Exhibit 99.3

AECOM Investor Presentation

World Trade Center

Manhattan, New York, U.S.A.

Safe Harbor Disclosures

Cautionary Note Regarding Forward-Looking Statements

All statements in these slides and the related presentation other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws. These forward-looking statements, which are based on current expectations, estimates and projections about the industry and markets in which AECOM and URS operate and beliefs of and assumptions made by AECOM management and URS management, involve uncertainties that could significantly affect the financial results of AECOM or URS or the combined company. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words and similar expressions are intended to identify such forward-looking statements. Such forward-looking statements include, but are not limited to, statements about the benefits of the transaction involving AECOM and URS, including future financial and operating results, the combined company’s plans, objectives, expectations and intentions. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future – including statements relating to creating value for stockholders, benefits of the transaction to customers and employees of the combined company, integrating our companies, cost savings, synergies, earnings per share, backlog, and the expected timetable for completing the proposed transaction – are forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance that our expectations will be attained and therefore, actual outcomes and results may differ materially from what is expressed or forecasted in such forward-looking statements. For example, these forward-looking statements could be affected by factors including, without limitation: • risks associated with the ability to consummate the merger and the timing of the closing of the merger; • the failure to obtain the necessary debt financing arrangements set forth in the commitment letter received in connection with the merger; • the interest rate on any borrowings incurred in connection with the transaction; • the impact of the indebtedness incurred to finance the transaction; • the ability to successfully integrate our operations and employees; • the ability to realize anticipated benefits and synergies of the transaction; • the potential impact of announcement of the transaction or consummation of the transaction on relationships, including with employees, customers and competitors; • the outcome of any legal proceedings that have been or may be instituted against AECOM and/or URS and others following announcement of the transaction; • the ability to retain key personnel; • the amount of the costs, fees, expenses and charges related to the merger and the actual terms of the financings that will be obtained for the merger; and • changes in financial markets, interest rates and foreign currency exchange rates.

Additional factors that could cause actual results to differ materially from the forward-looking statements included in this presentation include those additional risks and factors discussed in the reports filed with the SEC by AECOM and URS. AECOM and URS do not intend, and undertake no obligation, to update any forward-looking statement.

Non-GAAP Measures

Certain measures contained in these slides and the related presentation are not measures calculated in accordance with generally accepted accounting principles (“GAAP”). They should not be considered a replacement for GAAP results. Non-GAAP financial measures appearing in these slides are identified in the footnotes. A reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures is incorporated in our press release on the Investors section of our Web site at: http://investors.aecom.com.

Additional Information about the Proposed Transaction and Where to Find It

In connection with the proposed transaction, AECOM intends to file with the SEC a registration statement on Form S-4 that will include a joint proxy statement of AECOM and URS that also constitutes a prospectus of AECOM. Investors and security holders are urged to read the joint proxy statement/prospectus and other relevant documents filed with the SEC, when they become available, because they will contain important information about the proposed transaction.

Investors and security holders may obtain free copies of these documents, when they become available, and other documents filed with the SEC at www.sec.gov. In addition, investors and security holders may obtain free copies of the documents filed with the SEC by AECOM by contacting AECOM Investor Relations at 1-213-593-8000. Investors and security holders may obtain free copies of the documents filed with the SEC by URS by contacting URS Investor Relations at 877-877-8970. Additionally, information about the transaction is available online at www.aecom-urs.com.

AECOM and URS and their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about AECOM’s directors and executive officers is available in AECOM’s proxy statement for its 2014 Annual Meeting of Stockholders filed with the SEC on January 24, 2014. Information about URS’ directors and executive officers is available in URS’ proxy statement for its 2014 Annual Meeting of Stockholders filed with the SEC on April 17, 2014. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the merger when they become available. Investors should read the joint proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from AECOM or URS by using the sources indicated above.

