QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. 5)

| Filed by the Registrant | | ý |

| Filed by a Party other than the Registrant | | o |

| Check the appropriate box: |

| o | | Preliminary proxy statement |

| o | | Confidential, for the Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive proxy statement |

| o | | Definitive additional materials |

| o | | Soliciting Material Pursuant to Rule 240.14a-12 |

WORLD HEART CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | 1) | | Title of each class of securities to which transaction applies: |

|

|

|

|

|

| | | 2) | | Aggregate number of securities to which transaction applies: |

|

|

|

|

|

| | | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined) : |

|

|

|

|

|

| | | 4) | | Proposed maximum aggregate value of transaction: |

|

|

|

|

|

| | | 5) | | Total fee paid: |

|

|

|

|

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | 1) | | Amount previously paid: |

|

|

|

|

|

| | | 2) | | Form, Schedule or Registration Statement No.: |

|

|

|

|

|

| | | 3) | | Filing party: |

|

|

|

|

|

| | | 4) | | Date filed: |

|

|

|

|

|

WORLD HEART CORPORATION

1 Laser Street, Ottawa, Ontario, Canada

K2E 7V1

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Annual and Special Meeting of the Shareholders of World Heart Corporation (WorldHeart) will be held at the Fairmont Royal York Hotel, 100 Front Street West Toronto, Ontario, Canada M5J 1E3 in the Algonquin Room on Monday, July 18, 2005 at 10:00 a.m. for the following purposes:

- 1.

- to receive and to consider the audited consolidated financial statements of WorldHeart for the year ended December 31, 2004, that have been prepared in accordance with generally accepted accounting principles in Canada and the United States, together with the report of the auditors thereon;

- 2.

- to elect directors;

- 3.

- to appoint auditors and to authorize the directors to fix their remuneration;

- 4.

- to consider and, if thought advisable, pass a resolution (the MedQuest Resolution) to approve the issuance of WorldHeart common shares to MedQuest Products, Inc. (MedQuest) in connection with the acquisition by WorldHeart of the business of MedQuest, conditional upon the approval of items 5 and 6 set out in this Notice;

- 5.

- to consider and, if thought advisable, pass a resolution (the Maverick Resolution) to approve the private placement of WorldHeart common shares to Maverick Venture Management, LLC (Maverick), conditional upon the approval of items 4 and 6 set out in this Notice;

- 6.

- to consider and, if thought advisable, pass a resolution approving the reduction of the exercise price of the warrants issued by WorldHeart in September 2004, from $1.55 per common share to $1.00 per common share, for a period of 14 days following the approval of such resolution (the Warrant Amendment Resolution);

- 7.

- to consider and, if thought advisable, to pass a resolution (ESOP Resolution #1) approving an amendment to the World Heart Corporation Employee Stock Option Plan (the Plan) increasing the maximum number of common shares that may be issued under the Plan;

- 8.

- to consider and, if thought advisable, to pass a resolution (ESOP Resolution #2) approving an amendment to the Plan removing the restriction that the aggregate number of shares issued to any person under the Plan be limited to 5% of the issued and outstanding common shares.

- 9.

- to consider and, if thought advisable, to pass a resolution (the Option Amendment Resolution) amending certain options granted to directors and executive officers of WorldHeart, conditional on approval of item 7 set out in this Notice;

- 10.

- to consider and, if thought advisable, to pass a special resolution authorizing the continuance of WorldHeart under theCanada Business Corporations Act (the Continuance Resolution); and

- 11.

- to transact such other business as may properly come before the meeting or any adjournment thereof.

This Notice is accompanied by a Form of Proxy and a Management Information Circular. The holders of common shares of record on June 10, 2005 will be entitled to receive notice of the Annual and Special Meeting of Shareholders.

DATED at Ottawa, Canada, this 13th day of June, 2005.

BY ORDER OF THE BOARD OF DIRECTORS

C. Ian Ross,Chairman

If you are unable to attend the meeting in person, you are invited to complete, sign and return the accompanying Form of Proxy in the envelope provided and the Form of Proxy must be deposited not later than 5:00 p.m. (Ottawa time) on Friday, July 15, 2005 with CIBC Mellon Trust Company, Attention: Proxy Department, 200 Queen's Quay East, Unit #6, Toronto, Ontario, M5A 4K9.

WORLD HEART CORPORATION

MANAGEMENT INFORMATION CIRCULAR

June 13, 2005

SUMMARY

�� The following is a summary of the information provided in this circular and should be read together with the more detailed information and financial data and statements contained elsewhere in this circular.

| MedQuest Products, Inc. | | MedQuest is a development stage medical devices company focused on the development of a non-pulsatile continuous blood flow, or rotary, ventricular assist device. Currently, most heart assist devices intended for chronic use are pulsatile, mimicking the natural heart's pumping action. Continuous blood flow ventricular assist devices (VADs) are expected to be smaller, less complex and valveless, have lower energy needs and be potentially less costly than other VADs. MedQuest has conducted animal trials with respect to its rotary VAD, which incorporates advanced magnetic levitation technology. Human trials of this VAD are expected to commence in 2005. See "MATTERS TO BE ACTED UPON — MedQuest Resolution — Acquisition of MedQuest — MedQuest Business" starting on page 69. |

| Agreement with MedQuest | | We have entered into an agreement, as amended by amendment no. 1, (the MedQuest Agreement), pursuant to which we will: |

| | | • | acquire all of the assets and business of MedQuest (the MedQuest Acquisition); |

| | | • | assume substantially all of MedQuest's contracts and licenses; |

| | | • | assume responsibility for certain liabilities of MedQuest, including amounts outstanding to its majority shareholder, Maverick Venture Management, LLC (Maverick), for loans to fund continuing operations between the date of signing the MedQuest Agreement and completion of the MedQuest Acquisition; |

| | | • | issue 9,300,000 common shares to MedQuest, valued at $1.35 per common share; and |

| | | • | pay $10,000 in cash. |

| | | See "MATTERS TO BE ACTED UPON — MedQuest Resolution — Acquisition of MedQuest — MedQuest Agreement" starting on page 72. |

| Maverick | | Maverick holds approximately 82% of the outstanding common stock of MedQuest and 100% of the outstanding preferred stock of MedQuest. Maverick is a limited liability company controlled by Kevin Compton. |

| Agreement with Maverick | | Concurrently with the MedQuest Agreement, we have entered into an agreement, as amended by amendment no. 1, (the Maverick Agreement) with MedQuest's majority shareholder, Maverick, pursuant to which, we will: |

| | | • | issue 8,888,889 common shares to Maverick at a price of $1.35 per common share for total gross proceeds of $12,000,000; and |

| | | • | pay $3,500,000 owed to Maverick by MedQuest for loans to fund the continuing operations of MedQuest between the date of signing the MedQuest Agreement and closing of the MedQuest Acquisition. |

1

|

|

|

|

|

|

See "MATTERS TO BE ACTED UPON — Maverick Resolution — Private Placement to Maverick — Maverick Agreement" starting on page 78. |

Reasons for seeking approval from shareholders |

|

Under the terms of the MedQuest Agreement and the Maverick Agreement, we will, subject to the approval of our shareholders and the satisfaction of certain conditions, issue an aggregate of 18,188,889 common shares. The rules of the Nasdaq National Market (NASDAQ) and the Toronto Stock Exchange (TSX) require us to seek shareholder approval whenever we propose to issue shares in such an amount that the recipient of the shares will have enough voting power to materially affect the control of WorldHeart. Because of Maverick's substantial equity interest in MedQuest, the stock exchange rules state that shares issued to MedQuest and to Maverick must be aggregated in determining whether control of WorldHeart is materially affected by the proposed transactions. The acquisition of MedQuest and concurrent private placement to Maverick will result in MedQuest and Maverick holding in aggregate approximately one third of the outstanding common shares of WorldHeart assuming the proposed conversion of the debentures and exercise of the warrants. See "MATTERS TO BE ACTED UPON — MedQuest Resolution — Acquisition of MedQuest — Regulatory Approvals" starting on page 66 and " — Maverick Resolution — Private Placement to Maverick — Regulatory Approvals" starting on page 78. |

Recommendation of the Board |

|

The board of directors considered various positive and negative factors in assessing the MedQuest Acquisition and concurrent private placement. These factors are described in detail in the section "MATTERS TO BE ACTED UPON — MedQuest Resolution — Acquisition of MedQuest" and " — Maverick Resolution — Private Placement to Maverick". After careful consideration, the board of directors concluded that the MedQuest Acquisition and private placement to Maverick are in the best interests of WorldHeart. |

|

|

The board of directors recommends that shareholdersvote for the resolution approving the issuance of common shares in connection with the MedQuest Acquisition and the Maverick private placement. |

