FIAT INDUSTRIAL S.p.A. Financial Statements

(pursuant to Article 2501-quater of the Civil Code)

at December 31, 2012

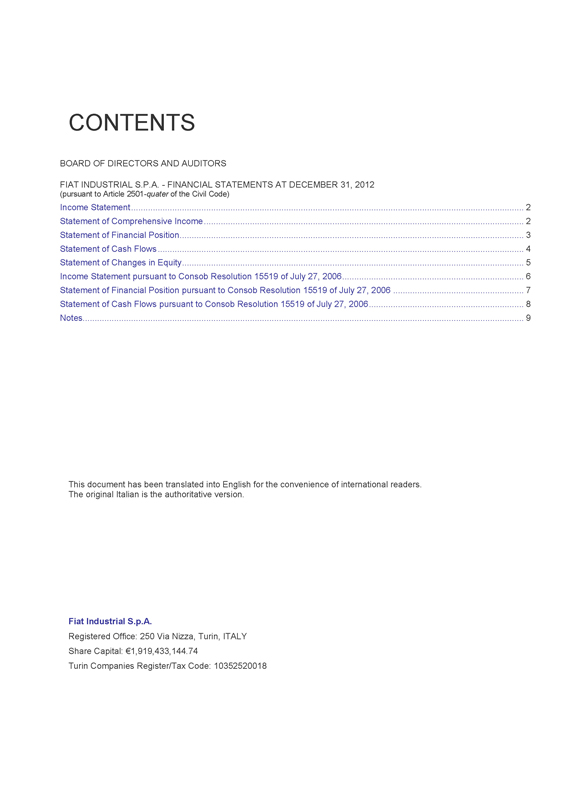

CONTENTS

BOARD OF DIRECTORS AND AUDITORS

FIAT INDUSTRIAL S.P.A. - FINANCIAL STATEMENTS AT DECEMBER 31, 2012

(pursuant to Article 2501-quater of the Civil Code)

Income Statement 2

Statement of Comprehensive Income 2

Statement of Financial Position 3

Statement of Cash Flows 4

Statement of Changes in Equity 5

Income Statement pursuant to Consob Resolution 15519 of July 27, 2006 6

Statement of Financial Position pursuant to Consob Resolution 15519 of July 27, 2006 7

Statement of Cash Flows pursuant to Consob Resolution 15519 of July 27, 2006 8

Notes 9

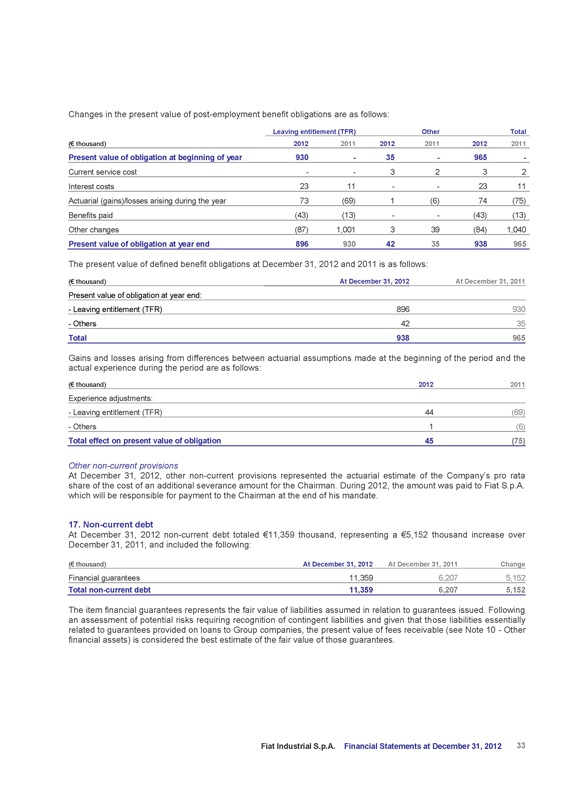

This document has been translated into English for the convenience of international readers.

The original Italian is the authoritative version.

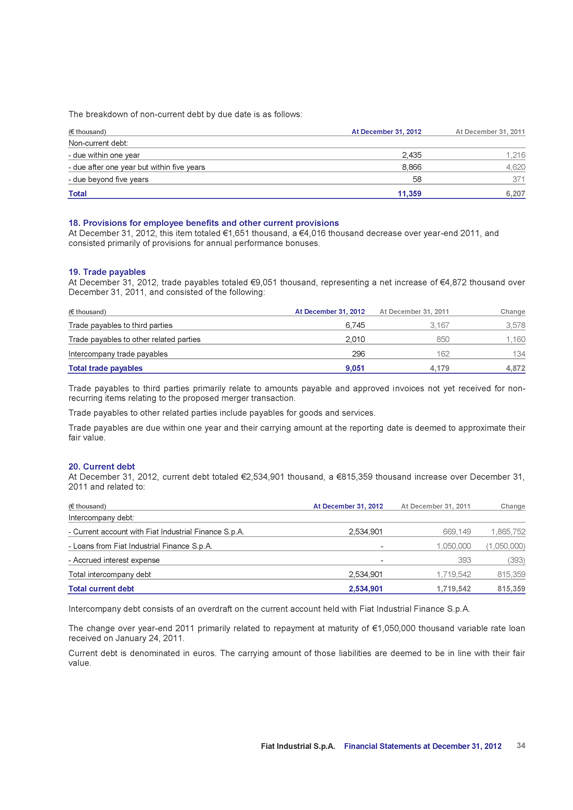

Fiat Industrial S.p.A.

Registered Office: 250 Via Nizza, Turin, ITALY

Share Capital: €1,919,433,144.74

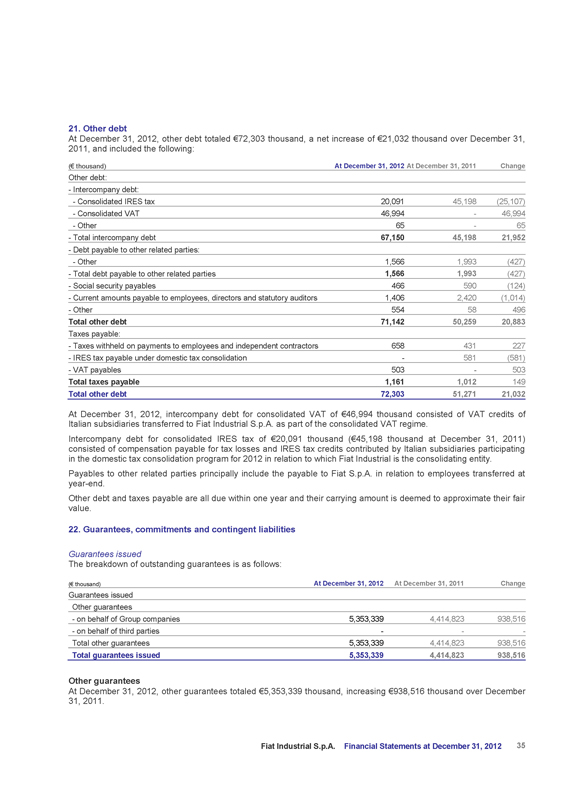

Turin Companies Register/Tax Code: 10352520018

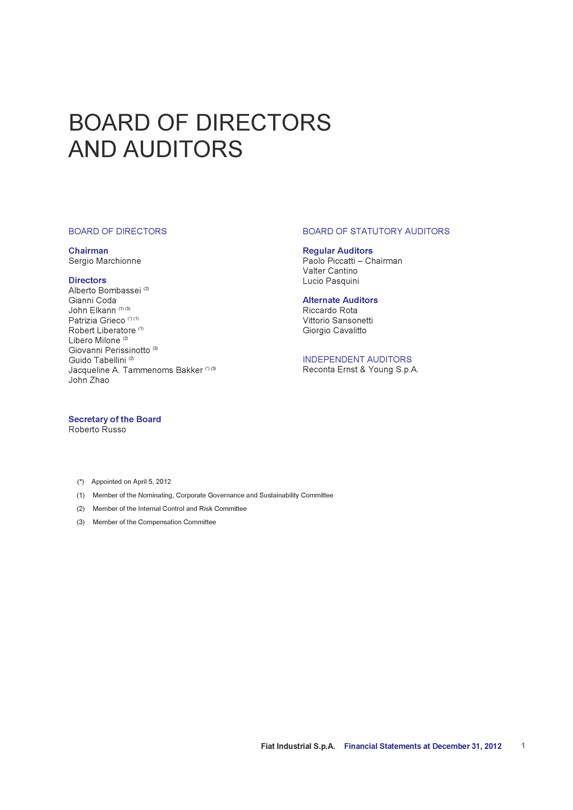

BOARD OF DIRECTORS AND AUDITORS

BOARD OF DIRECTORS

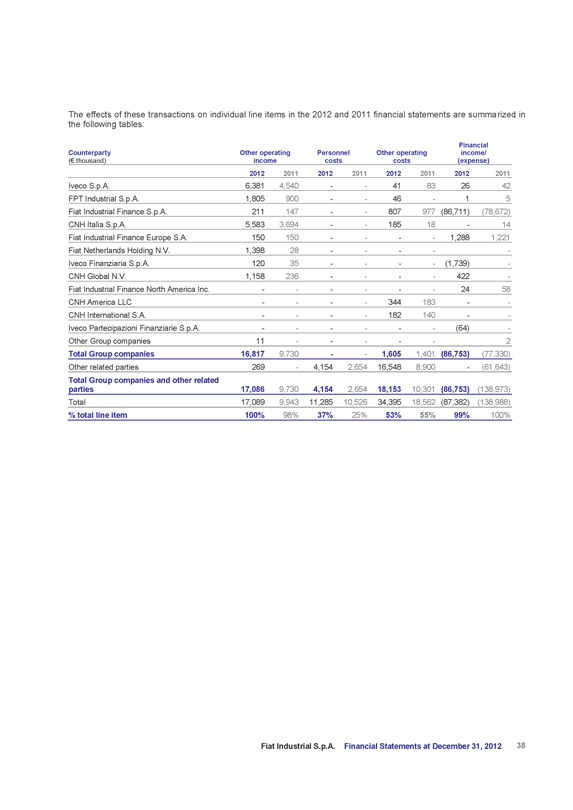

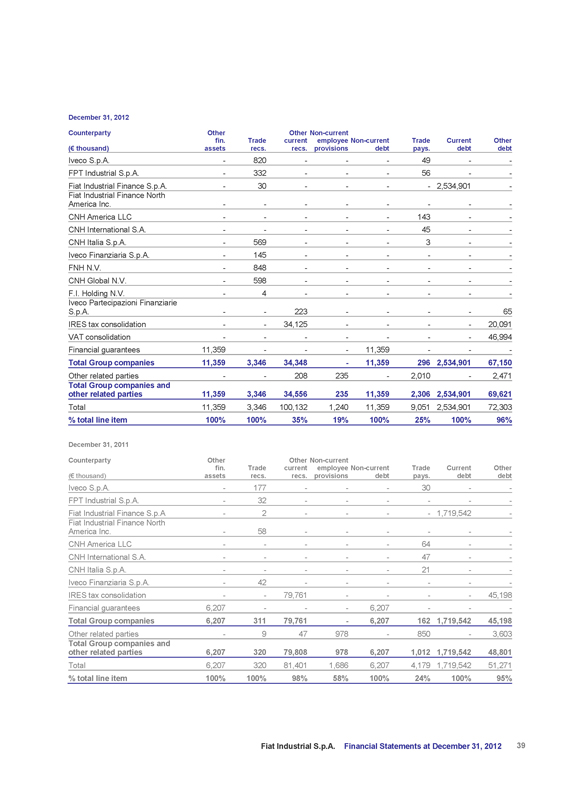

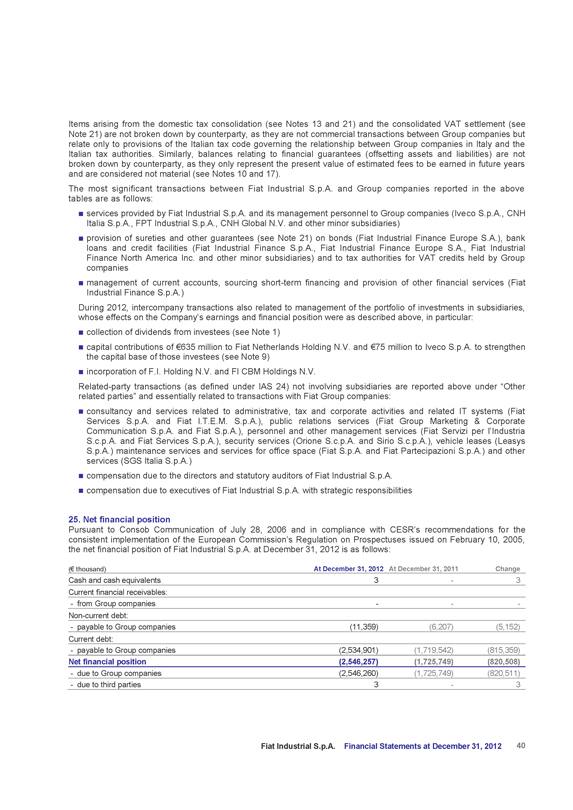

Chairman

Sergio Marchionne

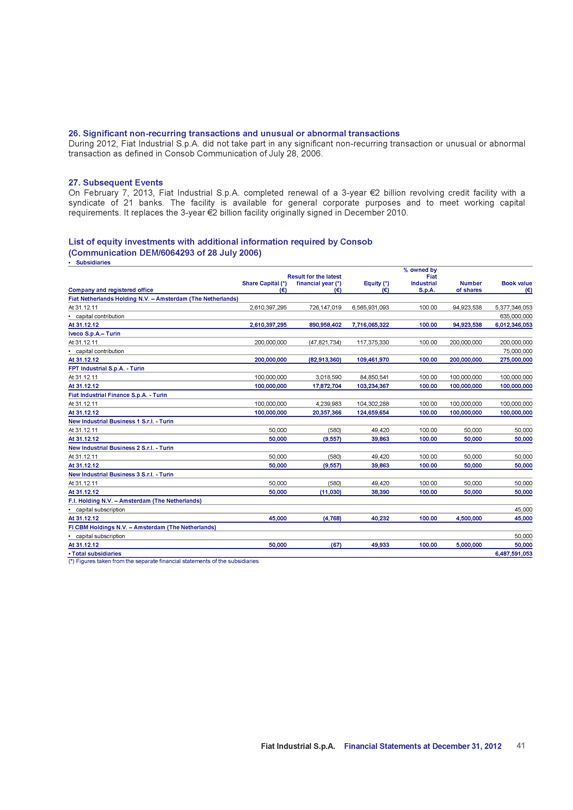

Directors

Alberto Bombassei (2)

Gianni Coda

John Elkann (1) (3)

Patrizia Grieco (*) (1)

Robert Liberatore (1)

Libero Milone (2)

Giovanni Perissinotto (3)

Guido Tabellini (2)

Jacqueline A. Tammenoms Bakker (*) (3)

John Zhao

BOARD OF STATUTORY AUDITORS

Regular Auditors

Paolo Piccatti - Chairman

Valter Cantino

Lucio Pasquini

Alternate Auditors

Riccardo Rota

Vittorio Sansonetti

Giorgio Cavalitto

INDEPENDENT AUDITORS

Reconta Ernst & Young S.p.A.

Secretary of the Board

Roberto Russo

(*) Appointed on April 5, 2012

(1) Member of the Nominating, Corporate Governance and Sustainability Committee

(2) Member of the Internal Control and Risk Committee

(3) Member of the Compensation Committee

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 1

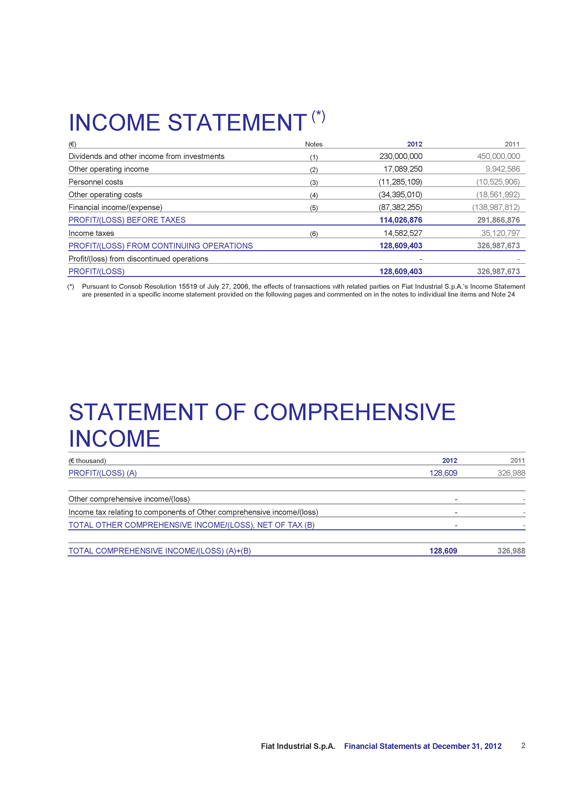

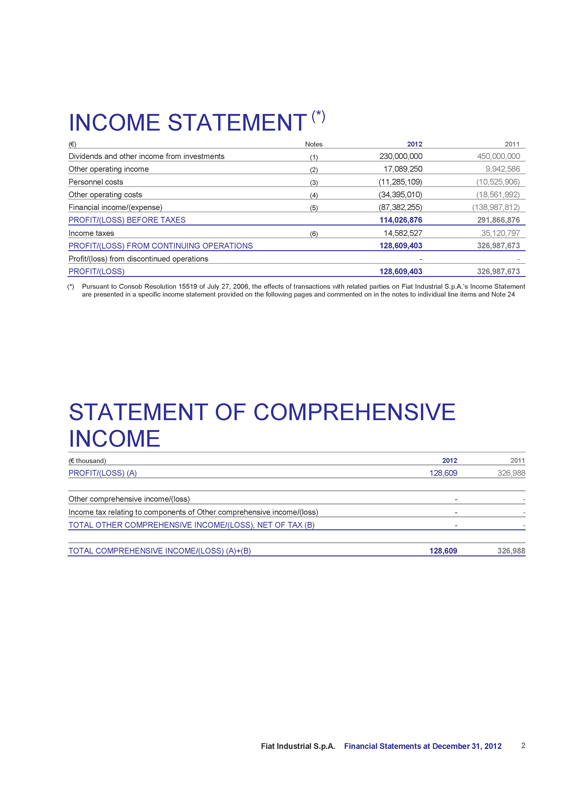

INCOME STATEMENT (*)

(€) Notes 2012 2011

Dividends and other income from investments (1) 230,000,000 450,000,000

Other operating income (2) 17,089,250 9,942,586

Personnel costs (3) (11,285,109) (10,525,906)

Other operating costs (4) (34,395,010) (18,561,992)

Financial income/(expense) (5) (87,382,255) (138,987,812)

PROFIT/(LOSS) BEFORE TAXES 114,026,876 291,866,876

Income taxes (6) 14,582,527 35,120,797

PROFIT/(LOSS) FROM CONTINUING OPERATIONS 128,609,403 326,987,673

Profit/(loss) from discontinued operations - -

PROFIT/(LOSS) 128,609,403 326,987,673

(*) Pursuant to Consob Resolution 15519 of July 27, 2006, the effects of transactions with related parties on Fiat Industrial S.p.A.’s Income Statement are presented in a specific income statement provided on the following pages and commented on in the notes to individual line items and Note 24

