FOIA Confidential Treatment Requested by West Corporation Pursuant to Rule 83 (17 C.F.R. 200.83)

WSTC 1

November 9, 2015

Via EDGAR

Securities and Exchange Commission

100 F Street, NE

Mail Stop 3561

Washington, D.C. 20549-3561

Attention: Jennifer Thompson

Form 10-K for the Fiscal Year Ended December 31, 2014

Filed February 19, 2015

File No. 1-35846

Dear Ms. Thompson:

West Corporation (the “Company”) has received and reviewed the comment from the staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) in your letter dated October 26, 2015 (the “October 26 Comment Letter”) regarding the Staff’s review of the Company’s responses to comments raised in your letter dated September 24, 2015 (the “September 24 Comment Letter”). For the convenience of the Staff’s review, the Company has set forth the comment contained in the October 26 Comment Letter in italics followed by the responses of the Company. References to prior comments and comment numbers relate to the comments contained in the September 24 Comment Letter.

Due to the commercially sensitive nature of certain information contained herein, this response letter includes a request for confidential treatment of the portions of this letter bracketed below pursuant to Rule 83 of the Commission’s Rules on Information and Requests (17 C.F.R. § 200.83) (“Rule 83”). Information that has been omitted in the EDGAR version of this response letter has been noted with a placeholder identified by the mark “[**].”

In accordance with Rule 83, the Company requests confidential treatment of the highlighted and bracketed portions (the “Confidential Information”) of this response letter. Please inform the following person of any request for disclosure of the Confidential Material made pursuant to the Freedom of Information Act, Privacy Act or otherwise so that the undersigned may substantiate the foregoing request for confidential treatment in accordance with Rule 83:

West Corporation

11808 Miracle Hills Drive

Omaha, NE 68154

Attention: Jan D. Madsen, Chief Financial Officer

Telephone: (402) 963-1200

Securities and Exchange Commission

November 9, 2015

[Confidential Treatment Requested by West Corporation]

WSTC 2

Form 10-K For the Fiscal Year Ended December 31, 2014

17. Segments, page F-38

| 6. | We note your response to comment 6. To assist us with better understanding how you concluded it was appropriate to aggregate your five operating segments into one reportable segment, please address the following: |

| | • | | We note the similarities you discuss with regard to the products and services of your operating segments. However, it appears after reviewing your website that your Specialized Agent Services operating segment offers healthcare advocacy products and services to employees of large organizations and cost containment solutions, and your Interactive Services operating segment offers professional services such as strategic consultation. Explain to us further how these products and services are similar, or dissimilar, from the products and services offered through your other operating segments. |

Response:

All of the Company’s operating segments manage and process large-scale voice and data management services that are complex and mission critical and help our clients communicate. The services offered by our operating segments are broad, but rely upon similar technologies, core competencies, shared infrastructure and have many common customers focused in a small number of industry sectors. Our business activities focus on providing our clients with integrated business solutions that cut across many of the service offerings.

The Company’s strategy has begun evolving to emphasize key industry markets and enterprise clients where we believe we can develop effective solutions for their specific communication challenges by leveraging existing products, infrastructure and/or core capabilities from across all of the operating segments. For example, the Company’s acquisition of Health Advocate in 2014 expanded our human capital expertise in the healthcare market which we are leveraging in sales of products of the other operating segments and in developing new solutions for the healthcare market.

