Exhibit 99.2

Forward-Looking Statements Certain statements contained in this document may be characterized as forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements include, but are not limited to, Forrester’s statements regarding the benefits of the SiriusDecisions transaction, the anticipated timing of the transaction and the products and markets of each company. These statements are based on Forrester's current plans and expectations and involve risks and uncertainties that could cause actual future activities and results of operations to be materially different from those set forth in the forward-looking statements. Important factors that could cause actual future activities and results to differ include, among others, the risk that the transaction may not be completed in a timely manner or at all, which may adversely affect Forrester’s business and the price of the common stock of Forrester; the failure to satisfy the conditions to the consummation of the transaction, including the receipt of certain regulatory approval; the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the risk that SiriusDecisions will not be integrated successfully; the ability of Forrester to successfully integrate SiriusDecisions’ operations, products, services; the risk that Forrester following this transaction will not realize its financing or operating strategies; and the outcome of any legal proceedings that may be instituted against Forrester or SiriusDecisions related to the merger agreement or the transaction. Forrester undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. For further information, please refer to Forrester's reports and filings with the Securities and Exchange Commission.

Today’s speakers George Colony CEO and Chairman of the Board Mike Doyle Chief Financial Officer

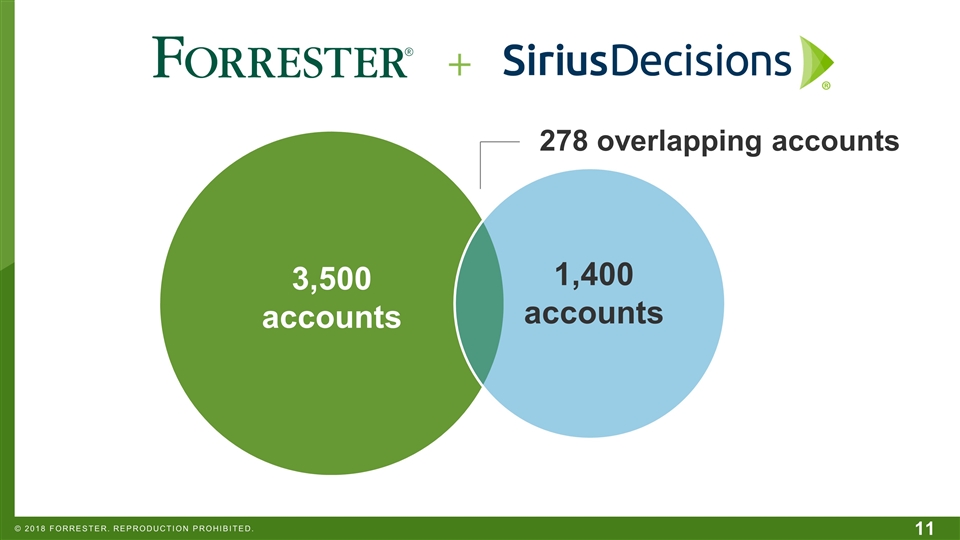

SiriusDecisions Founded in 2001 by John Neeson and Rich Eldh Revenue of $87 million, trailing 12-month basis, growing 22% 340 employees, 1,400 accounts, primarily in North America Serving business-to-business CMOs, CSOs, and Product Heads Research, Events, Consulting The Sirius Way Methodologies for marketing, sales, and product management Fact-based research based on user data and best practices.

Forrester Unique Value Proposition “We work with business and technology leaders to develop customer-obsessed strategies that drive growth.”

Forrester + SiriusDecisions Unique Value Proposition “We work with business and technology leaders to develop customer-obsessed strategies and operations that drive growth.”

Strategy + Operations

Our clients will now know what to do, and how to do it.

Opportunity One: Cross-Sell Sell SiriusDecisions to Forrester clients Sell Forrester to SiriusDecisions clients.

