UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14D-9

Solicitation/Recommendation Statement

under Section 14(d)(4) of the Securities Exchange Act of 1934

NET SERVIÇOS DE COMUNICAÇÃO S.A.

(Name of Subject Company)

NET SERVIÇOS DE COMUNICAÇÃO S.A.

(Name of Person Filing Statement)

Preferred Shares, no par value, and

American Depositary Shares, each representing one Preferred Share

(Title of Class of Securities)

N/A (Preferred Shares)

64109T201 (American Depositary Shares)

(CUSIP Number of Class of Securities)

José Antonio Guaraldi Felix

Investor Relations Officer

Rua Verbo Divino, 1356

São Paulo-SP-04719-002

Brazil

Telephone: (55)-11-2111-2785

with copies to:

Nicolas Grabar, Esq.

Neil Whoriskey, Esq.

Cleary Gottlieb Steen & Hamilton LLP

One Liberty Plaza

New York, NY 10006

Telephone: (212)-225-2000

(Name, Address and Telephone Number of Persons Authorized to Receive Notices and Communications

on Behalf of the Person Filing Statement)

| ¨ | | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

INTRODUCTION

Net Serviços de Comunicação S.A. (“Net”) is filing this Solicitation/Recommendation Statement on Schedule 14D-9 (together with any exhibits and annexes attached hereto, this “Statement”) in connection with the tender offer (the “Offer”) by Empresa Brasileira de Telecomunicações S.A.—Embratel (“Embratel”) and Embratel Participações S.A. (“Embrapar” and together with Embratel, the “Offerors”), each a corporation organized under the laws of the Federative Republic of Brazil, to purchase any and all outstanding common shares, no par value (“Common Shares”), and outstanding preferred shares, no par value (“Preferred Shares”), including Preferred Shares represented by American Depositary Shares (“ADSs”), of Net, other than those held by the Offerors or their affiliates, in cash at a price of 29.02 Brazilianreais (“R$”) per Common Share and per Preferred Share (for reference, equivalent to approximately U.S.$13.30 per ADS based on the average of the buy and sell U.S. dollar-Brazilianreal exchange rates indicated under “transaction PTAX 800, option 5” published by the Central Bank of Brazil through the SISBACEN system at 7:00 p.m., Brasilia time, on October 11, 2013, which was U.S.$1.00 = R$2.1818), in each case plus interest at the benchmark interest rate of the Interbank Deposit Certificate,Certificado de Depósito Interbancário (the “CDI Rate,” for reference, approximately 9.32% on October 11, 2013), calculated pro rata from August 19, 2013 through the Auction Date (as defined herein), net of the stock exchange and settlement fee described in the offer to purchase dated October 17, 2013 (the “Offer to Purchase”), any applicable brokerage fees or commissions and applicable withholding taxes, upon the terms and subject to the conditions set forth in the Offer to Purchase and the related ADS letter of transmittal (the “ADS Letter of Transmittal”). The offer price as announced on June 7, 2012 in a statement of material fact by Embrapar is comprised of a base price of R$26.64 per Common Share and per Preferred Share (the “base offer price”) plus accrued interest at the CDI Rate from June 8, 2012 through the Auction Date. R$29.02 represents the base offer price plus accrued interest at the CDI Rate from June 8, 2012 through and including August 18, 2013, a recent date, and is being disclosed for illustrative purposes. Banco Itaú BBA S.A., the Brazilian intermediary agent, will notify the BM&FBOVESPA—Bolsa de Valores Mercadorias e Futuros (the “São Paulo Stock Exchange”) of the offer price, including all accrued interest through the Auction Date, at least three Brazilian business days before the Auction Date. The São Paulo Stock Exchange will disclose the offer price on or before the Auction Date. ADS holders tendering the Preferred Shares represented by their ADSs through The Bank of New York Mellon, as receiving agent, will receive payment in U.S. dollars, which shall also be net of expenses for converting Brazilianreais to U.S. dollars, any applicable taxes and fees associated with the cancellation of the ADSs representing Preferred Shares purchased in the Offer. The Offer is not subject to any conditions other than that the Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) be validly tendered. The Offer to Purchase and ADS Letter of Transmittal have been filed as exhibits to the combined Schedule TO and Schedule 13E-3 filed by the Offerors, dated October 17, 2013 (the “Schedule TO”).

In accordance with applicable Brazilian regulations, subject to the terms and conditions described in the Offer to Purchase and the ADS Letter of Transmittal, the Offerors will purchase the Common Shares and Preferred Shares tendered in the Offer through an auction on the São Paulo Stock Exchange. Holders of Common Shares and Preferred Shares must qualify for, and be represented at the auction by, a Brazilian brokerage firm authorized to conduct trades on the São Paulo Stock Exchange. The auction is currently scheduled to occur at 1:00 p.m., New York City time, on November 27, 2013 (the “Auction Date”). The Schedule TO states that the Offerors will pay for the Common Shares and Preferred Shares purchased in the tender offer on the settlement date (the “Settlement Date”), which is expected to be the third Brazilian business day after the Auction Date, in accordance with the rules established by the clearing and settlement chamber of the São Paulo Stock Exchange.

The Offer is being conducted concurrently in the United States and Brazil and is being made to all holders of Common Shares, Preferred Shares and ADSs. The Offer to Purchase is intended solely for holders of Common Shares and Preferred Shares that are U.S. residents (within the meaning of Rule 14d-1(d) under the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”)) and all holders of ADSs representing Preferred Shares wherever located. Holders of Common Shares and Preferred Shares that are not U.S. residents may not use this offer document. A separate offer document, called anEdital, for use by holders of Common Shares and Preferred Shares that are not U.S. residents, is being published in Portuguese concurrently in Brazil as required under applicable Brazilian law. In addition, a short circular corresponding to theEdital for use by

2

holders of Preferred Shares listed on theMercado de Valores Latinoamericanos is being published in Spanish concurrently in Spain as required under applicable Spanish law.

The information set forth in the Offer to Purchase under “Summary Term Sheet” is incorporated herein by reference.

The Offer to Purchase and the related ADS Letter of Transmittal contain important information that you should read before making any decision in connection with the Offer.

Item 1. Subject Company Information.

The name of the subject company is Net Serviços de Comunicação S.A., a corporation (sociedade anônima) organized under the laws of the Federative Republic of Brazil. Net Serviços de Comunicação S.A. is referred to herein as “Net.” Net’s principal executive offices are located at Rua Verbo Divino, 1356, 1st floor, São Paulo, SP, Brazil 04719-002. The telephone number of Net is +55 11 2111-2606.

The securities to which this Statement relates are Net’s Common Shares, Preferred Shares and ADSs. The principal market on which the Common Shares are traded is the São Paulo Stock Exchange, where they are listed under the ticker symbol “NETC3.” The principal market on which the Preferred Shares are traded is the São Paulo Stock Exchange, where they are listed under the ticker symbol “NETC4.” ADSs representing Preferred Shares are traded on the NASDAQ Global Market (“NASDAQ”) under the ticker symbol “NETC.” Each ADS represents one Preferred Share of Net. There are 114,459,685 Common Shares and 228,503,916 Preferred Shares (including Preferred Shares underlying ADSs) and, as of December 31, 2012, approximately 0.8 million ADSs issued and outstanding. The information set forth in the Offer to Purchase under the caption “The Tender Offer—7. Certain information about the Common Shares, Preferred Shares and ADSs” is incorporated herein by reference.

Item 2. Identity and Background of Filing Person.

Name and Address

The name, business address and business telephone number of Net, which is the subject company and the person filing this Statement, are set forth in Item 1 above.

The Schedule TO states that the principal executive offices of Embratel are located at Av. Presidente Vargas, no. 1012, Centro, Rio de Janeiro—20071-002. The principal executive offices of Embrapar are located at Rua Regente Feijó, 166 sala 1687-B, Centro, Rio de Janeiro—20060-060. The information set forth in the Offer to Purchase under the caption “The Tender Offer—9. Certain Information about Embratel and Embrapar” is incorporated herein by reference.

The Offer

This Statement relates to the Offer, which is described in the Introduction above. The Offer is a “unified offer” for Brazilian purposes, in that it satisfies two different offer requirements under Brazilian law: (i) a mandatory offer in connection with an indirect change in control of Net (the “Change in Control of Net”); and (ii) a voluntary offer in connection with Net’s withdrawal from the Level 2 listing regime of the São Paulo Stock Exchange (the “Level 2 Delisting”). After the completion of the Offer, the Common Shares and Preferred Shares will continue to be listed on the São Paulo Stock Exchange under its general listing regime. The information set forth in the Offer to Purchase under the captions “Summary Term Sheet,” “Introduction,” “Special Factors,” “The Tender Offer—1. Terms of the Tender Offer and Expiration Date,” “The Tender Offer—2. Acceptance for Payment and Payment for Shares,” “The Tender Offer—3. Procedures for Participating in the Tender Offer,” “The Tender Offer—4. Withdrawal Rights,” “The Tender Offer—6. Certain U.S. Federal Income and Brazilian Tax Consequences” and “The Tender Offer—5. Source and Amount of Funds” are incorporated herein by reference.

