UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

Westside Energy Corporation

(Name of Registrant as Specified In Its Charter)

NA

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

On December 31, 2007, Westside Energy Corporation (the “Company”) entered into a definitive agreement to combine with privately held Crusader Energy Group (which includes Knight Energy Group, LLC; Knight Energy Group II, LLC; Knight Energy Management, LLC; Crusader Energy Group, LLC; Crusader Management Corporation; RCH Upland Acquisition, LLC; and Hawk Energy Fund I, LLC). Set forth below are copies of slide show presentations being given to certain stockholders of the Company showing information with respect to the combined companies.

Westside Energy Corporation and Crusader Energy Group January 2008 |

2 Additional Information The proposed combination will be submitted to Westside’s stockholders for their consideration, and Westside will file with the SEC a definitive proxy statement to be used by Westside to solicit the approval of its stockholders for the proposed combination. Westside may also file other documents concerning the proposed combination. Current and potential stockholders are urged to read the proxy statement regarding the proposed combination when it becomes available and any other relevant documents filed with the SEC, as well as any amendments or supplements to the proxy statement. They will contain important information. Free copies of the proxy statement, as well as other filings containing information about Westside will be available at the SEC’s internet site (http://www.sec.gov). When issued, copies of the proxy statement may also be obtained, without charge, by directing a request to: Westside Energy Corporation, 3131 Turtle Creek Blvd Suite 1300, Dallas, Texas 75219, or by telephone at (214) 522-8990. Westside and its directors and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of Westside in connection with the proposed combination. Additional information regarding the interests of those participants may be obtained by reading the proxy statement regarding the proposed combination when it becomes available. |

3 Forward-Looking Statements Certain statements in this presentation regarding future expectations, plans for acquisitions and dispositions, oil and gas reserves, exploration, development, production and pricing may be regarded as “forward-looking statements” within the meaning of the Securities Litigation Reform Act. They are subject to various risks, such as operating hazards, drilling risks, the inherent uncertainties in interpreting engineering data relating to underground accumulations of oil and gas, as well as other risks discussed in detail in the Company’s periodic reports and other documents filed with the SEC. Actual results may vary materially. Except for historical information, statements made in this presentation, including those relating to the pending combination with Crusader, estimates of oil and gas reserves, and future expenses are forward- looking statements as defined by the SEC. The pending combination with Crusader is subject to approval of the combination by the Westside stockholders, and these statements assume the Westside stockholders approve the combination and are based on other assumptions and estimates that management believes are reasonable based on currently available information; however, management’s assumptions and Westside’s future performance are subject to a wide range of business risks and uncertainties and there is no assurance that these goals and projections can or will be met. Any number of factors could cause actual results to differ materially from those in the forward-looking statements, including, but not limited to, the failure of the Westside stockholders to approve the combination, the volatility of oil and gas prices, the costs and results of drilling and operations, the timing of production, mechanical and other inherent risks associated with oil and gas production, weather, the availability of drilling equipment, changes in interest rates, litigation, uncertainties about reserve estimates, environmental risks and other risks and uncertainties set forth in Westside’s periodic reports and other documents filed with the SEC. Westside undertakes no obligation to publicly update or revise any forward-looking statements. |

4 Transaction Overview Key Terms Shares issued: 152,433,684 common shares Options granted to Crusader: 35,000,000 options $3.00 strike price, termination date of 12/31/12 LTIP: 2,310,000 shares Customary fiduciary out and break-up fees BOD: 7 Crusader/ 0 Westside Cash consideration: $500,000 Pro Forma Shares Outstanding Existing Westside shares: 26.4 million shares³ Existing Westside warrants: 0.6 million warrants 4 Shares Issued to Crusader: 152.4 million shares Options issued to Crusader: 35 million options 5 Potential Crusader capital draw: 19.3 million shares 6 LTIP: 2.31 million shares Corporate Name: Crusader Energy Group Inc. Headquarters: Oklahoma City Market cap: Approximately $500 million 1,2 Executive: Chairman: Robert Raymond CEO: David Le Norman CFO: John Heinen COO: Paul Legg Operations Expected proved reserves at 12/31/07: 150 Bcfe Current production: 26,000 mcfe/d Acreage: 765,000 gross; 316,000 net The combination of Westside and Crusader will create a growth-oriented oil and gas company with a large unconventional resource base (1) Excludes out of the money warrants and options. (2) Based on WHT share price of $2.83 as of 1/4/07. (3) Includes 1,045,000 in unvested shares that vest in a change of control. (4) 166,392 have an exercise price of $0.50 and expire 2/28/09. 100,000 have an exercise price of $0.50 and expire 5/7/09. 300,000 have an exercise price of $2.00 and expire 10/29/09. $0.7 million in proceeds if exercised. (5) Exercise price of $3.00/share. Expire 12/31/12. $105 million in proceeds if exercised. (6) Potential $58 million Crusader capital draw at $3.00 per share. Transaction Overview Pro Forma Profile |