This communication shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

July 13, 2014 2

Agenda

1. Strategic Rationale

2. Terms of Transaction

3. Rationale Details

4. Cost Synergies

5. Financials

6. Integrated Platform

7. Summary

July 13, 2014 3

Transformational Milestone Creates an E&C Leader

Compelling value for stockholders

Accelerates AECOM’s strategy

Benefits clients and employees of both companies

July 13, 2014 4

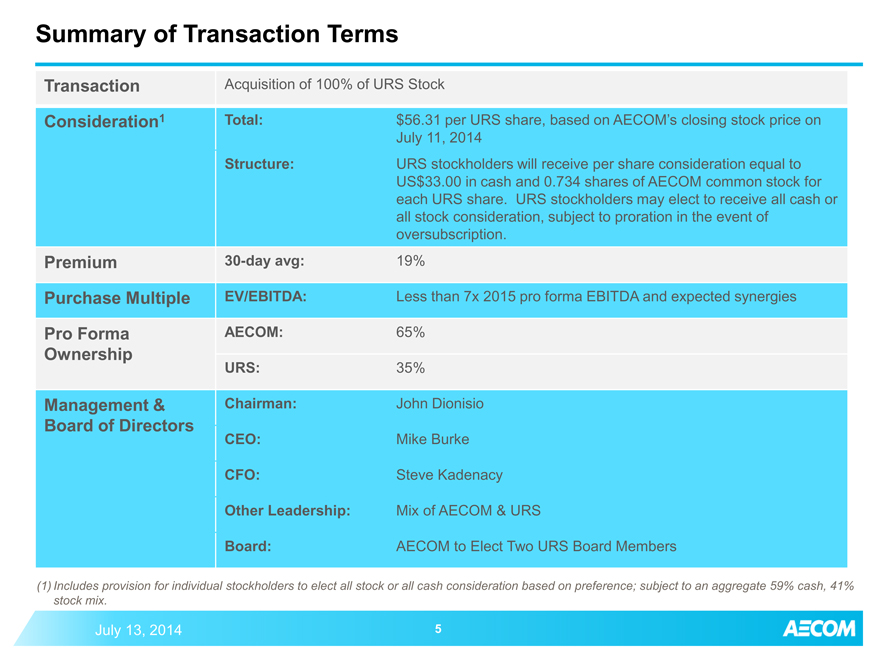

Summary of Transaction Terms

Transaction Acquisition of 100% of URS Stock

Consideration1 Total: $56.31 per URS share, based on AECOM’s closing stock price on

July 11, 2014

Structure: URS stockholders will receive per share consideration equal to

US$33.00 in cash and 0.734 shares of AECOM common stock for

each URS share. URS stockholders may elect to receive all cash or

all stock consideration, subject to proration in the event of

oversubscription.

Premium 30-day avg: 19%

Purchase Multiple EV/EBITDA: Less than 7x 2015 pro forma EBITDA and expected synergies

Pro Forma AECOM: 65%

Ownership

URS: 35%

Management & Chairman: John Dionisio

Board of Directors

CEO: Mike Burke

CFO: Steve Kadenacy

Other Leadership: Mix of AECOM & URS

Board: AECOM to Elect Two URS Board Members

(1) Includes provision for individual stockholders to elect all stock or all cash consideration based on preference; subject to an aggregate 59% cash, 41% stock mix.

July 13, 2014 5

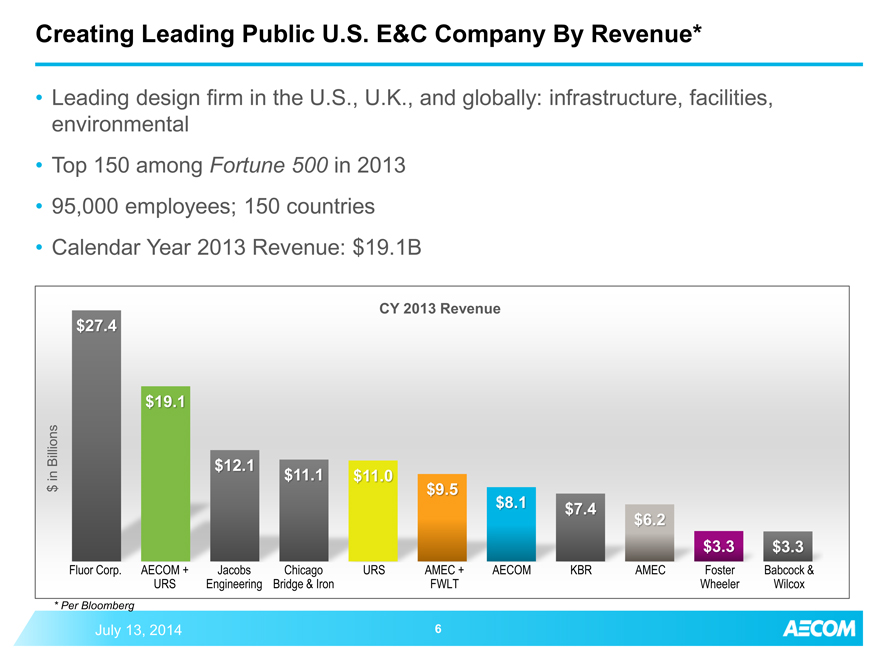

Creating Leading Public U.S. E&C Company By Revenue*

Leading design firm in the U.S., U.K., and globally: infrastructure, facilities, environmental Top 150 among Fortune 500 in 2013 95,000 employees; 150 countries Calendar Year 2013 Revenue: $19.1B