Net intends to make information relating to the Offer available on the Internet at http://ir.netservicos.com.br.

3

Item 3. Past Contacts, Transactions, Negotiations and Agreements.

Except as described in this Item 3, on the date of the filing of this Statement, there is no material agreement, arrangement or understanding or any actual or potential conflict of interest between Net and its affiliates, on the one hand, and (i) the executive officers, directors or affiliates of Net or (ii) the Offerors or their respective executive officers, directors or affiliates, on the other hand.

Executive Officers and Directors of Net

The executive officers of Net areJoséAntonio Guaraldi Félix (CEO), Roberto Catalão Cardoso (CFO), Daniel Feldmann Barros (COO), and Rodrigo Marques de Oliveira. The directors of Net are Mr. Guaraldi Félix, Mr. Catalão Cardoso, Mr. Feldmann Barros, Mr. Marques de Oliveira, Oscar Von Hauske Solis, Carlos Henrique Moreira, Jose Formoso Martínez, Mauro Szwarcwald, Isaac Berensztejn, Antonio Oscar de Carvalho Petersen Filho, Antonio João Filho, Carlos Hernán Zenteno de Los Santos and Fernando Ceylão Filho. Certain members of Net’s board of directors and executive officers may have interests in the Offer that are different from, or in addition to, the interests of holders of Net’s Common Shares and Preferred Shares. Mr. Von Hauske Solis, Mr. Moreira, Mr. Formoso Martínez, Mr. Szwarcwald, Mr. Berensztejn, Mr. Petersen Filho, Mr. Filho and Mr. Zenteno de Los Santos serve as officers and/or directors of the Offerors or their affiliates. Under Brazilian law, all directors of Brazilian companies are required to vote on behalf of the company regardless of whether the shareholders that appointed them have different interests on any particular matter. For further information about Net’s directors and executive officers, see Annex B to this Schedule 14D-9.

The business address and phone number of the directors and executive officers of Net is the same as that of Net noted above.

Executive Officers and Directors of the Offerors

The information set forth in the Offer to Purchase under “Schedule I—Information about the Directors and Executive Officers of Embratel, Embrapar and Certain of Their Affiliates” is incorporated by reference.

Shareholders’ Agreements

In March 2005, Globo Comunicação e Participações S.A. (“Globo”), Distel Holdings S.A. (“Distel”, and together with Globo, “Grupo Globo”), Embratel, Embrapar and GB Empreendimentos e Participações S.A. (“GB”), together with the parent company of Embratel and Embrapar, Telmex Internacional, S.A.B. de C.V. (“Telmex Internacional”), entered into a shareholders’ agreement with respect to Net, and Grupo Globo and Telmex Internacional entered into a separate shareholders’ agreement with respect to GB (these shareholders’ agreements together, the “Old Shareholders’ Agreements”). The Old Shareholders’ Agreements contained provisions relating to, among other things, the transfer of Net’s shares and of the shares issued by GB, rights of first refusal and governance, including the right of each of Grupo Globo, Telmex Internacional and GB to appoint members to Net’s board of directors and board of executive officers. A summary of the Old Shareholders’ Agreements can be found in Net’s Annual Report on Form 20-F for the fiscal year ended December 31, 2011, under “Item 7—Major Shareholders and Related Party Transactions.”

Law 12,485 expressly revoked previous foreign ownership limitations on the exercise of control over cable companies in Brazil. On March 16, 2012, Embrapar exercised its option under the Old Shareholders’ Agreements to purchase 5.5% of the shares with voting rights of GB, which has direct control of Net, previously held by Grupo Globo. On September 17, 2012, Globo, Embrapar and Embratel undertook a corporate reorganization of their holdings in GB and Net to address regulatory concerns raised by the Brazilian National Telecommunications Agency,Agência Nacional de Telecomunicações—Anatel (“Anatel”). As a result of the reorganization, Embratel and Embrapar no longer directly owned any of Net’s shares.

On December 21, 2012, EG, Embrapar, Embratel and GB, together with Net, América Móvil S.A.B. de C.V. (“América Móvil”) and Globo, entered into a shareholders’ agreement with respect to Net (the “New Net Shareholders’ Agreement”), and Globo, Embrapar and Embratel, together with EG, Net and América Móvil,

4

entered into a separate shareholders’ agreement with respect to EG (the “EG Shareholders’ Agreement” and, together with the New Net Shareholders’ Agreement, the “New Shareholders’ Agreements”). The New Shareholders’ Agreements, which replaced the Old Shareholders’ Agreements, contain provisions relating to the transfer of shares of Net and EG and certain other governance rights of Net and EG described below. The New Shareholders’ Agreements are Exhibits (d)(i) and (d)(ii) to this Statement and are incorporated herein by reference.

Right of first refusal and transfer of shares. The New Shareholders’ Agreements establish specific rules for the transfer of Net’s shares and EG’s shares. In the event that one or more shareholders party to either of the New Shareholders’ Agreements wish to transfer their shares, the transferring shareholders are required to notify in writing the non-transferring shareholders party to such New Shareholders’ Agreement in order to enable them to exercise their right of first refusal.

Under the New Shareholders’ Agreements, transfers of Net’s shares or EG’s shares to Net’s competitors, as defined in the New Shareholders’ Agreements, are not permitted. Furthermore, the shareholders party to the New Shareholders’ Agreements may not encumber or otherwise create any liens on Net’s shares or EG’s shares, except under limited circumstances.

Tag-along rights. Under the New Shareholders’ Agreements, in the event of a sale of control of Net by any shareholder party to the New Shareholders’ Agreements, each of the other shareholders party to the New Shareholders’ Agreements will have the right to require such selling shareholder to include in the sale such other shareholder’s shares of Net or EG, subject to the same price and payment conditions; provided that, if the number of shares of Net or EG, as the case may be, exceeds the number of shares the purchaser is willing to acquire, the number of shares of Net or EG, as the case may be, sold will be reduced proportionately for each selling shareholder.

Prior meetings. The New Net Shareholders’ Agreements provide that a meeting of the representatives of Globo and the Offerors must be held prior to each of Net’s, or any of Net’s subsidiaries’, general shareholders’ meetings or board of directors meetings at which certain matters (“Relevant Matters”), are to be considered. The prior meeting is to establish the position that will be adopted at the general shareholders meeting or board of directors meeting, as the case may be, by the shareholders party to the New Shareholders’ Agreements. Relevant matters must be approved at a prior meeting by the affirmative vote of shareholders party to the New Shareholders’ Agreements. The shareholders are then required to vote or instruct their respective directors to vote, as the case may be, in accordance with the outcome of the vote at such prior meeting.

Relevant matters. The New Shareholders’ Agreements require the approval of Globo and the Offerors at a prior meeting as described above for specified Relevant Matters. These Relevant Matters include certain extraordinary corporate transactions relating to Net, including certain business combinations, amendments to Net’s by-laws with respect to certain matters, amendments to any agreements with Globo, execution, renewal or amendment to agreements for the purchase of broadcasting rights from non-Brazilian providers and the exercise of Net’s voting rights in any company controlled by Net with respect to certain matters.

Representations and warranties. In the New Net Shareholders’ Agreements, Net represents and warrants that it will not, and the Offerors and América Móvil represent and warrant that they will not, approve or permit: (i) any change in Net’s corporate purpose; (ii) a transfer or encumbrance of Net’s assets that jeopardizes Net’s provision of telecommunication services; (iii) the acquisition by Net, in excess of specified thresholds, of assets not related to telecommunication services; (iv) the acquisition of an equity interest in companies whose activities do not relate to the provision of telecommunication services; (v) any redemption of Net’s shares that either change EG’s equity interest in Net or change the rights of EG or Globo pursuant to the New Shareholders’ Agreements.

Board of directors (Conselho de Administração). The New Net Shareholders’ Agreements require that Net’s board of directors be comprised of ten sitting members and an equal number of alternates. Currently, all ten

5

sitting members and their alternates are appointed (and can be dismissed) by the Offerors. Upon any change in applicable law contemplated by Section 7.3 of the EG Shareholders’ Agreement, one sitting member and one respective alternate may be designated by Globo and elected to the board of directors upon the affirmative vote of EG and the Offerors. The nine remaining sitting members and their alternates shall be appointed (and can be dismissed) by the Offerors.

