HARMONY GOLD MINING COMPANY LIMITED

Technical Report Summary of the

Mineral Resources and Mineral Reserves

for

Tshepong Operations

Free State Province, South Africa

| | |

Effective Date: 30 June 2022 Final Report Date: 30 July 2022 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | |

IMPORTANT NOTICE

This Technical Report Summary has been prepared for Harmony Gold Mining Company Limited in support of disclosure and filing requirements with the United States Securities and Exchange Commission’s (SEC) under Regulation S-K 1300; 229.601(b)(96). The quality of information, estimates, and conclusions contained in this Technical Report Summary apply as of the effective date of this report. Subsequent events that may have occurred since that date may have resulted in material changes to such information, estimates and conclusions in this summary. No other party is entitled to rely on this report beyond its intended use and any reliance by a third party on this report is done so at that party’s own risk.

|

| | |

Effective Date: 30 June 2022 ii |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

Signature Page

/s/ Bothepha Phetlhu

___________________________________

Ms Bothepha Phetlhu

BTech (Geology), M (Eng)

SACNASP (No. 120348)

Ore Reserve Manager

Phakisa Mine

Harmony Gold Mining Company Limited

/s/ Andrew Louw

___________________________________

Mr Andrew Louw

B.Sc. (Hons) Geohydrology, CEE Diploma

SACNASP (No. 136445)

Ore Reserve Manager

Tshepong Mine

Harmony Gold Mining Company Limited

List of Contents

| | |

Effective Date: 30 June 2022 iii |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | | | | | | | | | | | | | |

| 1 | Executive Summary | 1 |

| 2 | Introduction | 7 |

| 3 | Property Description and Location | 8 |

| 3.1 | Mineral Tenure | 8 |

| 3.2 | Property Permitting Requirements | 8 |

| 4 | Accessibility, Climate, Local Resources, Infrastructure and Physiography | 11 |

| 4.1 | Accessibility | 11 |

| 4.2 | Physiology and Climate | 11 |

| 4.3 | Local Resources and Infrastructure | 11 |

| 5 | History | 12 |

| 5.1 | Historical Ownership and Development | 12 |

| 5.2 | Historical Exploration | 13 |

| 5.3 | Previous Mineral Resource and Mineral Reserve Estimates | 13 |

| 5.4 | Past Production | 15 |

| 6 | Geological Setting, Mineralisation and Deposit | 16 |

| 6.1 | Regional Geology | 16 |

| 6.2 | Local Geology | 16 |

| 6.3 | Property Geology | 19 |

| | 6.3.1 | Basal Reef Lithology | 19 |

| | 6.3.2 | B Reef Lithology | 19 |

| | 6.3.3 | Structure | 22 |

| 6.4 | Mineralisation | 23 |

| | 6.4.1 | Basal Reef | 23 |

| | 6.4.2 | B Reef | 23 |

| | 6.4.3 | Alteration | 23 |

| 6.5 | Deposit Type | 23 |

| 6.6 | Commentary on Geological Setting, Mineralisation and Deposit | 24 |

| 7 | Exploration | 25 |

| 7.1 | Geophysical Surveys | 25 |

| 7.2 | Topographic Surveys | 25 |

| 7.3 | Underground Mapping | 25 |

| 7.4 | Channel Sampling Methods and Sample Quality | 25 |

| 7.5 | Surface Drilling Campaigns, Procedures, Sampling, Recoveries and Results | 26 |

| | 7.5.1 | Drilling Methods | 28 |

| | 7.5.2 | Collar and Downhole Surveys | 28 |

| | 7.5.3 | Logging Procedures | 28 |

| | 7.5.4 | Drilling Results | 28 |

| | 7.5.5 | Core Recovery | 31 |

| | 7.5.6 | Sample Length and True Thickness | 31 |

| 7.6 | Underground Drilling Campaigns, Procedures and Sampling | 32 |

| | 7.6.1 | Drilling Methods | 32 |

| | 7.6.2 | Collar and Downhole Surveys | 32 |

| | 7.6.3 | Logging Procedures | 32 |

| | 7.6.4 | Drilling Results | 33 |

| | 7.6.5 | Core Recovery | 33 |

| | 7.6.6 | Sample Length and True Thickness | 33 |

| | |

Effective Date: 30 June 2022 iv |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | | | | | | | | | | | | | |

| 7.7 | Hydrogeology | 33 |

| 7.8 | Geotechnical Data | 33 |

| 7.9 | Commentary on Exploration | 37 |

| 8 | Sample Preparation, Analyses and Security | 38 |

| 8.1 | Sampling Method and Approach | 38 |

| | 8.1.1 | Channel Samples | 38 |

| | 8.1.2 | Core Samples | 38 |

| 8.2 | Density Determination | 39 |

| 8.3 | Sample Security | 39 |

| 8.4 | Sample Storage | 39 |

| 8.5 | Laboratories Used | 39 |

| 8.6 | Laboratory Sample Preparation | 39 |

| 8.7 | Assaying Methods and Analytical Procedures | 40 |

| 8.8 | Sampling and Assay Quality Control (“QC”) Procedures and Quality Assurance (“QA”) | 40 |

| | 8.8.1 | Standards | 40 |

| | 8.8.2 | Blanks | 41 |

| | 8.8.3 | Duplicates | 41 |

| 8.9 | Comment on Sample Preparation, Analyses and Security | 41 |

| 9 | Data verification | 42 |

| 9.1 | Databases | 42 |

| 9.2 | Data Verification Procedures | 42 |

| 9.3 | Limitations to the Data Verification | 42 |

| 9.4 | Comment on Data Verification | 42 |

| 10 | Mineral Processing and Metallurgical Testing | 43 |

| 10.1 | Extent of Processing, Testing and Analytical Procedures | 43 |

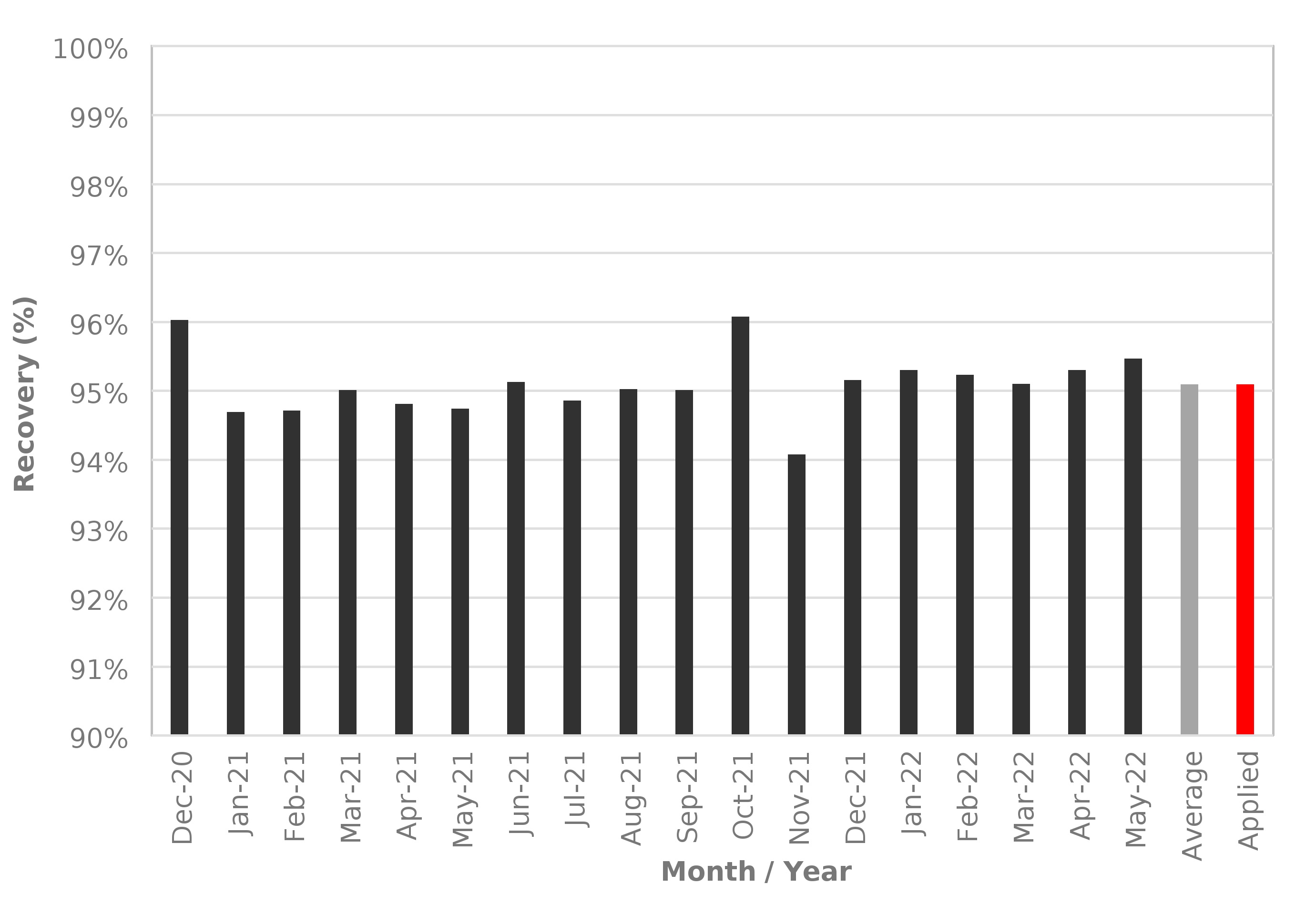

| 10.2 | Test Results and Recovery Estimates | 43 |

| 10.3 | Degree of Representation of Mineral Deposit | 43 |

| 10.4 | Commentary of Mineral Processing and Metallurgical Testing | 43 |

| 11 | Mineral Resource Estimate | 45 |

| 11.1 | Geological Database | 45 |

| 11.2 | Global Statistics | 45 |

| 11.3 | Geological Interpretation | 46 |

| 11.4 | Structural Wireframe Model | 46 |

| 11.5 | Compositing | 46 |

| 11.6 | Capping | 47 |

| 11.7 | Variography | 47 |

| 11.8 | Mineral Resource Estimation Methods and Parameters | 49 |

| 11.9 | Density Assignment | 51 |

| 11.1 | Model Validation | 51 |

| 11.11 | Mineral Resource Evaluation | 51 |

| 11.12 | Mineral Resource Classification and Uncertainties | 51 |

| 11.13 | Mineral Resource Estimate | 52 |

| 11.14 | Mineral Resource Reconciliation | 56 |

| 11.15 | Comment on Mineral Resource Estimates | 56 |

| 12 | Mineral Reserve Estimate | 57 |

| 12.1 | Phakisa | 57 |

| | |

Effective Date: 30 June 2022 v |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | | | | | | | | | | | | | |

| | 12.1.1 | Key Assumptions, Parameters, and Methods Used to Estimate the Mineral Reserve | 57 |

| | 12.1.2 | Modifying Factors | 58 |

| | 12.1.3 | Mineral Reserve Estimate | 58 |

| | 12.1.4 | Mineral Reserve Reconciliation | 59 |

| 12.2 | Tshepong | 59 |

| | 12.2.1 | Key Assumptions, Parameters, and Methods Used to Estimate the Mineral Reserve | 59 |

| | 12.2.2 | Modifying Factors | 60 |

| | 12.2.3 | Mineral Reserve Estimate | 60 |

| | 12.2.4 | Mineral Reserve Reconciliation | 61 |

| 12.3 | Commentary on Mineral Reserve Estimate | 61 |

| 13 | Mining Method | 62 |

| 13.1 | Mining Operations | 62 |

| | 13.1.1 | Phakisa | 62 |

| | 13.1.2 | Tshepong | 62 |

| | 13.1.3 | Sequential Grid Mining (“SGM”) | 63 |

| | 13.1.4 | Open Stoping | 63 |

| | 13.1.5 | Breast Mining | 63 |

| | 13.1.6 | Integrated Approach | 63 |

| 13.2 | Mine Design | 64 |

| | 13.2.1 | Mine Design Parameters | 66 |

| 13.3 | Geotechnical Considerations and Seismic Monitoring | 67 |

| 13.4 | Geohydrological Considerations | 68 |

| 13.5 | Mine Plan Development and Life of Mine (“LOM”) Schedule | 68 |

| 13.6 | Mining Rates | 72 |

| 13.7 | Grade and Dilution Control | 72 |

| 13.8 | Mining Equipment and Machinery | 72 |

| 13.9 | Ore transport | 73 |

| 13.10 | Mining Personnel | 73 |

| 13.11 | Commentary on Mining Methods | 75 |

| 14 | Processing and Recovery Methods | 76 |

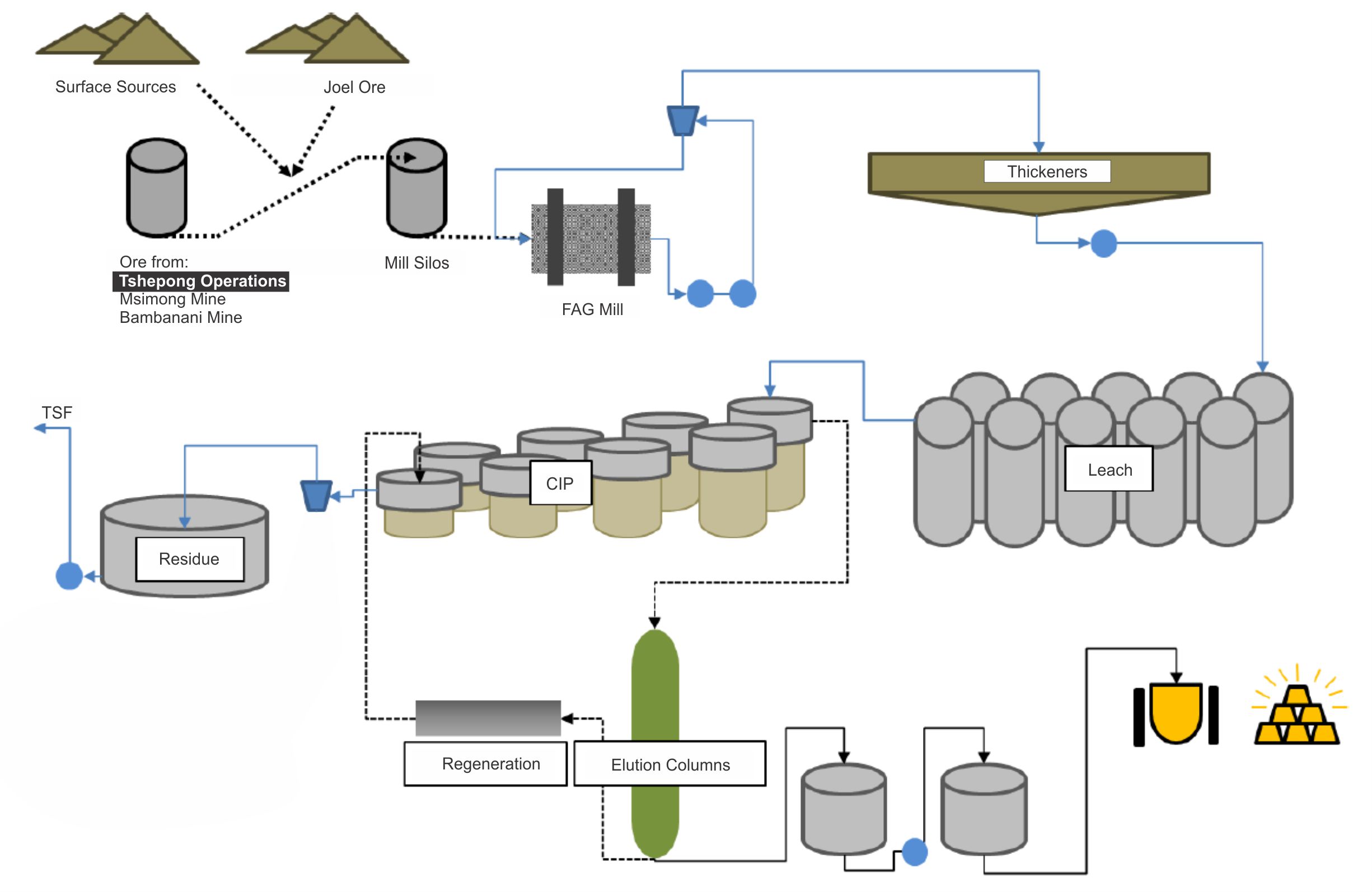

| 14.1 | Mineral Processing Description | 76 |

| 14.2 | Plant Throughput, Design, Equipment Characteristics and Specifications | 78 |

| 14.3 | Energy, Water, Process Material and Personnel Requirements | 78 |

| | 14.3.1 | Energy | 78 |

| | 14.3.2 | Water | 78 |

| | 14.3.3 | Process Material | 78 |

| | 14.3.4 | Personnel | 78 |

| 14.4 | Commentary on the Processing and Recovery Methods | 78 |

| 15 | Infrastructure | 80 |

| 15.1 | Surface Infrastructure | 80 |

| | 15.1.1 | Ore and Waste Rock Storage Facilities | 80 |

| | 15.1.2 | Tailings Storage Facilities | 80 |

| | 15.1.3 | Rail | 80 |

| 15.2 | Underground Infrastructure and Shafts | 86 |

| | |

Effective Date: 30 June 2022 vi |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | | | | | | | | | | | | | |

| | 15.2.1 | RailVeyorTM | 86 |

| 15.3 | Power and Electrical | 86 |

| 15.4 | Water Usage | 86 |

| 15.5 | Logistics and Supply | 87 |

| 15.6 | Commentary on Infrastructure | 87 |

| 16 | Market Studies | 88 |

| 16.1 | Market Overview | 88 |

| 16.2 | Global Production and Supply | 88 |

| | 16.2.1 | New Mine Production | 88 |

| | 16.2.2 | Recycling | 88 |

| 16.3 | Global Consumption and Demand | 88 |

| | 16.3.1 | Jewellery | 88 |

| | 16.3.2 | Investment | 89 |

| | 16.3.3 | Currency | 89 |

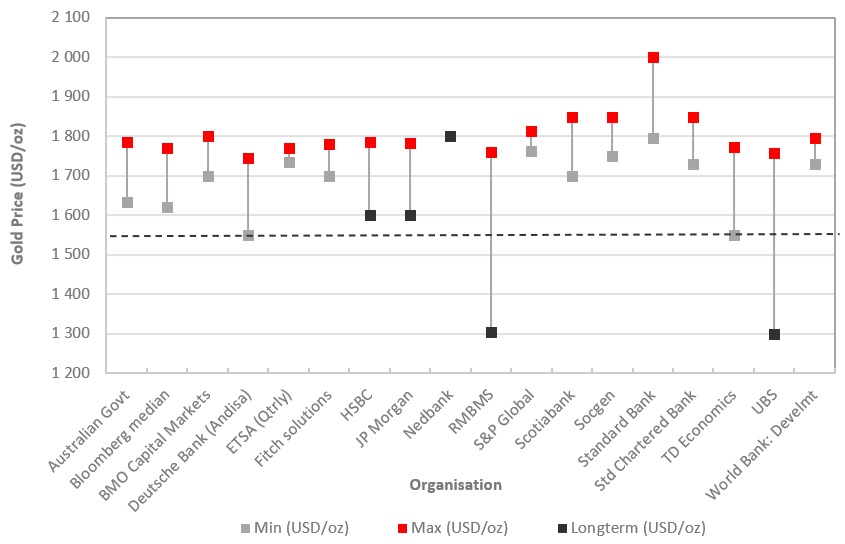

| 16.4 | Gold Price | 89 |

| | 16.4.1 | Historical Gold Price | 89 |

| | 16.4.2 | Forecast Gold Price | 89 |

| | 16.4.3 | Harmony Group Gold Hedging Policy | 89 |

| 16.5 | Commentary on Market Studies | 91 |

| 16.6 | Material Contracts | 91 |

| 17 | Environmental Studies, Permitting and Plans, Negotiations, or Agreements with Local Individuals or Groups | 92 |

