- TEN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Tenneco (TEN) PRE 14APreliminary proxy

Filed: 12 Mar 21, 5:14pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

Tenneco Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| 1 | Title of each class of securities to which transaction applies: | |||

| 2 | Aggregate number of securities to which transaction applies: | |||

| 3 | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4 | Proposed maximum aggregate value of transaction: | |||

| 5 | Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| 1 |

Amount Previously Paid: | |||

| 2 | Form, Schedule or Registration Statement No.: | |||

| 3 | Filing Party: | |||

| 4 | Date Filed: | |||

SEC 1913 (02-02) | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

Tenneco Inc. intends to release definitive copies of the proxy statement to stockholders on or about April 1, 2021.

Proxy Statement and

Notice of 2021 Annual Meeting

Driving Advancements in Global Mobility –

Solutions for cleaner, more efficient, comfortable and reliable performance

Friday, May 14, 2021 at 10:00 a.m., Central Time

|

To the Stockholders of Tenneco Inc.:

I cordially invite you to attend Tenneco’s 2021 Annual Meeting of Stockholders to be held Friday, May 14, 2021, at 10:00 a.m., Central Time. Similar to last year, this year’s annual meeting will be held entirely online to allow for greater participation in light of the ongoing public health impact of the coronavirus outbreak (COVID-19). Stockholders may participate in this year’s annual meeting by visiting the following website www.virtualshareholdermeeting.com/TEN2021.

Your vote is very important! Whether or not you plan to attend the annual meeting, we urge you to read the enclosed proxy statement and vote as soon as possible via the Internet, by telephone or, if you receive a paper proxy card or voting instruction form in the mail, by mailing the completed proxy card or voting instruction form.

A record of our activities for the year 2020 is contained in our Form 10-K. Thank you for your confidence and continued support.

Brian J. Kesseler

Chief Executive Officer

Tenneco Inc.

April 1, 2021

PRELIMINARY PROXY STATEMENT—SUBJECT TO COMPLETION

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

What: | The Annual Meeting of Stockholders of Tenneco Inc. (the “Annual Meeting”) |

When: | Friday, May 14, 2021 at 10:00 a.m., Central Time |

Where: | Due to the ongoing public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our partners and stockholders, the Annual Meeting will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting physically, however you will be able to vote and submit questions electronically. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/TEN2021, you must enter the control number found on your proxy card, voting instruction form or Notice card. |

Items of

Business: | 1. To elect the 10 director nominees listed in this proxy statement; |

| 2. | To ratify the appointment of PricewaterhouseCoopers LLP as independent public accountants for 2021; |

| 3. | To approve our executive compensation in an advisory vote; |

| 4. | To approve the Tenneco Inc. 2021 Long-Term Incentive Plan; |

| 5. | To ratify the Section 382 Rights Agreement, dated as of April 15, 2020, between the Company and Equiniti Trust Company, as rights agent; and |

| 6. | To consider any other matters, if properly raised. |

Who may vote: | Owners of class A voting common stock (“class A common stock”) as of the close of business on March 24, 2021 may vote at the Annual Meeting. |

Voting: | YOUR VOTE IS VERY IMPORTANT. All stockholders are cordially invited to attend the Annual Meeting virtually. You may vote during the Annual Meeting by following the instructions available on the meeting website during the meeting, but if you are not able to attend virtually, please submit your vote as soon as possible as instructed in the Notice, proxy card or voting instruction form. You can vote via mail, telephone or the Internet. Whether or not you plan to attend the Annual Meeting, we urge you to vote and submit your proxy in advance of the Annual Meeting using one of these methods. |

| Stockholders of record have been mailed a Notice of Internet Availability of Proxy Materials, which provides stockholders with instructions on how to access our proxy materials and our Form 10-K on the Internet and, if they prefer, how to request paper copies of these materials. |

Questions: | For any questions regarding the Annual Meeting, please contact Tenneco at (847) 482-5000, attention: Corporate Secretary. |

By Order of the Board of Directors

Thomas J. Sabatino, Jr.

Corporate Secretary

Lake Forest, Illinois

April 1, 2021

The Notice of Annual Meeting of Stockholders and the attached proxy statement are first being made available to stockholders of record as of March 24, 2021 on or about April 1, 2021.

i

ii

iii

IMPORTANT NOTICE REGARDING THE

AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 14, 2021

Pursuant to the “notice and access” rules adopted by the Securities and Exchange Commission, we have elected to provide stockholders access to our proxy materials over the internet. Accordingly, we mailed a Notice of Internet Availability of Proxy Materials (the “Notice”) on April 1, 2021 to our stockholders of record. The Notice provides you with instructions regarding how to:

| · | View our proxy materials for the 2021 Annual Meeting of Stockholders and our Form 10-K (which includes our audited financial statements) on the internet at www.proxyvote.com; |

| · | Instruct us to provide our future proxy materials to you electronically by email; and |

| · | If you prefer, request paper copies of our proxy materials and Form 10-K. |

Plan participants who hold Tenneco shares in their 401(k) accounts and other stockholders who have previously requested paper copies of these materials may receive these materials by email or by mail. We elected to use electronic notice and access for our proxy materials because this process will reduce our printing and mailing costs and, by reducing the amount of printed materials, will reduce the environmental impact of our Annual Meeting of Stockholders. Choosing to receive your future proxy materials by email will help us in these efforts. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it.

iv

PROXY STATEMENT

The Board of Directors (the “Board”) of Tenneco Inc. first released these proxy materials to our stockholders on or about April 1, 2021. We are furnishing this proxy statement in connection with the solicitation by our Board of proxies to be voted at the Annual Meeting of Stockholders on May 14, 2021 or at any adjournment or postponement thereof (the “Annual Meeting”). All references to “Tenneco,” “we,” “us,” “our” and “the company” refer to Tenneco Inc. and its consolidated subsidiaries.

|

The following summary sets forth information contained elsewhere in this proxy statement. You should read the entire proxy statement before casting your vote.

Annual Meeting of Stockholders

Due to the ongoing public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our partners and stockholders, the Annual Meeting will be held in a virtual meeting format only.

WHEN May 14, 2021, at 10:00 a.m., Central Time. | WHERE You will not be able to attend the Annual Meeting physically however you will be able to vote and submit questions electronically. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/TEN2021, you must enter the control number found on your proxy card, voting instruction form or Notice card. | |

You are entitled to vote at the meeting if you were a holder of record of our class A voting common stock (“class A common stock”) at the close of business on March 24, 2021. Please see pages 5-8 for instructions on how to vote your shares.

Voting Recommendations of the Board

Our Board recommends that you vote FOR the proposal below

Our Board recommends that you vote FOR the proposal below

Item

| Description

| Our Board’s

| Page

| |||

1. |

Elect Directors | FOR EACH NOMINEE RECOMMENDED BY OUR BOARD

|

9 | |||

2. |

Ratify appointment of the independent auditor |

FOR |

76 | |||

3. |

Approve, on an advisory basis, executive compensation |

FOR |

78 | |||

4. | Approve the Tenneco Inc. 2021 Long-Term Incentive Plan (the “2021 LTIP”)

|

FOR |

80 | |||

5. | To ratify the Section 382 Rights Agreement, dated as of April 15, 2020, between the Company and Equiniti Trust Company, as rights agent (the “Rights Agreement”)

|

FOR |

90 |

1

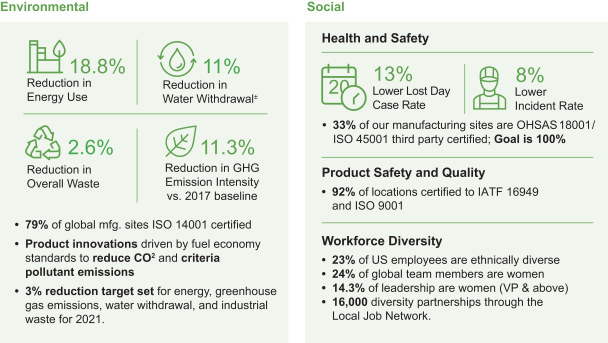

The Board has nominated the following 10 individuals to stand for election for a one-year term expiring at the annual meeting of stockholders to be held in 2022. Each nominee is independent, other than Mr. Kesseler. You can find additional information under “Election of Directors (Item 1)” beginning on page 9.

