UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14C

(RULE 14c-101)

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| o | Preliminary Information Statement |

| | |

| x | Definitive Information Statement |

| | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14c-5 (d)(2)) |

| PANACEA GLOBAL, INC. |

| (Name of Registrant as Specified in Charter) |

| |

Payment of Filing Fee. (Check the appropriate box):

| o | No fee required. |

| | | |

| o | Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11 |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | (5) | Total fee paid: |

| | | |

| | | |

| o | Fee paid previously with preliminary materials. |

| | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | | |

| | (2) | Form, Schedule or Registration Statement No: |

| | | |

| | | |

| | (3) | Filing Party: |

| | | |

| | | |

| | (4) | Date Filed: |

| | | |

PANACEA GLOBAL, INC.

88 Toporowski Ave.,

Richmond Hill, Ontario, Canada L4S2V6

(416) 450-6414

NOTICE OF ACTION BY

WRITTEN CONSENT OF MAJORITY STOCKHOLDERS

WE ARE NOT ASKING YOU FOR A PROXY

AND YOU ARE REQUESTED NOT TO SEND US A PROXY

THIS IS NOT A NOTICE OF A MEETING OF STOCKHOLDERS AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER ANY MATTER DESCRIBED HEREIN.

We are furnishing this notice and the accompanying information statement (the “Information Statement”) to the holders of shares of common stock, par value $0.001 per share (“Common Stock”) of Panacea Global, Inc. (the “Company”) pursuant to Section 14 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Regulation 14C and Schedule 14C thereunder, and Section 78.320 of the Nevada Revised Statutes (the “NRS”) in connection with the approval of the actions described below (the “Actions”) taken by written consent of the holders of a majority of the issued and outstanding shares of Common Stock:

| 1. | The amendment of the Company’s Certificate of Incorporation to change the Company’s name to “Panacea Global Holdings, Inc.”; |

| 2. | The implementation of a reverse stock split of the outstanding shares of Common Stock at a ratio of up to one-to-thirty (the “Reverse Stock Split”); and |

| 3. | The adoption of the 2011 Panacea Global, Inc. Omnibus Incentive Plan (the “Plan”). |

The purpose of this Information Statement is to notify our stockholders that on September 6, 2011 the owners of approximately 53.24% of our issued and outstanding shares of Common Stock as of such date executed a written consent approving the Actions. In accordance with Rule 14c-2 promulgated under the Exchange Act, the Actions will become effective no sooner than 20 days after we mail this notice and the accompanying Information Statement to our stockholders.

The written consent that we received constitutes the only stockholder approval required for the Actions under Nevada law and, as a result, no further action by any other stockholder is required to approve the Actions and we have not and will not be soliciting your approval of the Actions.

This notice and the accompanying Information Statement are being mailed to our stockholders on or about September 28, 2011. This notice and the accompanying Information Statement shall constitute notice to you of the action by written consent in accordance with Section 78.320 of the NRS and Rule 14c-2 promulgated under the Exchange Act.

| | By Order of the Board of Directors, /s/ Mahmood Moshiri Chief Executive Officer, President, Chief Medical Officer and Director |

TABLE OF CONTENTS

| GENERAL | 1 |

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 3 |

| | |

| INTERESTS OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON | 3 |

| | |

| ACTION ONE – AMENDMENT OF THE COMPANY’S CERTIFICATE OF INCORPORATION TO CHANGE THE COMPANY’S NAME TO “PANACEA GLOBAL HOLDINGS, INC.” | 4 |

