Exhibit 99.1

Copyright (c) 2015 Simulations Plus, Inc. 1 Simulations Plus, Inc. and Cognigen Corp. (NASDAQ:SLP ) Conference Call and Webinar January 14, 2015

Copyright (c) 2015 Simulations Plus, Inc. 2 With the exception of historical information, the matters discussed in this presentation are forward - looking statements that involve a number of risks and uncertainties. The actual results of the Company could differ significantly from those statements. Factors that could cause or contribute to such differences include, but are not limited to: continuing demand for the Company’s products, competitive factors, the Company’s ability to finance future growth, the Company’s ability to produce and market new products in a timely fashion, the Company’s ability to continue to attract and retain skilled personnel, and the Company’s ability to sustain or improve current levels of productivity. Further information on the Company’s risk factors is contained in the Company’s quarterly and annual reports and filed with the Securities and Exchange Commission. Safe Harbor Statement

Copyright (c) 2015 Simulations Plus, Inc. 3 • Major software provider for pharmaceutical research and development • Consulting services for problem drugs and formulations • Expertise and software tools span from earliest drug discovery through clinical trials and beyond patent life to supporting generic companies • New applications being explored in aerospace and general healthcare • Acquisition of Cognigen Corp. in September 2014 more than doubles workforce, expected to add $4 - 5 million to revenues in FY15 – first combined fiscal quarter just completed on November 30 • Consolidated revenues up 54% over last year’s first fiscal quarter; gross profit increased 41% • Currently distributing dividend of $0.20/year per share ($0.05/quarter) , subject to board approval each quarter Simulations Plus, Inc. Overview

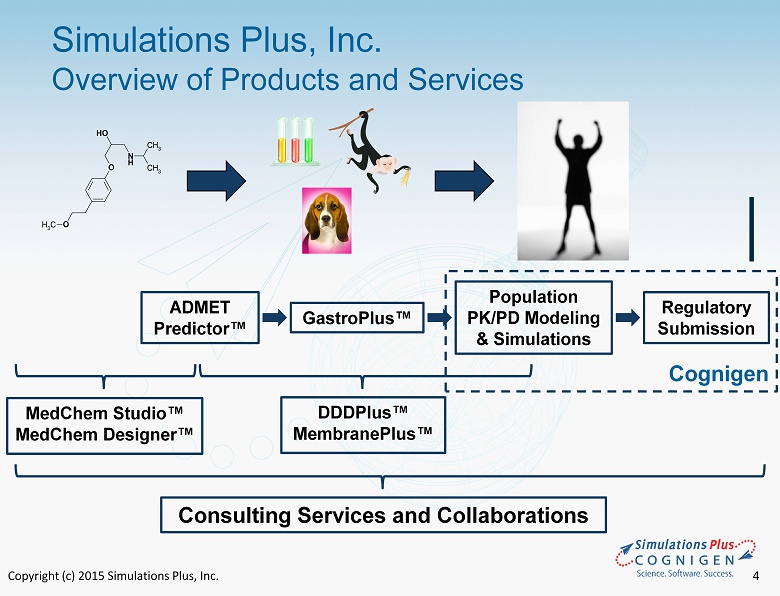

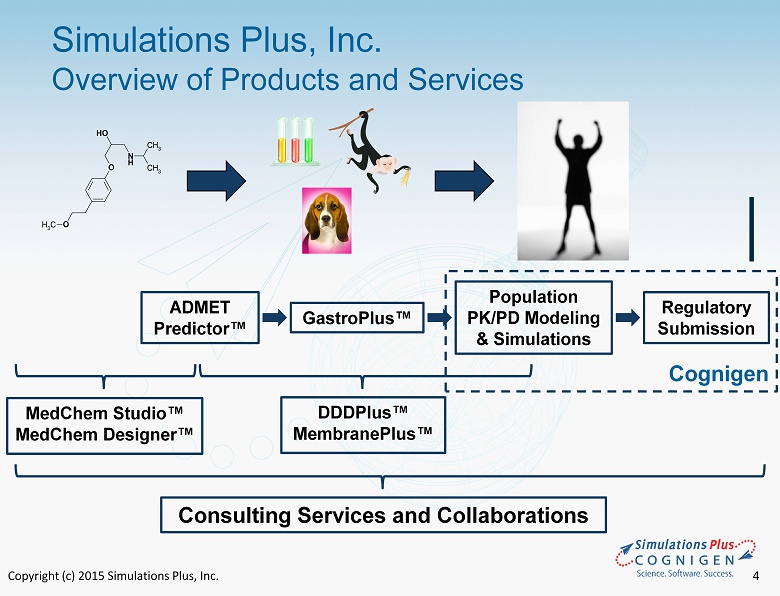

Copyright (c) 2015 Simulations Plus, Inc. 4 Simulations Plus, Inc. Overview of Products and Services 4 N H O OH O CH 3 CH 3 CH 3 ADMET Predictor ™ GastroPlus ™ Population PK/PD Modeling & Simulations Regulatory Submission MedChem Studio ™ MedChem Designer™ DDDPlus ™ MembranePlus ™ Consulting Services and Collaborations Cognigen