Name

| Age

| Director

| Professional Background

| Standing

| ||||

Roy V. Armes

|

68

|

2020

|

Former President and CEO, Cooper Tire & Rubber Company

| Audit, Nominating / Governance

| ||||

Thomas C. Freyman

|

66

|

2013

|

Former CFO, Abbott

|

Audit, Compensation

| ||||

Denise Gray

|

58

|

2019

|

President of LG Energy Solution Michigan Inc. Tech Center

|

Audit, Compensation

| ||||

Brian J. Kesseler

|

54

|

2016

|

Chief Executive Officer, Tenneco

| |||||

Dennis J. Letham | 69 | 2007 | Former CFO, Anixter International | |||||

James S. Metcalf

|

63

|

2014

|

Chairman of the Board and CEO, Cornerstone Building Brands; Former Chairman, President and CEO, USG Corporation

|

Compensation

| ||||

Aleksandra A. Miziolek

|

64

|

2020

|

Former Chief Transformation Officer and former Senior Vice President and General Counsel, Cooper-Standard Holdings Inc.

|

Compensation, Nominating / Governance

| ||||

Charles K. Stevens, III

|

61

|

2020

|

Former Executive Vice President and Senior Advisor and former Executive Vice President and Chief Financial Officer of General Motors Company

|

Compensation, Nominating / Governance

| ||||

John S. Stroup

|

54

|

2020

|

Executive Chairman, Belden, Inc.(until May 2021) and Operating Advisor to Clayton, Dubilier & Rice

| Audit | ||||

Jane L. Warner

|

74

|

2004

|

Former Executive Vice President, Illinois Tool Works

| Audit, Nominating / Governance

|

2

Key Features of Our Executive Compensation Program

| • | Double-trigger change in control vesting for benefits and awards granted under our long-term incentive plan after November 5, 2020 (page 39) |

| • | Pay-for-performance strategy aligns executive and stockholder financial interests (page 41) |

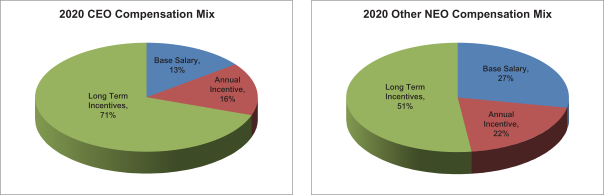

| • | Incentive compensation made up approximately 87% of target Chief Executive Officer pay granted for 2020 (page 39) |

| • | Incentive pay programs feature multiple performance metrics (pages 43-48) |

| • | Rigorous stock ownership requirements for officers and directors (page 52) |

| • | No pledging or hedging of Tenneco stock by officers or directors (pages 52-53) |

| • | Clawback policy that requires reimbursement of incentive compensation in certain circumstances (page 53) |

| • | Nine of our 10 current director nominees are independent (page 21) |

| • | Significant Board and governance refreshment process in 2020, as a result of which (i) we appointed one of our independent directors as non-executive Chairman, (ii) our committees were reconstituted in April 2020 and remain fully independent, and (iii) four of nine independent director nominees have joined our Board since the beginning of 2020 |

| • | Directors elected annually and majority voting for all directors in an uncontested election (plurality voting in a contested election), with a resignation policy for directors who fail to receive the required vote |

| • | Stockholders meeting certain requirements may nominate directors and have them |

3

included in the proxy statement, known as “proxy access” (page 26) |

| • | Extensive Board oversight of risk management, with particular focus on our strategic, operational, compliance and financial risks (page 22) |

| • | Separate Chairman and Chief Executive Officer roles (page 21) |

| • | Executive sessions of non-management directors are conducted regularly (page 21) |

| • | Comprehensive annual self-assessments of Board and its committees |

| • | Code of Conduct for directors, officers and employees and an additional Code of Ethical Conduct for Financial Managers that applies to our Chief Executive Officers, Chief Financial Officer and other key financial managers |

| • | Corporate Social Responsibility and Sustainability Report published on our website |

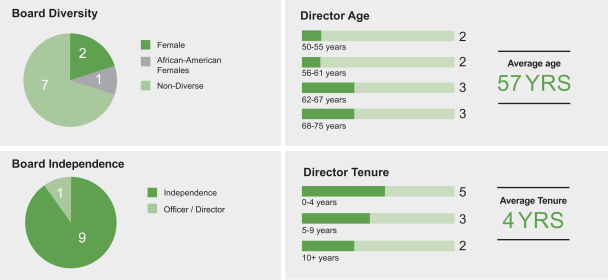

Environmental and Social Highlights

For a more detailed view of the Company’s performance across our global portfolio, please see our Corporate Social Responsibility and Sustainability Report (CSR Report), which can be found on our public website. Our CSR Report was developed in accordance with the Global Reporting Initiative Standards. Additional disclosures about Human Capital Resources can be found in our 2020 Annual Report on Form 10-K filed with the SEC.

4

|

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will consider and vote on the following matters:

| · | The election of the 10 director nominees named in this proxy statement to our Board, each for a term of one year; |

| · | The ratification of the appointment of PricewaterhouseCoopers LLP as our independent public accountants for the fiscal year ending December 31, 2021; |

| · | To approve our executive compensation in an advisory vote; |

| · | To approve the 2021 LTIP; and |

| · | To ratify the Rights Agreement. |

The stockholders will also act on any other business that may properly come before the Annual Meeting.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

If your shares are registered directly in your name with our transfer agent, EQ Shareowner Services, you are considered, with respect to those shares, the “stockholder of record.” If your shares are held in a stock brokerage account or by a bank or other record holder, you are considered the “beneficial owner” of shares held in “street name.” As the beneficial owner, you have the right to direct your broker, bank or other record holder on how to vote your shares, and you are also invited to attend the Annual Meeting. Your broker, bank or other record holder should have enclosed or provided voting instructions for you to use in directing the voting of your shares.

What do I need to do to attend the Annual Meeting online?

Due to the ongoing public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our partners and stockholders, we will be hosting the Annual Meeting via the Internet. It will be a completely virtual meeting. You will not be able to attend the Annual Meeting physically, but your right to vote will not be affected and you will be able to submit questions electronically during the annual meeting.

You are entitled to participate in the Annual Meeting if you were a stockholder as of the close of business on March 24, 2021. To be admitted to the Annual Meeting at www.virtualshareholdermeeting.com/TEN2021, you must enter the control number found on your proxy card, voting instruction form or notice card. If you are a beneficial shareholder, you may contact the bank, broker or other record holder where you hold your account if you have questions about obtaining your control number.

We encourage you to access the Annual Meeting online up to 30 minutes prior to its start time. If you encounter any difficulties accessing the Virtual Annual Meeting during the check-in or meeting time, please contact the technical support number that will be posted on the log-in page.

Additional information regarding the rules of conduct will be posted prior to and during the meeting at the abovementioned website.

5

Who is entitled to vote at the Annual Meeting?

Only holders of record of our class A common stock at the close of business on March 24, 2021 are entitled to vote. There were [●] shares of class A common stock outstanding on March 24, 2021. Stockholders are entitled to cast one vote per share of class A common stock on all matters. There were [●] shares of class B non-voting common stock outstanding on March 24, 2021.