Business covenants. Under the EG Shareholders’ Agreement and subject to certain ownership requirements, América Móvil agrees not to, and not to cause a related party to, own, conduct or participate in the management of any broadcast television or platform (other than Net’s) or content production businesses (other than those specified in the EG Shareholders’ Agreement) in Brazil. Under the New Net Shareholders’ Agreement, the Offerors and EG agree to prevent Net from extending a loan to any company that is not controlled by Net.

Term. The New Shareholders’ Agreements shall be valid and effective so long as Globo holds, directly or indirectly, at least 10,250,648 of EG’s shares, irrespective of whether these are common or preferred shares and of the percentage ownership represented by such shares.

Material Transactions with Affiliates

Net has engaged in a variety of related party transactions, a summary of which can be found in Net’s Annual Report on Form 20-F for the fiscal year ended December 31, 2012, under “Item 7—Major Shareholders and Related Party Transactions.” The agreements governing those transactions are Exhibits (e)(iii)—(xviii) to this Statement and are incorporated herein by reference. The information set forth in the Offer to Purchase under the caption “Special Factors—Interests of Certain Persons in the Tender Offer; Security Ownership; Transactions and Arrangements Concerning the Common Shares, Preferred Shares and ADSs” and “Schedule 2: Recent Acquisitions of Net’s Securities by the Offerors” is incorporated herein by reference.

On May 29, 2013, Embrapar announced its plan to merge GB into Net and the merger became effective on August 30, 2013. As a result of the merger, Embrapar and Embratel directly own a combined 89,446,769 Common Shares and 223,080,448 Preferred Shares of Net, representing 78.15% of the total number of Net’s Common Shares, 97.63% of the total number of its Preferred Shares (including Preferred Shares represented by ADSs) and 91.13% of the total number of Net’s Common Shares and Preferred Shares (including Preferred Shares represented by ADSs), taken as a whole. EG Participações S.A., an entity controlled by Embrapar (“EG”), owns 14,080,704 Common Shares, currently representing 12.30% of the total number of Net’s Common Shares, or 4.11% of the total number of Net’s Common Shares and Preferred Shares (including Preferred Shares represented by ADSs), taken as a whole. EG has issued and outstanding 7,040,352 common shares and 7,040,352 preferred shares. While EG’s common shares and preferred shares have equivalent economic rights, the preferred shares have no voting rights. Embrapar and Embratel together own 51% of EG’s common shares, and Globo owns the remaining 49% of EG’s common shares and 100% of its preferred shares. See Item 6 “Interest in Securities of the Subject Company” for more information on the merger.

Item 4. The Solicitation/Recommendation.

Recommendation of the Board

Pursuant to the São Paulo Stock Exchange’s Corporate Governance Level 2 Listing Regulation (the “Level 2 Regulation”), Net’s board of directors is required to prepare a reasoned opinion recommending in favor or against the acceptance of the Offer and may not remain neutral. At a meeting held on October 15, 2013 and attended by eight of the ten members of Net’s board of directors, the board of directors of Net, by a unanimous vote of those in attendance, recommended that holders of Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) tender their shares into the Offer, but informed such holders that the decision to tender is ultimately at their discretion. The board did not submit the Offer for the approval of a majority of the unaffiliated shareholders as the Offer is not structured in such a manner that such approval is

6

required. The board’s recommendation was based on: (i) the board’s determination that the Offer is procedurally and substantively fair to the unaffiliated holders of Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) (as more fully described below); and (ii) the additional factors it is required to consider pursuant to the Level 2 Regulation (as more fully described below). The factors that the board of directors of Net considered in making its recommendation and reaching its determination are described in this Statement.

In evaluating the offer, members of Net’s board of directors relied upon their knowledge of the business, financial condition and prospects of Net and consulted with Net’s management and advisors. In making the determination and recommendation set forth above, Net’s board of directors considered the factors set forth below.

Position of Net’s Board of Directors Regarding the Fairness of the Offer

In making its determination as to the fairness of the Offer, Net’s board of directors considered a number of factors, including, without limitation, those described below. The board of directors did not find it practicable to, and did not make any specific assessment of, quantify or otherwise attempt to assign relative weights to, the specific factors considered by it. Rather, the board of directors viewed its decision and recommendation as based on the totality of the information presented to it and considered by it.

In reaching its conclusion that the consideration that unaffiliated holders of Common Shares, Preferred Shares and ADSs will receive in the Offer is fair, and that such transaction is substantively fair to unaffiliated shareholders, Net’s board of directors considered and relied upon a number of factors, including the following:

| • | | Change in Control of Net: Minimum Price: The minimum price requirements under Brazilian law applicable to the Offer are intended to protect minority shareholders by ensuring that they have an opportunity to sell their Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) at a fair price in connection with the Change in Control of Net. The base offer price represents a premium of R$20.52 to the price paid by the Offerors to Globo, as adjusted by the SELIC rate through the announcement of the offer price on June 7, 2012, in the transaction that resulted in the Change of Control of Net, which triggered the mandatory tender offer. The base offer price also represents a premium to the minimum price we are required to pay unaffiliated Shareholders as a result of the Change in Control of Net, whether this is R$5.98 plus interest at the SELIC rate, calculated pro rata from March 5, 2012 until the Settlement Date, as we believe, or R$9.41 plus interest at the SELIC rate, calculatedpro ratafrom March 21, 2005 until the Settlement Date, as the CVM has indicated. |

| • | | Market Price and Premium: The board of directors considered the historical market prices of the Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) compared to the base offer price. The base offer price compares favorably to current and historical market prices for Common Shares and Preferred Shares, particularly in light of the limited level of liquidity in the shares. The base offer price represents a premium of approximately 32% for the Common Shares and approximately 28% for the Preferred Shares over the weighted average trading prices for the 60 days prior to March 5, 2012, the last trading day before announcement of the Offer in Brazil. The base offer price is also approximately 112% higher than the net asset value of the Common Shares and the Preferred Shares as of March 31, 2012. The base offer price also represents a premium of approximately 10% over the weighted average trading prices for the ADSs on NASDAQ for the 60 calendar days ending on March 5, 2012. |

| • | | Valuation Report of BTG Pactual: Brazilian law requires that in a tender offer of this type, a valuation report on the economic value of the company subject to the tender offer (the “Valuation Report”) must be prepared in accordance with specific procedures established by Brazilian regulations. The Level 2 Regulation, which applies to Net, governs the appointment of the appraiser by unaffiliated minority shareholders. The Offerors paid for the Valuation Report, and the unaffiliated minority shareholders of Net selected BTG Pactual S.A. (“BTG Pactual”) as the appraiser. The base offer price falls within the price range reflecting the economic value of Net’s Common Shares and Preferred Shares indicated by BTG Pactual in its Valuation Report, |

7

| | which report was obtained pursuant to the Level 2 Regulation to protect minority shareholders. While the base offer price is below the midpoint of that range, it is within the range that BTG Pactual determined would constitute the economic value of Net’s Common Shares and Preferred Shares. The information set forth in the Offer to Purchase under the caption “Special Factors—Valuation Report of BTG Pactual” is incorporated herein by reference. |

| • | | Credit Suisse Opinion: The Net board of directors considered the opinion, dated October 15, 2013, of Banco de Investimentos Credit Suisse (Brasil) S.A. (“Credit Suisse”) to the Net board of directors as to the fairness, from a financial point of view and as of the date of the opinion, of the offer price of R$29.02 per Common Share and per Preferred Share to be paid in the Offer to holders of Common Shares and Preferred Shares, collectively as a group (other than the Offerors and their respective affiliates), which opinion was based on and subject to the assumptions made, procedures followed, matters considered and limitations on the review undertaken by Credit Suisse. See Annex A to this Schedule 14D-9 and the summary under “—Opinion of Banco de Investimentos Credit Suisse (Brasil) S.A.” for more information. |