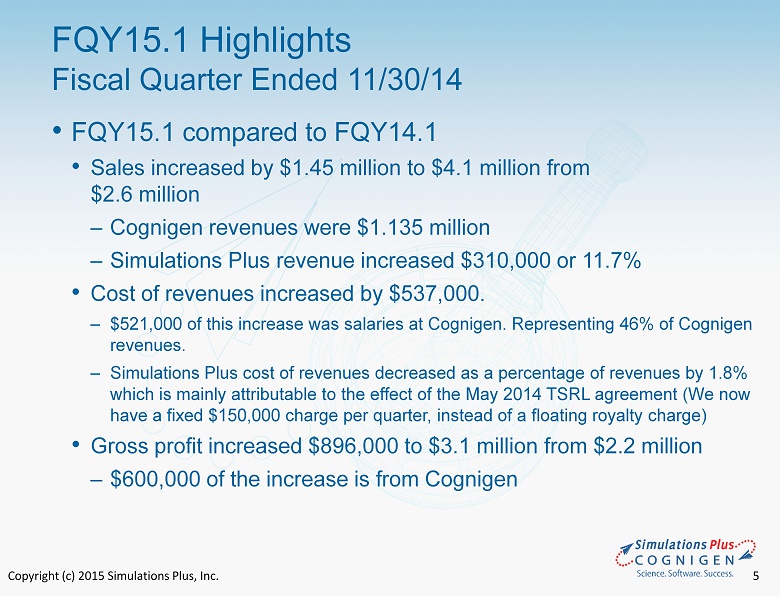

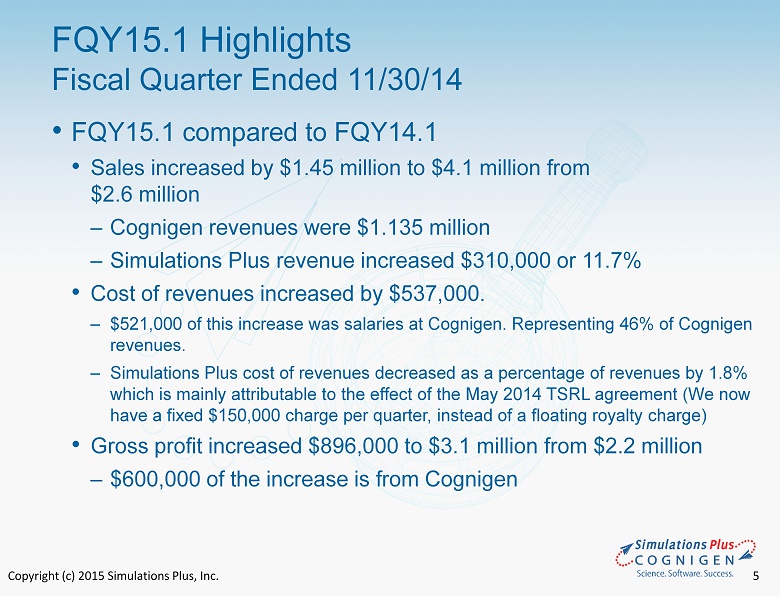

Copyright (c) 2015 Simulations Plus, Inc. 5 • FQY15.1 compared to FQY14.1 • Sales increased by $ 1.45 million to $4.1 million from $2.6 million ‒ Cognigen revenues were $ 1.135 million ‒ Simulations Plus revenue increased $310,000 or 11.7% • Cost of revenues increased by $537,000. ‒ $521,000 of this increase was salaries at Cognigen. Representing 46% of Cognigen revenues. ‒ Simulations Plus cost of revenues decreased as a percentage of revenues by 1.8% which is mainly attributable to the effect of the May 2014 TSRL agreement (We now have a fixed $150,000 charge per quarter, instead of a floating royalty charge) • Gross profit increased $896,000 to $3.1 million from $2.2 million ‒ $600,000 of the increase is from Cognigen FQY15.1 Highlights Fiscal Quarter Ended 11/30/14

Copyright (c) 2015 Simulations Plus, Inc. 6 • FQY15.1 compared to FQY14.1(Cont’d) • Consolidated Gross margin decreased to 75.6% from 82.5% ‒ Cognigen gross margin for the quarter was 53% ‒ Simulations Plus margin for the quarter was 84.3% up from 82.5% the prior year • SG&A increased $1.0 million to $2.1 million from $1.1 million the prior year ‒ $538,000 of the increase is from Cognigen ‒ During the current fiscal quarter we incurred approximately $410,000 in one - time costs associated with the Cognigen acquisition, which was charged to SG&A. ‒ Simulations Plus SG&A increased $72,000 due to increases in commissions paid to our Asian dealers, increased travel for training programs and trade shows, and increased salary and benefit costs. ‒ As a percent of revenues, SG&A increased to 51% from 40% ‒ The expenses of the Cognigen acquisition represented approximately 10% of the increase. FQY15.1 Highlights Fiscal Quarter Ended 11/30/14