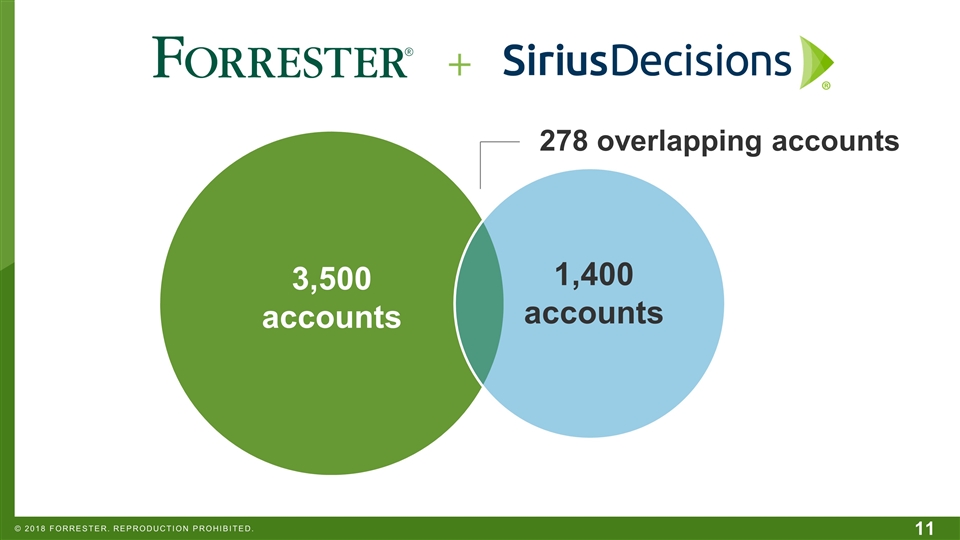

278 overlapping accounts 3,500 accounts 1,400 accounts

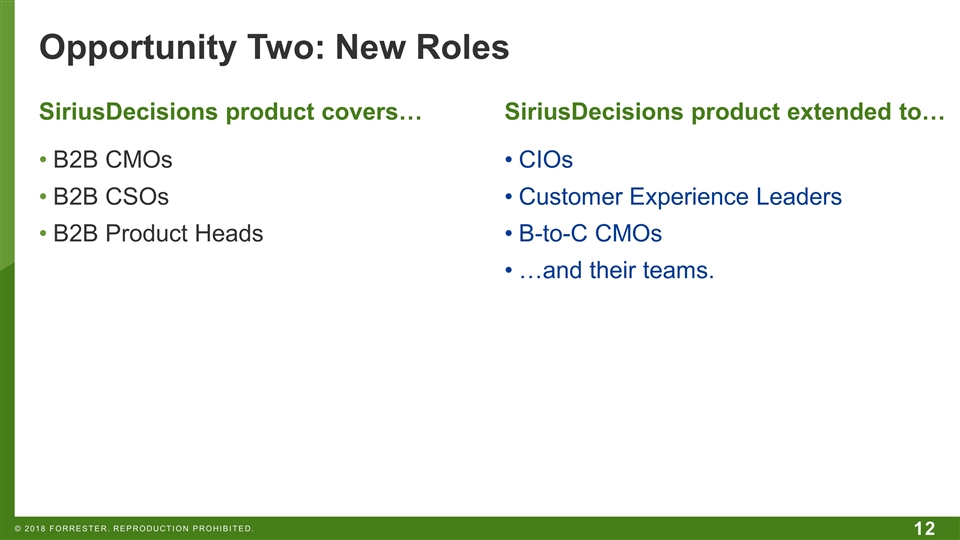

Opportunity Two: New Roles B2B CMOs B2B CSOs B2B Product Heads CIOs Customer Experience Leaders B-to-C CMOs …and their teams. SiriusDecisions product covers… SiriusDecisions product extended to…

