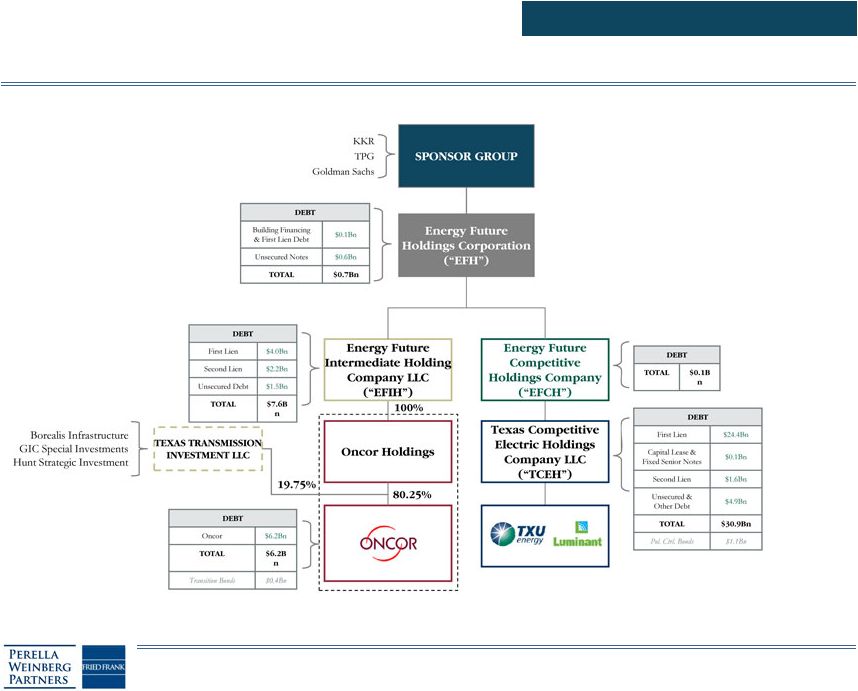

4 DRAFT; SUBJECT TO MATERIAL REVISION; PREPARED AT THE REQUEST OF COUNSEL; SUBJECT TO F.R.E. 408 Confidential – Subject to F.R.E. 408 ILLUSTRATIVE TRANSACTION RATIONALE TCEH FIRST LIEN LENDERS Receive substantially all of the value attributable to TCEH assets Receive control of EFH without paying for control premium Obtain expeditious control of TCEH assets Receive upside value of Oncor assets, after redemption of the New Tracking Stock Benefit from delevered EFIH with virtually no future restructuring risk Avoid costs of contentious Chapter 11 Avoid diminution in value of the retail business associated with a potentially lengthy and contentious Chapter 11 process EFIH FIRST LIENS Receive cash in excess of par value in near term EFIH SECOND LIENS 35% of holdings repaid at par plus coupon through utilization of equity claw At each holder's election, may tender additional Notes for cash equal to equity claw price Reinstated holders benefit from delevered capital structure and improved liquidity profile EFIH UNSECURED NOTES Receive New Tracking Stock designed to capture par plus accrued interest of EFIH Unsecured Notes plus an annual return Provides unlimited timeframe to recapture Oncor value through New Tracking Stock Benefit from delevered EFIH, improved liquidity profile, and removal of bankruptcy overhang Benefit from potential incremental value that may be generated through amending Oncor ring-fenced structure Ability to prove value and backstop / participate in rights offering for New Tracking Stock Protected from any future volatility of TCEH earnings OTHER TCEH CREDITORS Receive limited duration warrants at appropriate strike prices to capture value at in-the-money enterprise valuation levels Potential to participate in Oncor valuation upside as well EFH UNSECURED DEBT Continue to receive benefit of EFH and EFIH value through ownership of New Tracking Stock and New EFH Equity SPONSORS Continue to receive benefit of EFH and EFIH value through ownership of New Tracking Stock and New EFH Equity Granted full releases MANAGEMENT To receive new incentive plan to ensure alignment of interests with new ownership of EFH The table below illustrates certain potential benefits associated with the proposed transaction A consensual restructuring would provide significant benefits to all parties by, among other things, avoiding the significant costs in money and time associated with a protracted and contentious process |