CY 2013 Revenue

$27.4

$19.1

Billions $12.1

in $11.1 $11.0

$ $9.5

$8.1 $7.4

$6.2

$3.3 $3.3

Fluor Corp. AECOM + Jacobs Chicago URS AMEC + AECOM KBR AMEC Foster Babcock &

URS Engineering Bridge & Iron FWLT Wheeler Wilcox

* Per Bloomberg

July 13, 2014

6

Clear Strategic Benefits

Enhanced ability to meet increasing demand for integrated services

Expansion within attractive market sectors, such as oil and gas, government services and power

Better positioning within growing international markets in Asia, Africa, Middle East and Australia

Unmatched pool of talent, with 95,000 employees in 150 countries

July 13, 2014

7

Delivers Compelling Upside to Both AECOM and URS Shareholders

The combination with URS offers compelling upside to the stockholders of both companies:

AECOM: Expected to be accretive to GAAP EPS and more than 25% accretive to cash EPS(1) in FY 2015, excluding transaction-related costs

URS: Immediate cash value; ability to participate in future growth prospects

(1) Defined as GAAP EPS + after-tax per share amortization of acquisition intangibles and stock-based consideration from accelerated vesting of performance shares.

July 13, 2014

8

Accelerates AECOM’s Strategy

The combination dramatically accelerates AECOM’s

strategy to deliver integrated services across its global

platform.

Adds new capabilities and end-market Enhances AECOM’s ability to deliver expertise particularly in the integrated services that clients higher-growth energy markets are increasingly demanding

July 13, 2014

9

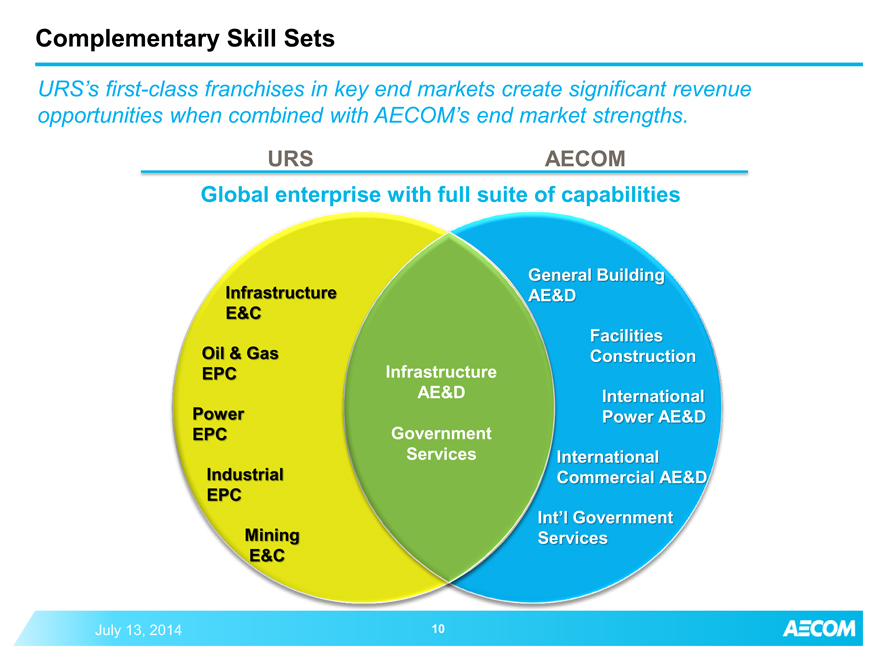

Complementary Skill Sets

URS’s first-class franchises in key end markets create significant revenue opportunities when combined with AECOM’s end market strengths.

