EXHIBIT 99.2

Simulations Plus, Inc. (NASDAQ:SLP) Fiscal Year 2014 and 4 th Quarter FY14 Conference Call and Webinar November 25, 2014 Copyright (c) 2014 Simulations Plus, Inc. 1

With the exception of historical information, the matters discussed in this presentation are forward - looking statements that involve a number of risks and uncertainties. The actual results of the Company could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: continuing demand for the Company’s products, competitive factors, the Company’s ability to finance future growth, the Company’s ability to produce and market new products in a timely fashion, the Company’s ability to continue to attract and retain skilled personnel, and the Company’s ability to sustain or improve current levels of productivity. Further information on the Company’s risk factors is contained in the Company’s quarterly and annual reports and filed with the Securities and Exchange Commission. Safe Harbor Statement Copyright (c) 2014 Simulations Plus, Inc. 2

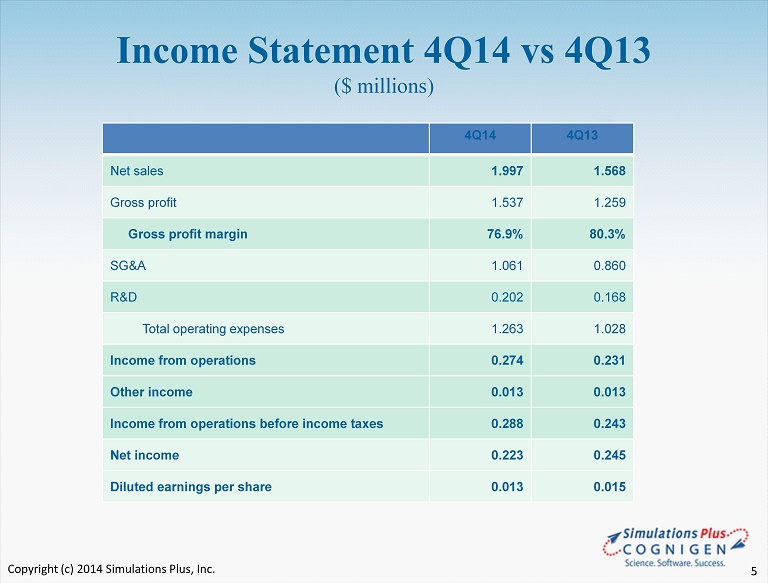

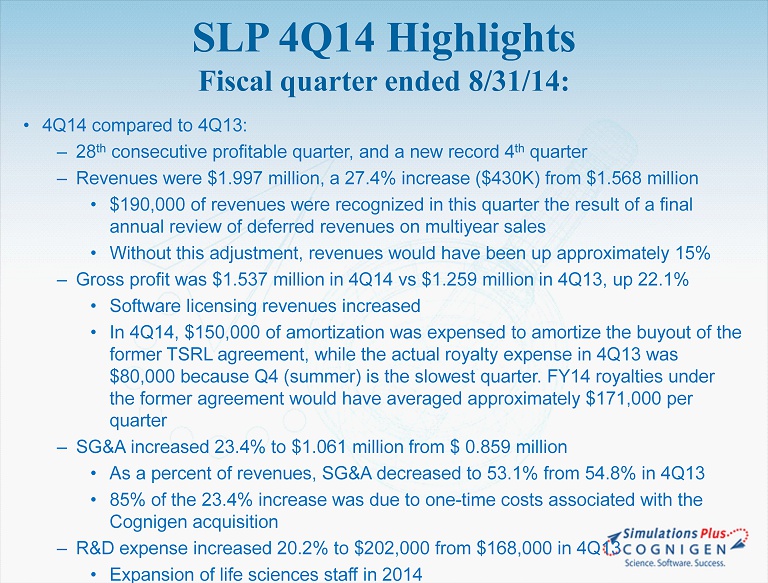

• 4Q14 compared to 4Q13 : – 28 th consecutive profitable quarter, and a new record 4 th quarter – Revenues were $1.997 million, a 27.4% increase ($430K) from $1.568 million • $190,000 of revenues were recognized in this quarter the result of a final annual review of deferred revenues on multiyear sales • Without this adjustment, revenues would have been up approximately 15% – Gross profit was $1.537 million in 4Q14 vs $1.259 million in 4Q13, up 22.1% • Software licensing revenues increased • In 4Q14, $ 150,000 of amortization was expensed to amortize the buyout of the former TSRL agreement, while the actual royalty expense in 4Q13 was $80,000 because Q4 (summer) is the slowest quarter. FY14 royalties under the former agreement would have averaged approximately $171,000 per quarter – SG&A increased 23.4% to $1.061 million from $ 0.859 million • As a percent of revenues, SG&A decreased to 53.1% from 54.8% in 4Q13 • 85% of the 23.4% increase was due to one - time costs associated with the Cognigen acquisition – R&D expense increased 20.2% to $202,000 from $168,000 in 4Q13 • Expansion of life sciences staff in 2014 SLP 4Q14 Highlights Fiscal quarter ended 8/31/14:

• 4Q14 compared to 4Q13 :( con’t ) – Operating income increased $45,000 or 18.3% to $288,000 in 4Q14 – Income taxes increased $67,000 in 4Q14, • 4Q13 income taxes were a credit of $2,000 based on 4Q13 year end tax adjustments. – Net Income decreased 8.9% to $223,000 from $245,000 in 4Q13 – Diluted earnings per share was $0.013, a decrease from $0.015 in 4Q13 – Cash dividend of $0.05/share was distributed during 4Q14 SLP 4Q14 Highlights Fiscal quarter ended 8/31/14:

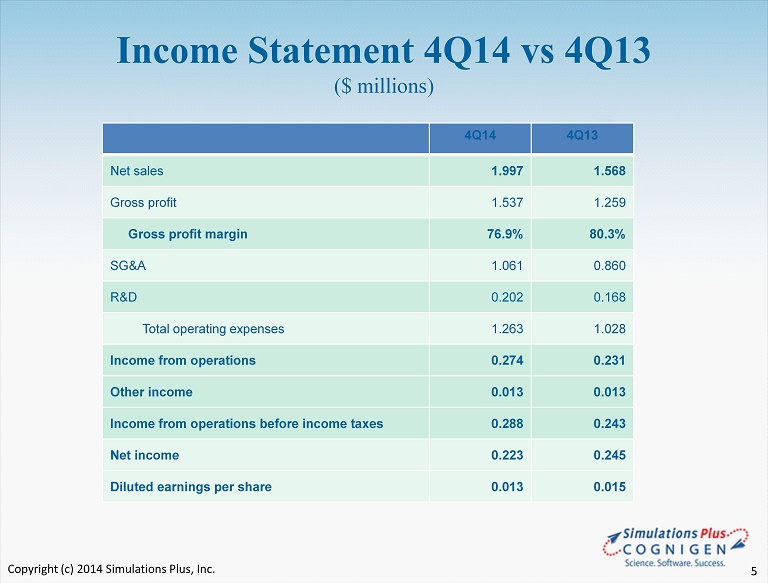

Income Statement 4Q14 vs 4Q13 ($ millions) 4Q14 4Q13 Net sales 1.997 1.568 Gross profit 1.537 1.259 Gross profit margin 76.9% 80.3% SG&A 1.061 0.860 R&D 0.202 0.168 Total operating expenses 1.263 1.028 Income from operations 0.274 0.231 Other income 0.013 0.013 Income from operations before income taxes 0.288 0.243 Net income 0.223 0.245 Diluted earnings per share 0.013 0.015 Copyright (c) 2014 Simulations Plus, Inc. 5

