SOLEDAD MOUNTAINFEASIBILITY

STUDY

Submitted to:

GOLDEN QUEEN MINING CO. LTD.

Date:

May 2, 2011

Norwest Corporation

Suite 1830, 1066 W Hastings Street

Vancouver, British Columbia

V6E 3X2

Tel: (604) 602-8992

Fax: (604) 602-8951

Emailvancouver@norwestcorp.com

www.norwestcorp.com

Author:

SEAN ENNIS, P.ENG.

| |

| GOLDEN QUEEN MINING CO. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| TOC - 1 |

| |

| GOLDEN QUEEN MINING CO. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| TOC - 2 |

| |

| GOLDEN QUEEN MINING CO. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| TOC - 3 |

| |

| GOLDEN QUEEN MINING CO. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| TOC - 4 |

| |

| GOLDEN QUEEN MINING CO. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| TOC - 5 |

LIST OF TABLES

| |

| GOLDEN QUEEN MINING CO. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| TOC - 6 |

LIST OF FIGURES

| |

| GOLDEN QUEEN MINING CO. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| TOC - 7 |

| |

| GOLDEN QUEEN MINING CO. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| TOC - 8 |

| CERTIFICATE of AUTHENTICATION |

This report has been prepared for Golden Queen Mining Co. Ltd. This report presents the results of the updated feasibility level mine development plan prepared by Norwest Corporation. The report relies upon a geological model created by qualified independent third party consultants that was accepted by Norwest. Norwest has relied on other information prepared by third party consultants and the client where noted.

This report has been prepared and reviewed by Sean Ennis, P.Eng. on behalf of Norwest.

Norwest Corporation APEGGA permit number P – 5015.

“original signed and sealed by author”

| | May 2, 2011 |

| | |

| | Sean Ennis, P.Eng. |

| | Vice President, Mining |

| | Norwest Corporation |

| |

| GOLDEN QUEEN MINING CO. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| TOC - 9 |

EXECUTIVE SUMMARY

Norwest Corporation (Norwest) has completed an updated feasibility level Technical Report at the request of Golden Queen Mining Co. Ltd. (GQM) on the company’s Soledad Mountain gold-silver property in California (the Project). The feasibility report serves as a basis for a National Instrument 43-101 Technical Report submitted on March 31, 2011. GQM is listed on the Toronto Stock Exchange (TSX-GQM).

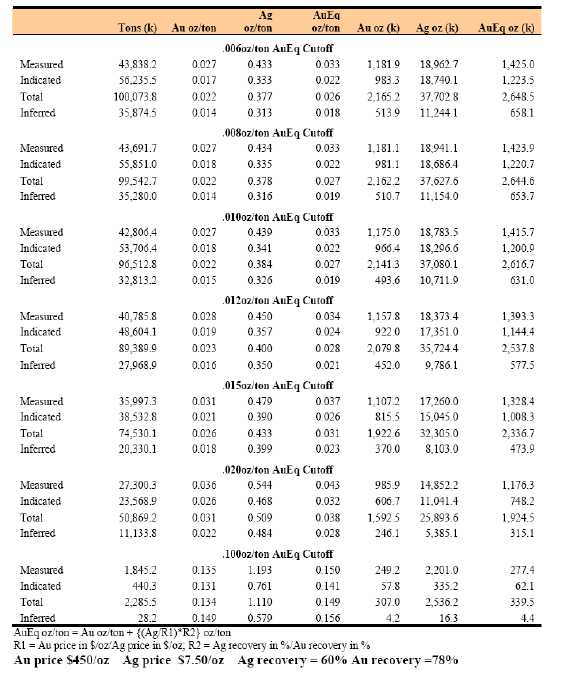

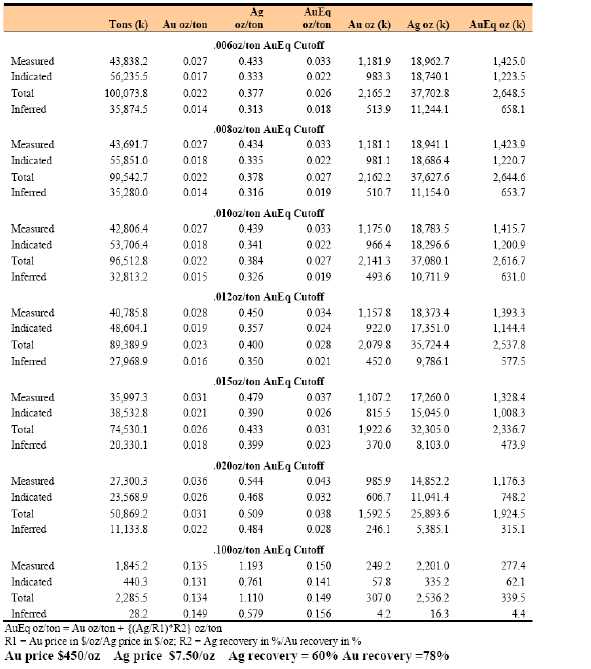

The Soledad Mountain property is located just south of the town of Mojave, California and has been subject to extensive exploration as well as previous underground mining operations during the early 1900s and the 1930s. Since control of the property was gained by GQM in 1986, exploration has been carried out periodically as well as on-going technical assessment work in support of Project development. A 43-101 Technical Report was completed by SRK Consulting (U.S.), Inc. (SRK) of Lakewood, Colorado in March 2006 (NI 43-101 Technical Report Soledad Mountain Project, Mojave, CA,. March 2006) and filed with Canadian securities regulators. This report described the geological resource base and geological model for the project and included a listing of resources classified according to NI 43-101 standards. The mineral resource classification is summarized in Table ES.1 which is taken from the SRK document.

As part of their project work, SRK completed a review of the geological model for the property which served as the basis for the calculation of the mineral resource quantities. This model was provided to Norwest by GQM for use in preparing the mining feasibility study. Norwest has accepted this model and relied upon it in the preparation of the mine plan. Excerpts from the SRK NI 43-101 report have been included in this technical report where necessary for clarity; otherwise specific references to the appropriate sections of that document are made.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| ES-1 |

TABLE ES.1

SUMMARY OF MINERAL RESOURCES TAKEN FROM SRK TECHNICAL REPORT

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| ES-2 |

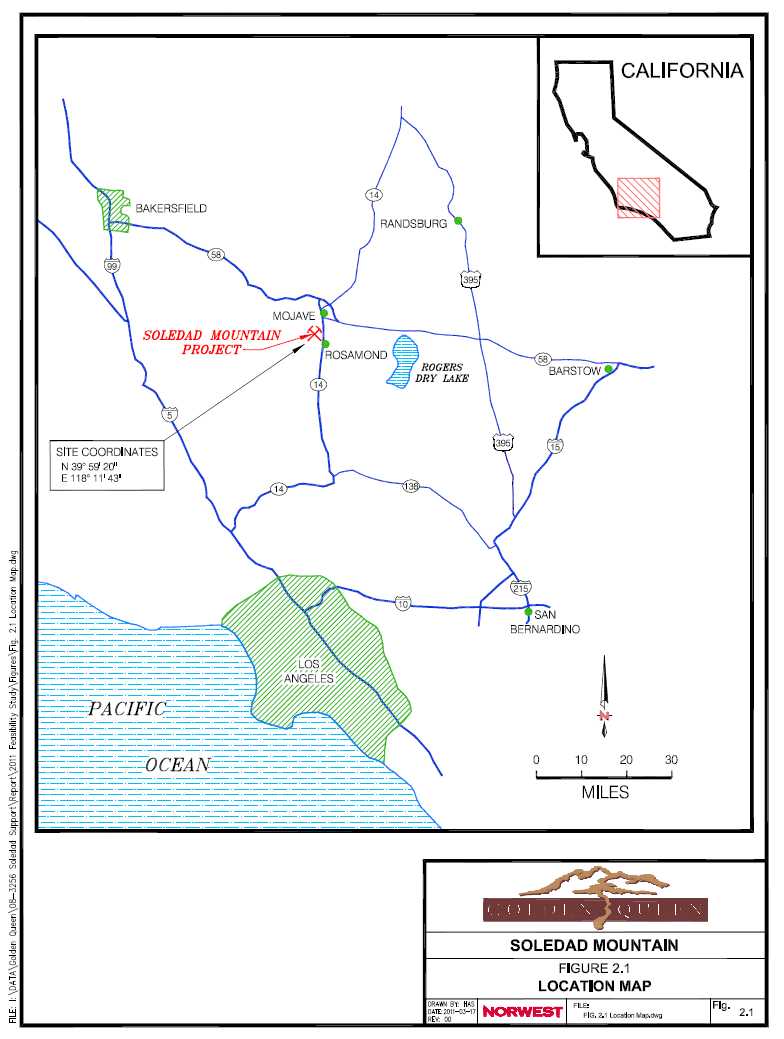

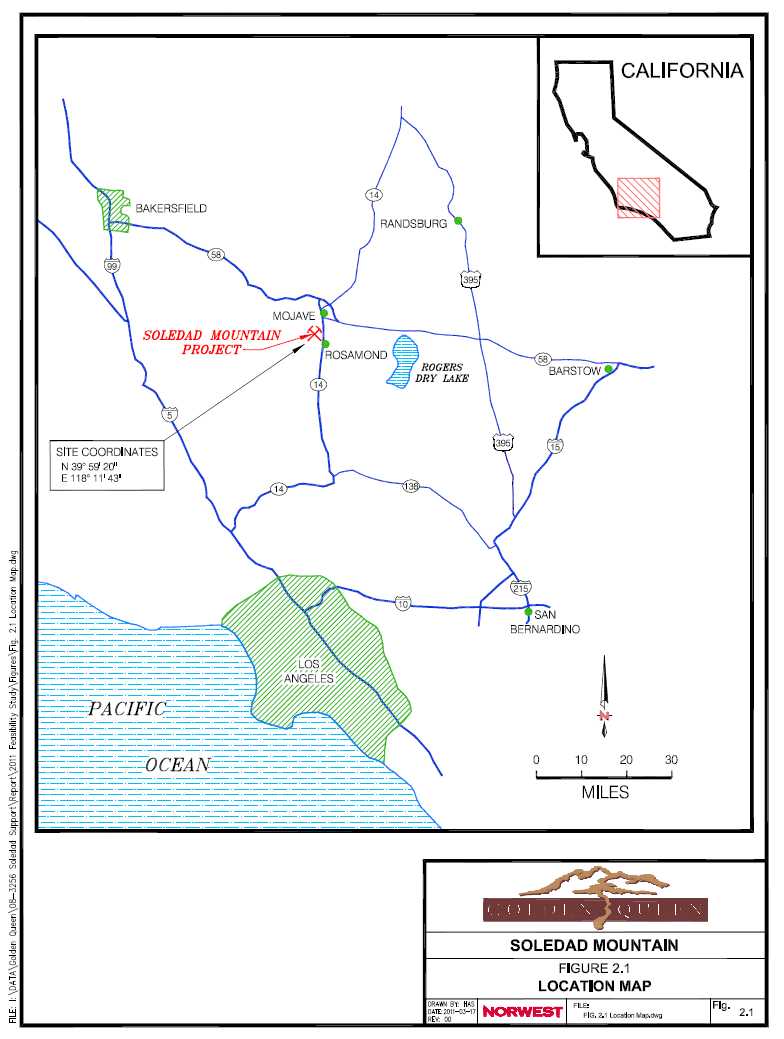

PROJECT DESCRIPTION

The Project is located in Kern County in southern California approximately 5 miles south of the town of Mojave. The metropolitan areas of Rosamond and Lancaster lie approximately 9 miles and 20 miles to the south respectively. Los Angeles is about 90 miles south of Mojave. The site location is shown in Figure ES-1.

