Execution Version AMENDMENT NO. 1 TO CREDIT AGREEMENT AMENDMENT NO. 1 TO CREDIT AGREEMENT, dated as of June 27, 2019 (this “Agreement”), by and among Coty Inc., a Delaware corporation (the “Parent Borrower”), Coty B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of the Netherlands (the “Dutch Borrower”), the Lenders party hereto (which such Lenders constitute the Required TLA Lenders and the Required Revolving Lenders) and JPMorgan Chase Bank, N.A., as administrative agent (in such capacity, the “Administrative Agent”). RECITALS: WHEREAS, reference is hereby made to the Amended and Restated Credit Agreement, dated as of April 5, 2018 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Existing Credit Agreement” and, as amended by this Agreement, the “Credit Agreement”), by and among the Parent Borrower, the lenders from time to time party thereto and the Administrative Agent and Collateral Agent (capitalized terms used but not otherwise defined herein having the meanings provided in the Credit Agreement); WHEREAS, the Parent Borrower has requested that the Required TLA Lenders and the Required Revolving Lenders amend the Credit Agreement pursuant to Section 10.02(b) of the Credit Agreement as set forth herein; and NOW, THEREFORE, in consideration of the premises and agreements, provisions and covenants herein contained and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows: SECTION 1. Amendments to Credit Agreement. Each of the parties hereto agrees that, effective on the First Amendment Effective Date, (a) the Existing Credit Agreement shall be amended to delete the stricken text (indicated textually in the same manner as the following example: stricken text) and to add the double-underlined text (indicated textually in the same manner as the following example: double-underlined text) as set forth in the pages of the Existing Credit Agreement attached as Annex I hereto and (b) Exhibit B to the Credit Agreement shall be replaced in its entirety with the form of Compliance Certificate attached as Annex II hereto. SECTION 2. First Amendment Effective Date Conditions. This Agreement will become effective as of June 27, 2019 (the “First Amendment Effective Date”); provided that each of the following conditions shall have been satisfied (or waived) in accordance with the terms therein on or prior to such date: (a) Executed Agreement. The Administrative Agent shall have received a counterpart of this Agreement signed on behalf of (i) the Parent Borrower and the Dutch Borrower, (ii) the Administrative Agent, (iii) the Required TLA Lenders and (iv) the Required Revolving Lenders. (b) Closing Certificate. The Administrative Agent shall have received a certificate from a Responsible Officer of the Parent Borrower certifying (i) the representations and warranties set forth herein and in the Loan Documents are true and correct in all material respects with the same force and effect as if such representations and warranties had been made on and as of the First Amendment Effective Date except to the extent that such representations and warranties relate specifically to another date; provided that any representation and warranty that is qualified as to materiality shall be true and correct in all respects (after giving effect to such

qualification therein) and (ii) at the time of and immediately after giving effect to this Agreement, no Default or Event of Default shall exist or result therefrom. (c) No Default. At the time of and immediately after giving effect to this Agreement, no Default or Event of Default shall exist or result therefrom. (d) Fees and Expenses. The Administrative Agent shall have received (i) for the account of each Term A Lender and Revolving Lender who has delivered a counterpart to this Agreement, an amendment fee in an amount equal to 0.10% of the aggregate principal amount of the Revolving Commitments and outstanding Term A Loans of such Lender after giving effect to the Commitment Reduction (as defined below) paid by or on behalf of the Parent Borrower and (ii) all other expenses due and payable on or prior to the First Amendment Effective Date, to the extent invoiced at least three (3) Business Days prior to the First Amendment Effective Date (or such shorter period reasonably agreed by the Parent Borrower). (e) Commitment Reduction. The Revolving Commitments shall have been reduced from $3,250,000,000 to $2,750,000,000 in accordance with Section 2.08 of the Credit Agreement (the “Commitment Reduction”). SECTION 3. Representations and Warranties. By its execution of this Agreement, each Loan Party party hereto hereby represents and warrants that: (a) Organization; Powers. The Parent Borrower and each of its Restricted Subsidiaries (a) is validly existing under the laws of the jurisdiction of its organization or formation, except, in the case of a Restricted Subsidiary, where the failure to be so could not reasonably be expected to result in a Material Adverse Effect, (b) has all requisite power and authority to carry on its business as now conducted, except, in the case of a Restricted Subsidiary, where the failure to have such could not reasonably be expected to result in a Material Adverse Effect and (c) except where the failure to do so, individually or in the aggregate, could not reasonably be expected to result in a Material Adverse Effect, is qualified to do business in, and is in good standing (where relevant) in, its jurisdiction of organization or formation and every other jurisdiction where such qualification is required. (b) Authorization; Enforceability. The Parent Borrower and each Loan Party has the corporate or other organizational power and authority to execute, deliver and carry out the terms and provisions of the Loan Documents to which it is a party and has taken all necessary corporate or other organizational action to authorize the execution, delivery and performance of the Loan Documents to which it is a party. This Agreement has been duly executed and delivered by the Parent Borrower and constitutes, and each other Loan Document to which any Loan Party is to be a party, when executed and delivered by such Loan Party, will constitute, a legal, valid and binding obligation of the Parent Borrower or such other Loan Party (as the case may be), enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium, capital impairment, recognition of judgments, recognition of choice of law, enforcement of judgments or other similar laws or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law and other matters which are set out as qualifications or reservations as to matters of law of general application in any legal opinion delivered to the Administrative Agent in connection with the Loan Documents.