Effects on Shareholders |

|

As a result of the number of common shares being issued pursuant to the MedQuest Agreement and the Maverick Agreement there will be significant dilution of existing shareholders' equity interests in WorldHeart. |

|

|

Assuming the issuance of 9,300,000 common shares to MedQuest and without regard to the other issuances proposed in this circular, the voting power of each common share would be reduced by 35.2%. Assuming the issuance of 8,888,889 shares to Maverick and without regard to the other issuances proposed in this circular, the voting power of each common share would be reduced by 34.2%. The combined effect of the issuances to MedQuest and Maverick without regard to the other issuances proposed in this circular is that the voting power of each common share will be reduced by 51.6%. |

As a condition to the closing of the MedQuest Acquisition and Maverick private placement, the holders of debentures convertible into, and warrants to purchase, WorldHeart common shares issued in September 2004

2

must convert their debentures and exercise their warrants, if shareholders approve the amendment to the warrant exercise price of $1.00 per common share at this Annual and Special Meeting. Under their terms, the debentures are convertible and the warrants are exercisable at the option of the holder at any time up to September 15, 2009. As an inducement for the exercise of the warrants we have agreed to amend the warrants, and to make a tender offer to exchange amended warrants, subject to shareholder approval, to reduce the exercise price from $1.55 per common share to $1.00 per common share for a period of up to 14 days following approval by our shareholders. See "MATTERS TO BE ACTED UPON — Warrant Amendment Resolution — Amendment to September 2004 Warrants" starting on page 84.

Assuming the conversion of all debentures and exercise of all warrants, and without regard to the other issuances proposed in this circular, the voting power of each common share will be reduced by 53.85%. The combined effect of the conversion of all debentures and exercise of all warrants, and the issuances to MedQuest and Maverick, is that the voting power of each common share will be reduced by 69.06%.

The board of directors believes the amendment to the exercise price of the warrants is in the best interests of WorldHeart and recommends that shareholdersvote for the warrant amendment resolution.

WorldHeart is dependent on its ability to attract and retain qualified scientific, technical and key management personnel. In accordance with the revised WorldHeart strategic plan adopted by the board of directors in August 2004 and a revised approach to compensation of its employees, including its executive officers and key employees. The board of directors determined that at present, cash incentives should be reduced and the long term equity component of the compensation of WorldHeart's executive officers and key employees should be increased whereby on an aggregate basis executive officers and key employees should be entitled to hold up to 10% of the common shares of WorldHeart on a fully diluted basis. The board of directors determined that such a long term equity component would create greater incentive for the WorldHeart executive officers and key employees.

In order to achieve the objectives of the revised approach to compensation, WorldHeart needs to amend its employee stock option plan, as amended and restated on January 31, 2004 (the Plan), to increase the maximum number of common shares which may be issued under the Plan from 1,501,857 common shares to 9,772,505 common shares, and to remove from the Plan the restriction that the aggregate number of shares issued to any person under the Plan be limited to 5% of the issued and outstanding common shares, from time to time. See "MATTERS TO BE ACTED UPON — ESOP Resolution #1 and ESOP Resolution #2 — Amendments to the World Heart Corporation Employee Stock Option Plan" starting on page 85.

In the event that none of the issuances proposed in this circular are approved and the number of common shares available under the Plan is increased, the Plan will constitute 18% of the issued and outstanding common shares and 12% of the fully diluted common shares.

The board of directors believes the amendments to the Plan are in the best interests of WorldHeart and recommends that shareholdersvote for the Plan amendment resolutions.

In addition to the amendments to the Plan, our shareholders are also being asked to approve certain amendments to options held by executive officers and directors of WorldHeart. On September 23, 2004, the executive officers and directors of WorldHeart agreed to forfeit conditionally certain options held by them, none of which had an exercise price that was at or below the then-current market price of our common shares, and also received a new grant of options conditional on shareholder approval. For stock exchange purposes, the forfeiture and new grant of options are regarded as amendments to the existing options held by the executive officers and directors and are treated as having the effect of repricing the forfeited options, and because these individuals are insiders of WorldHeart, approval of our disinterested shareholders is required in respect of the amendments to these options. For a complete list of the forfeited options and grant of new options, see "MATTERS TO BE ACTED UPON — Option Amendment Resolution — Amendment to Certain Options Held by Executive Officers and Directors" starting at page 89.

3

The board of directors believes the amendments to certain options held by executive officers and directors are in the best interests of WorldHeart and recommends that shareholdersvote for the option amendment resolution.

We intend to file articles of continuance pursuant to Section 187 of theCanada Business Corporations Act (the CBCA) to continue WorldHeart under the provisions of the CBCA from theBusiness Corporations Act (Ontario) as if the company had been incorporated under the CBCA. Management and the board of directors believe that the continuance of WorldHeart under the CBCA is appropriate to permit increased non-Canadian participation on the board of directors given the international scope of WorldHeart's business. Continuance under the CBCA will permit WorldHeart to take advantage of recent amendments to the CBCA which modernize corporate law procedures and requirements, and will help facilitate the planned movement of its operations to the United States. See "MATTERS TO BE ACTED UPON — Continuance Resolution — Continuance under the Canada Business Corporations Act" starting on page 90.

The board of directors believes the continuance of WorldHeart under the CBCA is in the best interests of WorldHeart and recommends that shareholdersvote for the resolution authorizing the continuance.

Business of WorldHeart

WorldHeart is a global medical devices company focused on the development, production, sales and support of VADs. VADs in general are mechanical assist devices that can provide an effective treatment for end-stage heart failure by supplementing the circulatory function of the heart by re-routing blood flow through a mechanical pump. The short supply of donor organs makes it impossible for medical professionals to keep pace with the number of patients requiring heart transplants each year. Heart-assist devices such as WorldHeart's products provide end-stage heart failure patients with the opportunity to live more normal and active lives during bridge-to-transplant and destination therapy. There have been more than 10,000 VADs, produced by a number of suppliers, used clinically throughout the world over the past 10 years. See "BUSINESS OF WORLD HEART CORPORATION" starting on page 19.

Risk Factors

You should be aware of the following risks relating to WorldHeart's business and operations as well as to the combined operations of WorldHeart and MedQuest, if the MedQuest Acquisition is approved by our shareholders:

- •

- We have had substantial losses and limited revenues earned since incorporation.

- •

- We will require significant capital investment to bring future products and product enhancements to market.

- •

- We may be unable to obtain regulatory approvals.

- •

- We are dependent on a limited number of products.

- •

- Market acceptance of our technologies and products is uncertain.

- •

- We face significant competition and technological obsolescence of our products.

- •

- There are limitations on third-party reimbursement for the cost of implanting our devices.

- •

- We control intellectual property and if we cannot protect our intellectual property, our business could be adversely affected.

- •

- We are exposed to product liability claims because of the nature of our business.

- •

- We face risks associated with our manufacturing operations, risks resulting from dependence on third-party manufacturers, and risks related to dependence on sole suppliers.

- •

- We are dependent on key personnel.

- •

- The price of our shares is highly volatile.

4

- •

- We incur risks associated with acquisitions.

In addition to the above risk factors, you should also be aware of the following risks associated with the particular matters being put before you at this Annual and Special Meeting:

- •

- The availability of additional common shares on the completion of the transactions could depress the price of our common shares.

- •

- The acquisition of MedQuest may stimulate competition and we may not be able to compete successfully.

- •

- The integration of the WorldHeart and MedQuest businesses may be costly and we may fail to successfully effect the integration.

See "RISK FACTORS" starting on page 51.

Summary Financial Information

| | Three Months Ended March 31,

| |

| |

| |

| |

| |

| |

|---|

| | Year Ended December 31,

| |

|---|

U.S. GAAP

| |

|---|

| | 2005

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

| |

|---|

| | (Unaudited)

| |

| |

| |

| |

| |

| |

|---|

| Net revenue | | $ | 3,416,988 | | $ | 9,575,761 | | $ | 6,755,807 | | $ | 6,436,696 | | $ | 5,329,357 | | $ | 3,147,950 | |

| Net loss for the period | | | (3,942,396 | ) | | (26,141,798 | ) | | (14,629,054 | ) | | (24,552,673 | ) | | (35,012,010 | ) | | (26,210,754 | ) |

| Net loss applicable to common shareholders | | | (3,942,396 | ) | | (26,141,798 | ) | | (18,168,304 | ) | | (29,010,753 | ) | | (39,578,696 | ) | | (28,284,926 | ) |

| Basic and diluted loss per common share | | | (0.24 | ) | | (1.70 | ) | | (2.90 | ) | | (11.42 | ) | | (18.39 | ) | | (13.31 | ) |

| | As at March 31,

| | As at December 31,

|

|---|

| | 2005

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

|---|

| | (Unaudited)

