Exhibit 99.2

Confidential Information Memorandum December 2018

2 In connection with the potential transactions described herein (the “Potential Transaction”) involving Pernix Therapeutics Ho ldi ngs, Inc. (together with its subsidiaries and affiliates, “Pernix” or the “Company”) this Confidential Information Memorandum and any associated information and due diligence - related materials provided herewith or hereafter (collectively, the “Materials”) have been or will be prepared by Pernix solely for informational purposes from certain materials, information and/or data supplied by the Company, as well as fro m public sources reasonably believed to be reliable. These Materials are being furnished through Guggenheim Securities, LLC (“Guggenheim Securities”) as the Company’s financial advisor and investment bank er solely to the recipient and solely in connection with its consideration and evaluation of the Company and the Potential Transaction. The Materials have been or will be prepared to assist interested qualified parties in making their own evaluation of the Comp any and the Potential Transaction and do not purport to contain all of the materials, information and/or data that an interested party may desire or require in connection therewith. In all cases, interested qu ali fied parties should conduct their own investigation and analyses of the Company, the Materials and the Potential Transaction. None of the Company, Guggenheim Securities or their respective subsidiaries and affiliates, directors, officers, employees, r epr esentatives, consultants, legal counsel and/or agents: ▪ Has independently verified the accuracy and/or completeness of the Materials, including without limitation any estimates or f ina ncial forecasts or projections; ▪ Makes any representation, guaranty or warranty as to the accuracy or completeness of the Materials, including without limitat ion any estimates or financial forecasts or projections; or ▪ Will have any responsibility, obligation or liability with respect to any representations (express or implied) contained in, or for any omissions from, the Materials and/or any other written or oral communication transmitted to the recipient in the course of such recipient’s investigation and evaluation of the Company and the Potential Transaction. The Materials contain certain forward - looking statements, assumptions, estimates, financial forecasts and projections (with resp ect to, among other things and without limitation, the Company’s revenues, operating costs, earnings, cash flows and capitalization) and other information with respect to ( i ) the Company’s industry and its attendant competitive dynamics, (ii) the Company and (iii) its customer relationships, supplier relationships and other operational and financial drivers. Such forward - looking statements, assumptions , estimates, financial forecasts, projections and other information are based the judgment and current expectations of the Company’s management, are subject to significant business, economic and/or competiti ve uncertainties, are inherently difficult to predict, may or may not prove to be correct, are not guarantees of future performance and reflect various risks, uncertainties and contingencies; accordingly, ac tua l future results may differ materially from any financial forecasts or projections due to a variety of factors, many or all of which are beyond the control of the Company and Guggenheim Securities. None of the C omp any, Guggenheim Securities or their respective subsidiaries and affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents undertakes any obligation to provid e a dditional materials, information and/or data or to correct or update the Materials. By accepting these Materials, the recipient hereby acknowledges and agrees that: ▪ The Materials and the Potential Transaction are subject to the terms and conditions of that certain Confidential Disclosure A gre ement previously executed by the recipient and the Company. ▪ Each of Pernix and Guggenheim Securities reserves the exclusive right, in its sole discretion, to ( i ) conduct any process and implement any procedures with respect to a Potential Transaction (collectively, the “Process”) that the Company and/or Guggenheim Securities may determine (including, without limitation, negotiating with a ny other party and/or entering into a definitive agreement without prior notice to the recipient or any other party), (ii) modify, for any reason or no reason whatsoever, such Process at any time wi tho ut prior notice to the recipient or any other party and (iii) reject or accept, for any reason or no reason whatsoever, any participant in such Process and/or any potential proposal or offer; provided, that in no event will the recipient or any of its representatives have any rights or claims of any kind whatsoever against the Company, Guggenheim Securities and/or their respective representatives arising out of any of the foregoing. ▪ Unless and until a binding definitive agreement, if any, between the Company and the recipient with respect to a Potential Tr ans action has been duly executed and delivered, the Company will not be under any legal obligation of any kind whatsoever with respect to any such Potential Transaction by virtue of ( i ) the Materials, (ii) the Process and/or (iii) any oral or written expression or communication with respect to any such Potential Transaction (whether by the Company, Guggenheim Securities and/or any of their representatives) . The Company intends to conduct its business in the ordinary course during the evaluation period; however, the Company reserve s t he right to take any action during such period, whether or not in the ordinary course of business, including but not limited to the sale of any businesses or assets of the Company or potential acquisition s o f businesses or assets, which it deems necessary or prudent in the conduct of its business. As Pernix’s financial advisor and investment banker, Guggenheim Securities has obligations solely to the Company and will be entitled to be paid a fee or fees upon the successful consummation of a Potential Transaction or otherwise pursuant to the terms of its engagement letter. By accepting these Materials, the recipient hereby ack nowledges and agrees that neither Guggenheim Securities nor any of its subsidiaries, affiliates, directors, officers, employees, representatives, consultants, legal counsel and/or agents ( i ) is acting as a financial advisor or investment banker to the recipient with respect to a Potential Transaction or (ii) owes any duty of loyalty or care to the recipient (whether in contract, in tort or otherwise) with respec t t o the Materials or any Potential Transaction, in all cases notwithstanding any commercial relationship that may currently exist or have previously existed between the recipient and Guggenheim Securities o r a ny of its subsidiaries, affiliates, directors, officers, employees, representatives or consultants, legal counsel and/or agents. Disclaimer

3 ▪ Pernix Therapeutics Holdings, Inc. has engaged Guggenheim Securities as its financial advisor and investment banker to assist in the evaluation of various strategic and financial alternatives, including a potential sale of the Company. ▪ All inquiries regarding the Company, the Process and the Potential Transaction, as well as any requests for additional information and access to the Company’s management, should only be directed to one of the representatives of Guggenheim Securities listed below. Unless otherwise approved in advance by Guggenheim Securities, prospective acquirors should under no circumstances communicate directly with the Company or its management, employees, customers, suppliers and other constituencies. Guggenheim Securities, LLC 330 Madison Avenue New York, NY 10017 (212) 518 - 9200 Guggenheim Securities, LLC Healthcare Liability Management Ken Springer Senior Managing Director (212) 901 - 9322 ken.springer @ guggenheimpartners.com Punit Mehta Senior Managing Director (212) 518 - 9187 punit.mehta @ guggenheimpartners.com Stuart Erickson Senior Managing Director (212) 518 - 9005 stuart.erickson @ guggenheimpartners.com Peter Schwaikert Managing Director (212) 381 - 4134 peter.schwaikert @ guggenheimpartners.com Zachary Yost Associate (212) 518 - 9599 zachary.yost@ guggenheimpartners.com Transaction Summary and Contact Information

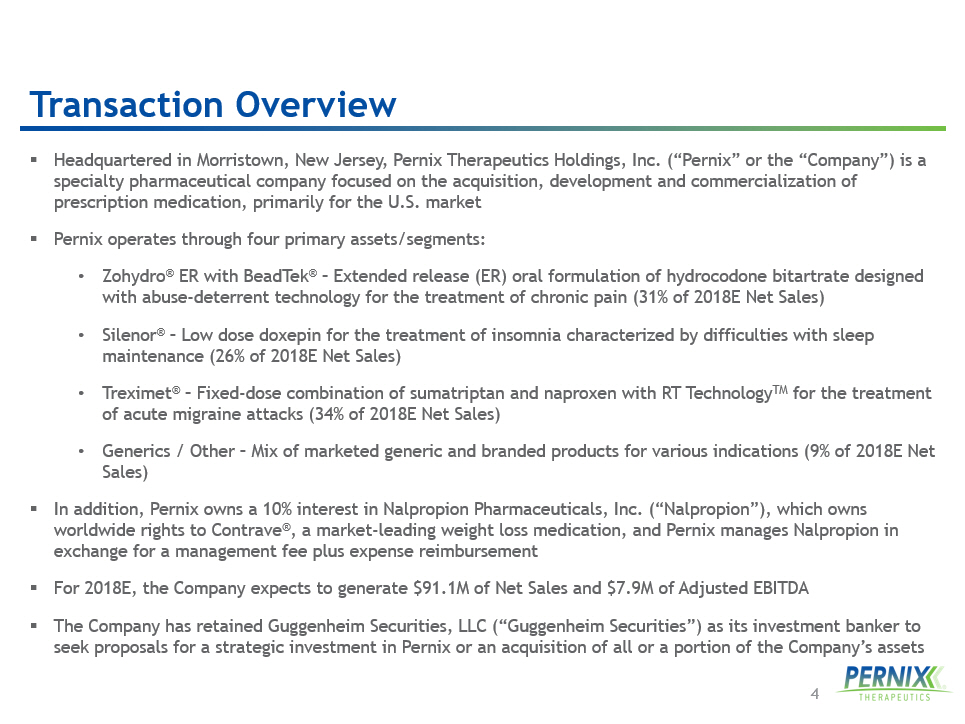

4 Transaction Overview ▪ Headquartered in Morristown, New Jersey, Pernix Therapeutics Holdings, Inc. (“Pernix” or the “Company”) is a specialty pharmaceutical company focused on the acquisition, development and commercialization of prescription medication, primarily for the U.S. market ▪ Pernix operates through four primary assets/segments: • Zohydro ® ER with BeadTek ® – Extended release (ER) oral formulation of hydrocodone bitartrate designed with abuse - deterrent technology for the treatment of chronic pain (31% of 2018E Net Sales) • Silenor ® – Low dose doxepin for the treatment of insomnia characterized by difficulties with sleep maintenance (26% of 2018E Net Sales) • Treximet ® – Fixed - dose combination of sumatriptan and naproxen with RT Technology TM for the treatment of acute migraine attacks (34% of 2018E Net Sales) • Generics / Other – Mix of marketed generic and branded products for various indications (9% of 2018E Net Sales) ▪ In addition, Pernix owns a 10% interest in Nalpropion Pharmaceuticals, Inc. (“ Nalpropion ”), which owns worldwide rights to Contrave ® , a market - leading weight loss medication, and Pernix manages Nalpropion in exchange for a management fee plus expense reimbursement ▪ For 2018E, the Company expects to generate $91.1M of Net Sales and $7.9M of Adjusted EBITDA ▪ The Company has retained Guggenheim Securities, LLC (“Guggenheim Securities”) as its investment banker to seek proposals for a strategic investment in Pernix or an acquisition of all or a portion of the Company’s assets

5 ▪ Company Overview ▪ Overview of Products • Zohydro ® ER with BeadTek ® • Silenor ® • Treximet ® / Treximet ® Authorized Generic • Generics and Other Products • Contrave ® ▪ Financial Summary Table of Contents

Company Overview

7 ▪ Pernix is a specialty pharmaceutical company with a scalable commercial platform focused on pain and CNS ▪ Differentiated product portfolio consisting of both branded and generic products led by Zohydro ® ER with BeadTek ® and Silenor ® ▪ Fully integrated and dedicated specialty sales force focused on promoting 2 growing brands in pain and CNS, supplemented by best - in - class prescription fulfillment service: ▪ Dedicated sales force with high potential and expertise in Pain and CNS, highlighted by a proven track record of driving growth ▪ Recently purchased a 10% interest in Nalpropion , which owns worldwide rights to Contrave ® , a market - leading branded prescription medication indicated for weight - loss; Pernix’s management of Nalpropion provides meaningful incremental economics to the Company ▪ Experienced specialty pharmaceutical management team with significant turnaround experience Diverse Product Portfolio Generics [including Authorized Generic] Company Highlights Owned and marketed by Nalpropion

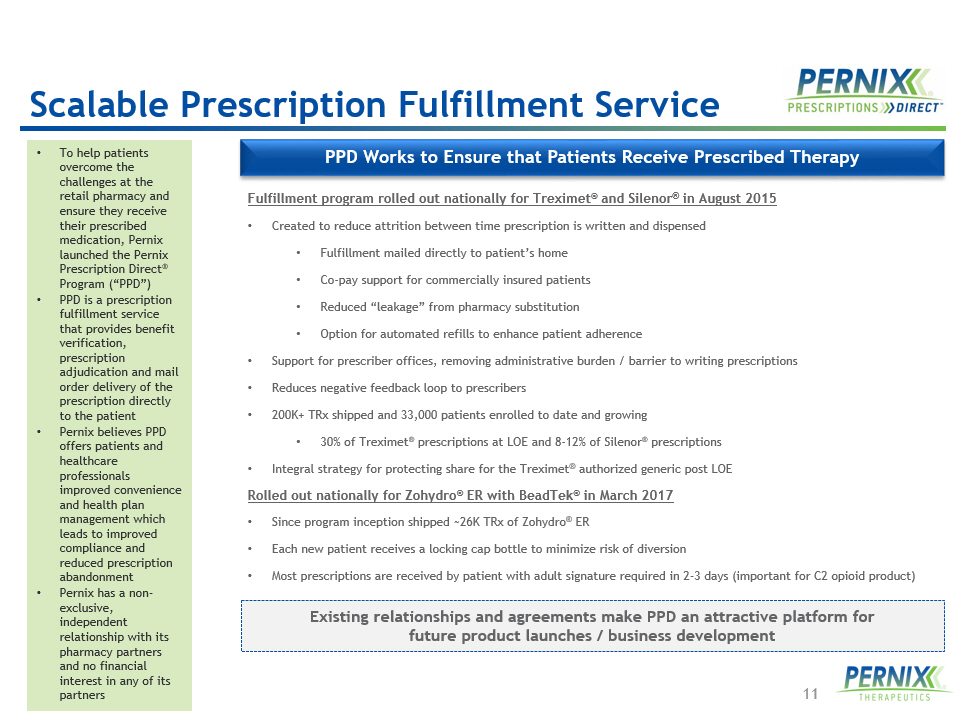

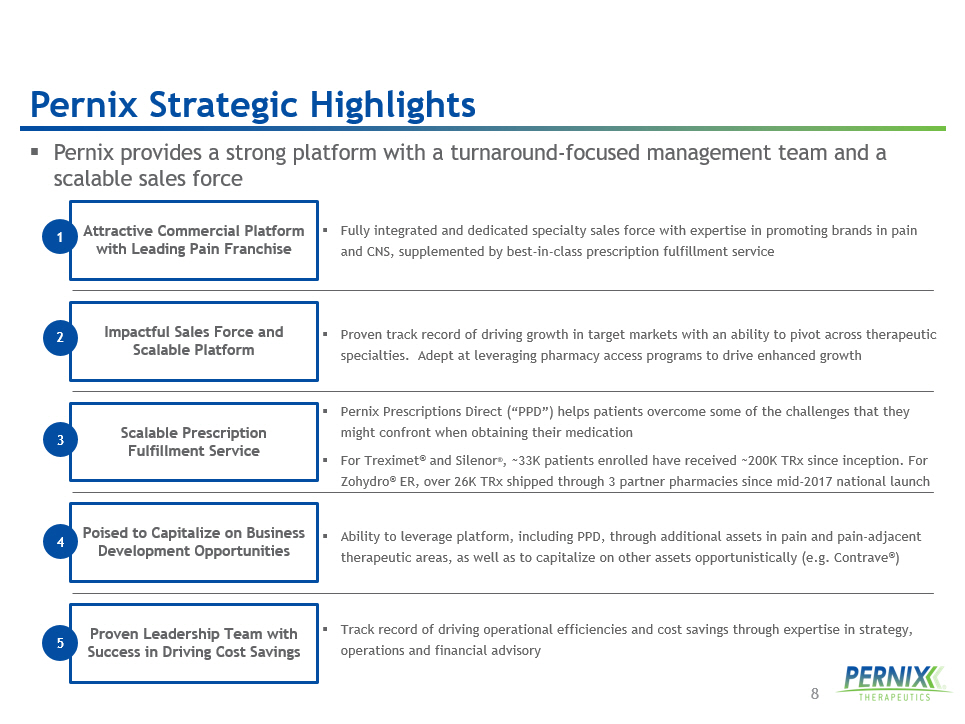

8 ▪ Pernix provides a strong platform with a turnaround - focused management team and a scalable sales force ▪ Pernix Prescriptions Direct (“PPD”) helps patients overcome some of the challenges that they might confront when obtaining their medication ▪ For Treximet ® and Silenor ® , ~33K patients enrolled have received ~200K TRx since inception. For Zohydro ® ER, over 26K TRx shipped through 3 partner pharmacies since mid - 2017 national launch ▪ Fully integrated and dedicated specialty sales force with expertise in promoting brands in pain and CNS, supplemented by best - in - class prescription fulfillment service ▪ Ability to leverage platform, including PPD, through additional assets in pain and pain - adjacent therapeutic areas, as well as to capitalize on other assets opportunistically (e.g. Contrave ® ) ▪ Track record of driving operational efficiencies and cost savings through expertise in strategy, operations and financial advisory ▪ Proven track record of driving growth in target markets with an ability to pivot across therapeutic specialties. Adept at leveraging pharmacy access programs to drive enhanced growth Proven Leadership Team with Success in Driving Cost Savings Poised to Capitalize on Business Development Opportunities Impactful Sales Force and Scalable Platform Attractive Commercial Platform with Leading Pain Franchise 1 4 5 2 Scalable Prescription Fulfillment Service 3 Pernix Strategic Highlights

9 - Description : Extended - release, fixed dose combination of bupropion HCl and naltrexone HCl indicated for weight loss; represents the market - leading, branded weight loss prescription medication in the U.S. - Strategy : Operated via an SPV called Nalpropion , which Pernix manages in exchange for a fee plus expense reimbursements; marketed via innovative social media and TV campaigns - Loss of Exclusivity: 02/02/2030 (Company is filing patents to extend). Actavis filed an appeal, which is pending. If trial court decision would be reversed, a generic version of Contrave could be launched prior to the expiration of one or more of the patents at issue - Description : Extended release (ER) oral formulation of hydrocodone bitartrate designed with abuse - deterrent technology for the treatment of chronic pain - Strategy : Focus on high potential Pain Specialists and their associated NP/PA providers, highlighting clinical advantages and ease of access through PPD platform - Loss of Exclusivity: Could be as early as 10/1/19 per ongoing litigation matter; otherwise 3/1/2029 - Description : Low dose doxepin for the treatment of insomnia characterized by difficulties with sleep maintenance - Strategy : Promote clinical advantages to high value Psych, PCP and Pain targets, leveraging access through PPD platform with the ability to pursue an OTC switch internally or with an external partner - Loss of Exclusivity: 1/1/2020 - Description : Fixed - dose combination of sumatriptan and naproxen with RT Technology (1) for the treatment of acute migraine attacks - Strategy : Maximize distribution of both Brand and Authorized Generic versions via traditional wholesale markets as well as market share protection via PPD platform - Loss of Exclusivity: 2/15/18 - Description: Portfolio of generic and branded products used for a variety of indications - Strategy: Marketed through Cypress and Macoven through contracts with large and small wholesalers ▪ Product portfolio has generated commercial expertise in pain and other CNS indications with capacity to drive growth and value for additional products [Brand & Authorized Generic] Generics Owned and marketed by Nalpropion Attractive Platform With Leading Pain Franchise 1) RT Technology™ is a rapid release technology used in making TREXIMET ® tablets. This technology enables the tablets to rapidly break apart into small pieces and disperse in the stomach.

