Exhibit 99.2

EXECUTIVE SUMMARY

On February 25, 2007, TXU Corp. (now named Energy Future Holdings Corp. (“EFH”)) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Texas Energy Future Merger Sub Corp and Texas Energy Future Holdings Limited Partnership (“Texas Holdings”), a limited partnership established by investment funds associated with Kohlberg Kravis Roberts & Co. (“KKR”) and TPG Capital, LP (“TPG”). EFH announced that the Merger Agreement was approved by its existing shareholders on September 7, 2007. Under the terms of the Merger Agreement, EFH shareholders were entitled to receive $69.25 per share in cash for each share of EFH common stock they held. The “Transaction” was completed on October 10, 2007 and investment funds associated with or designated by KKR, TPG, and Goldman, Sachs & Co. (collectively, the “Sponsors”), and certain other co-investors (collectively with the Sponsors, the “Investor Group”) became the owners of EFH.

The Sponsors engaged Citigroup Global Markets Inc., J.P. Morgan Securities Inc., Credit Suisse Securities (USA) LLC, Goldman Sachs Credit Partners L.P. (“GSCP”), Lehman Brothers Inc. and Morgan Stanley Senior Funding, Inc. (collectively, the “Arrangers”) to provide committed financing for the Transaction. The Arrangers’ commitment consisted of the following:

| | • | | $24,500 million of senior secured credit facilities (the “Facilities”) described herein issued at Texas Competitive Electric Holdings Company LLC (“TCEH”). The Facilities are comprised of: (i) a $16,450 million Term Loan B, (ii) a $4,100 million Delayed Draw Term Loan, (iii) a $2,700 million Revolving Credit Facility, and (iv) a $1,250 million Deposit Letter of Credit Facility; |

| | • | | a cash posting credit facility (the “Commodity Collateral Revolver”), the size of which is determined by the mark-to-market exposure, inclusive of any unpaid settlement amounts, of TCEH and its subsidiaries on a portfolio of certain commodity swaps and futures transactions that are set forth in the Commodity Collateral Revolver (the commitment for this facility was provided only by GSCP); |

| | • | | replacement or amendment of accounts receivable securitization facilities for TXU Receivables Company, a subsidiary of EFH; |

| | • | | $6,750 million of TCEH senior unsecured cash pay and toggle bridge loans; and |

| | • | | $4,500 million of EFH senior unsecured cash pay and toggle bridge loans. |

Proceeds from the debt financing and the Investor Group’s equity contribution were used: (i) to purchase outstanding public EFH shares, (ii) to finance the repayment of certain existing indebtedness, (iii) for working capital and general corporate purposes, and (iv) to pay fees and expenses.

B. COMPANY OVERVIEW

TCEH, formerly named TXU Energy Company LLC, is a holding company for EFH’s Luminant and TXU Energy businesses, which are engaged in competitive electricity market activities largely in the Electric Reliability Council of Texas (“ERCOT”) region. The Luminant businesses include power generation operations (“Luminant Power”), wholesale energy markets operations (“Luminant Energy”) and power generation facility construction activities (“Luminant Construction”). The TXU Energy business is comprised of retail electricity sales operations (“TXU Energy”). Luminant Power, Luminant Energy, Luminant Construction and TXU Energy conduct their operations through a number of separate legal entities that, in accordance with regulatory requirements, operate independently within the competitive Texas power market.

1

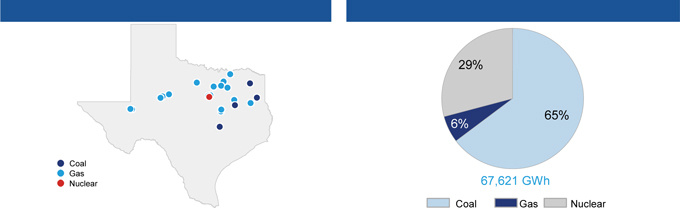

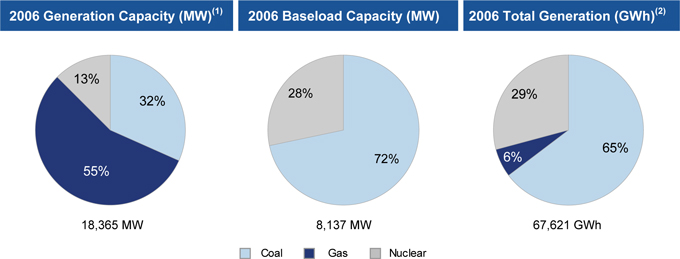

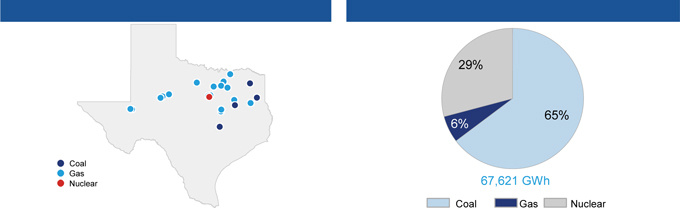

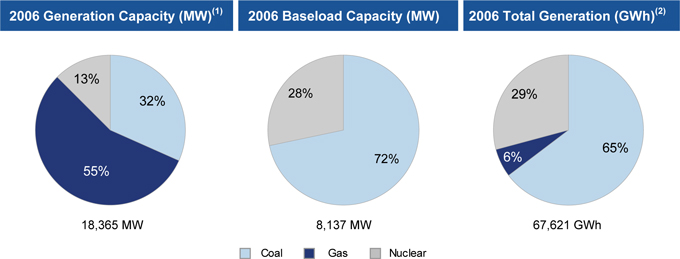

As of June 30, 2007,Luminant Power had 18,365 MW of generation capacity in Texas (which includes 585 MW representing nine combustion turbine units currently operated for an unaffiliated party’s benefit). This amount includes 8,137 MW of low-cost baseload solid fuel generation capacity represented by 2,300 MW of nuclear generation capacity and 5,837 MW of lignite/coal-fueled generation capacity. Luminant Power owns and operates the largest generation fleet in Texas and ranks second in unregulated generation output in the U.S.

Luminant Energysupports Luminant Power and TXU Energy by optimizing the performance of the generation assets and sourcing the electricity requirements for TXU Energy’s customers as well as providing related services to other market participants. Luminant Energy manages the risks of imbalances between generation supply and sales load through wholesale markets activities that include physical purchases and sales and transacting in financial instruments.

Luminant Construction is currently building three new lignite coal-fueled generation facilities in Texas with expected generation capacity totaling approximately 2,200 MW. The three facilities are fully permitted and are expected to come on-line in the 2009-2010 timeframe.

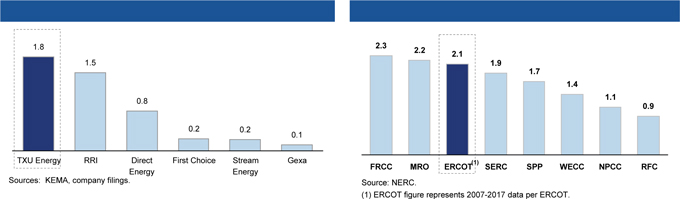

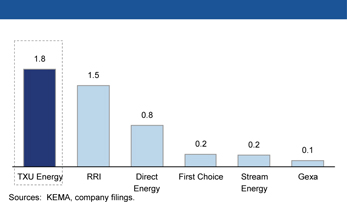

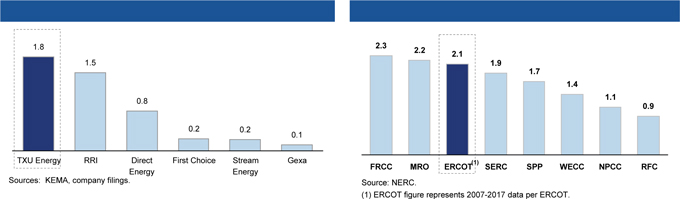

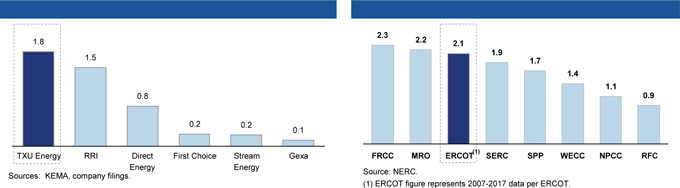

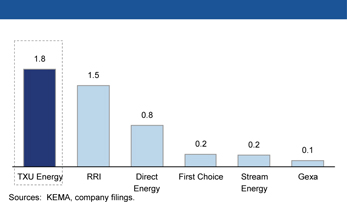

TXU Energy provides competitive electricity and related services to more than 2.1 million retail electricity customers in Texas, which includes 1.8 million residential customers. As of June 30, 2007, TXU Energy’s estimated share of total ERCOT retail residential and small business electric customers was approximately 35% and 25%, respectively.

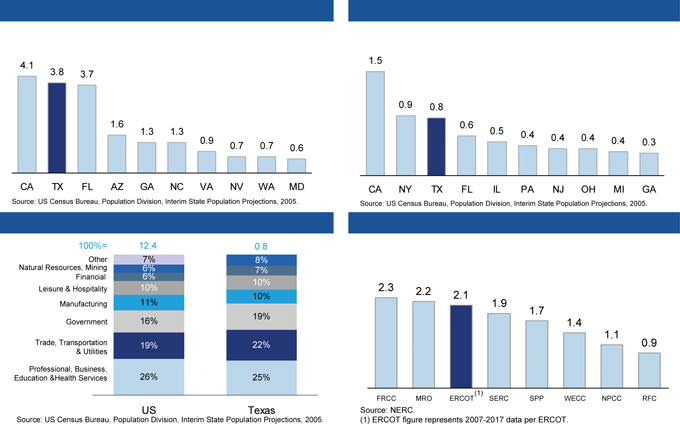

Definitions: Florida Reliability Coordinating Council (FRCC), Midwest Reliability Organization (MRO), Electric Reliability Council of Texas (ERCOT), SERC Reliability Corporation (SERC), Southwest Power Pool, Inc. (SPP), Western Electricity Coordinating Council (WECC), Northeast Power Coordinating Council (NPCC), Reliability First Corporation (RFC)

2

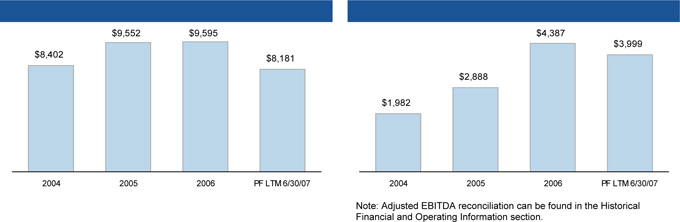

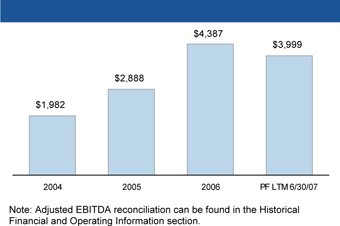

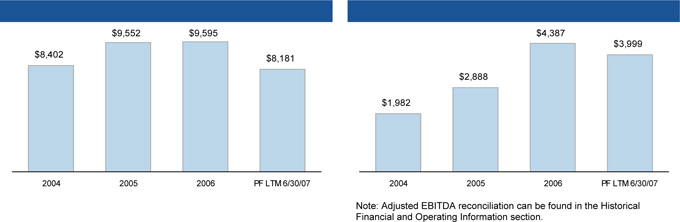

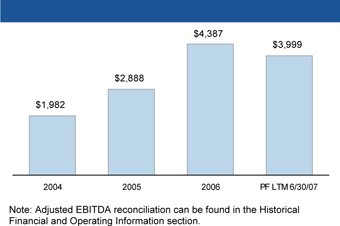

For the twelve months ended June 30, 2007, on a pro forma basis, TCEH had Operating Revenues of $8,181 million and Adjusted EBITDA of $3,999 million on a consolidated basis. A reconciliation of net income to Adjusted EBITDA is included below in this memorandum.

