Exhibit 99.2

Simulations Plus, Inc . and Cognigen Corp (NASDAQ:SLP) LD Micro Investor Conference Los Angeles December 3, 2014 Copyright (c) 2014 Simulations Plus, Inc. 1

With the exception of historical information, the matters discussed in this presentation are forward - looking statements that involve a number of risks and uncertainties. The actual results of the Company could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: continuing demand for the Company’s products, competitive factors, the Company’s ability to finance future growth, the Company’s ability to produce and market new products in a timely fashion, the Company’s ability to continue to attract and retain skilled personnel, and the Company’s ability to sustain or improve current levels of productivity. Further information on the Company’s risk factors is contained in the Company’s quarterly and annual reports and filed with the Securities and Exchange Commission. Safe Harbor Statement Copyright (c) 2014 Simulations Plus, Inc. 2

Major software provider for pharmaceutical research and development Consulting services for problem drugs and formulations Expertise and software tools span from earliest drug discovery through clinical trials and beyond patent life to supporting generic companies Three different active collaborations with U.S. FDA – one funded by FDA at $200,000/year for up to three years was just awarded Currently distributing dividend of $0.20/year per share ($ 0.05/ quarter) New applications being explored in aerospace and general healthcare Acquisition of Cognigen Corp in September more than doubles workforce, expected to add $4 - 5 million to revenues in FY15 – first combined fiscal quarter just completed on November 30 – preliminary consolidated revenues up 50% over last year’s first fiscal quarter Simulations Plus, Inc. Overview Copyright (c) 2014 Simulations Plus, Inc. 3

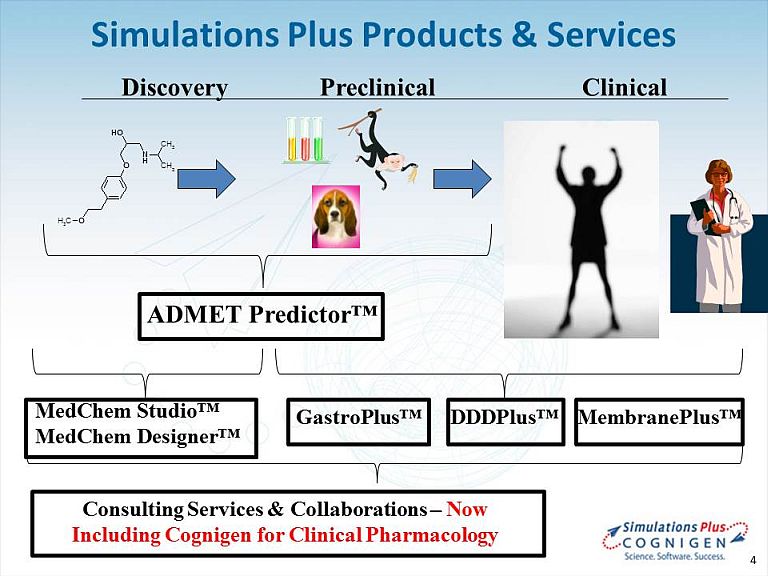

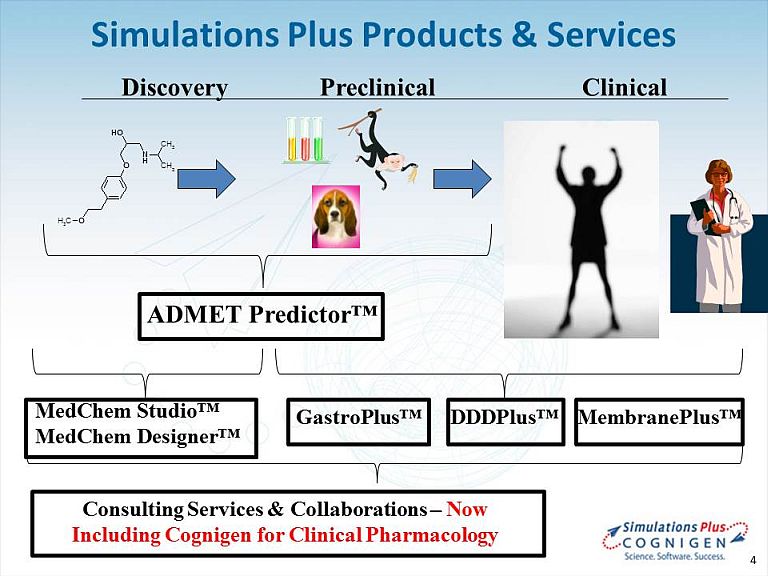

N H O OH O CH 3 CH 3 CH 3 Discovery Preclinical Clinical MedChem Studio™ MedChem Designer™ GastroPlus™ DDDPlus ™ ADMET Predictor™ Simulations Plus Products & Services Consulting Services & Collaborations – Now Including Cognigen for Clinical Pharmacology MembranePlus™ 4