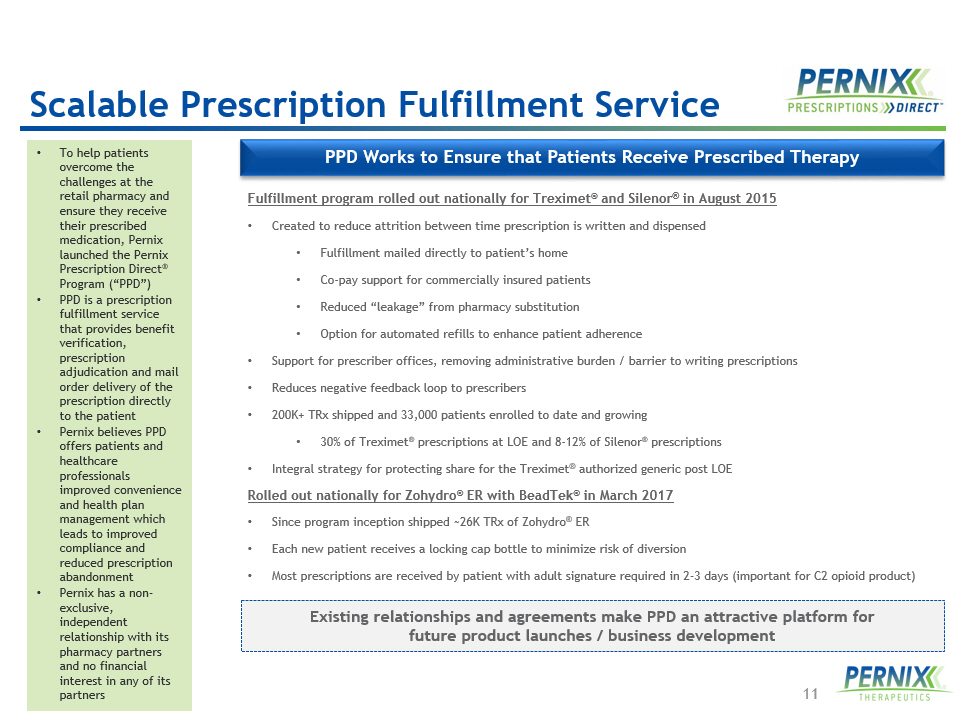

10 ▪ Fully integrated and dedicated specialty sales force focused on brands in pain and CNS ▪ Commercial efforts are further augmented by Pernix Prescriptions Direct (PPD), a best - in - class prescription processing service that provides benefit verification, prescription, adjudication, and mail order delivery of the prescription directly to the patients PPD Fulfillment Program Internal Sales Force • PPD is designed to help patients overcome challenges at the retail pharmacy and ensure they receive their prescribed medication through mail order delivery (initial fill & refill) • For Treximet ® and Silenor ® , ~200K TRx shipped and 33,000+ patients enrolled to date and growing • For Zohydro ® ER, over 26K TRx shipped through 3 partner pharmacies since national launch in mid - 2017 Doctor Patient Expertise in Pain and CNS Impactful Sales Force and Scalable Platform

11 PPD Works to Ensure that Patients Receive Prescribed Therapy Fulfillment program rolled out nationally for Treximet ® and Silenor ® in August 2015 • Created to reduce attrition between time prescription is written and dispensed • Fulfillment mailed directly to patient’s home • Co - pay support for commercially insured patients • Reduced “leakage” from pharmacy substitution • Option for automated refills to enhance patient adherence • Support for prescriber offices, removing administrative burden / barrier to writing prescriptions • Reduces negative feedback loop to prescribers • 200K+ TRx shipped and 33,000 patients enrolled to date and growing • 30% of Treximet ® prescriptions at LOE and 8 - 12% of Silenor ® prescriptions • Integral strategy for protecting share for the Treximet ® authorized generic post LOE Rolled out nationally for Zohydro ® ER with BeadTek ® in March 2017 • Since program inception shipped ~26K TRx of Zohydro ® ER • Each new patient receives a locking cap bottle to minimize risk of diversion • Most prescriptions are received by patient with adult signature required in 2 - 3 days (important for C2 opioid product) • To help patients overcome the challenges at the retail pharmacy and ensure they receive their prescribed medication, Pernix launched the Pernix Prescription Direct ® Program (“PPD”) • PPD is a prescription fulfillment service that provides benefit verification, prescription adjudication and mail order delivery of the prescription directly to the patient • Pernix believes PPD offers patients and healthcare professionals improved convenience and health plan management which leads to improved compliance and reduced prescription abandonment • Pernix has a non - exclusive, independent relationship with its pharmacy partners and no financial interest in any of its partners Existing relationships and agreements make PPD an attractive platform for future product launches / business development Scalable Prescription Fulfillment Service

12 ▪ Pernix has several potential inorganic growth opportunities that span a variety of indications and business models Bolt - On Focus Sales force 1 Pain (Non - Opioid) 5 Opportunistic / Generics 4 Neuroscience 2 Pain (Opioid) Existing Capabilities Leveraged Sector Backdrop Sales force CNS expertise from past Treximet ® promotion Existing portfolio & sales channel x Social / medical need x Attractive future growth prospects x Large player exits x Commonly prescribed despite negative perception x Broad, attractive indication x High deal / licensing activity 3 Pain Adjacent Sales force x Highlighted as pain regimen evolves x Greenspace areas with unmet needs Poised to Capitalize on BD Opportunities

13 $85.9 $89.3 $72.6 $62.7 $8.2 $6.1 $0.8 $0.1 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 2015 2016 2017 2018E Adjusted SG&A R&D 2015 – 2018E Adjusted Operating Expenses ($M) (1) ▪ Management has overseen a significant rationalization of Pernix’s cost structure in recent years ▪ 2018 adjusted operating expenses are projected to be 33% (or $31 million (1) ) lower than in 2015, driven by: • Two sales force reorganizations • Elimination of low ROI R&D projects • Rationalization of home office staff • Tight management of third party spend ▪ As a result, Adjusted EBITDA nearly doubled from 2016 to 2017 despite a 6.4% drop in Adjusted Net Sales 1) Represents fully burdened Pernix operating expenses, excluding any shared service reimbursement from Nalpropion . SG&A is non - GAAP, pro - forma for certain adjustments. $94.1 $95.4 $73.4 $62.7 Proven Leadership Team With Success In Driving Cost Savings

14 Net Sales Forecast $24 $28 $28 $29 $31 $34 $23 $23 $21 $10 $5 $6 $68 $31 $10 $10 $10 $10 $31 $9 $9 $9 $8 $8 $0 $20 $40 $60 $80 $100 $120 $140 $160 2017A 2018E 2019E 2020E 2021E 2022E Zohydro Silenor Treximet Brand and Authorized Generic Generics / Other Forecast • Compression in 2018E Treximet ® franchise revenue driven by ( i ) loss of exclusivity in February 2018, which enabled three competitors to enter the market and (ii) lower than anticipated gross - to - nets on branded Treximet ® due to delayed MAC pricing from managed care providers and low net pricing for Treximet ® AG as a result of pricing pressure from generic entrants • Withdrawal of IDA (1) and desvenalfaxine ($18.2M 2017A revenue) contributed to lower 2018E revenue for Generics / Other • Silenor LOE to occur in January 2020; opportunity to complete an OTC switch through a development partner Notes: Projections are subject to numerous assumptions and risks. For Zohydro ® ER, assumes settlement with IP litigation counterparties. (1) Isometheptene /Dichloralphenazone/APAP Capsules. $146 $91 $68 $57 $55 $57 ($ in millions) A B C A B C

Overview of Products

Zohydro ® ER with BeadTek ®

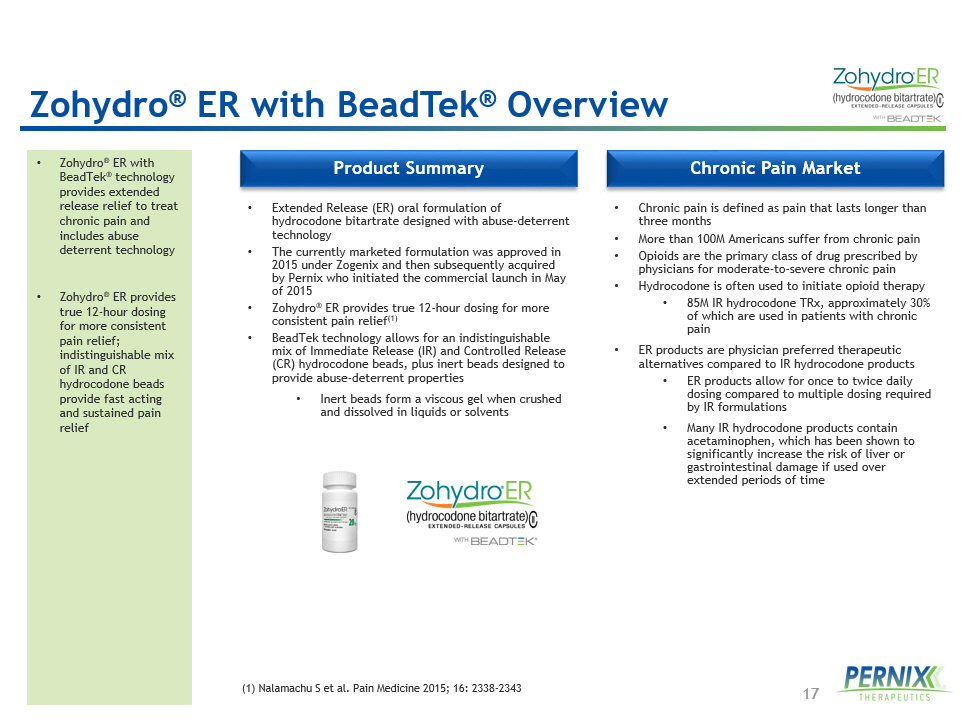

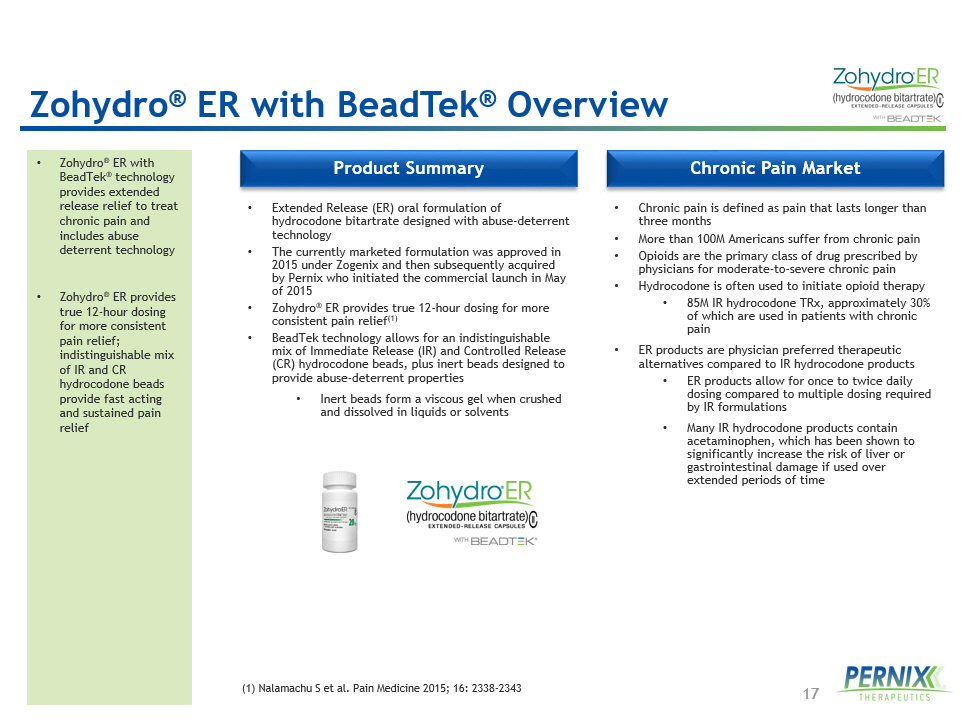

17 Chronic Pain Market Product Summary • Extended Release (ER) oral formulation of hydrocodone bitartrate designed with abuse - deterrent technology • The currently marketed formulation was approved in 2015 under Zogenix and then subsequently acquired by Pernix who initiated the commercial launch in May of 2015 • Zohydro ® ER provides true 12 - hour dosing for more consistent pain relief (1) • BeadTek technology allows for an indistinguishable mix of Immediate Release (IR) and Controlled Release (CR) hydrocodone beads, plus inert beads designed to provide abuse - deterrent properties • Inert beads form a viscous gel when crushed and dissolved in liquids or solvents • Chronic pain is defined as pain that lasts longer than three months • More than 100M Americans suffer from chronic pain • Opioids are the primary class of drug prescribed by physicians for moderate - to - severe chronic pain • Hydrocodone is often used to initiate opioid therapy • 85M IR hydrocodone TRx , approximately 30% of which are used in patients with chronic pain • ER products are physician preferred therapeutic alternatives compared to IR hydrocodone products • ER products allow for once to twice daily dosing compared to multiple dosing required by IR formulations • Many IR hydrocodone products contain acetaminophen, which has been shown to significantly increase the risk of liver or gastrointestinal damage if used over extended periods of time • Zohydro ® ER with BeadTek ® technology provides extended release relief to treat chronic pain and includes abuse deterrent technology • Zohydro ® ER provides true 12 - hour dosing for more consistent pain relief; indistinguishable mix of IR and CR hydrocodone beads provide fast acting and sustained pain relief (1) Nalamachu S et al. Pain Medicine 2015; 16: 2338 - 2343 Zohydro ® ER with BeadTek ® Overview

18 Positioning / Messaging • Trusted hydrocodone, in a unique ER formulation, for a simple 1:1 conversion from IR hydrocodone • True 12 - hour dosing allows more consistent pain relief • Contains an indistinguishable mix of IR and CR hydrocodone beads, plus inert beads designed to provide abuse - deterrent properties • Unique formulation with 20% IR beads and 80% ER beads • Demonstrated pain control and tolerability with no pattern of end - of - dose failure (“EODF”) (1) • Proven to significantly reduce disability scores • No acetaminophen • Measurable levels within 30 minutes of first dose • Minimal peaks and troughs compared to IR hydrocodone • Zohydro ® ER with BeadTek ® dosing fits guidelines suggesting use of lower morphine milligram equivalents (MMEs) • No change in starting dose for patients with mild or moderate hepatic impairment, not contra - indicated for patients with severe hepatic impairment • Zohydro ® ER with BeadTek ® offers true 12 - hour pain relief (twice - a - day dosing) and includes abuse deterrent technology • Reduced risk of hepatic impairment when used chronically due to absence of acetaminophen in formulation • 1:1 conversion allows for easy and effective transition from IR hydrocodone to ER hydrocodone Start fast, finish strong Morning dose to evening dose (1) 11.6 Hours 12.3 Hours + 0.95 hours ranging from 8.4 to 14.6 (n=151) + 0.93 hours ranging from 9.5 to 15.4 (n=151) Zohydro ® ER with BeadTek ® is the Hydrocodone You Know in a Unique ER Formulation that Delivers True 12 - hour Pain Control from Start to Finish (1) Nalamachu S et al. Pain Medicine 2015; 16: 2338 - 2343 Zohydro ® ER with BeadTek ® Positioning

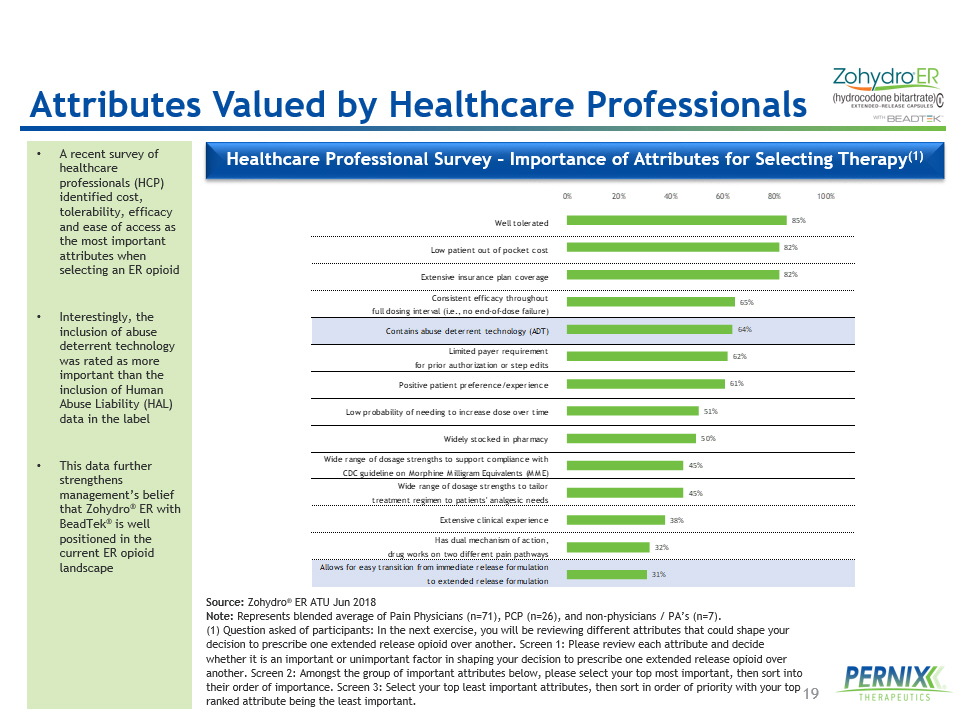

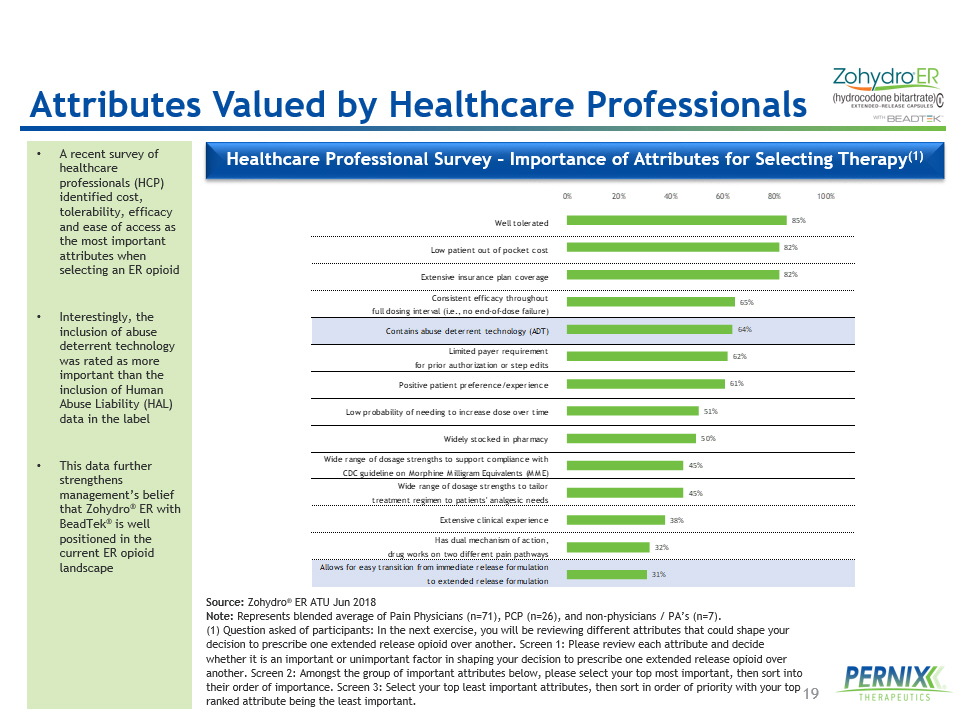

19 Well tolerated Low patient out of pocket cost Extensive insurance plan coverage Consistent efficacy throughout full dosing interval (i.e., no end-of-dose failure) Contains abuse deterrent technology (ADT) Limited payer requirement for prior authorization or step edits Positive patient preference/experience Low probability of needing to increase dose over time Widely stocked in pharmacy Wide range of dosage strengths to support compliance with CDC guideline on Morphine Milligram Equivalents (MME) Wide range of dosage strengths to tailor treatment regimen to patients' analgesic needs Extensive clinical experience Has dual mechanism of action, drug works on two different pain pathways Allows for easy transition from immediate release formulation to extended release formulation 85% 82% 82% 65% 64% 62% 61% 51% 50% 45% 45% 38% 32% 31% 0% 20% 40% 60% 80% 100% • A recent survey of healthcare professionals (HCP) identified cost, tolerability, efficacy and ease of access as the most important attributes when selecting an ER opioid • Interestingly, the inclusion of abuse deterrent technology was rated as more important than the inclusion of Human Abuse Liability (HAL) data in the label • This data further strengthens management’s belief that Zohydro ® ER with BeadTek ® is well positioned in the current ER opioid landscape Healthcare Professional Survey – Importance of Attributes for Selecting Therapy (1) Source: Zohydro ® ER ATU Jun 2018 Note: Represents blended average of Pain Physicians (n=71), PCP (n=26), and non - physicians / PA’s (n=7). (1) Question asked of participants: In the next exercise, you will be reviewing different attributes that could shape your decision to prescribe one extended release opioid over another. Screen 1: Please review each attribute and decide whether it is an important or unimportant factor in shaping your decision to prescribe one extended release opioid over another. Screen 2: Amongst the group of important attributes below, please select your top most important, then sort into their order of importance. Screen 3: Select your top least important attributes, then sort in order of priority with your top ranked attribute being the least important. Attributes Valued by Healthcare Professionals

