UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2010

— OR—

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 1-12833

Energy Future Holdings Corp.

(Exact name of registrant as specified in its charter)

| | |

| Texas | | 75-2669310 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

| 1601 Bryan Street Dallas, TX 75201-3411 | | (214) 812-4600 |

| (Address of principal executive offices)(Zip Code) | | (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Each Exchange in Which Registered |

| 9.75% Senior Secured Notes due 2019 | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨ (The registrant is not currently required to submit such files.)

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-Accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark if the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

As of February 15, 2011, there were 1,671,912,118 shares of common stock, without par value, outstanding of Energy Future Holdings Corp. (substantially all of which were owned by Texas Energy Future Holdings Limited Partnership, Energy Future Holdings Corp.’s parent holding company, and none of which is publicly traded).

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

i

Energy Future Holdings Corp.’s (EFH Corp.) annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports are made available to the public, free of charge, on the EFH Corp. website at http://www.energyfutureholdings.com, as soon as reasonably practicable after they have been filed with or furnished to the Securities and Exchange Commission. The information on EFH Corp.’s website shall not be deemed a part of, or incorporated by reference into, this report on Form 10-K. Readers should not rely on or assume the accuracy of any representation or warranty in any agreement that EFH Corp. has filed as an exhibit to this Form 10-K because such representation or warranty may be subject to exceptions and qualifications contained in separate disclosure schedules, may represent the parties’ risk allocation in the particular transaction, may be qualified by materiality standards that differ from what may be viewed as material for securities law purposes or may no longer continue to be true as of any given date.

This Form 10-K and other Securities and Exchange Commission filings of EFH Corp. and its subsidiaries occasionally make references to EFH Corp. (or “we,” “our,” “us” or “the company”), EFCH, EFIH, TCEH, TXU Energy, Luminant, Oncor Holdings or Oncor when describing actions, rights or obligations of their respective subsidiaries. These references reflect the fact that the subsidiaries are consolidated with, or otherwise reflected in, their respective parent companies’ financial statements for financial reporting purposes. However, these references should not be interpreted to imply that the parent company is actually undertaking the action or has the rights or obligations of the relevant subsidiary company or vice versa.

ii

GLOSSARY

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below.

| | |

| 1999 Restructuring Legislation | | Texas Electric Choice Plan, the legislation that restructured the electric utility industry in Texas to provide for retail competition |

| |

| 2009 Form 10-K | | EFH Corp.’s Annual Report on Form 10-K for the year ended December 31, 2009 |

| |

| Adjusted EBITDA | | Adjusted EBITDA means EBITDA adjusted to exclude noncash items, unusual items and other adjustments allowable under certain of our debt arrangements. See the definition of EBITDA below. Adjusted EBITDA and EBITDA are not recognized terms under GAAP and, thus, are non-GAAP financial measures. We are providing Adjusted EBITDA in this Form 10-K (see reconciliations in Exhibit 99(b), 99(c) and 99(d)) solely because of the important role that Adjusted EBITDA plays in respect of certain covenants contained in our debt arrangements. We do not intend for Adjusted EBITDA (or EBITDA) to be an alternative to net income as a measure of operating performance or an alternative to cash flows from operating activities as a measure of liquidity or an alternative to any other measure of financial performance presented in accordance with US GAAP. Additionally, we do not intend for Adjusted EBITDA (or EBITDA) to be used as a measure of free cash flow available for management’s discretionary use, as the measure excludes certain cash requirements such as interest payments, tax payments and other debt service requirements. Because not all companies use identical calculations, our presentation of Adjusted EBITDA (and EBITDA) may not be comparable to similarly titled measures of other companies. |

| |

| ancillary services | | Refers to services necessary to support the transmission of energy and maintain reliable operations for the entire transmission system. |

| |

| baseload | | Refers to the minimum constant level of electricity demand in a system, such as ERCOT, and/or to the electricity generation facilities or capacity normally expected to operate continuously throughout the year to serve such demand, such as our nuclear and lignite/coal-fueled generation units. |

| |

| CAIR | | Clean Air Interstate Rule |

| |

| Capgemini | | Capgemini Energy LP, a provider of business support services to EFH Corp. and its subsidiaries |

| |

| CATR | | Clean Air Transport Rule |

| |

| CFTC | | Commodity Futures Trading Commission |

| |

| CO2 | | carbon dioxide |

| |

| Competitive Electric segment | | Refers to the EFH Corp. business segment that consists principally of TCEH. |

| |

| CREZ | | Competitive Renewable Energy Zone |

| |

| DOE | | US Department of Energy |

| |

| EBITDA | | Refers to earnings (net income) before interest expense, income taxes, depreciation and amortization. See the definition of Adjusted EBITDA above. |

| |

| EFCH | | Refers to Energy Future Competitive Holdings Company, a direct, wholly-owned subsidiary of EFH Corp. and the direct parent of TCEH, and/or its subsidiaries, depending on context. |

iii

| | |

| EFH Corp. | | Refers to Energy Future Holdings Corp., a holding company, and/or its subsidiaries, depending on context. Its major subsidiaries include TCEH and Oncor. |

| |

| EFH Corp. Senior Notes | | Refers collectively to EFH Corp.’s 10.875% Senior Notes due November 1, 2017 (EFH Corp. 10.875% Notes) and EFH Corp.’s 11.25%/12.00% Senior Toggle Notes due November 1, 2017 (EFH Corp. Toggle Notes). |

| |

| EFH Corp. Senior Secured Notes | | Refers collectively to EFH Corp.’s 9.75% Senior Secured Notes due October 15, 2019 (EFH Corp. 9.75% Notes) and EFH Corp.’s 10.000% Senior Secured Notes due January 15, 2020 (EFH Corp. 10% Notes). |

| |

| EFIH | | Refers to Energy Future Intermediate Holding Company LLC, a direct, wholly-owned subsidiary of EFH Corp. and the direct parent of Oncor Holdings. |

| |

| EFIH Finance | | Refers to EFIH Finance Inc., a direct, wholly-owned subsidiary of EFIH, formed for the sole purpose of serving as co-issuer with EFIH of certain debt securities. |

| |

| EFIH Notes | | Refers collectively to EFIH’s and EFIH Finance’s 9.75% Senior Secured Notes due October 15, 2019 (EFIH 9.75% Notes) and EFIH’s and EFIH Finance’s 10.000% Senior Secured Notes due December 1, 2020 (EFIH 10% Notes). |

| |

| EPA | | US Environmental Protection Agency |

| |

| EPC | | engineering, procurement and construction |

| |

| ERCOT | | Electric Reliability Council of Texas, the independent system operator and the regional coordinator of various electricity systems within Texas |

| |

| ERISA | | Employee Retirement Income Security Act of 1974, as amended |

| |

| FASB | | Financial Accounting Standards Board, the designated organization in the private sector for establishing standards for financial accounting and reporting |

| |

| FERC | | US Federal Energy Regulatory Commission |

| |

| GAAP | | generally accepted accounting principles |

| |

| GHG | | greenhouse gas |

| |

| GWh | | gigawatt-hours |

| |

| IRS | | US Internal Revenue Service |

| |

| kV | | kilovolts |

| |

| kWh | | kilowatt-hours |

| |

| Lehman | | Refers to certain subsidiaries of Lehman Brothers Holdings Inc., which filed for bankruptcy under Chapter 11 of the US Bankruptcy Code in 2008. |

| |

| LIBOR | | London Interbank Offered Rate. An interest rate at which banks can borrow funds, in marketable size, from other banks in the London interbank market. |

| |

| Luminant | | Refers to subsidiaries of TCEH engaged in competitive market activities consisting of electricity generation and wholesale energy sales and purchases as well as commodity risk management and trading activities, all largely in Texas. |