How do I vote my shares during the Annual Meeting?

During the Annual Meeting, you may vote shares held in your name as the stockholder of record or held in street name as the beneficial owner by following the instructions available on the meeting website, proxy card, voting instruction form or notice card.

Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Annual Meeting.

How do I vote my shares without attending the Annual Meeting?

There are three ways to vote by proxy:

| · | By Internet — You can vote over the internet by following the instructions on the Notice or proxy card; |

| · | By Mail — If you received your proxy materials by mail, you can vote by filling out the accompanying proxy card and returning it in the return envelope that we have enclosed for you; or |

| · | By Telephone — You can vote by telephone by following the instructions on the proxy card. |

If you received a proxy card in the mail but choose to vote by internet or by telephone, you do not need to return your proxy card.

If your shares are held in street name, follow the voting instructions on the form that you receive from your bank, broker or other nominee. The availability of telephone and internet voting will depend on the bank’s, broker’s or other nominee’s voting process. Your bank, broker or other nominee may not be permitted to exercise voting discretion as to some of the matters to be acted upon. Therefore, please give voting instructions to your bank, broker or other nominee.

Unless you hold your shares through the company’s 401(k) plans, you may vote via the internet or by telephone until 11:59 p.m. Eastern Time, on May 13, 2021, or the company’s agent must receive your paper proxy card on or before May 13, 2021. If you hold your shares through the company’s 401(k) plans, you may vote via the internet or by telephone until 11:59 p.m., Eastern Time, on May 11, 2021, or the company’s agent must receive your paper proxy card on or before May 11, 2021.

How will my proxy be voted?

All properly completed, unrevoked proxies that are timely received will be voted in accordance with the specifications made.

If a properly executed, unrevoked written proxy card does not specifically direct the voting of shares covered, the proxy will be voted:

| · | FOR the election of all nominees for election as director described in this proxy statement; |

6

| · | FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent public accountants for 2021; |

| · | FOR the approval, in an advisory vote, of our executive compensation; |

| · | FOR the approval of the 2021 LTIP; |

| · | FOR the ratification of the Rights Agreement; and |

| · | in accordance with the judgment of the persons named in the proxy as to such other matters as may properly come before the Annual Meeting. |

The Board is not aware of any other matters that may properly come before the Annual Meeting. However, should any such matters come before the Annual Meeting, it is the intention of the persons named in the enclosed form of proxy card to vote all proxies (unless otherwise directed by stockholders) in accordance with their judgment on such matters.

May I revoke or change my vote?

If you are a stockholder of record, you may revoke your proxy at any time before it is actually voted by giving written notice of revocation to our Corporate Secretary, by delivering a proxy bearing a later date (including by telephone or by internet) or by attending virtually and voting during the Annual Meeting. Virtual attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically make that request. If you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker or other record holder or, by attending virtually and voting during the Annual Meeting.

Will my vote be made public?

All proxies, ballots and voting materials that identify the votes of specific stockholders will generally be kept confidential, except as necessary to meet applicable legal requirements and to allow for the tabulation of votes and certification of the vote.

What constitutes a quorum, permitting the Annual Meeting to conduct its business?

The presence at the Annual Meeting, in person or by proxy, of holders of a majority of the issued and outstanding shares of class A common stock as of the record date is considered a quorum for the transaction of business. If you submit a properly completed proxy or if you virtually attend the Annual Meeting to vote during the meeting, your shares of class A common stock will be considered part of the quorum.

Abstentions and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A broker non-vote occurs when a bank, broker or other nominee holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. The election of directors (Item 1), the advisory vote on executive compensation (Item 3), the approval of the 2021 LTIP (Item 4) and the ratification of the Rights Agreement (Item 5) are “non-discretionary” items. If you do not instruct your bank, broker or other nominee how to vote with respect to any of these items, your bank, broker or other nominee may not vote with respect to the applicable proposal and those votes will be counted as “broker non-votes.”

How many votes are needed to approve a proposal?

Assuming the presence of a quorum, each director nominee receiving a majority of the votes cast at the Annual Meeting (in person or by proxy) will be elected as a director (Item 1). A “majority of

7

the votes cast” means the number of “For” votes cast exceeds the number of “Against” votes cast. A proxy marked “Abstain” with respect to any director will not be counted in determining the total number of votes cast. Because the election of directors is determined on the basis of a majority of the votes cast, abstentions and broker non-votes have no effect on the election of directors.

Assuming the presence of a quorum, the affirmative vote of a majority of the shares present, in person or by proxy, at the Annual Meeting and entitled to vote is required to ratify the appointment of PricewaterhouseCoopers LLP as our independent public accountants for 2021 (Item 2), to approve our executive compensation in an advisory vote (Item 3) and to ratify the Rights Agreement (Item 5). Because the vote standard for the approval of these proposals is a majority of shares present and entitled to vote, abstentions have the effect of a vote against the proposals and broker non-votes have no effect on the proposals.

Assuming the presence of a quorum, the affirmative vote of a majority of the votes cast at the Annual Meeting is required to approve the 2021 LTIP (Item 4). Because the vote standard for the approval of this proposal is a majority of the votes cast, abstentions have the effect of a vote against the proposal and broker non-votes have no effect on the proposal.

Who will count the vote?

Representatives of Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspectors of election.

How can I find the voting results of the Annual Meeting?

We will report the voting results in a Current Report on Form 8-K within four business days after the end of the Annual Meeting.

How is the solicitation being made?

The cost of solicitation of proxies will be borne by us. Solicitation will be made by mail, and may be made by directors, officers and employees, personally or by telephone, email or fax. Proxy cards and materials also will be distributed to beneficial owners of stock through brokers, custodians, nominees and other like parties, and we expect to reimburse such parties for their charges and expenses. We have engaged Innisfree M&A Incorporated to assist us in the solicitation of proxies, at an estimated cost of $25,000 plus expense reimbursement.

Does Tenneco allow stockholders to have proxy access for the nomination of directors?

Yes. The Board has adopted proxy access By-Law provisions to permit eligible stockholders to include nominees in the company’s proxy statement and form of proxy. See “Submission of Stockholder Proposals” for further information.

Where can I find more information about Tenneco?

We file reports and other information with the U.S. Securities and Exchange Commission (“SEC”). This information is available at our website at http://www.tenneco.com and at the internet site maintained by the SEC at http://www.sec.gov.

8

(ITEM 1)

|

Our Board is currently comprised of 10 directors, Roy V. Armes, Thomas C. Freyman, Denise Gray, Brian J. Kesseler, Dennis J. Letham, James S. Metcalf, Aleksandra A. Miziolek, Charles K. Stevens, III, John S. Stroup and Jane L. Warner.

Unless otherwise indicated in your proxy, the persons named as proxy voters in the accompanying proxy card, or their substitutes, will vote your proxy for all the nominees, each of whom has been designated as such by the Board. In the event that any nominee for director withdraws or for any reason is not able to serve as a director, we will vote your proxy for the remainder of those nominated for director (except as otherwise indicated in your proxy) and for any replacement nominee designated by the Nominating and Governance Committee of the Board.

You may vote “For” or “Against” any or all of the director nominees, or you may “Abstain” from voting. Assuming a quorum, each director nominee receiving a majority of the votes cast at the Annual Meeting (in person or by proxy) will be elected as a director. A “majority of the votes cast” means the number of “For” votes cast exceeds the number of “Against” votes cast. A proxy marked “Abstain” with respect to any director will not be counted in determining the total number of votes cast.