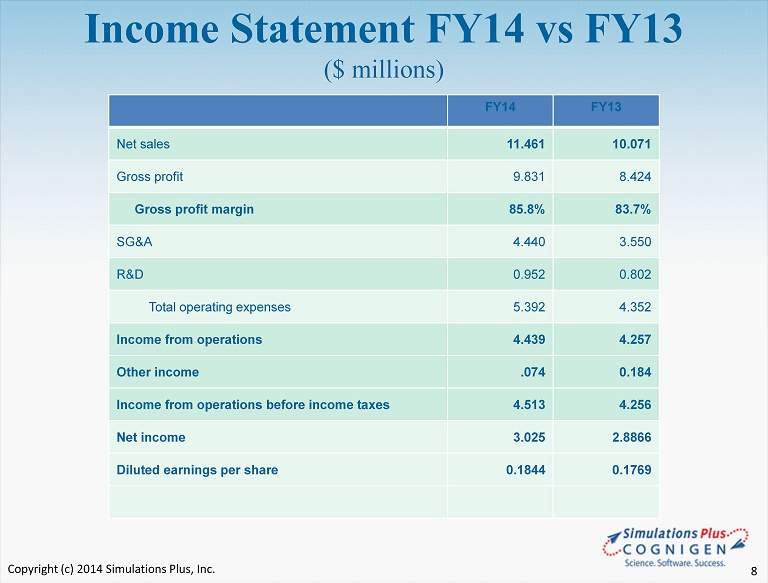

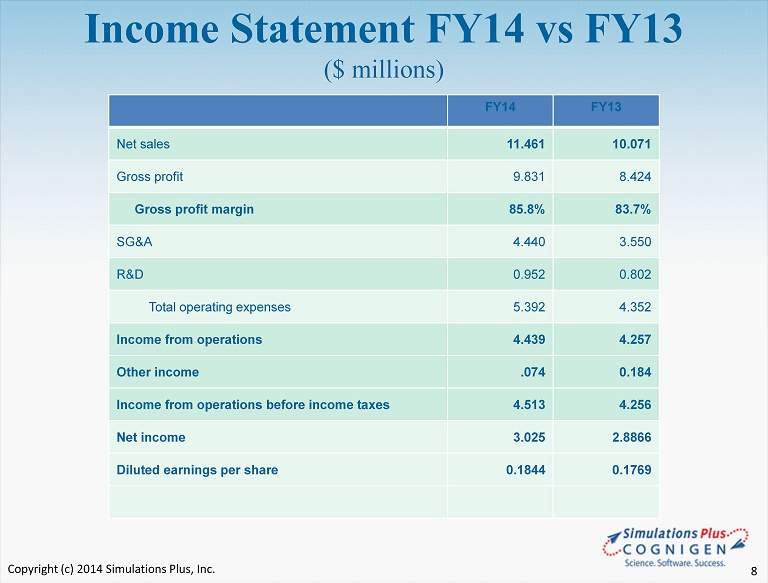

• FY14 compared to FY13: – Sales increased by $1.4 million or 13.8% to $11.5 million from $10.1 million to set a new fiscal year record – Cost of sales as a percentage of sales decreased 1.3% or $ 17,000 to 14.2% from 16.3% in FY13 • Decrease was attributable to a reduction in royalty expenses attributable to the TSRL agreement – Gross profit increased 16.7% to $9.8 million from $8.4 million in FY13 – Gross margin increased to 85.8% from 83.7% – SG&A increased 25.1% to $4.4 million from $ 3.5 million • As a percent of revenues, SG&A increase to 38.7% from 35.2% • Due to increases in marketing, travel, one - time consulting and professional fees, sales commissions, and salaries and wages. • Professional fees associated with the Cognigen acquisition accounted for almost 75% of the 3.4% increase SLP FY14 Highlights Fiscal year ended 8/31/14: Copyright (c) 2014 Simulations Plus, Inc. 6

• FY14 compared to FY13 ( con’t ) – R&D expense increased 18.7% to $953,000 from $802,000 the prior year • Increase was due to an increase in life science staffing and included R&D expenditures for COX2/COX1 NCE project of approximately $50,000 – Net Income increased by $139,000 or 4.8% to $3.0 million in FY14 from $ 2.9 million in FY13 – Diluted earnings per share was $0.1844, an increase of $0.0075 from $0.1769 in FY13 – Cash dividends totaling $0.19/share were distributed during FY14 SLP FY14 Highlights Fiscal year ended 8/31/14: Copyright (c) 2014 Simulations Plus, Inc. 7

Income Statement FY14 vs FY13 ($ millions) FY14 FY13 Net sales 11.461 10.071 Gross profit 9.831 8.424 Gross profit margin 85.8% 83.7% SG&A 4.440 3.550 R&D 0.952 0.802 Total operating expenses 5.392 4.352 Income from operations 4.439 4.257 Other income .074 0.184 Income from operations before income taxes 4.513 4.256 Net income 3.025 2.8866 Diluted earnings per share 0.1844 0.1769 Copyright (c) 2014 Simulations Plus, Inc. 8

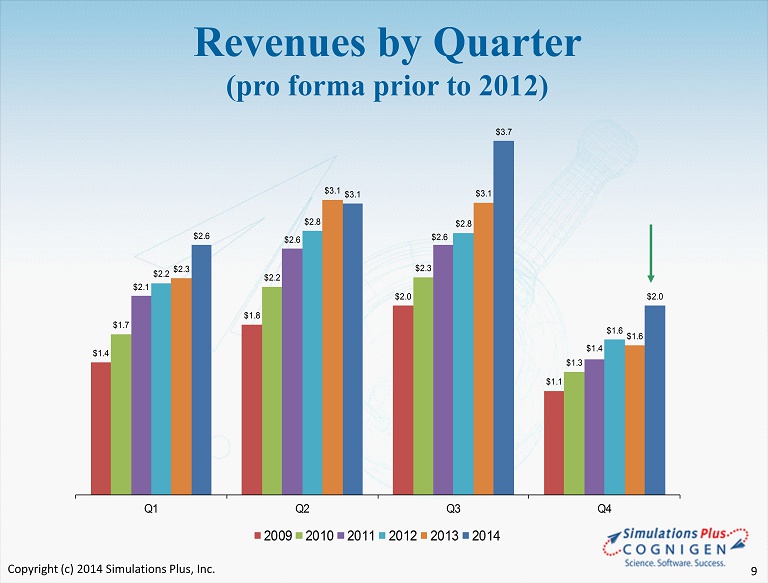

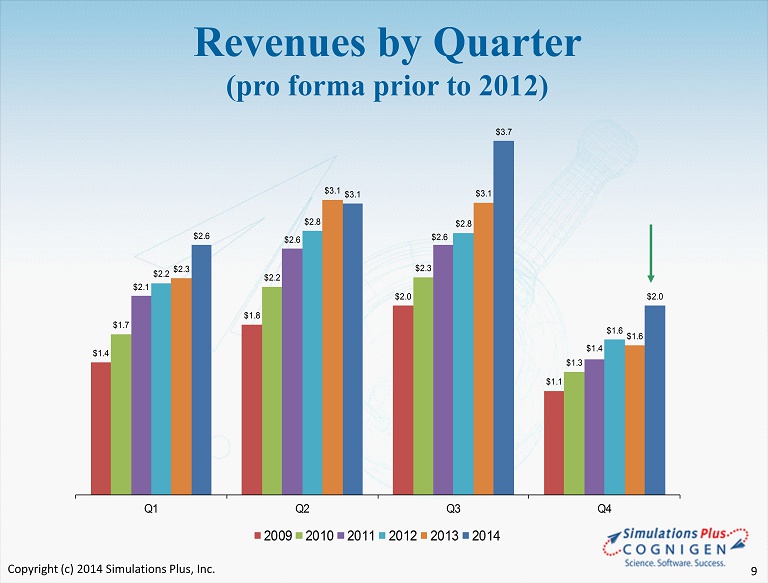

$1.4 $1.8 $2.0 $1.1 $1.7 $2.2 $2.3 $1.3 $2.1 $2.6 $2.6 $1.4 $2.2 $2.8 $2.8 $1.6 $2.3 $3.1 $3.1 $1.6 $2.6 $3.1 $3.7 $2.0 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 Revenues by Quarter (pro forma prior to 2012) Copyright (c) 2014 Simulations Plus, Inc. 9

