UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number:

811-02328

Boulder Growth & Income Fund, Inc.

(Exact Name of Registrant as Specified in Charter)

Fund Administrative Services, LLC

2344 Spruce Street, Suite A

Boulder, CO 80302

(Address of Principal Executive Offices)(Zip Code)

Fund Administrative Services, LLC

2344 Spruce Street, Suite A

Boulder, CO 80302

(Name and Address of Agent for Service)

Registrant’s Telephone Number, including Area Code:

(303) 444-5483

Date of Fiscal Year End: November 30

Date of Reporting Period: December 1, 2015 – November 30, 2016

Item 1. Reports to Stockholders.

The Report to Stockholders is attached herewith.

Distribution Policy

November 30, 2016

Boulder Growth & Income Fund, Inc. (the “Fund”), acting pursuant to a Securities and Exchange Commission exemptive order and with the approval of the Fund’s Board of Directors (the “Board”), has adopted a plan, consistent with its investment objectives and policies to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plan, the Fund began distributing $0.033 per share on a monthly basis in November 2015. Subsequently, on November 10, 2016 the Board announced an increase in the monthly distribution to $0.034 per share. The fixed amount distributed per share is subject to change at the discretion of the Fund’s Board. Under the Plan, the Fund will typically distribute most or all of its available investment income to its stockholders, consistent with its primary investment objectives and as required by the Internal Revenue Code of 1986, as amended (the “Code”). The Fund may also distribute long-term capital gains and short-term capital gains and return capital to stockholders in order to maintain a level distribution. Each monthly distribution to stockholders is expected to be at the fixed amount established by the Board, except for extraordinary distributions and potential distribution rate increases or decreases to enable the Fund to comply with the distribution requirements imposed by the Code. Stockholders should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the Plan. The Fund’s total return performance on net asset value is presented in its financial highlights table. The Board may amend, suspend or terminate the Fund’s Plan without prior notice if it deems such action to be in the best interest of the Fund or its stockholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Fund’s stock is trading at or above net asset value) or widening an existing trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, investments in foreign securities, foreign currency fluctuations and changes in the Code. Please refer to the Fund’s prospectus for a more complete description of its risks.

| Boulder Growth & Income Fund, Inc. | Table of Contents |

Letter from the Advisers | 2 |

Financial Data | 8 |

Portfolio of Investments | 9 |

Statement of Assets & Liabilities | 13 |

Consolidated Statement of Operations | 14 |

Consolidated Statements of Changes in Net Assets | 15 |

Consolidated Statement of Cash Flows | 16 |

Consolidated Financial Highlights | 18 |

Notes to Financial Statements | 21 |

Report of Independent Registered Public Accounting Firm | 36 |

Additional Information | 37 |

Summary of Dividend Reinvestment Plan | 40 |

Directors & Officers | 42 |

| Annual Report | November 30, 2016 | 1 |

| Boulder Growth & Income Fund, Inc. | Letter from the Advisers |

| | November 30, 2016 (Unaudited) |

Dear Stockholders:

When I sat down to write last year’s stockholder letter, I was optimistic about the performance potential of the Boulder Growth & Income Fund, Inc. (the “Fund”) heading into the 2016 fiscal year. What occurred over the twelve‐month period ending November 30, 2016 (the “period”) greatly exceeded those expectations. As illustrated in the table below, for the period, the Fund generated a return of 16.4% on net assets, which materially exceeded the 8.0% return generated by the S&P 500 Index, the 10.9% return generated by the Dow Jones Industrial Average (DJIA) and the 5.6% return generated by the NASDAQ Composite. In addition, the Fund’s return on net assets for the period also significantly outperformed the 9.1% return generated by the Morningstar Large Value Fund Category benchmark.

This strong period performance has allowed the Fund to maintain its outperformance relative to the S&P 500 Index and the Dow Jones Industrial Average on an annualized net assets basis since we became the investment advisers to the Fund in January of 2002. Furthermore, the Fund continues to outperform the Morningstar Large Value Fund Category benchmark over all historical periods where data is available on a net assets basis.

On a market price basis, the Fund generated a return of 18.2% for the period outpacing the Fund’s return performance on net assets of 16.4%. This outperformance was due in part to a reduction in the discount of the Fund’s share price relative to its net asset value (the “discount”) over the period. While the discount reduction experienced during the period was good to see, we continue to believe the Fund’s discount is unreasonable and undeserved for all the reasons discussed in prior stockholder letters. While frustrated by the discount’s persistence despite our many efforts, we remain undaunted in the face of this challenge. Together with the Fund’s Board, we will continue our work to seek to identify additional ways to drive a long‐term and sustainable reduction in the Fund’s discount.

| | 3 Months | 6 Months | One Year | Three Years* | Five Years* | Ten Years* | Since January 2002** |

| BIF (NAV) | 3.5% | 9.1% | 16.4% | 7.7% | 12.9% | 7.4% | 7.9% |

| BIF (Market) | 2.6% | 9.4% | 18.2% | 8.3% | 12.8% | 3.5% | 6.0% |

| S&P 500 Index | 1.8% | 6.0% | 8.0% | 9.0% | 14.4% | 6.9% | 6.7% |

| DJIA | 4.6% | 9.0% | 10.9% | 8.6% | 12.5% | 7.4% | 7.2% |

| NASDAQ Composite | 2.5% | 8.3% | 5.6% | 10.9% | 16.8% | 9.4% | 8.2% |

| Morningstar Large Value Fund Category† (NAV) | 3.1% | 7.1% | 9.1% | 6.3% | 11.0% | 5.7% | N/A |

| ** | Annualized since January 2002, when the current advisers became investment advisers to the Fund. Does not include the effect of dilution on non-participating stockholders from the December 2002 rights offering. |

| † | The Morningstar Large Value Fund Category is comprised of a group of open-end funds that invest primarily in big U.S. companies that are less expensive or growing more slowly than other large-cap stocks. Large Cap stocks are defined as stocks in the top 70% of the capitalization of the U.S. equity market. Additional information about Morningstar’s Category Classifications can be found at www.morningstar.com. |

| Boulder Growth & Income Fund, Inc. | Letter from the Advisers |

| | November 30, 2016 (Unaudited) |

The performance data quoted represents past performance. Past performance is no guarantee of future results. Fund returns include reinvested dividends and distributions, but do not reflect the reduction of taxes that a stockholder would pay on Fund distributions or the sale of Fund shares and do not reflect brokerage commissions, if any. Returns of the S&P 500 Index, the DJIA, and the NASDAQ Composite include reinvested dividends and distributions, but do not reflect the effect of commissions, expenses or taxes, as applicable. Returns of the Morningstar Large Value Fund Category benchmark include reinvested dividends and distributions and expense or taxes, but do not reflect the effect of commissions, as applicable. You cannot invest directly in any of these indices. The investment return and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted.

The Fund’s strong performance on an absolute and relative basis for the period was aided by the performance of a few of the Fund’s larger positions. Chief among these was the Fund’s combined position in the Class A and Class B shares of Berkshire Hathaway, Inc., which was the largest contributor to the Fund’s overall performance due to its large position size at approximately 28.9% of total assets at period end and its total return over the period of approximately 17.6%. Additional contributors to the Fund’s absolute and relative performance over the period were its larger positions in Yum! Brands, Chevron Corporation, JPMorgan Chase & Company and Caterpillar Inc. The solid performance from these positions was partially offset by the negative absolute performance of the Fund’s positions in Heineken NV, Heineken Holdings NV, Sanofi, Community Bank, Midland Holdings Limited and the residual interest in Ithan Creek Partners L.P.

How do we feel about the Fund’s prospects in the coming fiscal year? That is a great question, but one I will address a little later in this letter. Instead, there are a few topics of note I want to cover first, principally the recent increase in the monthly managed distribution rate, the Fund’s new leverage facility and the potential for return of capital through the managed distribution.

On November 10, 2016, the Fund’s Board announced a 3.03% increase in the monthly distribution to $0.034 per share starting with the November 2016 distribution. This was the first increase since the managed distribution program was instituted in November of 2015. As noted in the press release announcing the increase, the new distribution amount on an annualized basis equated to approximately 4.9% of market price and 3.9% of net asset value based on the closing market data for the Fund as of November 9, 2016. While decisions related to the distribution are solely the domain of the Board and outside our purview, we were supportive of the decision to increase the monthly distribution amount and are pleased to implement it.

I know many of you share this sentiment, but as to be expected, some would have liked to see a much bigger increase based on the argument that a materially higher distribution amount would likely aid in a reduction of the discount. From my perspective, while there may be merit in the argument that a higher distribution might aid in discount reduction, I believe a responsible managed distribution policy requires greater consideration than just the impact on the discount.

