UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Schedule TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1)

OR 13(E)(1) OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 2)

NET SERVIÇOS DE COMUNICAÇÃO S.A.

(Name of Subject Company)

EMPRESA BRASILEIRA DE TELECOMUNICAÇÕES S.A. – EMBRATEL

(Offeror)

EMBRATEL PARTICIPAÇÕES S.A.

(Bidder and Affiliate of Offeror)

(Name of Filing Persons)

Preferred Shares, no par value, and American Depositary Shares, each representing one Preferred Share

(Title of Class of Securities)

N/A (Preferred Shares)

64109T201 (American Depositary Shares)

(CUSIP Number of Class of Securities)

Isaac Berensztejn

Chief Financial Officer

Empresa Brasileira de Telecomunicações S.A. – Embratel

Av. Presidente Vargas, n° 1012

20071-002 Rio de Janeiro, RJ, Brazil

Telephone: 55 21 2121-3636

with copies to

Daniel Sternberg, Esq.

Nicolas Grabar, Esq.

Duane McLaughlin, Esq.

Cleary Gottlieb Steen & Hamilton LLP

One Liberty Plaza

New York, NY 10006

Telephone: (212) 225-2000

(Name, Addresses and Telephone Numbers of Persons Authorized to Receive Notices and Communications on Behalf of Filing Persons)

CALCULATION OF FILING FEE

Transaction Valuation(1) | Amount of Filing Fee(2) | |

$2,603,382,015 | $185,621.14 |

| (1) | Estimated for purposes of calculating the filing fee pursuant to Rule 0-11(d) only. The Transaction Valuation was calculated assuming the purchase of all outstanding Preferred Shares, no par value (including Preferred Shares represented by American Depositary Shares), other than shares owned directly or indirectly by the Filing Person at a purchase price of R$23.00 in cash per Preferred Share. As of June 30, 2010, there were 228,503,916 Preferred Shares outstanding (including Preferred Shares represented by American Depositary Shares), of which 29,379,149 are owned directly or indirectly by the Filing Person. As a result, this calculation assumes the purchase of 199,124,767 outstanding Preferred Shares. The Transaction Valuation was calculated in Brazilianreais (R$) and converted into U.S. dollars at the exchange rate indicated under “transaction PTAX 800, option 5” published by the Central Bank of Brazil through the SISBACEN system at 7:00 p.m., Brasilia time, on August 26, 2010 of US$1 = R$1.7592. |

| (2) | The amount of the filing fee, calculated in accordance with Rule 0–11(d) of the Securities Exchange Act of 1934, equals 0.00007130 of the transaction valuation. |

| x | Check box if any part of the fee is offset as provided by Rule 0–11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

Amount Previously Paid: | $185,621.14 | |

Form or Registration No: | Schedule TO-T | |

Filing Party: | Empresa Brasileira de Telecomunicações s.a. – Embratel | |

Date Filed: | August 30, 2010 |

| ¨ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| x | third–party tender offer subject to Rule 14d–1. |

| ¨ | issuer tender offer subject to Rule 13e–4. |

| x | going–private transaction subject to Rule 13e–3. |

| ¨ | amendment to Schedule 13D under Rule 13d–2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer:¨

2

This Amendment No. 2 amends and supplements the Tender Offer Statement on the combined Schedule TO and Schedule 13E-3 under cover of Schedule TO (the “Schedule TO”) filed with the Securities and Exchange Commission (“SEC”) by Empresa Brasileira de Telecomunicações S.A. (“Embratel”), as amended and supplemented by Amendment No. 1 to the Schedule TO filed with the SEC on September 2, 2010. The Schedule TO relates to the offer by Embratel (the “Tender Offer”) to purchase any and all preferred shares, no par value (“Preferred Shares”), including Preferred Shares represented by American Depositary Shares (“ADSs”), of Net Serviços de Comunicação S.A., a corporation organized under the laws of the Federative Republic of Brazil (“Net”), from all holders other than Embratel Participações S.A. (“Embrapar”), wherever located. The Tender Offer is being made on the terms and subject to the conditions set forth in the offer to purchase dated August 30, 2010 (the “Offer to Purchase”) attached and filed with the Schedule TO as Exhibit (a)(1)(i).