| | |

| ACTION TWO – IMPLEMENTATION OF THE REVERSE STOCK SPLIT | 4 |

| | |

| ACTION THREE – APPROVAL OF THE PANACEA GLOBAL, INC. 2011 OMNIBUS INCENTIVE PLAN | 7 |

| | |

| WHERE YOU CAN FIND MORE INFORMATION | 11 |

| | |

| DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS | 11 |

| | |

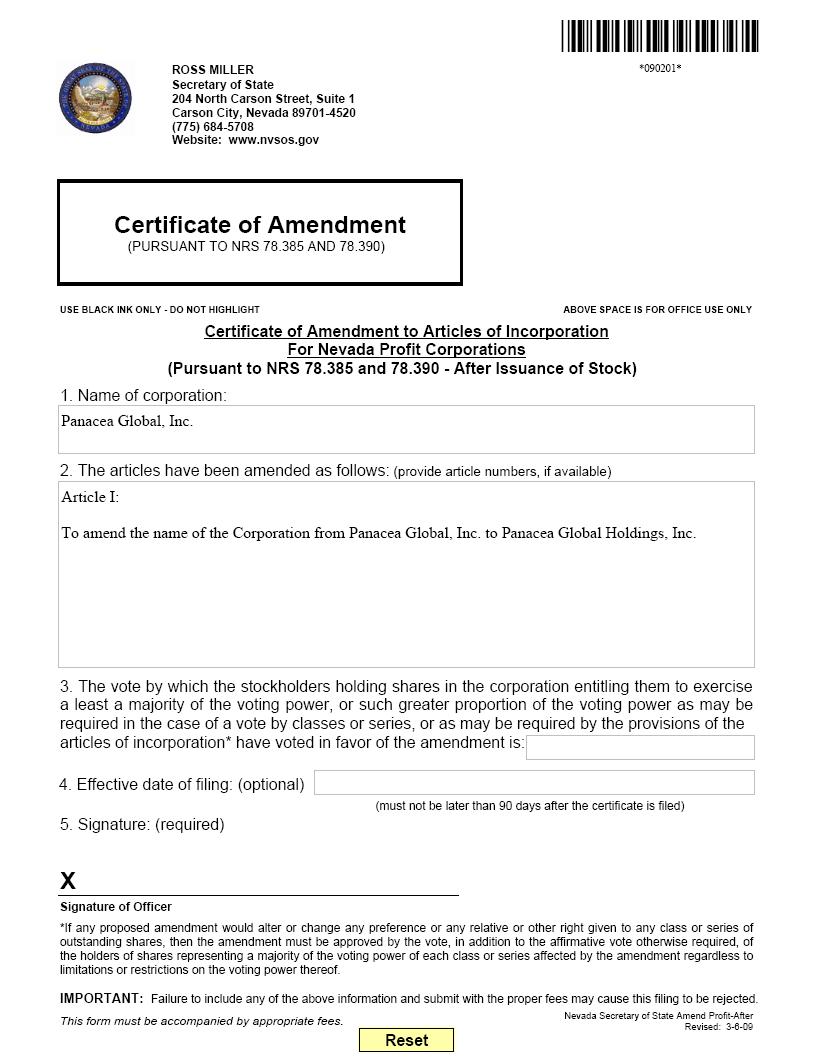

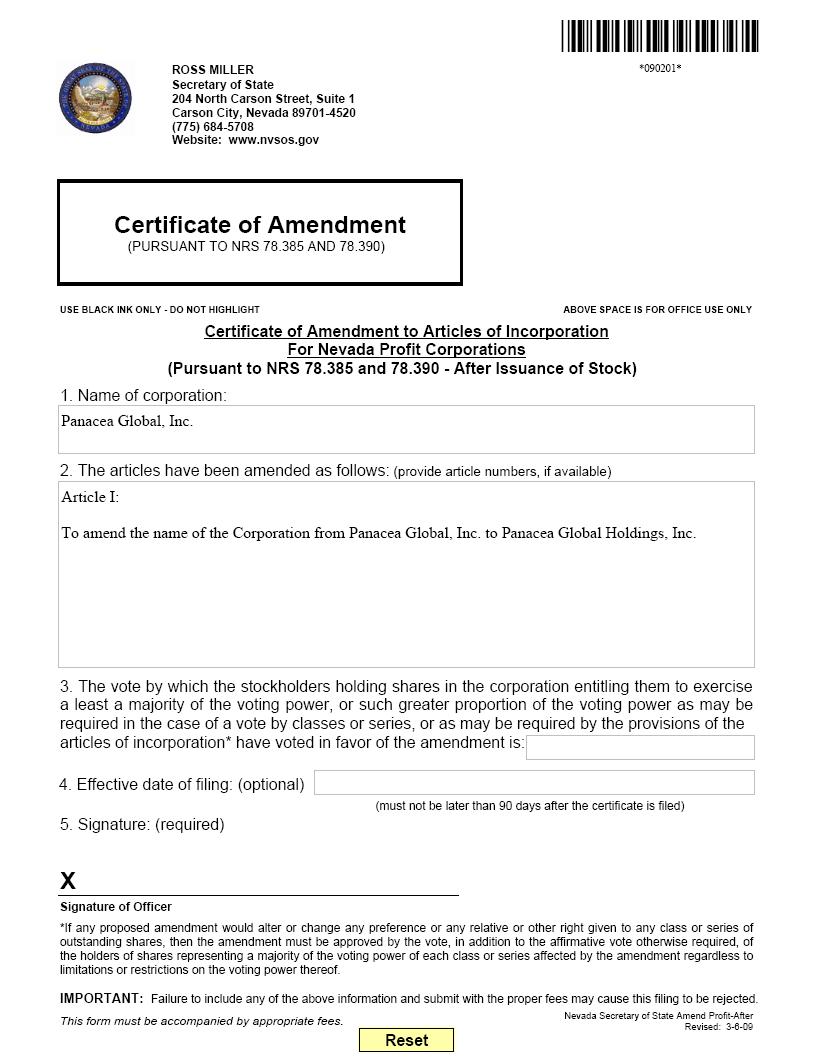

| ANNEX I: CERTIFICATE OF AMENDMENT | |

| | |

| ANNEX II: PANACEA GLOBAL, INC. 2011 OMNIBUS PLAN | |

PANACEA GLOBAL, INC.

88 Toporowski Ave.,

Richmond Hill, Ontario, Canada L4S2V6

(416) 450-6414

__________________________________

INFORMATION STATEMENT

Action by Written Consent of Majority Stockholders

__________________________________

WE ARE NOT ASKING YOU FOR A

PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY

GENERAL

This Information Statement is being furnished to the holders of shares of common stock, par value $0.001 per share (“Common Stock”) of Panacea Global, Inc. in connection with the action by written consent of the holders of a majority of our issued and outstanding shares of Common Stock taken without a meeting to approve the actions described in this Information Statement. In this Information Statement, all references to “the Company,” “we,” “us” or “our” refer to Panacea Global, Inc. We are mailing this Information Statement to our stockholders of record as of September 6, 2011 (the “Record Date”) on or about September 28, 2011.

Pursuant to Rule 14c-2 promulgated by the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the actions described herein will not become effective until 20 calendar days following the date on which this Information Statement is first mailed to our stockholders.

The entire cost of furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries and other like parties to forward this Information Statement to the beneficial owners of the Company’s Common Stock held of record by them and will reimburse such persons for their reasonable charges and expenses in connection therewith.

Actions by Consenting Stockholders

On July 26, 2011 and September 6, 2011, in accordance with Section 78.320 of the Nevada Revised Statutes, as amended (the “NRS”), the Board of Directors (the “Board”) of the Company unanimously adopted resolutions approving the following actions (the “Actions”):

| · | Action One: The amendment of our certificate of incorporation (the “Certificate of Incorporation”) to change our name to “Panacea Global Holdings, Inc.” (the “Name Change”). |

| · | Action Two: The implementation of a reverse stock split of the outstanding shares of Common Stock at a ratio of up to one-to-thirty (the “Reverse Stock Split”). |

| · | Action Three: The adoption of the 2011 Panacea Global, Inc. Omnibus Incentive Plan (the “Plan”). |

In order to obtain the approval of our stockholders for the Actions, we could have convened a special meeting of the stockholders for the specific purpose of voting on such matters. However, Section 78.320 of the NRS and Article II, Section 11 of our Bylaws provides that any action that may be taken at any annual or special meeting of stockholders may be taken without a meeting and without prior notice if a consent in writing setting forth the action taken is signed by the holders of outstanding shares of Common Stock having not less than the minimum number of votes that would be necessary to take such action. In order to eliminate the costs and management time involved in holding a meeting and obtaining proxies and in order to effect the above actions as early as possible in order to accomplish the purposes hereafter described, we elected to utilize the written consent of the holders of a majority of the outstanding shares of our Common Stock

As of the close of business of the Record Date, we had 94,463,586 shares of Common Stock outstanding and entitled to vote on the Actions. Each share of Common Stock outstanding as of the close of business on the Record Date was entitled to one vote.

On the Record Date, pursuant to Section 78.320 of the NRS and Article II, Section 11 of our Bylaws, we received written consents for the Actions from stockholders holding an aggregate of 50,300,000 shares of our Common Stock, representing 53.24% of our outstanding shares of Common Stock. Thus, your consent is not required and is not being solicited in connection with the approval of the Actions.

The following sets forth those holders who consented to the Actions and provides the number of shares beneficially owned and the percentage interest of outstanding shares of Common Stock for each such holder (the “Majority Stockholders”) as of the Record Date:

| Holder | | Beneficial Ownership | | Percentage of Beneficial Ownership | |

Panacea Pharmaceuticals Inc., 209 Perry Parkway, STE 13 Gaithersburg, MD 20877-2143 | | 35,500,000 | | 37.58% | |

Moshiri Mahmood 88 Toporowski Ave Richmond Hill, Ontario Canada L4S 2V6 | | 14,800,000 | | 15.66% | |

Notice Pursuant to Section 78.320 of the NRS

Pursuant to Section 78.320 of the NRS, we are required to provide prompt notice of the taking of the corporate action without a meeting to the holders of record of our Common Stock who have not consented in writing to such action. This Information Statement is intended to provide such notice.

Dissenters’ Rights of Appraisal

Stockholders who did not consent to the Actions are not entitled to assert dissenters’ or appraisal rights under Section 78.3793 of the NRS.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding our shares of Common Stock beneficially owned as of the Record Date for (i) each stockholder known to be the beneficial owner of 5% or more of the Company’s outstanding shares of Common Stock, (ii) each named executive officer and director, and (iii) all executive officers and directors as a group. A person is considered to beneficially own any shares: (i) over which such person, directly or indirectly, exercises sole or shared voting or investment power, or (ii) of which such person has the right to acquire beneficial ownership at any time within 60 days through an exercise of stock options or warrants. Unless otherwise indicated, voting and investment power relating to the shares shown in the table for our directors and executive officers is exercised solely by the beneficial owner or shared by the owner and the owner’s spouse or children.

For purposes of this table, a person or group of persons is deemed to have “beneficial ownership” of any shares of Common Stock that such person has the right to acquire within 60 days of September 6, 2011. For purposes of computing the percentage of outstanding shares of our Common Stock held by each person or group of persons named above, any shares that such person or persons has the right to acquire within 60 days of September 6, 2011 is deemed to be outstanding, but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other person. The inclusion herein of any shares listed as beneficially owned does not constitute an admission of beneficial ownership. As of the Record Date we have 94,463,586 shares of Common Stock issued and outstanding.

| Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | | Percent of Class | |

Bowen Financial Advisory Group STE 205 A- Saffrey Square, P.O. Box N 9934 Nassau | | | 8,500,000 | | | | 8.99 | % |

Majid Haditaghi 47 Ardmore Crescent, Richmond Hill, Ontario Canada L4B-3P6 | | | 8,200,000 | | | | 8.68 | % |

Marciafor Holdings, Inc. STE 205 A- Saffrey Square, P.O. Box N 9934 Nassau | | | 8,000,000 | | | | 8.46 | % |

Moshiri Mahmood 88 Toporowski Ave Richmond Hill, Ontario Canada L4S 2V6 | | | 14,800,000 | | | | 15.66 | % |

Masoud Ataei Nia P.O.Box 117839 Dubai, UAE | | | 7,000,000 | | | | 7.41 | % |

Panacea Pharmaceuticals Inc., 209 Perry Parkway, STE 13 Gaithersburg, MD 20877-2143 | | | 35,500,000 | | | | 37.58 | % |

Binnay Sethi 61 Bowan Court Toronto, Ontario Canada M2K 3A7 | | | 1,000,000 | | | | 1.05 | % |

All Executive Officers and Directors as a group (2 persons) | | | 15,800,000 | | | | 16.71 | % |

INTERESTS OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

No officer, director or director nominee of the Company has any substantial interest in the Actions, other than his role as an officer, director or director nominee of the Company.

ACTION ONE – AMENDMENT OF THE COMPANY’S

CERTIFICATE OF INCORPORATION TO CHANGE THE

COMPANY’S NAME TO “PANACEA GLOBAL HOLDINGS, INC.”