In my previous letter, I wrote about the market’s potential hesitancy to trust that the actions taken over the past few years to improve the Fund will be sustained. To rebuild that trust, we must be consistent. To be consistent, we must take actions that we believe are sustainable. For a managed distribution program to be sustainable, it must accommodate the realities of the underlying investment philosophy and objective. Therefore, a managed distribution program must be tailored to fit within the confines of the investment philosophy and objective. If it is not, then either the distribution program will prove to be unsustainable or it will be sustained at the sacrifice of the investment philosophy and objective.

| Annual Report | November 30, 2016 | 3 |

| Boulder Growth & Income Fund, Inc. | Letter from the Advisers |

| | November 30, 2016 (Unaudited) |

To put this another way, imagine that you are a parent and your goal is to raise your young children to be healthy and happy. To achieve this, you make sure they eat a healthy diet full of fruits and vegetables and other good stuff, but you still allow them to occasionally indulge in ice cream and soda. The good diet keeps them healthy and the occasional treats provide a little happiness boost without materially impacting overall health. Given the choice though, your children would probably push for ice cream and soda at every meal and get rid of all that healthy nonsense. If you did this, your children would be exceedingly happy and their health may not immediately appear to be any worse for the wear. The problem is that over time it will become clear that this diet can only be sustained by sacrificing the long‐term health of your children. If you truly want your children to be both happy and healthy, then you are probably going to stick to the healthy diet with occasional treats. You will probably lose some popularity points with your children, but as your parents may have told you growing up: “It’s not my job to be popular, but to raise you right!”

We hold ourselves to a similar standard. The Fund’s investment philosophy is to invest in good businesses at attractive valuations for the long‐run and its investment objective is total return comprised of both income and capital appreciation. In my opinion, the Fund’s current managed distribution program allows for us to adhere to this investment philosophy and objective in a sustainable manner. Do I believe that this precludes potential increases in the future? I would think not if such increases are believed to be sustainable and allow for the efficient execution of the Fund’s stated investment philosophy and objective. It is only through such sustainable actions that we will achieve the consistency needed to regain the market’s trust.

After that lengthy discussion about consistency, it seems only fitting that I briefly highlight some recent changes for the Fund. In July of 2016, the Fund replaced its $55 million credit facility on more favorable terms with a new $75 million credit facility. In addition to the increase in borrowing capacity, the new credit facility carries a lower borrowing rate and eliminates a commitment fee on unused borrowings. At period end, the Fund has approximately $50 million borrowed under the new credit facility with roughly $25 million in available borrowing capacity. However, we continue to believe the Fund has ample capacity for additional leverage and should be able to increase its borrowing limit under current market conditions on relatively short notice if needed. In association with the change in credit facilities, the Fund also moved to a new custodian under an arrangement that should yield additional cost savings for the Fund. Additional information about the new credit facility and custodian can be found in this annual report.

Now I would like to switch gears a little and bring attention to a monthly notice that all stockholders should be receiving called the “Notification of Sources of Distribution”, also known as a Section 19(a) notice. The purpose of the 19(a) notice is to provide stockholders with estimates of the current and year‐to‐date distributions and their sources, be it from net investment income, net realized short‐term capital gains, net realized long‐term gains and/or return of capital or other capital source. As the numbers provided in the 19(a) notice are estimates, they will not always match up with what you may see in your end of year 1099 tax form due to a variety of reasons. While we have not received final numbers at the time of this letter, we anticipate one possible difference between the estimates provided in the 19(a) notice and your 1099 tax forms being the fact that a portion of your distribution will likely be classified as a return of capital.

| Boulder Growth & Income Fund, Inc. | Letter from the Advisers |

| | November 30, 2016 (Unaudited) |

We bring this to your attention for a couple of reasons. First, we want to make sure everyone is aware of this to prevent any potential surprises come tax time. Second, it provides us with an opportunity to provide additional insight into how we manage the Fund, specifically, our thoughts on return of capital in respect to a managed distribution program.

A common view on this matter is that receiving a distribution comprised of return of capital is a bad thing, because investors may view it as simply being paid back with their own money. We are troubled by this view as we believe it oversimplifies a nuanced issue and can be potentially costly to investors. We believe return of capital can be a positive or a negative, but to know which depends on an analysis that incorporates other important factors, such as return performance and individual tax implications.

To illustrate this, let us assume you invest $100 with a gentleman named Bob and he promises to pay you a 10% distribution annually on your investment. Ten years go by and as promised Bob has paid you a $10 distribution every year for a total of $100 in cumulative distributions. Are you happy with this result? The answer depends. How well did Bob invest your money? If Bob earned 0% on your money every year, then that $10 distribution was being wholly funded by a return of your own capital. In this scenario, you are probably going to be pretty upset with Bob when he tells you in year 11 that there is no money left and he cannot pay another distribution. Alternatively, if Bob generated a 10% return every year on your money, then the distribution is being fully funded by the performance of the underlying investment. In this case, you should be pretty happy with Bob as the 10% annual distribution fully reflects a 10% annual return on the money you invested.

To make this interesting, let us now consider how Bob funded that first $10 distribution. To keep this simple, let us assume he invested all of the money in the equity of a single company that does not pay any dividends. This means that the 10% annual return was driven entirely though capital appreciation. He bought the stock for $100 and a year later it is worth $110, so to fund the distribution at the end of the year he sells $10 worth of the stock. Doing the math, this transaction will result in a capital gain of approximately $0.91 and a return of capital of approximately $9.09. Are you upset with receiving a return of capital under this scenario? Ignoring any tax consequences for the moment, we suggest you should not be as the distribution has effectively been fully earned by the performance of the underlying investment. If we factor in potential tax impacts, we argue that receiving a return of capital may be preferred, especially for a long‐term investor, because it does not immediately trigger a taxable event.

This is obviously a simple example and does not take into account a variety of factors that should be considered in relation to one’s individual circumstances, but I believe it helps illustrate two general points. The first is that investors should absolutely be aware of how distributions are being funded, but if there is a return of capital it should not immediately trigger condemnation, but further investigation. The second is that we do not view management of the distribution’s composition as the primary objective of our investment process. Our investment process is guided first and foremost by making decisions we believe will maximize the Fund’s total return in line with its investment philosophy and objective. If a return of capital results from these actions, the adviser is comfortable with this provided the Fund earns an investment return in excess of the distribution over time.

| Annual Report | November 30, 2016 | 5 |

| Boulder Growth & Income Fund, Inc. | Letter from the Advisers |

| | November 30, 2016 (Unaudited) |

To wrap this letter up, I want to provide you with some brief thoughts on the current market environment and our general outlook. To begin, we do not make any type of macro forecasts, because, quite frankly, we are not smart enough. We also do not rely on the macro forecasts of others, because, quite frankly, we do not think they are smart enough. Instead we gauge the general attractiveness of the market by the availability of what we believe are appealing investment opportunities as determined by bottom‐up investment analysis. From our viewpoint, the recent surge in the markets has reduced the number of available investment opportunities that meet our internal return hurdles. As a result, our outlook has become more cautious than it was just a year ago. While it is impossible to know what the future may bring, we believe the Fund is well‐positioned to manage a changing market environment. If valuations trend towards excessive premiums in the future, the Fund could increase its cash position by reducing or exiting current investment positions or by opportunistically utilizing covered calls. If valuations trend toward attractive discounts, the Fund could invest in potentially attractive investment opportunities by utilizing incremental leverage. Regardless of what is to come, Stewart, Joel and I will be right alongside you as fellow stockholders.

As always, I look forward to writing you again soon and I would like to wish you all the best in the new year.

Sincerely,

Brendon Fischer, CFA

Portfolio Manager

December 12, 2016

The views and opinions in the preceding commentary are as of the date of this letter and are subject to change at any time. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Portfolio weightings and other figures in the foregoing commentary are provided as of period-end, unless otherwise stated.

Note to Stockholders on the Fund’s Discount. As most stockholders are aware, the Fund’s shares presently trade at a significant discount to net asset value. The Fund’s board of directors is aware of this, monitors the discount and periodically reviews the limited options available to mitigate the discount. In addition, there are several factors affecting the Fund’s discount over which the board and management have little control. In the end, the market sets the Fund’s share price. For long‐term stockholders of a closed‐end fund, we believe the Fund’s discount should only be one of many factors taken into consideration at the time of your investment decision.