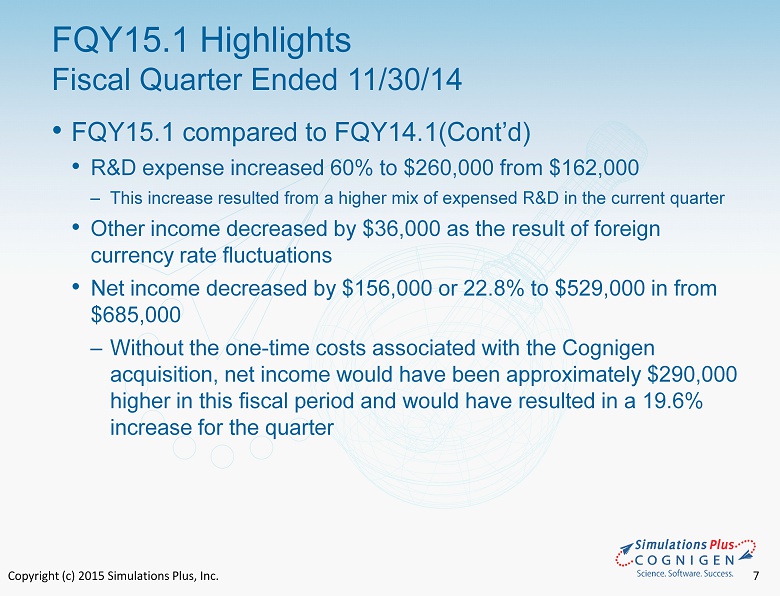

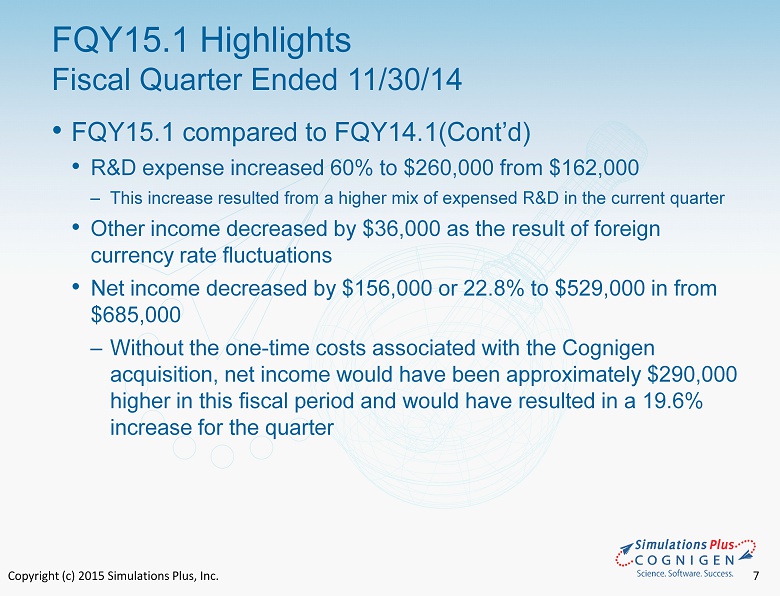

Copyright (c) 2015 Simulations Plus, Inc. 7 • FQY15.1 compared to FQY14.1(Cont’d) • R&D expense increased 60% to $260,000 from $162,000 ‒ This increase resulted from a higher mix of expensed R&D in the current quarter • Other income decreased by $ 36,000 as the result of foreign currency rate fluctuations • Net income decreased by $156,000 or 22.8% to $529,000 in from $ 685,000 ‒ Without the one - time costs associated with the Cognigen acquisition, net income would have been approximately $290,000 higher in this fiscal period and would have resulted in a 19.6% increase for the quarter FQY15.1 Highlights Fiscal Quarter Ended 11/30/14

Copyright (c) 2015 Simulations Plus, Inc. 8 • FQY15.1 compared to FQY14.1(Cont’d) • Diluted earnings per share was $ 0.03 a decrease of $ 0.01 from $ 0.04 • Without one - time charges, diluted earnings per share would have been approximately 58% higher at $0.045 per share • Cash dividends totaling $0.05/share were distributed during this fiscal quarter FQY15.1 Highlights Fiscal Quarter Ended 11/30/14

Copyright (c) 2015 Simulations Plus, Inc. 9 FY15.1 Sales By Region Europe 19% North America 56% Asia 25% South America <1% Japan = 50% India = 15% China = 28% Korea = 7%

Copyright (c) 2015 Simulations Plus, Inc. 10 New Customers By Quarter 10 11 9 9 14 17 12 14 15 21 13 10 18 18 16 9 15 22 20 18 Q1 Q2 Q3 Q4 2010 2011 2012 2013 2014 2015 23

Copyright (c) 2015 Simulations Plus, Inc. 11 Consolidated Income Statement FQY15.1 Versus FQY14.1 ($ millions) FQY15.1 FQY14.1 Net sales 4.086 2.641 Gross profit 3.088 2.193 Gross profit margin 75.6% 83.0% SG&A 2.079 1.071 R&D 0.260 0.162 Total operating expenses 2.339 1.233 Income from operations 0.749 0.959 Other income(expense) (.003) 0.033 Income from operations before income taxes 0.746 0.992 Net income 0.529 0.685 Diluted earnings per share 0.031 0.043