STATEMENT OF COMPREHENSIVE INCOME

(€ thousand)

2012 2011

PROFIT/(LOSS) (A) 128,609 326,988

Other comprehensive income/(loss) - -

Income tax relating to components of Other comprehensive income/(loss) - -

TOTAL OTHER COMPREHENSIVE INCOME/(LOSS), NET OF TAX (B) - -

TOTAL COMPREHENSIVE INCOME/(LOSS) (A)+(B) 128,609 326,988

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 2

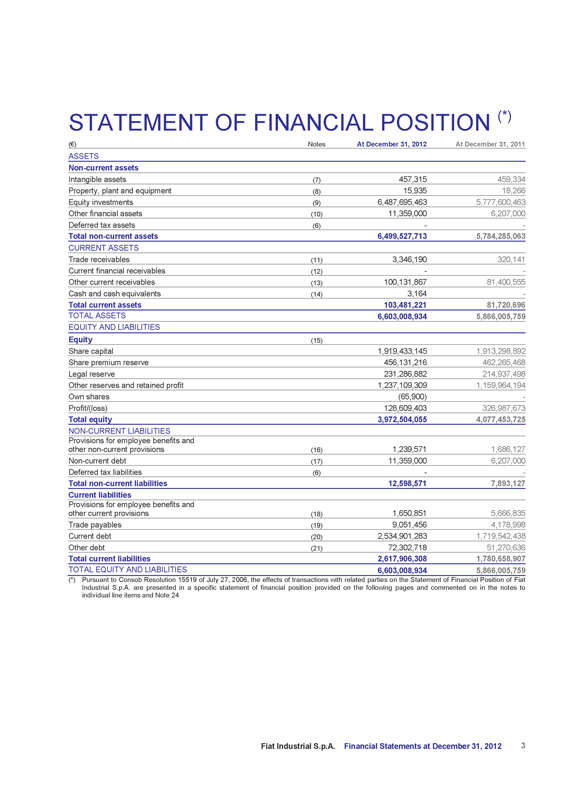

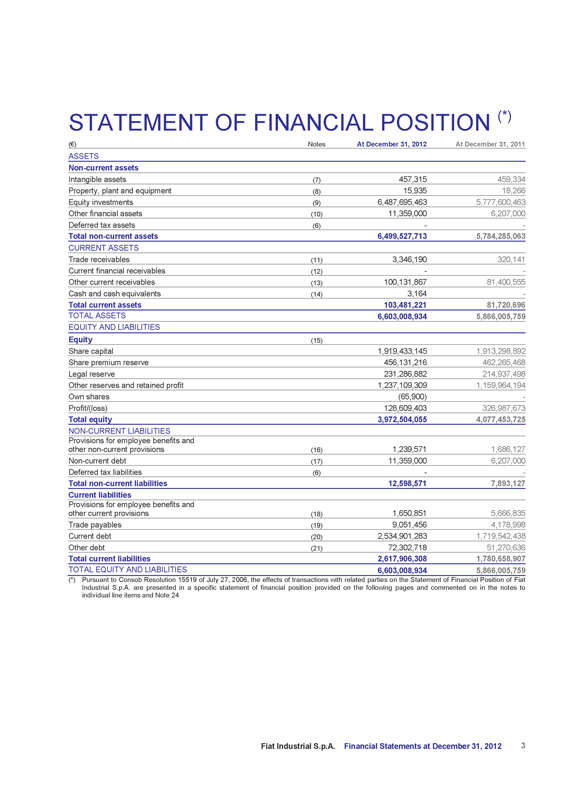

STATEMENT OF FINANCIAL POSITION (*)

(€) Notes At December 31, 2012 At December 31, 2011

ASSETS

Non-current assets

Intangible assets (7) 457,315 459,334

Property, plant and equipment (8) 15,935 18,266

Equity investments (9) 6,487,695,463 5,777,600,463

Other financial assets (10) 11,359,000 6,207,000

Deferred tax assets (6) - -

Total non-current assets 6,499,527,713 5,784,285,063

CURRENT ASSETS

Trade receivables (11) 3,346,190 320,141

Current financial receivables (12) - -

Other current receivables (13) 100,131,867 81,400,555

Cash and cash equivalents (14) 3,164 -

Total current assets 103,481,221 81,720,696

TOTAL ASSETS 6,603,008,934 5,866,005,759

EQUITY AND LIABILITIES

Equity (15)

Share capital 1,919,433,145 1,913,298,892

Share premium reserve 456,131,216 462,265,468

Legal reserve 231,286,882 214,937,498

Other reserves and retained profit 1,237,109,309 1,159,964,194

Own shares (65,900) -

Profit/(loss) 128,609,403 326,987,673

Total equity 3,972,504,055 4,077,453,725

NON-CURRENT LIABILITIES

Provisions for employee benefits and other non-current provisions (16) 1,239,571 1,686,127

Non-current debt (17) 11,359,000 6,207,000

Deferred tax liabilities (6) - -

Total non-current liabilities 12,598,571 7,893,127

Current liabilities

Provisions for employee benefits and other current provisions (18) 1,650,851 5,666,835

Trade payables (19) 9,051,456 4,178,998

Current debt (20) 2,534,901,283 1,719,542,438

Other debt (21) 72,302,718 51,270,636

Total current liabilities 2,617,906,308 1,780,658,907

TOTAL EQUITY AND LIABILITIES 6,603,008,934 5,866,005,759

(*) Pursuant to Consob Resolution 15519 of July 27, 2006, the effects of transactions with related parties on the Statement of Financial Position of Fiat Industrial S.p.A. are presented in a specific statement of financial position provided on the following pages and commented on in the notes to individual line items and Note 24

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 3

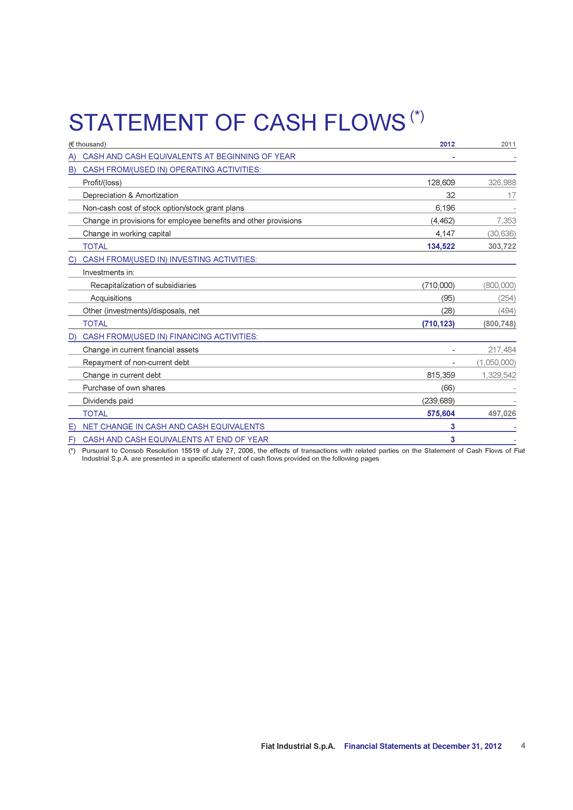

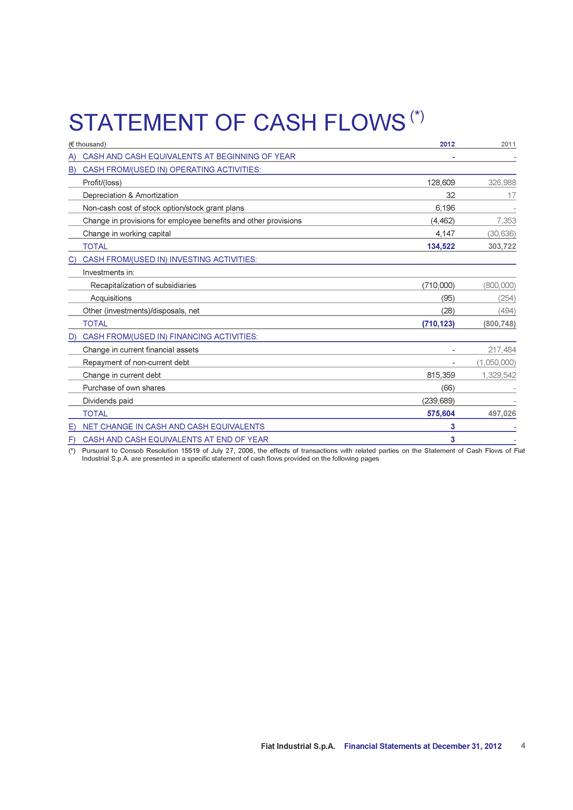

STATEMENT OF CASH FLOWS (*)

(€ thousand) 2012 2011

A) CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR - -

B) CASH FROM/(USED IN) OPERATING ACTIVITIES:

Profit/(loss) 128,609 326,988

Depreciation & Amortization 32 17

Non-cash cost of stock option/stock grant plans 6,196 -

Change in provisions for employee benefits and other provisions (4,462) 7,353

Change in working capital 4,147 (30,636)

TOTAL 134,522 303,722

C) CASH FROM/(USED IN) INVESTING ACTIVITIES:

Investments in:

Recapitalization of subsidiaries (710,000) (800,000)

Acquisitions (95) (254)

Other (investments)/disposals, net (28) (494)

TOTAL (710,123) (800,748)

D) CASH FROM/(USED IN) FINANCING ACTIVITIES:

Change in current financial assets - 217,484

Repayment of non-current debt - (1,050,000)

Change in current debt 815,359 1,329,542

Purchase of own shares (66) -

Dividends paid (239,689) -

TOTAL 575,604 497,026

E) NET CHANGE IN CASH AND CASH EQUIVALENTS 3 -

F) CASH AND CASH EQUIVALENTS AT END OF YEAR 3 -

(*) Pursuant to Consob Resolution 15519 of July 27, 2006, the effects of transactions with related parties on the Statement of Cash Flows of Fiat Industrial S.p.A. are presented in a specific statement of cash flows provided on the following pages

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 4

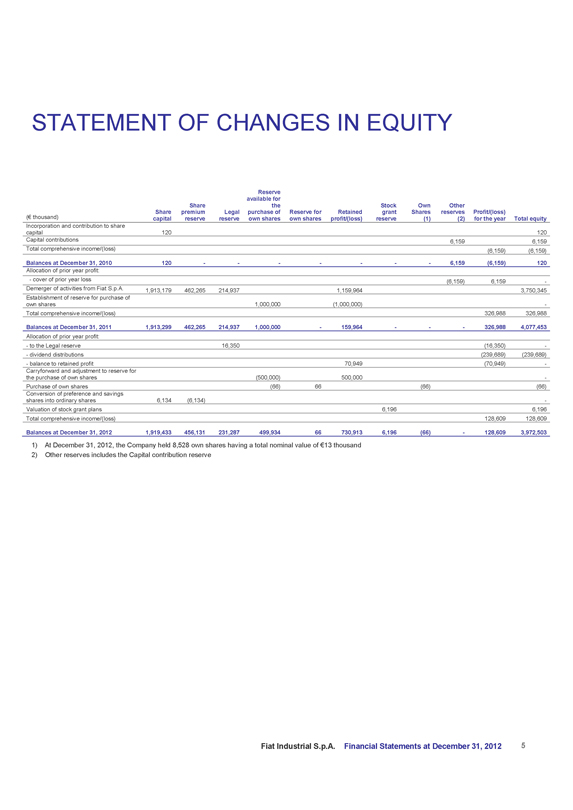

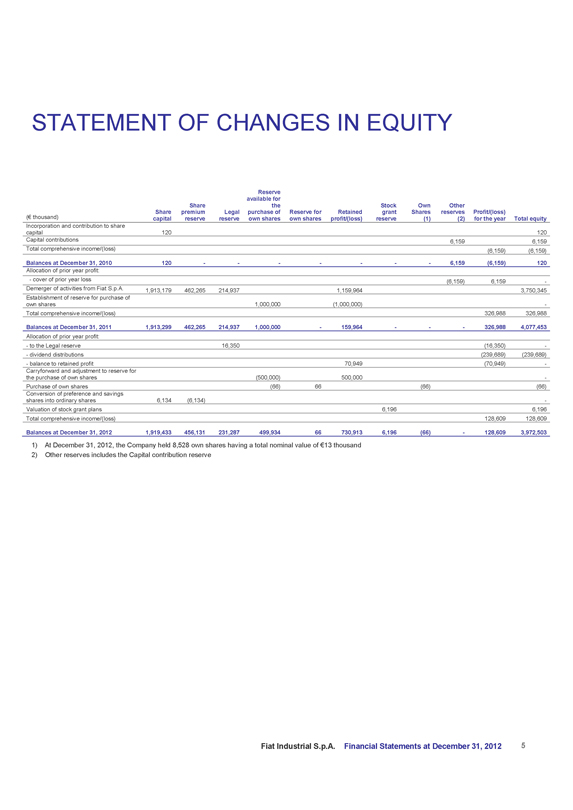

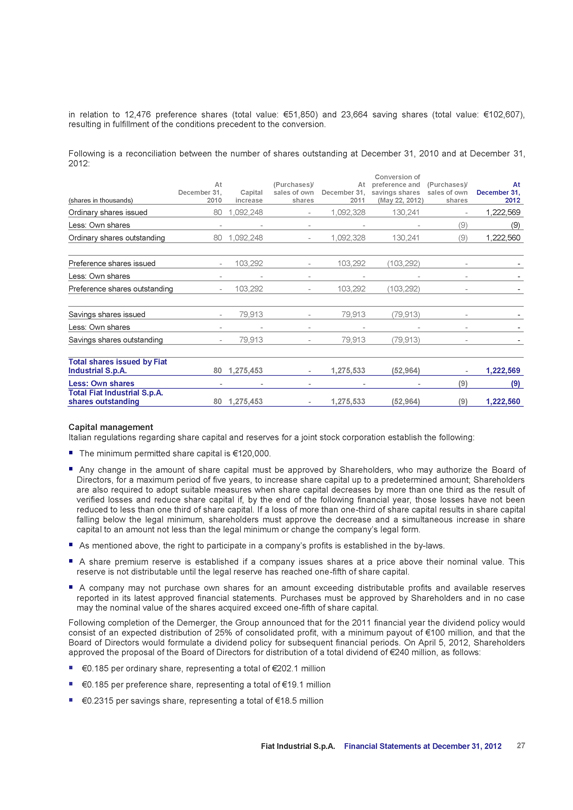

STATEMENT OF CHANGES IN EQUITY

(€ thousand) Share capital Share premium reserve Legal reserve Reserve available for the purchase of own shares Reserve for own shares Retained profit/(loss) Stock grant reserve Own Shares (1) Other reserves (2) Profit/(loss) for the year Total equity

Incorporation and contribution to share capital 120 120

Capital contributions 6,159 6,159

Total comprehensive income/(loss) (6,159) (6,159)

Balances at December 31, 2010 120 - - - - - - - 6,159 (6,159) 120

Allocation of prior year profit:

- cover of prior year loss (6,159) 6,159 -

Demerger of activities from Fiat S.p.A. 1,913,179 462,265 214,937 1,159,964 3,750,345

Establishment of reserve for purchase of own shares 1,000,000 (1,000,000) -

Total comprehensive income/(loss) 326,988 326,988

Balances at December 31, 2011 1,913,299 462,265 214,937 1,000,000 - 159,964 - - - 326,988 4,077,453

Allocation of prior year profit:

- to the Legal reserve 16,350 (16,350) -

- dividend distributions (239,689) (239,689)

- balance to retained profit 70,949 (70,949) -

Carryforward and adjustment to reserve for the purchase of own shares (500,000) 500,000 -

Purchase of own shares (66) 66 (66) (66)

Conversion of preference and savings shares into ordinary shares 6,134 (6,134) -

Valuation of stock grant plans 6,196 6,196

Total comprehensive income/(loss) 128,609 128,609

Balances at December 31, 2012 1,919,433 456,131 231,287 499,934 66 730,913 6,196 (66) - 128,609 3,972,503

1) At December 31, 2012, the Company held 8,528 own shares having a total nominal value of €13 thousand