iv

| | |

| market heat rate | | Heat rate is a measure of the efficiency of converting a fuel source to electricity. Market heat rate is the implied relationship between wholesale electricity prices and natural gas prices and is calculated by dividing the wholesale market price of electricity, which is based on the price offer of the marginal supplier in ERCOT (generally natural gas plants), by the market price of natural gas. Forward wholesale electricity market price quotes in ERCOT are generally limited to two or three years; accordingly, forward market heat rates are generally limited to the same time period. Forecasted market heat rates for time periods for which market price quotes are not available are based on fundamental economic factors and forecasts, including electricity supply, demand growth, capital costs associated with new construction of generation supply, transmission development and other factors. |

| |

| Merger | | The transaction referred to in “Merger Agreement” (defined immediately below) that was completed on October 10, 2007 |

| |

| Merger Agreement | | Agreement and Plan of Merger, dated February 25, 2007, under which Texas Holdings agreed to acquire EFH Corp. |

| |

| Merger Sub | | Texas Energy Future Merger Sub Corp, a Texas corporation and a wholly-owned subsidiary of Texas Holdings that was merged into EFH Corp. on October 10, 2007 |

| |

| MMBtu | | million British thermal units |

| |

| Moody’s | | Moody’s Investors Services, Inc. (a credit rating agency) |

| |

| MW | | megawatts |

| |

| MWh | | megawatt-hours |

| |

| NERC | | North American Electric Reliability Corporation |

| |

| NOx | | nitrogen oxide |

| |

| NRC | | US Nuclear Regulatory Commission |

| |

| NYMEX | | Refers to the New York Mercantile Exchange, a physical commodity futures exchange. |

| |

| Oncor | | Refers to Oncor Electric Delivery Company LLC, a direct, majority-owned subsidiary of Oncor Holdings and an indirect subsidiary of EFH Corp., and/or its consolidated bankruptcy-remote financing subsidiary, Oncor Electric Delivery Transition Bond Company LLC, depending on context, that is engaged in regulated electricity transmission and distribution activities. |

| |

| Oncor Holdings | | Refers to Oncor Electric Delivery Holdings Company LLC, a direct, wholly-owned subsidiary of EFIH and the direct majority owner of Oncor, and/or its subsidiaries, depending on context. |

| |

| Oncor Ring-Fenced Entities | | Refers to Oncor Holdings and its direct and indirect subsidiaries, including Oncor. |

| |

| OPEB | | other postretirement employee benefits |

| |

| PUCT | | Public Utility Commission of Texas |

| |

| PURA | | Texas Public Utility Regulatory Act |

v

| | |

| purchase accounting | | The purchase method of accounting for a business combination as prescribed by US GAAP, whereby the cost or “purchase price” of a business combination, including the amount paid for the equity and direct transaction costs are allocated to identifiable assets and liabilities (including intangible assets) based upon their fair values. The excess of the purchase price over the fair values of assets and liabilities is recorded as goodwill. |

| |

| Regulated Delivery segment | | Refers to the EFH Corp. business segment that consists of the operations of Oncor. |

| |

| REP | | retail electric provider |

| |

| RRC | | Railroad Commission of Texas, which among other things, has oversight of lignite mining activity in Texas |

| |

| S&P | | Standard & Poor’s Ratings Services, a division of the McGraw-Hill Companies Inc. (a credit rating agency) |

| |

| SARs | | Stock Appreciation Rights |

| |

| SARs Plan | | Refers to the Oncor Electric Delivery Company Stock Appreciation Rights Plan |

| |

| SEC | | US Securities and Exchange Commission |

| |

| Securities Act | | Securities Act of 1933, as amended |

| |

| SG&A | | selling, general and administrative |

| |

| SO2 | | sulfur dioxide |

| |

| Sponsor Group | | Refers collectively to the investment funds affiliated with Kohlberg Kravis Roberts & Co. L.P., TPG Capital, L.P. and GS Capital Partners, an affiliate of Goldman, Sachs & Co. (See Texas Holdings below.) |

| |

| TCEH | | Refers to Texas Competitive Electric Holdings Company LLC, a direct, wholly-owned subsidiary of EFCH and an indirect subsidiary of EFH Corp., and/or its subsidiaries, depending on context, that are engaged in electricity generation and wholesale and retail energy markets activities. Its major subsidiaries include Luminant and TXU Energy. |

| |

| TCEH Finance | | Refers to TCEH Finance, Inc., a direct, wholly-owned subsidiary of TCEH, formed for the sole purpose of serving as co-issuer with TCEH of certain debt securities. |

| |

| TCEH Senior Notes | | Refers collectively to TCEH’s 10.25% Senior Notes due November 1, 2015 and 10.25% Senior Notes due November 1, 2015, Series B (collectively, TCEH 10.25% Notes) and TCEH’s 10.50%/11.25% Senior Toggle Notes due November 1, 2016 (TCEH Toggle Notes). |

| |

| TCEH Senior Secured Facilities | | Refers collectively to the TCEH Initial Term Loan Facility, TCEH Delayed Draw Term Loan Facility, TCEH Revolving Credit Facility, TCEH Letter of Credit Facility and TCEH Commodity Collateral Posting Facility. See Note 11 to Financial Statements for details of these facilities. |

| |

| TCEH Senior Secured Second Lien Notes | | Refers collectively to TCEH’s 15% Senior Secured Second Lien Notes due April 1, 2021 and TCEH’s 15% Senior Secured Second Lien Notes due April 1, 2021, Series B. |

| |

| TCEQ | | Texas Commission on Environmental Quality |

vi

| | |

| Texas Holdings | | Refers to Texas Energy Future Holdings Limited Partnership, a limited partnership controlled by the Sponsor Group that owns substantially all of the common stock of EFH Corp. |

| |

| Texas Holdings Group | | Refers to Texas Holdings and its direct and indirect subsidiaries other than the Oncor Ring-Fenced Entities. |

| |

| Texas Transmission | | Refers to Texas Transmission Investment LLC, a limited liability company that owns a 19.75% equity interest in Oncor. Texas Transmission is not affiliated with EFH Corp., any of its subsidiaries or any member of the Sponsor Group. |

| |

| TRE | | Refers to Texas Reliability Entity, Inc., an independent organization that develops reliability standards for the ERCOT region and monitors and enforces compliance with NERC standards and ERCOT protocols. |

| |

| TXU Energy | | Refers to TXU Energy Retail Company LLC, a direct, wholly-owned subsidiary of TCEH engaged in the retail sale of electricity to residential and business customers. TXU Energy is a REP in competitive areas of ERCOT. |

| |

| TXU Gas | | TXU Gas Company, a former subsidiary of EFH Corp. |

| |

| US | | United States of America |

| |

| VIE | | variable interest entity |

vii

PART I

Items 1. and 2. BUSINESS AND PROPERTIES

References in this report to “we,” “our,” “us” and “the company” are to EFH Corp. and/or its subsidiaries as apparent in the context. See “Glossary” for descriptions of major subsidiaries and other defined terms.

EFH Corp. Business and Strategy

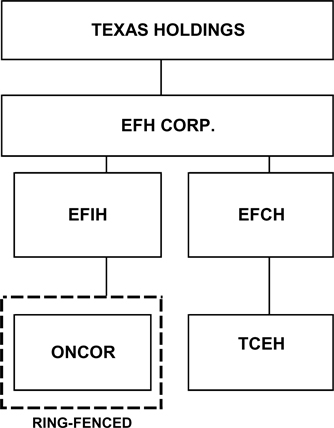

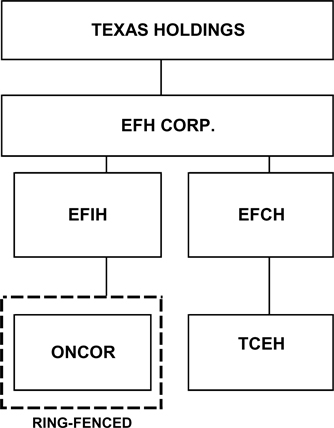

We are a Dallas, Texas-based energy company with a portfolio of competitive and regulated energy businesses in Texas. EFH Corp. is a holding company conducting its operations principally through its TCEH and Oncor subsidiaries. TCEH is wholly-owned, and EFH Corp. holds an approximately 80% equity interest in Oncor. Immediately below is an organization chart of the key subsidiaries discussed in this report.