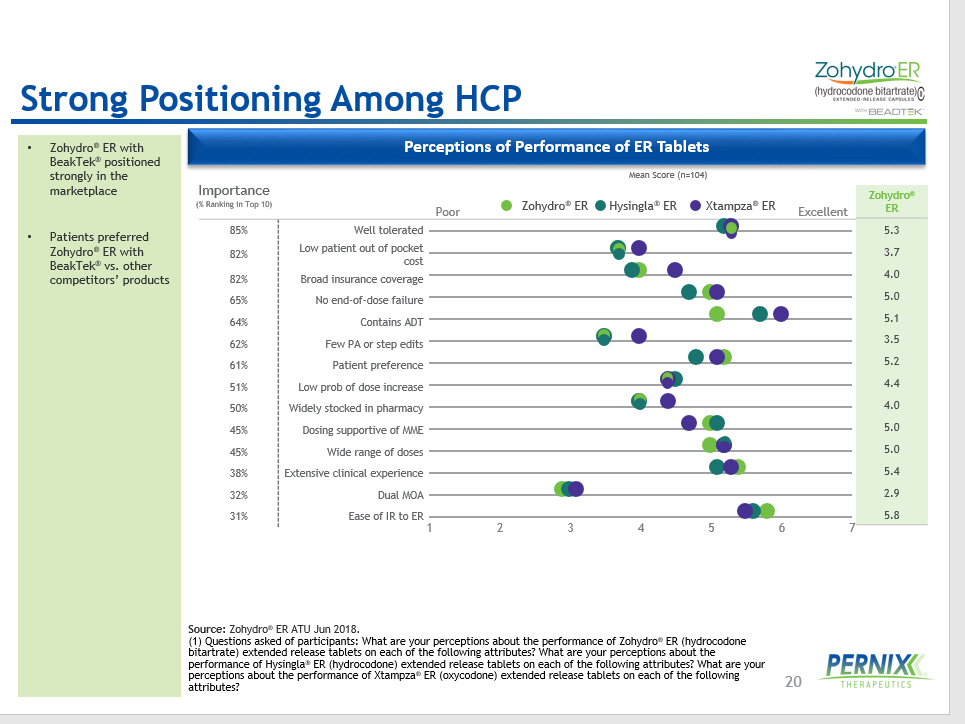

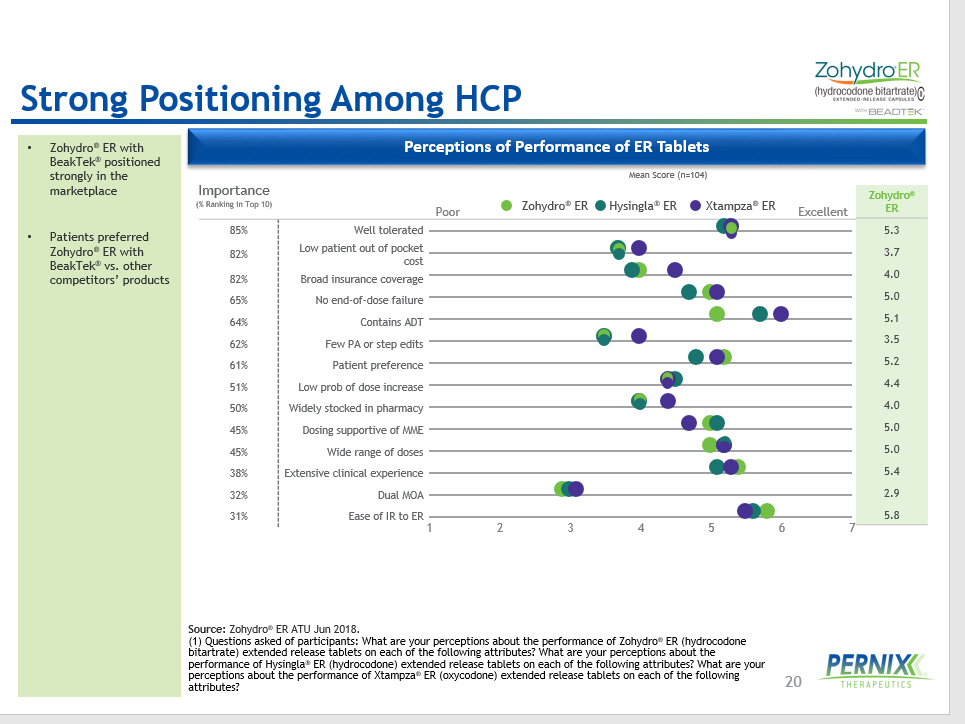

20 Strong Positioning Among HCP Source: Zohydro ® ER ATU Jun 2018. (1) Questions asked of participants: What are your perceptions about the performance of Zohydro ® ER (hydrocodone bitartrate) extended release tablets on each of the following attributes? What are your perceptions about the performance of Hysingla ® ER (hydrocodone) extended release tablets on each of the following attributes? What are your perceptions about the performance of Xtampza ® ER (oxycodone) extended release tablets on each of the following attributes? 1 2 3 4 5 6 7 85% Well tolerated 82% Low patient out of pocket cost 82% Broad insurance coverage 65% No end - of - dose failure 64% Contains ADT 62% Few PA or step edits 61% Patient preference 51% Low prob of dose increase 50% Widely stocked in pharmacy 45% Dosing supportive of MME 45% Wide range of doses 38% Extensive clinical experience 32% Dual MOA 31% Ease of IR to ER Poor Excellent Mean Score (n=104) Importance (% Ranking in Top 10) Zohydro ® ER Hysingla ® ER Xtampza ® ER Perceptions of Performance of ER Tablets • Zohydro ® ER with BeakTek ® positioned strongly in the marketplace • Patients preferred Zohydro ® ER with BeakTek ® vs. other competitors’ products Zohydro ® ER 5.3 3.7 4.0 5.0 5.1 3.5 5.2 4.4 4.0 5.0 5.0 5.4 2.9 5.8

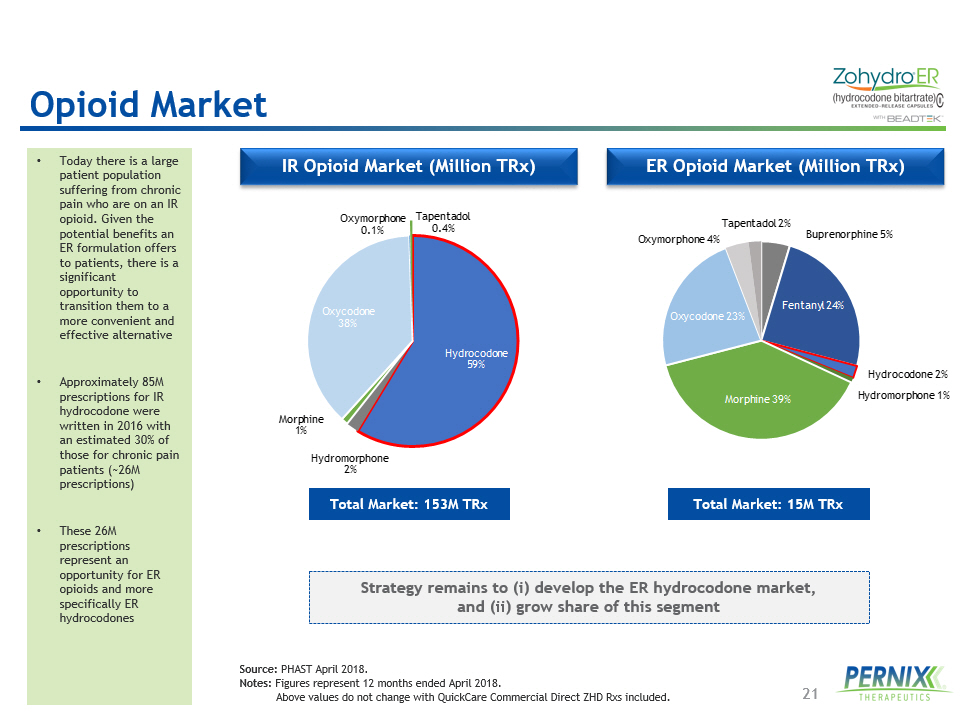

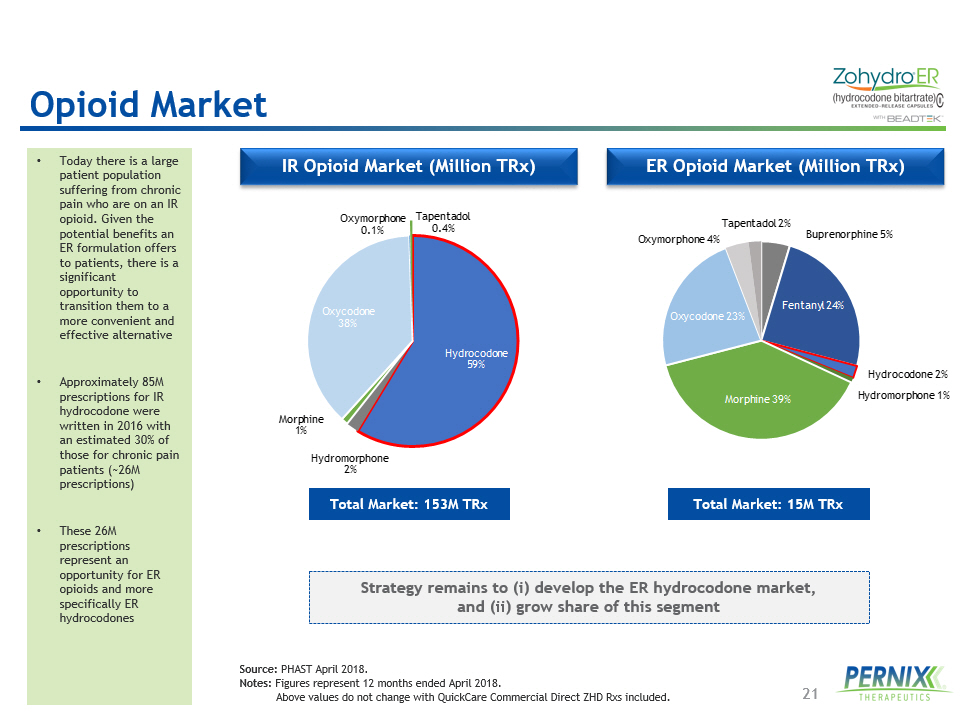

21 ER Opioid Market (Million TRx) IR Opioid Market (Million TRx) • Today there is a large patient population suffering from chronic pain who are on an IR opioid. Given the potential benefits an ER formulation offers to patients, there is a significant opportunity to transition them to a more convenient and effective alternative • Approximately 85M prescriptions for IR hydrocodone were written in 2016 with an estimated 30% of those for chronic pain patients (~26M prescriptions) • These 26M prescriptions represent an opportunity for ER opioids and more specifically ER hydrocodones Total Market: 153M TRx Total Market: 15M TRx Source: PHAST April 2018. Notes: Figures represent 12 months ended April 2018. Above values do not change with QuickCare Commercial Direct ZHD Rxs included. Opioid Market Hydrocodone 59% Hydromorphone 2% Morphine 1% Oxycodone 38% Oxymorphone 0.1% Tapentadol 0.4% Buprenorphine 5% Fentanyl 24% Hydrocodone 2% Hydromorphone 1% Morphine 39% Oxycodone 23% Oxymorphone 4% Tapentadol 2% Strategy remains to ( i ) develop the ER hydrocodone market, and (ii) grow share of this segment

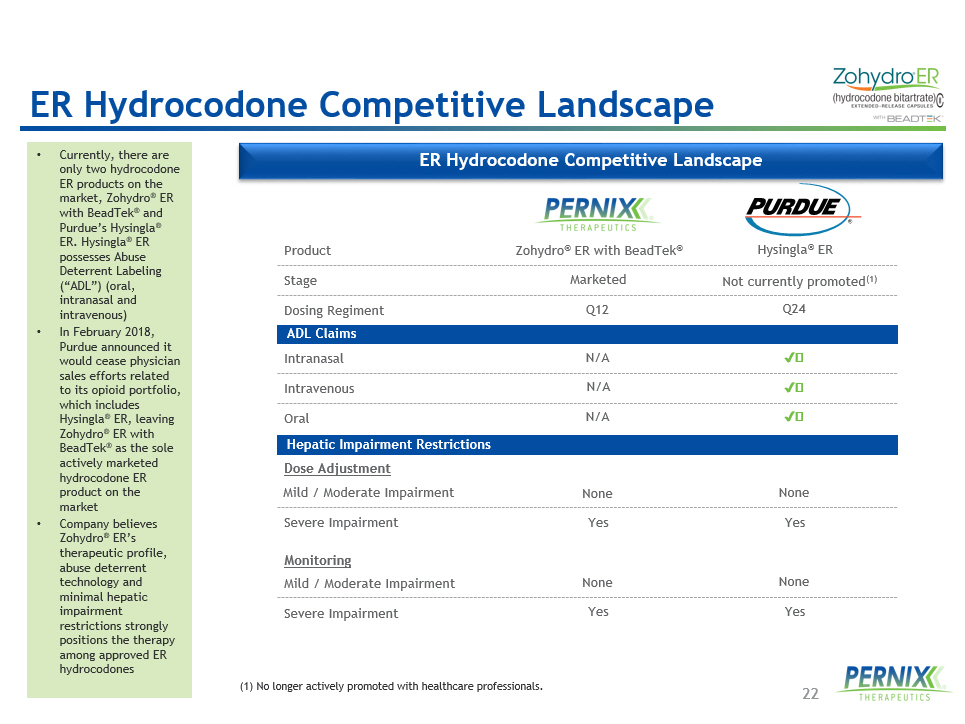

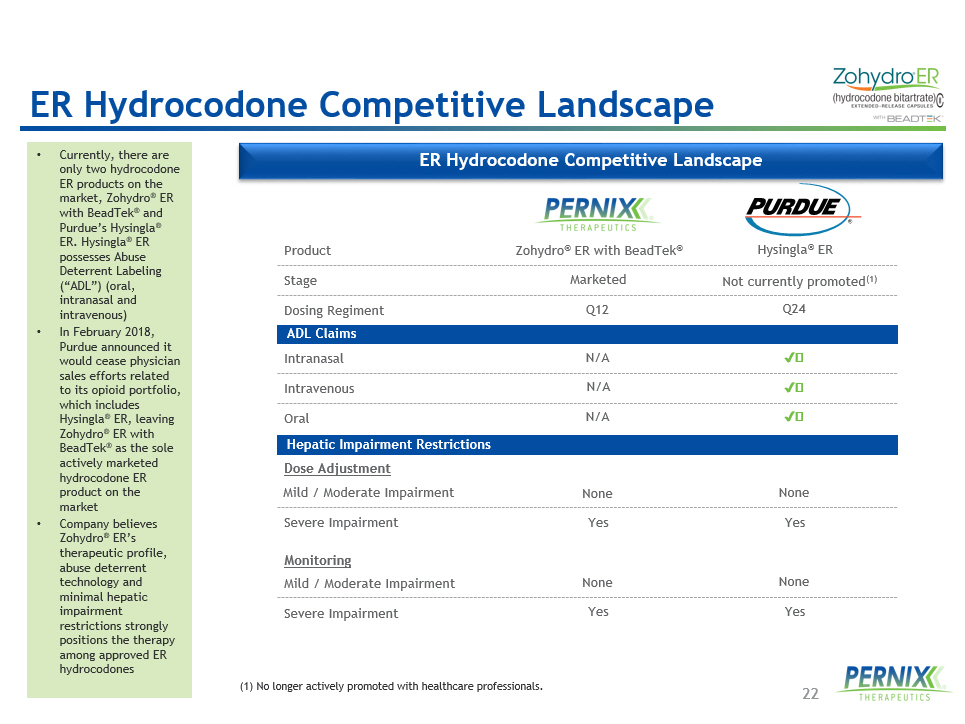

22 ER Hydrocodone Competitive Landscape • Currently, there are only two hydrocodone ER products on the market, Zohydro ® ER with BeadTek ® and Purdue’s Hysingla ® ER. Hysingla ® ER possesses Abuse Deterrent Labeling (“ADL”) (oral, intranasal and intravenous) • In February 2018, Purdue announced it would cease physician sales efforts related to its opioid portfolio, which includes Hysingla ® ER, leaving Zohydro ® ER with BeadTek ® as the sole actively marketed hydrocodone ER product on the market • Company believes Zohydro ® ER’s therapeutic profile, abuse deterrent technology and minimal hepatic impairment restrictions strongly positions the therapy among approved ER hydrocodones Product Stage Intranasal Intravenous Oral Dose Adjustment Mild / Moderate Impairment Monitoring Mild / Moderate Impairment Severe Impairment Severe Impairment Dosing Regiment ADL Claims Hepatic Impairment Restrictions Zohydro ® ER with BeadTek ® Marketed Q12 N/A N/A N/A None Yes None Yes Hysingla ® ER Not currently promoted (1) Q24 ✔️ None Yes None Yes ✔️ ✔️ (1) No longer actively promoted with healthcare professionals. ER Hydrocodone Competitive Landscape

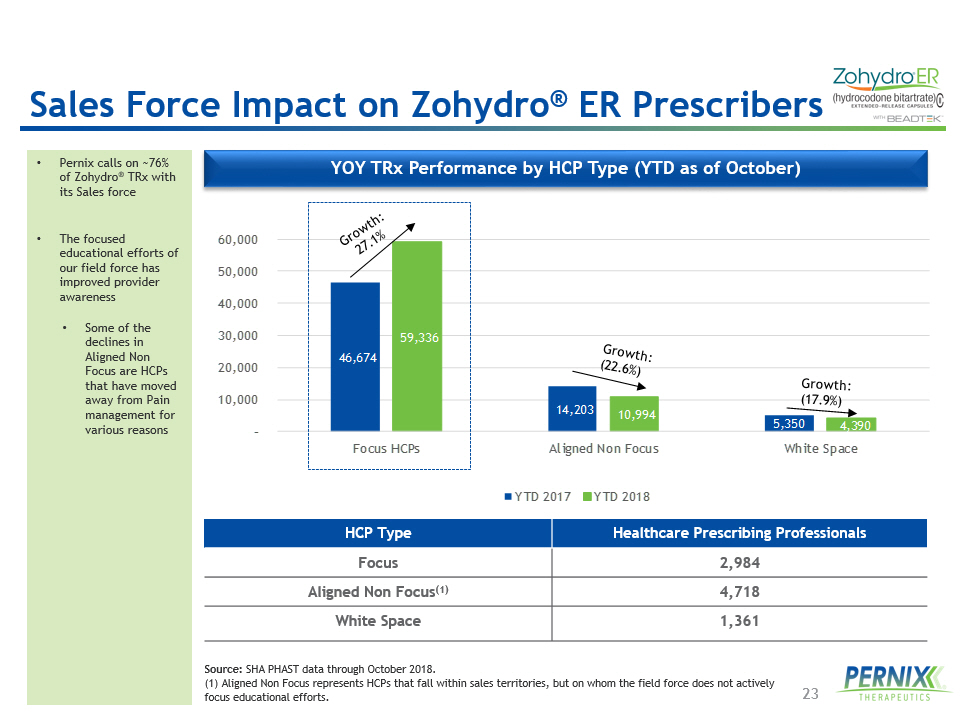

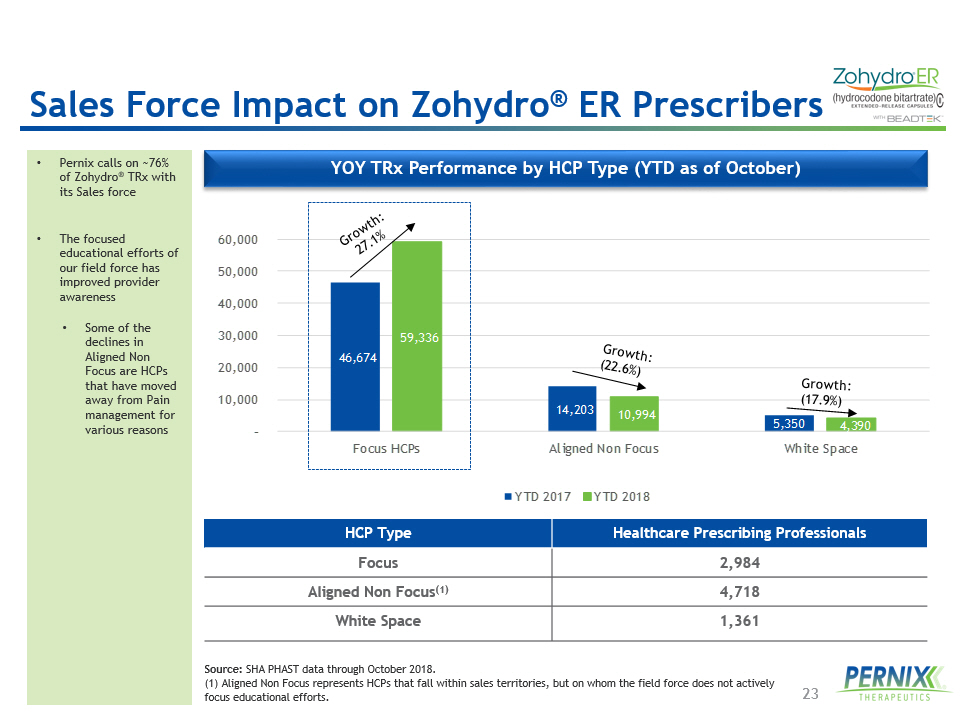

23 Sales Force Impact on Zohydro ® ER Prescribers • Pernix calls on ~76% of Zohydro ® TRx with its Sales force • The focused educational efforts of our field force has improved provider awareness • Some of the declines in Aligned Non Focus are HCPs that have moved away from Pain management for various reasons 46,674 14,203 5,350 59,336 10,994 4,390 – 10,000 20,000 30,000 40,000 50,000 60,000 Focus HCPs Aligned Non Focus White Space YTD 2017 YTD 2018 YOY TRx Performance by HCP Type (YTD as of October) HCP Type Healthcare Prescribing Professionals Focus 2,984 Aligned Non Focus (1) 4,718 White Space 1,361 Source: SHA PHAST data through October 2018 . ( 1 ) Aligned Non Focus represents HCPs that fall within sales territories, but on whom the field force does not actively focus educational efforts.