(c) Governmental Approvals; No Conflicts. Governmental Approvals; No Conflicts. The execution, delivery and performance of the Loan Documents: (a) do not require any consent or approval of, registration or filing with, or any other action by, any Governmental Authority, except (i) such as have been obtained or made and are in full force and effect, (ii) filings necessary to perfect Liens created under the Loan Documents and (iii) for consents, approvals, registrations, filing or other actions, the failure of which to obtain or make would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect, (b) will not violate (i) any applicable Law or regulation or (ii) in any material respect, the charter, by-laws or other organizational documents of the Parent Borrower or any of its Restricted Subsidiaries or any order of any Governmental Authority binding on such Person, (c) will not violate or result in a default under any material indenture, agreement or other instrument binding upon the Parent Borrower or any of its Restricted Subsidiaries or its assets, or give rise to a right thereunder to require any payment to be made by the Parent Borrower or any of its Restricted Subsidiaries, and (d) will not result in the creation or imposition of any material Lien on any asset of the Parent Borrower or any of its Restricted Subsidiaries, except Liens created under and Liens permitted by the Loan Documents, and except to the extent such violation or default referred to in clause (b)(i) or (c) above could not reasonably be expected to result in a Material Adverse Effect. SECTION 4. Reaffirmation of the Loan Parties. Each Loan Party party hereto hereby consents to the amendment of the Credit Agreement effected hereby and confirms and agrees that, notwithstanding the effectiveness of this Agreement, each Loan Document to which such Loan Party is a party is, and the obligations of such Loan Party contained in the Credit Agreement, this Agreement or in any other Loan Document to which it is a party are, and shall continue to be, in full force and effect and are hereby ratified and confirmed in all respects, in each case as amended by this Agreement. For greater certainty and without limiting the foregoing, each Loan Party party hereto hereby confirms that the existing guarantees and/or security interests granted by such Loan Party in favor of the Administrative Agent for the benefit of the Secured Parties pursuant to the Loan Documents in the Collateral described therein shall continue to secure the obligations of the Loan Parties under the Credit Agreement and the other Loan Documents as and to the extent provided in the Loan Documents. SECTION 5. Amendment, Modification and Waiver. This Agreement may not be amended, modified or waived except as permitted by Section 10.02 of the Credit Agreement. The execution, delivery and effectiveness of this Agreement shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any of the Loan Documents, nor, except as expressly provided herein, constitute a waiver or amendment of any provision of any of the Loan Documents. SECTION 6. Entire Agreement. This Agreement, the Credit Agreement, the other Loan Documents and any separate letter agreements with respect to fees payable to the Administrative Agent, the Collateral Agent or the Lenders, embody the final, entire agreement among the parties relating to the subject matter hereof and supersede any and all previous commitments, agreements, representations and understandings, whether oral or written, relating to the subject matter hereof and may not be contradicted or varied by evidence of prior, contemporaneous or subsequent oral agreements or discussions of the parties hereto. There are no unwritten oral agreements among the parties hereto. SECTION 7. GOVERNING LAW. THIS AGREEMENT SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAW OF THE STATE OF NEW YORK. SECTION 8. Severability. Any provision of this Agreement held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such

invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions hereof; and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in any other jurisdiction. SECTION 9. Counterparts; Effectiveness. This Agreement may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. This Agreement shall become effective when it shall have been executed by the Administrative Agent and when the Administrative Agent shall have received counterparts hereof which, when taken together, bear the signatures of each of the other parties hereto, and thereafter shall be binding upon and inure to the benefit of the parties hereto and their respective successors and permitted assigns. Delivery of an executed counterpart of a signature page of this Agreement by email or other electronic means (including a “.pdf” or “.tif” file) shall be effective as delivery of a manually executed counterpart of this Agreement. SECTION 10. WAIVER OF JURY TRIAL. EACH PARTY HERETO HEREBY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF OR RELATING TO THIS AGREEMENT, ANY OTHER LOAN DOCUMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY (WHETHER BASED ON CONTRACT, TORT OR ANY OTHER THEORY). EACH PARTY HERETO (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF ANY OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT AND THE OTHER PARTIES HERETO HAVE BEEN INDUCED TO ENTER INTO THE LOAN DOCUMENTS BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS SECTION 10. SECTION 11. Loan Document; Effect of Amendment. On and after the First Amendment Effective Date, this Agreement shall constitute a “Loan Document” for all purposes of the Credit Agreement and the other Loan Documents (it being understood that for the avoidance of doubt this Agreement may be amended or waived solely by the parties hereto as set forth in Section 5 above). Upon and after the execution of this Agreement by each of the parties hereto, each reference in the Credit Agreement to “this Agreement”, “hereunder”, “hereof” or words of like import referring to the Credit Agreement, and each reference in the other Loan Documents to “the Credit Agreement”, “thereunder”, “thereof” or words of like import referring to the Credit Agreement, shall mean and be a reference to the Credit Agreement as modified hereby. [SIGNATURE PAGES FOLLOW]

IN WITNESS WHEREOF, each of the undersigned has caused its duly authorized officer to execute and deliver this Agreement as of the date first set forth above. COTY INC. By: Name: Pierre dre T erisse Title: Chief inancial Officer ::TYB.V.tl u Name: Christian Bruechle Title: Director [Signature Page to Amendment No. I to Credit Agreement]

JPMORGAN CHASE BANK, N.A., as Administrative Agent, Term A Lender and Revolving Lender ~Title: Executive Director

Bank of America, N.A., as a Revolving Lender I Term A Lender Name: J. as Cosgrove Title: Director [Signature Page to Amendment No. I]

Bayerische Landesbank, New York Branch, as a Revolving Lender/Term A Lender ,/- By: ------ ------- Name: Rolf Siebert Title: Executive Director By ~1~ Name: Gina Sandella Title: Vice President [Signature Page to Amendment No. 1]

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. NEW YORK BRANCH, as a Revolving Lender/Term A Lender Younger T tle: Executive irector By: ~~::::::::::=====N e: Miriam Trautmann==--- Title: Senior Vice President [Signature Page to Amendment No. l]

The Bank of Nova Scotia, as both a Revolving Lender and a Term A Lender /; By: -------=Name: /413Winston----=..a::~'------- Lua~- -- Title: Director [Signature Page to Amendment No. I]

Bank of Montreal, as a Revolving Lender I Term A Lender By: _______::::=::::::::=':::="---1..t. Name: Chad Beltz Title: Vice President [Signature Page to Amendment No. l]

BNP Paribas, as a Revolving Lender/Term A Lender By:-----------~ Name: ~t) \'{~~ Title: ~~G- "b,.NCh~ By:----------- Name: RICHARD PACE Title: ana ing Director [Signature Page to Amendment No. I]

Citibank, N.A., as a Revolving Lender and Term A By:NrunUK-Lender Title: Managing Director [Signature Page to Amendment No. 1]

CREDIT AGRICOLE CORPORATE AND INVESTMENT BANK, as a Revolving Lender and a Term A Lender By: . a.&r. 1:/1 Name: Andr Sidford Title: Managing Director By: ~S~ ~ Myr~a rtinez Title: Vice President [Signature Page to Amendment No. l]

Credit Industriel et Commercial, New York Branch, as a Revolving Lender/ Term A Lender By: ----==:...._-..,.....-7"<----<----------- Name· Weiss Titl . Managing Director By: ~~~ Name:~ Title: Managing Director [Signature Page to Amendment No. 1]

DEUTSCHE BANK AG NEW YORK BRANCH, as a Revolving Lender and Term A Lender 2- By: -?'L c::/, - ·· · "KJafue: Ming K. hu title: Director By: ------------- Name: Virginia Cosenza Title: Vice President [Signature Page to Amendment No. I]

Fifth Third Bank, as a Revolving Lender/Term A Lender By:~'~ Name~ ·stopher Gri~ Title: Vice President By:------------- Name: Title: [Signature Page to Amendment No. I]