Net’s board of directors believes that the procedures governing the Offer are fair to unaffiliated shareholders for the following reasons:

| • | | Mandatory Offer: Brazilian law and the Level 2 Regulation requires the Offerors to make the Offer as a result of the Change in Control of Net and provides for a minimum price. The Level 2 Regulation also requires Offerors to conduct a public tender offer for all of the outstanding Common Shares and Preferred Shares not held by their affiliates because of Net’s shareholders’ vote to approve the Level 2 Delisting, and it provides for a minimum price to be determined through a valuation report by an independent third party. |

| • | | Unconditional Offer: Regarding the treatment of Net’s minority shareholders in the Offer, Net considered that as a mandatory tender offer, the Offer is not subject to any conditions, such as conditions relating to the number of Common Shares or Preferred Shares (including Preferred Shares represented by ADSs) tendered or to any financing requirements to complete the Offer. Rather, subject to the terms of the Offer, any and all Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) validly tendered by any holder will be accepted by the Offerors. |

| • | | Future Liquidity of Shares: Net’s board of directors considered that, except for the Offer, holders of Common Shares and Preferred Shares, including those represented by ADSs, will not likely have an opportunity in the foreseeable future to dispose of their Common Shares or Preferred Shares at prices other than those available in private or open market transactions, because the Offerors have stated that they have no current plans of disposing of their interest in Net or of seeking the liquidation of Net. Net’s board of directors also considered that the liquidity of the Common Shares and Preferred Shares would likely be reduced due to the Level 2 Delisting. Net’s board of directors further considered that after this Offer, there will be even less liquidity in Net’s Preferred Shares, given the Offeror’s stated intentions to cause Net to take steps following the completion of the Offer that are necessary to delist the Preferred Shares and the ADSs from NASDAQ and, if the relevant requirements are met, terminate the registration of the Preferred Shares and the ADSs under the Exchange Act, as amended. |

| • | | Valuation Report of BTG Pactual: The appointment of BTG Pactual to prepare the Valuation Report followed the procedures of the Level 2 Regulation. At a duly called shareholder meeting (at which the required quorum of unaffiliated holders of minority shares was present) held on April 5, 2012, unaffiliated holders of minority shares, by a majority of the votes cast at that meeting, had the option to select an appraiser from among the three independent, specialized third-party valuation firms recommended by Net’s board of directors to prepare the Valuation Report. At that meeting, unaffiliated holders of minority shares unanimously selected BTG Pactual as the appraiser. When BTG Pactual delivered its initial Valuation Report on May 25, 2012, the Offerors were contemplating using it to comply with the requirements for both the Level 2 Delisting and a voluntary tender offer in connection with the deregistration of Net as a public company in Brazil. As permitted under Brazilian law for such deregistration offers, shareholders representing more than 10% of Net’s outstanding shares requested a special shareholders’ meeting to decide |

8

| | on the commissioning of an additional valuation of the Common Shares and Preferred Shares. After the Offerors announced on July 5, 2012 that they had decided not to pursue the deregistration of Net, Net’s board of directors confirmed that a special shareholders’ meeting to discuss the preparation of an additional valuation report was no longer necessary. In accordance with applicable Brazilian law and regulations, the Valuation Report was submitted to the CVM for review and comment. A revised version of the Valuation Report was made public on October 30, 2012, and the final version was made public on September 27, 2013, which will be made available for inspection and copying at the principal executive offices of Net during its regular business hours by any interested holder of Common Shares or Preferred Shares or by any holder of ADSs representing Preferred Shares of Net or a representative of any such interested holder who has been so designated in writing. |

| • | | Credit Suisse Opinion: The Net board of directors received an opinion, dated October 15, 2013, of Credit Suisse in connection with the Offer. |

Net recognized that there are some detriments to holders of Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) who tender in the offer, including the following:

| | • | | Shareholders will no longer be able to participate in any future growth of Net. |

| | • | | Shareholders may incur a taxable gain from the sale of their Common Shares or Preferred Shares (including Preferred Shares represented by ADSs). |

Net’s board of directors did not consider the third-party sale value or liquidation value of Net because the Offerors have stated their intention for Net to continue operating as a going concern. Net’s board of directors did, however, consider Net’s net book value of R$13.82 per Common Share and per Preferred Share as of June 30, 2013 (unaudited), calculated by dividing stockholders’ equity by the number of Common Shares and Preferred Shares. Net’s net book value per Common Share and per Preferred Share as set forth in the Valuation Report was R$12.54. This value is substantially below the offer price.

Net’s board is not aware of any firm offers made by any unaffiliated party for Net, a controlling interest in Net or a substantial part of Net’s assets during the past two years and therefore did not consider any such offers in reaching its conclusion as to fairness. No unaffiliated representative has been retained by a majority of directors who are not employees of Net to act solely on behalf of the unaffiliated shareholders for purposes of negotiating the terms of the Offer or for the purposes of preparing a report concerning the fairness of the transaction.

In evaluating the procedural and substantive fairness of the tender offer, Net’s board of directors considered the technical objections raised by certain of its shareholders representing more than 10% of Net’s outstanding shares not held by the Offerors or their affiliates (the “Petitioning Shareholders”). The Petitioning Shareholders alleged that the Valuation Report contained certain errors, inconsistencies and deficiencies in methodology. As part of its review process, the Brazilian Securities and Exchange Commission,Comissão de Valores Mobiliários (“CVM”), conveyed the Petitioning Shareholders’ concerns to BTG Pactual and requested that it make certain clarifications in a revised Valuation Report, which the Offerors filed on September 14, 2012. Because BTG Pactual (i) did not alter the price range previously indicated as reflecting the economic value of Net’s Common Shares and Preferred Shares; and (ii) addressed the Petitioning Shareholders’ concerns, its revisions to the Valuation Report did not change Net’s board’s position as to the substantive fairness of the tender offer. In addition, the Petitioning Shareholders alleged that, in accordance with Brazilian law, they were entitled to commission an additional valuation of Net’s Common Shares and Preferred Shares. On July 30, 2013, the Colegiado, the highest organ of the CVM, dismissed the Petitioning Shareholders’ claims as groundless and denied their request for an additional valuation report. On August 29, 2013, the Petitioning Shareholders asked the CVM to require Net to provide an update to BTG Pactual’s Valuation Report. After due consideration, on October 1, 2013, the Colegiado denied the Petitioning Shareholders’ request for an update of the Valuation Report.

9

In making its determinations as to the procedural and substantive fairness of the tender offer, Net’s board of directors recognized that it has not retained an unaffiliated representative that is not an employee of Net to act solely on behalf of unaffiliated holders of Common Shares, Preferred Shares or ADSs for purposes of negotiating the terms of the tender offer. This is not required as a matter of Brazilian law. In any event, the absence of a separate unaffiliated representative did not affect Net’s board of directors’ determination based on the factors set forth above. Net’s board of directors recognized that the tender offer is not structured in such a way that approval of at least a majority of the unaffiliated holders is required. Net’s board of directors felt that the absence of such a condition supported its determination, rather than detracted from it. It noted that the absence of such a condition means that each and every unaffiliated holder that wants to take advantage of the tender offer can do so, irrespective of the views of the other holders. Accordingly, the absence of such a condition did not affect Net’s board of directors’ determination, based on the factors set forth above, that the tender offer is procedurally and substantively fair to the unaffiliated holders of Common Shares and Preferred Shares (including Preferred Shares representing ADSs).

Additional Factors Considered by Net’s Board of Directors Pursuant to the Level 2 Regulation

In addition to the factors that Net’s board of directors considered in reaching its determination on the fairness of the Offer, it also considered the following additional factors required by the Level 2 Regulation to make its recommendation that the holders of Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) tender their shares into the Offer:

| • | | Interest of Holders and Liquidity of Shares: Net’s board of directors considered whether the Offer would present holders of Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) with an opportunity to sell their shares given the level of liquidity in such shares. Considering the reduced liquidity in Net’s shares in recent years, Net’s board of directors felt the Offer represented a significant opportunity for holders of Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) to dispose of their shares. |

| • | | Impact of the Offer on Net: Net’s board of directors considered the impact of the Offer on Net’s interests. It concluded that the Offer is unlikely to have a material impact on Net’s interests or result in any material change in Net’s activities or economic performance. It also concluded that, since Net has no plans of accessing Brazilian capital markets, the Level 2 Delisting will likely result in a reduction of the expenses that Net currently has to incur in order to comply with the Level 2 listing regime of the São Paulo Stock Exchange. In addition, the Change of Control of Net, which triggered the mandatory Offer, is likely to have a positive impact on the Company as the result of synergies among Net, Embratel and the other companies in Embratel’s economic group. |

| • | | Strategic Plans of the Offerors: On April 11, 2013, Net and Embrapar announced a potential corporate reorganization involving Claro, S.A., a company also indirectly controlled by América Móvil, intended to consolidate the corporate structures of Net and Embrapar with some of their respective subsidiaries in Brazil into a single company. Except for that announcement, Net’s board of directors did not consider any strategic plans of the Offerors for Net following the Offer, because the Offerors did not announce any such plans. |

Opinion of Banco de Investimentos Credit Suisse (Brasil) S.A.