5 Combined Company Highlights Combination creates a growth-oriented oil and gas company with a large unconventional resource base Expected total net proved reserve base of more than 150 Bcfe as of 12/31/07 80% natural gas Estimated reserve life of 15.8 years Current production of 26,000 Mcfe per day Total acreage in excess of 765,000 gross acres (316,000 net) – 92% undeveloped Ft. Worth Basin Barnett Shale (67,400 net acres) Delaware and Val Verde Basins in West Texas (82,500 net acres) Anadarko Basin (89,950 net acres) Bakken Shale of the Williston Basin (23,500 net acres) Strong balance sheet expected to allow for funding of capital expenditures from operating cash flow and debt without the need for further equity 2008 capital expenditures budget is estimated to be more than $190 million |

6 Crusader Management History and Track Record 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1995 2002 Sold Le Norman Energy Corp for $72M Joined Patina Oil & Gas as Sr. VP Formed Le Norman Partners $4M Equity Contribution 2000 Sold Le Norman Partners for $40M 2003 Patina sold to Noble Energy, Inc. for $3.4B $2.7B increase in market cap during Le Norman’s tenure 2004 Formed Crusader Energy Corp $38M Total Equity Investment 2004 Sold Crusader Energy Corp for $107.5M 2005 Formed Crusader Energy II, LLC $48M Equity Investment 2005 Formed Crusader Energy III, LLC $12M Equity Investment 2005 Formed Hawk Energy Fund I, LP $38M Total Equity Investment 2005 Crusader Energy II and Crusader Energy III consolidated into Knight Energy Group, LLC with $175M new equity Investment 2006 Signed agreement with Westside Energy Corp 2007 Management team has an average of 25 years of industry experience Track record of creating value for investors Formed Le Norman Energy Corp $120K Equity Investment |

7 7 Combined Company… Expected Proved Reserves of 150 Bcfe as of 12/31/07 33% proved developed (PDP) 26,000 Mcfe/d current production 15.8 year reserve life index 765,000 gross (316,000 net) acres 4,796 potential drilling locations 473 producing wells Potential drilling locations Net undeveloped acreage Bakken Shale Play Cleveland Sand Play Barnett Shale Play West Texas Shales Play Total: 4,796 locations Total: 288,480 net acres Other 15% Bakken 2% Barnett 4% Cleveland 4% West Texas 75% West Texas 29% Other 36% Bakken 8% Cleveland 5% Barnett 22% Portfolio Highlights Areas of Operation Development Inventory |

8 Built-In Future Growth 3,622 1,174 3,616 Gross Wells in Inventory Risk Profile West Texas (40 acre) South South Louisiana Louisiana West West Texas Texas (80 acre) (80 acre) Cleveland Play Anadarko Base Barbee JV Mayfield Ft. Worth Basin / Barnett Shale Bakken Shale Ranch Eureka Anadarko Growth High Medium 8,506 Total Low Baca County Weyer- hauser Biscuit Hill Large, Multi-Year Drilling Inventory |

9 Emerging Play Upside 2 rig program 67,400 acres Barnett Shale – Ft. Worth Basin Spud 1st well 1Q 2008 18,000 acres Topeka / Wabaunsee – Baca Co, CO 1st well WOPL, acquiring seismic, leasing 15,500 acres South Louisiana Spud 1st well in 1Q 2008 23,500 acres Bakken Shale – Williston Basin Drilling 4 rigs, leasing, and seismic 82,500 acres Woodford / Barnett Shale – West Texas 2 rig program 28,500 acres Cleveland Play – Ellis Co, OK Play Net Acreage Activity |

10 10 Cleveland Sand Play 42,500 gross (28,500 net) acres of leasehold 2-rig operated drilling program with 3rd rig to be added in 2008 24 horizontal wells drilled and completed in the last 2 years Significant improvements in drilling time, frac technique and total well cost through optimization and best practices 2008 capital budget - $31.0 million 2009 capital budget - $27.6 million CRUSADER FOCUS AREA Cleveland Sand Play Outline |