24 8,539 5,000 6,000 7,000 8,000 9,000 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Jul-17 Oct-17 Jan-18 Apr-18 Jul-18 Oct-18 Zohydro Total TRx Source: Symphony Health Integrated DataVerse (IDV) Zohydro ® ER with BeadTek ® TRx Trends Monthly TRx Steady increase in TRx • Reduction of sales force in July 2016 • Stockout of 20mg dosage strength, which represented the largest volume mg strength in 2016, announced in May 2017 • Reduction of sales force in January 2018 • Return to market of 20mg dosage strength announced March 2018 • On November 21, 2018, the Company announced that the 20mg dosage strength will be on back order until at least the second quarter of 2019. Refer to 8 - K filed on 11/21 A B C A 42.4% growth since April 2015 D C B E D E

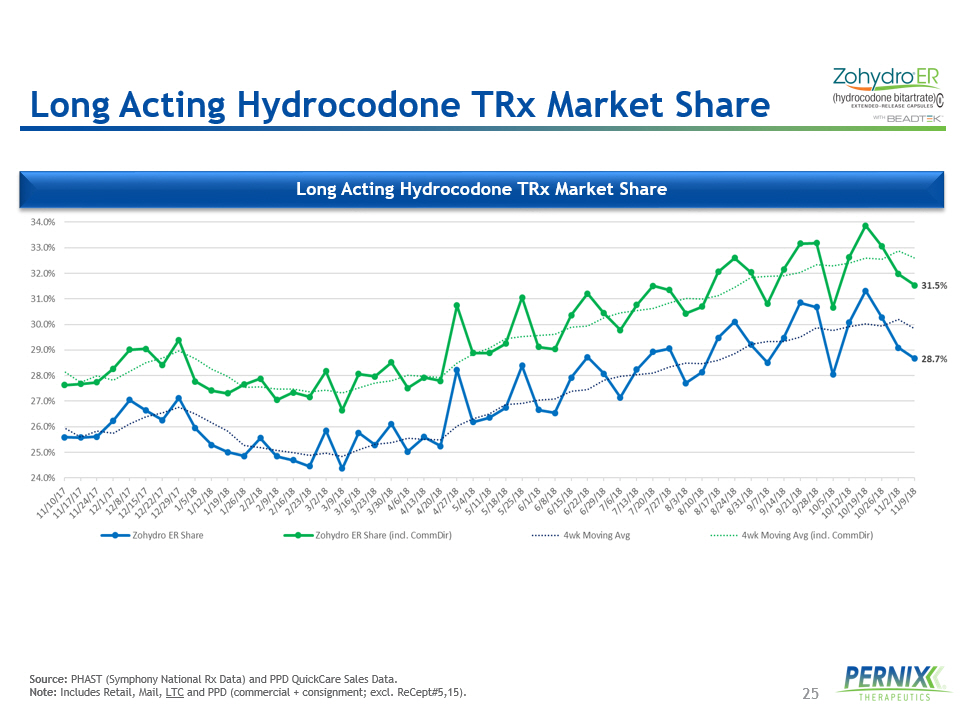

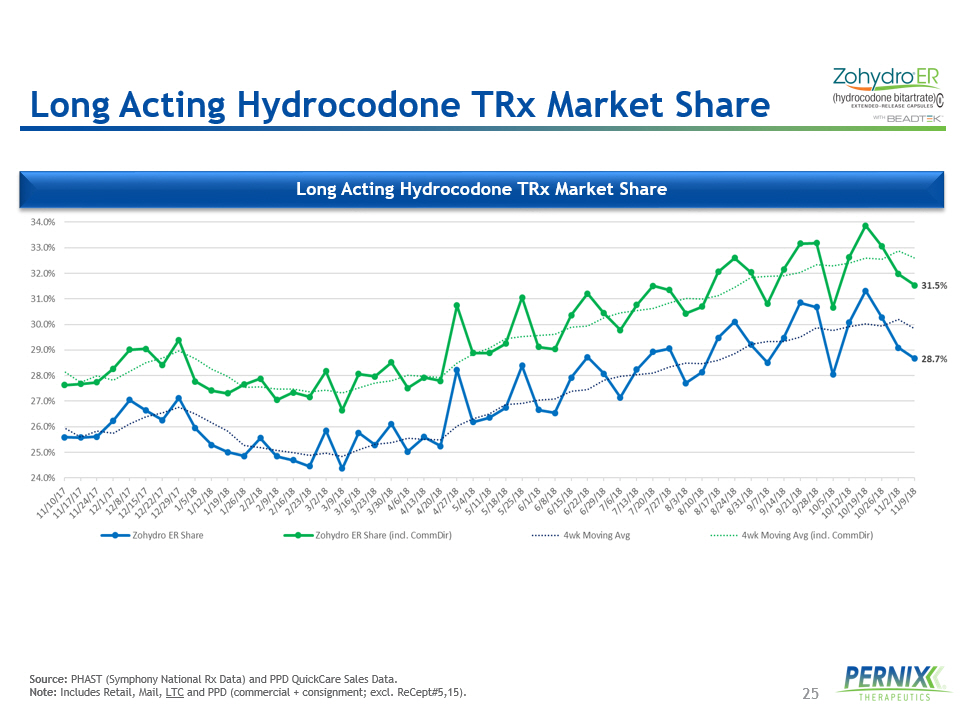

25 Long Acting Hydrocodone TRx Market Share Source: PHAST (Symphony National Rx Data) and PPD QuickCare Sales Data. Note: Includes Retail, Mail, LTC and PPD (commercial + consignment; excl. ReCept#5,15). Long Acting Hydrocodone TRx Market Share

26 Zohydro ® ER New Patient Starts Zohydro ® ER Source of Business • Primary source of business for Zohydro ® ER with BeadTek ® is patients on IR hydrocodone • Physicians prefer to stay within the same molecule when switching a patient from an IR to an ER therapy or adding on an ER therapy • TRx data indicates that 50 % of Zohydro ® ER with BeadTek ® new patient starts are derived from patients on IR hydrocodone • 41 % added to IR hydrocodone, 9 % switched from IR hydrocodone. Importantly, add - on and switch patients show significantly higher adherence to therapy than new - to - market patients • Remaining 50 % of new patient starts are derived from: • Patients new to market ( 11 %) • Add - ons to non - hydrocodone IR therapy ( 11 %) • Add - ons to neuropathic pain therapies ( 12 %) • Other ( 16 %), including switch from non - hydrocodone IR / ER opioid therapy, switch from Hysingla ® ER and switch from / add to Tramadol • < 1 % of all patients new to Zohydro ® ER with BeadTek ® are switched from Hysingla ® ER and vice versa • Conversion of IR hydrocodone market is a core component of Zohydro ® ER with BeadTek ® growth strategy • 50% of Zohydro ® ER with BeadTek ® new patients starts are switched from or added on to IR hydrocodone scripts • As of December 2016, Zohydro ® ER with BeadTek ® and Hysingla ® ER accounted for only 0.4% of all hydrocodone prescriptions • Zohydro ® ER with BeadTek ® peak volume forecast represents only 0.3% of current IR hydrocodone market Zohydro ® ER with BeadTek ® Source of Business 480 ; 6% 1,144 ; 15% 97 ; 1% 66 ; 1% 703 ; 9% 1,087 ; 15% 3,946 ; 53% Continuing Mono Continuing Concomitant Reinitiated Mono Reinitiated Concom New to Market Switch Add-On

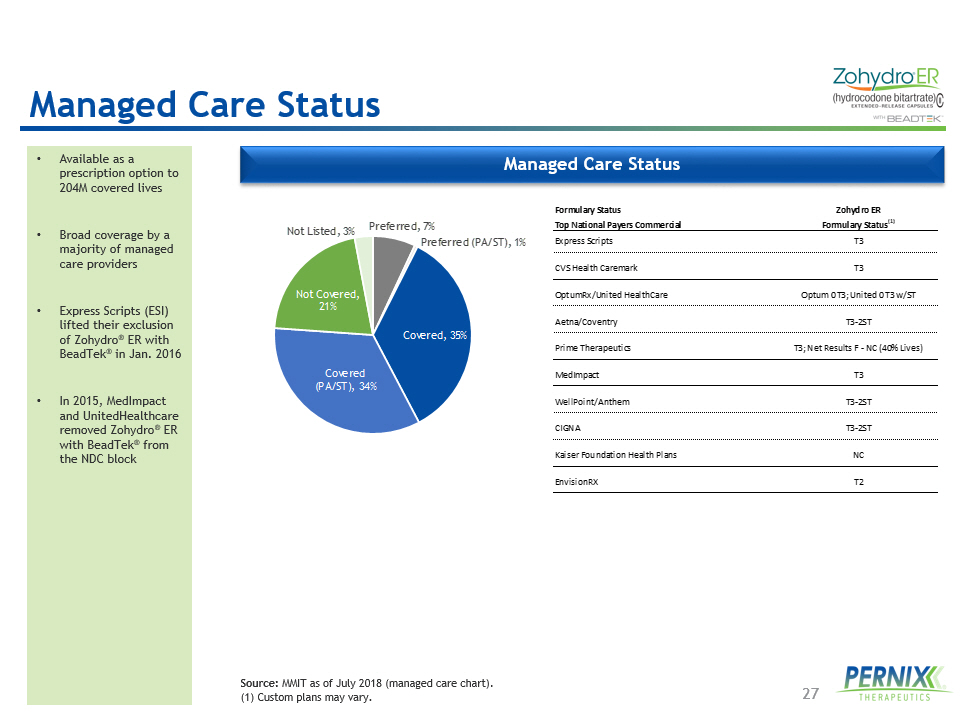

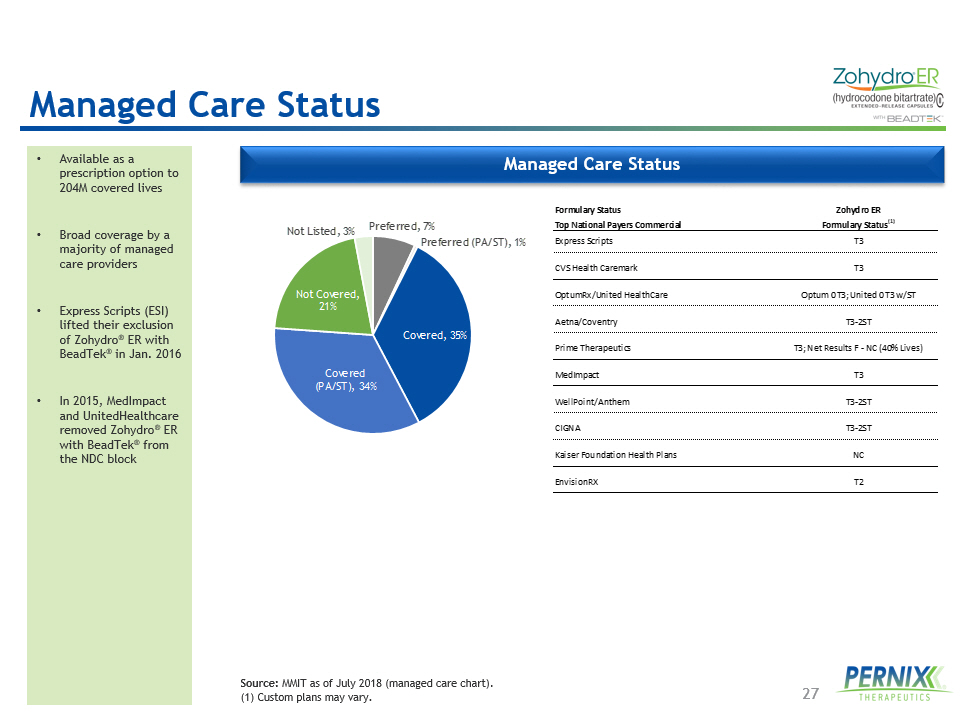

27 Managed Care Status • Available as a prescription option to 204M covered lives • Broad coverage by a majority of managed care providers • Express Scripts (ESI) lifted their exclusion of Zohydro ® ER with BeadTek ® in Jan. 2016 • In 2015, MedImpact and UnitedHealthcare removed Zohydro ® ER with BeadTek ® from the NDC block Source: MMIT as of July 2018 (managed care chart). (1) Custom plans may vary. Formulary Status Zohydro ER Top National Payers Commercial Formulary Status (1) Express Scripts T3 CVS Health Caremark T3 OptumRx/United HealthCare Optum 0 T3; United 0 T3 w/ST Aetna/Coventry T3-2ST Prime Therapeutics T3; Net Results F - NC (40% Lives) MedImpact T3 WellPoint/Anthem T3-2ST CIGNA T3-2ST Kaiser Foundation Health Plans NC EnvisionRX T2 Preferred , 7% Preferred (PA/ST) , 1% Covered , 35% Covered (PA/ST) , 34% Not Covered , 21% Not Listed , 3% Managed Care Status

28 Zohydro ® ER Issued Patents IP Settlement Update • Teva/Actavis litigation: resolved via settlement in January 2018 under which Pernix will grant Actavis a license to begin selling a generic version of Zohydro ® ER on March 1, 2029 • Alvogen litigation: • Settlement with Alvogen with respect to 2019 patents and 9,132,096. • On August 27, 2018, Patents 9,265,760 and 9,339,499 were ruled to be infringed but invalid; however, this finding is subject to appeal • Zohydro ® ER with BeadTek ® is covered by 15 Orange Book listed patents, the latest expiring in 2034 • Patents on hepatic impairment data cover critical safety information relating to dosing of hepatically impaired patients. The patents possess a broad scope covering both generics and branded competitors U.S. Patent Appl. No. General Claim Scope Expiration Date Ownership 6,228,398 Multiparticulate modified release compositions 11/01/2019 In - Licensed from Recro 6,902,742 Multiparticulate modified release compositions 11/01/2019 In - Licensed from Recro 9,265,760 Critical safety information relating to dosing patients with hepatic impairment 7/25/2033 Solely owned by Pernix 9,339,499 Method of treating patients with hepatic impairment 7/25/2033 Solely owned by Pernix 9,326,982 Method of treating patients with hepatic impairment 7/25/2033 Solely owned by Pernix 9,333,201 Method of treating patients with hepatic impairment 7/25/2033 Solely owned by Pernix 9,421,200 Method of treating patients with hepatic impairment 7/25/2033 Solely owned by Pernix 9,433,619 Method of treating patients with hepatic impairment 7/25/2033 Solely owned by Pernix 9,610,286 Method of treating patients with hepatic impairment 7/25/2033 Solely owned by Pernix 10,028,946 Method of treating patients with hepatic impairment 7/25/2033 Solely owned by Pernix 9,132,096 Abuse deterrent compositions 9/12/2034 In - Licensed from Recro 9,452,163 Abuse deterrent compositions 9/12/2034 In - Licensed from Recro 9,486,451 Abuse deterrent compositions 9/12/2034 In - Licensed from Recro 9,713,611 Abuse deterrent compositions 9/12/2034 In - Licensed from Recro 10,092,559 Abuse deterrent compositions 9/12/2034 In - Licensed from Recro IP Status

29 $24 $28 $28 $29 $31 $34 76% 74% 73% 73% 74% 74% 0% 10% 20% 30% 40% 50% 60% 70% 80% $0 $5 $10 $15 $20 $25 $30 $35 $40 2017A 2018E 2019E 2020E 2021E 2022E Sales Gross Margin 2017A - 2022E Net Product Sales • 2018 YTD net sales up 22 % vs. 2017 driven by acceleration of TRx growth and recent gross - to - net favorability • TRx up 6.8 % in Q 3 2018 vs.Q 3 2017 , largely driven by repositioning sales force to focus on Zohydro ® ER with BeadTek ® • For projection period, Zohydro ® ER with BeadTek ® assumed to experience ~ 3 % year - over - year TRx growth and ~ 8 % WAC growth • Zohydro ® ER with BeadTek ® market positioning strengthened on account of its top competitor ceasing active physician marketing efforts in February 2018 • Projections assume settlement with IP litigation counterparties • 2019 includes impact of 20 mg stockout for first six months, plus reduced sales force Note: Projections are subject to numerous assumptions and risks. ($ in millions) Zohydro ® ER with BeadTek ® Forecast A A

Silenor ®

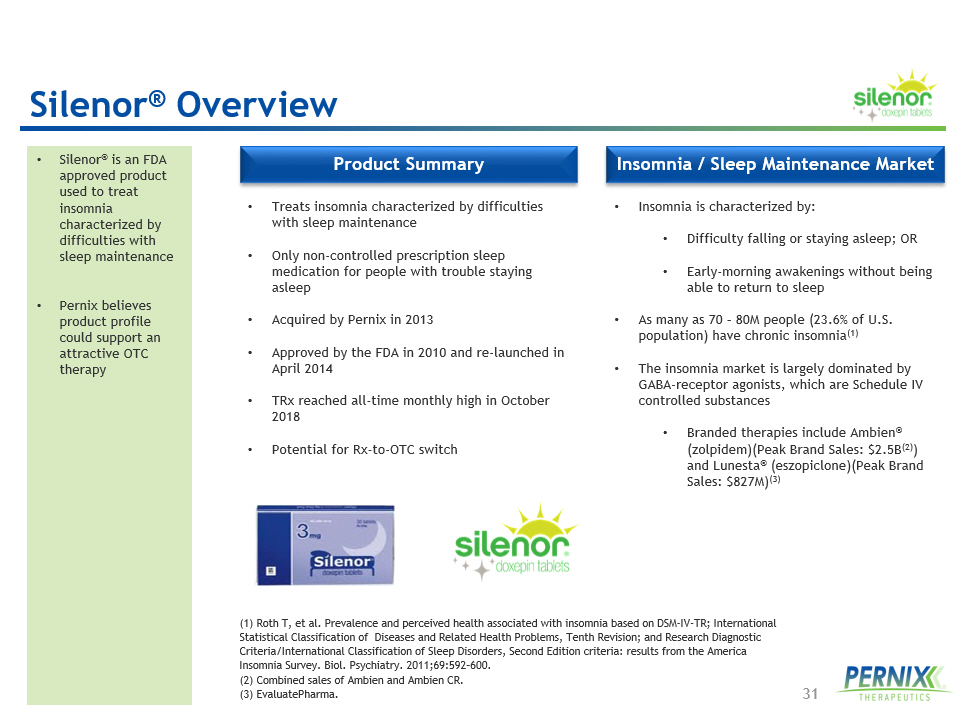

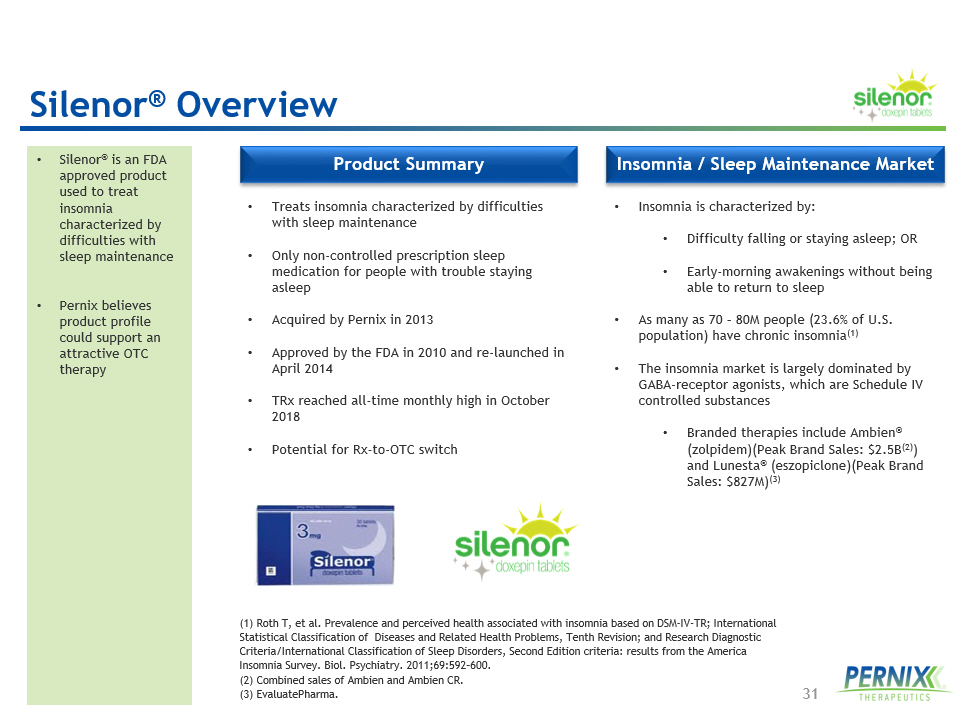

31 Insomnia / Sleep Maintenance Market Product Summary • Treats insomnia characterized by difficulties with sleep maintenance • Only non - controlled prescription sleep medication for people with trouble staying asleep • Acquired by Pernix in 2013 • Approved by the FDA in 2010 and re - launched in April 2014 • TRx reached all - time monthly high in October 2018 • Potential for Rx - to - OTC switch • Insomnia is characterized by: • Difficulty falling or staying asleep; OR • Early - morning awakenings without being able to return to sleep • As many as 70 – 80M people (23.6% of U.S. population) have chronic insomnia (1) • The insomnia market is largely dominated by GABA - receptor agonists, which are Schedule IV controlled substances • Branded therapies include Ambien ® (zolpidem)(Peak Brand Sales: $2.5B (2) ) and Lunesta ® ( eszopiclone )(Peak Brand Sales: $827M) (3) • Silenor ® is an FDA approved product used to treat insomnia characterized by difficulties with sleep maintenance • Pernix believes product profile could support an attractive OTC therapy (1) Roth T, et al. Prevalence and perceived health associated with insomnia based on DSM - IV - TR; International Statistical Classification of Diseases and Related Health Problems, Tenth Revision; and Research Diagnostic Criteria/International Classification of Sleep Disorders, Second Edition criteria: results from the America Insomnia Survey. Biol. Psychiatry. 2011;69:592 – 600. (2) Combined sales of Ambien and Ambien CR. (3) EvaluatePharma . Silenor ® Overview