Note to Stockholders on Leverage. The Fund is currently leveraged through a credit facility. The Fund may utilize leverage to seek to enhance the returns for its stockholders over the long‐term; however, this objective may not be achieved in all interest rate environments. Leverage creates certain risks for stockholders, including the likelihood of greater volatility of the Fund’s NAV and market price. There are certain risks associated with borrowing through a line of credit, including, but not limited to risks associated with purchasing securities on margin. In addition, borrowing through a line of credit subjects the Fund to contractual restrictions on its operations and requires the Fund to maintain certain asset coverage ratios on its outstanding indebtedness.

| Boulder Growth & Income Fund, Inc. | Letter from the Advisers |

| | November 30, 2016 (Unaudited) |

Note to Stockholders on Concentration of Investments. The Fund's investment advisers feel it is important that stockholders be aware that the Fund is highly concentrated in a small number of positions. Concentrating investments in a fewer number of securities may involve a degree of risk that is greater than a fund which has less concentrated investments spread out over a greater number of securities. In particular, the Fund is highly concentrated in Berkshire Hathaway, Inc., which, in addition to other business risks, is currently dependent on Warren Buffett for major investment decisions and all major capital allocation decisions. If Mr. Buffett were no longer able to fulfill his responsibilities to Berkshire Hathaway, Inc., the effect on the value of the Fund’s position in Berkshire Hathaway, Inc. could be materially negative.

| Annual Report | November 30, 2016 | 7 |

| Boulder Growth & Income Fund, Inc. | Financial Data |

November 30, 2016 (Unaudited)

| | | Net Asset Value | | | Per Share of Common Stock Market Price | | | Dividend Paid* | |

| 11/30/15 | | $ | 9.93 | | | $ | 7.78 | | | $ | 0.033 | |

| 12/31/15 | | | 9.71 | | | | 7.74 | | | | 0.123 | |

| 1/31/16 | | | 9.30 | | | | 7.03 | | | | 0.033 | |

| 2/29/16 | | | 9.37 | | | | 7.09 | | | | 0.033 | |

| 3/31/16 | | | 10.02 | | | | 7.85 | | | | 0.033 | |

| 4/30/16 | | | 10.22 | | | | 8.05 | | | | 0.033 | |

| 5/31/16 | | | 10.20 | | | | 8.10 | | | | 0.033 | |

| 6/30/16 | | | 10.31 | | | | 8.13 | | | | 0.033 | |

| 7/31/16 | | | 10.54 | | | | 8.48 | | | | 0.033 | |

| 8/31/16 | | | 10.63 | | | | 8.53 | | | | 0.033 | |

| 9/30/16 | | | 10.40 | | | | 8.38 | | | | 0.033 | |

| 10/31/16 | | | 10.22 | | | | 8.22 | | | | 0.033 | |

| 11/30/16 | | | 10.87 | | | | 8.65 | | | | 0.034 | |

| * | Please refer to page 39 for classifications of dividends for the year ended November 30, 2016. |

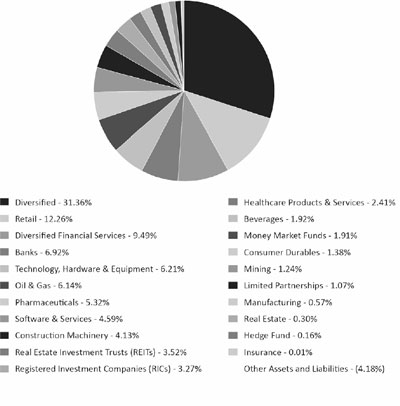

INVESTMENTS AS A % OF TOTAL NET ASSETS

AVAILABLE TO COMMON STOCKHOLDERS

| Boulder Growth & Income Fund, Inc. | Portfolio of Investments |

November 30, 2016

| Description | | Shares | | | Value (Note 2) | |

| LONG TERM INVESTMENTS 102.27% | | | | | | |

| DOMESTIC COMMON STOCK 94.73% | | | | | | |

| Banks 6.92% | | | | | | |

Community Bank(1) | | | 60,000 | | | $ | 8,496,000 | |

MidCountry Financial Corp.*(1)(2) | | | 310,300 | | | | 3,444,330 | |

| Perpetual Federal Savings Bank | | | 102,952 | | | | 2,522,324 | |

| Wells Fargo & Co. | | | 1,233,600 | | | | 65,282,112 | |

| | | | | | | | 79,744,766 | |

| Construction Machinery 4.13% | | | | | | | | |

Caterpillar, Inc.(3)(4) | | | 498,700 | | | | 47,655,772 | |

| | | | | | | | | |

| Consumer Durables 1.38% | | | | | | | | |

Mattel, Inc.(3)(4) | | | 505,000 | | | | 15,942,850 | |

| | | | | | | | | |

| Diversified 30.14% | | | | | | | | |

Berkshire Hathaway, Inc., Class A*(3)(4) | | | 1,144 | | | | 271,128,000 | |

Berkshire Hathaway, Inc., Class B*(3) | | | 485,000 | | | | 76,358,400 | |

| | | | | | | | 347,486,400 | |

| Diversified Financial Services 9.49% | | | | | | | | |

American Express Co.(3)(4) | | | 210,000 | | | | 15,128,400 | |

Goldman Sachs Group, Inc.(3) | | | 37,200 | | | | 8,157,588 | |

JPMorgan Chase & Co.(3)(4) | | | 1,028,000 | | | | 82,414,760 | |

South Street Securities Holdings, Inc.*(1)(2) | | | 25,000 | | | | 3,742,000 | |

| | | | | | | | 109,442,748 | |

| Healthcare Products & Services 2.41% | | | | | | | | |

Johnson & Johnson(3)(4) | | | 250,000 | | | | 27,825,000 | |

| | | | | | | | | |

| Insurance 0.01% | | | | | | | | |

Forethought Financial Group, Inc., Escrow ‐ Class A*(1)(2) | | | 19,678 | | | | 128,930 | |

| | | | | | | | | |

| Manufacturing 0.57% | | | | | | | | |

3M Co.(3)(4) | | | 38,000 | | | | 6,526,120 | |

| | | | | | | | | |

| Mining 1.24% | | | | | | | | |

Freeport‐McMoRan, Inc.*(3)(4) | | | 929,000 | | | | 14,260,150 | |

| | | | | | | | | |

| Oil & Gas 6.14% | | | | | | | | |

Chevron Corp.(3)(4) | | | 635,100 | | | | 70,851,756 | |

| | | | | | | | | |

| Pharmaceuticals 3.36% | | | | | | | | |

| Pfizer, Inc. | | | 1,207,100 | | | | 38,796,194 | |

| | | | | | | | | |

| Real Estate Investment Trusts (REITs) 2.61% | | | | | | | | |

LTC Properties, Inc.(3)(4) | | | 112,000 | | | | 5,091,520 | |

| Annual Report | November 30, 2016 | 9 |

| Boulder Growth & Income Fund, Inc. | Portfolio of Investments |

November 30, 2016

| Description | | Shares | | | Value (Note 2) | |

| Real Estate Investment Trusts (REITs) (continued) | | | | | | |

Ventas, Inc.(3)(4) | | | 414,000 | | | $ | 25,013,880 | |

| | | | | | | | 30,105,400 | |

| Registered Investment Companies (RICs) 3.27% | | | | | | | | |

| Cohen & Steers Infrastructure Fund, Inc. | | | 1,914,058 | | | | 37,687,802 | |