| 17.1 | Results of Environmental Studies | 92 |

| 17.2 | Waste and Tailings Disposal, Monitoring & Water Management | 92 |

| 17.3 | Permitting and Licences | 93 |

| 17.4 | Local Stakeholder Plans and Agreements | 94 |

| 17.5 | Mine Closure Plans | 94 |

| 17.6 | Status of Issues Related to Environmental Compliance, Permitting, and Local Individuals or Groups | 95 |

| 17.7 | Local Procurement and Hiring | 95 |

| 17.8 | Commentary on Environmental Studies, Permitting and Plans, Negotiations, or Agreements with Local Individuals or Groups | 95 |

| 18 | Capital and Operating Costs | 96 |

| 18.1 | Capital Costs | 96 |

| 18.2 | Operating Costs | 96 |

| 18.3 | Comment on Capital and Operating Costs | 96 |

| 19 | Economic Analysis | 97 |

| 19.1 | Key Economic Assumptions and Parameters | 97 |

| | 19.1.1 | Gold Price | 97 |

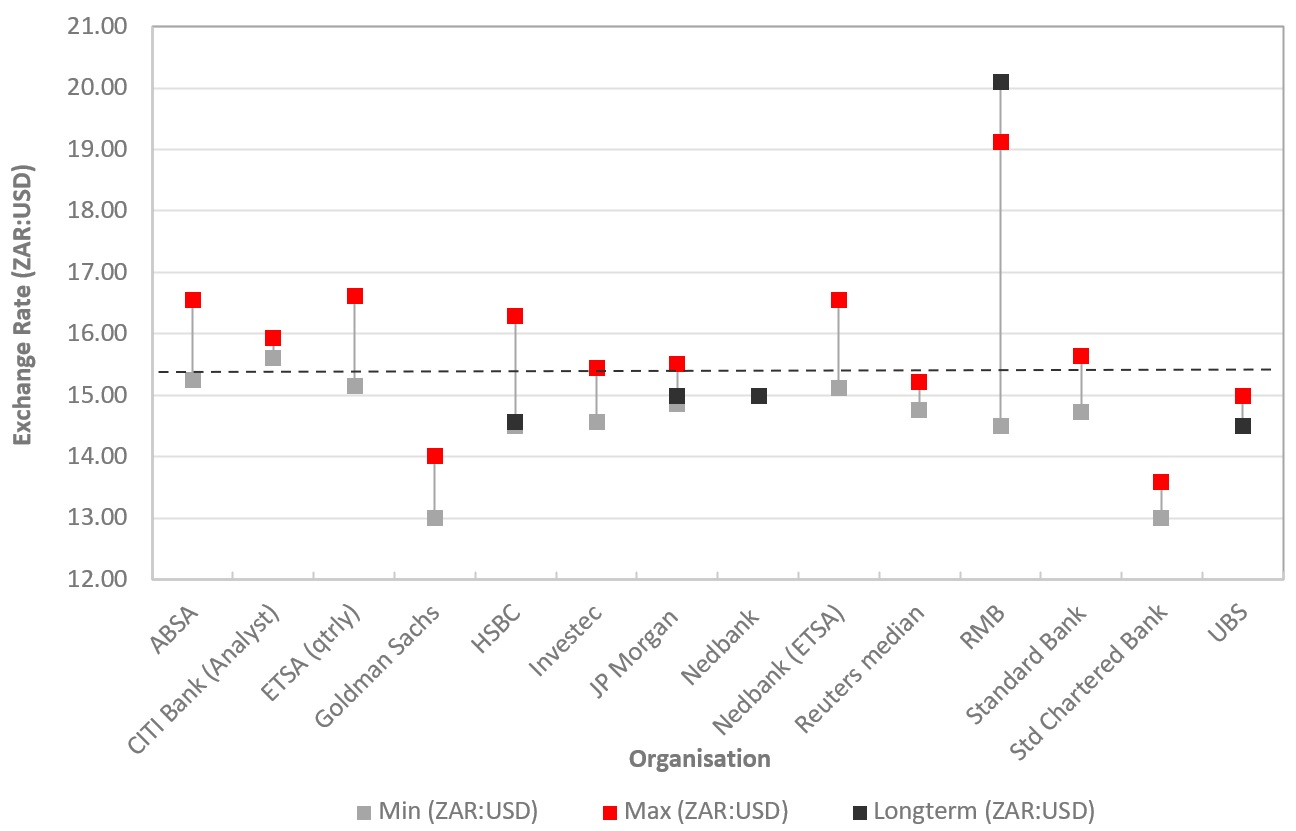

| | 19.1.2 | Exchange Rate | 97 |

| | 19.1.3 | Royalties | 97 |

| | 19.1.4 | Taxes | 98 |

| | 19.1.5 | Summary | 98 |

| 19.2 | Economic Analysis | 99 |

| 19.3 | Sensitivity Analysis | 99 |

| 20 | Adjacent properties | 102 |

| | |

Effective Date: 30 June 2022 vii |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | | | | | | | | | | | | | |

| 21 | Other Relevant Data and Information | 103 |

| 22 | Interpretation and Conclusions | 104 |

| 23 | Recommendations | 106 |

| 24 | References | 107 |

| 25 | Reliance on Information Provided by the Registrant | 108 |

| | |

Effective Date: 30 June 2022 viii |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