Items 1 through 11 of the Schedule TO, to the extent such Items incorporate by reference the information contained in the Offer to Purchase, are hereby amended and supplemented as described below. All page references in this Amendment No. 2 refer to the Offer to Purchase.

SUMMARY TERM SHEET—Introductory Paragraph

The first two sentences of the first paragraph on page 1 are hereby amended and restated in their entirety to read as follows:

This summary term sheet summarizes the material terms of the tender offer. You should also read carefully the remainder of this offer to purchase and the related letter of transmittal because important additional information is contained in the remainder of this offer to purchase and the related letter of transmittal.

SPECIAL FACTORS—Certain Rights of Shareholders Following the Tender Offer—Subsequent Payments

The first bullet point under the heading titled Subsequent Payments on page 17 is amended and restated in its entirety to read as follows:

the price per share that the holder would have the right to receive by virtue of the occurrence of one or more of the events described below.

SPECIAL FACTORS—Position of Embratel Regarding Fairness of the Tender Offer to Unaffiliated Holders of Preferred Shares and ADSs

The heading titled Position of Embratel Regarding Fairness of the Tender Offer to Unaffiliated Holders of Preferred Shares and ADSs on page 18 is amended and restated to read as follows:

Position of Embratel and Embrapar Regarding Fairness of the Tender Offer to Unaffiliated Holders of Preferred Shares and ADSs.

The following sentence is inserted as a fourth sentence to the first paragraph of the heading titled Position of Embratel Regarding Fairness of the Tender Offer to Unaffiliated Holders of Preferred Shares and ADSs on page 18:

For purposes of this section of the offer to purchase, titled Position of Embratel and Embrapar Regarding Fairness of the Tender Offer to Unaffiliated Holders of Preferred Shares and ADSs, the terms “we,” “us” and “our” refer to Embratel and Embrapar jointly.

The fourth paragraph under the heading titled Position of Embratel Regarding Fairness of the Tender Offer to Unaffiliated Holders of Preferred Shares and ADSs on page 18 is amended and restated in its entirety to read as follows:

3

In reaching our conclusion that the tender offer is substantively fair to unaffiliated shareholders, we considered and relied upon a number of factors, including the following:

| • | The tender offer price compares favorably to current and historical market prices for Preferred Shares. The tender offer price represents a premium of approximately 23.1% for Preferred Shares over the weighted average trading prices for the 30 calendar days ending on August 4, 2010, the last trading day before announcement of the tender offer in Brazil (the “Tender Offer Announcement Date”). |

| • | We believe that, except for the tender offer, holders of Preferred Shares and ADSs will not likely have an opportunity in the foreseeable future to dispose of their Preferred Shares or ADSs at prices other than those available in private or open market transactions (to the extent that any public trading market may continue to exist following the tender offer) because we expect that Net will continue to operate as a going concern and we have no current plans of disposing of our interest in Net or of seeking the liquidation of Net. See—”Purpose of and Reasons for the Tender Offer; Plans for Net Following the Tender Offer—Plans for Net Following the Tender Offer.” |

| • | The R$23.00 per Preferred Share to be received by holders in connection with the transaction falls within a range of implied value per Preferred Share determination of Itaú BBA pursuant to its discounted cash flow analysis. |

| • | The consideration payable to pursuant to the tender offer will be paid entirely in cash, which provides certainty of value. |

| • | The tender offer is not subject to any conditions relating to the number of Preferred Shares (including Preferred Shares represented by ADSs) tendered or to any financing condition. |