| | | | | | | | | |

| Retail 12.26% | | | | | | | | |

| Wal‐Mart Stores, Inc. | | | 818,100 | | | | 57,618,783 | |

Yum China Holdings, Inc.*(3)(4) | | | 915,000 | | | | 25,729,800 | |

| Yum! Brands, Inc. | | | 915,000 | | | | 58,001,850 | |

| | | | | | | | 141,350,433 | |

| Software & Services 4.59% | | | | | | | | |

International Business Machines Corp.(3)(4) | | | 145,200 | | | | 23,554,344 | |

Oracle Corp.(3)(4) | | | 731,200 | | | | 29,386,928 | |

| | | | | | | | 52,941,272 | |

| Technology, Hardware & Equipment 6.21% | | | | | | | | |

| Cisco Systems, Inc. | | | 1,822,200 | | | | 54,338,004 | |

Harris Corp.(3) | | | 166,300 | | | | 17,222,028 | |

| | | | | | | | 71,560,032 | |

TOTAL DOMESTIC COMMON STOCK (Cost $598,045,098) | | | | | | | 1,092,305,625 | |

| | | | | | | | | |

| FOREIGN COMMON STOCK 6.31% | | | | | | | | |

| Beverages 1.92% | | | | | | | | |

| Heineken Holding NV | | | 180,000 | | | | 12,646,346 | |

| Heineken NV | | | 126,780 | | | | 9,502,492 | |

| | | | | | | | 22,148,838 | |

| Diversified 1.22% | | | | | | | | |

| CK Hutchison Holdings, Ltd. | | | 1,155,500 | | | | 14,077,838 | |

| | | | | | | | | |

| Pharmaceuticals 1.96% | | | | | | | | |

| Sanofi | | | 53,000 | | | | 4,275,256 | |

| Sanofi, ADR | | | 455,300 | | | | 18,303,060 | |

| | | | | | | | 22,578,316 | |

| Real Estate 0.30% | | | | | | | | |

Midland Holdings, Ltd.* | | | 10,956,000 | | | | 3,432,357 | |

| | | | | | | | | |

| Real Estate Investment Trusts (REITs) 0.91% | | | | | | | | |

| Kiwi Property Group, Ltd. | | | 10,198,025 | | | | 10,544,476 | |

| | | | | | | | | |

| TOTAL FOREIGN COMMON STOCK (Cost $53,969,097) | | | | | | | 72,781,825 | |

| Boulder Growth & Income Fund, Inc. | Portfolio of Investments |

November 30, 2016

| Description | | Shares | | | Value (Note 2) | |

| LIMITED PARTNERSHIPS 1.07% | | | | | | |

| Enterprise Products Partners L.P. | | | 476,800 | | | $ | 12,363,424 | |

| | | | | | | | | |

| TOTAL LIMITED PARTNERSHIPS (Cost $10,814,578) | | | | | | | 12,363,424 | |

| | | | | | | | | |

| HEDGE FUND 0.16% | | | | | | | | |

Ithan Creek Partners L.P.*(1)(2) | | | | | | | 1,816,469 | |

| | | | | | | | | |

| TOTAL HEDGE FUND (Cost $930,451) | | | | | | | 1,816,469 | |

| | | | | | | | | |

TOTAL LONG TERM INVESTMENTS (Cost $663,759,224) | | | | | | | 1,179,267,343 | |

| | | | | | | | | |

| SHORT TERM INVESTMENTS 1.91% | | | | | | | | |

| Money Market Funds 1.91% | | | | | | | | |

| State Street Global Advisors U.S. Government Money Market Fund, Class N, 7‐Day Yield ‐ 0.000% | | | 21,992,390 | | | | 21,992,390 | |

| | | | | | | | | |

| TOTAL MONEY MARKET FUNDS (Cost $21,992,390) | | | | | | | 21,992,390 | |

| | | | | | | | | |

TOTAL SHORT TERM INVESTMENTS (Cost $21,992,390) | | | | | | | 21,992,390 | |

| | | | | | | | | |

TOTAL INVESTMENTS 104.18% (Cost $685,751,614) | | | | | | | 1,201,259,733 | |

| | | | | | | | | |

| LEVERAGE FACILITY (4.34%) | | | | | | | (50,028,290 | ) |

| | | | | | | | | |

| OTHER ASSETS AND LIABILITIES 0.16% | | | | | | | 1,863,735 | |

| | | | | | | | | |

| TOTAL NET ASSETS AVAILABLE TO COMMON STOCKHOLDERS 100.00% | | | | | | $ | 1,153,095,178 | |

* | Non-income producing security. |

(1) | Fair valued security under procedures established by the Fund's Board of Directors. Total value of fair valued securities as of November 30, 2016 was $17,627,729 or 1.53% of Total Net Assets Available to Common Stockholders. |

(2) | Restricted Security; these securities may only be resold in transactions exempt from registration under the Securities Act of 1933. (See Notes 12 and 13). |

| Annual Report | November 30, 2016 | 11 |

| Boulder Growth & Income Fund, Inc. | Portfolio of Investments |

November 30, 2016

(3) | Memo Pledged security; a portion or all of the security is pledged as collateral for borrowings as of November 30, 2016. (See Note 14). |

(4) | Loaned security; a portion or all of the security is on loan as of November 30, 2016. (See Note 14). |

Percentages are stated as a percent of the Total Net Assets Available to Common Stockholders.

Regional Breakdown as a % of Total Net Assets Available to Common Stockholders

| United States | 97.87% |

| France | 1.96% |

| Netherlands | 1.92% |

| Hong Kong | 1.52% |

| New Zealand | 0.91% |

| Leverage Facility | (4.34)% |

| Other Assets and Liabilities | 0.16% |

See Accompanying Notes to Financial Statements.

| Boulder Growth & Income Fund, Inc. | Statement of Assets and Liabilities |

November 30, 2016

| ASSETS: | | | |

Total Investments at Value (Cost $685,751,614)* | | $ | 1,201,259,733 | |

| Cash | | | 6,250 | |

| Receivable for investments sold | | | 982,810 | |

| Dividends and interest receivable | | | 2,319,156 | |

| Prepaid expenses and other assets | | | 140,687 | |

| Total Assets | | | 1,204,708,636 | |

| | | | | |

| LIABILITIES: | | | | |

| Loan payable (Note 14) | | | 50,028,290 | |

| Interest due on loan payable (Note 14) | | | 52,531 | |

| Investment co‐advisory fees payable (Note 3) | | | 962,593 | |

| Administration and co‐administration fees payable (Note 3) | | | 205,077 | |

| Audit fees payable | | | 138,700 | |

| Printing fees payable | | | 80,516 | |

| Directors' fees and expenses payable (Note 3) | | | 71,908 | |

| Custody fees payable | | | 38,005 | |

| Legal fees payable | | | 21,790 | |

Accrued expenses and other payables | | | 14,048 | |

| Total Liabilities | | | 51,613,458 | |

| TOTAL NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS | | $ | 1,153,095,178 | |

| | | | | |

| NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) CONSIST OF: | | | | |

| Par value of common stock (Note 5) | | $ | 1,060,968 | |

| Paid‐in capital in excess of par value of common stock | | | 643,359,297 | |

| Overdistributed net investment loss | | | (3,826,710 | ) |

| Accumulated net realized loss | | | (3,010,971 | ) |

| Net unrealized appreciation | | | 515,512,594 | |

| TOTAL NET ASSETS (APPLICABLE TO COMMON STOCKHOLDERS) | | $ | 1,153,095,178 | |

| | | | | |

| Net Asset Value, $1,153,095,178/106,096,817 common stock outstanding | | $ | 10.87 | |

| * | Securities loaned, at value $47,474,474. |

See Accompanying Notes to Financial Statements.

| Annual Report | November 30, 2016 | 13 |

| Boulder Growth & Income Fund, Inc. | Consolidated Statement of Operations |

For the Year Ended November 30, 2016(a)

| INVESTMENT INCOME: | | | |

| Dividends from unaffiliated securities (net of foreign withholding taxes $231,806) | | $ | 24,157,693 | |

| Dividends from affiliated securities | | | 136,461 | |

| Securities lending income | | | 14,722 | |

| Total Investment Income | | | 24,308,876 | |

| | | | | |

| EXPENSES: | | | | |

| Investment co‐advisory fees (Note 3) | | | 11,190,211 | |

| Administration and co‐administration fees (Note 3) | | | 2,056,245 | |

| Interest on loan (Note 14) | | | 641,609 | |

| Directors' fees and expenses (Note 3) | | | 257,489 | |

| Legal fees | | | 229,431 | |

| Audit fees | | | 179,684 | |

| Printing fees | | | 169,904 | |

| Insurance expense | | | 149,872 | |

| Custody fees | | | 143,647 | |

| Transfer agency fees | | | 32,841 | |

| Other | | | 278,067 | |

| Total Expenses | | | 15,329,000 | |

| Net Investment Income | | | 8,979,876 | |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

| Net realized gain on: | | | | |

| Unaffiliated securities | | | 39,962,584 | |

| Affiliated securities | | | 1,698,449 | |

| Foreign capital gains tax | | | (5,466 | ) |

| Foreign currency related transactions | | | 10,360 | |

| | | | 41,665,927 | |

| Long‐term capital gain distributions from other investment companies | | | 2,310,723 | |

| Net change in unrealized appreciation/(depreciation) on: | | | | |

| Unaffiliated securities | | | 101,778,604 | |

| Affiliated securities | | | (3,423,885 | ) |

| Foreign currency related translations | | | 4,475 | |

| | | | 98,359,194 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | | | 142,335,844 | |

| NET INCREASE IN NET ASSETS APPLICABLE TO COMMON STOCKHOLDERS RESULTING FROM OPERATIONS | | $ | 151,315,720 | |

| (a) | Financial Statements consolidated through March 31, 2016, the dissolution date of FOFI 1, Ltd. (See Note 2). |

See Accompanying Notes to Financial Statements.