C. SUMMARY FINANCIAL INFORMATION

TCEH Selected Financial Data

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | | | Six Months Ended June 30, | | | Pro Forma

LTM 6/30/07(1) | |

($ in millions) | | 2004 | | | 2005 | | | 2006 | | | 2006 | | | 2007 | | |

Operating revenues | | $ | 8,402 | | | $ | 9,552 | | | $ | 9,595 | | | $ | 4,478 | | | $ | 3,411 | | | $

|

8,181 |

|

Operating costs and expenses: | | | | | | | | | | | | | | | | | | | | | | | | |

Fuel, purchased power costs and delivery fees | | | 5,173 | | | | 5,545 | | | | 3,922 | | | | 1,733 | | | | 1,900 | | | | 4,244 | |

Operating costs | | | 703 | | | | 667 | | | | 613 | | | | 307 | | | | 319 | | | | 626 | |

Depreciation and amortization | | | 350 | | | | 313 | | | | 333 | | | | 169 | | | | 160 | | | | 672 | |

Selling, general and administrative expenses | | | 666 | | | | 522 | | | | 532 | | | | 242 | | | | 285 | | | | 634 | |

Franchise and revenue-based taxes | | | 117 | | | | 114 | | | | 126 | | | | 54 | | | | 53 | | | | 125 | |

Other income | | | (110 | ) | | | (64 | ) | | | (25 | ) | | | (1 | ) | | | (9 | ) | | | (25 | ) |

Other deductions | | | 611 | | | | 15 | | | | 200 | | | | 195 | | | | 15 | | | | 20 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total costs and expenses | | $ | 7,510 | | | $ | 7,112 | | | $ | 5,701 | | | $ | 2,699 | | | $ | 2,723 | | | $ | 6,296 | |

Operating Income | | $ | 892 | | | $ | 2,440 | | | $ | 3,894 | | | $ | 1,779 | | | $ | 688 | | | $ | 1,885 | |

Net income | | $ | 378 | | | $ | 1,414 | | | $ | 2,435 | | | $ | 1,063 | | | $ | 480 | | | $ | (205 | ) |

Provision for income taxes | | | 162 | | | | 687 | | | | 1,277 | | | | 590 | | | | 180 | | | | (241 | ) |

Interest expense | | | 353 | | | | 393 | | | | 384 | | | | 202 | | | | 190 | | | | 2,619 | |

Depreciation and amortization | | | 350 | | | | 313 | | | | 333 | | | | 169 | | | | 160 | | | | 672 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

EBITDA | | $ | 1,243 | | | $ | 2,807 | | | $ | 4,429 | | | $ | 2,024 | | | $ | 1,010 | | | $ | 2,845 | |

Total Adjustments to EBITDA | | | 739 | | | | 81 | | | | (42 | ) | | | 27 | | | | 661 | | | | 1,154 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA(2) | | $ | 1,982 | | | $ | 2,888 | | | $ | 4,387 | | | $ | 2,051 | | | $ | 1,671 | | | $ | 3,999 | |

Capital Expenditures(3) | | $ | 281 | | | $ | 309 | | | $ | 388 | | | $ | 218 | | | $ | 381 | | | $ | 551 | |

| (1) | Pro forma LTM period financial information includes adjustments for purchase accounting and financing related to the Transaction. |

| (2) | A detailed Adjusted EBITDA reconciliation is provided in the Historical Financial and Operating Information section. |

| (3) | Excludes Oak Grove and Sandow 5 capital expenditures transferred into TCEH in October 2007. |

3

D. PRO FORMA CONSOLIDATED SOURCESAND USES ASOF 6/30/07

($ in millions)

| | | | | | |

Sources | | Amount | | % | |

Cash and Other Sources(1) | | $ | 641 | | 1.5 | % |

| TCEH | | | | | | |

Revolver(2) | | | — | | 0.0 | |

Deposit LC Facility(3) | | | — | | 0.0 | |

Commodity Collateral Revolver(4) | | | 687 | | 1.6 | |

Term Loan B | | | 16,450 | | 37.3 | |

Delayed Draw Term Loan(5) | | | 2,150 | | 4.9 | |

Senior Unsecured Cash Pay Bridge | | | 5,000 | | 11.3 | |

Senior Unsecured PIK Toggle Bridge | | | 1,750 | | 4.0 | |

Existing Debt | | | 1,627 | | 3.7 | |

| Energy Future Competitive Holdings | | | | | | |

Existing Debt | | | 217 | | 0.5 | |

| Energy Future Holdings Corp. | | | | | | |

Senior Unsecured Cash Pay Bridge | | | 2,000 | | 4.5 | |

Senior Unsecured PIK Toggle Bridge | | | 2,500 | | 5.7 | |

Existing Debt | | | 2,793 | | 6.3 | |

| Common Equity | | | 8,300 | | 18.8 | |

| | | | | | |

Total Sources to Fund the Transaction | | $ | 44,115 | | 100.0 | % |

| | |

Uses | | Amount | | % | |

Purchase of Equity | | $ | 32,384 | | 73.4 | % |

Refinance Existing Debt | | | 5,470 | | 12.4 | |

Rollover Existing Debt | | | 4,637 | | 10.5 | |

Fees, Expenses & Other | | | 1,624 | | 3.7 | |

| | | | | | |

Total Uses for the Transaction | | $ | 44,115 | | 100.0 | % |

Note: Excludes Oncor related debt of $5,128 million, including transition bonds and $113 million related to repurchasing receivables from the accounts receivable securitization facility.

| (1) | Includes cash on hand, LESOP liquidation, and return of initial margin in connection with Commodity Collateral Revolver. Does not include any changes in amount of available funds under the amendments to the accounts receivable securitization facility for TCEH. |

| (2) | Revolver commitment of $2,700 million. |

| (3) | Deposit LC Facility of $1,250 million that will be reflected as debt on the balance sheet of TCEH offset by $1,250 million in restricted cash. |

| (4) | Assumed drawdown of $687 million based on natural gas forward curve as of June 30, 2007; actual drawn amount at closing was ~$380 million. Annual interest expense for CCR is fixed, irrespective of drawn amount. |

| (5) | Total quantum of Delayed Draw Term Loan of $4,100 million, of which $2,150 million was funded at close. |

4

E. TCEH PRO FORMA CAPITALIZATIONASOF 6/30/07

| | | | | | | | | | |

| | | | | | | Excludes borrowings related to

new plants not yet in service |

($ in millions) | | Funded

Amount | | Multiple of

PF Adjusted

LTM EBITDA | | Funded

Amount | | Multiple of

PF Adjusted

LTM EBITDA |

Revolving Credit Facility(1) | | | — | | | | | — | | |

Deposit LC Facility(2) | | | — | | | | | — | | |

Commodity Collateral Revolver(3) | | $ | 687 | | | | $ | 687 | | |

Term Loan B | | | 16,450 | | | | | 16,450 | | |

Delayed Draw Term Loan | | | 2,150 | | | | | — | | |

Capital Leases | | | 92 | | | | | 92 | | |

| | | | | | | | | | |

Total Senior Secured Debt | | | 19,379 | | 4.8x | | | 17,229 | | 4.3x |

Senior Unsecured Bridge Facility | | | 6,750 | | | | | 6,750 | | |

Pollution Control Revenue Bonds | | | 1,535 | | | | | 1,535 | | |

| | | | | | | | | | |

Total Debt | | | 27,664 | | 6.9x | | | 25,514 | | 6.4x |

LTM 06/30/07 Pro Forma Adjusted EBITDA(4) | | $ | 3,999 | | | | $ | 3,999 | | |

Note: As of June 30, 2007.

| (1) | Revolver commitment of $2,700 million. |

| (2) | Deposit LC Facility of $1,250 million that will be shown as debt on TCEH’s balance sheet offset by $1,250 million of restricted cash. |

| (3) | Commodity Collateral Revolver will be drawn as needed to provide cash collateral for certain natural cash hedges. Assumed drawdown of $687 million based on natural gas forward curve as of June 30, 2007; actual drawn amount at closing was ~$380 million. Annual interest expense for CCR is fixed, irrespective of drawn amount. |

| (4) | A detailed Adjusted EBITDA reconciliation is provided in the Historical Financial and Operating Information section. |

F. TREATMENTOF EXISTING TCEH INDEBTEDNESS

| | | | | |

Tranche | | Size ($mm) | | Treatment |

Existing Short Term Debt | | $ | 2,195 | | Refinanced at close |

6.125% notes due 2008 | | | 250 | | Substantially all refinanced at close |

Floating Rate notes due 2008 | | | 1,000 | | Refinanced at close |

7.000% notes due 2013 | | | 1,000 | | Substantially all refinanced at close |

Pollution Control Revenue Bonds | | | 1,535 | | Remain outstanding |

Capital Leases | | | 92 | | Remain outstanding |

Note: Debt balances as of June 30, 2007.

