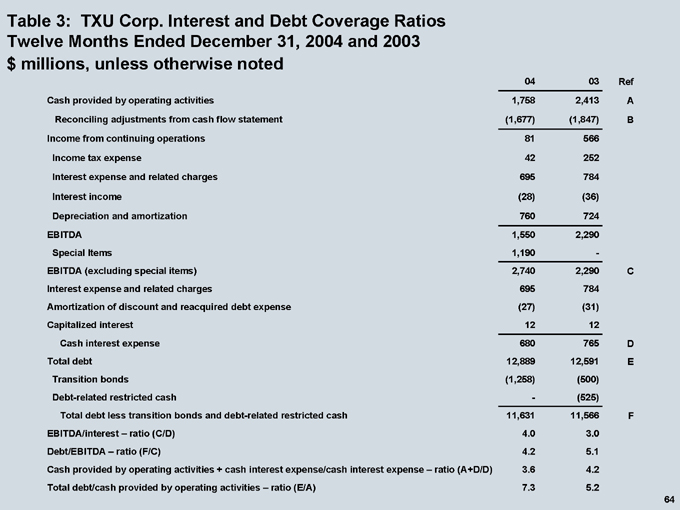

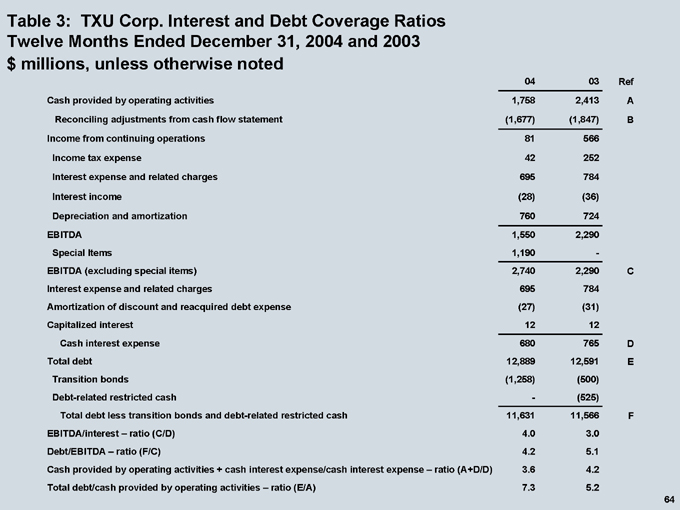

Table 3: TXU Corp. Interest and Debt Coverage Ratios Twelve Months Ended December 31, 2004 and 2003 $ millions, unless otherwise noted

04 03 Ref

Cash provided by operating activities 1,758 2,413 A

Reconciling adjustments from cash flow statement (1,677) (1,847) B

Income from continuing operations 81 566

Income tax expense 42 252

Interest expense and related charges 695 784

Interest income (28) (36)

Depreciation and amortization 760 724

EBITDA 1,550 2,290

Special Items 1,190 —

EBITDA (excluding special items) 2,740 2,290 C

Interest expense and related charges 695 784

Amortization of discount and reacquired debt expense (27) (31)

Capitalized interest 12 12

Cash interest expense 680 765 D

Total debt 12,889 12,591 E

Transition bonds (1,258) (500)

Debt-related restricted cash — (525)

Total debt less transition bonds and debt-related restricted cash 11,631 11,566 F

EBITDA/interest – ratio (C/D) 4.0 3.0

Debt/EBITDA – ratio (F/C) 4.2 5.1

Cash provided by operating activities + cash interest expense/cash interest expense – ratio (A+D/D) 3.6 4.2

Total debt/cash provided by operating activities – ratio (E/A) 7.3 5.2

64

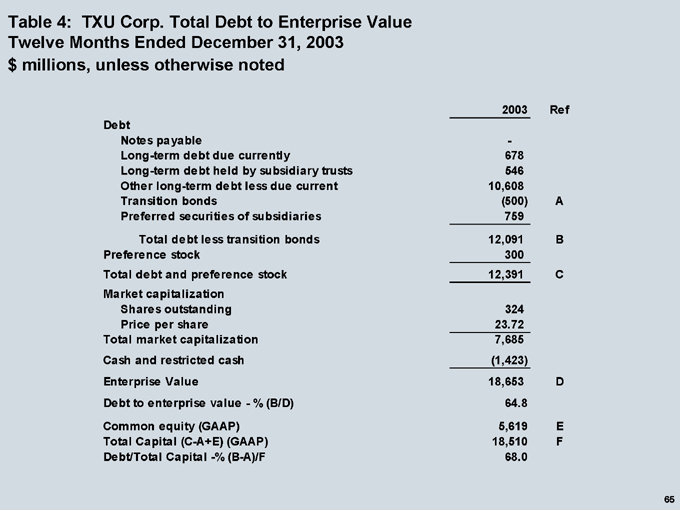

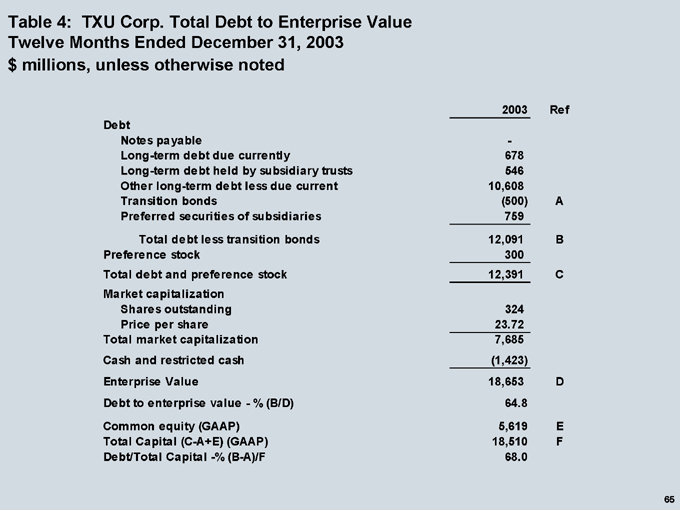

Table 4: TXU Corp. Total Debt to Enterprise Value Twelve Months Ended December 31, 2003 $ millions, unless otherwise noted

2003 Ref

Debt

Notes payable —

Long-term debt due currently 678

Long-term debt held by subsidiary trusts 546

Other long-term debt less due current 10,608

Transition bonds (500) A

Preferred securities of subsidiaries 759

Total debt less transition bonds 12,091 B

Preference stock 300

Total debt and preference stock 12,391 C

Market capitalization

Shares outstanding 324

Price per share 23.72

Total market capitalization 7,685

Cash and restricted cash (1,423)