URS AECOM Global enterprise with full suite of capabilities

General Building Infrastructure AE&D

E&C

Facilities Oil & Gas Construction EPC Infrastructure AE&D International Power Power AE&D EPC Government Services International Industrial Commercial AE&D EPC

Int’l Government Mining Services E&C

July 13, 2014

10

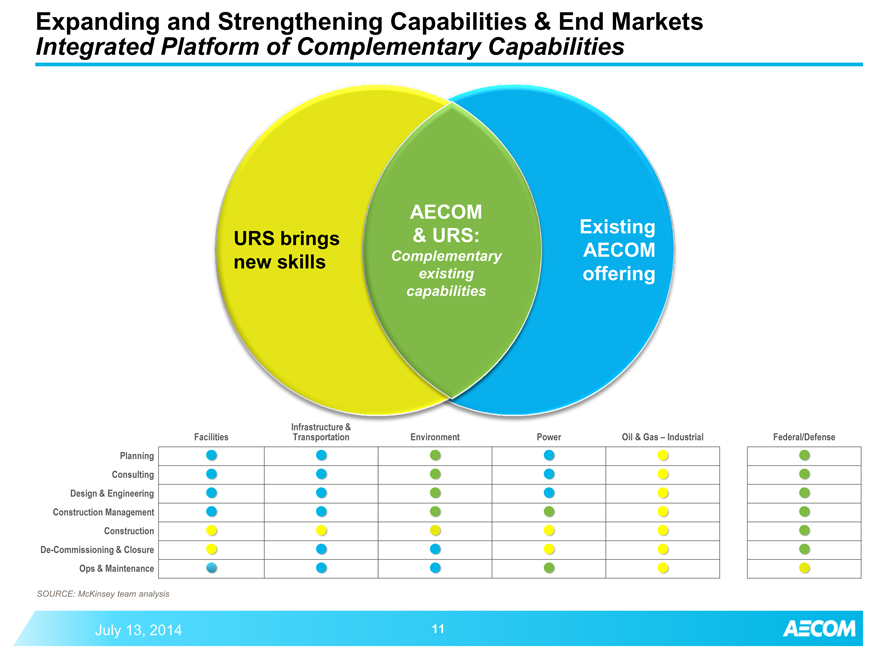

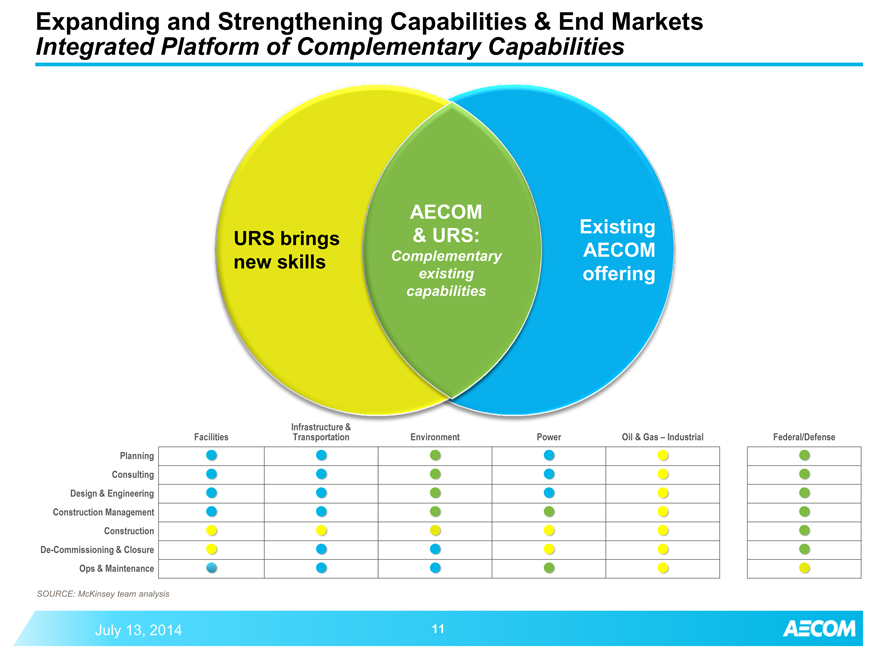

Expanding and Strengthening Capabilities & End Markets Integrated Platform of Complementary Capabilities

URS brings new skills

AECOM & URS: Complementary existing capabilities

Existing AECOM offering

Facilities Infrastructure & Transportation Environment Power Oil & Gas – Industrial Federal/Defense