Modeling & simulation support for 30 - 40 drugs per year Total of >100 different compounds over the last 5 years Well - established quality management system and successful client audit record 44 client audits over the last 10 years; no findings Track record of successful regulatory submissions utilizing pharmacometric modeling and simulation >25 regulatory submissions over the last 5 years alone New KIWI proprietary software provides access to Cognigen cloud – licensed to two organizations to date Little marketing and sales efforts prior to acquisition – now can cost - effectively piggy - back on Simulations Plus’ activities Cognigen Division: Overview Copyright (c) 2014 Simulations Plus, Inc. 5

6 • Data assembly and exploratory analyses • PK/PD modeling of drug concentrations and patient outcomes from Phase 1, 2 and 3 studies • Clinical trial simulations to guide study design • Briefing books for regulatory interactions • Regulatory submissions • Scientific writing • Training workshops Cognigen Selected Services

7 • Worked with 22 clients on 62 projects covering 38 different compounds • Average length of current client relationship is 6 years ranging from 1 to 14 years • 6 new clients • 6 Regulatory Submissions Cognigen Calendar 2014 Overview

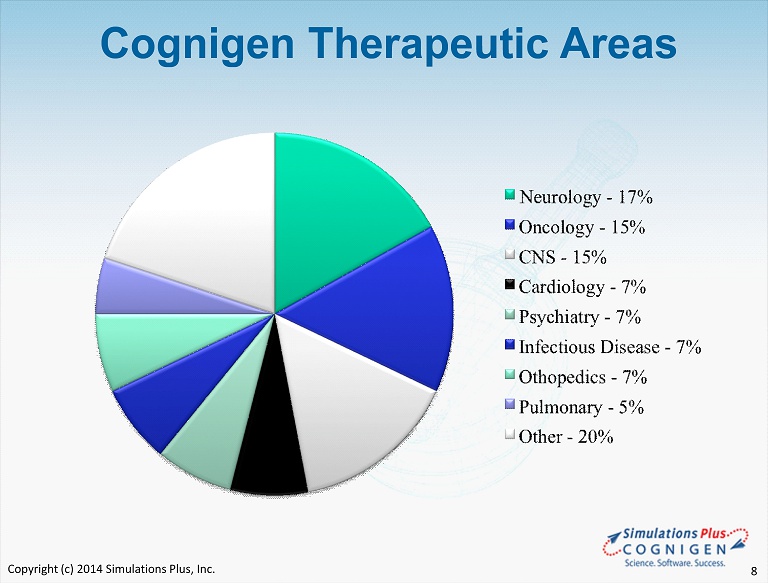

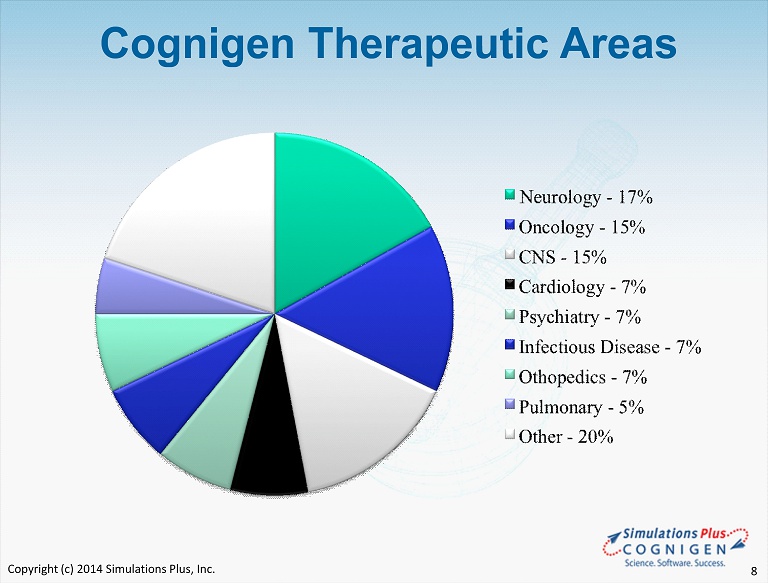

Cognigen Therapeutic Areas Copyright (c) 2014 Simulations Plus, Inc. 8

9 • Significant investment in IT infrastructure and workflow processes • Recently upgraded computer systems, implemented automated offsite backup storage, and installed green technology to reduce computer cooling costs • KIWI - a validated platform for model development and private cloud computing Cognigen Infrastructure