| |

| |

| |

| |

| |

|

|---|

| Total assets | | $ | 38,443,395 | | $ | 42,258,430 | | $ | 50,180,069 | | $ | 27,739,896 | | $ | 46,060,330 | | $ | 72,138,615 |

| Long term liabilities | | | 7,482,670 | | | 8,193,508 | | | — | | | 2,167,860 | | | 2,187,246 | | | 3,529,947 |

| | Three Months

Ended

March 31,

| |

| |

| |

| |

| |

| |

|---|

| | Year Ended December 31,

| |

|---|

Canadian GAAP

| |

|---|

| | 2005

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

| |

|---|

| | (Unaudited)

| |

| |

| |

| |

| |

| |

|---|

| Net revenue | | $ | 3,416,988 | | $ | 9,575,761 | | $ | 6,755,807 | | $ | 6,436,696 | | $ | 5,329,357 | | $ | 3,147,950 | |

| Net loss for the period | | | (4,547,982 | ) | | (22,806,805 | ) | | (23,547,313 | ) | | (31,690,859 | ) | | (42,405,977 | ) | | (20,462,528 | ) |

| Net loss applicable to common shareholders | | | (4,547,982 | ) | | (22,806,805 | ) | | (25,471,708 | ) | | (31,690,859 | ) | | (42,405,977 | ) | | (20,462,528 | ) |

| Basic and diluted loss per common share | | | (0.27 | ) | | (1.48 | ) | | (4.07 | ) | | (12.48 | ) | | (19.70 | ) | | (9.63 | ) |

| | As at

March 31,

| | As at December 31,

|

|---|

| | 2005

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

|---|

| | (Unaudited)

| |

| |

| |

| |

| |

|

|---|

| Total assets | | $ | 38,443,395 | | $ | 42,258,430 | | $ | 50,180,069 | | $ | 28,553,444 | | $ | 48,896,985 | | $ | 77,309,002 |

| Long term liabilities | | | 2,806,699 | | | 2,547,027 | | | — | | | 46,114,470 | | | 41,278,601 | | | 40,191,228 |

Complete audited consolidated financial statements for WorldHeart under U.S. GAAP and Canadian GAAP can be found in Appendices B-1 and B-2, respectively and interim unaudited consolidated financial statements for three months ended March 31, 2005 for WorldHeart under U.S. GAAP can be found in Appendix B-3.

5

Selected Historical Financial Data of MedQuest Products, Inc.

| | Nine Months Ended March 31,

| |

| |

| |

| |

| |

| |

|---|

| | Year Ended June 30,

| |

|---|

U.S. GAAP

| |

|---|

| | 2005

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

| |

|---|

| | (Unaudited)

| |

| |

| |

| |

| |

| |

|---|

| Net revenue | | $ | 101,840 | | $ | 99,389 | | $ | — | | $ | 304,149 | | $ | — | | $ | — | |

| Net loss for the period | | | (3,077,030 | ) | | (2,232,937 | ) | | (3,777,799 | ) | | (4,650,433 | ) | | (1,875,889 | ) | | (40,104 | ) |

| | As at

March 31,

| | As at June 30,

|

|---|

| | 2005

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

|---|

| | (Unaudited)

| |

| |

| |

| |

| |

|

|---|

| Total assets | | $ | 1,030,918 | | $ | 1,402,418 | | $ | 652,631 | | $ | 1,717,199 | | $ | 4,131,038 | | $ | 409,074 |

| Long term liabilities | | | 110,114 | | | 111,193 | | | 157,948 | | | 221,240 | | | 46,799 | | | 3,900 |

| | Nine Months Ended

March 31,

| |

| |

| |

|---|

| | Year Ended June 30,

| |

|---|

Canadian GAAP

| |

|---|

| | 2005

| | 2004

| | 2003

| |

|---|

| | (Unaudited)

| |

| |

| |

|---|

| Net revenue | | $ | 101,840 | | $ | 99,389 | | $ | — | |

| Net loss for the period | | | (3,207,773 | ) | | (2,573,702 | ) | | (4,238,997 | ) |

| | As at

March 31,

| | As at June 30,

|

|---|

| | 2005

| | 2004

| | 2003

|

|---|

| | (Unaudited)

| |

| |

|

|---|

| Total assets | | $ | 1,030,918 | | $ | 1,402,418 | | $ | 652,631 |

| Long term liabilities | | | 110,114 | | | 111,193 | | | 157,948 |

Complete audited financial statements for MedQuest can be found in Appendix D.

| | U.S. GAAP

Three Months Ended

March 31, 2005

| | U.S. GAAP

Year Ended

December 31, 2004

| | Canadian GAAP

Year Ended

December 31, 2004

| |

|---|

| Net revenue | | $ | 3,416,988 | | $ | 9,575,761 | | $ | 9,575,761 | |

| Net loss for the year | | | (4,797,650 | ) | | (28,626,183 | ) | | (26,514,976 | ) |

| Loss applicable to common shareholders | | | (4,797,650 | ) | | (28,626,183 | ) | | (26,514,976 | ) |

| Basic and diluted loss per common share | | | (0.09 | ) | | (0.52 | ) | | (0.48 | ) |

| | U.S. GAAP

As at

March 31, 2005

| | Canadian GAAP

As at

December 31, 2004

|

|---|

| Total assets | | $ | 61,506,468 | | $ | 77,012,518 |

| Long term obligations | | | 118,944 | | | 126,482 |

| Book value per common share | | | 0.92 | | | 1.24 |

Complete pro forma combined condensed financial statements can be found in Appendix F.

6

TABLE OF CONTENTS

| | Page

|

|---|

| SUMMARY | | 1 |

| | MedQuest Acquisition and Maverick Private Placement | | 1 |

| | Amendment to September 2004 Warrants | | 2 |

| | Amendments to the World Heart Corporation Employee Stock Option Plan | | 3 |

| | Amendments to Certain Options Held by Executive Officers and Directors | | 3 |

| | Continuance under the CBCA | | 4 |

| Business of WorldHeart | | 4 |

| Risk Factors | | 4 |

| Summary Financial Information | | 5 |

| | Selected Historical Financial Data of World Heart Corporation | | 5 |

| | Selected Historical Financial Data of MedQuest Products, Inc. | | 6 |

| | Selected Unaudited Pro Forma Combined Condensed Financial Information | | 6 |

| SOLICITATION OF PROXIES BY MANAGEMENT | | 9 |

| APPOINTMENT OF PROXY HOLDERS AND REVOCATION OF PROXIES | | 9 |

| VOTING OF PROXIES | | 9 |

| INFORMATION FOR BENEFICIAL SHAREHOLDERS | | 10 |

| VOTING SHARES, RECORD DATE AND PRINCIPAL HOLDERS | | 11 |

| SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS | | 14 |

| CORPORATE STRUCTURE | | 15 |

| Name, Address, and Incorporation | | 15 |

| Intercorporate Relationships | | 15 |

| DEVELOPMENT OF THE BUSINESS | | 15 |

| Three Year History and Development of WorldHeart | | 15 |

| Significant Acquisitions | | 18 |

| BUSINESS OF WORLD HEART CORPORATION | | 19 |

| Business Overview and Our Products | | 19 |

| | The Novacor LVAS | | 19 |

| | Our Next-Generation VAD Platform | | 19 |

| Third-party Reimbursement for VADs | | 20 |

| Application of VADs in Patient Care | | 20 |

| | Current Treatment Methods for End-Stage Heart Failure | | 20 |

| | Advantages of VADs | | 21 |

| Marketing, Training and Distribution Strategy | | 22 |

| Sources and Availability of Raw Materials | | 22 |

| Intellectual Property | | 23 |

| Product Liability Insurance | | 23 |

| Competition | | 23 |

| | Overview | | 23 |

| | Future Competition | | 24 |

| Regulatory Matters | | 25 |

| | Overview | | 25 |

| | United States Regulation | | 25 |

| | Canadian Regulation | | 25 |

| | Regulatory Requirements in Other Countries | | 25 |

| | Other Regulatory Requirements | | 26 |

| Our Employees | | 26 |

| Our Facilities | | 26 |

| Annual and Quarterly Information | | 26 |

| | Selected Historical Financial Data of World Heart Corporation | | 26 |

| | Selected Historical Financial Data of MedQuest Products, Inc. | | 28 |

| MANAGEMENT'S DISCUSSION & ANALYSIS | | 30 |

| SELECTED PRO FORMA INFORMATION | | 30 |

| Selected Unaudited Pro Forma Consolidated Financial Information | | 30 |

| SHARE CAPITAL AND PRIOR SALES | | 31 |

| | Common Shares | | 31 |

| | Preferred Shares | | 32 |

| | Dividends | | 33 |

| | Options to Purchase Shares | | 33 |

| CORPORATE GOVERNANCE | | 34 |

| Information about the Board of Directors and its Committees | | 34 |

| | Audit Committee | | 34 |

| | Compensation Committee | | 34 |

| | Corporate Governance and Nominating Committee | | 35 |

| | Strategic Planning Committee | | 35 |

| Toronto Stock Exchange Corporate Governance Practices | | 35 |

| Report of the Audit Committee | | 39 |

| Communication with Shareholders | | 40 |

| Shareholder Proposals | | 40 |

| MEETINGS OF DIRECTORS | | 40 |

| Board of Directors and Committee Meetings Held | | 41 |

| COMPENSATION OF DIRECTORS | | 41 |

| DIRECTORS' AND OFFICERS' INDEMNIFICATION | | 42 |

| EXECUTIVE OFFICERS | | 42 |

| EXECUTIVE COMPENSATION | | 44 |

| OPTION GRANTS IN LAST FISCAL YEAR | | 45 |

| LONG TERM INCENTIVE PLAN AWARDS IN LAST FISCAL YEAR | | 46 |

| AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND OPTIONS/SAR VALUES | | 46 |