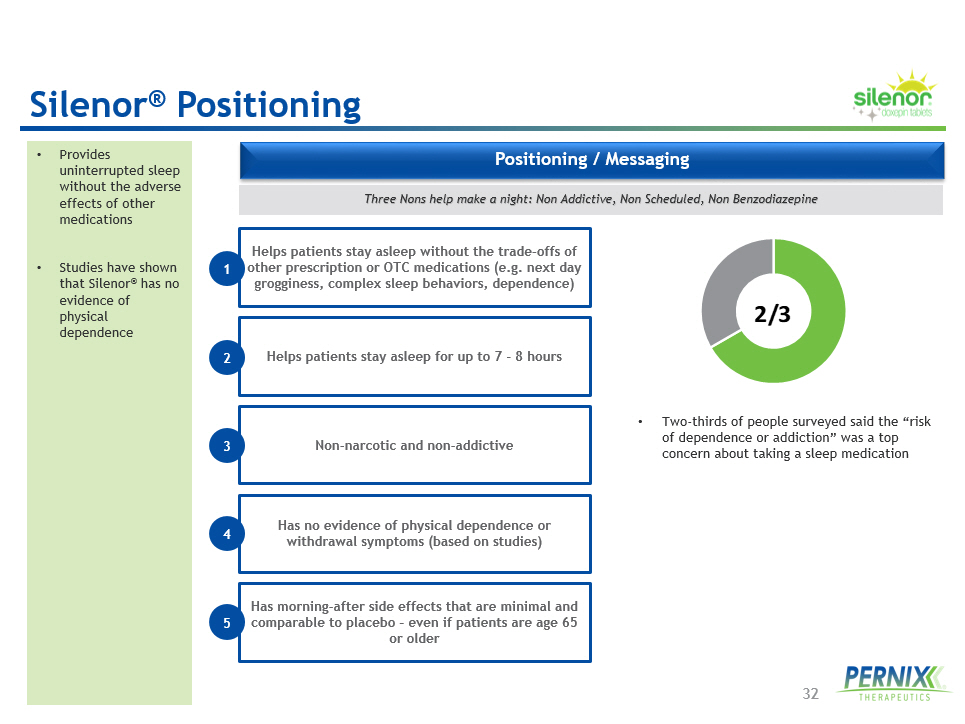

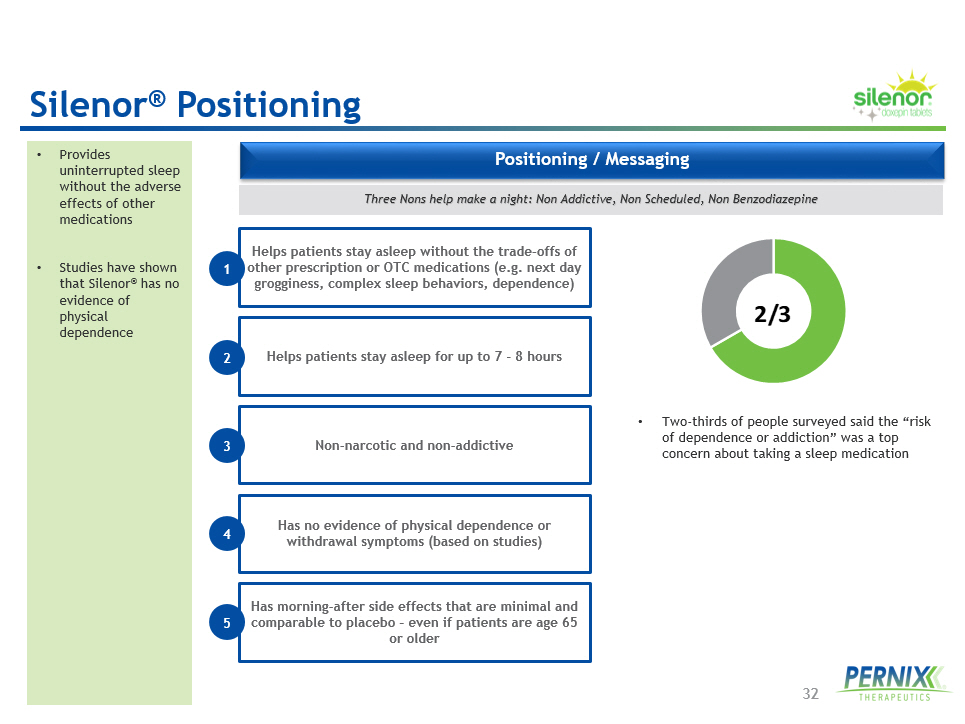

32 Positioning / Messaging • Provides uninterrupted sleep without the adverse effects of other medications • Studies have shown that Silenor ® has no evidence of physical dependence • Two - thirds of people surveyed said the “risk of dependence or addiction” was a top concern about taking a sleep medication 2/3 Three Nons help make a night: Non Addictive, Non Scheduled, Non Benzodiazepine Silenor ® Positioning Helps patients stay asleep without the trade - offs of other prescription or OTC medications (e.g. next day grogginess, complex sleep behaviors, dependence) 1 Helps patients stay asleep for up to 7 - 8 hours Non - narcotic and non - addictive Has no evidence of physical dependence or withdrawal symptoms (based on studies) Has morning - after side effects that are minimal and comparable to placebo – even if patients are age 65 or older 2 3 4 5

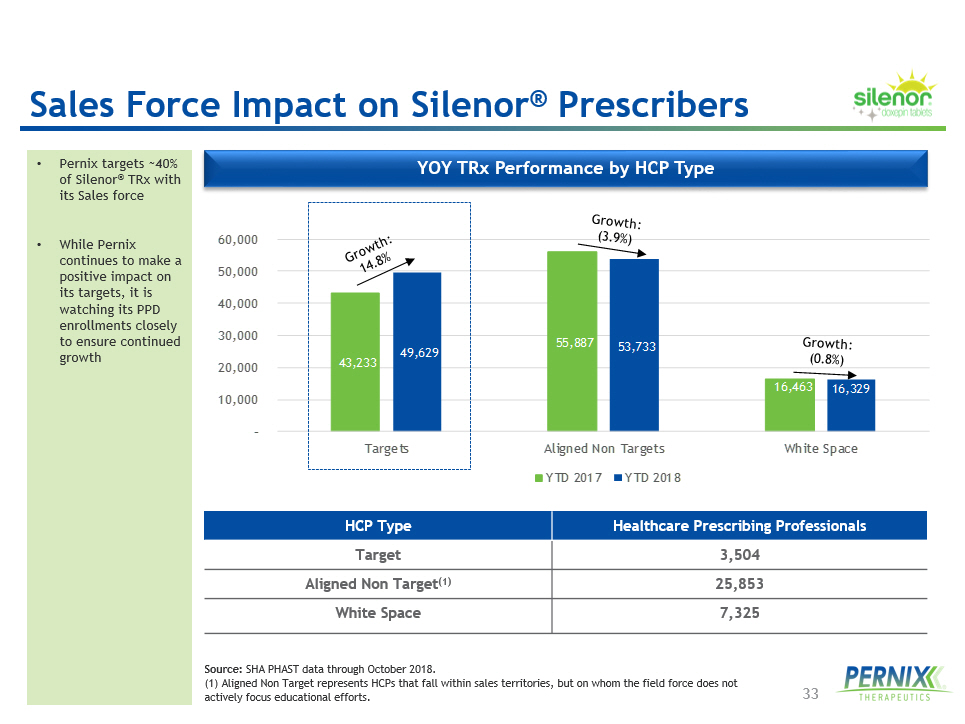

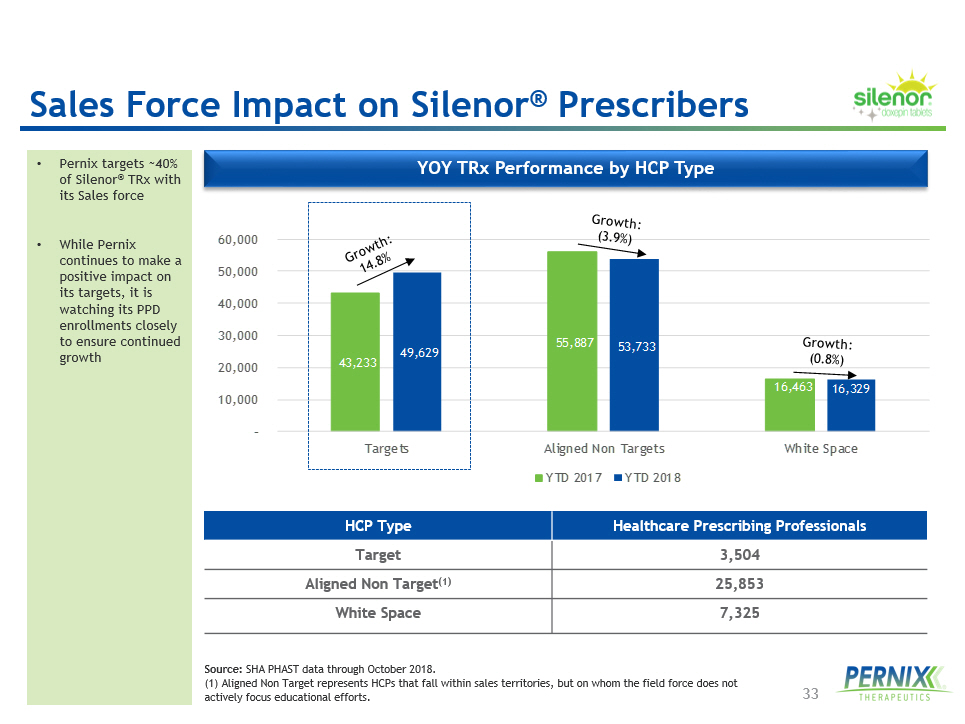

33 Sales Force Impact on Silenor ® Prescribers • Pernix targets ~40% of Silenor ® TRx with its Sales force • While Pernix continues to make a positive impact on its targets, it is watching its PPD enrollments closely to ensure continued growth 43,233 55,887 16,463 49,629 53,733 16,329 – 10,000 20,000 30,000 40,000 50,000 60,000 Targets Aligned Non Targets White Space YTD 2017 YTD 2018 YOY TRx Performance by HCP Type HCP Type Healthcare Prescribing Professionals Target 3,504 Aligned Non Target (1) 25,853 White Space 7,325 Source: SHA PHAST data through October 2018. (1) Aligned Non Target represents HCPs that fall within sales territories, but on whom the field force does not actively focus educational efforts.

34 Arousability Study Conclusions • Phase IV study assessing the effects of a nighttime administration of Silenor ® 6 mg, zolpidem 10 mg, and placebo on arousability, gait/balance, and cognitive performance • Assessed the effects of Silenor ® 6 mg, zolpidem 10 mg and matching placebos in 52 normal healthy adult male volunteers • The results, released on June 16 , 2016 , demonstrate: • Silenor ® 6 mg is superior to zolpidem 10 mg on all measures analyzed (arousability, gait, balance, memory) on a statistically significant basis • Subjects taking Silenor ® 6 mg did not have impairment on any of these measures and were comparable to placebo • Silenor ® 6 mg and both placebo groups were superior to zolpidem on all measures • Zolpidem subjects experienced significant impairments, including difficulty waking up and in their ability to walk • A recent Phase IV arousability study demonstrated that Silenor ® was statistically superior to zolpidem when measuring the impairment of arousability , gait / balance and cognitive performance after nighttime administration • The study also showed that nighttime administration of Silenor ® had similar results to placebo on the same measurements Measure Silenor ® 6 mg Zolpidem 10 mg Placebo (two groups) p - value (Silenor ® vs. Zolpidem ® ) Auditory Awakening Threshold (avg) 85 decibel (dB); 17% didn’t wake up prior to maximum tone 103 dB; 64% didn’t wake up prior to maximum tone 85 dB and 78 dB (21% and 6%) p<0.0001 Tandem Walk (avg # steps off beam) 1.3 8.1 1.1 and 1.0 p<0.0001 Tandem Walk (avg time to walk across beam ) 5.0 seconds 6.7 seconds 4.8 and 4.8 seconds p<0.0001 Berg Balance Scale (avg score) 54.5 51.4 55.0 and 55.2 p<0.0001 Free Recall Memory Test (avg words recalled at Tmax and next morning) 7.9 and 6.8 4.8 and 2.2 7.7 and 6.5/ 8.1 and 7.0 p<0.0001 Arousability Study: Positive Results (1) Christopher D, et al. Arousability and fall risk during forced awakenings from nocturnal sleep among healthy males following administration of Zolpidem 10 mg and Doxepin 6 mg: A randomized, placebo - controlled, four - way crossover trial; Sleep, Volume 40, Issue 7; 1 July 2017.

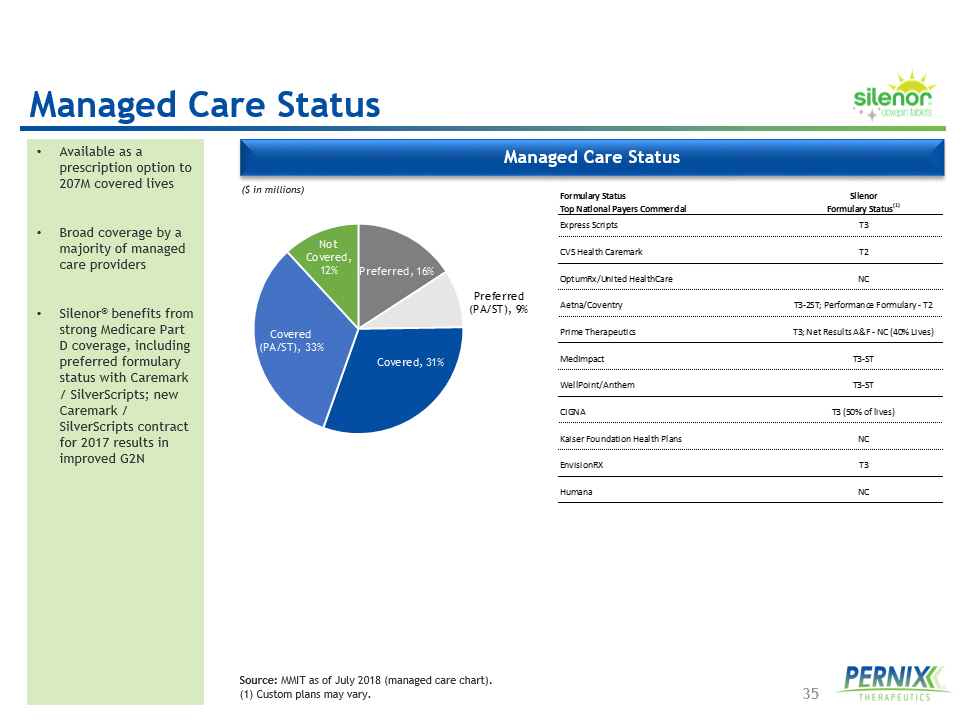

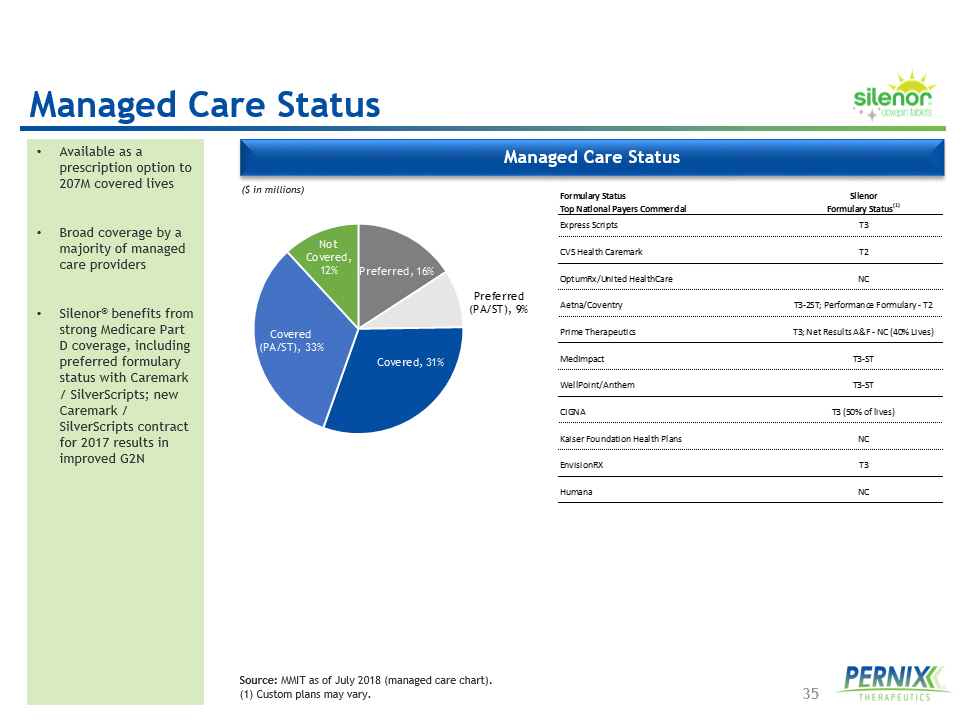

35 Managed Care Status • Available as a prescription option to 207M covered lives • Broad coverage by a majority of managed care providers • Silenor ® benefits from strong Medicare Part D coverage, including preferred formulary status with Caremark / SilverScripts ; new Caremark / SilverScripts contract for 2017 results in improved G2N ($ in millions) Source: MMIT as of July 2018 (managed care chart). ( 1 ) Custom plans may vary. Formulary Status Silenor Top National Payers Commercial Formulary Status (1) Express Scripts T3 CVS Health Caremark T2 OptumRx/United HealthCare NC Aetna/Coventry T3-2ST; Performance Formulary - T2 Prime Therapeutics T3; Net Results A&F - NC (40% Lives) MedImpact T3-ST WellPoint/Anthem T3-ST CIGNA T3 (50% of lives) Kaiser Foundation Health Plans NC EnvisionRX T3 Humana NC Preferred , 16% Preferred (PA/ST) , 9% Covered , 31% Covered (PA/ST) , 33% Not Covered , 12% Managed Care Status

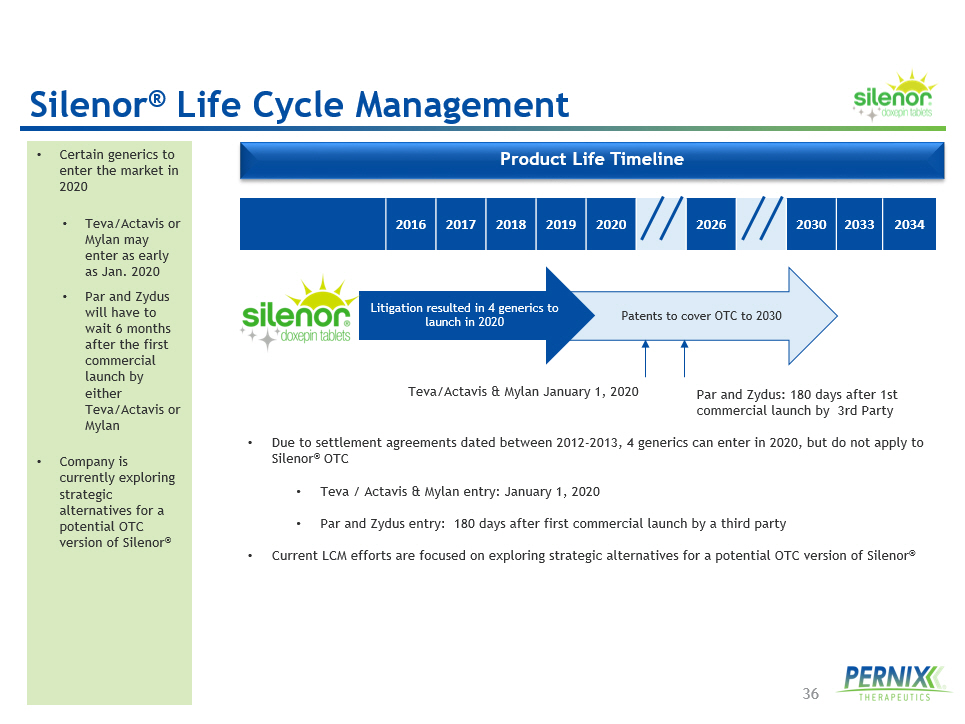

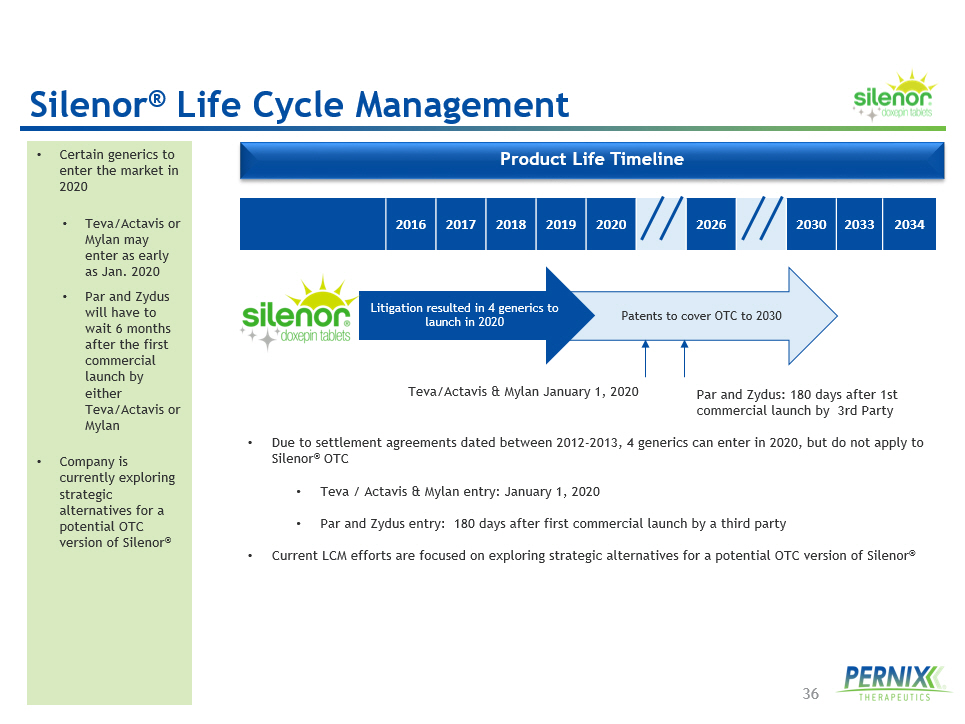

36 Product Life Timeline • Due to settlement agreements dated between 2012 - 2013, 4 generics can enter in 2020, but do not apply to Silenor ® OTC • Teva / Actavis & Mylan entry: January 1, 2020 • Par and Zydus entry: 180 days after first commercial launch by a third party • Current LCM efforts are focused on exploring strategic alternatives for a potential OTC version of Silenor ® • Certain generics to enter the market in 2020 • Teva /Actavis or Mylan may enter as early as Jan. 2020 • Par and Zydus will have to wait 6 months after the first commercial launch by either Teva /Actavis or Mylan • Company is currently exploring strategic alternatives for a potential OTC version of Silenor ® 2016 2017 2018 2019 2020 2026 2030 2033 2034 Patents to cover OTC to 2030 Litigation resulted in 4 generics to launch in 2020 Teva/Actavis & Mylan January 1, 2020 Par and Zydus: 180 days after 1st commercial launch by 3rd Party Silenor ® Life Cycle Management