5

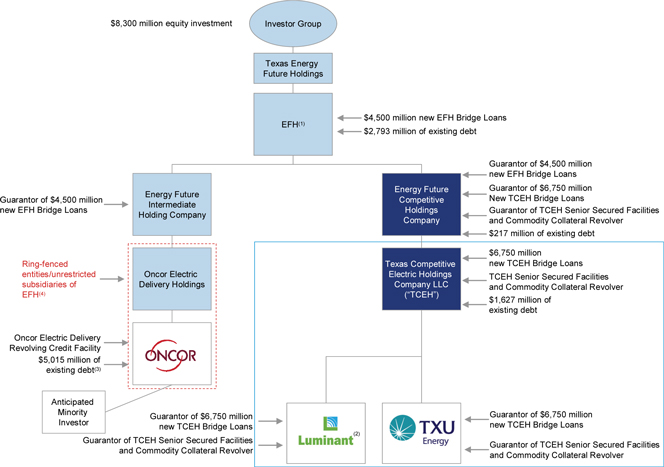

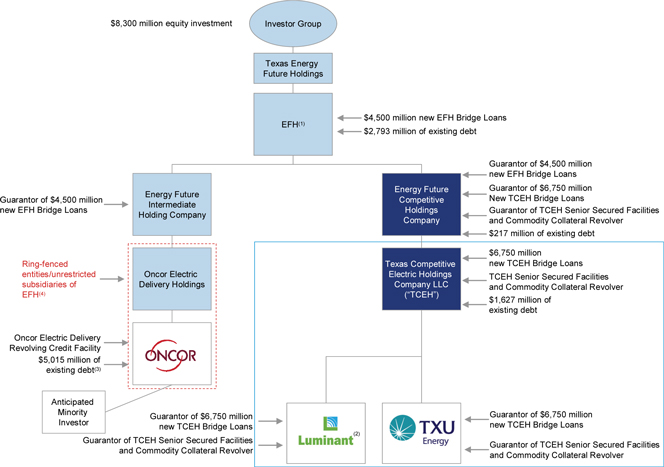

G. OWNERSHIP AND CORPORATE STRUCTURE

Below is a summary of ownership and corporate structure after giving effect to the Transaction.

| (1) | Summary diagram excludes subsidiaries of EFH that are not subsidiaries of Energy Future Intermediate Holding Company or Energy Future Competitive Holdings Company, including TXU Receivables Company, which buys receivables from TXU Energy and sells undivided interest in such receivables under the TXU receivables program. The existing debt amount for EFH includes approximately $93 million related to a financing lease of an indirect subsidiary of EFH not included in the diagram above. |

| (2) | Holding company for the Luminant businesses, including Luminant Power, Luminant Energy and Luminant Construction. |

| (3) | Includes securitization bonds issued by Oncor Electric Delivery Transmission Bond Company LLC; excludes $113 million related to repurchasing receivables from the accounts receivables facility. |

| (4) | None of the ring-fenced entities will secure or guarantee any of the debt incurred to fund the Transaction. |

Ring-Fencing of Oncor Electric Delivery

Certain structural and operational measures that are based on principles articulated by rating agencies and commitments made by Texas Energy Future Holdings and Oncor Electric Delivery to the Public Utility Commission of Texas (“PUCT”) and the Federal Energy Regulatory Commission (“FERC”) have been implemented to further separate Oncor Electric Delivery from EFH and its other subsidiaries in order to mitigate Oncor Electric Delivery’s credit exposure to those entities and to reduce the risk that the assets and liabilities of Oncor Electric Delivery would be substantively consolidated with the assets and liabilities of EFH or any of its other subsidiaries in the event of a bankruptcy of one or more of those entities.

6

TCEH KEY INVESTMENT CONSIDERATIONS

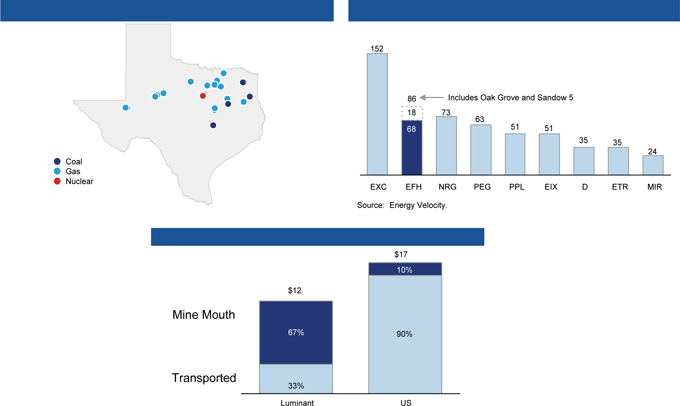

A. SCALE AND DIVERSITY OF BUSINESSES

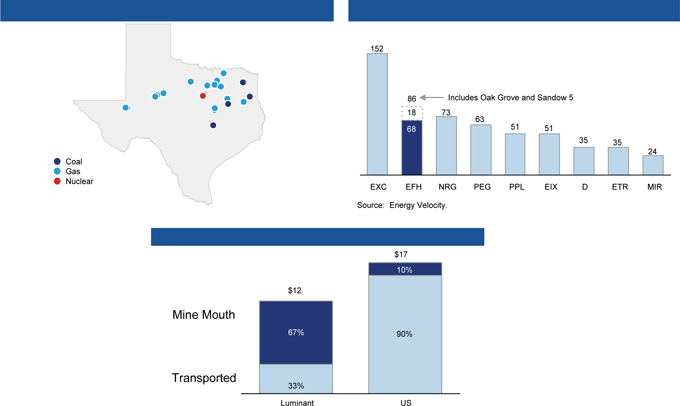

TCEH consists of two large-scale electricity businesses operarting in an attractive electricity market. Luminant has a large and diversified competitive power generation portfolio with approximately 18,365 MW of generation capacity as of June 30, 2007 (which includes 585 MW representing nine combustion turbine units currently operated for an unaffiliated party’s benefit). Its diversified portfolio consists of approximately 8,137 MW of low-cost solid fuel baseload generation capacity (approximately 72% lignite/coal and 28% nuclear) in ERCOT, a market in which power prices are predominantly set by natural gas-fueled generation that is more costly than the solid fuel that powers TCEH’s baseload plants at current commodity levels. In addition, as of June 30, 2007, Luminant owned or operated 10,228 MW of intermediate and peaking facilities, which provide the ability to meet ERCOT requirements at various levels of demand. Luminant’s lignite/coal-fueled plants are near lignite reserves that are controlled by Luminant and supply approximately 67% of the fuel used to operate these plants, which reduces Luminant’s reliance on third-party coal suppliers and railroads. Luminant controls approximately 1.0 billion tons, or over 21 years of fuel (assuming current mine production levels), of proven lignite reserves and operates the nation’s 13th largest mining company. Luminant is also developing and constructing three new lignite coal-fueled generation facilities in Texas with expected generation capacity totaling approximately 2,200 MW of additional installed low-cost baseload capacity. TCEH expects two of these units, representing approximately 1,400 MW, to be operational in 2009 and the remaining unit, representing approximately 800 MW, to be operational in 2010.

(1) Includes 585 MW of combustion turbines included in a tolling agreement to an unaffiliated third party and 1,329 MW of mothballed gas plants.

TXU Energy is a large scale competitive retailer that provides competitive electricity and related services to more than 2.1 million electricity customers in Texas. As of June 30, 2007, TXU Energy held approximately 62% retail residential market share in its historical market area located in the north-central, eastern and western parts of Texas, including the Dallas–Fort Worth area. As of June 30, 2007, TXU Energy’s estimated share of total ERCOT retail residential and small business electric customers was approximately 35% and 25%, respectively.

7

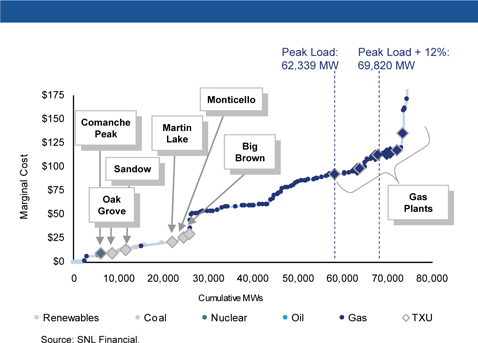

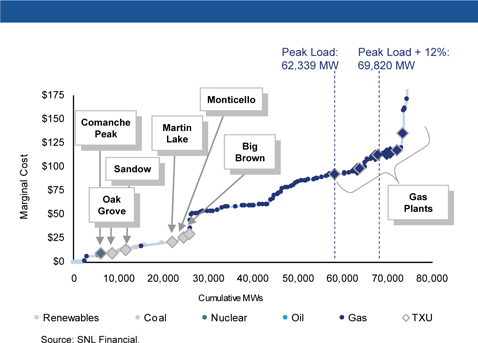

B. LOW COST ASSET BASE

Luminant is the largest provider of baseload power in Texas with approximately 8,137 MW of existing low-cost solid fuel baseload capacity (coal and nuclear) in a gas-on-the-margin market. Luminant’s baseload generation facilities operate at high utilization levels, incur comparatively low operations and maintenance costs and benefit from a number of long-term fuel contracts on attractive terms.

Luminant’s low cost position is supported by a number of factors, including TCEH’s control of an estimated 858 million tons of dedicated and in excess of 119 million tons of undedicated proven lignite reserves to its generator plants. Importantly, these lignite reserves, which are near a number of the lignite coal-fueled plants that TCEH operates, provide a low cost source of fuel for such plants, and reduce Luminant’s exposure to rising coal and rail contract prices, which have been observed throughout the sector.

Luminant is currently developing three new lignite coal-fueled generation facilities in Texas with expected generation capacity totaling approximately 2,200 MW which is expected to further enhance TCEH’s low-cost position.

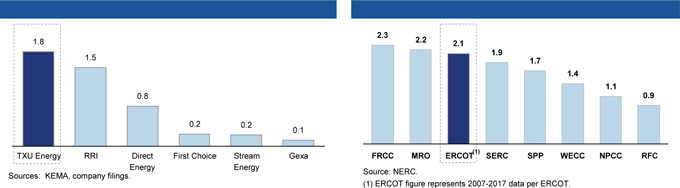

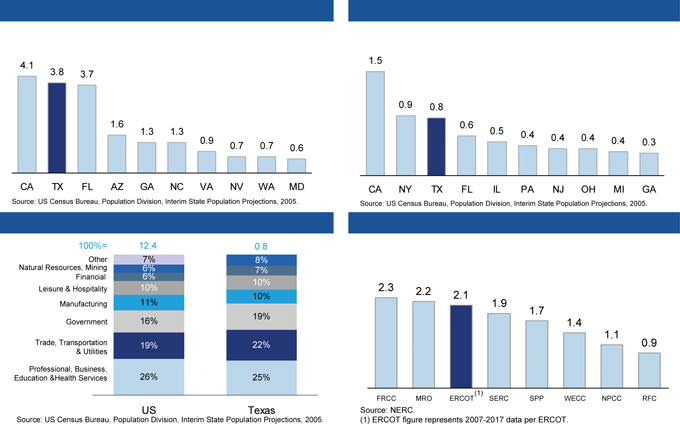

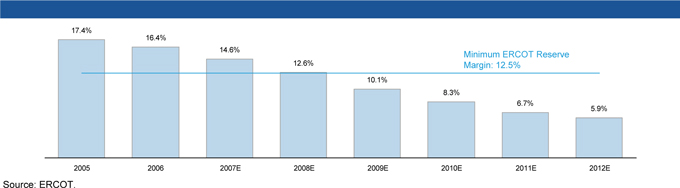

C. FAVORABLE MARKET DYNAMICS

TCEH operates primarily in ERCOT, which represents approximately 85% of the electricity consumed in Texas. The strong regional economic growth in Texas continues to support demand growth for electricity in ERCOT. According to ERCOT, peak demand in ERCOT is expected to grow at an average rate of over 2.1% per year over the period from 2007 to 2017. ERCOT expects reserve margins to continue to decline, which presents additional investment opportunities. Reserve margin is the percentage by which available capacity is expected to exceed forecasted peak demand. Power prices are generally driven by natural gas prices in ERCOT, where natural gas-fueled plants set the market price approximately 90% of the time. Texas has one of the highest retail energy consumption profiles in the country with approximately 14 MWh of consumption per household. ERCOT has experienced over 2.1% annual retail growth over the period from 2002 to 2006, making it one of the fastest growing NERC regions.