| EMPLOYMENT AGREEMENTS | | 46 |

| EQUITY COMPENSATION PLAN INFORMATION | | 47 |

| LOANS TO DIRECTORS AND OFFICERS | | 48 |

| REPORT ON EXECUTIVE COMPENSATION AND COMPOSITION OF THE COMPENSATION COMMITTEE | | 48 |

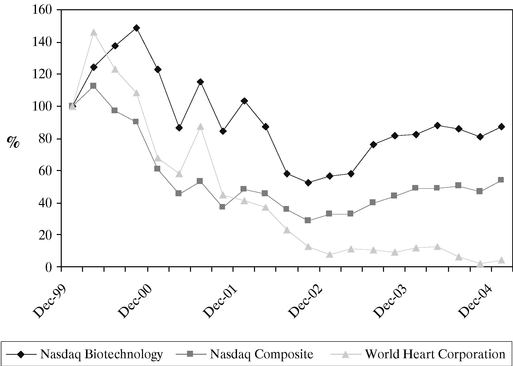

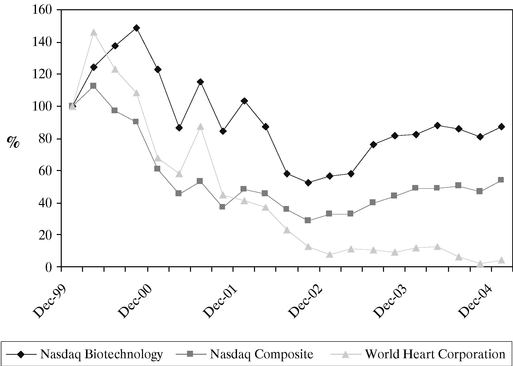

| PERFORMANCE GRAPH | | 50 |

| | Stock Exchange Price | | 50 |

| RISK FACTORS | | 51 |

| Risk Factors Relating to our Business | | 51 |

| Risk Factors Related to the MedQuest Acquisition, the Maverick Private Placement and the Warrant Exercise & Debenture Conversion | | 57 |

| MATERIAL CONTRACTS | | 58 |

| MATTERS TO BE ACTED UPON | | 61 |

| Audited Consolidated Financial Statements | | 61 |

| Election of Directors | | 61 |

| | Recommendation of WorldHeart's Board of Directors | | 65 |

| Appointment of Auditors | | 65 |

| | Audit Service Fees | | 65 |

| | | |

7

| | Audit-Related Service Fees | | 66 |

| | Tax Service Fees | | 66 |

| | Other Service Fees | | 66 |

| | Recommendation of WorldHeart's Board of Directors | | 66 |

| MedQuest Resolution — Acquisition of MedQuest | | 66 |

| | Regulatory Approvals | | 66 |

| | Background and Reasons for the MedQuest Acquisition | | 67 |

| | MedQuest Business | | 71 |

| | MedQuest Agreement | | 74 |

| | Related Agreements | | 79 |

| | General Effect on Existing Shareholders | | 79 |

| | Recommendations of WorldHeart's Board of Directors | | 80 |

| Maverick Resolution — Private Placement to Maverick | | 80 |

| | Regulatory Approvals | | 80 |

| | Background and Reasons for the Maverick Private Placement | | 81 |

| | Maverick Agreement | | 82 |

| | Related Agreements | | 85 |

| | General Effect on Existing Shareholders | | 85 |

| | Recommendations of WorldHeart's Board of Directors | | 85 |

| Warrant Amendment Resolution — Amendment to September 2004 Warrants | | 85 |

| | Recommendation of WorldHeart's Board of Directors | | 87 |

| ESOP Resolution #1 and ESOP Resolution #2 — Amendments to the World Heart Corporation Employee Stock Option Plan | | 87 |

| | Recommendations of WorldHeart's Board of Directors | | 91 |

| Option Amendment Resolution — Amendment to Certain Options Held by Executive Officers and Directors | | 91 |

| | Recommendations of WorldHeart's Board of Directors | | 92 |

| Continuance Resolution — Continuance under the Canada Business Corporations Act | | 92 |

| | Required Shareholder Approval and Conditions | | 92 |

| | Reasons for the Proposed Continuance | | 93 |

| | CBCA Versus OBCA | | 94 |

| | Articles of Continuance | | 95 |

| | Dissent Rights | | 95 |

| | Recommendation of WorldHeart's Board of Directors | | 95 |

| MATERIAL TAX CONSIDERATIONS | | 95 |

| OTHER MATTERS | | 95 |

| TRANSFER AGENT | | 96 |

| EXPERTS | | 96 |

| ADDITIONAL INFORMATION | | 96 |

| APPROVAL OF THE BOARD OF DIRECTORS | | 97 |

| CONSENT OF INDEPENDENT ACCOUNTANTS | | 98 |

| AUDITORS' CONSENT | | 99 |

| CONSENT OF INDEPENDENT ACCOUNTANTS | | 100 |

| APPENDIX A-1 MEDQUEST RESOLUTION | | A-1-1 |

| APPENDIX A-2 MAVERICK RESOLUTION | | A-2-1 |

| APPENDIX A-3 WARRANT AMENDMENT RESOLUTION | | A-3-1 |

| APPENDIX A-4 ESOP RESOLUTION #1 | | A-4-1 |

| APPENDIX A-5 ESOP RESOLUTION #2 | | A-5-1 |

| APPENDIX A-6 OPTION AMENDMENT RESOLUTION | | A-6-1 |

| APPENDIX A-7 CONTINUANCE RESOLUTION | | A-7-1 |

| APPENDIX B-1 WORLD HEART CORPORATION US GAAP FINANCIAL ANNUAL STATEMENTS | | B-1-1 |

| APPENDIX B-2 WORLD HEART CORPORATION CANADIAN GAAP ANNUAL FINANCIAL STATEMENTS | | B-2-1 |

| APPENDIX B-3 WORLD HEART CORPORATION US GAAP QUARTERLY FINANCIALS FOR THE PERIOD ENDED MARCH 31, 2005 | | B-3-1 |

| APPENDIX C-1 WORLD HEART CORPORATION US GAAP MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | C-1-1 |

| APPENDIX C-2 WORLD HEART CORPORATION CANADIAN GAAP MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | C-2-1 |

| APPENDIX C-3 WORLD HEART CORPORATION MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS FOR THE PERIOD ENDED MARCH 31, 2005 | | C-3-1 |

| APPENDIX D MEDQUEST PRODUCTS, INC. FINANCIAL STATEMENTS | | D-1 |

| APPENDIX E MEDQUEST PRODUCTS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | E-1 |

| APPENDIX F PRO FORMA FINANCIAL STATEMENTS | | F-1 |

| APPENDIX G MEDQUEST AGREEMENT | | G-1 |

| APPENDIX H MAVERICK AGREEMENT | | H-1 |

| APPENDIX I FORM OF CONVERSION AND EXERCISE AGREEMENT | | I-1 |

| APPENDIX J RIGHTS OF DISSENTING SHAREHOLDERS | | J-1 |

| APPENDIX K — LIST OF 2004 WARRANTHOLDERS | | K-1 |

8

SOLICITATION OF PROXIES BY MANAGEMENT

This circular is furnished in connection with thesolicitation by the management of World Heart Corporation (WorldHeart) of proxies to be used at the Annual and Special Meeting of Shareholders of WorldHeart to be held on Monday, July 18, 2005 (the Annual and Special Meeting) at the Fairmont Royal York Hotel, 100 Front Street West, Toronto, Ontario, Canada M5J 1E3 in the Algonquin Room at 10:00 a.m. and at any adjournment thereof for the purposes set forth in the accompanying Notice of Annual and Special Meeting of Shareholders. While management intends to solicit most proxies by mail, some proxies may be solicited by telephone or other personal contact by directors or officers of WorldHeart. The cost of such solicitation will be borne by WorldHeart. The information provided herein is given as of June 10, 2005, unless otherwise specified.

