Balance Sheets

Statements of Cash Flows – 3 Months

Statements of Cash Flows – 9 Months

Attachment 2

Reconciliation of GAAP to Non-GAAP Earnings Measures – 3 Months

Reconciliation of GAAP to Non-GAAP Earnings Measures – 9 Months

Reconciliation of GAAP Revenue and Earnings to Non-GAAP Revenue and Earnings Measures – 3 and 9 Months

Reconciliation of GAAP Revenue to Non-GAAP Revenue Measures – 3 and 9 Months

Reconciliation of Non-GAAP Measures – Debt Net of Total Cash/Adjusted LTM EBITDA including noncontrolling interests Reconciliation of GAAP to Non-GAAP Revenue Measures – Original Equipment, Original Equipment Service and Aftermarket Revenue – 3 and 9 Months

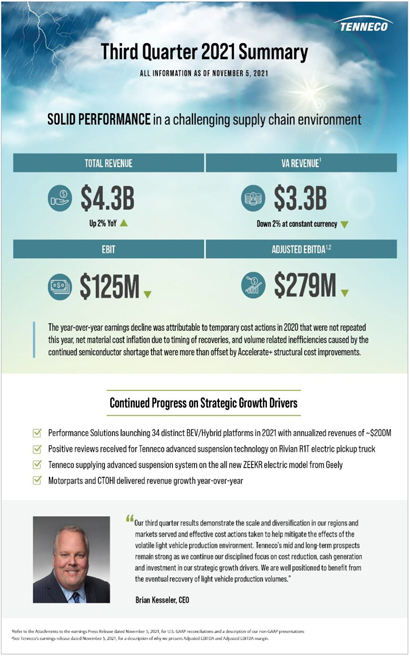

About Tenneco

Tenneco is one of the world’s leading designers, manufacturers, and marketers of automotive products for original equipment and aftermarket customers, with full year 2020 revenues of $15.4 billion and approximately 73,000 team members working at more than 270 sites worldwide. Through our four business groups, Motorparts, Performance Solutions, Clean Air and Powertrain, Tenneco is driving advancements in global mobility by delivering technology solutions for diversified global markets, including light vehicle, commercial truck, off-highway, industrial, motorsport and the aftermarket.

Visit www.tenneco.com to learn more.

Investors and others should note that Tenneco routinely posts important information on its website and considers the Investor section, www.investors.tenneco.com, a channel of distribution.

About Guidance

Revenue estimates and other forecasted information in this release are based on OE manufacturers’ programs that have been formally awarded to the company; programs where Tenneco is highly confident that it will be awarded business based on informal customer indications consistent with past practices; and Tenneco’s status as supplier for the existing program and its relationship with the customer. This information is also based on anticipated vehicle production levels and pricing, including precious metals pricing and the impact of material cost changes. Unless otherwise indicated, our methodology does not attempt to forecast currency fluctuations, and accordingly, reflects constant currency. Certain elements of the restructuring and related expenses, legal settlements, substrate pricing, and other unusual charges we incur from time to time cannot be forecasted accurately. In this respect, we are not able to forecast corresponding GAAP measures without unreasonable efforts on account of these factors and other factors not in our control.

Safe Harbor

This press release contains forward-looking statements. The words “will,” “would,” “could,” “expect,” “anticipate,” and similar expressions (and variations thereof), identify these forward-looking statements. These forward-looking statements are based on the current expectations of the Company (including its subsidiaries). Because these statements involve risks and uncertainties, actual results may differ materially from the expectations expressed in the forward-looking statements.

Important factors that could cause actual results to differ materially from the expectations reflected in the forward-looking statements include: general economic, business, market and social conditions, including the effects of the COVID-19 pandemic and the impact of inflationary pressures on materials, labor and other