We believe that the tender offer is procedurally fair to unaffiliated shareholders for the following reasons:

| • | Although not required to do so by applicable Brazilian law, we obtained a valuation report prepared by Itaú BBA in compliance with the requirements of the CVM that apply to tender offers in which a valuation report is used to determine the minimum price payable. |

| • | Applicable Brazilian law and regulations provide various protections for unaffiliated shareholders, including in particular: (1) the requirement described above that, if we were to launch a further tender offer for Preferred Shares or Net takes certain other corporate actions within a period of one year after completion of this tender offer at a higher price than the tender offer price, shareholders that sold their Preferred Shares in this tender offer would be entitled to receive a payment of any incremental value paid to holders of Preferred Shares in the subsequent transaction, (2) the shareholder put right, as described herein. See—”Certain Rights of Shareholders Following the Tender Offer—Shareholder Put Right” and (3) the protection of the public float in the form of the restriction on our ability to purchase more than one-third of the outstanding Preferred Shares held by public shareholders in the event that more than one-third but fewer than two-thirds of Preferred Shares held by public shareholders are tendered into the offer. |

| • | Acceptance of the tender offer is voluntary and we do not have the ability or the intention to “squeeze out” holders that elect not to accept the tender offer. |

4

SPECIAL FACTORS—Valuation Report of Banco Itaú BBA S.A.

The first paragraph under the heading titled Valuation Report of Banco Itaú BBA S.A. on page 22 is amended and restated in its entirety to read as follows:

While we are conducting a voluntary tender offer for the Preferred Shares in which a valuation report is not mandatory, and this tender offer is not a registered public offer in Brazil, we are conducting the offer in compliance with several of the procedures required under CVM Instruction 361 for registered public offers, including the solicitation of a valuation report. Therefore, Embratel retained Itaú BBA, an investment bank, to prepare a valuation report in compliance with the requirements of CVM Instruction 361, which is dated August 5, 2010. Embratel selected Itaú BBA to provide the valuation report on the basis of Itaú BBA’s experience in similar transactions, its reputation in the Brazilian investment community and its familiarity with Net and its business. Itaú BBA’s valuation report does not express an opinion as to the fairness of the offer price and Itaú BBA did not recommend or otherwise pass upon the offer price, which was determined solely by Embratel and Embrapar.

The second bullet point under the heading titled Valuation Report of Banco Itaú BBA S.A. on page 22 is amended and restated in its entirety to read as follows:

The valuation report regarding Net was prepared in compliance with CVM Instruction 361/02. The valuation report was prepared exclusively in Portuguese, and in case it is translated to another language, the reader is advised to refer to the Portuguese original in the case of any discrepancy or ambiguity in the translation.

The second sentence of the third paragraph on page 24 is hereby amended and restated in its entirety to read as follows:

Itaú BBA measured the volume weighted average price of the Preferred Shares over the respective one, three, six and twelve month periods preceding delivery of the valuation report. This analysis demonstrated a valuation range between R$18.38 (with respect to the three month period) and R$21.10 (with respect to the twelve month period) per Preferred Share over the 12 months preceding the valuation report. Itaú BBA used the 12 month range because it is consistent with best practices in Brazil and the guidelines provided by CVM Instruction 361/02.

SPECIAL FACTORS—Valuation Report of Banco Itaú BBA S.A.—Volume Weighted Average Price Analysis

The paragraph under the subheading titled Volume Weighted Average Price Analysis on page 24 is hereby amended and restated in its entirety to read as follows:

Itaú BBA measured the volume weighted average price of the Preferred Shares over the respective one, three, six and twelve month periods preceding delivery of the valuation report. This analysis demonstrated a valuation range between R$18.38 (with respect to the three month period) and R$21.10 (with respect to the twelve month period) per Preferred Share over the 12 months preceding the valuation report. Itaú BBA used the 12 month range because it is consistent with best practices in Brazil and the guidelines provided by CVM Instruction 361/02.