On September 6, 2011, the Board approved resolutions authorizing the amendment of the Company’s Certificate of Incorporation to change the Company’s name to “Panacea Global Holdings, Inc.” (the “Name Change”). On September 6, 2011, pursuant to Section 78.320 of the NRS, we received written consents for the Name Change from the Majority Stockholders.

Reasons for the Name Change

The Board believes that the Name Change better reflects our corporate structure and the nature of our current and anticipated business operations. In that regard, the Company is a holding company that primarily operates its business through its wholly owned subsidiary, Panacea Global, Inc., a Delaware corporation (“Panacea Delaware”). The Board also believes that the Name Change will enable the Company to differentiate itself from Panacea Delaware, which, prior to the effectiveness of the Name Change, has the same corporate name as the Company.

Effect of the Name Change

The Name Change will not affect in any way the validity or transferability of stock certificates outstanding, the capital structure of the Company or the trading of the Company’s stock on the OTC Bulletin Board (the “OTCBB”). It will not be necessary for stockholders to surrender their existing stock certificates. Instead, when certificates are presented for transfer, new certificates bearing the name “Panacea Global Holdings, Inc.” will be issued. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Currently our Common Stock is quoted on the OTCBB under the symbol “PANG.” It is anticipated that the Common Stock will trade under a new symbol following the Name Change. A new CUSIP number will also be assigned to the Common Stock following the Name Change.

Effective Date of the Name Change

The Name Change will become effective upon the filing of a Certificate of Amendment to our Certificate of Incorporation with the Secretary of State of the State of Nevada or at such later time as indicated in such amendment. We intend to file the Certificate of Amendment to our Certificate of Incorporation in the form attached hereto as Annex I with the Secretary of State of the State of Nevada promptly after the 20 day period following the date on which this Information Statement is first mailed to our stockholders.

ACTION TWO – IMPLEMENTATION OF THE REVERSE STOCK SPLIT

On September 6, 2011, the Board approved resolutions authorizing the Company to implement a reverse stock split of the outstanding shares of Common Stock at a ratio of up to one-to-thirty (the “Reverse Stock Split”). On September 6, 2011, pursuant to Section 78.320 of the NRS, we received written consents for the Reverse Stock Split from the Majority Stockholders.

Reasons for the Reverse Stock Split

The Reverse Stock Split is intended to increase the per share stock price of our Common Stock. As of the Record Date, the last reported closing price of the Common Stock was $0.40 per share. The Board believes that if we are successful in maintaining a higher price per share of our Common Stock, we will be able to generate greater interest among investors and institutions. If we are successful in generating such interest, we anticipate that our Common Stock would have greater liquidity and a stronger investor base.

The Company cannot assure you that it will be successful in generating greater interest among investors and institutions. Stockholders should also note that if the Company elects to implement a Reverse Stock Split, there is no assurance that prices for shares of the Common Stock after the Reverse Stock Split will increase proportionally to the exchange ratio of the Reverse Stock Split (or at all). Other factors such as our financial results, market conditions and the market perception of our business may adversely affect the market price of our Common Stock. The Company cannot guarantee to stockholders that the price of its shares will reach or sustain any price level in the future, and it is possible the Reverse Stock Split will have no lasting impact on its share price. Furthermore, the liquidity of our Common Stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split. Consequently, there can be no assurance that the Reverse Stock Split will achieve the desired results.

The Board may determine in its discretion whether to effect the Reverse Stock Split at any time, if at all, and if so at what exchange ratio of one post-Reverse Stock Split share of Common Stock (the “New Shares”) for up to thirty pre-Reverse Stock Split shares of Common Stock (the “Old Shares”). In determining the range of Reverse Stock Split ratios, the Board considered numerous factors, including

| · | the historical and projected performance of the Common Stock and volume level before and after the Reverse Stock Split; |

| · | the prevailing trading price for the Common Stock and the volume level thereof; |

| · | potential devaluation of our market capitalization as a result of the Reverse Stock Split; |

| · | prevailing market conditions and general economic and other related conditions prevailing in our industry and in the marketplace generally; and |

| · | the projected impact of the Reverse Stock Split ratio on trading liquidity in the Common Stock. |

In evaluating the Reverse Stock Split, the Board also took into consideration negative factors associated with reverse stock splits in general. These factors include the negative perception of reverse stock splits held by some investors, analysts and other stock market participants, as well as the fact that the stock price of some companies that have effected reverse stock splits has subsequently declined back to pre-reverse stock split levels. The Board, however, determined that these negative factors were outweighed by the potential benefits.

Effects of the Reverse Stock Split

At the Effective Time (as defined below), each lot of up to thirty Old Shares, as determined by the Board, issued and outstanding immediately prior to the Effective Time will, automatically and without any further action on the part of our stockholders, be combined into and become one New Share, subject to the treatment for fractional shares described below, and each certificate which, immediately prior to the Effective Time, represented Old Shares will be deemed cancelled and, for all corporate purposes, will be deemed to evidence ownership of New Shares. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

The Reverse Stock Split will be effected simultaneously for all our then-existing Old Shares and the exchange ratio will be the same for all of our shares of outstanding Common Stock. The Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s percentage ownership interests in the Company, subject to the treatment for fractional shares described below. See “Fractional Shares” below. The New Shares issued pursuant to the Reverse Stock Split will be fully paid and non-assessable. All New Shares will have the same par value, voting rights and other rights as Old Shares. Stockholders of the Company do not have preemptive rights to acquire additional shares of Common Stock. The information in the following table is based on 94,463,586 shares of Common Stock outstanding as of the Record Date.

Proposed Reverse Stock Split | | Percentage Reduction in the Outstanding Shares of Common Stock | | Common Stock Outstanding after the Reverse Stock Split | | Common Stock Available for Issuance after the Reverse Stock Split |

| 1 for 5 | | 80.0% | | 18,892,717 | | 281,108,283 |

| 1 for 10 | | 90.0% | | 9,446,359 | | 290,553,641 |

| 1 for 15 | | 93.3% | | 6,297,572 | | 293,702,478 |

| 1 for 20 | | 95.0% | | 4,723,179 | | 295,276,821 |

| 1 for 25 | | 96.0% | | 3,778,543 | | 296,221,457 |

| 1 for 30 | | 96.7% | | 3,148,786 | | 296,851,214 |

A new CUSIP number will also be assigned to the Common Stock following the Reverse Stock Split.

Commencing at the Effective Time, all outstanding options, warrants and other convertible securities entitling holders thereof to purchase shares of Common Stock would entitle such holders to receive, upon exercise of their securities, a fraction (depending on the actual exchange ratio of the Reverse Stock Split) of the number of shares of Common Stock which such holders may purchase upon exercise or conversion of their securities. In addition, commencing at the Effective Time, the exercise or conversion price of all outstanding options, warrants and other convertible securities of the Company would be increased proportionally, based on the actual exchange ratio of the Reverse Stock Split.

Effective Increase in Authorized Shares of Common Stock

The number of authorized shares of our Common Stock would remain the same following the Reverse Stock Split. Therefore, the implementation of the Reverse Stock Split would have the effect of increasing the number of shares of Common Stock remaining available for issuance. We believe that the availability of the additional shares of Common Stock would provide us with the flexibility to meet business needs as they arise, to take advantage of favorable opportunities and to respond to a changing corporate environment.

We also believe that the increased reserve of shares available for issuance would give us the flexibility of using Common Stock to raise capital and/or as consideration in acquiring other businesses. Such acquisitions may be effected using shares of Common Stock or other securities convertible into Common Stock and/or by using capital that may need to be raised by selling such securities. We have no plans or agreements in place for any acquisition at this time.

We have no plans, proposals or arrangements, written or otherwise, at this time, to issue any of the additional available authorized shares of Common Stock that would result from a Reverse Stock Split.

The increased reserve of shares of Common Stock available for issuance may be used to facilitate public or private financings. If sufficient operating funds cannot be generated by operations, we may need to, among other things, issue and sell unregistered shares of Common Stock, or securities convertible into Common Stock, in private transactions. We have no plans or agreements in place for any financing at this time. Such transactions might not be available on terms favorable to us, or at all. We may sell Common Stock at prices less than the public trading price of the Common Stock at the time and we may grant additional contractual rights not available to other holders of Common Stock, such as warrants to purchase additional shares of Common Stock or anti-dilution protections.