Greywolf CLO IV, Ltd. as a Term A Lender By: Greywolf Loan Management LP, as Portfolio Manager . ;...•~::;~.,. '· ~~,..,,., By: Name: William Troy Title: Authorized Signatory By: Name: Title: [Signature Page to Amendment No. 1]

HSBC Bank USA, National Association as a Revolving Lenderrferm A lender .,,{/ By:~~ --~~~_:::::"_ /)_ Name: Emily Barker #22403 Title: Vice President [Signature Page to A mendment No. I J

[LENDER], HSBC BANK.AUSTRALIA LIMITED as a [Term A Len erJ By: ---l----,IIC-:------,f---,----_._.,_... ( (l?j Name: Title: RESTRICTED [Signature Page to Amendment No. 1]

., ING BANK, A BRANCH OF ING DIBA AG, as a Term A Lender [Signature Page to Amendment No. 1]

ING Bank N.V., Dublin Branch, as a Revolving Lender ~~ ~ By: /' ~ Name: Bafi'.'y Fehily Title: Managing D= Name: Sean Hassett Title: Director [Signature Page to Amendment No. 1]

INTESA SANPAOLO S.p.A., New York Branch . as a Revolving Lender and Term A Lender 8 ~am0~~f~ o Title: Regional Business Manager ·L [Signature Page to Amendment No. 1]

LANDESBANK BADEN-WURTTEMBERG, ACTING THROUGH ITS NEW YORK BRANCH as a Revolving Lender I Term A Lender By: Name: Dr. Martin Breckheimer Title: Executive Director By: Name: Raf Enders Title: Executive Director (Signature Page to Amendment No. 1]

[LENDER], as a [Revolving Lende,}l[Term A Lender] By: -~------',4:;...__----~ Name: Matthias Metzger Title: SVP /, By: tO.b, ~ Name/ Title/ [Signature Page to Amendment No. I]

LIBERTY BANK, as a Term A Lender By: C&AJS~ Name: Title: Carla Balesano Senior Vice President By:-------------- Name: Title: [Signature Page to Amendment No. 1]

M&G Conservative European Loan Fund Limited, as a Term A Lender By: ~ 51ae Name: Title: Aditi Rao Authorised Signatory [Signature Page to Amendment No. 1]

MIZUHO BANK, LTD., as a Revolving Lender/Term A Lender By: ~ ~ Name.Tracy Rahn Title: Authorized Signatory Signature Page to Amendment No. 1

MORGAN STANLEY SENIOR FUNDING, INC. as a Revolving Lender I Term A Lender By~@~.--A~~/-· _·- Name~SRINIVASAN Title: VICE PRESIDENT [Signature Page to Amendment No. 1]

MORGAN STANLEY BANK, N.A. as a Revolving Lender I Term A Lender ~ ~. By:~- Name: GA ~IVASAN Title: AUTHORIZED SIGNATORY [Signature Page to Amendment No. 1]

MUFG BANK LTD., as a Revolving Lender and Term A Lender By: ~~ Name: Liwei Liu Title: Vice President [Signature Page to Amendment No. l]

PT. Bank Negara Indonesia (Persero ), Tbk New York Agency as a Term A Lender By: __......,. ____________ Name: Aidil Azhar Title: General Manager [Signature Page to Amendment No. l]

ROYAL BANK OF CANADA, --------·--·-···--···-·······---·-·· ------------s-a-Re-WJfvfng-L-ender-and--'Ferm-A---·- -·---·-·····---· Lender [Signature Page to Amendment No. l]

SANTANDER BANK, N.A., as a Revolving Lender/Term A Lender By: A]Atr; ~ Name: Andres Barbosa Title: Executive Director By: ~ ; Name: aniel Kostman Title: Executive Director [Signature Page to Amendment No. lJ

Scotiabank (Ireland) DAC as a Term A Lender ry Theresa Mulvany Title: Associate Director By: E _&e,11 l1 Ll-j Name: Edel Herlihy Title: Ch ief Risk Officer [Signature Page to Amendment No. l]

Virtus Seix Floating Rate High Income Fund, as a Term A Lender By: Seix Investment Advisors LLC, as Subadviser By: Name: Deirdre A. Dillon, Esq. Title: Chief Compliance Officer [Signature Page to Amendment No. 1]

Sumitomo Mitsui Banking Corporation as a [Revolving Lender]/[Term A Lender] [Signature Page to Amendment No. I]

TD Bank, N.A., as a Revolving Lender/Term A Lender ame: Michele Dragone Title: Senior Vice Presi [Signature Page to Amendment No. 1]

TriState Capital Bank, as a Term A Lender By: Jwc,er Name:'1:llen Frank Title: Senior Vice President [Signature Page to Amendment No. 1]

s; ____; _&_l_4--=-=-t~~~~=~~{!~l~'---- Name: Tommaso Maiocchi Title: Associate Director [Signature Page to Amendment No. I]

Wells Fargo Bank, National Association, as a Revolving Lender/Term A Lender By: ((Y-J, '~"\ __ / ·~ Name: Ekta Patel Title: Managing Director By: ------------- Name: Title: [Signature Page to Amendment No. I]

/ ' == ~~ //-I+ /" By: _ _ J}------"<-l ·_l-1,e..::......::lc.....;...ot: ---=l.<..:.....:;..h _,.____ Name: Tommaso Maiocchi Title: Associate Director [Signature Page to Amendment No. 1]

ANNEX I AMENDMENTS TO CREDIT AGREEMENT [Changed pages to Credit Agreement follow]