Access to site is from State Route 14 and Silver Queen Road, an existing paved County road. Mojave is a railroad hub for the Burlington Northern/Santa Fe and Union Pacific/Southern Pacific railroad lines. Services such as a hospital, ambulance, fire-protection, garbage and hazardous waste disposal, schools, motels and housing, shopping, airport and recreation are available in Mojave and its surroundings. Telephone service is available on site.

The Project is within the Mojave Mining District along with the former Cactus Gold Mine, Standard Hill Mine and Tropico Mine. These former operating mines are located within a 5 mile radius of the Soledad Mountain site.

REGIONAL GEOLOGY

Soledad Mountain is located within the Mojave structural block, a triangular-shaped area bounded to the east by the northwest-trending San Andreas Fault and to the north by the northeast-trending Garlock Fault. The Mojave block is broken into an orthogonal pattern of fracture systems. These fracture zones likely developed as the result of Late Cretaceous compressional stresses that were present prior to formation of the Garlock and San Andreas Faults. Gold and silver mineralization at Soledad Mountain is hosted by northwest-trending, en-echelon faults and fracture systems. Cretaceous quartz monzonite forms the basement of stratigraphic sequences in the Mojave block. The quartz monzonite is overlain by Miocene-age, quartz latitic and rhyolitic volcanic rocks. Volcanic centres appear to have formed at intersections of the northeast and northwest-trending fracture systems.

Gold deposits in the Mojave block include Soledad Mountain, Standard Hill, Cactus and Tropico. At Soledad Mountain gold mineralization occurs in low-sulfidation style, quartz-adularia veins and stockworks that strike northwest. Gold mineralization at Standard Hill, located 1 mile northeast of Soledad, consists of north to northwest-striking quartz veins in Cretaceous quartz monzonite and Tertiary, quartz latitic volcanic rocks. At the Cactus Gold Mine, 5 miles west of Soledad, gold occurs in northwest and northeast-striking quartz veins, breccias and irregular zones of silicification in quartz latite, rhyolitic flows and rhyolitic intrusive breccias.

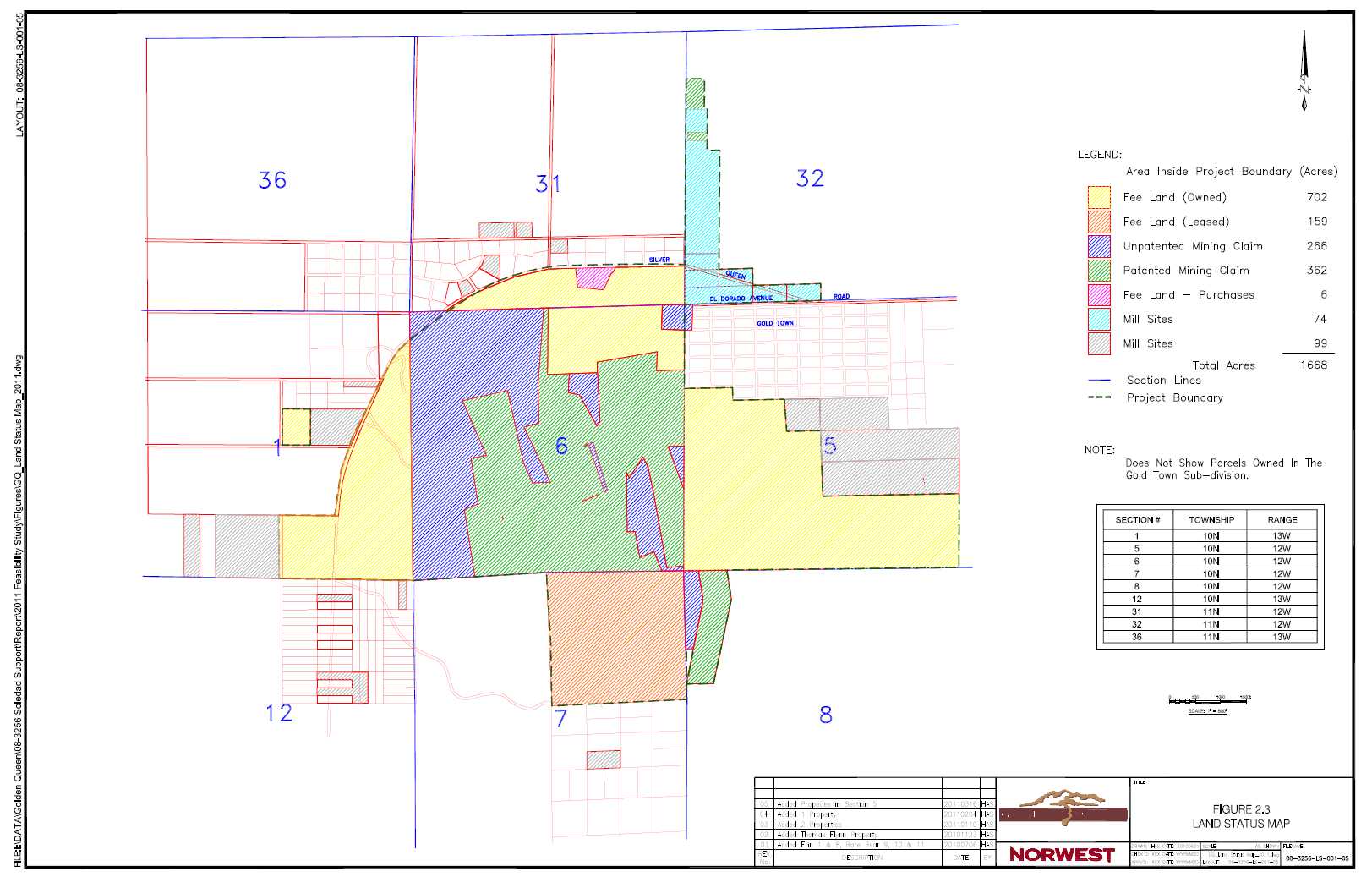

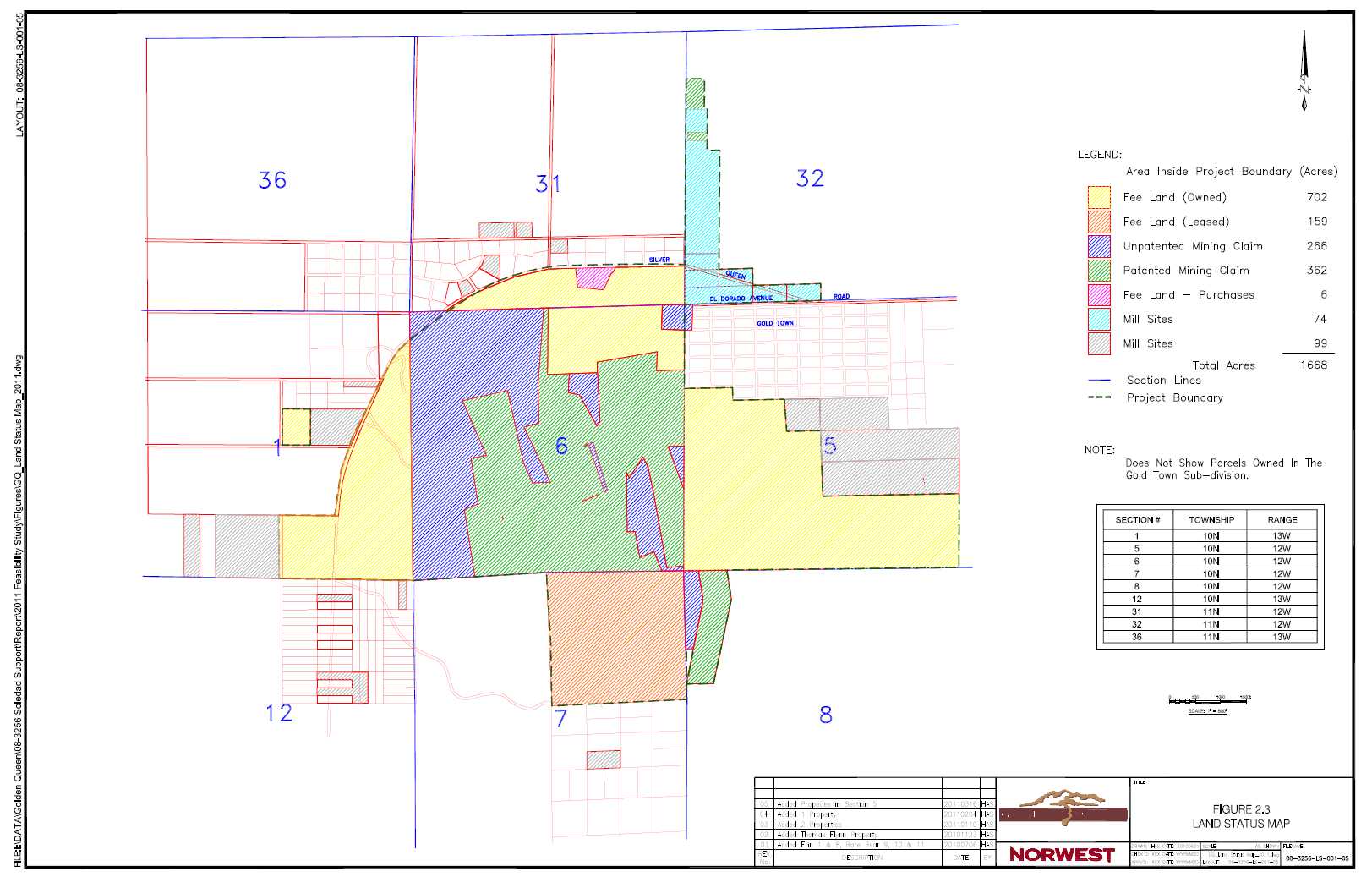

PROJECT LAND RIGHTS

GQM controls approximately 2,500 acres (1,000 hectares) of land in the area, consisting of private (fee land and patented lode mining claims and millsites) and federal lands (unpatented lode mining claims and millsites) administered by the Bureau of Land Management (BLM), collectively referred to as the Property. The total area required for the Project, which is surrounded by a Project boundary, is approximately 1,300 acres (500 hectares) in size. The actual area that will be disturbed by mining, waste rock disposal, the construction of the heap leach pads and the heap and the facilities will be approximately 912 acres (369 hectares) in size of which approximately 835 acres (338 hectares) will be reclaimed during and at the end of the mine life.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| ES-3 |

The Property is located west of California State Highway 14 and largely south of Silver Queen Road in Kern County, California, and covers all of Section 6 and portions of Sections 5, 7 and 8 in Township 10 North (T10N), Range 12 West (R12W), portions of Sections 1 and 12 in T10N, R13W, portions of Section 18 in T9N, R12W, and portions of Section 32 in T11N, R12W, all from the San Bernardino Baseline and Meridian. The Project facilities will be located in Section 6 of T10N, R12W. Two water production wells have been drilled in Section 32, T11N, R12W, on land controlled by GQM.