Planning

Consulting

Design & Engineering

Construction Management

Construction

De-Commissioning & Closure

Ops & Maintenance

SOURCE: McKinsey team analysis

July 13, 2014

11

AECOM

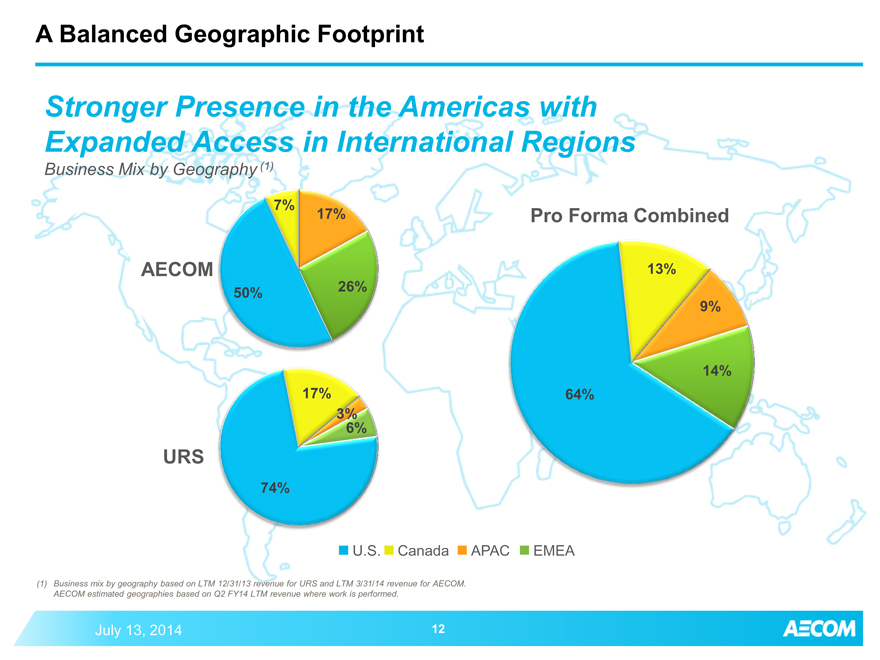

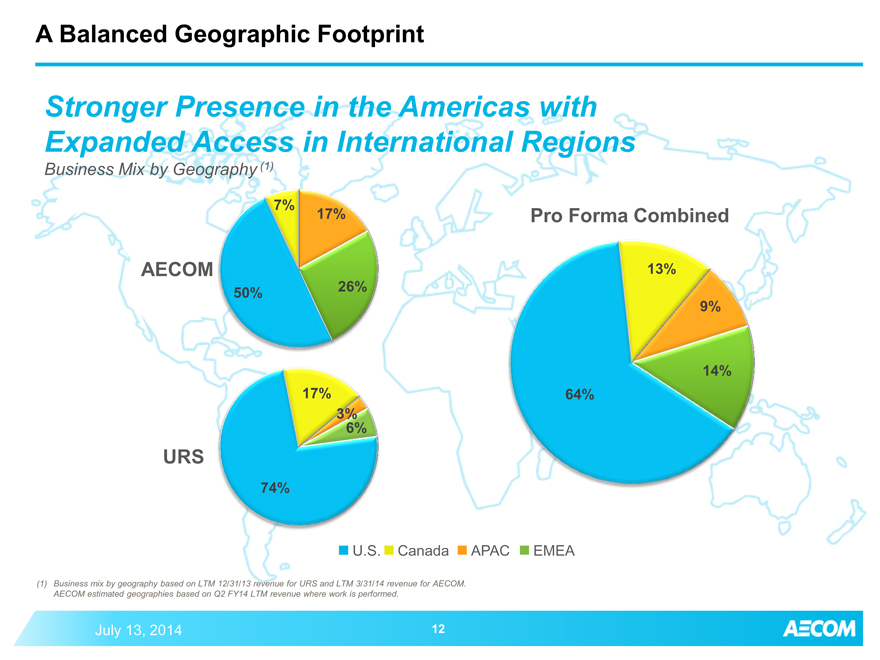

A Balanced Geographic Footprint

Stronger Presence in the Americas with Expanded Access in International Regions

Business Mix by Geography (1)

AECOM

7% 17%

50%

26%

URS

17%

3%

6%

74%

Pro Forma Combined

64%

13%

9%

14%

U.S. Canada APAC EMEA

(1) Business mix by geography based on LTM 12/31/13 revenue for URS and LTM 3/31/14 revenue for AECOM.

AECOM estimated geographies based on Q2 FY14 LTM revenue where work is performed.

July 13, 2014

12

AECOM

Creates Growth Opportunities for Key Stakeholders: People

Our 95,000 people benefit as we capitalize

on our greater scale and capital to invest in and develop our people – advancing their career opportunities and expanding their capacity to compete globally.

July 13, 2014 13

AECOM

Creates Growth Opportunities for Key Stakeholders: Clients

Clients benefit from a larger and more diverse, yet integrated, portfolio of services in more places around the world.

July 13, 2014 14

AECOM

Creates Growth Opportunities for Key Stakeholders: Shareholders

Our stockholders benefit from the opportunities for a business well-positioned to create long-term stockholder value.