In addition, the increased reserve of shares available for issuance may be used for our equity incentive plans for grants to our employees, consultants and directors. Our Board believes that it is critical to incentivize our officers and employees to increase our revenues and profitability, and as a result, our market value, through equity incentive awards. Such equity incentive plans may also be used to attract and retain employees or in connection with potential acquisitions.

The possible future issuance of shares of equity securities consisting of Common Stock or securities convertible into Common Stock could affect our current stockholders in a number of ways, including the following:

| · | diluting the voting power of the current holders of Common Stock; |

| · | diluting the market price of the Common Stock, to the extent that the shares of Common Stock are issued and sold at prices below current trading prices of the Common Stock, or if the issuance consists of equity securities convertible into Common Stock, to the extent that the securities provide for the conversion into Common Stock at prices that could be below current trading prices of the Common Stock; |

| · | diluting the earnings per share and book value per share of the outstanding shares of Common Stock; and |

| · | making the payment of dividends on Common Stock potentially more expensive. |

Fractional Shares

No scrip or fractional shares would be issued if, as a result of the Reverse Stock Split, a stockholder would otherwise become entitled to receive a fractional share of Common Stock. In lieu of issuing fractional shares, the Company would round up to one whole share of Common Stock in the event a stockholder would be entitled to receive a fractional share of Common Stock.

Effect on Voting Rights of, and Dividends on, Common Stock

Proportionate voting rights and other rights of the holders of Common Stock would not be affected by the Reverse Stock Split. The percentage of outstanding shares owned by each stockholder prior to the Reverse Stock Split, if implemented, will remain the same, except for adjustment as a consequence of rounding up of any fractional shares created by the Reverse Stock Split. See “Fractional Shares” above.

We have not in the past declared, nor do we have any plans to declare in the foreseeable future, any distributions of cash, dividends or other property, and we are not in arrears on any dividends. Therefore, we do not believe that the Reverse Stock Split would have any effect with respect to future distributions, if any, to our stockholders.

Effect on Liquidity

The decrease in the number of shares of our Common Stock outstanding as a consequence of the Reverse Stock Split may decrease the liquidity in our Common Stock if the anticipated beneficial effects do not occur. See “Purposes of the Reverse Stock Split” above. If implemented, the Reverse Stock Split may result in some stockholders owning “odd-lots” of less than 100 shares of Common Stock on a post-split basis. Odd lots may be more difficult to sell, or require greater transaction costs per share to sell than shares in “even lots” of even multiples of 100 shares.

Potential Anti-Takeover Effect

The increased proportion of authorized but unissued shares of our Common Stock to outstanding shares thereof could, under certain circumstances, have an anti-takeover effect. For example, such a change could permit future issuances of our Common Stock that would dilute the stock ownership of a person seeking to effect a change in composition of our Board or contemplating a tender offer or other transaction for the combination of our Company with another entity. The Reverse Stock Split, however, is not being proposed in response to any effort of which we are aware to accumulate shares of our Common Stock or to obtain control of us. The Company currently has no intention of going private and the Reverse Stock Split is not intended to be a first step in a going private transaction and will not have the effect of a going private transaction covered by Rule 13e-3 under the Exchange Act.

Certain U.S. Federal Income Tax Consequences

The discussion below is only a summary of certain U.S. federal income tax consequences of the Reverse Stock Split generally applicable to beneficial holders of shares of our Common Stock and does not purport to be a complete discussion of all possible tax consequences. This summary addresses only those stockholders who hold their Old Shares as “capital assets” as defined in the Internal Revenue Code of 1986, as amended (the “Code”), and will hold the New Shares as capital assets. This discussion does not address all U.S. federal income tax considerations that may be relevant to particular stockholders in light of their individual circumstances or to stockholders that are subject to special rules, such as financial institutions, tax-exempt organizations, insurance companies, dealers in securities, and foreign stockholders. The following summary is based upon the provisions of the Code, applicable Treasury Regulations thereunder, judicial decisions and current administrative rulings, as of the date hereof, all of which are subject to change, possibly on a retroactive basis. Tax consequences under state, local, foreign, and other laws are not addressed herein. Each stockholder should consult his, her or its own tax advisor as to the particular facts and circumstances that may be unique to such stockholder and also as to any estate, gift, state, local or foreign tax considerations arising out of the Reverse Stock Split.

The Reverse Stock Split will qualify as a recapitalization for U.S. federal income tax purposes. As a result:

| · | Stockholders should not recognize any gain or loss as a result of the Reverse Stock Split. |

| · | The aggregate basis of a stockholder’s pre-Reverse Stock Split shares will become the aggregate basis of the shares held by such stockholder immediately after the Reverse Stock Split. |

| · | The holding period of the shares owned immediately after the Reverse Stock Split will include the stockholder’s holding period before the Reverse Stock Split. |

The above discussion is not intended or written to be used, and cannot be used by any person, for the purpose of avoiding U.S. federal tax penalties. It was written solely in connection with the proposed Reverse Stock Split of our Common Stock.

Effective Date of the Reverse Stock Split

If the Board determines to effect a Reverse Stock Split, the Reverse Stock Split will become effective upon the filing of a Certificate of Amendment to our Certificate of Incorporation with the Secretary of State of the State of Nevada or at such later time as indicated in such amendment (the “Effective Time”), but in no event prior to the end of the 20 day period following the date on which this Information Statement is mailed first to our stockholders. It is expected that such filing will take place promptly after the 20 day period following the date on which this Information Statement is mailed to our stockholders. However, the exact timing of the filing of the amendment will be determined by the Board based on its evaluation as to when such action will be the most advantageous to us and our stockholders, and the Board. In addition, the Board reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior to filing the amendment, the Board, in its sole discretion, determines that it is no longer in our best interests and the best interests of our stockholders.

ACTION THREE – APPROVAL OF THE

PANACEA GLOBAL, INC. 2011 OMNIBUS INCENTIVE PLAN

On July 26, 2011, the Board adopted The Panacea Global, Inc. 2011 Omnibus Incentive Plan (the “Plan”). On September 6, 2011, pursuant to Section 78.320 of the NRS, we received written consents approving the Plan from the Majority Stockholders.

Reasons for the Plan

The purpose of the Plan is to recognize the contributions made to the Company by its employees, consultants and advisors; to provide these individuals with additional incentives to devote themselves to the future success of the Company; and to improve the ability of the Company to attract, retain and motivate individuals upon whom the sustained growth and financial success of the Company depends.

Summary of the Plan

The Plan provides for the grant of stock options, both non-qualified and incentive, to purchase shares of Common Stock (“Options”). The Plan also provides for awards (“Awards”) of stock appreciation rights, restricted stock, restricted stock units, phantom stock and dividend equivalent rights.

This summary is qualified in its entirety by the more detailed terms and conditions of the Plan, which is filed as Annex II to this Information Statement. The Company intends to file a registration statement under the Securities Act of 1933, as amended (the “Securities Act”), to register the shares of Common Stock to be issued pursuant to the Plan. The key provisions of the Plan are as follows:

Number of Shares. The maximum number of shares of Common Stock that may be issued under the Plan is 10,000,000. The maximum number of shares will be adjusted to reflect certain changes in the Company’s capitalization, including the Reverse Stock Split if approved and implemented. If any shares subject to any Option or Award expire or are forfeited, canceled or settled for cash without delivery of shares of Common Stock, the shares subject to such Option or Award will again be available pursuant to the Plan.

Administration. The Plan is administered by the Board, or, at the discretion of the Board, by a committee composed of two or more members of the Board (for purposes of this Information Statement, the Board and such committee are referred to herein as the “Committee.”

Eligibility. All employees (including all executive officers), directors, consultants and advisors of the Company or its subsidiaries and affiliates are eligible to receive Options or Awards under the Plan.

Term of the Plan. The Plan is effective as of July 26, 2011 and provides that no Options or Awards may be granted after July 26, 2021.

Options and Awards. From time to time, at its discretion, the Committee may select eligible recipients to whom Options or Awards will be granted, determine when each Option or Award will be granted, determine the number of shares subject to such Option or Award and, subject to the provisions of the Plan, determine the terms and conditions of each Option or Award. The Plan allows the Committee to determine certain terms in a grant of Options or Awards, including terms regarding payment methods, vesting schedules, restrictions on restricted stock and the timing and conditions of the lapse of such restrictions, acceleration of expiration or termination dates, and imposing or removing restrictions on an Award.