2) Other reserves includes the Capital contribution reserve

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 5

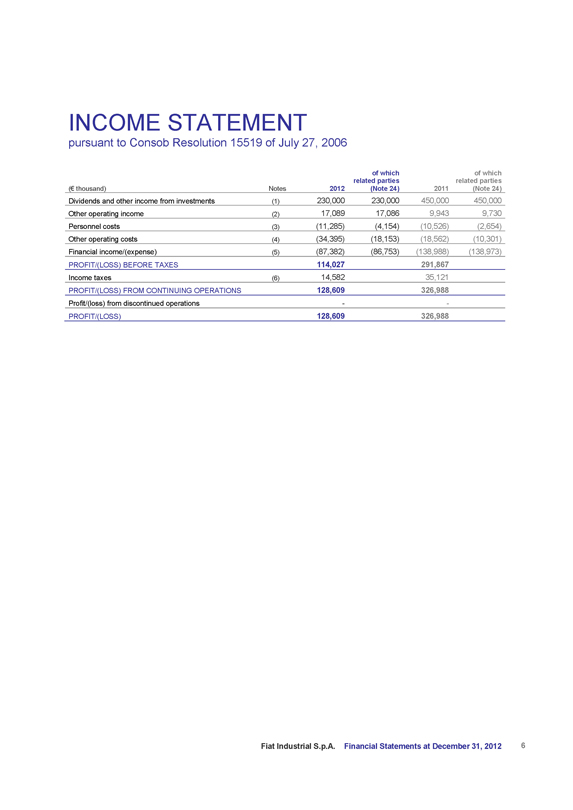

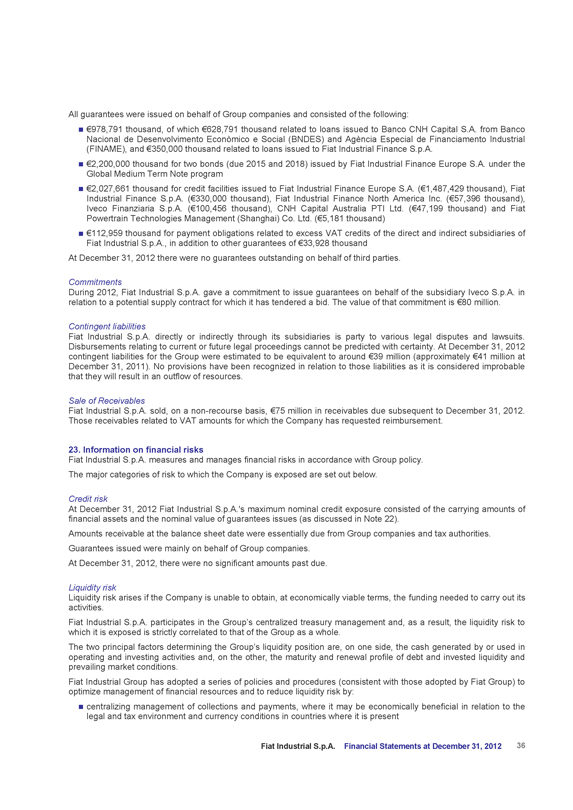

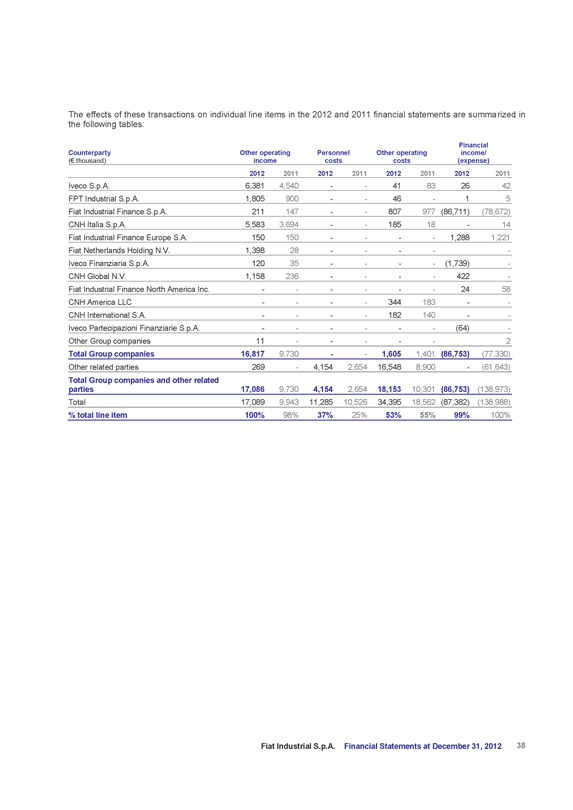

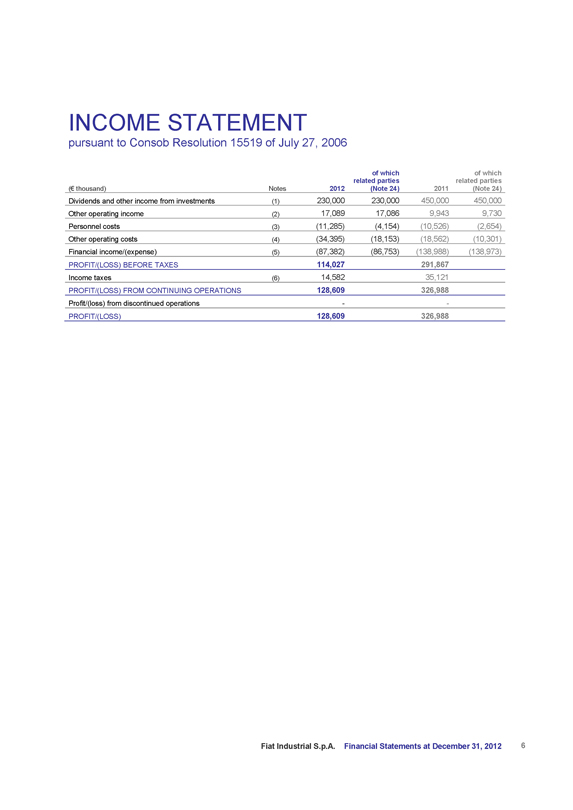

INCOME STATEMENT

pursuant to Consob Resolution 15519 of July 27, 2006

(€ thousand) Notes 2012 of which related parties (Note 24) 2011 of which related parties (Note 24)

Dividends and other income from investments (1) 230,000 230,000 450,000 450,000

Other operating income (2) 17,089 17,086 9,943 9,730

Personnel costs (3) (11,285) (4,154) (10,526) (2,654)

Other operating costs (4) (34,395) (18,153) (18,562) (10,301)

Financial income/(expense) (5) (87,382) (86,753) (138,988) (138,973)

PROFIT/(LOSS) BEFORE TAXES 114,027 291,867

Income taxes (6) 14,582 35,121

PROFIT/(LOSS) FROM CONTINUING OPERATIONS 128,609 326,988

Profit/(loss) from discontinued operations - -

PROFIT/(LOSS) 128,609 326,988

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 6

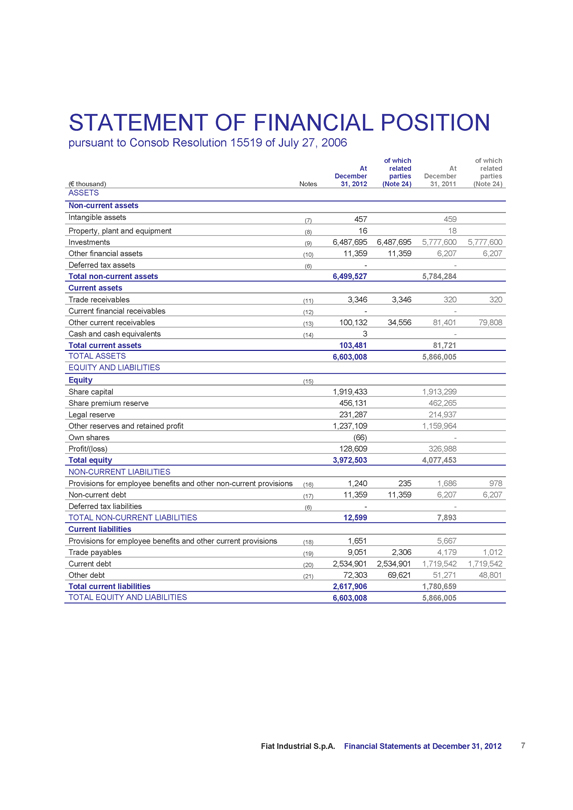

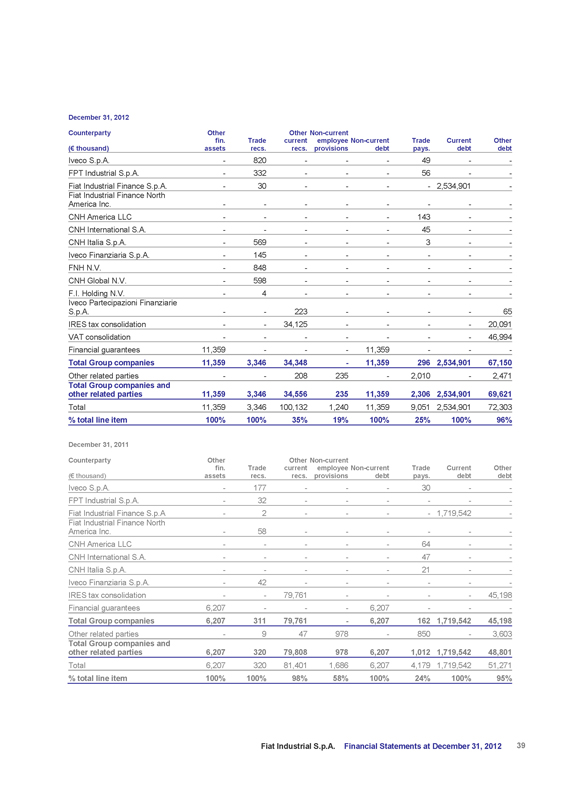

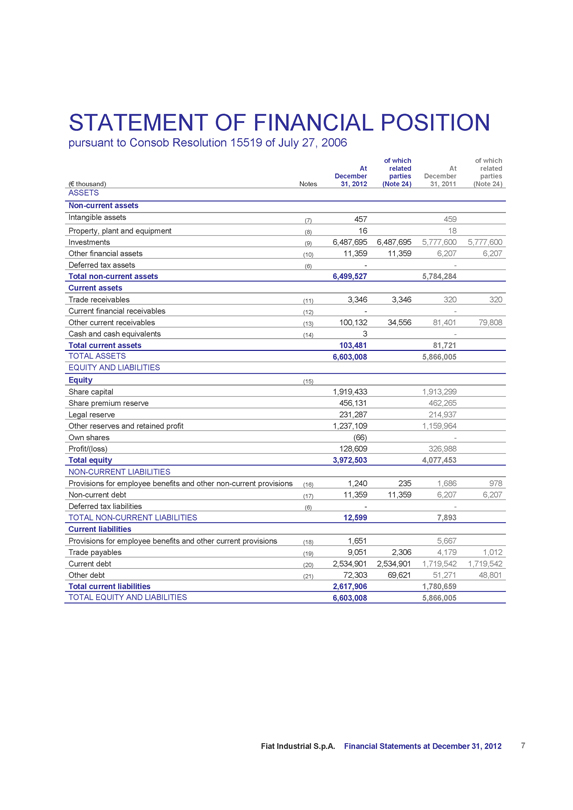

STATEMENT OF FINANCIAL POSITION

pursuant to Consob Resolution 15519 of July 27, 2006

(€ thousand) Notes At December 31, 2012 of which related parties (Note 24) At December 31, 2011 of which related parties (Note 24)

ASSETS

Non-current assets

Intangible assets (7) 457 459

Property, plant and equipment (8) 16 18

Investments (9) 6,487,695 6,487,695 5,777,600 5,777,600

Other financial assets (10) 11,359 11,359 6,207 6,207

Deferred tax assets (6) - -

Total non-current assets 6,499,527 5,784,284

Current assets

Trade receivables (11) 3,346 3,346 320 320

Current financial receivables (12) - -

Other current receivables (13) 100,132 34,556 81,401 79,808

Cash and cash equivalents (14) 3 -

Total current assets 103,481 81,721

TOTAL ASSETS 6,603,008 5,866,005

EQUITY AND LIABILITIES

Equity (15)

Share capital 1,919,433 1,913,299

Share premium reserve 456,131 462,265

Legal reserve 231,287 214,937

Other reserves and retained profit 1,237,109 1,159,964

Own shares (66) -

Profit/(loss) 128,609 326,988

Total equity 3,972,503 4,077,453

NON-CURRENT LIABILITIES

Provisions for employee benefits and other non-current provisions (16) 1,240 235 1,686 978

Non-current debt (17) 11,359 11,359 6,207 6,207

Deferred tax liabilities (6) - -

TOTAL NON-CURRENT LIABILITIES 12,599 7,893

Current liabilities

Provisions for employee benefits and other current provisions (18) 1,651 5,667

Trade payables (19) 9,051 2,306 4,179 1,012

Current debt (20) 2,534,901 2,534,901 1,719,542 1,719,542

Other debt (21) 72,303 69,621 51,271 48,801

Total current liabilities 2,617,906 1,780,659

TOTAL EQUITY AND LIABILITIES 6,603,008 5,866,005

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 7

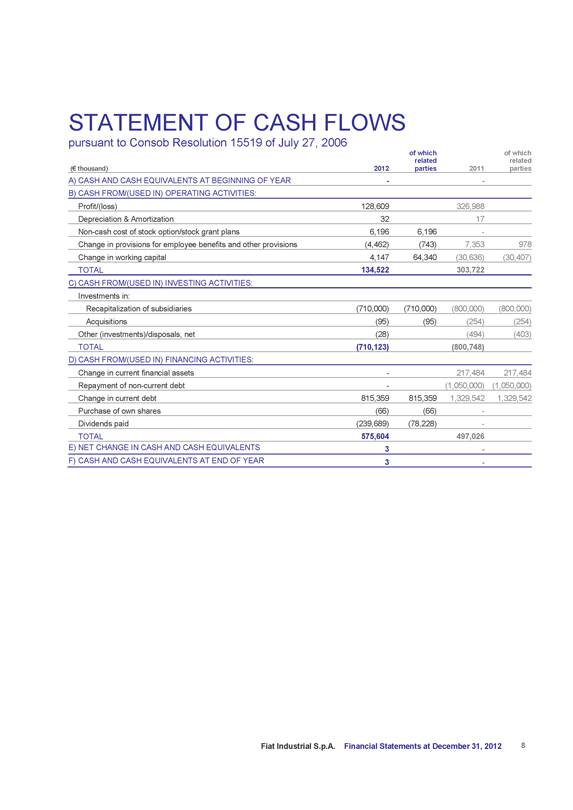

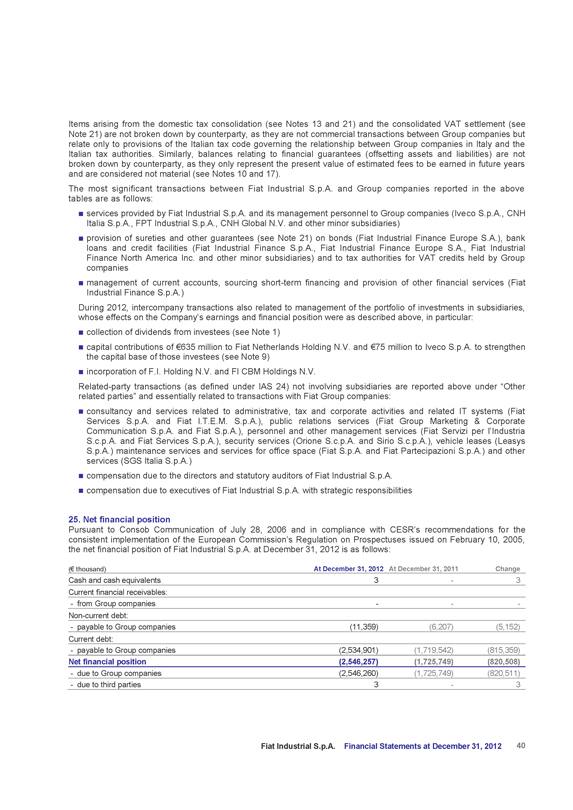

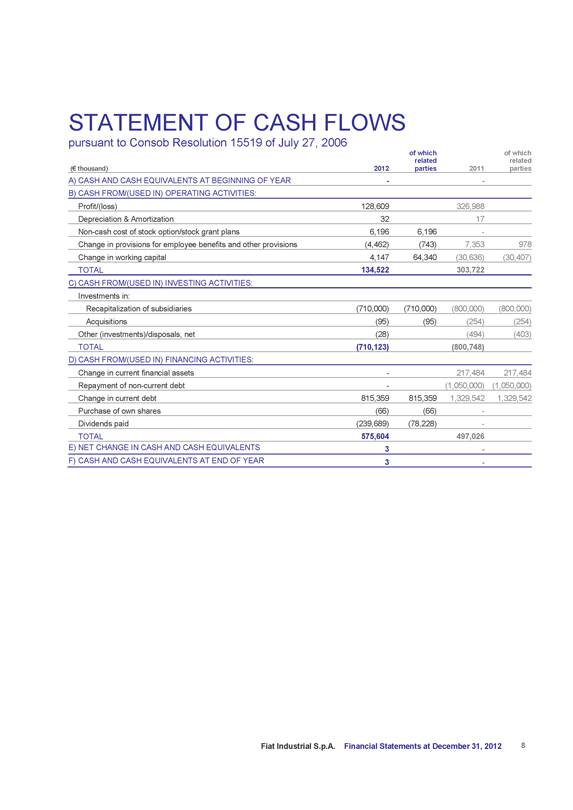

STATEMENT OF CASH FLOWS

pursuant to Consob Resolution 15519 of July 27, 2006

(€ thousand) 2012 of which related parties 2011 of which related parties

A) CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR - -

B) CASH FROM/(USED IN) OPERATING ACTIVITIES:

Profit/(loss) 128,609 326,988

Depreciation & Amortization 32 17

Non-cash cost of stock option/stock grant plans 6,196 6,196 -

Change in provisions for employee benefits and other provisions (4,462) (743) 7,353 978

Change in working capital 4,147 64,340 (30,636) (30,407)

TOTAL 134,522 303,722

C) CASH FROM/(USED IN) INVESTING ACTIVITIES:

Investments in:

Recapitalization of subsidiaries (710,000) (710,000) (800,000) (800,000)

Acquisitions (95) (95) (254) (254)

Other (investments)/disposals, net (28) (494) (403)

TOTAL (710,123) (800,748)

D) CASH FROM/(USED IN) FINANCING ACTIVITIES:

Change in current financial assets - 217,484 217,484

Repayment of non-current debt - (1,050,000) (1,050,000)

Change in current debt 815,359 815,359 1,329,542 1,329,542

Purchase of own shares (66) (66) -

Dividends paid (239,689) (78,228) -

TOTAL 575,604 497,026

E) NET CHANGE IN CASH AND CASH EQUIVALENTS 3 -

F) CASH AND CASH EQUIVALENTS AT END OF YEAR 3 -

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 8

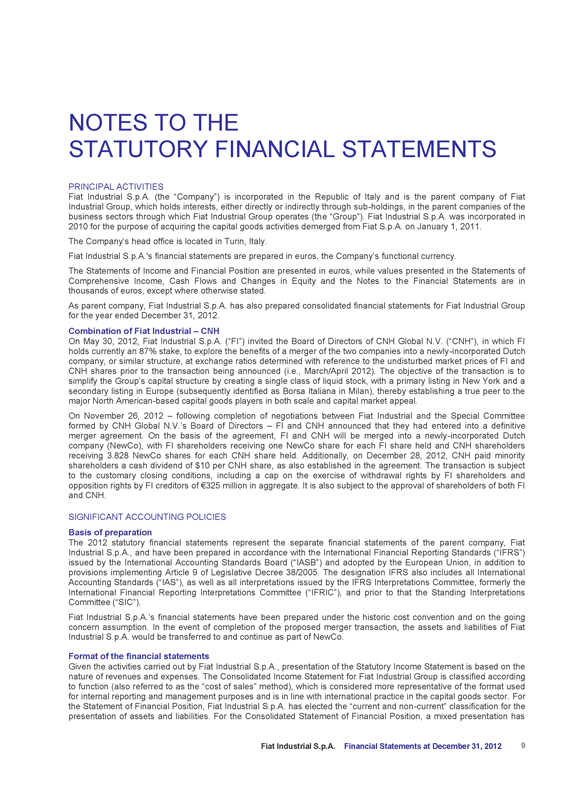

NOTES TO THE

STATUTORY FINANCIAL STATEMENTS

PRINCIPAL ACTIVITIES

Fiat Industrial S.p.A. (the “Company”) is incorporated in the Republic of Italy and is the parent company of Fiat Industrial Group, which holds interests, either directly or indirectly through sub-holdings, in the parent companies of the business sectors through which Fiat Industrial Group operates (the “Group”). Fiat Industrial S.p.A. was incorporated in 2010 for the purpose of acquiring the capital goods activities demerged from Fiat S.p.A. on January 1, 2011.

The Company’s head office is located in Turin, Italy.

Fiat Industrial S.p.A.’s financial statements are prepared in euros, the Company’s functional currency.

The Statements of Income and Financial Position are presented in euros, while values presented in the Statements of Comprehensive Income, Cash Flows and Changes in Equity and the Notes to the Financial Statements are in thousands of euros, except where otherwise stated.

As parent company, Fiat Industrial S.p.A. has also prepared consolidated financial statements for Fiat Industrial Group for the year ended December 31, 2012.

Combination of Fiat Industrial - CNH

On May 30, 2012, Fiat Industrial S.p.A. (“FI”) invited the Board of Directors of CNH Global N.V. (“CNH”), in which FI holds currently an 87% stake, to explore the benefits of a merger of the two companies into a newly-incorporated Dutch company, or similar structure, at exchange ratios determined with reference to the undisturbed market prices of FI and CNH shares prior to the transaction being announced (i.e., March/April 2012). The objective of the transaction is to simplify the Group’s capital structure by creating a single class of liquid stock, with a primary listing in New York and a secondary listing in Europe (subsequently identified as Borsa Italiana in Milan), thereby establishing a true peer to the major North American-based capital goods players in both scale and capital market appeal.