Additional Growth Opportunities • MembranePlus™ : new software product to simulate in vitro permeability experiments • Released in 1Q15 • Webinar held December 2, 2014 – nearly 100 attendees • Continued enhancement of current software products expands application space: • Dermal and improved oral cavity dosing modules in GastroPlus™ • Addition of biologics (antibodies) to GastroPlus • Addition of large animals to GastroPlus • Penetration of clinical pharmacology departments to provide more detailed mechanistic modeling for clinical trial data analysis – regulatory agencies want this • Cloud offerings • AEROModeler ™ - application of our artificial neural network ensemble (ANNE) technology to predict aerodynamic force coefficients for missiles at arbitrary Mach number and angle of attack - much faster than conventional methods • Presented at our first aerospace conference in June 2014 • MRIModeler™ - application of our artificial neural network ensemble (ANNE) technology to analysis of magnetic resonance imaging (MRI) data to classify patients as healthy or likely to experience various disease states • Presented at our first MRI conference in September 2014 Copyright (c) 2014 Simulations Plus, Inc. 10

Marketing and Sales Program • Conferences/Scientific Meetings continue to be primary source of leads • During FY14 we participated in 48 scientific meetings and conferences in the U.S., Europe, and Asia with 30 scientific posters and presentations. In 4Q14 , we presented at our first aerospace conference. (In 1Q15 we presented at our first MRI conference.) • Trainings and Workshops • Conducted 21 on - site training courses at client sites in FY14 • Conducted training workshops in Germany, New Jersey, Japan and Korea • 2015 workshops scheduled for U.S., Europe, Asia • Strategic Digital Marketing Initiatives • Hosted 7 webinars on our new software updates & applications - over 1100 registrations • Active updates of LinkedIn, Facebook, and Twitter accounts help with outreach programs • We believe fundamental industry shift continues – GastroPlus User Group now has over 560 members on LinkedIn – Added 75 new customers during FY14 (includes new companies as well as new departments within existing large customers ) – added 23 new customers in 1QFY15 – New companies in U.S., Europe, India, Japan, China, and Korea – New divisions at the U.S. EPA and Chinese FDA Copyright (c) 2014 Simulations Plus, Inc. 11

FY14 Sales – by Region Europe 26% North America 49% Asia 25% South America <1% Japan = 61% India = 15% China = 12% Korea = 6%

10 11 9 9 14 17 12 14 15 21 13 10 18 18 16 9 15 22 20 18 Q1 Q2 Q3 Q4 2010 2011 2012 2013 2014 2015 New Customers by Quarter Copyright (c) 2014 Simulations Plus, Inc. 13 23