TCEH is a holding company for subsidiaries engaged in competitive electricity market activities largely in Texas including electricity generation, wholesale energy sales and purchases, commodity risk management and trading activities, and retail electricity sales.

TCEH owns or leases 15,427 MW of generation capacity in Texas, which consists of lignite/coal, nuclear and natural gas-fueled generation facilities. This capacity includes two new lignite-fueled units that achieved substantial completion (as defined in the EPC agreements for the units) in the fourth quarter 2009 and a third new lignite-fueled unit that achieved substantial completion (as defined in the EPC agreement for the unit) in the second quarter 2010. In addition, TCEH is the largest purchaser of wind-generated electricity in Texas and the fifth largest in the US. TCEH provides competitive electricity and related services to approximately two million retail electricity customers in Texas.

1

Oncor is engaged in regulated electricity transmission and distribution operations in Texas that are primarily regulated by the PUCT. Oncor provides both distribution services to retail electric providers that sell electricity to consumers and transmission services to other electricity distribution companies, cooperatives and municipalities. Oncor operates the largest transmission and distribution system in Texas, delivering electricity to approximately three million homes and businesses and operating more than 118,000 miles of transmission and distribution lines. A significant portion of Oncor’s revenues represent fees for delivery services provided to TCEH. Distribution revenues from TCEH represented 36% and 38% of Oncor’s total revenues for the years ended December 31, 2010 and 2009, respectively.

EFH Corp. and Oncor have implemented certain structural and operational “ring-fencing” measures based on commitments made by Texas Holdings and Oncor to the PUCT that are intended to enhance the credit quality of Oncor. These measures serve to mitigate Oncor’s and Oncor Holdings’ credit exposure to the Texas Holdings Group and to reduce the risk that the assets and liabilities of Oncor or Oncor Holdings would be substantively consolidated with the assets and liabilities of the Texas Holdings Group in the event of a bankruptcy of one or more of those entities. See Note 1 to Financial Statements for a description of the material features of these “ring-fencing” measures.

As of December 31, 2010, we had approximately 9,200 full-time employees (including approximately 3,800 at Oncor), including approximately 2,750 employees under collective bargaining agreements (including approximately 650 at Oncor).

EFH Corp.’s Market

We operate primarily within the ERCOT market. This market represents approximately 85% of the electricity consumption in Texas. ERCOT is the regional reliability coordinating organization for member electricity systems in Texas and the system operator of the interconnected transmission grid for those systems. ERCOT’s membership consists of approximately 300 corporate and associate members, including electric cooperatives, municipal power agencies, independent generators, independent power marketers, investor-owned utilities, REPs and consumers.

The ERCOT market operates under reliability standards set by the NERC. The PUCT has primary jurisdiction over the ERCOT market to ensure adequacy and reliability of power supply across Texas’s main interconnected transmission grid. The ERCOT independent system operator is responsible for procuring energy on behalf of its members while maintaining reliable operations of the electricity supply system in the market. Its responsibilities include centralized dispatch of the power pool and ensuring that electricity production and delivery are accurately accounted for among the generation resources and wholesale buyers and sellers. The ERCOT independent system operator also serves as agent for procuring ancillary services for those members who elect not to provide their own ancillary services.

Significant changes in the operations of the wholesale electricity market resulted from the change from a zonal to a nodal market implemented by ERCOT in December 2010. The nodal market design reflects a substantial increase in settlement price points for participants and establishes a new “day-ahead market,” operated by ERCOT, in which participants can enter into forward sales and purchases of electricity. The nodal market also establishes hub trading prices, which represent the average of node prices within geographic regions, at which participants can hedge and trade power through bilateral transactions. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Significant Activities and Events – Wholesale Market Design – Nodal Market” for additional discussion of the ERCOT nodal market.

Oncor, along with other owners of transmission and distribution facilities in Texas, assists the ERCOT independent system operator in its operations. Oncor has planning, design, construction, operation and maintenance responsibility for the portion of the transmission grid and for the load-serving substations it owns, primarily within its certificated distribution service area. Oncor participates with the ERCOT independent system operator and other ERCOT utilities in obtaining regulatory approvals and planning, designing and constructing new transmission lines in order to remove existing constraints on the ERCOT transmission grid. The transmission lines are necessary to meet reliability needs, support renewable energy production and increase bulk power transfer capability.

2

The following data is derived from information published by ERCOT:

Installed generation capacity in the ERCOT market estimated for 2011 totals approximately 85,000 MW, including approximately 3,000 MW mothballed (idled) capacity, as well as more than 10,000 MW of wind, water and other resources that may not be available coincident with system need. In August 2010, ERCOT’s hourly demand peaked at a record 65,776 MW. Of ERCOT’s estimate of total available capacity for 2011, approximately 60% is natural gas-fueled generation, approximately 28% is lignite/coal and nuclear-fueled baseload generation and approximately 12% in wind and other renewable resources. In November 2010, ERCOT changed its minimum reserve margin planning criterion to 13.75% from 12.5%; the reserve margin is projected by ERCOT to be 15.94% in 2011, 15.78% in 2012, and 13.14% by 2013. Reserve margin is the difference between system generation capability and anticipated peak load.

The ERCOT market has limited interconnections to other markets in the US, which currently limits potential imports into and exports out of the ERCOT market to 1,106 MW of generation capacity (or approximately 2% of peak demand). In addition, wholesale transactions within the ERCOT market are generally not subject to regulation by the FERC.

Natural gas-fueled generation is the predominant electricity capacity resource in the ERCOT market and accounted for approximately 39% of the electricity produced in the ERCOT market in 2010. Because of the significant natural gas-fueled capacity and the ability of such facilities to more readily increase or decrease production when compared to baseload generation, marginal demand for electricity is usually met by natural gas-fueled facilities. As a result, wholesale electricity prices in ERCOT largely correlate with natural gas prices.

EFH Corp.’s Strategies

Each of our businesses focuses its operations on key safety, reliability, economic and environmental drivers for that business, as described below:

| | • | | TCEH focuses on optimizing and developing its generation fleet to safely provide reliable electricity supply in a cost-effective manner and in consideration of environmental impacts, hedging its electricity price risk and providing high quality service and innovative energy products to retail and wholesale customers. |

| | • | | Oncor focuses on delivering electricity in a safe and reliable manner, minimizing service interruptions and investing in its transmission and distribution infrastructure to maintain its system, serve its growing customer base with a modernized grid and support renewable energy production. |

Other elements of our strategies include:

| | • | | Increase value from existing business lines. Our strategy focuses on striving for top quartile or better performance across our operations in terms of safety, reliability, cost and customer service. In establishing tactical objectives, we incorporate the following core operating principles: |

| | • | | Safety: Placing the safety of communities, customers and employees first; |

| | • | | Environmental Stewardship: Continuing to make strategic and operational improvements that lead to cleaner air, land and water; |

| | • | | Customer Focus: Delivering products and superior service to help customers more effectively manage their use of electricity; |

| | • | | Community Focus: Being an integral part of the communities in which we live, work and serve; |

| | • | | Operational Excellence: Incorporating continuous improvement and financial discipline in all aspects of the business to achieve top-tier results that maximize the value of the company for stakeholders, including operating world-class facilities that produce and deliver safe and dependable electricity at affordable prices, and |

| | • | | Performance-Driven Culture: Fostering a strong values- and performance-based culture designed to attract, develop and retain best-in-class talent. |

