UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ý

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material Pursuant to 240.14a-12

PERNIX THERAPEUTICS HOLDINGS, INC.

__________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

ý No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

______________________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

______________________________________________________________________________________

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

______________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

______________________________________________________________________________________

(5) Total fee paid:

______________________________________________________________________________________

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

______________________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

______________________________________________________________________________________

(3) Filing Party:

______________________________________________________________________________________

(4) Date Filed:

______________________________________________________________________________________

PERNIX THERAPEUTICS HOLDINGS, INC.

10 North Park Place, Suite 201

Morristown, New Jersey 07960

September 27, 2017

To Our Stockholders:

You are cordially invited to join us at our 2017 Annual Meeting of Stockholders, or the 2017 Annual Meeting,to be held at the Hyatt Morristown at Headquarters Plaza, 3 Speedwell Avenue, Morristown, New Jersey 07960, on November 15, 2017 at 9:30 a.m., local time. For directions to attend the meeting and vote in person, please visit our proxy website at https://www.investorvote.com/PTX.

The attached Notice of Annual Meeting and Proxy Statement describe the matters proposed byourBoard of Directors to be considered and voted upon by our stockholders at the 2017 Annual Meeting.

Once again, we are taking advantage of the Securities and Exchange Commission's Notice and Access proxy rule, which allows companies to furnish proxy materials via the Internet as an alternative to the traditional approach of mailing a printed set to each stockholder. We believe this approach provides you, as our stockholders, the proxy materials you need while reducing printing and postage costs associated with delivery and reducing the environmental impact of our2017Annual Meeting. In accordance with these rules, we have sent a Notice of Internet Availability of Proxy Materials to those stockholders who have not previously elected to receive a printed set of proxy materials. The Notice contains instructions on how to access our Proxy Statement and Annual Report to Stockholders, as well as how to vote online, by telephone, or in person at the 2017 Annual Meeting.

Your vote is important. Whether you own relatively few or a large number of shares of our stock, it is important that your shares be represented and voted at the2017Annual Meeting. Please vote your shares online or by telephone or, if you received a printed set of proxy materials by mail, by returning the accompanying proxy card. Further instructions on how to vote your shares can be found in our Proxy Statement.

Thank you for your support of our company.

Sincerely,

John Sedor

Chairman of the Board and

Chief Executive Officer

PERNIX THERAPEUTICS HOLDINGS, INC.

10 North Park Place, Suite 201

Morristown, New Jersey 07960

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 2017 Annual Meeting of the Stockholders of Pernix Therapeutics Holdings, Inc., a Maryland corporation (hereinafter, "we," "us," and the "Company"), will be held at the Hyatt Morristown at Headquarters Plaza, 3 Speedwell Avenue, Morristown, New Jersey 07960, on November 15, 2017 at 9:30 a.m., local time, to vote upon the following matters:

- to elect five directors for a term of one year;

- to approve thePernix Therapeutics Holdings, Inc.2017 Omnibus Incentive Plan;

- to approve, on an advisory basis, our executive compensation as disclosed in the attached proxy statement;

- to ratify the selection of Cherry Bekaert L.L.P. asourindependent registered public accounting firm for the fiscal year ending December 31, 2017; and

- to transact such other business as may properly come before the meeting or any postponement or adjournment thereof.

Only stockholders of record at the close of business on September 25, 2017 are entitled to notice of, and to vote at, the 2017 Annual Meeting.

Once again, instead of mailing a printed copy of our proxy materials (including our annual report) to each stockholder of record, we have decided to provide access to these materials via the Internet. This delivery method reduces the amount of paper necessary to produce these materials, as well as the costs associated with printing and mailing these materials to all stockholders. Accordingly, on October 2, 2017, we began mailing a Notice of Internet Availability of Proxy Materials (the "Notice") to all stockholders of record as of September 25, 2017 and posted our proxy materials on our website as described in the Notice. As explained in greater detail in the Notice, all stockholders may access our proxy materials on our website or may request a printed set of our proxy materials. In addition, the Notice and website provide information on how to request to receive all future proxy materials in printed form or electronically.

Your vote is important. If you are unable to attend in person and wish to have your shares voted, please vote as soon as possible, whether online, by telephone, or by returning a proxy card sent to you in response to your request for printed proxy materials.

By Order of the Board of Directors

John Sedor

Chairman of the Board and

Chief Executive Officer

Morristown, New Jersey

September 27, 2017

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY OF OUR PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON NOVEMBER 15, 2017.

This proxy statement is available at https://www.investorvote.com/PTX

PERNIX THERAPEUTICS HOLDINGS, INC.

10 North Park Place, Suite 201

Morristown, New Jersey 07960

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS,

THE ANNUAL MEETING AND VOTING

Q: | Why am I receiving these proxy materials? |

A: | You are receiving these proxy materials because you owned shares of common stock of our company, Pernix Therapeutics Holdings, Inc., or we, us, andthe Company, at the close of business on September 25, 2017, and, therefore, are eligible to vote atour2017 annual meeting of stockholders, orthe2017Annual Meeting. Our board of directors, orthe Board,is soliciting your proxy to vote at the2017Annual Meeting. |

Q: | Why did I receive the one-page Notice of Internet Availability of Proxy Materials? |

A: | Since we are providing proxy materials to you primarily online, instead of mailing printed copies to each owner of our common stock, you received a one-page Notice of Internet Availability of ProxyMaterials, orthe Notice. The Notice was mailed to stockholders beginning October 2, 2017 and it directs you to a website where you can view our proxy materials, including this proxy statement and our annual report. If you would like to obtain a paper copy of the proxy materials, including our annual report, please follow the instructions on the Notice. |