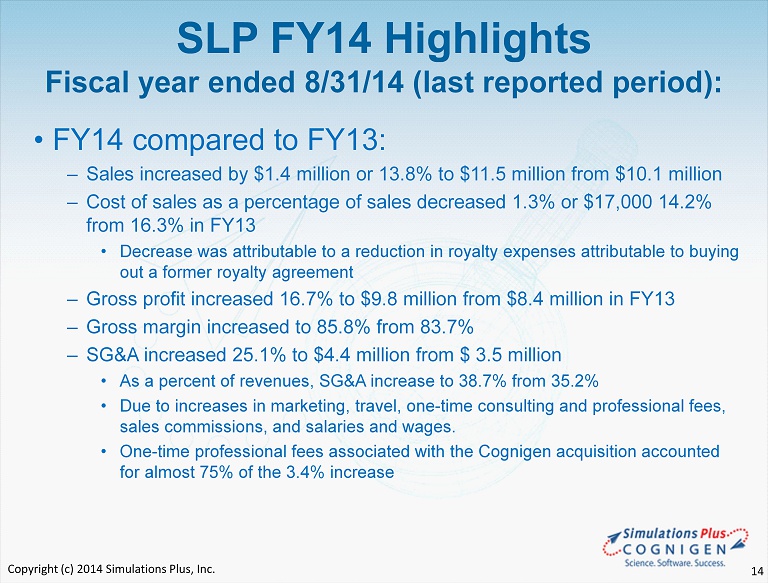

• FY14 compared to FY13: – Sales increased by $1.4 million or 13.8% to $11.5 million from $10.1 million – Cost of sales as a percentage of sales decreased 1.3% or $17,000 14.2% from 16.3% in FY13 • Decrease was attributable to a reduction in royalty expenses attributable to buying out a former royalty agreement – Gross profit increased 16.7% to $9.8 million from $8.4 million in FY13 – Gross margin increased to 85.8% from 83.7% – SG&A increased 25.1% to $4.4 million from $ 3.5 million • As a percent of revenues, SG&A increase to 38.7% from 35.2% • Due to increases in marketing, travel, one - time consulting and professional fees, sales commissions, and salaries and wages. • One - time professional fees associated with the Cognigen acquisition accounted for almost 75% of the 3.4% increase SLP FY14 Highlights Fiscal year ended 8/31/ 14 (last reported period): Copyright (c) 2014 Simulations Plus, Inc. 14

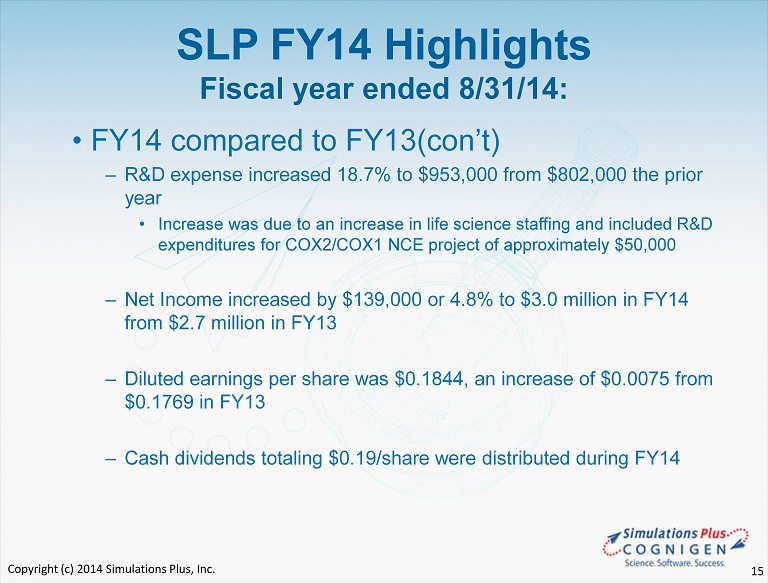

• FY14 compared to FY13 ( con’t ) – R&D expense increased 18.7% to $953,000 from $802,000 the prior year • Increase was due to an increase in life science staffing and included R&D expenditures for COX2/COX1 NCE project of approximately $50,000 – Net Income increased by $139,000 or 4.8% to $3.0 million in FY14 from $2.7 million in FY13 – Diluted earnings per share was $0.1844, an increase of $0.0075 from $0.1769 in FY13 – Cash dividends totaling $0.19/share were distributed during FY14 SLP FY14 Highlights Fiscal year ended 8/31/14: Copyright (c) 2014 Simulations Plus, Inc. 15

Income Statement FY14 vs FY13 ($ millions) FY14 FY13 Net sales 11.461 10.071 Gross profit 9.831 8.424 Gross profit margin 85.8% 83.7% SG&A 4.440 3.550 R&D 0.952 0.802 Total operating expenses 5.392 4.352 Income from operations 4.439 4.257 Other income .074 0.184 Income from operations before income taxes 4.513 4.256 Net income 3.025 2.8866 Diluted earnings per share 0.1844 0.1769 Copyright (c) 2014 Simulations Plus, Inc. 16

FY14 Recap Sales increase & Net income Sales Incr 1,390,000 Royalties 425,000 Software Amort - 90,000 TSRL Amort - 175,000 Net incr. from Sales/COGS 1,550,000 Increased expenses - 1,350,000 Increase in net income 225,000 Additional Expenses Labor related expense increase 304,000 Legal costs 288,000 Excel Partners 96,000 Sales rep Commissions 144,000 Other Expensed R&D 100,000 Travel 80,000 CEO bonus 60,000 NCE 50,000 Decrease in other Income - (Sublease and Forex) 110,000 Income tax expense 118,000 Increase in expenses 1,350,000 1 7