Copyright (c) 2015 Simulations Plus, Inc. 12 Consolidating Income Statement FQY15.1 ($ millions) SLP Cognigen Eliminations FQY15.1 Net sales 2.951 1.135 0.00 4.086 Gross profit 2.488 0.600 0.00 3.088 Gross profit margin 84.3% 52.9% 0.00 75.6% SG&A 1.541 0.537 0.00 2.079 R&D 0.260 0.000 0.00 0.260 Total operating expenses 1.801 0.537 0.00 2.339 Income from operations 0.686 0.063 0.00 0.749 Other income(expense) (.003) .000 0.00 (.003) Income from operations before income taxes 0.683 0.063 0.00 0.746 Net income 0.489 0.040 0.00 0.529

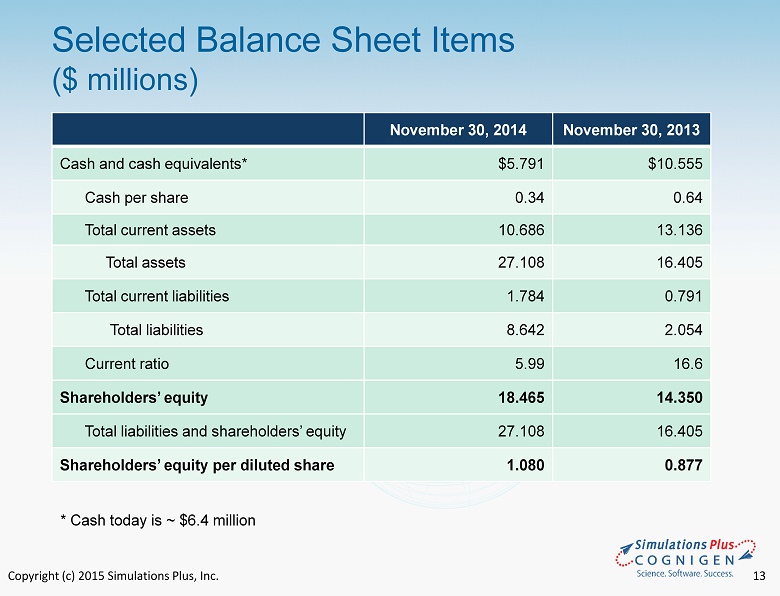

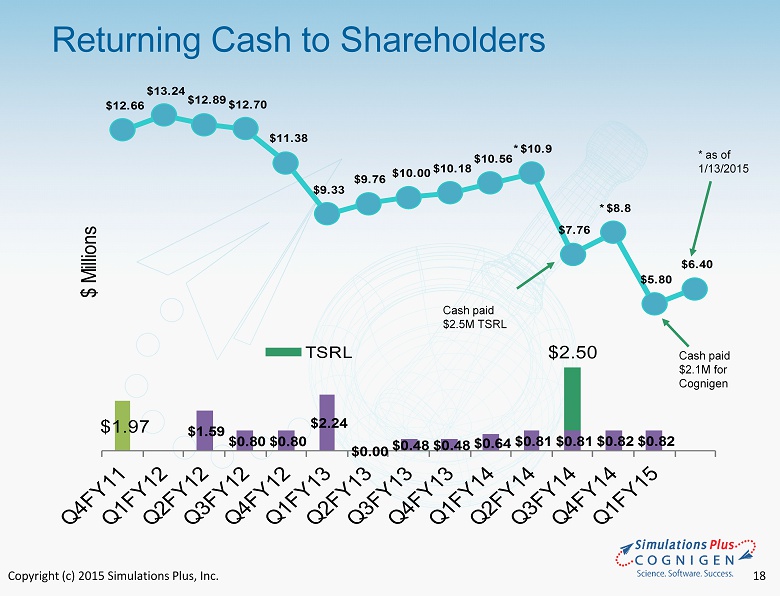

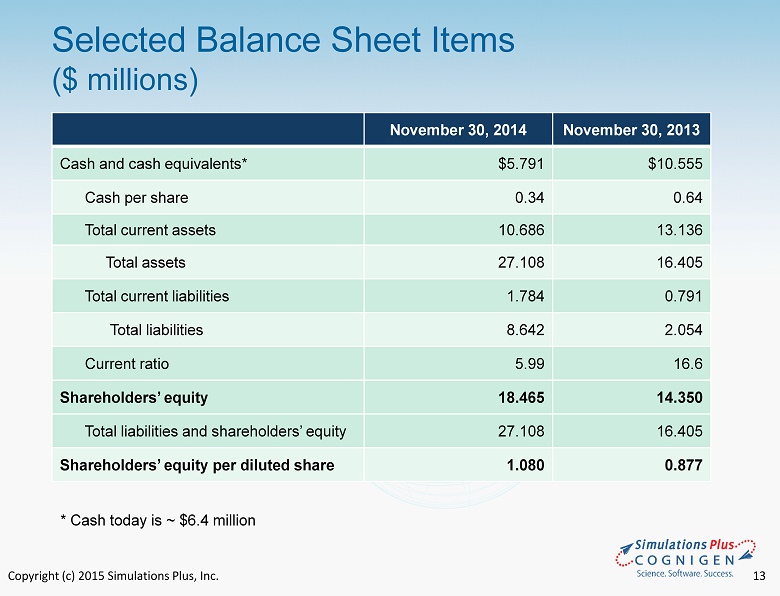

Copyright (c) 2015 Simulations Plus, Inc. 13 Selected Balance Sheet Items ($ millions) November 30, 2014 November 30, 2013 Cash and cash equivalents* $5.791 $10.555 Cash per share 0.34 0.64 Total current assets 10.686 13.136 Total assets 27.108 16.405 Total current liabilities 1.784 0.791 Total liabilities 8.642 2.054 Current ratio 5.99 16.6 Shareholders’ equity 18.465 14.350 Total liabilities and shareholders’ equity 27.108 16.405 Shareholders’ equity per diluted share 1.080 0.877 * Cash today is ~ $6.4 million