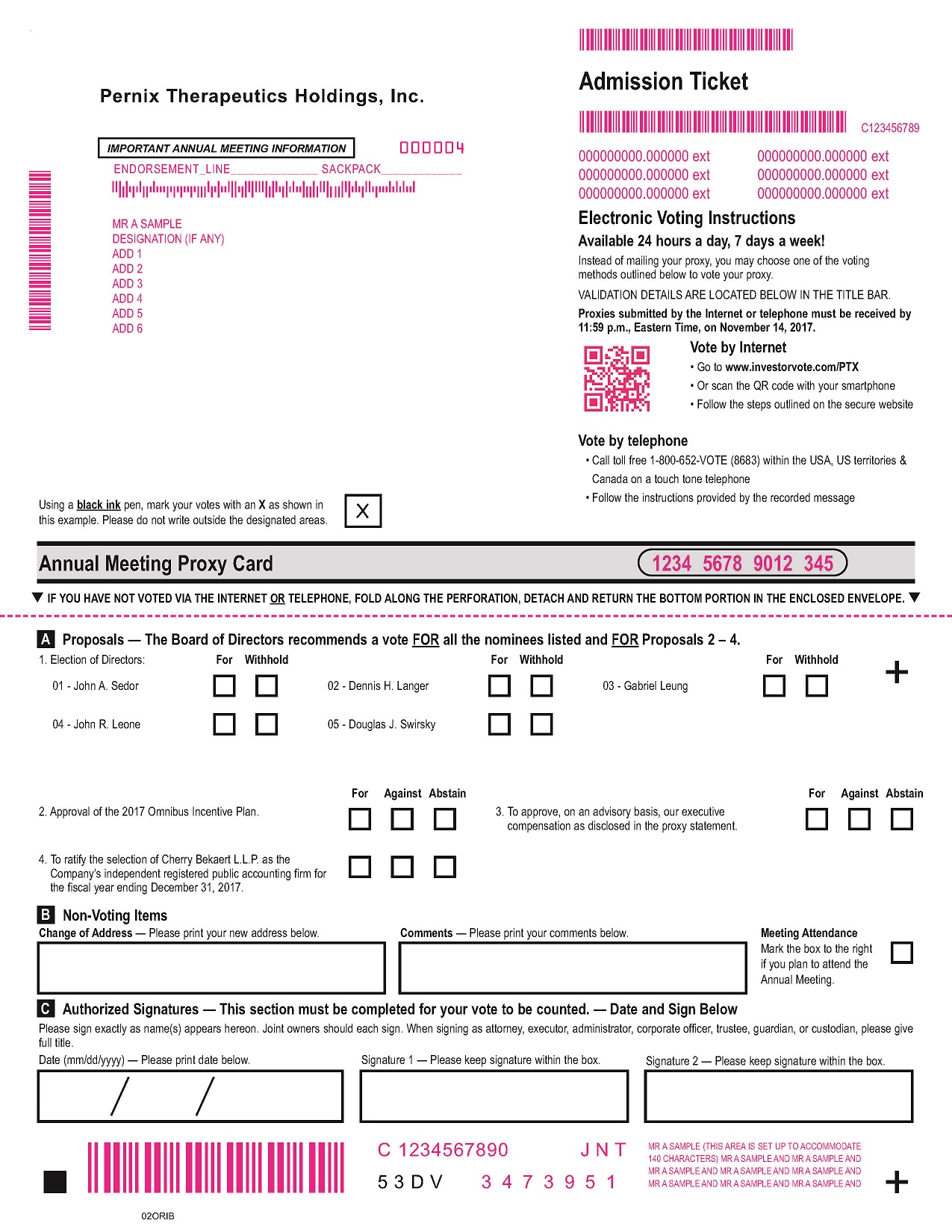

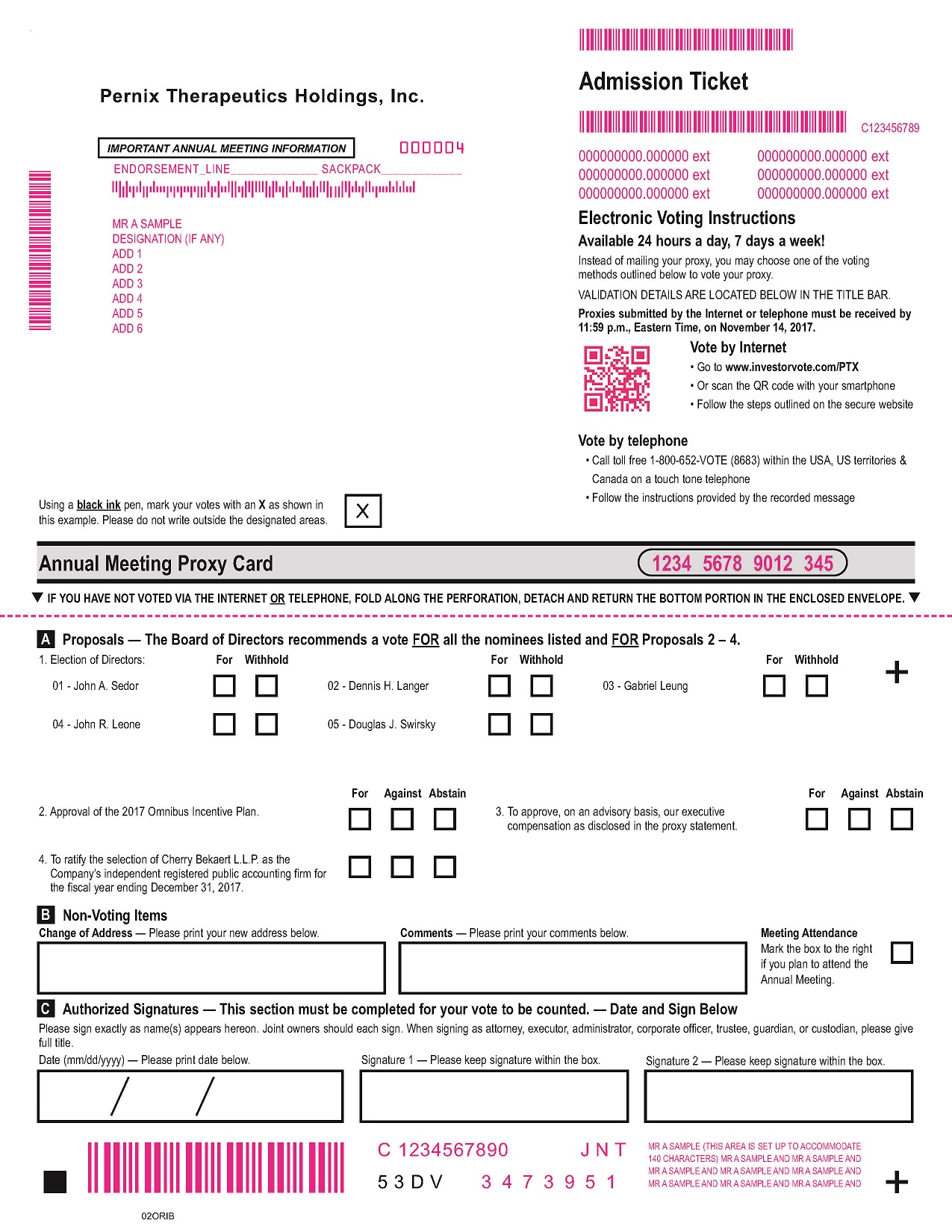

Q: | On what matters will I be voting? |

A: | At the2017Annual Meeting, our stockholders will be asked (1) to elect five directors to each serve a one-year term; (2) to approve thePernix Therapeutics Holdings, Inc.2017 Omnibus Incentive Plan; (3) to approve, on an advisory basis, our executive compensation as disclosed in this proxy statement (the "say-on-pay" vote); and (4) to ratify the appointment of Cherry Bekaert L.L.P.,as ourindependent registered public accounting firm for the fiscal year ending December 31, 2017. |

Q: | Could other matters be considered and voted upon at the2017Annual Meeting? |

A: | Our Board does not expect to bring any other matter before the2017Annual Meeting and is not aware of any other matter that may be considered at the2017Annual Meeting. In addition, pursuant to our bylaws, the time has elapsed for any stockholder to properly bring a matter before the2017Annual Meeting. However, if any other matter does properly come before the2017Annual Meeting, the proxy holders will vote the proxies as the Board may recommend. |

Q: | Where and when will the2017Annual Meeting be held? |

A: | The2017Annual Meeting will be held at the Hyatt Morristown at Headquarters Plaza, 3 Speedwell Avenue, Morristown, New Jersey 07960, on November 15, 2017 at 9:30 a.m., local time. |

Q: | How can I obtain directions to the2017Annual Meeting? |

A: | For directions to the location of our 2017 Annual Meeting, please visit our proxy website at https://www.investorvote.com/PTX. |

Q: | Who is soliciting my proxy? |

A: | Our Board is soliciting your proxy to vote at the2017Annual Meeting. By completing and returning a proxy card, you are authorizing the proxy holder to vote your shares at the2017Annual Meeting as you have instructed. |

Q: | How many votes may I cast? |

A: | Each holder of common stock is entitled to one vote, in person or by proxy, for each share of our common stock held of record on the record date. |

Q: | How many votes can be cast by all stockholders? |

A: | Our common stock is the only class of security outstanding and entitled to vote at the2017Annual Meeting. As of the record date, we had 11,532,423 shares of common stock outstanding, each of which is entitled to one vote. |

Q: | How many shares must be present to hold the2017Annual Meeting? |

A: | Our bylaws provide that 50% ofallthevotes entitled to be cast at the 2017 Annual Meetingconstitutes a quorum and must be present in person or by proxy to conduct a meeting of our stockholders. |

Q: | What is the difference between holding shares as a stockholder of record and as a beneficial owner? |

A: | If your shares are registered directly in your name with our transfer agent, Computershare, you are considered, with respect to those shares, the "stockholder of record." The Notice has been directly sent to you by us. |

| If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the "beneficial owner" of shares held in "street name." The Notice has been forwarded to you by your broker, bank, or nominee who is considered, with respect to those shares, the stockholder of record. If you are a beneficial owner, you have the right to direct your broker, bank, or nominee how to vote your shares by following the instructions that they have included with these proxy materials. |

Q: | How do I vote? |

A: | You may vote using any of the following methods: |

| - In person at the Annual Meeting: You may vote in person at the2017Annual Meeting, either by attending the2017Annual Meeting yourself or authorizing a representative to attend the2017Annual Meeting on your behalf. You may also execute a proper proxy designating that person. If you are a beneficial owner of shares held in street name, you must obtain a proxy from your broker, bank, or nominee naming you as the proxy holder and present it to the inspectors of election with your ballot when you vote at the2017Annual Meeting.

|

| - Other ways to vote: You may also vote online or by telephone as instructed on the Notice, or by returning a proxy card or voting instruction form sent to you in response to your request for printed proxy materials.

|

Q: | Once I deliver my proxy, can I revoke or change my vote? |

A: | Yes. You may revoke or change your proxy at any time before it is voted by giving a written revocation notice to our corporate secretary, by delivering timely a proxy with a later date, or by voting in person at the2017Annual Meeting. |

Q: | Can my shares be voted if I do not return the proxy card and do not attend the2017Annual Meeting in person? |