Net retained Credit Suisse to render an opinion to Net’s board of directors as to the fairness, from a financial point of view, of the offer price of R$29.02 per Common Share and per Preferred Share to be paid in the Offer to holders of Common Shares and Preferred Shares, collectively as a group (other than the Offerors and their respective affiliates). On October 15, 2013, Credit Suisse delivered to Net’s board of directors a written opinion, dated October 15, 2013, to the effect that, as of that date and based on and subject to various assumptions made, procedures followed, matters considered and limitations on the review undertaken, the offer price of R$29.02 per Common Share and per Preferred Share to be paid in the Offer to holders of Common Shares and Preferred Shares, collectively as a group (other than the Offerors and their respective affiliates), was fair, from a financial point of view, to such holders.

10

The full text of Credit Suisse’s written opinion, dated October 15, 2013, to Net’s board of directors, which sets forth, among other things, the assumptions made, procedures followed, matters considered and limitations on the review undertaken by Credit Suisse in connection with such opinion, is attached to this document as Annex A and is incorporated into this document by reference in its entirety. The description of Credit Suisse’s opinion set forth in this document is qualified in its entirety by reference to the full text of Credit Suisse’s opinion. Credit Suisse’s opinion was provided to Net’s board of directors (in its capacity as such) for its information in connection with its evaluation of the offer price of R$29.02 per Common Share and per Preferred Share from a financial point of view in accordance with Item 5.8 of the BM&FBovespa Corporate Level 2 By-Laws and did not address any other aspect of the Offer, including the relative merits of the Offer as compared to alternative transactions or strategies that might be available to Net or its shareholders or the underlying business decision of Net’s board of directors or any other party or entity with respect to the Offer. Credit Suisse was not requested to, and it did not, participate in the negotiation or structuring of the Offer and it was not requested to, and it did not, solicit third-party indications of interest in acquiring all or any part of Net. The opinion should not be construed as creating any fiduciary duty on Credit Suisse’s part to any party and it does not constitute advice or a recommendation to any shareholder as to whether such shareholder should tender Common Shares or Preferred Shares in the Offer or how any Net shareholder or board member should otherwise act on any matter relating to the Offer. Credit Suisse’s opinion was not prepared with a view toward compliance with any legal or regulatory provisions in Brazil or abroad, including Instrução CVM nº 361/2002, Instrução CVM nº 319/1999 and/or Law nº 6404/1976, and did not constitute a valuation report (alaudo orlaudo de avaliação) issued for purposes of any such legal or regulatory provisions.

In arriving at its opinion, Credit Suisse reviewed (i) the draft Notice of Unified Offer to Purchase Common Shares and Preferred Shares Issued by Net Serviços De Comunicação S.A. Offer (Edital de Oferta Pública Unificada de Aquisição de Ações Ordinárias e Ações Preferenciais de Emissão da Net Serviços De Comunicação S.A.), publicly available on October 4, 2013, as filed by the Offerors with the CVM (such notice, the “Notice of Public Tender Offer”) and directed at holders of Common Shares or Preferred Shares that are not U.S. residents and (ii) Amendment No. 2 to the Tender Offer Statement on Schedule TO publicly filed on October 18, 2012 by the Offerors with the SEC, including the draft Offer to Purchase, dated October 17, 2012, directed at holders of American Depositary Shares representing Preferred Shares (“Net ADS”) or holders of Common Shares or Preferred Shares that are U.S. residents (collectively, the “Schedule TO” and, together with the Notice of Public Tender Offer, the “Tender Offer Documents”), and certain publicly available business and financial information relating to Net. Credit Suisse also reviewed certain other information relating to Net provided to or discussed with Credit Suisse by Net, including financial forecasts and estimates approved for Credit Suisse’s use by the board of directors of Net, and met with Net’s senior management to discuss the business and prospects of Net. Credit Suisse also considered certain financial and stock market data of Net, and compared that data with similar data for other publicly held companies in businesses it deemed similar to that of Net, and Credit Suisse considered, to the extent publicly available, the financial terms of certain other business combinations and transactions which have been effected or announced. Credit Suisse also considered such other information, financial studies, analyses and investigations and financial, economic and market criteria which it deemed relevant.

In connection with its review, Credit Suisse did not independently verify any of the foregoing information and Credit Suisse assumed and relied upon such information being complete and accurate in all material respects. With respect to the financial forecasts and estimates for Net that Credit Suisse utilized in its analyses, including estimates of potential net operating loss carryforwards expected to be utilized by Net, Net’s management advised Credit Suisse, and Credit Suisse assumed, at Net’s direction, that such forecasts and estimates were reasonably prepared on bases reflecting the best currently available estimates and judgments of Net’s management as to the future financial performance of Net and the other matters covered thereby. Credit Suisse utilized certain publicly available Brazilianreais to United States dollar exchange rate forecasts and assumed, at Net’s direction, that such forecasts were reasonable to utilize for purposes of Credit Suisse’s analyses and opinion. Credit Suisse expressed no view or opinion as to any currency or exchange rate fluctuations between Brazilian and United States

11

currencies and assumed, at Net’s direction, that any such fluctuations would not in any respect be meaningful to Credit Suisse’s analyses or opinion. Credit Suisse also relied upon, at Net’s direction and without independent verification, the assessments of Net’s management as to macroeconomic conditions and the telecommunications regulatory environment in Brazil and Credit Suisse assumed, at Net’s direction, that there would be no changes in such macroeconomic conditions or regulatory environment that would impact Net in any respect meaningful to Credit Suisse’s analyses or opinion.

Credit Suisse assumed, at Net’s direction, that, in the course of obtaining any regulatory or third party consents, approvals or agreements in connection with the Offer, no delay, limitation, restriction or condition would be imposed that would have an adverse effect on Net or the Offer and that the Offer would be launched and consummated in accordance with the terms described in the Tender Offer Documents and as registered with the CVM on October 7, 2013 without waiver, modification or amendment of any material term, condition or agreement. Credit Suisse was not requested to, and it did not, make an independent evaluation or appraisal of the assets or liabilities (contingent or otherwise) of Net, nor was Credit Suisse furnished with any such evaluations or appraisals.

Credit Suisse’s opinion addressed only the fairness, from a financial point of view and as of the date of its opinion, of the offer price of R$29.02 per Common Share and per Preferred Share to be paid in the Offer to holders of Common Shares and Preferred Shares, collectively as a group (other than the Offerors and their respective affiliates), without regard to individual circumstances of specific holders with respect to control, voting or other rights or aspects which may distinguish such holders or Net securities held by such holders and Credit Suisse’s analyses and opinion did not address, take into consideration or give effect to, any rights, preferences, restrictions or limitations that might be attributable to any such securities. Credit Suisse’s opinion also did not address any other aspect or implication of the Offer, including, without limitation, the form or structure of the Offer, any fees, expenses or taxes payable in respect of Common Shares or Preferred Shares, the mechanism for determining, and timing of payment of interest on, the offer price or currency fluctuations relating to the offer price depending on whether paid in Brazilianreais or United States dollars, any differences in, or relative fairness of the offer price among, Net securities or any agreement, arrangement or understanding entered into in connection with the Offer or otherwise. In addition, Credit Suisse’s opinion did not address the fairness of the amount or nature of, or any other aspect relating to, any compensation to any officers, directors or employees of any party to the Offer, or class of such persons, relative to the offer price of R$29.02 per Common Share and per Preferred Share or otherwise. The issuance of Credit Suisse’s opinion was approved by Credit Suisse’s authorized internal committee.

Credit Suisse’s opinion was necessarily based on information made available to it as of the date of its opinion and financial, economic, market, currency exchange rates and other conditions as they existed and could be evaluated on that date and upon certain assumptions regarding such financial, economic, market, currency exchange rates and other conditions, which are subject to volatility and which, if different than assumed, could have a material impact on Credit Suisse’s analyses and opinion. Credit Suisse did not express any opinion as to the prices at which securities of Net would trade at any time. Although future events and other developments may affect Credit Suisse’s opinion and financial analyses, Credit Suisse is under no obligation to update, revise, correct or revoke its opinion or the underlying financial analyses, in whole or in part, as a result of any subsequent development or for any other reason.