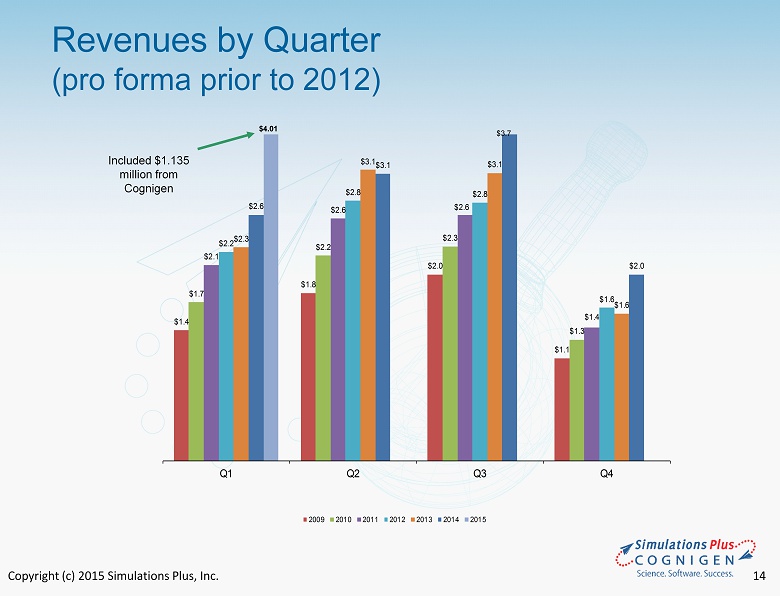

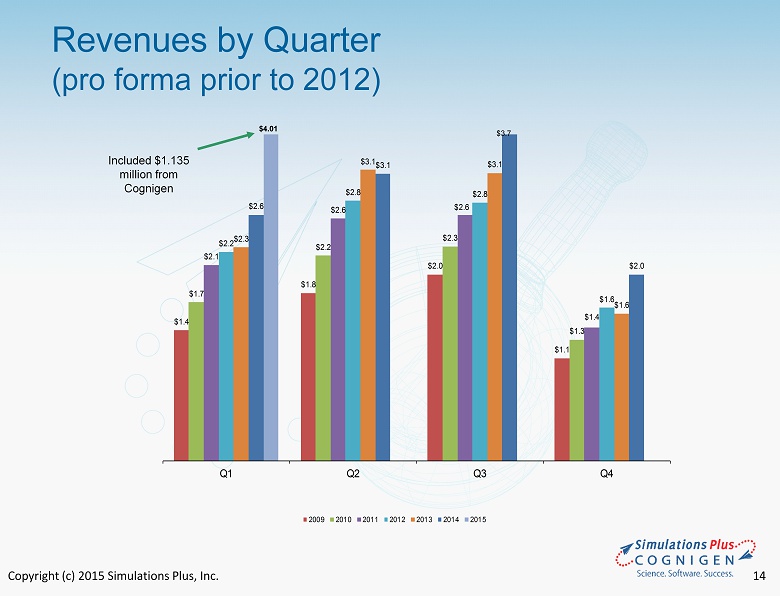

Copyright (c) 2015 Simulations Plus, Inc. 14 Revenues by Quarter (pro forma prior to 2012) $1.4 $1.8 $2.0 $1.1 $1.7 $2.2 $2.3 $1.3 $2.1 $2.6 $2.6 $1.4 $2.2 $2.8 $2.8 $1.6 $2.3 $3.1 $3.1 $1.6 $2.6 $3.1 $2.0 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 2015 $3.7 $4.01 Included $1.135 million from Cognigen