A: | If you are a stockholder of record and do not vote the shares held in your name, your shares will not be voted. However,wemay vote your shares if you have returned a blank or incomplete proxy card (see "What happens if I return a proxy card without instructions?" below regarding record holders). |

| - If you are the beneficial owner of shares held in street name and you do not provide voting instructions to your broker, bank, or nominee, your shares will not be voted on any proposal for which your broker does not have discretionary authority to vote, ora "broker non-vote. Brokers generally have discretionary authority to vote shares held in street name on "routine" matters but not on "non-routine" matters. The proposal to ratify the appointment ofourindependentregistered public accounting firm isconsidered a "routine" matter, while each of theproposalsto elect directors,to approve the 2017 Omnibus Incentive Plan and to approvethe say-on-pay vote, is a "non-routine" matter.

|

Q: | What happens if I submit a proxy without voting instructions? |

A: | - Record holders : If you are a stockholder of record and return a proxy card without voting instructions, your shares will be voted (1) FOR each of the five director nominees, (2) FOR approval of thePernix Therapeutics Holdings, Inc.2017 Omnibus Incentive Plan; (3) FOR approval of our executive compensation as disclosed in this proxy statement and (4) FOR the ratification of the appointment of Cherry Bekaert L.L.P. as our independentregistered public accounting firmfor the fiscal year ending December 31, 2017.

|

| - Street holders : If you are a beneficial owner of shares and do not give voting instructions to your broker, bank, or nominee, they will only be entitled to vote your shares with respect to "routine" items, such as the proposal to ratify the appointment ofourindependentregistered public accounting firm.

|

Q: | What are my voting options for each proposal? How does the Board of Directors recommend that I vote? How many votes are required to approve each proposal? How are votes counted? |

A: | The following chart explains what your voting options are with regard to each matter proposed in this proxy statement, how our Board recommends that you vote, and what vote is required for that proposal to be approved: |

Proposal | | Your Voting Options | | Recommendation of the Board of Directors | | Vote Required for Approval |

Election of Directors | | You may vote "FOR" all nominees, "AGAINST" all nominees, or "FOR" all but one or more nominees. | | The Board recommends you vote "FOR" allfivenominees. | | Affirmative vote of a majorityof the votes cast |

| | | | | | |

Approval of 2017 Omnibus Incentive Plan | | You may vote "FOR" or "AGAINST" this proposal or you may "ABSTAIN" from voting. | | The Board recommends that you vote "FOR" the approval of the2017Omnibus Incentive Plan | | Affirmative vote of a majority of the votes cast |

Proposal | | Your Voting Options | | Recommendation of the Board of Directors | | Vote Required for Approval |

| | | | | | |

Say-on-Pay (advisory) | | You may vote "FOR" or "AGAINST" this proposal or you may "ABSTAIN" from voting. | | The Board recommends that you vote "FOR" the approval, on an advisory basis, of the compensation of our named executive officers as disclosed in this proxy statement. | | Affirmative vote of a majority of the votes cast |

| | | | | | |

Ratification of Selection of Auditors for2017 | | You may vote "FOR" or "AGAINST" this proposal or you may "ABSTAIN" from voting. | | The Board recommends that you vote "FOR" ratification of our selection of Cherry Bekaert L.L.P. as our independent registered public accounting firm for2017. | | Affirmative vote of a majority of the votes cast |

| - Any Other Matters . Anyother matters coming before the 2017 Annual Meeting will be decided by the affirmative vote of a majority of the votes cast, except as otherwise provided by statute, regulation, or our articles of incorporation or bylaws.

|

Q: | What effect do abstentions and broker non-votes have on each proposal? |

A: | Abstentions occur when you or your broker marks "ABSTAIN" on a proxy card. Broker non-votes occur when brokers do not receive voting instructions from their customers and do not have discretionary voting authority with respect to a proposal. If you hold shares through a broker, bank or other nominee and you do not give instructions as to how to vote, your broker may have discretionary authority to vote your shares on certain routine items but not on other items. In the case of an uncontested election, our bylaws require that each director be elected by the vote of a majority of the votes cast with respect to that director's election by holders of shares present in person or represented by proxy at the 2017 Annual Meeting. For this purpose, a "majority of the votes cast" means that the number of votes cast "FOR" a director's election exceeds the number of votes cast "AGAINST" that director's election, with abstentions and broker non-votes not counted as a vote cast either "FOR" or "AGAINST."In the case of a contested election (i.e., an election in which the number of candidates exceeds the number of directors to be elected), directors will be elected by plurality vote. For this election, the election of directors at the 2017 Annual Meeting is uncontested, meaning that the nominees will be elected by a majority of the votes cast, as described above. |

| Approval of proposals 2 and 3 each require the affirmative vote of a majority of the total votes cast by holders of shares present in person or represented by proxy at the 2017 Annual Meeting and entitled to vote on these proposals, with abstentions and broker non-votes not counted as a vote cast either "FOR" or "AGAINST." Proposal No. 4 also requires the affirmative vote of a majority of the total votes cast by holders of shares present in person or represented by proxy at the 2017 Annual Meeting and entitled to vote on the proposal but is considered a "routine" matter. Therefore, a broker, bank, trustee or other nominee will be permitted to exercise its discretion on that proposal so there will be no broker non-votes with respect to Proposal No. 4. Abstentions will not be counted as a vote cast either "FOR" or "AGAINST" Proposed No. 4. |

Q: | What happens if a director nominee does not receive a majority of the votes cast with respect to that director nominee's election? |

A: | If a nominee for director who is an incumbent director is not elected and no successor has been elected at the meeting, the director will promptly tender his or her resignation to the Board. Our Nominating and Corporate Committee will recommend to the Board whether to accept the tendered resignation or whether other actions should be taken. The Board will then act on the tendered resignation, taking into account the Nominating and Corporate Governance Committee's recommendation, and publicly disclose its decision by press release and a Form 8-K filed with the Securities and Exchange Commission, or the SEC, (or other broadly disseminated means of communication) within 90 days from the date of certification of election results. The Board and Nominating and Corporate Governance Committee, in making such a determination and recommendation, may consider any factors or information as they considered appropriate and relevant. If a director's resignation is not accepted by the Board, such director will continue to serve until the next annual meeting of stockholders and until his or her successor is duly elected and qualified or until such director's earlier death, resignation, or removal. If a director's resignation is accepted by the Board, or if a nominee for director is not elected and the nominee is not an incumbent director, the Board, in its sole discretion, may either (i) fill a vacancy resulting from a failure to receive a majority vote pursuant to our bylaws or (ii) decrease the size of the Board to eliminate the vacancy. |

Q: | What happens if one or both of the non-incumbent director nominees does not receive a majority of the votes cast with respect to that director nominee's election? |

A: | At the recommendation of our Nominating and Corporate Governance Committee, our Board has nominated Douglas J. Swirsky to replace Mr. Konidaris on the Board and John R. Leone to replace Dr. Miao on the Board. If Mr. Swirsky receives a majority of the votes cast with respect to his election but Mr. Leone does not, then Mr. Swirsky will be elected to the Board to replace Mr. Konidaris, but Mr. Leone will not be elected to the Board and Dr. Miao will continue on the Board as a director until his successor is elected and qualified. If Mr. Leone receives a majority of the votes cast with respect to his election but Mr. Swirsky does not, then Mr. Leone will be elected to the Board to replace Dr. Miao, but Mr. Swirsky will not be elected to the Board and Mr. Konidaris will continue on the Board as a director until his successor is elected and qualified. If neither of Messrs. Swirsky or Leone receives a majority of the votes cast with respect to his election, then neither will be elected as a member of the Board and each of Dr. Miao and Mr. Konidaris will continue on the Board as a director until each person's successor is elected and qualified. |

Q: | Who pays for soliciting proxies? |

A: | We are paying for all costs of soliciting proxies. Our directors, officers, and employees may request the return of proxies by mail, telephoneor online. We are also requesting that banks, brokerage houses, and other nominees or fiduciaries forward the soliciting material to their principals and that they obtain authorization for the execution of proxies. We will reimburse them for their expenses. |

Q: | What happens if the2017Annual Meeting is postponed or adjourned? |

A: | Your proxy will still be good and may be voted at the postponed or adjourned meeting. You will still be able to change or revoke your proxy at any time until it is voted. |

Q: | How can stockholders present proposals for inclusion in our proxy materials relating to our 2018 annual meeting? |