SPECIAL FACTORS—Valuation Report of Banco Itaú BBA S.A.—Discounted Cash Flow Analysis

The fourth sentence of the first paragraph of the subheading titled Discounted Cash Flow Analysis on page 24 is hereby amended and restated in its entirety to read as follows:

“Terminal value” refers to the value of a particular asset based on cash flows occurring after the ten year forecast period. Itaú BBA calculated, on the basis of market consensus, free cash flow as EBIT (Earnings before Interest and Taxes), minus Income Tax and Social Corporate Contribution, plus depreciation and amortization, minus capital expenditures (“CAPEX”) and plus or minus additional changes in net working capital. In connection with this analysis, Itaú BBA made

5

assumptions with regard to Net Revenue, EBITDA margins (such margins equal to EBITDA divided by net revenues) and CAPEX spending as follows:

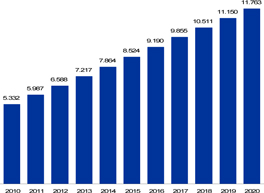

| a) | Net Revenues (R$ million): |

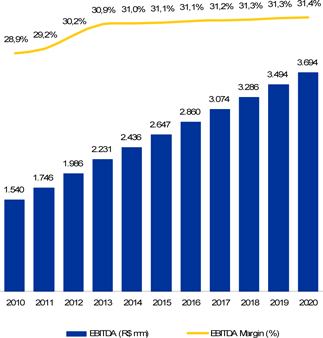

| b) | EBITDA (R$ million) |

6

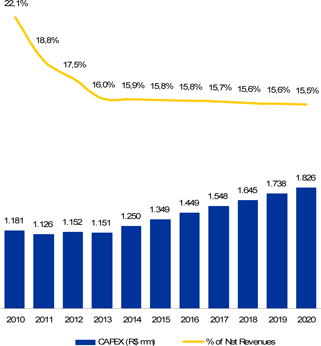

| c) | CAPEX (R$ million) |

Consistent with the guidelines of CVM instruction 361/02, Itaú BBA makes no representations regarding the reasonableness of the above assumptions. The foregoing figures are based on publicly available information through 2013. With respect to the period from 2014-2020, Itaú BBA based its estimates of Net Revenue, CAPEX spending, and EBITDA margins on a comparison of the four companies in the Brazilian telecom sector that are more mature than Net. Itaú BBA determined that over time Net’s EBITDA margin, CAPEX spending, and Net Revenues should converge to the average of the current levels of EBITDA margin, CAPEX spending, and Net Revenues of these four companies. The figures are thus projected to increase proportionately each year until they equal the present averages for these other companies.

The first, second and third sentences of the second paragraph of the subheading titled Discounted Cash Flow Analysis on page 24 are hereby amended and restated in their entirety to read as follows:

In calculating the terminal values of Net at the end of the period, Itaú BBA applied a range of perpetuity growth rates of free cash flow in 2020 ranging from 3% to 4% in nominal dollars. Itaú BBA calculated the perpetuity growth rates of free cash flow based on the projected long term Net Revenue rate of 5.5% depicted above. Because Itaú BBA calculated the long term Net Revenue rate in reais it deducted the 2% inflation difference between Brazil and the United States from the figure, arriving at a long term growth rate of 3.5% in U.S. dollars. Itaú BBA performed a 0.5% sensitivity analysis in both directions. The free cash flows and terminal values were then discounted back to June 30, 2010, using a low-end dollar-based weighted average cost of capital (“WACC”) of 8.9% in nominal terms and a high-end dollar-based WACC of 9.9% in nominal terms. Itaú BBA calculated the WACC using the Capital Asset Pricing Model (“CAPM”), which compares cost of equity to cost of debt to arrive at a nominal discount rate. Itaú BBA determined a cost of equity of 11.1% in nominal U.S. dollars based on the following components of CAPM:

7

Cost of Equity

Risk Free Rate | 4.2 | % | |

Brazil Risk Premium | 2.3 | % |

Market Risk Premium | 7.1 | % | |

Re-levered Regional Beta | 0.664 |

Itaú BBA determined a cost of debt after taxes of 4.5% in US dollars based on the following components of CAPM:

Cost of Debt

Cost of Debt before Taxes | 6.8 | % | |

Effective Tax Rate | 34 | % |

Comparing these calculations to public market estimates of Net’s capital structure, Itaú BBA arrived at a nominal discount rate of 9.4% (U.S. dollars) (weighted by the estimated capital structure of 74% equity and 26% debt). Itaú BBA performed a sensitivity analysis of 0.5% in both directions. Itaú BBA viewed this discount rate range as appropriate for companies with the risk characteristics of Net.

