UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________

FORM 10-K

________________________

| x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 29, 2006

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from _____ to _____

Commission file number 1-7567

_________________________

URS CORPORATION

(Exact name of registrant as specified in its charter)

Delaware | | 94-1381538 |

| (State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

| | | |

600 Montgomery Street, 26th Floor | | |

San Francisco, California | | 94111-2728 |

| (Address of principal executive offices) | | (Zip Code) |

(415) 774-2700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class: | | Name of each exchange on which registered: |

| | | |

| Common Shares, par value $.01 per share | | New York Stock Exchange |

| | | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes xNo o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes xNo o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act.

Large accelerated filer xAccelerated filer o Non-Accelerated filer o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes oNo x

The aggregate market value of the common stock of the registrant held by non-affiliates on February 19, 2007 and June 30, 2006 (the last business day of the registrant’s most recently completed second fiscal quarter) was $2,277.9 million and $2,147.9 million, respectively, based upon the closing sales price of the registrant’s common stock on such date as reported in the consolidated transaction reporting system. On February 19, 2007, and June 30, 2006, there were 52,504,697 shares and 51,872,502 shares of the registrant’s common stock outstanding, respectively.

Documents Incorporated by Reference

Part III incorporates information by reference from the registrant’s definitive proxy statement for the Annual Meeting of Stockholders to be held on May 24, 2007.

Table of ContentsURS CORPORATION AND SUBSIDIARIES

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “will,” and similar terms used in reference to our future revenue, service and business trends; future accounting policies and actuarial estimates; future stock-based compensation expenses; future retirement plan expenses; future legal proceedings and accruals; future insurance coverage; future guarantees and debt service; future capital resources; future effectiveness of our disclosure and internal controls over financial reporting and future economic and industry conditions. We believe that our expectations are reasonable and are based on reasonable assumptions. However, such forward-looking statements by their nature involve risks and uncertainties. We caution that a variety of factors, including but not limited to the following, could cause our business and financial results to differ materially from those expressed or implied in our forward-looking statements: an economic downturn; changes in our book of business; our compliance with government contract procurement regulations; our ability to procure government contracts; our reliance on government appropriations; the ability of the government to unilaterally terminate our contracts; our ability to make accurate estimates and control costs; our and our partners’ ability to bid on, win, perform and renew contracts and projects; environmental issues and liabilities; liabilities for pending and future litigation; the impact of changes in laws and regulations; a decline in defense spending; industry competition; our ability to attract and retain key individuals; employee, agent or partner misconduct; risks associated with changes in equity-based compensation requirements; our leveraged position and ability to service our debt; risks associated with international operations; business activities in high security risk countries; third party software risks; terrorist and natural disaster risks; our relationships with our labor unions; our ability to protect our intellectual property rights; anti-takeover risks and other factors discussed more fully in Management’s Discussion and Analysis of Financial Condition and Results of Operations beginning on page 28, Risk Factors beginning on page 14 , as well as in other reports subsequently filed from time to time with the United States Securities and Exchange Commission. We assume no obligation to revise or update any forward-looking statements.

| | PART I | |

| | | |

| Business | 3 |

| Risk Factors | 14 |

| Unresolved Staff Comments | 23 |

| Properties | 23 |

| Legal Proceedings | 23 |

| Item 4. | Submission of Matters to a Vote of Security Holders | 24 |

| Item 4A. | Executive Officers of the Registrant | 24 |

| | | |

| | PART II | |

| | | |

| Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 25 |

| Selected Financial Data | 26 |

| Management’s Discussion and Analysis of Financial Condition and Results of Operations | 28 |

| Quantitative and Qualitative Disclosures about Market Risk | 52 |

| Consolidated Financial Statements and Supplementary Data | 54 |

| | |

| | December 29, 2006 and December 30, 2005 | 56 |

| | | |

| | Years ended December 29, 2006, December 30, 2005, two months ended December 31, 2004, and year ended October 31, 2004 | 57 |

| | | |

| | Year ended December 29, 2006, year ended December 30, 2005, two months ended December 31, 2004, and year ended October 31, 2004 | 58 |

| | | |

| | Year ended December 29, 2006, year ended December 30, 2005, two months ended December 31, 2004, and year ended October 31, 2004 | 59 |

| | | 61 |

| Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 116 |

| Controls and Procedures | 116 |

| Other Information | 117 |

| | | |

| | PART III | |

| | | |

| Directors and Executive Officers and Corporate Governance | 117 |

| Executive Compensation | 117 |

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 118 |

| Certain Relationships and Related Transactions, and Director Independence | 118 |

| Principal Accounting Fees and Services | 118 |

| | |

| | PART IV | |

| | | |

| Exhibits, Financial Statement Schedules | 118 |

Summary

We are one of the largest engineering design services firms worldwide and a major U.S. federal government contractor for systems engineering and technical assistance and operations and maintenance services. Our business focuses primarily on providing fee-based professional and technical services in the engineering and construction services and defense markets, although we perform some limited construction work. We operate through two divisions: the URS Division and the EG&G Division. Our URS Division provides a comprehensive range of professional planning and design, program management, construction management, and operations and maintenance services to various government agencies and departments in the United States and internationally, as well as to private industry clients. Our EG&G Division provides planning, systems engineering and technical assistance, operations and maintenance, and program management services to various U.S. federal government agencies, primarily the Departments of Defense and Homeland Security. For information on our business by segment and geographic regions, please refer to Note 7, “Segment and Related Information” to our “Consolidated Financial Statements and Supplementary Data,” which is included under Item 8 of this report.

Clients, Services and Markets

We market our services to federal government agencies, state and local government agencies, private industry, and international clients through our extensive network of approximately 370 offices and contract-specific job sites across the U.S. and in more than 20 foreign countries.

We focus our expertise on eight key markets: transportation, environmental, facilities, industrial infrastructure and process, water/wastewater, homeland security, defense systems, and installations and logistics.

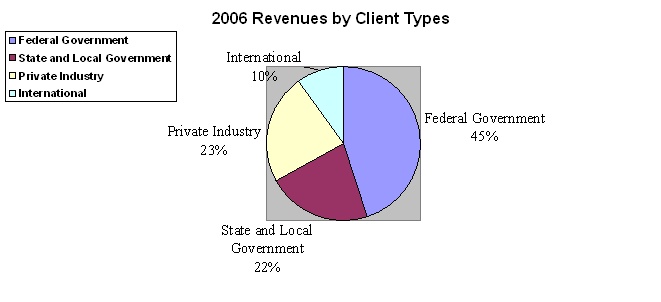

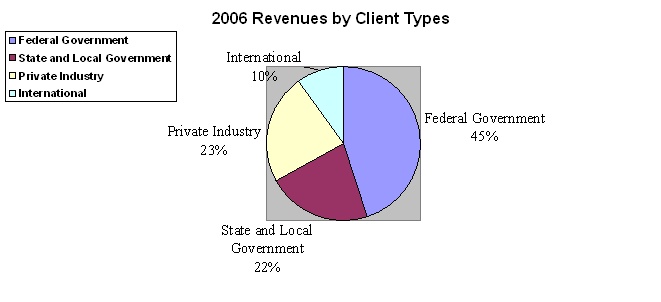

The following table summarizes our revenues, representative services and representative markets by client type for our fiscal year ended December 29, 2006.