A: | Any stockholder who wishes to present a proposal for inclusion in our proxy materials relating to our 2018 annual meeting must give us notice in advance of the meeting in accordance with Rule 14a-8(e) as promulgated by the Securities and Exchange Commission, orthe SEC,under the Securities Exchange Act of 1934, as amended, orthe Exchange Act. This rule requires that notice must be received by our corporate secretary at our principal executive offices no later thanJune 4, 2018, although this date will change if the date of our2018annual meeting is 30 calendar days earlier or later thanNovember 15, 2018.We currently expect our 2018 annual meeting to be held more than 30 calendar days prior to the one year anniversary of the 2017 Annual Meeting. Consequently, the deadline for submitting stockholders proposals is a reasonable time before we begin to print and send our proxy materials for the 2018 annual meeting of stockholders. Our principal executive offices are located at 10 North Park Place, Suite 201, Morristown, New Jersey 07960. In addition, under our bylaws, any director nominee or proposal for consideration at the 2018 Annual Meeting submitted by a stockholder other than pursuant to Rule 14a-8 will be considered timely if such proposal or director nomination is received by our Corporate Secretary at our principal executive offices within the time periods set forth in our bylaws. If the 2018 Annual Meeting is held on a date no more than 30 days before or 60 days after November 15, 2018, the anniversary date of the 2017 Annual Meeting, then a stockholder proposal or director nominee must be received no earlier than July 18, 2018 and no later than August 17, 2018. As we currently expect our 2018 annual meeting to be held more than 30 calendar days prior to the one year anniversary of the 2017 Annual Meeting, our bylaws require any such proposals or director nominees must be received no earlier than 120 days prior to the actual meeting date of the 2018 Annual Meeting and no later than the close of business on the later of the 90th day prior to the actual meeting date of the 2018 Annual Meeting or the 20th day following the date on which public announcement of the date of the 2018 Annual Meeting is first made. These same deadlines would apply if the 2018 Annual Meeting is held on a date more than 60 days after the one year anniversary of the 2017 Annual Meeting. |

All stockholder proposals and recommendations for nomination for director must comply with Article III of our bylaws in order to be eligible for consideration at a stockholders' meeting. Any individual recommended by a stockholder as a candidate for director must satisfy the director qualification requirements contained in Article IV of our bylaws in order to serve as a member of our Board.

Stockholders should refer to the bylaws for a complete description of the requirements. Our bylaws are filed with the SEC and also may be obtained as described under "Investors -Corporate Governance - Documents and Charters."

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act, as amended, requires our directors and officers, and persons who own more than ten percent of our common stock, to file initial reports of ownership and changes in ownership with the SEC. Directors and officers and stockholders owning more than ten percent of our common stock are required by the SEC to furnish us with copies of all reports filed pursuant to Section 16(a).

Based on our review of Section 16(a) reports filed by or on behalf of our directors, officers, and stockholders owning greater than ten percent of our common stock, or written representations that no filings were required, we believe that all such required reports were filed on a timely basis during fiscal year 2016.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as ofSeptember 25, 2017, by:

- our named executive officers;

- each of our directors/director nominees;

- all of our current directors and executive officers as a group; and

- each stockholder known by us to own beneficially more than five percent of our common stock.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. Shares of common stock that may be acquired by an individual or group within 60 days ofSeptember 25, 2017, pursuant to derivative securities, such as options, warrants or restricted stock units, are deemed to be outstanding for the purpose of computing the percentage ownership of such individual or group, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Percentage of ownership is based on an aggregate of11,532,423shares of common stock outstanding as ofSeptember 25, 2017.

Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them, based on information provided to us by such stockholders. Unless otherwise indicated, the address for each director and executive officer is: c/o Pernix Therapeutics Holdings, Inc., 10 North Park Place, Suite 201, Morristown, NJ 07960.

| | Number of Shares of Common Stock | Percentage of Common Stock |

Beneficial Owner | | Beneficially Owned | | Beneficially Owned |

John Sedor (1) | | 103,990 | | * |

Graham Miao (1) | | 45,368 | | * |

Tasos G. Konidaris (1) | | 6,000 | | * |

Kenneth Pina | | - | | * |

Gabriel Leung | | 1,000 | | * |

Dennis H. Langer | | 1,000 | | * |

Douglas J. Swirsky | | - | | * |

John R. Leone | | - | | * |

All current executive officers and directors | | 157,358 | | 1.36% |

as a group (6 persons) (1) | | | | |

Five Percent Stockholders | | | | |

Renaissance Technologies, LLC (2) | | 692,950 | | 6.01% |

*Represents beneficial ownership of less than 1% of the shares of common stock.

- Consists of options to purchase shares of common stock that are either currently exercisable or are exercisable within 60 days ofSeptember 25, 2017.

- Based on a joint Schedule 13G filed with the SEC on February 14, 2017 by the following (a) Renaissance Technologies LLC, or RTC,which has sole voting and dispositive power of 692,950 shares and (b) Renaissance Technologies Holding Corporation which has sole voting and dispositive power of 692,950 shares, comprising the shares beneficially owned by RTC, because of its ownership of RTC. The address forboth reporting persons is800 Third Avenue, New York, NY 10022.

ELECTION OF DIRECTORS

(PROPOSAL 1)

General

Our bylaws provide thatat any regular meeting or at any special meeting called for that purpose, a majority of the entire Board may establish, increase or decreasethe number of directors, provided that the number thereof will not be less than the minimum number required by the General Laws of the State of Maryland now or hereafter in force, nor more than nine, andthe Board has set the number of directors at five. The current term of office of all five of our directors expires at our2017Annual Meeting. Graham G. Miao and Tasos G. Konidaris will not stand for re-election at our 2017 Annual Meeting but will continue to serve as directors until the expiration of their respective terms at the 2017 Annual Meeting. At the recommendation of our Nominatingand Corporate GovernanceCommittee, our Board has (i) re-nominated our three other current directors (Dr. Langer and Messrs. Sedor and Leung), (ii) nominated Douglas J. Swirsky to replace Mr. Konidaris and (iii) nominated John R. Leone to replace Dr. Miao to serve, in the case of each director nominee, a new term of office expiring at our 2018 annual meeting of stockholders or until his successor is duly elected and qualified.

Unless otherwise instructed, the proxy holders will vote the proxies received by them for each of the nominees named below. Each director nominee has indicated that he is willing and able to serve if elected. In the event that any nominee is unable or declines to serve as a director at the time ofthe 2017 AnnualMeeting, the proxies will be voted for any nominee designated by our current Board to fill the vacancy. In an uncontested election,under our bylaws,each director will be elected by a vote of the majority of the votes cast. A majority of votes cast shall mean that the number of votes cast "for" a director's election exceeds the number of votes cast "against" that director's election by the shares present in person or represented by proxy at the meeting and entitled to vote on the election of directors (with "abstentions" and "broker non-votes" not counted as a vote cast either "for" or "against" that director's election).

Incumbent Directors and Director Nominees

The following table sets forth certain information regarding incumbent directors and our nominees for election as directors, including whether each has been determined by our Board to be "independent" as defined by the listing standards of The NASDAQ Stock Market, LLC, orNASDAQ, his age, and, in the case of our incumbent director nominees, how long he has served as a director of our Company. Mr. Konidaris and Dr. Miao, two of our incumbent directors, will not stand for re-election at our 2017 Annual Meeting.

Name & Age | | Director Since | | Independent |

John Sedor, 73 | | 2014 | | No |

Graham Miao, 53 | | 2016 | | No |

Tasos G. Konidaris, 51 | | 2014 | | Yes |

Gabriel Leung, 55 | | 2016 | | Yes |

Dennis H. Langer, 65 | | 2016 | | Yes |

Douglas J. Swirsky, 47 | | - | | Yes |

John R. Leone, 70 | | - | | Yes |

Biographic information for each director nominee is detailed below under "Biographies of Director Nominees." Each director nominee's biography contains information regarding that person's service as a director, as applicable, business experience, other directorships held currently or at any time during the last five years, and the experiences, qualifications, attributes, or skills that led the Nominatingand Corporate GovernanceCommittee and our Board to determine that the person should serve as a director for our Company.

Director Nominations and Considerations

The Nominatingand Corporate GovernanceCommittee has established the following minimum qualifications that any prospective director nominee must satisfy before the Committee will recommend his or her nomination to our Board:

Director nominees should have a reputation for integrity, honesty and adherence to high ethical standards.

- Director nominees should have experience and the ability to exercise sound judgment in matters that relate to the current and long-term objectives of our Company and should be willing and able to contribute positively to the decision-making process of our Company.

- Director nominees should be evaluated in the context of the current composition of the Board such that the appointment of a director nominee would help ensure that certain "core competencies," as identified by the Nominating and Corporate Governance Committee (including accounting and finance expertise, sound business judgment, industry and management experience, crisis response, leadership experience and strategic insight) are represented on the Board.

- Director nominees should have a commitment to understand our Company and its industry and to regularly attend and participate in meetings of our Board and its committees.

- Director nominees should have the interest and ability to understand and consider the sometimes conflicting interests of the various constituencies of our Company, which include stockholders, employees, customers, governmental units, creditors and the general public, while remaining focused on acting in the interests of our stockholders.