List of Figures

| | | | | |

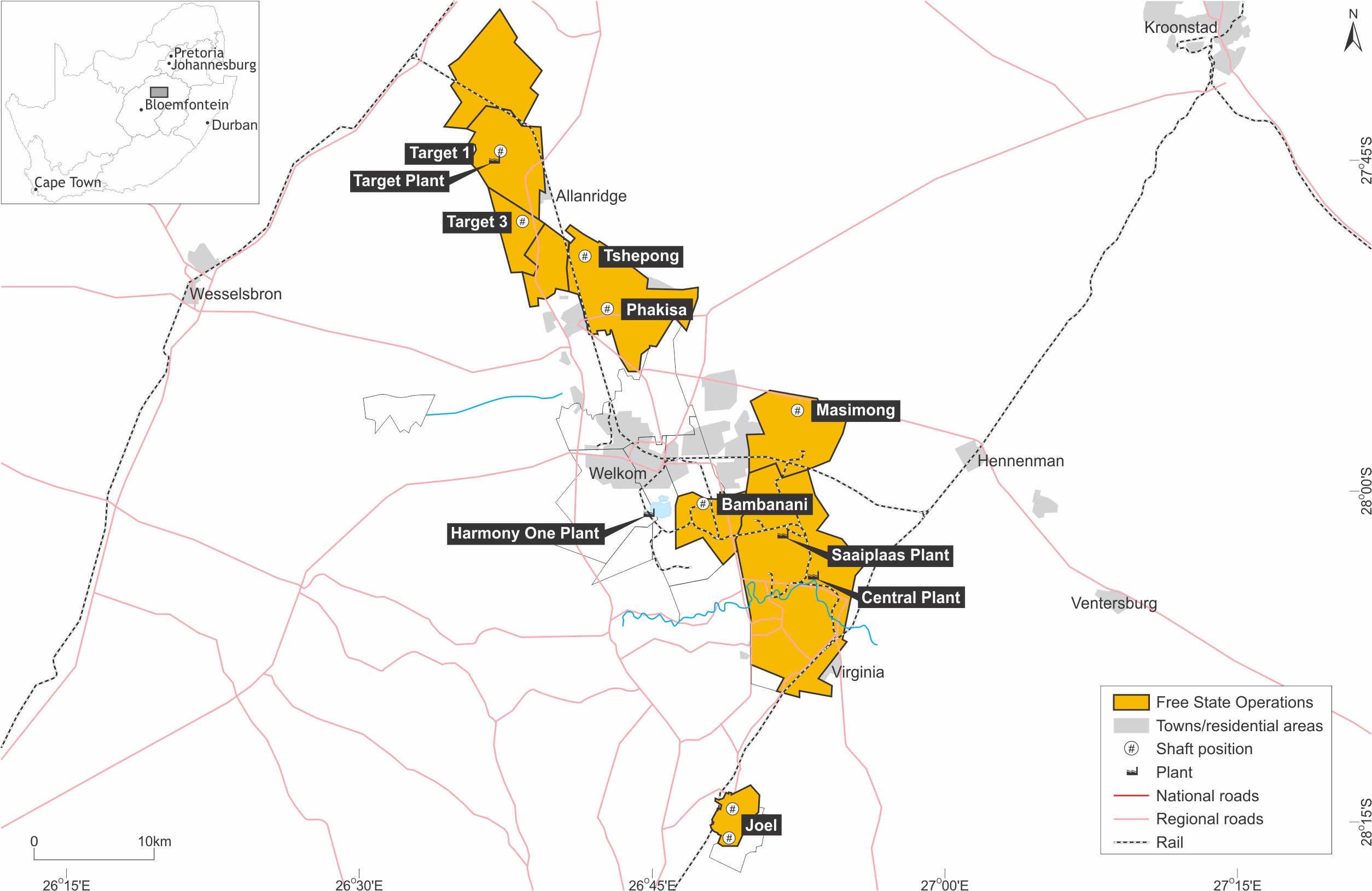

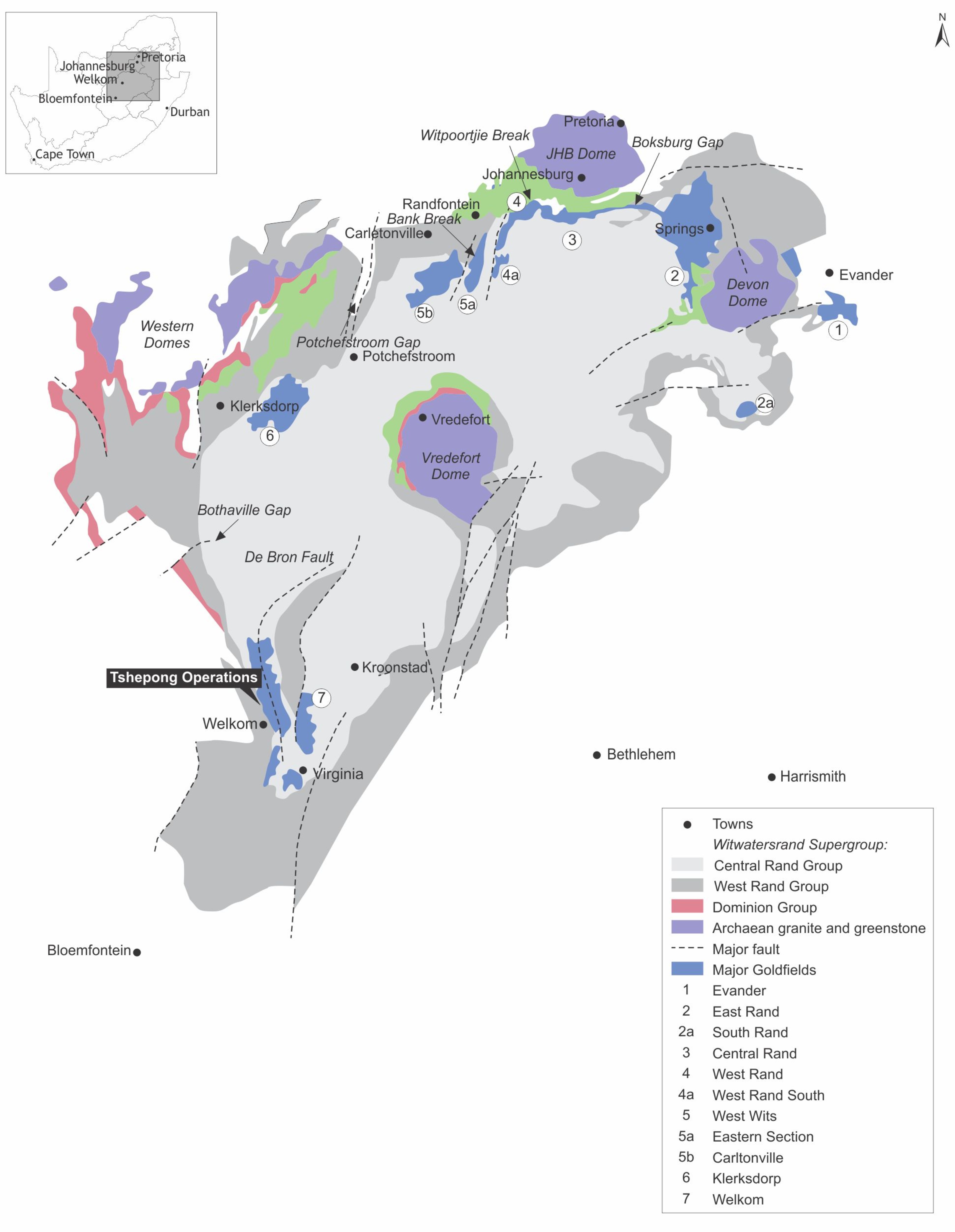

| Figure 3-1: Location of Tshepong Operations in the Free State Goldfield | 9 |

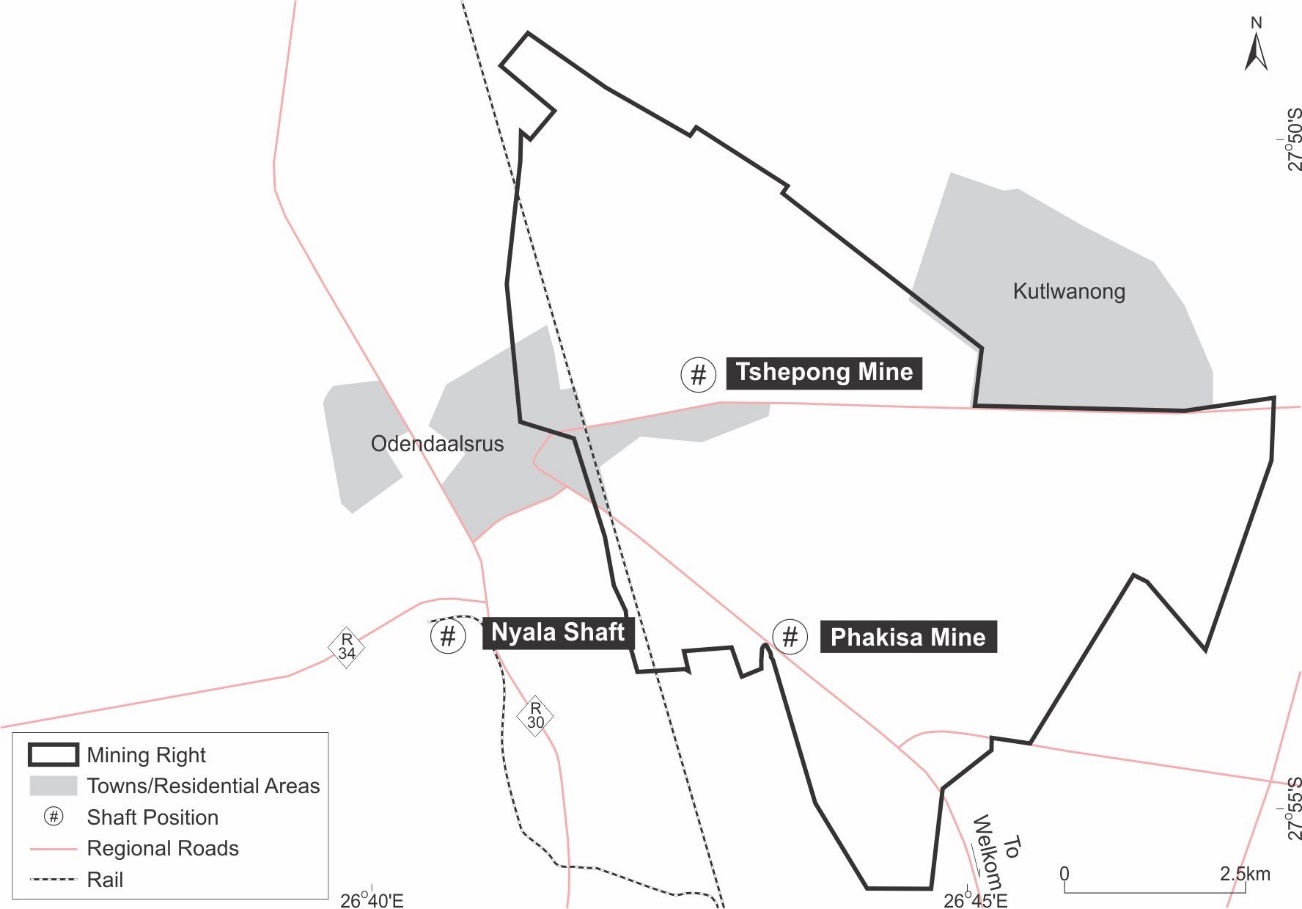

| Figure 3-2: Mineral Tenure for Tshepong Operations | 10 |

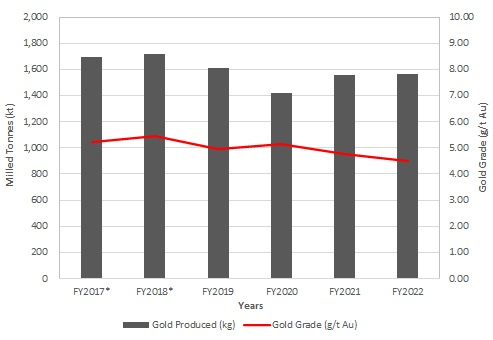

| Figure 5-1: Graph of Past Production – Tonnes and Grade | 15 |

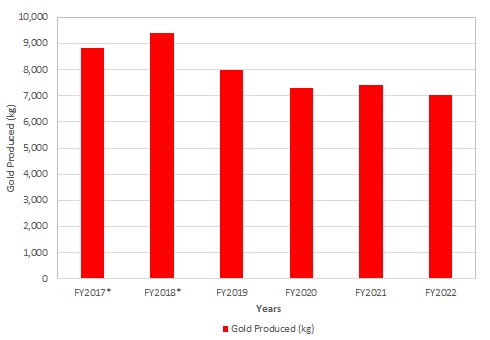

| Figure 5-2: Graph of Past Metal Production | 15 |

| Figure 6-1: Regional Geology of the Witwatersrand Basin | 17 |

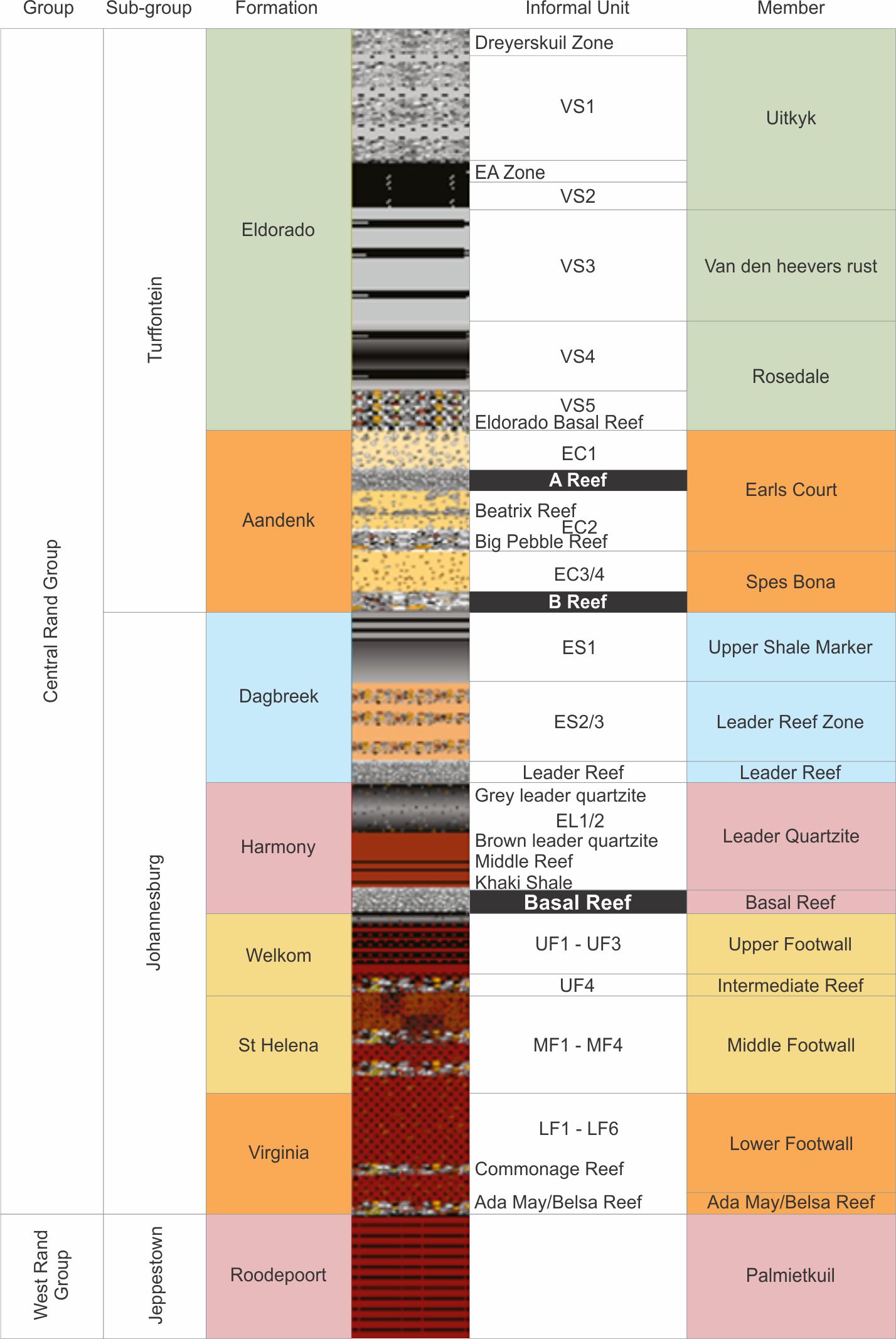

| Figure 6-2: Simplified stratigraphy of the Free State Goldfield | 18 |

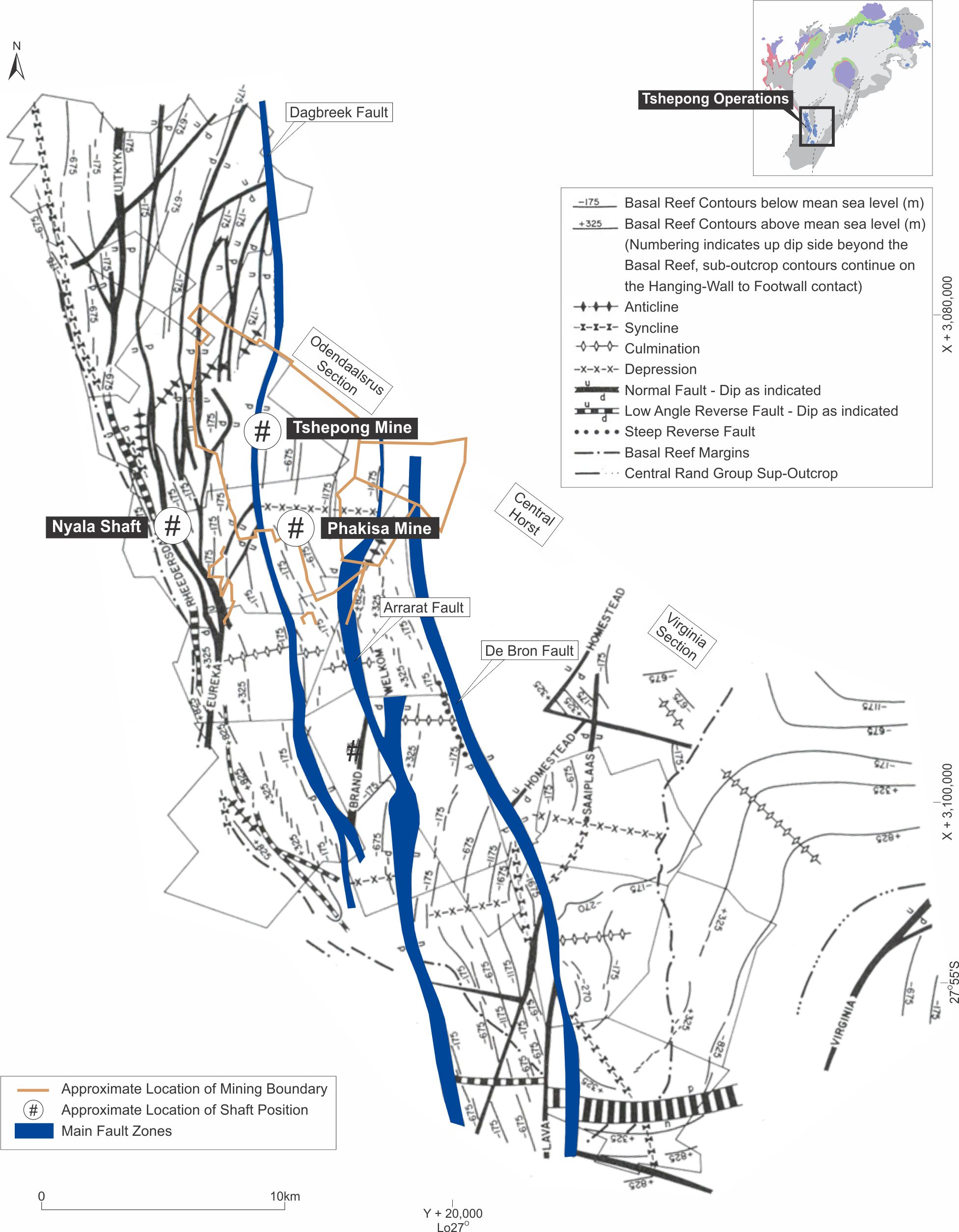

| Figure 6-3: Structural Geology of the Free State Goldfields | 20 |

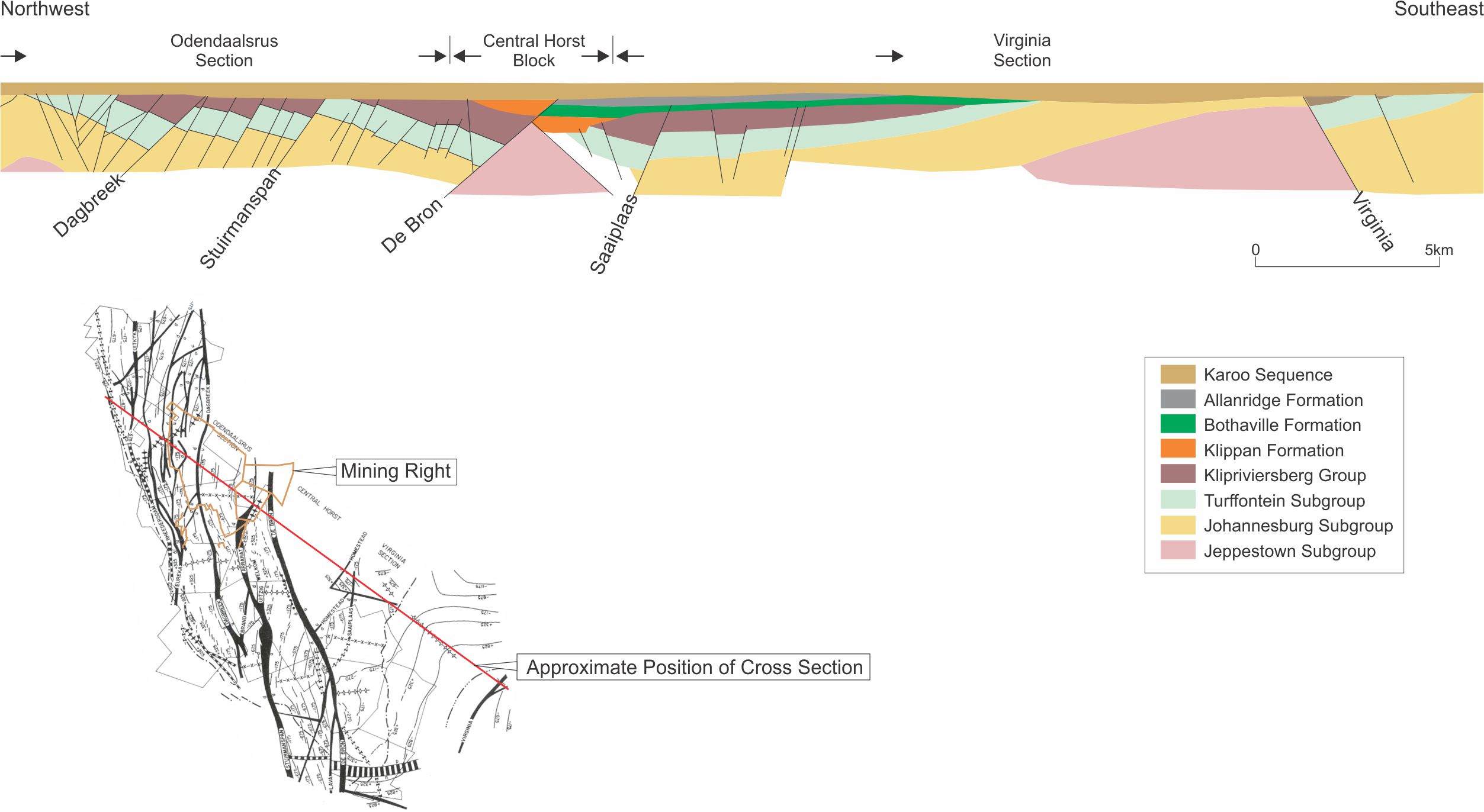

| Figure 6-4: Tshepong Operations Cross Section | 21 |

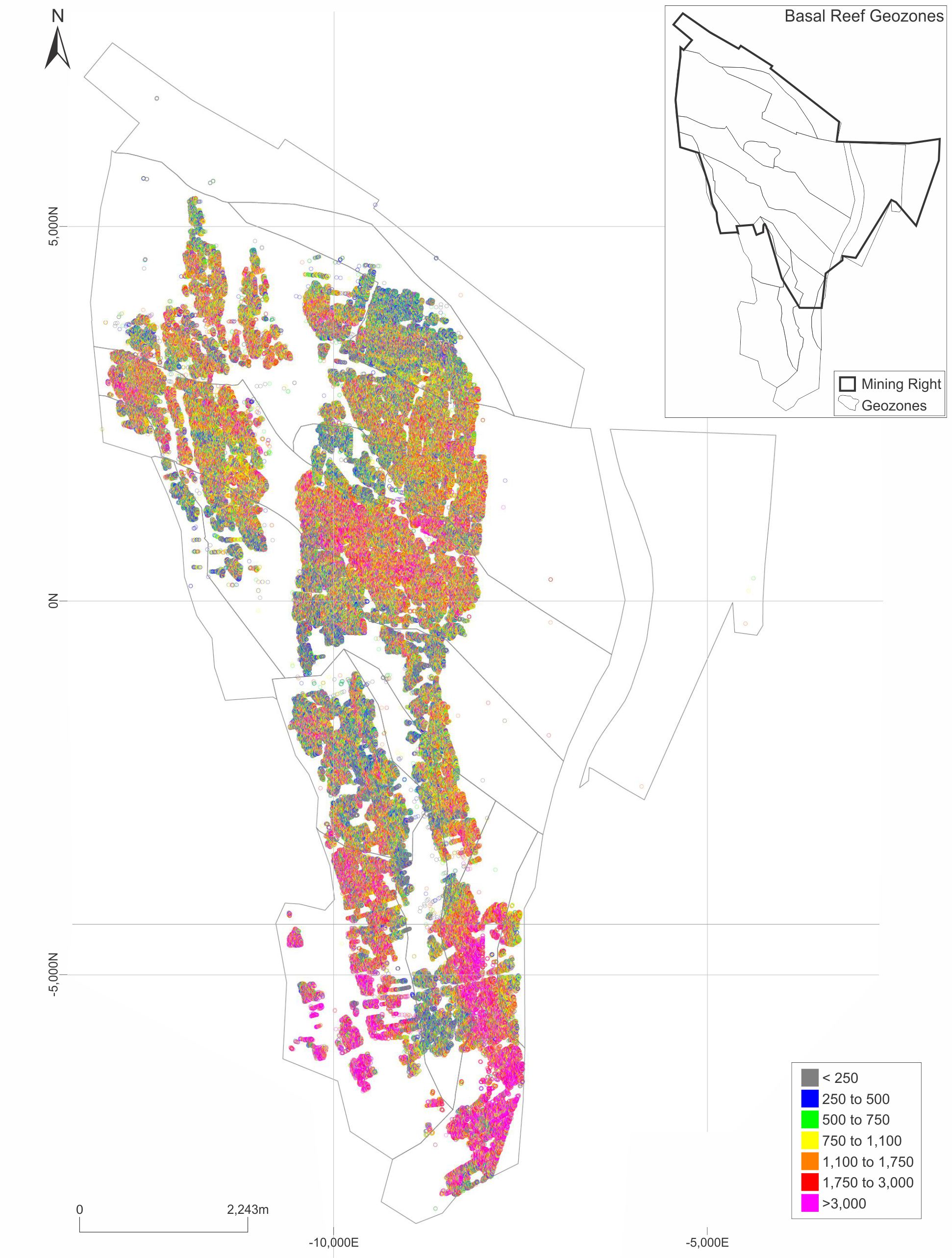