We express all dollar amounts in this circular in United States dollars, except where we indicate otherwise. References to "$" are to United States dollars and references to "Cdn$" are to Canadian dollars. On June 10, 2005, the noon exchange rate of Canadian currency in exchange for United States currency, as reported by the Bank of Canada, was Cdn$1.00 = $0.8004.

This circular is being sent to both registered and non-registered owners of common shares of WorldHeart. If you are a non-registered owner, and WorldHeart or its agent has sent these materials directly to you, your name and address and information about your holdings of common shares, have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding common shares on your behalf.

APPOINTMENT OF PROXY HOLDERS AND REVOCATION OF PROXIES

The persons named in the accompanying form of proxy are directors and/or officers of WorldHeart.A registered shareholder has the right to appoint a person, who need not be a shareholder of WorldHeart, other than the persons designated in the accompanying form of proxy, to attend and act on behalf of the shareholder at the meeting. To exercise this right, a shareholder may either insert such other person's name in the blank space provided in the accompanying form of proxy or complete another appropriate form of proxy.

To be valid, a proxy must be dated and signed by the shareholder or the shareholder's attorney authorized in writing or, if the shareholder is a corporation, by a duly authorized officer or attorney. The proxy, to be acted upon, must be deposited with WorldHeart, c/o its registrar and transfer agent, CIBC Mellon Trust Company, Attention: Proxy Department, 200 Queen's Quay East, Unit #6, Toronto, Ontario, M5A 4K9 by the close of business on the last business day prior to the date on which the meeting or any adjournment thereof is held, or with the Chair of the meeting on the day of the Annual and Special Meeting or any adjournment thereof.

A shareholder who has given a proxy may revoke it (a) by depositing an instrument in writing (including another proxy) executed by the shareholder or by the shareholder's attorney authorized in writing, either (i) with the Secretary at the registered office of WorldHeart, 1 Laser Street, Ottawa, Ontario, Canada K2E 7V1, at any time up to and including the last business day prior to the day of the Annual and Special Meeting or any adjournment thereof at which the proxy is to be used, or (ii) with the Chair of the meeting on the day of the meeting at any time before it is exercised on any particular matter, or (b) by attending the Annual and Special Meeting in person and personally voting the shares represented by the proxy prior to the exercise thereof, or (c) in any other manner permitted by law.

VOTING OF PROXIES

The directors and/or officers whose names are printed on the accompanying form of proxy will, on a show of hands or any ballot that may be called for, vote or withhold from voting the shares in respect of which they are appointed in accordance with the direction of the shareholder appointing them. If no choice is specified by the shareholder, the shares will be voted FOR the election of the management nominees for directors, the appointment of auditors, the MedQuest Resolution, the Maverick Resolution, the Warrant Amendment Resolution, ESOP Resolution #1 and ESOP Resolution #2, the Option Amendment Resolution and the Continuance Resolution, each as defined in, and on the terms disclosed in, this circular. Proxies indicating a vote FOR or AGAINST a particular proposal will not be voted on any motion to adjourn or postpone the consideration of that proposal.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to any other matter which may properly come before the meeting. As of the date of this circular, management is not aware of any other matter proposed or likely to come before the meeting. However, if any other matter properly comes before the meeting, it is the intention of the persons named in the enclosed form of proxy to vote on such other business in accordance with their judgement.

9

Voting at the Annual and Special Meeting will be by show of hands, except where a ballot is demanded by a shareholder or proxyholder entitled to vote at the Annual and Special Meeting or the chair of the meeting believes that the number of votes against a resolution is greater than 5% of all votes to be cast at the meeting in respect of the resolution. A shareholder or proxyholder may demand a ballot either before or after any vote by show of hands. In determining whether the requisite majority has been achieved to approve any proposal put before shareholders at the Annual and Special Meeting, only votes that have been cast FOR or AGAINST the proposal will be counted. Thus, if approval of a proposal requires a majority of the votes cast at the meeting, the proposal will be approved if the number of votes FOR is greater than the number of votes AGAINST. If approval is required from a certain percentage of the votes cast at the meeting, the proposal will be approved if the votes FOR as a percentage of the total sum of the votes FOR and AGAINST meets or exceeds the required percentage.

If an executed proxy is returned and the shareholder has specifically abstained from voting on any matter, the shares represented by such proxy will be considered present at the Annual and Special Meeting for purposes of determining a quorum but will not be considered to have been cast for purposes of calculating the vote on such matter and thus will have no effect on the outcome of the proposal.

If an executed proxy is returned by a broker, bank or other agent holding shares in street name that indicates that the broker does not have discretionary authority as to certain shares to vote on a proposal (broker non-votes), such shares will be considered present at the Annual and Special Meeting for purposes of determining a quorum but will not be considered to be entitled to vote on and thus will have no effect on the outcome of such proposal.

INFORMATION FOR BENEFICIAL SHAREHOLDERS

The information set forth in this section may be of importance to many shareholders, as a substantial number of shareholders do not hold the common shares of WorldHeart in their own name (beneficial shareholders). In certain cases, a shareholder's shares may be registered in the name of a third party, such as a broker, securities dealer, trust company, bank or other similar intermediary. Only proxies deposited by shareholders who appear on the records maintained by WorldHeart's registrar and transfer agent as registered holders of common shares of WorldHeart will be recognized and acted upon at the Annual and Special Meeting. If the common shares are listed in an account statement provided to a beneficial shareholder by a broker, the common shares are likely not to be registered in the shareholder's name. The common shares are likely to be registered under the name of the shareholder's broker or an agent of the broker. A significant number of shares are registered under the name of CEDE & Co. (the registration name for the Depository Trust Company which acts as nominee for many United States brokerage firms) or CDS & Co. (the registration name for The Canadian Depositary for Securities, which acts as nominee for many Canadian brokerage firms). Common shares held by brokers (or their agents or nominees) on behalf of the broker's client can only be voted (for or against resolutions) at the direction of the beneficial holder except for "routine matters" such as the election of directors and appointment of auditors.

Existing regulatory policy requires brokers and intermediaries to seek voting instructions from beneficial shareholders in advance of shareholders meetings. The various brokers and other intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by beneficial shareholders in order to ensure that their common shares are voted at the Annual and Special Meeting. The voting instruction form supplied to a beneficial shareholder by its broker (or the agent of the broker) is substantially similar to the form of proxy provided directly to the registered shareholders of WorldHeart. However, its purpose is limited to instructing the registered shareholder (i.e. the broker or agent of the broker) how to vote on behalf of the beneficial shareholder. A significant number of brokers now delegate the responsibility for obtaining instructions from clients to ADP Investor Communications (ADP) in Canada. ADP typically prepares a machine-readable voting instruction form, mails those forms to beneficial shareholders and asks beneficial shareholders to return the forms to ADP, or otherwise communicate voting instructions to ADP (by way of the Internet or telephone, for example). The voting instruction form will name the same persons as the proxy to represent the beneficial shareholder at the Annual and Special Meeting. A beneficial shareholder has the right to appoint a person, including the beneficial shareholder, other than the persons designated in the voting instruction form, to represent the beneficial shareholder at the Annual and Special Meeting. To exercise this right, the beneficial shareholder should insert the name of the desired representative in the blank space provided in the voting instruction form. ADP then tabulates the results of all instructions received and provides appropriate instruction respecting the voting of the common shares to be represented at the meeting.A beneficial

10

shareholder who receives an ADP voting instruction form cannot use the form to vote the common shares directly at the Annual and Special Meeting. The voting instruction forms must be returned to ADP (or instructions respecting the voting of the common shares must otherwise be communicated to ADP) in advance of the Annual and Special Meeting in order to have the common shares voted. If you have any questions respecting the voting of the common shares held through a broker or intermediary, please contact the broker or intermediary for assistance.

VOTING SHARES, RECORD DATE AND PRINCIPAL HOLDERS

As of June 10, 2005, there were issued and outstanding 17,101,400 common shares of WorldHeart. The board of directors has fixed the close of business on June 10, 2005 as the record date for the purposes of determining the shareholders entitled to receive notice of the Annual and Special Meeting (the Record Date). Each registered common shareholder is entitled to one vote for each common share held that is shown as registered in such holder's name on the list of shareholders prepared as of the close of business on the Record Date.

In the event of any transfer of shares by any shareholder after the Record Date, the transferee is entitled to vote those shares if the transferee produces properly endorsed share certificates or otherwise establishes that the transferee owns the shares, and requests the Secretary of WorldHeart to include the transferee's name on the shareholders' list not later than ten days before the meeting.