Enterprise Value 18,653 D

Debt to enterprise value—% (B/D) 64.8

Common equity (GAAP) 5,619 E

Total Capital (C-A+E) (GAAP) 18,510 F

Debt/Total Capital -% (B-A)/F 68.0

65

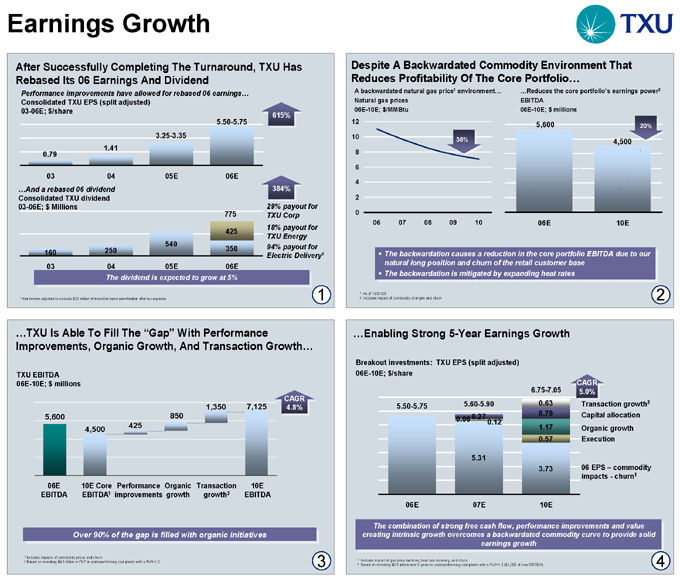

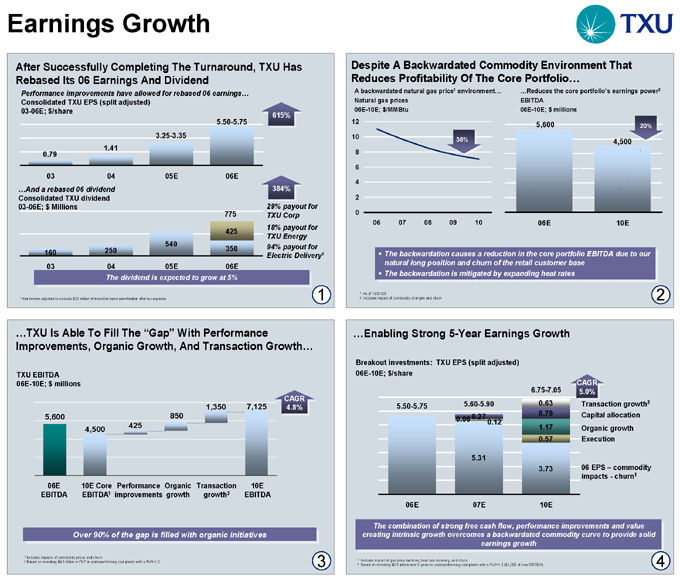

Earnings Growth

After Successfully Completing The Turnaround, TXU Has Rebased Its 06 Earnings And Dividend

Performance improvements have allowed for rebased 06 earnings…

Consolidated TXU EPS (split adjusted) 03-06E; $/share

0.79 03 1.41 04 3.25-3.35 05E 5.50-5.75 06E

615% 384%

…And a rebased 06 dividend

Consolidated TXU dividend 03-06E; $ Millions

160 03 250 04 540 05E 775 425 350 06E

29% payout for TXU Corp 18% payout for TXU Energy 94% payout for Electric Delivery1

The dividend is expected to grow at 5%

1 Net income adjusted to exclude $32 million of transition bond amortization after tax expense

Despite A Backwardated Commodity Environment That Reduces Profitability Of The Core Portfolio…

A backwardated natural gas price1 environment… Natural gas prices 06E-10E; $/MMBtu

12 10 8 6 4 2 0

36%

06 07 08 09 10

…Reduces the core portfolio’s earnings power2 EBITDA

06E-10E; $ millions

5,600 06E

4,500 10E

20%

The backwardation causes a reduction in the core portfolio EBITDA due to our natural long position and churn of the retail customer base

The backwardation is mitigated by expanding heat rates

1 As of 10/31/05

2 Includes impact of commodity changes and churn

…TXU Is Able To Fill The “Gap” With Performance

Improvements, Organic Growth, And Transaction Growth…

TXU EBITDA 06E-10E; $ millions

5,600 4,500 425 850 1,350 7,125 CAGR 4.8%

06E EBITDA

10E Core EBITDA1

Performance improvements

Organic growth

Transaction growth2

10E EBITDA

Over 90% of the gap is filled with organic initiatives

1 Includes impacts of commodity prices and churn

2 Based on investing $6.5 billion in FCF in underperforming coal plants with a PV/I=1.3

…Enabling Strong 5-Year Earnings Growth

Breakout investments: TXU EPS (split adjusted) 06E-10E; $/share

5.50-5.75

5.60-5.90

0.06 0.27 0.12 5.31

6.75-7.05

0.63 0.79 1.17 0.57

3.73

06E 07E 10E

CAGR 5.0%

Transaction growth2 Capital allocation Organic growth Execution

06 EPS – commodity impacts - churn1

The combination of strong free cash flow, performance improvements and value creating intrinsic growth overcomes a backwardated commodity curve to provide solid earnings growth