- Director nominees should not have, nor appear to have, a conflict of interest that would impair the director nominee's ability to represent the interests of our stockholders and to fulfill the responsibilities of a director.

In addition to these minimum qualifications, the Nominatingand Corporate GovernanceCommittee will only recommend a director nominee to our Board if, following the election or appointment of that nominee:

- A majority of the Board of Directors will be independent under NASDAQ listing rules.

- Each of the Audit, Compensation and Nominating and Corporate Governance Committees of the Board of Directors will be comprised entirely of independent directors.

- At least one member of the Audit Committee will have the experience, education, and other qualifications necessary to qualify as an "audit committee financial expert" as defined by the rules of the SEC.

Our Nominating and Corporate Governance Committee does not have a formal policy with regard to the consideration of diversity in identifying director candidates, but seeks a diverse group of candidates who possess the background, skills and expertise to make a significant contribution to our Board, to us and our stockholders.

Please see "The Board of Directors and Board Committees - Director Independence and Board Leadership Structure" for more information regarding the determination of director independence.

Consideration of Candidates Recommended by Stockholders

Our Board is open to suggestions from our stockholders on candidates for election to the Board. All nominations of candidates for election as directors must comply with Article III of our bylaws, which are on file with the SEC and available as described under "Corporate Governance - Availability of Corporate Governance Documents." To serve as a member of our Board, nominees must satisfy the director qualification requirements detailed in Article IV of our bylaws as well as any established by the Nominatingand Corporate GovernanceCommittee (current qualifications are detailed above under "Director Nominations and Considerations"). The Nominatingand Corporate GovernanceCommittee's policy is to consider director candidates recommended by stockholders on the same basis and in the same manner as it considers all other director candidates.

A stockholder may nominate a candidate for election as a director by sending the information relating to such person that is required to be disclosed in solicitation of proxies for the election of directors that is required by Regulation 14A promulgated under the Exchange Act, including such person's written consent to being named in the proxy statement as a nominee and to serving as a director.

The information should be sent to the committee addressed as follows: Corporate Secretary, Pernix Therapeutics Holdings, Inc., 10 North Park Place, Suite 201, Morristown, New Jersey 07960. In accordance with our bylaws, the nomination must be delivered, by personal delivery or first class mail, to this address (our principal executive offices), and must be received no earlier than 120 days prior and no later than 90 days prior to the anniversary date of the previous year's annual meeting; provided, however, that in the event that the date of the annual meeting is advanced by more than 30 days or delayed by more than 60 days from such anniversary date of the previous year's annual meeting, the nomination must be received no earlier than 120 days prior to the actual annual meeting date and no later than the close of business on the later of 90 days prior to the actual annual meeting date or 20 days following the date on which public announcement of the date of such meeting is first made. The notice of the proposal also must comply with the content requirements for such notices set forth in our bylaws.

Biographies of Director Nominees

In choosing our directors, we have sought persons with the highest personal and professional ethics, integrity, and values, who can commit themselves to representing the long-term interests of our stockholders. Our directors must also have an inquisitive and objective perspective, practical wisdom, and mature judgment. Our directors must be willing to devote sufficient time to carrying out their duties and responsibilities effectively and should be committed to serve on our Board for an extended period of time. In addition to these attributes, each of our directors has a strong and unique background and experience that led us to conclude that he should serve as a director of our Company. These qualifications are set forth below in each director's biography. Additionally, in determining the composition of our Board, we consider the director independence and committee requirements oftheNASDAQ listing rules and all legal requirements.

John A. Sedor. Mr. Sedor has served as our Chief Executive Officer and as Chairman of our Board since July 2016 and has served as a member of our Board since March 2014. Prior to July 2016, Mr. Sedor served as our Chairman of the Board and Interim Chief Executive Officer since May 2016. Mr. Sedor has been Chairman and Chief Executive Officer of SEDOR Pharmaceuticals, LLC since 2014 and from 2011 until February 2014 served as President, Chief Executive Officer and a director of Cangene Corporation, a fully integrated developer and manufacturer of immune therapeutics, until its acquisition by Emergent Biosolutions. Prior to that, from 2008 until 2011, Mr. Sedor served as President and Chief Executive Officer of CPEX Pharmaceuticals, orCPEX,since its spin-off from Bentley Pharmaceuticals, Inc., orBentley,in 2008 until its acquisition by Footstar, Inc. Mr. Sedor was President of Bentley from 2005 until the spin-off of CPEX. From 2001 to May 2005, he was President and CEO of Sandoz, Inc. (a division of Novartis AG). From 1998-2001 Mr. Sedor was President and Chief Executive Officer at Verion, Inc., a drug delivery company. Previously, Mr. Sedor served as President and Chief Executive Officer at Centeon, LLC, a joint venture between two major multinational corporations, Rhône-Poulenc Rorer and Hoechst AG and as Executive Vice President at Rhône-Poulenc Rorer, Revlon Health Care and Parke-Davis. Mr. Sedor holds a Bachelor of Science degree in Pharmacy/Chemistry from Duquesne University, and has studied strategic marketing at both Northwestern University's Kellogg Graduate School of Management and Harvard Business School. He has also attended Harvard's Executive Forum. We believe that Mr. Sedor is qualified to serve on our Board due to his intimate knowledge of the business and affairs of our Company, as its Chief Executive Officer, his many years of service as Chief Executive Officer of SEDOR Pharmaceuticals, LLC and Cangene Corporation and his extensive experience within our industry.

Relevant Experience:

- Public pharmaceutical company senior management

- Pharmaceutical company strategic planning and business development

- Board membership on public pharmaceutical company

DennisH.Langer M.D., J.D. Dr. Langer has served as an independent member of our Board and also as the Chairman of the Compensation Committee since November 2016. He also serves on our Audit and Nominatingand Corporate GovernanceCommittees. From January 2013 to July 2014, Dr. Langer served as Chairman and Chief Executive Officer of AdvanDx, Inc., a healthcare solutions company. From 2005 to 2010, Dr. Langer served as a Managing Partner of Phoenix IP Ventures, LLC, a private equity/venture capital firm specializing in life sciences. From January 2004 to July2005, he was President, North America, of Dr. Reddy's Laboratories, Inc., a multinational pharmaceutical company. From September 1994 until January 2004, Dr. Langer held several high-level positions at GlaxoSmithKline plc, and its predecessor, SmithKline Beecham, including most recently as a Senior Vice President of Research and Development. Prior to SmithKline Beecham, Dr. Langer was President and CEO of Neose Technologies, Inc. and before that held R&D and marketing positions at pharmaceutical companies Eli Lilly and Company, Abbott Laboratories and G. D. Searle & Company. At the beginning of his career, he was a Chief Resident at Yale University School of Medicine, and held clinical fellowships at Harvard Medical School and the National Institutes of Health. Dr. Langer currently serves as a director of Myriad Genetics, Inc., Dicerna Pharmaceuticals, Inc., and several private companies. Dr. Langer served as a director of several pharmaceutical and biotechnology companies, including Auxilium Pharmaceuticals, Inc., Ception Therapeutics, Inc. (acquired by Cephalon, Inc.), Cytogen Corporation, (acquired by EUSA Pharma, Inc.) Delcath Systems, Inc., or Delcath, Myrexis, Inc. Pharmacopeia, Inc. (acquired by Ligand Pharmaceuticals, Inc.), Sirna Therapeutics, Inc. (acquired by Merck & Co., Inc.), Innocall Holdings plc, and Transkaryotic Therapies, Inc. (acquired by Shire plc), Dr. Langer is a Clinical Professor, Department of Psychiatry, Georgetown University School of Medicine. Dr. Langer received a J.D. from Harvard Law School, a M.D. from Georgetown University School of Medicine, and a B.A. in Biology from Columbia University. We believe that Dr. Langer is qualified to serve on our Board due to his many years of experience serving as director of several biotechnology, specialty pharmaceutical, and diagnostic companies, and as the Chief Executive Officer and/or co-founder of several health care companies.