On November 26, 2012 - following completion of negotiations between Fiat Industrial and the Special Committee formed by CNH Global N.V.’s Board of Directors - FI and CNH announced that they had entered into a definitive merger agreement. On the basis of the agreement, FI and CNH will be merged into a newly-incorporated Dutch company (NewCo), with FI shareholders receiving one NewCo share for each FI share held and CNH shareholders receiving 3.828 NewCo shares for each CNH share held. Additionally, on December 28, 2012, CNH paid minority shareholders a cash dividend of $10 per CNH share, as also established in the agreement. The transaction is subject to the customary closing conditions, including a cap on the exercise of withdrawal rights by FI shareholders and opposition rights by FI creditors of €325 million in aggregate. It is also subject to the approval of shareholders of both FI and CNH.

SIGNIFICANT ACCOUNTING POLICIES

Basis of preparation

The 2012 statutory financial statements represent the separate financial statements of the parent company, Fiat Industrial S.p.A., and have been prepared in accordance with the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) and adopted by the European Union, in addition to provisions implementing Article 9 of Legislative Decree 38/2005. The designation IFRS also includes all International Accounting Standards (“IAS”), as well as all interpretations issued by the IFRS Interpretations Committee, formerly the International Financial Reporting Interpretations Committee (“IFRIC”), and prior to that the Standing Interpretations Committee (“SIC”).

Fiat Industrial S.p.A.’s financial statements have been prepared under the historic cost convention and on the going concern assumption. In the event of completion of the proposed merger transaction, the assets and liabilities of Fiat Industrial S.p.A. would be transferred to and continue as part of NewCo.

Format of the financial statements

Given the activities carried out by Fiat Industrial S.p.A., presentation of the Statutory Income Statement is based on the nature of revenues and expenses. The Consolidated Income Statement for Fiat Industrial Group is classified according to function (also referred to as the “cost of sales” method), which is considered more representative of the format used for internal reporting and management purposes and is in line with international practice in the capital goods sector. For the Statement of Financial Position, Fiat Industrial S.p.A. has elected the “current and non-current” classification for the presentation of assets and liabilities. For the Consolidated Statement of Financial Position, a mixed presentation has

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 9

been elected, as permitted under IAS 1, with the current and non-current classification applied to assets only. That election was based on the fact that the consolidated financial statements include both industrial companies and financial services companies. The financing portfolios of financial services companies are included under current assets, as those assets will be realized in the course of the normal operating cycle. In addition, the financial services companies only obtain a portion of their funding directly from the market. The remainder of their funding is obtained from Group treasury companies (included under industrial activities), which provide funding to both industrial companies and financial services companies within the Group, on the basis of their individual requirements. The distribution of financial services activities within the Group has no impact on the presentation of financial liabilities for Fiat Industrial S.p.A. However, for the Consolidated Statement of Financial Position, the distribution of those activities means that a classification of financial liabilities between current and non-current would not be meaningful.

The Statement of Cash Flows is presented using the indirect method.

With regard to the requirements of Consob Resolution 15519 of July 27, 2006 relating to the format of the financial statements, supplementary Statements of Income, Financial Position and Cash Flows with a breakdown of related party transactions have been provided separately so that the overall reading of the principal statements is not compromised.

Intangible assets

Purchased or internally-generated intangible assets are recognized, in accordance with IAS 38 - Intangible Assets, where it is probable that the use of the asset will generate future economic benefits and where the cost of the asset can be determined reliably.

Intangible assets with a finite useful life are measured at purchase or manufacturing cost, net of amortization (charged on a straight-line basis over the estimated useful life) and any impairment losses.

In accordance with IFRS 3 - Business combinations, goodwill is recognized on the date of acquisition of a business or business unit where the amount of the consideration (measured at fair value) plus the value of any non-controlling interests and the fair value of the equity interest previously held in the acquired entity (if any) is higher than the acquisition-date fair value of the identifiable assets acquired net of the identifiable liabilities assumed. Goodwill is not amortized, but is tested for impairment annually or more frequently if specific events or changes in circumstances indicate that an impairment loss has occurred. After initial recognition, goodwill is measured at cost (as defined above) less any impairment losses.

Property, plant and equipment

Cost

Property, plant and equipment are stated at acquisition or production cost, net of accumulated depreciation and impairment losses.

Subsequent expenditures are only capitalized where they increase the future economic benefits of the asset to which they relate. All other expenditures are expensed as incurred.

The method and rates used for depreciating assets are provided below.

Leases where the lessor retains substantially all the risks and rewards of ownership of the assets are classified as operating leases. Costs related to operating leases are recognized on a straight-line basis over the duration of the lease.

Depreciation

Depreciation is calculated on a straight-line basis over the estimated useful life of an asset as follows:

Annual depreciation

rate

Furniture

12%

Fixtures

20%

Impairment

The Company reviews, at least annually, the recoverability of the carrying amount of intangible assets, tangible assets and investments in subsidiaries, in order to determine whether those assets have suffered a loss in value. Where there are indications of impairment, the carrying amount of the asset is reduced to its recoverable amount.

In relation to investments in subsidiaries that have distributed a dividend, the following are also considered indicators of impairment: if the carrying amount of the investment in the separate financial statements exceeds the book value of that

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 10

company’s equity (including any associated goodwill) as recognized in the consolidated financial statements

if dividends exceed the comprehensive income of the investee for the period to which the dividend relates The recoverable amount of an asset is the higher of fair value less disposal costs and its value in use.

When testing for impairment of investments in subsidiaries whose market value (fair value less disposal costs) cannot be reliably measured, the recoverable amount is based on value in use, which - in line with the requirements of paragraph 33 of IAS 28 - is determined by estimating the present value of estimated future cash flows and a theoretical terminal value.

Where impairment of an asset subsequently reverses, the carrying amount of that asset is increased to the revised estimate of its recoverable amount, not to exceed the carrying amount that would have been determined had no impairment loss been recognized. A reversal of an impairment loss is recognized immediately in the income statement.

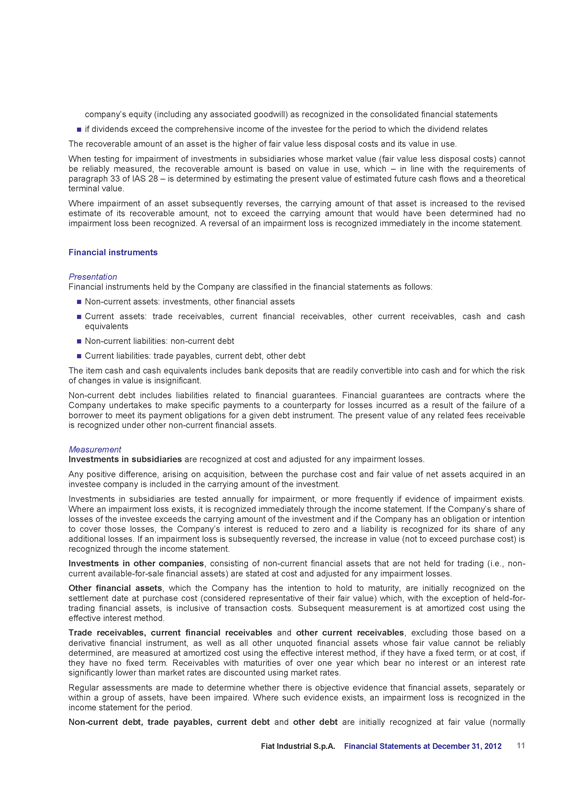

Financial instruments

Presentation

Financial instruments held by the Company are classified in the financial statements as follows:

Non-current assets: investments, other financial assets

Current assets: trade receivables, current financial receivables, other current receivables, cash and cash equivalents

Non-current liabilities: non-current debt

Current liabilities: trade payables, current debt, other debt

The item cash and cash equivalents includes bank deposits that are readily convertible into cash and for which the risk of changes in value is insignificant.

Non-current debt includes liabilities related to financial guarantees. Financial guarantees are contracts where the Company undertakes to make specific payments to a counterparty for losses incurred as a result of the failure of a borrower to meet its payment obligations for a given debt instrument. The present value of any related fees receivable is recognized under other non-current financial assets.

Measurement

Investments in subsidiaries are recognized at cost and adjusted for any impairment losses.

Any positive difference, arising on acquisition, between the purchase cost and fair value of net assets acquired in an investee company is included in the carrying amount of the investment.

Investments in subsidiaries are tested annually for impairment, or more frequently if evidence of impairment exists. Where an impairment loss exists, it is recognized immediately through the income statement. If the Company’s share of losses of the investee exceeds the carrying amount of the investment and if the Company has an obligation or intention to cover those losses, the Company’s interest is reduced to zero and a liability is recognized for its share of any additional losses. If an impairment loss is subsequently reversed, the increase in value (not to exceed purchase cost) is recognized through the income statement.

Investments in other companies, consisting of non-current financial assets that are not held for trading (i.e., non-current available-for-sale financial assets) are stated at cost and adjusted for any impairment losses.

Other financial assets, which the Company has the intention to hold to maturity, are initially recognized on the settlement date at purchase cost (considered representative of their fair value) which, with the exception of held-for-trading financial assets, is inclusive of transaction costs. Subsequent measurement is at amortized cost using the effective interest method.

Trade receivables, current financial receivables and other current receivables, excluding those based on a derivative financial instrument, as well as all other unquoted financial assets whose fair value cannot be reliably determined, are measured at amortized cost using the effective interest method, if they have a fixed term, or at cost, if they have no fixed term. Receivables with maturities of over one year which bear no interest or an interest rate significantly lower than market rates are discounted using market rates.

Regular assessments are made to determine whether there is objective evidence that financial assets, separately or within a group of assets, have been impaired. Where such evidence exists, an impairment loss is recognized in the income statement for the period.

Non-current debt, trade payables, current debt and other debt are initially recognized at fair value (normally

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 11

represented by the cost of the transaction from which the liability arises), in addition to any transaction costs.

With the exception of derivative instruments and liabilities arising from financial guarantees, financial liabilities are subsequently measured at amortized cost using the effective interest method. Measurement of financial liabilities hedged by derivative instruments follows the principles of hedge accounting for fair value hedges. Gains and losses arising from subsequent measurement at fair value, caused by fluctuations in interest rates, are recognized through the income statement and are offset by the effective portion of the gain or loss arising from subsequent measurement at fair value of the hedging instrument.

Liabilities arising from financial guarantees are measured at the higher of the estimate of the contingent liability (determined in accordance with IAS 37 - Provisions, Contingent Liabilities and Contingent Assets) and the amount initially recognized less any amounts already released to profit and loss.

Derivative financial instruments

Derivative financial instruments are used for hedging purposes, in order to reduce currency, interest rate and market price risks.

In accordance with IAS 39, derivative financial instruments qualify for hedge accounting only when at the inception of the hedge there is formal designation and documentation of the hedging relationship, the hedge is expected to be highly effective, its effectiveness can be reliably measured and it is highly effective throughout the financial reporting periods for which the hedge is designated.

All derivative financial instruments are measured at fair value in accordance with IAS 39.

When derivative financial instruments qualify for hedge accounting, the following accounting treatment applies:

Fair value hedge - Where a derivative financial instrument is designated as a hedge of the exposure to changes in fair value of a recognized asset or liability that is attributable to a particular risk and could affect the income statement, the gain or loss from remeasuring the hedging instrument at fair value is recognized in the income statement. The gain or loss on the hedged item attributable to the hedged risk adjusts the carrying amount of the hedged item and is recognized in the income statement.

Cash flow hedge - Where a derivative financial instrument is designated as a hedge against variability in future cash flows of an existing asset or liability or a transaction considered highly probable that could impact the income statement, the effective portion of the gain or loss on the hedging instrument is recognized in other comprehensive income. Any cumulative gain or loss is reversed from other comprehensive income and recognized in the income statement in the same period in which the hedged transaction affects the income statement. The gain or loss associated with a hedge or part of a hedge that has become ineffective is recognized in the income statement immediately. When a hedging instrument or hedge relationship is terminated, but the hedged transaction has not yet occurred, any gain or loss previously recognized in other comprehensive income is recognized through profit and loss at the time the hedged transaction occurs. If the hedged transaction is no longer probable, the cumulative unrealized gain or loss recognized in other comprehensive income is immediately transferred to the income statement. If hedge accounting cannot be applied, the gains or losses from the fair value measurement of derivative financial instruments are recognized immediately in the income statement.

Sales of receivables

Factored receivables are derecognized if, and only if, the risks and rewards of ownership have been substantially transferred to the buyer. Whether sold on a recourse or non-recourse basis, if this condition is not satisfied the receivables continue to be recognized in the financial statements, even if there has been a change in legal ownership. In such cases, a financial liability is recognized for an amount equivalent to the advance received.

Employee benefits

Post-employment benefit plans

The Company provides pension plans and other post-employment benefit plans to its employees. Pension plans in which the Company is obliged to participate under Italian law are defined contribution plans, while other post-employment benefit plans, in which the Company’s participation is generally subject to collective bargaining agreements, are defined benefit plans. Costs associated with payments to defined contribution plans are recognized in the income statement when incurred. Defined benefit plans are based on an employee’s working life and on the salary or wage received by the employee over a predetermined period of service.

In accordance with Law 296 of December 27, 2006 and subsequent decrees and regulations issued in the first half of 2007, the leaving entitlement payable to employees of Group companies in Italy (Trattamento di Fine Rapporto or “TFR”) qualifies as a defined benefit plan for benefits accrued prior to January 1, 2007 (and not yet paid out as at the

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 12

balance sheet date), while benefits accruing after that date are classified as defined contributions.

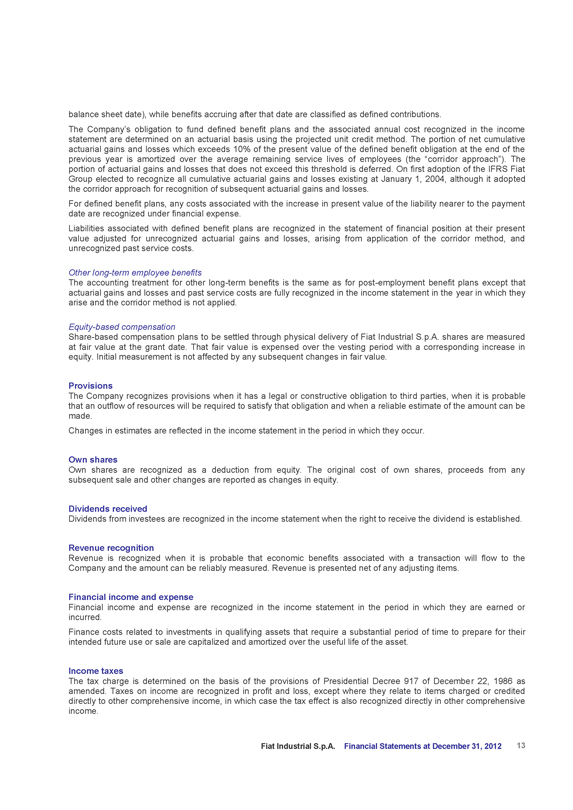

The Company’s obligation to fund defined benefit plans and the associated annual cost recognized in the income statement are determined on an actuarial basis using the projected unit credit method. The portion of net cumulative actuarial gains and losses which exceeds 10% of the present value of the defined benefit obligation at the end of the previous year is amortized over the average remaining service lives of employees (the “corridor approach”). The portion of actuarial gains and losses that does not exceed this threshold is deferred. On first adoption of the IFRS Fiat Group elected to recognize all cumulative actuarial gains and losses existing at January 1, 2004, although it adopted the corridor approach for recognition of subsequent actuarial gains and losses.

For defined benefit plans, any costs associated with the increase in present value of the liability nearer to the payment date are recognized under financial expense.

Liabilities associated with defined benefit plans are recognized in the statement of financial position at their present value adjusted for unrecognized actuarial gains and losses, arising from application of the corridor method, and unrecognized past service costs.

Other long-term employee benefits

The accounting treatment for other long-term benefits is the same as for post-employment benefit plans except that actuarial gains and losses and past service costs are fully recognized in the income statement in the year in which they arise and the corridor method is not applied.

Equity-based compensation

Share-based compensation plans to be settled through physical delivery of Fiat Industrial S.p.A. shares are measured at fair value at the grant date. That fair value is expensed over the vesting period with a corresponding increase in equity. Initial measurement is not affected by any subsequent changes in fair value.

Provisions

The Company recognizes provisions when it has a legal or constructive obligation to third parties, when it is probable that an outflow of resources will be required to satisfy that obligation and when a reliable estimate of the amount can be made.

Changes in estimates are reflected in the income statement in the period in which they occur.

Own shares

Own shares are recognized as a deduction from equity. The original cost of own shares, proceeds from any subsequent sale and other changes are reported as changes in equity.

Dividends received

Dividends from investees are recognized in the income statement when the right to receive the dividend is established.

Revenue recognition

Revenue is recognized when it is probable that economic benefits associated with a transaction will flow to the Company and the amount can be reliably measured. Revenue is presented net of any adjusting items.

Financial income and expense

Financial income and expense are recognized in the income statement in the period in which they are earned or incurred.

Finance costs related to investments in qualifying assets that require a substantial period of time to prepare for their intended future use or sale are capitalized and amortized over the useful life of the asset.

Income taxes

The tax charge is determined on the basis of the provisions of Presidential Decree 917 of December 22, 1986 as amended. Taxes on income are recognized in profit and loss, except where they relate to items charged or credited directly to other comprehensive income, in which case the tax effect is also recognized directly in other comprehensive income.

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 13

For deferred tax assets and liabilities, determination is based on the temporary differences existing between the carrying amount of an asset or liability in the statement of financial position and its corresponding tax basis. Deferred tax assets resulting from unused tax losses and temporary differences are recognized to the extent that it is probable that future taxable profit will be available against which they can be utilized.

Current and deferred income taxes and liabilities are offset when there is a legal right to do so. Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period when the temporary difference is reversed.

Fiat Industrial S.p.A. and almost all its Italian subsidiaries have elected to take part in the domestic tax consolidation program pursuant to Articles 117/129 of Presidential Decree 917/1986 for a three-year period beginning in 2011. Fiat Industrial S.p.A. acts as the consolidating company, creating a single taxable base so that companies taking part in the program can benefit from potential offsetting of taxable income and tax losses. Each company participating in the consolidation transfers its taxable income or tax losses to the consolidating company. Fiat Industrial S.p.A. recognizes a receivable for companies contributing taxable income, corresponding to the amount of IRES (corporate income tax) payable on their behalf. For companies contributing a tax loss, Fiat Industrial S.p.A. recognizes a payable for the amount of the loss actually set off at group level.

Dividends payable

Dividends payable are recognized as changes in equity in the period in which they are approved by Shareholders.

Use of estimates

The preparation of financial statements and related disclosures that conform to IFRS requires that management make judgments, estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities existing at the balance sheet date. The estimates and assumptions used are based on information available at the balance sheet date, past experience and other factors considered relevant. Actual results could differ from those estimates.

Conditions attributable to the economic and financial crisis that have existed since 2008 have resulted in assumptions regarding future performance being subject to significant uncertainty. As a consequence, it cannot be excluded that actual results in future periods could differ from estimates, requiring adjustments, even significant, to the carrying amount of the item(s) in question, which at present can neither be estimated nor predicted. The line item most impacted by the use of estimates is “investments in subsidiaries” included under non-current assets, where estimates are used for carrying out impairment tests. No particular or significant issues have arisen, however, in relation to estimates used in measurement of employee benefits, taxes or provisions also taking into consideration their level of materiality.

Estimates and assumptions are reviewed periodically and the effects of any changes are recognized directly in profit and loss in the period in which the estimate is revised, if the revision affects only that period, or in the period of the revision and future periods, if the revision affects both current and future periods.