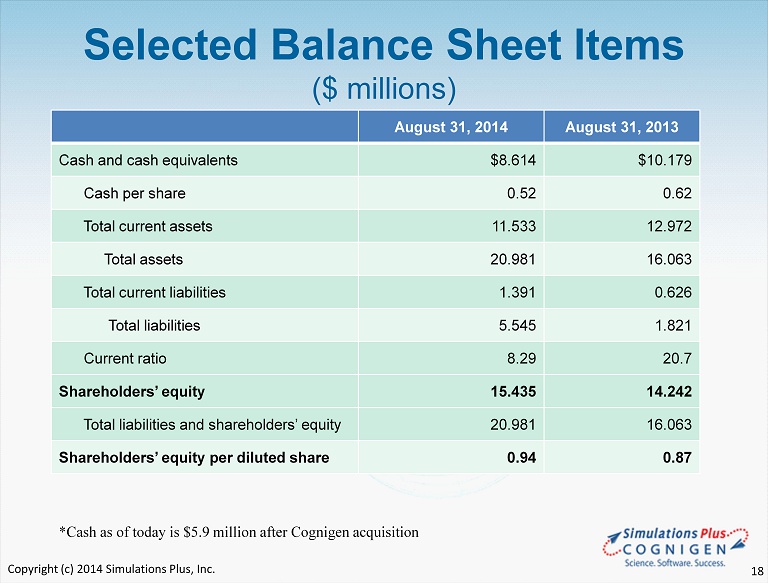

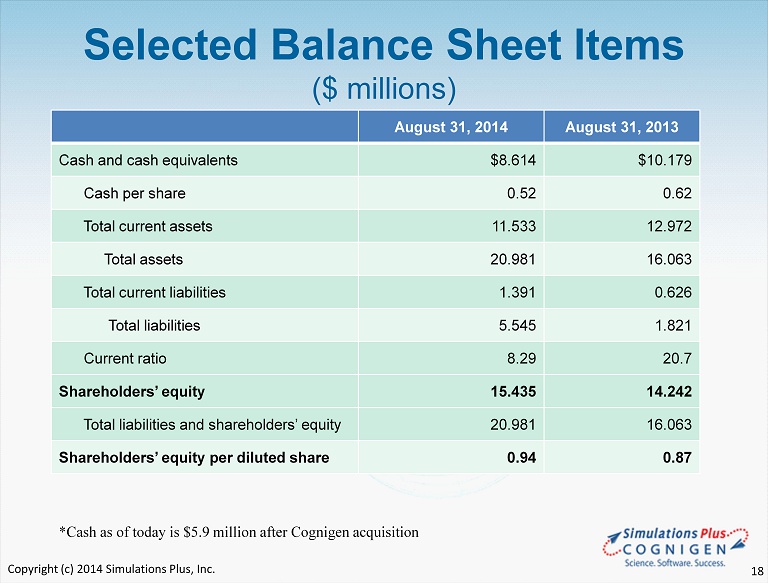

Selected Balance Sheet Items ($ millions) August 31, 2014 August 31, 2013 Cash and cash equivalents $8.614 $10.179 Cash per share 0.52 0.62 Total current assets 11.533 12.972 Total assets 20.981 16.063 Total current liabilities 1.391 0.626 Total liabilities 5.545 1.821 Current ratio 8.29 20.7 Shareholders’ equity 15.435 14.242 Total liabilities and shareholders’ equity 20.981 16.063 Shareholders’ equity per diluted share 0.94 0.87 *Cash as of today is $5.9 million after Cognigen acquisition Copyright (c) 2014 Simulations Plus, Inc. 18

$1.4 $1.8 $2.0 $1.1 $1.7 $2.2 $2.3 $1.3 $2.1 $2.6 $2.6 $1.4 $2.2 $2.8 $2.8 $1.6 $2.3 $3.1 $3.1 $1.6 $2.6 $3.1 $2.0 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 2015 Revenues by Quarter (pro forma prior to 2012) $3.7 Copyright (c) 2014 Simulations Plus, Inc. 19 $ 3.96 preliminary