3

| | • | | Pursue growth opportunities across business lines. Scale in our operating businesses allows us to take part in large capital investments, such as new generation projects and investments in the transmission and distribution system, with a smaller fraction of overall capital at risk and with an enhanced ability to streamline costs. We expect to also explore smaller-scale growth initiatives that are not expected to be material to our performance over the near term but can enhance our growth profile over time. Specific growth initiatives include: |

| | • | | Pursue generation development opportunities to help meet ERCOT’s growing electricity needs over the longer term from a diverse range of alternatives such as nuclear, renewable energy and advanced coal technologies. |

| | • | | Profitably increase the number of retail customers served throughout the competitive ERCOT market areas by delivering superior value through high quality customer service and innovative energy products, including leading energy efficiency initiatives and service offerings. |

| | • | | Invest in transmission and distribution technology upgrades, including advanced metering systems and energy efficiency initiatives, and construct new transmission and distribution facilities to meet the needs of the growing Texas market. These growth initiatives benefit from regulatory capital recovery mechanisms known as “capital trackers” that enable adequate and timely recovery of transmission and advanced metering investments through regulated rates. |

| | • | | Reduce the volatility of cash flows through an electricity price risk management strategy. We actively manage our exposure to wholesale electricity prices in ERCOT through contracts for physical delivery of electricity, exchange traded and “over-the-counter” financial contracts, ERCOT “day-ahead market” transactions and bilateral contracts with other wholesale market participants, including other generators and end-use customers. These hedging activities include shorter-term agreements, longer-term electricity sales contracts and forward sales of natural gas. |

The strong historical correlation between natural gas prices and wholesale electricity prices in the ERCOT market provides us an opportunity to manage our exposure to variability of wholesale electricity prices. We have established a long-term hedging program designed to reduce exposure to changes in future electricity prices due to changes in the price of natural gas. Under the program, TCEH has entered into market transactions involving natural gas-related financial instruments, and as of December 31, 2010, has effectively sold forward approximately 1.0 billion MMBtu of natural gas (equivalent to the natural gas exposure of approximately 125,000 GWh at an assumed 8.0 market heat rate) for the period January 1, 2011 through December 31, 2014 at weighted average annual hedge prices ranging from $7.19 per MMBtu to $7.80 per MMBtu.

These transactions, as well as forward power sales, have effectively hedged an estimated 62% of the natural gas price exposure related to TCEH’s expected generation output for the period beginning January 1, 2011 and ending December 31, 2014 (on an average basis for such period and assuming an 8.0 market heat rate). The hedges were entered into with the continuing expectation that wholesale electricity prices in ERCOT will largely correlate with natural gas prices, which are expected to be the marginal fuel for the purpose of setting electricity prices approximately 75% to 90% of the time. If this correlation changes, the cash flows targeted under the long-term hedging program may not be achieved. As of December 31, 2010, more than 95% of the long-term hedging program transactions were directly or indirectly secured by a first-lien interest in TCEH’s assets (including the transactions supported by the TCEH Commodity Collateral Posting Facility), thereby reducing the cash and letter of credit collateral requirements for the hedging program. For additional discussion of the long-term hedging program, see Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” specifically sections entitled “Significant Activities and Events – Natural Gas Prices and Long-Term Hedging Program,” “Key Risks and Challenges – Natural Gas Price and Market Heat-Rate Exposure” and “Financial Condition – Liquidity and Capital Resources – Liquidity Effects of Commodity Hedging and Trading Activities.”

4

| | • | | Strengthen balance sheet through a liability management program. In 2009, we initiated a liability management program focused on improving our balance sheet, and we expect to opportunistically look for ways to reduce the amount and extend the maturity of our outstanding debt. Activities under the liability management program do not include debt issued by Oncor or its subsidiaries. The program has resulted in the capture of $2.0 billion of debt discount and the extension of approximately $5.0 billion of maturities from 2014-2017 to 2019-2021. Activities to date have included debt exchanges, issuances and repurchases completed in 2010 and 2009 discussed below under Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Significant Activities and Events – Liability Management Program” and the August 2009 amendment to the Credit Agreement governing the TCEH Senior Secured Facilities that provided additional flexibility in restructuring debt obligations. See Note 11 to Financial Statements for additional discussion of these transactions. |

Future activities under the liability management program may include the purchase of our outstanding debt for cash in open market purchases or privately negotiated transactions (including pursuant to a Section 10b-5(1) plan) or via public or private exchange or tender offers. Moreover, as part of our liability management program, we may refinance our existing debt, including the TCEH Senior Secured Credit Facilities.

In evaluating whether to undertake any liability management transaction, including any refinancing, we will take into account liquidity requirements, prospects for future access to capital, contractual restrictions, the market price of our outstanding debt and other factors. Any liability management transaction, including any refinancing, may occur on a stand-alone basis or in connection with, or immediately following, other liability management transactions.

| | • | | Pursue new environmental initiatives. We are committed to continue to operate in compliance with all environmental laws, rules and regulations and to reduce our impact on the environment. EFH Corp.’s Sustainable Energy Advisory Board advises in the pursuit of technology development opportunities that reduce our impact on the environment while balancing the need to help address the energy requirements of Texas. The Sustainable Energy Advisory Board is comprised of individuals who represent the following interests, among others: the environment, labor unions, customers, economic development in Texas and technology/reliability standards. In addition, we are focused on and are pursuing opportunities to reduce emissions from our existing and new lignite/coal-fueled generation units. We have voluntarily committed to reduce emissions of mercury, NOx and SO2 at our existing units. We expect to make these reductions through a combination of investment in new emission control equipment, new coal cleaning technologies and optimizing fuel blends. In addition, we expect to invest $400 million over a five-year period that began in 2008 in programs designed to encourage customer electricity demand efficiencies, representing $200 million more than amounts planned to be invested by Oncor to meet regulatory requirements. As of December 31, 2010, we invested a cumulative total of $229 million in these programs. |

Seasonality

Our revenues and results of operations are subject to seasonality, weather conditions and other electricity usage drivers, with revenues being highest in the summer.

5

Operating Segments

We have aligned and report our business activities as two operating segments: the Competitive Electric segment (primarily represented by TCEH) and the Regulated Delivery segment (primarily represented by Oncor). See Note 23 to Financial Statements for additional financial information for the segments.

Competitive Electric Segment

Key management activities, including commodity price risk management and electricity sourcing for our retail and wholesale customers, are performed on an integrated basis. However, for purposes of operational accountability, performance management and market identity, the segment operations have been grouped into Luminant, which is engaged in electricity generation and wholesale markets activities, and TXU Energy, which is engaged in retail electricity sales activities. These activities are conducted through separate legal entities.

Luminant — Luminant’s existing electricity generation fleet consists of 14 plants in Texas with total installed nameplate generating capacity as shown in the table below:

| | | | | | | | | | | | |

Fuel Type | | Installed Nameplate

Capacity (MW) | | | Number of

Plants | | | Number of

Units (a) | |

Nuclear | | | 2,300 | | | | 1 | | | | 2 | |

Lignite/coal | | | 8,017 | | | | 5 | | | | 12 | |

Natural gas (b)(c) | | | 5,110 | | | | 8 | | | | 26 | |

| | | | | | | | | | | | |

Total | | | 15,427 | | | | 14 | | | | 40 | |

| | | | | | | | | | | | |

| | (a) | Leased units consist of six natural gas-fueled combustion turbine units totaling 390 MW of capacity. All other units are owned. |

| | (b) | Includes 1,655 MW representing four units mothballed and not currently available for dispatch. See “Natural Gas-Fueled Generation Operations” below. |

| | (c) | Includes 1,268 MW representing eight units currently operated for unaffiliated parties. |

The generation plants are located primarily on land owned in fee. Nuclear and lignite/coal-fueled (baseload) plants are generally scheduled to run at capacity except for periods of scheduled maintenance activities or, in the case of lignite/coal-fueled units, short-term production backdown in periods of low wholesale power prices (i.e., economic backdown). The natural gas-fueled generation units supplement the baseload generation capacity in meeting consumption in peak demand periods as production from a certain number of these units can more readily be ramped up or down as demand warrants.