July 13, 2014 15

AECOM

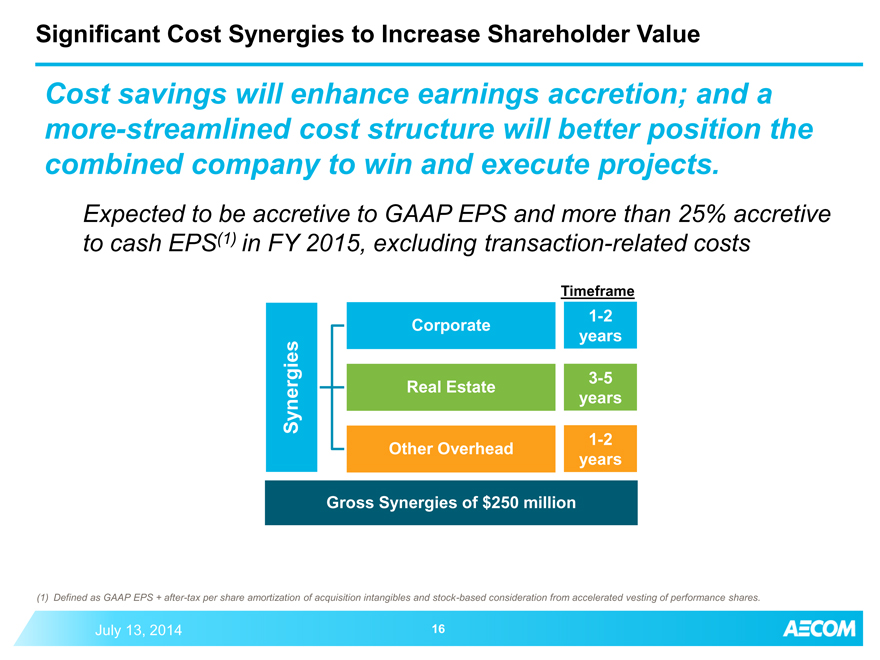

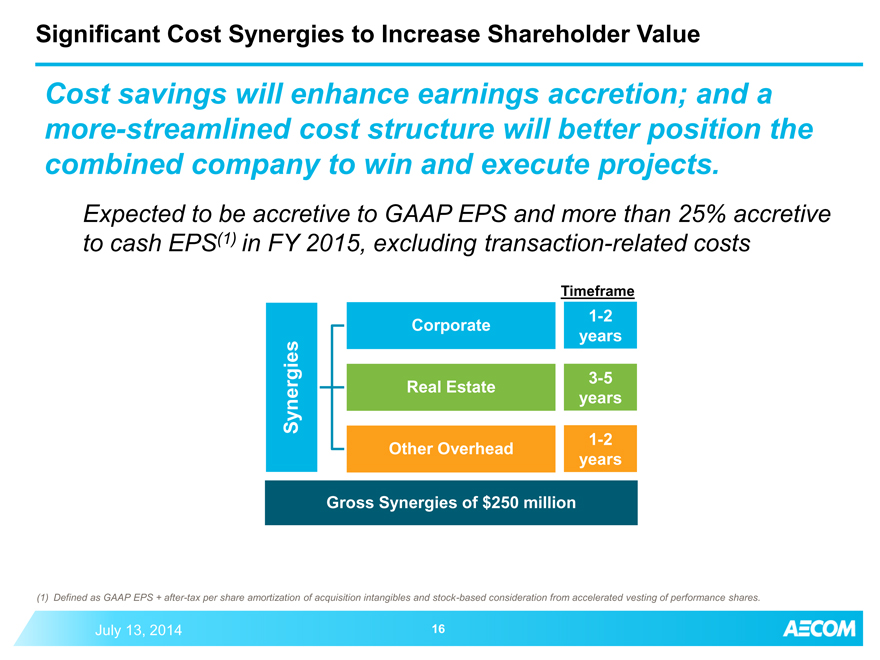

Significant Cost Synergies to Increase Shareholder Value

Cost savings will enhance earnings accretion; and a more-streamlined cost structure will better position the combined company to win and execute projects.

Expected to be accretive to GAAP EPS and more than 25% accretive to cash EPS(1) in FY 2015, excluding transaction-related costs

Timeframe

Synergies

Corporate

1-2 years

Real Estate

3-5 years

Other Overhead

1-2 years

Gross Synergies of $250 million

(1) Defined as GAAP EPS + after-tax per share amortization of acquisition intangibles and stock-based consideration from accelerated vesting of performance shares.