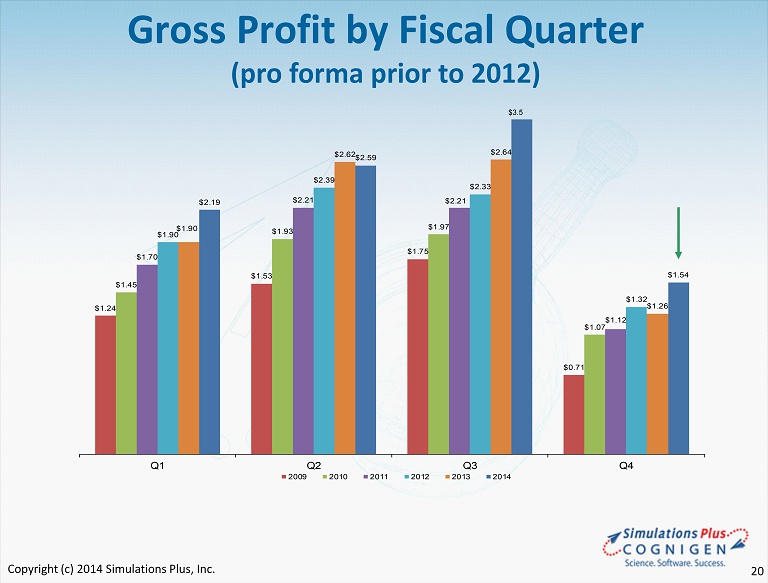

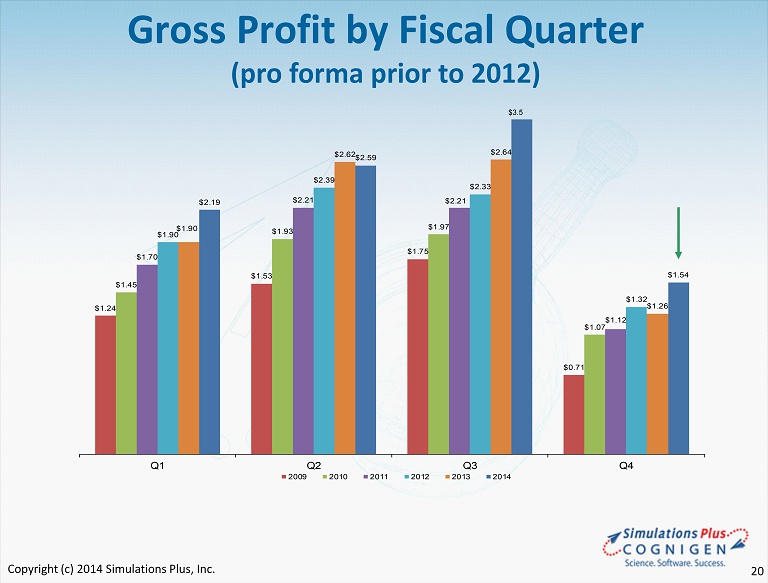

$1.24 $1.53 $1.75 $0.71 $1.45 $1.93 $1.97 $1.07 $1.70 $2.21 $2.21 $1.12 $1.90 $2.39 $2.33 $1.32 $1.90 $2.62 $2.64 $1.26 $2.19 $2.59 $1.54 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 Gross Profit by Fiscal Quarter (pro forma prior to 2012) $3.5 Copyright (c) 2014 Simulations Plus, Inc. 20

$0.55 $0.73 $0.93 $0.20 $0.73 $1.28 $1.23 $0.36 $1.00 $1.48 $1.48 $0.27 $1.23 $1.38 $1.48 $0.58 $1.09 $1.76 $1.73 $0.44 $1.20 $1.35 $0.67 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 EBITDA by Fiscal Quarter $2.1 Copyright (c) 2014 Simulations Plus, Inc. 21