Options. Options granted under the Plan may be either incentive stock options (“ISOs”) or non-qualified stock options. ISOs are intended to qualify as “incentive stock options” within the meaning of Section 422 of the Code. Unless an Option is specifically designated at the time of grant as an ISO, Options are non-qualified options.

The exercise price of the Options is determined by the Committee, provided that the exercise price of an ISO must be at least 100% of the fair market value of a share of Common Stock on the date the Option is granted, or at least 110% of the fair market value if the recipient owns shares possessing more than 10% of the total combined voting power of all classes of stock of the Company. The aggregate fair market value, determined as of the time of grant, of the shares with respect to which an ISO is exercisable for the first time by the recipient during any calendar year (under all incentive stock option plans of the Company) may not exceed $100,000. The term of each Option is fixed by the Committee.

Maximum Grants. The Plan provides that the maximum number of shares for which Options may be granted to any single optionee in any fiscal year is 5,000,000 shares.

Holding Period. No Option may be exercised unless six months, or such greater period of time as may be specified in the Option grant documents, have elapsed from the date of grant.

Termination of Options. All Options terminate on the earliest of:

| (a) | Expiration of the Option term specified in the option document, which shall not exceed (i) ten years from the date of grant, or (ii) five years from the date of grant of an ISO if the optionee on the date of grant owns, directly or by attribution under Section 424(d) of the Code, shares of capital stock of the Company possessing more than ten percent (10%) of the total combined voting power of all classes of capital stock of the Company or of an affiliate; |

| (b) | Expiration of ninety (90) days from the date the optionee’s employment or service with the Company or its affiliate terminates for any reason other than disability or death; |

| (c) | Expiration of one year from the date the optionee’s employment or service with the Company or its affiliate terminates due to the optionee’s disability or death; |

| (d) | A finding by the Committee, after full consideration of the facts presented on behalf of both the Company and the optionee, that the optionee has (i) committed a material and serious breach or neglect of optionee’s responsibilities to the Company; (ii) breached his or her employment or service contract with the Company or an affiliate; (iii) committed a willful violation or disregard of standards of conduct established by law; committed fraud, willful misconduct, misappropriation of funds or other dishonesty; (v) been convicted of a crime of moral turpitude; or (vi) accepted employment with another company or performed work or provided advice to another company, as an employee, consultant or in any other similar capacity, while still an employee of the Company, then the Option shall terminate on the date of such finding. In such event, in addition to immediate termination of the Option, the optionee shall automatically forfeit all shares for which the Company has not yet delivered the share certificates upon refund by the Company of the Option price of such shares; or |

| (e) | The date, if any, set by the Committee as an accelerated expiration date. |

No Repricing. Option and stock appreciation rights repricing (including reducing the exercise price of Options or replacing an Option or stock appreciation right with cash or another award type) is prohibited without stockholder approval under the Plan.

Provisions Relating to a “Change of Control” of the Company. In the event of a Change of Control (as defined below), the Committee may take whatever action with respect to Options and Awards outstanding as it deems necessary or desirable, including, without limitation, accelerating the expiration or termination date or the date of exercisability in any option documents, or removing any restrictions from or imposing any additional restrictions on any outstanding Awards or Options. A “Change of Control” shall be deemed to occur if:

| (a) | any person who is not an affiliate of the Company becomes a beneficial owner of a majority of the outstanding voting power of the Company’s capital stock; |

| (b) | the stockholders of the Company approve and there is consummated any plan of liquidation providing for the distribution of all or substantially all of the Company’s assets; or |

| (c) | there is consummated a merger, consolidation or other form of business combination involving the Company, or, in one transaction or a series of related transactions, a sale of all or substantially all of the assets of the Company, unless, in any such case: (i) the business of the Company is continued following such transaction by a resulting entity (which may be, but need not be, the Company) (the “Surviving Company”); and (ii) persons who were the beneficial owners of a majority of the outstanding voting power of the Company immediately prior to the completion of such transaction beneficially own, by reason of such prior beneficial ownership, a majority of the outstanding voting power of the Surviving Company (or a majority of the outstanding voting power of the direct or indirect parent of the Surviving Company, as the case may be) immediately following the completion of such transaction. |

For purposes of the definition of “Change of Control,” the terms “person,” “beneficial owner,” “beneficial ownership,” “affiliate,” and “control” shall have the meanings ascribed to such terms under Sections 13(d) and 3(a)(9) and Rule 13d-3 under the Exchange Act and Rule 501 under the Securities Act, as applicable.

Amendment and Termination. The Board may amend the Plan from time to time in such manner as it may deem advisable. Nevertheless, the Board may not: (i) change the class of individuals eligible to receive an ISO, (ii) increase the maximum number of shares as to which Options or Awards may be granted, or (iii) make any other change or amendment as to which stockholder approval is required in order to satisfy the conditions set forth in Rule 16b-3 promulgated under the Exchange Act, in each case without obtaining approval, within twelve months before or after such action, by (A) vote of a majority of the votes cast at a duly called meeting of the stockholders at which a quorum representing a majority of all outstanding voting stock of the Company is, either in person or by proxy, present and voting on the matter, or (B) a method and in a degree that would be treated as adequate under applicable state law for actions requiring stockholder approval, including, without limitation, by written consent of stockholders constituting a majority of the voting power of all shares of outstanding voting stock of the Company entitled to vote. No amendment to the Plan shall adversely affect any outstanding Option or Award, however, without the consent of the optionee or grantee.

Federal Income Tax Consequences. The following discussion is a summary of certain current federal income tax consequences of the issuance of Options and the acquisition of shares of Common Stock by exercising Options, or receiving Awards under the Plan, and does not present a complete analysis of all tax consequences which may be relevant to any particular recipient. It does not purport to discuss state or local income tax laws.

Options. With respect to ISOs, for federal income tax purposes an optionee will not have taxable income upon grant or exercise. However, upon exercise of an ISO, an optionee will generally recognize income for alternative minimum tax purposes in an amount equal to the difference between the exercise price of the ISO and the fair market value of the shares received. Any gain realized on sale of the shares acquired upon exercise of an ISO will be treated as long-term capital gain, provided the optionee does not dispose of the shares for at least two years after the date of grant or within one year after the date of exercise. No gain or loss will generally be recognized by an optionee upon, nor will any deduction be allowed to the Company as a result of, the grant or exercise of ISOs.

In general, in the case of non-qualified stock options or ISOs as to which the foregoing holding period limitations have not been satisfied, an optionee will have taxable income at ordinary income rates upon exercise (or at the time of a sale of ISO stock which does not satisfy the holding periods) for the difference between the exercise price and the fair market value at the date of exercise or, if the optionee is subject to certain restrictions imposed by federal securities laws, upon the lapse of those restrictions, unless the optionee elects under Section 83(b) of the Code within 30 days after exercise to be taxed upon exercise. The amount of that difference will generally be a deductible expense to the Company.

The ability of the Company to deduct compensation expense is generally subject to limitations under Section 162(m) of the Code (applicable to compensation in excess of $1,000,000 paid to certain “covered” employees). Any income recognized as ordinary compensation income on the exercise of a non-qualified stock option should, however, be exempt from these Code limitations as “performance-based” compensation provided the option grant meets certain requirements. It is the Company’s intention to administer the Plan in accordance with all applicable “performance-based” compensation requirements, including administration of the Plan with respect to “covered” employees by a committee of two or more “outside” directors (as that term is used in applicable IRS regulations) and to make Option grants to such employees with an exercise price that is at least equal to the fair market value of the shares on the date of grant. Under these circumstances, such Options should, on exercise, result in a deductible compensation expense that is exempt from Section 162(m) of the Code as “performance-based” compensation.

Restricted Shares. For federal income tax purposes, the recipient of an Award of restricted shares will not recognize income and the Company will not be entitled to a deduction at the time of such Award because the restricted shares are subject to risk of forfeiture and are not transferable. When the risk of forfeiture and non-transferability restrictions lapse, the recipient will recognize ordinary income and the Company will be entitled to a deduction (subject generally to a $1,000,000 limitation on deductible compensation of certain employees of the Company as provided under Section 162(m) of the Code) in an amount equal to the then fair market value of the restricted shares.