1 Includes impact of gas price declines, heat rate recovery, and churn

2 Based on investing $6.5 billion over 5 years in underperforming coal plants with a PV/I=1.3 ($1,350 of new EBITDA)

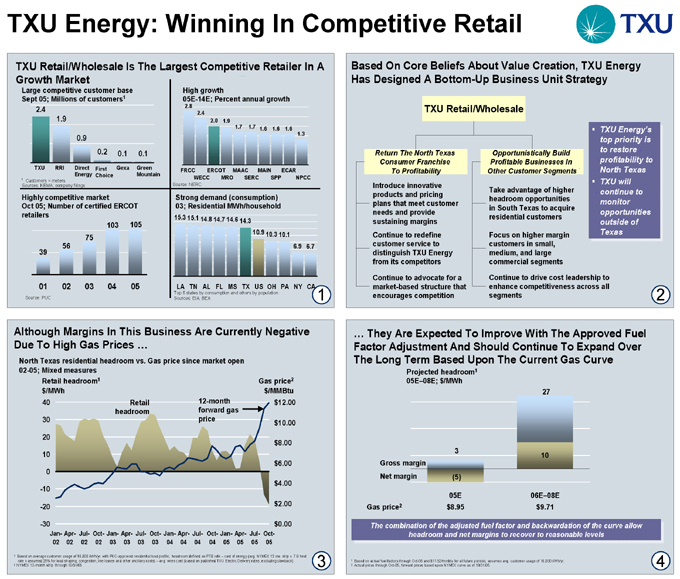

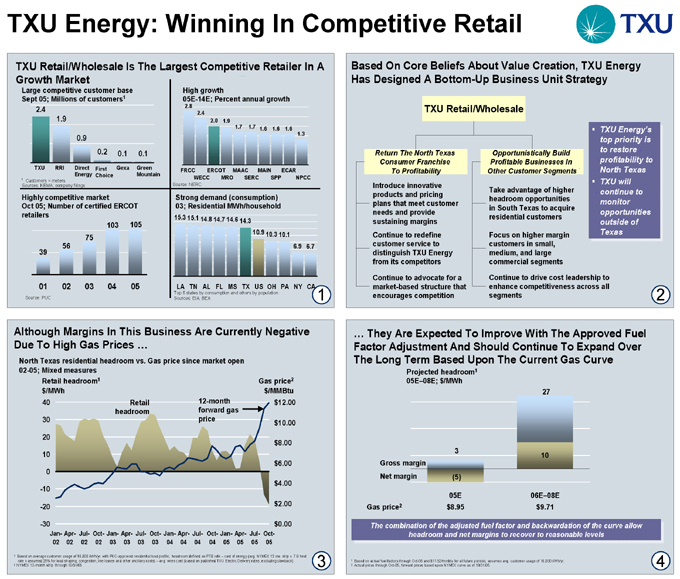

TXU Energy: Winning In Competitive Retail

TXU Retail/Wholesale Is The Largest Competitive Retailer In A Growth Market

Large competitive customer base Sept 05; Millions of customers1

2.4 1.9

0.9

0.2 0.1 0.1

TXU RRI Direct First Gexa Green Energy Choice Mountain

1 Customers = meters

Sources: KEMA, company filings

Highly competitive market

Oct 05; Number of certified ERCOT retailers

103 105 75 56 39

01 02 03 04 05

Source: PUC

High growth

05E-14E; Percent annual growth

2.8 2.4

2.0 1.9

1.7 1.7 1.6 1.6 1.6 1.3

FRCC ERCOT MAAC MAIN ECAR

WECC MRO SERC SPP NPCC

Source: NERC

Strong demand (consumption) 03; Residential MWh/household

15.3 15.1 14.8

14.7 14.6 14.3

10.9 10.3 10.1

6.9 6.7

LA TN AL FL MS TX US OH PA NY CA

Top 6 states by consumption and others by population Sources: EIA, BEA

Based On Core Beliefs About Value Creation, TXU Energy Has Designed A Bottom-Up Business Unit Strategy

TXU Retail/Wholesale

Return The North Texas Consumer Franchise To Profitability

Introduce innovative products and pricing plans that meet customer needs and provide sustaining margins

Continue to redefine customer service to distinguish TXU Energy from its competitors

Continue to advocate for a market-based structure that encourages competition

Opportunistically Build Profitable Businesses In Other Customer Segments

Take advantage of higher headroom opportunities in South Texas to acquire residential customers

Focus on higher margin customers in small, medium, and large commercial segments

Continue to drive cost leadership to enhance competitiveness across all segments

TXU Energy’s top priority is to restore profitability to North Texas

TXU will continue to monitor opportunities outside of Texas

Although Margins In This Business Are Currently Negative Due To High Gas Prices …

North Texas residential headroom vs. Gas price since market open 02-05; Mixed measures

Retail headroom1 $/MWh

40 30 20 10 0 -10 -20 -30

Jan- Apr- Jul- Oct- Jan- Apr- Jul- Oct- Jan- Apr- Jul- Oct- Jan- Apr- Jul- Oct-

02 02 02 02 03 03 03 03 04 04 04 04 05 05 05 05

Gas price2 $/MMBtu $12.00 $10.00 $8.00 $6.00 $4.00 $2.00 $0.00

Retail 12-month headroom forward gas price

1 Based on average customer usage of 16,000 kWh/yr. with PUC-approved residential load profile; headroom defined as PTB rate – cost of energy (avg. NYMEX 12 mo. strip x 7.8 heat rate x assumed 25% for load shaping, congestion, line losses and other ancillary costs) – avg. wires cost (based on published TXU Electric Delivery rates, excluding clawback).

2 NYMEX 12-month strip through 10/31/05.

… They Are Expected To Improve With The Approved Fuel Factor Adjustment And Should Continue To Expand Over The Long Term Based Upon The Current Gas Curve

Projected headroom1 05E–08E; $/MWh

Gross margin Net margin

27

10

05E 06E–08E Gas price2 $8.95 $9.71

The combination of the adjusted fuel factor and backwardation of curve allow headroom and net margins to recover to reasonable levels

1 Based on actual fuel factors through Oct-05 and $11.52/mmbtu for all future periods; assumes avg. customer usage of 16,000 kWh/yr.

2 Actual prices through Oct-05, forward prices based upon NYMEX curve as of 10/31/05. 4

TXU Energy: Winning In Competitive Retail

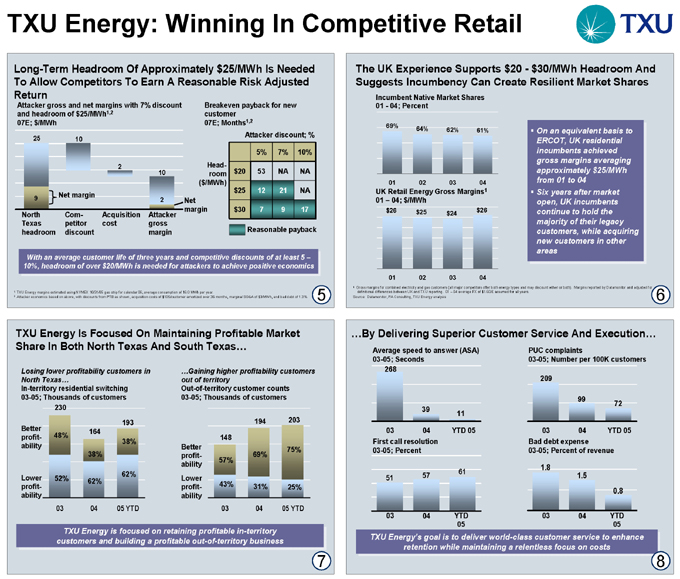

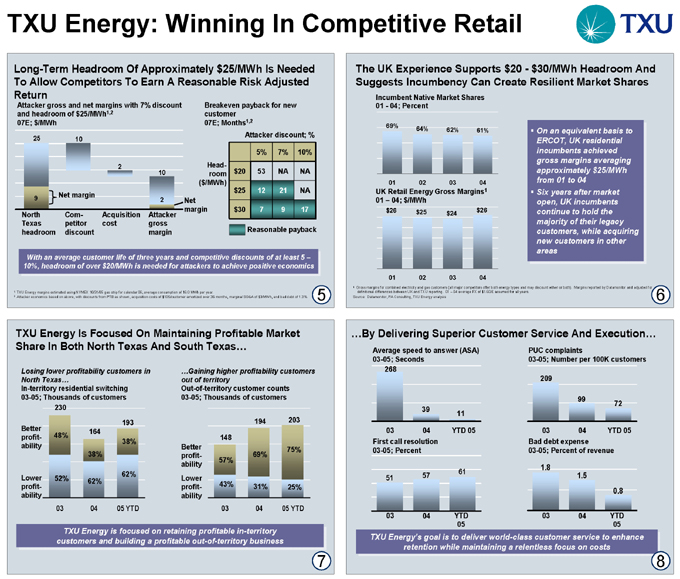

Long-Term Headroom Of Approximately $25/MWh Is Needed To Allow Competitors To Earn A Reasonable Risk Adjusted Return