July 13, 2014 16

AECOM

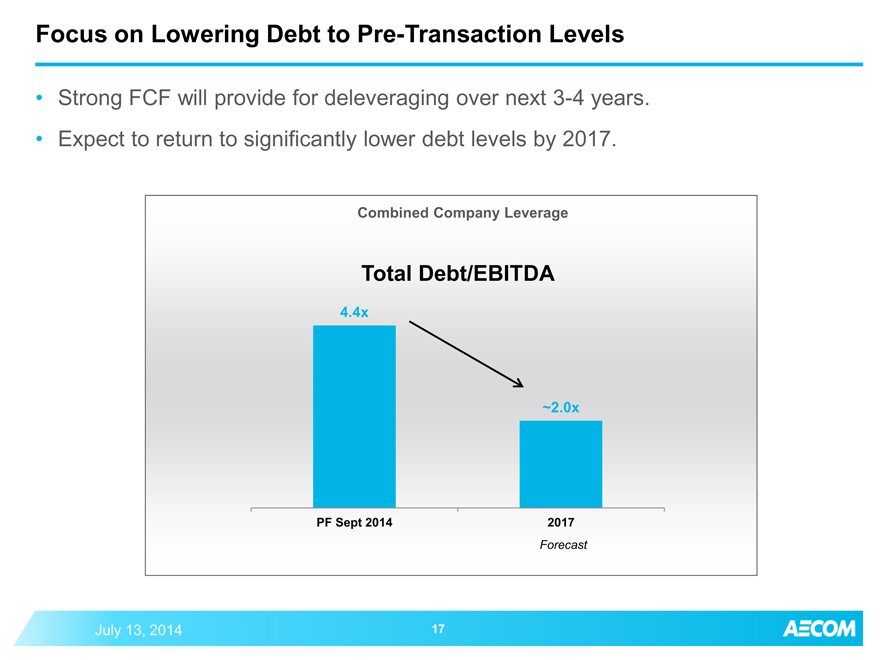

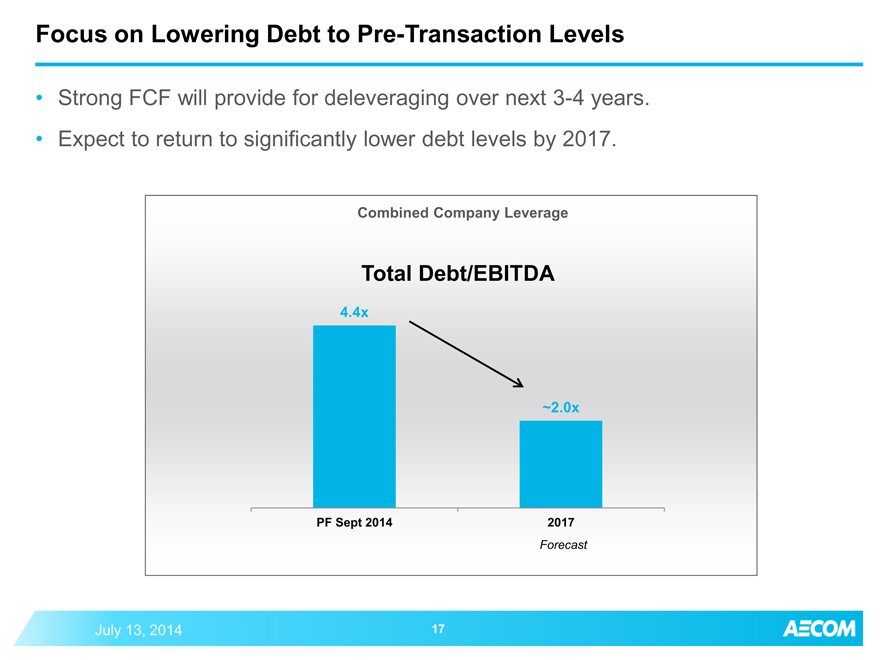

Focus on Lowering Debt to Pre-Transaction Levels

Strong FCF will provide for deleveraging over next 3-4 years. Expect to return to significantly lower debt levels by 2017.

Combined Company Leverage

Total Debt/EBITDA

4.4x

~2.0x

PF Sept 2014

2017

Forecast

July 13, 2014 17

AECOM

AECOM Fiscal Year 2014 Outlook

For full fiscal year 2014, still targeting lower end of diluted EPS range of $2.50 to $2.60, excluding transaction-related costs.

Q3 EPS will be approximately 25% of full-year results.

Backlog remains at record levels and has continued to grow.