Client Types | % of Revenues | Representative Services | Representative Markets |

| Federal Government | | · Operations and Maintenance · Systems Engineering and Technical Assistance · Planning and Design · Program Management · Construction Management | · Facilities · Environmental · Homeland Security · Defense Systems · Installations and Logistics · Transportation |

| State and Local Government | | · Planning and Design · Program Management · Construction Management · Operations and Maintenance | · Transportation · Facilities · Homeland Security · Environmental · Water/Wastewater |

| Private Industry | 23% | · Planning and Design · Program Management · Construction Management · Operations and Maintenance | · Environmental · Industrial Infrastructure and Process · Facilities · Water/Wastewater |

| International | | · Planning and Design · Program Management · Construction Management · Operations and Maintenance | · Transportation · Facilities · Environmental · Water/Wastewater · Homeland Security · Defense Systems |

Clients

We provide our services to a broad range of domestic and international clients, including agencies of the U.S. federal government, state and local government agencies and private industry clients located both in the U.S. and abroad. The following table summarizes the primary client types serviced by our URS and EG&G Divisions for the fiscal year ended December 29, 2006.

Client Types | URS Division | EG&G Division |

| Federal Government | ü | ü |

| State and Local Government | ü | — |

| Private Industry | ü | — |

| International | ü | — |

| ü | a primary client type for the division. |

| — | not a primary client type for the division. |

U.S. Federal Government. We are a major government contractor for planning and design, systems engineering and technical assistance, operations and maintenance services, program management, and construction management, providing services to the Departments of Defense, Homeland Security, Justice, Energy and Treasury, the Environmental Protection Agency, NASA, the United States Postal Service and the General Services Administration. Following a steady decline in uniformed and civilian personnel levels throughout the 1990s, the Department of Defense (“DOD”) has used contractors for large, multi-service government outsourcing contracts in support of military operations. Our revenues from U.S. federal government agencies exclude revenues arising from federal grants or matching funds allocated to and passed through state and local government agencies. We serve U.S. federal government clients through both our URS and EG&G Divisions.

State and Local Government. Our state and local government agency clients include various local municipalities, community planning boards, state and municipal departments of transportation and public works, transit authorities, water and wastewater authorities, environmental protection agencies, school boards and authorities, judiciary agencies, public hospitals, ports and harbors, and airport authorities. In the United States, substantially all spending for infrastructure - transportation facilities, public buildings and water/wastewater systems - is coordinated through these agencies. Our state and local government revenues include those originating from federal grants or matching funds provided to state and local government agencies. Our state and local government clients are primarily served by the URS Division.

Private Industry. Most of our private industry clients are Fortune 500 companies, many with international operations, from a broad range of industries, including chemical, pharmaceutical, oil and gas, power, manufacturing, mining and pipelines. Over the past several years, many of these companies have reduced the number of service providers they use, selecting larger, multi-service contractors with international operations in order to control overhead costs. Our private industry clients are served primarily through the URS Division.

International. The focus of our international business is to provide a range of services to our multinational private industry clients and foreign governmental agencies in the Americas (outside the U.S.), Europe and Asia Pacific. Although both the URS and EG&G Divisions work outside of the United States, our international client base is served primarily by the URS Division.

Services

We provide professional planning and design, systems engineering and technical assistance, program management, construction management, and operations and maintenance services to the U.S. federal, state, and local government agencies, as well as private industry and international clients. These services are delivered through a network of offices and contract-specific job sites. Although we are typically the prime contractor, in some cases, we provide services as a subcontractor or through joint ventures or partnership agreements with other service providers. The following table summarizes the services provided by our URS and EG&G Divisions for the fiscal year ended December 29, 2006.

Services | URS Division | EG&G Division |

| Planning and Design | ü | ü |

| Systems Engineering and Technical Assistance | — | ü |

| Construction Management | ü | — |

| Program Management | ü | ü |

| Operations and Maintenance | ü | ü |

| ü | the division provides the listed service. |

| — | | the division does not provide the listed service. |

Planning and Design. The planning process is typically used to develop a blueprint or overall scheme for a project. Based on the project requirements identified during the planning process, detailed plans are developed, which may include material specifications, construction cost estimates and schedules. Our planning and design services include the following:

| · | transportation planning; |

| · | technical and economic feasibility studies; |

| · | environmental impact assessments; |

| · | permitting, to ensure compliance with applicable regulations; |

| · | the analysis of alternative designs; and |

| · | the development of conceptual and final design documents. |

We provide planning and design services for the construction of new transportation projects and for the renovation and expansion of existing transportation infrastructure, including bridges, highways, roads, airports, mass transit systems and railroads, and ports and harbors. We also plan and design many types of facilities, such as schools, courthouses, hospitals, corporate offices and retail outlets, as well as water supply and conveyance systems and wastewater treatment plants. Our planning and design capabilities support homeland defense and global threat reduction programs; hazardous waste clean-up activities at military bases; and environmental assessment, due diligence and permitting at commercial and industrial facilities. We also provide design support to military clients for major research and development projects.

Systems Engineering and Technical Assistance. We provide a broad range of systems engineering and technical assistance to all branches of the U.S. military for the design and development of new weapons systems and the modernization of aging weapons systems. We have the expertise to support a wide range of platforms including aircraft and helicopters, tracked and wheeled vehicles, ships and submarines, shelters and ground support equipment. Representative systems engineering and technical assistance services include:

| · | defining operational requirements and developing specifications for new weapons systems; |

| · | reviewing hardware and software design data; and |

| · | developing engineering documentation for these systems. |

We support a number of activities including technology insertion, system modification, installation of new systems/equipment, design of critical data packages, and configuration management.

Construction Management. We serve as the client’s representative and monitor the progress, cost and quality of construction projects in process. As construction managers, we typically oversee and coordinate the activities of construction contractors, providing a variety of services, including:

| · | cost and schedule management; |

| · | contract administration; |

| · | quality control and quality assurance; and |

| · | claims and dispute resolution. |

We provide construction management services for transportation, facilities, environmental and water/wastewater projects.

Program Management. We provide the technical and administrative services required to manage, coordinate and integrate the multiple and concurrent assignments that comprise a large program - from concept through completion. For large military programs, which typically involve naval, ground, vessel and airborne platforms, our program management services include logistics planning, acquisition management, risk management of weapons systems, safety management and subcontractor management. We also provide program management services for large capital improvement programs, which include planning, coordination, schedule and cost control, and design, construction, and commissioning oversight.