Attacker gross and net margins with 7% discount and headroom of $25/MWh1,2 07E; $/MWh

25 10

2

10

9

Net margin

North Com- Acquisition Attacker Texas petitor cost gross headroom discount margin

Net margin

Breakeven payback for new customer 07E; Months1,2

Attacker discount; %

Headroom

($/MWh)

5% 7% 10%

$20 53 NA NA

$25 12 21 NA

$30 7 9 17

Reasonable payback

With an average customer life of three years and competitive discounts of at least 5 – 10%, headroom of over $20/MWh is needed for attackers to achieve positive economics

1 TXU Energy margins estimated using NYMEX 10/31/05 gas strip for calendar 06, average consumption of 16.0 MWh per year.

2 Attacker economics based on above, with discounts from PTB as shown, acquisition costs of $105/customer amortized over 36 months, marginal SG&A of $3/MWh, and bad debt of 1.3%.

5

The UK Experience Supports $20—$30/MWh Headroom And Suggests Incumbency Can Create Resilient Market Shares

Incumbent Native Market Shares 01—04; Percent

69%

64% 62% 61%

01 02 03 04

UK Retail Energy Gross Margins1 01 – 04; $/MWh

$26 $ 25 $26 $24

01 02 03 04

On an equivalent basis to ERCOT, UK residential incumbents achieved gross margins averaging approximately $25/MWh from 01 to 04 from 01 to 04

Six years after market open, UK incumbents continue to hold thecontinue to hold the majority of their legacy customers, while acquiring new customers in other areas

1 Gross margins for combined electricity and gas customers (all major competitors offer both energy types and may discount either or both). Margins reported by Datamonitor and adjusted for definitional differences between UK and TXU reporting. 01 – 04 average FX of $1.60/£ assumed for all years.

Source: Datamonitor, PA Consulting, TXU Energy analysis 6

TXU Energy Is Focused On Maintaining Profitable Market Share In Both North Texas And South Texas…

Losing lower profitability customers in North Texas…

In-territory residential switching 03-05; Thousands of customers

Better profitability

Lower profitability

230

193 164 48% 38% 38%

62% 52% 62%

03 04 05 YTD

…Gaining higher profitability customers out of territory

Out-of-territory customer counts 03-05; Thousands of customers

Better profitability Lower profitability

194 203 148 75% 69% 57%

43% 31% 25%

03 04 05 YTD

TXU Energy is focused on retaining profitable in-territory customers and building a profitable out-of-territory business

…By Delivering Superior Customer Service And Execution…

Average speed to answer (ASA) 03-05; Seconds

268

39

11

03 04 YTD 05

First call resolution 03-05; Percent

61

51 57

03 04 YTD 05

PUC complaints

03-05; Number per 100K customers

209

99

72

03 04 YTD 05

Bad debt expense 03-05; Percent of revenue

1.8

1.5

0.8

03 04 YTD 05

TXU Energy’s goal is to deliver world-class customer service to enhance retention while maintaining a relentless focus on costs

8

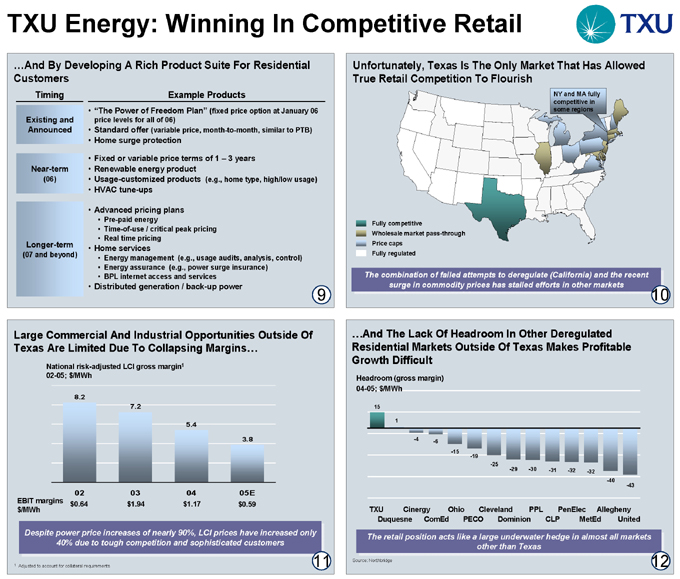

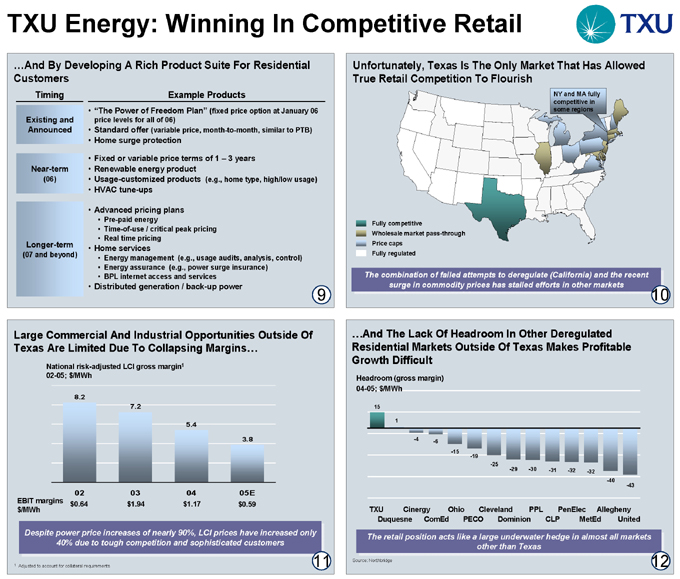

TXU Energy: Winning In Competitive Retail

…And By Developing A Rich Product Suite For Residential Customers

Timing Example Products

Existing and Announced

Near-term

Longer-term

(07 and beyond)

“The Power of Freedom Plan” (fixed price option at January 06 price levels for all of 06) Standard offer (variable price, month-to-month, similar to PTB)

Home surge protection

Fixed or variable price terms of 1 – 3 years Renewable energy product

Usage-customized products (e.g., home type, high/low usage)