July 13, 2014 18

AECOM

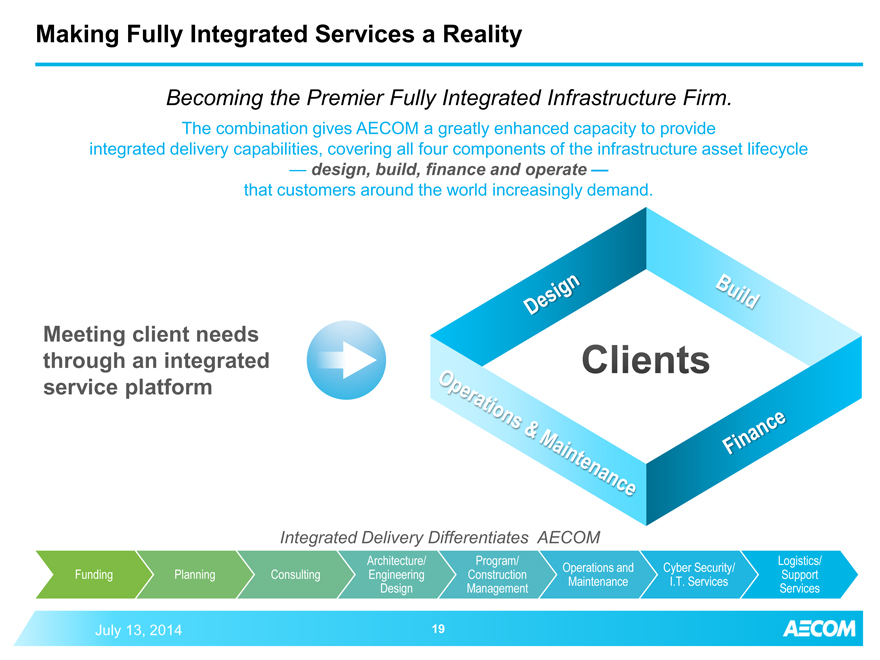

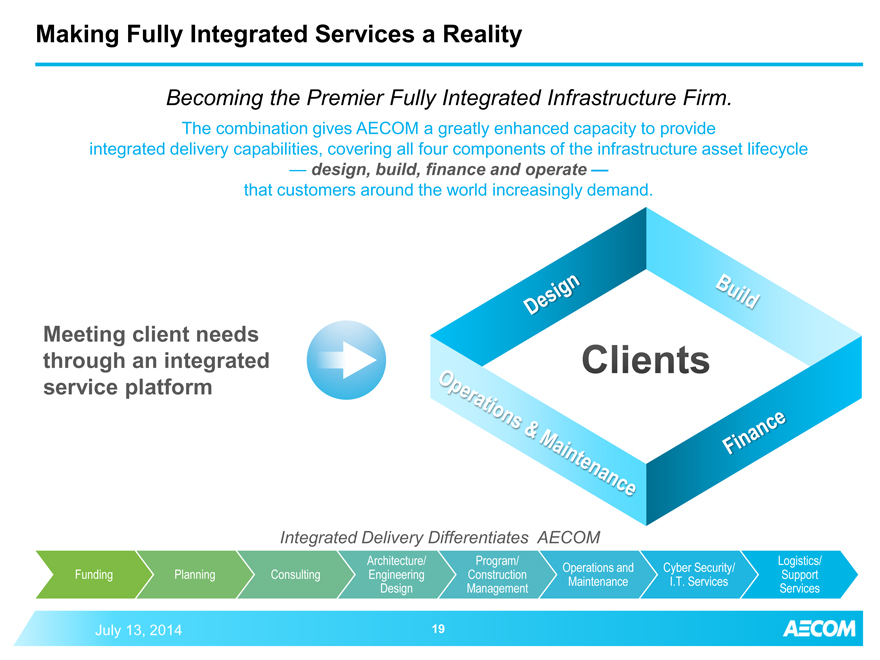

Making Fully Integrated Services a Reality

Becoming the Premier Fully Integrated Infrastructure Firm.

The combination gives AECOM a greatly enhanced capacity to provide integrated delivery capabilities, covering all four components of the infrastructure asset lifecycle

— design, build, finance and operate — that customers around the world increasingly demand.

Meeting client needs through an integrated service platform

Clients

Design

Build

Operations & Maintenance

Finance

Integrated Delivery Differentiates AECOM

Funding

Planning

Consulting

Architecture/ Engineering Design

Program/ Construction Management

Operations and Maintenance

Cyber Security/

I.T. Services

Logistics/ Support Services

July 13, 2014 19

AECOM

Thank you!

World Trade Center

Manhattan, New York, U.S.A.

AECOM