Operations and Maintenance. We provide operations and maintenance services in support of large military and other non-military installations and operations. Our services include:

| · | management of military base logistics, including overseeing the operation of government warehousing and distribution centers, as well as government property and asset management; |

| · | maintenance, modification, overhaul and life service extension services for military vehicles, vessels and aircraft; |

| · | operation and maintenance of chemical agent disposal systems; |

| · | comprehensive military flight training services; and |

| · | support of high security systems. |

Markets

We focus our expertise on eight key markets: transportation, environmental, industrial infrastructure and process, facilities, water/wastewater, homeland security, installations and logistics and defense systems. Our domestic and international network of offices allows us to perform business development and sales activities on a localized basis. In addition, for large-scale projects and multinational clients, we coordinate national and international marketing efforts on a company-wide basis. The following table summarizes the markets served by our URS and EG&G Divisions, as separate reporting segments, for our fiscal year ended December 29, 2006.

Markets | URS Division | EG&G Division |

| Transportation | ü | — |

| Environmental | ü | — |

| Industrial Infrastructure and Process | ü | — |

| Facilities | ü | — |

| Water/Wastewater | ü | — |

| Homeland Security | ü | ü |

| Installations and Logistics | ü | ü |

| Defense Systems | — | ü |

| ü | the division serves this market. |

| — | the division does not serve this market. |

Transportation

We provide a full range of planning and design, program management and construction management services for surface transportation, air transportation, rail transportation, and ports and harbors projects as described below.

Surface Transportation. We provide services for all types of surface transportation systems and networks, including highways, bridges, tunnels and interchanges and toll road facilities. Our expertise also includes the planning and design, and operations and maintenance of intelligent transportation systems, such as traffic management centers. Historically, we have emphasized the design of new transportation systems, but in recent years, we also have focused on the rehabilitation and expansion of existing systems.

Air Transportation. We provide comprehensive services for the development of new airports and the modernization and expansion of existing facilities, including airport terminals; hangars and air cargo buildings; air traffic control towers; runways and taxiways; and related airport infrastructure such as roadways, parking garages and people movers. We also specialize in baggage, communications and aircraft fueling systems. We have completed projects at both general aviation and large-hub international airports throughout the world. In the growing area of airport security, we assist airport authorities and owners, and airline carriers in all aspects of security-related projects. For example, we provide a full range of planning and design, program management, construction management, and operations and maintenance services for airport security systems, including baggage screening and perimeter access control systems.

Rail Transportation. We provide services to freight and passenger railroads and urban mass transit agencies. We have planned, designed and managed the construction of commuter rail systems, freight rail systems, heavy and light rail transit systems, and high-speed rail systems. Our specialized expertise in transportation structures, including terminals, stations, parking facilities, bridges, tunnels and power, signals and communications systems, complements these capabilities.

Ports and Harbors. We provide comprehensive services to waterfront property ownerships, ports and harbors authorities, port tenants, waterfront cities and counties, construction contractors and the DOD for the planning, design and construction management of container terminals, liquid and dry bulk terminals, storage facilities, piers, wharves, seawalls and slope protection, recreational marinas and small craft harbors. We also provide environmental and geotechnical services for waterfront projects, as well as specialized services in port security and Tsunami modeling.

Environmental

We provide a variety of engineering and environmental services related to protecting, preserving and restoring our air, water and soil quality for U.S. federal government, state and local government agencies, and commercial and industrial clients in the private sector. Our services include environmental impact assessments, permitting and regulatory compliance, environmental management and pollution control, waste management, remediation design, program management, construction management, demolition and environmental clean-up. We provide air quality monitoring and modeling, and design air emissions control systems. We also provide comprehensive services related to the identification, characterization and remediation of hazardous waste sites.

Industrial Infrastructure and Process

We provide planning and engineering design services for new industrial infrastructure and process facilities, as well as the expansion and upgrade of existing facilities. We provide services to clients in the oil and gas, power, chemical/pharmaceutical, manufacturing, pipeline and mining sectors. Our work in the oil and gas and pipeline sectors involves refineries, gas processing facilities, gas and liquid pipelines and gas storage facilities. In the chemical/pharmaceutical market, we provide services for petrochemical, specialty chemical and polymer facilities. Our work for the manufacturing sector involves pulp and paper, food and light manufacturing facilities. We also provide infrastructure design services for mining facilities.

Facilities

We provide planning, architectural and engineering design, program management, construction management for new facilities and the rehabilitation and expansion of existing facilities. Our work involves a broad range of building types, including education, judicial, correctional, health care, retail, sports, recreational, industrial, research and office facilities. We also provide historic preservation, adaptive reuse and seismic upgrade services.

Water/Wastewater

We provide services for the planning, design and construction of all types of water/wastewater treatment facilities and systems. Services are provided for new and expanded water supply, storage, distribution and treatment systems, municipal wastewater treatment and sewer systems, levees, and watershed, storm water management, flood control systems, and coastal restoration. We also provide design and seismic retrofit of earth, rock fill and concrete dams, as well as the design of reservoirs and impoundments.

Homeland Security

We provide a variety of services to the Department of Homeland Security (“DHS”), DOD, and other federal departments and state and local government agencies in support of homeland security activities. This work includes conducting threat assessments of public facilities, planning and conducting emergency preparedness exercises, and designing force protection systems and security systems.

In addition, our related global threat reduction services focus on the elimination and dismantlement of nuclear, chemical and biological weapons of mass destruction (“WMDs”). Our services include operating and maintaining chemical agent disposal facilities and providing advisory services for dismantling and eliminating WMDs. We also develop emergency response strategies and conduct first responder training for the military and other federal state and local government agencies.

Installations and Logistics

We assist the U.S. federal government by providing services to support the operations of complex government and military installations and the management of logistics activities for government supply and distribution networks.

Installations Management. We provide comprehensive services for the operation and maintenance of complex government installations, including military bases and test ranges. Our services vary from managing basic base operations to the design, installation and maintenance of complex equipment for testing new weapons.

Logistics. We provide a number of DOD agencies and defense prime contractors with turn-key logistics support services focused on developing and managing integrated supply and distribution networks. We oversee warehousing, packaging, delivery, and traffic management for the distribution of government equipment and materials. We also manage depot equipment maintenance, safety, security and contracting.

Defense Systems

We provide a variety of services to the U.S. federal government in support of military activities. These services include Defense Systems & Services, Field Services and Flight Services & Training.

Defense Systems & Services. We provide a variety of weapons system design and modernization services to DOD weapons systems management offices, laboratories, technical centers, support centers, and maintenance activities. Our services include acquisition support for new defense systems, engineering and technical assistance for the modernization of existing systems, and maintenance planning to help extend their service life.

Field Services. We maintain, modify and overhaul aircraft, ground vehicles, such as Humvees, tanks, and armored personnel carriers, and associated support equipment for the U.S. Army, U.S. Air Force, U.S. Navy and U.S. Coast Guard. We provide these services for military operations both in the U.S. and abroad.

Flight Services & Training. We provide a variety of services to the U.S. Army, U.S. Air Force, and U.S. Coast Guard to support undergraduate and graduate-level training for pilots of military fixed wing and rotary wing aircraft. We also assist with the acquisition of military parts for these aircraft.