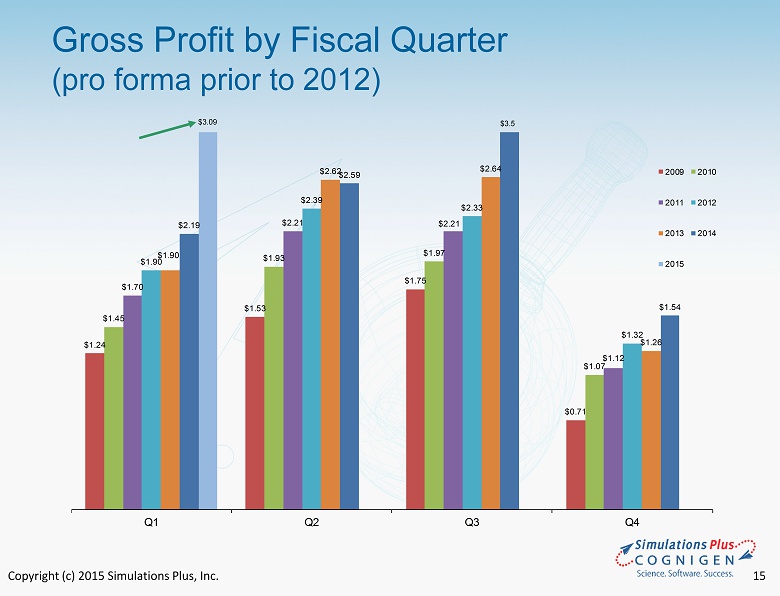

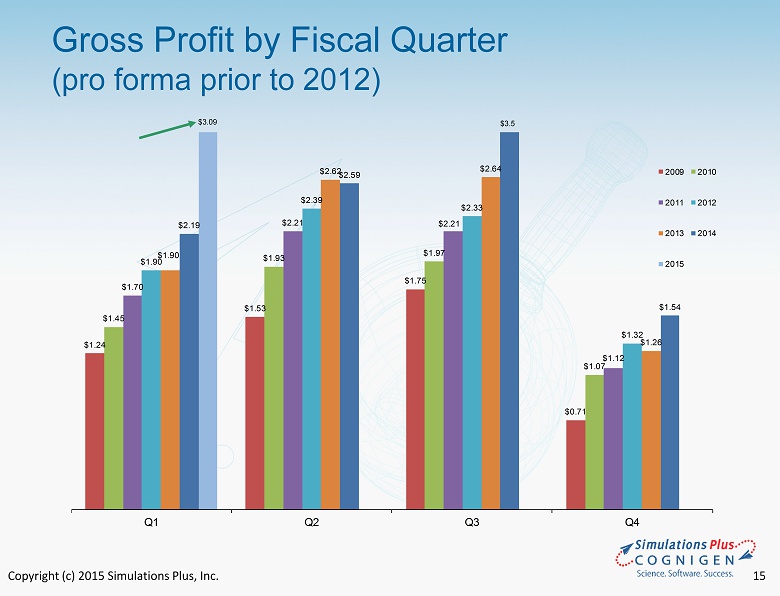

Copyright (c) 2015 Simulations Plus, Inc. 15 $1.24 $1.53 $1.75 $0.71 $1.45 $1.93 $1.97 $1.07 $1.70 $2.21 $2.21 $1.12 $1.90 $2.39 $2.33 $1.32 $1.90 $2.62 $2.64 $1.26 $2.19 $2.59 $1.54 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 2015 Gross Profit by Fiscal Quarter (pro forma prior to 2012 ) $3.5 $3.09