Restricted Stock Units/Stock Appreciation Rights/Phantom Stock. For federal income tax purposes, there are no immediate tax consequences of receiving an Award of restricted stock units, stock appreciation rights or phantom stock under the Plan. A grantee who is awarded any of these will be required to recognize ordinary income in an amount equal to the fair market value of shares issued to such grantee at the end of the vesting or restriction period or, if later, the payment date. Assuming the Company complies with applicable reporting requirements and with the restrictions of Section 162(m) of the Code, the Company will be entitled to a business expense deduction in the same amount and generally at the same time as the grantee recognizes ordinary income.

Dividend Equivalent Rights. A grantee who receives dividend equivalent rights will be required to recognize ordinary income for federal income tax purposes equal to any amount distributed to the grantee pursuant to the Award of such rights. Assuming the Company complies with applicable reporting requirements and with the restrictions of Section 162(m) of the Code, the Company will be entitled to a business expense deduction in the same amount and generally at the same time as the grantee recognizes ordinary income.

Performance-Based Awards. The Committee may grant Awards that have vesting requirements linked to the attainment of one or more “performance targets” applicable to any such Award. In the event the grantee of any such Award terminates employment prior to the end of the “performance period” applicable to the Award, the grantee will forfeit his or her rights to the Award. In addition, in the event the “performance target” that applies to an Award is not attained by the end of the applicable “performance period,” all rights to the Award will also be forfeited. The Committee has discretion as to the determination of whether performance-based Awards will vest or be forfeited upon a change in control of the Company. The Committee also has the right to cause any performance-based Award to be forfeited, at its discretion, without regard to whether applicable performance targets are attained if the Committee determines that such a forfeiture is appropriate.

If performance-based Awards are granted, the Committee must establish one or more performance targets for each performance period, which may vary for different grantees. In all cases, the performance target(s) established with respect to any performance period will be established within the first 90 days of the performance period or, if shorter, within the first twenty-five percent (25%) of such performance period. Each performance target will be in the form of a goal as to which an objective method (or methods) is available for determining whether it has been achieved. In addition, the Committee will establish in connection with the performance targets applicable to a performance period an objective method for computing the portion of a particular performance-based Award that will be treated as vested as a result of attaining such performance target(s).

If performance-based Awards are granted, the performance targets established must be based upon one or more of the following business criteria (which may be determined for these purposes by reference to (i) the Company as a whole, (ii) any of the Company’s subsidiaries, operating divisions, business segments or other operating units, or (iii) any combination thereof): earnings before interest, taxes, depreciation, and amortization; profit before taxes; stock price; market share; gross revenue; net revenue; pretax income; net operating income; cash flow; earnings per share; return on equity; return on invested capital or assets; cost reductions and savings; return on revenues or productivity; loss ratio; expense ratio; combined ratio; product spread; or any variations or combinations of the preceding business criteria, which may also be modified at the discretion of the Committee to take into account extraordinary items or which may be adjusted to reflect such costs or expense as the Committee deems appropriate.

Performance-based Awards cannot be made in excess of the limitations established under the special performance-based provisions of the Plan. Specifically, no grantee may receive, individually or in aggregate under the Plan, performance-based Awards in excess of 5,000,000 shares.

Unlike Awards that vest solely by reason of a period of continuous employment, performance-based Awards are intended to qualify as “performance-based” compensation for purposes of Section 162(m) of the Code because vesting is linked to bona fide performance targets established by the Committee consistent with the requirements set forth in the Plan. As a consequence, it is anticipated that at the time a performance-based Award becomes vested, the value of the underlying shares will be included in the income of the grantee and will be deductible by the Company without regard to the limitations imposed on deductibility under Section 162(m) of the Code.

Election under Section 83(b) of the Code. An Option or Award recipient may elect pursuant to Section 83(b) of the Code to include the underlying shares in his income at their fair market value at the time of grant, in which event the Company would be entitled to a corresponding deduction. Such election must be made within 30 days after the grant date. If this election is made, any appreciation in value recognized by the recipient on a subsequent disposition of the Option or Award will in general be taxed at capital gains rates and not as ordinary income. If, however, a recipient who makes a Section 83(b) election forfeits the Option or Award back to the Company, the recipient will not recognize a loss on such forfeiture. In some cases, the particular restrictions with respect to an Award may be such that a recipient will not be entitled to make the Section 83(b) election.

Code Section 409A. The Company has structured the Plan with the intention that Options and Awards granted under the Plan comply with Section 409A of the Code. To the extent a grantee would be subject to the additional 20% tax imposed on certain nonqualified deferred compensation plans as a result of a provision of an Option or Award under the Plan, the provision will be deemed amended to the minimum extent necessary to avoid application of the 20% additional tax.

Code Section 280G. To the extent payments that are contingent on a change in control are determined to exceed certain Code Section 280G limitations on “golden parachutes,” the Code provides that these payments may be subject to a 20% nondeductible excise tax and the Company’s deduction with respect to the associated compensation expense may be disallowed in whole or in part.

WHERE YOU CAN FIND MORE INFORMATION

The Company files annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other information with the SEC. You may obtain such SEC filings from the SEC’s website at http://www.sec.gov. You can also read and copy these materials at the SEC’s public reference room at 100 F Street, N.E., Washington, D.C. 20549. You can obtain information about the operation of the SEC’s public reference room by calling the SEC at 1-800-SEC-0330.

DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS

If hard copies of the materials are requested, we will send only one Information Statement and other corporate mailings to stockholders who share a single address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of the Information Statement to a stockholder at a shared address to which a single copy of the Information Statement was delivered. You may make such a written or oral request by (a) sending a written notification stating (i) your name, (ii) your shared address and (iii) the address to which the Company should direct the additional copy of the Information Statement, to the Company at Corporate Secretary, 88 Toporowski Ave., Richmond Hill, Ontario, Canada L4S2V6, (416) 450-6414.

If multiple stockholders sharing an address have received one copy of this Information Statement or any other corporate mailing and would prefer the Company to mail each stockholder a separate copy of future mailings, you may send notification to or call the Company’s principal executive offices. Additionally, if current stockholders with a shared address received multiple copies of this Information Statement or other corporate mailings and would prefer the Company to mail one copy of future mailings to stockholders at the shared address, notification of such request may also be made by mail or telephone to the Company’s principal executive offices.

| | By Order of the Board of Directors, /s/ Mahmood Moshiri Chief Executive Officer, President, Chief Medical Officer and Director |

PANACEA GLOBAL, INC.

2011 OMNIBUS INCENTIVE PLAN

1. Purpose. Panacea Global, Inc. (the “Company”) hereby adopts The Panacea Global, Inc. 2011 Omnibus Incentive Plan (the “Plan”), effective as of July 26, 2011. The Plan is intended to recognize the contributions made to the Company by its associates (including associates who are members of the Board of Directors), directors, consultants and advisors of the Company or any Affiliate, to provide such persons with additional incentive to devote themselves to the future success of the Company or an Affiliate, and to improve the ability of the Company or an Affiliate to attract, retain, and motivate individuals upon whom the Company’s sustained growth and financial success depend, by providing such persons with an opportunity to acquire or increase their proprietary interest in the Company. To this end, the Plan provides for the grant of stock options, stock appreciation rights, restricted stock, restricted stock units, phantom stock and dividend equivalent rights. Any of these awards may, but need not, be made as performance incentives to reward attainment of annual or long-term performance goals in accordance with the terms hereof, which awards are anticipated to result in “performance-based” compensation (as that term is used for purpose of Section 162(m) of the Code). Stock options granted under the Plan may be Non-Qualified Stock Options or ISOs, as provided herein, except that stock options granted to outside directors and any consultants or advisers providing services to the Company or an Affiliate shall in all cases be Non-Qualified Stock Options. No Performance-Based Award shall become vested unless this Plan, including the provisions of Section 16, has been disclosed to and approved by the Company’s shareholders. This Plan is intended to compensate Participants for services rendered to the Company or any Affiliate, such compensation to be based on the terms of an employment relationship, a service contract or arrangement or the Participant’s appointment as a director or officer of the Company. Any grant or award made pursuant to this Plan to a Participant shall state that such grant or award is being made in respect of services rendered by such Participant to a particular legal entity, whether the Company or an Affiliate.

