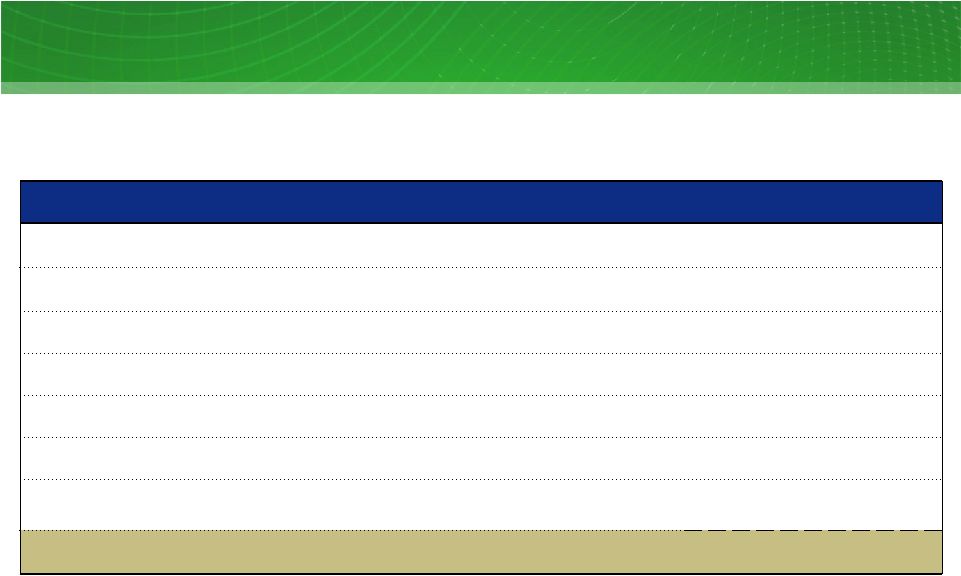

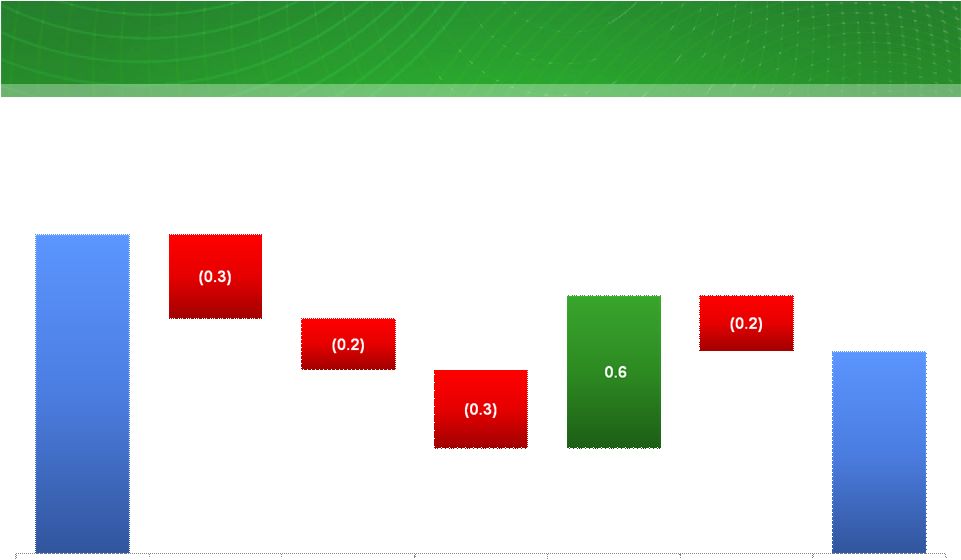

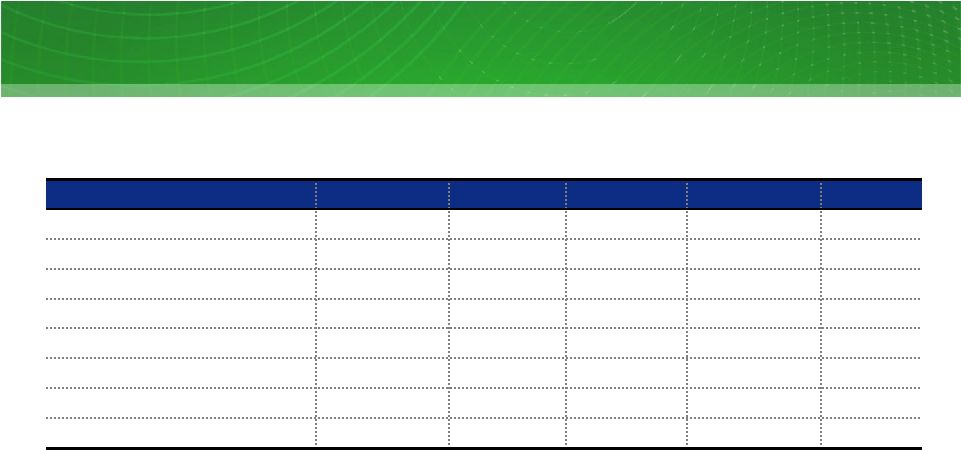

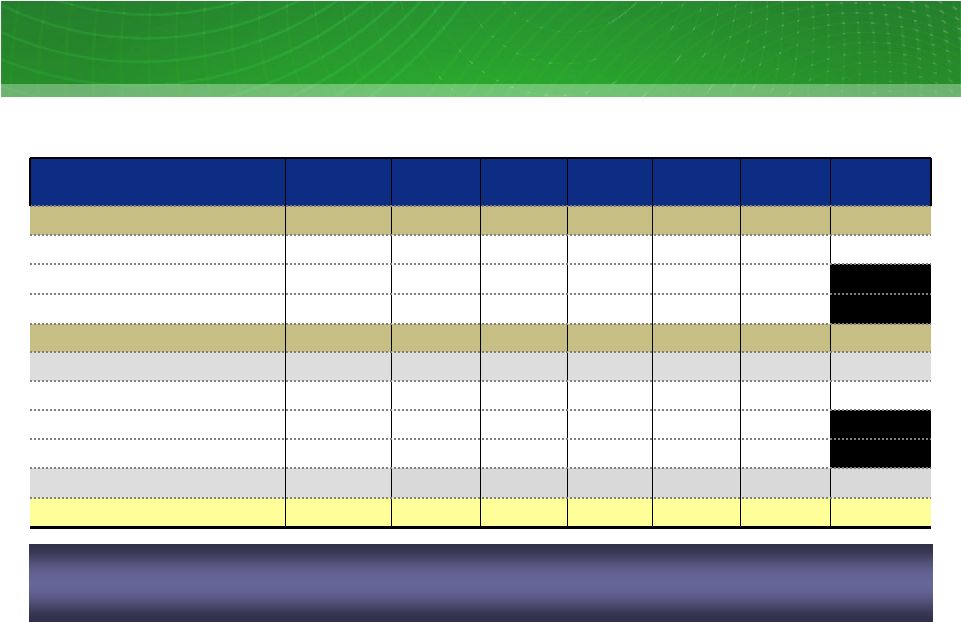

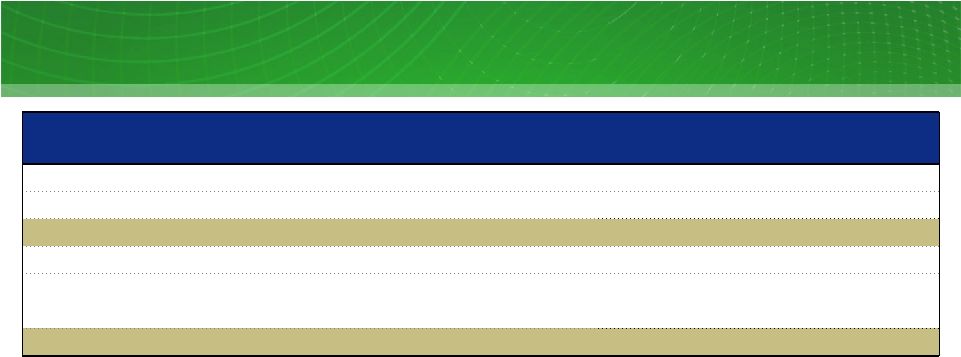

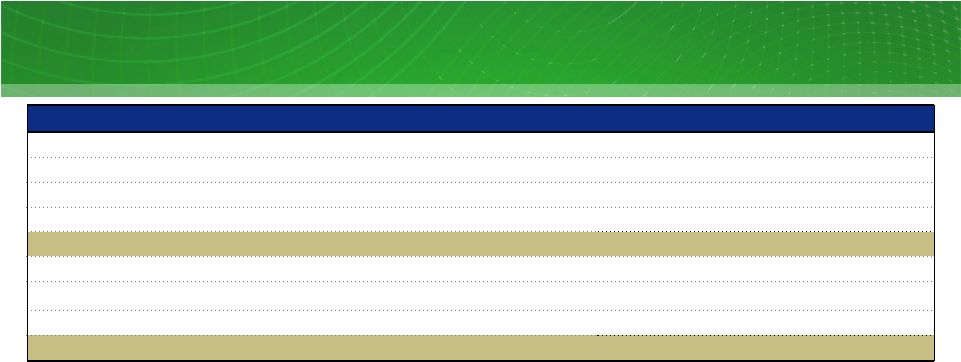

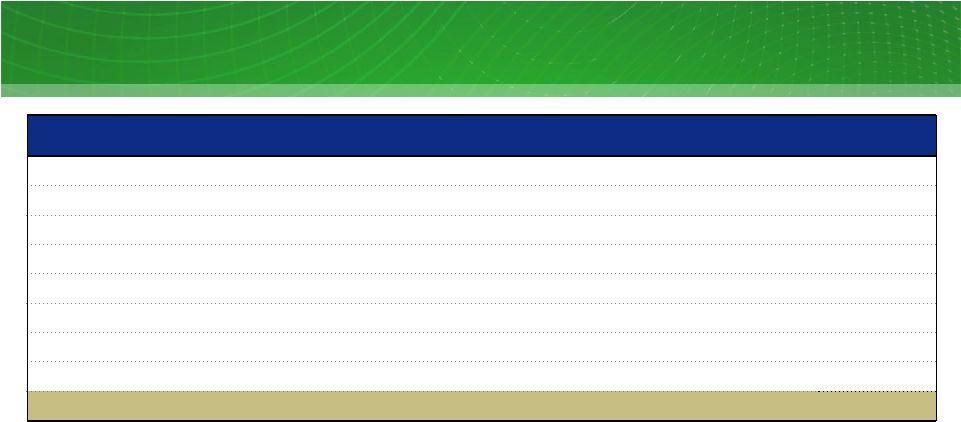

Consolidated key drivers of the change in (non-GAAP) operating results FY 1 10 vs. FY 09; $ millions, after tax 1 Full year ended December 31 2 Competitive business consists of Competitive Electric segment and Corp. & Other. EFH Corp. Adjusted (Non-GAAP) Operating Results Key Drivers (after tax) – FY 6 Description/Drivers Better (Worse) Than FY 09 Competitive business²: Impact of new lignite-fueled generation units 255 Lower amortization of intangibles arising from purchase accounting 87 Higher retail volumes primarily due to weather 8 Higher fuel costs at legacy baseload units due to increased coal transportation