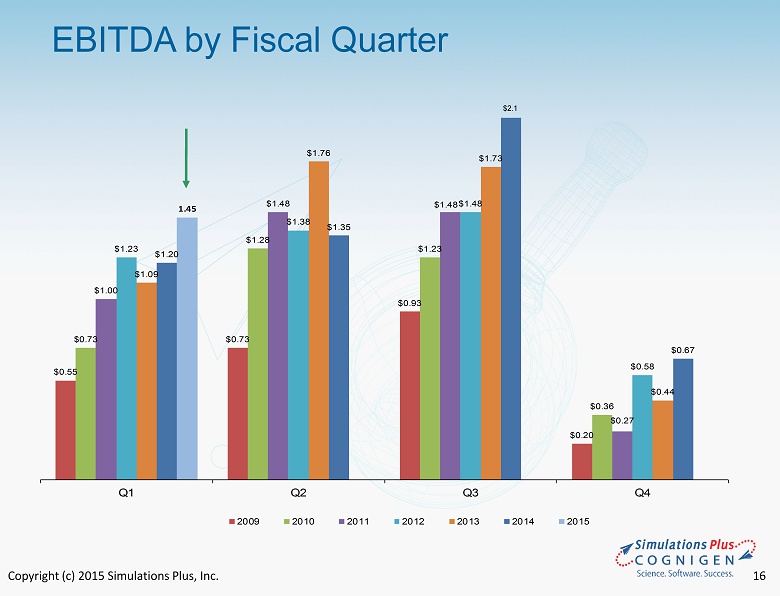

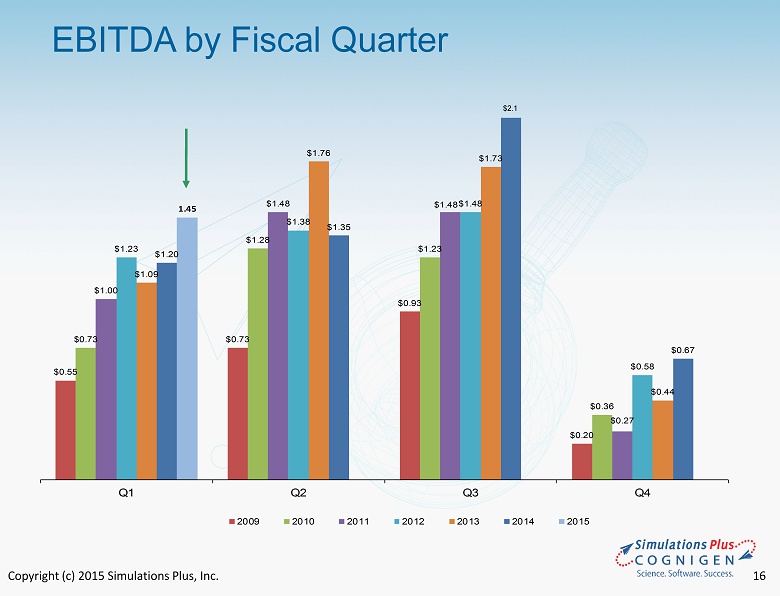

Copyright (c) 2015 Simulations Plus, Inc. 16 EBITDA by Fiscal Quarter $0.55 $0.73 $0.93 $0.20 $0.73 $1.28 $1.23 $0.36 $1.00 $1.48 $1.48 $0.27 $1.23 $1.38 $1.48 $0.58 $1.09 $1.76 $1.73 $0.44 $1.20 $1.35 $0.67 1.45 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 2015 $2.1

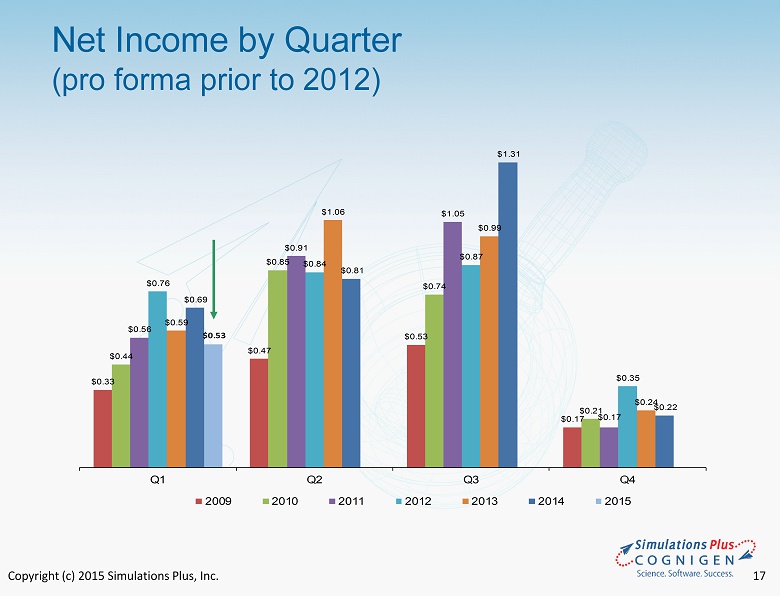

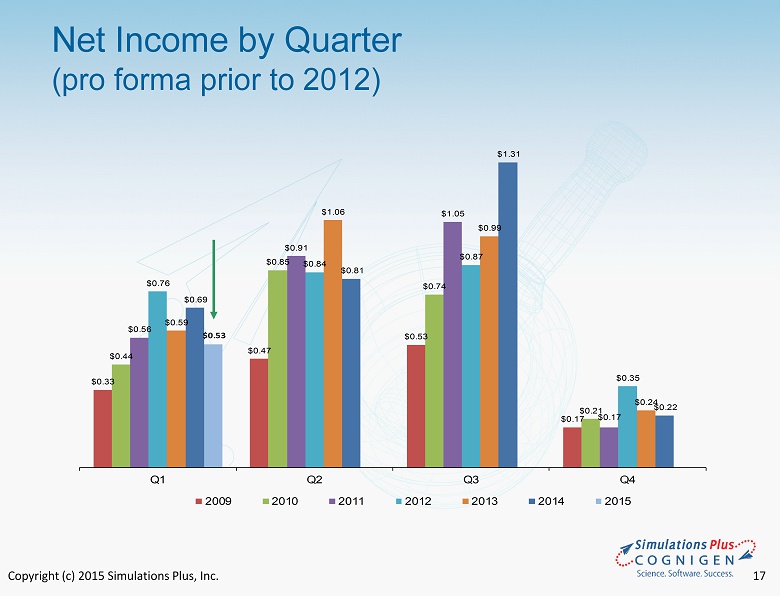

Copyright (c) 2015 Simulations Plus, Inc. 17 Net Income by Quarter (pro forma prior to 2012) $ 0.33 $ 0.47 $ 0.53 $ 0.17 $ 0.44 $ 0.85 $ 0.74 $ 0.21 $ 0.56 $ 0.91 $ 1.05 $ 0.17 $ 0.76 $ 0.84 $ 0.87 $ 0.35 $ 0.59 $ 1.06 $ 0.99 $ 0.24 $ 0.69 $ 0.81 $ 1.31 $ 0.22 $ 0.53 Q1 Q2 Q3 Q4 2009 2010 2011 2012 2013 2014 2015

Copyright (c) 2015 Simulations Plus, Inc. 19 • Cognigen • Penetration of clinical pharmacology departments to provide more detailed mechanistic modeling for clinical trial data analysis – regulatory agencies want this • Expand marketing effort for KIWI ™ • Expand marketing effort for modeling & simulation services • Piggyback onto Simulations Plus’ presence at national and international scientific meetings Simulations Plus, Inc. Additional Growth Opportunities