| Boulder Growth & Income Fund, Inc. | Consolidated Statements of Changes in Net Assets |

| | | For the Year Ended November 30, 2016(a) | | | For the Year Ended November 30, 2015 | |

| OPERATIONS: | | | | | | |

| Net investment income | | $ | 8,979,876 | | | $ | 3,769,777 | |

| Net realized gain | | | 41,665,927 | | | | 15,817,573 | |

| Long‐term capital gain distributions from other investment companies | | | 2,310,723 | | | | 1,626,928 | |

| Net change in unrealized appreciation/(depreciation) | | | 98,359,194 | | | | (110,424,541 | ) |

| Net Increase/(Decrease) in Net Assets Applicable to Common Stockholders Resulting from Operations | | | 151,315,720 | | | | (89,210,263 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO COMMON STOCKHOLDERS (NOTE 10): | | | | | | | | |

| From net investment income | | | (35,058,085 | ) | | | (3,501,195 | ) |

| From net realized capital gains | | | (16,561,199 | ) | | | (7,500,036 | ) |

| Total Distributions: Common Stockholders | | | (51,619,284 | ) | | | (11,001,231 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Value of common shares issued in the Reorganization (Note 15) | | | – | | | | 864,982,044 | |

| Net Increase in Net Assets from Capital Share Transactions | | | – | | | | 864,982,044 | |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 1,053,398,742 | | | | 288,628,192 | |

End of period (including (overdistributed)/accumulated net investment income of $(3,826,710) and $5,111,969, respectively) | | $ | 1,153,095,178 | | | $ | 1,053,398,742 | |

(a) | Financial Statements consolidated through March 31, 2016, the dissolution date of FOFI 1, Ltd. (See Note 2). |

See Accompanying Notes to Financial Statements.

| Annual Report | November 30, 2016 | 15 |

| Boulder Growth & Income Fund, Inc. | Consolidated Statement of Cash Flows |

For the Year Ended November 30, 2016(a)

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net increase in net assets from operations | | $ | 151,315,720 | |

| Adjustments to reconcile net decrease in net assets from operations to net cash provided by operating activities: | | | | |

| Purchase of investment securities | | | (94,304,934 | ) |

| Proceeds from disposition of investment securities | | | 128,943,634 | |

| Net sales of short‐term investment securities | | | 5,424,542 | |

| Net realized gain on investments | | | (41,661,033 | ) |

| Net realized gain on foreign capital gains tax | | | 5,466 | |

| Net change in unrealized appreciation on investments | | | (98,354,719 | ) |

| Increase in dividends and interest receivable | | | (36,666 | ) |

| Decrease in prepaid expenses & other assets | | | 29,398 | |

| Increase in interest due on loan payable | | | 46,456 | |

| Increase in co‐advisory fees payable | | | 51,636 | |

| Increase in administration and co‐administration fees payable | | | 33,031 | |

| Increase in directors' fees and expenses payable | | | 70,764 | |

| Decrease in legal fees payable | | | (4,921 | ) |

| Decrease in audit fees payable | | | (7,948 | ) |

| Decrease in custody fees payable | | | (35,328 | ) |

| Increase in printing fees payable | | | 62,975 | |

| Decrease in accrued expenses and other payables | | | (47,842 | ) |

| Net Cash Provided by Operating Activities | | | 51,530,231 | |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from Loan | | | 28,290 | |

| Cash distributions paid on Common Stockholders | | | (51,619,284 | ) |

| Net Cash Used in Financing Activities | | | (51,590,994 | ) |

| Effect of exchange rates on cash | | | 4,384 | |

| | | | | |

| Net decrease in cash | | | (56,379 | ) |

| Cash and foreign currency, beginning balance | | | 62,629 | |

| Cash and foreign currency, ending balance | | $ | 6,250 | |

| | | | | |

| Cash paid for interest on loan during the period was: | | $ | 595,153 | |

| (a) | Financial Statements consolidated through March 31, 2016, the dissolution date of FOFI 1, Ltd. (See Note 2). |

See Accompanying Notes to Financial Statements.

Intentionally Left Blank

| Boulder Growth & Income Fund, Inc. | Consolidated Financial Highlights |

Contained below is selected data for a share of common stock outstanding, total investment return, ratios to average net assets and other supplemental data for the period indicated. This information has been determined based upon information provided in the financial statements and market price data for the Fund’s shares.

| OPERATING PERFORMANCE: |

| Net asset value ‐ Beginning of Period |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: |

Net investment income(a) |

| Net realized and unrealized gain/(loss) on investments |

| Total from Investment Operations |

| AUCTION MARKET PREFERRED STOCK TRANSACTIONS |

| Distributions from net investment income |

| Distributions from long‐term capital gains |

| Total Auction Preferred Stock Transactions |

| Net Increase/(Decrease) from Operations Applicable to Common Stockholders |

| DISTRIBUTIONS TO COMMON STOCKHOLDERS |

| Distributions from net investment income |

| Distributions from net realized capital gains |

| Total Distributions Paid to Common Stockholders |

| Net Increase/(Decrease) in Net Asset Value |

| Common Share Net Asset Value ‐ End of Period |

| Common Share Market Value ‐ End of Period |

Total Return, Common Share Net Asset Value(c) |

Total Return, Common Share Market Value(c) |

RATIOS TO AVERAGE NET ASSETS AVAILABLE TO COMMON STOCKHOLDERS:(e) |

| Ratio of operating expenses to average net assets including waiver |

| Ratio of operating expenses to average net assets excluding waiver |

| Ratio of operating expenses to average net assets excluding interest on loan |

| Ratio of net investment income to average net assets including waiver |

| Ratio of net investment income to average net assets excluding waiver |

| SUPPLEMENTAL DATA: |

| Portfolio turnover rate |

| Net Assets Applicable to Common Stockholders, End of Year (000's) |

| Number of Common Shares Outstanding, End of Year (000's) |

Ratio of Net Operating Expenses including waiver, when applicable, to Total Average Net Assets including Auction Market Preferred Stock(e) |

| BORROWINGS AT END OF PERIOD |

| Aggregate Amount Outstanding (000s) |

| Asset Coverage Per $1,000 |

| Boulder Growth & Income Fund, Inc. | Consolidated Financial Highlights |

| For the Year Ended November 30, 2016 | | | For the Year Ended November 30, 2015 | | | For the Year Ended November 30, 2014 | | | For the Year Ended November 30, 2013 | | | For the Year Ended November 30, 2012 | |

| $ | 9.93 | | | $ | 11.32 | | | $ | 10.12 | | | $ | 8.54 | | | $ | 7.38 | |

| | | | | | | | | | | | | | | | | | | |

| | 0.08 | | | | 0.05 | | | | 0.03 | | | | 0.06 | | | | 0.10 | |

| | 1.35 | | | | (1.12 | ) | | | 1.61 | | | | 1.88 | | | | 1.19 | |

| | 1.43 | | | | (1.07 | ) | | | 1.64 | | | | 1.94 | | | | 1.29 | |

| | | | | | | | | | | | | | | | | | | |

| | – | | | | – | | | | – | | | | (0.00 | )(b) | | | (0.01 | ) |

| | – | | | | – | | | | – | | | | (0.01 | ) | | | (0.01 | ) |

| | – | | | | – | | | | – | | | | (0.01 | ) | | | (0.02 | ) |

| | 1.43 | | | | (1.07 | ) | | | 1.64 | | | | 1.93 | | | | 1.27 | |

| | | | | | | | | | | | | | | | | | | |

| | (0.33 | ) | | | (0.03 | ) | | | (0.00 | )(b) | | | (0.16 | ) | | | (0.01 | ) |

| | (0.16 | ) | | | (0.29 | ) | | | (0.44 | ) | | | (0.19 | ) | | | (0.10 | ) |

| | (0.49 | ) | | | (0.32 | ) | | | (0.44 | ) | | | (0.35 | ) | | | (0.11 | ) |

| | 0.94 | | | | (1.39 | ) | | | 1.20 | | | | 1.58 | | | | 1.16 | |

| $ | 10.87 | | | $ | 9.93 | | | $ | 11.32 | | | $ | 10.12 | | | $ | 8.54 | |

| $ | 8.65 | | | $ | 7.78 | | | $ | 9.06 | | | $ | 7.92 | | | $ | 6.53 | |

| | 16.38 | % | | | (9.04 | )% | | | 18.08 | % | | | 24.52 | % | | | 17.89 | %(d) |

| | 18.21 | % | | | (10.95 | )% | | | 20.76 | % | | | 27.54 | % | | | 12.94 | % |

| | | | | | | | | | | | | | | | | | | |

| | 1.43 | % | | | 1.48 | % | | | 1.72 | % | | | 1.74 | % | | | 3.17 | % |

| | 1.43 | % | | | 1.50 | % | | | 1.83 | % | | | 1.84 | % | | | 3.28 | % |

| | 1.37 | % | | | N/A | (f) | | | N/A | (f) | | | N/A | (f) | | | N/A | (f) |

| | 0.84 | % | | | 0.42 | % | | | 0.32 | % | | | 0.62 | % | | | 1.22 | % |

| | 0.84 | % | | | 0.40 | % | | | 0.21 | % | | | 0.52 | % | | | 1.11 | % |

| | | | | | | | | | | | | | | | | | | |

| | 9 | % | | | 12 | % | | | 4 | % | | | 11 | % | | | 20 | % |

| $ | 1,153,095 | | | $ | 1,053,399 | | | $ | 288,628 | | | $ | 257,975 | | | $ | 217,631 | |

| | 106,097 | | | | 106,097 | | | | 25,496 | | | | 25,496 | | | | 25,496 | |

| | | | | | | | | | | | | | | | | | | |

| | N/A | | | | N/A | | | | N/A | | | | N/A | | | | 2.83 | % |

| | | | | | | | | | | | | | | | | | | |

| $ | 50,028 | | | $ | 50,000 | | | $ | 11,168 | | | $ | 25,043 | | | | N/A | |

| $ | 24,049 | | | $ | 22,068 | | | $ | 26,845 | | | $ | 11,301 | | | | N/A | |

See Accompanying Notes to Consolidated Financial Statements.