| Figure 7-1: Location of Channel Samples Collected from the Basal Reef | 26 |

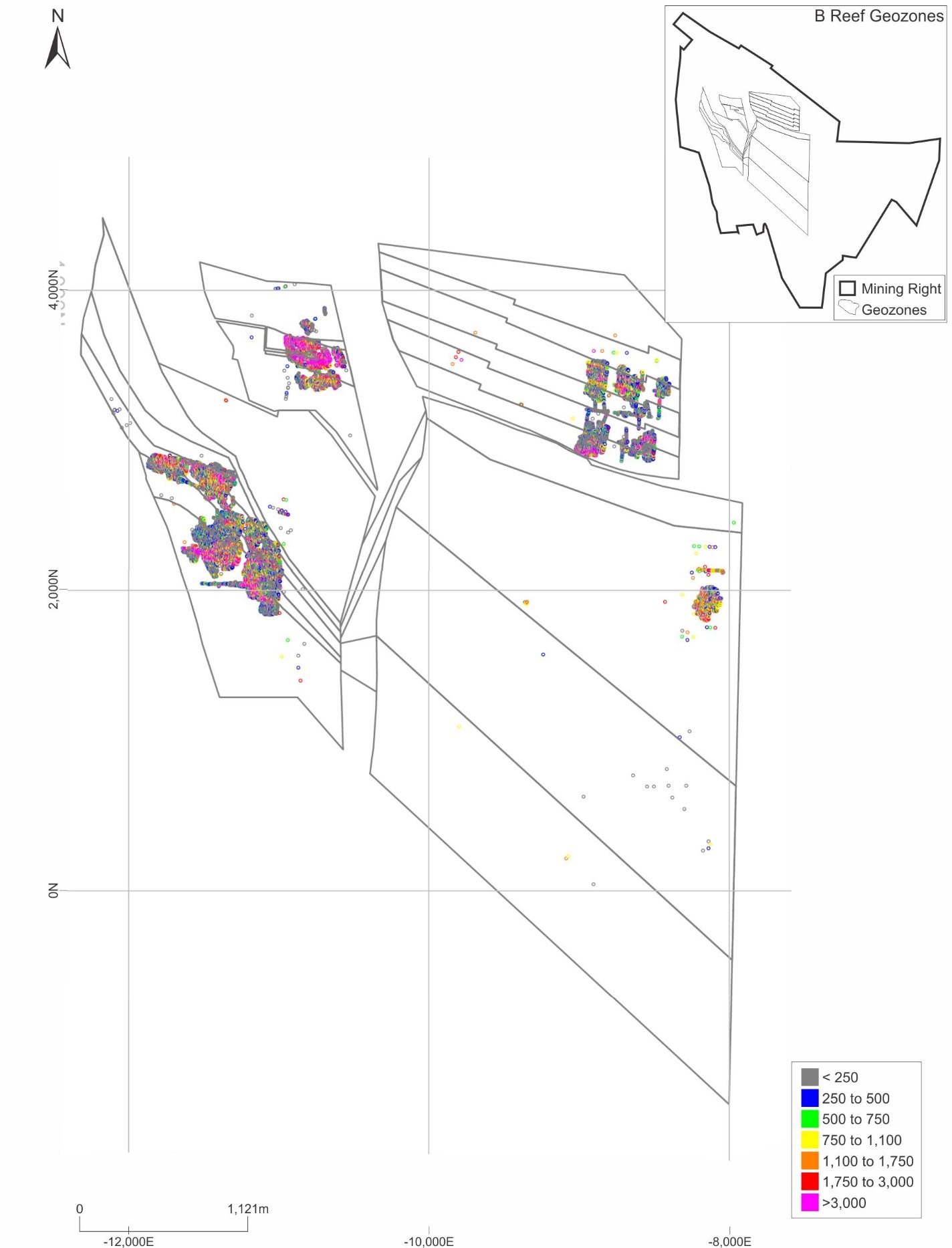

| Figure 7-2: Location of Channel Samples Collected from the B Reef | 27 |

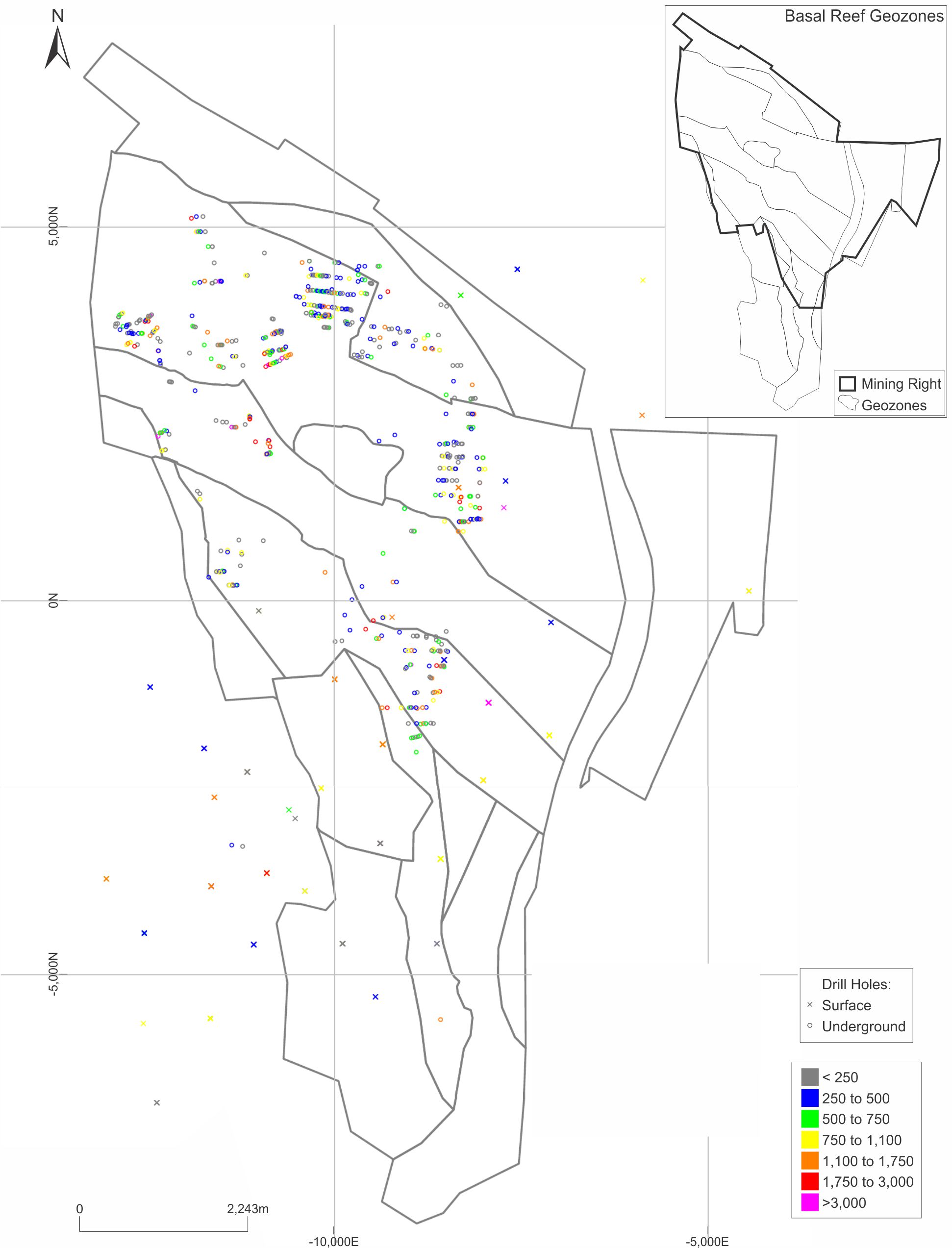

| Figure 7-3: Location of Surface and Underground Drill Holes on the Basal Reef | 29 |

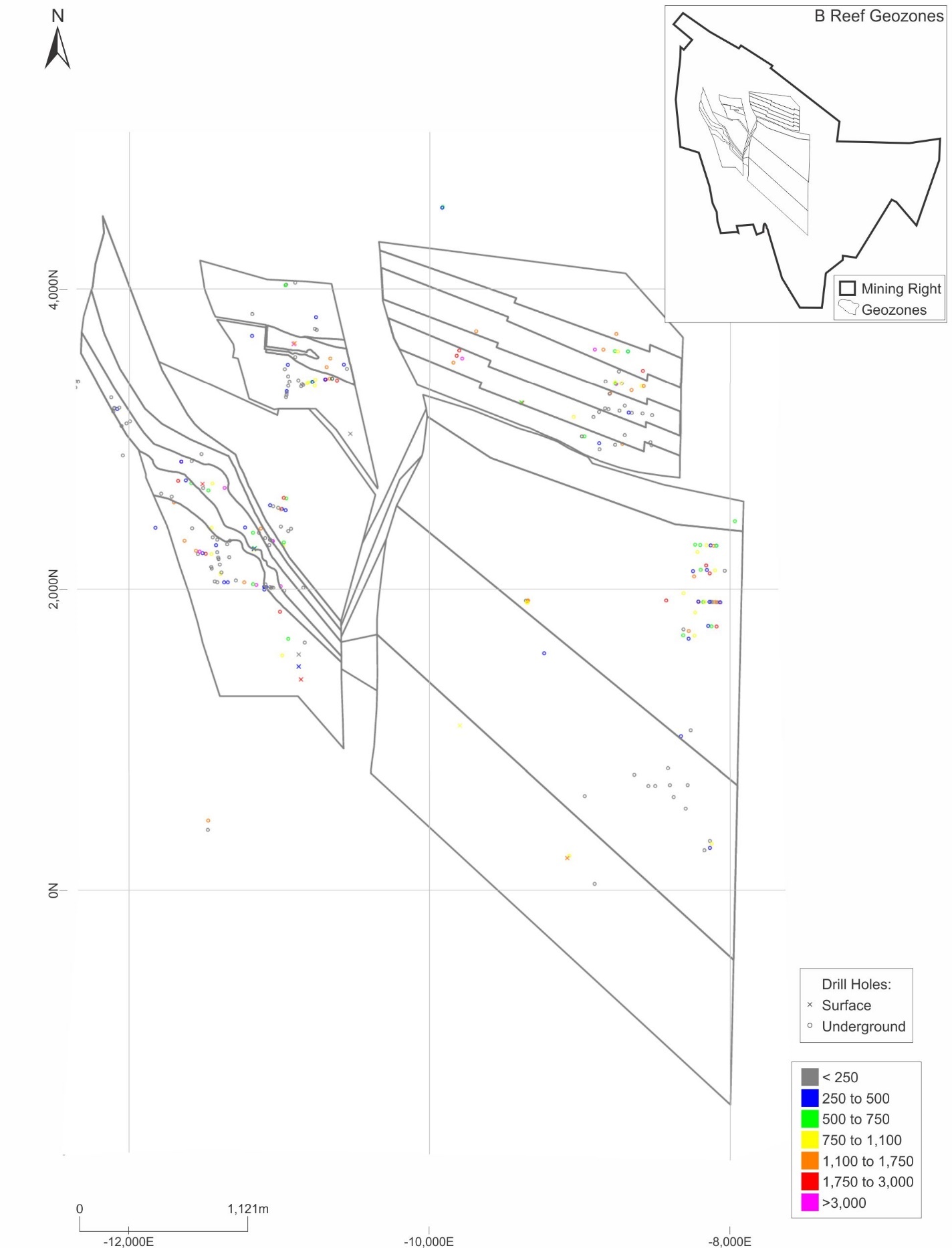

| Figure 7-4: Location of Surface and Underground Drill Holes on the B Reef | 30 |

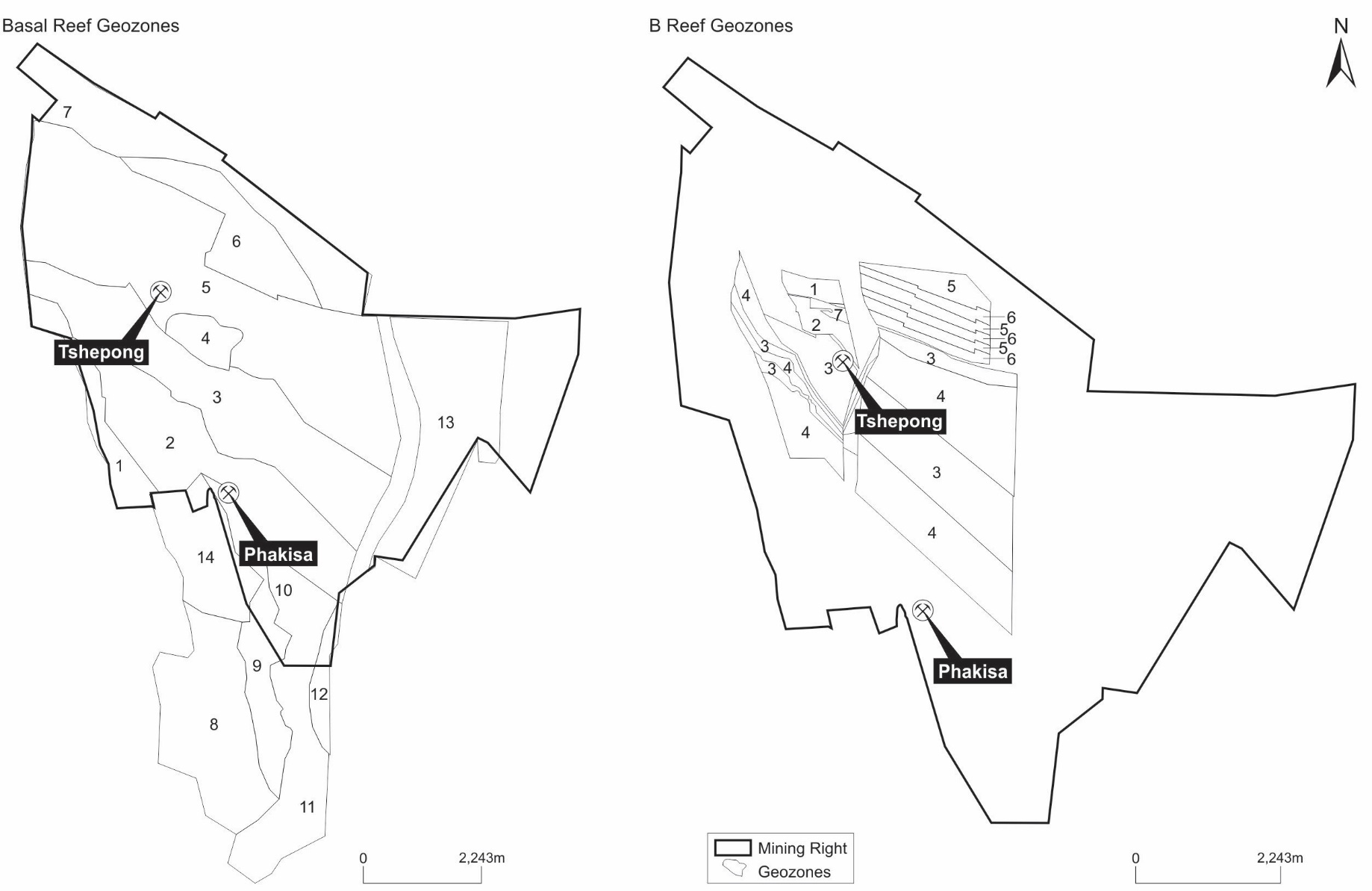

| Figure 11-1: Tshepong Operations Basal and B Reef Geozones | 48 |

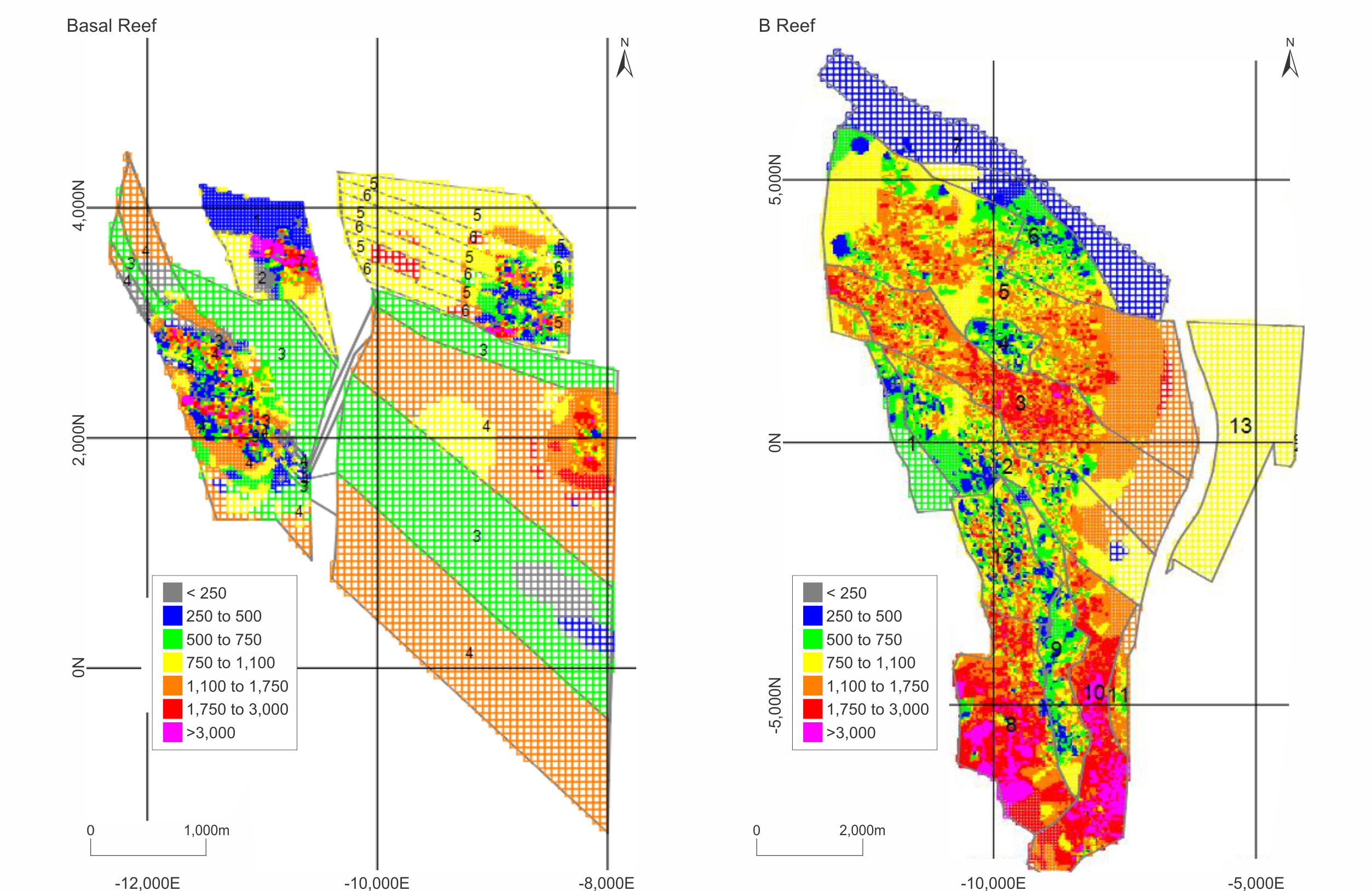

| Figure 11-2: Tshepong Operations Basal Reef and B Reef Estimation Results | 50 |

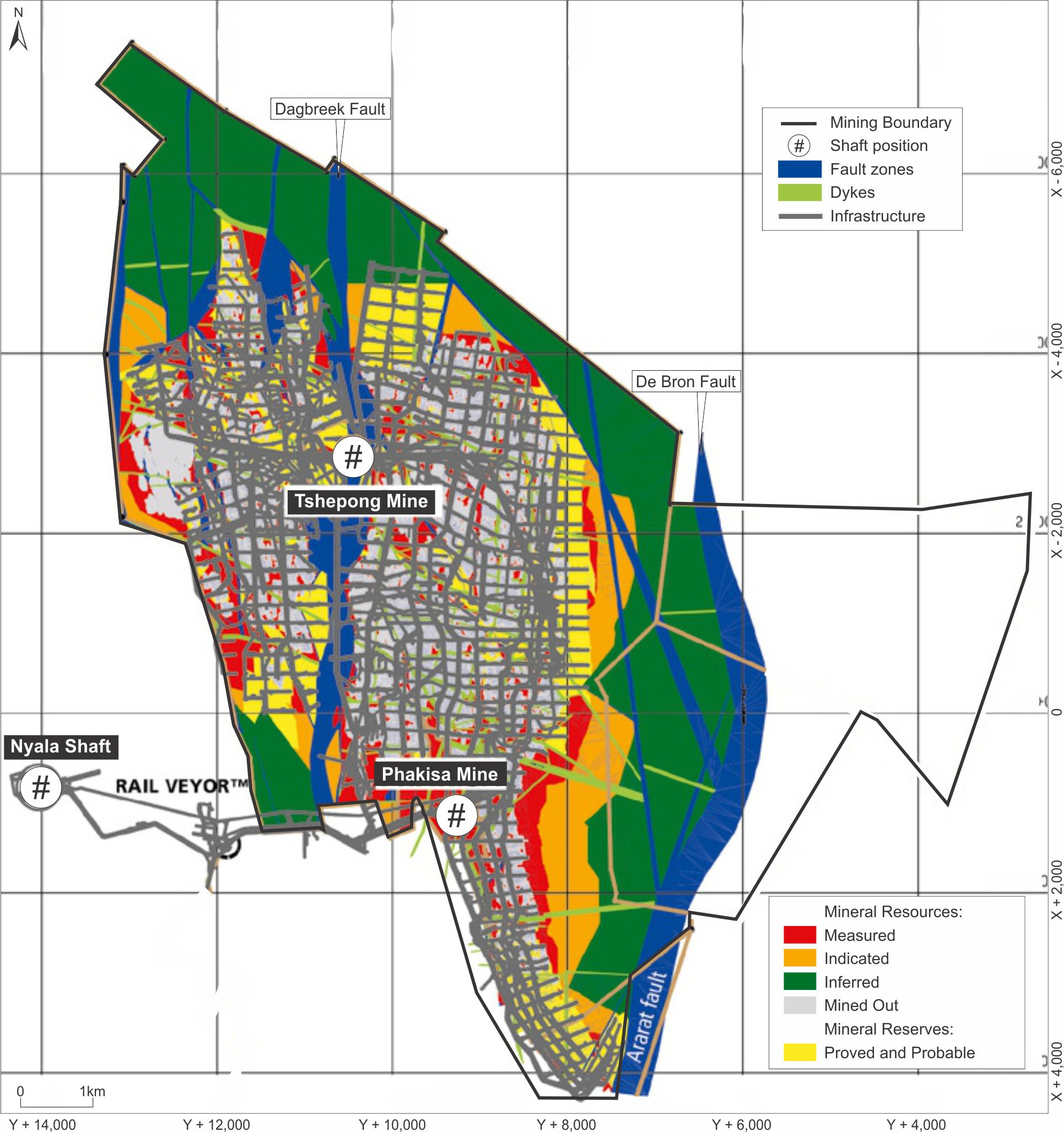

| Figure 11-3: Location and Classification of Tshepong Operations Mineral Resources and Mineral Reserves for the Basal Reef | 53 |

| Figure 11-4: Location and Classification of Tshepong Operations Mineral Resources and Mineral Reserves for the B Reef | 54 |