If an incumbent director is not elected, that director remains in office until the director’s successor is duly elected and qualified or until the director’s death, resignation or retirement. To address this potential outcome, the Board adopted a director resignation policy in Tenneco’s By-Laws. Under this policy, the Board will nominate for directors only those incumbent candidates who tender, in advance, irrevocable resignations, and the Board has obtained such conditional resignations from the nominees in this year’s proxy statement. The irrevocable resignations will be effective upon the failure to receive the required vote at any annual meeting of stockholders at which they are nominated for re-election and Board acceptance of the resignation. If a nominee fails to receive the required vote, the Nominating and Governance Committee will recommend to the Board whether to accept or reject the tendered resignation. The Board will publicly disclose its decision within 90 days following certification of the stockholder vote. The director whose resignation is under consideration will not participate in the recommendation of the Nominating and Governance Committee or the Board’s decision with respect to the resignation. If the Board does not accept the resignation, the director will continue to serve until the next annual meeting of stockholders and until his or her successor is duly elected, or until his or her earlier resignation or removal. If the Board accepts the resignation, then the Board, in its sole discretion, may fill any resulting vacancy or may decrease the size of the Board (but not below the minimum number of directors required under our Certificate of Incorporation).

Included in the incumbent directors nominated for re-election is Mr. John S. Stroup, who was appointed by the Board as a director effective September 18, 2020, after being identified by an independent third-party search firm that was engaged by our Nominating and Governance Committee.

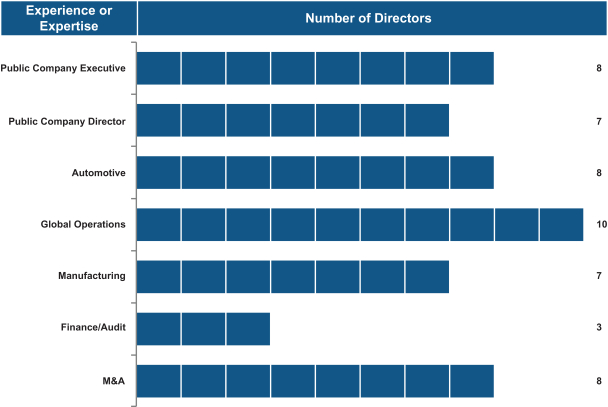

The following table identifies the balance of experience, skills and qualifications that the nominees bring to the Board. The skills and qualifications that are marked below are reviewed by the Governance Committee and the Board when making nomination decisions and reviewing Board

9

succession planning and the fact that a particular skill or qualification is not designated as to one or more nominees does not mean that those nominees do not also possess the specific experience and qualification. The table below illustrates how the Board is well-positioned to provide direction and oversight with respect to our overall performance, strategic direction and significant corporate policies.

The name, age and business experience of each nominee follows, as well as a description of the specific experience and qualifications of each nominee that led to the Board’s conclusion that such nominee should serve as a director.

10

|

Nominees for Election to the Board

The Board recommends that you vote FOR each nominee listed below.

| Roy V. Armes Age: 68 Committee: Audit, Nominating and Governance |

Mr. Armes is the former Chairman, President and Chief Executive Officer of Cooper Tire & Rubber Company (“Cooper”), a global company that specializes in the design, manufacture, marketing and sales of passenger car, light and medium truck, motorcycle and racing tires. Prior to joining Cooper in January 2007, Mr. Armes concluded an extensive career at Whirlpool Corporation, where he served in a variety of leadership positions across the company, both in the U.S. and key emerging markets globally, most recently serving as Senior Vice President, Project Management Office. Mr. Armes has served as a director of AGCO Corporation since 2013 and The Manitowoc Company, Inc. since 2018. He formerly was a board member of JLG Industries, Inc. Mr. Armes joined our Board in March 2020.

Skills and qualifications:

As the former Chairman, President and Chief Executive Officer of Cooper, Mr. Armes brings significant industry knowledge and experience in the automotive aftermarket and with original equipment manufacturers, the two primary channels through which Tenneco sells its products. Mr. Armes holds a bachelor’s degree in mechanical engineering from the University of Toledo.

| Thomas C. Freyman Age: 66 Committees: Audit (Chair), Compensation |

Mr. Freyman served as Executive Vice President, Finance and Administration for Abbott Laboratories from June 2015 until his retirement in February 2017. Prior to that, he served as Chief Financial Officer and Executive Vice President, Finance for Abbott Laboratories since 2004. He was first appointed Chief Financial Officer and Senior Vice President, Finance in 2001. From 1999 to 2001, he served as Vice President and Controller of Abbott Laboratories’ Hospital Products Division. Prior to that, he held a number of financial planning and analysis positions with Abbott Laboratories including Treasurer for Abbott Laboratories’ international operations and Corporate Vice President and Treasurer. Mr. Freyman is a director of Hanger, Inc. and AbbVie Inc. Mr. Freyman was formerly a director of Allergan plc (prior to its acquisition by AbbVie Inc. in May 2020). He has been a director of our company since 2013.

Skills and qualifications:

As a former Chief Financial Officer of a Fortune 200 company†, Mr. Freyman brings substantial expertise in finance and accounting to our Board and our Audit Committee. Throughout his more than 30-year career with Abbott Laboratories, Mr. Freyman served in diverse financial and accounting roles throughout Abbott Laboratories’ global organization. Prior to his career with Abbott

11

Laboratories, he was a certified public accountant with the firm of Ernst & Whinney (now Ernst & Young) where he gained substantial experience in auditing, tax and financial reporting. The Board has designated Mr. Freyman as an “audit committee financial expert” as that term is defined in the SEC’s rules adopted pursuant to the Sarbanes-Oxley Act of 2002. Mr. Freyman holds a bachelor’s degree in Accounting from the University of Illinois and a master’s degree in management from Northwestern University.

| † | At the time of his retirement. |

12

| Denise Gray Age: 58 Committees: Audit, Compensation |

Ms. Gray is currently president of LG Energy Solution Michigan Inc. Tech Center in Troy, Michigan overseeing the North American subsidiary of South Korean LG Energy Solution Inc., one of the world’s largest lithium-ion battery manufacturers. Prior to that she was President and Chief Executive Officer of LG Chem Power, Inc., a company focused on bringing lithium-ion polymer battery technology to North America for applications in the automotive and commercial markets from September 2015 until March 2018. From March 2013 until September 2015 she was Vice President, Powertrain Electrification at AVL List GMBH in Graz, Austria and North America. She also spent 30 years at General Motors in roles of increasing responsibility including heading up Global Battery Systems Engineering where she was recognized as “the battery czar,” and a driving force behind General Motors’ Chevrolet Volt vehicle. She has been a director of our company since March 2019.

Skills and qualifications:

With over 30 years of experience in the automotive industry, Ms. Gray has substantial understanding of the opportunities and needs of our business. Her current and former leadership roles as a President and Chief Executive Officer of companies at the forefront of battery technology bring valuable insight into the future direction of the automotive industry to our company. She holds a bachelor’s degree in Electrical Engineering from Kettering University and a master’s degree in Engineering Management Technology from Rensselaer Polytechnic Institute.

| Brian J. Kesseler Age: 54 |

Mr. Kesseler was named our Chief Executive Officer in January 2020 and served as our Co-Chief Executive Officer from October 2019 to January 2020. Mr. Kesseler joined Tenneco in January 2015 as our Chief Operating Officer until his appointment in May 2017 as our Chief Executive Officer. Prior to that, Mr. Kesseler was president of Johnson Controls Power Solutions, and served as Chief Operating Officer for that business from May 2012 until January 2013. He originally joined Johnson Controls in 1994 and served in leadership roles of increasing responsibility including, from 2009 to 2012, in the Building Efficiency division, where he was Vice President and General Manager with responsibility for Europe Systems & Services, North America Service and the Unitary Products Group. Prior to Johnson Controls, he was with Ford Motor Company, serving in the North America Assembly operations. He has been a director of our company since 2016.