With regard to investments in subsidiaries, the use of estimates essentially related to determination of their recoverable value. For the investment in Fiat Netherlands Holding N.V. (parent company of CNH and principal foreign subsidiaries of Iveco), the book value recognized by Fiat Industrial S.p.A. is significantly lower than the book value of equity reported in the separate and consolidated financial statements of the investee for the year ended December 31, 2012 (prepared under IFRS), which reflected the results of a thorough process for the determination of the recoverability of assets.

With regard to the investments in Iveco S.p.A. and FPT Industrial S.p.A., an impairment test was conducted to determine value in use based on the present value of expected cash flows. The estimates took into account the expected results for 2013, based on assumptions and information consistent with the “Subsequent Events and Outlook” section of the Report on Operations, as well as management’s financial projections for the period 2014-2016. As an additional measure of prudence, a sensitivity analysis was conducted to take account of uncertainty relating to the timing of a full market recovery. Discount rates (after tax) of 10.1% and 10.3% were used for Iveco S.p.A. and FPT Industrial S.p.A., respectively, which take account of the sectors and geographic markets in which they operate. The calculations of terminal value assumed growth rates of 1.4% and 0.8% respectively. On the basis of the estimates and assumptions applied, it was determined that the value of the assets concerned is recoverable.

No impairment was identified for Fiat Industrial Finance S.p.A.

Accounting principles, amendments and interpretations adopted from January 1, 2012

On October 7, 2010, the IASB issued amendments to IFRS 7 - Financial Instruments: Disclosures. The amendments

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 14

are intended to improve the understanding of transfers of financial assets (derecognition) for users of financial statements, including the possible effects of any risks that may remain with the entity that transferred the assets. The amendments also require additional disclosures if a disproportionate amount of transfers are undertaken around the end of a reporting period and are to be applied prospectively. The Group applied those amendments from January 1, 2012. Adoption of the revised standard had no effect on measurement of items in the financial statements and only a limited effect on disclosure.

Accounting standards, amendments and interpretations effective from January 1, 2012 but not applicable to the Company

On December 20, 2010, the IASB issued a minor amendment to IAS 12 - Income taxes, which clarified determination of deferred taxes on investment properties measured at fair value. The amendment introduced the assumption that deferred taxes on investment properties recognized at fair value in accordance with IAS 40 are determined assuming that the carrying amount will be recovered through disposal. Following introduction of this amendment, SIC-21 - Income Taxes - Recovery of Revalued Non-Depreciable Assets will no longer be applicable. The amendment is effective retrospectively from January 1, 2012 and has no impact on the Company.

Accounting standards, amendments and interpretations not yet applicable and not early adopted by the Company

On May 12, 2011, the IASB issued IFRS 10 - Consolidated Financial Statements that will replace SIC-12 - Consolidation - Special Purpose Entities and parts of IAS 27 - Consolidated and Separate Financial Statements (which will be renamed Separate Financial Statements and addresses accounting treatment for investments in separate financial statements). IFRS 10 builds on existing standards and establishes criteria for determining control which are the same for all entities, including special purpose entities. The standard provides additional guidance for situations where control may be difficult to determine. The standard is effective retrospectively from January 1, 2013. The European Union concluded the endorsement process for this standard postponing mandatory adoption to January 1, 2014, but permitting early adoption. The Company elected to adopt the standard from January 1, 2013. No significant effect on the Company’s financial statements is expected from the adoption of this standard.

On May 12, 2011, the IASB issued IFRS 11 - Joint Arrangements which supersedes IAS 31 - Interests in Joint Ventures and SIC-13 - Jointly controlled Entities - Non-monetary Contributions by Venturers. The new standard sets out criteria for identifying joint arrangements, by focusing on the rights and obligations of the arrangement rather than its legal form, and establishes the equity method as the sole method of accounting for interests in jointly-controlled entities in the consolidated financial statements. The standard is applicable retrospectively from January 1, 2013. Following issue of the new standard, IAS 28 - Investments in Associates has been amended to also include investments in jointly-controlled entities in its scope of application (from the effective date of the standard). The European Union concluded the endorsement process for this standard postponing mandatory adoption to January 1, 2014, but permitting early adoption. The Company elected to adopt the standard effective January 1, 2013. No significant effect on the Company’s financial statements is expected from the adoption of this standard.

On May 12, 2011, the IASB issued IFRS 12 - Disclosure of Interests in Other Entities, a new and comprehensive standard on disclosure requirements for all forms of interests in other entities, including subsidiaries, joint arrangements, associates, special purpose vehicles and other unconsolidated vehicles. The standard is effective retrospectively from January 1, 2013. The European Union concluded the endorsement process for this standard postponing mandatory adoption to January 1, 2014, but permitting early adoption. The Company elected to adopt the standard effective January 1, 2013. No significant effect on the Company’s financial statements is expected from the adoption of this standard.

On May 12, 2011, the IASB issued IFRS 13 - Fair Value Measurement, which clarifies rules for determination of fair value for reporting purposes and applies to all IFRS that require or allow fair value measurement or disclosures based on fair value. The standard is applicable prospectively from January 1, 2013. No significant effect on the Company’s financial statements is expected from the adoption of this standard.

On June 16, 2011, the IASB issued an amended version of IAS 19 - Employee Benefits which is applicable retrospectively from January 1, 2013. The amendment concerns the requirements for recognizing defined benefit plans and termination benefits. The principal changes to defined benefit plans concern the recognition of the plan deficit or surplus to the balance sheet, the introduction of net interest cost and the classification of the net interest cost arising from defined benefit plans, as described below:

Recognition of the plan deficit or surplus: the amendment removes the option to defer actuarial gains and losses under the “corridor method” and requires their direct recognition to Other comprehensive gains/ (losses). In addition, the amendment requires immediate recognition to the income statement of costs concerning prior year labor contracts.

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 15

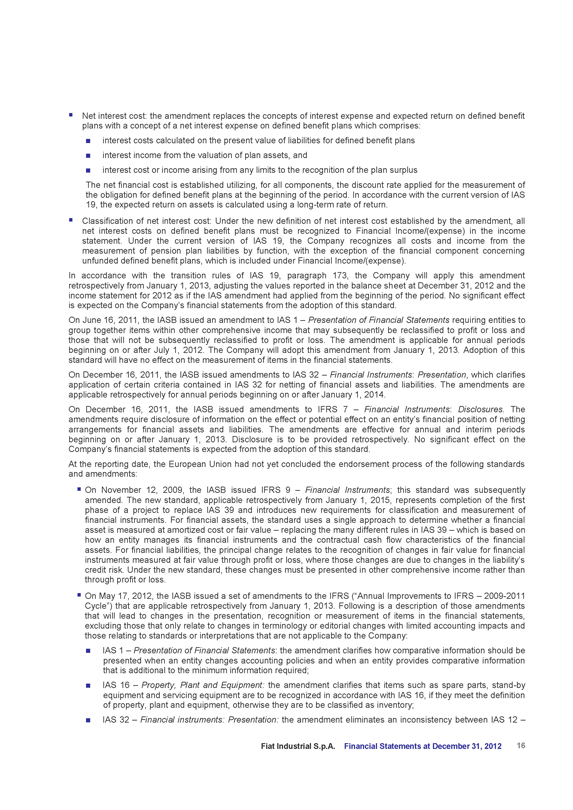

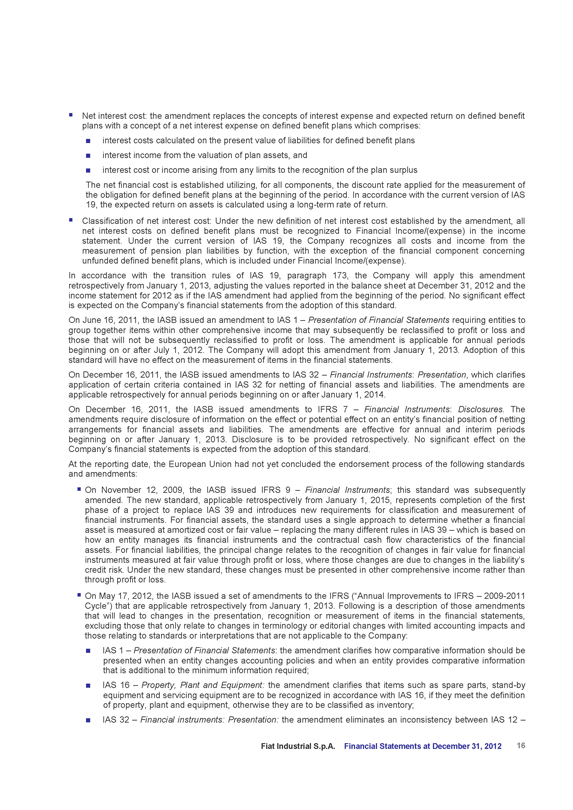

Net interest cost: the amendment replaces the concepts of interest expense and expected return on defined benefit plans with a concept of a net interest expense on defined benefit plans which comprises:

interest costs calculated on the present value of liabilities for defined benefit plans

interest income from the valuation of plan assets, and

interest cost or income arising from any limits to the recognition of the plan surplus

The net financial cost is established utilizing, for all components, the discount rate applied for the measurement of the obligation for defined benefit plans at the beginning of the period. In accordance with the current version of IAS 19, the expected return on assets is calculated using a long-term rate of return.

Classification of net interest cost: Under the new definition of net interest cost established by the amendment, all net interest costs on defined benefit plans must be recognized to Financial Income/(expense) in the income statement. Under the current version of IAS 19, the Company recognizes all costs and income from the measurement of pension plan liabilities by function, with the exception of the financial component concerning unfunded defined benefit plans, which is included under Financial Income/(expense).

In accordance with the transition rules of IAS 19, paragraph 173, the Company will apply this amendment retrospectively from January 1, 2013, adjusting the values reported in the balance sheet at December 31, 2012 and the income statement for 2012 as if the IAS amendment had applied from the beginning of the period. No significant effect is expected on the Company’s financial statements from the adoption of this standard.

On June 16, 2011, the IASB issued an amendment to IAS 1 - Presentation of Financial Statements requiring entities to group together items within other comprehensive income that may subsequently be reclassified to profit or loss and those that will not be subsequently reclassified to profit or loss. The amendment is applicable for annual periods beginning on or after July 1, 2012. The Company will adopt this amendment from January 1, 2013. Adoption of this standard will have no effect on the measurement of items in the financial statements.

On December 16, 2011, the IASB issued amendments to IAS 32 - Financial Instruments: Presentation, which clarifies application of certain criteria contained in IAS 32 for netting of financial assets and liabilities. The amendments are applicable retrospectively for annual periods beginning on or after January 1, 2014.

On December 16, 2011, the IASB issued amendments to IFRS 7 - Financial Instruments: Disclosures. The amendments require disclosure of information on the effect or potential effect on an entity’s financial position of netting arrangements for financial assets and liabilities. The amendments are effective for annual and interim periods beginning on or after January 1, 2013. Disclosure is to be provided retrospectively. No significant effect on the Company’s financial statements is expected from the adoption of this standard.

At the reporting date, the European Union had not yet concluded the endorsement process of the following standards and amendments:

On November 12, 2009, the IASB issued IFRS 9 - Financial Instruments; this standard was subsequently amended. The new standard, applicable retrospectively from January 1, 2015, represents completion of the first phase of a project to replace IAS 39 and introduces new requirements for classification and measurement of financial instruments. For financial assets, the standard uses a single approach to determine whether a financial asset is measured at amortized cost or fair value - replacing the many different rules in IAS 39 - which is based on how an entity manages its financial instruments and the contractual cash flow characteristics of the financial assets. For financial liabilities, the principal change relates to the recognition of changes in fair value for financial instruments measured at fair value through profit or loss, where those changes are due to changes in the liability’s credit risk. Under the new standard, these changes must be presented in other comprehensive income rather than through profit or loss.

On May 17, 2012, the IASB issued a set of amendments to the IFRS (“Annual Improvements to IFRS - 2009-2011 Cycle”) that are applicable retrospectively from January 1, 2013. Following is a description of those amendments that will lead to changes in the presentation, recognition or measurement of items in the financial statements, excluding those that only relate to changes in terminology or editorial changes with limited accounting impacts and those relating to standards or interpretations that are not applicable to the Company:

IAS 1 - Presentation of Financial Statements: the amendment clarifies how comparative information should be presented when an entity changes accounting policies and when an entity provides comparative information that is additional to the minimum information required;

IAS 16 - Property, Plant and Equipment: the amendment clarifies that items such as spare parts, stand-by equipment and servicing equipment are to be recognized in accordance with IAS 16, if they meet the definition of property, plant and equipment, otherwise they are to be classified as inventory;

IAS 32 - Financial instruments: Presentation: the amendment eliminates an inconsistency between IAS 12 -

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 16

Income Taxes and IAS 32 concerning the recognition of tax arising from distributions to shareholders, and establishes that such tax is to be recognized in profit or loss when the distribution relates to income originally recognized in profit or loss;

IAS 34 - Interim Financial Reporting: the amendment clarifies that disclosures on total assets and total liabilities for a particular reportable segment are to be provided if, and only if:

a) a measure of total assets or total liabilities, or both, is regularly provided to the chief operating decision maker, and

b) there has been a material change from the amount disclosed for that reportable segment in the previous annual financial statements.

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 17

COMPOSITION AND PRINCIPAL CHANGES

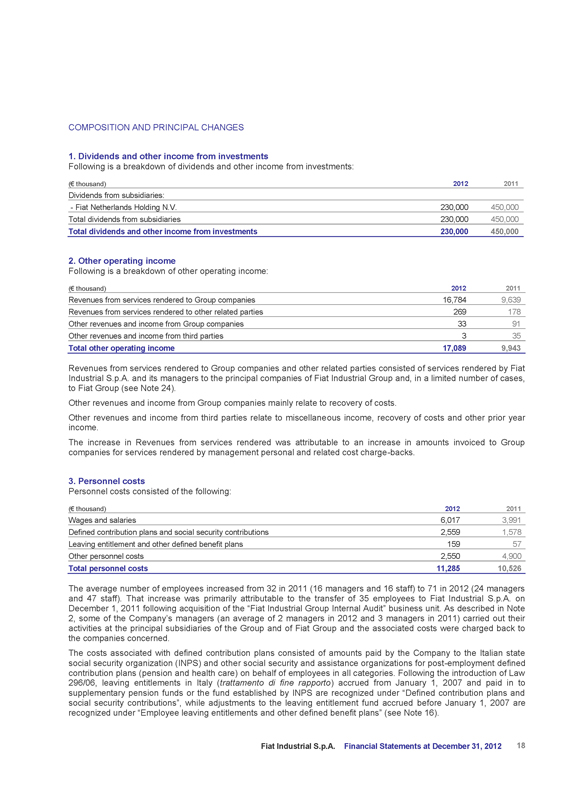

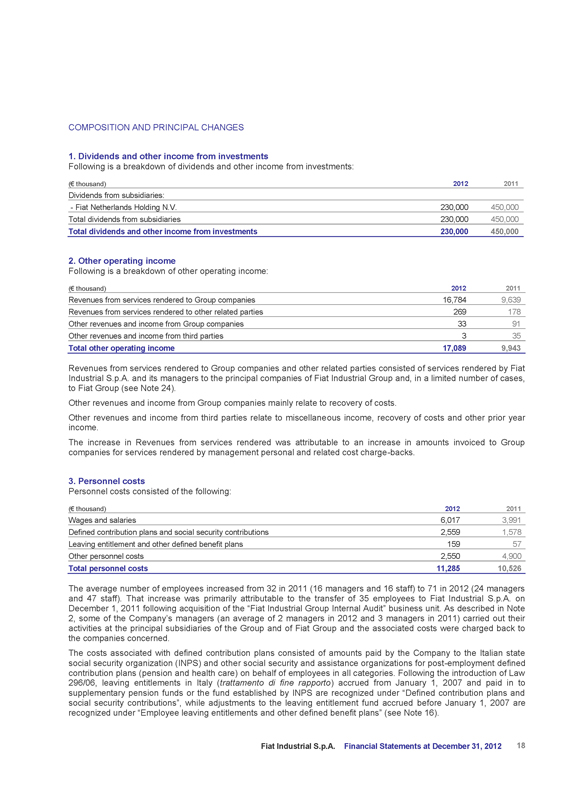

1. Dividends and other income from investments

Following is a breakdown of dividends and other income from investments:

(€ thousand)

2012 2011

Dividends from subsidiaries:

- Fiat Netherlands Holding N.V. 230,000 450,000

Total dividends from subsidiaries 230,000 450,000

Total dividends and other income from investments 230,000 450,000

2. Other operating income

Following is a breakdown of other operating income:

(€ thousand)

2012 2011

Revenues from services rendered to Group companies 16,784 9,639

Revenues from services rendered to other related parties 269 178

Other revenues and income from Group companies 33 91

Other revenues and income from third parties 3 35

Total other operating income 17,089 9,943

Revenues from services rendered to Group companies and other related parties consisted of services rendered by Fiat Industrial S.p.A. and its managers to the principal companies of Fiat Industrial Group and, in a limited number of cases, to Fiat Group (see Note 24).

Other revenues and income from Group companies mainly relate to recovery of costs.

Other revenues and income from third parties relate to miscellaneous income, recovery of costs and other prior year income.

The increase in Revenues from services rendered was attributable to an increase in amounts invoiced to Group companies for services rendered by management personal and related cost charge-backs.

3. Personnel costs

Personnel costs consisted of the following:

(€ thousand)

2012 2011

Wages and salaries 6,017 3,991

Defined contribution plans and social security contributions 2,559 1,578

Leaving entitlement and other defined benefit plans 159 57

Other personnel costs 2,550 4,900

Total personnel costs 11,285 10,526

The average number of employees increased from 32 in 2011 (16 managers and 16 staff) to 71 in 2012 (24 managers and 47 staff). That increase was primarily attributable to the transfer of 35 employees to Fiat Industrial S.p.A. on December 1, 2011 following acquisition of the “Fiat Industrial Group Internal Audit” business unit. As described in Note 2, some of the Company’s managers (an average of 2 managers in 2012 and 3 managers in 2011) carried out their activities at the principal subsidiaries of the Group and of Fiat Group and the associated costs were charged back to the companies concerned.

The costs associated with defined contribution plans consisted of amounts paid by the Company to the Italian state social security organization (INPS) and other social security and assistance organizations for post-employment defined contribution plans (pension and health care) on behalf of employees in all categories. Following the introduction of Law 296/06, leaving entitlements in Italy (trattamento di fine rapporto) accrued from January 1, 2007 and paid in to supplementary pension funds or the fund established by INPS are recognized under “Defined contribution plans and social security contributions”, while adjustments to the leaving entitlement fund accrued before January 1, 2007 are recognized under “Employee leaving entitlements and other defined benefit plans” (see Note 16).