GQM holds or controls via agreement 33 patented lode mining claims, 134 unpatented lode mining claims, 1 patented millsite, 12 unpatented millsites, 1 unpatented placer claim and 867 acres of fee land. A summary of the land held or controlled by GQM is shown in Table ES-2.

TABLE ES.2

LAND STATUS

| Land Status | Acres | Hectares |

| Fee Land (Owned) | 702 | 284 |

| Unpatented Mining Claims | 266 | 108 |

| Patented Mining Claims | 353 | 143 |

| Fee Land (Purchases) | 6 | 2 |

| Fee Land (Leased) | 159 | 64 |

| Millsites | 74 | 30 |

| Total | 1,560 | 631 |

GQM holds or controls the properties under mining leases with 53 individual landholders, two groups of landholders and 2 incorporated entities. Contact information for the landholders is available on file at the GQM offices in Vancouver.

GQM believes that all the land required for the Project either has been secured under a mining lease or is held by GQM through ownership of the land in fee or via unpatented mining claims. GQM executed land purchases or entered into agreements from 1990 onwards, and is continuing to add to its land position in the area.

GQM carried out an aerial survey of the Project area in 2004 and produced a topographic map with 5 ft contour intervals in the Project area using California State Plane Zone 5 coordinates.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| ES-4 |

A formal title review was done by Gresham Savage Nolan & Tilden, a firm with extensive experience in title matters. The report was dated September 6, 1996 and was updated to April 26, 1999.

A formal title review was again done by an independent landman, Sylvia Good, in May 2004.

Further details of the property holdings are contained in the 2006 SRK Technical Report in Section 4 of that report.

MINE PLAN AND MINERAL RESERVES

The mineral resource estimates for the project are based on the values calculated by SRK in their 2006 Technical Report and are summarized in Table ES-1. Norwest utilized the geological model and resource classifications referenced in the SRK report in the preparation of the mining plan for the property.