Skills and qualifications:

Mr. Kesseler brings to our Board more than 30 years of experience in the automotive industry in increasingly senior management roles. As Chief Operating Officer, he oversaw our global operations for over two years, including in key growth areas. Mr. Kesseler has extensive knowledge of our company and its global operations. That, together with his passion for our industry, leadership qualities and track record of elevating performance, makes him a particular asset to our company, both as a member of the Board and as our Chief Executive Officer. Mr. Kesseler holds a bachelor’s degree in Finance from Michigan State University and an M.B.A. from Baldwin-Wallace College.

13

| Dennis J. Letham Age: 69 Chairman |

Mr. Letham served as Executive Vice President, Finance and Chief Financial Officer of Anixter International Inc. from 1995 until his retirement in June 2011, where he oversaw the company’s finance, accounting, tax, legal, human resources and internal audit activities in 50 countries. Before assuming his role as Chief Financial Officer in 1995, Mr. Letham served as Executive Vice President and Chief Financial Officer of Anixter, Inc., the principal operating subsidiary of Anixter International, which he joined in 1993. Previously, he had a 10-year career with National Intergroup Inc., where he was Senior Vice President and Chief Financial Officer, as well as Vice President and Controller, Director of Corporate Accounting and Manager for Internal Audit. Mr. Letham began his career at Arthur Andersen & Co. in 1973 where he held progressive responsibilities in the Audit Department. Mr. Letham is a director of Extra Space Storage Inc. and chairman of its audit committee and was a director of Interline Brands, Inc. and chairman of its audit committee through August 2015 when it was sold to The Home Depot, Inc. He has been a director of our company since 2007.

Skills and qualifications:

Mr. Letham’s substantial experience in finance and accounting makes him a valuable asset to our Board and our Audit Committee. Throughout his more than 40-year career, Mr. Letham has gained a deep understanding of the operations and financial reporting and accounting functions of large organizations. His 15 years of experience as the Chief Financial Officer of Anixter, a large international public company, give him substantial insight into the complex financial, accounting and operational issues that a large multinational company such as ours can encounter. Mr. Letham holds a bachelor’s degree from Pennsylvania State University’s Accounting Honors program. He also is a Certified Public Accountant.

| James S. Metcalf Age: 63 Committee: Compensation (Chair) |

Mr. Metcalf is Chairman of the Board and Chief Executive Officer of Cornerstone Building Brands, the newly merged NCI Building Systems, Inc. and Ply Gem Building Products Company. He retired in October 2016 as the Chairman, President and Chief Executive Officer of USG Corporation. At the time of his retirement, he had served as its Chairman since December 2011 and had served as its Chief Executive Officer and President since January 2011. From January 2006 through January 2011, he was President and Chief Operating Officer of USG. Prior to that Mr. Metcalf held many positions at USG including President, Building Systems; President and Chief Executive Officer, L&W Supply; Senior Vice President, Sales and Marketing, USG Interiors, Inc.; Vice President, National Accounts, United States Gypsum Company; Director, Retail Marketing, USG Corporation; Director, Retail Sales, USG Interiors, Inc.; and National Accounts Manager, United States Gypsum Company. He also serves as a board member for the National Association of Manufacturers and as a policy advisory board member for the Joint Center for Housing Studies at Harvard University. He has been a director of our company since 2014.

Skills and qualifications:

As a current and former Chief Executive Officer of major manufacturers of construction materials, Mr. Metcalf brings substantial executive leadership experience to our Board and our Nominating and Governance Committee. Further, Mr. Metcalf’s service in leadership roles in multiple areas within a large manufacturing company gives him particular insight into the types of strategic, operational and financial issues faced by companies such as ours. Mr. Metcalf holds a bachelor’s degree from The Ohio State University. He also holds an M.B.A. from Pepperdine University and completed the Stanford Executive Program.

14

| Aleksandra (“Aleks”) A. Miziolek Age: 64 Committee: Compensation, Nominating and Governance |

Ms. Miziolek concluded an approximately 6-year tenure in 2019 with Cooper-Standard Holdings Inc., a leading global supplier of systems and components for the automotive industry, most recently serving as Chief Transformation Officer. In this role, Ms. Miziolek led crucial transformation initiatives aimed at increasing profitability and was actively involved in the development of the Company’s growth strategy for its nonautomotive specialty markets and material science businesses. She also served as Cooper-Standard Holdings’ Senior Vice President, General Counsel, Secretary and Chief Compliance Officer beginning in 2014. Prior to joining Cooper-Standard Holdings, Ms. Miziolek spent 32 years with the law firm of Dykema Gossett, where she held several key leadership positions, such as Director of the Automotive Industry Group, and built a successful M&A and infrastructure practice spanning multiple industries. She has been a director of our company since March 2020.

Skills and qualifications:

Her in-depth knowledge of the automotive industry, experience leading transformational initiatives and significant legal expertise make her a valuable addition to our board. Ms. Miziolek holds a juris doctor and bachelor’s degree from Wayne State University. She is also a NACD Board Leadership Fellow and serves as an Advisor to OurOffice, Inc., a DEI technology solutions provider.

| Charles K. Stevens, III Age: 60 Committees: Compensation, Nominating and Governance |

Mr. Stevens retired from General Motors Company (“GM”) in March 2019 after a 40-year career at the company. Mr. Stevens served as Executive Vice President and Senior Advisor of GM between September 2018 and March 2019. Prior to that, he was Executive Vice President and Chief Financial Officer from January 2014 until September 2018 where he was responsible for leading GM’s financial and accounting operations worldwide. He served as Chief Financial Officer of GM North America from 2010 until 2014. He served as Interim Chief Financial Officer of GM South America from 2011 to 2013 and led GM’s financial operations for GM Mexico from 2008 to 2010 and GM Canada from 2006 to 2008. From 1994 to 2005, he held several leadership positions in GM’s Asia Pacific Region. He began his career at Buick Motor Division in 1978. Mr. Stevens currently serves on the boards of directors of Masco Corporation (since 2018), Flex Ltd. (since 2018), and Eastman Chemical Company (since 2020). He has been a director of our company since February 2020.

Skills and qualifications:

As the former Chief Financial Officer of General Motors, Mr. Stevens brings significant auto industry experience and expertise across finance and accounting operations, international financial matters and mergers and acquisitions. He received a bachelor’s degree in Industrial Administration from General Motors Institute (now Kettering University) and an M.B.A. from the University of Michigan, Flint.

15

| John S. Stroup Age: 54 Committee: Audit |

Mr. Stroup is the Executive Chairman† of Belden, Inc. (“Belden”) since 2020, a global supplier of specialty networking solutions built around two global business platforms - Enterprise Solutions and Industrial Solutions. Mr. Stroup is also an Operating Advisor to Clayton, Dubilier & Rice. Mr. Stroup joined Belden as President and Chief Executive Officer in 2005. He has been the Chairman of the Board of Belden since 2016. Prior to Belden, Mr. Stroup was employed by Danaher Corporation, a manufacturer of professional instrumentation, industrial technologies, and tools and components, since 2000. At Danaher, he initially served as Vice President, Business Development and was promoted to President of a division of Danaher’s Motion Group and later to Group Executive of the Motion Group. Earlier, he was Vice President of Marketing and General Manager with Scientific Technologies Inc. Mr. Stroup is a director of RBS Global, Inc. RBS Global manufactures power transmission components, drives, conveying equipment and other related products under the Rexnord name. He has been a director of our company since September 2020.