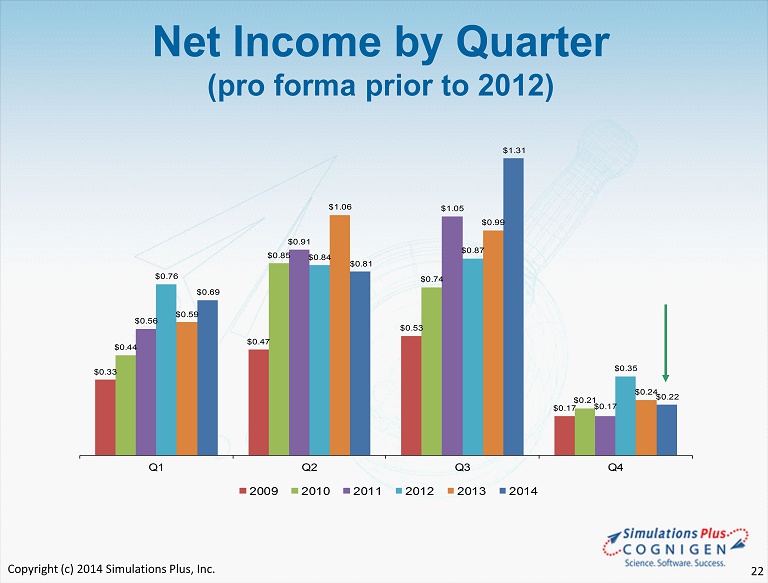

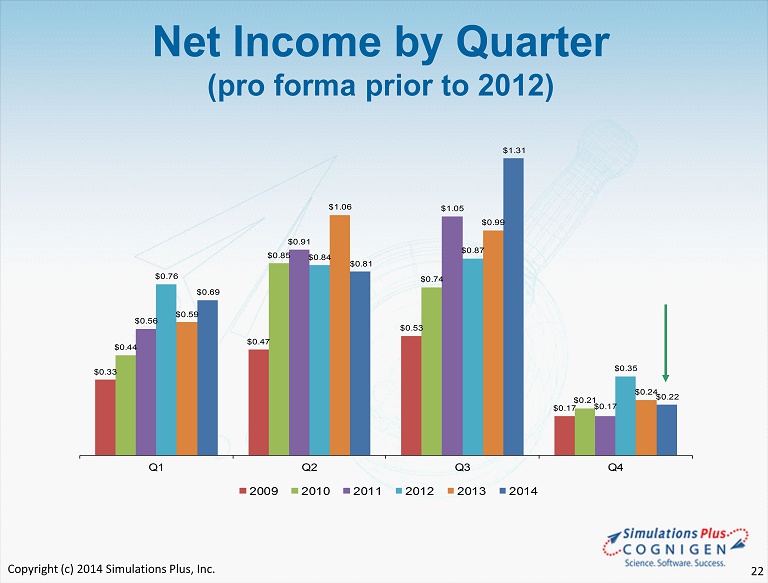

Net Income by Quarter (pro forma prior to 2012) $0.33 $0.47 $0.53 $0.17 $0.44 $0.85 $0.74 $0.21 $0.56 $0.91 $1.05 $0.17 $0.76 $0.84 $0.87 $0.35 $0.59 $1.06 $0.99 $0.24 $0.69 $0.81 $1.31 $0.22 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 Copyright (c) 2014 Simulations Plus, Inc. 22