SPECIAL FACTORS—Valuation Report of Banco Itaú BBA S.A.—Comparable Market Multiples

The two paragraphs under the subheading titled Comparable Market Multiples on page 25 are hereby amended and restated in their entirety to read as follows:

Itaú BBA reviewed and compared certain financial information of Net to corresponding financial information, ratios and public market multiples for certain publicly traded corporations in the telecommunications sector in Brazil. Itaú BBA examined both EV/EBITDA and P/E multiples, and determined that the multiple that best estimated Net’s value was EV/EBITDA, which means the value of the enterprise which contemplates the equity value plus net debt divided by EBITDA (earnings before interest, taxes, depreciation and amortization). Itaú BBA determined that the P/E multiples were not as effective because such multiples vary excessively for companies in the sector due to differences in capital structure. The results of this analysis are summarized as follows:

Company | P/E (2010 E) | EV/EBITDA (2010 E) | ||

Telemar Norte Leste | 7.5x | 3.6x | ||

Vivo Participações | 13.5x | 3.9x | ||

TELESP | 9.1x | 3.5x | ||

TIM Participações | 27.1x | 4.1x | ||

Net Serviços de Comunicação | 19.4x | 5.1x |

Although none of the selected companies is directly comparable to Net, the companies included were chosen because they are the only publicly traded companies in Brazil with business and market characteristics that, for purposes of analysis, may be considered similar to certain business and market characteristics of Net. Itaú BBA multiplied the highest and lowest multiples in the range by Net’s consensus EBITDA projection for 2010 of R$1.54 billion, subtracted Net’s net debt as of June 30, 2010 of R$1.203 billion and divided that amount by the number of outstanding Preferred Shares as of June 30, 2010 of 342.96 million, resulting in a range of values per Preferred Share of between R$12.13-R$19.50.

SPECIAL FACTORS—Valuation Report of Banco Itaú BBA S.A.—Precedent Transactions Multiples

The first two sentences of the first paragraph of the subheading titled Precedent Transactions Multiples on page 25 are hereby amended and restated in their entirety to read as follows:

Itaú BBA analyzed the multiples of certain precedent transactions in the Brazilian Pay TV sector since 2006 to estimate Net’s value in the case of a strategic transaction. Although two out of the

8

three transactions reviewed include Net as a participant, Itaú BBA determined that use of the transactions was appropriate because the Brazilian Pay TV sector is highly concentrated and the transactions were the most recent and relevant in the sector. Itaú BBA determined that the most relevant multiple for estimating Net’s value was EV/EBITDA. The results of this analysis are summarized as follows:

The third paragraph on page 26 is hereby amended and restated in its entirety to read as follows:

Itaú BBA received U.S.$466,000 from Net for coordination and distribution services of unsecured and unsubordinated notes issued by Net in January 2010.

Pursuant to Itaú BBA’s engagement letter, Embratel has agreed to pay Itaú BBA U.S.$400,000 for the preparation of its valuation report, which fee shall be due whether or not the tender offer is consummated. Additionally, Itaú BBA is the intermediary institution for the tender offer in Brazil, for which service it will receive a flat fee of U.S.$500,000 and a success fee of 0.12% over the value of the Preferred Shares acquired in excess of 50% of all Preferred Shares.

THE TENDER OFFER—Section 1—Terms of the Tender Offer and Expiration Date—General

The second complete sentence on page 28 is hereby amended and restated in its entirety to read as follows:

As promptly as practicable, and in no event later than three business days, after receipt of the proceeds, The Bank of New York Mellon, as receiving agent, will convert such proceeds into U.S. dollars and will distribute them to the holders of ADSs representing Preferred Shares accepted for purchase in the tender offer.

THE TENDER OFFER—Section 1—Terms of the Tender Offer and Expiration Date—Proration

The third paragraph of the subheading titled Proration on page 28 is deleted in its entirety.