AMENDED AND RESTATED CREDIT AGREEMENT, dated as of April 5, 2018 (this “Agreement”) among COTY INC., a Delaware corporation (the “Parent Borrower”), COTY B.V., a private company with limited liability (besloten vennootschap met beperkte aansprakelijkheid) incorporated under the laws of the Netherlands, having its corporate seat in Amsterdam, the Netherlands and registered with the trade register of the Chamber of Commerce under number 37069236 (the “Dutch Borrower”), the LENDERS party hereto from time to time and JPMORGAN CHASE BANK, N.A., as Administrative Agent and as Collateral Agent, which amends and restates that certain Credit Agreement, dated as of October 27, 2015 (as amended restated, amended and restated, supplemented or otherwise modified from time to time prior to effectiveness of this Agreement, the “Existing Coty Credit Agreement”), by and among the Parent Borrower, the financial institutions party thereto from time to time as lenders and JPMorgan Chase Bank, N.A., as Administrative Agent and as Collateral Agent. WHEREAS reference is made to the Credit Agreement, dated as of January 26, 2016 (as amended restated, amended and restated, supplemented or otherwise modified from time to time prior to effectiveness of this Agreement, the “Existing Galleria Credit Agreement” and, together with the Existing Coty Credit Agreement, the “Existing Credit Agreements”), by and among Galleria Co., a Delaware corporation (the “Galleria Borrower”), the financial institutions party thereto from time to time as lenders and JPMorgan Chase Bank, N.A., as Administrative Agent and as Collateral Agent; WHEREAS, the Parent Borrower has requested that (A) for the purpose of, among other things, refinancing the term loans outstanding under each Existing Credit Agreement prior to effectiveness of this Agreement (1) the Term A Lenders extend credit in the form of (i) Term A USD Loans on the Restatement Effective Date in an aggregate principal amount of $1,000,000,000 and (ii) Term A EUR Loans on the Restatement Effective Date in an aggregate principal amount of €2,035,000,000 and (2) the Term B Lenders extend credit in the form of (i) Term B USD Loans on the Restatement Effective Date in an aggregate principal amount of $1,400,000,000 and (ii) Term B EUR Loans on the Restatement Effective Date in an aggregate principal amount of €850,000,000, (B) for the purpose of, among other things, refinancing the revolving loans outstanding under each Existing Credit Agreement prior to effectiveness of this Agreement and for general corporate purposes or any purpose not prohibited under the Loan Documents, the Revolving Lenders extend credit in the form of Revolving Loans, the Swingline Lenders extend credit in the form of Swingline Loans and the Issuing Banks issue Letters of Credit in an aggregate amount at any time outstanding of up to $3,250,000,0002,750,000,000 and (C) the Existing L/C Issuer maintain the Existing Letters of Credit as Letters of Credit hereunder; and WHEREAS, the Lenders and Issuing Banks party hereto, as applicable, have agreed to provide such Loans and Letters of Credit and the Parent Borrower, the other Loan Parties hereto, the Administrative Agent, the Collateral Agent and the Lenders and Issuing Banks party hereto have agreed to amend and restate the Existing Coty Credit Agreement as provided herein. NOW, THEREFORE, in consideration of the premises and the covenants and agreements contained herein, the parties hereto hereby agree as follows: 1

in connection with the Original Transactions, the Transactions and any Permitted Acquisition; plus (f) (i) solely for purposes of actual compliance with Section 7.01 (and not, for the avoidance of doubt, compliance on a Pro Forma Basis therewith), pro forma cost savings, operating expense reductions and synergies related to, and net of the amount of actual benefits realized during such Subject Period from, Specified Transactions, restructurings and cost savings initiatives or other similar initiatives that are reasonably identifiable, factually supportable and projected by the Parent Borrower in good faith to result from actions that have been taken or with respect to which substantial steps have been taken, committed to be taken or are expected to be taken (in the good faith determination of the Parent Borrower), in each case within thirty six (36) months after such Specified Transaction, restructuring, cost savings initiative or other initiative, and (ii) in each other calculation of Adjusted EBITDA, pro forma cost savings, operating expense reductions and synergies related to, and net of the amount of actual benefits realized during such Subject Period from, Specified Transactions, restructurings and cost savings initiatives or other similar initiatives that are reasonably identifiable, factually supportable and projected by the Parent Borrower in good faith to result from actions that have been taken or with respect to which substantial steps have been taken, committed to be taken or are expected to be taken (in the good faith determination of the Parent Borrower), in each case within twenty four (24) months after such Specified Transaction, restructuring, cost savings initiative or other initiative; plus (g) (i) pro forma cost savings, operating expense reductions and synergies related to, and net of the amount of actual benefits realized during such Subject Period from, the Original Transactions that are reasonably identifiable, factually supportable and projected by the Parent Borrower in good faith to be realized, and to result from actions that have been taken, committed to be taken or with respect to which substantial steps have been taken or are expected to be taken (in the good faith determination of the Parent Borrower) provided that such pro forma cost savings, operating expense reductions and synergies shall not exceed, for (x) the Subject Periods ending on or prior to June 30, 2019, $375,000,000 (y) the Subject Periods ending, September 30, 2019, December 31, 2019, March 31, 2020 and June 30, 2020, $150,000,000; and (z) for each Subject Period thereafter, zero. (h) [reserved]; (i) the amount of any charge, cost or expense in connection with a single or one-time event, including, without limitation, in connection with (x) any acquisition or other investment consummated before or after the Restatement Effective Date and (y) the consolidation, closing or reconfiguration of any facility during such Subject Period; minus (j) the EBITDA of each Prior Company and, as applicable but without duplication, the EBITDA of the Parent Borrower and each Restricted Subsidiary attributable to all Prior 3

necessary, to the next 1/100 of 1%) of the quotations for such day for such transactions received by the Administrative Agent from three federal funds brokers of recognized standing selected by it. “Fee Letters” means any Fee Letter in connection with the Transactions dated on or prior to the Restatement Effective Date among the Parent Borrower and the Arrangers. “Financial Covenant” means the covenant set forth in Section 7.01. “Financial Covenant Event of Default” has the meaning set forth in clause (d) of Section 8.01. “Financial Officer” means the chief financial officer, executive vice president of finance and administration, principal accounting officer, treasurer or controller of, unless otherwise noted, the Parent Borrower (or any other officer acting in substantially the same capacity of the foregoing). “First Amendment Effective Date” means June 27, 2019. “First Lien Net Leverage Ratio” means, as of any date of determination, the ratio of (a)Total Indebtedness secured by a Lien on any asset or property of the Borrowers or any other Loan Party that is not subordinated to the Liens securing the Obligations minus unrestricted cash and Cash Equivalents of the Parent Borrower and its Restricted Subsidiaries as determined in accordance with GAAP to (b) Adjusted EBITDA for the most recently ended Test Period. “Fixed Amounts” has the meaning set forth in Section 1.03. “Fixed Incremental Amount” has the meaning set forth in the definition of “Incremental Amount.” “Foreign Benefit Plan” means each employee benefit plan (within the meaning of Section 3(3) of ERISA, whether or not subject to ERISA) that is not subject to United States law and is sponsored, maintained or contributed to by any Loan Party or any ERISA Affiliate. “Foreign Currency Letter of Credit” means any Letter of Credit denominated in an Alternative Currency. “Foreign Lender” means any Lender that is organized under the laws of a jurisdiction other than the United States of America, any state thereof or the District of Columbia. “Foreign Subsidiary” means any Subsidiary that is not a Domestic Subsidiary. “GAAP” means generally accepted accounting principles in the United States of America. “Global Intercompany Note” means the Intercompany Note, dated as of October 27, 2015, executed by the Borrowers and each Restricted Subsidiary, as amended, restated, supplemented or otherwise modified from time to time. 31