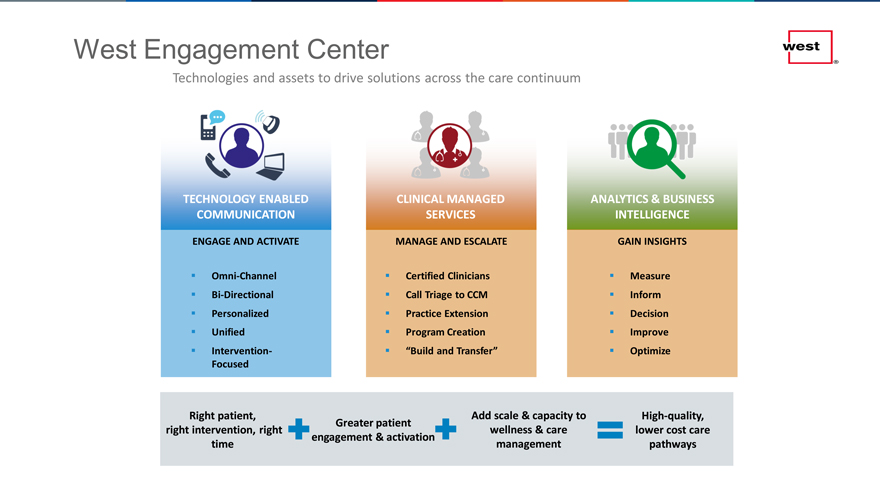

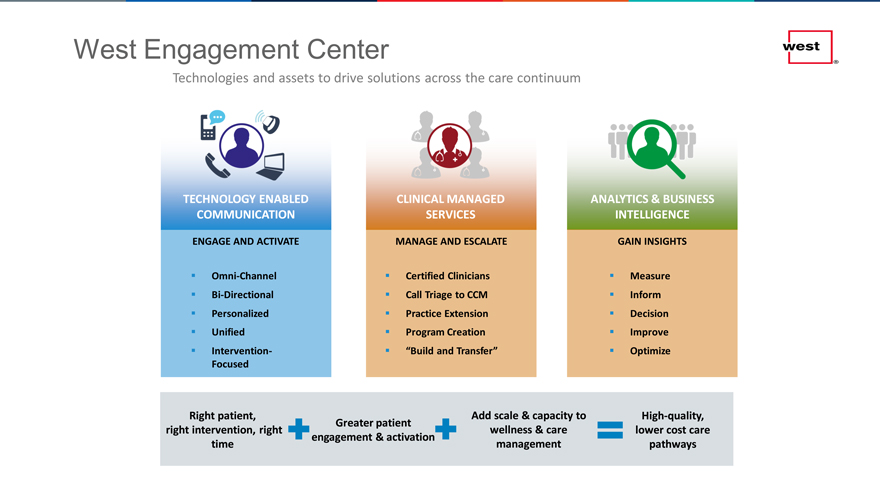

As an example attached hereto as Exhibit 1, the Company has included a go-to-market slide used when meeting with prospective clients in the healthcare market. In this example, the healthcare advocacy services provided by our Specialized Agent Services operating segment, as depicted as clinical managed services, utilizes the technology-enabled communication infrastructure from the Company’s Interactive Services operating segment. Highly trained agents within Specialized Agent Services use analytics and business intelligence to provide solutions to the healthcare market.

Securities and Exchange Commission

November 9, 2015

[Confidential Treatment Requested by West Corporation]

WSTC 3

Across all segments, the value of the products and services to our customers is based on voice and data communications technology infrastructure and data analytics. In contrast, the divested agent-based businesses were call centers where we linked to the customer’s technology and the value was in the labor and the management of the labor. The personnel providing the healthcare advocacy and cost containment solutions utilize the same managed network as the other operating segments to access and use complex data analytics to manage and process large-scale voice and data communication on behalf of our customers.

In support of selected industries and enterprise client solution initiatives, the Company has begun evolving the sales strategy to further leverage marketing efforts and its large sales force to sell communication solutions managed by each of the operating segments. A “One West” marketing initiative to brand all products and services under the West name was recently launched. Examples of our sales initiatives include having sales personnel from the Unified Communications operating segment sell products managed by the Safety Services operating segment along with Unified Communications products. In addition, we have dedicated sales professionals to the healthcare market to focus on selling all existing West products and services and to identify opportunities for the Company to develop new solutions for the healthcare market.

In the October 26 Comment Letter, the Staff references that the Interactive Services website references strategic consultation services. In conjunction with the development of a customized communications and data analytics solution for our customers, strategic consultation may be provided but consulting services are not separately offered or billed to customers.

In summary, all five operating segments process large-scale voice and data management services that are complex and mission critical and help our clients communicate. The services offered by our operating segments rely upon similar technologies, core competencies, shared infrastructure and have many common customers focused in a small number of industry sectors. Our business activities focus on providing our clients with integrated business solutions that cut across many of our service offerings. The Company’s conclusion that the products are similar is based on how we are managing the business to provide solution sets that drive value to our customers and solve their communication needs leveraging common communications technology infrastructure and data analytics.

| | • | | With regard to the nature of your production services we note your analysis of revenue per employee. Please provide to us the revenue per employee for each operating segment. If there are differences in the revenue per employee across your operating segments help us understand the reasons for any differences. Further, tell us if your Specialized Agent Services business is more labor centric as opposed to technology centric. In this regard, we note your reference to “highly trained employees” which provide the services in the Specialized Agent Services business as opposed to your other operating segments which appear to utilize and leverage the use of technology to provide the vast amount of your products and services. Please explain in further detail how you concluded your Specialized Agent Services business is qualitatively similar in this regard. |