Relevant Experience:

- Public pharmaceutical company senior management experience

- Pharmaceutical company strategic planning and business development experience

- Financial expertise

Gabriel Leung. Mr. Leung has served as an independent member of our Board and also as Chairman of the Nominatingand Corporate GovernanceCommittee since November 2016. He also serves on our Audit and Compensation Committees. Since 2011, Mr. Leung has served as the Vice Chairman and a member of the board of directors of NovoCure Limited, a publicly listed commercial-stage oncology company. He was most recently Executive Vice President of OSI Pharmaceuticals, Inc., or OSI,and President of OSI's Oncology and Diabetes Business, from 2003 to 2010, prior to its acquisition by Astellas Pharma Inc. Mr. Leung was responsible for the launch of erlotinib, orTarceva,at OSI. Prior to his tenure at OSI, from 1999 to 2003, Mr. Leung served as Group Vice President of the global prescription business at Pharmacia Corporation, or Pharmacia. From 1991 to 1999, Mr. Leung was an executive at Bristol-Myers Squibb Company. In addition, Mr. Leung served as a director for Albany Molecular Research Inc., a global contract research and manufacturing company, from 2010 to 2016 and as a director of Delcath from 2011 to 2015. Mr. Leung earned his B.S. in Pharmacy with high honors at the University of Texas at Austin. Mr. Leung attended graduate school at the University of Wisconsin- Madison, where he earned his M.S. in Pharmacy, with a concentration in pharmaceutical marketing. We believe that Mr. Leung is qualified to serve on our Board due to his many years of experience serving as director and executive of several pharmaceutical companies.

Relevant Experience:

- Public pharmaceutical company senior management experience

- Pharmaceutical company strategic planning and business development experience

- Financial expertise

Douglas J. Swirsky.Mr. Swirsky was most recently president, CEO, and a director of GenVec, Inc., or GenVec, a publicly traded biotechnology company; a position he held from 2013 through the sale of the company in 2017. He joined GenVec in 2006 as chief financial officer, treasurer, and corporate secretary. Prior to joining GenVec, Mr. Swirsky was a managing director and the head of life sciences investment banking at Stifel Nicolaus from 2005 to 2006 and held investment banking positions at Legg Mason from 2002 until Stifel Financial's acquisition of the Legg Mason Capital Markets business in 2005. Mr. Swirsky has also previously held investment banking positions at UBS, PaineWebber, and Morgan Stanley. His experience also includes positions in public accounting and consulting. Mr. Swirsky is the chairman of the board of directors of Fibrocell Science, Inc. and the chairman of the board of directors of Cellectar Biosciences, Inc. Within the past five years, Mr. Swirsky also served as a director of PolyMedix, Inc. He received his B.S. in Business Administration from Boston University and his M.B.A. from the Kellogg School of Management at Northwestern University. Mr. Swirsky is a certified public accountant and a CFA® charter holder.

Relevant Experience:

- Public company chief executive officer

- Strong accounting and finance background, including experience as a public company chief financial officer and as a certified public accountant

- Audit committee experience

- Board membership on public pharmaceutical companies

John R. Leone. Mr. Leone is currently an Operating Partner at Madryn Asset Management, an investment platform focused on providing capital to healthcare companies. Madryn Asset Management was spun out from Visium Asset Management where Mr. Leone was a Partner from May 2013 to January 2017. Prior to joining Visium, Mr. Leone was a Partner at Paul Capital Healthcare, a private equity firm that managed one of the largest dedicated healthcare funds globally (2007 to 2013). Previously, Mr. Leone served as President and Chief Executive Officer at Cambrex Corporation and as Senior Vice President and Chief Operating Officer of U.S. Commercial Operations at Aventis Pharmaceuticals. While at Aventis, he played a key role in spearheading the successful integration of its predecessor companies, Rhone-Poulenc Rorer and Hoechst Marion Roussel, and had responsibility for all commercial business units, including oncology, metabolism, cardiovascular, dermatology, respiratory and anti-infective. Mr. Leone currently serves as the chairman of the board of directors of Windtree Therapeutics, Inc. Mr. Leone also served as a director of ViroPharma Incorporated from January 2006 until its acquisition in March 2014 and as a director of InKine Pharmaceutical Company, Inc. from March 2005 until its acquisition in October 2005. Mr. Leone received his B.S. degree in Engineering from the U.S. Military Academy at West Point and his M.B.A. from the University of Colorado.

Relevant Experience:

- Public pharmaceutical company senior management experience

- Pharmaceutical company strategic planning and business development experience

- Financial expertise

- Board membership on public pharmaceutical company

Required Vote:

In an uncontested election, such as the 2017 Annual Meeting,our directors are elected bythevote of a majority of the votes castwith respect to that director's election by holders of shares present in person or represented by proxy at the 2017 Annual Meeting. A director nominee who fails to receive a majority of "FOR" votes will not be elected and, if such director nominee is an incumbent director, will be required to tender his or her resignation to our Board. If Mr. Swirsky receives a majority of the votes cast with respect to his election but Mr. Leone does not, then Mr. Swirsky will be elected to the Board to replace Mr. Konidaris, but Mr. Leone will not be elected to the Board and Dr. Miao will continue on the Board as a director until his successor is elected and qualified. If Mr. Leone receives a majority of the votes cast with respect to his election but Mr. Swirsky does not, then Mr. Leone will be elected to the Board to replace Dr. Miao, but Mr. Swirsky will not be elected to the Board and Mr. Konidaris

will continue on the Board as a director until his successor is elected and qualified. If neither of Messrs. Swirsky or Leone receives a majority of the votes cast with respect to his election, then neither will be elected as a member of the Board and each of Dr. Miao and Mr. Konidaris will continue on the Board as a director until each person's successor is elected and qualified.

For detailed information on the treatment of such resignations by our Board and the process by which any replacement directors are appointed, please see the section above entitled "Questions and Answers About the Proxy Materials, the 2017 Annual Meeting and Voting."

Board Recommendation:

The Board of Directors believes that the election of each of the five nominees listed above is in the best interests of Pernix and the best interests of our stockholders and therefore recommends a vote FOR each of the five nominees listed above.

CORPORATE GOVERNANCE

Our Board and management have adopted corporate governance practices designed to aid in the fulfillment of their respective duties and responsibilities to our stockholders. Together, our articles of incorporation, bylaws, code of business conduct and ethics, and Board committee charters form the framework for the governance of our Company. Copies of these documents are available as described below under "-Availability of Corporate Governance Documents."

Code of Business Conduct and Ethics

We have a written Code of Conduct and Ethics that applies toourdirectors, officers, including our Chief Executive Officer and President and Chief Financial Officer, employees, consultants and contractorsand those of oursubsidiaries. The Code of Business Conduct and Ethics is a set of policies on key integrity issues that will encourage representatives of the Company to act ethically and legally. It includesourpolicies with respect to conflicts of interest, compliance with laws, insider trading, corporate opportunities, competition and fair dealing, discrimination and harassment, health and safety, record-keeping, confidentiality, protection and proper use ofcorporateassets, payments to government personnel and reports to and communications with the SEC and the public. Any waivers of the Code of Ethics for directors or executive officers must be approved by our Board and disclosed in a Form 8-K filed with the SEC within four days of the waiver.

Availability of Corporate Governance Documents

You may access our articles of incorporation, our bylaws, our Code of Business Conduct and Ethics, all committee charters, and other corporate governance documents under the "Investors- CorporateGovernance - Documents & Charters" section of our website at http://www.pernixtx.com. You also may request printed copies, which will be mailed to you without charge, by writing to us in care of our Corporate Secretary, Pernix Therapeutics Holdings, Inc., 10 North Park Place, Suite 201, Morristown, New Jersey 07960.

Communications with the Board, Committees, or Individual Directors

Stockholders and other interested parties may communicate with our Board or specific members of our Board, including the members of our various Board committees, by submitting a letter addressed in care of the Board of Directors atourprincipal executive offices: Pernix Therapeutics Holdings, Inc., 10 North Park Place, Suite 201, Morristown, New Jersey 07960Attention: Corporate Secretary. Subject to certain exceptions,any stockholder communication addressed in this manner will be delivered, unopenedto the Board, committees of the Board, individual directors or the independent directors as requested or as appropriate, depending on the facts and circumstances outlined in the communication.

The Board's Role in Risk Oversight

The Board's role in our risk oversight process includes regular discussions and meetings with members of senior management on areas of material risk tous, including operational, financial, legal, regulatory, strategic and reputational risks. In addition, several members of the Board are actively involved in several key areas of risk, namely, regulatory strategy and interactions with the U.S. Food and Drug Administration, and financing matters. Due to the relatively small size of the Board, and our centralized management, senior management is able to frequently interact with the full Board (or the appropriate committee in the case of risks that are under the purview of a particular Committee). This structure enables the Board and committees to be heavily involved in the risk oversight role.

CERTAIN RELATIONSHIPS AND RELATED-PARTY TRANSACTIONS

RelatedPartyPolicy

The Board has adopted a written RelatedPartyTransaction Policy, orthe RelatedPartyPolicy,that is administered by the Audit Committee of the Board. The RelatedPartyPolicy applies to anyfinancialtransaction, arrangement or relationship, or anyseries ofsimilartransactions, arrangements or relationships (including any indebtedness or guarantee of indebtedness), in which we were, are or will be a participant, and in which any related party had, has or will havea direct or indirect material interest.