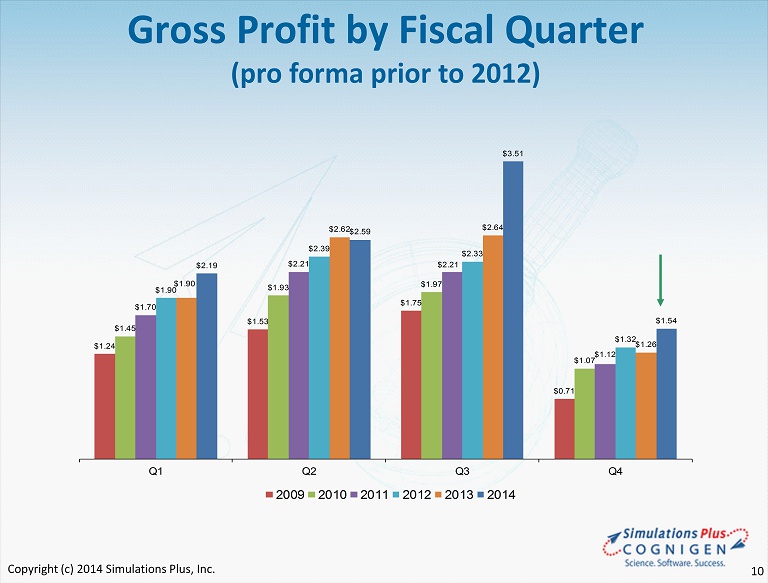

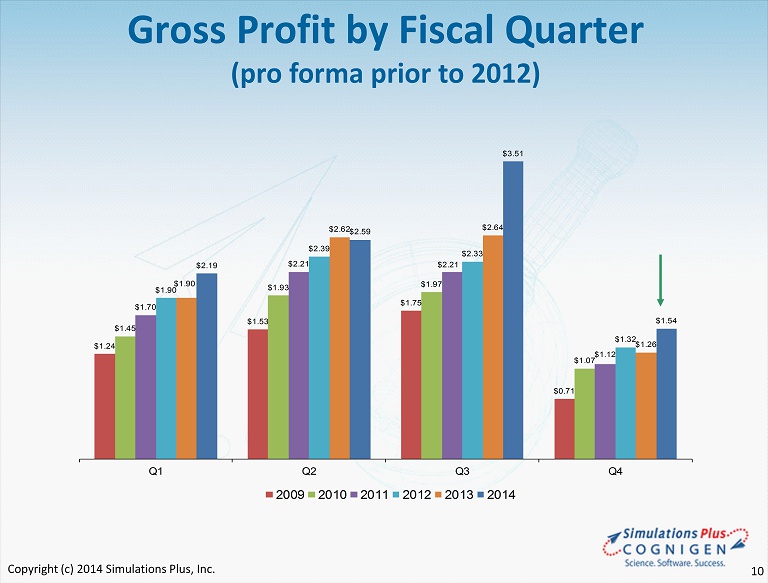

$1.24 $1.53 $1.75 $0.71 $1.45 $1.93 $1.97 $1.07 $1.70 $2.21 $2.21 $1.12 $1.90 $2.39 $2.33 $1.32 $1.90 $2.62 $2.64 $1.26 $2.19 $2.59 $3.51 $1.54 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 Gross Profit by Fiscal Quarter (pro forma prior to 2012) Copyright (c) 2014 Simulations Plus, Inc. 10

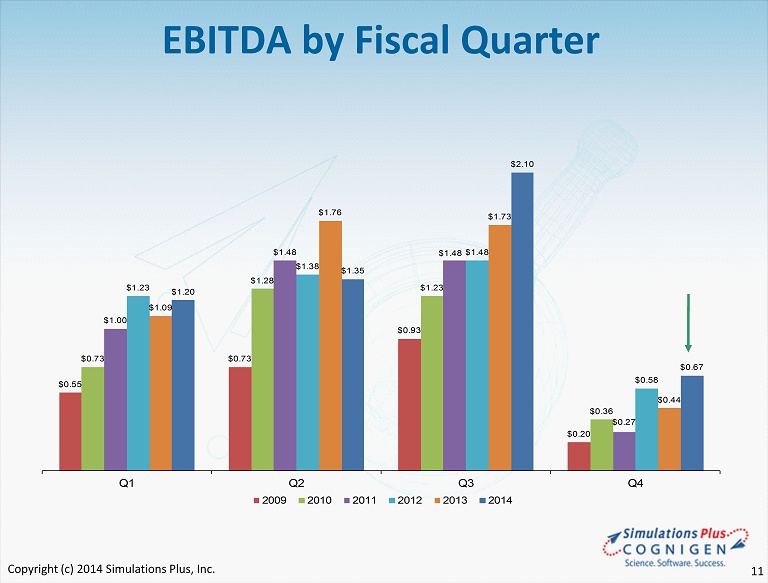

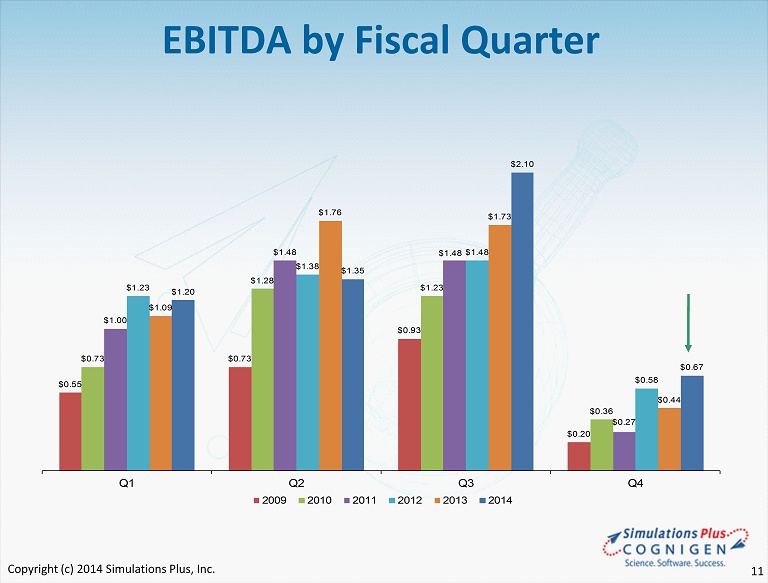

$0.55 $0.73 $0.93 $0.20 $0.73 $1.28 $1.23 $0.36 $1.00 $1.48 $1.48 $0.27 $1.23 $1.38 $1.48 $0.58 $1.09 $1.76 $1.73 $0.44 $1.20 $1.35 $2.10 $0.67 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 EBITDA by Fiscal Quarter Copyright (c) 2014 Simulations Plus, Inc. 11