11 11 Cleveland Sand Play ($2,000) ($1,000) $0 $1,000 $2,000 $3,000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 0% 50% 100% 150% 200% $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 Expected proved reserves per well of 1.0 Bcf of gas (gross) and 80 Mbbl of oil (gross) with initial production rates of 1.0 Mmcf/d and 200 – 300 BOPD Average NRI: ~40% Average WI: ~50% $2.5 million AFE gross drilling & completion costs Nearly 200 potential drilling locations Excellent rate of return – 112% at $8/Mcf Henry Hub and $80/bbl NYMEX Crusader operated Current net production rate of 6,670 Mcfe/d January 4, 2008 closed acquisition of 5% working interest partner to acquire 760 net Mcfe/d of production Key Observations Rate of Return (Pre-Tax) Cumulative Well Cash Flow Profile at $8.00 Henry Hub |

12 12 CRUSADER AREAS OF INTEREST Ft. Worth Basin Barnett Shale Play 78,850 gross (67,370 net) acres of leasehold Active 2-rig drilling program in Hill/Ellis Counties with expansion opportunity available Rapidly evolving completion technology in area due to extremely high activity level Near term activity focused in Hill/Ellis counties Large acreage block to southwest in area of very early activity by other operators 2008 Capital Budget - $38.3 million 2009 Capital Budget - $54.5 million Barnett Shale Play Outline |

13 13 Ft. Worth Basin Barnett Shale Play ($2,000) ($1,000) $0 $1,000 $2,000 $3,000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 0% 10% 20% 30% 40% 50% 60% 70% $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 Significant development opportunity in Hill and Ellis Counties Average NRI: 51% Average WI: 65% Expected reserves per well of 1.8 – 3.0 Bcfe (gross) $2.5 – 3.5 million AFE gross drilling & completion costs Rate of return – 43% at $8/mcf Henry Hub 192 potential drilling locations (excluding large acreage block to southwest) Key Observations Rate of Return (Pre-Tax) Cumulative Well Cash Flow Profile at $8.00 Henry Hub |

14 14 CRUSADER AREA OF INTEREST West Texas Shale Play 325,000 gross (82,525 net) acres of leasehold Currently 3-rig Chesapeake drilling program on Crusader leasehold Crusader plans to spud first operated well in 1st qtr 2008 3D seismic acquisition in progress on Terrell County acreage Up to 1.5 Tcfe of gas in place per section 2008 Capital Budget - $27.4 million 2009 Capital Budget - $36.2 million West Texas Shale Play Outline |

15 15 West Texas Shale Play ($3,000) ($2,000) ($1,000) $0 $1,000 $2,000 $3,000 $4,000 $5,000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 0% 10% 20% 30% 40% 50% 60% 70% $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 Very early results indicate expected Proved Reserve potential of 3-5 Bcf for vertical wells, 6-10 Bcf for horizontal wells Average NRI: 3.75% (non-op) – 37.5% (op) Average WI: 5% (non-op) – 50% (op) Multi-pay potential in the Woodford, Barnett, Atoka, and Wolfcamp Shales 9,000 – 13,000 ft TVD 3,562 potential drilling locations at 80-acre spacing Over 7,000 potential drilling locations at 40-acre spacing Vertical Wells: Gross drilling & completion costs - $5 million Rate of return – 31% at $8/mcf Henry Hub Horizontal Wells: Gross drilling & completion costs - $8 million Rate of return – 40% at $8/Mcf Henry Hub Key Observations Rate of Return (Pre-Tax) Cumulative Well Cash Flow Profile at $8.00 Henry Hub (Vertical Well) |