“Market Intercreditor Agreement” means an intercreditor agreement the terms of which are consistent with market terms governing security arrangements for the sharing of liens or arrangements relating to the distribution of payments, as applicable, at the time the intercreditor agreement is proposed to be established in light of the type of Indebtedness subject thereto. “Material Acquisition” means any acquisition (including pursuant to a merger, consolidation, amalgamation or otherwise) (a) of at least a majority of the Equity Interests of a Person, all or substantially all of the assets of any other Person or all or substantially all of the assets of a division, line of business or branch of such Person (in each case, in one transaction or a series of transactions) and (b) involves the payment of consideration or assumption of Indebtedness by the Parent Borrower and its Restricted Subsidiaries in excess of $350,000,000. “Material Adverse Effect” means a material and adverse effect on (a) the business, assets, financial condition or results of operations of the Parent Borrower and its Restricted Subsidiaries, taken as a whole, (b) the rights of or remedies available to the Administrative Agent, the Collateral Agent or any of the Lenders, taken as a whole, under any Loan Document or (c) the ability of the Loan Parties (taken as a whole) to perform their payment obligations under the Loan Documents. “Material Indebtedness” means Indebtedness (other than the Loans and Letters of Credit but including, without limitation, obligations calculated on a mark to market basis in respect of one or more Swap Agreements) of any one or more of the Parent Borrower and the Restricted Subsidiaries in an aggregate principal amount exceeding the Threshold Amount. “Material Subsidiary” means a Restricted Subsidiary that is not an Immaterial Subsidiary. “Moody’s” means Moody’s Investors Service, Inc., or any successor to the rating agency business thereof. “Multicurrency LC Exposure” means, at any time, the sum of (a) the Dollar Equivalent of the aggregate undrawn amount of all outstanding Letters of Credit denominated in Alternative Currencies at such time plus (b) the Dollar Equivalent of the aggregate amount of all LC Disbursements in respect of such Letters of Credit that have not yet been reimbursed by or on behalf of any of the Borrowers at such time. The Multicurrency LC Exposure of any Revolving Lender at any time shall be its USD/Multicurrency Applicable Percentage of the total Multicurrency LC Exposure at such time. “Multicurrency Revolving Exposure” means, at any time, the sum of (a) the Dollar Equivalent of the principal amount of the Multicurrency Revolving Loans outstanding at such time and (b) the Multicurrency LC Exposure outstanding at such time. “Multicurrency Revolving Loans” means the revolving loans made by Lenders holding USD/Multicurrency Revolving Commitments under Section 2.01. “Multicurrency Revolving Sublimit” means $3,250,000,0002,750,000,000. 40

acquisition, cancellation or termination of any Equity Interests in the Parent Borrower or any Restricted Subsidiary. “Restricted Subsidiaries” means the Subsidiary Loan Parties and each other Subsidiary of any Borrower that is not an Unrestricted Subsidiary. “Return” means, with respect to any Investment, any dividend, distribution, interest, fee, premium, return of capital, repayment of principal, income, profit and any other amount received or realized in respect thereof. “Revaluation Date” has the meaning set forth in Section 1.06(e). “Revolver Extension Request” has the meaning set forth in Section 2.24(b). “Revolver Extension Series” has the meaning set forth in Section 2.24(b). “Revolving Availability Period” means the period from and including the Restatement Effective Date to but excluding the earlier of the Revolving Maturity Date and the date of termination of the Revolving Commitments. “Revolving Commitment” means the USD/Multicurrency Revolving Commitment. The aggregate amount of the Lenders’ Revolving Commitment as of the RestatementFirst Amendment Effective Date is $3,250,000,0002,750,000,000. “Revolving Exposure” means, with respect to any Lender at any time, the sum of (a) the outstanding principal amount of such Lender’s Revolving Loans at such time that are denominated in Dollars, plus (b) the Dollar Equivalent at such time of the aggregate outstanding principal amount of such Lender’s Revolving Loans at such time that are denominated in Alternative Currencies, plus (c) such Lender’s LC Exposure at such time, plus (d) such Lender’s Swingline Exposure at such time. “Revolving Facility” means the Revolving Commitments and the extensions of credit made thereunder. “Revolving Lender” means, as of any date of determination, each Lender with a Revolving Commitment or, if the Revolving Commitments have terminated or expired, a Lender with Revolving Exposure. “Revolving Loan” means a Loan made pursuant to clause (e) of Section 2.01, an Incremental Revolving Loan made under the Revolving Facility or any Loan made pursuant to any Extended Revolving Commitments, as the context may require. “Revolving Maturity Date” means the date that is five (5) years from the Restatement Effective Date or, with respect to any Extended Revolving Commitments, the final maturity date applicable thereto as specified in the applicable Extension Request accepted by the respective Lender or Lenders. 51

jurisdiction other than the State of New York, “UCC” means the Uniform Commercial Code as in effect from time to time in such other jurisdiction for purposes of the provisions hereof relating to such perfection, effect of perfection or non-perfection or priority. “Undisclosed Administration” means in relation to a Lender or a parent company of such Lender, the appointment of an administrator, provisional liquidator, conservator, receiver, trustee, custodian or other similar official by a supervisory authority or regulator under or based on the law in the country where such Lender or parent company, as the case may be, is subject to home jurisdiction supervision if applicable law requires that such appointment is not to be publicly disclosed “Unrestricted Subsidiaries” means each Subsidiary of the Parent Borrower (other than a Borrower) designated by the Parent Borrower as an “Unrestricted Subsidiary” pursuant to Section 5.13. “U.S. Person” means any Person that is a “United States person” as defined in Section 7701(a)(30) of the Code. “USD/Multicurrency Applicable Percentage” means, with respect to any USD/Multicurrency Revolving Lender, subject to Section 2.21, the percentage of the total USD/Multicurrency Revolving Commitments represented by such Lender’s USD/Multicurrency Revolving Commitment. If the USD/Multicurrency Revolving Commitments have terminated or expired, the USD/Multicurrency Applicable Percentages shall be determined based upon the USD/Multicurrency Revolving Commitments most recently in effect, giving effect to any assignments. “USD/Multicurrency Revolving Commitment” means, with respect to each Lender, the commitment, if any, of such Lender to make USD/Multicurrency Revolving Loans and to acquire participations in Letters of Credit denominated in Alternative Currencies hereunder, as such commitment may be (a) reduced from time to time pursuant to Section 2.08, (b) reduced or increased from time to time pursuant to assignments by or to such Lender pursuant to Section 10.04, (c) as established or increased from time to time pursuant to an Incremental Assumption Agreement, (d) as established from time to time pursuant to a Refinancing Amendment and (e) as established from time to time pursuant to an Extension Amendment. The amount of each Lender’s USD/Multicurrency Revolving Commitment as of the Restatement Effective Date is set forth on Schedule 2.01. The aggregate amount of the Lenders’ USD/Multicurrency Revolving Commitments as of the RestatementFirst Amendment Effective Date is $3,250,000,0002,750,000,000. “USD/Multicurrency Revolving Exposure” means, with respect to any Lender at any time, the sum of the outstanding principal amount of such Lender’s (or its Affiliate’s) USD/Multicurrency Revolving Loans and its Multicurrency LC Exposure at such time. “USD/Multicurrency Revolving Facility” means the USD/Multicurrency Revolving Commitments and the extensions of credit made thereunder. “USD/Multicurrency Revolving Lender” means, as of any date of determination, each Lender with a USD/Multicurrency Revolving Commitment or, if the USD/Multicurrency 60