Response:

As requested, the Company is providing revenue per employee for each operating segment based on 2015 projections:

| | | | | | | | | | | | | | | | | | | | |

| | | Specialized

Agent

Services | | | Interactive

Services | | | Unified

Communications | | | Telecom

Services | | | Safety

Services | |

Revenue per FTE employee | | $ | [**] | | | $ | [**] | | | $ | [**] | | | $ | [**] | | | $ | [**] | |

Securities and Exchange Commission

November 9, 2015

[Confidential Treatment Requested by West Corporation]

WSTC 4

Currently, the Specialized Agent Services segment is more labor intensive than our other operating segments. However, the Company does project that the revenue per FTE employee will increase each year based on the expected mix of products sales and as we enhance our products and services to bundle in more technology and data analytics features.

In the Company’s previous response to the September 24 Comment Letter, we disclosed the consolidated revenue per employee metric to demonstrate how the Company’s profile had changed as a result of the divestiture of our agent-based businesses. The revenue per FTE metric is utilized at the total Company level, not used to allocate resources, but rather to differentiate the Company from the divested businesses. The Company did not consider the revenue per employee metric by operating segment to evaluate the similarity of the production processes. Instead, the Company focused on the common communications technology infrastructure and the ability to terminate a communication at multiple end points. Although the Specialized Agent Services operating segment currently utilizes more live agents to support their specific clients, other operating segments have products where trained agents are integral to the solution. Both the Unified Communications and Interactive Services operating segments employ agents to assist in providing various solutions, such as web events and operator-assisted conference calls, on behalf of our customers.