Major Customer

Our largest client type is the U.S. federal government (45% of our total fiscal 2006 revenues) and our largest customer is the U.S. Army. During 2006, we had multiple contracts with the U.S. Army, which collectively contributed more than 10% of our consolidated revenues, as summarized in the following table, for the years ended December 29, 2006 and December 30, 2005, the two months ended December 31, 2004, and year ended October 31, 2004. However, we are not dependent on any single contract on an ongoing basis, and we believe that the loss of any contract would not have a material adverse effect on our business.

| | | URS Division | | EG&G Division | | Total | | % of Our Consolidated Revenues | |

| | | (In millions, except for percentages) | |

Year ended December 29, 2006 | | | | | | | | | |

| The U.S. Army (1) | | $ | 107.8 | | $ | 735.2 | | $ | 843.0 | | | 20 | % |

| | | | | | | | | | | | | | |

Year ended December 30, 2005 | | | | | | | | | | | | | |

| The U.S. Army (1) | | $ | 109.2 | | $ | 682.2 | | $ | 791.4 | | | 20 | % |

| | | | | | | | | | | | | | |

Two months ended December 31, 2004 | | | | | | | | | | | | | |

| The U.S. Army (1) | | $ | 17.1 | | $ | 91.2 | | $ | 108.3 | | | 19 | % |

| | | | | | | | | | | | | | |

Year ended October 31, 2004 | | | | | | | | | | | | | |

| The U.S. Army (1) | | $ | 96.0 | | $ | 490.7 | | $ | 586.7 | | | 17 | % |

| | | | | | | | | | | | | | |

| (1) | The U.S. Army includes U.S. Army Corps of Engineers. |

Competition

Our industry is highly fragmented and intensely competitive. Our competitors are numerous, ranging from small private firms to multi-billion dollar companies. The technical and professional aspects of our services generally do not require large upfront capital expenditures and therefore provide limited barriers against new competitors. Some of our competitors have achieved greater market penetration in some of the markets in which we compete and have substantially more financial resources and/or financial flexibility than we do. To our knowledge, no individual company currently dominates any significant portion of our markets. Competition in our industry is based on quality of performance, reputation, expertise, price, technology, customer relationships, range of service offerings, and domestic and international office networks.

We believe that we are well positioned to compete in our markets because of our solid reputation, our long-term client relationships, our extensive network of offices and our broad range of services. We are one of the largest engineering design services firms worldwide and a major U.S. federal government contractor for systems engineering and technical assistance, operations and maintenance, and program management services. We provide a comprehensive portfolio of services ranging from engineering planning and design to operations and maintenance. In addition, as a result of our national and international network of approximately 370 offices and contract-specific job sites, we can offer our governmental and private clients localized knowledge and expertise that is backed by the support of our worldwide professional staff.

The competitive environments in which each business segment operates are described below:

URS Division. The URS Division's business segment is highly competitive and characterized by competition primarily based on performance, reputation, expertise, price, technology, customer relationships, range of service offerings, and domestic and international office networks. Our competitors are numerous, ranging from small private firms to multi-billion dollar companies. The primary competitors of our URS Division include AECOM Technology Corporation, CH2M HILL Companies, Ltd., Earth Tech Inc. (a subsidiary of Tyco International, Ltd.), Fluor Corporation, Jacobs Engineering Group Inc., Parsons Brinckerhoff Inc., the Shaw Group, Inc., Tetra Tech, Inc. and Washington Group International, Inc. The URS Division’s contract mix is weighted more towards providing professional engineering and operations and maintenance services via cost-plus, time-and-materials and negotiated fixed-price contracts, which are generally lower risk than lump-sum, low-bid fixed-price contracts and, our portfolio is comprised of a larger number of generally smaller contracts.

EG&G Division. The EG&G Division's business segment is highly competitive and characterized by competition primarily based on quality of performance, reputation, expertise, price, technology, customer relationships and range of service offerings. Our competitors are numerous, ranging from small private firms to multi-billion dollar companies. The primary competitors of our EG&G Division include DynCorp International LLC, General Dynamics Corporation, KBR, L-3 Communications Corporation, Raytheon Corporation, and Science Application International Corporation (SAIC).

Backlog, Designations, Option Years and Indefinite Delivery Contracts

We determine the value of all contract awards that may potentially be recognized as revenues over the life of the contracts. We categorize the value of our book of business into backlog, designations, option years and indefinite delivery contracts, or “IDCs,” based on the nature of the award and its current status. As of December 29, 2006 and December 30, 2005, our total book of business was $12.4 billion and $11.5 billion, respectively. A discussion and breakdown of our book of business are included below.

Backlog. Our contract backlog consists of the amount billable at a particular point in time for future services under signed contracts, including task orders that are actually issued and funded under IDCs. Our consolidated contract backlog was $4,637.2 million and $3,837.7 million at December 29, 2006 and December 30, 2005, respectively.

Designations. Our clients often designate us as the recipient of future contracts. These “designations” are projects that clients have awarded to us, but for which we do not yet have signed contracts. As of December 29, 2006 and December 30, 2005, the estimated value of our consolidated designations was $1,580.4 million and $1,476.2 million, respectively.

Option Years. A significant portion of the EG&G Division’s contracts are multi-year contracts with a base period, plus option years. The base periods of these contracts can vary from one to five years. The option years are exercised at the option of our clients without requiring us to go through an additional competitive bidding process and would only be canceled through a termination for default or if a client decides to end the project (a termination for convenience). As of December 29, 2006 and December 30, 2005, the estimated value of the option years on our contracts was $1,010.0 million and $1,092.2 million, respectively.

Indefinite Delivery Contracts. Indefinite delivery contracts are signed contracts under which we perform work only when the client issues specific task orders. Generally, the terms of these contracts exceed one year and often include a maximum term and potential value. IDCs generally range from one to twenty years in length. When such task orders are signed and funded, we transfer their value into backlog. As of December 29, 2006 and December 30, 2005, the estimated remaining value of our consolidated IDCs was $5,177.7 million and $5,064.7 million, respectively.

While the value of our book of business is a predictor of future revenues, we have no assurance, nor can we provide assurance that we will ultimately realize the maximum potential values for backlog, designations, option years or IDCs. Based on our historical experience, our backlog has the highest likelihood of being converted into revenues because it is based upon signed and executable contracts with our clients. Although there is a high probability that our designations will eventually convert into revenues, they are not as certain as backlog because our clients have not yet signed a contract with us. Due to the nature of option years, which are exercisable at the option of our clients, the likelihood of their conversion into revenues is lower than that of backlog, but higher than that of designations because we have a signed contract with the client and do not need to go through a competitive bidding process to obtain the option on the contract. Because we do not perform work under IDCs until specific task orders are issued, the value of our IDCs are not as likely to convert into revenues as other categories of our book of business.

Acquisitions

We have historically made strategic acquisitions in order to diversify our client base, increase the range of services we offer and expand the markets we serve. In September 2006, we acquired Cash & Associates, a small civil and structural engineering firm that specializes in the planning and design and program management of ports and harbors projects. The acquisition of Cash & Associates enhances our capabilities in the ports and harbors market, which we expect will experience significant growth over the next 10 years, due to increased maritime trade and the need for additional infrastructure and security.