exchange rates after the last time such determinations were made and, in any such cases, the applicable limits set forth in Articles II or VIII , as applicable, will not be deemed to have exceeded solely as a result of such fluctuations in currency exchange rates. For the avoidance of doubt, in no event shall a prepayment be required under Section 2.11(b) if the Dollar Equivalent of the relevant amounts set forth therein does not exceed 5% of such relevant amounts solely as a result of fluctuations in currency exchange rates. (h) For purposes of any determination under Article V, Article VI (other than the calculation of compliance with any financial ratio for purposes of taking any action hereunder) or Article VIII with respect to the amount of any Indebtedness, Lien, Restricted Payment, debt prepayment, Investment, Disposition, affiliate transaction or other transaction, event or circumstance, or any determination under any other provision of this Agreement (any of the foregoing, a “subject transaction”), in a currency other than Dollars, (i) the Dollar Equivalent of a subject transaction in a currency other than Dollar shall be calculated based on the rate of exchange quoted on the applicable Reuters World Currency Page (or any successor page thereto, or in the event such rate does not appear on any Reuters Page, by reference to such other publicly available service for displaying exchange rates as may be agreed upon by the Administrative Agent and the Parent Borrower) for such foreign currency, as in effect at 12:00 noon (London time) on the date of such subject transaction (which, in the case of any Restricted Payment, shall be deemed to be the date of the declaration thereof and, in the case of the incurrence of Indebtedness, shall be deemed to be on the date first committed); provided, that if any Indebtedness is incurred (and, if applicable, associated Lien granted) to refinance or replace other Indebtedness denominated in a currency other than Dollar, and the relevant refinancing or replacement would cause the applicable Dollar-denominated restriction to be exceeded if calculated at the relevant currency exchange rate in effect on the date of such refinancing or replacement, such Dollar- denominated restriction shall be deemed not to have been exceeded so long as the principal amount of such refinancing or replacement Indebtedness (and, if applicable, associated Lien granted) does not exceed an amount sufficient to repay the principal amount of such Indebtedness being refinanced or replaced, except by an amount equal to (x) unpaid accrued interest and premiums (including tender premiums) thereon plus other reasonable and customary fees and expenses (including upfront fees and original issue discount) incurred in connection with such refinancing or replacement and (y) additional amounts permitted to be incurred under Section 6.01 and (ii) for the avoidance of doubt, no Default or Event of Default shall be deemed to have occurred solely as a result of a change in the rate of currency exchange occurring after the time of any subject transaction so long as such subject transaction was permitted at the time incurred, made, acquired, committed, entered or declared as set forth in clause (i). For purposes of Article VII and the calculation of compliance with any financial ratio for purposes of taking any action hereunder, on any relevant date of determination, amounts denominated in currencies other than Dollars shall be translated into Dollars at the applicable currency exchange rate used in preparing the financial statements delivered pursuant to Sections 5.01(a) or (b) , as applicable, for the most recently ended Test Period and will, with respect to any Indebtedness, reflect the currency translation effects, determined in accordance with GAAP, of any Swap Agreement permitted hereunder in respect of currency exchange risks with respect to the applicable currency in effect on the date of determination for the Dollar Equivalent amount of such Indebtedness. Notwithstanding the foregoing sentence, solely for purposes of the calculation of the amount 66

referenced in clause (a) of the definition of the term “Total Net Leverage Ratio” for purposes of the Financial Covenant referenced in Section 7.01, the currency exchange rate with respect to Euros in relation to Dollars on any relevant date of determination shall be the arithmetic average of the average monthly rate at which Euros may be exchanged into Dollars for the twelve (12) months prior to such date (as reasonably determined by the Parent Borrower in good faith). Section 1.07 Cashless Rollovers. Notwithstanding anything to the contrary contained in this Agreement or in any other Loan Document, to the extent that any Lender extends the maturity date of, or replaces, renews or refinances, any of its then-existing Loans with Incremental Loans, Extended Term Loans, or Loans in connection with any Specified Refinancing Debt or Loan Modification or loans incurred under a new credit facility, in each case, to the extent such extension, replacement, renewal or refinancing is effected by means of a “cashless roll” by such Lender, such extension, replacement, renewal or refinancing shall be deemed to comply with any requirement hereunder or any other Loan Document that such payment be made “in Dollars”, “in immediately available funds”, “in cash” or any other similar requirement. Section 1.08 Pro Forma Calculations. (a) Notwithstanding anything to the contrary herein, Adjusted EBITDA, EBITDA, Consolidated Net Income and any financial ratios or tests, including the First Lien Net Leverage Ratio, the Secured Net Leverage Ratio and the Total Net Leverage Ratio, shall be calculated in the manner prescribed by this Section 1.08; provided that notwithstanding anything to the contrary in clauses (b), (c) or (d) of this Section 1.08, when calculating the Total Net Leverage Ratio for purposes of determining actual compliance (and not Pro Forma Compliance, compliance on a Pro Forma Basis or determining compliance giving Pro Forma Effect to a transaction) with Section 7.01, the events described in this Section 1.08 that occurred subsequent to the end of the applicable Test Period shall not be given Pro Forma Effect. (b) For purposes of calculating Adjusted EBITDA, EBITDA, Consolidated Net Income and any financial ratios or tests, including the First Lien Net Leverage Ratio, the Secured Net Leverage Ratio and the Total Net Leverage Ratio, Specified Transactions (and the incurrence or repayment of any Indebtedness in connection therewith, subject to clause (d) of this Section 1.08) that have been made (i) during the applicable Test Period or (ii) subsequent to such Test Period and prior to or simultaneously with the event for which the calculation of Adjusted EBITDA, EBITDA, Consolidated Net Income or any such ratio is made shall be calculated on a Pro Forma Basis assuming that all such Specified Transactions (and any increase or decrease in Adjusted EBITDA, EBITDA, Consolidated Net Income and the component financial definitions used therein attributable to any Specified Transaction) had occurred on the first day of the applicable Test Period. (c) Whenever Pro Forma Effect is to be given to a Specified Transaction, the pro forma calculations shall be made in good faith by a Responsible Officer of the Parent 67