To the knowledge of the directors and officers of WorldHeart, as of June 10, 2005, the persons who beneficially own or exercise control or direction over common shares carrying more than 5% of the voting rights attached to all the common shares of WorldHeart entitled to be voted at the meeting and the shareholdings of the executive officers and directors of WorldHeart, are as follows:

Name and Address of Shareholder

| | Title of

Class

| | Amount and Nature of

Beneficial Ownership

| | Percentage of Class

|

|---|

Austin W. Marxe and David M. Greenhouse

153 East 53rd Street

New York, NY 10022 | | Common Shares | | 12,064,250 | (1) | 45.16% |

Edwards Lifesciences Corporation

One Edwards Way

Irvine, California 92614 | | Common Shares | | 2,437,634 | (2) | 7.47% |

Zesiger Capital Group LLC

320 Park Avenue, 30th Floor

New York, NY 10022 | | Common Shares | | 3,478,666 | (3) | 18.02% |

Jal S. Jassawalla

34 East Altarinda Drive

Orinda, CA 94563 | | Common Shares | | 10,000 | (4) | 0.06% |

D. Mark Goudie

4 Woodrow Avenue

Stittsville, ON K2S 1G9 | | Common Shares | | 45,035 | (5) | 0.26% |

Piet Jansen

A.J. Ernststraat 893

1081 HL Amsterdam

Netherlands | | Common Shares | | 0 | (6) | 0% |

John Marinchak

1720 Magnolia Way

Walnut Creek, CA 94595 | | Common Shares | | 0 | (7) | 0% |

Phillip Miller

968 Regal Road

Berkeley, CA 94708 | | Common Shares | | 5,000 | (8) | 0.03% |

Richard Juelis

349 Oyster Point Blvd. Ste 200

S San Francisco, CA 94080 | | Common Shares | | 0 | (9) | 0% |

| | | | | | | |

11

C. Ian Ross

140 Pioneer Lane, RR # 3

Collingwood, ON L9Y 3Z2 | | Common Shares | | 865 | (10) | less than 0.01% |

John F. Carlson

2 Raccoon Road

St. Paul, MN 55127-2118 | | Common Shares | | 0 | (11) | 0% |

William C. (Bill) Garriock

1 St. Ives Crescent

Toronto, Ontario M4N 3B3 | | Common Shares | | 0 | (12) | 0% |

Robert J. Majteles

31 Sea View Avenue

Piedmont, CA 94611 | | Common Shares | | 0 | (13) | 0% |

Michael A. Roth and Brian J. Stark

3600 South Lake Drive

St. Francis, WI 53235 | | Common Shares | | 4,314,875 | (14) | 20.15% |

Reid S. Walker, G. Stacy Smith

and Patrick P. Walker

c/o Walker Smith

300 Crescent Court, Suite 1111

Dallas, TX 75201 | |

Common Shares | |

3,206,525 |

(15) |

16.36% |

Bristol Investment Fund Ltd.

c/o Bristol Capital Advisors, LLC

10990 Wilshire Boulevard,

Suite 1410

Los Angeles, CA 90024 | | Common Shares | | 1,606,743 | (16) | 8.9% |

Sherfam Inc.

150 Signet Drive

Weston, Ontario M9L 1T9 | | Common Shares | | 1,409,113 | (17) | 7.61% |

Federated Investors, Inc.

Federated Investors Tower,

Pittsburgh, PA 15222-3779 | | Common Shares | | 1,410,138 | (18) | 7.62% |

MedCap Partners

500 Third Street, Suite 535

San Francisco, CA 94107 | | Common Shares | | 921,658 | (19) | 5.11% |

Sceptre Investment Counsel Limited

26 Wellington St. E., 12th Floor

Toronto, Ontario M5E 1W4 | | Common Shares | | 1,232,856 | (20) | 6.72% |

FCP OP MEDICAL BioHe@lth Trends

4, rue Jean Monnet

Luxembourg

L-2180 | | Common Shares | | 960,000 | (21) | 5.32% |

John Vajda

330 N. Mathilda Ave. Ste. 407

Sunnyvale, CA 94085 | | Common Shares | | 0 | (22) | 0% |

| Executive Officers and Directors of WorldHeart as a group (11) | | Common Shares | | 60,900 | | 0.24% |

- (1)

- Special Situations Fund III, L.P. owns 1,421,381 common shares, Special Situations Cayman Fund, L.P. owns 331,420 common shares and Special Situations Private Equity Fund, L.P. owns 698,546 common shares (collectively, the Special Situation Funds). These funds also hold debentures convertible into 4,000,000 common shares and warrants to purchase 5,612,902 common shares, of which warrants

12

to acquire 1,612,902 common shares have an exercise price of Cdn$7.42 expiring September 23, 2008 and warrants to acquire 4,000,000 common shares have an exercise price of $1.55 expiring September 15, 2009. MGP Advisors Limited (MGP) is the general partner of Special Situations Fund III, L.P. AWM Investment Company, Inc. (AWM) is the general partner of MGP and the general partner of and investment advisor to Special Situations Cayman Fund, L.P. MG Advisors, L.L.C. (MG) is the general partner of and investment advisor to Special Situations Private Equity Fund, L.P. Austin W. Marxe and David M. Greenhouse are the principal owners of MGP, AWM and MG and are principally responsible for the selection, acquisition and disposition of the portfolio securities by each investment adviser on behalf of its fund.

- (2)

- Edwards Lifesciences Corporation, a publicly traded company, indirectly through Edwards Lifesciences LLC (Edwards) and Edwards Lifesciences (U.S.) Inc. owns 1,269,063 common shares and warrants to acquire 1,168,571 common shares.

- (3)

- Zesiger Capital Group LLC (Zesiger) is an investment adviser registered under the U.S. Investment Advisers Act of 1940. The beneficial owners of Zesiger are Albert Leroy Zesiger, Barrie Ramsay Zesiger, John Jude Kayola, James Francis Cleary, Donald Lee Devivo and Robert Kennedy Winters. Zesiger exercises control or direction, on behalf of accounts fully managed by it, over 1,276,964 common shares, 3% unsecured debentures in the aggregate principal amount of $800,000 convertible into 640,000 common shares, and warrants to purchase an additional 1,561,702 common shares. The common shares held by Zesiger are held on behalf of accounts over which Zesiger has discretionary authority. Pursuant to its investment management agreements with its clients, Zesiger has full discretion to acquire, hold and dispose of all of the securities referred to above. Zesiger also has the right to exercise the voting rights associated with the securities with respect to accounts holding 821,710 common shares. The following are the persons who beneficially own the shares held by Zesiger Capital Group LLC: City of Milford Pension and Retirement Fund; National Federation of Independent Business; National Federation of Independent Business Pension Trust; Norwalk Employees Pension Plan; City of Stamford Firemen's Pension Fund; Asphalt Green, Inc.; Asphalt Green Defined Contribution Plan; William B. Lazar; Lazar Foundation; Helen Hunt (includes common shares held by Helen Hunt Alternatives Fund, of which Helen Hunt is the President); Barrie Ramsay Zesiger; Alexa Zesiger Carver; David Zesiger; HBL Charitable Unitrust; Jeanne L. Morency; Psychology Associates; Peter Looram; Meehan Foundation; Miriam F. Meehan Trust; Domenic J. Mizio; Morgan Trust Co. of the Bahamas Ltd. as Trustee U/A/D 11/30/93; John Rowan; Susan Iris Halpern; Theeuwes Family Trust, Felix Theeuwes Trustee; Robert K. Winters; Francois deMenil; and Allan B. and Joanne K. Vidinsky 1993 Trust.

- (4)

- Mr. Jassawalla holds options for 1,788,929 common shares, all of which are subject to shareholder approval. Of those, no options are exercisable within 60 days.

- (5)

- Mr. Goudie holds options for 80,000 common shares, all of which are subject to shareholder approval. Of those, options for 40,000 common shares are exercisable within 60 days.

- (6)

- Mr. Jansen holds options for 325,000 common shares, all of which are subject to shareholder approval. Of those, no options are exercisable within 60 days.

- (7)

- Mr. Marinchak holds options for 260,000 common shares, all of which are subject to shareholder approval. Of those, no options are exercisable within 60 days.

- (8)

- Mr. Miller holds options for 325,270 common shares, all of which are subject to shareholder approval. Of those, no options are exercisable within 60 days.

- (9)

- Mr. Juelis holds options for 275,000 common shares, all of which are subject to shareholder approval. Of those, no options are exercisable within 60 days.

- (10)

- Mr. Ross holds options for 130,365 common shares, all of which are subject to shareholder approval. Of those, options for 365 common shares are exercisable within 60 days.

- (11)

- Mr. Carlson holds options for 130,000 common shares, all of which are subject to shareholder approval. Of those, no options are exercisable within 60 days.

- (12)

- Mr. Garriock holds options for 130,000 common shares, all of which are subject to shareholder approval. Of those, no options are exercisable within 60 days.