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 18

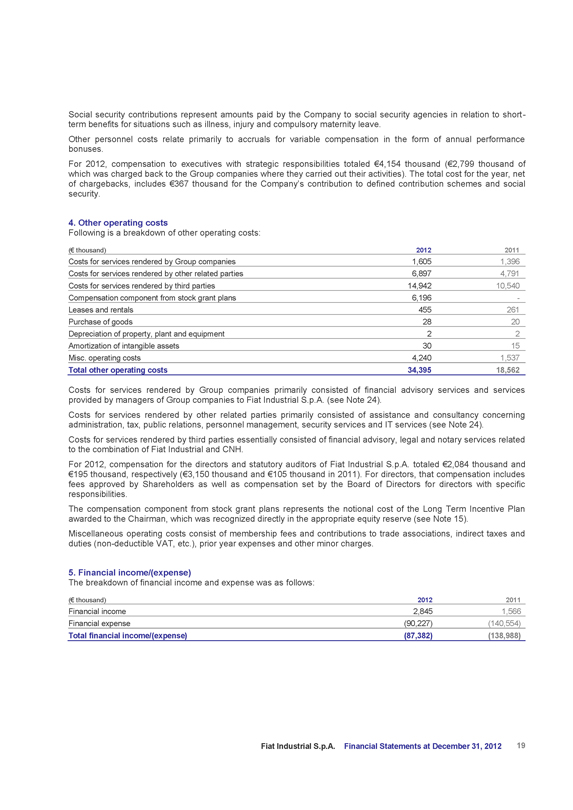

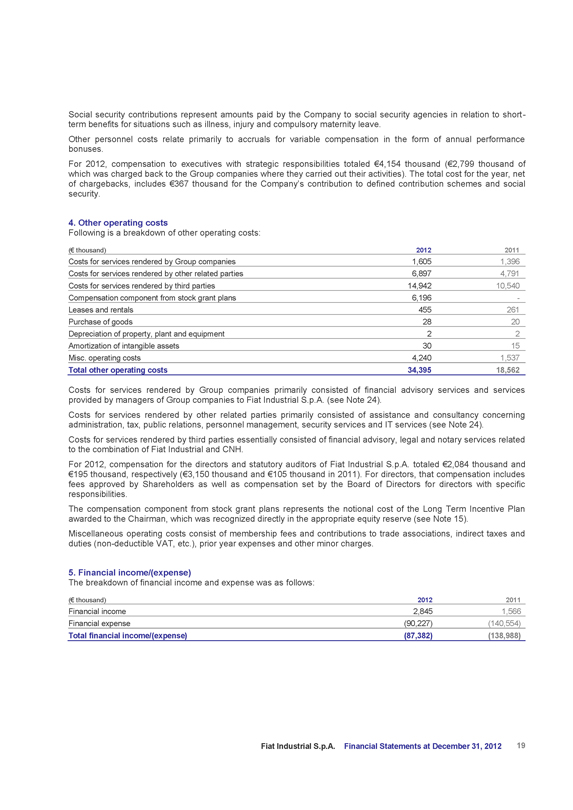

Social security contributions represent amounts paid by the Company to social security agencies in relation to short-term benefits for situations such as illness, injury and compulsory maternity leave.

Other personnel costs relate primarily to accruals for variable compensation in the form of annual performance bonuses.

For 2012, compensation to executives with strategic responsibilities totaled €4,154 thousand (€2,799 thousand of which was charged back to the Group companies where they carried out their activities). The total cost for the year, net of chargebacks, includes €367 thousand for the Company’s contribution to defined contribution schemes and social security.

4. Other operating costs

Following is a breakdown of other operating costs:

(€ thousand)

2012 2011

Costs for services rendered by Group companies

1,605 1,396

Costs for services rendered by other related parties

6,897 4,791

Costs for services rendered by third parties

14,942 10,540

Compensation component from stock grant plans

6,196 -

Leases and rentals

455 261

Purchase of goods

28 20

Depreciation of property, plant and equipment

2 2

Amortization of intangible assets

30 15

Misc. operating costs

4,240 1,537

Total other operating costs

34,395 18,562

Costs for services rendered by Group companies primarily consisted of financial advisory services and services provided by managers of Group companies to Fiat Industrial S.p.A. (see Note 24).

Costs for services rendered by other related parties primarily consisted of assistance and consultancy concerning administration, tax, public relations, personnel management, security services and IT services (see Note 24).

Costs for services rendered by third parties essentially consisted of financial advisory, legal and notary services related to the combination of Fiat Industrial and CNH.

For 2012, compensation for the directors and statutory auditors of Fiat Industrial S.p.A. totaled €2,084 thousand and €195 thousand, respectively (€3,150 thousand and €105 thousand in 2011). For directors, that compensation includes fees approved by Shareholders as well as compensation set by the Board of Directors for directors with specific responsibilities.

The compensation component from stock grant plans represents the notional cost of the Long Term Incentive Plan awarded to the Chairman, which was recognized directly in the appropriate equity reserve (see Note 15).

Miscellaneous operating costs consist of membership fees and contributions to trade associations, indirect taxes and duties (non-deductible VAT, etc.), prior year expenses and other minor charges.

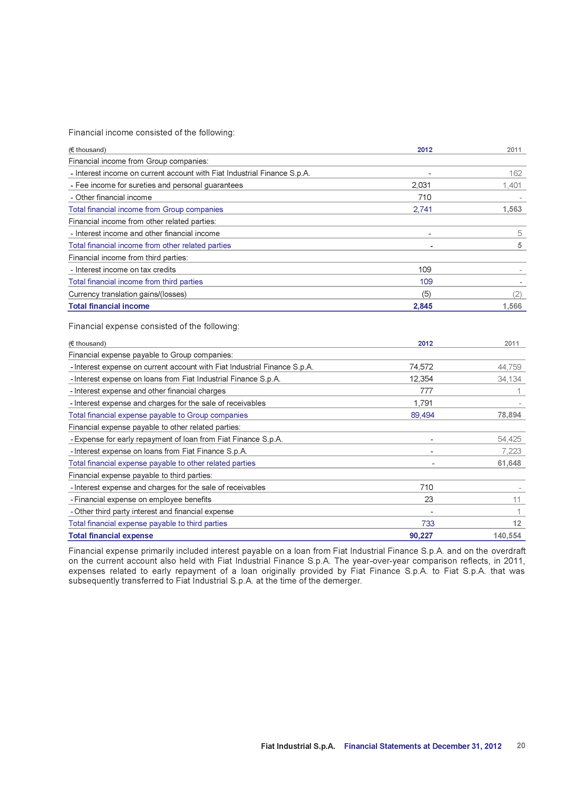

5. Financial income/(expense)

The breakdown of financial income and expense was as follows:

(€ thousand) 2012 2011

Financial income 2,845 1,566 Financial expense (90,227) (140,554)

Total financial income/(expense) (87,382) (138,988)

Fiat Industrial S.p.A. Financial Statements at December 31, 2012

19

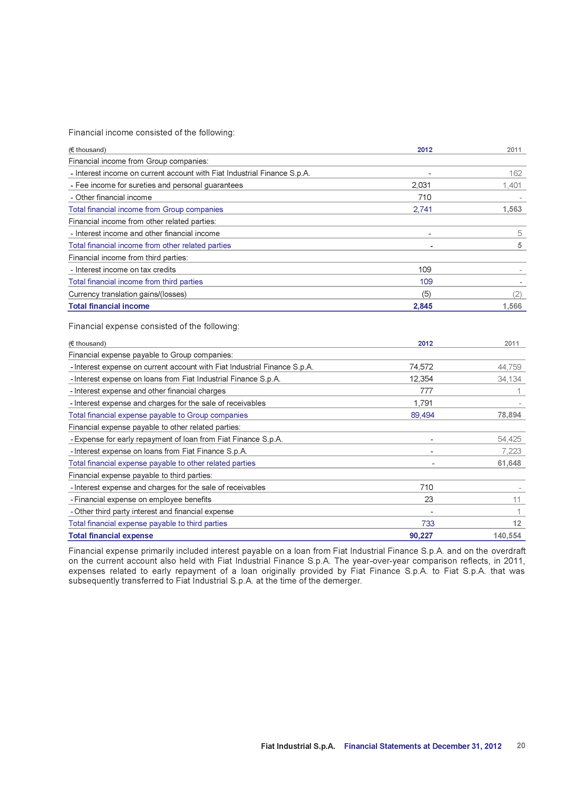

Financial income consisted of the following:

(€ thousand)

2012 2011

Financial income from Group companies:

- Interest income on current account with Fiat Industrial Finance S.p.A.

- 162 - Fee income for sureties and personal guarantees

2,031 1,401

- Other financial income

710 -

Total financial income from Group companies 2,741 1,563

Financial income from other related parties:

- Interest income and other financial income

- 5 Total financial income from other related parties

- 5 Financial income from third parties:

- Interest income on tax credits

109 -

Total financial income from third parties

109 -

Currency translation gains/(losses)

(5) (2)

Total financial income

2,845 1,566

Financial expense consisted of the following:

(€ thousand) 2012 2011

Financial expense payable to Group companies:

- Interest expense on current account with Fiat Industrial Finance S.p.A.

74,572 44,759

- Interest expense on loans from Fiat Industrial Finance S.p.A.

12,354 34,134

- Interest expense and other financial charges

777 1

- Interest expense and charges for the sale of receivables

1,791 -

Total financial expense payable to Group companies

89,494 78,894

Financial expense payable to other related parties:

- Expense for early repayment of loan from Fiat Finance S.p.A.

- 54,425

- Interest expense on loans from Fiat Finance S.p.A.

- 7,223

Total financial expense payable to other related parties

- 61,648

Financial expense payable to third parties:

- Interest expense and charges for the sale of receivables

710 -

- Financial expense on employee benefits

23 11

- Other third party interest and financial expense

- 1

Total financial expense payable to third parties

733 12

Total financial expense

90,227 140,554

Financial expense primarily included interest payable on a loan from Fiat Industrial Finance S.p.A. and on the overdraft on the current account also held with Fiat Industrial Finance S.p.A. The year-over-year comparison reflects, in 2011, expenses related to early repayment of a loan originally provided by Fiat Finance S.p.A. to Fiat S.p.A. that was subsequently transferred to Fiat Industrial S.p.A. at the time of the demerger.

Fiat Industrial S.p.A. Financial Statements at December 31, 2012

20

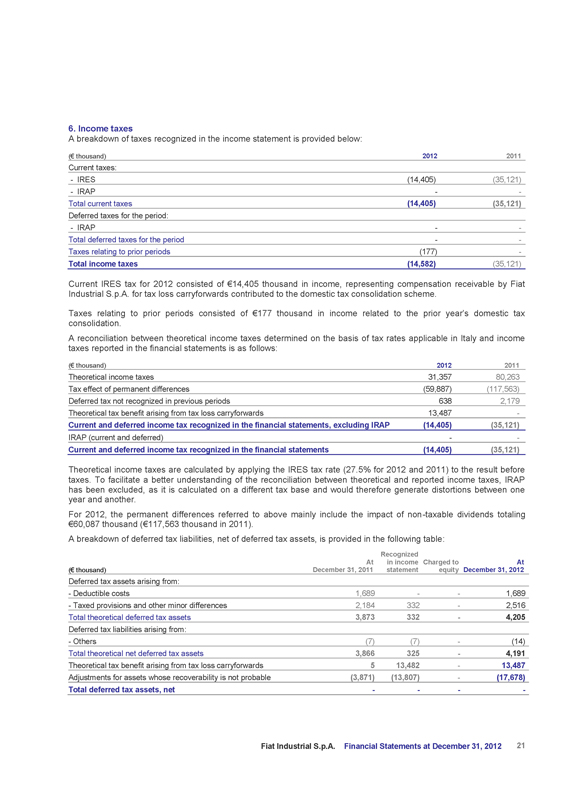

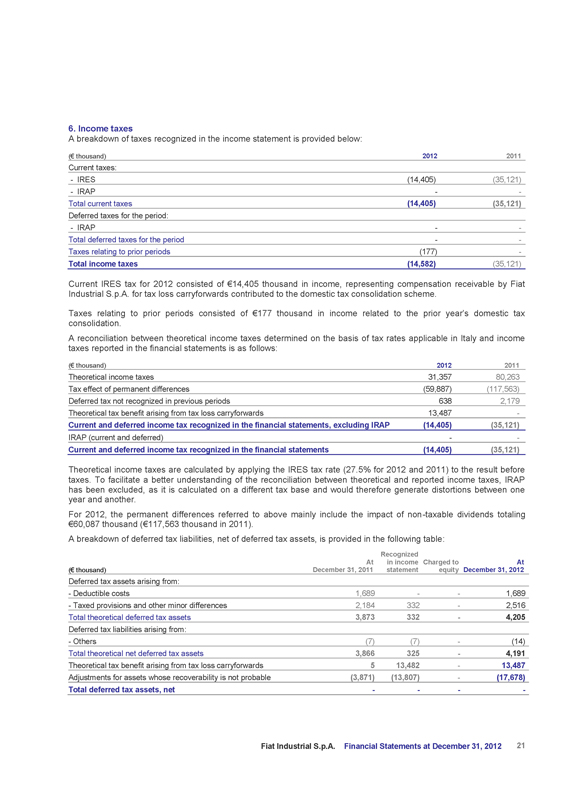

6. Income taxes

A breakdown of taxes recognized in the income statement is provided below:

(€ thousand) 2012 2011

Current taxes:

- IRES (14,405) (35,121)

- IRAP - -

Total current taxes (14,405) (35,121)

Deferred taxes for the period:

- IRAP - -

Total deferred taxes for the period - -

Taxes relating to prior periods (177) -

Total income taxes (14,582) (35,121)

Current IRES tax for 2012 consisted of €14,405 thousand in income, representing compensation receivable by Fiat

Industrial S.p.A. for tax loss carryforwards contributed to the domestic tax consolidation scheme.

Taxes relating to prior periods consisted of €177 thousand in income related to the prior year’s domestic tax consolidation.

A reconciliation between theoretical income taxes determined on the basis of tax rates applicable in Italy and income taxes reported in the financial statements is as follows:

(€ thousand)

2012 2011 Theoretical income taxes 31,357 80,263

Tax effect of permanent differences (59,887) (117,563)

Deferred tax not recognized in previous periods 638 2,179

Theoretical tax benefit arising from tax loss carryforwards 13,487 -

Current and deferred income tax recognized in the financial statements, excluding IRAP

(14,405) (35,121) IRAP (current and deferred) - -

Current and deferred income tax recognized in the financial statements (14,405) (35,121)

Theoretical income taxes are calculated by applying the IRES tax rate (27.5% for 2012 and 2011) to the result before taxes. To facilitate a better understanding of the reconciliation between theoretical and reported income taxes, IRAP has been excluded, as it is calculated on a different tax base and would therefore generate distortions between one year and another.

For 2012, the permanent differences referred to above mainly include the impact of non-taxable dividends totaling

€60,087 thousand (€117,563 thousand in 2011).

A breakdown of deferred tax liabilities, net of deferred tax assets, is provided in the following table:

(€ thousand) At December 31, 2011 Recognized in income statement Charged to equity At December 31, 2012

Deferred tax assets arising from:

- Deductible costs

1,689 - - 1,689 - Taxed provisions and other minor differences

2,184 332 - 2,516

Total theoretical deferred tax assets

3,873 332 -

4,205 Deferred tax liabilities arising from:

- Others (7) (7) - (14)

Total theoretical net deferred tax assets

3,866 325 - 4,191 Theoretical tax benefit arising from tax loss carryforwards

5 13,482 - 13,487

Adjustments for assets whose recoverability is not probable

(3,871) (13,807) - (17,678)

Total deferred tax assets, net - - - -

Fiat Industrial S.p.A. Financial Statements at December 31, 2012

21

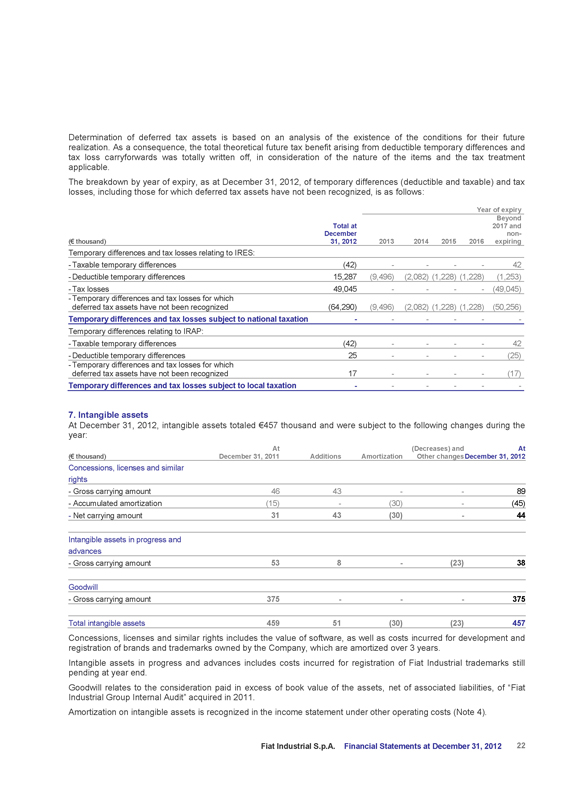

Determination of deferred tax assets is based on an analysis of the existence of the conditions for their future realization. As a consequence, the total theoretical future tax benefit arising from deductible temporary differences and tax loss carryforwards was totally written off, in consideration of the nature of the items and the tax treatment applicable.

The breakdown by year of expiry, as at December 31, 2012, of temporary differences (deductible and taxable) and tax losses, including those for which deferred tax assets have not been recognized, is as follows:

Year of expiry

(€ thousand) Total at December 31, 2012 2013 2014 2015 2016 Beyond 2017 and non-expiring

Temporary differences and tax losses relating to IRES:

- Taxable temporary differences

(42) - - - -

42 - Deductible temporary differences

15,287 (9,496) (2,082) (1,228) (1,228) (1,253) - Tax losses 49,045 - - - - (49,045)

- Temporary differences and tax losses for which deferred tax assets have not been recognized

(64,290) (9,496) (2,082) (1,228) (1,228) (50,256)

Temporary differences and tax losses subject to national taxation - - - - - -

Temporary differences relating to IRAP: - Taxable temporary differences

(42) - - - - 42 - Deductible temporary differences

25 - - - - (25)

- Temporary differences and tax losses for which deferred tax assets have not been recognized

17 - - - -

(17)

Temporary differences and tax losses subject to local taxation

- - - - - -

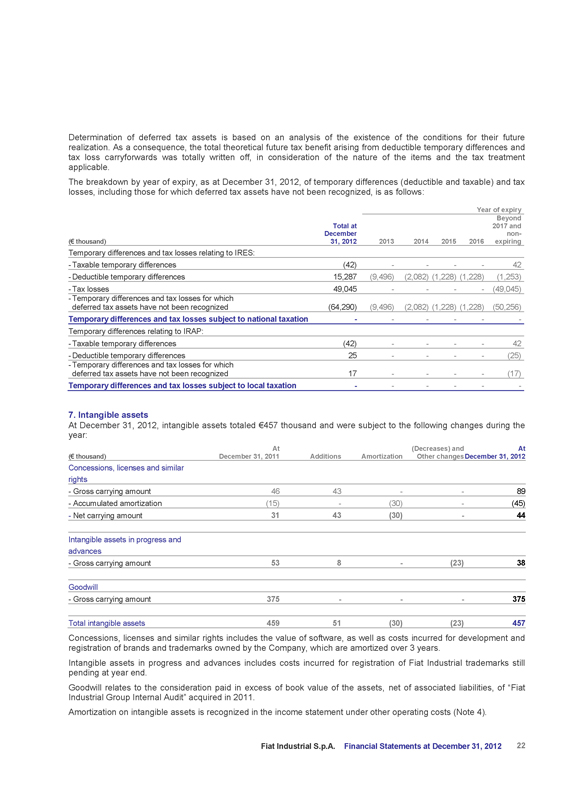

7. Intangible assets

At December 31, 2012, intangible assets totaled €457 thousand and were subject to the following changes during the year:

(€ thousand) At December 31, 2011 Additions Amortization (Decreases) and Other changes At December 31, 2012

Concessions, licenses and similar rights

- Gross carrying amount

46 43 - - 89 - Accumulated amortization (15) - (30) - (45) - Net carrying amount 31 43 (30) -

44 Intangible assets in progress and advances

- Gross carrying amount 53 8 - (23) 38 Goodwill

- Gross carrying amount

375 - - 375

Total intangible assets 459 51(30) (23) 457

Concessions, licenses and similar rights includes the value of software, as well as costs incurred for development and registration of brands and trademarks owned by the Company, which are amortized over 3 years.