| Annual Report | November 30, 2016 | 19 |

| Boulder Growth & Income Fund, Inc. | Consolidated Financial Highlights |

| (a) | Calculated based on the average number of common shares outstanding during each fiscal period. |

| (b) | Amount represents less than $(0.005) per common share. |

| (c) | Total return based on per share net asset value reflects the effects of changes in net asset value on the performance of the Fund during each fiscal period. Total return based on common share market value assumes the purchase of common shares at the market price on the first day and sale of common shares at the market price on the last day of the period indicated. Dividends and distributions, if any, are assumed to be reinvested at prices obtained under the Fund's distribution reinvestment plan. |

| (d) | Total return includes an increase from payment by affiliates classified as litigation income. Excluding such item, the total return would have been decreased by 0.60%. |

| (e) | Ratios do not include the effect of dividends to preferred stockholders. Also, these ratios do not reflect the proportionate share of income and expenses of the underlying investee funds (i.e. those listed under Hedge Fund or Registered Investment Companies on the Portfolio of Investments). |

| (f) | Interest expense was incurred but was not presented separately in previously issued financial statements. |

The table below sets out information with respect to Taxable Auction Market Preferred Stock previously issued.(1)(2)

| | | Par Value (000) | | | Total Shares Outstanding (000) | | | Asset Coverage Per Share(3) | | | Involuntary Liquidating Preference Per Share(4) | |

| 11/30/16 | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| 11/30/15 | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| 11/30/14 | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| 11/30/13 | | | N/A | | | | N/A | | | | N/A | | | | N/A | |

| 11/30/12 | | $ | 25,000 | | | $ | 1.00 | | | $ | 242,669 | | | $ | 25,000 | |

| (1) | See Note 6 in Notes to Financial Statements. |

| (2) | The Auction Market Preferred Stock ("AMPS") issued by the Fund were fully redeemed at the liquidation preference, plus accumulated but unpaid dividends, on April 23, 2013. |

| (3) | Calculated by subtracting the Fund's total liabilities from the Fund's total assets and dividing by the number of AMPS outstanding. |

| (4) | Excludes accumulated undeclared dividends. |

See Accompanying Notes to Consolidated Financial Statements.

| Boulder Growth & Income Fund, Inc. | Notes to Financial Statements |

November 30, 2016

NOTE 1. FUND ORGANIZATION

Boulder Growth & Income Fund, Inc. (the “Fund” or “BIF”), is a non‐diversified, closed‐end management company organized as a Maryland corporation and is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund is considered an investment company for financial reporting purposes under generally accepted accounting principles in the United States of America (“GAAP”).

On March 20, 2015 (the “Reorganization Date”), Boulder Total Return Fund, Inc. (“BTF”), The Denali Fund Inc. (“DNY”) and First Opportunity Fund, Inc. (“FOFI” and, together with BTF and DNY, the “Acquired Funds”) reorganized into the Fund (the “Reorganization”), pursuant to a certain Agreement and Plan of Reorganization.

Details of the Reorganization are further described in Note 15 – Fund Reorganization.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The preparation of financial statements is in accordance with GAAP, which requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

Basis for Consolidation: The accompanying consolidated financial statements include the account of FOFI 1, Ltd. (the “Subsidiary”) a wholly‐owned subsidiary of the Fund, organized under the laws of the Cayman Islands. In accordance with the Agreement and Plan of Reorganization, the ownership of the Subsidiary was transferred from FOFI to the Fund on the Reorganization Date. FOFI 1, Ltd. was dissolved on March 31, 2016.

Portfolio Valuation: Equity securities for which market quotations are readily available (including securities listed on national securities exchanges and those traded over‐the‐counter) are valued based on the last sales price at the close of the applicable exchange. If such equity securities were not traded on the valuation date, but market quotations are readily available, they are valued at the bid price provided by an independent pricing service or by principal market makers. Equity securities traded on NASDAQ are valued at the NASDAQ Official Closing Price. Debt securities are valued at the mean between the closing bid and asked prices, or based on a matrix system which utilizes information (such as credit ratings, yields and maturities) from independent pricing services, principal market makers, or other independent sources. Money market mutual funds are valued at their net asset value. Short‐term fixed income securities such as Commercial Paper, Bankers Acceptances and U.S. Treasury Bills, having a maturity of less than 60 days are valued using market quotations or a matrix method provided by a pricing service. If prices are not available from the pricing service, then the securities will be priced at fair value under procedures approved by the Board of Directors (the “Board”). The Board has delegated to the Valuation Committee, the responsibility of determining the fair value of any security or financial instrument owned by the Fund for which market quotations are not readily available or where the pricing agent or market maker does not provide a valuation or methodology, or provides a valuation or methodology that, in the judgment of the Valuation Committee, does not represent fair value (“Fair Value Securities”). The Valuation Committee uses a third‐party pricing consultant to assist the committee in analyzing, developing, applying and documenting a methodology with respect to certain Fair Value Securities. The Valuation Committee and the valuation consultant, as appropriate, use valuation techniques that could utilize both observable and unobservable inputs. In such circumstances, the Valuation Committee is responsible for (i) identifying Fair Value Securities, (ii) analyzing each Fair Value Security and developing, applying and documenting a methodology for valuing Fair Value Securities, and (iii) periodically reviewing the appropriateness and accuracy of the methods used in valuing Fair Value Securities. The appointment of any officer or employee of the advisers or Fund to the Valuation Committee shall be promptly reported to the Board and ratified by the Board at its next regularly scheduled meeting. The Valuation Committee is responsible for reporting to the Board, on a quarterly basis, valuations and certain findings with respect to the Fair Value Securities. Such valuations and findings are reviewed by the entire Board on a quarterly basis.

| Annual Report | November 30, 2016 | 21 |

| Boulder Growth & Income Fund, Inc. | Notes to Financial Statements |

November 30, 2016

The Portfolio of Investments includes investments valued at $17,627,729 (1.53% of total net assets), whose fair values have been estimated by management in the absence of readily determinable fair values. Due to the inherent uncertainty of the valuation of these investments, these values may differ from the values that would have been used had a ready market for these investments existed and the differences could be material.

The Fund’s investment in an unregistered pooled investment vehicle (“Hedge Fund”) is valued, as a practical expedient, at the most recent net asset value determined by the Hedge Fund manager according to such manager’s policies and procedures based on valuation information reasonably available to the Hedge Fund manager at that time; provided, however, that the Valuation Committee may consider whether it is appropriate, in light of relevant circumstances, to adjust such valuation in accordance with the Fund’s valuation procedures. If the Hedge Fund does not report a value to the Fund on a timely basis, the fair value of the Hedge Fund shall be based on the most recent value reported by the Hedge Fund, as well as any other relevant information available at the time the Fund values its portfolio. The frequency and timing of receiving valuations for the Hedge Fund investment is subject to change at any time, without notice to investors, at the discretion of the Hedge Fund manager or the Fund.

For valuation purposes, the last quoted prices of non‐U.S. equity securities may be adjusted under certain circumstances described below. If the Valuation Committee determines that developments between the close of a foreign market and the close of the New York Stock Exchange (“NYSE”) will, in its judgment, materially affect the value of some or all of the Fund’s portfolio securities, the Valuation Committee may adjust the previous closing prices to reflect what it believes to be the fair value of the securities as of the close of the NYSE. In deciding whether it is necessary to adjust closing prices to reflect fair value, the Valuation Committee reviews a variety of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. The Valuation Committee may also fair value securities in other situations, such as when a particular foreign market is closed but the U.S. market is open. The Valuation Committee may use outside pricing services to provide it with closing prices. The Valuation Committee may consider whether it is appropriate, in light of relevant circumstances, to adjust such valuation in accordance with the Fund’s valuation procedures. The Valuation Committee cannot predict how often it will use closing prices and how often it will determine it necessary to adjust those prices to reflect fair value. If the Valuation Committee adjusts prices, the Valuation Committee will periodically compare closing prices, the next day’s opening prices in the same markets and those adjusted prices as a means of evaluating its security valuation process.

| Boulder Growth & Income Fund, Inc. | Notes to Financial Statements |

November 30, 2016

Various inputs are used to determine the value of the Fund's investments. Observable inputs are inputs that reflect the assumptions market participants would use based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions based on the best information available in the circumstances.