8

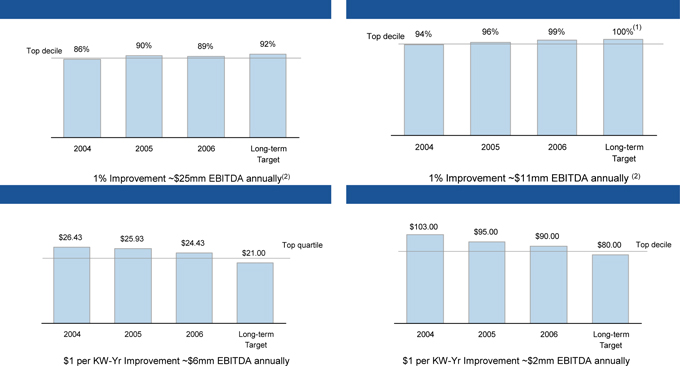

D. STRONG OPERATING PERFORMANCE

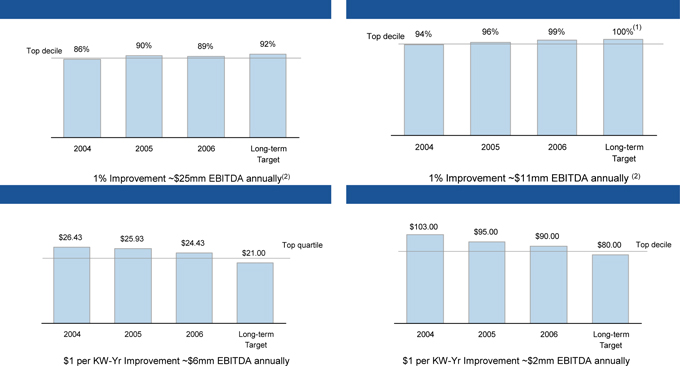

Luminant Power is an industry-leading operator of baseload solid fuel plants. Based on its benchmark analysis, TCEH believes that compared with the U.S. merchant coal plant fleet, Luminant Power’s lignite/coal plants achieved top decile capacity factors and top quartile costs per MWh in 2005 and 2006. Similarly, TCEH believes that its nuclear units achieved top decile capacity factors and top quartile costs per MWh in 2006. Luminant Power’s lignite/coal-fueled plants achieved a capacity factor of 89.1% for 2006 and Luminant Power’s nuclear plants achieved a capacity factor of 98.8% for 2006. Luminant Power’s ongoing operating system initiatives are focused on achieving industry-leading capacity factors while continuing to manage costs. The capacity factor of a power plant is generally the ratio of the actual output of such power plant over a period of time as compared to its potential output if the plant operated at full capacity during such period.

| (1) | Normalized for one outage per year. 100% long-term target based on nameplate capacity, equivalent to 96% of actual current capacity due to upgrades. |

| (2) | Based on an annual average power price of $65/MWh. |

| (3) | Normalized for one outage per year. |

TXU Energy is committed to providing its customers with industry-leading customer service and creating an innovative set of new products and services to meet customer needs and use electricity more efficiently. For the twelve months ended June 30, 2007, call answer times averaged under 15 seconds, which dropped from an average of over 100 seconds for the same

9

period in 2004. Customer call satisfaction scores in North Texas improved 16 percent in the twelve months ended June 30, 2007, as compared to the twelve months ended June 30, 2006. Meanwhile, TXU Energy continues to offer the broadest set of customer products of any retailer in the ERCOT market.

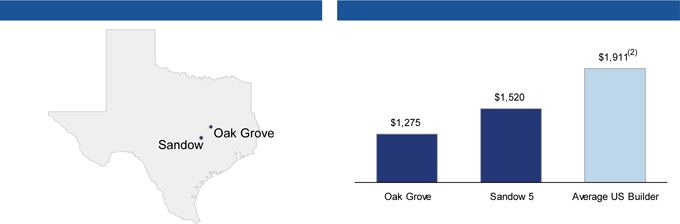

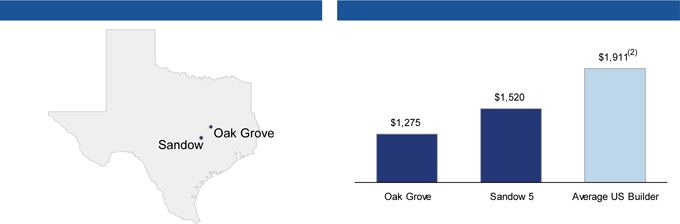

E. ATTRACTIVE OPPORTUNITIES FOR CAPITAL INVESTMENT

TCEH has a number of attractive opportunities for capital investment. Luminant Construction is building three, new low-cost lignite coal-fueled generation units in the state of Texas with total estimated capacity of approximately 2,200 MW. The three units consist of one new generation unit at a site owned by Alcoa Inc. that is adjacent to an existing TCEH lignite coal-fueled generation plant site (Sandow) and two units at a TCEH site that was originally slated for the construction of a generation plant a number of years ago (Oak Grove). Aggregate capital expenditures to develop these three units are expected to total approximately $3.25 billion, including all construction, site preparation and mining development costs.

These construction projects represent highly attractive investment opportunities for TCEH, as the projects benefit from a number of strategic advantages, including: (i) TCEH’s incumbent position in the ERCOT market, (ii) TCEH’s control of attractive brownfield development sites with access to low-cost lignite fuel, (iii) TCEH’s first mover advantage in seeking, siting and permitting approval and (iv) TCEH’s low cost development contracts with leading Engineering, Procurement and Construction (EPC) firms.

| (1) | Estimates of construction expenses excluding mine development costs. |

| (2) | Based on average of pulverized coal plant construction cost estimates/targets for 2002 – 2007. |

F. ATTRACTIVE CASH FLOW GENERATION

TCEH’s high operating margins, low maintenance capital expenditures and modest working capital requirements are key drivers of its strong cash flow generation. For the twelve months ended June 30, 2007, on a pro forma basis, TCEH generated Adjusted EBITDA of $3,999 million.

10

Specific characteristics of TCEH’s businesses that support its attractive cash flow generation are outlined below.

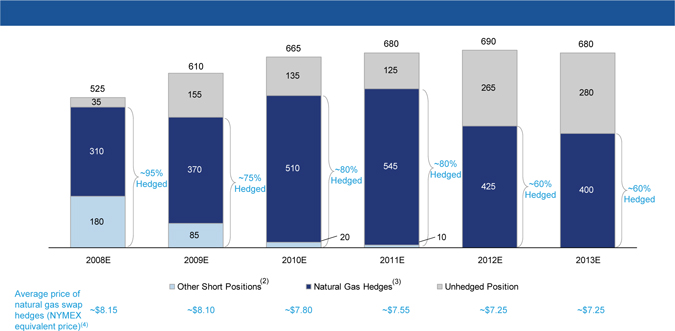

Luminant’s Ability to Hedge Future Cash Flows through Long-Term Hedging Program

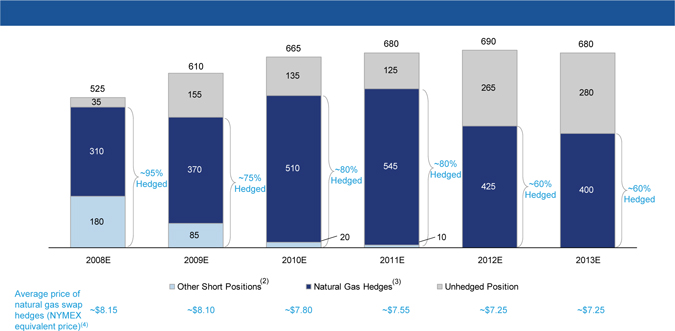

The strong historical correlation between natural gas prices and power prices in ERCOT combined with significant liquidity in certain natural gas markets currently provides an opportunity for management of TCEH’s exposure to natural gas prices. As a result, TCEH plans to hedge up to 80% of the equivalent natural gas price exposure of its expected baseload generation output on a rolling five-year basis. As of October 10, 2007, approximately 2.6 billion MMBtu of natural gas (equivalent to the natural gas exposure of over 300,000 GWh at an assumed 8.5 MMBtu/MWh market heat rate) have been effectively sold forward over the period from 2008 to 2013 at average annual prices ranging from $7.25 per MMBtu to $8.15 per MMBtu. For the period from 2008 to 2013, and taking into consideration the estimated portfolio impacts of certain of TCEH’s other business, these transactions result in TCEH having effectively hedged approximately 75% of its expected baseload generation natural gas price exposure for such period (on an average basis).

TCEH believes this hedging program provides it with visibility and stability of future revenues and cash flows.

TXU Energy’s Strong Market Position

TXU Energy’s brand recognition, innovative products, and industry leading customer service result in a uniquely valuable residential business.

11

G. STRONG LEADERSHIP

Luminant and TXU Energy will have separate leadership teams consistent with the separation of EFH’s legacy businesses into distinct operating entities. Each business has its own chief executive officer who, together with the respective management teams, will focus on optimizing operations and maximizing performance for that specific business unit, independent of the other business units(1). The management teams for each business will be comprised of highly experienced professionals.

In addition, the following prominent people will also join the Board of Directors of EFH:

| | • | | Donald L. Evans, former U.S. Secretary of Commerce; |

| | • | | James R. Huffines, Chairman of the University of Texas Board of Regents; |

| | • | | Lyndon L. Olson Jr., former Texas State Representative and former U.S. Ambassador to Sweden; |

| | • | | Kneeland Youngblood, a former director of the U.S. Enrichment Corporation; and |

| | • | | William Reilly, Chairman Emeritus of the World Wildlife Fund and former EPA Administrator, who will lead the adoption of corporate governance policies that tie EFH’s operations and goals to environmental stewardship. |

Finally, former U.S. Secretary of State James A. Baker, III will serve as Advisory Chairman to TEF.

| (1) | While the businesses will operate separately, Luminant’s wholesale market operations will continue to manage the commodity risks for both Luminant and TXU Energy. |

12

ERCOT MARKET OVERVIEW

TCEH operates primarily within the Electric Reliability Council of Texas (“ERCOT”) region, which represents approximately 85% of electricity consumption in Texas. ERCOT is the regional reliability coordinating organization for member electricity systems in Texas and the system operator of the interconnected transmission system for those systems. ERCOT’s membership consists of 236 members, including electric cooperatives, municipal power agencies, investor-owned independent generators, independent power marketers, transmission service providers and distribution services providers, independent REPs and consumers.

