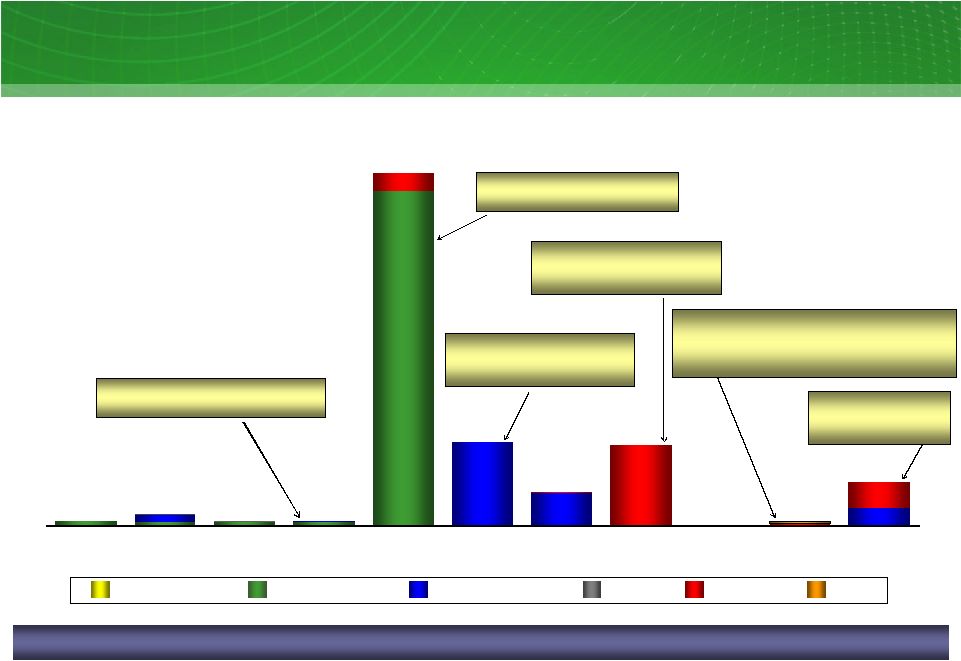

24 Operating revenues less fuel, purchased power costs, and delivery fees, plus or minus net gain (loss) from commodity hedging and trading activities, which on an adjusted (non-GAAP) basis, exclude unrealized gains and losses. The purchase method of accounting for a business combination as prescribed by GAAP, whereby the purchase price of a business combination is allocated to identifiable assets and liabilities (including intangible assets) based upon their fair values. The excess of the purchase price over the fair values of assets and liabilities is recorded as goodwill. Depreciation and amortization due to purchase accounting represents the net increase in such noncash expenses due to recording the fair market values of property, plant and equipment, debt and other assets and liabilities, including intangible assets such as emission allowances, customer relationships and sales and purchase contracts with pricing favorable to market prices at the date of the Merger. Amortization is reflected in revenues, fuel, purchased power costs and delivery fees, depreciation and mortization, other income and interest expense in the income statement. Open EBITDA estimates assume generation is sold at market observed forward prices less production costs and retail volumes are sold at market observed retail rates and historical retail profitability percentage. Estimates exclude all impacts of natural gas and power hedging activities, specifically the impacts of the TCEH Long-Term Hedging Program and any heat rate hedges. Additionally, this calculation includes provisions for fuel expense and O&M based on expected power generation output along with purchased power for sales to retail customers, and SG&A based on the generation output and sales to retail customers. Financial Definitions Refers to the results of the Regulated Delivery segment, which consists of Oncor. Regulated Delivery segment Results Open EBITDA (non-GAAP) Refers to the combined results of the Competitive Electric segment and Corporate & Other. Contribution Margin (non- GAAP) Net income (loss) from continuing operations before interest expense and related charges, and income tax expense (benefit) plus depreciation and amortization. EBITDA (non-GAAP) Generally accepted accounting principles. GAAP Purchase Accounting Net income (loss) adjusted for items representing income or losses that are not reflective of underlying operating results. These items include unrealized mark-to-market gains and losses, noncash impairment charges and other charges, credits or gains that are unusual or nonrecurring. EFH Corp. uses adjusted (non-GAAP) operating earnings as a measure of performance and believes that analysis of its business by external users is enhanced by visibility to both net income (loss) prepared in accordance with GAAP and adjusted (non-GAAP) operating earnings (losses). Adjusted (non-GAAP) Operating Results EBITDA adjusted to exclude interest income, noncash items, unusual items, interest income, income from discontinued operations and other adjustments allowable under the EFH Corp. Senior Notes bond indenture. Adjusted EBITDA plays an important role in respect of certain covenants contained in the EFH Corp. Senior Notes. Adjusted EBITDA is not intended to be an alternative to GAAP results as a measure of operating performance or an alternative to cash flows from operating activities as a measure of liquidity or an alternative to any other measure of financial performance presented in accordance with GAAP, nor is it intended to be used as a measure of free cash flow available for EFH Corp.’s discretionary use, as the measure excludes certain cash requirements such as interest payments, tax payments and other debt service requirements. Because not all companies use identical calculations, Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Adjusted EBITDA (non-GAAP) Definition Measure Competitive Business Results |