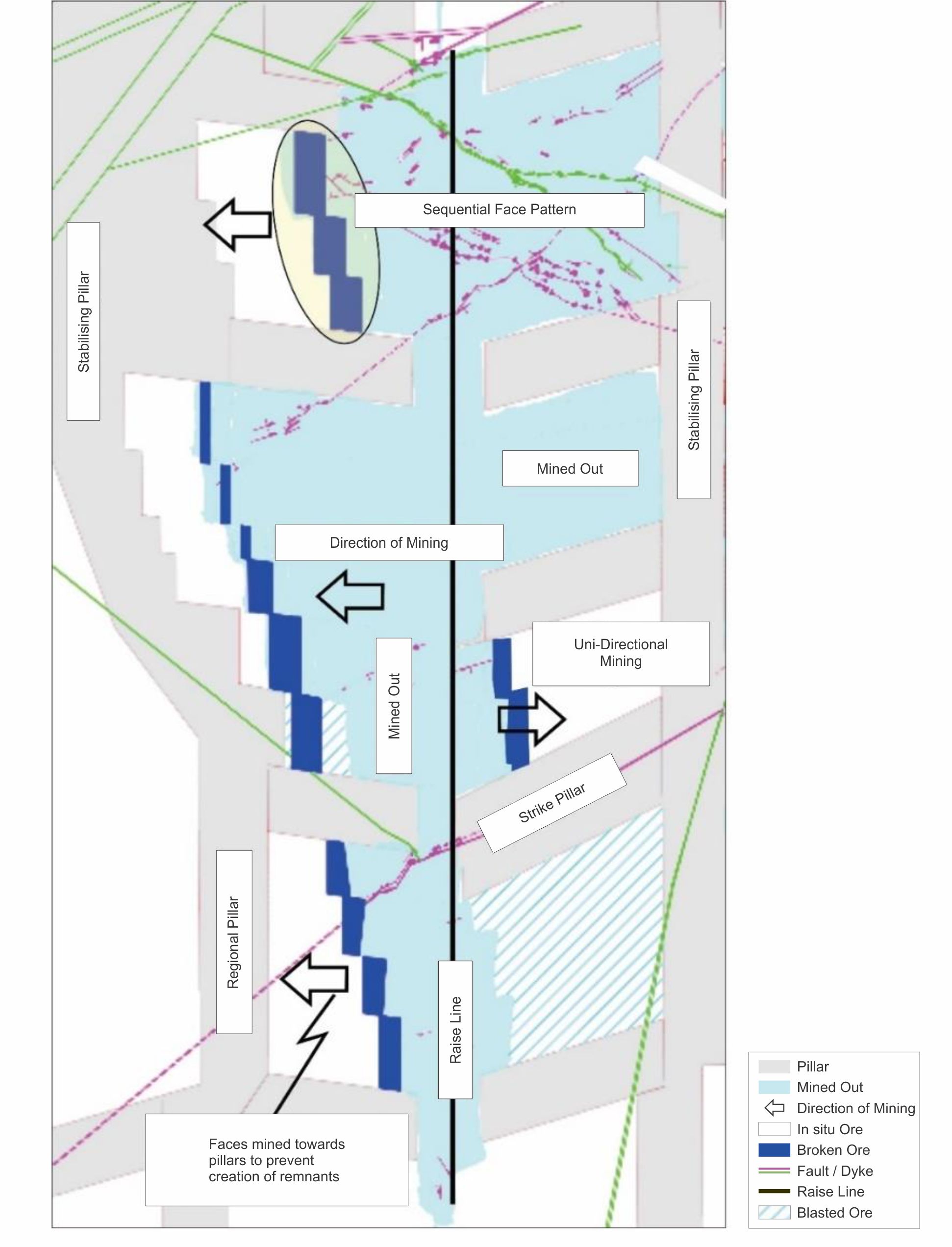

| Figure 13-1: Schematic Representation of the SGM Sequence | 65 |

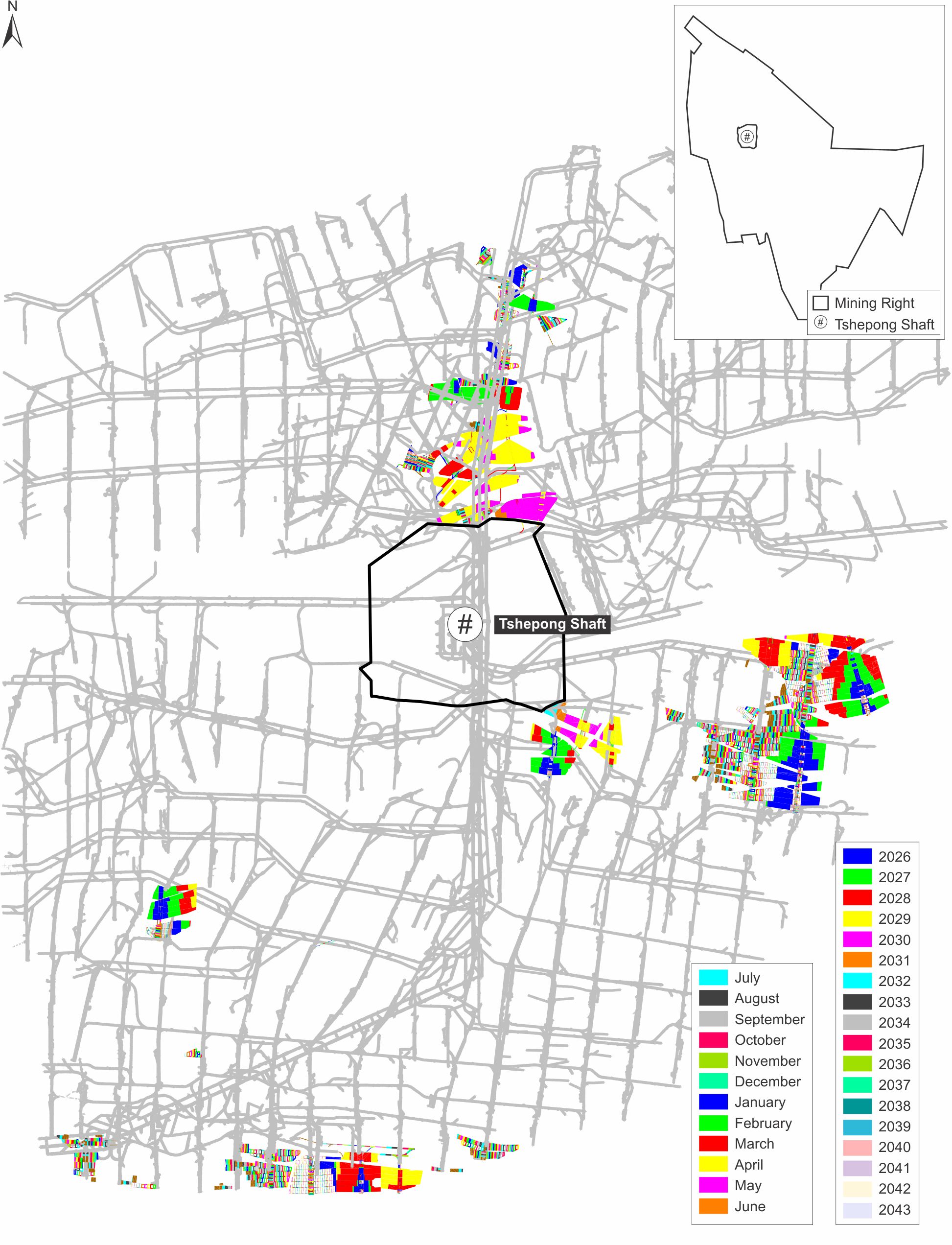

| Figure 13-2: Tshepong Operations LOM Plan | 69 |

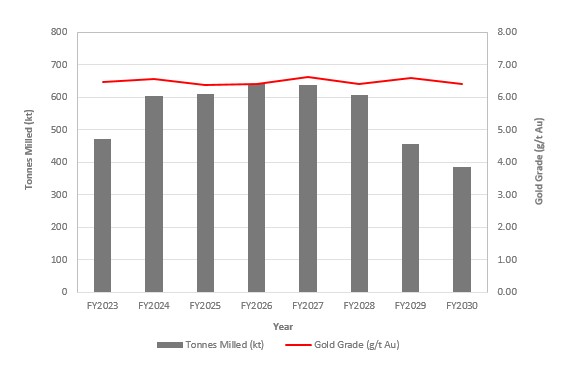

| Figure 13-3: Graph of Phakisa Mine LOM Plan – Tonnes and Grade | 70 |

| Figure 13-4: Graph of Phakisa Mine LOM Plan – Gold Produced (oz) | 70 |

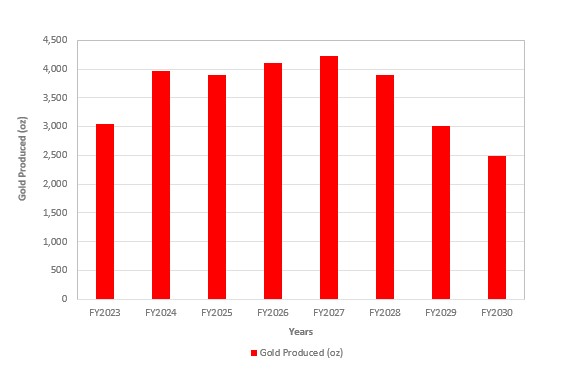

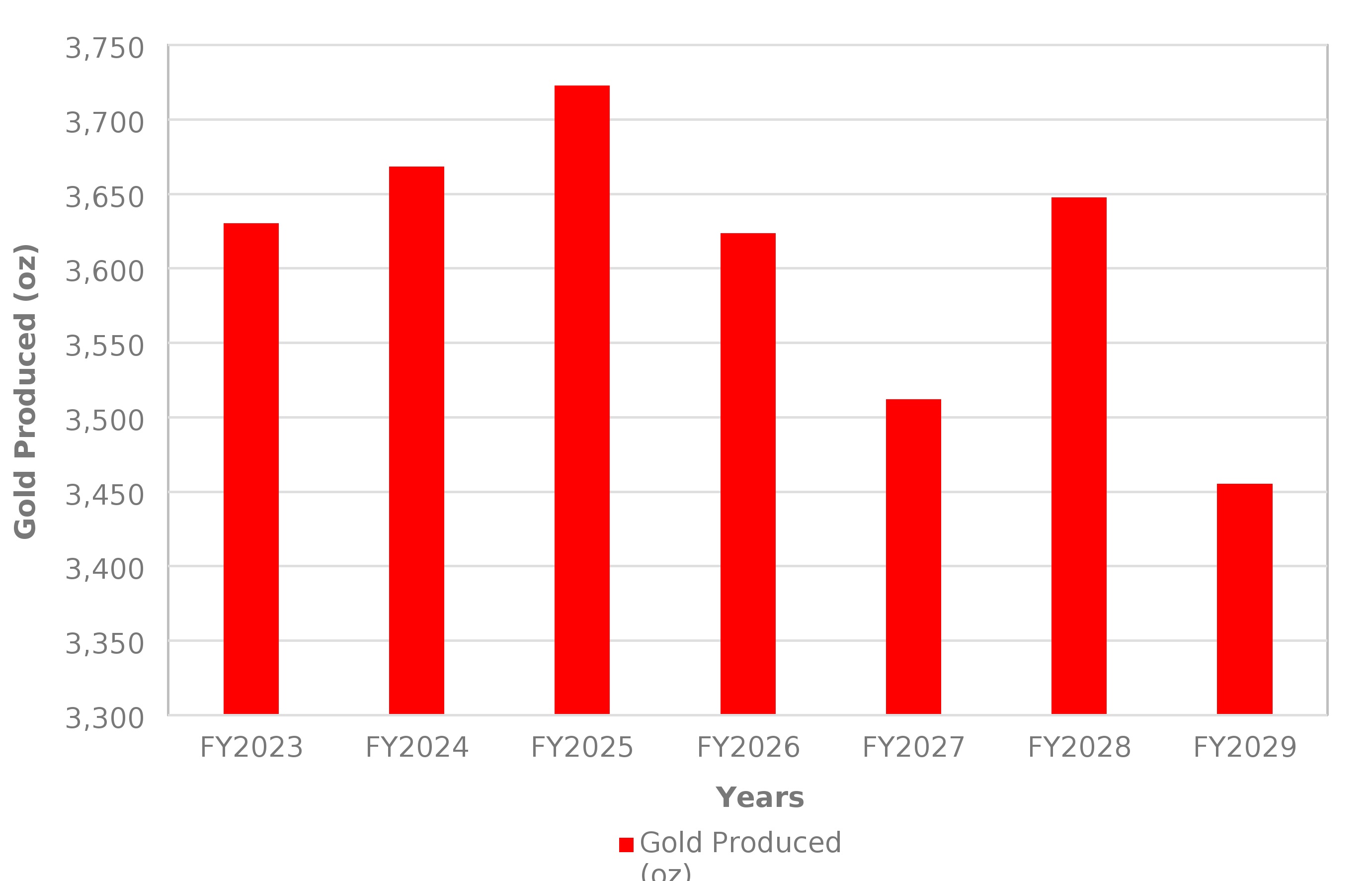

| Figure 13-5: Graph of Tshepong Mine LOM Plan – Tonnes and Grade | 71 |

| Figure 13-6: Graph of Tshepong Mine LOM Plan – Gold Produced (oz) | 71 |

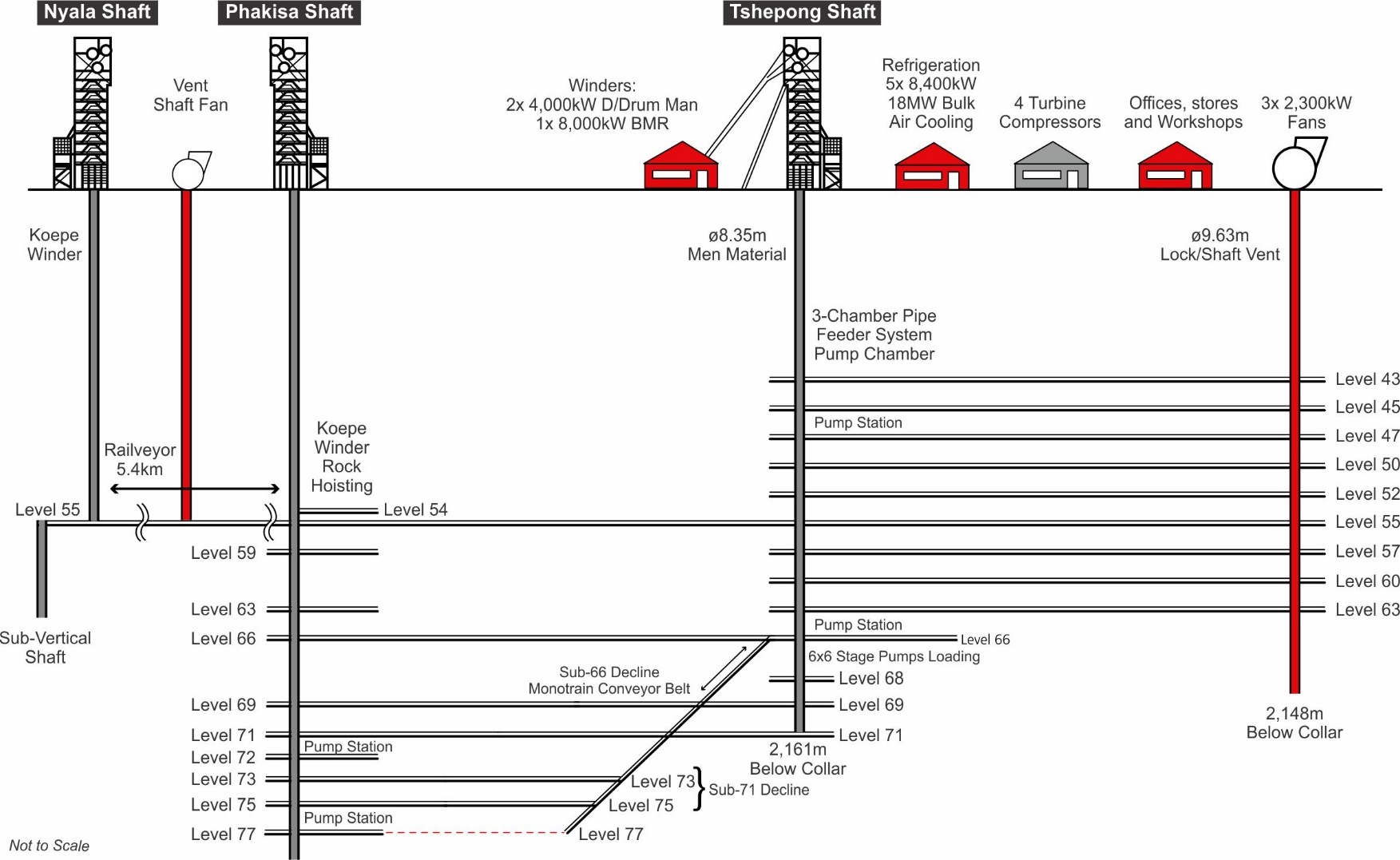

| Figure 13-7: Tshepong Operations Shaft and Underground Infrastructure | 74 |

| Figure 14-1: Schematic Flow Diagram of the Metallurgical Process | 77 |

| Figure 14-2: Graph of Tshepong Operations Historical Recovery Factor (18 month actual) | 79 |