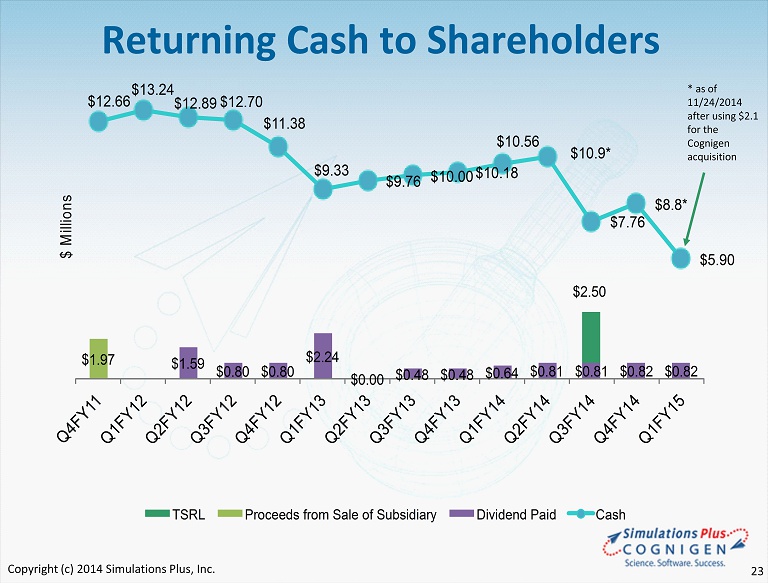

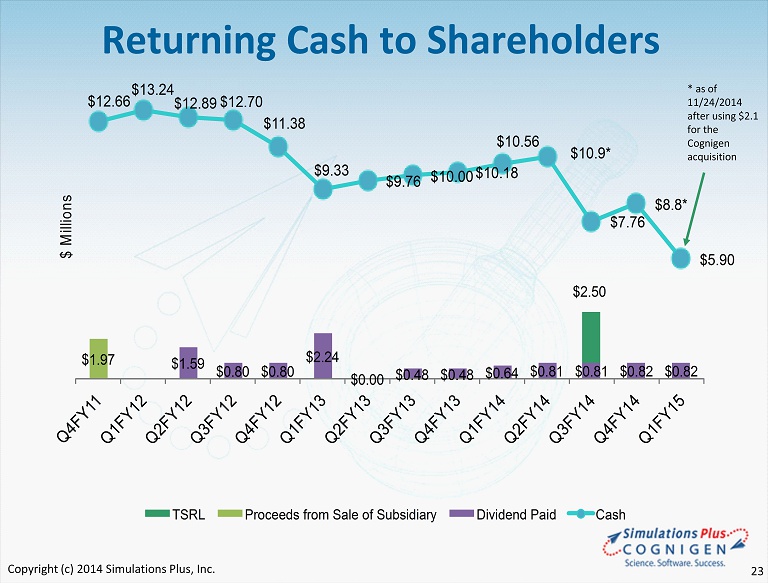

$1.59 $0.80 $0.80 $2.24 $0.00 $0.48 $0.48 $0.64 $0.81 $0.81 $0.82 $0.82 $1.97 $2.50 $12.66 $13.24 $12.89 $12.70 $11.38 $9.33 $9.76 $10.00 $10.18 $10.56 $10.9* $7.76 $8.8* $5.90 Q 4 F Y 1 1 Q 1 F Y 1 2 Q 2 F Y 1 2 Q 3 F Y 1 2 Q 4 F Y 1 2 Q 1 F Y 1 3 Q 2 F Y 1 3 Q 3 F Y 1 3 Q 4 F Y 1 3 Q 1 F Y 1 4 Q 2 F Y 1 4 Q 3 F Y 1 4 Q 4 F Y 1 4 Q 1 F Y 1 5 $ M i l l i o n s TSRL Proceeds from Sale of Subsidiary Dividend Paid Cash Returning Cash to Shareholders * as of 11/24/ 2014 after using $2.1 for the Cognigen acquisition Copyright (c) 2014 Simulations Plus, Inc. 23

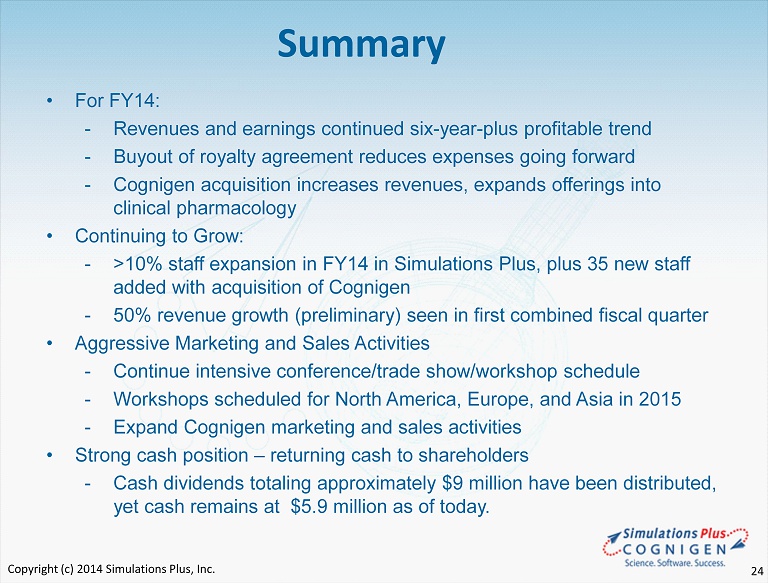

Summary • For FY14: - Revenues and earnings continued six - year - plus profitable trend - Buyout of royalty agreement reduces expenses going forward - Cognigen acquisition increases revenues, expands offerings into clinical pharmacology • Continuing to Grow: - >10% staff expansion in FY14 in Simulations Plus, plus 35 new staff added with acquisition of Cognigen - 50% revenue growth ( preliminary) seen in first combined fiscal quarter • Aggressive Marketing and Sales Activities - Continue intensive conference/trade show/workshop schedule - Workshops scheduled for North America, Europe, and Asia in 2015 - Expand Cognigen marketing and sales activities • Strong cash position – returning cash to shareholders - Cash dividends totaling approximately $9 million have been distributed, yet cash remains at $5.9 million as of today . Copyright (c) 2014 Simulations Plus, Inc. 24

Q&A Copyright (c) 2014 Simulations Plus, Inc. 25