Nuclear Generation Operations — Luminant operates two nuclear generation units at the Comanche Peak facility, each of which is designed for a capacity of 1,150 MW. Comanche Peak’s Unit 1 and Unit 2 went into commercial operation in 1990 and 1993, respectively, and are generally operated at full capacity to meet the load requirements in ERCOT. Refueling (nuclear fuel assembly replacement) outages for each unit are scheduled to occur every eighteen months during the spring or fall off-peak demand periods. Every three years, the refueling cycle results in the refueling of both units during the same year, which is planned for 2011 and last occurred in 2008. While one unit is undergoing a refueling outage, the remaining unit is intended to operate at full capacity. During a refueling outage, other maintenance, modification and testing activities are completed that cannot be accomplished when the unit is in operation. Over the last three years the refueling outage period per unit has ranged from 19 to 26 days. The Comanche Peak facility operated at a capacity factor of 95% in 2008, reflecting refueling of both units, and 100% in both 2009 and 2010.

Luminant has contracts in place for all of its uranium, nuclear fuel conversion services and nuclear fuel enrichment services for 2011. For the period of 2012 through 2018, Luminant has contracts in place for the acquisition of approximately 65% of its uranium requirements and 51% of its nuclear fuel conversion services requirements. In addition, Luminant has contracts in place for all of its nuclear fuel enrichment services through 2013, as well as all of its nuclear fuel fabrication services through 2018. Luminant does not anticipate any significant difficulties in acquiring uranium and contracting for associated conversion services and enrichment services in the foreseeable future.

6

Luminant believes its on-site used nuclear fuel storage capability is sufficient for a minimum of three years. The nuclear industry is continuing to review ways to enhance security of used-fuel storage with the NRC to fully utilize physical storage capacity. Future on-site used nuclear fuel storage capability will require the use of the industry technique of dry cask storage.

The Comanche Peak nuclear generation units have an estimated useful life of 60 years from the date of commercial operation. Therefore, assuming that Luminant receives 20-year license extensions, similar to what has been granted by the NRC to several other commercial generation reactors over the past several years, plant decommissioning activities would be scheduled to begin in 2050 for Comanche Peak Unit 1 and 2053 for Unit 2 and common facilities. Decommissioning costs will be paid from a decommissioning trust that, pursuant to state law, is funded from Oncor’s customers through an ongoing delivery surcharge. (See Note 18 to Financial Statements for discussion of the decommissioning trust fund.)

Nuclear insurance provisions are discussed in Note 12 to Financial Statements.

Nuclear Generation Development —In September 2008, a subsidiary of TCEH filed a combined operating license application with the NRC for two new nuclear generation units, each with approximately 1,700 MW (gross capacity), at its existing Comanche Peak nuclear generation site. In connection with the filing of the application, in January 2009, subsidiaries of TCEH and Mitsubishi Heavy Industries Ltd. (MHI) formed a joint venture, Comanche Peak Nuclear Power Company (CPNPC), to further the development of the two new nuclear generation units using MHI’s US–Advanced Pressurized Water Reactor technology. The TCEH subsidiary owns an 88% interest in CPNPC, and a MHI subsidiary owns a 12% interest.

In March 2009, the NRC announced an official review schedule for the license application. Based on the schedule, the NRC expects to complete its review by December 2011, and it is expected that a license would be issued approximately one year later. In November 2009, CPNPC filed a comprehensive revision to the license application that updated the license application for developments occurring after the initial filing.

In 2009, the DOE announced that it had selected four applicants to proceed to the due diligence phase of its Loan Guarantee Program and to commence negotiations towards potential loan guarantees for their respective generation projects. CPNPC was not among the initial four applicants selected by the DOE; however, CPNPC continues to update the DOE on its progress, with the goal of securing a DOE loan guarantee for financing the proposed units prior to commencement of construction.

Lignite/Coal-Fueled Generation Operations — Luminant’s lignite/coal-fueled generation fleet capacity totals 8,017 MW (including three recently constructed new units) and consists of the Big Brown (2 units), Monticello (3 units), Martin Lake (3 units), Oak Grove (2 units) and Sandow (2 units) plants. These plants are generally operated at full capacity to help meet the load requirements in ERCOT, and maintenance outages are scheduled during seasonal off-peak demand periods. Over the last three years, the total annual scheduled and unscheduled outages per unit (excluding the three new units) averaged 33 days. Luminant’s lignite/coal-fueled generation fleet operated at a capacity factor of 87.6% in 2008, 86.5% in 2009 and 82.2% in 2010, which represents top quartile performance of US coal-fueled generation facilities. The 2008 performance reflects extended unplanned outages at several units, and the 2010 and 2009 performance reflects increased economic backdown of the units, reflecting short-term periods when wholesale electricity market prices were less than production costs.

Luminant recently completed the construction of three lignite-fueled generation units with a total capacity of 2,180 MW. The three units consist of one unit at a leased site that is adjacent to an existing lignite-fueled generation unit (Sandow) and two units at an owned site (Oak Grove). The Sandow unit and the first Oak Grove unit achieved substantial completion (as defined in the EPC agreements for the respective units) in the fourth quarter 2009. The second Oak Grove unit achieved substantial completion (as defined in the EPC agreement for the unit) in the second quarter 2010. Accordingly, Luminant has operational control of these units.

7

Aggregate cash capital expenditures for these three units totaled approximately $3.25 billion including all construction, site preparation and mining development costs. The investment included approximately $500 million for state-of-the-art emissions controls for the three new units. Including capitalized interest and the step-up in construction work-in-process balances to fair value as a result of purchase accounting for the Merger in 2007, carrying value of the units totaled approximately $4.8 billion upon completion.

Luminant also has an environmental retrofit program under which it plans to install additional environmental control systems at its existing lignite/coal-fueled generation facilities. Capital expenditures associated with these additional environmental control systems could exceed $1.0 billion, of which $377 million was spent through 2010. Luminant has not yet completed all detailed cost and engineering studies for the additional environmental systems, and the cost estimates could change materially as it determines the details of and further evaluates the engineering and construction costs related to these investments.

Approximately 58% of the fuel used at Luminant’s lignite/coal-fueled generation plants in 2010 was supplied from lignite reserves owned in fee or leased surface-minable deposits dedicated to the Big Brown, Monticello, Martin Lake and Oak Grove plants, which were constructed adjacent to the reserves. Luminant owns in fee or has under lease an estimated 800 million tons of lignite reserves dedicated to its generation plants, including 246 million tons associated with an undivided interest in the lignite mine that provides fuel for the Sandow facility. Luminant also owns in fee or has under lease in excess of 85 million tons of reserves not currently dedicated to specific generation plants. In 2010, Luminant recovered approximately 27.5 million tons of lignite to fuel its generation plants. Luminant utilizes owned and/or leased equipment to remove the overburden and recover the lignite.

Luminant’s lignite mining operations include extensive reclamation activities that return the land to productive uses such as wildlife habitats, commercial timberland and pasture land. In 2010, Luminant reclaimed 1,729 acres of land. In addition, Luminant planted 1.2 million trees in 2010, the majority of which were part of the reclamation effort.

Luminant supplements its lignite fuel at Big Brown, Monticello and Martin Lake with western coal from the Powder River Basin in Wyoming. The coal is purchased from multiple suppliers under contracts of various lengths and is transported from the Powder River Basin to Luminant’s generation plants by railcar. Based on its current usage, Luminant believes that it has sufficient lignite reserves for the foreseeable future and has contracted more than 95% of its western coal resources and all of the related transportation through 2012.