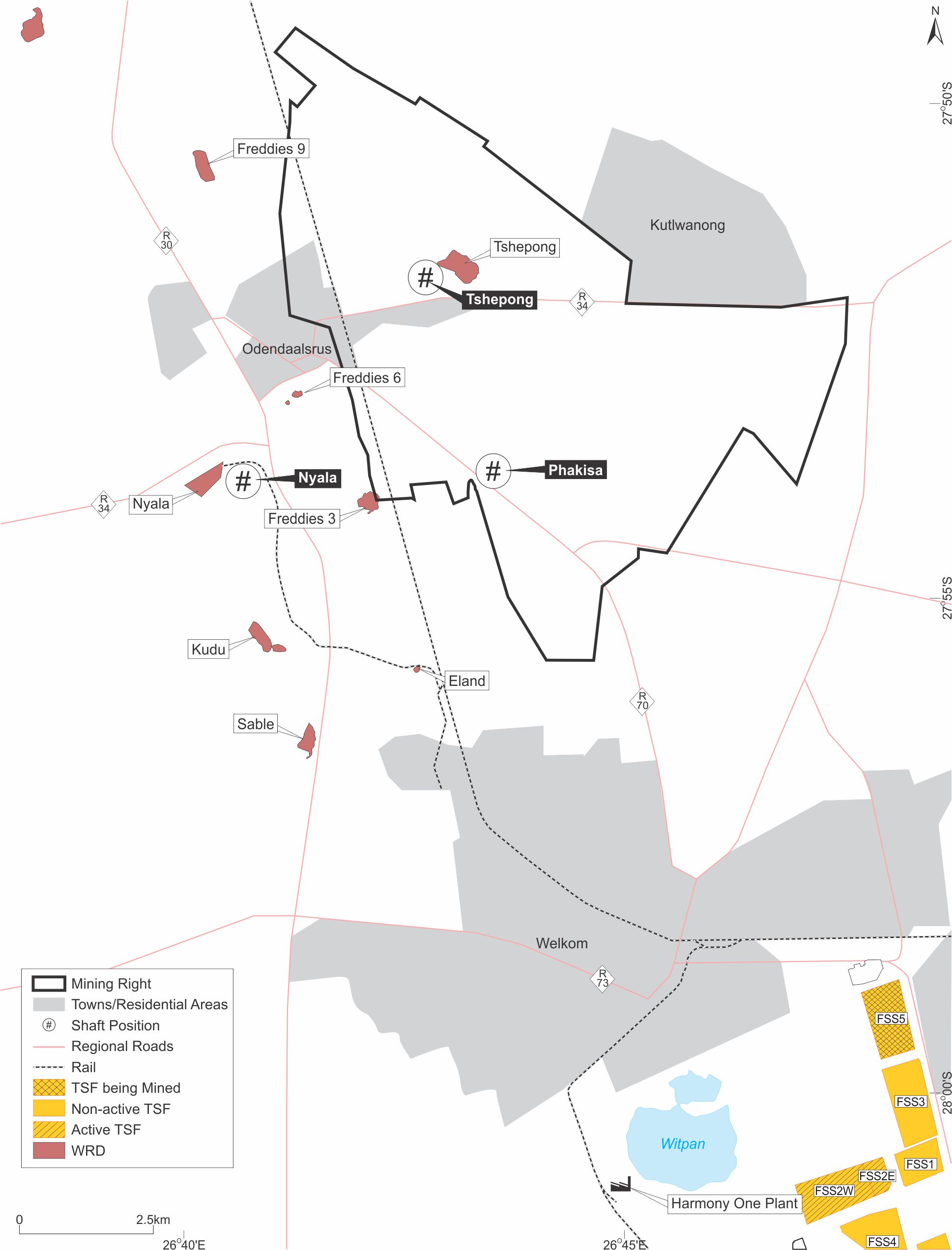

| Figure 15-1: Tshepong Operations Surface Layout and Infrastructure | 81 |

| Figure 15-2: Phakisa Detailed Surface Infrastructure | 82 |

| Figure 15-3: Tshepong Detailed Surface Infrastructure | 83 |

| Figure 15-4: Nyala Detailed Surface Infrastructure | 84 |

| Figure 15-5: Harmony One Plant Detailed Surface Infrastructure | 85 |

| Figure 16-1: Graph of Annual Gold Price History – ZAR/kg | 90 |

| Figure 16-2: Graph of Consensus View of Forecast Gold Price | 90 |

| Figure 19-1: Graph of Consensus ZAR : USD Exchange Rate Forecast | 98 |

| | |

Effective Date: 30 June 2022 iv |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

List of Tables

| | | | | |

| Table 1-1: Summary of the Phakisa Mineral Resources as at 30 June 2022 (Exclusive of Mineral Reserves) | 2 |

| Table 1-2: Summary of the Tshepong Mineral Resources as at 30 June 2022 (Exclusive of Mineral Reserves) | 3 |

| Table 1-3: Summary of the Phakisa Mineral Reserves as at 30 June 2022 | 4 |

| Table 1-4: Summary of the Tshepong Mineral Reserves as at 30 June 2022 | 4 |

| Table 1-5: Summary of Capital Cost Estimate for Tshepong Operations | 5 |

| Table 1-6: Summary of Operating Cost Estimate for Tshepong Operations | 6 |

| Table 1-7: Status of Environmental Permits and Licences | 6 |

| Table 2-1: QP Qualification, Section Responsibilities and Personal Inspections | 7 |

| Table 3-1: Summary of Mining Rights for Tshepong Operations | 8 |

| Table 5-1: Summary of Historical Ownership Changes and Activities of Tshepong Operations | 12 |

| Table 5-2: Summary of the Previous Phakisa Mineral Resources as at 30 June 2021 (Exclusive of Mineral Reserves) | 13 |

| Table 5-3: Summary of the Previous Tshepong Mineral Resources as at 30 June 2021 (Exclusive of Mineral Reserves) | 13 |

| Table 5-4: Summary of the Previous Phakisa Mineral Reserves as at 30 June 2021 | 14 |

| Table 5-5: Summary of the Previous Tshepong Mineral Reserves as at 30 June 2021 | 14 |

| Table 7-1: Summary of Surface and Underground Drilling for Phakisa | 31 |

| Table 7-2: Summary of Surface and Underground Drilling for Tshepong | 31 |

| Table 7-3: Drill hole Acceptance Criteria | 31 |

| Table 7-4: Summary of Recent Phakisa Underground Drill Holes Intersecting the Basal Reef | 34 |

| Table 7-5: Summary of Recent Phakisa Underground Drill Holes Intersecting the B Reef | 35 |

| Table 7-6: Summary of Recent Tshepong Underground Drill Holes Intersecting the Basal Reef | 36 |

| Table 7-7: Summary of Recent Tshepong Underground Drill Holes Intersecting the B Reef | 37 |

| Table 8-1: Summary of Harmony Assay Laboratory SRM Performance for Phakisa | 40 |

| Table 8-2: Summary of Harmony Assay Laboratory SRM Performance for Tshepong | 41 |

| Table 11-1: Global Statistics for Basal and B Reef | 46 |

| Table 11-2: Capping Values by Reef and Geozone | 49 |

| Table 11-3: Harmony Economic Assumptions (30 June 2022) | 51 |

| Table 11-4: Summary of the Phakisa Mineral Resources as at 30 June 2022 (Exclusive of Mineral Reserves) | 55 |

| Table 11-5: Summary of the Tshepong Mineral Resources as at 30 June 2022 (Exclusive of Mineral Reserves) | 55 |

| Table 12-1: Phakisa Modifying Factors Used for Mineral Reserve Determination | 58 |

| Table 12-2: Summary of the Phakisa Mineral Reserves as at 30 June 2022 | 58 |

| Table 12-3: Tshepong Modifying Factors Used for Mineral Reserve Determination | 60 |

| Table 12-4: Summary of the Tshepong Mineral Reserves as at 30 June 2022 | 60 |

| Table 13-1: Phakisa Mine Design Parameters | 66 |

| Table 13-2: Tshepong Mine Design Parameters | 67 |

| Table 13-3: Phakisa Mine Mining Personnel | 73 |

| Table 13-4: Tshepong Mine Mining Personnel | 75 |

| Table 14-1: Key Design Parameters and Equipment Specifications | 78 |

| Table 14-2: Harmony One Plant Consumables | 78 |

| Table 14-3: Harmony One Plant Personnel | 78 |

| Table 16-1: Material Contracts | 91 |

| | |

Effective Date: 30 June 2022 iv |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | | | | |

| Table 17-1: Status of Environmental Permits and Licences | 94 |

| Table 18-1: Summary of Capital Cost Estimate for Tshepong Operations | 96 |

| Table 18-2: Summary of Operating Cost Estimate for Tshepong Operations | 96 |

| Table 19-1: Conversions Used in Gold Price Calculations | 97 |

| Table 19-2: ZAR:USD Exchange Rate Performance (June 2019 – June 2022) | 97 |

| Table 19-3: Key Economic Assumptions and Parameters for Tshepong Operations Cash Flow | 98 |

| Table 19-4: Tshepong Operations Cash Flow | 100 |

| Table 19-5: Gold Price Sensitivity Analysis | 101 |

| Table 19-6: Total Operating Cost Sensitivity Analysis | 101 |

| Table 19-7: Gold price, Operating Costs, and Production Variation Sensitivity Analysis | 101 |

| Table 25 1: Other Specialists | 108 |

| | |

Effective Date: 30 June 2022 v |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

Units of Measure and Abbreviations

| | | | | |

| Unit / Abbreviation | Description or Definition |

| °C | degrees Celsius |

| µm | Micrometres |

| 2D | Two-dimensional |

| 3D | Three-dimensional |

| AE | Abnormal expenditure |

| Ag | Silver |

| AngloGold Ashanti | AngloGold Ashanti Limited |

| ARM | African Rainbow Minerals Limited |

| ARMGold | ARM Gold Division |

| Au | Gold |

| AuBIS | Harmony electronic database |

| Ave. | Average |

| BLR | Black Reef |

| BMD | Below mine datum |

| Bn | Billion |

| c. | Approximately |

| CIP | Carbon-In-Pulp |

| CLR | Carbon Leader Reef |

| cm | Centimetre |

| cmg/t | Centimetre-grams per tonne |

| CODM | Chief Operating Decision-Maker |

| Company | Harmony Gold Mining Company Limited |

| COP | Code of Practice |

| CRG | Central Rand Group |

| CRM | Certified Reference Material |

| CV | Coefficient of Variation |

| DBH | Dewatering borehole |

| DMRE | Department of Mineral Resources and Energy |

| DWAFEC | Department of Water Affairs, Forestry and Environmental Conservation |

| DWS | Department of Water and Sanitation |

| EIA | Environmental Impact Assessment |

| EMPR | Environmental Management Programme |

| EMS | Environmental Management System |

| EMTS | Electric Monorail Transport System |

| ESG | Environmental Social and Governance |

| ETF | Exchange traded fund |

| FAG | Fully autogenous |

| FX | Foreign Exchange rate |

| g | Gram |

| g/t | Grams per metric tonne |

| GBH | Groundwater boreholes |

| GDARD | Gauteng Department of Agriculture and Rural Development |

| GHG | Greenhouse gas |

| GISTM | Global Industry Standard on Tailings Management |

| ha | Hectare |

| Harmony | Harmony Gold Mining Company Limited |

| HLS | Heavy liquid separation |

| HPE | Hydro-powered |

| kg | Kilogram |

| | |

Effective Date: 30 June 2022 iv |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | | | | |

| km | Kilometre |

km2 | Square kilometre |

| kWh | Kilowatt-hour |

| LBMA | London Bullion Market Association |

| LIB | Long Inclined Borehole |

| LOM | Life of Mine |

| LOI | Loss on ignition |

| Ltd | Limited |

| m | Metre |

| M | Million |

m3/hr | Cubic metres per hour |

| MCC | Mining Charter Compliance |

| MCF | Mine Call Factor |

| Moz | Million troy ounces |

| MPRDA | Mineral and Petroleum Resources Development Act, 28 of 2002 |

| Mt | Million tonnes |

| Mtpa | Million tonnes per annum |

| Mtpm | Million tonnes per month |

| NEMA | National Environmental Management Act, 107 of 1998 |

| No. | Number |

| NPV | Net present value |

| oz | Troy ounce |

| OTC | Over the counter |

| Phakisa | Phakisa Mine |

| Pty | Proprietary |

| QA/QC | Quality Assurance/Quality Control |

| QEMSCAN | Scanning electron microscope |

| QP | Qualified Person |

| ROM | Run-of-Mine |

| SACNASP | South African Council for Natural Scientific Professions |

| SAMREC | The South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves |

| SD | Standard Deviation |

| SEC | Securities and Exchange Commission |

| SGM | Sequential Grid Mining |

| SLP | Social Labour Plan |

| t | Metric tonne |

t/m3 | Tonne per cubic metre |

| Target | Target Mine |

| TCFD | Task Force on Climate-Related Financial Disclosure |

| TMS | Trace mineral search |

| TRS | Technical Report Summary |

| TSF | Tailings Storage Facility |

| Tshepong | Tshepong Mine |

| USD | United States Dollars |

| USD/oz | United States Dollar per troy ounce |

| WRG | West Rand Group |

| WUL(s) | Water Use Licence(s) |

| XRD | X-ray diffraction |

| ZAR | South African Rand |

| ZAR/kg | South African Rand per kilogram |

| | |

Effective Date: 30 June 2022 v |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

Glossary of Terms

| | | | | |

| Term | Definition |

| Co-kriging | A method that is used to predict the value of the point at unobserved locations by sample points that are known to be spatially interconnected by adding other variables that have a correlation with the main variable or can also be used to predict 2 or more variables simultaneously. |

| Cut-off grade | Cut-off grade is the grade (i.e., the concentration of metal or mineral in rock) that determines the destination of the material during mining. For purposes of establishing “prospects of economic extraction,” the cut-off grade is the grade that distinguishes material deemed to have no economic value (it will not be mined in underground mining or if mined in surface mining, its destination will be the waste dump) from material deemed to have economic value (its ultimate destination during mining will be a processing facility). Other terms used in similar fashion as cut-off grade include net smelter return, pay limit, and break-even stripping ratio. |

| Dilution | Unmineralised rock that is by necessity, removed along with ore during the mining process that effectively lowers the overall grade of the ore. |

| Head grade | The average grade of ore fed into the mill. |

| Economically viable | Economically viable, when used in the context of Mineral Reserve determination, means that the qualified person has determined, using a discounted cash flow analysis, or has otherwise analytically determined, that extraction of the Mineral Reserve is economically viable under reasonable investment and market assumptions. |

| Indicated Mineral Resource | Indicated Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an Indicated Mineral Resource is sufficient to allow a qualified person to apply modifying factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an Indicated Mineral Resource has a lower level of confidence than the level of confidence of a Measured Mineral Resource, an Indicated Mineral Resource may only be converted to a probable Mineral Reserve. |

| Inferred Mineral Resource | Inferred Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an Inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an Inferred Mineral Resource has the lowest level of geological confidence of all Mineral Resources, which prevents the application of the modifying factors in a manner useful for evaluation of economic viability, an Inferred Mineral Resource may not be considered when assessing the economic viability of a mining project and may not be converted to a Mineral Reserve. |

| Kriging | A method of interpolation based on Gaussian process governed by prior covariances. It uses a limited set of sampled data points to estimate the value of a variable over a continuous spatial field |

| Mine Call Factor | The ratio, expressed as a percentage, of the total quantity of recovered and unrecovered mineral product after processing with the amount estimated in the ore based on sampling. |

| Measured Mineral Resource | Measured Mineral Resource is that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a Measured Mineral Resource is sufficient to allow a qualified person to apply modifying factors, as defined in this section, in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a Measured Mineral Resource has a higher level of confidence than the level of confidence of either an Indicated Mineral Resource or an Inferred Mineral Resource, a Measured Mineral Resource may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve. |

| Mineral Reserve | Mineral Reserve is an estimate of tonnage and grade or quality of Indicated and Measured Mineral Resources that, in the opinion of the qualified person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of a Measured or Indicated Mineral Resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted. |

| Mineral Resource | Mineral Resource is a concentration or occurrence of material of economic interest in or on the Earth’s crust in such form, grade or quality, and quantity that there are reasonable prospects for economic extraction. A Mineral Resource is a reasonable estimate of mineralisation, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralisation drilled or sampled. |

| | |

Effective Date: 30 June 2022 iv |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | | | | |

| Modifying Factors | Modifying factors are the factors that a qualified person must apply to Indicated and Measured Mineral Resources and then evaluate in order to establish the economic viability of Mineral Reserves. A qualified person must apply and evaluate modifying factors to convert Measured and Indicated Mineral Resources to Proven and Probable Mineral Reserves. These factors include but are not restricted to; mining; processing; metallurgical; infrastructure; economic; marketing; legal; environmental compliance; plans, negotiations, or agreements with local individuals or groups; and governmental factors. The number, type and specific characteristics of the modifying factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project. |

| Pre-Feasibility Study | A pre-feasibility study (or preliminary feasibility study) is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a qualified person has determined (in the case of underground mining) a preferred mining method, or (in the case of surface mining) a pit configuration, and in all cases has determined an effective method of mineral processing and an effective plan to sell the product. |

| (1) A pre-feasibility study includes a financial analysis based on reasonable assumptions, based on appropriate testing, about the modifying factors and the evaluation of any other relevant factors that are sufficient for a qualified person to determine if all or part of the Indicated and Measured Mineral Resources may be converted to Mineral Reserves at the time of reporting. The financial analysis must have the level of detail necessary to demonstrate, at the time of reporting, that extraction is economically viable. |

| (2) A pre-feasibility study is less comprehensive and results in a lower confidence level than a feasibility study. A pre-feasibility study is more comprehensive and results in a higher confidence level than an initial assessment. |

| Probable Mineral Reserve | Probable Mineral Reserve is the economically mineable part of an Indicated and, in some cases, a Measured Mineral Resource. |

| Proven Mineral Reserve | Proven Mineral Reserve is the economically mineable part of a Measured Mineral Resource and can only result from conversion of a Measured Mineral Resource. |

| Qualified Person | A qualified person is: |

| (1) A mineral industry professional with at least five years of relevant experience in the type of mineralisation and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and |

| (2) An eligible member or licensee in good standing of a recognized professional organization at the time the technical report is prepared. For an organization to be a recognized professional organization, it must: |

| (i) Be either: |

| (A) An organization recognized within the mining industry as a reputable professional association; or |

| (B) A board authorized by U.S. federal, state or foreign statute to regulate professionals in the mining, geoscience or related field; |

| (ii) Admit eligible members primarily on the basis of their academic qualifications and experience; |

| (iii) Establish and require compliance with professional standards of competence and ethics; |

| (iv) Require or encourage continuing professional development; |

| (v) Have and apply disciplinary powers, including the power to suspend or expel a member regardless of where the member practices or resides; and |

| (vi) Provide a public list of members in good standing. |

| Tailings | Finely ground rock of low residual value from which valuable minerals have been extracted is discarded and stored in a designed dam facility. |

| | |

Effective Date: 30 June 2022 v |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

1Executive Summary

Section 229.601(b)(96) (1)

The Qualified Person(s) (“QP”) of Harmony Gold Mining Company Limited (“Harmony” or the “Company”) have prepared this Technical Report Summary (“TRS”) to disclose the Mineral Resource and Mineral Reserve estimates for the Company’s Tshepong Operations. The TRS has been prepared in accordance with the U.S. Securities and Exchange Commission (“SEC”) property disclosure regulations, S-K 1300, with an effective date as at 30 June 2022. No material changes have occurred between the effective date and the date of signature of this TRS.