Intangible assets in progress and advances includes costs incurred for registration of Fiat Industrial trademarks still pending at year end.

Goodwill relates to the consideration paid in excess of book value of the assets, net of associated liabilities, of “Fiat Industrial Group Internal Audit” acquired in 2011.

Amortization on intangible assets is recognized in the income statement under other operating costs (Note 4).

Fiat Industrial S.p.A. Financial Statements at December 31, 2012

22

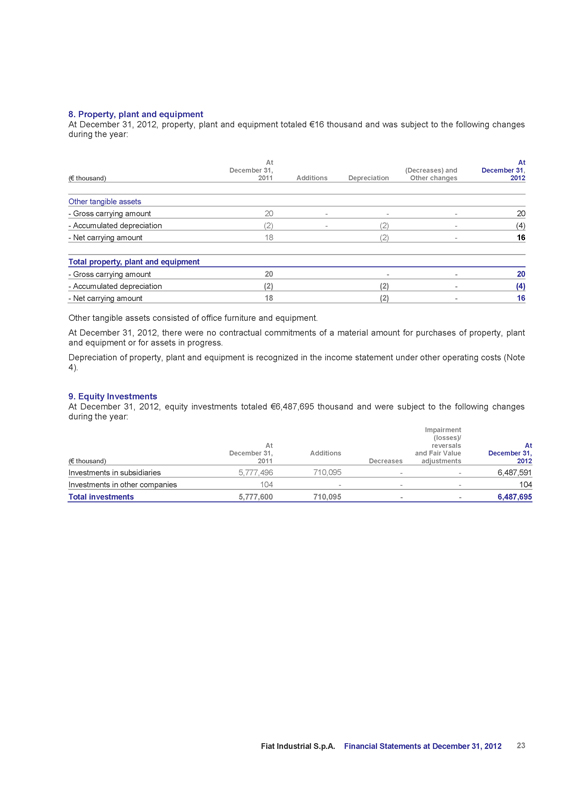

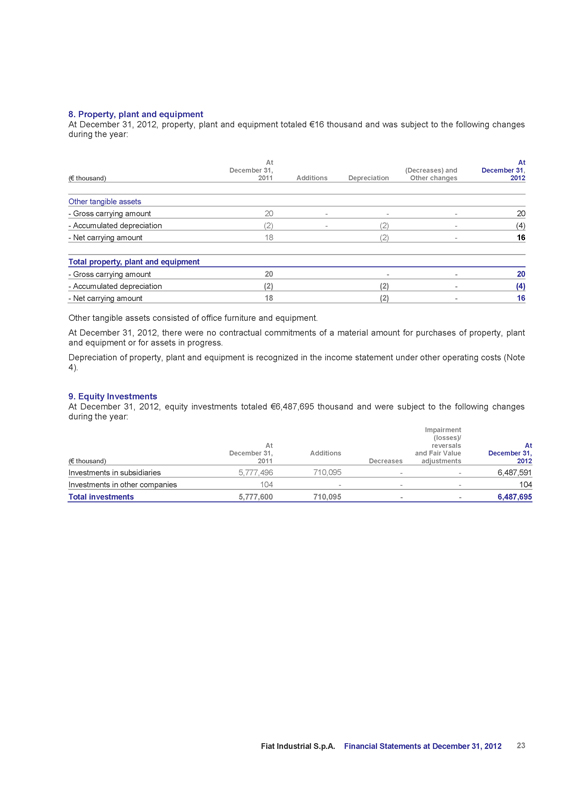

8. Property, plant and equipment

At December 31, 2012, property, plant and equipment totaled €16 thousand and was subject to the following changes during the year:

(€ thousand) At December 31, 2011 Additions Depreciation (Decreases) and Other changes At December 31, 2012

Other tangible assets

- Gross carrying amount

20 - - - 20 - Accumulated depreciation (2) - (2) - (4) - Net carrying amount 18 (2) - 16 Total property, plant and equipment

- Gross carrying amount 20 - - 20 - Accumulated depreciation (2) (2) - (4) - Net carrying amount 18 (2) - 16

Other tangible assets consisted of office furniture and equipment.

At December 31, 2012, there were no contractual commitments of a material amount for purchases of property, plant and equipment or for assets in progress.

Depreciation of property, plant and equipment is recognized in the income statement under other operating costs (Note 4).

9. Equity Investments

At December 31, 2012, equity investments totaled €6,487,695 thousand and were subject to the following changes during the year:

(€ thousand) At December 31, 2011 Additions Decreases Impairment (losses)/reversals and Fair Value adjustments

At December 31, 2012

Investments in subsidiaries

5,777,496 710,095 - - 6,487,591

Investments in other companies

104 - - - 104

Total investments

5,777,600 710,095 - - 6,487,695

Fiat Industrial S.p.A. Financial Statements at December 31, 2012

23

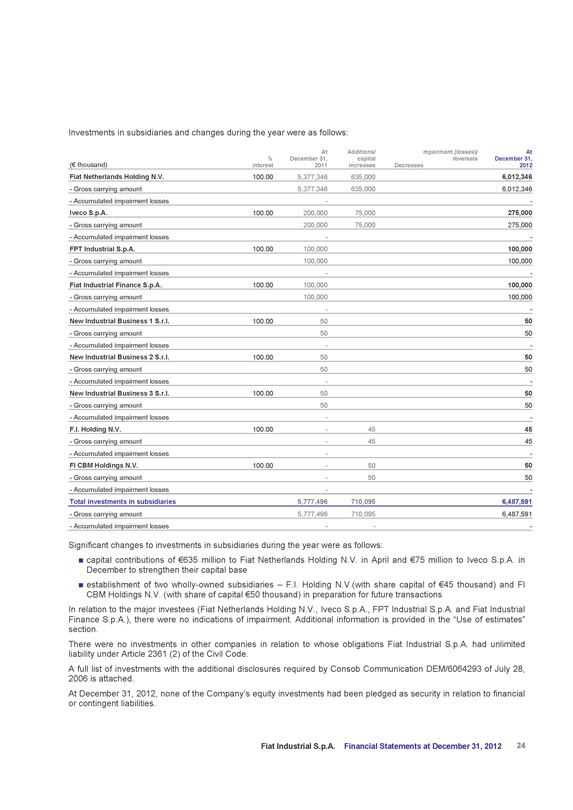

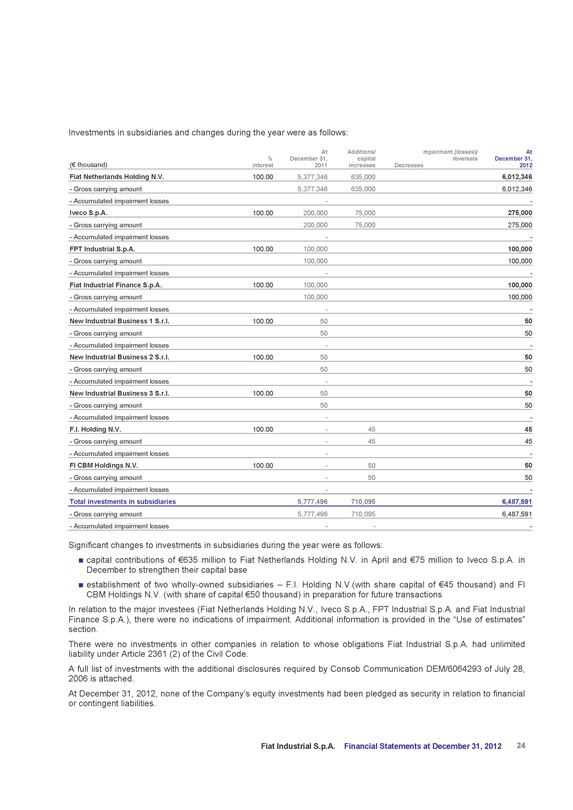

Investments in subsidiaries and changes during the year were as follows:

(€ thousand) % interest At December 31, 2011 Additions/capital increases Decreases mpairment (losses)/reversals At December 31, 2012

Fiat Netherlands Holding N.V. 100.00 5,377,346 635,000 6,012,346

- Gross carrying amount 5,377,346 635,000 6,012,346

- Accumulated impairment losses - -

Iveco S.p.A. 100.00 200,000 75,000 275,000

- Gross carrying amount 200,000 75,000 275,000

- Accumulated impairment losses - -

FPT Industrial S.p.A. 100.00 100,000 100,000

- Gross carrying amount 100,000 100,000

- Accumulated impairment losses - -

Fiat Industrial Finance S.p.A. 100.00 100,000 100,000

- Gross carrying amount 100,000 100,000

- Accumulated impairment losses - -

New Industrial Business 1 S.r.l. 100.00 50 50

- Gross carrying amount 50 50

- Accumulated impairment losses - -

New Industrial Business 2 S.r.l. 100.00 50 50

- Gross carrying amount 50 50

- Accumulated impairment losses - -

New Industrial Business 3 S.r.l. 100.00 50 50

- Gross carrying amount 50 50

- Accumulated impairment losses - -

F.I. Holding N.V. 100.00 - 45 45

- Gross carrying amount - 45 45

- Accumulated impairment losses - -

FI CBM Holdings N.V. 100.00 - 50 50

- Gross carrying amount - 50 50

- Accumulated impairment losses - -

Total investments in subsidiaries 5,777,496 710,095 6,487,591

- Gross carrying amount 5,777,496 710,095 6,487,591

- Accumulated impairment losses - - -

Significant changes to investments in subsidiaries during the year were as follows:

capital contributions of €635 million to Fiat Netherlands Holding N.V. in April and €75 million to Iveco S.p.A. in December to strengthen their capital base

establishment of two wholly-owned subsidiaries - F.I. Holding N.V.(with share capital of €45 thousand) and FI CBM Holdings N.V. (with share of capital €50 thousand) in preparation for future transactions

In relation to the major investees (Fiat Netherlands Holding N.V., Iveco S.p.A., FPT Industrial S.p.A. and Fiat Industrial

Finance S.p.A.), there were no indications of impairment. Additional information is provided in the “Use of estimates” section.

There were no investments in other companies in relation to whose obligations Fiat Industrial S.p.A. had unlimited liability under Article 2361 (2) of the Civil Code.

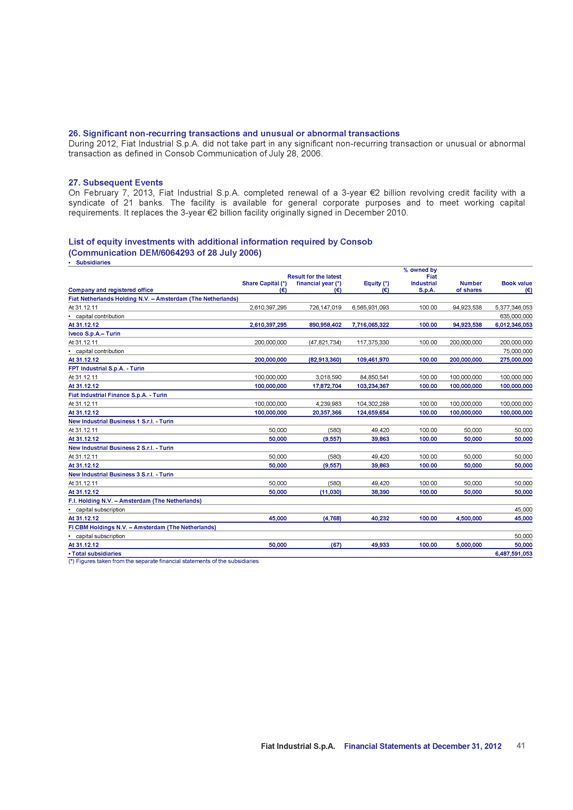

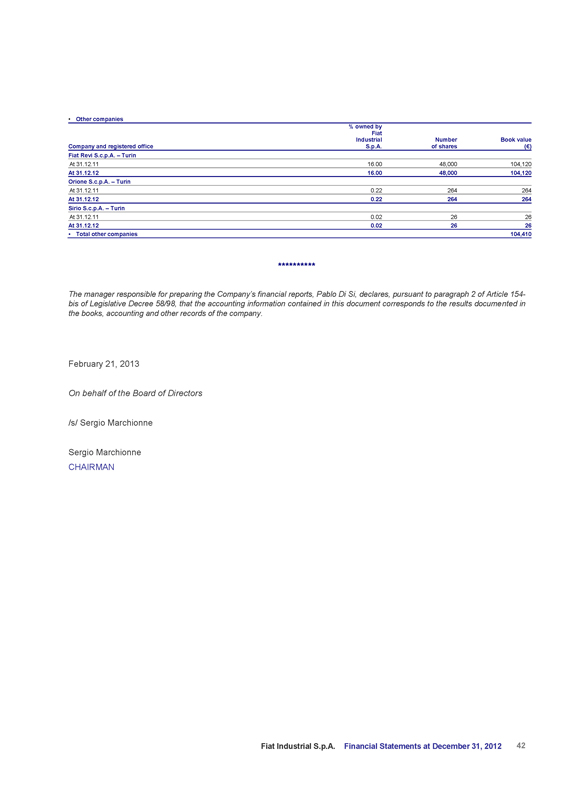

A full list of investments with the additional disclosures required by Consob Communication DEM/6064293 of July 28, 2006 is attached.

At December 31, 2012, none of the Company’s equity investments had been pledged as security in relation to financial or contingent liabilities.

Fiat Industrial S.p.A. Financial Statements at December 31, 2012

24

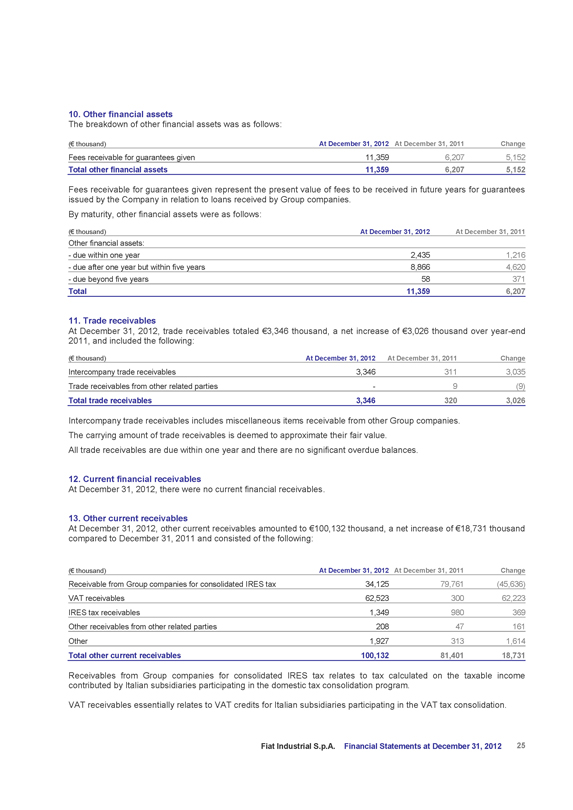

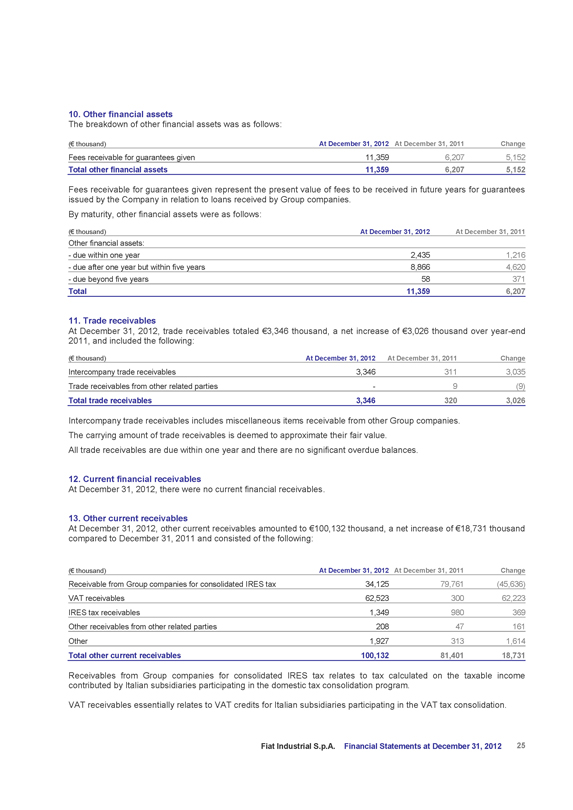

10. Other financial assets

The breakdown of other financial assets was as follows:

(€ thousand) At December 31, 2012 At December 31, 2011 Change

Fees receivable for guarantees given 11,359 6,207 5,152

Total other financial assets 11,359 6,207 5,152

Fees receivable for guarantees given represent the present value of fees to be received in future years for guarantees issued by the Company in relation to loans received by Group companies.

By maturity, other financial assets were as follows:

(€ thousand) At December 31, 2012 At December 31, 2011

Other financial assets:

- due within one year 2,435 1,216

- due after one year but within five years 8,866 4,620

- due beyond five years 58 371

Total 11,359 6,207

11. Trade receivables

At December 31, 2012, trade receivables totaled €3,346 thousand, a net increase of €3,026 thousand over year-end

2011, and included the following:

(€ thousand) At December 31, 2012 At December 31, 2011 Change

Intercompany trade receivables 3,346 311 3,035

Trade receivables from other related parties - 9 (9)

Total trade receivables 3,346 320 3,026

Intercompany trade receivables includes miscellaneous items receivable from other Group companies. The carrying amount of trade receivables is deemed to approximate their fair value.

All trade receivables are due within one year and there are no significant overdue balances.

12. Current financial receivables

At December 31, 2012, there were no current financial receivables.

13. Other current receivables

At December 31, 2012, other current receivables amounted to €100,132 thousand, a net increase of €18,731 thousand compared to December 31, 2011 and consisted of the following:

(€ thousand) At December 31, 2012 At December 31, 2011 Change

Receivable from Group companies for consolidated IRES tax 34,125 79,761 (45,636)

VAT receivables 62,523 300 62,223

IRES tax receivables 1,349 980 369

Other receivables from other related parties 208 47 161

Other 1,927 313 1,614

Total other current receivables 100,132 81,401 18,731

Receivables from Group companies for consolidated IRES tax relates to tax calculated on the taxable income contributed by Italian subsidiaries participating in the domestic tax consolidation program.

VAT receivables essentially relates to VAT credits for Italian subsidiaries participating in the VAT tax consolidation.

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 25

IRES tax receivables include credits transferred to Fiat Industrial S.p.A. by Italian subsidiaries participating in the domestic tax consolidation program for 2012 and 2011.

The items other receivables from other related parties and other consist of miscellaneous amounts receivable. The carrying amount of other current receivables is deemed to approximate their fair value.