HVAC tune-ups

Advanced pricing plans

Pre-paid energy

Time-of-use / critical peak pricing Real time pricing

Home services

Energy management (e.g., usage audits, analysis, control) Energy assurance (e.g., power surge insurance) BPL internet access and services

Distributed generation / back-up power

9

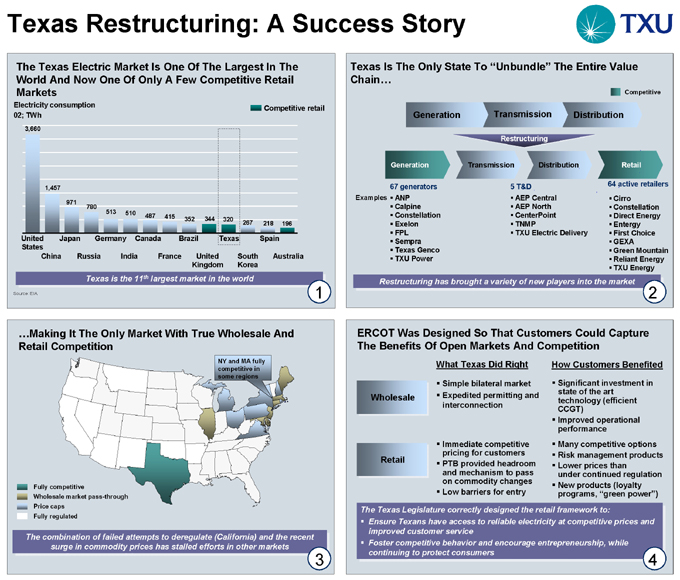

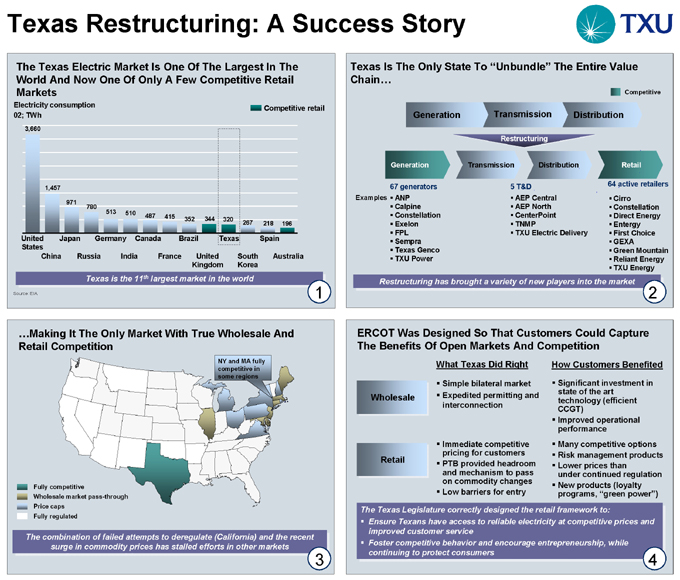

Unfortunately, Texas Is The Only Market That Has Allowed True Retail Competition To Flourish

NY and MA fully competitive in some regions

Fully competitive

Wholesale market pass-through Price caps Fully regulated

The combination of failed attempts to deregulate (California) and the recent surge in commodity prices has stalled efforts in other markets

10

Large Commercial And Industrial Opportunities Outside Of Texas Are Limited Due To Collapsing Margins…

National risk-adjusted LCI gross margin1 02-05; $/MWh

8.2

7.2

5.4

3.8

02 03 04 05E

EBIT margins $0.64 $1.94 $1.17 $0.59 $/MWh

Despite power price increases of nearly 90%, LCI prices have increased only 40% due to tough competition and sophisticated customers 11

1 Adjusted to account for collateral requirements

…And The Lack Of Headroom In Other Deregulated Residential Markets Outside Of Texas Makes Profitable Growth Difficult

Headroom (gross margin) 04-05; $/MWh

15

-4 -6 -15 -19 -25

-29 -30 -31 -32 -32 -40 -43

TXU Cinergy Ohio Cleveland PPL PenElec Allegheny Duquesne ComEd PECO Dominion CLP MetEd United

The retail position acts like a large underwater hedge in almost all markets other than Texas

Source: Northbridge

12

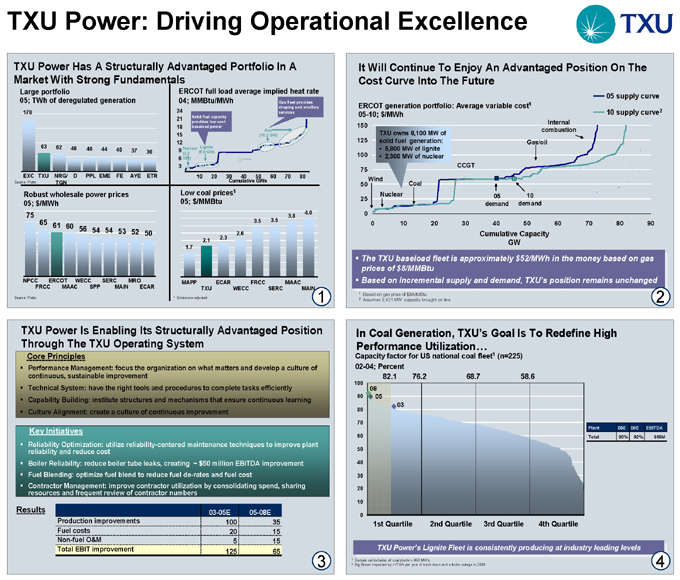

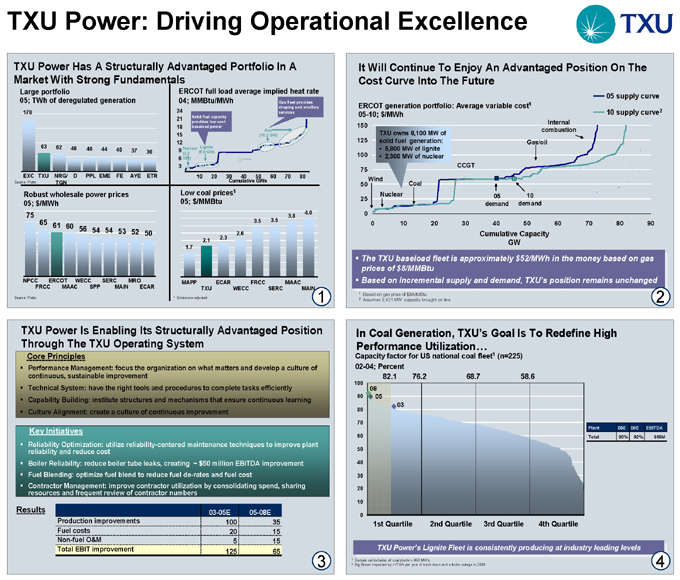

TXU Power: Driving Operational Excellence

TXU Power Has A Structurally Advantaged Portfolio In A Market With Strong Fundamentals