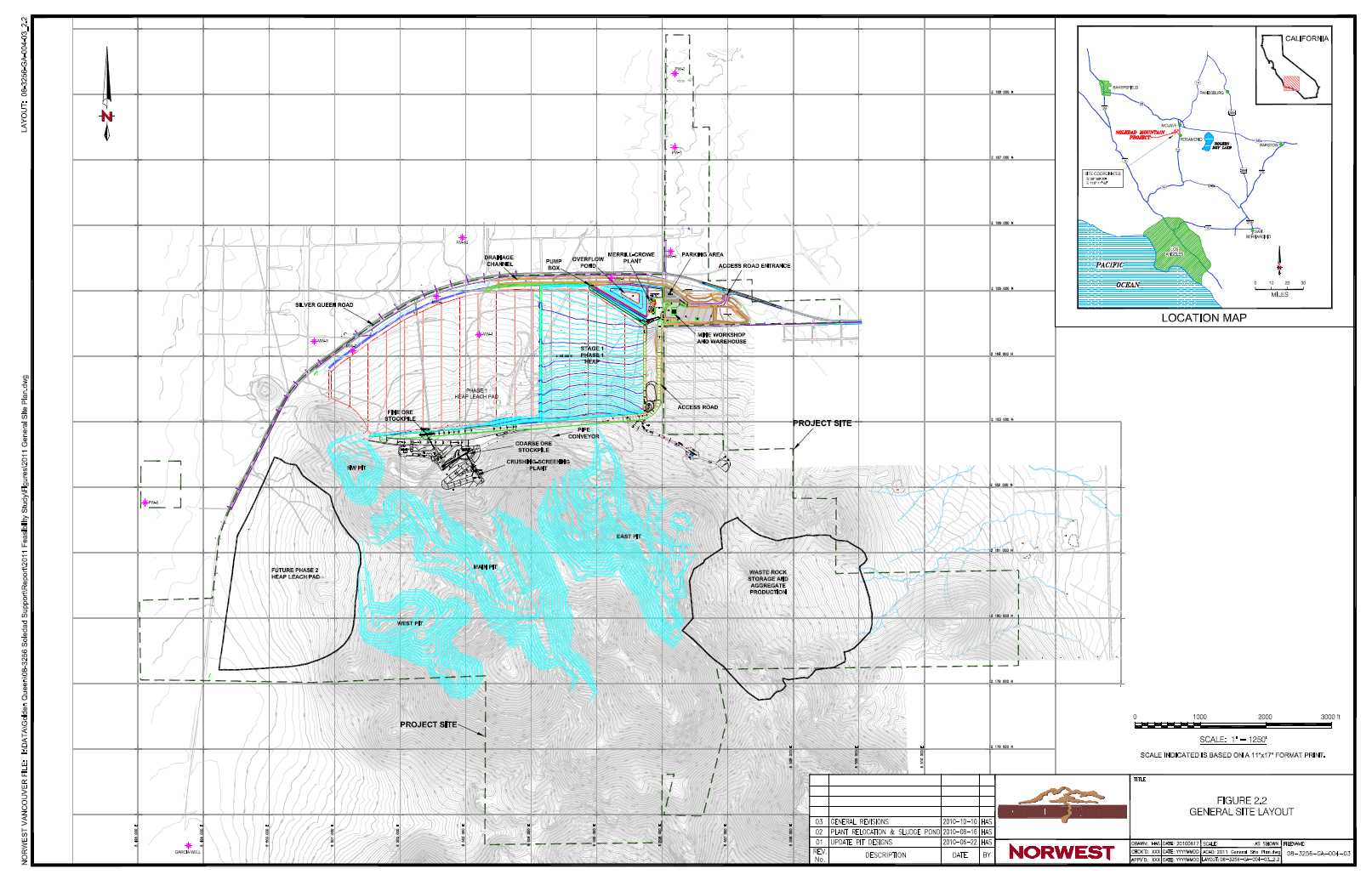

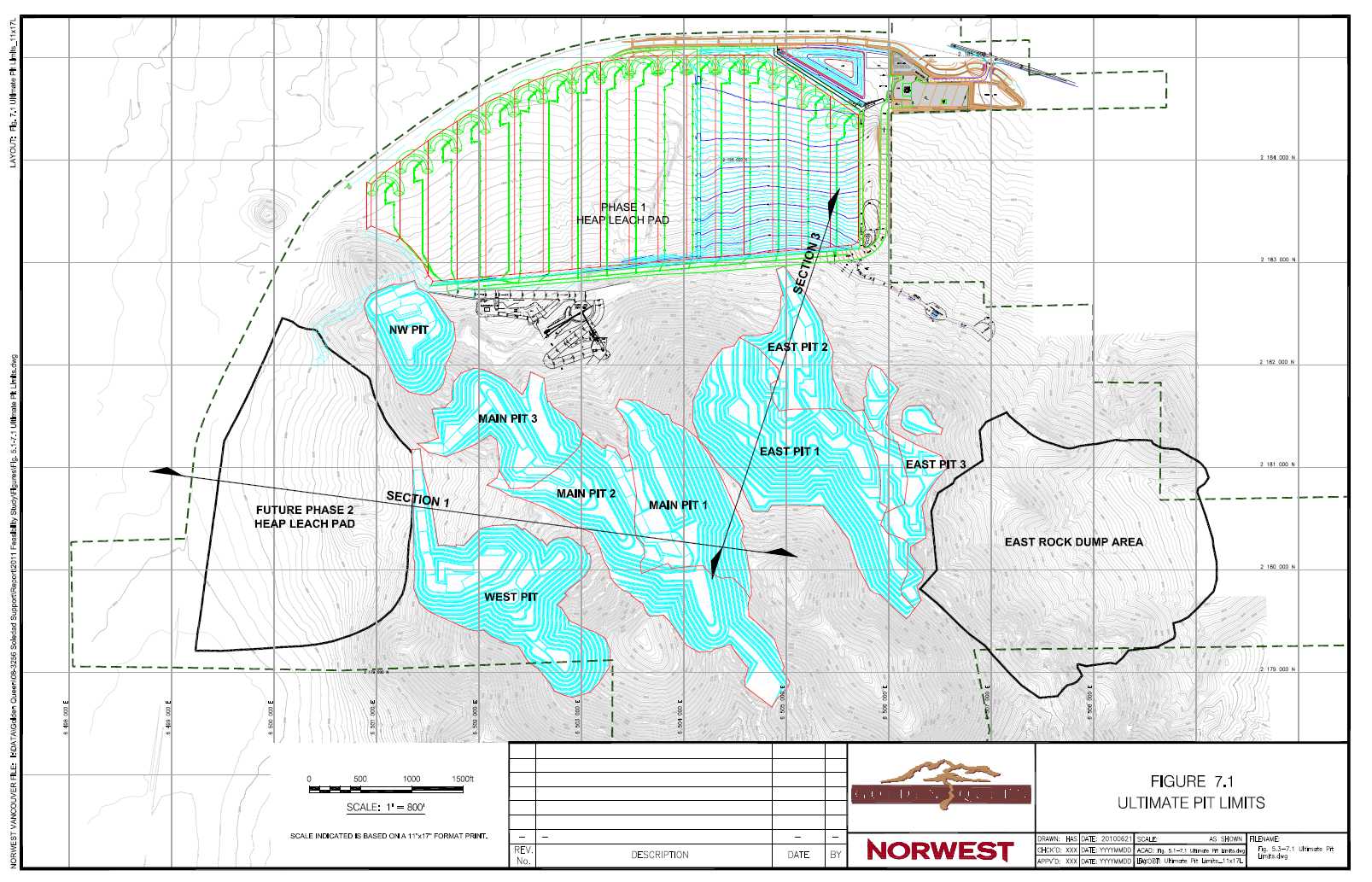

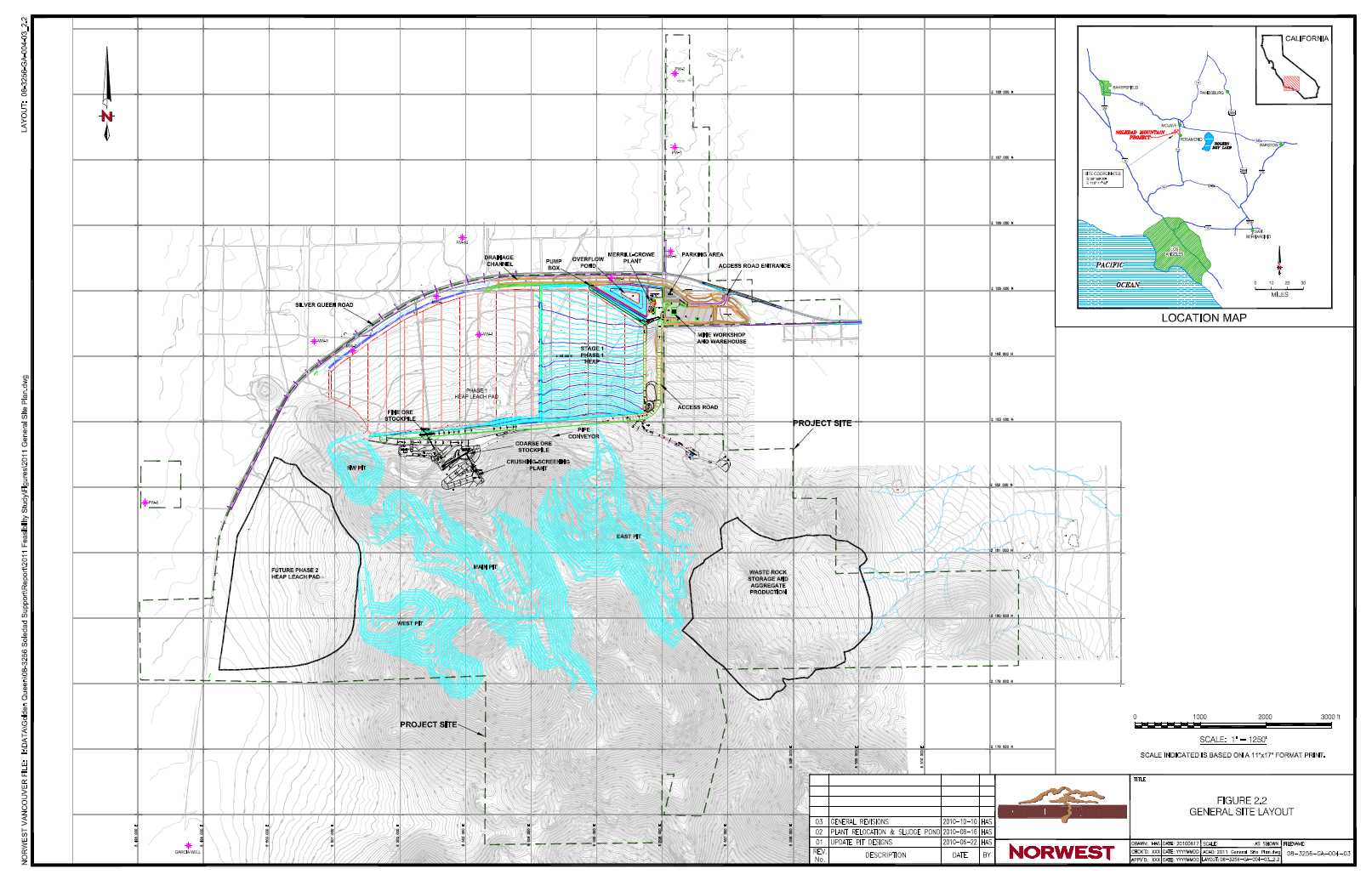

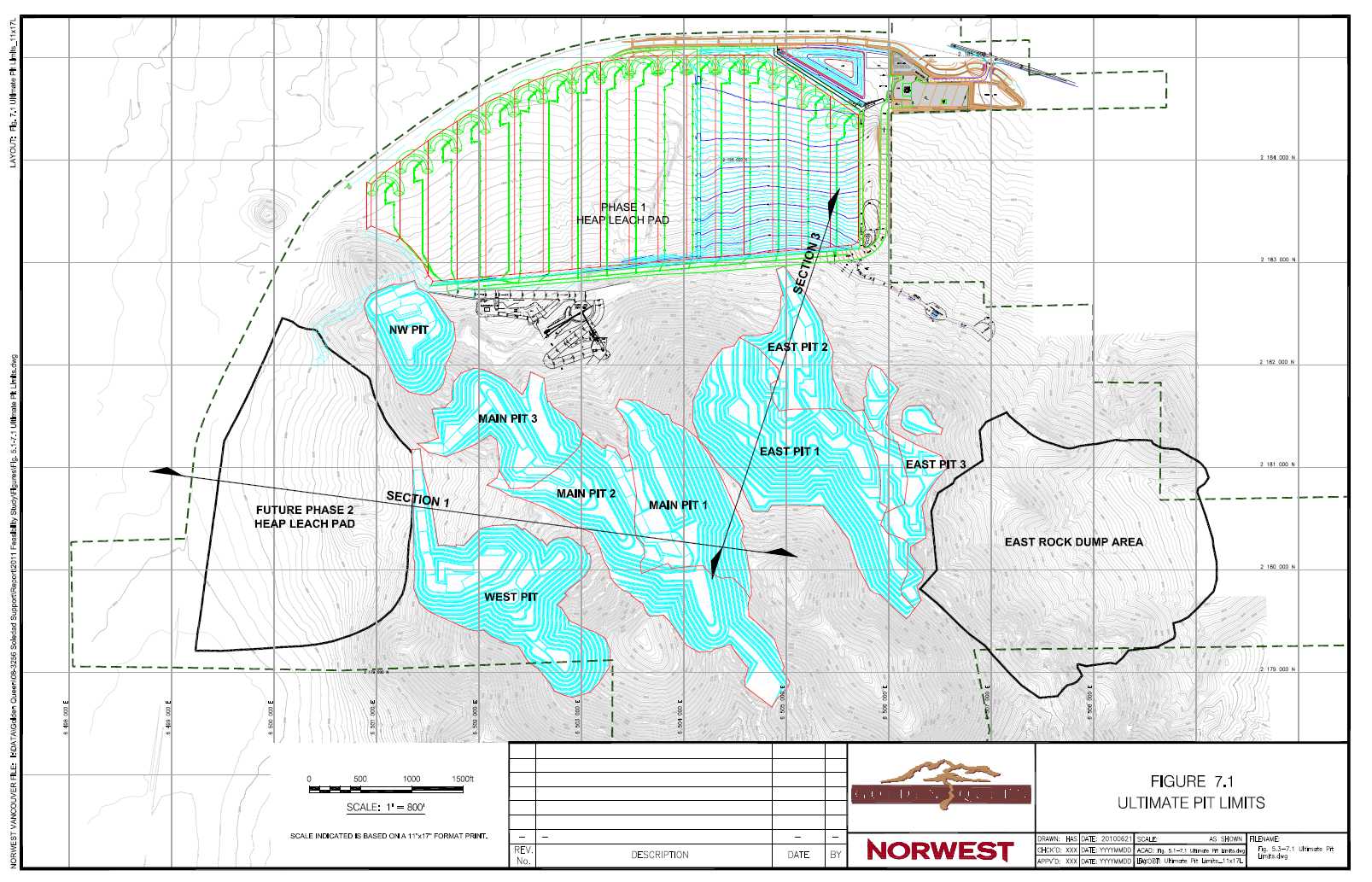

The feasibility level mine plan was developed for an open pit mining operation feeding approximately 5 million tons per year of ore to a crushing-screening plant for placement on a heap leach pad. Gold and silver would be recovered from the leach solution on-site in the form of dorè. The pit designs for the property were based upon the results of a series of Lerchs-Grossman pit optimization analyses and the calculated reserves are summarized in Table ES.3 below. The reserve calculations allow for a mining dilution of 2.5 ft at the ore waste contact (equivalent to approximately 15%). Dilution has been assigned a zero grade. The cut-off grade for the calculated reserves is 0.015 oz/ton gold or gold equivalent.

TABLE ES.3

PROVEN AND PROBABLE MINERAL RESERVES AT SOLEDAD MOUNTAIN

| Proven and Probable Mineral Reserve Estimates |

| Mine Cut-Off Grade=0.008 gold oz/ton | Gold | Silver | Contained Metal |

Reserve

Category | t

| ton

| g/t

| oz/ton

| g/t

| oz/ton

| oz

| oz

|

| Proven | 28,301,000 | 31,196,000 | 0.823 | 0.0240 | 13.716 | 0.400 | 748,700 | 12,478,400 |

| Probable | 20,091,500 | 22,146,000 | 0.545 | 0.0159 | 11.453 | 0.334 | 352,900 | 7,381,900 |

Total &

Average |

48,392,000 |

53,342,000 |

0.708 |

0.0207 |

12.767 |

0.372 |

1,101,600 |

19,860,300 |

Note: 74,000 tons of ore, 2,000 oz of gold and 9,900 oz of silver is added into the probable category. This is from road construction within the defined resource boundary, but outside the pit limit.