Other current receivables are almost entirely due within one year.

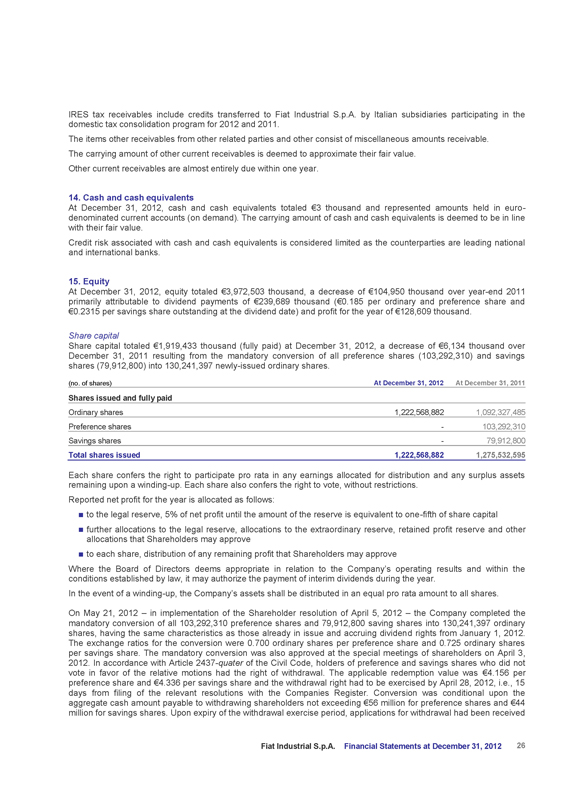

14. Cash and cash equivalents

At December 31, 2012, cash and cash equivalents totaled €3 thousand and represented amounts held in euro-denominated current accounts (on demand). The carrying amount of cash and cash equivalents is deemed to be in line with their fair value.

Credit risk associated with cash and cash equivalents is considered limited as the counterparties are leading national and international banks.

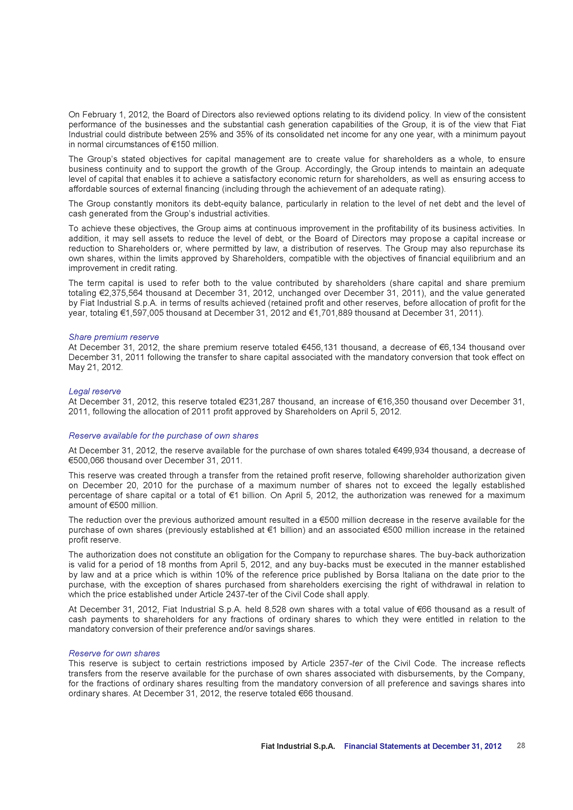

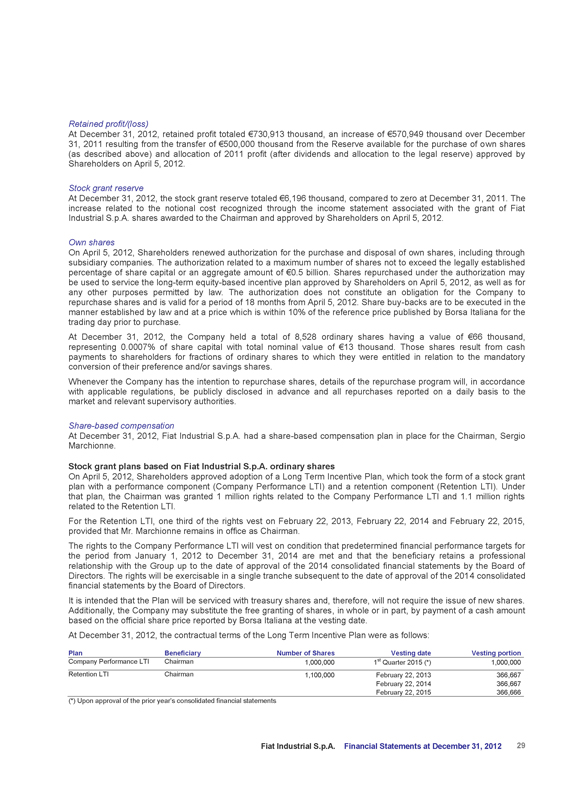

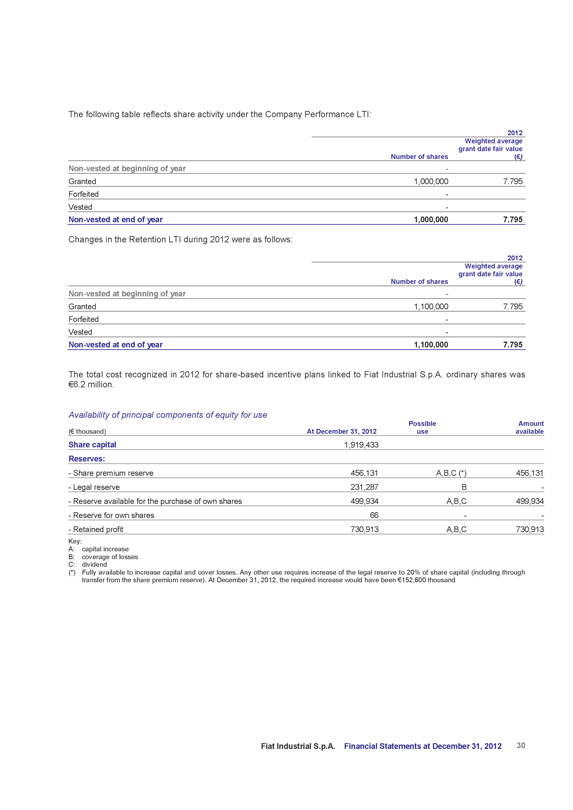

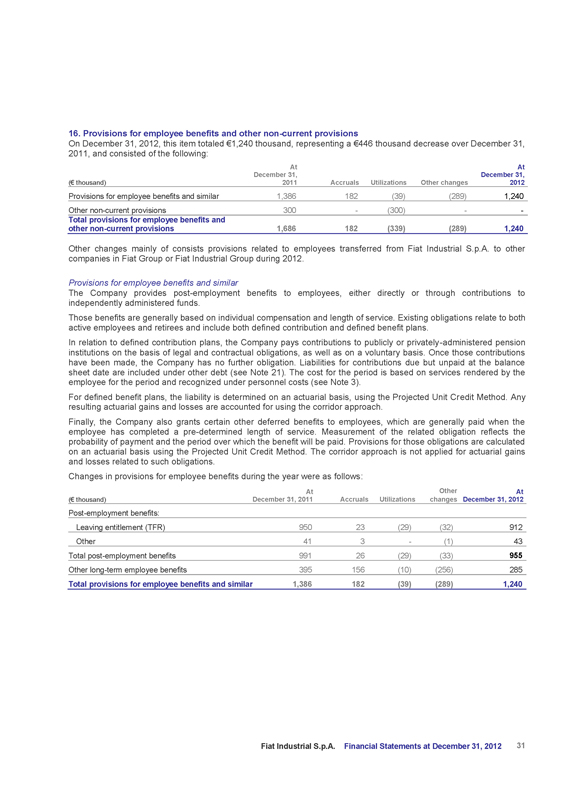

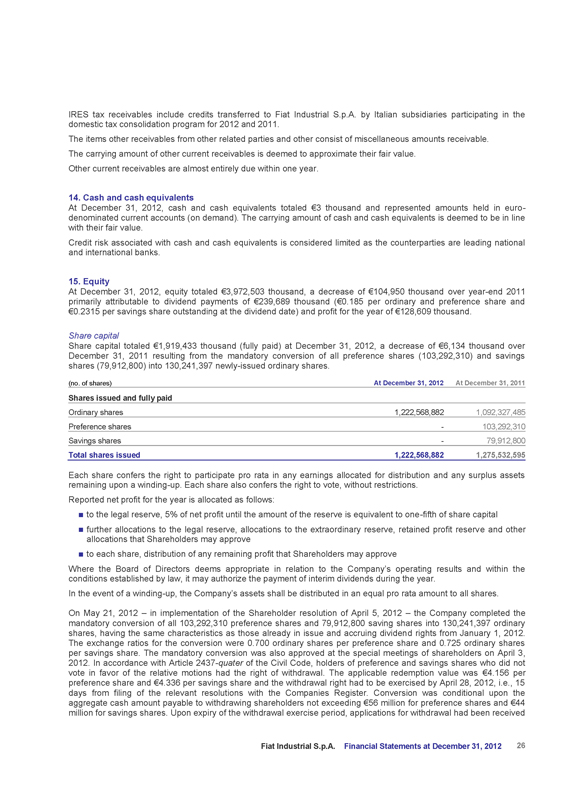

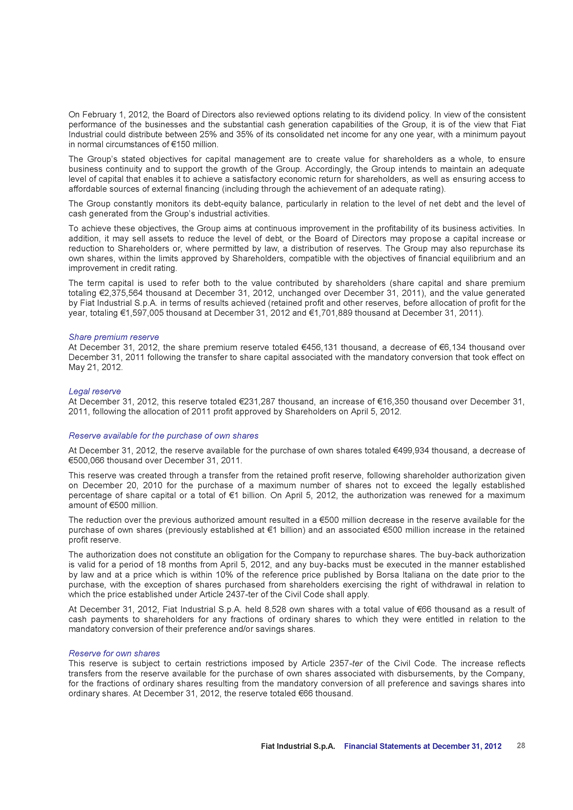

15. Equity

At December 31, 2012, equity totaled €3,972,503 thousand, a decrease of €104,950 thousand over year-end 2011 primarily attributable to dividend payments of €239,689 thousand (€0.185 per ordinary and preference share and €0.2315 per savings share outstanding at the dividend date) and profit for the year of €128,609 thousand.

Share capital

Share capital totaled €1,919,433 thousand (fully paid) at December 31, 2012, a decrease of €6,134 thousand over

December 31, 2011 resulting from the mandatory conversion of all preference shares (103,292,310) and savings shares (79,912,800) into 130,241,397 newly-issued ordinary shares.

(no. of shares) At December 31, 2012 At December 31, 2011

Shares issued and fully paid

Ordinary shares 1,222,568,882 1,092,327,485

Preference shares - 103,292,310

Savings shares - 79,912,800

Total shares issued 1,222,568,882 1,275,532,595

Each share confers the right to participate pro rata in any earnings allocated for distribution and any surplus assets remaining upon a winding-up. Each share also confers the right to vote, without restrictions.

Reported net profit for the year is allocated as follows:

to the legal reserve, 5% of net profit until the amount of the reserve is equivalent to one-fifth of share capital

further allocations to the legal reserve, allocations to the extraordinary reserve, retained profit reserve and other allocations that Shareholders may approve

to each share, distribution of any remaining profit that Shareholders may approve

Where the Board of Directors deems appropriate in relation to the Company’s operating results and within the conditions established by law, it may authorize the payment of interim dividends during the year.

In the event of a winding-up, the Company’s assets shall be distributed in an equal pro rata amount to all shares.

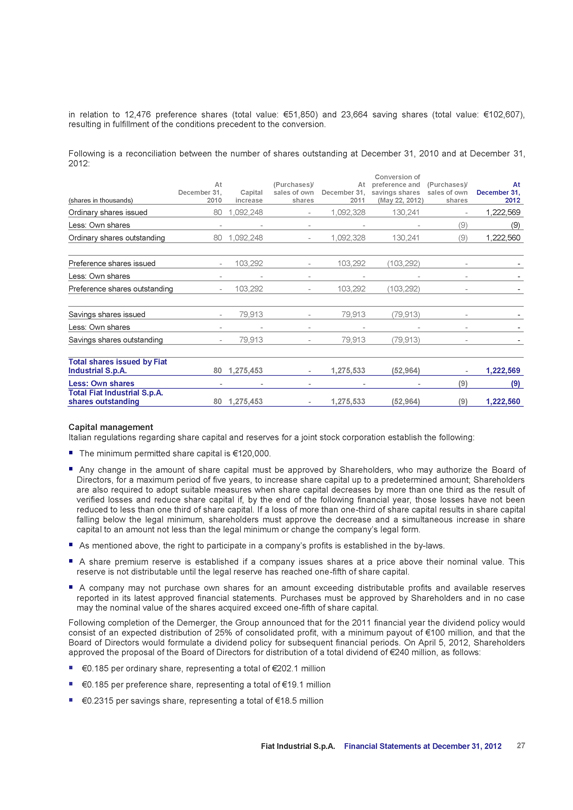

On May 21, 2012 - in implementation of the Shareholder resolution of April 5, 2012 - the Company completed the mandatory conversion of all 103,292,310 preference shares and 79,912,800 saving shares into 130,241,397 ordinary shares, having the same characteristics as those already in issue and accruing dividend rights from January 1, 2012. The exchange ratios for the conversion were 0.700 ordinary shares per preference share and 0.725 ordinary shares per savings share. The mandatory conversion was also approved at the special meetings of shareholders on April 3, 2012. In accordance with Article 2437-quater of the Civil Code, holders of preference and savings shares who did not vote in favor of the relative motions had the right of withdrawal. The applicable redemption value was €4.156 per preference share and €4.336 per savings share and the withdrawal right had to be exercised by April 28, 2012, i.e., 15 days from filing of the relevant resolutions with the Companies Register. Conversion was conditional upon the aggregate cash amount payable to withdrawing shareholders not exceeding €56 million for preference shares and €44 million for savings shares. Upon expiry of the withdrawal exercise period, applications for withdrawal had been received

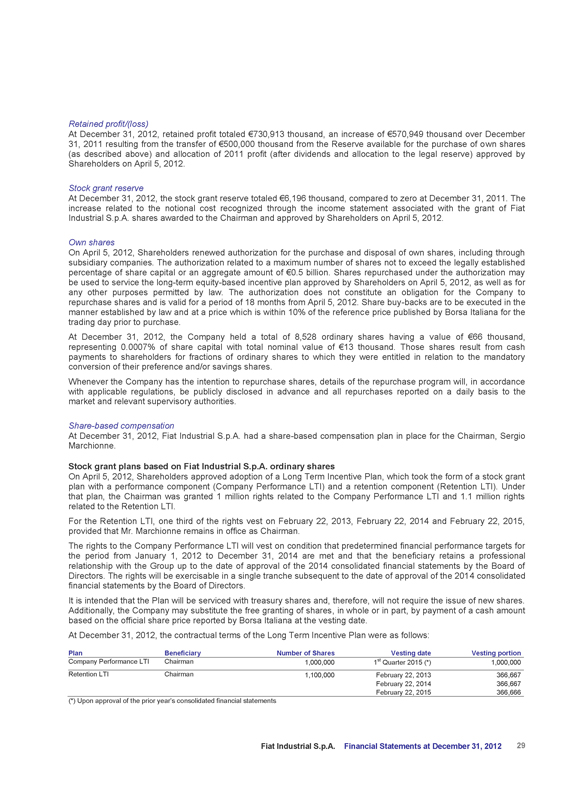

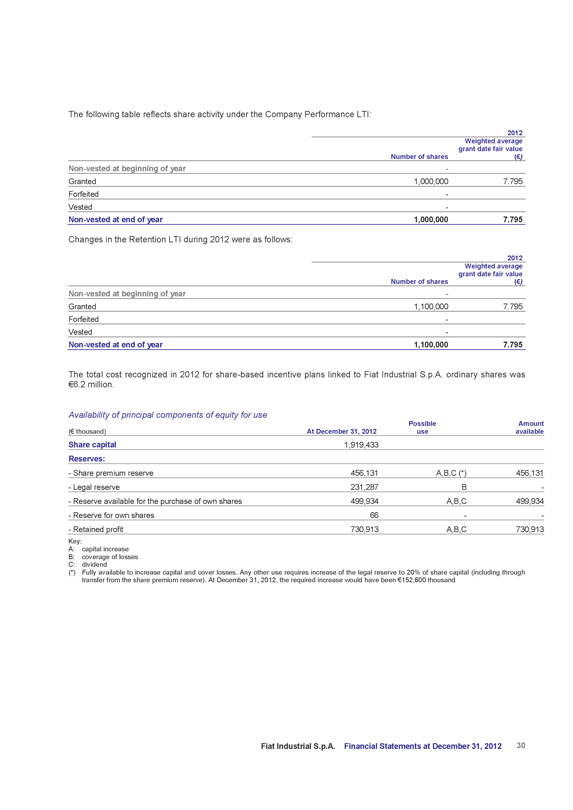

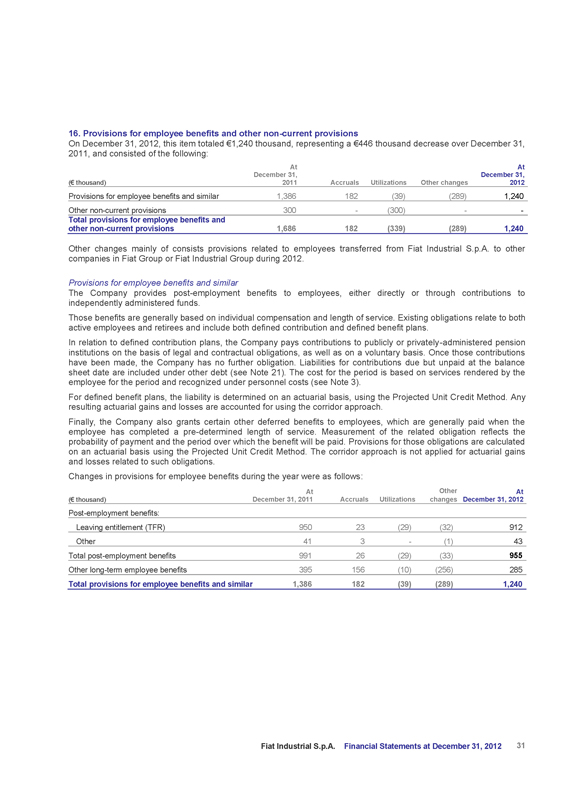

Fiat Industrial S.p.A. Financial Statements at December 31, 2012 26