History

We were originally incorporated in California on May 1, 1957 under the former name of Broadview Research Corporation. On May 18, 1976, we re-incorporated in Delaware. On March 28, 1974, we changed our name to URS Corporation. Since then, we have implemented several name changes as a result of mergers and acquisitions. On February 21, 1990, we changed our name back to URS Corporation.

Regulations

We provide services for contracts that are subject to government oversight, including environmental laws and regulations, general government procurement laws and regulations, and other government regulations and requirements. For more information on risks associated with our government regulations, please refer to Item 1A, “Risk Factors,” of this report.

Environmental. A portion of our business involves the planning, design, program management, and construction management and operation and maintenance of pollution control facilities, as well as the assessment, design and management of remediation activities at hazardous waste or Superfund sites and military bases. In addition, we have contracts with U.S. governmental entities to destroy hazardous materials, including chemical agents and weapons stockpiles. These activities may require us to manage, handle, remove, treat, transport and dispose of toxic or hazardous substances.

Some environmental laws including the Resource Conservation and Recovery Act of 1976, as amended, (“RCRA”), and the Comprehensive Environmental Response Compensation and Liability Act of 1980, as amended, (“CERCLA”), as well as other governmental laws can impose liability for the entire cost of the clean-up of contaminated facilities or sites upon present and former owners and operators as well as generators, transporters and persons arranging for the treatment or disposal of such substances. While we strive to handle hazardous and toxic substances with care and in accordance with safe methods, the possibility of accidents, leaks, spills and the events of force majeure always exist. Humans exposed to these materials, including workers or subcontractors engaged in the transportation and disposal of hazardous materials, and persons in affected areas may be injured or become ill, resulting in lawsuits that expose us to liability and may result in substantial damage awards against us. Liabilities for contamination or human exposure to hazardous or toxic materials or a failure to comply with applicable regulations could result in substantial costs to us, including clean-up costs, fines and civil or criminal sanctions, third party claims for property damage or personal injury, or cessation of remediation activities.

Some of our business operations are covered by Public Law 85-804, which provides for government indemnification against claims and damages arising out of unusually hazardous or nuclear activities performed at the request of the government. Should public policies and laws be changed, however, government indemnification may not be available in the case of any future claims or liabilities relating to hazardous activities that we undertake to perform.

Government Procurement. The services we provide to the U.S. federal government are subject to the Federal Acquisition Regulation (“FAR”), the Truth in Negotiations Act (“TINA”), the Cost Accounting Standards (“CAS”), the Service Contract Act (“SCA”), DOD security regulations and other rules and regulations applicable to government contracts. These laws and regulations affect how we transact business with our government clients and in some instances, impose added costs to our business operations. A violation of specific laws and regulations could lead to fines, contract termination or suspension of future contracts. Our government clients can also terminate or modify any of their contracts with us at their convenience, and many of our government contracts are subject to renewal or extension annually.

Other regulations and requirements. We provide services to the U.S. DOD and other defense-related entities that often require specialized professional qualifications and security clearances. Our international business is also subject to the Foreign Corrupt Practices Act, as well as various export control, anti-boycott, and embargo laws. In addition, as engineering design services professionals, we are subject to a variety of local, state and foreign licensing and permit requirements.

Sales and Marketing

Our URS Division performs business development and sales activities primarily through our network of local offices around the world. For large, market-specific projects requiring diverse technical capabilities, we utilize the companywide resources of specific disciplines. This often involves coordinating marketing efforts on a regional, national or global level. Our EG&G Division performs business development and sales activities primarily through its management groups, which address specific markets, such as homeland security and defense systems. In addition, our EG&G Division coordinates national marketing efforts on large projects and for multi-division or multi-market scope efforts. Over the past year, the URS Division and the EG&G Division have jointly pursued several federal defense and homeland security projects, and have been successful in marketing EG&G’s technical capabilities to URS’ established state and local government clients.

Seasonality

We experience seasonal trends in our business in connection with federal holidays, such as Memorial Day, Independence Day, Thanksgiving, Christmas and New Year’s Day. Our revenues are typically lower during these times of the year because many of our clients’ employees as well as our own employees do not work during these holidays, resulting in fewer billable hours worked on projects and thus lesser revenues recognized. In addition to holidays, our business also is affected by seasonal bad weather conditions that occasionally cause some of our offices to close temporarily.

Raw Materials

As a professional services company, our business is not heavily dependent on raw materials. Risks associated with the procurement of raw materials for our construction services projects are generally passed through to our clients. We do not foresee the lack of availability of raw materials as a factor that could have a material adverse effect on our business in the near term.

Insurance

Our insurance policy includes primary and excess limits totaling $125.0 million per loss and $125.0 million in the aggregate for general liability, professional errors and omissions liability and contractor’s pollution liability insurance (in addition to other policies for some specific projects). The general liability policy includes a self-insured claim retention of $4.0 million (or $10.0 million in some circumstances). The professional errors and omissions liability and contractor’s pollution liability insurance policies each include a self-insured claim retention amount of $10.0 million each. Parties may seek damages that substantially exceed our insurance coverage.

Excess insurance policies above our primary policy limits provide for coverages on a “claims made” basis, covering only claims actually made and reported during the policy period currently in effect. Thus, if we do not continue to maintain these policies, we will have no coverage for claims made after the termination date, even for claims based on events that occurred during the term of coverage. While we intend to maintain these policies, we may be unable to maintain existing coverage levels. We have maintained insurance without lapse for many years with limits in excess of losses sustained.

Employees

As of January 31, 2007, we had approximately 26,000 full-time employees and 3,300 temporary or part-time workers. The URS Division and the EG&G Division employed approximately 17,000 and 12,300 persons (including temporary and part-time workers), respectively. At various times, we have employed up to several thousand workers on a temporary or part-time basis to meet our contractual obligations. Approximately 2,300 of our employees are covered by collective bargaining agreements. These agreements are subject to amendment on various dates ranging from March 2007 to July 2010.

Available Information

Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available free of charge on our web site at www.urscorp.com. These reports, and any amendments to these reports, are made available on our web site as soon as reasonably practicable after we electronically file or furnish the reports with the Securities and Exchange Commission (“SEC”). You may read and copy any materials filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information about the public reference room. The SEC also maintains a web site (www.sec.gov) containing reports, proxy, and other information that we filed with the SEC. In addition, our Corporate Governance Guidelines, the charters for our Audit, Board Affairs and Compensation Committees, and our Code of Business Conduct and Ethics are available on our web site at www.urscorp.com under the “Corporate Governance” section. Any waivers or amendments to our Code of Business Conduct and Ethics will be posted on our web site. A printed copy of this information is also available without charge by sending a written request to: Corporate Secretary, URS Corporation, 600 Montgomery Street, 26th Floor, San Francisco, CA 94111-2728.