These inputs are summarized in the three broad levels listed below.

| Level 1 — | Unadjusted quoted prices in active markets for identical investments |

| Level 2 — | Significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| Level 3 — | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The following is a summary of the inputs used as of November 30, 2016 in valuing the Fund’s investments carried at value:

Investments in Securities at Value* | | Level 1 -

Quoted Prices | | | Level 2 -

Significant Observable

Inputs | | | Level 3 -

Significant Unobservable Inputs | | | Total | |

| Domestic Common Stock | | | | | | | | | | | | |

| Banks | | $ | 67,804,436 | | | $ | – | | | $ | 11,940,330 | | | $ | 79,744,766 | |

| Diversified Financial Services | | | 105,700,748 | | | | – | | | | 3,742,000 | | | | 109,442,748 | |

| Insurance | | | – | | | | – | | | | 128,930 | | | | 128,930 | |

| Other | | | 902,989,181 | | | | – | | | | – | | | | 902,989,181 | |

| Foreign Common Stock | | | | | | | | | | | | | | | | |

| Other | | | 72,781,825 | | | | – | | | | – | | | | 72,781,825 | |

| Limited Partnerships | | | 12,363,424 | | | | – | | | | – | | | | 12,363,424 | |

Hedge Fund** | | | N/A | | | | N/A | | | | N/A | | | | 1,816,469 | |

| Short Term Investments | | | 21,992,390 | | | | – | | | | – | | | | 21,992,390 | |

| TOTAL | | $ | 1,183,632,004 | | | $ | – | | | $ | 15,811,260 | | | $ | 1,201,259,733 | |

| * | For detailed descriptions, see the accompanying Portfolio of Investments. |

| ** | In accordance with ASU 2015-07 and Subtopic 820-10, certain investments that are measured at fair value using the net asset value per share (or its equivalent) as a practical expedient have not been classified in the fair value hierarchy. The fair value amount presented in the Total column of this table is intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

The Fund evaluates transfers into or out of Level 1, Level 2 and Level 3 as of the end of the reporting period.

There were no transfers in or out of Levels 1 and 2 during the year ended November 30, 2016.

| Annual Report | November 30, 2016 | 23 |

| Boulder Growth & Income Fund, Inc. | Notes to Financial Statements |

November 30, 2016

The following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value:

| Boulder Growth & Income Fund | | Domestic Common Stock | | | Foreign Common Stock | | | Total | |

| Balance as of November 30, 2015 | | $ | 15,984,351 | | | $ | 1,456,741 | | | $ | 17,441,092 | |

| Realized Gain/(Loss) | | | (94,027 | ) | | | (452,857 | ) | | | (546,884 | ) |

| Change in Unrealized Appreciation/(Depreciation) | | | (59,234 | ) | | | 60,527 | | | | 1,293 | |

| Purchases | | | – | | | | – | | | | – | |

| Sales Proceeds | | | (19,830 | ) | | | (1,064,411 | ) | | | (1,084,241 | ) |

| Transfer into Level 3 | | | – | | | | – | | | | – | |

| Transfer out of Level 3 | | | – | | | | – | | | | – | |

| Balance as of November 30, 2016 | | $ | 15,811,260 | | | $ | – | | | $ | 15,811,260 | |

| Net change in unrealized appreciation/(depreciation) included in the Statements of Operations attributable to Level 3 investments held at November 30, 2016 | | $ | (157,243 | ) | | $ | – | | | $ | (157,243 | ) |

Net change in unrealized appreciation/depreciation on Level 3 securities is included on the Statement of Assets and Liabilities under Net unrealized appreciation on investments and foreign currency translation.

| Boulder Growth & Income Fund, Inc. | Notes to Financial Statements |

November 30, 2016

The table below provides additional information about the Level 3 Fair Value Measurements as of November 30, 2016 where the Fund used its own significant assumptions:

Quantitative Information about Level 3 Fair Value Measurements

| Asset Class | Industry Group | | Fair Value (USD) | | Valuation Technique | Unobservable Inputs(a) | | Value/Range | |

| Domestic Common Stocks: | | |

| Banks | | $ | 11,940,330 | | Comparable Company Approach | Discount for lack of marketability | | 10% ‐ 32 | % |

| | | | | | | | Price to Tangible Book Value Multiple | | | 1.382x ‐ 1.924 | x |

| Diversified Financial Services | | $ | 3,742,000 | | Comparable Company Approach | Discount for lack of marketability | | | 10 | % |

| | | | | | | | Price to Tangible Book Value Multiple | | | 2.017 | x |

| Insurance | | $ | 128,930 | | Future Cash Distribution less a 20% discount | Discount for lack of marketability | | | 20 | % |

| | | | | | | | Future Cash Distribution | | $ | 8.19 | |

| Grand Total | | $ | 15,811,260 | | | | | | | |

| (a) | A change to the unobservable input may result in a significant change to the value of the investment as follows: |

| Unobservable Input | Impact to Value if Input Increases | Impact to Value if Input Decreases |

| Discount for Lack of Marketability | Decrease | Increase |

| Price to Tangible Book Value Multiple | Increase | Decrease |

| Future Cash Distribution | Increase | Decrease |

Securities Transactions and Investment Income: Securities transactions are recorded as of the trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded as of the ex‐dividend date or for certain foreign securities, when the information becomes available to the Fund. Non‐cash dividends included in dividend income, if any, are recorded at the fair market value of the securities received. Interest income, including amortization of premium and accretion of discount on debt securities, as required, is recorded on the accrual basis.

Dividend income from investments in real estate investment trusts (“REITs”) is recorded at management’s estimate of income included in distributions received. Distributions received in excess of this amount are recorded as a reduction of the cost of investments. The actual amount of income and return of capital are determined by each REIT only after its fiscal year‐end, and may differ from the estimated amounts. Such differences, if any, are recorded in the Fund’s following year.

| Annual Report | November 30, 2016 | 25 |

| Boulder Growth & Income Fund, Inc. | Notes to Financial Statements |

November 30, 2016

Foreign Currency Translations: The Fund may invest a portion of its assets in foreign securities. In the event that the Fund executes a foreign security transaction, the Fund will generally enter into a forward foreign currency contract to settle the foreign security transaction. Foreign securities may carry more risk than U.S. securities, such as political, market and currency risks. See Foreign Issuer Risk under Note 7.

The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the exchange rate prevailing at the end of the period, and purchases and sales of investment securities, income and expenses transacted in foreign currencies are translated at the exchange rate on the dates of such transactions. Foreign currency gains and losses result from fluctuations in exchange rates between trade date and settlement date on securities transactions, foreign currency transactions, and the difference between the amounts of foreign interest and dividends recorded on the books of the Fund and the amounts actually received.

The portion of realized and unrealized gains or losses on investments due to fluctuations in foreign currency exchange rates is not separately disclosed and is included in realized and unrealized gains or losses on investments, when applicable.

Dividends and Distributions to Stockholders: It is the Fund’s policy to distribute substantially all net investment income and net realized gains to stockholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Distributions to stockholders are recorded on the ex‐dividend date. Any net realized short‐term capital gains will be distributed to stockholders at least annually. Any net realized long‐term capital gains may be distributed to stockholders at least annually or may be retained by the Fund as determined by the Fund’s Board. Capital gains retained by the Fund are subject to tax at the corporate tax rate. Subject to the Fund qualifying as a registered investment company, any taxes paid by the Fund on such net realized long‐term gains may be used by the Fund’s stockholders as a credit against their own tax liabilities.

Indemnifications: Like many other companies, the Fund’s organizational documents provide that its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, both in some of its principal service contracts and in the normal course of its business, the Fund enters into contracts that provide indemnifications to other parties for certain types of losses or liabilities. The Fund’s maximum exposure under these arrangements is unknown as this could involve future claims against the Fund.

Federal Income Tax: For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its earnings to its stockholders. Accordingly, no provision for federal income or excise taxes has been made.