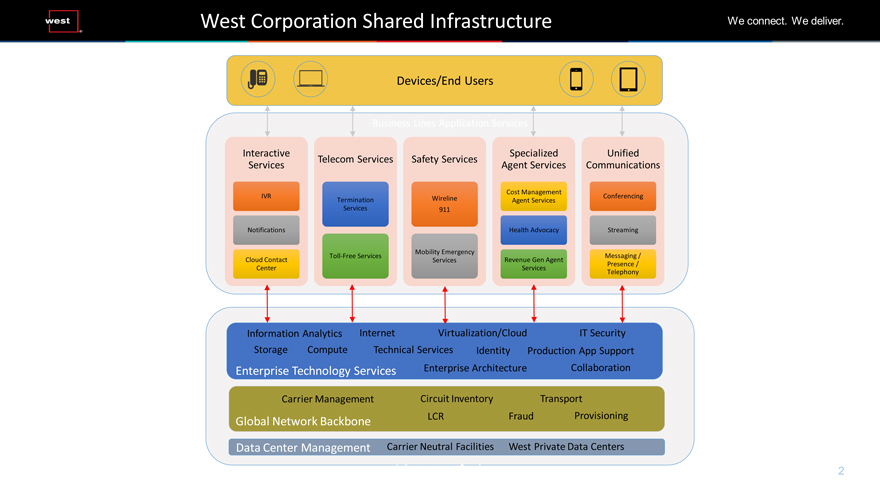

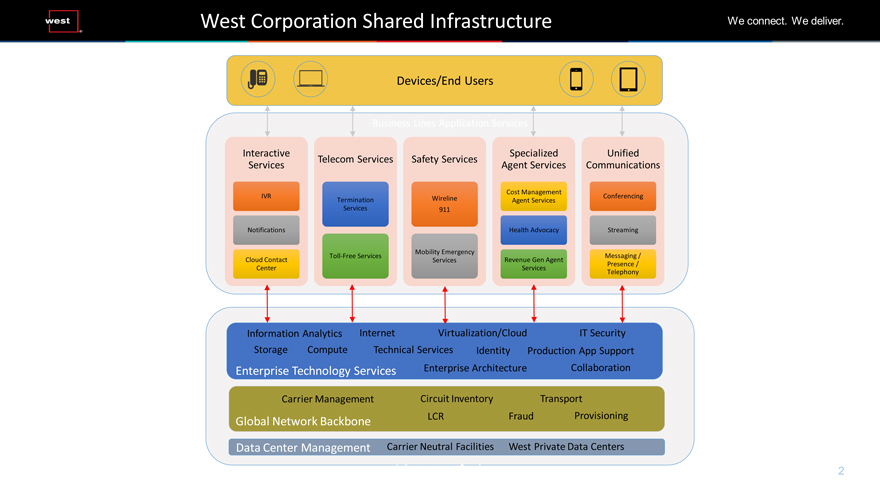

The Company has included a diagram, attached hereto as Exhibit 2, to outline the underlying infrastructure of the production or delivery of our services. The diagram, utilized internally to portray how management views the Company’s underlying technology, illustrates how all of the operating segments utilize a common set of enterprise technology services, a global telecommunications network backbone, and common data center management and infrastructure. The diagram also illustrates some of the functions performed by the Company to manage the underlying infrastructure. Each external interaction can be initiated and/or terminated to the device (mobile devices, landline phone or computer) chosen by the requester. In addition, the diagram illustrates how communications are facilitated by computer ports or trained professional people. In many cases, the same information can be delivered by a computer port or a human but must match the initiating device or client requirements.

| | • | | Provide to us more detailed qualitative and quantitative information with regard to the customers you serve by operating segment, including but not limited to revenue by industry served. In this regard, we note from your website that your Safety Services operating segment appears to provide services to public safety or government agencies. Please explain to us how you considered whether or how a government agency is a similar customer compared to a corporation. For example, a government agency and a corporation are dependent on very different funding and capital raising mechanisms to purchase your products or services. Lastly, it appears your Telecom Services operating segment focuses almost exclusively on telecommunication customers as opposed to your other operating segments which could have a wide variety of customers. Please advise us in further detail how you reasonably concluded your customers are similar across your operating segments. |

Securities and Exchange Commission

November 9, 2015

[Confidential Treatment Requested by West Corporation]

WSTC 5

Response:

As requested, the Company is providing an analysis of customer revenue by industry served. The Company analyzed revenue from the top 50 customers of each of our operating segments for the nine months ended September 30, 2015, which represented over 46% of our consolidated revenue. The Company focuses primarily on the top five industries noted in the table below based on the Company’s ability to provide unique communication solutions for that industry.

Operating Segment Revenue by Industry for the Top 50 Customers per Segment:

| | | | | | | | | | | | | | | | | | | | | | | | |

Industry | | Unified

Communications | | | Interactive

Services | | | Safety

Services | | | Telecom

Services | | | Specialized

Agent

Services | | | Total | |

Tele-communication | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Finance | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Healthcare | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Manufacturing | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Information technology | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Utilities/Energy | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Retail | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Insurance | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Other | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % |

As the Staff notes, the Safety Services operating segment does provide services to public safety and government agencies. However, public safety and government agency customers’ revenue represents only about [**]% of Safety Services total revenue, [**]% of their top 50 customers and less than [**]% of the Company’s consolidated revenue. Although not included in their top 50 customers, Unified Communications and Interactive Services also have revenue from government agencies.

The Company acknowledges that the Telecom Services operating segment is focused almost exclusively on the telecommunications industry. However, the acquisition of the Telecom Services business originally had the primary objective of leveraging their telecom infrastructure across West to manage the Company’s telecom expenses. Over [**]% of Telecom Services year to date 2015 revenue was generated from intercompany services. After adjusting for the recently announced large lost client, over [**]% of Telecom Services revenue will be generated from intercompany services. In addition, the other four operating segments also have customers in the telecommunications industry.

In the evaluation and conclusion that customers are similar, the Company focused on the similarities captured in the chart above and the evolution to a go-to-market strategy focused on key industries and enterprise clients and bundling products and core competencies to deliver solutions to their unique communication challenges.

Securities and Exchange Commission

November 9, 2015

[Confidential Treatment Requested by West Corporation]

WSTC 6

| | • | | Please explain to us in further detail how you concluded your five operating segments were economically similar pursuant to the aggregation criteria in ASC 280-10-50-11 and ASC 280-10-55-7A through 55-7C. Provide us in tabular format your historical and projected revenues, gross margins, and Adjusted EBITDA margins separately for each operating segment. Please provide the historical information for the last three fiscal years. We may have further substantial comment after reviewing your response. |

Response:

Please see Exhibit 3 for the historical and projected revenues, gross margins and Adjusted EBITDA margins.

ASC 280-10-55-7A states that operating segments are considered similar if they can be expected to have essentially the same future prospects. Sales and margin trends should be evaluated based on future prospects and not necessarily on only the current indicators.

