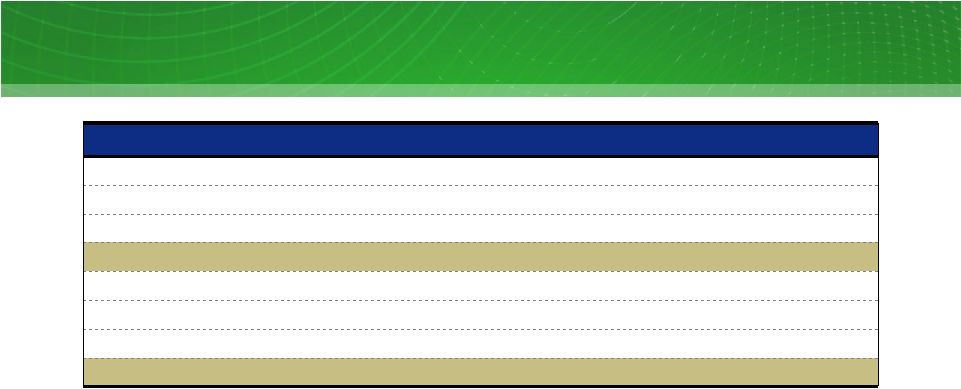

Table 4: TCEH Adjusted EBITDA Reconciliation Three and Nine Months Ended September 30, 2010 and 2011 $ millions Factor Q3 10 Q3 11 YTD 10 YTD 11 Net loss (3,690) (709) (3,646) (1,660) Income tax expense (benefit) 214 (375) 260 (874) Interest expense and related charges 852 1,372 2,516 3,020 Depreciation and amortization 345 371 1,027 1,097 EBITDA (2,279) 659 157 1,583 Adjustments to EBITDA (pre-tax): Interest income (23) (20) (65) (66) Amortization of nuclear fuel 38 35 102 104 Purchase accounting adjustments 33 32 124 147 Impairment of assets and inventory write down - 427 1 427 Impairment of goodwill 4,100 - 4,100 - Unrealized net (gain) loss resulting from hedging transactions (767) (138) (1,615) 247 EBITDA amount attributable to consolidated unrestricted subsidiaries - (2) - (5) Amortization of ”day one” net loss on Sandow 5 power purchase agreement (9) - (19) - Corp. depreciation, interest and income tax expense included in SG&A 4 4 9 11 Noncash compensation expense - 5 11 8 Severance expense - 50 3 52 Transition and business optimization costs 4 1 18 2 33 Transaction and merger expenses 5 9 9 29 28 Restructuring and other 6 2 (3) 1 70 Expenses incurred to upgrade or expand a generation station 7 - - 100 100 TCEH Adjusted EBITDA per Incurrence Covenant 1,109 1,076 2,940 2,739 Expenses related to unplanned generation station outages 31 71 122 162 Pro forma adjustment for Oak Grove 2 reaching 70% capacity in Q2 2011 8 - 7 - 32 Other adjustments allowed to determine Adjusted EBITDA per Maintenance Covenant 9 10 - 19 8 TCEH Adjusted EBITDA per Maintenance Covenant 1,150 1,154 3,081 2,941 1 Includes amortization of the intangible net asset value of retail and wholesale power sales agreements, environmental credits, coal purchase contracts, nuclear fuel contracts and power purchase agreements and the stepped up value of nuclear fuel. Also includes certain credits and gains on asset sales not recognized in net income due to purchase accounting. 2 Impairment of assets includes impairment of emissions allowances and certain assets relating to mining operations due to EPA rule and impairment of land. 3 Includes expenses recorded under stock-based compensation accounting standards and excludes capitalized amounts. 4 Includes certain incentive compensation expenses, systems development professional fees related to major generation operations and retail billing / customer care computer applications and costs relating to certain growth initiatives. 5 Includes costs related to the 2007 merger and the Sponsor Group management fee. 6 Includes net third-party fees paid in connection with the amendment and extension of the TCEH Senior Secured Facilities, gains on termination of a long-term power sales contract and settlement of amounts due from a hedging/trading counterparty, and reversal of certain liabilities accrued in purchase accounting. 7 Reflects noncapital outage costs. 8 Represents the annualization of the actual six months ended September 30, 2011 EBITDA results for Oak Grove 2, which achieved the requisite 70% average capacity factor in the second quarter 2011. 9 Primarily pre-operating expenses related to Oak Grove and Sandow 5 generation facilities. 40 3 2 1 |