Large portfolio

05; TWh of deregulated generation

178

63 62 46 46

44 40 37 30

EXC

Source: Platts

TXU

NRG/TGN

D

PPL

EME

FE

AYE

ETR

Robust wholesale power prices 05; $/MWh

75

65

61 60

56 54 54 53 52 50

NPCC ERCOT WECC SERC MRO

FRCC MAAC SPP MAIN ECAR

Source: Platts

ERCOT full load average implied heat rate

04; MMBtu/MWh

Gas fleet provides shaping and ancillary services

Solid fuel capacity provides low cost baseload power

Nuclear (2.3 GW) TXU Units

Lignite (5.8 GW)

Gas (10.2 GW)

24 21 18 15 12 9 6 3

10 20 30 40 50 60 70 80

Cumulative GWs

Low coal prices1 05; $/MMBtu

1.7

2.1

2.3

2.6

3.5

3.5

3.8

4.0

MAPP ECAR FRCC MAAC

TXU WECC SERC MAIN

It Will Continue To Enjoy An Advantaged Position On The Cost Curve Into The Future

ERCOT generation portfolio: Average variable cost1 05-10; $/MWh

150 125 100 75 50 25 0

TXU owns 8,100 MW of solid fuel generation:

5,800 MW of lignite

2,300 MW of nuclear

Wind

Nuclear

Coal

CCGT

05 demand

10 demand

Gas/oil

Internal combustion

05 supply curve

10 supply curve2

0 10 20 30 40 50 60 70 80 90

Cumulative Capacity GW

The TXU baseload fleet is approximately$52/MWh in the money based on gas prices of $8/MMBtu

Based on incremental supply and demand, TXU’s position remains unchanged

1 | | Based on gas price of $8/MMBtu |

2 | | Assumes 8,421 MW capacity brought on line |

TXU Power Is Enabling Its Structurally Advantaged Position Through The TXU Operating System

Core Principles

Performance Management: focus the organization on what matters and develop a culture of continuous, sustainable improvement Technical System: have the right tools and procedures to complete tasks efficiently Capability Building: institute structures and mechanisms that ensure continuous learning Culture Alignment: create a culture of continuous improvement

Key Initiatives

Reliability Optimization: utilize reliability-centered maintenance techniques to improve plant reliability and reduce cost Boiler Reliability: reduce boiler tube leaks, creating ~ $50 million EBITDA improvement Fuel Blending: optimize fuel blend to reduce fuel de-rates and fuel cost Contractor Management: improve contractor utilization by consolidating spend, sharing resources and frequent review of contractor numbers

Results

03-05E 05-08E Production improvements 100 35 Fuel costs 20 15 Non-fuel O&M 5 15 Total EBIT improvement 125 65

In Coal Generation, TXU’s Goal Is To Redefine High Performance Utilization…

Capacity factor for US national coal fleet1 (n=225) 02-04; Percent

100 90 80 70 60 50 40 30 20 10 0

82.1 76.2 68.7 58.6

08

05

03

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

Plant 05E 08E EBITDA

Total 90% 92% $69M

TXU Power’s Lignite Fleet is consistently producing at industry leading levels

1 | | Sample set includes all coal plants > 450 MW’s |

2 | | Big Brown impacted by >1TWh per year of back-down and a boiler outage in 2008 |

TXU Power: Driving Operational Excellence

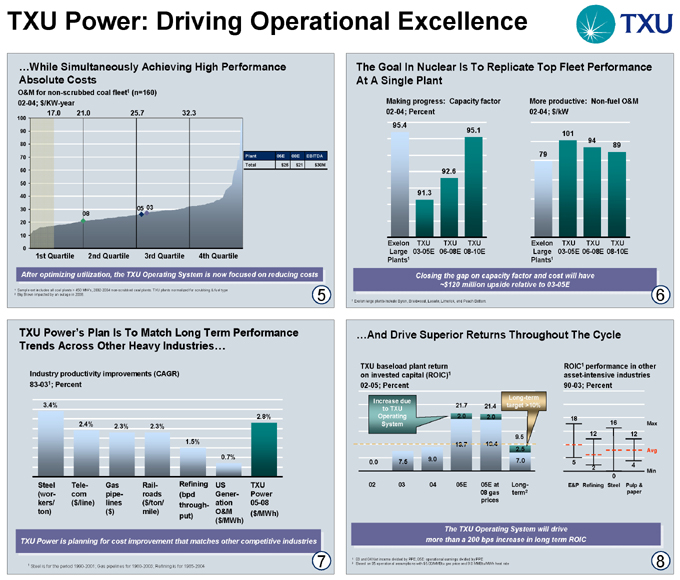

…While Simultaneously Achieving High Performance Absolute Costs

O&M for non-scrubbed coal fleet1 (n=160) 02-04; $/KW-year

100 90 80 70 60 50 40 30 20 10 0

17.0 21.0 25.7 32.3

08

05

03

Plant 05E 08E EBITDA

Total $26 $21 $30M

1st Quartile 2nd Quartile 3rd Quartile 4th Quartile

After optimizing utilization, the TXU Operating System is now focused on reducing costs

1 Sample set includes all coal plants > 450 MW’s, 2002-2004 non-scrubbed coal plants. TXU plants normalized for scrubbing & fuel type

2 | | Big Brown impacted by an outage in 2008. |

The Goal In Nuclear Is To Replicate Top Fleet Performance At A Single Plant

Making progress: Capacity factor 02-04; Percent

95.4

91.3

92.6

95.1

Exelon Large Plants1

TXU 03-05E

TXU 06-08E

TXU 08-10E

More productive: Non-fuel O&M 02-04; $/kW

79

101

94

89

Exelon Large Plants1

TXU 03-05E

TXU 06-08E

TXU 08-10E

Closing the gap on capacity factor and cost will have ~ $120 million upside relative to 03-05E

1 | | Exelon large plants include Byron, Braidwood, Lasalle, Limerick, and Peach Bottom. |

TXU Power’s Plan Is To Match Long Term Performance Trends Across Other Heavy Industries…

Industry productivity improvements (CAGR) 83-031; Percent

3.4%

2.4%

2.3%

2.3%

1.5%

0.7%

2.8%

Steel (workers/ ton)

Tele-com

($/line)

Gas pipelines

($)

Railroads

($/ton/ mile)

Refining (bpd throughput)

US Generation O&M

($/MWh)

TXU Power 05-08

($/MWh)

TXU Power is planning for cost improvement that matches other competitive industries

1 | | Steel is for the period 1990-2001; Gas pipelines for 1980-2003; Refining is for 1985-2004 |