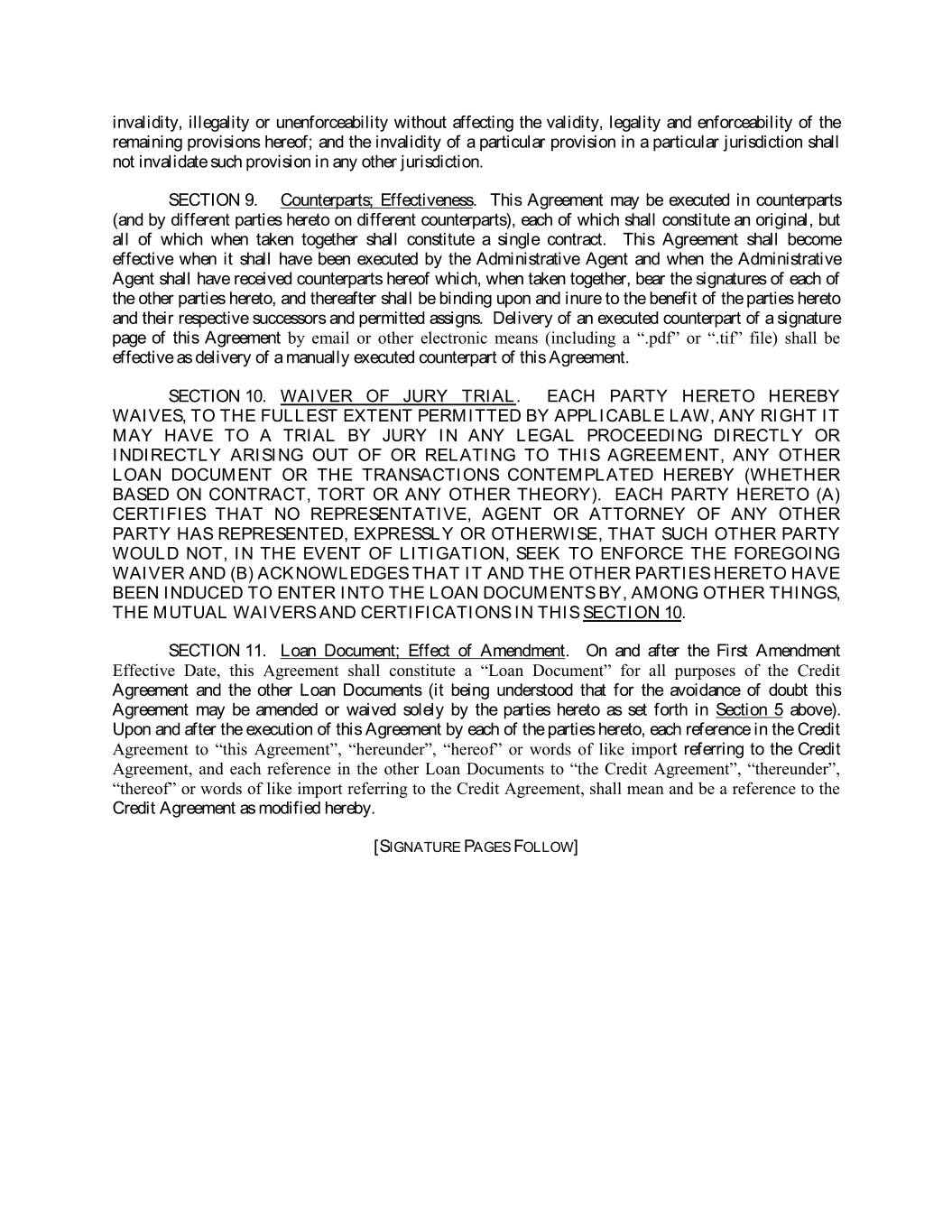

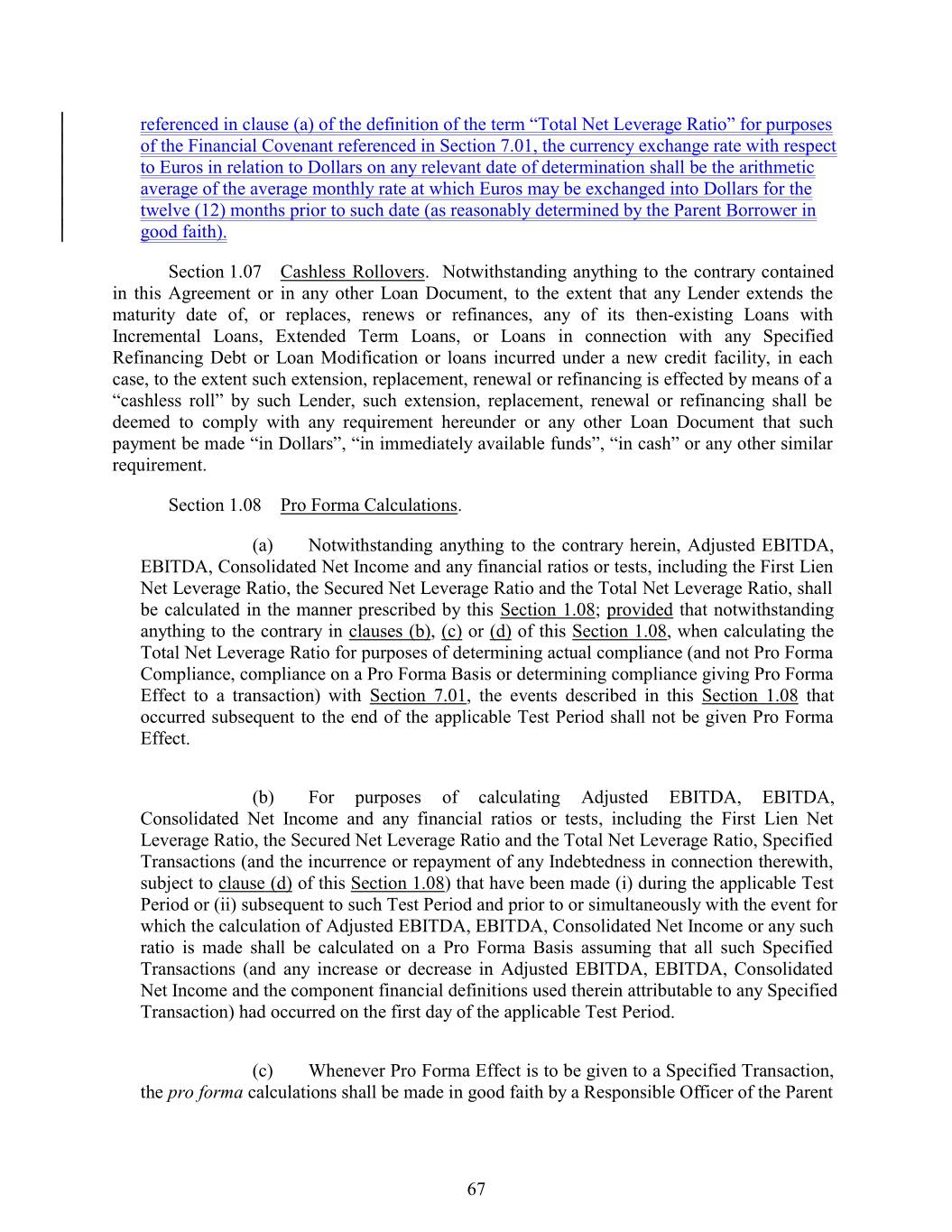

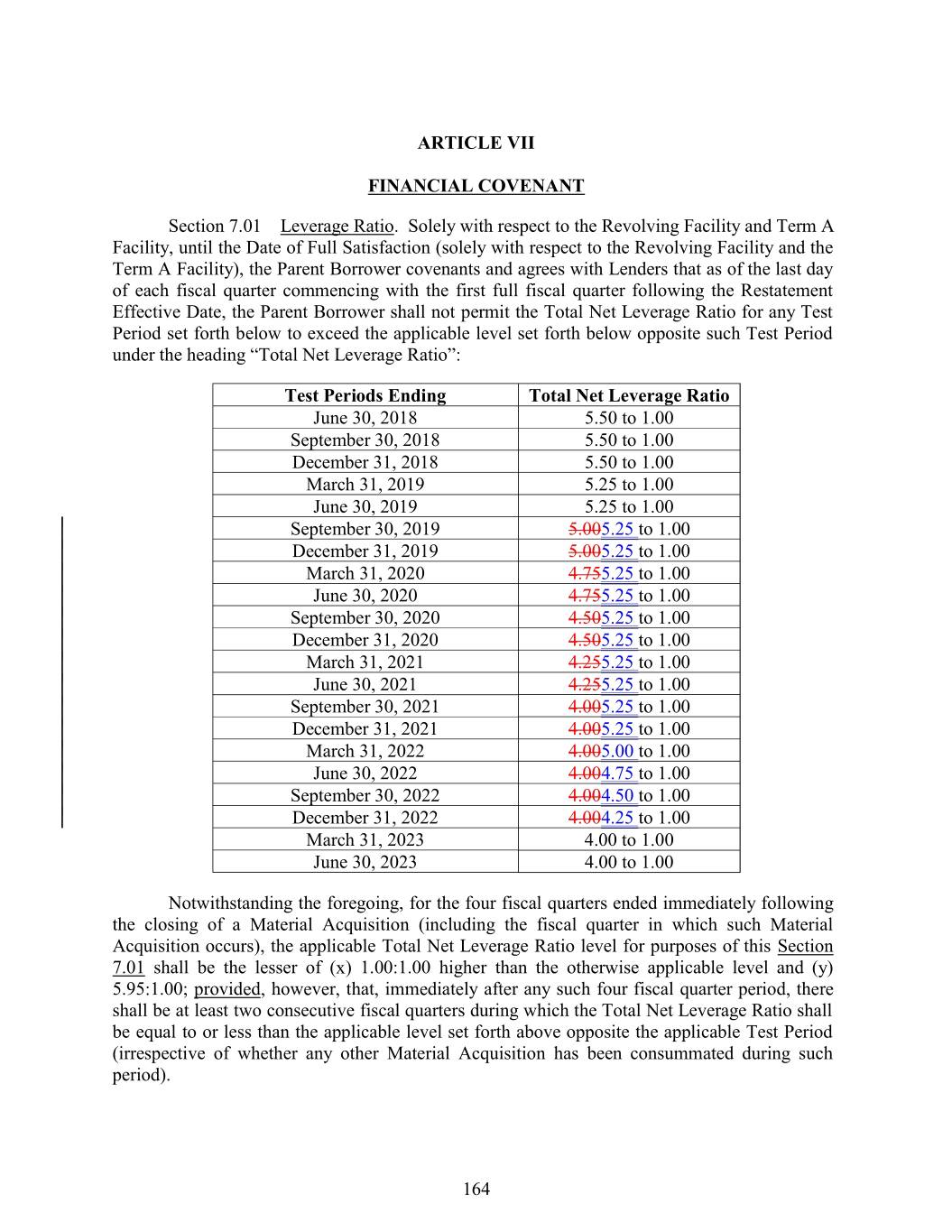

ARTICLE VII FINANCIAL COVENANT Section 7.01 Leverage Ratio. Solely with respect to the Revolving Facility and Term A Facility, until the Date of Full Satisfaction (solely with respect to the Revolving Facility and the Term A Facility), the Parent Borrower covenants and agrees with Lenders that as of the last day of each fiscal quarter commencing with the first full fiscal quarter following the Restatement Effective Date, the Parent Borrower shall not permit the Total Net Leverage Ratio for any Test Period set forth below to exceed the applicable level set forth below opposite such Test Period under the heading “Total Net Leverage Ratio”: Test Periods Ending Total Net Leverage Ratio June 30, 2018 5.50 to 1.00 September 30, 2018 5.50 to 1.00 December 31, 2018 5.50 to 1.00 March 31, 2019 5.25 to 1.00 June 30, 2019 5.25 to 1.00 September 30, 2019 5.005.25 to 1.00 December 31, 2019 5.005.25 to 1.00 March 31, 2020 4.755.25 to 1.00 June 30, 2020 4.755.25 to 1.00 September 30, 2020 4.505.25 to 1.00 December 31, 2020 4.505.25 to 1.00 March 31, 2021 4.255.25 to 1.00 June 30, 2021 4.255.25 to 1.00 September 30, 2021 4.005.25 to 1.00 December 31, 2021 4.005.25 to 1.00 March 31, 2022 4.005.00 to 1.00 June 30, 2022 4.004.75 to 1.00 September 30, 2022 4.004.50 to 1.00 December 31, 2022 4.004.25 to 1.00 March 31, 2023 4.00 to 1.00 June 30, 2023 4.00 to 1.00 Notwithstanding the foregoing, for the four fiscal quarters ended immediately following the closing of a Material Acquisition (including the fiscal quarter in which such Material Acquisition occurs), the applicable Total Net Leverage Ratio level for purposes of this Section 7.01 shall be the lesser of (x) 1.00:1.00 higher than the otherwise applicable level and (y) 5.95:1.00; provided, however, that, immediately after any such four fiscal quarter period, there shall be at least two consecutive fiscal quarters during which the Total Net Leverage Ratio shall be equal to or less than the applicable level set forth above opposite the applicable Test Period (irrespective of whether any other Material Acquisition has been consummated during such period). 164