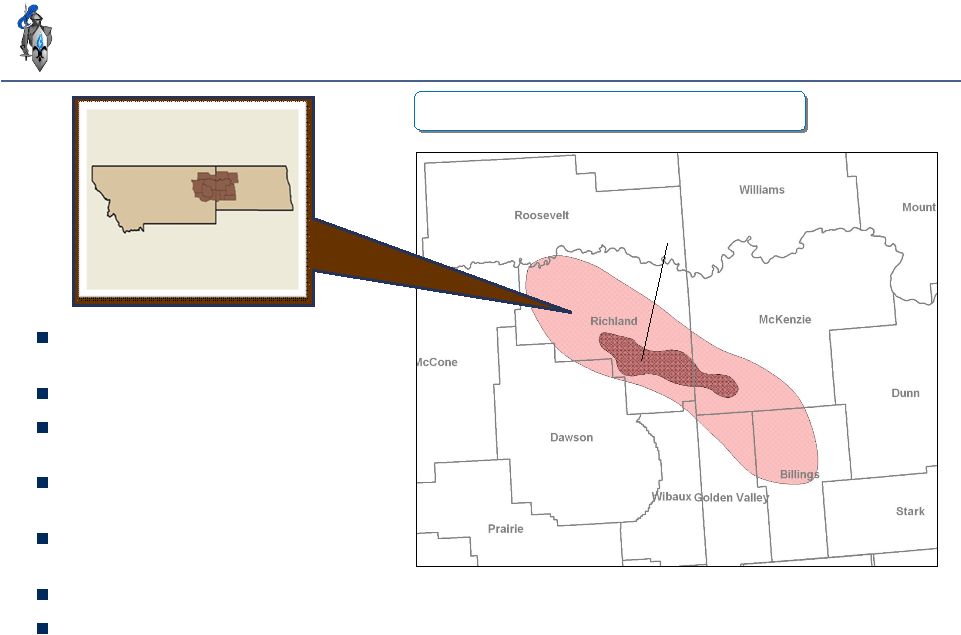

16 16 Bakken Shale Play 37,760 gross (23,550 net) acres of leasehold First well spud planned for 1st Qtr 2008 Technology transfer of multi-stage fracturing in horizontal wells Leasehold is adjacent to very active drilling development Plan to keep 1 rig active through 2009 with opportunity to accelerate later 2008 capital budget - $18.6 million 2009 capital budget - $20.9 million CRUSADER AREA OF INTEREST MONTANA NORTH DAKOTA Bakken Shale Play Outline |

17 17 Bakken Shale Play ($4,000) ($3,000) ($2,000) ($1,000) $0 $1,000 $2,000 $3,000 $4,000 $5,000 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 0% 10% 20% 30% 40% 50% 60% $40.00 $50.00 $60.00 $70.00 $80.00 $90.00 $100.00 Expected Proved Reserves per well of 231,000 Bbl and 400 Mmcf with historical technology High net revenue interest (>80%) Crusader operated with high average working interest (75%) $4.5 million AFE gross drilling & completion costs Rate of return – 30% at $80/Bbl NYMEX and $8.00/Mcf Henry Hub 118 potential drilling locations Key Observations Rate of Return (Pre-Tax) Cumulative Well Cash Flow Profile at $80.00 NYMEX |

18 2008 Capital Budget and Key Projects Total: $190.0 million Other 30% West Texas 14% Barnett 20% Bakken 10% Continue to develop the existing Cleveland Play and begin expanding into new prospect areas Acquire 3D seismic and begin a company- operated drilling program in the West Texas Shales Begin company-operated drilling program in the Bakken Shale Play Optimize the Barnett properties Drill 10-well program in Baca County, CO to evaluate development of low-risk, low- cost gas play Acquire 3D seismic and participate in development of non-operated drilling program in South Louisiana Cleveland 16% (including seismic costs) South Louisiana 5% Baca 5% 2008 Capital Budget Key Projects and Objectives |

19 Pro Forma Share Count and Capitalization (1) Vest in a change of control. (2) Potential $58 million Crusader capital draw at $3.00 per share. (3) Exercise price of $3.00/share. Expire 12/31/12. $105 million in proceeds if exercised. (4) 166,392 have an exercise price of $0.50 and expire 2/28/09. 100,000 have an exercise price of $0.50 and expire 5/7/09. 300,000 have an exercise price of $2.00 and expire 10/29/09. $0.7 million in proceeds if exercised. Shares Outstanding Pro Forma Balance Sheet Westside Shares Outstanding 25,361,273 Westside Unvested Shares 1 1,045,000 Shares Issued to Crusader 152,433,684 Basic Shares Outstanding 178,839,957 Potential Crusader $58MM Capital Draw 2 19,290,000 Crusader Options 3 35,000,000 Westside Warrants 4 566,392 Diluted Shares Outstanding 233,696,349 LTIP 2,310,000 Diluted Shares (including LTIP) 236,006,349 12/31/2007 Cash $26.2 Knight I Senior 37.0 Hawk IBC Facility 1.3 Knight I Subordinated 30.0 Wellington Facility 25.0 Total Debt 93.3 Net Debt $67.0 Potential Crusader Capital Draw 58.0 Adjusted Net Debt $9.0 |