…And Drive Superior Returns Throughout The Cycle

TXU baseload plant return on invested capital (ROIC)1 02-05; Percent

Increase due to TXU

Operating System

0.0

7.5

9.0

21.7

2.0

19.7

21.4

2.0

19.4

Long-term target >10%

9.5

2.5 7.0

02 03 04 05E

05E at 08 gas prices

Long-term2

ROIC1 performance in other asset-intensive industries 90-03; Percent

18

12

16

0

12

Max

Avg

Min

E&P

Refining

Steel

Pulp & paper

The TXU Operating System will drive more than a 200 bps increase in long term ROIC

1 | | 03 and 04 Net income divided by PPE; 05E: operational earnings divided by PPE |

2 | | Based on 05 operational assumptions with $5.00/MMBtu gas price and 9.0 MMBtu/MWh heat rate |

TXU Power: Expanding In Coal Generation

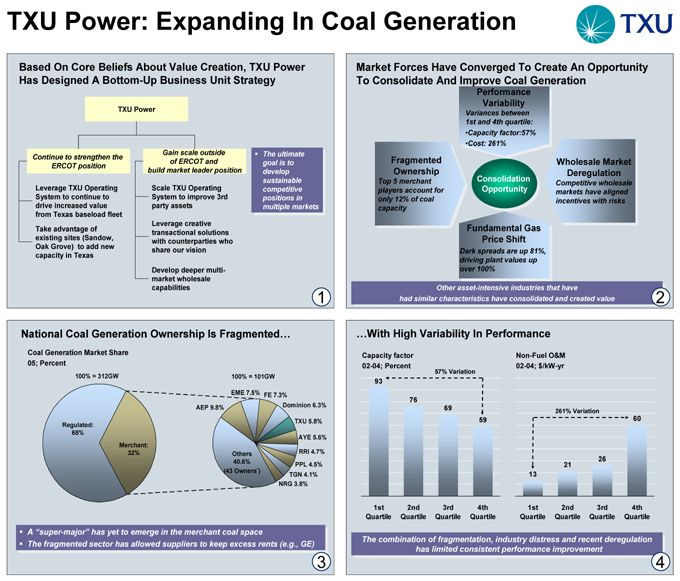

Based On Core Beliefs About Value Creation, TXU Power Has Designed A Bottom-Up Business Unit Strategy

TXU Power

Continue to strengthen the ERCOT position

Leverage TXU Operating System to continue to drive increased value from Texas baseload fleet Take advantage of existing sites (Sandow, Oak Grove) to add new capacity in Texas

Gain scale outside of ERCOT and build market leader position

Scale TXU Operating System to improve 3rd party assets

Leverage creative transactional solutions with counterparties who share our vision

Develop deeper multi-market wholesale capabilities

The ultimate goal is to develop sustainable competitive positions in multiple markets

Market Forces Have Converged To Create An Opportunity To Consolidate And Improve Coal Generation

Performance Variability

Variances between 1st and 4th quartile: •Capacity factor:57% •Cost: 261%

Fragmented Ownership

Top 5 merchant players account for only 12% of coal capacity

Consolidation Opportunity

Wholesale Market Deregulation

Competitive wholesale markets have aligned incentives with risks

Fundamental Gas Price Shift

Dark spreads are up 81%, driving plant values up over 100%

Other asset-intensive industries that have had similar characteristics have consolidated and created value

National Coal Generation Ownership Is Fragmented…

Coal Generation Market Share 05; Percent

100% = 312GW

Regulated: 68%

Merchant: 32%

100% = 101GW

AEP 9.8%

EME 7.5% FE 7.3%

Dominion 6.3%

TXU 5.8%

AYE 5.6%

RRI 4.7%

PPL 4.5%

TGN 4.1%

NRG 3.8%

Others 40.6% (43 Owners*)

A “super-major” has yet to emerge in the merchant coal space

The fragmented sector has allowed suppliers to keep excess rents (e.g., GE)

…With High Variability In Performance

Capacity factor 02-04; Percent

57% Variation

93

76

69

59

1st Quartile

2nd Quartile

3rd Quartile

4th Quartile

Non-Fuel O&M 02-04; $/kW-yr

261% Variation

13

21

26

60

1st Quartile

2nd Quartile

3rd Quartile

4th Quartile

The combination of fragmentation, industry distress and recent deregulation has limited consistent performance improvement

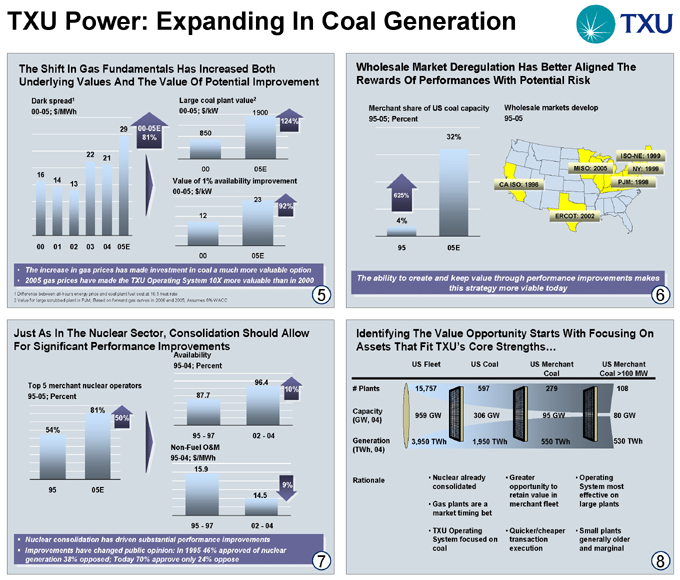

TXU Power: Expanding In Coal Generation

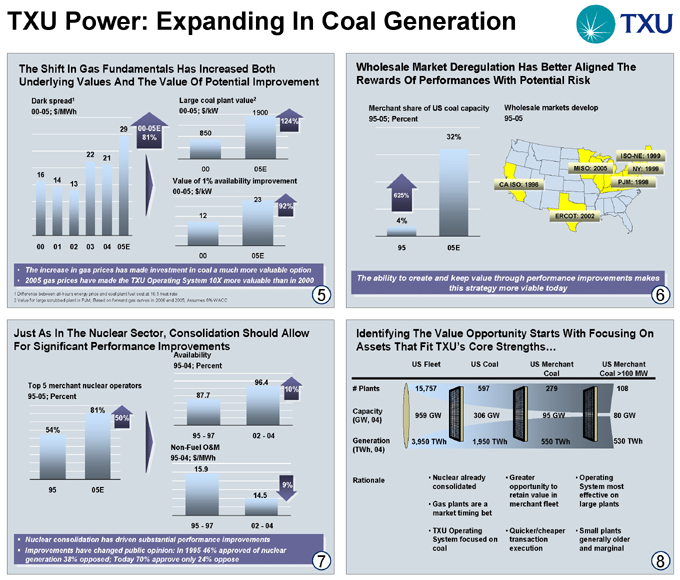

The Shift In Gas Fundamentals Has Increased Both Underlying Values And The Value Of Potential Improvement