In addition to the other information included or incorporated by reference in this Form 10-K, the following risk factors could affect our financial condition and results of operations and should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations beginning on page 28 and the consolidated financial statements and related notes beginning on page 56 .

Demand for our services is cyclical and vulnerable to economic downturns. If the economy weakens, then our revenues, net income and financial condition may deteriorate.

Demand for our services in our infrastructure and defense markets is cyclical and vulnerable to sudden economic downturns, which may result in clients delaying, curtailing or canceling proposed and existing projects. For example, there was a decrease in our URS Division revenues of $77.9 million, or 3.4%, in fiscal year 2002 compared to fiscal year 2001 as a result of the general economic decline. Our clients may demand better pricing terms and their ability to pay our invoices may be affected by a weakening economy. Our government clients may face budget deficits that prohibit them from funding proposed and existing projects. Our business traditionally lags the overall recovery in the economy; therefore, our business may not recover immediately when the economy improves. If the economy weakens, then our revenues, net income and overall financial condition may deteriorate.

We may not realize the full amount of revenues reflected in our book of business, which could harm our operations and significantly reduce our future revenues.

We account for all contract awards that may eventually be recognized as revenues as our “book of business,” which includes backlog, designations, option years and IDCs. Our backlog consists of the amount billable at a particular point in time, including task orders issued under IDCs. As of December 29, 2006, our backlog was approximately $4.6 billion. Our designations consist of projects that clients have awarded us, but for which we do not yet have signed contracts. Our option year contracts are multi-year contracts with base periods, plus option years that are exercisable by our clients without the need for us to go through another competitive bidding process. Our IDCs are signed contracts under which we perform work only when our clients issue specific task orders. Our book of business estimates may not result in actual revenues in any particular period because clients may modify or terminate projects and contracts and may decide not to exercise contract options or issue task orders. If we do not realize a substantial amount of our book of business, our operations could be harmed and our future revenues could be significantly reduced.

As a government contractor, we are subject to a number of procurement laws, regulations and government audits; a violation of any such laws and regulations could result in sanctions, contract termination, forfeiture of profit, harm to our reputation or loss of our status as an eligible government contractor.

We must comply with and are affected by federal, state, local and foreign laws and regulations relating to the formation, administration and performance of government contracts. For example, we must comply with the FAR, the TINA, the CAS, the SCA and the DOD security regulations, as well as many other laws and regulations. These laws and regulations affect how we transact business with our clients and in some instances, impose additional costs on our business operations. Even though we take precautions to prevent and deter fraud, misconduct and non-compliance, we face the risk that our employees or outside partners may engage in misconduct, fraud or other improper activities. Government agencies, such as the U.S. Defense Contract Audit Agency (“DCAA”), routinely audit and investigate government contractors. These government agencies review and audit a government contractor’s performance under its contracts and cost structure, and compliance with applicable laws, regulations and standards. In addition, during the course of its audits, the DCAA may question our incurred project costs, and if the DCAA believes we have accounted for such costs in a manner inconsistent with the requirements for the FAR or CAS, the DCAA auditor may recommend to our U.S. government corporate administrative contracting officer to disallow such costs. Historically, we have not experienced significant disallowed costs as a result of government audits. However, we can provide no assurance that the DCAA or other government audits will not result in material disallowances for incurred costs in the future. Government contract violations could result in the imposition of civil and criminal penalties or sanctions, contract termination, forfeiture of profit, and/or suspension of payment, any of which could make us lose our status as an eligible government contractor. We could also suffer serious harm to our reputation.

Because we depend on federal, state and local governments for a significant portion of our revenue, our inability to win or renew government contracts during regulated procurement processes could harm our operations and significantly reduce or eliminate our profits.

Revenues from federal government contracts and state and local government contracts represented approximately 45% and 22%, respectively, of our total revenues for the year ended December 29, 2006. Government contracts are awarded through a regulated procurement process. The federal government has increasingly relied upon multi-year contracts with pre-established terms and conditions, such as IDCs, that generally require those contractors who have previously been awarded the IDC to engage in an additional competitive bidding process before a task order is issued. The increased competition, in turn, may require us to make sustained efforts to reduce costs in order to realize revenues and profits under government contracts. If we are not successful in reducing the amount of costs we incur, our profitability on government contracts will be negatively impacted. Moreover, even if we are qualified to work on a government contract, we may not be awarded the contract because of existing government policies designed to protect small businesses and underrepresented minority contractors. Our inability to win or renew government contracts during regulated procurement processes could harm our operations and significantly reduce or eliminate our profits. Each year some government contracts may be dependent on the legislative appropriations process. If legislative appropriations are not made in subsequent years of a multiple-year government contract, then we may not realize all of our potential revenues and profits from that contract.

Each year the funding for some of our government contracts may be dependent on the legislative appropriations process. For example, the passage of the SAFETEA-LU highway and transit bill in August of 2005 has provided additional funding for state transportation projects in which we provide services. Legislatures may appropriate funds for a given project on a year-by-year basis, even though the project may take more than one year to perform. As a result, at the beginning of a project, the related contract may only be partially funded, and additional funding is committed only as appropriations are made in each subsequent year. These appropriations, and the timing of payment of appropriated amounts, may be influenced by, among other things, the state of the economy, competing political priorities, curtailments in the use of government contracting firms, rise in raw material costs, delays associated with a lack of a sufficient number of government staff to oversee contracts, budget constraints, the timing and amount of tax receipts and the overall level of government expenditures. If appropriations are not made in subsequent years of a multiple-year contract, we may not realize all of our potential revenues and profits from that contract.

Our government contracts may give the government the right to modify, delay, curtail or terminate our contracts at their convenience at any time prior to their completion and, if we do not replace these contracts, then we may suffer a decline in revenues.

Government projects in which we participate as a contractor or subcontractor may extend for several years. Generally, government contracts include the right for the government to modify, delay, curtail or terminate contracts and subcontracts at their convenience any time prior to their completion. Any decision by a government client to modify, delay, curtail or terminate our contracts at their convenience may result in a decline in revenues.

If we are unable to accurately estimate and control our contract costs, then we may incur losses on our contracts, which could decrease our operating margins and significantly reduce or eliminate our profits.

It is important for us to control our contract costs so that we can maintain positive operating margins. We generally enter into three principal types of contracts with our clients: cost-plus, fixed-price and time-and-materials. Under cost-plus contracts, which may be subject to contract ceiling amounts, we are reimbursed for allowable costs and fees, which may be fixed or performance-based. If our costs exceed the contract ceiling or are not allowable under the provisions of the contract or any applicable regulations, we may not be reimbursed for all of the costs we incur. Under fixed-price contracts, we receive a fixed price regardless of what our actual costs will be. Consequently, we realize a profit on fixed-price contracts only if we control our costs and prevent cost over-runs on the contracts. Under time-and-materials contracts, we are paid for labor at negotiated hourly billing rates and for other expenses. Profitability on our contracts is driven by billable headcount and our ability to manage costs. Under each type of contract, if we are unable to control costs, we may incur losses on our contracts, which could decrease our operating margins and significantly reduce or eliminate our profits.