Property Description

The Tshepong Operations comprise the underground and surface assets associated with two mines, namely Tshepong Mine (“Tshepong” or “Tshepong Mine”) and Phakisa Mine (“Phakisa” or “Phakisa Mine”), situated between the towns of Welkom and Odendaalsrus in the Free State Province of South Africa. The mines are both moderate to deep-level gold mines, operating at depths of between 1.6km and 2.4km below mine datum (“BMD”). The primary reef mined is the Basal Reef, with additional gold mineralisation being found in the B Reef and A Reef.

Mining at Tshepong Operations is carried out under the following mining right, covering both Tshepong and Phakisa:

•FS30/5/1/284MR, which is valid from 11 December 2007 to 10 December 2029 and covers an area of 10,798.74 hectares (“ha”).

The mining right is held in a joint venture between African Rainbow Minerals Limited (“ARM”) Gold Division (“ARMGold”) and Harmony.

All relevant underground mining and surface right permits, and any other permit related to the work conducted on the property have been obtained and are valid. There are no known legal proceedings (including violations or fines) against Harmony, which threaten its mineral rights, tenure, or operations.

Ownership

The Tshepong Operations are wholly owned by Harmony, including the associated mineral rights. Harmony commenced acquiring the assets through the acquisition of AngloGold Ashanti Limited’s (“AngloGold Ashanti”) Free State operations in 2001, together with ARMGold. ARMGold was subsequently incorporated into Harmony in 2003, giving Harmony 100% ownership and control of the Tshepong Operations.

Geology and Mineralisation

The Tshepong Operations are situated in the Free State Goldfield, on the southwestern margin of the Witwatersrand Basin of South Africa, one of the most prominent gold provinces in the world. The major gold bearing conglomerate reefs are mostly confined to the Central Rand Group (“CRG”) of the Witwatersrand Supergroup.

The general orientation of the Witwatersrand Supergroup succession in this goldfield is interpreted as north-trending, within a syncline that is plunging to the north. The syncline has been divided by faults into the Odendaalsrus, Central Horst and Virginia sections. The Tshepong Operation mining right area is also affected by the Ophir and Dagbreek faults.

Tshepong Operations exploited primarily the Basal Reef, which occurs within the Harmony Formation of the Johannesburg Subgroup of the CRG.

Mineralisation also occurs within the stratigraphically higher A and B reefs of the Kimberley (formerly Aandenk) Formation, within the Turffontein subgroup of the CRG. However, only the B Reef can be economically extracted.

Mineralisation is associated with the presence of medium to coarse, clast-supported oligomictic pebble horizons. The presence of allogenic pyrite and detrital carbon is also common.

| | |

Effective Date: 30 June 2022 1 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

Status of Exploration, Development and Operation

The Basal Reef at Tshepong Operations has been extensively explored. Recent exploration has mainly focused on improving confidence in the geological model, as well as adding and upgrading Mineral Resources to replace the mining depletion. Geological data has been obtained through underground channel sampling, mapping and drilling. Initial exploration included a historical geophysical seismic survey and surface diamond core drilling. This was followed up with, closer spaced underground data gathering exercises.

Mineral Resource Estimate

The Mineral Resources for the Basal Reef and B Reef (both Tshepong and Phakisa Mines) were estimated by the Harmony QP in Datamine™ Studio software. The QP created block models based on a verified electronic database containing surface drill hole data, as well as underground drilling, mapping, and sampling data obtained up until December 2020. Gold values were estimated using ordinary and simple macro kriging interpolation methods.

The Mineral Resources for Phakisa were originally prepared, classified and reported according to the South African Code for the Reporting of Exploration Results, Mineral Resources and Mineral Reserves (“SAMREC, 2016”). For the purposes of this TRS, the Mineral Resources have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K).

The QP compiling the Mineral Resource estimate for Phakisa is Ms B Phetlhu, Ore Reserve Manager at Phakisa and employee of Harmony.

The Mineral Resource estimate for Phakisa, as at 30 June 2022, exclusive of the reported Mineral Reserves is summarised in Table 1-1.

Table 1-1: Summary of the Phakisa Mineral Resources as at 30 June 2022 (Exclusive of Mineral Reserves) 1-8

| | | | | | | | | | | |

| METRIC |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Measured | 4.741 | 13.25 | 62,797 |

| Indicated | 7.264 | 11.27 | 81,831 |

| Total / Ave. Measured + Indicated | 12.005 | 12.05 | 144,627 |

| Inferred | 27.491 | 10.77 | 295,943 |

| IMPERIAL |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Measured | 5.226 | 0.386 | 2.019 |

| Indicated | 8.007 | 0.329 | 2.631 |

| Total / Ave. Measured + Indicated | 13.233 | 0.351 | 4.650 |

| Inferred | 30.303 | 0.314 | 9.515 |

| Notes: |

| 1. Mineral Resources are reported with an effective date of 30 June 2022 were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Resources have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Qualified Person responsible for the estimate is Ms B Phetlhu, who is Ore Reserve Manager at Phakisa, and a Harmony employee. |

| 2. The Mineral Resource tonnes are reported as in-situ with reasonable prospects for economic extraction. |

| 3. No modifying factors or dilution sources have been included to in-situ Reserve which was subtracted from the SAMREC Resource in order to obtain the S-K 1300 Resource. |

| 4. The Mineral Resources are reported using a cut-off value of 780cmg/t determined at a 90% profit guidance, and a gold price of USD1,723/oz. |

| 5. Tonnes are reported as rounded to three decimal places. Gold values are rounded to zero decimal places. |

| 6. Mineral Resources are exclusive of Mineral Reserves. Mineral Resources are not Mineral Reserves and do not necessarily demonstrate economic viability. |

| 7. Rounding as required by reporting guidelines may result in apparent summation differences. |

| 8. The Mineral Resource estimate is for Harmony’s 100% interest. |

| | |

Effective Date: 30 June 2022 2 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

The Mineral Resources for Tshepong were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Resources have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Mineral Resource estimate, as at 30 June 2022, exclusive of the reported Mineral Reserves is summarised in Table 1-2

The QP compiling the Mineral Resource estimate for Tshepong is Mr A Louw, Ore Reserve Manager at Tshepong and employee of Harmony.

Table 1-2: Summary of the Tshepong Mineral Resources as at 30 June 2022 (Exclusive of Mineral Reserves) 1-8

| | | | | | | | | | | |

| METRIC |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Measured | 12.484 | 12.13 | 151,437 |

| Indicated | 3.977 | 10.20 | 40,575 |

| Total / Ave. Measured + Indicated | 16.462 | 11.66 | 192,012 |

| Inferred | 9.43 | 10.18 | 96,037 |

| IMPERIAL |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Measured | 13.762 | 0.354 | 4.869 |

| Indicated | 4.384 | 0.298 | 1.305 |

| Total / Ave. Measured + Indicated | 18.146 | 0.340 | 6.173 |

| Inferred | 10.399 | 0.297 | 3.088 |

| Notes: |

| 1. Mineral Resources are reported with an effective date of 30 June 2022 were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Resources have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Qualified Person responsible for the estimate is Mr A Louw, who is Ore Reserve Manager at Tshepong, and a Harmony employee. |

| 2. The Mineral Resource tonnes are reported as in-situ with reasonable prospects for economic extraction. |

| 3. No modifying factors or dilution sources have been included to in-situ Reserve which was subtracted from the SAMREC Resource in order to obtain the S-K 1300 Resource. |

| 4. The Mineral Resources are reported using a cut-off value of 648cmg/t determined at a 90% profit guidance, and a gold price of USD1,723/oz. |

| 5. Tonnes are reported as rounded to three decimal places. Gold values are rounded to zero decimal places. |

| 6. Mineral Resources are exclusive of Mineral Reserves. Mineral Resources are not Mineral Reserves and do not necessarily demonstrate economic viability. |

| 7. Rounding as required by reporting guidelines may result in apparent summation differences. |

| 8. The Mineral Resource estimate is for Harmony’s 100% interest. |

Mineral Reserve Estimate

Mineral Reserves are derived from the Mineral Resources, a detailed business plan and the operational mine planning processes. Mine planning utilises and takes into consideration historical technical parameters achieved. In addition, Mineral Resource conversion to Mineral Reserves considers Modifying Factors, dilution, ore losses, minimum mining widths, planned mine call and plant recovery factors.

The Mineral Reserves for Phakisa were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Reserves have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Mineral Reserve estimate for Phakisa, as at 30 June 2022, is summarised in Table 1-3.

The QP compiling the Mineral Resource estimate for Phakisa is Ms B Phetlhu, Ore Reserve Manager at Phakisa and employee of Harmony.

| | |

Effective Date: 30 June 2022 3 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

Table 1-3: Summary of the Phakisa Mineral Reserves as at 30 June 2022 1-5

| | | | | | | | | | | |

| METRIC |

| Mineral Reserve Category | Milled Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Proved | 3.759 | 6.98 | 26,243 |

| Probable | 0.176 | 6.49 | 1,143 |

| Total (Proved + Probable) | 3.935 | 6.96 | 27,386 |

| | | | | | | | | | | |

| IMPERIAL |

| Mineral Reserve Category | Milled Tonnes (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Proved | 4.144 | 0.204 | 0.844 |

| Probable | 0.194 | 0.189 | 0.037 |

| Total (Proved + Probable) | 4.338 | 0.203 | 0.880 |

| Notes: |

| 1. The Mineral Reserves were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Reserves have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Qualified Person responsible for the estimate is Ms B Phetlhu, who is Ore Reserve Manager at Phakisa, and a Harmony employee. |

| 2. Tonnes, grade, and gold content are declared as net delivered to the mills. |

| 3. Figures are fully inclusive of all mining dilutions, gold losses and are reported as mill delivered tonnes and head grades. Metallurgical recovery factors have not been applied to the reserve figures. |

| 4. Gold content has not taken metallurgical recovery factors into account. |

| 5. Mineral Reserves are reported using a cut-off grade of 791cmg/t determined using a gold price of USD1,546/oz gold. |

The Mineral Reserves for Tshepong were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Reserves have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Mineral Reserve estimate for Tshepong, as at 30 June 2022 is summarised in Table 1-4.

The QP compiling the Mineral Resource estimate for Tshepong is Mr A Louw, Ore Reserve Manager at Tshepong and employee of Harmony.

Table 1-4: Summary of the Tshepong Mineral Reserves as at 30 June 2022 1-5

| | | | | | | | | | | |

| METRIC |

| Mineral Reserve Category | Milled Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Proved | 4.157 | 5.15 | 21,419 |

| Probable | 0.336 | 7.63 | 2,565 |

| Total (Proved + Probable) | 4.493 | 5.34 | 23,985 |

| IMPERIAL |

| Mineral Reserve Category | Milled Tonnes (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Proved | 4.583 | 0.150 | 0.689 |

| Probable | 0.371 | 0.223 | 0.082 |

| Total (Proved + Probable) | 4.953 | 0.156 | 0.771 |

| Notes: |

| 1. The Mineral Reserves were originally prepared, classified and reported according to SAMREC, 2016. For the purposes of this TRS, the Mineral Reserves have been classified in accordance with § 229.1302(d)(1)(iii)(A) (Item 1302(d)(1)(iii)(A) of Regulation S-K). The Qualified Person responsible for the estimate is Mr A Louw, who is Ore Reserve Manager at Tshepong, and a Harmony employee. |

| 2. Tonnes, grade, and gold content are declared as net delivered to the mills. |

| 3. Figures are fully inclusive of all mining dilutions, gold losses and are reported as mill delivered tonnes and head grades. Metallurgical recovery factors have not been applied to the reserve figures. |

| 4. Gold content has not taken metallurgical recovery factors into account. |

| 5. Mineral Reserves are reported using a cut-off grade of 650cmg/t determined using a gold price of USD1,546/oz gold. |

In the opinion of the QP, given that the Phakisa and Tshepong mines are established operations, the modifying factors informing the Mineral Reserve estimates would at a minimum, satisfy the confidence levels of a Pre-Feasibility Study.

The declared Mineral Reserves are depleted to generate the Tshepong Operation cash flows. The economic analysis of the cash flows displays positive results and are deemed both technically and economically achievable.

| | |

Effective Date: 30 June 2022 4 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

Capital and Operating Cost Estimates

The capital cost estimates for the Tshepong Operations are determined at a corporate level, using the business plan as the basis. The capital costs are associated with major equipment outside the main operating sections which is termed abnormal expenditure (“AE”), infrastructure development, as well as ongoing capital development (“OCD”). Costs associated with the Mining Charter Compliance (“MCC”), as per South Africa’s Social Labour Plan (“SLP”) requirements are also included in the capital estimates.

The capital costs are presented in Table 1-5.

The operating cost estimates for Tshepong Operations are categorised into direct and total costs. The operating cost estimates are shown in Table 1-6.

The capital and operating costs are reported in ZAR terms and on a real basis. The economic analysis, including the capital and operating costs are reported for the period comprising financial year (“FY23”) July – June. Both, the capital and operating estimates are accounted for in the economic analysis of Tshepong Operations. The results of the economic analysis demonstrate positive returns over the LOM.

Permitting Requirements

The permits held by Tshepong Operations are presented in Table 1-7.

Tshepong Operations have the necessary valid permits, administered and managed by various departments, and do not require any additional permits to continue with their mining operations, except for the application which have been submitted to amend the Water Use Applications.

An application to renew and amend water use application was submitted to the respective regulator. The approval for these environmental permits is pending at the effective date of this TRS. Based on current industry norms, a realistic timeframe to obtain relevant authorisations is estimated between 12 and 18 months.

There is no material litigation (including violations or fines) against the Company as at the date of this report which threatens its mineral rights, tenure, or operations.

Conclusions

Under the assumptions in this TRS, Tshepong Operations show a positive cash flow over the life-of-mine which supports the Mineral Resource and Mineral Reserve estimates. The mine plan is achievable under the set of assumptions and parameters used.

Recommendations

The gold output can be optimised through improvement of quality of mining and this will result in achieving planned shaft call factor. This impact will be realised through our currently implemented Business Initiative programme that will look at driving quality of mining through measures such as in-stope water controls and better fragmentation during blasting to contain the gold.

Table 1-5: Summary of Capital Cost Estimate for Tshepong Operations

| | | | | |

| Capital Cost Element (ZAR'000s) | Total LOM (FY2023 - FY2030) |

| AE | 302,068 |

| Shaft Projects | 227,797 |

| Major Projects | 400,470 |

| |

| Total | 930,335 |

| OCD | 2,565,792 |

| Total (including OCD) | 3,496,125 |

| | |

Effective Date: 30 June 2022 5 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

Table 1-6: Summary of Operating Cost Estimate for Tshepong Operations

| | | | | |

| Operating Cost Element (ZAR'000) | Total LOM (FY2023 - FY2030) |

| Mining | 14,280,664 |

| Services | 4,299,907 |

| Medical Hub / Station | 781,819 |

| Engineering | 12,794,649 |

| |

| |

| Total Direct Costs | 32,157,038 |

| Mine Overheads | 1,652,395 |

| Royalties | 463,002 |

| Ongoing Capex | 2,565,792 |

| Total Cost | 36,838,228 |

Table 1-7: Status of Environmental Permits and Licences

| | | | | | | | | | | | | | |

| Permit / Licence | Reference No. | Issued By | Date Granted | Validity |

| Environmental Management Programme | FS 30/5/1/2/3/2/1(84)EM | DMRE | 16-Apr-10 | LOM |

| Environmental Management Updated | FS 30/5/1/2/2/84MR | DWAFEC | Pending Approval Submitted in 2019 | LOM |

| Water Permit 936B. Harmony. Free State Geduld Mines. Discharge of untreated effluents | B33/2/340/31 | DWAFEC | 02-Apr-81 | LOM |

| Water Permit 870B. Harmony. Discharge of untreated effluents. | B33/2/340/25 | DWAFEC | 27-May-91 | LOM |

| Water Permit 1214N. Free State Consolidated Gold Mine. Tshepong, Freddie’s and Phakisa shafts. | B33/2/340/12 | DWAFEC | Not indicated. | LOM |

| Notes: DWAFEC - Department of Water Affairs, Forestry and Environmental Conservation, DWA - Department of Water Affairs. |

| | |

Effective Date: 30 June 2022 6 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

2Introduction

Section 229.601(b)(96) (2) (i-v)

This TRS on Tshepong Operations has been prepared for the registrant, Harmony. The TRS has been prepared in accordance with the U.S. SEC Disclosure by Registrants Engaged in Mining Operations (disclosure regulations S-K 1300). It has been prepared to meet the requirements of Section 229.601(b)96 - Technical Report Summary. The purpose of this TRS is to provide open and transparent disclosure of all material, exploration activities, Mineral Resource and Mineral Reserve information to enable the investor to understand the Tshepong Operations, which forms part of Harmony’s activities.

This TRS has been prepared from the following sources of information:

•Harmony Operational Report 2021;

•File 18 (Competency Report) Phakisa Mineral Resource and Reserve Statement FY2023;

•Phakisa Gold Mine 2022 SAMREC Table 1;

•Tshepong Gold Mine 2022 SAMREC Table 1;

•2021 Report to Shareholders; and

•Harmony Mineral Resources and Mineral Reserves Report at 30 June 2021 (“HAR-RR21”).

The TRS was prepared by QPs employed on a full-time basis by the registrant. The QPs qualifications, areas of responsibility and personal inspection of the property are summarised in Table 2-1.

Table 2-1: QP Qualification, Section Responsibilities and Personal Inspections

| | | | | | | | | | | | | | |

| Qualified Person | Professional Organisation | Qualification | TRS Section Responsibility | Personal Insp. |

| Mr A Louw | SACNASP | BSc. Hons. (Geohydro) | All Sections (Tshepong) | Full Time |

| Ms B Phetlhu | SACNASP | BTech. (Geol), M (Eng) | All Sections (Phakisa) | Full Time |

This TRS is the first filing of such a document with the SEC and has an effective date as at 30 June 2022. No material changes have occurred between the effective date and the date of signature.

| | |

Effective Date: 30 June 2022 7 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

3Property Description and Location

Section 229.601(b)(96) (3) (i-vii)

The Tshepong Operations comprise two operating underground gold mines namely, Tshepong and Phakisa. Tshepong is a mature, moderate to deep-level underground operation that uses conventional undercut mining, to depths of 2,400m BMD. Phakisa, younger than Tshepong, is a moderate to deep-level underground operation using conventional underground mining methods to depths of 2,427m BMD. The mines utilise the Tshepong, Phakisa and Nyala shafts.

The mines are located in the Free State Province of South Africa, approximately 250km southwest of Johannesburg and 15km to the north of the town of Welkom (Figure 3-1). Tshepong is situated at a latitude of 27°51’56.45”S and longitude of 26°42’45.15”E. Phakisa is situated adjacent to the south of Tshepong, and is located at a latitude of 27°54’1.27”S and longitude of 26°43’30.05”E.