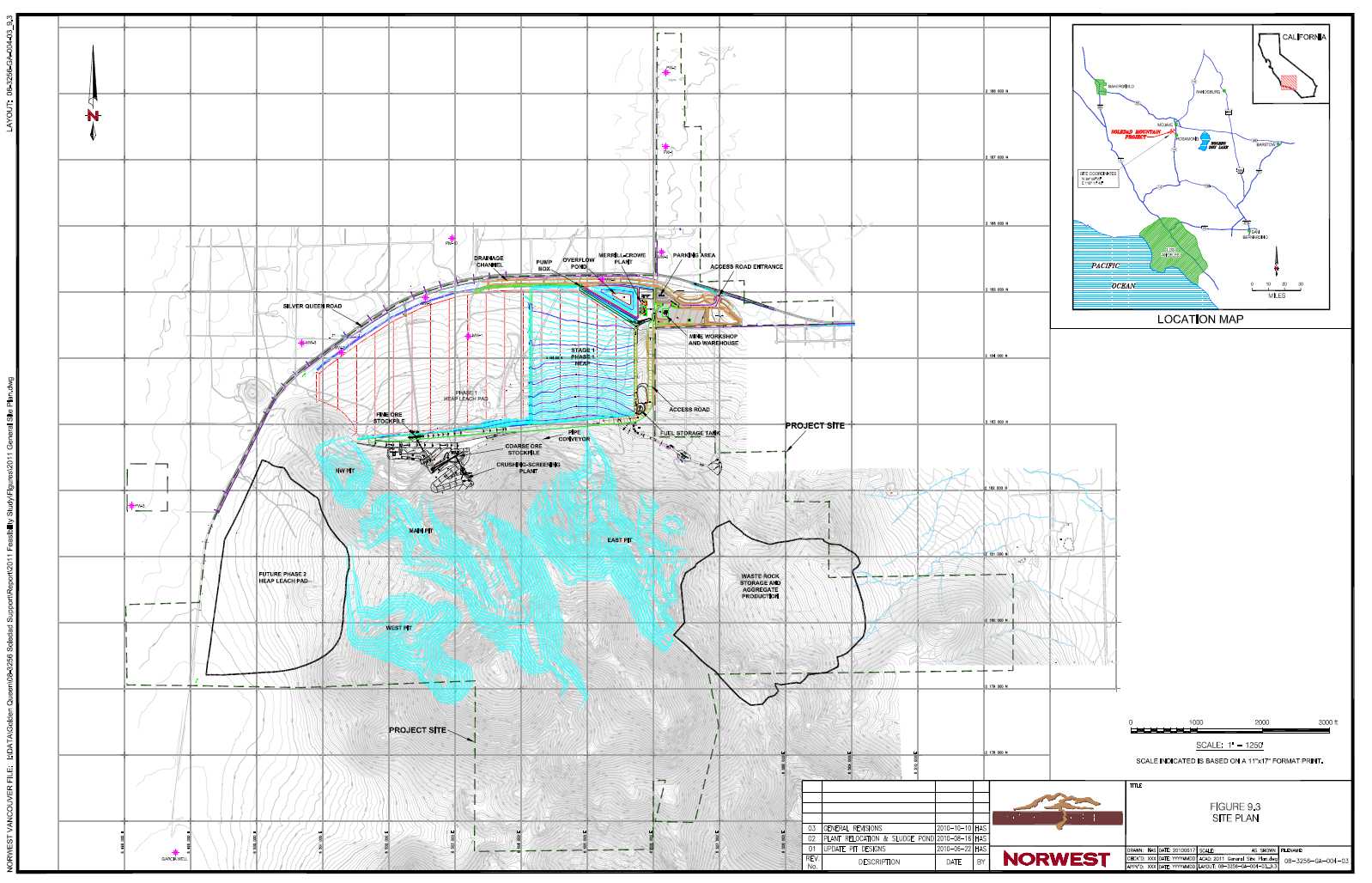

The mine plan is based on utilizing wheel loaders and 100 ton capacity haul trucks for the primary mining supported by a smaller development fleet for pioneering access roads, upper pit benches and final ore mining at the bottom of the various mining phases. The primary mining fleet is supported by additional equipment for road maintenance, dumping operations, stockpile activities and feed to the crushing-screening plant. The projected life of the heap leach operation is 12 years of mining and three years of additional leaching and rinsing Figure ES-1 provides a general site layout.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| ES-5 |