Due to the divestiture completed in 2015, the continued integration of recent acquisitions and the transformation of the business to the “One West” strategy, the historic organic growth rate of these operating segments is not representative of the Company’s expectation of future results. As part of the Company’s transformation from a labor-intensive business to a technology-based business, the Company has been investing in tuck-in acquisitions to expand our product offerings to existing customers or expand our customer base. The Company expects product and sales synergies from the integration of these acquisitions to increase organic revenue growth. The Company has also launched other initiatives to enhance organic growth including a “One West” branding initiative and other product and sales initiatives in key markets. Therefore, in performing the analysis of organic revenue growth and adjusted EBITDA margins, the Company focused on 2015 and future year projections. As part of the Company’s normal annual planning cycle, the three year projections have recently been updated. The analysis that follows is based on the updated projections.

As part of the evaluation of similarity in future revenue trends, the Company made adjustments, consistent with recent press releases, for acquisitions, foreign currency translation fluctuations and the loss of two large clients. Exhibit 3 shows projected 2015 adjusted organic revenue growth rates ranging from[**]% to [**]%. Excluding Telecom Services, the projected 2015 adjusted organic revenue growth rates range from[**]% to [**]%. The preliminary 2016 revenue budget targets result in adjusted organic growth rates that vary from [**]% to [**]% across the operating segments. The Company’s 2016 planning process is still underway with final expectations for 2016 revenue and adjusted EBITDA margins to be established in January. Projected growth rates are expected to converge to the low to mid-single digits as the Company continues to execute on its strategies around key industry market solutions, cross sales and tuck-in acquisitions that expand clients in key industries or enhance products supporting key growth markets across our existing operating segments.

Securities and Exchange Commission

November 9, 2015

[Confidential Treatment Requested by West Corporation]

WSTC 7

The exhibit provided shows the projected range of 2015 Adjusted EBITDA margin to be between [**]% to [**]%, a difference of [**] percentage points. Our major competitors have EBITDA margins ranging from approximately 13% to 33%. Prior to the loss of Telecom Services’ largest client, the range in Adjusted EBITDA margin in 2018 across all five operating segments was projected to be [**]% to [**]%, which the Company considered to be similar economic characteristics. Current 2018 projections show an Adjusted EBITDA range of [**]% to [**]%, excluding the Telecom Services operating segment. This narrowing in the expected Adjusted EBITDA range is the result of the anticipated benefits of the “One West” strategy and continued evolution in our shared services model.

The Company continues to further evolve to a shared services model for support functions such as Information Technology, which includes voice and data management services, shared network infrastructure, common data center environments and common call routing paths as well as Finance, Human Resources, Facilities, etc. For the nine months ended September 30, 2015, these shared service expenses represented [**]% of the Company’s consolidated selling, general and administrative expenses. These common infrastructure services support the similar production processes of each of our operating segments.

The Company has also initiated several “One West” operating infrastructure and technology projects, such as data center consolidations, common cloud infrastructure development, and carrier management centralization. Other “One West” opportunities to enhance the Company’s performance are under evaluation. The Company expects to continue to evolve as it implements the “One West” strategy. The Company expects that the implementation of these expense initiatives will support the further convergence of Adjusted EBITDA margins over the next few years.

The Company acknowledges that the Adjusted EBITDA margins projected for the Telecom Services operating segment have changed since our analysis performed in the first quarter of 2015. Telecom Services revenue from external clients is now projected to be only about [**]% of consolidated 2016 revenue and the acquisition of the Telecom Services business originally had the primary objective of leveraging their telecom infrastructure across West to manage our telecom expenses. [**]

In summary, based on the facts and analysis discussed, the Company believes it has demonstrated and satisfied the aggregation requirements ofASC 280-10-50-11, and based on the future range of revenue growth and Adjusted EBITDA margins, the Company has concluded the operating segments have similar economic characteristics. The one reportable segment aligns with our current organizational structure and our current initiatives, while providing the users of our financial statements the ability to assess the Company’s future cash flow prospects and make informed judgments about the Company.

| | • | | Tell us if there are any other economic measures that are provided to the CODM that he uses to assess performance and allocate resources among the operating segments. If so, tell us how you considered any other economic measures for purposes of determining economic similarity. For example, if the CODM uses any financial metrics, return on investment or other industry performance measures, please explain that in your response. |

Securities and Exchange Commission

November 9, 2015

[Confidential Treatment Requested by West Corporation]

WSTC 8

Response:

Currently no other economic measures are provided to the CODM to assess operating segment performance or allocate resources. The CODM receives other economic metrics only on a consolidated basis.