THE TENDER OFFER—Section 3—Procedures for Participating in the Tender Offer—Holders of ADSs—Tender of Preferred Shares Represented by ADSs through the Receiving Agent

The first paragraph on page 34 is hereby amended and restated in its entirety to read as follows:

If the Preferred Shares underlying a holder’s ADSs are not accepted for purchase for any reason (including, without limitation, any pro rata reduction of Preferred Shares accepted for purchase in the tender offer as described in Section 1—”Terms of the Tender Offer and Expiration Date”), those ADSs will be returned promptly after the expiration or termination of the tender offer or the proper withdrawal of the Preferred Shares underlying the ADSs, as applicable, or, in the case of ADSs transferred through DTC, the unpurchased ADSs will be credited to the account at DTC from which they were transferred promptly, and in any event, within three days after the expiration or termination of the tender offer or the proper withdrawal of the Preferred Shares underlying the ADSs, as applicable.

THE TENDER OFFER—Section 10—Certain Information About Net—Financial Information

The second paragraph of the subheading titled Financial Information on page 44 is amended and restated in its entirety to read as follows:

The consolidated financial information of Net set forth below was excerpted from the annual report on Form 20-F of Net for its fiscal year ended December 31, 2009 (“2009 Form 20-F”) and, according to the 2009 Form 20-F, was prepared in accordance with International Financial Accounting Standards (“IFRS”) and which is hereby incorporated by reference in its entirety.

9

SCHEDULE 1—INFORMATION ABOUT THE DIRECTORS AND EXECUTIVE OFFICERS OF EMBRATEL AND EMBRAPAR AND CERTAIN OF THEIR AFFILIATES—1. Directors and Executive Officers of Embratel

The following sentence is inserted as the second sentence of the first paragraph of the subheading titled Directors and Executive Officers of Embratel on page S-1:

Unless otherwise indicated, each person listed below is a citizen of Brazil.

The following sentence is inserted as the fifth sentence of the paragraph titled Biographical Information under the heading titled José Formoso Martínez:

Mr. Formoso Martínez is a citizen of Mexico.

The following sentence is inserted as the fourth sentence of the paragraph titled Biographical Information under the heading titled Oscar Von Hauske Solis:

Mr. Von Hauske Solis is a citizen of Mexico.

SCHEDULE 1—INFORMATION ABOUT THE DIRECTORS AND EXECUTIVE OFFICERS OF EMBRATEL AND EMBRAPAR AND CERTAIN OF THEIR AFFILIATES—2. Directors and Executive Officers of Embrapar

The following sentence is inserted as the second sentence of the first paragraph of the subheading titled Directors and Executive Officers of Embrapar on page S-3:

Unless otherwise indicated, each person listed below is a citizen of Brazil.

SCHEDULE 2—Acquisition of Preferred Shares by Embratel from August 30, 2008

The following sentence is inserted at the beginning of Schedule 2:

Embratel has effected the following acquisitions of Preferred Shares on the São Paulo Stock Exchange since August 30, 2008:

| ITEM 12. | EXHIBITS. | |

| (a)(1)(viii) | Net’s annual report on Form 20-F for the year ended December 31, 2009, filed with the SEC on May 21, 2010 (SEC File No. 000-28860)(the “Net 2009 20-F”)(incorporated herein by reference) | |

10

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

EMPRESA BRASILEIRA DE TELECOMUNICAÇÕES S.A. | ||

By: | /s/ José Formoso Martínez | |

Name: José Formoso Martínez Title: President Date: September 21, 2010 | ||

| EMBRATEL PARTICIPAÇÕES S.A. | ||

By: | /s/ José Formoso Martínez | |

Name: José Formoso Martínez Title: President Date: September 21, 2010 | ||

11

EXHIBIT INDEX

| (a)(1)(viii) | Net’s annual report on Form 20-F for the year ended December 31, 2009, filed with the SEC on May 21, 2010 (SEC File No. 000-28860)(the “Net 2009 20-F”)(incorporated herein by reference) |

12