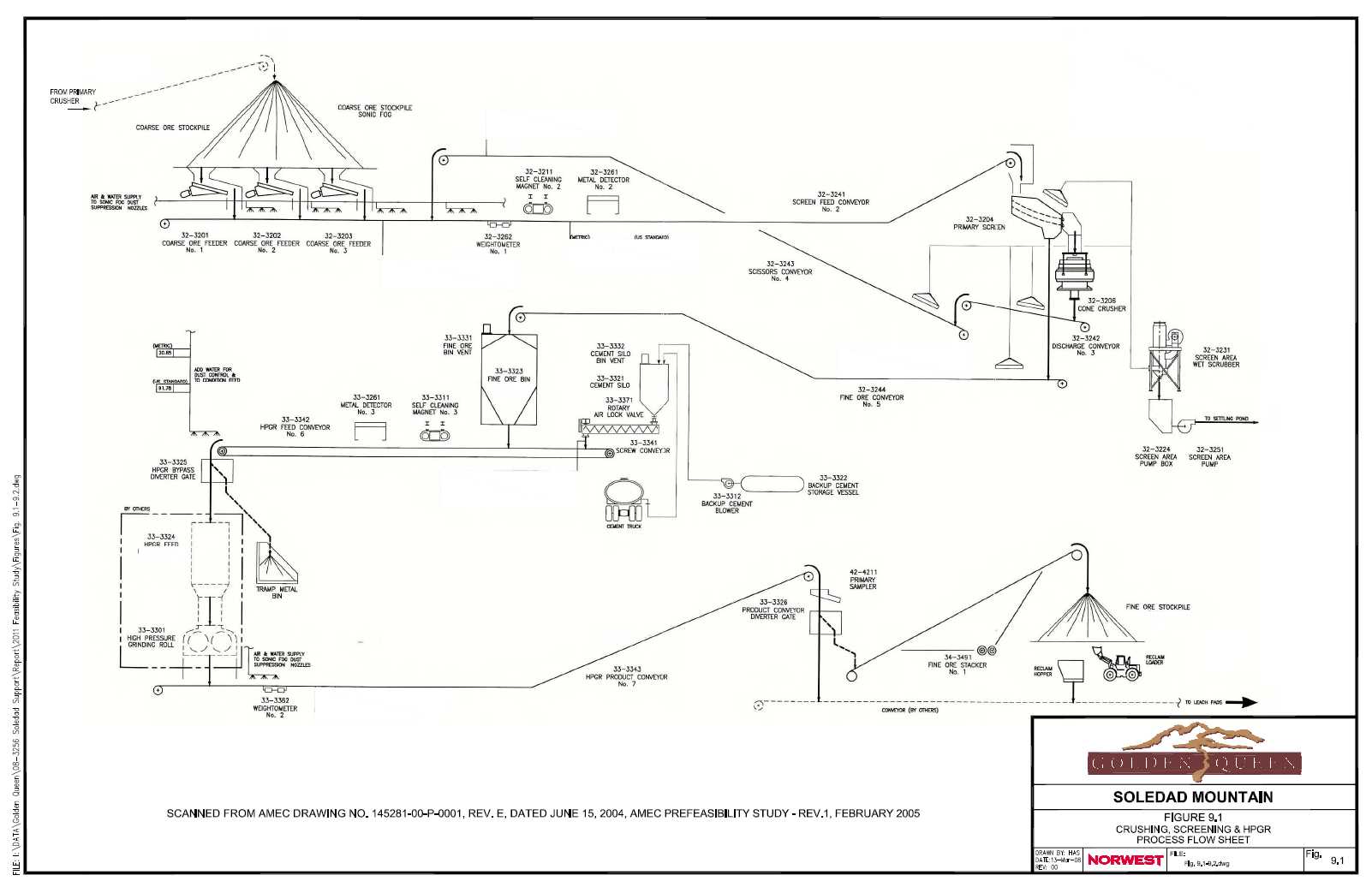

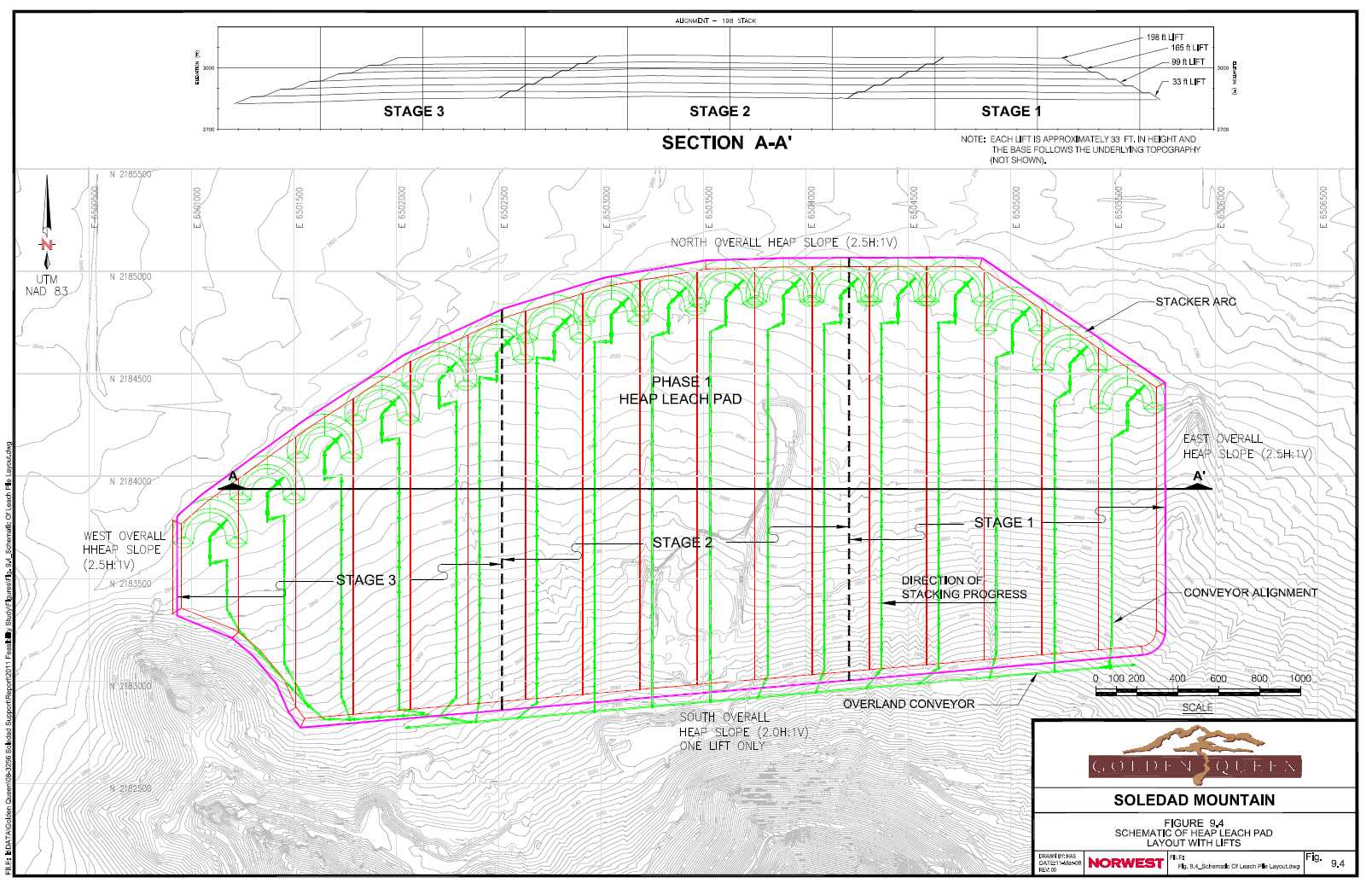

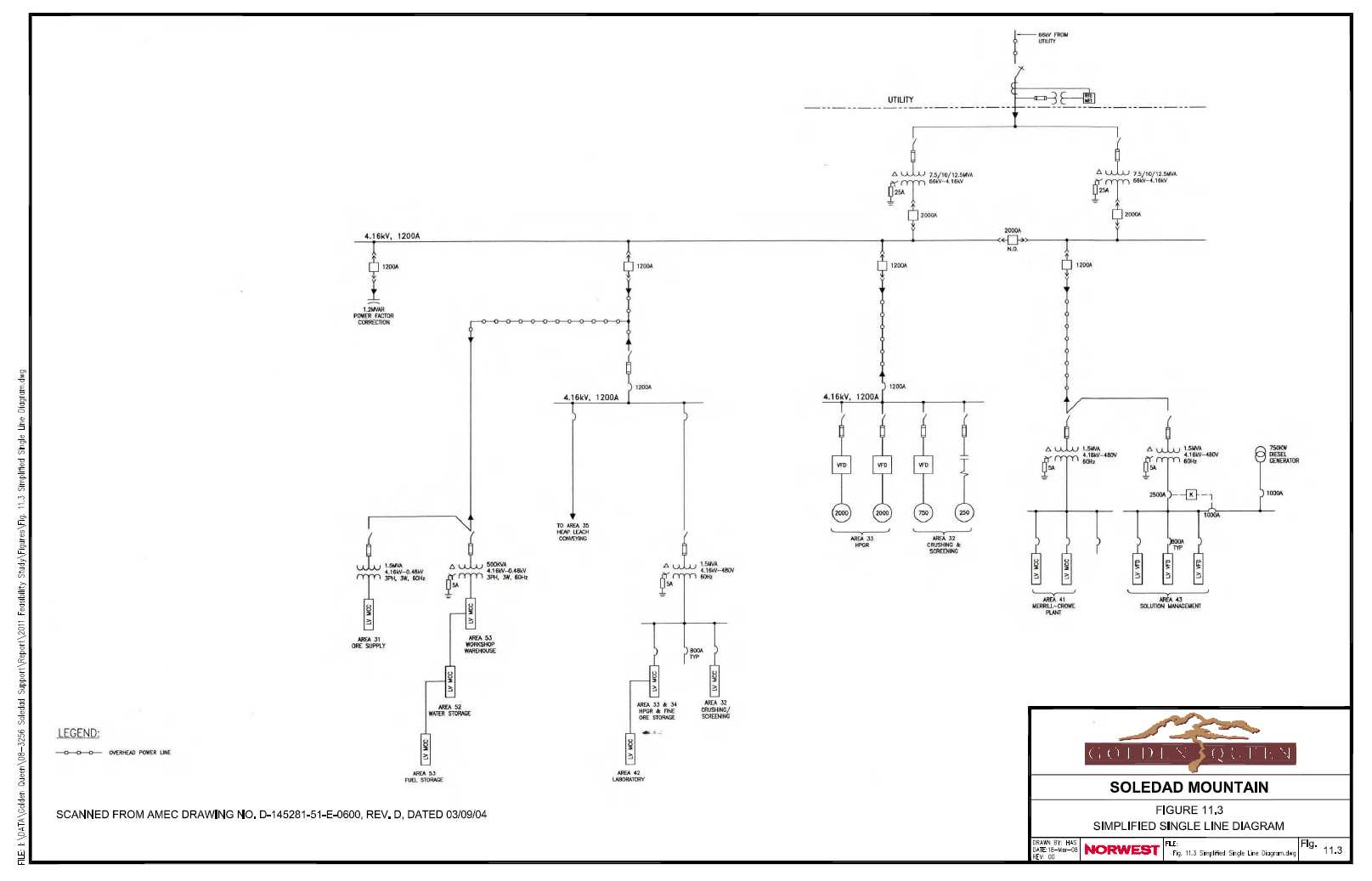

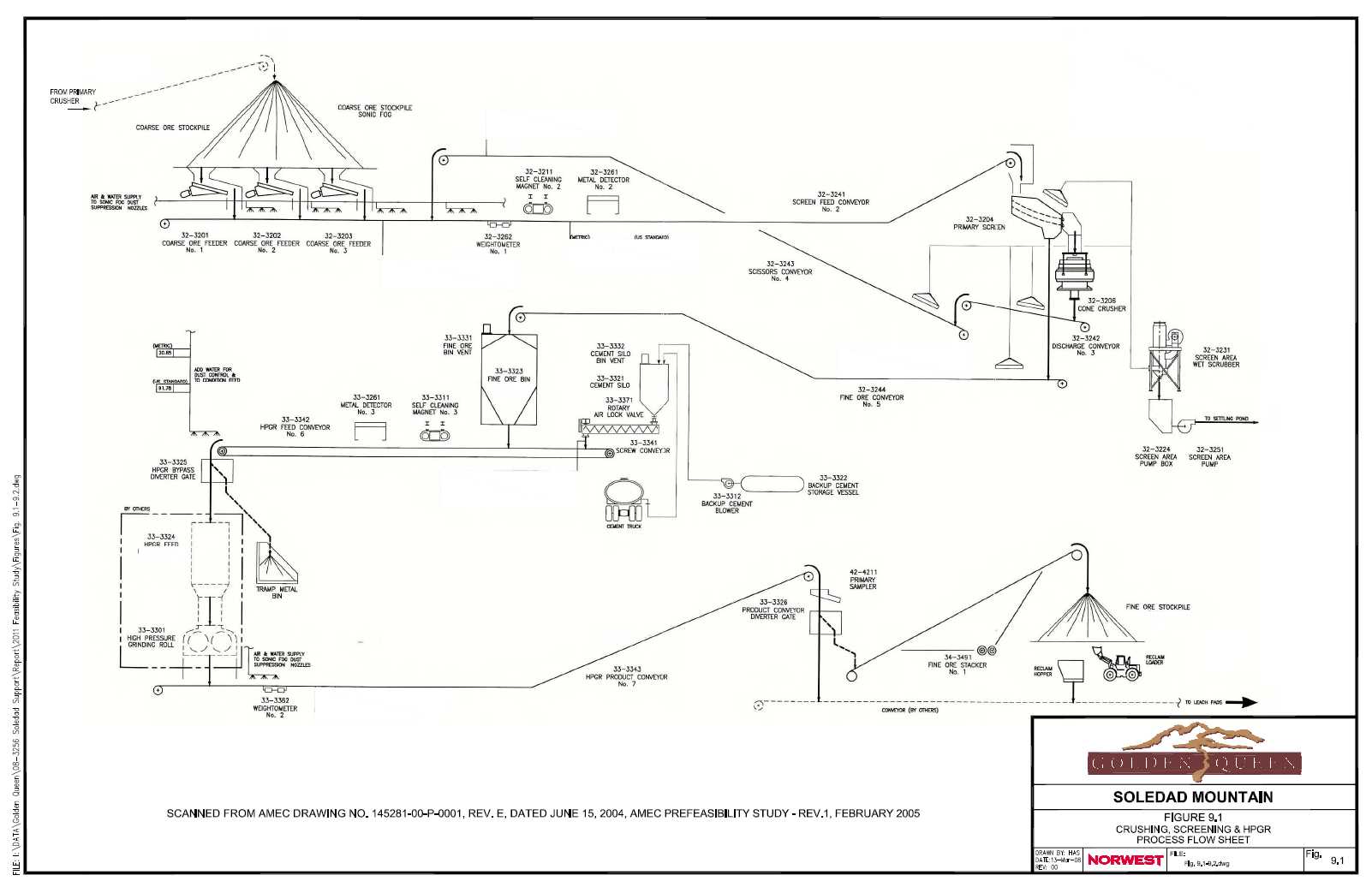

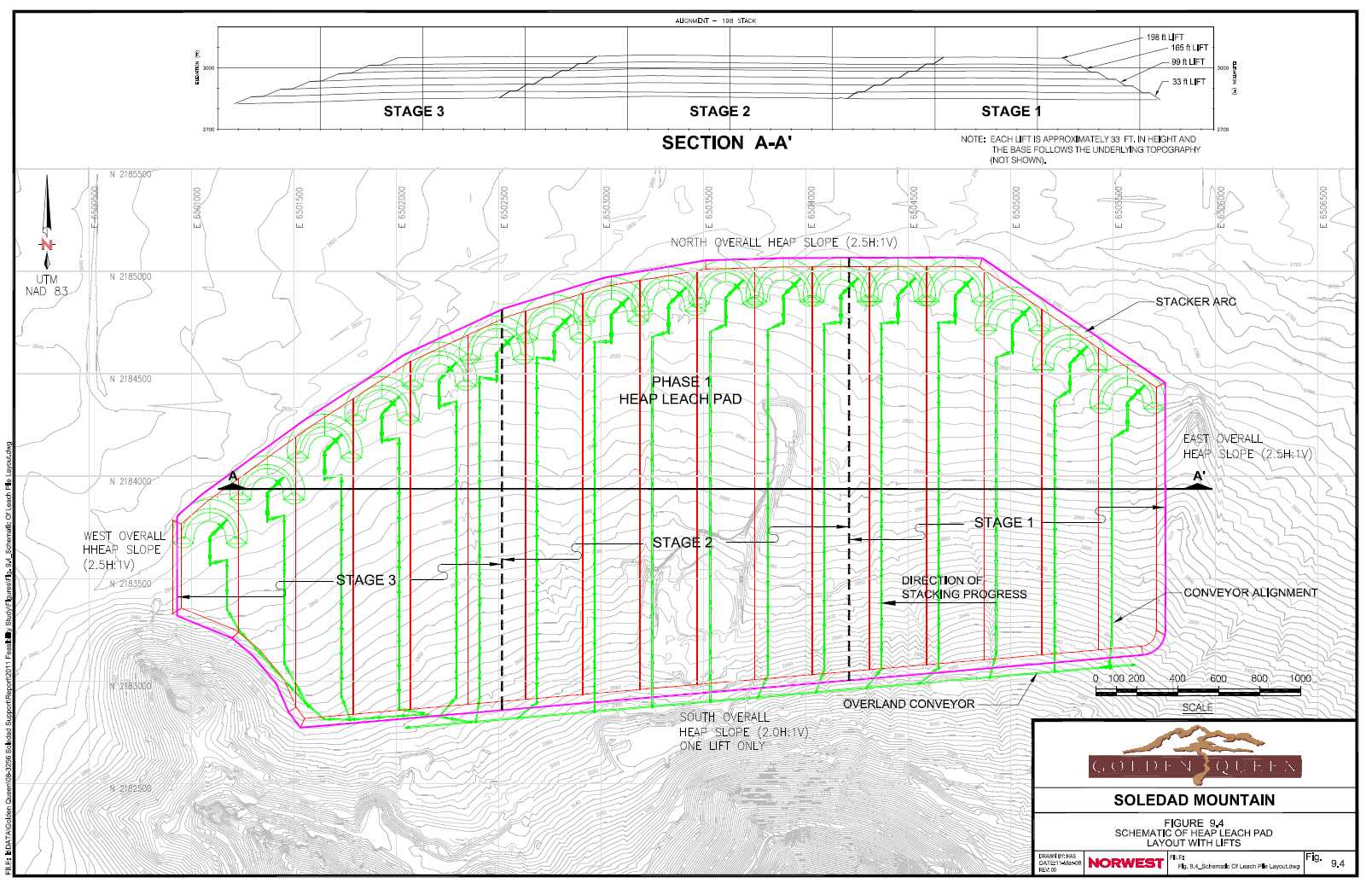

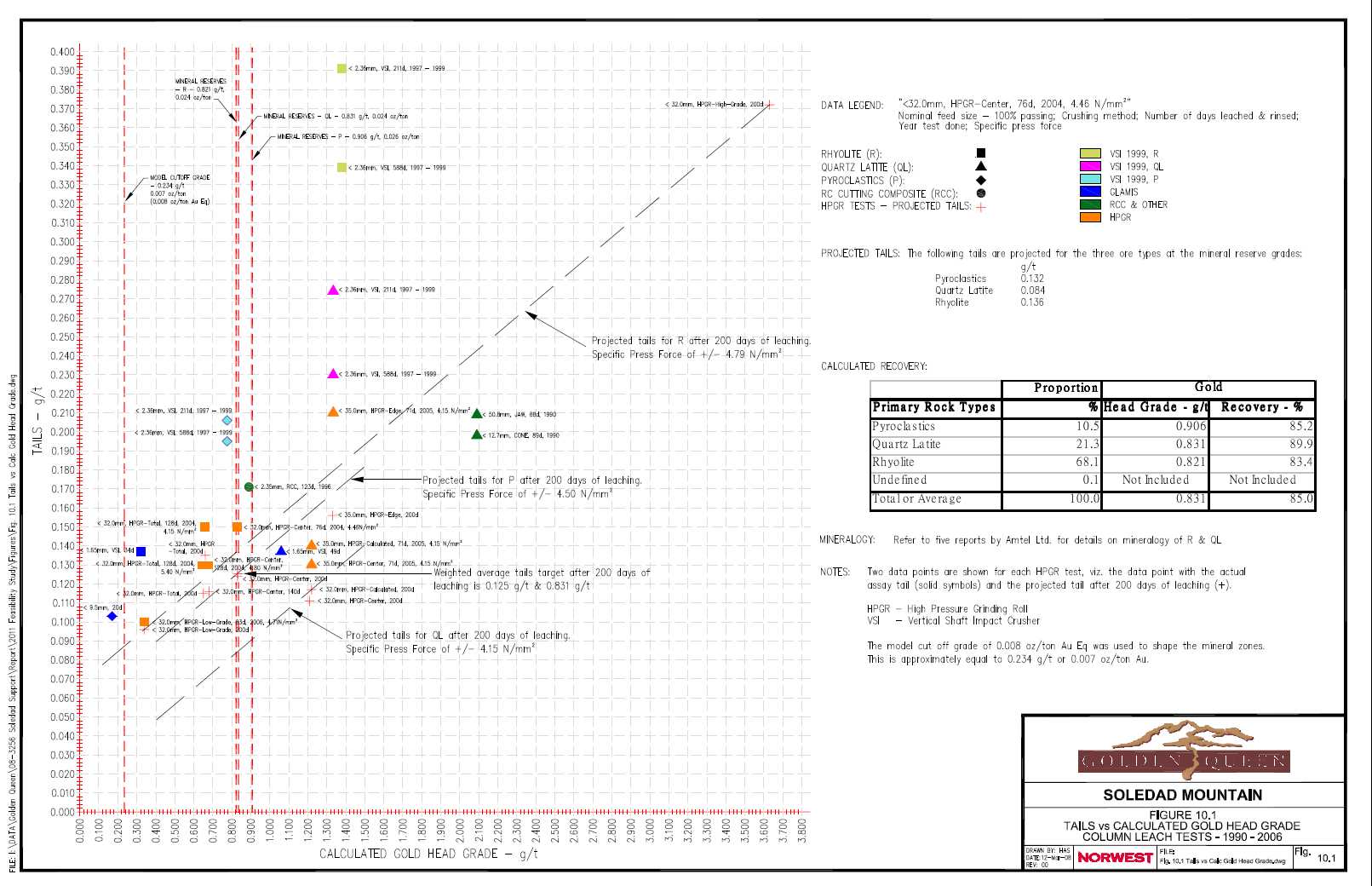

The crushing-screening plant includes a primary and secondary crusher and screen. A high pressure grinding roll (HPGR) is used as part of the crushing circuit to prepare the ore for stacking on the leach pad. The leach pad is designed to have capacity for the total mine production with placement of approximately 53 million tons of ore on the pad. Pregnant solution will be handled through a Merrill-Crowe plant which will extract the gold and silver from solution for the production of dorè. The dorè will be transported to an off-site smelter and refinery for final production of saleable gold and silver.