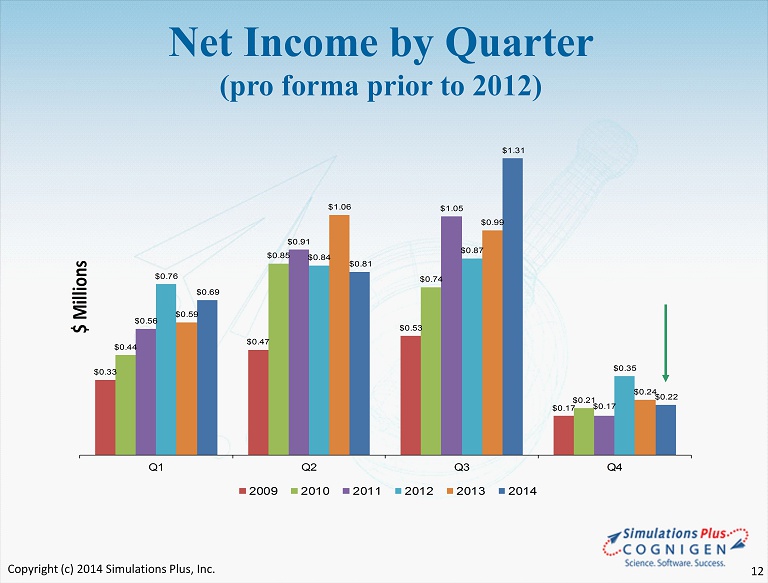

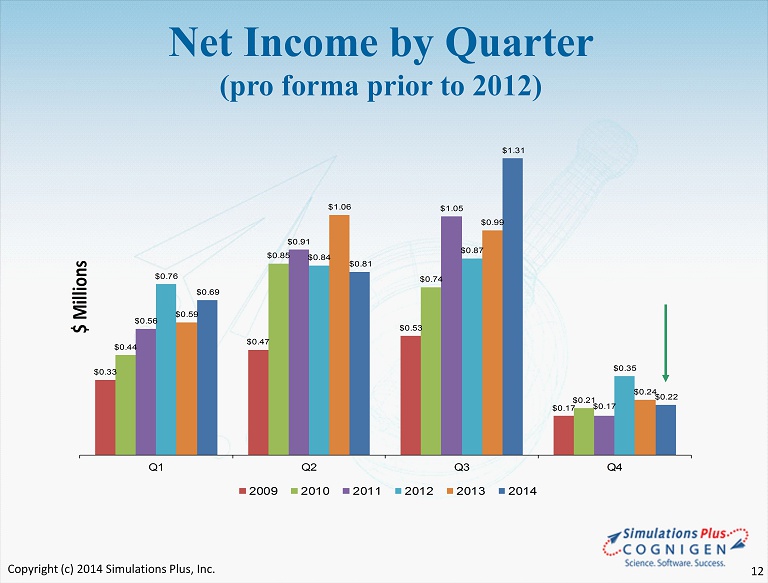

Net Income by Quarter (pro forma prior to 2012) $0.33 $0.47 $0.53 $0.17 $0.44 $0.85 $0.74 $0.21 $0.56 $0.91 $1.05 $0.17 $0.76 $0.84 $0.87 $0.35 $0.59 $1.06 $0.99 $0.24 $0.69 $0.81 $1.31 $0.22 Q1 Q2 Q3 Q4 $ Millions 2009 2010 2011 2012 2013 2014 Copyright (c) 2014 Simulations Plus, Inc. 12

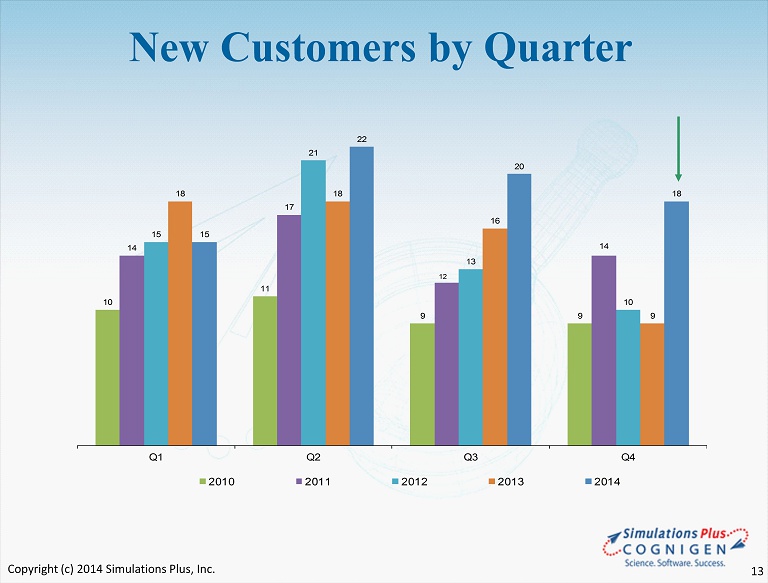

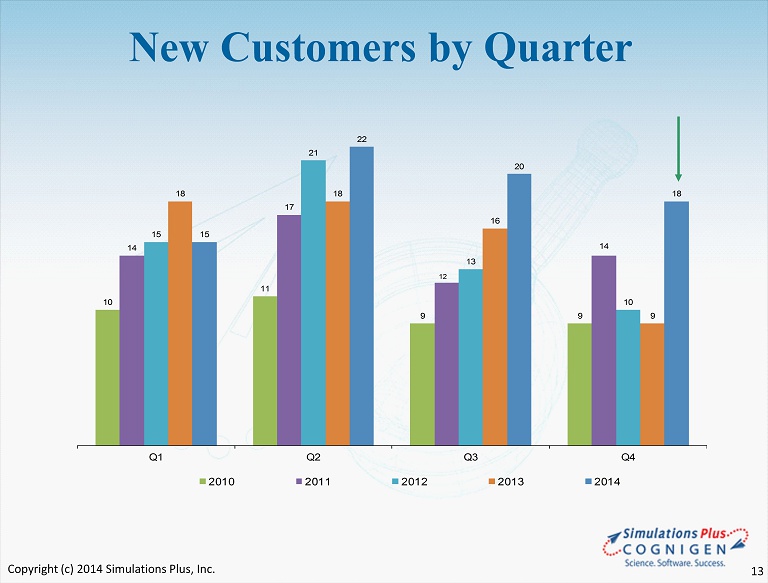

10 11 9 9 14 17 12 14 15 21 13 10 18 18 16 9 15 22 20 18 Q1 Q2 Q3 Q4 2010 2011 2012 2013 2014 New Customers by Quarter Copyright (c) 2014 Simulations Plus, Inc. 13