- (13)

- Mr. Majteles holds options for 130,000 common shares, all of which are subject to shareholder approval. Of those, no options are exercisable within 60 days.

- (14)

- Michael Roth and Brian Stark currently beneficially own an aggregate of 4,314,875 common shares, including 1,600,000 common shares issuable pursuant to the conversion of debentures and 2,291,244 common shares issuable pursuant to the exercise of warrants. All of the foregoing represents securities held directly by SF Capital Partners Ltd. ("SF Capital"). Michael Roth and Brian Stark are the managing members of Stark Offshore Management, LLC ("Stark Offshore"), which acts as investment manager and has sole power to direct the management of SF Capital. Through Stark Offshore, they possess voting and dispositive power over all of the foregoing shares.

- (15)

- Reid S. Walker, G. Stacy Smith and Patrick P. Walker beneficially own debentures convertible into 896,431 common shares and warrants to acquire 1,600,000 common shares. The common shares are owned by (i) WS Capital, L.L.C., a Texas limited liability company ("WS Capital"), for the account of (1) Walker Smith Capital, L.P., a Texas limited partnership ("WSC"), (2) Walker Smith Capital (Q.P.), L.P., a Texas limited partnership ("WSCQP"), and (3) Walker Smith International Fund, Ltd., a British Virgin Islands exempted company ("WS International"), and (ii) WSV Management, L.L.C., a Texas limited liability company ("WSV"), for the account of (1) WS Opportunity Fund, L.P., a Texas limited partnership ("WSO"), (2) WS Opportunity Fund (Q.P.), L.P., a Texas limited partnership ("WSOQP"), and (3) WS Opportunity Fund International, Ltd., a Cayman Islands exempted company ("WSO International"). WS Capital is the general partner of WS Capital Management, L.P., a Texas limited partnership ("WSC Management"). WSC Management is the general partner of WSC and WSCQP and the agent and attorney-in-fact for WS International. WSV is the general partner of WS Ventures Management, L.P., a Texas limited partnership ("WSVM"). WSVM is the general partner of WSO and

13

WSOQP and the agent and attorney-in-fact for WSO International. Reid S. Walker and G. Stacy Smith are principals of WS Capital and WSV, and Patrick P. Walker is a principal of WSV.

- (16)

- Bristol Investment Fund Ltd. owns debentures convertible into 160,000 common shares and warrants to acquire 800,000 common shares. Paul Kessler, as manager of Bristol Capital Advisors, LLC, the investment manager to Bristol Investment Fund, Ltd., has voting and investment control over the securities held by Bristol Investment Fund, Ltd.

- (17)

- Sherfam Inc. owns 416,257 common shares, debentures convertible into 330,000 common shares and warrants to acquire 662,856 common shares. Bernard C. Sherman has sole voting and dispositive control of The Bernard Sherman 2000 Trust and owns 99% of the outstanding capital stock of Sherman Holdings Inc., which collectively hold 99% of the outstanding common and preferred shares of Shermco Inc., which in turn owns all of the outstanding capital stock of Sherfam Inc.

- (18)

- Federated Investors, Inc. owns 820,257 common shares and warrants to acquire 1,410,138 common shares. Federated Investors, Inc. is the parent holding company of Federated Investment Management Company, Federated Investment Counseling, and Federated Global Investment Management Corp. (the Investment Advisers), which act as investment advisers to registered investment companies and separate accounts that own shares of common stock in WorldHeart. All of the outstanding voting stock of Federated Investors, Inc. is held in the Voting Shares Irrevocable Trust for which John F. Donahue, Rhodora J. Donahue and J. Christopher Donahue act as trustees.

- (19)

- MedCap Partners owns 460,829 common shares and warrants to acquire 460,829 common shares. MedCap Management & Research LLC (MMR) as general partner and investment manager of MedCap Partners, and C. Fred Toney as managing member of MMR, may be deemed to own beneficially the securities owned by MedCap Partners in that they may be deemed to have the power to direct the voting or disposition of the securities.

- (20)

- Sceptre Investment Counsel Limited, a publicly traded mutual fund company, owns warrants to acquire 1,232,856 common shares.

- (21)

- FCP OP MEDICAL BioHe@lth Trends, a publicly traded investment fund, owns debentures convertible into 480,000 common shares and warrants to acquire 480,000 common shares.

- (22)

- Mr. Vajda holds options for 250,000 common shares, all of which are subject to shareholder approval. Of those, no options are exercisable within 60 days.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This circular includes "forward-looking statements" within the meaning of Section 27A of the United States Securities Act of 1933 and Section 21E of the United States Securities Exchange Act of 1934. The forward-looking statements contain information that is generally stated to be anticipated, expected or projected by WorldHeart, and involves known and unknown risks, uncertainties and other factors that may cause the actual results and performance of WorldHeart to be materially different from any future results and performance expressed or implied by such forward-looking information. Potential risks and uncertainties include, without limitation, the uncertainties inherent in the development of a new product for use in the human body, our potential need for significant additional funding, our need for acceptance from third-party payers, extensive government regulation of our products, and rapid developments in technology, including developments by competitors. Important factors that could cause our actual results to differ materially from those expressed or implied by such forward-looking statements include:

- •

- our ability to successfully complete pre-clinical and clinical development of our products;

- •

- our ability to successfully integrate technologies or companies that we may acquire, from time to time, into our operations;

- •

- our ability to obtain and enforce in a timely manner patent and other intellectual property protection for our technology and products;

- •

- our ability to avoid, either by product design, licensing arrangement or otherwise, infringement of third parties' intellectual property;

- •

- decisions, and the timing of decisions made by health regulatory agencies regarding approval of our products;

- •

- our ability to complete and maintain corporate alliances relating to the development and commercialization of our technology and products;

- •

- the competitive environment and impact of technological change;

- •

- the continued availability of capital to finance our activities in the event that profitability is not achieved; and

- •

- other factors we discuss in this circular under the heading "RISK FACTORS."

14

We undertake no obligation to update publicly or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

CORPORATE STRUCTURE

Name, Address, and Incorporation

We were incorporated by articles of incorporation under the laws of the Province of Ontario on April 1, 1996. Our registered office is located at 1 Laser Street, Ottawa, Ontario, Canada, K2E 7V1 and our telephone number is (613) 226-4278. Our head office is located at 7799 Pardee Lane, Oakland, California, USA, 94621 and we have an office at Cereslaan 34, 5384 VT, Heesch, Netherlands.

Our articles of incorporation were amended on June 22, 2000 to create a first series of 1,374,750 preferred shares designated as Cumulative Redeemable Convertible Preferred Shares, Series A (the Series A Shares), in connection with the acquisition by WorldHeart of the Novacor division (Novacor) of Edwards Lifesciences LLC (Edwards), a subsidiary of Edwards Lifesciences Corporation. On November 26, 2003, our articles were amended to amend the rights and privileges of the Series A Shares in connection with the conversion by Edwards Lifesciences (U.S) Inc., a subsidiary of Edwards Lifesciences Corporation, of its Series A Shares as part of our financing transaction completed in September 2003. Our articles were amended again on December 1, 2003, to effect a one common share for seven common shares share consolidation.

Intercorporate Relationships

World Heart Inc. is our wholly-owned subsidiary, incorporated under the laws of the State of Delaware on May 22, 2000. World Heart Inc. acquired the assets and liabilities of the Novacor division of Edwards in June 2000 and is responsible for the manufacturing and primary sales, marketing and support of the Novacor® left ventricular assist system (Novacor LVAS) as well as next-generation product development.

World Heart B.V. is our wholly-owned subsidiary, incorporated under the laws of the Netherlands on March 5, 2004, through which we carry on sales, sales support and distribution in Europe.

2007262 Ontario Inc. (2007262), is an associated research and development company of WorldHeart, incorporated under the laws of the Province of Ontario on November 29, 2001 to carry out specified research and development for us. WorldHeart and New Generation Biotech (Equity) Fund Inc. (NewGen), an Ontario labour-sponsored venture capital corporation, each hold 100 common shares of 2007262. WorldHeart holds all the issued and outstanding non-voting Series 1 preferred shares and non-voting Series 2 preferred shares of 2007262.

WorldHeart has entered into an asset purchase agreement, as amended by amendment no. 1, (the MedQuest Agreement) with MedQuest Products, Inc. (MedQuest) to acquire the assets of MedQuest and not the issued and outstanding shares of MedQuest, as more fully described in this circular. Therefore, if the acquisition is approved and completed, the assets of MedQuest will form a part of WorldHeart's assets and no new subsidiary will be created.