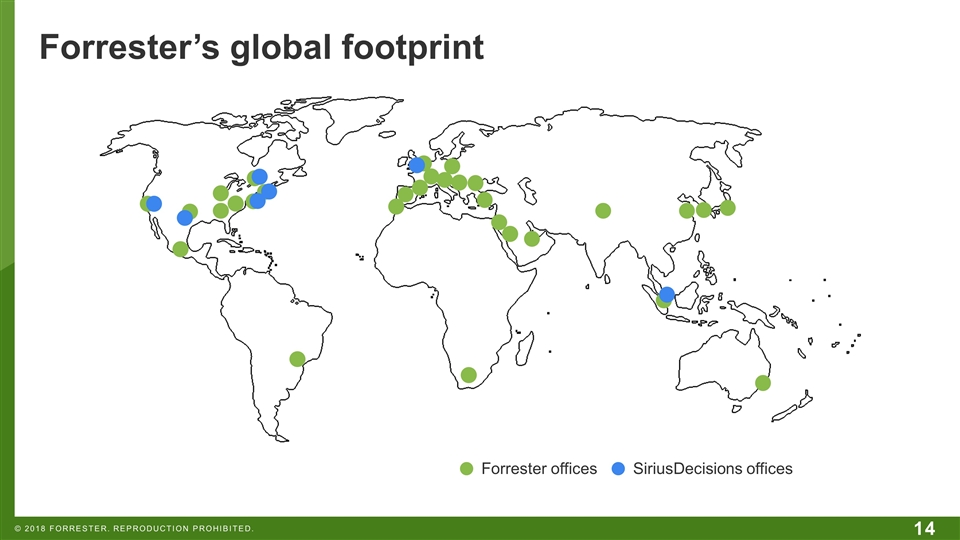

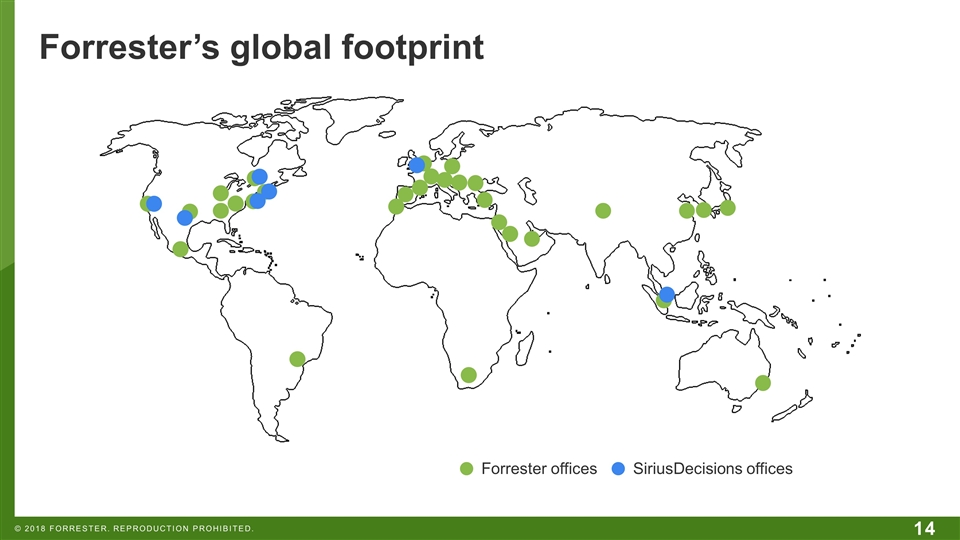

Opportunity Three: Global Sell SiriusDecisions in Europe and Asia.

Forrester’s global footprint Forrester offices SiriusDecisions offices

Opportunity Four: New Verticals Expand SiriusDecisions beyond Tech and Advanced Manufacturing to Financial Services, Healthcare, and other industries.

Opportunity Five: Scale Serve more clients, with more value Eliminate duplicate office locations Gain efficiency by consolidating support functions Leverage best practices from both companies Leverage tech investments Be more innovative.