Dark spread1 00-05; $/MWh

16

14

13

22

21

29

00-05E 00-05E

81% 81%

00 01 02 03 04 05E

Large coal plant value2 00-05; $/kW

850

1900

124% 124% 00 05E

Value of 1% availability improvement 00-05; $/kW

12

23

92% 92%

00 05E

The increase in gas prices has made investment in coal a much more valuable option 2005 gas prices have made the TXU Operating System 10X more valuable than in 2000

1 | | Difference between all-hours energy price and coal plant fuel cost at 10.5 heat rate |

2 | | Value for large scrubbed plant in PJM; Based on forward gas curves in 2000 and 2005; Assumes 6% WACC |

Wholesale Market Deregulation Has Better Aligned The Rewards Of Performances With Potential Risk

Merchant share of US coal capacity 95-05; Percent

625% 625%

4%

32%

95 05E

Wholesale markets develop 95-05

CA ISO: 1996 CA

MISO: 2005

ERCOT: 2002

ISO-NE: 1999 ISO-NE:

NY: 1999 NY:

PJM: 1998

The ability to create and keep value through performance improvements makes this strategy more viable today

Just As In The Nuclear Sector, Consolidation Should Allow For Significant Performance Improvements

Top 5 merchant nuclear operators 95-05; Percent

54%

81%

50% 50%

95 05E

Availability 95-04; Percent

87.7

96.4

10% 10%

95—97 02—04

Non-Fuel O&M 95-04; $/MWh

15.9

14.5

9%

95—97 02—04

Nuclear consolidation has driven substantial performance improvements Improvements have changed public opinion: In 1995 46% approved of nuclear generation 38% opposed; Today 70% approve only 24% oppose

Identifying The Value Opportunity Starts With Focusing On Assets That Fit TXU’s Core Strengths…

US Fleet US Coal US Merchant Coal US Merchant Coal >100 MW

# Plants 15,757 597 279 108

Capacity (GW, 04) 959 GW 306 GW 95 GW 80 GW

Generation (TWh, 04) 3,950 TWh 1,950 TWh 550 TWh 530 TWh

Rationale

Nuclear already consolidated

Gas plants are a market timing bet

TXU Operating System focused on coal

Greater opportunity to retain value in merchant fleet

Quicker/cheaper transaction execution

Operating System most effective on large plants

Small plants generally older and marginal

TXU Power: Expanding In Coal Generation

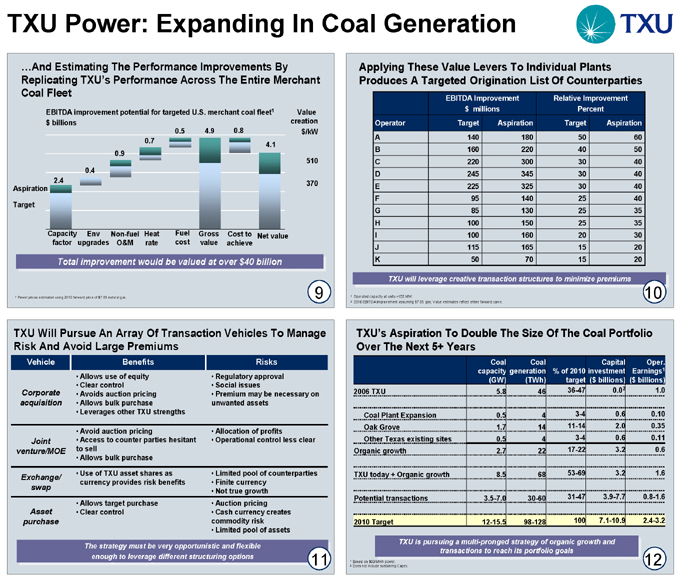

…And Estimating The Performance Improvements By Replicating TXU’s Performance Across The Entire Merchant Coal Fleet

EBITDA improvement potential for targeted U.S. merchant coal fleet1 $ billions

Aspiration

Target

2.4

0.4

0.9

0.7

0.5

4.9

0.8

4.1

Value creation $/kW

510

370

Capacity factor

Env upgrades

Non-fuel O&M

Heat rate

Fuel cost

Gross value

Cost to achieve

Net value

Total improvement would be valued at over $ 40 billion

1 | | Power prices estimated using 2010 forward price of $7.05 natural gas. |

9

Applying These Value Levers To Individual Plants Produces A Targeted Origination List Of Counterparties

EBITDA Improvement Relative Improvement

$ millions Percent

Operator Target Aspiration Target Aspiration

A 140 180 50 60

B 160 220 40 50

C 220 300 30 40

D 245 345 30 40

E 225 325 30 40

F 95 140 25 40

G 85 130 25 35

H 100 150 25 35

I 100 160 20 30

J 115 165 15 20

K 50 70 15 20

TXU will leverage creative transaction structures to minimize premiums

1 | | Operated capacity at units >100 MW. |

2 | | 2010 EBITDA improvement assuming $7.05 gas; Value estimates reflect entire forward curve. |

10

TXU Will Pursue An Array Of Transaction Vehicles To Manage Risk And Avoid Large Premiums

Vehicle Benefits Risks

Allows use of equity Regulatory approval

Clear control Social issues

Corporate acquisition Avoids auction pricing

Allows bulk purchase Premium may be necessary on unwanted assets

Leverages other TXU strengths

Avoid auction pricing Allocation of profits

Joint venture/MOE Access to counter parties hesitant to sell Operational control less clear

Allows bulk purchase

Exchange/ swap Use of TXU asset shares as Limited pool of counterparties

currency provides risk benefits Finite currency

Not true growth

Asset purchase Allows target purchase Auction pricing

Clear control Cash currency creates commodity risk

Limited pool of assets

The strategy must be very opportunistic and flexible enough to leverage different structuring options

11

TXU’s Aspiration To Double The Size Of The Coal Portfolio Over The Next 5+ Years

Coal capacity (GW) Coal generation (TWh) % of 2010 target Capital investment ($ billions) Oper. Earnings1 ($ billions)

2006 TXU 5.8 46 36-47 0.02 1.0

Coal Plant Expansion 0.5 4 3-4 0.6 0.10

Oak Grove 1.7 14 11-14 2.0 0.35

Other Texas existing sites 0.5 4 3-4 0.6 0.11

Organic growth 2.7 22 17-22 3.2 0.6

TXU today + Organic growth 8.5 68 53-69 3.2 1.6

Potential transactions 3.5-7.0 30-60 31-47 3.9-7.7 0.8-1.6

2010 Target 12-15.5 98-128 100 7.1-10.9 2.4-3.2

TXU is pursuing a multi-pronged strategy of organic growth and transactions to reach its portfolio goals

1 | | Based on $60/MWh power. |