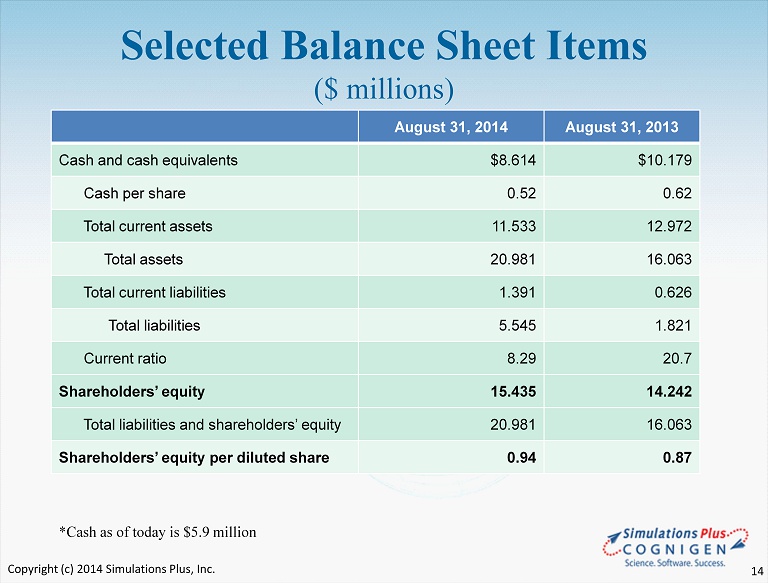

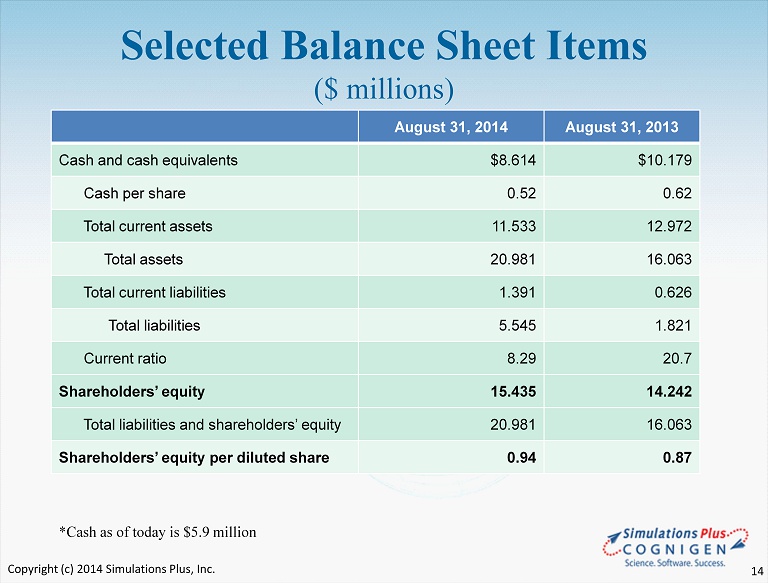

Selected Balance Sheet Items ($ millions) August 31, 2014 August 31, 2013 Cash and cash equivalents $8.614 $10.179 Cash per share 0.52 0.62 Total current assets 11.533 12.972 Total assets 20.981 16.063 Total current liabilities 1.391 0.626 Total liabilities 5.545 1.821 Current ratio 8.29 20.7 Shareholders’ equity 15.435 14.242 Total liabilities and shareholders’ equity 20.981 16.063 Shareholders’ equity per diluted share 0.94 0.87 *Cash as of today is $5.9 million Copyright (c) 2014 Simulations Plus, Inc. 14

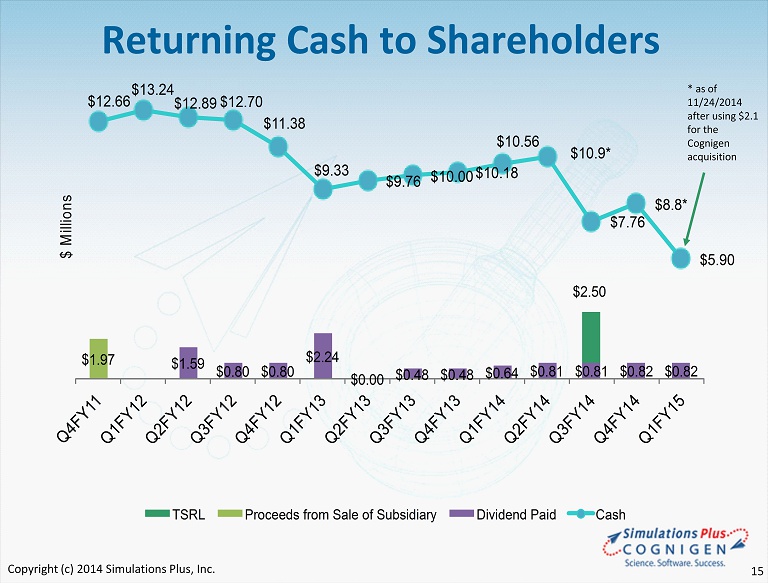

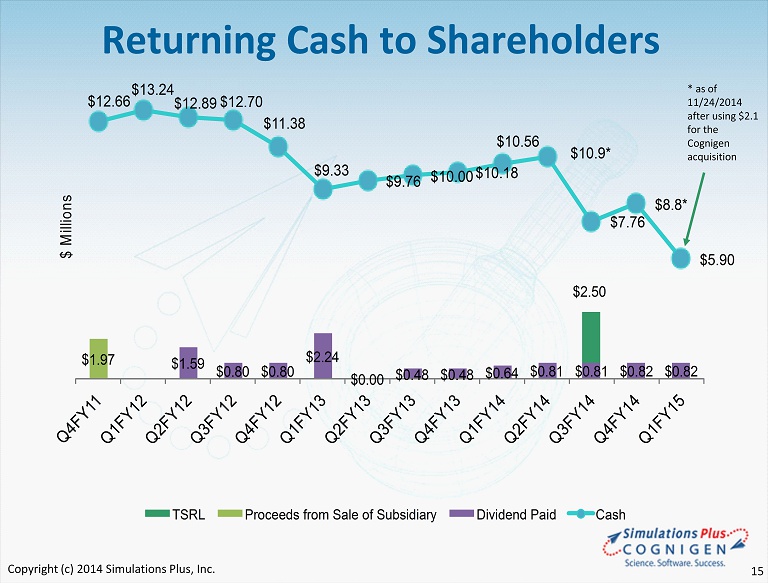

$1.59 $0.80 $0.80 $2.24 $0.00 $0.48 $0.48 $0.64 $0.81 $0.81 $0.82 $0.82 $1.97 $2.50 $12.66 $13.24 $12.89 $12.70 $11.38 $9.33 $9.76 $10.00 $10.18 $10.56 $10.9* $7.76 $8.8* $5.90 Q 4 F Y 1 1 Q 1 F Y 1 2 Q 2 F Y 1 2 Q 3 F Y 1 2 Q 4 F Y 1 2 Q 1 F Y 1 3 Q 2 F Y 1 3 Q 3 F Y 1 3 Q 4 F Y 1 3 Q 1 F Y 1 4 Q 2 F Y 1 4 Q 3 F Y 1 4 Q 4 F Y 1 4 Q 1 F Y 1 5 $ M i l l i o n s TSRL Proceeds from Sale of Subsidiary Dividend Paid Cash Returning Cash to Shareholders * as of 11/24/ 2014 after using $2.1 for the Cognigen acquisition Copyright (c) 2014 Simulations Plus, Inc. 15