Our actual results could differ from the estimates and assumptions that we use to prepare our financial statements, which may significantly reduce or eliminate our profits.

To prepare financial statements in conformity with generally accepted accounting principles, management is required to make estimates and assumptions as of the date of the financial statements, which affect the reported values of assets and liabilities and revenues and expenses and disclosures of contingent assets and liabilities. Areas requiring significant estimates by our management include:

| · | the application of the “percentage-of-completion” method of accounting, and revenue recognition on contracts, change orders, and contract claims; |

| · | provisions for uncollectible receivables and customer claims and recoveries of costs from subcontractors, vendors and others; |

| · | provisions for income taxes and related valuation allowances; |

| · | value of goodwill and recoverability of other intangible assets; |

| · | valuation of assets acquired and liabilities assumed in connection with business combinations; |

| · | valuation of defined benefit pension plans and other employee benefit plans; |

| · | valuation of stock-based compensation expense; and |

| · | accruals for estimated liabilities, including litigation and insurance reserves. |

Our actual results could differ from those estimates, which may significantly reduce or eliminate our profits.

Our use of the “percentage-of-completion” method of accounting could result in a reduction or a reversal of previously recorded revenues and profits.

A substantial portion of our revenues and profits are measured and recognized using the “percentage-of-completion” method of accounting, which is discussed in Note 1, “Accounting Policies,” to our “Consolidated Financial Statements and Supplementary Data” included under Item 8 of this report. Our use of this accounting method results in recognition of revenues and profits ratably over the life of a contract, based generally on the proportion of costs incurred to date to total costs expected to be incurred for the entire project. The effects of revisions to revenues and estimated costs are recorded when the amounts are known or can be reasonably estimated. Such revisions could occur in any period and their effects could be material. Although we have historically made reasonably reliable estimates of the progress towards completion of long-term engineering, program management, construction management or construction contracts in process, the uncertainties inherent in the estimating process make it possible for actual costs to vary materially from estimates, including reductions or reversals of previously recorded revenues and profits.

If our goodwill or intangible assets become impaired, then our profits may be significantly reduced or eliminated.

Because we have grown through acquisitions, goodwill and other intangible assets represent a substantial portion of our assets. Goodwill and other net purchased intangible assets were $993.0 million as of December 29, 2006. If any of our goodwill or intangible assets were to become impaired, we would be required to write off the impaired amount, which may significantly reduce or eliminate our profits.

Our failure to successfully bid on new contracts and renew existing contracts with private and public sector clients could adversely reduce or eliminate our profitability.

Our business depends on our ability to successfully bid on new contracts and renew existing contracts with private and public sector clients. Contract proposals and negotiations are complex and frequently involve a lengthy bidding and selection process, which are affected by a number of factors, such as market conditions, financing arrangements and required governmental approvals. For example, a client may require us to provide a bond or letter of credit to protect the client should we fail to perform under the terms of the contract. If negative market conditions arise, or if we fail to secure adequate financial arrangements or the required governmental approval, we may not be able to pursue particular projects, which could adversely reduce or eliminate our profitability.

If we fail to timely complete, miss a required performance standard or otherwise fail to adequately perform on a project, then we may incur a loss on that project, which may reduce or eliminate our overall profitability.

We may commit to a client that we will complete a project by a scheduled date. We may also commit that a project, when completed, will achieve specified performance standards. If the project is not completed by the scheduled date or fails to meet required performance standards, we may either incur significant additional costs or be held responsible for the costs incurred by the client to rectify damages due to late completion or failure to achieve the required performance standards. The uncertainty of the timing of a project can present difficulties in planning the amount of personnel needed for the project. If the project is delayed or canceled, we may bear the cost of an underutilized workforce that was dedicated to fulfilling the project. In addition, performance of projects can be affected by a number of factors beyond our control, including unavoidable delays from weather conditions, unavailability of vendor materials, changes in the project scope of services requested by clients or labor disruptions. In some cases, should we fail to meet required performance standards, we may also be subject to agreed-upon financial damages, which are determined by the contract. To the extent that these events occur, the total costs of the project could exceed our estimates and we could experience reduced profits or, in some cases, incur a loss on a project, which may reduce or eliminate our overall profitability.

If our partners fail to perform their contractual obligations on a project, we could be exposed to liability, loss of reputation or reduced or eliminated profits.

We sometimes enter into subcontracts, joint ventures and other contractual arrangements with outside partners to jointly bid on and execute a particular project. The success of these joint projects depends upon, among other things, the satisfactory performance of the contractual obligations of our partners. If any of our partners fails to satisfactorily perform its contractual obligations, we may be required to make additional expenditures and provide additional services to complete the project. If we are unable to adequately address our partner’s performance issues, then our client could terminate the joint project, exposing us to liability, loss of reputation or reduced or eliminated profits.

We may be subject to substantial liabilities under environmental laws and regulations.

A portion of our environmental business involves the planning, design, program management, construction management and operation and maintenance of pollution control facilities, hazardous waste or Superfund sites and military bases. In addition, we have contracts with U.S. governmental entities to destroy hazardous materials, including chemical agents and weapons stockpiles. These activities may require us to manage, handle, remove, treat, transport and dispose of toxic or hazardous substances. We must comply with a number of governmental laws that strictly regulate the handling, removal, treatment, transportation and disposal of toxic and hazardous substances. Under the CERCLA and comparable state laws, we may be required to investigate and remediate regulated hazardous materials. CERCLA and comparable state laws typically impose strict, joint and several liabilities without regard to whether a company knew of or caused the release of hazardous substances. The liability for the entire cost of clean up can be imposed upon any responsible party. Other principal federal environmental, health and safety laws affecting us include, but are not limited to, the RCRA, the National Environmental Policy Act, the Clean Air Act, the Clean Air Interstate Rule, the Clean Air Mercury Rule, the Occupational Safety and Health Act, the Toxic Substances Control Act and the Superfund Amendments and Reauthorization Act. Our business operations may also be subject to similar state and international laws relating to environmental protection. Liabilities related to environmental contamination or human exposure to hazardous substances, or a failure to comply with applicable regulations could result in substantial costs to us, including clean-up costs, fines and civil or criminal sanctions, third party claims for property damage or personal injury or cessation of remediation activities. Our continuing work in the areas governed by these laws and regulations exposes us to the risk of substantial liability; however, we are currently not subject to any material claims under environmental laws and regulations.

Our liability for damages due to legal proceedings may adversely affect us and result in a significant loss.