ERCOT represents approximately 75% of the geographical area of Texas, but excludes El Paso, a large part of the Texas Panhandle and two small areas in the eastern part of the state. From 1994 through 2005, peak hourly demand in the ERCOT market grew at a compound annual rate of 2.8%, compared to a compound annual rate of growth of 2.3% for the entire United States over the same period. Going forward, ERCOT’s projected annual electricity demand growth is expected to be 2.1%.

For 2006, hourly demand ranged from a low of 21,309 MW to a high of 62,339 MW. ERCOT has limited interconnections to other markets outside of ERCOT, which is currently limited to 1,106 MW of generation capacity (or approximately 2% of peak demand in Texas) and wholesale transactions within the ERCOT market are not subject to regulation by the FERC.

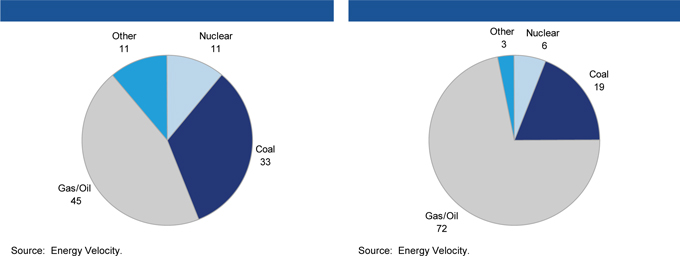

ERCOT is a large, diversified and growing market as shown below:

The ERCOT market has experienced significant construction of new gas-fired generation plants in recent years, with over 29,000 MW of mostly natural gas-fueled combined cycle generation capacity added to the market since 1996. New Combined Cycle Gas Turbine (“CCGT”) plants will cap long-run market heat rates at the point where builders can earn a reasonable return on their capital. At current forward gas price and $710/kW capital cost, the breakeven heat rate for a new CCGT facility would be ~9.0 MMBtu/MWh.

13

| | | | | | |

| | | Units | | Values | |

HSC Gas Price | | $/MMBtu | | $ | 7.20 | |

Advanced CCGT Heat Rate | | MMBtu/MWh | | | 6.8 | |

Construction Cost | | $/KW | | | 710 | |

Capacity Factor | | Percent | | | 85.0 | % |

Total Required Capacity Payment | | $/KW-year | | | 129 | |

Breakeven Heat Rate Calculator | | | | | | |

Total Breakeven Revenue | | $/MWh | | $ | 67.4 | |

Equivalent Heat Rate When Earning a Return | | MMBtu/MWh | | | 9.4 | |

Power Price When Not Earning Return | | $/MWh | | $ | 50.0 | |

Equivalent Heat Rate When Not Earning a Return | | MMBtu/MWh | | | 6.9 | |

7x24 Price | | $/MWh | | $ | 64.8 | |

Implied 7X24 Heat Rate | | MMBtu/MWh | | | 9.0 | |

Breakeven Spark Spread | | $/MWh | | $ | 15.8 | |

Note: EVA and EFH assumptions/analysis.

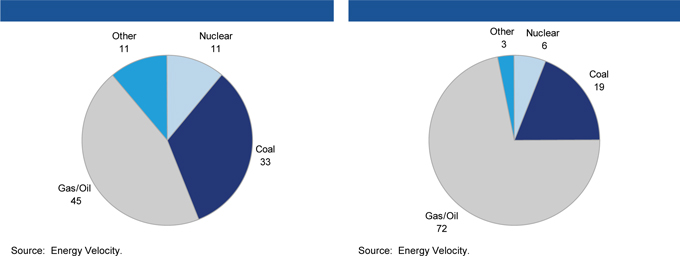

ERCOT’s generation mix is relatively unique in the U.S. ERCOT has 60% more relative gas capacity than the overall U.S. market and more gas capacity than any other NERC region in the U.S.

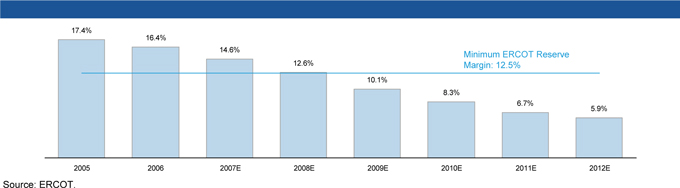

As of May 31, 2007, aggregate net generation capacity of approximately 76,801 MW existed in the ERCOT market, of which 72% was natural gas-fueled. Approximately 21,444 MW, or 27.9%, was lower marginal cost generation capacity such as coal, lignite and nuclear plants. As of May 31, 2007, Luminant Power’s lignite and nuclear baseload plants represented 8,137 MW, or 37.9%, of the total lower marginal cost generation capacity in the ERCOT market. ERCOT has established a target reserve margin level of approximately 12.5%; and the reserve margin at May 17, 2007, was 14.6%, forecast to drop to 12.6% by 2008 and 10.1% by 2009.

14

Natural gas-fueled generation is the predominant supply resource in the ERCOT region in terms of both the installed generation capacity and generation produced, accounting for approximately 72% of the installed generation capacity and 46% of the electricity produced in the ERCOT region. In the ERCOT market, buyers and sellers enter into bilateral wholesale capacity, power and ancillary services contracts or may participate in the centralized ancillary services market, including balancing energy, which ERCOT administers. An October 1, 2005 report titled “Report on Existing and Potential Electric System Constraints and Needs” found that natural gas-fueled power plants set the market price of power more than 90% of the time in the ERCOT market. As a result, natural gas-fueled plant operators are the marginal suppliers in ERCOT, and wholesale electricity prices are highly correlated to natural gas prices.

The ERCOT market is currently divided into four regions or congestion zones, namely: North, Houston, South and West, which reflect transmission constraints that are commercially significant and which have limits as to the amount of power that can flow across zones. Luminant Power’s baseload generation facilities are located primarily in the North region.

The ERCOT market operates under the reliability standards set by the NERC. The PUCT has primary jurisdiction over the ERCOT market to ensure the adequacy and reliability of power supply across Texas’s main interconnected power transmission grid. ERCOT is responsible for facilitating reliable operations of the bulk electric power supply system in the ERCOT market. The ERCOT independent system operator (“ERCOT ISO”) is responsible for maintaining reliable operations of the bulk electric power supply system in the ERCOT market. Its responsibilities include ensuring that electricity production and delivery are accurately accounted for among the generation resources and wholesale buyers and sellers. Unlike certain other regional power markets, the ERCOT market is not a centrally dispatched power pool, and the ERCOT ISO does not procure energy on behalf of its members. Members who sell and purchase power are responsible for contracting sales and purchases of power bilaterally. The ERCOT ISO also serves as agent for procuring ancillary services for those members who elect not to provide their own ancillary services.

TCEH believes that the ERCOT region presents an attractive competitive electric service market due to such factors as the following:

| • | | market rules support fair and robust competition, while providing opportunities to optimize the generation fleet operations and purchased power requirements; |

| • | | peak demand is expected to grow at an average rate of over 2.1% per year over the period from 2007 to 2017; and |

| • | | it is a sizeable market with over 62 gigawatts (“GW”) of peak demand and approximately 34 GW of average demand; and |

| • | | in the face of tightening reserve margins, creative solutions will likely be required, such as a portfolio of new generation technologies and efficiency/demand side management programs, particularly in the face of concerns about further reliance on traditional fossil fuel technologies and the long lead times and uncertainty associated with new nuclear power generation. |

15

BUSINESS DESCRIPTION

TCEH, formerly named TXU Energy Company LLC, is a holding company for the Luminant and TXU Energy businesses, which are engaged in competitive electricity market activities largely in ERCOT. The Luminant businesses include power generation operations, wholesale energy markets operations and power generation facility development activities. The TXU Energy business is comprised of retail electricity sales operations. Luminant Power, Luminant Energy, Luminant Construction and TXU Energy conduct their operations through a number of separate legal entities that, in accordance with regulatory requirements, operate independently within the competitive Texas power market.

As of June 30, 2007, Luminant Power had 18,365 MW of generation capacity in Texas (which includes 585 MW representing nine combustion turbine units currently operated for an unaffiliated party’s benefit). This amount includes 8,137 MW of low-cost baseload solid fuel generation capacity represented by 2,300 MW of nuclear generation capacity and 5,837 MW of lignite/coal-fueled generation capacity. Luminant Energy primarily optimizes the purchases and sales of energy for TXU Energy and Luminant Power and also provides related services to other market participants. Luminant Energy is the largest purchaser of wind-generated electricity in Texas and the fifth largest in the United States. Luminant Construction is currently building three new lignite coal-fueled generation facilities in Texas with expected generation capacity totaling approximately 2,200 MW.

TXU Energy provides competitive electricity and related services to more than 2.1 million electricity customers in Texas. As of June 30, 2007, TXU Energy’s estimated share of total ERCOT retail residential and small business electric customers was approximately 35% and 25%, respectively.

For the twelve months ended June 30, 2007, on a pro forma basis, TCEH had Operating Revenues of $8,181 million and Adjusted EBITDA of $3,999 million on a consolidated basis. See the Historical Financial and Operating Information section for a reconciliation of net income to Adjusted EBITDA.

A. LUMINANT

Luminant Power

Luminant Power’s electricity generation fleet consists of 19 plants in Texas with total generating capacity as of June 30, 2007 as shown in the table below:

| | | | | | |

Nuclear | | 2,300 | | 1 | | 2 |

Lignite/coal | | 5,837 | | 4 | | 9 |

Natural gas(2)(3) | | 10,228 | | 14 | | 45 |

Total | | 18,365 | | 19 | | 56 |

(1) Leased units consist of six natural gas-fueled units totaling 390 MW of capacity. All other units are owned.

(2) Includes 1,329 MW representing five units mothballed and not currently available for dispatch.

(3) Includes 585 MW representing nine combustion turbine units currently operated for an unaffiliated third party’s benefit.

The generation plants are located primarily on land owned in fee simple. Nuclear and lignite/coal-fueled (baseload) plants are generally scheduled to run at capacity except for periods of scheduled maintenance activities or, in the case some of the lignite/coal units, backdown due to brief, seasonal periods of low demand or transmission line outages. The natural gas-fueled generation units supplement the baseload generation capacity in meeting variable consumption as production from these units can more readily be ramped up or down as demand warrants.