Under the RelatedPartyPolicy, the facts and circumstances of the proposed transaction will be provided toa specified member ofsenior management,whowill determine whether the proposed transaction is a relatedpartytransaction that requires further review. Transactions that fall within the definition will be submitted to theChair of the Audit Committee, who will refer it to the fullAudit Committee for approval, ratification or other action ata special meeting orthe nextscheduledAudit Committee meeting. If the member ofsenior management determines that it is not practicable or desirable to waitfor advance Audit Committee approval, the Chair of the Audit Committee may take action on the proposed transaction between Audit Committee meetings, and the proposed transaction shall be considered, and if appropriate, ratified atthe next Audit Committee meeting. The Audit Committee or theChair of the Audit Committee, as applicable, may approve, based on good faith consideration of all the relevant facts and circumstances, only those relatedpartytransactions that are in, or not inconsistent with,ourbest interestsand is not in violation of any of our other polices or procedures.

In addition,in the eventmanagementbecomes aware ofany relatedpartytransactions that were not previously approved or ratified under the RelatedParty Policy, management will promptly notify the specified member of senior management. If such a transaction is pending, it will be referred for action by the Chair ofthe Audit Committeeor the Audit Committee in accordance with the procedures set forth above. If the transaction is ongoing, the Chair of the Audit Committee will, if practicable and desirable, convene a special meeting of the Audit Committee to consider such transaction or will take action on such action pursuant to delegated authority of the Audit Committee. The Chair of the Audit Committee or the Audit Committee, as applicable,will evaluate all options available, including, but not limited to, ratification, amendment, termination or rescission and, where appropriate, take disciplinary action. The Audit Committee will request that senior management evaluateourcontrols to ascertain the reason the transaction was not submitted to the Audit Committee for prior approval.

Certain Relationships and Transactions

4.25% Convertible Senior Notes due 2021

On April 22, 2015, we issued $130.0 million aggregate principal amount of 4.25% Convertible Senior Notes due 2021, or the 4.25% Convertible Notes. The 4.25% Convertible Notes mature on April 1, 2021, unless earlier converted, redeemed or repurchased. The 4.25% Convertible Notes are our general unsecured obligations and bear interest at a rate of 4.25% per annum, payable semiannually in arrears on April 1 and October 1 of each year. The 4.25% Convertible Notes were issued and sold in a private placement to certain institutional investors, including Aisling Capital LLC, or Aisling Capital. Steven A. Elms who, prior to his resignation on November 28, 2016, wasan independent member of our Board andAudit, Compensation and Nominating and Corporate Governance Committees, is a Managing Partner of Aisling Capital.

Aisling Capital acquired $2,500,000 aggregate in principal of 4.25% Convertible Notes and no principal payments have been made on the 4.25% Convertible Notes. In 2015, $73,489.58 of interest payments were made to Aisling Capital and in 2016 $106,250 of interest payments were made to Aisling Capital. As of the date hereof, $53,125 of interest payments were made to Aisling Capital in 2017.

2017 Exchange Transactions

On July 20, 2017, we entered into an exchange agreement, or the Exchange Agreement, between us and certain holders, or the Holders, of our outstanding 4.25% Convertible Notes pursuant to which the Holders tendered $51.8 million aggregate principal amount of the 4.25% Convertible Notes held by the Holders in exchange for (x) $36.2 million aggregate principal amount of 4.25%/5.25% Exchangeable Senior Notes due 2022, or the Exchangeable Notes, issued by Pernix Ireland Pain Limited, or PIPL, our wholly-owned subsidiary, and (y) 1,100,498 shares of our common stock, or the Exchange Shares. Highbridge Capital Management LLC, or Highbridge, is the trading manager of the Holders and is the beneficial holder of any Exchangeable Notes or Exchange Shares held by the Holders. Upon the closing of the transactions contemplated by the Exchange Agreement, the Holders acquired $36.2 million aggregate principal of the Exchangeable Notes and 1,100,498 shares of our common stock and Highbridge held on such date, through the Holders, more than five percent of our outstanding capital stock.

The Exchangeable Notes are guaranteed by us and each of our subsidiaries thereof. The Exchangeable Notes are senior, unsecured obligations of PIPL. Interest on the Exchangeable Notes will be paid in cash or a combination of cash and in-kind interest at PIPL's election. Interest paid in cash will accrue at a rate of 4.25% per annum, while interest paid in a combination of cash and in-kind will accrue at a rate of 5.25% per annum, with 2.25% per annum of interest (plus additional interest, if any) capitalized to the principal amount of the Exchangeable Notes, and the balance paid in cash. The maturity date of the indenture governing the Exchangeable Notes is July 15, 2022.

No principal payments or interest payments have been made on the Exchangeable Notes. Under the terms of the Exchangeable Notes, the first date on which we will be required to make an interest payment is January 15, 2018.

In connection with the execution of the Exchange Agreement, we, as borrowers and guarantors, and certain of our subsidiaries, as guarantors, and together with us, the ABL Borrowers, entered into a credit agreement providing for a new five-year $40 million asset-based revolving credit facility, or the New ABL Facility, with Cantor Fitzgerald Securities, as agent, and the Holders, as lenders. The New ABL Facility replaced our asset-based revolving credit agreement, dated as of August 21, 2015, by and among the ABL Borrowers, Wells Fargo Bank, National Association, as administrative agent, and the lenders party thereto, as amended, or the Old ABL Facility.

Our obligations under the New ABL Facility are guaranteed by the ABL Borrowers and the ABL Guarantors and are secured by, among other things, the ABL Borrowers' cash, inventory and accounts, in each case pursuant to a guaranty and security agreement between the ABL Borrowers, ABL Guarantors and Cantor Fitzgerald Securities as agent. Availability of borrowings under the New ABL Facility from time to time will be subject to a borrowing base calculation based upon a valuation of the ABL Borrowers' eligible inventories and eligible accounts receivable, each multiplied by an applicable advance rate, subject toadjustments in accordance with thecredit agreement governing the New ABL Facility. Borrowings under the New ABL Facility will bear interest at the rate of LIBOR plus 7.50%. In addition, the ABL Borrowers will be required to pay a commitment fee on the undrawn commitments under the New ABL Facility from time to time at a rate per annum of 0.25% on the unused commitments under the New ABL Facility, payable monthly.

As of September 25, 2017, we have borrowed $14.2 million under the New ABL Facility. We have made two interest payments on the amount borrowed under the New ABL Facility totaling approximately $0.2 million and $0.6 million have been paid as commitment fees.

In connection with the execution of the Exchange Agreement, PIPL entered into a term loan credit agreement with Cantor Fitzgerald Securities, as agent and the Holders, as lenders to obtain a new five-year $45 million delayed draw term loan facility, or the Term Facility. Cash interest on amounts borrowed under the Term Facility will accrue at a rate of 7.50% per annum, while the combination of cash and in-kind interest will accrue at a rate of 8.50% per annum, with up to 4.00% per annum added to the principal amount of loans and the balance paid in cash. The Term Facility will mature on July 21, 2022.

As of September 25, 2017, we have drawn $30 million under the Term Facility. No principal payments or interest payments have been made on the amount borrowed under the Term Facility.

In connection with the execution of the Exchange Agreement, we entered into a registration rights agreement with the Holders, pursuant to which we agreed to file a registration statement with the SEC to register the Exchange Shares andthe shares of common stockissuable in respect of the Exchangeable Notes. In July 2017, we filed a registration statement on Form S-3 in satisfaction of such registration rights and such registration statement was declared effective on August 11, 2017.

THE BOARD OF DIRECTORS AND BOARD COMMITTEES

Our bylaws authorize our Board to appoint one or more committees, each consisting of one or more directors. Our Board has established three standing committees: an Audit Committee, a Compensation Committee and a Nominatingand Corporate GovernanceCommittee. Our Board has adopted a charter for each committee, which describes the authority and responsibilities delegated to that committee by the Board. These charters are available as described under "Corporate Governance - Availability of Corporate Governance Documents."

Director Independence and Board Leadership Structure

Periodically, and at least annually in connection with its annual recommendation to the Board of a slate of director nominees, the Nominatingand Corporate GovernanceCommittee of our Board reviews the independence of the Board's current members (and director nominees who are not current members) and reports its findings to the full Board. Our Board then considers all relevant facts and circumstances in making an independence determination, including an analysis from the standpoint of the director and from that of persons or organizations with which the director has an affiliation.