In preparing its opinion to Net’s board of directors, Credit Suisse performed a variety of financial and comparative analyses, including those described below. The analyses considered Net as a standalone operation and therefore did not include benefits or operating, tax or other losses, including any premiums, synergies, incremental value and/or costs, if any, that may be realized upon consummation, or otherwise as a result of, the Offer or any other transaction. The summary of Credit Suisse’s analyses described below is not a complete description of the analyses underlying Credit Suisse’s opinion, but rather a summary description of material financial analyses provided to Net’s board of directors in connection with Credit Suisse’s opinion. The preparation of a fairness opinion is a complex process involving various determinations as to the most

12

appropriate and relevant methods of financial analysis and the application of those methods to the particular circumstances and, therefore, a fairness opinion is not readily susceptible to partial analysis or summary description. Credit Suisse arrived at its ultimate opinion based on the results of all analyses undertaken and factors considered by it and assessed as a whole and did not draw, in isolation, conclusions from or with regard to any one factor or method of analysis. Accordingly, Credit Suisse believes that its analyses must be considered as a whole and that selecting portions of its analyses and factors or focusing on information presented in tabular format, without considering all analyses and factors or the narrative description of the analyses, could create a misleading or incomplete view of the processes underlying its analyses and opinion.

In its analyses, Credit Suisse considered industry performance, general business, economic, market and financial conditions and other matters, many of which are beyond Net’s control. No company, transaction or business used in Credit Suisse’s analyses is identical to Net or the Offer, and an evaluation of the results of those analyses is not entirely mathematical. Rather, the analyses involve complex considerations and judgments concerning financial and operating characteristics and other factors that could affect the acquisition, public trading or other values of the companies, business segments or transactions analyzed. The estimates contained in Credit Suisse’s analyses and the ranges of valuations resulting from any particular analysis are not necessarily indicative of actual values or predictive of future results or values, which may be significantly more or less favorable than those suggested by the analyses. In addition, analyses relating to the value of businesses or securities do not purport to be appraisals or reflect the prices at which businesses or securities actually may be sold or acquired. Accordingly, the estimates used in, and the results derived from, Credit Suisse’s analyses are inherently subject to substantial uncertainty.

Credit Suisse was not requested to, and it did not, recommend the specific consideration payable in the Offer, which offer price of R$29.02 per Common Share and per Preferred Share was determined by the Offerors, and the decision of Net’s board of directors as to its recommendation with respect to the Offer was solely that of Net’s board of directors. Credit Suisse’s opinion and financial analyses were only one of many factors considered by Net’s board of directors in its evaluation of the Offer and should not be viewed as determinative of the views of Net’s board of directors or management with respect to the Offer or the offer price or as the sole basis for the evaluation of the Offer or the offer price and do not comprise all information that may be deemed necessary for such purpose.

The following is a summary of the material financial analyses provided to Net’s board of directors on October 15, 2013 in connection with Credit Suisse’s opinion. The financial analyses summarized below include information presented in tabular format. In order to fully understand Credit Suisse’s financial analyses, the tables must be read together with the text of each summary. The tables alone do not constitute a complete description of the financial analyses. Considering the data in the tables below without considering the full narrative description of the financial analyses, including the methodologies and assumptions underlying the analyses, could create a misleading or incomplete view of Credit Suisse’s financial analyses. In the analyses described below, implied per share reference ranges for Net were calculated based on internal estimates of Net’s management, taking into account, among other things, (i) Net’s outstanding net debt as of June 30, 2013, (ii) net contingent liabilities of Net as of June 30, 2013, (iii) the estimated present value (as of June 30, 2013) of net operating loss carryforwards anticipated by Net’s management to be utilized by Net and (iv) the estimated present value (as of June 30, 2013) of Net’s potential tax benefits related to goodwill amortization.

Discounted Cash Flow Analysis.Credit Suisse performed a discounted cash flow analysis of Net to calculate the estimated present value of the standalone unlevered, after-tax free cash flows that Net was forecasted to generate during the second half of the fiscal year ending December 31, 2013 through the full fiscal year ending December 31, 2022 based on internal estimates of Net’s management and certain publicly available Brazilianreais to United States dollar exchange rate forecasts. Credit Suisse applied to Net’s estimated cash flows a range of perpetuity growth rates of 2.75% to 3.75%. The present value (as of October 14, 2013) of the cash flows was then calculated using discount rates ranging from 8.50% to 11.00%. This analysis indicated the following

13

approximate implied per share reference range for Net, as compared to the offer price of R$29.02 per Common Share and per Preferred Share (assuming accrued interest thereon at the CDI Rate from June 18, 2012 through and including August 18, 2013):

| | |

Implied Per Share Reference Range | | Offer Price |

| R$20.24 – R$54.29 | | R$29.02 |

Selected Companies Analysis.Credit Suisse reviewed financial and stock market information of Net and the following seven selected publicly traded companies, one of which is a Latin American cable service provider, three of which are U.S. cable service providers and three of which are European cable service providers:

| | | | |

Selected Latin American Companies | | Selected U.S. Companies | | Selected European Companies |

• Megacable Holding S.A.B. de C.V. | | • Charter Communications, Inc. • Comcast Corporation • Time Warner Cable Inc. | | • Liberty Global Europe Ltd. • Ziggo Bond Company B.V. • Telenet Group Holding N.V. |

Credit Suisse reviewed enterprise values of the selected companies, calculated as equity values based on closing stock prices on October 14, 2013 plus debt less cash and cash equivalents, as a multiple of calendar year 2013 and calendar year 2014 estimated earnings before interest and taxes, referred to as EBIT. The overall low to high calendar year 2013 estimated EBIT multiples observed for the selected companies were 9.1x to 29.3x, with an observed calendar year 2013 estimated EBIT multiple of 13.1x for the selected Latin American company, 9.1x to 29.3x for the selected U.S. companies and 13.4x to 25.6x for the selected European companies. The overall low to high calendar year 2014 estimated EBIT multiples observed for the selected companies were 8.4x and 23.3x, with an observed calendar year 2014 estimated EBIT multiple of 11.3x for the selected Latin American company, 8.4x to 23.3x for the selected U.S. companies and 12.8x to 22.5x for the selected European companies. Credit Suisse then applied a range of calendar year 2013 and calendar year 2014 estimated EBIT multiples of 10.50x to 13.25x and 9.00x to 11.50x, respectively, derived from the selected companies to corresponding data of Net. Financial data of the selected companies were based on publicly available research analysts’ estimates, public filings and other publicly available information. Financial data of Net were based on internal estimates of Net’s management. This analysis indicated the following approximate implied per share reference ranges for Net as compared to the offer price of R$29.02 per Common Share and per Preferred Share (assuming accrued interest thereon at the CDI Rate from June 18, 2012 through and including August 18, 2013):

| | | | |

Implied Per Share Reference Ranges Based On: | | Offer Price |

2013 EBIT | | 2014 EBIT | | |

R$21.73 – R$29.27 | | R$26.04 – R$35.22 | | R$29.02 |

14

Selected Precedent Transactions Analysis.Credit Suisse reviewed publicly available financial information of the following 21 selected transactions involving cable television companies in Latin America (transactions for which information was publicly available have been designated with an asterisk; equity stakes acquired in such transactions have been noted parenthetically by each target company):

| | | | |

| Announcement Date | | Acquiror | | Target |

| Argentina |

10/2006 | | • Cablevisión S.A. de C.V. | | • Teledigital Cable S.A. (100%) |

10/2006 | | • Cablevisión S.A. de C.V. | | • Multicanal S.A. (100%) |

| Mexico |

*6/2010 | | • Megacable Holding S.A.B. de C.V. | | • Grupo Omnicable (100%) |

7/2008 | | • Megacable Holding S.A.B. de C.V. | | • Sistemas Generales de Telecomunicaciones, S.A. de C.V. (SIGETEL) (100%) |

2Q2008 | | • Megacable Holding S.A.B. de C.V. | | • Various companies (100%) |

11/2007 | | • Megacable Holding S.A.B. de C.V. | | • Tele Cable Centro Occidente, S. A. de C. V. (TCO) (51%) |

*8/2007 | | • Megacable Holding S.A.B. de C.V. | | • Acotel, S.A. de C.V. (100%) |

8/2007 | | • Megacable Holding S.A.B. de C.V. | | • Imatel Entretenimiento por Cable, S. A. de C. V. (IMATEL) (100%) |

7/2007 | | • Megacable Holding S.A.B. de C.V. | | • Giga Cable, S. A. de C. V. (Grupo IRA) (100%) |