Skills and qualifications:

His experience in strategic planning and general management of business units of other public companies, coupled with his in-depth knowledge of the Company, makes him an integral member of the Board and a highly qualified intermediary between management and the Company’s non-employee directors. He received a bachelor’s degree in Mechanical Engineering from Northwestern University and an M.B.A. from the University of California - Berkeley.

| † | Mr. Stroup intends to retire from Belden in May 2021, following Belden’s annual meeting of shareholders. |

| Jane L. Warner Age: 74 Committees: Audit, Nominating and Governance (Chair) |

From August 2007 until her retirement in March 2013, Ms. Warner served as Executive Vice President at Illinois Tool Works Inc., a Fortune 200† diversified manufacturer of highly engineered components and industrial systems and consumables, where she had worldwide responsibility for its Decorative Surfaces and Finishing Systems businesses. Ms. Warner joined Illinois Tool Works Inc. in December 2005 as Group President of its Worldwide Finishing business. She was previously the President of Plexus Systems, L.L.C., a manufacturing software company, from June 2004 to December 2005, and a Vice President with Electronic Data Systems from 2000 through June 2004, where she led their global manufacturing group. Ms. Warner served as Executive Vice President for first tier supplier Textron Automotive from 1994 through 1999, where she was President of its Kautex North America and Randall divisions. Previously, Ms. Warner held executive positions in manufacturing, engineering and human resources over a 20-year span at General Motors Corporation. Ms. Warner is a board member of Brunswick Corporation. Ms. Warner served on the board of directors of MeadWestvaco Corporation through August 2014 and Regal Beloit Corporation through April 2020. She is also a Trustee for John G. Shedd Aquarium and chairs its long range planning committee. She has been a director of our company since 2004.

Skills and qualifications:

With over 20 years of automotive industry experience, Ms. Warner has particular appreciation of the challenges facing our customers. Her automotive industry expertise is supplemented by her leadership roles in global manufacturing and manufacturing

16

information systems businesses, both of which are of particular relevance to a global manufacturing company such as ours. She also brings to us the financial understanding she has gained through her business unit leadership and as a member of the audit committee of both MeadWestvaco and Regal Beloit. Ms. Warner received bachelor’s and master’s degrees from Michigan State University. She also received an M.B.A. from Stanford University where she was a Sloan Fellow.

| † | At the time of her retirement. |

17

|

We have established a comprehensive corporate governance plan for the purpose of defining responsibilities, setting high standards of professional and personal conduct and assuring compliance with these responsibilities and standards. As part of its annual review process, the Board monitors developments in the area of corporate governance. Summarized below are some of the key elements of our corporate governance plan. Many of these matters are described in more detail elsewhere in this proxy statement.

Corporate Governance Enhancements

The Board named Dennis J. Letham as our non-executive Chairman of the Board in July 2020, and reconstituted the membership and appointed new chairpersons of each Board committee in April 2020. These changes were part of Tenneco’s significant 2020 Board and governance refreshment. In addition, four of our nine independent director nominees have joined our Board since the beginning of 2020.

Enhanced Director Independence (see p. 21)

Nine of our 10 current directors and nominees are independent under the New York Stock Exchange (“NYSE”) listing standards.

Non-management directors are scheduled to meet separately in executive session after every regularly scheduled Board meeting.

Audit Committee (see pp. 27-28 and pp. 74-75, 77)

All members meet the independence standards for audit committee membership under the NYSE listing standards and applicable SEC rules.

Each of Messrs. Freyman, Armes and Stroup has been designated as an “audit committee financial expert” as defined in the SEC rules.

All members of the Audit Committee satisfy the NYSE’s financial literacy requirements.

The Audit Committee operates under a written charter that governs its duties and responsibilities, including its sole authority to appoint, review, evaluate and replace our independent auditors.

The Audit Committee has adopted policies and procedures governing the pre-approval of all audit, audit-related, tax and other services provided by our independent auditors.

Compensation Committee (see pp. 23-24 and p. 73)

All members meet the independence standards for compensation committee membership under the NYSE listing standards.

The Compensation Committee operates under a written charter that governs its duties and responsibilities, including the responsibility for executive compensation.

Nominating and Governance Committee (see pp. 24-25)

All members are independent under the NYSE listing standards.

The Nominating and Governance Committee operates under a written charter that governs its duties and responsibilities.

Corporate Governance Principles

We have adopted Corporate Governance Principles, including qualification and independence standards for directors.

Stockholder Proxy Access (see p. 26)

The Board has adopted proxy access By-Law provisions to permit eligible stockholders to include nominees in the company’s proxy statement and form of proxy.

18

Stock Ownership Guidelines (see p. 52)

We have adopted Stock Ownership Guidelines to align the interests of our executives and directors with the interests of our stockholders and promote our commitment to sound corporate governance.

The Stock Ownership Guidelines apply to the non-management directors, the Chairman, the Chief Executive Officer, the Chief Operating Officer, the Chief Financial Officer, all Executive Vice Presidents, all Senior Vice Presidents and Vice Presidents (in the executive compensation band).

Anti-Hedging Policy and Trading Restrictions (see p. 52)

We have an insider trading policy which, among other things, prohibits our directors, officers and other employees from engaging in “insider trading,” trading in our securities on a short-term basis, purchasing our securities on margin, short-selling our securities or entering into transactions designed to hedge the risks and benefits of ownership of our securities.

Anti-Pledging Policy (see p. 53)

We have a policy under which our directors and executive officers are prohibited from pledging our securities as collateral.

Accounting Complaints and Communications with the Directors (see p. 29)

The Audit Committee has established a process for confidential and anonymous submissions by our employees, as well as submissions by other interested parties, regarding questionable accounting or auditing matters. Additionally, the Board has established a process for stockholders to communicate with the Board, as a whole, or any independent director.

Codes of Business Conduct and Ethics

We operate under a Code of Conduct that applies to all directors, officers and employees and covers a broad range of topics, including

data security, compliance with laws, restrictions on gifts and conflicts of interest. All salaried employees are required to affirm from time to time in writing their acceptance of, and compliance with, the Code of Conduct.

We have also adopted a Code of Ethical Conduct for Financial Managers that applies to our Chief Executive Officer, Chief Operating Officer, Chief Financial Officer, Controller and other key financial managers.

Transactions with Related Persons (see pp. 29-31)

We have adopted a Policy and Procedure for Transactions with Related Persons, under which our Audit Committee must generally pre-approve transactions involving more than $120,000 with our directors, executive officers, 5% or greater stockholders and their immediate family members.

Equity Award Policy (see p. 51)

We have adopted a written policy to be followed for all issuances by our company of compensatory awards in the form of our common stock or any derivative of our common stock.

Clawback Policy (see p. 53)

We have adopted a clawback policy under which we will, in specified circumstances, require reimbursement of annual and long-term incentives paid to an executive officer.

Double-Trigger Vesting (see p. 39)

Beginning with benefits and awards granted after November 2020, our long-term incentive plan provides that, in general, upon a change in control, the vesting will be accelerated if a qualifying termination occurs within 24 months.

Personal Loans

We comply with and operate in a manner consistent with the legislation prohibiting extensions of credit in the form of a personal loan to or for our directors or executive officers.

19

Governance Information Available Online

Additional information about our Governance and Company Policies is available on the internet at www.tenneco.com. (The contents of the website are not, however, a part of this proxy statement.)

Information on-line includes: Audit Committee, Compensation Committee and Nominating and Governance Committee Charters, Governance Principles, Stock Ownership Guidelines, Accounting Complaints Policy, Code of Ethical Conduct for Financial Managers, Code of Conduct, Policy and Procedures for Transactions with Related Persons, Equity Award Policy, Clawback Policy, Insider Trading Policy, Director Communications Policy, and Audit/Non-Audit Services Policy.

We intend to satisfy the disclosure requirements under Item 5.05 of Form 8-K and applicable NYSE rules regarding amendments to or waivers of our Code of Ethical Conduct for Financial Managers and Code of Conduct by posting this information on our website at www.tenneco.com.