16

The following charts provide an overview of Luminant’s generation assets and show how these assets provide Luminant with an advantage over its competitors:

Nuclear Generation Assets

Luminant Power operates two nuclear generation units at the Comanche Peak plant, each of which is designed for a capacity of 1,150 MW. Comanche Peak’s Unit 1 and Unit 2 went into commercial operation in 1990 and 1993, respectively, and are generally operated at full capacity to meet the load requirements in ERCOT. Refueling (nuclear fuel assembly replacement) outages for each unit are scheduled to occur every eighteen months during the spring or fall off-peak demand periods. Every three years, the refueling cycle results in the refueling of both units during the same year, with the next scheduled to occur in 2008. While one unit is undergoing a refueling outage, the remaining unit is intended to operate at full capacity. During a refueling outage, other maintenance, modification and testing activities are completed that cannot be accomplished when the unit is in operation. Over the last 3 years, the refueling outage period per unit has ranged from a high of 38 days in 2004 to a low of 18 days in 2006. The Comanche Peak plant operated at a capacity factor of 98.8% in 2006, which represents top decile performance of U.S. nuclear generation facilities.

Luminant Power has contracts in place for nuclear fuel conversion services through 2008. In addition, Luminant Power has contracts for the acquisition of uranium through 2009 and for nuclear fuel enrichment services through 2008, as well as for nuclear fuel fabrication services through 2016.

Contracts for the acquisition of raw uranium and nuclear fuel conversion services through 2012 and 2009, respectively, are currently being negotiated. Additional contracts to ensure a portion of nuclear fuel enrichment services through 2020 are being negotiated. Luminant Power does not anticipate any issues with finalizing these contracts and does not anticipate any significant difficulties in acquiring raw uranium and contracting for associated services in the foreseeable future.

17

Luminant Power’s on-site used nuclear fuel storage capability is sufficient for five to ten years. The nuclear industry is continuing to review ways to enhance security of used-fuel storage with the U.S. Nuclear Regulatory Commission (NRC) to fully utilize physical storage capacity.

The Comanche Peak nuclear generation units have an estimated useful life of 60 years from the date of commercial operation. Therefore, assuming that Luminant Power receives the requisite license extensions, plant decommissioning activities would be scheduled to begin in 2050 for Comanche Peak Unit 1 and 2053 for Unit 2 and common facilities. Decommissioning costs are fully recoverable from Oncor Electric Delivery’s customers through an ongoing delivery surcharge.

Lignite/Coal-Fueled Generation Assets

Luminant Power’s lignite/coal-fueled generation fleet has a nameplate capacity of 5,837 MW and consists of the Big Brown (2 units), Monticello (3 units), Martin Lake (3 units) and Sandow (1 unit) plants. These plants are generally operated at full capacity to meet the load requirements in ERCOT. Maintenance outages are scheduled during off-peak demand periods. Over the last three years, the total annual scheduled and unscheduled outages per unit averaged 33 days. Luminant Power’s lignite/coal-fueled generation fleet operated at a capacity factor of 89.1% in 2006, which represents top decile performance of US coal-fueled generation facilities.

Approximately 67% of the fuel used at Luminant Power’s lignite/coal-fueled generation plants in 2006 was supplied from owned in fee or leased proven surface-minable lignite reserves dedicated to the Big Brown, Monticello and Martin Lake plants, which were constructed adjacent to the reserves. TCEH, through its subsidiaries, owns in fee or has under lease an estimated 858 million tons of proven reserves dedicated to its generation plants, and also owns in fee or has under lease in excess of 119 million tons of proven reserves not currently dedicated to specific generation plants. In 2006, over 22 million tons of lignite were recovered to fuel Luminant Power’s plants. TCEH utilizes owned and/or leased equipment to remove the overburden and recover the lignite.

Lignite mining operations include extensive reclamation activities that return the land to productive uses such as wildlife habitats, commercial timberland and pasture land. In 2006 alone, regulatory authorities approved Luminant Power’s release from further reclamation obligation of approximately 8,000 acres of reclaimed land. Luminant Power planted more than 1.2 million trees as part of this reclamation. In 2006 Luminant won the Director’s Award, the nation’s highest honor for outstanding, innovative mining reclamation practices, awarded by the U.S. Department of the Interior’s Office of Surface Mining. This is Luminant Power’s ninth national mining award including two previous Director’s Awards.

Luminant Power supplements its lignite fuel at Big Brown, Monticello and Martin Lake with western coal from the Powder River Basin (PRB) in Wyoming. The coal is purchased from multiple suppliers under contracts of various lengths and is transported from the Powder River Basin to Luminant Power’s generating plants by railcar. Based on its current usage, Luminant Power believes that it has sufficient lignite reserves for the foreseeable future and has contracted 72% of its western coal resources and 100% of the related transportation through 2009.

18

Natural Gas-Fueled Generation Assets

Luminant Power also operates a fleet of natural gas-fueled generation units, which includes 45 units with a total 10,228 MW of currently available capacity. A significant number of the natural gas-fueled units have the ability to switch between natural gas and fuel oil. The gas units predominantly serve as peaking units that can be more readily ramped up or down as demand warrants.

Luminant Energy

Luminant Energy plays a pivotal role in supporting Luminant Power and TXU Energy by optimizing the performance of the generation assets and sourcing the electricity requirements for TXU Energy’s customers. Luminant Energy manages commodity price exposure across the complementary generation and retail businesses on a portfolio basis. Under this approach, Luminant Energy manages the risks of imbalances between generation supply and sales load, which primarily represent exposures to natural gas price movements and market heat rate changes (variations in the relationships between natural gas prices and wholesale electricity prices), through wholesale markets activities that include physical purchases and sales and transacting in financial instruments.

Luminant Energy manages the commodity exposure of the generation and retail portfolio through asset management and hedging activities. Luminant Energy provides TXU Energy with the electricity and related services to meet retail customer demand and the operating requirements of ERCOT. Luminant Energy also supports Luminant Power in selling forward generation and seeking to maximize the economic value of the fleet. In consideration of operational production and customer consumption levels that can be highly variable as well as opportunities for long-term purchases and sales with large wholesale electricity market participants, Luminant Energy buys and sells electricity for spot and short-term sales and also executes longer-term forward electricity purchase and sales agreements.

In its hedging activities, Luminant Energy enters into contracts for the physical delivery of electricity and natural gas, exchange traded and “over-the-counter” financial contracts and bilateral contracts with producers, generators and end-use customers. See the following Section C – “Long-Term Hedging Program” for further details on TCEH’s hedging program.

Luminant Energy also dispatches the gas-fueled generation fleet owned and operated by Luminant Power. Luminant Energy’s dispatching activities are performed through a centrally managed real-time operational staff that synthesizes operational activities across the fleet and interfaces with various wholesale market channels. Luminant Energy coordinates the overall commercial strategy for these plants working closely with Luminant Power. In addition, Luminant Energy manages the fuel procurement requirements for the natural gas-fueled generation plants.

Luminant Energy engages in commercial operations such as physical purchases, storage and sales of natural gas, electricity and natural gas trading and third-party asset management. Luminant Energy’s natural gas operations include well-head production contracts, transportation agreements, storage leases and retail sales. Luminant Energy currently manages approximately 18 billion cubic feet of natural gas storage capacity and has a presence outside of Texas in both electricity and natural gas commodity trading.

Luminant Energy manages exposure to wholesale commodity and credit related risk within established transactional risk management policies and limits. Luminant Energy targets best practices in risk management and risk control by employing proven principles used by financial institutions. These controls have been structured so that they are practical in application and consistent with stated business objectives. Risk management processes include capturing

19

transactions, performing and validating valuations and reporting exposures on a daily basis using commodity information systems designed to support a large transactional portfolio. A risk management forum meets regularly to ensure that business practices comply with approved transactional limits, commodities, instruments, exchanges and markets. Transactional risks are monitored and limits are enforced to comply with the established risk policy. Luminant Energy has a strict disciplinary program to address any violations of the risk management policies and periodically reviews these policies to ensure they are responsive to changing market and business conditions.

Luminant Energy is one of the largest purchasers of wind-generated electricity in Texas and the fifth largest in the United States.

Luminant Construction

Texas Generation Facilities Development

Luminant Construction is building three lignite coal-fueled generation units in the state of Texas with a total estimated capacity of approximately 2,200 MW. The three units consist of one new generation unit at a site leased from Alcoa Inc. that is adjacent to one of Luminant Power’s existing lignite coal-fueled generation plant sites (Sandow) and two new generation units at one of Luminant Power’s sites (Oak Grove) that was originally slated for the construction of a generation plant a number of years ago. Aggregate capital expenditures for these three units are expected to total approximately $3.25 billion including all construction, site preparation and mining development costs.

The development program includes up to $450 million for investments in state-of-the-art emissions controls for the three proposed new units. As part of the development program, additional environmental control systems will be included at certain of Luminant Power’s existing generation facilities. The capital expenditures for these additional environmental control systems are expected to total up to approximately $1.0 billion.

Design and procurement activities for the three proposed units are at an advanced stage and site construction is well underway. EPC agreements were executed for the Sandow 5 unit in May 2006 and for Oak Grove Units 1 and 2 in June 2006 with world-class EPC firms. A substantial majority of total construction, siting, and mining development costs are fixed through these agreements and other agreements with equipment providers, with the remainder subject to adjustment based on labor market conditions and final bids on non-EPC related construction costs. As of September 2007, fixed price agreements were in place for more than 75% of estimated total construction costs for the Oak Grove units (including mine development costs) and for more than 80% of estimated total construction costs for the Sandow 5 unit (including the mine acquisition). The target commercial online dates for the facilities are as follows: Sandow 5 - in the second quarter of 2009; Oak Grove Unit 1 - in the third quarter of 2009; and Oak Grove Unit 2 - in the first quarter of 2010. The pictures shown below were taken in September 2007 and reflect the construction progress at both the Oak Grove and Sandow facilities, respectively.

20

Air permits for the three units that are under construction have been obtained. In June 2007, the Texas Commission on Environmental Quality (“TCEQ”) voted to approve the air permit for the two Oak Grove units. Certain opponents of the new units at Oak Grove appealed the TCEQ’s permit decision to the district court in Travis County, Texas, but the permit remains in full force notwithstanding this action. In December 2006, certain environmental organizations filed a lawsuit in federal district court alleging that the permitted application for the Oak Grove units had violated provisions of the federal Clean Air Act and Texas Health and Safety Code. In May 2007, the district court granted TCEH’s motion to dismiss the plaintiffs’ complaint, and the decision of that court has been appealed to the United States Fifth Circuit Court of Appeals. The case has been remanded to district court where a TCEH subsidiary expects to file a new motion to dismiss. In August 2007, a subsidiary of TCEH acquired from Alcoa Inc. the air permit relating to the Sandow 5 facility that had been previously issued to Alcoa Inc. by the TCEQ.

In September 2007, subsidiaries of TCEH acquired certain assets of Alcoa Inc. relating to the operation at the Three Oaks Mine (the lignite mine that currently serves the Sandow 4 unit and will serve the Sandow 5 unit upon its completion), including rights to certain lignite reserves in the Three Oaks Mine for approximately $135 million, and assumed responsibility for mining operations at the Three Oaks Mine.