Copyright (c) 2015 Simulations Plus, Inc. 20 • Of 2,500 companies registered with FDA, both foreign and domestic, we have ~10% penetration with Simulations Plus products • http://www.fda.gov/Drugs/NewsEvents/ucm339912.htm • Continued enhancement of current software products to expand application space • Dermal and improved oral cavity dosing modules in GastroPlus™ • Addition of biologics (antibodies) to GastroPlus • Addition of large animals to GastroPlus • MembranePlus ™ • New software product to simulate in vitro permeability experiments released in 1Q15; Webinar held December 2, 2014 – nearly 100 attendees Simulations Plus, Inc. Additional Growth Opportunities, cont’d.

Copyright (c) 2015 Simulations Plus, Inc. 21 • AEROModeler ™ • Application of our artificial neural network ensemble (ANNE) technology to predict aerodynamic force coefficients for missiles at arbitrary Mach number and angle of attack - much faster than conventional methods ‒ Presented at our first aerospace conference in June 2014 ‒ Will be presenting at two aerospace conferences in 2015 • MRIModeler ™ • Application of our ANNE technology to analysis of magnetic resonance imaging (MRI) data to classify patients as healthy or likely to experience various disease states ‒ Presented at our first MRI conference in September 2014 Simulations Plus, Inc. Additional Growth Opportunities, cont’d.

Copyright (c) 2015 Simulations Plus, Inc. 22 • Conferences/scientific meetings continue to be primary source of leads • During FY14, we participated in 48 scientific meetings and conferences in the US, Europe, and Asia with 30 scientific posters and presentations • In 4Q14, we presented at our first aerospace conference • In 1Q15 we presented at our first MRI conference • Trainings and workshops • Conducted 21 onsite training courses at client sites in FY14 • Conducted training workshops in Germany, New Jersey, Japan, and Korea • 2015 workshops scheduled for US, Europe, and Asia Simulations Plus, Inc. Marketing and Sales Program

Copyright (c) 2015 Simulations Plus, Inc. 23 • Strategic digital marketing initiatives • Hosted 7 webinars on our new software updates and applications - over 1100 registrations • Active updates of LinkedIn, Facebook, and Twitter accounts help with outreach programs • We believe fundamental industry shift continues • Western GastroPlus User Group now has over 580 members on LinkedIn • Japan GastroPlus User Group continues to add new members • Added 75 new customers during FY14 (includes new companies, as well as new departments within existing large customers) – added 23 new customers in 1QFY15 ‒ New companies in US, Europe, India, Japan, China, and Korea ‒ New divisions at the US EPA and Chinese FDA Simulations Plus, Inc. Marketing and Sales Program

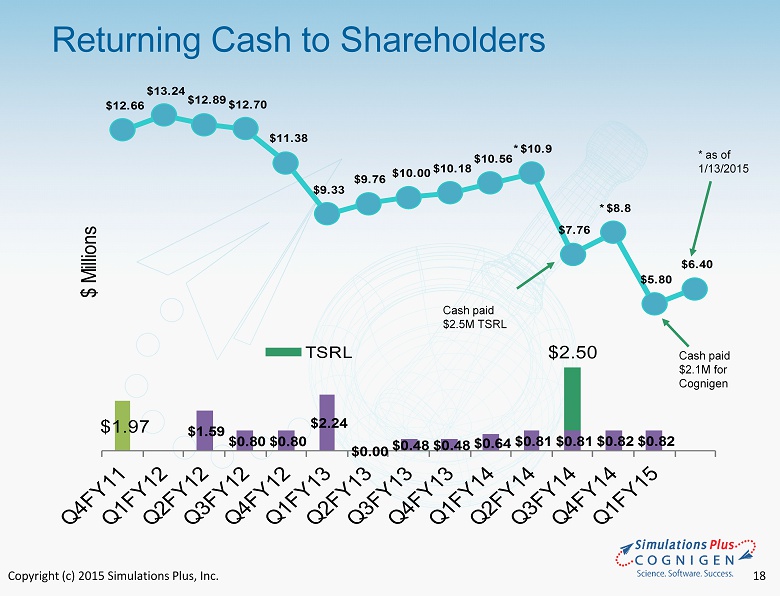

Copyright (c) 2015 Simulations Plus, Inc. 24 • For FQY15.1 - Revenues and earnings continued seven - year - plus profitable trend - Cognigen acquisition increases revenues, expands offerings into clinical pharmacology - Earnings for quarter lower due to one - time charges associated with the Cognigen acquisition • Continuing to grow - 54.7% revenue growth seen in first combined fiscal quarter - 35 new staff added with acquisition of Cognigen • Strong cash position – returning cash to shareholders - Cash dividends totaling approximately $9 million have been distributed, yet cash remains at $6.4 million as of today • Aggressive marketing and sales activities - Continue intensive conference/trade show/workshop schedule - Workshops scheduled for North America, Europe, and Asia in 2015 - Expand Cognigen marketing and sales activities Summary

Copyright (c) 2015 Simulations Plus, Inc. 25 Q&A