expenses and higher uranium and conversion costs (106) Lower net margin from asset management and retail activities (37) All other - net (4) Contribution margin 203 Lower costs related to outsourcing transition, new retail customer care system and other SG&A reductions 75 Gains on sales of assets (reported in other income) 57 Improvement in effective tax rate due primarily to lower accrued interest on uncertain tax positions 37 Lower retail bad debt expense 5 Higher depreciation reflecting the new lignite-fueled generation units and mining facilities and ongoing investment in the generation fleet (135) Higher operating costs related to the new and legacy baseload generation units (95) Higher net interest expense driven by lower capitalized interest due to completion of the new generation units (51) Total improvement - Competitive business 96 Regulated business: Higher distribution tariffs, including the rates approved in the September 2009 rate review order 62 Higher volumes primarily driven by the effects of weather 31 Surcharge to recover AMS deployment costs 30 Higher transmission revenues primarily due to a rate increase to recover ongoing investment 17 Higher depreciation reflecting higher depreciation rates approved in the September rate review order and infrastructure investment (75) Higher costs reflecting amortization of regulatory assets approved for recovery, AMS implementation and higher transmission fees (52) Change in effective tax rate due to accrued interest adjustment in 2009 and tax on Medicare subsidy (21) All other – net primarily includes noncontrolling interests and lower contractor, professional and outsourced services 19 Total improvement – Regulated business (~80% owned by EFH Corp.) 11 Total improvement in EFH Corp. adjusted (non-GAAP) operating results 107 |