Income and capital gain distributions are determined and characterized in accordance with income tax regulations, which may differ from U.S. GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities held by the Fund, timing differences and differing characterization of distributions made by the Fund as a whole.

| Boulder Growth & Income Fund, Inc. | Notes to Financial Statements |

November 30, 2016

As of and during the year ended November 30, 2016, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

NOTE 3. ADVISORY FEES, ADMINISTRATION FEES AND OTHER AGREEMENTS

Stewart Investment Advisers (“SIA”) and Rocky Mountain Advisers, LLC (“RMA”) (together with SIA, the “Advisers”) serve as co‐investment advisers to the Fund. The Fund pays the Advisers an Advisory Fee at an annual rate of 1.00% of the value of the Fund’s net assets plus the principal amount of leverage, if any (“Net Assets”).

For the year ended November 30, 2016, the Fund made net cash payments for advisory fees to SIA and RMA in the amounts of $2,784,644 and $8,353,932, respectively.

Stewart West Indies Trading Company, Ltd. is a Barbados international business company doing business as Stewart Investment Advisers. The equity owner of SIA is the Stewart West Indies Trust. RMA is owned by the Susan L. Ciciora Trust (the “SLC Trust”), which is also a stockholder of the Fund. SIA and RMA are considered “affiliated persons”, as that term is defined in the 1940 Act, of the Fund and Fund Administrative Services, LLC (“FAS”). RMA receives 75% of the fees earned by the Advisers and SIA receives 25% of the fees earned by the Advisers.

FAS serves as the Fund’s co‐administrator. Under the Administration Agreement, FAS provides certain administrative and executive management services to the Fund including, but not limited to, providing reviews and negotiations of service providers, maintaining investment records, assisting in the calculation and publication of total returns for the Fund, providing general counsel, legal, treasury and accounting services, and any other such administrative services as may be requested from time to time by the Fund’s management or the Board. The Fund pays FAS a monthly fee, calculated at an annual rate of 0.20% of the value of the Fund’s Net Assets up to $100 million, and 0.15% of the Fund’s Net Assets over $100 million. Notwithstanding, FAS has agreed to cap the Fund’s total administration costs at 0.30% (including administration, co‐administration, transfer agent and custodian fees). As such, FAS has agreed to waive a portion of its fee based on Net Assets should the total monthly administration expenses exceed 0.30%. As the Fund’s total monthly administration costs did not exceed 0.30% during the year ended November 30, 2016, there was no fee waiver for that period. The equity owners of FAS are the Lola Brown Trust No. 1B, the SLC Trust and the Stewart West Indies Trust.

As SIA, RMA and FAS are considered affiliates of the Fund, as that term is defined in the 1940 Act, agreements between the Fund and those entities are considered affiliated transactions.

ALPS Fund Services, Inc. (“ALPS”) serves as the Fund’s co‐administrator. As compensation for its services, ALPS receives certain out‐of‐pocket expenses and asset‐based fees, which are accrued daily and paid monthly. The fees paid to ALPS are calculated based on the Net Assets of the Fund. In addition, up until the dissolution of FOFI 1, Ltd on March 31, 2016, ALPS received a fee for administration services related to FOFI 1, Ltd.

| Annual Report | November 30, 2016 | 27 |

| Boulder Growth & Income Fund, Inc. | Notes to Financial Statements |

November 30, 2016

No persons (other than the Independent Directors) currently receive compensation from the Fund for acting as a director or officer; however, officers of the Fund may also be officers or employees of the Advisers or FAS and may receive compensation in such capacities. The Fund pays each member of the Board (a “Director”) who is not a director, officer, employee, or affiliate of the Advisers, FAS, or any of their affiliates a fee of $40,000 per annum, plus $5,000 for each in‐person meeting, $3,000 for each audit committee meeting, $1,000 for each nominating committee meeting and $1,000 for each telephonic meeting of the Board. The lead independent director of the Board receives an additional $3,125 for attending each regular quarterly meeting of the Board. The chairman of the audit committee receives an additional $3,000 for attending each regular meeting of the audit committee. The Fund will also reimburse all non‐interested Directors for travel and out‐of‐pocket expenses incurred in connection with such meetings.

State Street Bank and Trust Company (“State Street”) serves as the Fund’s custodian. Computershare Shareowner Services (“Computershare”) serves as the Fund’s common stock servicing agent, dividend‐paying agent and registrar. As compensation for State Street’s and Computershare’s services, the Fund pays each a monthly fee plus certain out‐of‐pocket expenses.

NOTE 4. SECURITIES TRANSACTIONS

Purchases and sales of securities, excluding short term securities during the year ended November 30, 2016 were $94,304,934 and $129,244,586 respectively.

NOTE 5. CAPITAL

At November 30, 2016, 249,990,000 of $0.01 par value common stock (the “Common Stock”) were authorized, of which 106,096,817 were outstanding.

Transactions in Common Stock were as follows:

| | | For the Year Ended November 30, 2016 | | | For the Year Ended November 30, 2015 | |

| Common Stock outstanding ‐ beginning of period | | | 106,096,817 | | | | 25,495,585 | |

| Shares issued in the Reorganization | | | – | | | | 80,601,232 | |

| Common Stock outstanding ‐ end of period | | | 106,096,817 | | | | 106,096,817 | |

NOTE 6. TAXABLE AUCTION MARKET PREFERRED STOCK

The Fund’s Articles of Incorporation authorize the issuance of up to 1,000 shares of $0.01 par value Auction Market Preferred Stock. On October 17, 2005, the Fund issued 1,000 AMPS. AMPS were senior to Common Stock and resulted in the financial leveraging of the Common Stock. Such leveraging tended to magnify both the risks and opportunities to common stockholders. Dividends on the AMPS were cumulative. The Fund’s AMPS had a liquidation preference of $25,000 per share plus any accumulated unpaid dividends, whether or not earned or declared by the Fund and had no mandatory retirement date.

| Boulder Growth & Income Fund, Inc. | Notes to Financial Statements |

November 30, 2016

On April 23, 2013 all outstanding AMPS issued by the Fund were redeemed at the liquidation preference plus accumulated but unpaid dividends.

The Fund obtained alternative financing to provide new funding in order to redeem the AMPS and provide leverage to the Fund going forward. See Note 14 ‐ Line of Credit and Securities Lending, for further information on the borrowing facility used by the Fund during, and as of, the year ended November 30, 2016.

NOTE 7. PORTFOLIO INVESTMENTS AND CONCENTRATION

Under normal market conditions, the Fund intends to invest at least 80% of its net assets in common stocks. Common stocks include dividend‐paying closed‐end funds and REITs. The portion of the Fund’s assets that are not invested in common stocks may be invested in fixed income securities and cash equivalents. The term “fixed income securities” includes bonds, U.S. Government securities, notes, bills, debentures, preferred stocks, convertible securities, bank debt obligations, repurchase agreements and short‐term money market obligations.

Concentration Risk: The Fund operates as a “non‐diversified” investment company, as defined in the 1940 Act. As a result of being “non‐diversified” with respect to 50% of the Fund’s portfolio, the Fund must limit the portion of its assets invested in the securities of a single issuer to 5%, measured at the time of purchase. In addition, no single investment can exceed 25% of the Fund’s total assets at the time of purchase. A more concentrated portfolio may cause the Fund’s net asset value to be more volatile and thus may subject stockholders to more risk. Thus, the volatility of the Fund’s net asset value and its performance in general, depends disproportionately more on the performance of a smaller number of holdings than that of a more diversified fund. As a result, the Fund is subject to a greater risk of loss than a fund that diversifies its investments more broadly.

As of November 30, 2016, the Fund held more than 25% of its assets in Berkshire Hathaway, Inc. In addition to market appreciation of the issuer since the time of purchase, the Fund acquired additional interest in Berkshire Hathaway, Inc. due to the Reorganization. After the Reorganization was completed, shares held of the issuer were liquidated to bring the concentration to 25%. Concentration of the Berkshire Hathaway, Inc. position was a direct result of market appreciation and decreased leverage since the time the Fund and the Acquired Funds purchased the security.

Foreign Issuer Risk: Investment in non‐U.S. issuers may involve unique risks compared to investing in securities of U.S. issuers. These risks may include, but are not limited to: (i) less information about non‐U.S. issuers or markets may be available due to less rigorous disclosure, accounting standards or regulatory practices; (ii) many non‐U.S. markets are smaller, less liquid and more volatile thus, in a changing market, the Advisers may not be able to sell the Fund’s portfolio securities at times, in amounts and at prices they consider reasonable; (iii) currency exchange rates or controls may adversely affect the value of the Fund’s investments; (iv) the economies of non‐U.S. countries may grow at slower rates than expected or may experience downturns or recessions; and, (v) withholdings and other non‐U.S. taxes may decrease the Fund’s return.

| Annual Report | November 30, 2016 | 29 |

| Boulder Growth & Income Fund, Inc. | Notes to Financial Statements |

November 30, 2016

NOTE 8. SIGNIFICANT STOCKHOLDERS