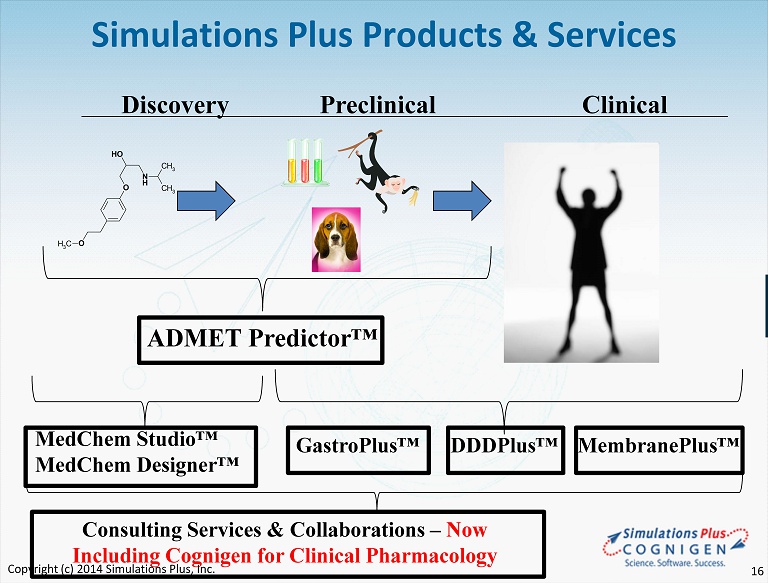

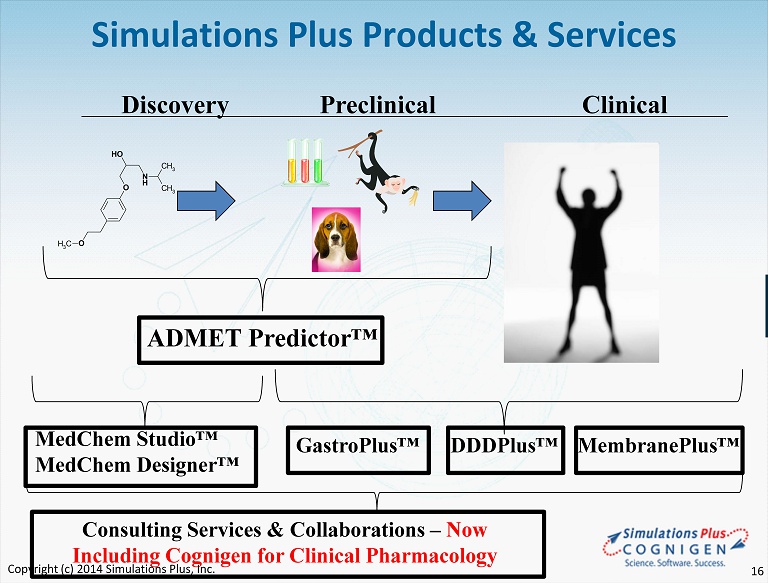

N H O OH O CH 3 CH 3 CH 3 Discovery Preclinical Clinical MedChem Studio™ MedChem Designer™ GastroPlus™ DDDPlus™ ADMET Predictor™ Simulations Plus Products & Services Consulting Services & Collaborations – Now Including Cognigen for Clinical Pharmacology MembranePlus™ Copyright (c) 2014 Simulations Plus, Inc. 16

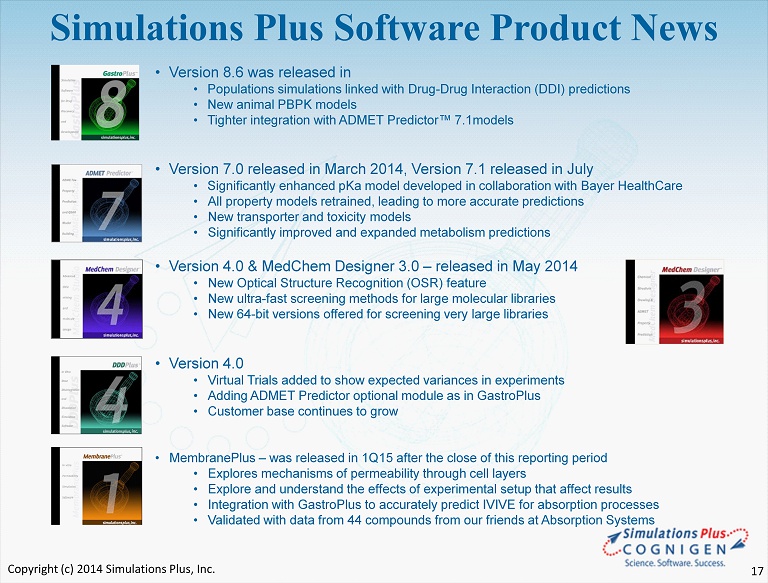

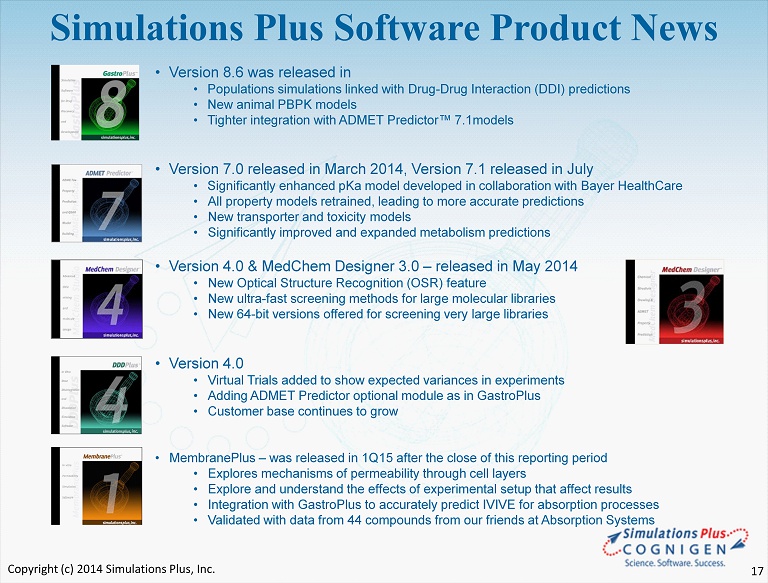

Simulations Plus Software Product News • Version 8.6 was released in • Populations simulations linked with Drug - Drug Interaction (DDI) predictions • New animal PBPK models • Tighter integration with ADMET Predictor™ 7.1models • Version 7.0 released in March 2014, Version 7.1 released in July • Significantly enhanced pKa model developed in collaboration with Bayer HealthCare • All property models retrained, leading to more accurate predictions • New transporter and toxicity models • Significantly improved and expanded metabolism predictions • Version 4.0 & MedChem Designer 3.0 – released in May 2014 • New Optical Structure Recognition (OSR) feature • New ultra - fast screening methods for large molecular libraries • New 64 - bit versions offered for screening very large libraries • Version 4.0 • Virtual Trials added to show expected variances in experiments • Adding ADMET Predictor optional module as in GastroPlus • Customer base continues to grow • MembranePlus – was released in 1Q15 after the close of this reporting period • Explores mechanisms of permeability through cell layers • Explore and understand the effects of experimental setup that affect results • Integration with GastroPlus to accurately predict IVIVE for absorption processes • Validated with data from 44 compounds from our friends at Absorption Systems Copyright (c) 2014 Simulations Plus, Inc. 17

Incorporated in 1992 in Buffalo, NY First contract research organization to offer PK/PD modeling and simulation services to Pharma 35 employees: ~1/3 scientists, ~1/3 data programmers, ~1/3 administrative support Cognigen Corporation: History Copyright (c) 2014 Simulations Plus, Inc. 18

Modeling & simulation support for 30 - 40 drugs per year Total of >100 different compounds over the last 5 years Experience in all phases of development Pre - clinical through commercialization, Phase 1 – Phase 4 Well - established quality management system and successful client audit record 44 client audits over the last 10 years; no findings Track record of successfully utilizing pharmacometric modeling and simulation to support regulatory filings >25 regulatory submissions over the last 5 years alone Cognigen Corporation: Overview Copyright (c) 2014 Simulations Plus, Inc. 19