*6/2007 | | • Grupo Televisa, S.A.B. | | • Cablémas, S.A. de C.V. (49%) |

*3/2006 | | • Grupo Televisa, S.A.B. | | • Televisión Internacional (50%) |

*3/2006 | | • Teleholding, S.A. de C.V. | | • RCN International Holdings, Inc. (48.9%) |

| Central America |

8/2008 | | • América Móvil, S.A.B. de C.V. | | • Estesa Holding Corp. (100%) |

*7/2008 | | • Millicom International Cellular S.A. | | • Amnet Telecommunications Holding Limited (100%) |

| Chile |

*1/2010 | | • Corp Group Interhold S.A. | | • VTR Globalcom S.A. (20%) |

| Brazil |

*8/2010 | | • Tel��fonos de México S.A.B. de C.V. (TELMEX) | | • Net (63%) |

9/2008 | | • Net | | • ESC90 Telecomunicações Ltda. (ESC 90) (100%) |

12/2007 | | • Net | | • 614 Telecomunicações Ltda. (Big TV) (100%) |

*10/2006 | | • Net | | • Vivax S.A. (100%) |

*3/2005 | | • Teléfonos de México S.A.B. de C.V. (TELMEX) | | • Net (37%) |

| Colombia |

8/2006 | | • Teléfonos de México S.A.B. de C.V. (TELMEX) | | • Superview Telecomunicaciones, S.A. (100%) |

Credit Suisse reviewed transaction values, calculated as the purchase prices paid for the target companies in the selected transactions plus debt, less cash and cash equivalents, as a multiple of such target companies’ latest 12 months EBITDA. The overall low to high latest 12 months EBITDA multiples observed for the selected transactions for which information was publicly available were 6.2x and 12.1x, with observed latest 12 months EBITDA multiples of 6.5x to 11.6x for the selected Mexico transactions, 7.1x for the selected Central America transactions, 6.2x for the selected Chile transactions, and 6.6x to 12.1x for the selected Brazil transactions. Credit Suisse then applied a range of latest 12 months EBITDA multiples of 6.0x to 6.5x derived from the selected transactions to Net’s latest 12 months (as of June 30, 2013) EBITDA. Financial data of the selected transactions were based on publicly available research analysts’ estimates, public filings and other publicly available information. Financial data of Net were based on Net’s public filings and internal estimates of Net’s management. This analysis indicated the following approximate implied per share reference range for Net as compared to the offer price of R$29.02 per Common Share and per Preferred Share (assuming accrued interest thereon at the CDI Rate from June 18, 2012 through and including August 18, 2013):

| | |

Implied Per Share Reference Range | | Offer Price |

| R$35.74 – R$39.30 | | R$29.02 |

15

Miscellaneous

Credit Suisse is an internationally recognized investment banking firm and is regularly engaged in the valuation of businesses and securities in connection with mergers and acquisitions, leveraged buyouts, negotiated underwritings, competitive biddings, secondary distributions of listed and unlisted securities, private placements and valuations for corporate and other purposes.

Credit Suisse and its affiliates in the past have provided, currently are providing and in the future may provide investment banking and other financial services to certain affiliates of Net, including its indirect controlling shareholder, América Móvil, S.A.B. de C.V. (“AMX”), for which services Credit Suisse and its affiliates have received and would expect to receive compensation, including having provided certain financial advisory services to AMX, having acted as joint bookrunner in connection with certain note offerings of AMX and acting as a lender under certain credit facilities of AMX. Credit Suisse is a full service securities firm engaged in securities trading and brokerage activities as well as providing investment banking and other financial services. In the ordinary course of business, Credit Suisse and its affiliates may acquire, hold or sell, for Credit Suisse’s and its affiliates own accounts and the accounts of customers, equity, debt and other securities and financial instruments (including bank loans and other obligations) of Net, the Offerors and their respective affiliates and any other company that may be involved in the Offer, as well as provide investment banking and other financial services to such companies.

For a description of the terms of Credit Suisse’s engagement, see the discussion under “Item 5. Persons/Assets Retained, Employed, Compensated or Used” below.

Certain Company Projections

Net does not, as a matter of course, make public forecasts or projections as to performance, earnings or other results beyond the current fiscal year due to the unpredictability of the underlying assumptions and estimates. However, in September 2013, Net’s management provided Credit Suisse with certain internal non-public financial and operational forecasts and projections which were approved by Net’s board of directors in October 2013 for Credit Suisse’s use in connection with its opinion delivered to Net’s board of directors (collectively, the “Company Projections”), as described under the heading “Item 4. The Solicitation/Recommendation—Opinion of Banco de Investimento Credit Suisse (Brasil) S.A.” The Company Projections have been set forth below for the limited purpose of giving Net’s shareholders access to the management projections provided to, or discussed with, Credit Suisse in connection with its opinion.

The Company Projections set forth below, at the time of their preparation in August 2013 and when approved by Net’s board of directors in October 2013 for Credit Suisse’s use in connection with its opinion, represented Net’s management’s best judgment as to the most likely future financial results of the Company. The Company Projections set forth below necessarily reflect numerous assumptions with respect to general business and economic conditions and other matters, many of which are inherently uncertain or beyond Net’s control, and do not take into account any changes in Net’s operations, strategy, management, business or capital structure after their preparation or which may result from the tender offer. Since the Company Projections cover multiple years, by their nature, they become subject to greater uncertainty with each successive year. The Company Projections have not been subsequently updated since they were produced in August 2013. It is not possible to predict whether the assumptions made in preparing the Company Projections will prove to be valid, and actual results may prove to be materially higher or lower than those contained in the Company Projections. The inclusion of this information should not be regarded as an indication that Net or anyone who received this information considered it to be necessarily predictive of actual future events, and this information should not be relied on as such. Neither Net nor any of its representatives makes any representations to shareholders regarding the validity, reasonableness, accuracy or completeness of such Company Projections.

16

The Company Projections include the following:

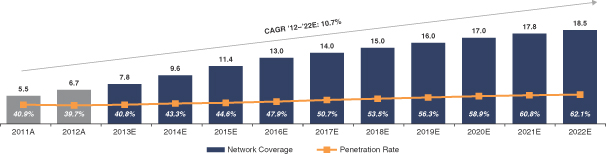

Operational Projections. Net’s management’s operational projections for the period from 2013 to 2022 include network coverage, the amount of homes passed and the number connected households and penetration rate for the period.

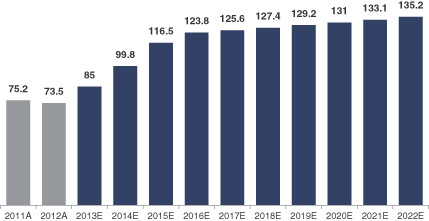

Network Coverage

(Km in thousands)

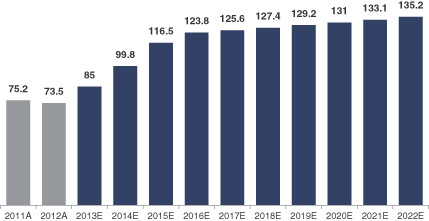

Net’s coverage was approximately 75,200 and 73,500 thousand kilometers in 2011 and 2012, respectively. The projected network coverage increase is from 85,000 kilometers in 2013 to 135,200,000 kilometers in 2022.

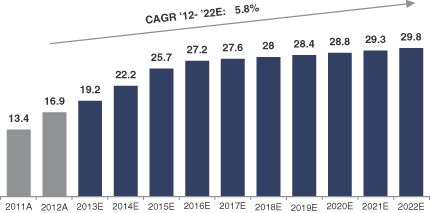

Homes Passed

(Millions)

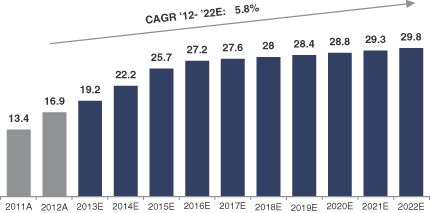

Net had approximately 13.4 million and 16.9 million homes passed in 2011 and 2012, respectively. The projected increase in the number of homes passed is from 19.2 million in 2013 to 29.8 million in 2022, representing an estimated compound annual growth rate of 5.8% for this forecasted period.

17

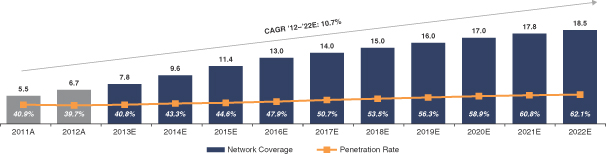

Connected Households and Penetration Rate

(Millions, unless stated)

The number of households connected using Net’s services was 5.5 million at the end of 2011 and 6.7 million at the end of 2012. The projected number of households connected by the end of 2013 was 7.8 million, which is projected to increase to 18.5 million households connected by the end of 2022, representing an estimated compound annual growth rate of 10.7% for this forecasted period. Net calculated the average number of connected households using the values for households connected at the end of each year analyzed. By 2022, Net’s market penetration is projected to increase to 62%. The amount of subscribers of Net’s pay TV, broadband or phone services is projected to increase from 5.3 million to 15 million, 5.4 million to 17.1 million and 4.8 million to 14.3 million, respectively, during this forecasted period.