Our Board has determined that, as of the record date, three of our five incumbent directors and both of our non-incumbent director nominees are independent under NASDAQ's listing rules. Messrs. Konidaris, Leung, Swirsky and Leone and Dr. Langer are independent; however, Mr. Sedor and Dr. Miao do not qualify as independent as they currentlyserveas our Chief Executive Officer andPresident andChief Financial Officer, respectively. Mr. Elms, who resigned from our Board as of November 28, 2016, was independent under NASDAQ's listing rules. Mr. Drysdale who resigned from our Board on May 9, 2016 did not qualify as independent as he previouslyserved as our Chief Executive Officer.

Our Board has determined that the roles of Chief Executive Officer and Chairman are best served by the same person at this time. The structure ensures that the independent directors will have more time to actively participate in board meetings with less time needed for any one independent director to focus on Chairman duties. We have no lead independent director due to the relatively small size of our Board and due to the fact that the independent directors currently carry out their responsibilities effectively.

Executive Sessions of the Board of Directors

We schedule executive sessions at which our independent directors meet without the presence or participation of management. Thepurpose of theexecutive sessionsis to promote open and candid discussion among our independent directors.

Board and Committee Meetings

Our Board met eleventimes in fiscal year 2016. All members of our Board attended at least 75% of the total number of meetings of the Board and of the Board committees of which he was a member during fiscal 2016.

We encourage our directors to attend every annual meeting of stockholders. Our bylaws require that we schedule a meeting of the Board on the same day as our annual meeting of stockholders, which facilitates our directors' attendance at the annual meeting. Each of our directors who was serving as a director as of the 2016 annual meeting attended that annual meeting.

The current members of each committee are identified in the following table, which also indicates the number of meetings each committee held in fiscal 2016. The role of each committee is discussed in detail below.

| | Board Committee | |

Director | | Audit | | Compensation | | Nominating and

Corporate Governance | |

John A. Sedor | | -- | | -- | | -- | |

Graham Miao(1) | | -- | | -- | | -- | |

Tasos G. Konidaris(2) | | Chair | | X | | X | |

Dennis H. Langer | | X | | Chair | | X | |

Gabriel Leung | | X | | X | | Chair | |

Number of Meetings in 2016 | | 4 | | 5 | | 1 | |

___________

(1) Dr. Miao will not stand for re-election at our 2017 Annual Meeting.

(2) Mr. Konidaris will not stand for re-election at our 2017 Annual Meeting and therefore his term on each of the committees on which he serves will expire as of the date of our 2017 Annual Meeting.

Audit Committee

Under its charter, the Audit Committee's responsibilities include:

- Appointing, retaining, evaluating, approving the compensation of, and assessing the independence of, our independent registered public accounting firm.

- Overseeing the work of our independent registered public accounting firm, including the experience and qualifications of the senior members of such firm and the proposed scope and approach of the annual audit.

- Ensuring that the lead partner of our independent registered public accounting firm having responsibility for our audit and the audit review partner are each rotated at least every five years.

- Reviewing and pre-approving all auditing services and non-audit services to be performed by our independent registered public accounting firm.

- Reviewing and discussing with management and our independent registered public accounting firm our annual and quarterly financial statements and related disclosures.

- Overseeing the integrity, adequacy and effectiveness of our financial reporting processes, internal control over financial reporting and disclosure controls and procedures and our Code of Business Conduct and Ethics.

- Overseeing our risk assessment and risk management policies.

- Establishing policies and procedures for the receipt and retention of accounting-related complaints and concerns.

- Meeting independently with our internal auditing staff, our independent registered public accounting firm and management.

- Reviewing and approving or ratifying any related person transactions and ensuring our independent registered public accounting firm is informed of any significant relationships we have with any related parties.

- Preparing the audit committee report required by SEC rules and reviewing any control disclosures and management certifications that are required by applicable SEC rules.

- Conducting an annual performance evaluation of the Audit Committee and the charter of the Audit Committee.

Our Audit Committee is also responsible for any audit reports the SEC requires us to include in our proxy statements. In this proxy statement, the requisite report may be found under the heading, "Audit Committee Report."

Each member of our Audit Committee also meets the criteria for independence set forth in Rule 10A-3(b)(1) promulgated under the Exchange Act. None of the members of our Audit Committee has participated in the preparation of our consolidated financial statements or those of our subsidiaries during the past three years, and all are able to read and understand fundamental financial statements and are financially literate under the applicable rules of the SEC and NASDAQ. Our Board has determined that Mr. Konidaris is an "audit committee financial expert" under SEC rules.

Compensation Committee

Under its charter, the Compensation Committee's responsibilities include:

- Reviewing our compensation practices, policies and arrangements to determine whether they encourage appropriate levels of risk-taking and whether the relationship between our risk management policies and practices and compensation are appropriately aligned.

- Reviewing and approving annual corporate goals and objectives applicableto the compensation of ourChief Executive Officer, evaluating the performance of our Chief Executive Officer in light of such goals and objectives and determining our Chief Executive Officer's compensation level based on such evaluations.

- Approving the compensation of all other executive officers.

- Approving any adoption, amendment or termination of our incentive compensation plans and equity-based plans (or recommending to our Board and, where appropriate or required, to our stockholders regarding any of the foregoing).

- Overseeing the administration of our compensation plansand equity-based plans, including thedetermination of the directors and employees who are to receive awards and the terms of those awards.

- Conducting an annual review and approval of compensation and benefits to directors.

- Composing, reviewing and recommending to the Board the "Compensation Discussion and Analysis," if required to be included, as applicable, in our Annual Report on Form 10-K, annual proxy statement, or any information statement, including the "Compensation Committee Report," if required.

- Reviewing, approving and recommending to the Board for approval any employment agreements and severance arrangements or plans of the Chief Executive Officer or other executive officers, including any agreements that adopt, amend or terminate such employment agreements, severance agreements or plans.

- Determining stock ownership guidelines, if any, for our Chief Executive Officer and other executive officers.

- Reviewing and recommending to the Board for approval, on an annual basis, (i) the frequency with which we conduct stockholder advisory votes on executive compensation (Say on Pay Vote) and (ii) any proposals related to the Say on Pay Vote to be included our annual proxy statement.

- Analyzing and making recommendations to our Board regarding director compensation and benefits for service on our Board and any committees thereof.

- Conducting an annual performance evaluation of the Compensation Committee.

Executive and Director Compensation Processes

Our executive compensation program isadministered by our Compensation Committee, subject to the oversight and approval of our Board. We compensate our executives through a combination of base salary, annual cash bonuses based on certain performance criteria and long-term incentives in the form of equity grants that are designed to be competitive with comparable companies within the pharmaceutical industry. Our executive compensation program is structured to align management's incentives with the long-term interests of our stockholders, and to maximize stockholder value.

In order to determine compensation for our named executive officers, our Compensation Committee reviews competitive information on executive compensation practices from our peer companies as well as an assessment of overall corporate performance and individual performance. In addition, our Chief Executive Officer provides a performance review and compensation recommendation for each named executive officer, other than himself. Our Chief Executive Officer does not submit an assessment of his own performance, does not present a recommendation on his own compensation, and does not participate in the portion of the meeting where his compensation is determined. Our Compensation Committee determines and approves the compensation for our Chief Executive Officer and all of our other executive officers.

Our Compensation Committee has also retained Radford, an Aon Hewitt company, or Radford, as its compensation consultant. Radford reported directly to the Compensation Committee and provided various executive compensation services to the Compensation Committee, including advising the Compensation Committee on the principal aspects of our executive compensation program and evolving industry practices and providing market information and analysis regarding the competitiveness of our executive compensation program design and our award values in relation to performance. Although the Compensation Committee considers Radford's advice and recommendations about our executive compensation program, the Compensation Committee ultimately makes its own decisions about these matters.

Radford provides no services to us other than its advice to the Compensation Committee on executive and director compensation matters. The Compensation Committee determined that the work of Radford does not present any conflicts of interest and the Compensation Committee is satisfied with the independence of Radford.

Our director compensation program is administered by our Compensation Committee, subject to the oversight and approval of our full Board. Our Compensation Committee conducts periodic reviews of director compensation and makes recommendations to the Board with respect thereto.

Nominatingand Corporate GovernanceCommittee

Under its charter, the Nominatingand Corporate GovernanceCommittee's responsibilities include:

- Establishing criteria for selecting new directors.

- Considering and recruiting candidates to fill new positions on our Board, including any candidate recommended by the stockholders.

- Conducting appropriate inquiries to establish a candidate's compliance with the qualification requirements established by the Nominating and Corporate Governance Committee.

- Assessing the contributions of directors slated for re-election and evaluating such directors in the context of the Board evaluation process and any other perceived needs of the Board.

- Recommending director nominees for approval by our Board.