37 Large Market Opportunity Product Opportunity • Potential to switch Silenor ® Rx to OTC for the treatment of occasional sleeplessness • Peak sales potential of approximately $100M • Two pre - IND FDA meetings held (latest in June 2015) provide visibility into development plan • Estimated 4 year development timeline at a cost of ~$13M - $20M • Great profile to support switch program: • Highly favorable safety profile • Addressed unmet need in OTC market for sleep maintenance with minimal next day effects • Non - scheduled / Non - addictive • No association with complex sleep behaviors • Potential for global expansion opportunities • Occasional sleeplessness is a large unmet consumer need • 80% of current sleep aid users are unsatisfied • Limited OTC options that mostly focus on sleep onset (e.g. diphenhydramine) • Current options carry undesirable side effects (morning drowsiness, dependence) • U.S. OTC Sleep Aid Market was estimated $648M in 2014 • Zzzquil TM is the most recent OTC sleep launch in the U.S. and achieved sales of ~$120M in second full year • Significant opportunity to expand the market with a differentiated product • Significant opportunity to potentially develop an OTC version of Silenor ® for occasional sleeplessness given favorable safety and use profile • Current OTC sleep alternatives often focus on sleep onset and possess undesirable side effects (e.g. morning drowsiness); U.S. sales for this category were an estimated $ 648 M in 2014 , and are expected to reach $ 787 M by 2019 • Pernix has had discussions with a number of potential strategic partners Source: Lightspeed GMI/Mintel. 80% % Unsatisfied Users $ 474 $174 US Market: $648M Sleep Aids PM Analgesics Silenor ® Rx to OTC

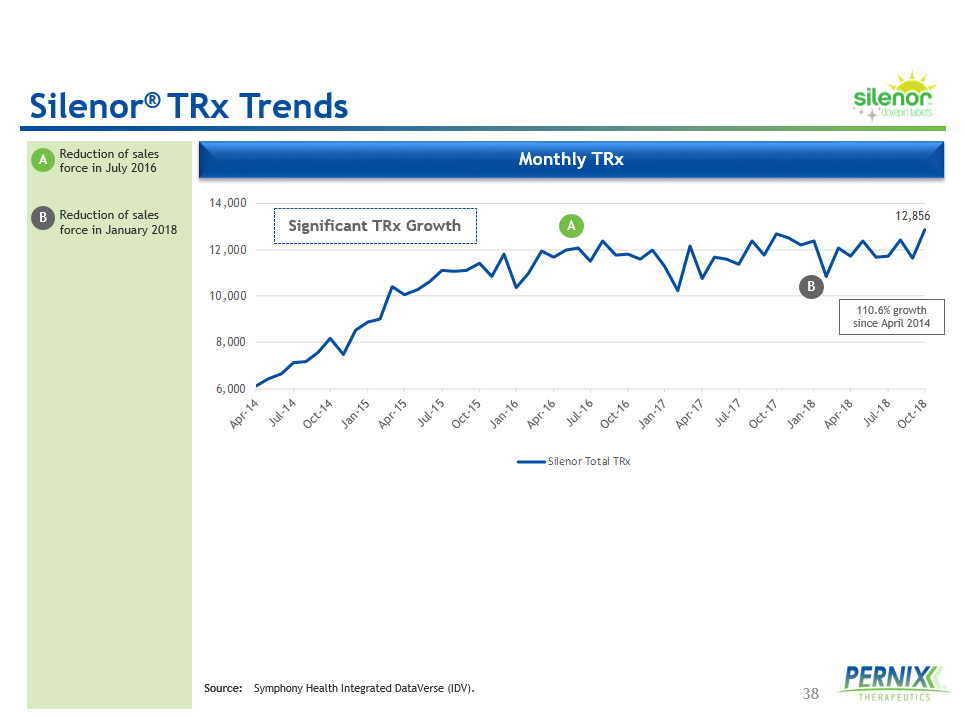

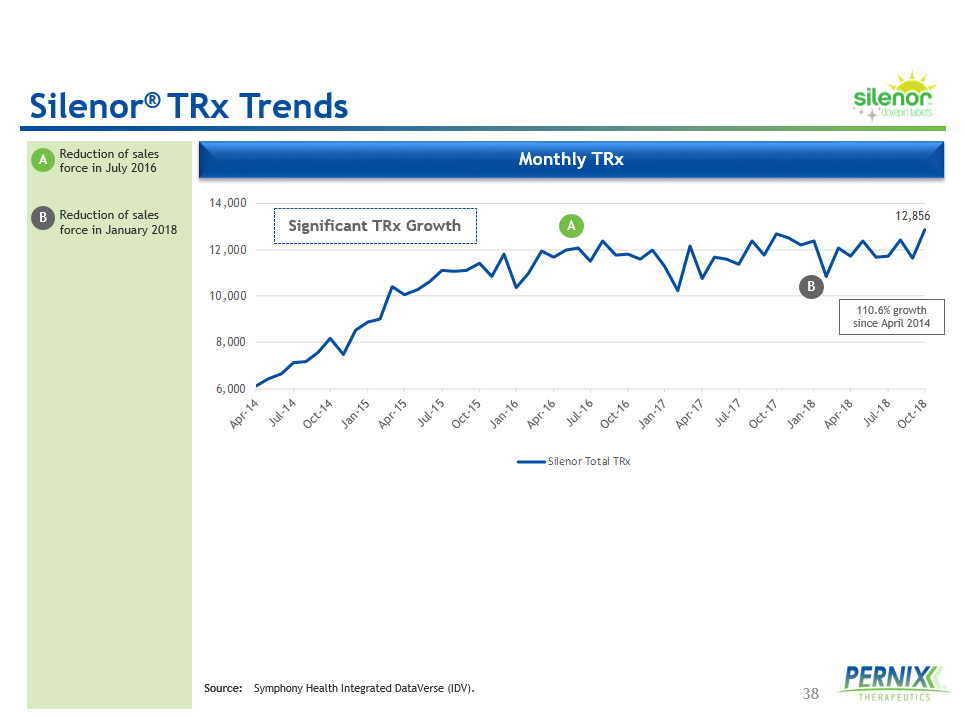

38 Source: Symphony Health Integrated DataVerse (IDV). Silenor ® TRx Trends 12,856 6,000 8,000 10,000 12,000 14,000 Silenor Total TRx Monthly TRx Significant TRx Growth • Reduction of sales force in July 2016 • Reduction of sales force in January 2018 A A 110.6% growth since April 2014 B B

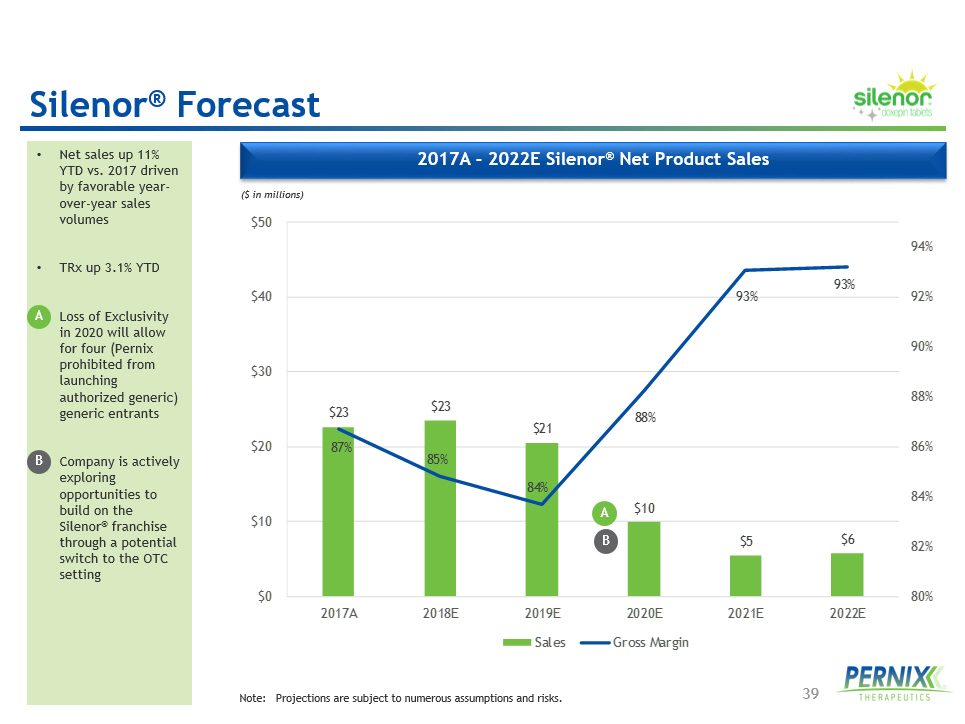

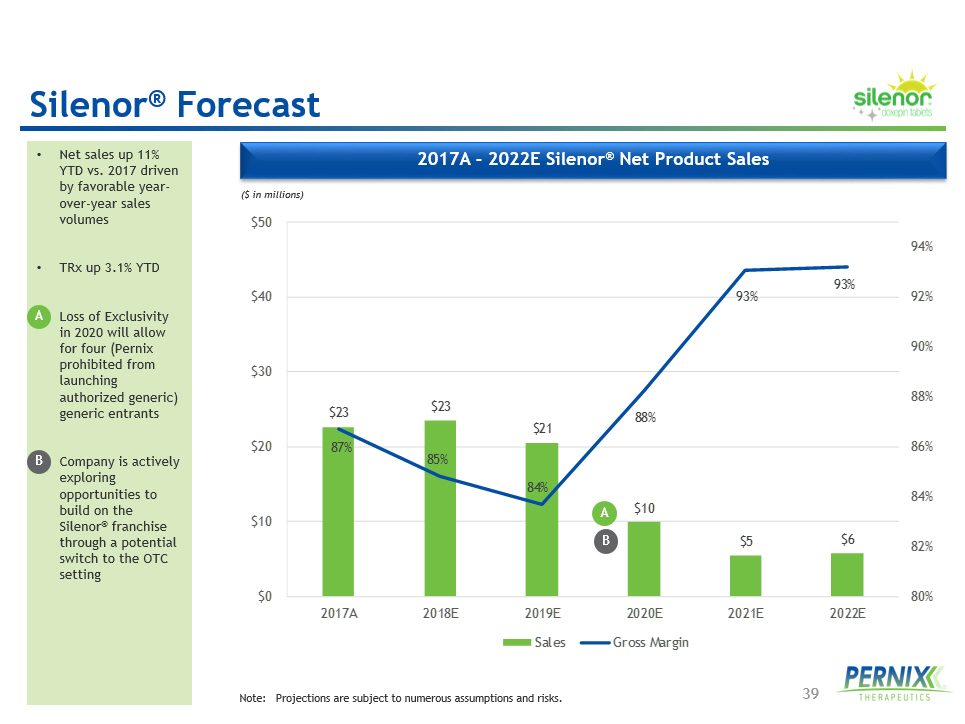

39 $23 $23 $21 $10 $5 $6 87% 85% 84% 88% 93% 93% 80% 82% 84% 86% 88% 90% 92% 94% $0 $10 $20 $30 $40 $50 2017A 2018E 2019E 2020E 2021E 2022E Sales Gross Margin 2017A - 2022E Silenor ® Net Product Sales • Net sales up 11% YTD vs. 2017 driven by favorable year - over - year sales volumes • TRx up 3.1% YTD • Loss of Exclusivity in 2020 will allow for four ( Pernix prohibited from launching authorized generic) generic entrants • Company is actively exploring opportunities to build on the Silenor ® franchise through a potential switch to the OTC setting ($ in millions) Note: Projections are subject to numerous assumptions and risks. Silenor ® Forecast A A B B

Treximet ® / Treximet ® Authorized Generic

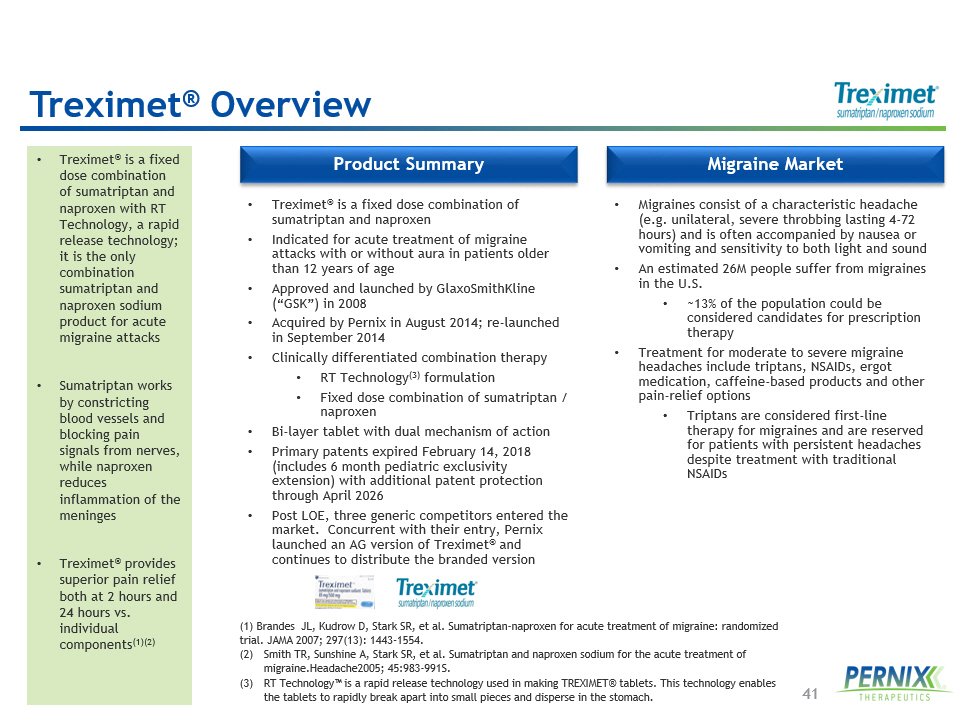

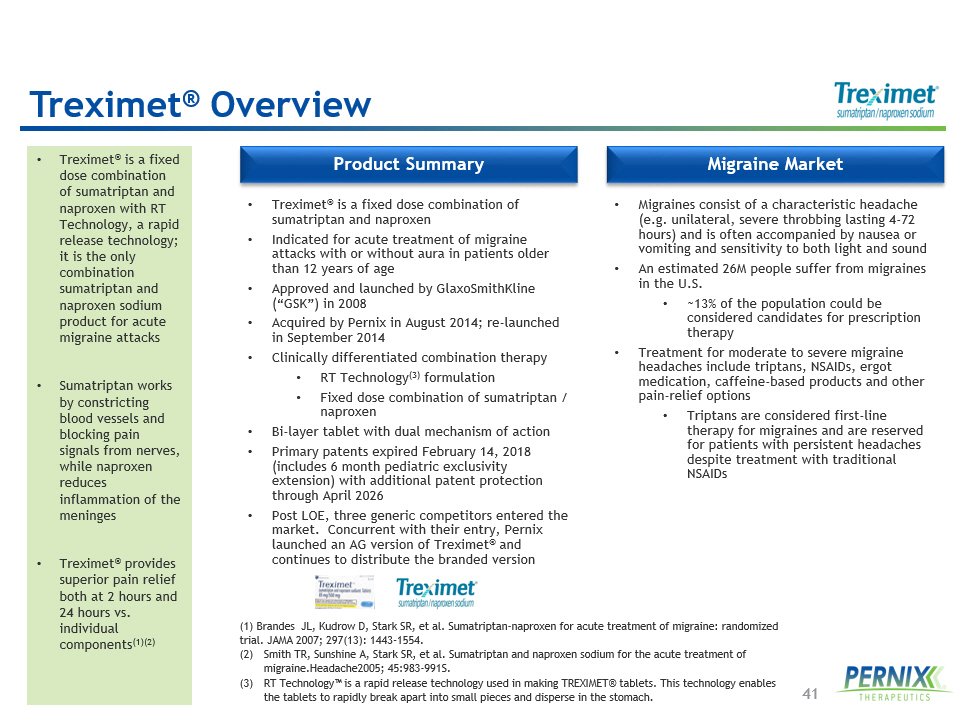

41 Migraine Market Product Summary • Treximet ® is a fixed dose combination of sumatriptan and naproxen • Indicated for acute treatment of migraine attacks with or without aura in patients older than 12 years of age • Approved and launched by GlaxoSmithKline ( “ GSK ” ) in 2008 • Acquired by Pernix in August 2014 ; re - launched in September 2014 • Clinically differentiated combination therapy • RT Technology ( 3 ) formulation • Fixed dose combination of sumatriptan / naproxen • Bi - layer tablet with dual mechanism of action • Primary patents expired February 14 , 2018 (includes 6 month pediatric exclusivity extension) with additional patent protection through April 2026 • Post LOE, three generic competitors entered the market. Concurrent with their entry, Pernix launched an AG version of Treximet ® and continues to distribute the branded version • Migraines consist of a characteristic headache (e.g. unilateral, severe throbbing lasting 4 - 72 hours) and is often accompanied by nausea or vomiting and sensitivity to both light and sound • An estimated 26M people suffer from migraines in the U.S. • ~13% of the population could be considered candidates for prescription therapy • Treatment for moderate to severe migraine headaches include triptans, NSAIDs, ergot medication, caffeine - based products and other pain - relief options • Triptans are considered first - line therapy for migraines and are reserved for patients with persistent headaches despite treatment with traditional NSAIDs • Treximet ® is a fixed dose combination of sumatriptan and naproxen with RT Technology, a rapid release technology; it is the only combination sumatriptan and naproxen sodium product for acute migraine attacks • Sumatriptan works by constricting blood vessels and blocking pain signals from nerves, while naproxen reduces inflammation of the meninges • Treximet ® provides superior pain relief both at 2 hours and 24 hours vs. individual components (1)(2) (1) Brandes JL, Kudrow D, Stark SR, et al. Sumatriptan - naproxen for acute treatment of migraine: randomized trial. JAMA 2007; 297(13): 1443 - 1554. (2) Smith TR, Sunshine A, Stark SR, et al. Sumatriptan and naproxen sodium for the acute treatment of migraine.Headache2005; 45:983 - 991S. (3) RT Technology™ is a rapid release technology used in making TREXIMET® tablets. This technology enables the tablets to rapidly break apart into small pieces and disperse in the stomach. Treximet ® Overview