3.1Mineral Tenure

South African Mining Law is regulated by the MPRDA which is the predominant piece of legislation dealing with acquisitions or rights to conduct reconnaissance, prospecting and mining. There are several other pieces of legislation which deal with such ancillary issues such as royalties (the Mineral and Petroleum Resources Royalty Act, 2008), title registration (the Mining Titles Registration Act, 1967), and health and safety (the Mine Health and Safety Act, 1996).

The current mining right for the Tshepong Operations encompasses an area of 10,798.74ha (Figure 3-2). Harmony holds several mining rights in the Free State goldfields which have been successfully converted and executed as new order mining rights, some of which are still to be registered at the Mineral and Petroleum Resources Titles Office (“MPRTO”). The mining right for Tshepong is presented in Table 3-1.

The Tshepong Operations are wholly owned by Harmony, including the associated mineral rights. Harmony commenced acquiring the assets through the acquisition of AngloGold Ashanti Limited’s (“AngloGold Ashanti”) Free State operations in 2001, together with ARMGold. ARMGold was subsequently incorporated into Harmony in 2003, giving Harmony 100% ownership and control of the Tshepong Operations.

Table 3-1: Summary of Mining Rights for Tshepong Operations

| | | | | | | | | | | | | | | | | |

| Licence Holder | Licence Type | Reference No. | Effective Date | Expiry Date | Area (ha) |

| ARMGold / Harmony JV | Mining Right | FS30/5/1/284MR | 11-Dec-2007 | 10-Dec-2029 | 10,798.74 |

There are no known legal proceedings (including violations or fines) against the Company which threatens its mineral rights, tenure, or operations.

3.2Property Permitting Requirements

All relevant underground mining and surface permits, and any other permit related to the work conducted on the property have been obtained and are valid.

Harmony has access to all the properties it requires to conduct its current mining activities. The surface lease and surface right areas are sufficient in size and nature to accommodate the required surface infrastructure to facilitate current and planned mining and processing operations.

Harmony monitors complaints and litigation against the Company as part of its risk management systems, policies and procedures. There is no material litigation (including violations or fines) against the Company as at the date of this report which threatens its mineral rights, tenure or operations.

| | |

Effective Date: 30 June 2022 8 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | |

| Figure 3-1: Location of Tshepong Operations in the Free State Goldfield |

|

| | |

Effective Date: 30 June 2022 9 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | |

Figure 3-2: Mineral Tenure for Tshepong Operations |

|

| | |

Effective Date: 30 June 2022 10 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

4Accessibility, Climate, Local Resources, Infrastructure and Physiography

Section 229.601(b)(96) (4) (i-iv)

4.1Accessibility

Access to the Tshepong Operations is accessible via the local R70 road between Welkom and Odendaalsrus (Figure 3-1). The area has well-established rail links and an airfield within close proximity.

Entry into the mining area is restricted by security fencing, security guards, booms and lockable gates at the main entrance. In addition, a communication system and access control system monitors personnel entering and leaving the mine property.

4.2Physiography and Climate

The mine lease area is flat with an average height of around 1,344m above mean sea level (“masl”). There are no prominent topographical landmarks in the area. The topography has been affected by the presence of slimes dams, waste rock dumps and solid waste disposal sites.

Tshepong Operations are situated in the Free State Goldfield, a semi-arid region with an annual rainfall of between 400mm and 600mm. Local thunderstorms and showers are responsible for most of the precipitation during summer, from October to March, peaking in January. Hail is sometimes associated with thunderstorms.

The seasonal fluctuations in mean temperatures between the warmest and the coldest months vary between an average minimum of 7.7°C in winter to a maximum of 37°C in summer. The month of July is generally the coldest month with the hottest month typically being February.

Tshepong and Phakisa are not restricted by climatic or seasonal variability.

4.3Local Resources and Infrastructure

The surrounding areas of Welkom and Odendaalsrus are well developed in terms of access and mining-related infrastructure, which supports the numerous operational gold mines in the area. The regional infrastructure includes national and provincial paved road networks, power transmission and distribution networks, water supply networks and communication infrastructure.

Tshepong has a twin shaft system with ore and waste being hoisted to surface through the main vertical shaft (Figure 3-2).

Phakisa operates a single vertical shaft for man and materials. Rock is transported from the underground working via a RailVeyorTM system to the Nyala Shaft for hoisting.

The Tshepong and Phakisa ore is transported, by rail, from their respective shafts to the Harmony One Plant in Welkom for processing (Figure 3-2).

Operations are powered by electricity from Eskom Holdings State Owned Company (“SOC”) Limited.

| | |

Effective Date: 30 June 2022 11 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

5History

Section 229.601(b)(96) (5) (i-ii)

5.1Historical Ownership and Development

Phakisa was formerly known as FSG 4, Freddies 4 and Tshepong South. Phakisa development commenced in October 1993 and shaft sinking was started in February 1994. In 1995, shaft sinking was halted on 59 Level due to the prevailing low gold price. Operations at Phakisa recommenced in September 1996 and sinking was completed to 75 Level, before being halted again in 1999.

The Feasibility Study for the initial development of Tshepong was concluded in 1984. Work to establish the site started in September 1984 and, by 1986, shaft sinking was underway. Sinking and equipping of the shaft were completed in 1991, with the mine being commissioned in November 1991.

Harmony acquired Phakisa as part of the acquisition from AngloGold Ashanti’s Free State operations (previously known as Freegold), which completed in September 2003. Sinking and equipping was completed to a depth of 2,427m in 2006.

The Phakisa and Tshepong operations were merged into the Tshepong Operations by Harmony in 2017.

The historical ownership and associated activities related to Tshepong operations are summarised in Table 5-1.

Table 5-1: Summary of Historical Ownership Changes and Activities of Tshepong Operations

| | | | | |

| Year | Asset History Highlights |

| Phakisa |

| 1994 | Shaft sinking began. |

| 2002 | Harmony (as part of a 50:50 joint venture with ARMGold) acquired Phakisa from AngloGold Ashanti. |

| 2003 | The Phakisa Shaft Project began development. ARMGold and Harmony merged. |

| 2005 | Phakisa shaft completed and shaft equipping underway. |

| 2008 | Phakisa started production with full-scale production planned by June 2011. |

| 2009 | Five ice plants commissioned, improving ventilation and cooling. |

| 2011 | Phakisa reached full production. |

| 2017 | Tshepong and Phakisa merged into Tshepong Operations |

| Tshepong |

| 1984 | The Feasibility Study for the Tshepong development section concluded. Site establishment started. |

| 1986 | Shaft sinking began. |

| 1991 | The Tshepong project was commissioned. |

| 2001 | AngloGold announced sale of its assets in the Free State to African Rainbow Metals and Harmony Gold Mining. African Rainbow and Harmony would hold equal joint venture interests, effective January 1, 2002. |

| 2003 | Harmony Gold and ARMGold merged. |

| 2004 | Tshepong began production and produced 390,747oz Au. Tshepong Sub 55 Decline Project (an extension at depth of the mine from the current shaft bottom to a depth of some 2,200m) was on schedule for completion in July 2006. |

| 2005 | Harmony completed 62% of the decline, including 1,500m of rail construction and 700m of the conveyer system. |

| 2006 | The mine operated at full capacity and the Tshepong Decline Project had been completed. |

| 2007 | Conversion of Harmony's old order mining rights into new order mining rights in terms of the MPRDA, including that for the Tshepong operation. |

| 2008 | The Tshepong Sub 66 decline project in a build-up phase, and the Sub 71 Decline project was under development. |

| 2017 | Tshepong and Phakisa merged into Tshepong Operations. |

| | |

Effective Date: 30 June 2022 12 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

5.2Historical Exploration

Strong linear B-Reef value trends running from Tshepong Mine into Phakisa Mine were identified where an expected value of the area averaged 1291cmg/t. A high level capital exploration drilling project for B-Reef was approved in August 2016 for Phakisa mine. Eight drill holes were planned, totalling of 5,180m at a total cost of ZAR5.5m. The exploration drilling programme was successfully concluded in October 2020, with the planned eight holes drilled in the target area which confirmed the extension of the Tshepong payshoot.

5.3Previous Mineral Resource and Mineral Reserve Estimates

The previous in-situ Mineral Resource estimates for the Tshepong Operations were declared as at 30 June 2021 by Harmony, according to the SAMREC, 2016. The previous Mineral Resource estimates, exclusive of Mineral Reserves, are summarised in Table 5-2 and Table 5-3 for Phakisa and Tshepong, respectively. These have been superseded by the current estimate prepared by Harmony in Section 11 of this TRS.

Table 5-2: Summary of the Previous Phakisa Mineral Resources as at 30 June 2021 (Exclusive of Mineral Reserves)

| | | | | | | | | | | |

| METRIC |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Measured | 5.676 | 12.20 | 69,228 |

| Indicated | 7.561 | 10.99 | 83,060 |

| Total / Ave. Measured + Indicated | 13.237 | 11.50 | 152,288 |

| Inferred | 26.303 | 10.80 | 283,991 |

| IMPERIAL |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Measured | 6.257 | 0.356 | 2.226 |

| Indicated | 8.335 | 0.320 | 2.670 |

| Total / Ave. Measured + Indicated | 14.592 | 0.336 | 4.896 |

| Inferred | 28.994 | 0.315 | 9.131 |

Table 5-3: Summary of the Previous Tshepong Mineral Resources as at 30 June 2021 (Exclusive of Mineral Reserves)

| | | | | | | | | | | |

| METRIC |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Measured | 3,680 | 15,88 | 58 449 |

| Indicated | 1,082 | 16,96 | 18 361 |

| Total / Ave. Measured + Indicated | 4,762 | 16,13 | 76 810 |

| Inferred | 8,999 | 10,65 | 95 795 |

| IMPERIAL |

| Mineral Resource Category | Tonnes (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Measured | 4,056 | 0,463 | 1,879 |

| Indicated | 1,193 | 0,495 | 0,590 |

| Total / Ave. Measured + Indicated | 5,249 | 0,470 | 2,469 |

| Inferred | 9,919 | 0,310 | 3,080 |

The previous Mineral Reserve estimate for Tshepong Operations was declared by Harmony as at 30 June 2021 in accordance with SAMREC, 2016. Modifying Factors were applied to the in situ Mineral Resources to arrive at the Mineral Reserve estimate. The Mineral Reserve estimate represents the ore delivered to the mill. The recovered gold content considers the plant recovery factor. Dilution and modifying factors are based on historic performance.

The previous Mineral Reserve estimate is summarised in Table 5-4 and Table 5-5, respectively. These have been superseded by the current estimate prepared by Harmony as detailed in Section 0 of this TRS.

| | |

Effective Date: 30 June 2022 13 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

Table 5-4: Summary of the Previous Phakisa Mineral Reserves as at 30 June 2021

| | | | | | | | | | | |

| METRIC |

| Mineral Reserve Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Proven | 3.900 | 6.36 | 24,793 |

| Probable | 0.371 | 6.58 | 2,445 |

| Total / Ave. Proven + Probable | 4.271 | 6.38 | 27,238 |

| IMPERIAL |

| Mineral Reserve Category | Tonnes (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Proven | 4.299 | 0.185 | 0.797 |

| Probable | 0.409 | 0.192 | 0.079 |

| Total / Ave. Proven + Probable | 4.708 | 0.186 | 0.876 |

Table 5-5: Summary of the Previous Tshepong Mineral Reserves as at 30 June 2021

| | | | | | | | | | | |

| METRIC |

| Mineral Reserve Category | Tonnes (Mt) | Gold Grade (g/t) | Gold Content (kg) |

| Proven | 16,150 | 5,63 | 90 979 |

| Probable | 4,313 | 4,28 | 18 458 |

| Total / Ave. Proven + Probable | 20,463 | 5,35 | 109 437 |

| IMPERIAL |

| Mineral Reserve Category | Tonnes (Mt) | Gold Grade (oz/t) | Gold Content (Moz) |

| Proven | 17,802 | 0,164 | 2,925 |

| Probable | 4,754 | 0,125 | 0,593 |

| Total / Ave. Proven + Probable | 22,556 | 0,156 | 3,518 |

| | |

Effective Date: 30 June 2022 14 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

5.4Past Production

The annual tonnage, grade and gold production for the Tshepong Operations is presented in Figure 5-1 and Figure 5-2. The reader should note that the Tshepong Operations were reported separately in FY16, FY17. Phakisa and Tshepong results have been combined since 2018.

| | |

| Figure 5-1: Graph of Past Production – Tonnes and Grade |

|

| Figure 5-2: Graph of Past Metal Production |

|

| | |

Effective Date: 30 June 2022 15 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

6Geological Setting, Mineralisation and Deposit

Section 229.601(b)(96) (6) (i-iii)

6.1Regional Geology

Tshepong and Phakisa are located on the southwestern margin of the Archean Witwatersrand Basin, one of the prominent gold provinces in the world. The Witwatersrand Basin is an approximately 7,000m thick terrigenous sequence comprising mainly arenaceous and argillaceous, together with minor rudaceous, lithologies deposited in a fluvio-deltaic environment in the centre of the Archaean Kaapvaal Craton of South Africa (Robb and Meyer, 1995). The regional geology of the Witwatersrand Basin is shown in Figure 6-1.

The Witwatersrand Basin hosts the Witwatersrand Supergroup, which either conformably or unconformably overlies the metamorphosed volcanic and minor clastic sediments of the Dominion Group (Tucker et al., 2016). The Dominion Group overlies the older granite-greenstone basement.

The majority of the Witwatersrand Supergroup is capped by the volcano-sedimentary sequence of the Ventersdorp Supergroup through an angular unconformity. The Ventersdorp Supergroup is in turn overlain by the dolomitic and quarzitic sequence of the Transvaal Supergroup, and sediments of the Karoo Supergroup (Tucker et al., 2016). Several suites of dykes and sills cut across the Archaean basement and the Witwatersrand, Ventersdorp, Transvaal and Karoo supergroups, and form important geological time-markers.

The Witwatersrand Supergroup is sub-divided into the basal West Rand Group (“WRG”) and overlying CRG (Robb and Robb, 1998). The WRG extends over an area of 43,000km2 and is up to 5,150m thick. It is sub-divided in three subgroups, namely, from bottom upwards, the Hospital Hill Subgroup; Government Subgroup and Jeppestown Subgroup. The stratigraphic succession of the WRG mainly consists of shale sediments, with occasional units of banded iron formation and conglomerate.

The CRG is up to 2,880m thick and covers an area of up to 9,750km2, with a basal extent of c.290km x 150km. It is sub-divided into the lower Johannesburg Subgroup and upper Turffontein Subgroup as shown in Figure 6-2. These subgroups are separated by the Booysens Shale Formation. The stratigraphic succession of the CRG comprises coarse-grained fluvio-deltaic sedimentary rocks.

The major gold bearing conglomerates are mostly confined to the CRG, and these conglomerate horizons are known as reefs. The most important reefs within the CRG are at six stratigraphic positions, three within the Johannesburg Sub-group and three within the Turffontein Sub-group. The reefs are mined in seven major goldfields, and a few smaller occurrences, which extend for over 400km in what has been called “The Golden Arc”. This arc is centred on the prominent Vredefort Dome, as shown in Figure 6-1,. which is thought to be a major meteorite impact site in the centre of the Witwatersrand Basin (Therriault et al., 1997). The goldfields, as shown in Figure 6-1, include: East Rand, South Rand, Central Rand, West Rand, West Wits, Klerksdorp, Free State (Welkom), and Evander.

6.2Local Geology

Tshepong and Phakisa are located within the Free State Goldfield (Figure 6-1). The stratigraphic column of the Free State Goldfield is presented in Figure 6-2. The Johannesburg Subgroup comprises the Virginia, St Helena, Welkom, Harmony and Dagbreek formations.

The Free State Goldfield forms a triangle between the towns of Allanridge, Welkom and Virginia. The area is host to several gold mines, all of which produce gold from auriferous bearing reefs situated within sediments of the Central Rand Group of the Witwatersrand Sequence (Figure 6-2). Most of the presently exploitable reefs are situated within five stratigraphically separate placers including the Basal/Steyn, Saaiplaas Leader, B, Kimberley and Eldorado, with the majority of tonnage derived from the Basal/ Steyn and Saaiplaas Leader.

The Witwatersrand and overlying Ventersdorp lavas were deposited in a basin with significant and continual down warping to accommodate the sediments and lavas. During Platburg times, the basin underwent a significant rifting and tilting event, resulting in the region being split by significant faults. These faults are generally westerly dipping, with downthrows to the west, and strata dipping generally to the east.

| | |

Effective Date: 30 June 2022 16 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | |

| Figure 6-1: Regional Geology of the Witwatersrand Basin |

|

| | |

Effective Date: 30 June 2022 17 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

| | |

| Figure 6-2: Simplified stratigraphy of the Free State Goldfield |

|

| | |

Effective Date: 30 June 2022 18 |

| | | | | |

| Technical Report Summary for

Tshepong Operations, Free State Province, South Africa |

The general orientation of the Witwatersrand Supergroup succession in the Free State Goldfield is interpreted as north-trending within a syncline that is plunging to the north (Figure 6-3). The syncline is cut by two major faults resulting in the formation of three major fault bounded blocks:

•Odendaalsrus Section to the west of the De Bron fault;

•the Central Horst between the De Bron and Homestead faults; and

•the Virginia Section to the east of the Homestead Fault.

The Central Horst was uplifted, and the Central Rand Group rocks eroded away prior to deposition of the Ventersdorp Supergroup and therefore comprises West Rand quartzites. The western margin of the Tshepong Lease is also marked by structures including the Ophir Fault that is bisected into eastern and western portions by a second, the Dagbreek Fault.

A cross section through the fault bounded blocks is presented in Figure 6-4.

6.3Property Geology

The principal gold-bearing orebody is the stratiform and strata-bound Basal Reef (or Basal Reef Zone (“BRZ”)) (Figure 6-2). A secondary reef, the B Reef, lying between 150m and 170m stratigraphically above the Basal Reef, contributes less than 20% to the mining production at Tshepong Mine.

6.3.1Basal Reef Lithology

The Basal Reef comprises a thin conglomerate, overlain by clean ‘placer’ quartzites. The Basal Reef is underlain by a thick series of siliceous and argillaceous quartzites comprising the Welkom Formation and overlain by shales and quartzites of the Harmony Formation, both of the Johannesburg Sub-group of the CRG. The Basal Reef sits unconformably on the Welkom Formation (Figure 6-2).

The Upper Cycle Black Chert facies Basal Reef prevails in the south of the Tshepong area and consists of a slightly polymictic (yellow shale specks present), matrix-supported medium-pebble conglomerate with a more gradational contact absent of carbon, where mineralisation is associated with fine disseminated and buck-shot pyrite. The conglomerate is slightly thicker compared to the Lower Cycle, but is also overlain by barren reef quartzite, the entire package being characteristically up to only 40cm thick. The lower Khaki Shale is up to 1m thicker.