* * * * *

The Company acknowledges that:

| | • | | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | • | | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | • | | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Thank you for your prompt attention to the Company’s responses. If you wish to discuss the responses being submitted herewith at any time, or it there is anything we can do to facilitate the Staff’s processing of this response, please feel free to contact me at (402) 963-1200.

|

| Very truly yours, |

|

| /s/ Jan D. Madsen |

| Jan D. Madsen |

| Chief Financial Officer |

| West Corporation |

| cc: | Jonathan Babb, Sidley Austin LLP (via e-mail) |

Trevor Barton, Deloitte & Touche LLP (via e-mail)

|

Exhibit 1

|

Exhibit 1

West Engagement Center

Technologies and assets to drive solutions across the care continuum

TECHNOLOGY ENABLED COMMUNICATION

ENGAGE AND ACTIVATE

Omni-Channel Bi-Directional Personalized Unified

Intervention-Focused

CLINICAL MANAGED SERVICES

MANAGE AND ESCALATE

Certified Clinicians Call Triage to CCM Practice Extension Program Creation

“Build and Transfer”

ANALYTICS & BUSINESS INTELLIGENCE

GAIN INSIGHTS

Measure Inform Decision Improve Optimize

Right patient, right intervention, right time

Greater patient engagement & activation

Add scale & capacity to wellness & care management

High-quality, lower cost care pathways

|

Exhibit 2

|

Exhibit 2

West Corporation Shared Infrastructure

We connect. We deliver.

Devices/End Users

Interactive Specialized Unified

Telecom Services Safety Services

Services Agent Services Communications

Cost Management

IVR Termination Wireline Agent Services Conferencing

Services 911

Notifications Health Advocacy Streaming

Mobility Emergency

Toll-Free Services Messaging /

Cloud Contact Services Revenue Gen Agent Presence /

Center Services Telephony

Information Analytics Internet Virtualization/Cloud IT Security

Storage Compute Technical Services Identity Production App Support

Enterprise Technology Services Enterprise Architecture Collaboration

Carrier Management Circuit Inventory Transport

Global Network Backbone LCR Fraud Provisioning

Data Center Management Carrier Neutral Facilities West Private Data Centers

Exhibit 3

West Corporation

Dollars in thousands

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | 2012 | | | 2013 | | | 2014 | | | 2015 P | | | 2016 P | | | 2017 P | | | 2018 P | |

Specialized Agent Services | | $ | [**] | | | $ | [**] | | | $ | [**] | | | $ | [**] | | | $ | [**] | | | $ | [**] | | | $ | [**] | |

Safety Services | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | |

Telecom Services | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | |

Interactive Services | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | |

Unified Communications | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated (before eliminations) | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Intercompany eliminations | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | | | | [**] | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated revenue | | $ | [**] | | | $ | [**] | | | $ | [**] | | | $ | [**] | | | $ | [**] | | | $ | [**] | | | $ | [**] | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

Revenue growth rate | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Specialized Agent Services | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Safety Services | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Telecom Services | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Interactive Services | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Unified Communications | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated (before eliminations) | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Adjusted organic constant currency revenue growth rate * | | | | | | | | | | | | | | | | | | | | | | | | | |

Specialized Agent Services | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Safety Services | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Telecom Services | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Interactive Services | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Unified Communications | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated | | | | | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

* Adjustments are for acquisitions, the loss of two large customers constant currency adjustments in 2015 and the growth in intercompany Telecom Services revenue. | |

| | | | | | | |

| Gross Margins | | 2012 | | | 2013 | | | 2014 | | | 2015 P | | | 2016 P | | | 2017 P | | | 2018 P | |

Specialized Agent Services | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Safety Services | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Telecom Services | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Interactive Services | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Unified Communications | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Adjusted EBITDA Margins | | 2012 | | | 2013 | | | 2014 | | | 2015 P | | | 2016 P | | | 2017 P | | | 2018 P | |

Specialized Agent Services | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Safety Services | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Telecom Services | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Interactive Services | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

Unified Communications | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Consolidated (excluding elims) | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % | | | [**] | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

P—Projected