Natural Gas-Fueled Generation Operations — Luminant’s fleet of 26 natural gas-fueled generation units totaling 5,110 MW of capacity includes 2,187 MW of currently available capacity, 1,268 MW of capacity being operated for unaffiliated third parties and 1,655 MW of capacity currently mothballed (idled). The natural gas-fueled units predominantly serve as peaking units that can be ramped up or down to balance electricity supply and demand.

Wholesale Operations — Luminant’s wholesale operations play a pivotal role in our competitive business portfolio by optimally dispatching the generation fleet, including the baseload facilities, sourcing all of TXU Energy’s electricity requirements and managing commodity price risk associated with electricity sales and generation fuel requirements.

Our electricity price exposure is managed across the complementary Luminant generation and TXU Energy retail businesses on a portfolio basis. Under this approach, Luminant’s wholesale operations manage the risks of imbalances between generation supply and sales load, as well as exposures to natural gas price movements and market heat rate changes (variations in the relationships between natural gas prices and wholesale electricity prices), through wholesale market activities that include physical purchases and sales and transacting in financial instruments.

Luminant’s wholesale operations provide TXU Energy and other retail and wholesale customers with electricity and related services to meet their demands and the operating requirements of ERCOT. In consideration of operational production and customer consumption levels that can be highly variable, as well as opportunities for long-term purchases and sales with large wholesale market participants, Luminant buys and sells electricity in short-term transactions and executes longer-term forward electricity purchase and sales agreements. Luminant is the largest purchaser of wind-generated electricity in Texas and the fifth largest in the US with more than 900 MW of existing wind power under contract.

Fuel price exposure, primarily relating to Powder River Basin coal, natural gas and fuel oil and the transportation of the fuel, is managed primarily through short- and long-term contracts for physical delivery of fuel as well as financial contracts.

8

In its hedging activities, Luminant enters into contracts for the physical delivery of electricity and fuel commodities, exchange traded and “over-the-counter” financial contracts and bilateral contracts with other wholesale electricity market participants, including generators and end-use customers. A major part of these hedging activities is a long-term hedging program, described above under “EFH Corp.’s Strategies”, designed to reduce exposure to changes in future electricity prices due to changes in the price of natural gas, principally utilizing natural gas-related financial instruments.

The wholesale operations also dispatch Luminant’s available generation capacity. These dispatching activities result in economic backdown of lignite/coal-fueled units and ramping up and down of natural gas-fueled units as market conditions warrant. Luminant’s dispatching activities are performed through a centrally managed real-time operational staff that synthesizes operational activities across the fleet and interfaces with various wholesale market channels. In addition, the wholesale operations manage the fuel procurement requirements for Luminant’s fossil fuel generation facilities.

Luminant’s wholesale operations include electricity and natural gas trading and third-party energy management activities. Natural gas transactions include direct purchases from natural gas producers, transportation agreements, storage leases and commercial retail sales. Luminant currently manages approximately 11 billion cubic feet of natural gas storage capacity.

Luminant’s wholesale operations manage exposure to wholesale commodity and credit-related risk within established transactional risk management policies, limits and controls. These policies, limits and controls have been structured so that they are practical in application and consistent with stated business objectives. Risk management processes include capturing transactions, performing and validating valuations and reporting exposures on a daily basis using risk management information systems designed to support a large transactional portfolio. A risk management forum meets regularly to ensure that business practices comply with approved transactional limits, commodities, instruments, exchanges and markets. Transactional risks are monitored to ensure limits comply with the established risk policy. Luminant has a disciplinary program to address any violations of the risk management policies and periodically reviews these policies to ensure they are responsive to changing market and business conditions.

TXU Energy — TXU Energy serves approximately two million residential and commercial retail electricity customers in Texas with approximately 62% of retail revenues in 2010 from residential customers. Texas is one of the fastest growing states in the nation with a diverse economy and, as a result, has attracted a number of competitors into the retail electricity market; consequently, competition is robust. TXU Energy, as an active participant in this competitive market, provides retail electric service to all areas of the ERCOT market now open to competition, including the Dallas/Fort Worth, Houston, Corpus Christi, and lower Rio Grande Valley areas of Texas. TXU Energy continues to market its services in Texas to add new customers and to retain its existing customers. There are approximately 120 active REPs certified to compete within the State of Texas. Based upon data published by the PUCT, as of September 30, 2010, approximately 53% of residential customers in competitive areas of ERCOT are served by REPs not affiliated with the pre-competition utility.

TXU Energy’s strategy focuses on providing its customers with high quality customer service and creating new products and services to meet customer needs; accordingly, a new customer management computer system was implemented in 2009, and other customer care enhancements are being implemented to further improve customer satisfaction. TXU Energy offers a wide range of residential products to meet various customer needs. TXU Energy is investing $100 million over the five-year period ending 2012, including a cumulative total of $39 million spent as of December 31, 2010, in energy efficiency initiatives as part of a program to offer customers a broad set of innovative energy products and services.

A subsidiary of EFH Corp. was recently certified by the Pennsylvania Public Utility Commission to sell retail electricity in Pennsylvania. While we have made no commitments to enter markets outside of Texas, we continuously monitor competitive retail markets for potential opportunities.

9

Regulation —Luminant is an exempt wholesale generator under the Energy Policy Act of 2005 and is subject to the jurisdiction of the NRC with respect to its nuclear generation plant. NRC regulations govern the granting of licenses for the construction and operation of nuclear-fueled generation facilities and subject such facilities to continuing review and regulation. Luminant also holds a power marketer license from the FERC and, with respect to any wholesale power sales outside the ERCOT market, is subject to market behavior and any other competition-related rules and regulations under the Federal Power Act that are administered by the FERC.

Luminant is also subject to the jurisdiction of the PUCT’s oversight of the competitive ERCOT wholesale electricity market. PUCT rules establish robust oversight, certain limits and a framework for wholesale power pricing and market behavior. Luminant is also subject to the requirements of the ERCOT Protocols, including Nodal Protocols and ERCOT reliability standards as adopted and enforced by the TRE and the NERC, including NERC critical infrastructure protection (CIP) standards.

TXU Energy is a licensed REP under the Texas Electric Choice Act and is subject to the jurisdiction of the PUCT with respect to provision of electricity service in ERCOT. PUCT rules govern the granting of licenses for REPs, including oversight but not setting of prices charged. TXU Energy is also subject to the requirements of the ERCOT Protocols, including Nodal Protocols and ERCOT reliability standards as adopted and enforced by the TRE and the NERC, including NERC CIP standards.

Regulated Delivery Segment

The Regulated Delivery segment consists of the operations of Oncor. Oncor is a regulated electricity transmission and distribution company that provides the service of delivering electricity safely, reliably and economically to end-use consumers through its distribution systems, as well as providing transmission grid connections to merchant generation facilities and interconnections to other transmission grids in Texas. Oncor’s service territory comprises 91 counties and over 400 incorporated municipalities, including Dallas/Fort Worth and surrounding suburbs, as well as Waco, Wichita Falls, Odessa, Midland, Tyler and Killeen. Oncor’s transmission and distribution assets are located principally in the north-central, eastern and western parts of Texas. Most of Oncor’s power lines have been constructed over lands of others pursuant to easements or along public highways, streets and rights-of-way as permitted by law. Oncor’s transmission and distribution rates are regulated by the PUCT.

Oncor is not a seller of electricity, nor does it purchase electricity for resale. It provides transmission services to other electricity distribution companies, cooperatives and municipalities. It provides distribution services to REPs, which sell electricity to retail customers. Oncor is also subject to the requirements of the ERCOT Protocols, including Nodal Protocols and ERCOT reliability standards as adopted and enforced by the TRE and the NERC.