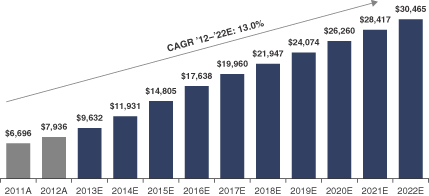

Financial Projections. Net’s management’s financial projections for each year in the period from 2013 to 2022 include revenues, EBITDA, capital expenditures and capital expenditures as a percentage of net revenues.

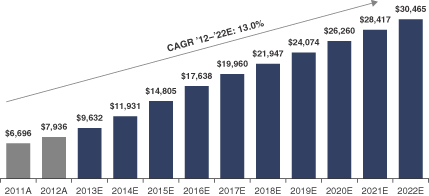

Revenues

(R$ Millions)

Revenue estimates are based on the average number of connected households using Net’s services and Net’s average revenue per user (“ARPU”) in the period analyzed, net of taxes and cancellations. Net’s ARPU per household connected was R$107.1 and R$106.7 in 2011 and 2012, respectively. From 2013 to 2022, Net’s projected ARPU per household connected increases from R$108.4 to R$138.0. Pay TV, broadband and phone revenues are projected to increase from R$5.1 billion to R$18.6 billion, R$2.1 billion to R$9.5 billion and R$0.6 billion to R$1.9 billion, respectively, from 2012 to 2022. Pay TV and broadband ARPU is projected to increase from R$37 per month to R$48 per month, respectively, while phone ARPU is projected to remain constant at R$12 per month, in each case from 2012 to 2022.

18

Net’s operating costs as a percentage of sales is projected to increase from 47.0% in 2012 to 51.8% by 2022, mainly driven by Net’s higher programming costs as a percentage of sales, which are projected to increase from 22.6% to 28.3% from 2012 to 2022. Selling, general and administrative expenses as a percentage of sales is projected to decrease from 24.9% in 2012 to 22.0% by 2022, primarily driven by lower selling expenses as a percentage of sales, which is projected to decrease from 12.1% to 9.3% over the forecasted period.

With respect to Net’s working capital for the period, accounts receivable days of sales are projected to average approximately 40 days, while payment days to suppliers are projected to average around 36 days from incurrence of related costs. Inventories as a percentage of revenue are projected to be approximately 0.6%, while programming costs are projected to have an average payment period of around 42 days from incurrence of related costs.

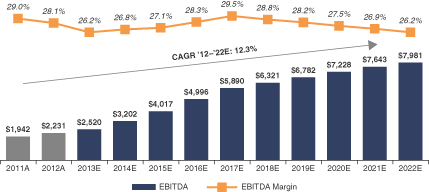

EBITDA

(R$ millions, unless stated)

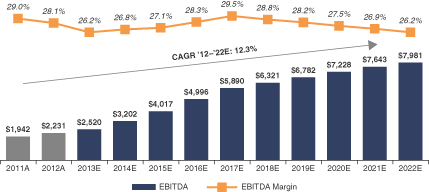

In 2011, Net’s EBITDA and EBITDA margin were R$1.9 billion and 29%, respectively, while those figures were R$2.2 billion and 28.1%, respectively, in 2012. From 2013 to 2022, Net’s projected EBITDA increases from R$2.5 billion in 2013 to R$8.0 billion in 2022, with EBITDA margins remaining flat at 26.2% during the same period. Net’s EBITDA margin is expected to decrease from 28.1% in 2012 to 26.8% in 2014 mainly due to increases in programming costs and selling expenses. EBITDA margin is expected to increase to 29.5% in 2017 due to lower selling costs as a percentage of sales and expected to level off to 27.5% thereafter.

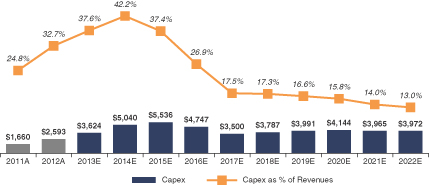

CAPEX and CAPEX as a Percentage of Net Revenues

19

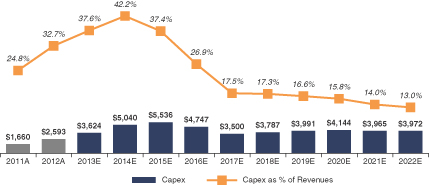

Capital expenditures are expected to be R$3.6 billion, R$5.0 billion and R$5.5 billion for 2013, 2014 and 2015, respectively. Capital expenditures are expected to average R$4.0 billion annually from 2016 to 2022. The projected increase from 2013 to 2015 is primarily related to upgrading customers to higher-value packages and Net’s network coverage expansion plan. Network expansion capital is projected to increase from 18.9% in 2012 to 16.4%, 29.2% and 31.8% during 2013, 2014 and 2015, respectively, and average 13.0% from 2016 through 2022.

As a result of the Merger (as defined below), Net expects a tax benefit resulting from goodwill amortization of approximately R$975,000,000, which will be accrued over a five-year period under the conditions provided for in the applicable tax legislation. See Item 6 “Interest in Securities of the Subject Company” for more information on the Merger.

The Company Projections were not prepared with a view to public disclosure or compliance with the published guidelines of the SEC or the guidelines established by the American Institute of Certified Public Accountants regarding projections and forecasts, and are included in this Statement only because such information was made available by Net to, or discussed with, Credit Suisse. Net’s independent registered public accounting firm has not examined, complied with or applied any agreed upon procedures with regard to this information, and, accordingly, assume no responsibility for this information. Net does not intend to update the Company Projections or otherwise provide any updated information with respect to any forward-looking statements.

The Company Projections contain forward-looking statements that involve risks and uncertainties. The foregoing Company Projections were based on assumptions of Net’s management as of August 2013 concerning Net’s business prospects in 2013 through 2022. The assumptions upon which the Company Projections were based necessarily involved judgments with respect to, among other things, industry performance, general business, economic, regulatory, market and financial conditions and other future events, as well as matters specific to Net’s business, all of which are difficult or impossible to predict and many of which are beyond Net’s control. The Company Projections also reflect assumptions as to certain business decisions that are subject to change. In addition, the Company Projections may be affected by Net’s ability to achieve strategic goals, objectives and targets over the applicable periods. The Company Projections are subjective in many respects and thus are susceptible to multiple interpretations and periodic revisions based on actual experience and business developments. As such, these Company Projections constitute forward-looking statements and are subject to risks and uncertainties, including the various risks set forth in Net’s periodic reports filed with the SEC.

None of Net nor any of its affiliates, officers, directors, advisors or other representatives can give any assurance that actual results will not differ from the Company Projections, and, except as provided by law, Net undertakes no obligation to update or otherwise revise or reconcile the Company Projections to reflect circumstances existing after the date such Company Projections were generated or to reflect the occurrence of future events even in the event that any or all of the assumptions underlying the projections are shown to be in error. None of Net nor any of its affiliates, officers, directors, advisors or other representatives has made or makes any representation to any shareholder of Net or other person regarding the ultimate performance of Net compared to the information contained in the Company Projections or that forecasted results will be achieved. None of Net or any of its affiliates, officers, directors, advisors or other representatives makes any representation to any shareholder of Net regarding the Company Projections. The Company Projections are not being included in this Statement to influence a shareholder’s decision whether to tender his or her shares in the tender offer.

In light of the foregoing factors and the uncertainties inherent in the Company Projections, shareholders are cautioned not to rely on the Company Projections.

20

Intent to Tender

To the extent known to Net after making reasonable inquiry, none of Net’s executive officers, directors, affiliates or subsidiaries currently intends to tender Commons Shares or Preferred Shares (including Preferred Shares represented by ADSs) held of record or beneficially owned by them pursuant to the Offer. Pursuant to its by-laws, all members of Net’s board of directors must own at least one Common Share. Each of the members of Net’s board of directors owns one Common Share of Net and, pursuant to this by-law requirement, will not tender it in the Offer.

Item 5. Persons/Assets, Retained, Employed, Compensated or Used.

Solicitations and Recommendations

Neither Net nor any person acting on its behalf has directly or indirectly employed, retained or compensated, or currently intends to employ, retain or compensate, any person to make solicitations or recommendations to holders of Common Shares and Preferred Shares (including Preferred Shares represented by ADSs) on Net’s behalf with respect to the Offer.

Expenses