In performing our services, we may be exposed to legal proceedings in connection with cost overruns, personal injury claims, property damage, labor shortages or disputes, weather problems and unforeseen engineering, architectural, environmental and geological problems. In some actions, parties may seek damages that exceed our insurance coverage. Currently, we have limits of $125.0 million per loss and $125.0 million in the aggregate for general liability, professional errors and omissions liability and contractor’s pollution liability insurance (in addition to other policies for some specific projects). The general liability policy includes a self-insured claim retention of $4.0 million (or $10.0 million in some circumstances). The professional errors and omissions liability and contractor’s pollution liability insurance policies include a self-insured claim retention amount of $10.0 million each. Our services may require us to make judgments and recommendations about environmental, structural, geotechnical and other physical conditions at project sites. If our performance, judgments and recommendations are later found to be incomplete or incorrect, then we may be liable for the resulting damages. Various legal proceedings are pending against us in connection with the performance of our professional services and other actions by us. Although the outcome of our legal proceedings cannot be predicted with certainty and no assurance can be provided as to a favorable outcome, based on our previous experience in these matters, we do not believe that any of our legal proceedings, individually or collectively, are likely to exceed established loss accruals or our various professional errors and omissions, project-specific and other insurance policies. However, the resolution of outstanding claims is subject to inherent uncertainty and it is reasonably possible that any resolution could have an adverse effect on us. If we sustain damages that exceed our insurance coverage or for which we are not insured, our results of operations and financial condition could be harmed.

Changes in environmental laws, regulations and programs could reduce demand for our environmental services, which could in turn negatively impact our revenues.

Our environmental services business is driven by federal, state, local and foreign laws, regulations and programs related to pollution and environmental protection. For example, passage of the Clean Air Interstate and Clean Air Mercury environmental rules has increased our emissions control business. On the other hand, a relaxation or repeal of these laws and regulations, or changes in governmental policies regarding the funding, implementation or enforcement of these programs, could result in a decline in demand for environmental services, which could in turn negatively impact our revenues.

A decline in U.S. defense spending or a change in budgetary priorities could harm our operations and significantly reduce our future revenues.

Revenues under contracts with the DOD and other defense-related clients represented approximately 36% of our total revenues for the fiscal year ended December 29, 2006. While spending authorization for defense-related programs has increased significantly in recent years due to greater homeland security and foreign military commitments, as well as the trend to outsource federal government jobs to the private sector, these spending levels may not be sustainable. For example, the DOD budget declined in the late 1980s and the early 1990s, resulting in DOD program delays and cancellations. Future levels of expenditures and authorizations for these programs may decrease, remain constant or shift to programs in areas where we do not currently provide services. As a result, a general decline in U.S. defense spending or a change in budgetary priorities could harm our operations and significantly reduce our future revenues.

Our overall market share will decline if we are unable to compete successfully in our industry.

Our industry is highly fragmented and intensely competitive. According to the publication Engineering News-Record, based on information voluntarily reported by 500 design firms, the top ten engineering design firms only accounted for approximately 32% of the total design firm revenues in 2005. Our competitors are numerous, ranging from small private firms to multi-billion dollar companies. In addition, the technical and professional aspects of our services generally do not require large upfront capital expenditures and provide limited barriers against new competitors.

Some of our competitors have achieved greater market penetration in some of the markets in which we compete and have substantially more financial resources and/or financial flexibility than we do. As a result of the number of competitors in the industry, our clients may select one of our competitors on a project due to competitive pricing or a specific skill set. If we are unable to maintain our competitiveness, our market share will decline. These competitive forces could have a material adverse effect on our business, financial condition and results of operations by reducing our relative share in the markets we serve.

Our failure to attract and retain key employees could impair our ability to provide services to our clients and otherwise conduct our business effectively.

As a professional and technical services company, we are labor intensive and therefore, our ability to attract, retain and expand our senior management and our professional and technical staff is an important factor in determining our future success. From time to time, it may be difficult to attract and retain qualified individuals with the expertise and in the timeframe demanded by our clients. For example, some of our government contracts may require us to employ only individuals who have particular government security clearance levels. In addition, we rely heavily upon the expertise and leadership of our senior management. The failure to attract and retain key individuals could impair our ability to provide services to our clients and conduct our business effectively.

Employee, agent, or partner misconduct or our failure to comply with laws or regulations could weaken our ability to win contracts with government clients, which could result in decreasing revenues.

As a federal, state and local government contractor, misconduct, fraud, non-compliance with applicable laws and regulations, or other improper activities by one of our employees, agents, or partners could have a significant negative impact on our business and reputation. Such misconduct could include the failure to comply with government procurement regulations, regulations regarding the protection of classified information, laws regarding the pricing of labor and other costs in government contracts, regulations on lobbying or similar activities, environmental laws and any other applicable laws or regulations. For example, we regularly provide services that may be highly sensitive or that relate to critical national security matters; if a security breach were to occur, our ability to procure future government contracts could be severely limited. Other examples of potential misconduct include time card fraud and violations of the Anti-Kickback Act. The precautions we take to prevent and detect these activities may not be effective, and we could face unknown risks or losses. Our failure to comply with applicable laws or regulations or acts of misconduct could subject us to fines and penalties, loss of security clearance and suspension or debarment from contracting, which could weaken our ability to win future contract with government clients.

Recent changes in accounting for equity-related compensation have impacted our financial statements and could negatively impact our ability to attract and retain key employees.

We adopted Statement of Financial Accounting Standards No. 123 (revised 2004), “Share-Based Payment,” (“SFAS 123(R)”) on December 31, 2005. At that time, we evaluated our current stock-based compensation plans and employee stock purchase plans. In order to minimize the volatility of our stock-based compensation expense, we are currently issuing restricted stock awards and units to selected employees rather than granting stock options. We also revised our employee stock purchase plan from a 15% discount on our stock price at the beginning or the end of the six-month offering period, whichever is lower, to a 5% discount on our stock price at the end of the six-month offering period. These changes to our equity-related compensation may negatively impact our ability to attract and retain key employees.

Our indebtedness could limit our ability to finance future operations or engage in other business activities.

As of December 29, 2006, we had $168.6 million of total outstanding indebtedness and $61.3 million in letters of credit outstanding against our revolving line of credit. This level of indebtedness could negatively affect us because it may impair our ability to borrow in the future and make us more vulnerable in an economic downturn. Our current credit facility contains customary financial, affirmative and negative covenants for a company with a similar financial position to ours. As of December 29, 2006, we were in compliance with all the convenants of our credit facility.

Because we are a holding company, we may not be able to service our debt if our subsidiaries do not make sufficient distributions to us.

We have no direct operations and no significant assets other than investments in the stock of our subsidiaries. Because we conduct our business operations through our operating subsidiaries, we depend on those entities for payments and dividends to generate the funds necessary to meet our financial obligations. Legal restrictions, including local regulations and contractual obligations associated with secured loans, such as equipment financings, could restrict our subsidiaries’ ability to pay dividends or make loans or other distributions to us. The earnings from, or other available assets of, these operating subsidiaries may not be sufficient to make distributions to enable us to pay interest on our debt obligations when due or to pay the principal of such debt at maturity. As of December 29, 2006, our debt service obligations, comprised of principal and interest (excluding capital leases), during the next twelve months will be approximately $17.0 million. Based on the current outstanding indebtedness of $114.0 million under our current credit facility, if market rates were to average 1% higher during that same twelve-month period, our net of tax interest expense would increase by approximately $0.7 million.

Our international operations are subject to a number of risks that could harm our operations and significantly reduce our future revenues.