Performance — Oncor achieved market-leading electricity delivery performance in 12 out of 14 key PUCT market metrics in 2010. These metrics measure the success of transmission and distribution companies in facilitating customer transactions in the competitive Texas electricity market.

Investing in Infrastructure and Technology —In 2010, Oncor invested $1.0 billion in its network to construct, rebuild and upgrade transmission lines and associated facilities, to extend the distribution infrastructure, and to pursue certain initiatives in infrastructure maintenance and information technology. Reflecting its commitment to infrastructure, in September 2008, Oncor and several other ERCOT utilities filed with the PUCT a plan to participate in the construction of transmission improvements designed to interconnect existing and future renewable energy facilities to transmit electricity from Competitive Renewable Energy Zones (CREZs) identified by the PUCT. In 2009, the PUCT awarded CREZ construction projects to Oncor, and Oncor currently estimates the costs of the projects to be approximately $1.75 billion. The projects involve the construction of transmission lines to support the transmission of electricity from renewable energy sources, principally wind generation facilities, in west Texas to population centers in the eastern part of the state. Through 2010, Oncor’s cumulative CREZ-related capital expenditures totaled $316 million, including $202 million invested in 2010. See Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Regulatory Matters – Oncor Matters with the PUCT.”

10

Oncor’s technology upgrade initiatives include development of a modernized grid through the replacement of existing meters with advanced digital metering equipment and development of advanced digital communication, data management, real-time monitoring and outage detection capabilities. This modernized grid is expected to produce electricity service reliability improvements and provide the potential for additional products and services from REPs that will enable businesses and consumers to better manage their electricity usage and costs. Oncor’s plans provide for the full deployment of over three million advanced meters to all residential and most non-residential retail electricity customers in Oncor’s service area. The advanced meters can be read remotely, rather than by a meter reader physically visiting the location of each meter. Advanced meters facilitate automated demand side management, which allows consumers to monitor the amount of electricity they are consuming and adjust their electricity consumption habits. As of December 31, 2010, Oncor has installed approximately 1,514,000 advanced digital meters, including 854,000 during the year ended December 31, 2010. As the new meters are integrated, Oncor reports 15-minute interval, billing-quality electricity consumption data to ERCOT for market settlement purposes. The data makes it possible for REPs to support new programs and pricing options. Cumulative capital expenditures for the deployment of the advanced meter system totaled $360 million as of December 31, 2010, including $164 million invested in 2010. Oncor expects to complete installations of the advanced meters by the end of 2012.

In addition to the potential energy efficiencies from advanced metering, Oncor expects to invest over $300 million ($100 million in excess of regulatory requirements) over the five-year period ending 2012 in programs designed to improve customer electricity demand efficiencies. As of December 31, 2010, Oncor has invested $190 million in these programs, including $65 million in 2010, and 47% of the amount in excess of regulatory requirements has been spent.

In a stipulation with several parties that was approved by the PUCT in 2007 (as discussed in Note 6 to Financial Statements), Oncor has committed to a variety of actions, including minimum capital spending of $3.6 billion over the five-year period ending December 31, 2012, subject to certain defined conditions. Approximately 72% of this total was spent as of December 31, 2010. This spending does not include the CREZ facilities.

Electricity Transmission —Oncor’s electricity transmission business is responsible for the safe and reliable operations of its transmission network and substations. These responsibilities consist of the construction and maintenance of transmission facilities and substations and the monitoring, controlling and dispatching of high-voltage electricity over Oncor’s transmission facilities in coordination with ERCOT.

Oncor is a member of ERCOT, and its transmission business actively assists the operations of ERCOT and market participants. Through its transmission business, Oncor participates with ERCOT and other member utilities to plan, design, construct and operate new transmission lines, with regulatory approval, necessary to maintain reliability, interconnect to merchant generation facilities, increase bulk power transfer capability and minimize limitations and constraints on the ERCOT transmission grid.

Transmission revenues are provided under tariffs approved by either the PUCT or, to a small degree related to an interconnection to other markets, the FERC. Network transmission revenues compensate Oncor for delivery of electricity over transmission facilities operating at 60 kV and above. Other services offered by Oncor through its transmission business include, but are not limited to: system impact studies, facilities studies, transformation service and maintenance of transformer equipment, substations and transmission lines owned by other parties.

PURA allows Oncor to update its transmission rates periodically to reflect changes in invested capital. This “capital tracker” provision encourages investment in the transmission system to help ensure reliability and efficiency by allowing for timely recovery of and return on new transmission investments.

As of December 31, 2010, Oncor’s transmission facilities included approximately 5,325 circuit miles of 345-kV transmission lines and approximately 9,979 circuit miles of 138-and 69-kV transmission lines. Sixty generation facilities totaling 34,357 MW are directly connected to Oncor’s transmission system, and 278 transmission stations and 705 distribution substations are served from Oncor’s transmission system.

11

As of December 31, 2010, Oncor’s transmission facilities have the following connections to other transmission grids in Texas:

| | | | | | | | | | | | |

| | | Number of Interconnected Lines | |

Grid Connections | | 345kV | | | 138kV | | | 69kV | |

Centerpoint Energy Inc. | | | 8 | | | | — | | | | — | |

American Electric Power Company, Inc (a) | | | 4 | | | | 7 | | | | 11 | |

Lower Colorado River Authority | | | 6 | | | | 21 | | | | 3 | |

Texas Municipal Power Agency | | | 8 | | | | 6 | | | | — | |

Texas New Mexico Power | | | 2 | | | | 9 | | | | 11 | |

Brazos Electric Power Cooperative, Inc. | | | 6 | | | | 109 | | | | 20 | |

Rayburn Country Electric Cooperative, Inc. | | | — | | | | 35 | | | | 7 | |

City of Georgetown | | | — | | | | 2 | | | | — | |

Tex-La Electric Cooperative of Texas, Inc. | | | — | | | | 12 | | | | 1 | |

Other small systems operating wholly within Texas | | | — | | | | 3 | | | | 3 | |

| | (a) | One of the 345-kV lines is an asynchronous high-voltage direct current connection with the Southwest Power Pool. |

Electricity Distribution— Oncor’s electricity distribution business is responsible for the overall safe and efficient operation of distribution facilities, including electricity delivery, power quality and system reliability. These responsibilities consist of the ownership, management, construction, maintenance and operation of the distribution system within Oncor’s certificated service area. Oncor’s distribution system receives electricity from the transmission system through substations and distributes electricity to end-users and wholesale customers through approximately 3,118 distribution feeders.

The Oncor distribution system includes over 3.1 million points of delivery. Over the past five years, the number of distribution system points of delivery served by Oncor, excluding lighting sites, grew an average of approximately 1.23% per year, adding approximately 29,378 points of delivery in 2010.

The Oncor distribution system consists of approximately 56,374 miles of overhead primary conductors, approximately 21,559 miles of overhead secondary and street light conductors, approximately 15,490 miles of underground primary conductors and approximately 9,640 miles of underground secondary and street light conductors. The majority of the distribution system operates at 25-kV and 12.5-kV.

Oncor’s distribution rates for residential and small commercial users are based on actual monthly consumption (kWh), and rates for large commercial and industrial users are based on the greater of actual monthly demand (kilowatt) or 80% of peak monthly demand during the prior eleven months.

Customers —Oncor’s transmission customers consist of municipalities, electric cooperatives and other distribution companies. Oncor’s distribution customers consist of more than 75 REPs in Oncor’s certificated service area, including TCEH. Distribution revenues from TCEH represented 36% of Oncor’s total revenues for 2010. Revenues from subsidiaries of Reliant Energy, Inc., each of which is a non-affiliated REP, represented 12% of Oncor’s total revenues for 2010. No other customer represented more than 10% of Oncor’s total operating revenues. The consumers of the electricity delivered by Oncor are free to choose their electricity supplier from REPs who compete for their business.