2. Definitions. Unless the context clearly indicates otherwise, the following terms shall have the following meanings:

A. “280G Cutback” shall have the meaning set forth in Section 19.

B. “Affiliate” means a corporation that is a parent corporation or a subsidiary corporation with respect to the Company within the meaning of Section 424(e) or (f) of the Code.

C. “Award” means an award of Restricted Stock, Restricted Stock Units, Stock Appreciation Rights, Phantom Stock or Dividend Equivalent Rights granted under the Plan, designated by the Committee at the time of such grant as an Award, and containing the terms specified herein for Awards.

D. “Award Date” means the date an Award is made under the Plan.

E. “Award Document” means the document described in Section 9 that sets forth the terms and conditions of each grant of an Award.

F. “Benefit Agreement” shall have the meaning set forth in Section 19.

G. “Board of Directors” means the Board of Directors of the Company.

H. “Change of Control” shall have the meaning as set forth in Section 10.

I. “Code” means the Internal Revenue Code of 1986, as amended.

J. “Committee” shall have the meaning set forth in Section 3.A.

K. “Common Stock” means the Common Stock, $.001 par value per share, of the Company.

L. “Company” shall have the meaning set forth in Section 1.

M. “Disability” shall have the meaning set forth in Section 22(e)(3) of the Code.

N. “Dividend Equivalent Right” means a right, granted to a Grantee under Section 9.D hereof, to receive cash, Stock, other Awards or other property equal in value to dividends paid with respect to a specified number of shares of Stock, or other periodic payments.

O. “Exchange Act” means the Securities Exchange Act of 1934, as amended.

P. “Fair Market Value” shall have the meaning set forth in Section 8.B.

Q. “Grantee” means a person who is granted Options, Restricted Stock, Restricted Stock Units, Stock Appreciation Rights, Phantom Stock or Dividend Equivalent Rights.

R. “Grant Date” means the date an Option is granted under the Plan.

S. “ISO” means an Option granted under the Plan that meets the requirements to qualify as an “incentive stock option” within the meaning of Section 422(b) of the Code and that is not designated as a Non-Qualified Stock Option.

T. “Non-Qualified Stock Option” means an Option granted under the Plan that is designated as a Non-Qualified Stock Option, or otherwise does not qualify, as an ISO within the meaning of Section 422(b) of the Code.

U. “Option” means either an ISO or a Non-Qualified Stock Option granted under the Plan.

V. “Optionee” means a person to whom an Option has been granted under the Plan, which Option has not been exercised and has not expired or terminated.

W. “Option Document” means the document described in Section 8 that sets forth the terms and conditions of each grant of Options.

X. “Option Price” means the price at which Shares may be purchased upon exercise of an Option, as calculated pursuant to Section 8.B.

Y. “Other Agreement” shall have the meaning set forth in Section 19.

Z. “Participant” shall mean those persons as may be designated by the Committee to participate in the Plan from time to time.

AA. “Parachute Payment” shall have the meaning set forth in Section 19.

BB. “Performance-Based Award” means an Award granted pursuant to Section 16.

CC. “Performance-Based Award Limitation” means the limitation on the number of Shares that may be granted pursuant to Performance-Based Awards to any one Participant, as set forth in Section 16.F.

DD. “Performance Period” means any period designated by the Committee as a period of time during which a Performance Target must be met for purposes of Section 16.

EE. “Performance Target” means the performance target established by the Committee for a particular Performance Period, as described in Section 16.B.

FF. “Phantom Stock” means the right, granted pursuant to Section 9.C of the Plan, to receive in cash the Fair Market Value of a share of Common Stock.

GG. “Plan” shall have the meaning set forth in Section 1.

HH. “Restricted Stock” means Shares issued to a person pursuant to an Award.

II. “Restricted Stock Unit” or “RSU” means a bookkeeping entry representing the equivalent of one (1) share of Common Stock awarded to a grantee under Section 9.B of the Plan.

JJ. “Section 409A” shall have the meaning set forth in Section 20.

KK. “Shares” means the shares of Common Stock that are the subject of Options or Awards.

LL. “Stock Appreciation Rights” or “SAR” means a right granted to a grantee under Section 9.A of the Plan.

MM. “Surviving Company” shall have the meaning set forth in Section 10.

NN. “Treasury Regulation” means the Income Tax regulations, including temporary regulations, promulgated under the Code, as such regulations may be amended from time to time (including corresponding provisions of succeeding regulations).

OO. “Unrestricted Stock” shall have the meaning set forth in Section 9.B.(ix)

3. Administration of the Plan.

A. Committee. The Plan shall be administered by the Board of Directors, or, in the discretion of the Board of Directors, by a committee composed of two (2) or more of the members of the Board of Directors. To the extent possible, and to the extent the Board of Directors deems it necessary or appropriate, each member of the Committee shall be a non- employee director (as such term is defined in Rule 16b-3 promulgated under the Exchange Act) and an outside director (as such term is defined in Treasury Regulations Section 1.162-27 promulgated under the Code); however, the Board of Directors may designate two or more committees to operate and administer the Plan in its stead. Any of such committees designated by the Board of Directors is referred to as the “Committee,” and, to the extent that the Plan is administered by the Board of Directors, “Committee” shall also refer to the Board of Directors as appropriate in the particular context. The Board of Directors may from time to time remove members from or add members to the Committee. Vacancies on the Committee, however caused, shall be filled by the Board of Directors.

B. Meetings. The Committee shall hold meetings at such times and places as it may determine. Acts approved at a meeting by a majority of the members of the Committee or acts approved in writing by the unanimous consent of the members of the Committee shall be the valid acts of the Committee.

C. Grants. The Committee shall from time to time at its discretion direct the Company to grant Options or Awards pursuant to the terms of the Plan. The Committee shall have plenary authority to (i) determine the Optionees and Grantees to whom and the times at which Options and Awards shall be granted, (ii) determine the price at which Options shall be granted, (iii) determine the type of Option to be granted and the number of Shares subject thereto, (iv) determine the number of Shares to be granted pursuant to each Award and (v) approve the form and terms and conditions of the Option Documents and of each Award; all subject, however, to the express provisions of the Plan. In making such determinations, the Committee may take into account the nature of the Optionee’s or Grantee’s services and responsibilities, the Optionee’s or Grantee’s present and potential contribution to the Company’s success and such other factors as it may deem relevant. The interpretation and construction by the Committee of any provisions of the Plan or of any Option or Award granted under it shall be final, binding and conclusive.

D. Exculpation. No member of the Committee shall be personally liable for monetary damages as such for any action taken or any failure to take any action in connection with the administration of the Plan or the granting of Options or Awards thereunder unless (i) the member of the Committee has breached or failed to perform the duties of his or her office, and (ii) the breach or failure to perform constitutes self-dealing, willful misconduct or recklessness; provided, however, that the provisions of this Section 3.D shall not apply to the responsibility or liability of a member of the Committee pursuant to any criminal statute or to the liability of a member of the Committee for the payment of taxes pursuant to local, state or federal law.

E. Indemnification. Service on the Committee shall constitute service as a member of the Board of Directors. Each member of the Committee shall be entitled without further act on his or her part to indemnity from the Company to the fullest extent provided by applicable law and the Company’s Articles of Incorporation and/or Bylaws in connection with or arising out of any action, suit or proceeding with respect to the administration of the Plan or the granting of Options or Awards thereunder in which he or she may be involved by reason of his or her being or having been a member of the Committee, whether or not he or she continues to be such member of the Committee at the time of the action, suit or proceeding.

4. Grants of Options under the Plan. A Non-Qualified Stock Option is an award in the form of an option to purchase shares of the Company’s Common Stock and that is designated as a Non-Qualified Stock Option or that otherwise does not qualify as an ISO. An ISO is an award in the form of an option to purchase shares of the Company’s Common Stock that meets the requirements of Code Section 422, or any successor section of the Code and that is not designated as a Non-Qualified Stock Option. Grants of Options under the Plan may be in the form of a Non-Qualified Stock Option, an ISO or a combination thereof, at the discretion of the Committee.

5. Eligibility. All employees (including employees who are members of the Board of Directors or its Affiliates), directors, consultants and advisors of the Company or its Affiliates shall be eligible to receive Options or Awards hereunder; provided, that only employees of the Company or its Affiliates shall be eligible to receive ISOs. The Committee, in its sole discretion, shall determine whether an individual qualifies as an employee of the Company or its Affiliates.