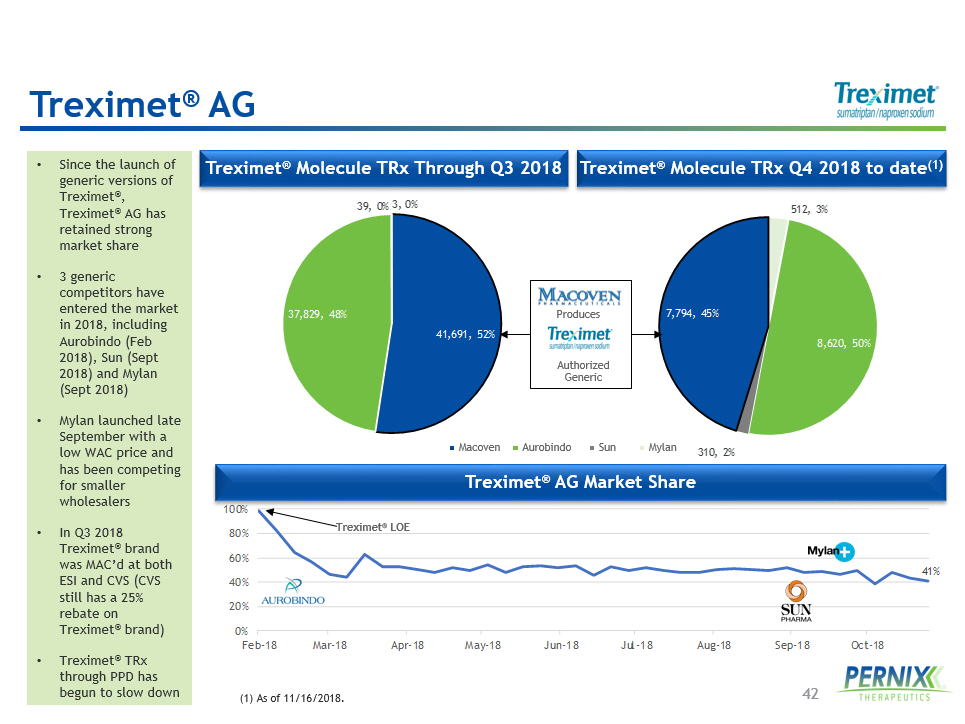

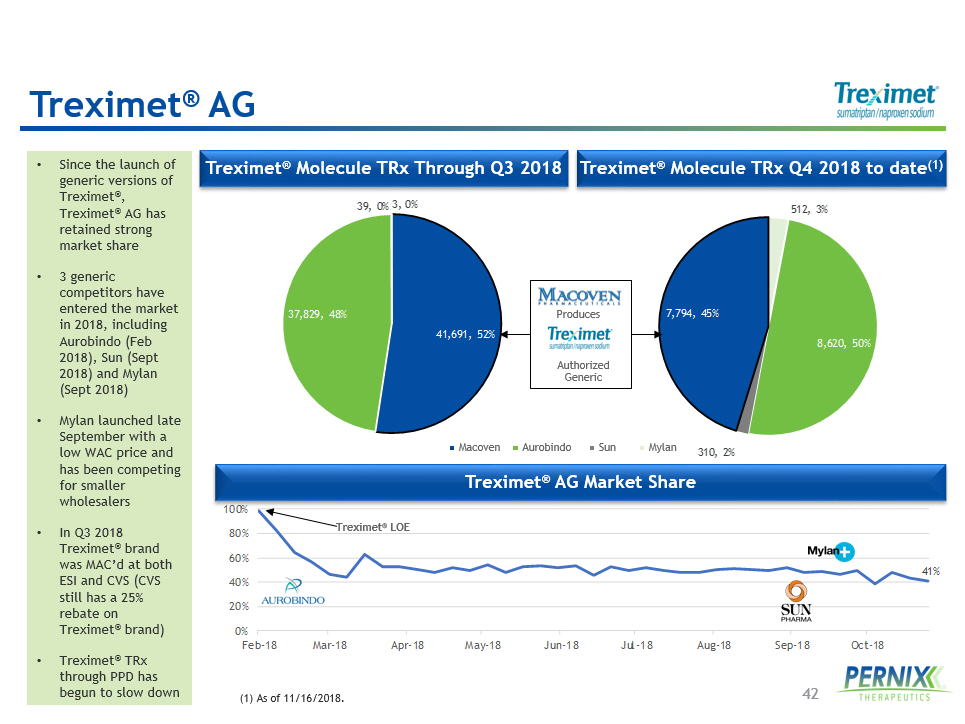

42 41% 0% 20% 40% 60% 80% 100% Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Oct-18 512 , 3% 8,620 , 50% 310 , 2% 7,794 , 45% 41,691 , 52% 37,829 , 48% 39 , 0% 3 , 0% • Since the launch of generic versions of Treximet ® , Treximet ® AG has retained strong market share • 3 generic competitors have entered the market in 2018, including Aurobindo (Feb 2018), Sun (Sept 2018) and Mylan (Sept 2018) • Mylan launched late September with a low WAC price and has been competing for smaller wholesalers • In Q3 2018 Treximet ® brand was MAC’d at both ESI and CVS (CVS still has a 25% rebate on Treximet ® brand) • Treximet ® TRx through PPD has begun to slow down Treximet ® AG Treximet ® Molecule TRx Q 4 2018 to date ( 1 ) Treximet ® Molecule TRx Through Q3 2018 (1) As of 11/16/2018. Treximet ® AG Market Share Treximet ® LOE Macoven Aurobindo Sun Mylan Authorized Generic Produces

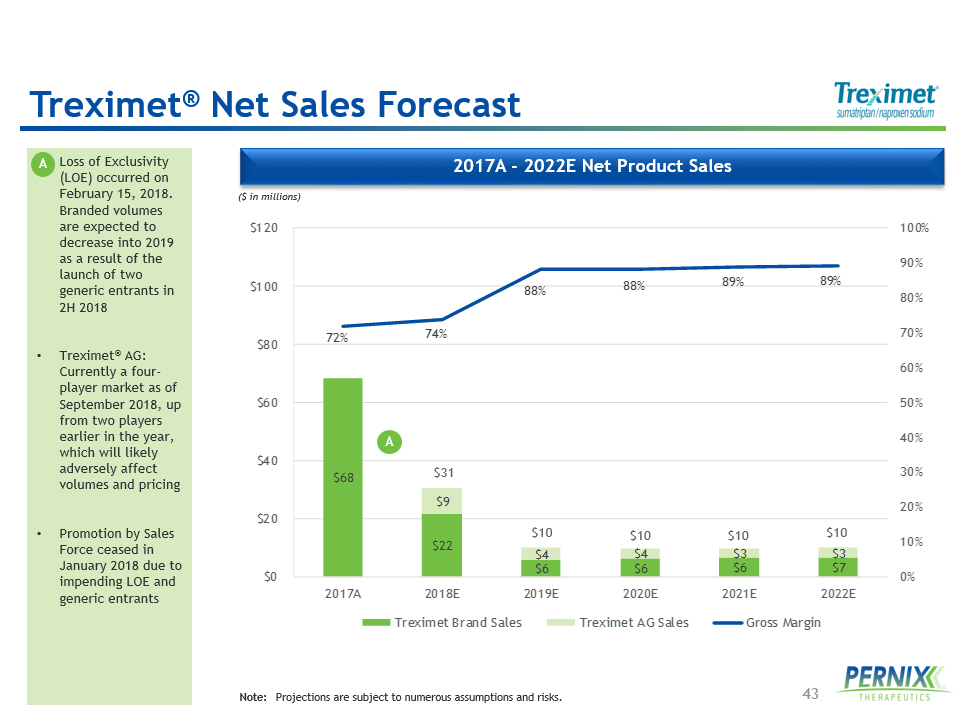

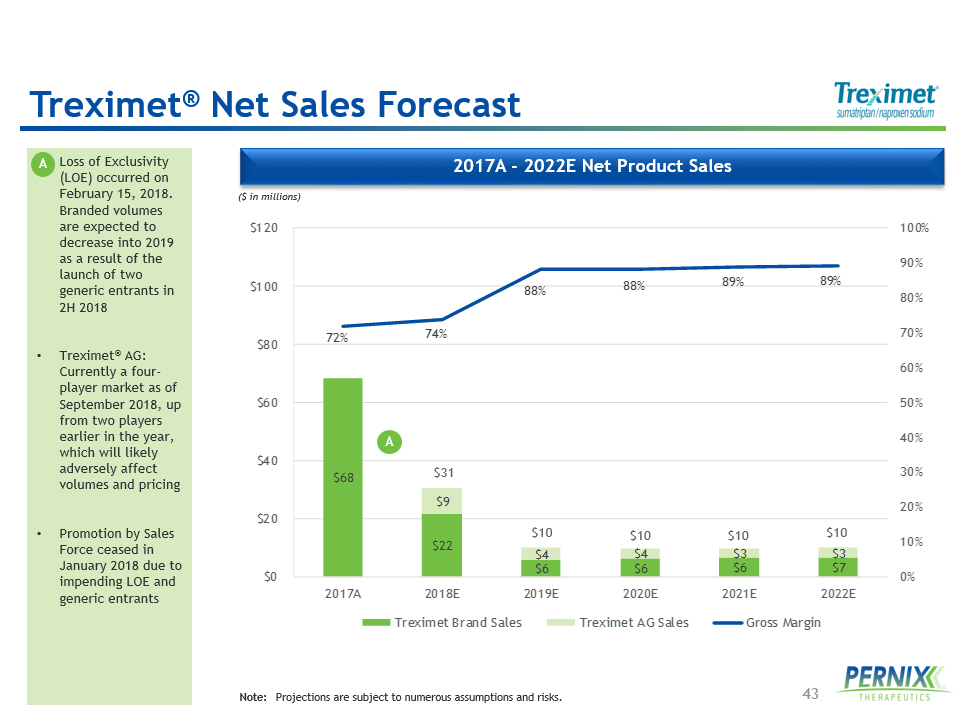

43 2017 A - 2022 E Net Product Sales • Loss of Exclusivity (LOE) occurred on February 15, 2018. Branded volumes are expected to decrease into 2019 as a result of the launch of two generic entrants in 2H 2018 • Treximet ® AG: Currently a four - player market as of September 2018, up from two players earlier in the year, which will likely adversely affect volumes and pricing • Promotion by Sales Force ceased in January 2018 due to impending LOE and generic entrants ($ in millions) Note: Projections are subject to numerous assumptions and risks. $68 $22 $6 $6 $6 $7 $9 $4 $4 $3 $3 72% 74% 88% 88% 89% 89% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% $0 $20 $40 $60 $80 $100 $120 2017A 2018E 2019E 2020E 2021E 2022E Treximet Brand Sales Treximet AG Sales Gross Margin $ 31 $10 $10 $10 $ 10 Treximet ® Net Sales Forecast A A

Generic & Other Branded Products

45 • Generic products are marketed through Cypress and Macoven • ~20 product portfolio • All manufacturing and packaging is done by third parties Overview • Pernix markets generic products primarily through two of its wholly - owned subsidiaries, Cypress Pharmaceuticals, Inc. (“Cypress”) and Macoven Pharmaceuticals, LLC (“Macoven”) • Cypress, founded in 1993, was acquired by Pernix in 2012; Macoven was acquired by Pernix in 2010 • ~20 products sold to a diverse customer base that includes all of the major wholesalers and retail pharmacies in the U.S. • All products are manufactured & packaged by third - party CMOs • Key product categories include Vitamins & Minerals, Dental and Urology • Attractive platform for acquiring non - promoted products and launching authorized generic products Drug Indication / Use LTM Net Sales ($M) % of Total Generic Net Sales Cytra Prevention of kidney stones and gout $1.4 9.3% Prenatal Products Prenatal vitamin 1.5 9.8% Rena Products Vitamin deficiency 1.1 7.6% Iron Products Vitamin deficiency 1.4 9.7% Phos-NaK Powder Prevention of kidney stones and gout 1.9 12.8% Fluoride Products Dental prophylaxis 1.5 10.3% Magnesium Products Vitamin deficiency 1.2 7.8% Hematinic Products Vitamin deficiency 0.2 1.3% ICAR Products AG Vitamin deficiency 0.4 3.0% Senna Products Stool softener 0.1 0.8% Discontinued / Other Product N/A 4.1 27.7% Total Generic Net Sales $14.8 100.0% LTM (as of 9/30/2018) Generic Products Net Sales Generic Products

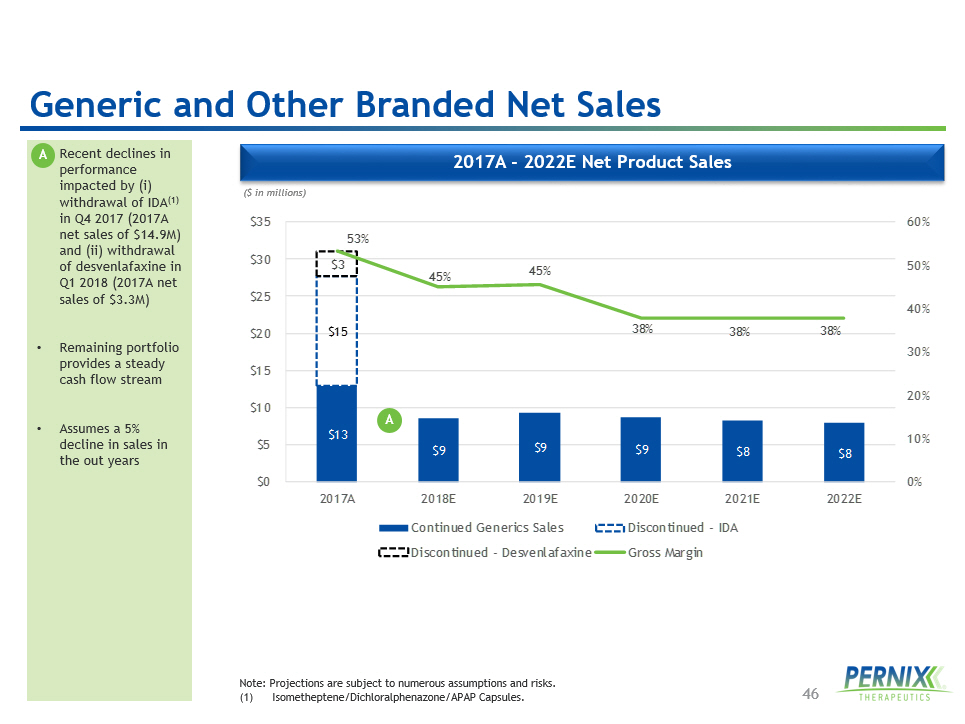

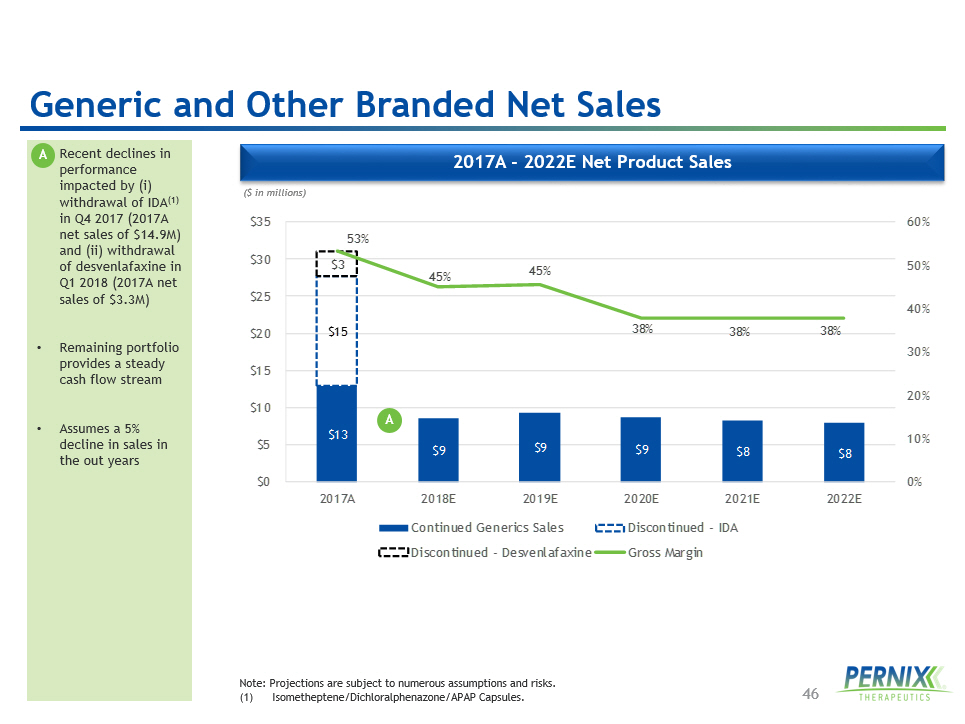

46 2017 A - 2022 E Net Product Sales • Recent declines in performance impacted by ( i ) withdrawal of IDA (1) in Q4 2017 (2017A net sales of $14.9M) and (ii) withdrawal of desvenlafaxine in Q1 2018 (2017A net sales of $3.3M) • Remaining portfolio provides a steady cash flow stream • Assumes a 5% decline in sales in the out years ($ in millions) Note: Projections are subject to numerous assumptions and risks. ( 1 ) Isometheptene /Dichloralphenazone/APAP Capsules. $13 $9 $9 $9 $8 $8 $15 $3 53% 45% 45% 38% 38% 38% 0% 10% 20% 30% 40% 50% 60% $0 $5 $10 $15 $20 $25 $30 $35 2017A 2018E 2019E 2020E 2021E 2022E Continued Generics Sales Discontinued - IDA Discontinued - Desvenlafaxine Gross Margin Generic and Other Branded Net Sales A A

Contrave ®

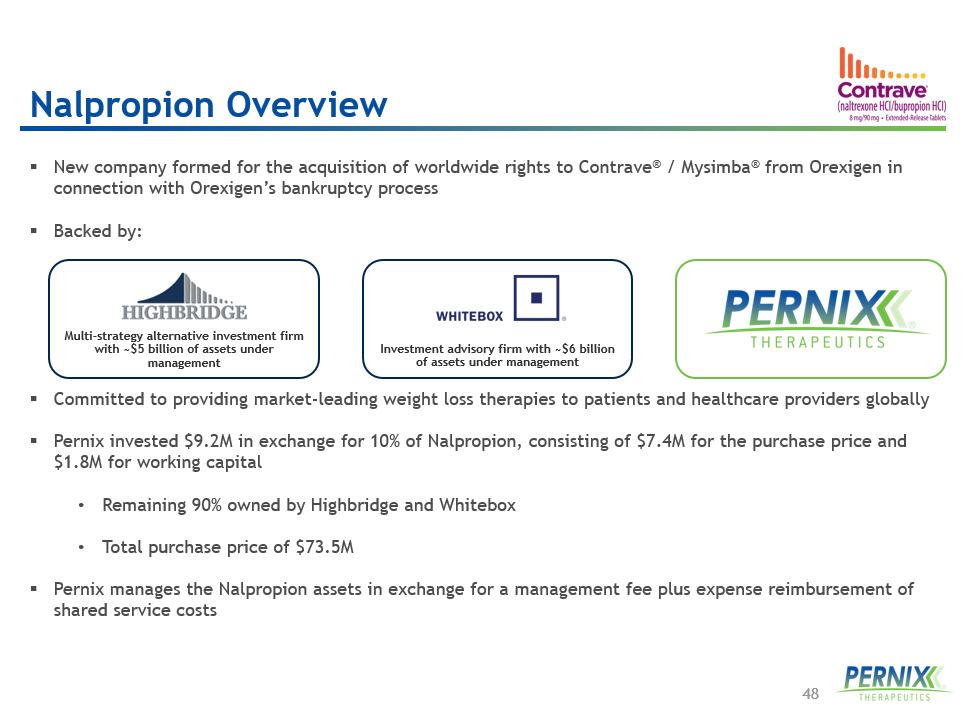

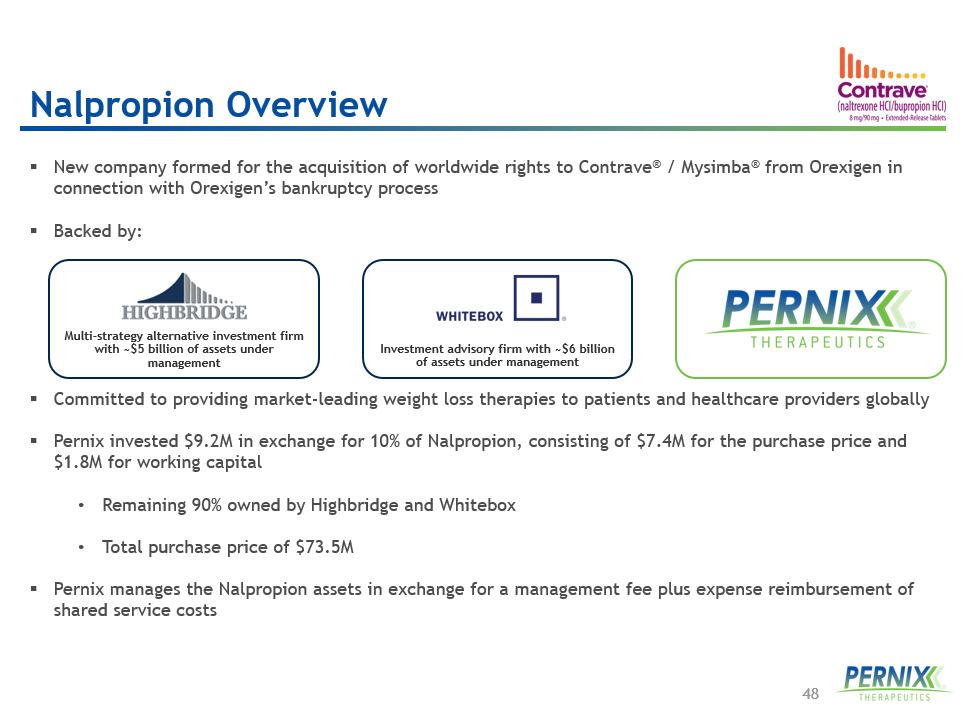

48 ▪ New company formed for the acquisition of worldwide rights to Contrave ® / Mysimba ® from Orexigen in connection with Orexigen’s bankruptcy process ▪ Backed by: ▪ Committed to providing market - leading weight loss therapies to patients and healthcare providers globally ▪ Pernix invested $9.2M in exchange for 10% of Nalpropion , consisting of $7.4M for the purchase price and $1.8M for working capital • Remaining 90% owned by Highbridge and Whitebox • Total purchase price of $73.5M ▪ Pernix manages the Nalpropion assets in exchange for a management fee plus expense reimbursement of shared service costs Multi - strategy alternative investment firm with ~$ 5 billion of assets under management Investment advisory firm with ~$6 billion of assets under management Nalpropion Overview