Regulation and Rates —As its operations are wholly within Texas, Oncor is not a public utility as defined in the Federal Power Act and, as a result, it is not subject to general regulation under this Act. However, Oncor is subject to reliability standards adopted and enforced by the TRE and the NERC, including NERC CIP standards, under the Federal Power Act.

The PUCT has original jurisdiction over transmission and distribution rates and services in unincorporated areas and in those municipalities that have ceded original jurisdiction to the PUCT and has exclusive appellate jurisdiction to review the rate and service orders and ordinances of municipalities. Generally, PURA prohibits the collection of any rates or charges by a public utility (as defined by PURA) that does not have the prior approval of the appropriate regulatory authority (PUCT or municipality with original jurisdiction). In accordance with a stipulation approved by the PUCT, Oncor filed a rate review with the PUCT in June 2008, based on a test year ended December 31, 2007. In August 2009, the PUCT issued a final order with respect to the rate review as discussed in Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Regulatory Matters.”

12

In January 2011, Oncor filed for a rate review with the PUCT and 203 cities (PUCT Docket No. 38929) based on a test year ended June 30, 2010. If approved as requested, this review would result in an aggregate annual rate increase of approximately $353 million over the test year period adjusted for the impact of weather. Oncor also requested a revised regulatory capital structure of 55% debt to 45% equity. The debt-to-equity ratio established by the PUCT is currently set at 60% debt to 40% equity. The PUCT, cities and other participating parties, with input from Oncor, established a procedural schedule for the review in January 2011. A hearing on the merits of Oncor’s request is scheduled to commence in May 2011, and resolution of the proposed increase is expected to occur during the second half of 2011.

At the state level, PURA requires owners or operators of transmission facilities to provide open-access wholesale transmission services to third parties at rates and terms that are nondiscriminatory and comparable to the rates and terms of the utility’s own use of its system. The PUCT has adopted rules implementing the state open-access requirements for utilities, including Oncor, that are subject to the PUCT’s jurisdiction over transmission services.

Securitization Bonds—The Regulated Delivery segment includes Oncor’s wholly-owned, bankruptcy-remote financing subsidiary, Oncor Electric Delivery Transition Bond Company LLC. This financing subsidiary was organized for the limited purpose of issuing certain securitization (transition) bonds in 2003 and 2004. Oncor Electric Delivery Transition Bond Company LLC issued $1.3 billion principal amount of transition bonds to recover generation-related regulatory asset stranded costs and other qualified costs under an order issued by the PUCT in 2002. At December 31, 2010, $663 million principal amount of transition bonds were outstanding, which mature in the period from 2011 to 2016.

13

Environmental Regulations and Related Considerations

Global Climate Change

Background — A growing concern has emerged nationally and internationally about global climate change and how greenhouse gas (GHG) emissions, such as CO2, might contribute to global climate change. We produce GHG emissions from the direct combustion of fossil fuels at our generation plants, primarily our lignite/coal-fueled generation units. CO2, methane and nitrous oxide are emitted in this combustion process, with CO2 representing the largest portion of these GHG emissions. GHG emissions (primarily CO2) from our combustion of fossil fuels represent the substantial majority of our total GHG emissions. For 2010, we estimate that our generation facilities produced 64 million short tons of CO2 based on continuously monitored data reported to and subject to approval by the EPA. Other aspects of our operations result in emissions of GHGs including, among other things, coal piles at our generation plants, sulfur hexafluoride in our electric operations, refrigerant from our chilling and cooling equipment, fossil fuel combustion in our motor vehicles and electricity usage at our facilities and headquarters. Because a substantial portion of our generation portfolio consists of lignite/coal-fueled generation facilities, our financial condition and/or results of operations could be materially adversely affected by the enactment of statutes or regulations that mandate a reduction in GHG emissions or that impose financial penalties, costs or taxes on those that produce GHG emissions. See Item 1A, “Risk Factors” for additional discussion of risks posed to us regarding global climate change regulation.

Global Climate Change Legislation — Several bills have been introduced in the US Congress or advocated by the Obama Administration that are intended to address climate change using different approaches, including most prominently a cap on carbon emissions with emitters allowed to trade unused emission allowances (cap-and-trade). In addition to potential federal legislation to regulate GHG emissions, the US Congress might also consider other legislation that could result in the reduction of GHG emissions, such as the establishment of renewable or clean energy portfolio standards.

Through our own evaluation and working in tandem with other companies and industry trade associations, we have supported the development of an integrated package of recommendations for the federal government to address the global climate change issue through federal legislation, including GHG emissions reduction targets for total US GHG emissions and rigorous cost containment measures to ensure that program costs are not prohibitive. In the event GHG legislation involving a cap-and-trade program is enacted, we believe that such a program should be mandatory, economy-wide, consistent with expected technology development timelines and designed in a way to limit potential harm to the economy and protect consumers. We believe that any mechanism for allocation of GHG emission allowances should include substantial allocation of allowances to offset the cost of GHG regulation, including the cost to electricity consumers. In addition, we participate in a voluntary electric utility industry sector climate change initiative in partnership with the DOE. Our strategies are generally consistent with the “EEI Global Climate Change Points of Agreement” published by the Edison Electric Institute in January 2009 and “The Carbon Principles” announced in February 2008 by three major financial institutions. Finally, we have created a Sustainable Energy Advisory Board that advises us on technology development opportunities that reduce the effects of our operations on the environment while balancing the need to address the energy requirements of Texas. Our Sustainable Energy Advisory Board is comprised of individuals who represent the following interests, among others: the environment, customers, economic development in Texas and technology/reliability standards. If, despite these efforts, a substantial number of our customers or others refuse to do business with us because of our GHG emissions, it could have a material adverse effect on our results of operations, financial position and liquidity.

Federal Level —Recent developments in the US Congress indicate that the prospects for passage of any cap-and-trade legislation in the near-term are not likely. However, if such legislation were to be adopted, our costs of compliance could be material.

14

In December 2009, the EPA issued a finding that GHG emissions endanger human health and the environment and that emissions from motor vehicles contribute to that endangerment. The EPA’s finding required it to begin regulating GHG emissions from motor vehicles and ultimately stationary sources under existing provisions of the federal Clean Air Act. Following its endangerment finding, the EPA took three regulatory actions with respect to the control of GHG emissions. First, in March 2010, the EPA completed a reconsideration of a memorandum issued in December 2008 by then EPA Administrator Stephen Johnson on the issue of when the Clean Air Act’s Prevention of Significant Deterioration (PSD) program would apply to newly identified pollutants such as GHG’s. The EPA determined that the Clean Air Act’s PSD permit requirements would apply when a nation-wide rule requiring the control of a pollutant takes effect. Under this determination, PSD permitting requirements became applicable to GHG emissions from planned stationary sources or planned modifications to stationary sources that had not been issued a PSD permit by January 2, 2011 – the first date that new motor vehicles must meet the new GHG standards. Second, in April 2010, the EPA adopted GHG emission standards for certain new motor vehicles. Third, in June 2010, the EPA finalized its so-called “tailoring rule” that established new thresholds of GHG emissions for the applicability of permits under the Clean Air Act for stationary sources, including our power generation facilities. The EPA’s tailoring rule defines the threshold of GHG emissions for determining applicability of the Clean Air Act’s PSD and Title V permitting programs at levels greater than the emission thresholds contained in the Clean Air Act. In December 2010, the EPA announced agreements with state and environmental groups to propose New Source Performance Standards for electric power plants by July 2011 and to finalize those standards by May 2012. In addition, in September 2009, the EPA issued a final rule requiring the reporting, by March 2011, of calendar year 2010 GHG emissions from specified large GHG emissions sources in the US (such reporting rule would apply to our lignite/coal-fueled generation facilities). If limitations on emissions of GHGs from existing sources are enacted, our costs of compliance could be material.