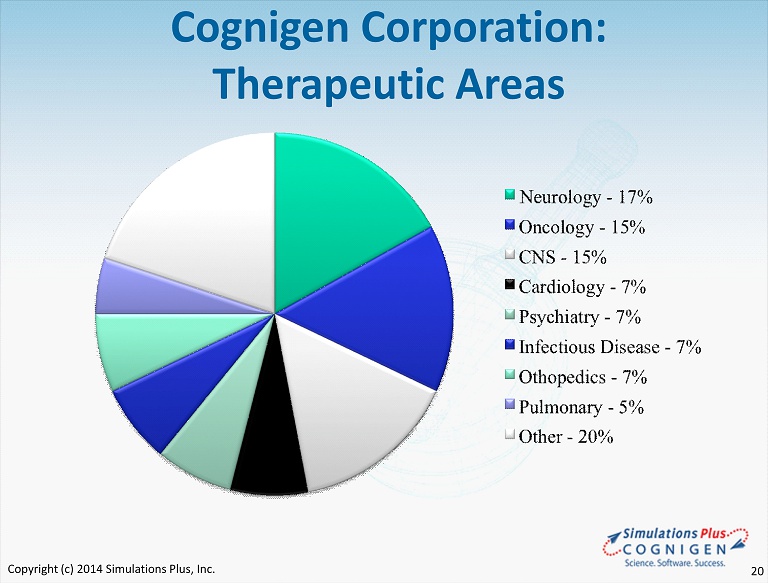

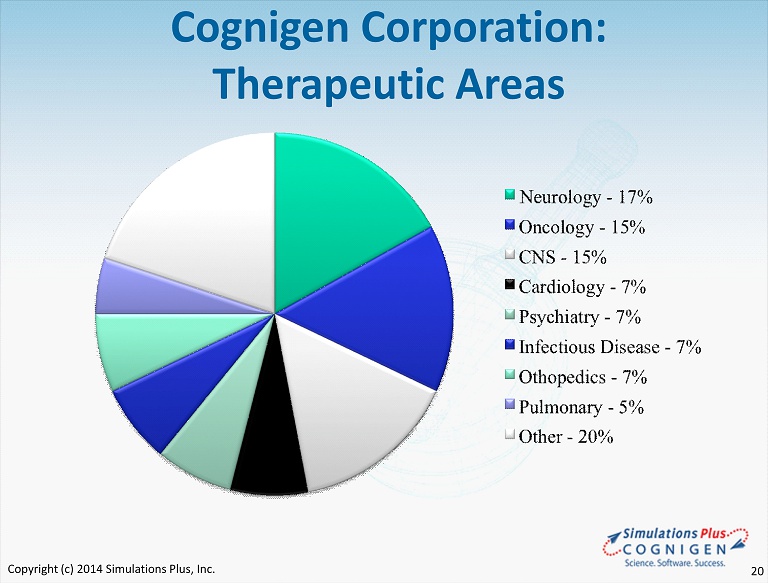

Cognigen Corporation: Therapeutic Areas Copyright (c) 2014 Simulations Plus, Inc. 20

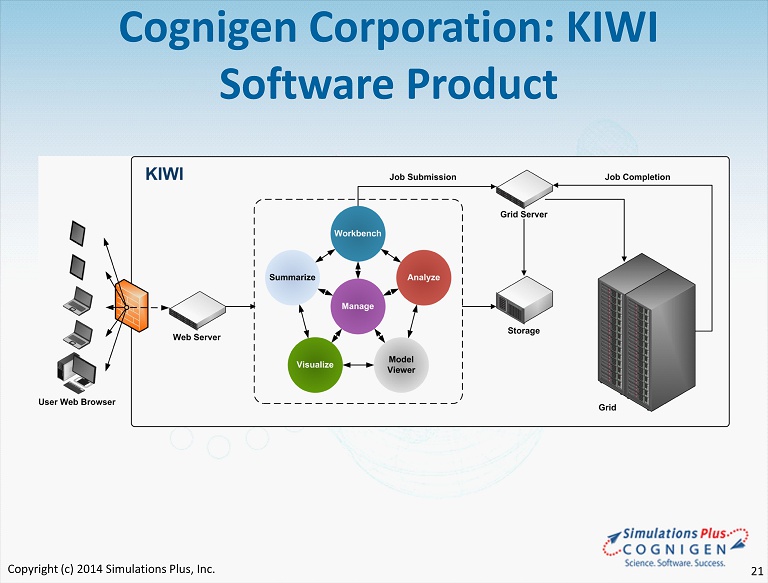

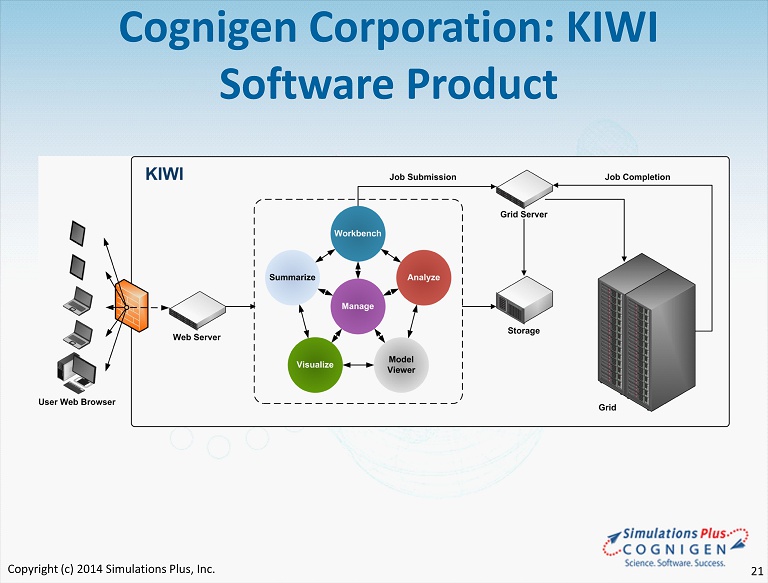

Cognigen Corporation: KIWI Software Product Copyright (c) 2014 Simulations Plus, Inc. 21