21

Nuclear Generation Development

TCEH is proceeding with the preparation of a combined license application for two new nuclear generation facilities each with approximately 1,700 MW (gross capacity) at its existing Comanche Peak nuclear generation site. It is currently anticipated that these new units would be developed by TCEH or its subsidiaries.

Investment in Cleaner Coal-Fueled Generation Technologies

In an initiative separate from but related to the planned generation development and related emissions controls investment spending, subsidiaries of TCEH expect to invest up to $2 billion over the next five to seven years for the development and commercialization of cleaner generation plant technologies, including integrated gasification combined cycle, the next generation of more efficient ultra-supercritical coal and pulverized coal emissions technology to reduce carbon dioxide emissions. TCEH has already initiated a number of actions, including research and development investments and partnerships, to advance next-generation technologies.

Integrated Gasification Combined Cycle (“IGCC”) Demonstration Plants

In March 2007, EFH and the Sponsors announced their intention to explore the development of two IGCC commercial demonstration plants to be located in Texas and expect to issue a request for proposal from companies offering coal gasification technologies with carbon dioxide capture.

B. TXU ENERGY

TXU Energy serves more than 2.1 million retail electricity customers, of which 1.8 million are in its historical service territory, which was the territory, largely in north Texas, being served by EFH’s regulated electric utility subsidiary at the time of entering retail competition on January 1, 2002. This territory, which is located in the north-central, eastern and western parts of Texas, has an estimated population in excess of 7 million, about one-third of the population of Texas, and comprises 92 counties and 370 incorporated municipalities, including Dallas/Fort Worth and surrounding suburbs, as well as Waco, Wichita Falls, Odessa, Midland, Tyler and Killeen.

Texas is one of the fastest growing states in the nation with a diverse and resilient economy and, as a result, has attracted a number of competitors into the deregulated retail electricity market. As a result, competition is expected to continue to be robust. TXU Energy, as an active participant in this competitive market, provides retail electric service to the other areas of ERCOT now open to competition including the Houston, Corpus Christi, and lower Rio Grande Valley areas of Texas. TXU Energy continues to market its services in Texas to add new customers and to retain its existing customers. As of September 2007, there are more than 100 Retail Electric Providers (“REPs”) certified to compete within the state of Texas.

As a result of the legislation that restructured the electric utility industry in Texas to provide for retail competition (1999 Restructuring Legislation), effective January 1, 2002, REPs affiliated with electricity delivery utilities were required to charge price-to-beat retail prices, established by the PUCT, to residential and small business customers located in their historical service territories. The price-to-beat mechanism was intended to spur competition as the rates were set such that competing REPs could profitably offer lower rates. TXU Energy, as a REP affiliated with an electricity delivery utility, was required to charge the price-to-beat retail price, adjusted for fuel factor changes, to these classes of customers until the earlier of January 1, 2005 or the date on which 40% of the electricity consumed by customers in that class was supplied by competing REPs. TXU Energy met the 40% threshold target calculation for its small business customers in December 2003 and began offering rates other than the price-to-beat retail prices to this customer class. Since January 1, 2005, TXU Energy has offered rates different from the price-to-beat retail

22

prices to all customer classes, but was required to make the price-to-beat retail prices available for residential and small business customers in its historical service territory until January 1, 2007. As of January 1, 2007, TXU Energy is no longer required to offer the price-to-beat retail price to any of its customer classes.

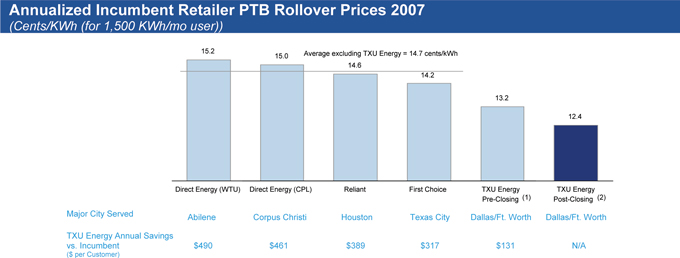

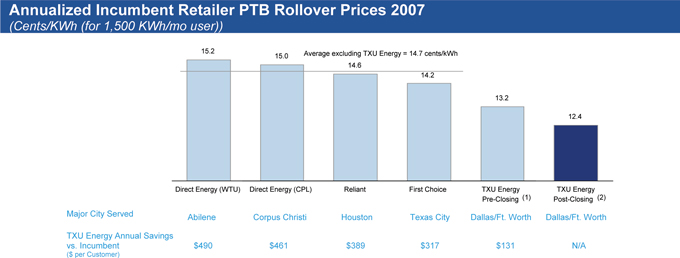

Retail Pricing

In connection with the Transaction, TXU Energy announced a 15 percent price reduction for residential customers in its historical service territory who have not already switched to one of the many pricing plans other than the basic month-to-month plan provided to legacy customers formerly on price to beat. These customers received a six percent reduction beginning in late March 2007 and an additional four percent reduction in June 2007 and as a result of the closing of the Transaction will now receive the remaining five percent reduction upon closing of the Transaction. In addition, TXU Energy announced that, upon closing of the Transaction, it will provide price protection to certain of its customers through December 2008. The specifics of this price discount program and other pricing activities are as follows:

| | • | | a six percent price discount effective with March 27, 2007 meter reads to those existing residential customers in the historical service territory with month-to-month service plans and a rate equivalent to the former price-to-beat rate; |

| | • | | an additional four percent price discount to the same class of customers as above effective with June 8, 2007 meter reads; |

| | • | | an additional five percent price discount to such customers as a result of the closing of the Transaction, effective in late October 2007; |

| | • | | protection against price increases above the rates prior to the six percent discount described above for bills based on meter readings ending between October 1, 2008 and December 31, 2009 (excluding increases in response to a change in law or regulatory charges); |

| | • | | protection against price increases at the full fifteen percent discounted level through December 2008 as a result of closing the Transaction (excluding increases in response to a change in law or regulatory charges); and |

| | • | | a customer appreciation bonus totaling $100 applied to residential customers’ bills, with $25 bonuses provided in each of the November 2006, February 2007, May 2007 and August 2007 bill cycles to each residential customer receiving service as of October 29, 2006 and living in areas where TXU Energy Retail offered its price-to-beat rate. |

| (1) | Prior to final 5% price cut that will take effect this month. |

| (2) | Includes final 5% price cut that will take effect this month. |

23

C. LONG-TERM HEDGING PROGRAM

In October 2005, TCEH initiated a long-term hedging program designed to reduce exposure to changes in future electricity prices due to changes in the price of natural gas. As described above, given the high correlation between wholesale power prices in ERCOT and the price of natural gas, entering into natural gas forward contracts enables TCEH to mitigate a significant portion of the commodity price risk associated with TCEH’s baseload generation assets. The hedging program also benefits from lien collateral structures given the “right way” risk features of coal and nuclear baseload assets in gas-on-the-margin markets. When commodity prices rise, the underlying value of these baseload assets generally rises in tandem, providing greater collateral protection for the short commodity hedge positions. Asset liens that benefit from this “right way” risk feature have been evident in several transactions by other baseload asset owners in the ERCOT market.

Under the program, TCEH or its subsidiaries have entered into market transactions involving natural gas-related financial instruments. As of October 10, 2007 and shown in the table below, these subsidiaries have effectively sold forward approximately 2.6 billion MMBtu of natural gas over the period from 2008 to 2013 at average annual prices ranging from $7.25 per MMBtu to $8.15 per MMBtu.

| (1) | Assumed natural gas conversion factor of -90% of the market-clearing heat rate given that coal is on the margin for select periods; during those periods, there is no natural-gas position that is generated. |

| (2) | Includes fixed price sold forward positions and estimates that of total non-contract in-territory load, 50% is a short-position in 2008, dropping to 25% in 2009. |

| (3) | Includes ~35 million MMBtu put option delta volume (notional 160 million MMBtu put purchased for 2008 to protect against downside gas movements). |

| (4) | Weighted average prices are based on actual contract prices and, importantly, certain of the volumes associated with TCEH’s CCR reflect a re-contracting of the volumes as of October 8, 2007. If the weighted average prices were adjusted to reflect a re-contracting of those same volumes as of the pro forma date (June 30, 2007) and consistent with the presentation of drawn balances under TCEH CCR, the weighted average prices would be $8.30, $8.25, $7.90, $7.75, $7.30 and $7.25 for 2008E through 2013E respectively. |

Prior to March 2007, a significant portion of the instruments under the long-term hedging program had been designated as cash flow hedges. In March 2007, these instruments were dedesignated as allowed under SFAS 133. Changes in fair value of these hedges that were deferred in TCEH’s accumulated other comprehensive income totaled $136 million in pretax gains at the time of the dedesignation. This amount would have been reclassified to net income as the related forecasted transactions settled, but the balance was eliminated as part of purchase accounting for the Transaction. Subsequent changes in the fair value of these instruments are being marked-to-market in net income, which has and could continue to result in significantly increased volatility in reported earnings. Based on the size of the long-term hedging program as of October 10, 2007, a

24

$1.00/MMBtu change in natural gas prices across the 2008 to 2013 curve would result in the recognition by TCEH of up to $2.6 billion in pretax unrealized mark-to-market gains or losses, which would be expected to later be offset by actual realized power prices.

Approximately 50% of Luminant’s natural gas hedge book is secured by a first-lien position in TCEH’s assets on a pari passu basis with the new Senior Secured Credit Facilities at TCEH. This structure offers the “right-way” risk features discussed above for coal and nuclear generation assets in a gas-on-the-margin market and requires no collateral posting. Approximately 80% of the existing hedge positions not secured directly by such first lien are supported by the new Commodity Collateral Posting Facility at TCEH. This facility, which is secured on a pari passu basis with the Facilities, is uncapped and provides liquidity through funding for variation margin relating to the hedge transactions supported by this facility. An additional structure is being evaluated for the hedge positions that are not supported by the first lien or Commodity Collateral Posting Facility.

D. LABOR CONTRACTS

Certain personnel engaged in TCEH activities are represented by labor unions and covered by collective bargaining agreements with varying expiration dates. New one-year labor agreements were reached in 2006 covering bargaining unit personnel engaged in TCEH’s lignite mining and nuclear generation operations. In January 2007, new one-year labor agreements were reached covering bargaining unit personnel engaged in TCEH’s natural gas-fueled generation operations. In June 2007, new eighteen-month labor agreements were reached covering bargaining unit personnel engaged in three of TCEH’s four lignite/coal-fueled generation operations. Changes in these collective bargaining agreements are not expected to have a material effect on TCEH’s financial position, results of operations or cash flows.