6. Shares Subject to Plan.

A. The aggregate maximum number of Shares for which Options or Awards may be granted pursuant to the Plan is 10,000,000, adjusted as provided in Section 11. The Shares shall be issued from authorized and unissued Common Stock or Common Stock held in or hereafter acquired for the treasury of the Company. If an Option terminates or expires without having been fully exercised for any reason, or if any Award or Option is canceled or forfeited for any reason, the Shares for which the Option was not exercised or that were canceled or forfeited pursuant to the Award or Option may again be the subject of an Option or Award granted pursuant to the Plan.

B. Shares covered by an Award or Option shall be counted as used as of the Award Date or Grant Date, as applicable. Any Shares that are subject to Awards or Options shall be counted against the limit set forth in Section 6.A one (1) Share for every one (1) Share subject to an Award or Option. With respect to SARs, the number of Shares subject to an award of SARs or Phantom Stock will be counted against the aggregate number of Shares available for issuance under the Plan regardless of the number of Shares actually issued to settle the SAR upon exercise. If any Shares covered by an Award or Option granted under the Plan are not purchased or are forfeited or expire, or if an Award or Option otherwise terminates without delivery of any Common Stock subject thereto or is settled in cash in lieu of shares, then the number of Shares counted against the aggregate number of Shares available under the Plan with respect to such Award or Option shall, to the extent of any such forfeiture, termination or expiration, again be available for granting Awards or Options under the Plan in the same amount as such Shares were counted against the limit set forth in this section.

7. Term of the Plan. No Option or Award may be granted under the Plan after July 26, 2021.

8. Option Documents and Terms. Each Option granted under the Plan shall be a Non-Qualified Stock Option unless the Option shall be specifically designated at the time of grant to be an ISO. Options granted pursuant to the Plan shall be evidenced by the Option Documents in such form as the Committee shall from time to time approve, which Option Documents shall comply with and be subject to the following terms and conditions and such other terms and conditions as the Committee shall from time to time require that are not inconsistent with the terms of the Plan.

A. Number of Option Shares. Each Option Document shall state the number of Shares to which it pertains. An Optionee may receive more than one Option, which may include Options that are intended to be ISOs and Options that are not intended to be ISOs, but only on the terms and subject to the conditions and restrictions of the Plan. The maximum number of Shares for which Options may be granted to any single Optionee in any fiscal year, adjusted as provided in Section 11, shall be 5,000,000 Shares. For purposes of the preceding sentence, an SAR shall be treated as a grant of an Option for the number of shares designated as the shares underlying the rights granted pursuant to the terms of such SAR.

B. Option Price. Each Option Document shall state the Option Price that, for all Options, shall be at least 100% of the Fair Market Value of the Shares at the time the Option is granted as determined by the Committee in accordance with this Section 8.B; provided, however, that if an ISO is granted to an Optionee who then owns, directly or by attribution under Section 424(d) of the Code, shares of capital stock of the Company possessing more than 10% of the total combined voting power of all classes of stock of the Company or an Affiliate, then the Option Price shall be at least 110% of the Fair Market Value of the Shares at the time the Option is granted. If the Common Stock is traded in a public market, then the Fair Market Value per Share shall be, if the Common Stock is listed on a national securities exchange or included in the NASDAQ National Market System, the last reported sale price per share thereof on the relevant date, or, if the Common Stock is not so listed or included, the mean between the last reported “bid” and “asked” prices per share thereof, as reported on NASDAQ or, if not so reported, as reported by the National Daily Quotation Bureau, Inc., or as reported in a customary financial reporting service, as applicable and as the Committee determines, on the relevant date. If the Common Stock is not traded in a public market on the relevant date, the Fair Market Value shall be as determined in good faith by the Committee.

C. Exercise. No Option shall be deemed to have been exercised prior to the receipt by the Company of written notice of such exercise and of payment in full of the Option Price for the Shares to be purchased. Each such notice shall specify the number of Shares to be purchased. Notwithstanding the foregoing, if the Company determines that issuance of Shares should be delayed pending (i) registration under federal or state securities laws, (ii) the receipt of an opinion that an appropriate exemption from such registration is available, (iii) the listing or inclusion of the Shares on any securities exchange or in an automated quotation system or (iv) the consent or approval of any governmental regulatory body whose consent or approval is necessary in connection with the issuance of such Shares, the Company may defer exercise of any Option granted hereunder until any of the events described in this Section 8.C has occurred.

D. Medium of Payment.

(i) An Optionee shall pay for Shares (a) in cash, (b) by certified check payable to the order of the Company, or (c) by such other mode of payment as the Committee may approve, including, without limitation, payment through a broker in accordance with procedures permitted by Regulation T of the Federal Reserve Board. Furthermore, the Committee may provide in an Option Document that payment may be made in whole or in part in shares of Common Stock held by the Optionee for at least six months. If payment is made in whole or in part in shares of Common Stock, then the Optionee shall deliver to the Company certificates registered in the name of such Optionee representing the shares of Common Stock owned by such Optionee, free of all liens, claims and encumbrances of every kind and having an aggregate Fair Market Value on the date of delivery that is at least as great as the Option Price of the Shares (or relevant portion thereof) with respect to which such Option is to be exercised by the payment in shares of Common Stock, accompanied by stock powers duly endorsed in blank by the Optionee. Notwithstanding the foregoing, the Committee may impose from time to time such limitations and prohibitions on the use of shares of Common Stock to exercise an Option as it deems appropriate.

(ii) With respect to an Option only, to the extent permitted by law and to the extent the Option Document so provides, payment of the Option Price for shares purchased pursuant to the exercise of an Option may be made all or in part by delivery (on a form acceptable to the Committee) of an irrevocable direction to a licensed securities broker acceptable to the Company to sell shares of Stock and to deliver all or part of the sales proceeds to the Company in payment of the Option Price and any withholding taxes described in Section 14.

E. Termination of Options.

(i) No Option shall be exercisable after the first to occur of the following:

(a) Expiration of the Option term specified in the Option Document, which shall not exceed (i) ten years from the date of grant, or (ii) five years from the date of grant of an ISO if the Optionee on the date of grant owns, directly or by attribution under Section 424(d) of the Code, shares of capital stock of the Company possessing more than ten percent (10%) of the total combined voting power of all classes of capital stock of the Company or of an Affiliate;

(b) Expiration of ninety (90) days from the date the Optionee’s employment or service with the Company or its Affiliate terminates for any reason other than Disability or death or as otherwise specified in Section 8.E.(i).(d) or Section 10 below;

(c) Expiration of one year from the date the Optionee’s employment or service with the Company or its Affiliate terminates due to the Optionee’s Disability or death;

(d) A finding by the Committee, after full consideration of the facts presented on behalf of both the Company and the Optionee, that the Optionee has (i) committed a material and serious breach or neglect of Optionee’s responsibilities to the Company; (ii) breached his or her employment or service contract with the Company or an Affiliate; (iii) committed a willful violation or disregard of standards of conduct established by law; committed fraud, willful misconduct, misappropriation of funds or other dishonesty; (v) been convicted of a crime of moral turpitude; or (vi) accepted employment with another company or performed work or provided advice to another company, as an employee, consultant or in any other similar capacity, while still an employee of the Company, then the Option shall terminate on the date of such finding. In such event, in addition to immediate termination of the Option, the Optionee shall automatically forfeit all Shares for which the Company has not yet delivered the share certificates upon refund by the Company of the Option Price of such Shares. Notwithstanding anything herein to the contrary, the Company may withhold delivery of share certificates pending the resolution of any inquiry that could lead to a finding resulting in a forfeiture; or

(e) The date, if any, set by the Board of Directors as an accelerated expiration date pursuant to Section 10 hereof.

(ii) Notwithstanding the foregoing, the Committee may extend the period during which an Option may be exercised to a date no later than the date of the expiration of the Option term specified in the Option Documents, as they may be amended, provided that any change pursuant to this Section 8.E.(ii) that would cause an ISO to become a Non-Qualified Stock Option may be made only with the consent of the Optionee.

(iii) During the period in which an Option may be exercised after the termination of the Optionee’s employment or service with the Company or any Affiliate, such Option shall only be exercisable to the extent it was exercisable immediately prior to such Optionee’s termination of service or employment, except to the extent specifically provided to the contrary in the applicable Option Document.