20

Board Leadership Structure

Our Board currently is comprised of 10 directors, nine of whom are independent and one of whom is an officer of our company. The Board believes that our ratio of outside directors to inside directors represents a commitment to the independence of the Board and a focus on matters of importance to our stockholders.

| Independent | Standing Committees | Role | ||||

Mr. Armes | ✓ | Audit, Nominating and Governance | ||||

Mr. Freyman | ✓ | Audit, Compensation | Audit Committee Chair | |||

Ms. Gray | ✓ | Audit, Compensation | ||||

Mr. Kesseler | ||||||

Mr. Letham | ✓ | Chairman | ||||

Mr. Metcalf | ✓ | Compensation | Compensation Committee Chair | |||

Ms. Miziolek | ✓ | Compensation, Nominating and Governance | ||||

Mr. Stroup | ✓ | Audit | ||||

Mr. Stevens | ✓ | Compensation, Nominating and Governance | ||||

Ms. Warner | ✓ | Audit, Nominating and Governance | Nominating and Governance Committee Chair | |||

On May 9, 2020. Mr. Gregg Sherrill, then Chairman of the Board, notified the Board of his intention to retire from the Board prior to the 2021 Annual Meeting. The Board appointed Mr. Letham, then our Lead Independent Director, to serve as our non-executive Chairman of the Board following Mr. Sherrill’s departure. Mr. Letham presides at all meetings of stockholders and the Board. With Mr. Kesseler’s appointment as Chief Executive Officer in May 2017, the Chairman and Chief Executive Officer roles were split. By having separate roles, the Chief Executive Officer is able to focus on the day-to-day business and affairs of the company and the Chairman is able to focus on key strategic issues, Board leadership and communication. Upon Tenneco’s completion of the acquisition of Federal-Mogul on October 1, 2018, Mr. Kesseler and Roger J. Wood were appointed Co-Chief Executive Officers in anticipation of our planned separation into two independent publicly traded companies. In January 2020, Mr. Wood ceased serving as Co-Chief Executive Officer, and Mr. Kesseler again became our sole Chief Executive Officer. Our Board believes this leadership structure is in the best interests of our company and its stockholders.

The non-management directors on the Board and each of its committees meet in regularly scheduled executive sessions without any members of management present. The purpose of these executive sessions is to promote open and candid discussion among the non-management directors. Our system has provided and will continue to provide appropriate checks and balances to protect stockholder value and allows for efficient management of our company.

21

Our Board has three standing committees — the Audit Committee, the Compensation Committee and the Nominating and Governance Committee. Each of these committees consists solely of independent directors and has its own chair who is responsible for directing the work of the committee in fulfilling its responsibilities.

Role of Board in Risk Oversight

Our Board recognizes that, although risk management is primarily the responsibility of the company’s management team, the Board plays a critical role in the oversight of risk, including the identification and management of risk. The Board believes that an important part of its responsibilities is to assess the major risks we face and review our strategies for monitoring and controlling these risks. The Board’s involvement in risk oversight involves the full Board, the Audit Committee, the Compensation Committee and the Nominating and Governance Committee.

We perform an annual enterprise risk assessment, which originates within our internal audit department and is performed in accordance with the standards adopted by the Committee of Sponsoring Organizations of the Treadway Commission (CSO). As part of its assessment, our internal audit department interviews each of our directors, as well as members of management, regarding the strategic, operational, legal, compliance, financial, environmental, safety, information technology, cybersecurity and reputational risks that our company faces. Our Vice President of Internal Audit and Chief Financial Officer review the results of this annual enterprise risk assessment with our Board. In addition, throughout the year, the Board meets with senior management to discuss:

| · | current business trends affecting us; |

| · | the major risk exposures facing us; and |

| · | the steps management has taken to monitor and mitigate such risks. |

The Board receives presentations throughout the year from senior management and leaders of our business units and functional groups regarding specific risks that we face. Finally, on an annual basis, management provides a comprehensive strategic review to the Board, which includes a discussion of the major risks faced by our company and our strategies to manage and minimize these risks.

The Audit Committee meets frequently during the year with senior management, our Vice President of Internal Audit and our independent public accountants and discusses the major risks facing us, and the steps management has taken to monitor and control such risks, as well as the adequacy of internal controls that could mitigate risks that could significantly affect our financial statements. At each regularly scheduled meeting, our Vice President of Internal Audit reviews with the Audit Committee the results of internal audit activities and testing since the Audit Committee’s prior meeting. In addition, at each regularly scheduled Audit Committee meeting, the company’s General Counsel provides a report to the Audit Committee regarding any significant litigation, environmental and regulatory risks faced by our company. The Audit Committee also maintains oversight over the company’s compliance programs, including compliance with the company’s Code of Conduct. The Chair of the Audit Committee provides the Board with a report concerning its risk oversight activities at each Board meeting. The Compensation Committee reviews our compensation structures and programs to ensure that they do not encourage excessive risk-taking. Further, our Nominating and Governance Committee reviews our policies and strategies related to matters of sustainability and corporate responsibility that are significant to the company and our stakeholders.

22

The Board has determined that all of our current non-management directors are “independent” as that term is defined under the listing standards of the NYSE. As part of its analysis, the Board determined that none of the non-management directors has a direct or indirect material relationship with our company. Under written guidelines adopted by the Board, the following commercial or charitable relationships are not considered to be material relationships that would impair a director’s independence:

| · | the director is an employee, director or beneficial owner of less than 10% of the shares of another company that (directly or indirectly through its subsidiaries or affiliates) does business with us and the annual sales to, or purchases from, us are less than 1% of the annual consolidated revenues of both our company and the other company; |

| · | the director is an employee, director or beneficial owner of less than 10% of the shares of another company that (directly or indirectly through its subsidiaries or affiliates) is indebted to us, or to which we are indebted, and the total amount of either company’s consolidated indebtedness to the other is less than 1% of the total consolidated assets of the indebted company; |

| · | the director is an employee, director or beneficial owner of another company in which we own a common equity interest, and the amount of our interest is less than 5% of the total voting power of the other company; or |

| · | the director serves as an employee, director or trustee of a charitable organization, and our discretionary charitable contributions to the organization are less than 1% of that organization’s total annual charitable receipts. |

During 2020, the Board held 20 meetings. All of our directors attended 75% or more of all meetings of the Board and the committees of the Board on which they served during 2020. The Board is scheduled to meet in executive session, without management, after every regularly scheduled Board meeting. Mr. Letham presides at all executive sessions of the Board.

All directors serving at the time attended last year’s annual meeting of stockholders. The Board has a policy that, absent unusual circumstances, all directors attend our annual meetings of stockholders.

The Compensation Committee is comprised solely of outside directors who meet the independence standards for compensation and nominating committee members as set forth in the NYSE listing standards.

23

The Compensation Committee has the responsibility, among other things, to:

| · | establish the compensation of our executive officers; |

| · | examine periodically our compensation philosophy and structure; |

| · | supervise our welfare and pension plans and compensation plans; |

| · | produce a report on executive compensation for inclusion in our annual proxy statement in accordance with applicable rules and regulations of the SEC; |

| · | review our compensation practices and policies for our employees to determine whether those practices and policies are reasonably likely to have a material adverse effect on us; |

| · | oversee our chief executive officer evaluation and succession planning; |

| · | review and recommend to the Board any company proposal regarding the advisory vote on executive compensation and any company proposal regarding the frequency of the advisory vote on executive compensation; |

| · | oversee our management evaluation and succession planning and our diversity initiatives in connection with management succession; and |

| · | review the qualifications of, and recommend candidates for, election as officers of our company. |

The Compensation Committee operates pursuant to a written charter, the current version of which was reaffirmed by the Board and the Compensation Committee in February 2021 as part of their annual review process. The Compensation Committee held 10 meetings during 2020.