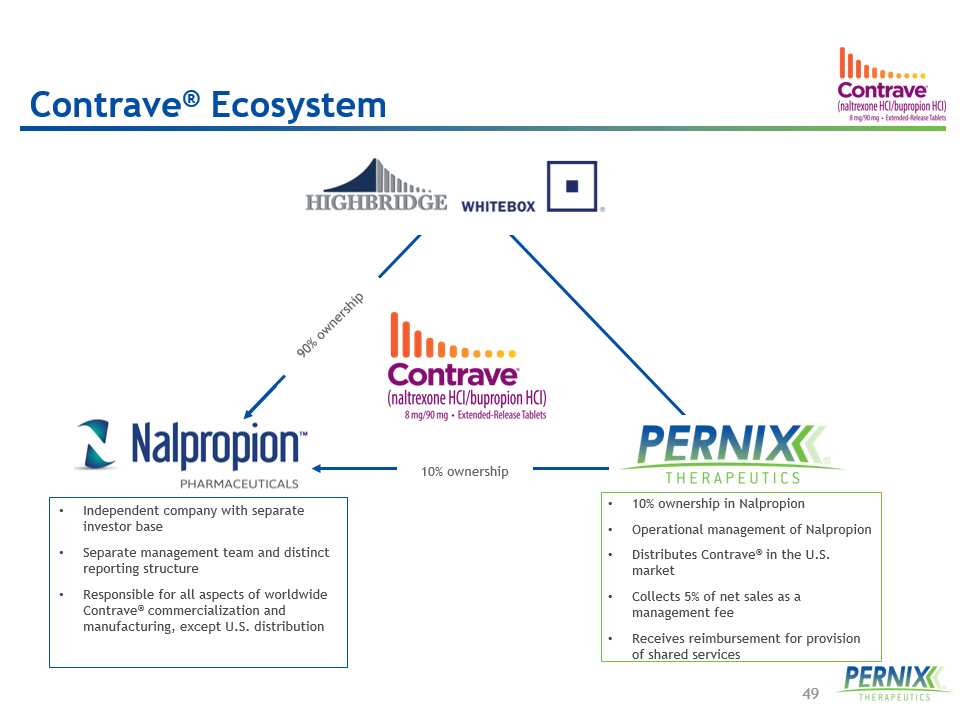

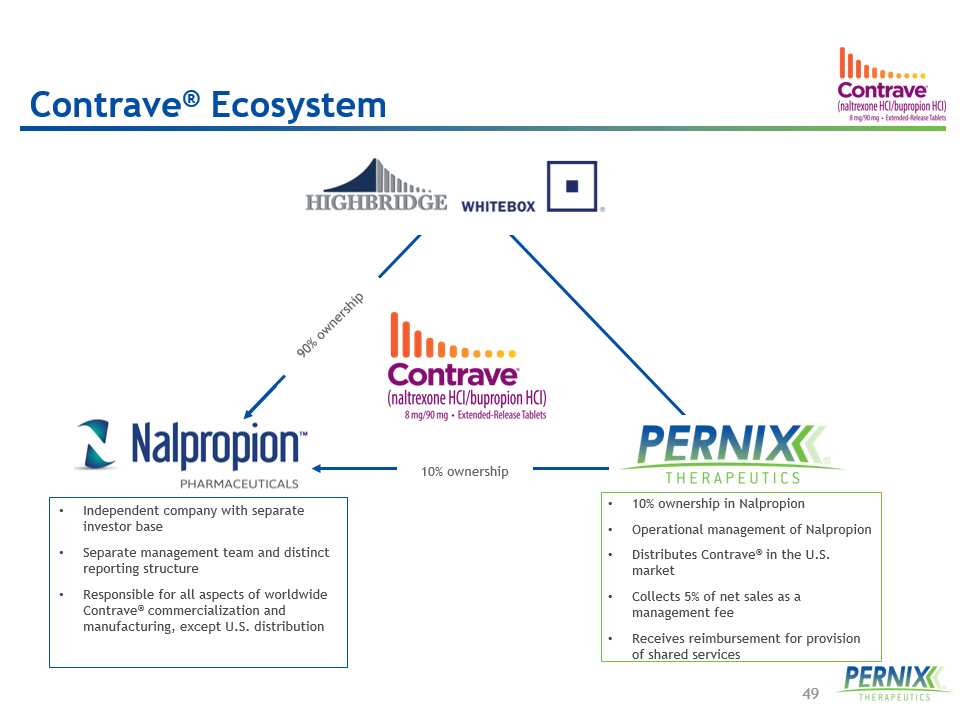

49 • Independent company with separate investor base • Separate management team and distinct reporting structure • Responsible for all aspects of worldwide Contrave ® commercialization and manufacturing, except U.S. distribution • 10% ownership in Nalpropion • Operational management of Nalpropion • Distributes Contrave ® in the U.S. market • Collects 5% of net sales as a management fee • Receives reimbursement for provision of shared services Contrave ® Ecosystem 10 % ownership

50 Progress Made Under New Ownership Inherited Challenges ▪ August / September U.S. net sales represented the best two months of 2018 ▪ Optimized cost structure driving improved profitability; positive EBITDA observed in August ▪ Significant improvements in net sales per TRx in the U.S. ▪ Multiple ongoing BD discussions focused on monetizing OUS territories ▪ Disruption from bankruptcy process ▪ Significantly bloated infrastructure and costs ▪ Orexigen’s lack of focus on key PBMs, resulting in certain 2019 exclusions ▪ Product recall initiated in August ▪ Declining revenue per TRx in the U.S. ▪ The acquisition of Contrave ® through Nalpropion demonstrates the success of deploying Pernix ’ s platform and management team to drive efficiencies and improved profitability Nalpropion / Contrave ® Momentum

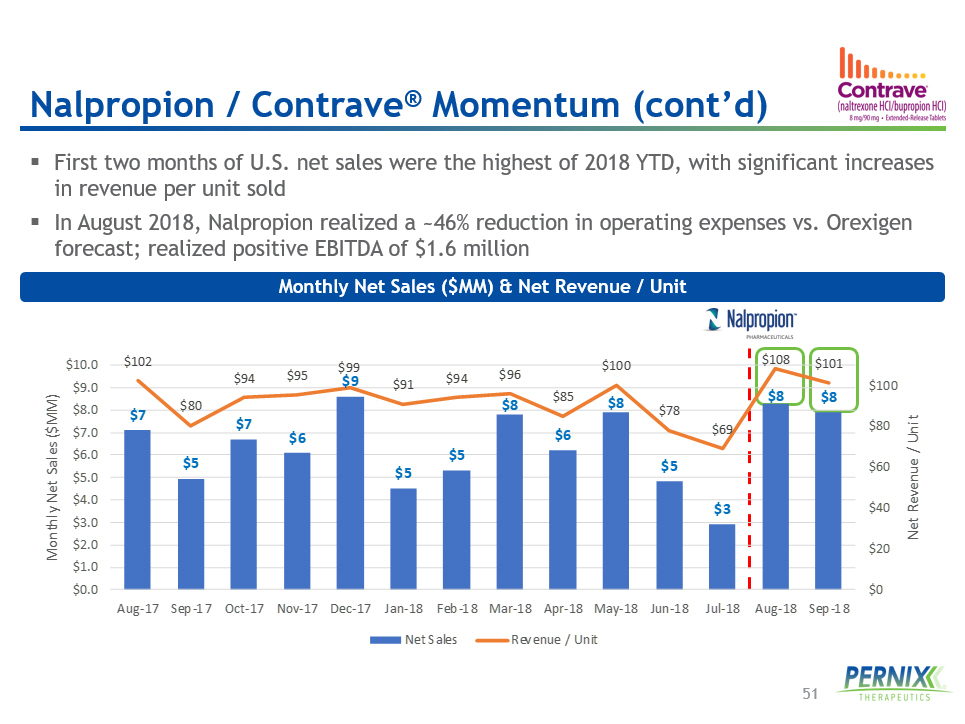

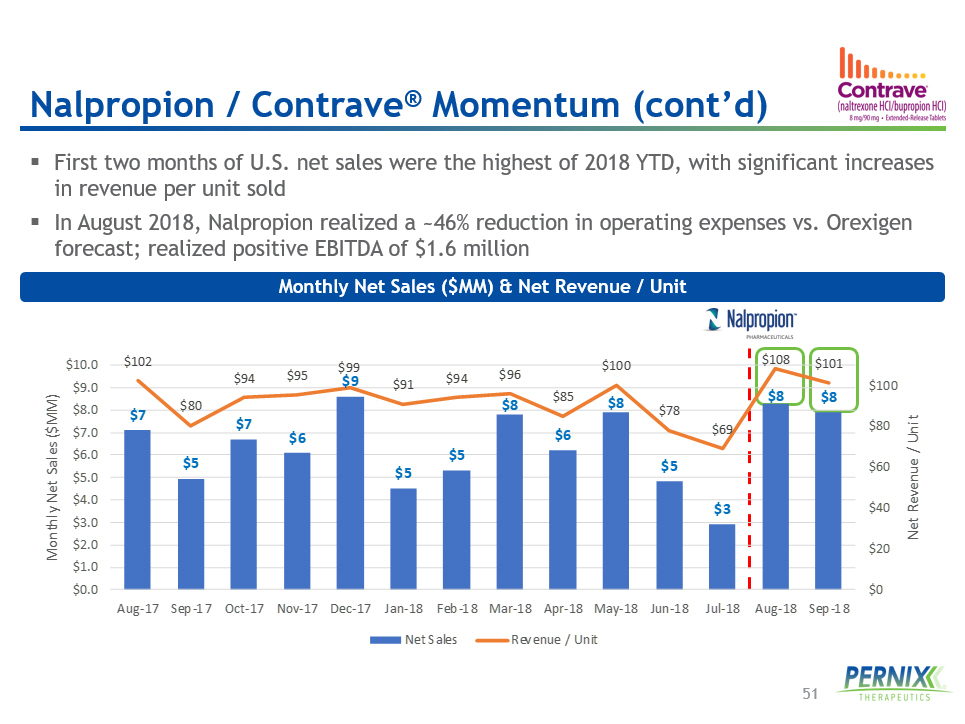

51 ▪ First two months of U.S. net sales were the highest of 2018 YTD, with significant increases in revenue per unit sold ▪ In August 2018 , Nalpropion realized a ~ 46 % reduction in operating expenses vs. Orexigen forecast; realized positive EBITDA of $ 1.6 million Monthly Net Sales ($MM) & Net Revenue / Unit Nalpropion / Contrave ® Momentum (cont’d) $7 $5 $7 $6 $9 $5 $5 $8 $6 $8 $5 $3 $8 $8 $102 $80 $94 $95 $99 $91 $94 $96 $85 $100 $78 $69 $108 $101 $0 $20 $40 $60 $80 $100 $0.0 $1.0 $2.0 $3.0 $4.0 $5.0 $6.0 $7.0 $8.0 $9.0 $10.0 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18 Sep-18 Net Revenue / Unit Monthly Net Sales ($MM) Net Sales Revenue / Unit

52 Weekly TRx (Jan 2016 to Nov 2018) Source: Symphony Health Integrated DataVerse (IDV). Recent TRx Trends 14,373 - 5,000 10,000 15,000 20,000 25,000 Jan-16 Mar-16 May-16 Jul-16 Sep-16 Nov-16 Jan-17 Mar-17 May-17 Jul-17 Sep-17 Nov-17 Jan-18 Mar-18 May-18 Jul-18 Sep-18 Nov-18 • March 15, 2016: Orexigen and Takeda announce termination of collaboration agreement for Contrave ® , pursuant to which Takeda no longer promotes Contrave ® • July 2016: Termination of collaboration agreement between Orexigen and Takeda effective • January 2017: Orexigen begins large investment in direct - to - consumer marketing campaign • March 12, 2018: Orexigen files for bankruptcy • July 30, 2018: Nalpropion acquires certain assets of Orexigen Therapeutics, including Contrave ® A B C A B C D D E E

Financial Summary

54 $163 $156 $146 $21 $15 $29 $0 $40 $80 $120 $160 $200 2015A 2016A 2017A Total Net Sales Adjusted EBITDA 2015A 2016A 2017A Net Sales Treximet (1) $89 $82 $68 Zohydro 17 25 24 Silenor 21 17 22 Other Products 37 32 31 Total Net Sales $163 $156 $146 Cost of Sales Treximet $21 $16 $19 Zohydro 4 7 6 Silenor 2 3 3 Other Products 17 15 14 Other 7 2 2 Total COGS $51 $43 $45 Selling Expense $40 $42 $35 Marketing Expense 22 14 12 G&A Expense 36 43 30 R&D Expense 8 6 1 D&A 95 86 73 Other Operating Expenses 24 47 7 Total Operating Expense $226 $238 $158 Loss From Operations ($114) ($125) ($56) Adjusted EBITDA $21 $15 $29 Non - GAAP Annual Financials Historical Revenue and Adj. EBITDA • Acquisitions of Treximet ® (Aug. 2014) and Zohydro ® ER with BeadTek ® (Apr. 2015) drove strong performance historically, but a challenging managed care environment negatively impacted gross - to - nets and the trajectory of those products • Net revenues in 2016 included a $15.3M reduction as a result of the unfavorable arbitration ruling in Pernix’s Treximet ® rebate dispute with GSK • In July 2016, the Company announced a restructuring of its sales force, resulting in a reduction of 54 positions primarily focused on the Treximet ® franchise – the realigned cost structure contributed to higher Adj. EBITDA in 2017 vs. 2016 ($ in millions) Historical Annual Financials A B A B 1 ) Treximet ® sales adjusted for GSK settlement (adjusted net sales by ($ 12.5 M) and $ 15.3 M in 2015 and 2016 , respectively).

55 4Q 2017 1Q 2018 2Q 2018 3Q 2018 LTM (1) Sales Treximet $18 $14 $5 $6 $42 Zohydro ER 6 7 8 7 28 Silenor 7 5 6 6 24 Other 11 2 2 3 17 Total Net Sales $42 $28 $21 $21 $112 COGS (14) (9) (6) (6) (35) Operating Expenses (53) (28) (20) (17) (118) EBIT ($25) ($9) ($4) ($2) ($40) Adjusted EBITDA $12 $3 ($0) ($0) $15 Non - GAAP Detailed 2018 Quarterly Results ( 2 ) Non - GAAP 2018 Quarterly Results • Revenue declines predominately attributable to Treximet ® LOE in February 2018 • Generic / Other revenue declined on account of the withdrawal of IDA and desvenlafaxine, which collectively accounted for $18.2M of revenue in 2017 • Operating expenses reduced in order to right - size the Company’s cost structure $42 $28 $21 $21 $12 $3 ($0) ($5) $5 $15 $25 $35 $45 4Q 2017 1Q 2018 2Q 2018 3Q 2018 Total Net Sales Adjusted EBITDA ($0) ($ in millions) 1) LTM as of 9/30/2018. 2) Excludes impact of Contrave ® . LTM (1) Quarterly Results A B C A B C

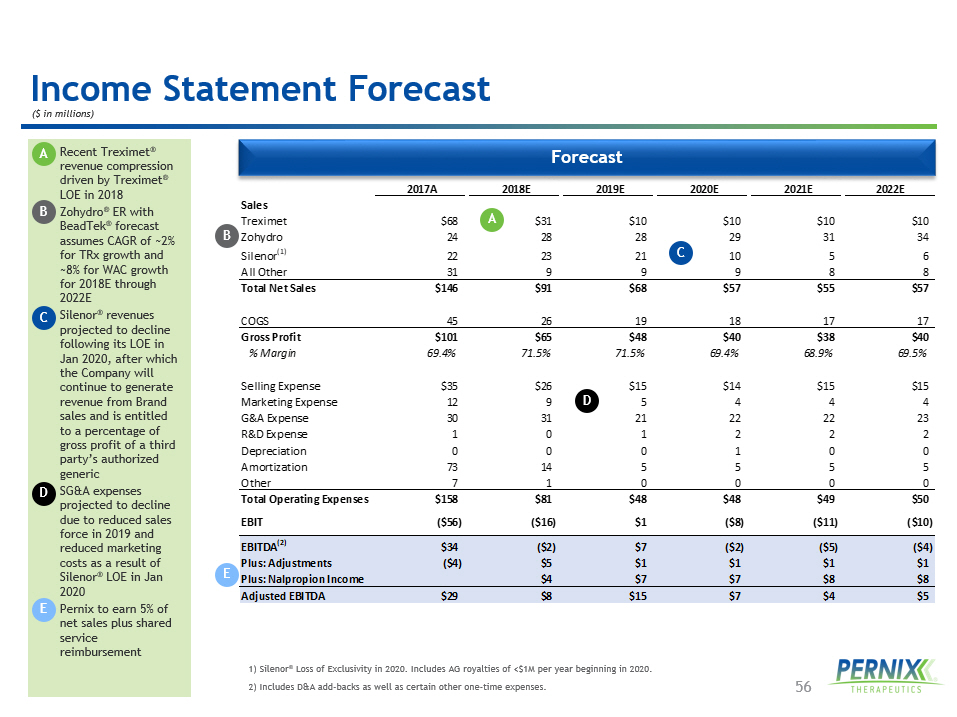

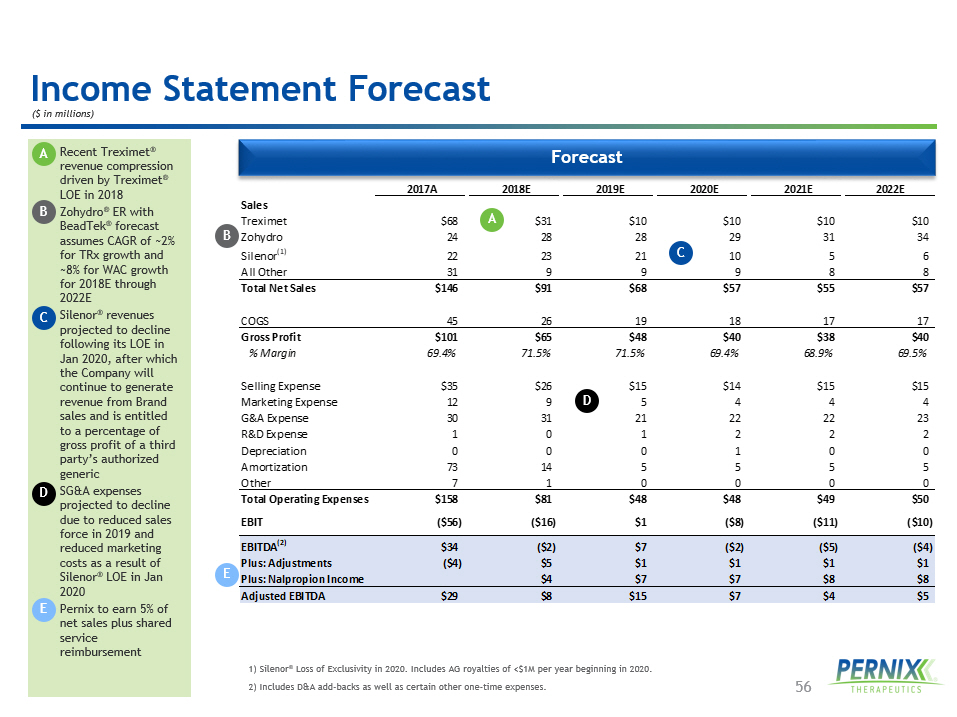

56 2017A 2018E 2019E 2020E 2021E 2022E Sales Treximet $68 $31 $10 $10 $10 $10 Zohydro 24 28 28 29 31 34 Silenor (1) 22 23 21 10 5 6 All Other 31 9 9 9 8 8 Total Net Sales $146 $91 $68 $57 $55 $57 COGS 45 26 19 18 17 17 Gross Profit $101 $65 $48 $40 $38 $40 % Margin 69.4% 71.5% 71.5% 69.4% 68.9% 69.5% Selling Expense $35 $26 $15 $14 $15 $15 Marketing Expense 12 9 5 4 4 4 G&A Expense 30 31 21 22 22 23 R&D Expense 1 0 1 2 2 2 Depreciation 0 0 0 1 0 0 Amortization 73 14 5 5 5 5 Other 7 1 0 0 0 0 Total Operating Expenses $158 $81 $48 $48 $49 $50 EBIT ($56) ($16) $1 ($8) ($11) ($10) EBITDA (2) $34 ($2) $7 ($2) ($5) ($4) Plus: Adjustments ($4) $5 $1 $1 $1 $1 Plus: Nalpropion Income $4 $7 $7 $8 $8 Adjusted EBITDA $29 $8 $15 $7 $4 $5 Forecast • Recent Treximet ® revenue compression driven by Treximet ® LOE in 2018 • Zohydro ® ER with BeadTek ® forecast assumes CAGR of ~ 2 % for TRx growth and ~ 8 % for WAC growth for 2018 E through 2022 E • Silenor ® revenues projected to decline following its LOE in Jan 2020 , after which the Company will continue to generate revenue from Brand sales and is entitled to a percentage of gross profit of a third party ’ s authorized generic • SG&A expenses projected to decline due to reduced sales force in 2019 and reduced marketing costs as a result of Silenor ® LOE in Jan 2020 • Pernix to earn 5 % of net sales plus shared service reimbursement 1) Silenor ® Loss of Exclusivity in 2020. Includes AG royalties of <$1M per year beginning in 2020. 2) Includes D&A add - backs as well as certain other one - time expenses. Income Statement Forecast ($ in millions) A B C D E A B C E D