Average annual metal production is expected to be in the range of 75,000 oz of gold and 950,000 oz of silver on a post-smelter metal recovery basis. Total post-smelter metal production is estimated at 936,000 oz gold and 10.4 million oz silver over a period of approximately 13 years.

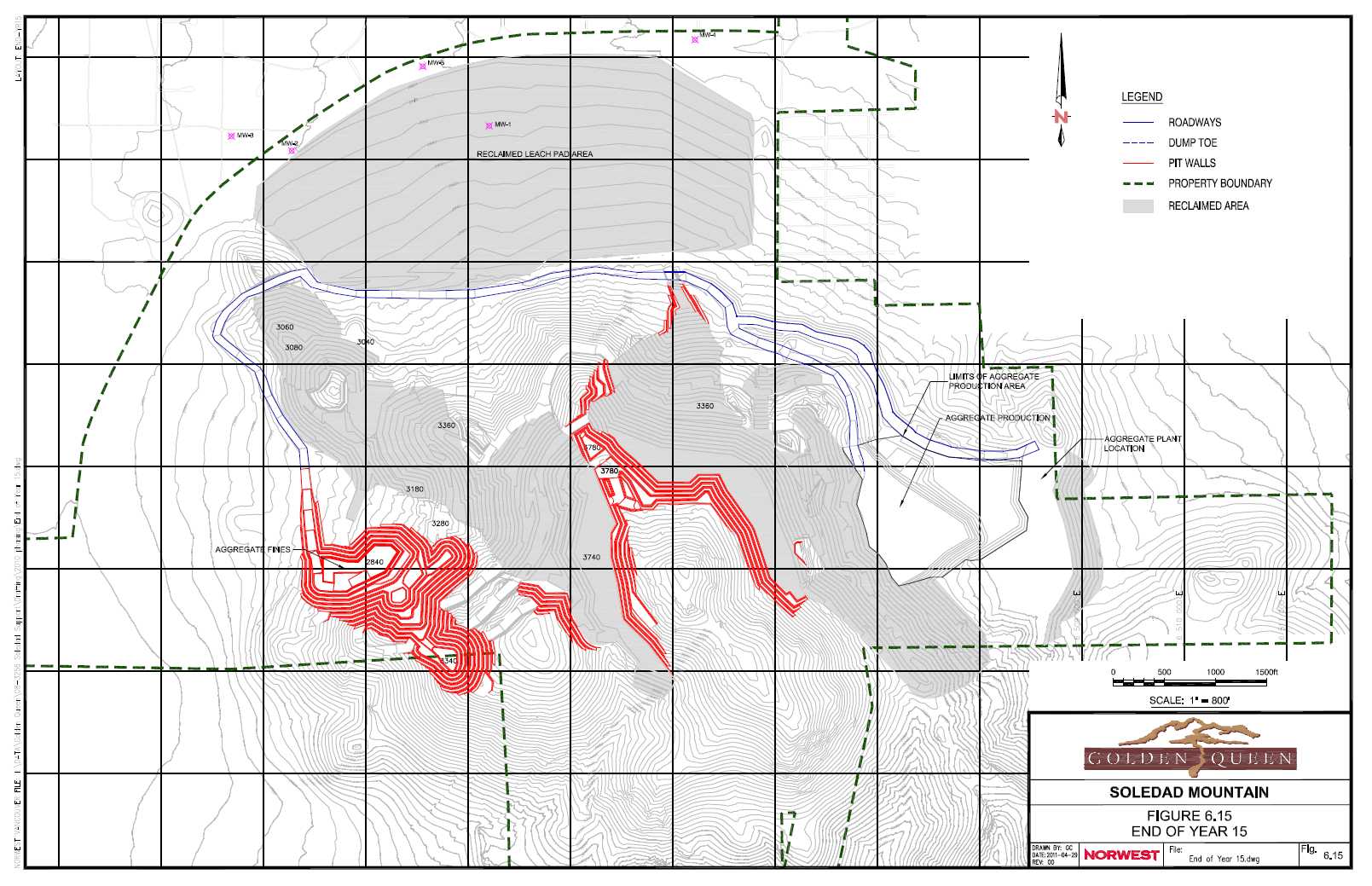

GQM is actively investigating the potential for developing a byproduct aggregate and construction materials business once the heap leach operation is in full production. The source of raw materials will be suitable quality waste rock specifically stockpiled for this purpose. Test work done in the 1990s confirmed the suitability of waste rock as aggregate and construction material. There is also the potential to market the rinsed leach material when mine operations cease. Based on currently projected mine plans, there may be sufficient material to allow aggregate for production for a period of up to thirty years. However, no contributions from the sale of such products will be included in the cash flow projections until long term contracts for the sales of these products are secured.