DEVELOPMENT OF THE BUSINESS

Three Year History and Development of WorldHeart

WorldHeart is a global medical devices company focused on the development, production, sales and support of ventricular assist devices (VADs). VADs are mechanical assist devices that supplement the circulatory function of the heart by re-routing blood flow through a mechanical pump. VADs are used for treatment of patients with end-stage heart failure (i.e. patients whose hearts are irreversibly damaged and which cannot be treated effectively by medical or surgical means other than a transplant). Bridge-to-transplant therapy involves implanting a VAD in a transplant-eligible patient to maintain or improve the patient's health until a donor heart becomes available. Destination therapy is the implanting of a VAD to provide long-term support for a patient not currently eligible for a natural heart transplant.

Our current business is based on two generations of implantable, pulsatile VADs, the current generation commercially available Novacor LVAS, and an in-development, next-generation Novacor II. A decision was made by management in August 2002, to consolidate WorldHeart's next-generation pulsatile VAD programs. At that time, development on the HeartSaverVAD, our initial next generation product, was effectively terminated in order to focus a more concentrated development effort on a new design of our next generation product, the Novacor II. This delayed our product development by about two years. As described in this circular, upon

15

completion of the MedQuest Acquisition we will be acquiring a next-generation, non-pulsatile, magnetically levitated, centrifugal, rotary VAD. These devices are also intended for use in both bridge-to-transplant therapy and destination therapy.

Following the acquisition of the Novacor division from Edwards in June 2000, we have focused our operations on:

- •

- the sales, support, production and enhancement of the Novacor LVAS; and

- •

- the development and commercialization of Novacor II, an optimized product based on patented technologies and experience gained from the development and commercialization of the Novacor LVAS and experience with other VAD development programs.

The Novacor LVAS and Novacor II are described in more detail in "BUSINESS OF WORLD HEART CORPORATION" starting on page 19.

Since January 1, 2002 a number of significant events have occurred indicating the increasing acceptance by the medical community of VAD-based therapy for treatment of end-stage heart failure that we expect will positively impact WorldHeart's business as well as all competitive VAD suppliers. We believe these events signal a future expansion in the use of VADs.

Significant industry developments include:

- •

- A decision in November 2002 by the United States Food and Drug Administration (FDA) to extend the use of VAD therapy to heart failure patients as destination therapy, which validates the use of VADs as a long-term treatment for late stage heart failure; and

- •

- Two significant increases in reimbursement for VADs in the United States (October 2003 and October 2004) which have increased average reimbursements for VAD implantation by over 70% to between $130,000 and $140,000.

A number of significant developments related specifically to WorldHeart's Novacor LVAS products have also occurred:

- •

- Approval was given by the FDA in the United States (January 2003) and by Health Canada (March 2003) of our expanded polytetrafluoroethylene (ePTFE) inflow conduit as a component of the Novacor LVAS product. Results in over 250 implanted patients to date indicate a reduction in stroke rate.

- •

- Approval was given by the FDA (January 2004) and Health Canada (September 2003) of product enhancements to the Novacor LVAS aimed at improving the recipient's quality of life — quieter pump operation, new battery packs that are 40% lighter and operate for 60% longer, and a smaller, quieter battery charging system. These enhancements have been commercially available in Europe since June 2002.

- •

- Approval was given in Japan for use (August 2001), importation (January 2002) and reimbursement (effective April 2004) of the Novacor LVAS.

- •

- Conditional approval was given by the FDA on July 21, 2004 of a Premarket Approval (PMA) Supplement application for a revision to the labeling of the Novacor LVAS to reflect the current device reliability data available to patients and physicians. The revised labeling indicates the demonstrated performance longevity of the Novacor LVAS, which encompasses implant duration from zero to more than 36 months. The revised labeling, which is based upon statistical analysis of 1,077 device implants, shows the chance for reoperation to either fix or replace the Novacor LVAS is 1.6% between zero and 6 months; 2.1% between 6 and 12 months; 11% between 12 and 24 months; and 16% between 24 and 36 months.

- •

- Unconditional approval was given by the FDA on July 30, 2004 of our Investigational Device Exemption Supplement for the RELIANT (RandomizedEvaluation of the NovacorLVASinaNon-Transplant Population) clinical trial (the RELIANT Trial). The RELIANT Trial will be conducted in up to 40 clinical centers and will enroll up to 390 patients. The data from the RELIANT Trial will support a PMA Supplement that will request a revision to the indication for use of the Novacor LVAS to include end-stage heart failure patients that are ineligible for heart transplantation. The RELIANT Trial randomizes patients who enter the RELIANT Trial to receive either a Novacor LVAS or a Thoratec Corporation (Thoratec) HeartMate ® XVE LVAS, (the HeartMate XVE), on a 2:1 ratio. Costs of implants, including device costs, for both the Novacor LVAS and HeartMate XVE are eligible for reimbursement by Centers

16

In 2003, we rationalized and reallocated our workforce to focus on sales, production, and support of the Novacor LVAS, on a basis consistent with the development plans and strategy for WorldHeart's next-generation VAD. We are continuing our rationalization and expect to consolidate certain of our operations with those of MedQuest if the acquisition of MedQuest is completed.

Effective January 1, 2004, we assumed full sales and support responsibility for the Novacor LVAS worldwide with the exception of Japan. Edwards was previously our exclusive distributor for the Novacor LVAS in all countries other than the United States where we sell directly. We continue to distribute the Novacor LVAS through Edwards in Japan and through other distributors in selected markets.

In September 2003, we completed a significant equity financing and restructuring. This financing and restructuring is described in the U.S. GAAP audited consolidated financial statements which are attached to this circular as Appendix B-1 and in the Canadian GAAP audited consolidated financial statements which are attached to this circular as Appendix B-2. In summary, the financing and restructuring included:

- •

- A Cdn$63,500,000 private placement of equity through the issuance of units, each unit was comprised of one common share and one warrant exercisable for one common share at an exercise price of Cdn$7.42. The warrants are callable by WorldHeart for cash should our common shares trade at or above Cdn$17.50 for 20 consecutive trading days. However, no more than 20% of the total warrants issued may be called in any three month period;

- •

- An exchange of the preferred shares of World Heart Inc. held by Edwards in the amount of $58 million plus accrued dividends for 711,589 common shares of WorldHeart;

- •

- The conversion of the Series A Shares of WorldHeart held by Edwards Lifesciences (U.S.) Inc. at a value of $20 million plus accrued dividends into 500,000 common shares of WorldHeart and 1,000,000 warrants, with each warrant exercisable for one common share of WorldHeart at an exercise price of Cdn$7.49 per common share; and

- •

- A consolidation of WorldHeart's common shares on the basis of one post-consolidation common share for seven pre-consolidation common shares.

On March 18, 2004, our common shares, which had been delisted from the NASDAQ National Market (NASDAQ) on October 15, 2002, were re-listed on NASDAQ under the symbol WHRT.

On April 22, 2004, with the announcement of our first quarter results, we commenced reporting our results in United States dollars.

On July 12, 2004, we announced that our first quarter results would be restated, and on August 12, 2004, we released our restated first quarter results. Restated revenues for the first quarter decreased by $1.3 million to $2.2 million and shipments of the Novacor LVAS kits decreased by 25 kits to a total of 26 kits. The restatement resulted partly in respect of a sale during the first quarter of 20 kits to a world-leading center, which has implanted more than 100 Novacor LVAS kits. It became apparent that there was the expectation on the part of the buyer that it would receive a limited right of return for certain Novacor LVAS kits that it purchased in the event that they were not implanted prior to reaching their sterilization expiry dates. As a result, we determined that the appropriate accounting treatment was to exclude revenue from this sale in accordance with our revenue recognition criteria. The effect of these restatements on the net loss was an increase of approximately $585,000 to a net loss of $4.1 million and an increase in the net loss per common share by four cents to a net loss per common share of 27 cents.

On July 28, 2004, we announced certain management changes including the appointment of Mr. Jal S. Jassawalla as President and Chief Executive Officer replacing Mr. Roderick M. Bryden who resigned from those positions and from the board of directors of WorldHeart. Mr. Griffin's employment was terminated as part of a number of management changes. Dr. Piet Jansen was appointed Managing Director, Europe and continued as Chief Medical Officer for WorldHeart. Mr. John Marinchak was appointed Vice President, Marketing and Sales. Also Mr. Robert W. Corson was appointed Vice President, Manufacturing replacing Mr. Robert Griffin who left WorldHeart in July 2004. Mr. Bryden resigned from WorldHeart at that time because the board and Mr. Bryden determined that new leadership was required for WorldHeart to seize new opportunities and to continue to build WorldHeart's leadership position in the heart assist business.

17

On August 12, 2004, Mr. Mark Goudie, Vice President, Finance and Chief Financial Officer was appointed to the board of directors to fill the vacancy created by the resignation of Mr. Bryden.

On August 25, 2004, we announced the consolidation of our operations from Ottawa, Ontario to Oakland, California to be substantially completed over a period of nine months.