For 2020, the Compensation Committee retained the services of Meridian Compensation Partners, LLC (“Meridian”) as its principal outside compensation consultant. Meridian reports directly to the Compensation Committee and has been engaged to:

| · | assist the committee in reviewing and assessing the adequacy of executive compensation, including salary, annual cash incentive award targets and equity-based and other long-term incentive compensation awards; |

| · | provide plan design advice; and |

| · | provide annual competitive market studies against which committee members can analyze executive compensation. |

From time to time, the Compensation Committee will review materials prepared by other consultants to assist them with specific compensation matters. For a discussion of the role of our executive officers in the establishment of executive officer compensation, see “Executive Compensation — Compensation Discussion and Analysis.” Our executive officers do not participate in the process for establishing director compensation.

A report of the Compensation Committee regarding executive compensation appears elsewhere in this proxy statement. For a more detailed discussion of the processes and procedures for considering and determining executive compensation, see “Executive Compensation — Compensation Discussion and Analysis.”

Nominating and Governance Committee

The Nominating and Governance Committee is comprised solely of outside directors who meet the general independence standards as set forth in the NYSE listing standards.

24

The Nominating and Governance Committee has the responsibility, among other things, to:

| · | review and determine the desirable balance of experience, qualifications and expertise among members of the Board; |

| · | identify possible candidates for membership on the Board and recommend a slate of nominees for election as directors at each annual meeting of stockholders; |

| · | review the function and composition of the other committees of the Board and recommend membership on these committees; |

| · | oversee our director compensation program; |

| · | develop and recommend to the Board for approval any revisions to our Corporate Governance Principles; and |

| · | oversee our policies and strategies related to matters of sustainability, corporate responsibility, political contributions and philanthropy. |

The Nominating and Governance Committee operates pursuant to a written charter, the current version of which was reaffirmed by the Board and the Nominating and Governance Committee in February 2021 as part of their annual review process. The Nominating and Governance Committee held nine meetings during 2020.

For 2020, the Nominating and Governance Committee utilized the services of Meridian its principal outside compensation consultant with respect to director compensation. Meridian reports directly to the Nominating and Governance Committee in connection with apprising the committee members regarding best practices and pay levels in association with director compensation.

For our director compensation, Meridian prepares comparative market data and presents that information directly to the Nominating and Governance Committee. The Nominating and Governance Committee reviews this data and establishes director compensation in consultation with Meridian.

Other than its services as a compensation consultant, Meridian provides no other services to the Nominating and Governance Committee, the Compensation Committee or our company.

Consideration of Director Nominees

The Nominating and Governance Committee regularly assesses the size of the Board, the need for expertise on the Board and whether any vacancies are expected on the Board. The Nominating and Governance Committee’s process for identifying and evaluating nominees is as follows:

| · | In the case of incumbent directors, the Nominating and Governance Committee reviews annually such directors’ overall service to us during their term, including the specific experience, qualifications, attributes and skills that such directors bring to service on our Board, the number of meetings attended, the level of participation, the quality of performance and any transactions of such directors with us during their term. |

| · | In the event that vacancies are anticipated or otherwise arise, the Nominating and Governance Committee considers various potential candidates for director that may come to its attention through a variety of sources, including current Board members, stockholders or other persons, including professional search firms. All candidates for director are evaluated at regular or special meetings of the Nominating and Governance Committee. |

25

In evaluating and determining whether to recommend a person as a candidate for election as a director, the Nominating and Governance Committee considers each candidate’s experience, qualifications, attributes and skills as well as the specific qualification standards set forth in our By-Laws and Corporate Governance Principles, including:

| · | personal and professional ethics, integrity and values; |

| · | an ability and willingness to undertake the requisite time commitment to Board functions; |

| · | independence pursuant to the guidelines set forth in the Corporate Governance Principles and applicable rules and regulations; |

| · | age, which must be less than 75 at the time of election unless otherwise determined in the good faith judgment of our Board; |

| · | the potential impact of service on the board of directors of other public companies, including competitors of our company; and |

| · | an absence of employment at a competitor of our company. |

The Nominating and Governance Committee and the Board value diversity, and believe that a diverse Board composition provides significant benefit to our company. Each candidate is reviewed in light of the overall composition and skills of the entire Board at the time, including the varied characteristics of the Board members and candidate in terms of opinions, perspectives, personal and professional experiences and backgrounds. The nominees selected are those whose experience and background are deemed to provide the most valuable contribution to the Board. In 2020, the Board adopted the “Rooney Rule” under which the Board set forth in its Corporate Governance Guidelines the Nominating and Governance Committee’s commitment to include, in each pool of qualified candidates from which director nominees are chosen, candidates who bring gender, racial, ethnic and cultural diversity.

Our By-Laws permit, under certain circumstances, a stockholder or group of no more than 20 stockholders (meeting our continuous ownership requirement of 3% or more of our outstanding common stock held continuously for at least the previous three years) to nominate a candidate or candidates for election to the Board at an annual meeting of stockholders, constituting up to two directors or 20% of the number of directors then serving on the Board (rounded down to the nearest whole number), whichever is greater. In order to require us to include such candidate or candidates in our proxy statement and form of proxy, stockholders and nominees must submit a notice of proxy access nomination together with certain related information required by our By-Laws.

Our By-Laws also permit stockholders entitled to vote at the meeting to nominate directors for consideration at an annual meeting of stockholders without requiring that their nominees be included in our proxy statement and form of proxy. Stockholders may nominate persons for election to the Board at an annual meeting of stockholders by submitting a letter of nomination, together with certain related information required by our By-Laws.

Pursuant to our By-Laws, written notice by stockholders of qualifying nominations for election to the Board must have been received by our Corporate Secretary by February 11, 2021.

Correspondence related to stockholder proposals must be sent in writing to our Corporate Secretary at our principal executive offices, 500 North Field Drive, Lake Forest, Illinois 60045. For more information on submitting a nomination, visit www.tenneco.com or see “Submission of Stockholder Proposals.”

26

The Audit Committee is comprised solely of directors who are all financially literate and who meet all of the independence standards for audit committee membership as set forth in the Sarbanes-Oxley Act of 2002 and the SEC rules adopted thereunder and the NYSE listing standards. The Board has designated each of Messrs. Freyman, Armes and Stroup as an “audit committee financial expert” as that term is defined in the SEC rules adopted pursuant to the Sarbanes-Oxley Act of 2002.

Management is responsible for maintaining our internal controls over financial reporting. Our independent public accounting firm is responsible for performing an independent audit of our consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report on its audit. The Audit Committee’s duty is to oversee and monitor these activities on behalf of the Board. Specifically, the Audit Committee has the responsibility, among other things, to:

| · | select and approve the compensation of our independent public accountants; |

| · | review and approve the scope of the independent public accountants’ audit activity and all non-audit services; |

| · | review the independence, qualifications and performance of our independent public accountants; |

| · | review with management and the independent public accountants the adequacy of our basic accounting system and the effectiveness of our internal audit plan and activities; |

| · | review with management and the independent public accountants our certified financial statements and exercise general oversight over the financial reporting process; |

| · | review litigation and other legal matters that may affect our financial condition and monitor compliance with business ethics and other policies; |

| · | provide an avenue of communication among the independent public accountants, management, the internal auditors and the Board; and |

| · | prepare the audit-related report required by the SEC to be included in our annual proxy statement. |

In fulfilling its responsibilities, the Audit Committee reviewed with management and our independent public accountants:

| · | significant issues, if any, regarding accounting principles and financial statement presentations, including any significant changes in our selection or application of accounting principles, and significant issues, if any, as to the adequacy of our internal controls and any special audit steps adopted in view of material internal control deficiencies; |