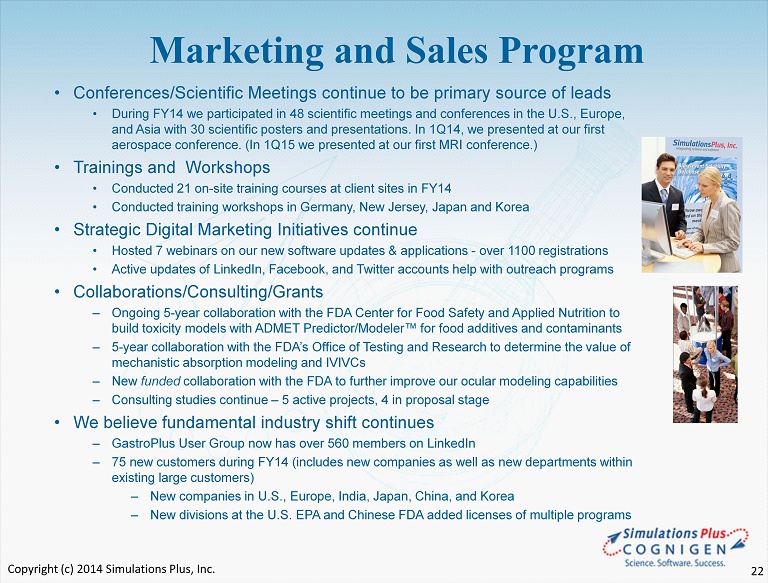

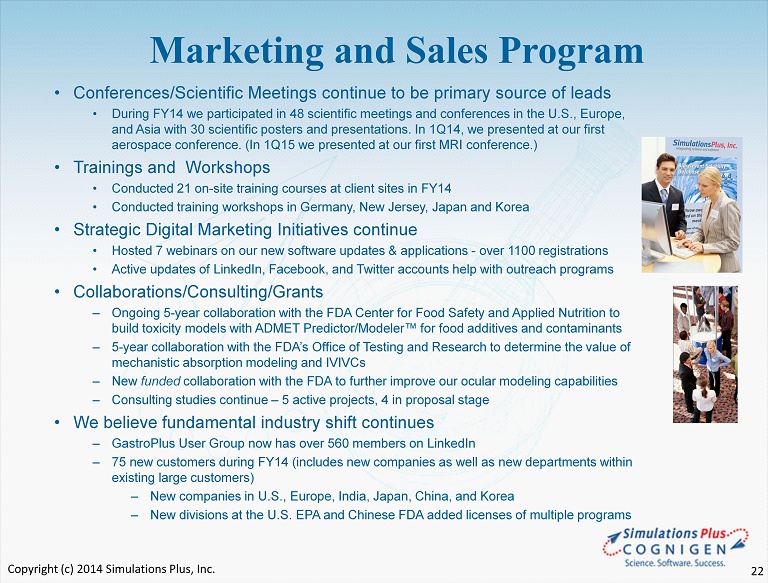

Marketing and Sales Program • Conferences/Scientific Meetings continue to be primary source of leads • During FY14 we participated in 48 scientific meetings and conferences in the U.S., Europe, and Asia with 30 scientific posters and presentations. In 1Q14, we presented at our first aerospace conference. (In 1Q15 we presented at our first MRI conference.) • Trainings and Workshops • Conducted 21 on - site training courses at client sites in FY14 • Conducted training workshops in Germany, New Jersey, Japan and Korea • Strategic Digital Marketing Initiatives continue • Hosted 7 webinars on our new software updates & applications - over 1100 registrations • Active updates of LinkedIn, Facebook, and Twitter accounts help with outreach programs • Collaborations/Consulting/Grants – Ongoing 5 - year collaboration with the FDA Center for Food Safety and Applied Nutrition to build toxicity models with ADMET Predictor/Modeler™ for food additives and contaminants – 5 - year collaboration with the FDA’s Office of Testing and Research to determine the value of mechanistic absorption modeling and IVIVCs – New funded collaboration with the FDA to further improve our ocular modeling capabilities – Consulting studies continue – 5 active projects, 4 in proposal stage • We believe fundamental industry shift continues – GastroPlus User Group now has over 560 members on LinkedIn – 75 new customers during FY14 (includes new companies as well as new departments within existing large customers) – New companies in U.S., Europe, India, Japan, China, and Korea – New divisions at the U.S. EPA and Chinese FDA added licenses of multiple programs Copyright (c) 2014 Simulations Plus, Inc. 22

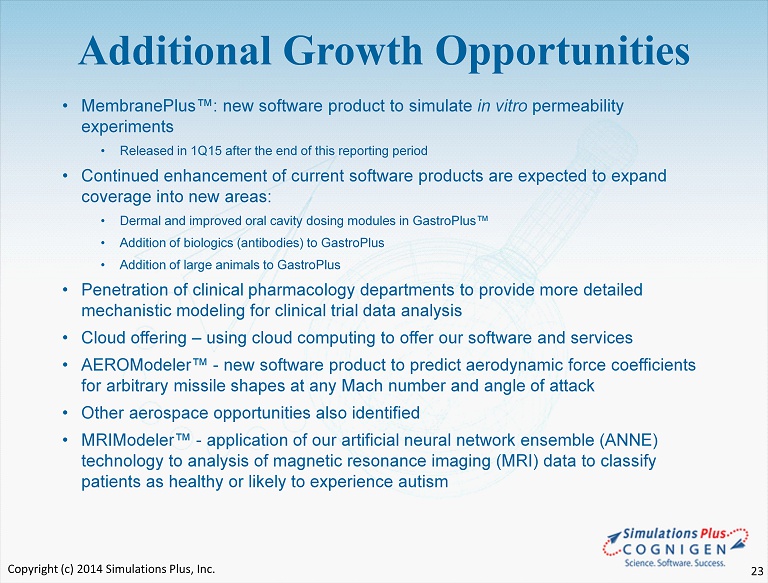

Additional Growth Opportunities • MembranePlus™: new software product to simulate in vitro permeability experiments • Released in 1Q15 after the end of this reporting period • Continued enhancement of current software products are expected to expand coverage into new areas: • Dermal and improved oral cavity dosing modules in GastroPlus™ • Addition of biologics (antibodies) to GastroPlus • Addition of large animals to GastroPlus • Penetration of clinical pharmacology departments to provide more detailed mechanistic modeling for clinical trial data analysis • Cloud offering – using cloud computing to offer our software and services • AEROModeler™ - new software product to predict aerodynamic force coefficients for arbitrary missile shapes at any Mach number and angle of attack • Other aerospace opportunities also identified • MRIModeler™ - application of our artificial neural network ensemble (ANNE) technology to analysis of magnetic resonance imaging (MRI) data to classify patients as healthy or likely to experience autism Copyright (c) 2014 Simulations Plus, Inc. 23

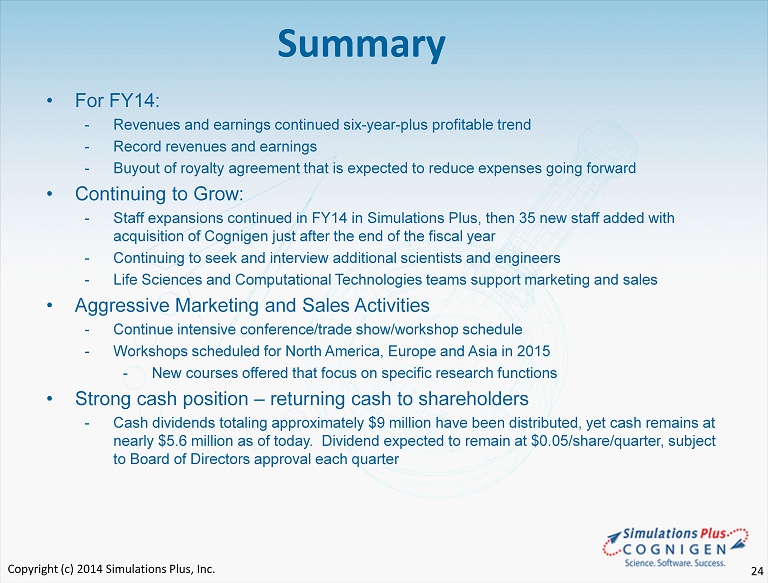

Summary • For FY14: - Revenues and earnings continued six - year - plus profitable trend - Record revenues and earnings - Buyout of royalty agreement that is expected to reduce expenses going forward • Continuing to Grow: - Staff expansions continued in FY14 in Simulations Plus, then 35 new staff added with acquisition of Cognigen just after the end of the fiscal year - Continuing to seek and interview additional scientists and engineers - Life Sciences and Computational Technologies teams support marketing and sales • Aggressive Marketing and Sales Activities - Continue intensive conference/trade show/workshop schedule - Workshops scheduled for North America, Europe and Asia in 2015 - New courses offered that focus on specific research functions • Strong cash position – returning cash to shareholders - Cash dividends totaling approximately $9 million have been distributed, yet cash remains at nearly $5.6 million as of today. Dividend expected to remain at $0.05/share/quarter, subject to Board of Directors approval each quarter Copyright (c) 2014 Simulations Plus, Inc. 24

Q&A Copyright (c) 2014 Simulations Plus, Inc. 25