25

BUSINESS STRATEGY

Each of TCEH’s respective businesses focuses its operations on the following key drivers:

| | • | | Luminant focuses on optimizing its existing generation fleet to provide safe, reliable and cost-competitive power, as well as developing additional power generation capacity to meet the growing demand for power in Texas; and |

| | • | | TXU Energy focuses on providing high quality customer service, including continually improving customer service and developing innovative energy products to meet customers’ needs. |

Other elements of TCEH’s strategy include:

Increase Value from Its Existing Businesses

TCEH’s strategy focuses on striving for consistent top decile performance across its operations in terms of reliability, cost and customer service. TCEH will continue to focus on upgrading four critical skill sets: operational excellence across its businesses; market leadership; a systematic risk/return mindset applied to all key decisions; and rigorous performance management targeting industry-leading performance standards for productivity, reliability and customer service. An example of how TCEH implements these principles is a program called the “Luminant Operating System,” which is a program to drive ongoing productivity improvements in Luminant’s businesses through application of lean operating techniques and deployment of a high-performance industrial culture.

Pursue Growth Opportunities Across Business Lines

TCEH believes building upon and leveraging its scale advantages enables it to sustainably create value by eliminating duplicative costs, efficiently managing supply costs, and building and standardizing distinctive process expertise. Scale also allows TCEH to take part in large capital investments, such as new generation projects, with a smaller fraction of overall capital at risk and with an enhanced ability to streamline costs. The growth initiatives for each business include:

| | • | | Luminant: Construction of three new lignite coal-fueled generation facilities at existing sites with onsite lignite fuel supplies, as well as the development of wind generation projects in the near to medium term. Pursuit of new generation opportunities to meet ERCOT’s growing generation needs over the longer term from a diverse range of alternatives such as nuclear, renewables and advanced coal technologies such as Integrated Gasification Combined Cycle. |

| | • | | TXU Energy: Retain existing customers and increase the number of customers served both in TXU Energy’s historic territory, as well as in other Texas markets such as Houston, through innovative products and superior customer service. |

Reduce the Volatility of Cash Flows Through Established Risk Management Strategy

A key component of TCEH’s risk management strategy is its plan to hedge up to 80% of the natural gas exposure of Luminant Power’s baseload generation output on a rolling five year basis. The strong historical correlation between natural gas prices and power prices in ERCOT combined with the significant liquidity in certain natural gas markets currently provides an opportunity for management of TCEH’s exposure to natural gas prices. At the close of the Transaction, TCEH had up to approximately $5.9 billion of available Revolving Credit Facility, Deposit Letter of Credit Facility, and Delayed Draw Term Loan borrowing capacity which should provide significant liquidity for its operations, including for TCEH’s long-term hedging strategies, particularly regarding its

26

commodity and market heat rate exposures. TCEH also has incremental, dedicated credit facilities to support collateral posting for specifically identified commodity hedge transactions. In addition, certain existing and future hedging transactions will be secured with a first lien security interest in TCEH’s assets, which reduces the liquidity requirements of entering into commodity hedge transactions because no cash or letter of credit collateral will be required for these transactions. Approximately 50% of Luminant’s natural gas hedging transactions are secured by this first lien security interest in TCEH’s assets.

Environmental Focus

EFH has announced that:

| | • | | it is committed to continuing to operate in compliance with all environmental laws, rules and regulations and to reduce its impact on the environment; |

| | • | | it will put in place a Sustainable Energy Advisory Board that will focus on assisting EFH in pursuing technology development opportunities that utilize America’s vast energy resources with technologies designed to reduce EFH’s impact on the environment while balancing the need to address the energy requirements of Texas. EFH’s Sustainable Energy Advisory Board will be comprised of individuals who represent interests including: the environment, customers, Texas economic development and ERCOT reliability standards; |

| | • | | it is focused on and is pursuing opportunities to reduce emissions from its existing and planned new lignite/coal-fueled generation units in ERCOT. Accordingly, in connection with its plans to build three new lignite coal-fueled generation units, EFH has committed to reduce emissions of mercury, nitrogen oxide and sulfur dioxide from its existing baseload generation units by 20% from 2005 levels, through a combination of investment in new emission control equipment and fuel switching; and |

| | • | | it also expects such investments to reduce future costs associated with complying with environmental emissions standards. |

27

ENVIRONMENTAL CONSIDERATIONS

Climate Change and Carbon Dioxide

Luminant’s baseload lignite coal-fueled power plants are significant sources of carbon dioxide (“CO2”) emissions. The three new lignite coal-fueled units being developed will generate additional CO2 emissions. EFH participates in a voluntary electric utility industry sector climate change initiative in partnership with the U.S. Department of Energy. This initiative supports the Bush Administration’s greenhouse gas emissions intensity reduction program, Climate VISION. In addition, EFH has participated in a voluntary greenhouse gas emission reduction program under the Energy Policy Act of 1992 and since 1995 has reported the results of its program annually to the U.S. Department of Energy.

EFH has announced a commitment to reduce carbon dioxide CO2 emissions and intent to join the U.S. Climate Action Partnership (“USCAP”), which is a broad-based group of businesses and leading environmental groups organized to work with the President, the Congress and all other stakeholders to enact environmentally effective and economically sustainable climate change programs. As part of its support of USCAP, EFH announced it is pledging to support a mandatory cap and trade program to reduce CO2 emissions.

EFH’s stated approach to addressing global climate change is based upon the following principles:

| | • | | Climate change is a global issue requiring a comprehensive solution addressing all greenhouse gases, sources and economic sectors in all countries; |

| | • | | Development of U.S. energy and environmental policy should seek to ensure U.S. energy security and independence; |

| | • | | Solutions should encourage investment in a diverse supply of new generation to meet U.S. needs to maintain adequate reserve margins and support economic growth, as well as address customer’s needs for affordable and reliable energy; |

| | • | | Policies should encourage significant investments in research and development and deployment of a broad spectrum of solutions, including energy efficiency, renewable energy and coal, natural gas and nuclear-fueled generation technologies; and |

| | • | | Any mandate to reduce greenhouse gas emissions should be developed under a market-based framework that is consistent with expected technology development timelines and supports the displacement of old, inefficient power generation technology with advanced, more efficient technology. |

EFH’s stated strategies for lowering greenhouse gas emissions include:

| | • | | Investing in technology - EFH expects to invest up to $2 billion over the next five to seven years for the development and commercialization of cleaner power plant technologies, including integrated gasification combined cycle, the next generation of more efficient ultra-supercritical coal and pulverized coal emissions technology to reduce CO2 emission intensity. A number of actions, including research and development investments and partnerships, have already been initiated to advance next-generation technologies; |

| | • | | Providing electricity from renewable sources - EFH intends to become a leader in providing electricity from renewable sources by more than doubling its purchases of wind power to more than 1,500 MW. EFH also intends to promote solar power through solar/photovoltaic rebates; |

| | • | | Committing to demand side management initiatives - EFH intends to invest $400 million over the next five years in programs designed to encourage customer electricity demand efficiencies; |

28

| | • | | Reducing CO2 emissions by increasing production efficiency - EFH expects to increase production efficiency of its existing generation facilities by up to 2 percent; and |

| | • | | Developing a nuclear generation facility - EFH plans to develop an application to file with the NRC for combined construction and operating licenses for up to 3,400 MW of new nuclear generation capacity at its Comanche Peak nuclear generation plant. EFH expects to submit the application in 2008. Nuclear generation is the lowest emission source of baseload generation available. |

Increasing public concern and political pressure from local, regional, national and international bodies, may result in the passage of new laws mandating limits on greenhouse gas emissions. A series of reports by the Intergovernmental Panel on Climate Change earlier this year attracted considerable public attention and concern. Several bills addressing climate change have been introduced in the U.S. Congress and in April 2007, the U.S. Supreme Court issued a decision ruling the Environmental Protection Agency (“EPA”) improperly declined to address CO2 impacts in a rulemaking related to new motor vehicle emissions. While this decision is not directly applicable to power plant emissions, the reasoning of the decision could affect other regulatory programs that are. Various proposals in the U.S. Congress could require TCEH to purchase offsets or allowances for some or all of its CO2 emissions, or otherwise affect TCEH based on the amount of CO2 it generates. The impact on TCEH of any future greenhouse gas regulation will depend in large part on the details of the requirements and the timetable for mandatory compliance. TCEH continues to assess the financial and operational risks posed by possible future legislative changes pertaining to greenhouse gas emissions, but because these proposals are in the formative stages, TCEH is unable to predict any future impacts on its financial condition and operations.

Sulfur Dioxide, Nitrogen Oxide and Mercury Air Emissions

The federal Clean Air Act includes provisions which, among other things, place limits on the sulfur dioxide (“SO2”), nitrogen oxide (“NOx”), and mercury emissions produced by certain generation plants. In addition to the new source performance standards applicable to SO2 (associated with acid rain) and NOx (associated with ozone formulation), the Clean Air Act requires that fossil-fueled plants have sufficient SO2 emission allowances and meet certain NOx emission standards. TCEH’s generation plants meet the SO2 allowance requirements and NOx emission rates.

In 2005, the EPA issued a final rule to further reduce SO2 and NOx emissions from power plants. The SO2 and NOx reductions required under the Clean Air Interstate Rule (“CAIR”) are based on a cap and trade approach (market-based) in which a cap is put on the total quantity of emissions allowed in 28 eastern states (including Texas), emitters are required to have allowances for each ton emitted, and emitters are allowed to trade emissions under the cap. The CAIR reductions are proposed to be phased in between 2009 and 2015.

Also in 2005, the EPA published a final rule requiring reductions of mercury emissions from coal-fueled generation plants. The Clean Air Mercury Rule (“CAMR”) is based on a cap and trade approach on a nationwide basis. The mercury reductions are proposed to be phased in between 2010 and 2018.

SO2 reductions required under the proposed regional haze/visibility rule (or so-called BART rule) only apply to units built between 1962 and 1977. The reductions would be required on a unit-by-unit basis. The EPA provides the option for states to use CAIR to satisfy the BART reductions for electric generating units and Texas has chosen this option.

EFH has announced that it expects that upon completion of its plan to develop three new lignite coal-fueled generation units in Texas, emissions of NOx, SO2 and mercury from its entire lignite coal-fueled generation fleet, including both the new and existing units, will be reduced by 20% from 2005 levels. This reduction is expected to be accomplished through the installation of emissions control equipment in both the new and existing units and fuel blending at some existing units. Capital expenditures for additional air control systems at existing facilities are expected to total up to approximately $1 billion, as well as additional costs for facility operations and maintenance in the future, and will be coordinated with the CAIR, CAMR and BART rules for the most cost-effective compliance plan options.

29

The Clean Air Act also requires each state to monitor air quality for compliance with federal health standards. The standards for ozone are not being achieved in several areas of Texas. The TCEQ proposed new State Implementation Plan rules in December 2006 to deal with 8-hour ozone standards. These rules, if adopted, would require further NOx emission reductions from certain TCEH facilities in the Dallas-Fort Worth area.

Water