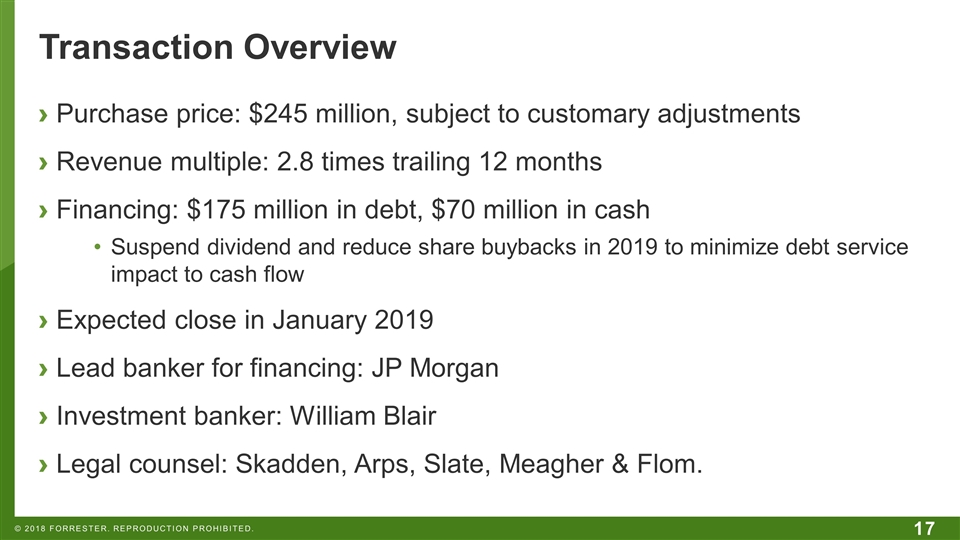

Transaction Overview Purchase price: $245 million, subject to customary adjustments Revenue multiple: 2.8 times trailing 12 months Financing: $175 million in debt, $70 million in cash Suspend dividend and reduce share buybacks in 2019 to minimize debt service impact to cash flow Expected close in January 2019 Lead banker for financing: JP Morgan Investment banker: William Blair Legal counsel: Skadden, Arps, Slate, Meagher & Flom.

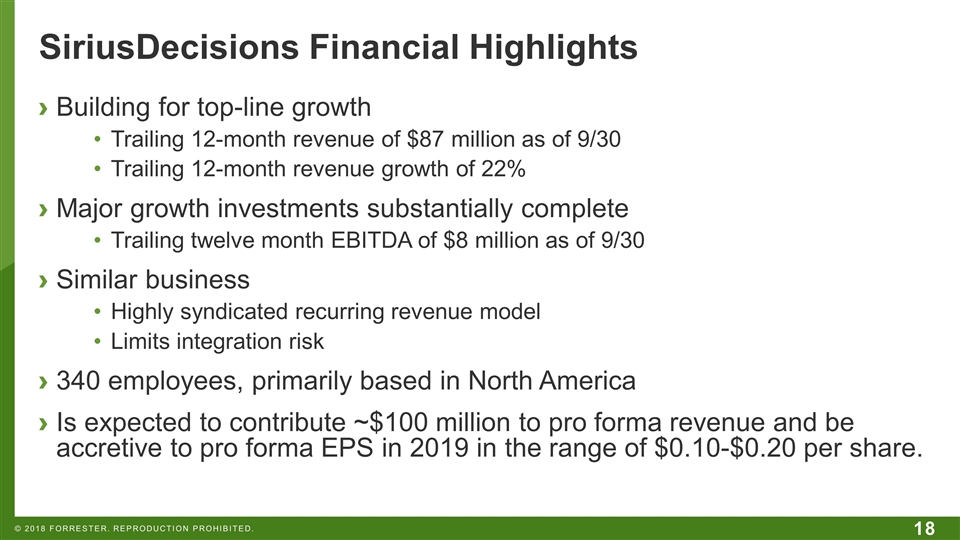

SiriusDecisions Financial Highlights Building for top-line growth Trailing 12-month revenue of $87 million as of 9/30 Trailing 12-month revenue growth of 22% Major growth investments substantially complete Trailing twelve month EBITDA of $8 million as of 9/30 Similar business Highly syndicated recurring revenue model Limits integration risk 340 employees, primarily based in North America Is expected to contribute ~$100 million to pro forma revenue and be accretive to pro forma EPS in 2019 in the range of $0.10-$0.20 per share.

Two Powerful New Platforms Fueling Our Growth… The Real-Time Customer Experience Cloud FeedbackNow Glimpzit The Sirius Way SiriusDecisions.