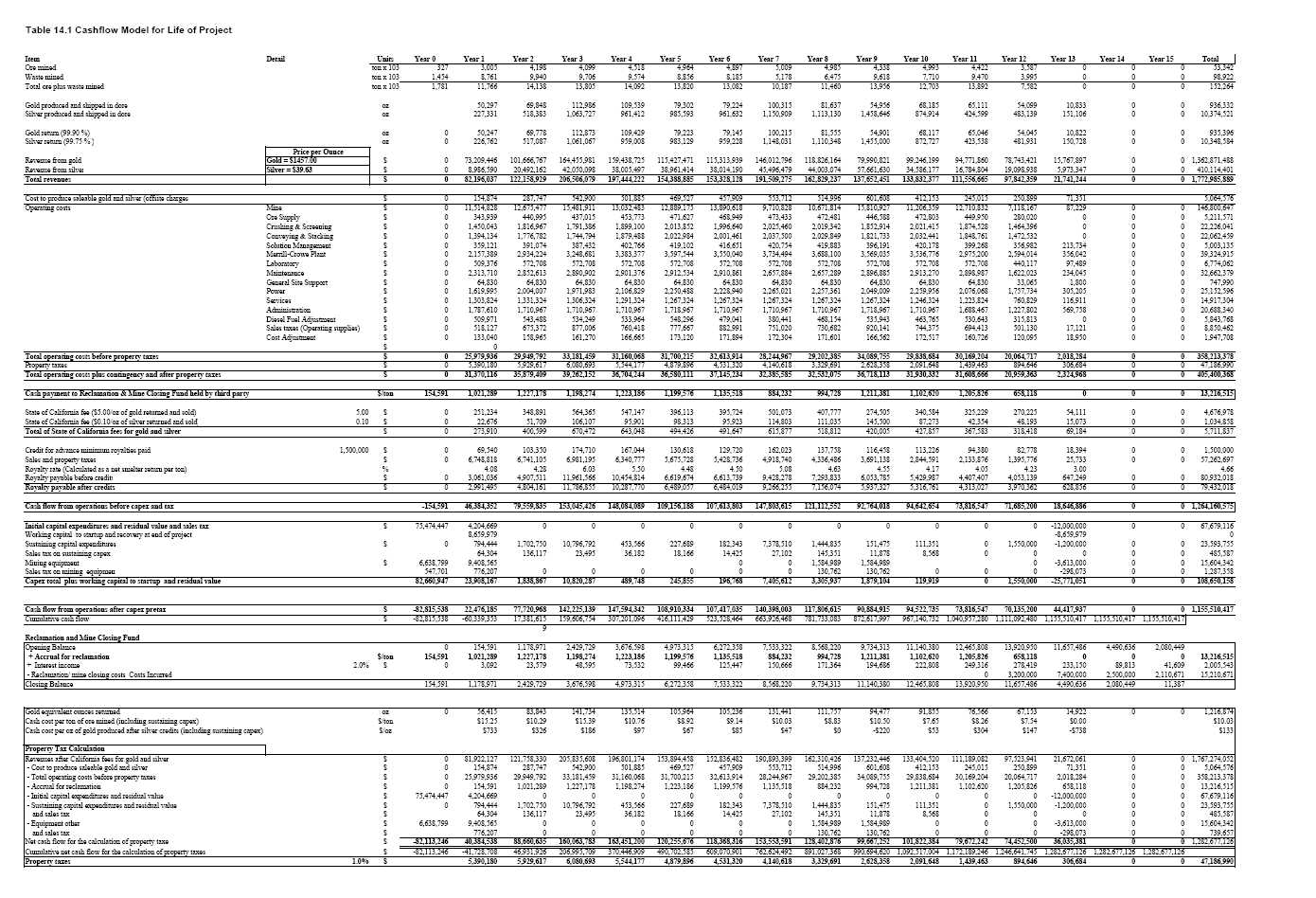

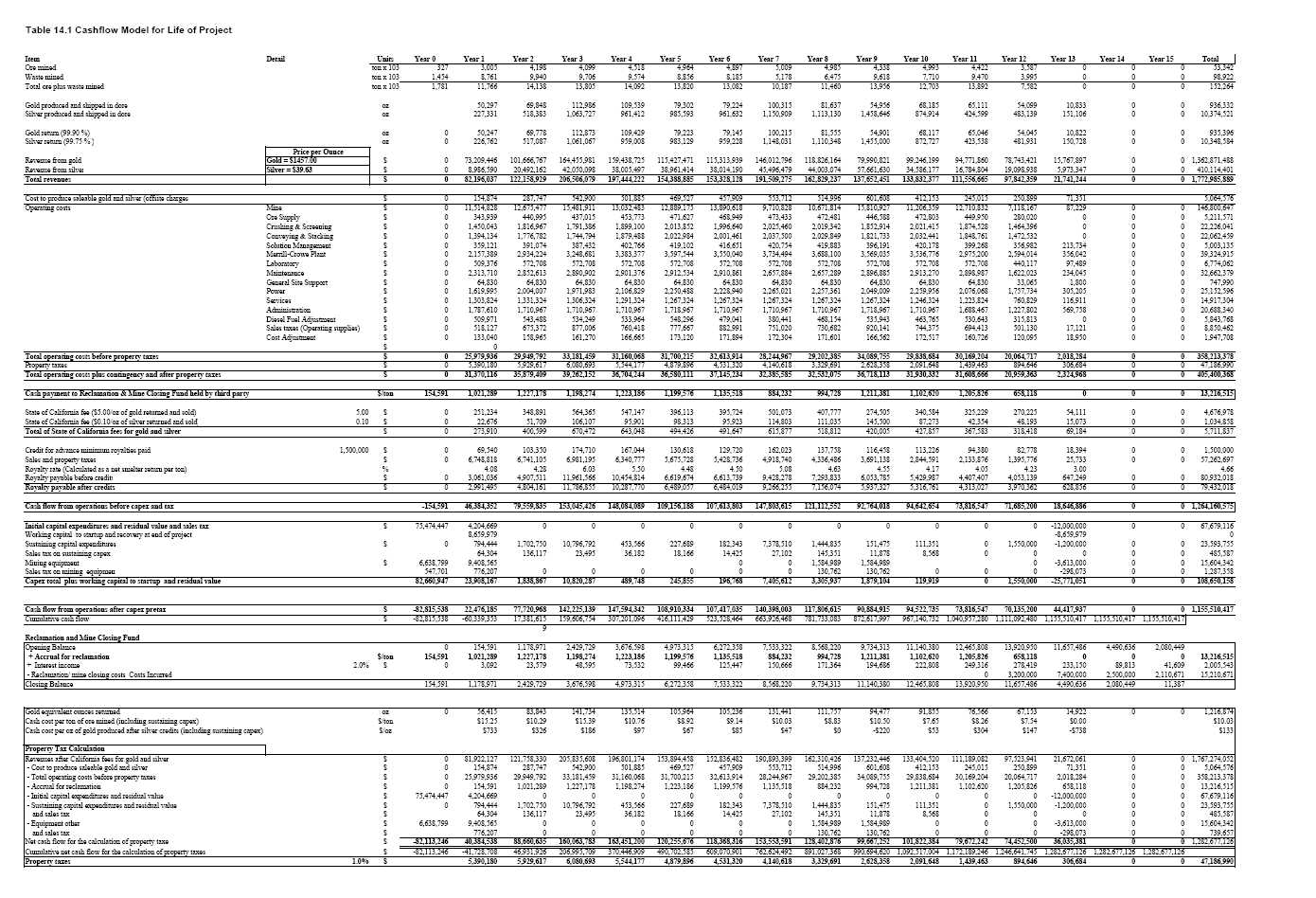

PROJECT ECONOMICS

NOTE: All costs are reported in US dollars.

The Project requires development capital of $79.7 million plus $17.4 million for major mining equipment and $8.7 million in working capital. The total initial capital required is $105.7 million. In addition, there is $25.3 million in sustaining capital required over the life of the mine which includes leach pad expansions and replacement mining equipment. The average operating cost per ton of ore crushed is $6.72/ton. Operating costs over the life of the project have been calculated at $133/oz net of silver credits at $39.63/oz silver.

Project cash flows for the base case use the current gold price of $1,437.00/oz and for a silver price of $39.63/oz (London closing, April 5th) at the start of April 2011 for the life of the project. Capital and operating costs are also not inflated. The estimated net present value (NPV) for the base case scenario was $678 million at a 8% discount rate with an internal rate of return of 84%, both calculated on a pre-tax basis.

Sensitivity analyses were carried out using alternate gold and silver price cases including the 36 month average price case with the gold price at $1061.25/oz and the silver price at $17.78/oz. This case showed an NPV of $343 million and an internal rate of return of 52%.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| ES-6 |

CAUTIONARY STATEMENT

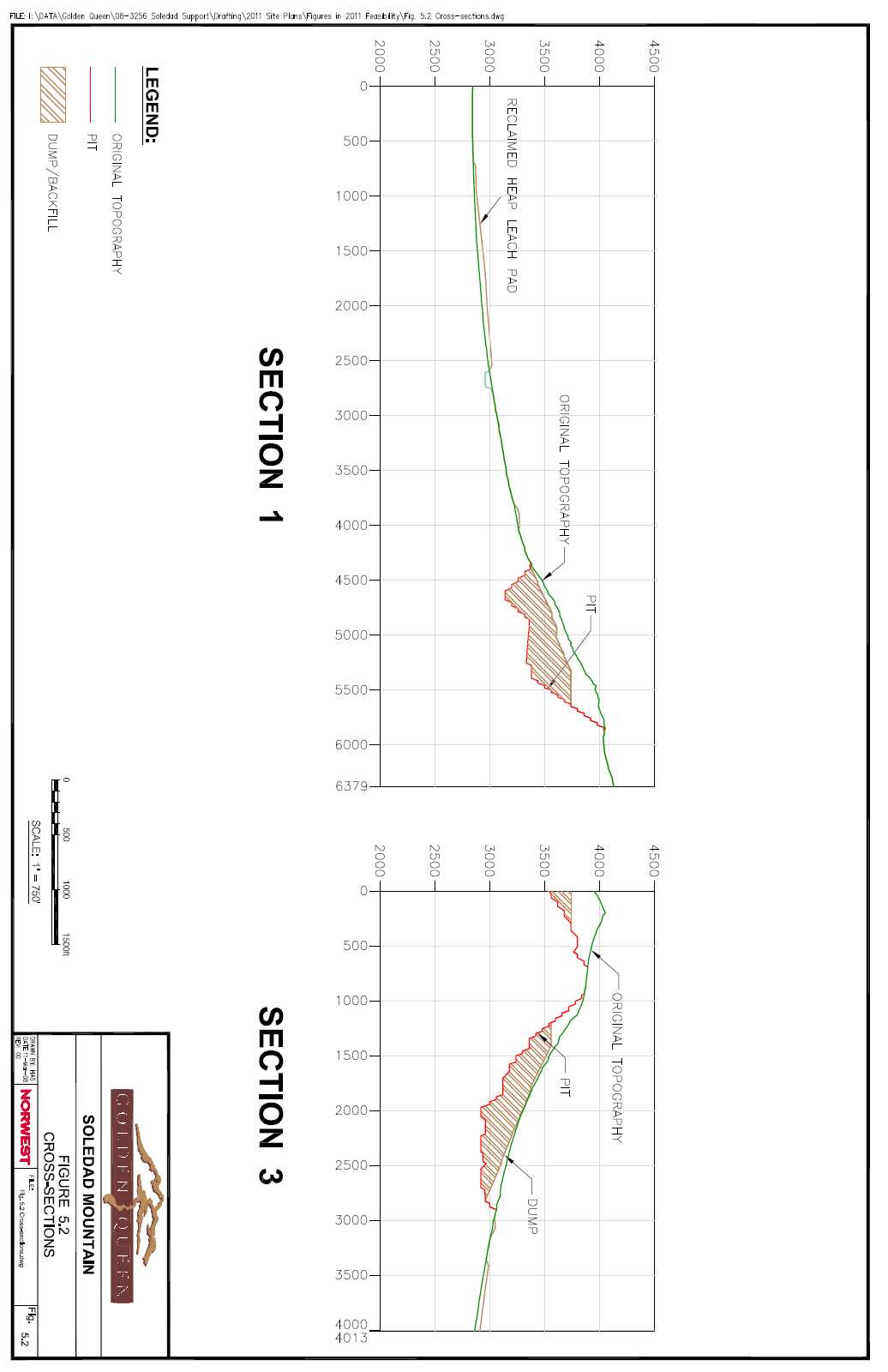

As noted in Section 1.3, the Project has been approved by the Kern County Planning Commission and the Kern Country Planning and Community Development Department. The Commission accepted the project plan subject to a number of Conditions of Approval. A number of these conditions specifically address issues related to reclamation of the property including backfilling and restoration to approximate pre-mining topography.

The mine plan presented in this document represents best efforts by Norwest to develop a mine plan which maximizes in-pit backfill while not unduly penalizing the Project’s economic viability. The pit shells used as a basis for this feasibility were selected based on consideration of both economic and waste volume considerations with the goal of developing pit configurations which balanced ore tonnage against waste quantities.

In order for the current mine plan to meet all the conditions laid out by the County, approximately 19 million tons of waste rock must be sold as aggregate and removed from site prior to final reclamation. In addition, all the leached residues must be either permitted to remain in place or be sold as aggregate. If this quantity cannot be sold, the necessity of handling this additional volume as part of the reclamation plan will affect the overall ore tonnage that can be mined at site. While no costs or revenues associated with aggregate production using this material, have been included in the Project economic analysis, removal of these materials is an integral component of the integrated mining and backfilling plan. If these quantities of material remain onsite, it will require revision of the mining plan in order to meet the backfill requirements which could reduce the life of the heap leach operation by up to 2 – 4 years.

Norwest has worked with GQM to develop a scenario which limits the effect of this on the mine life and GQM has had promising discussions with a local aggregate contractor regarding the saleability of the waste rock and leached residues into the regional market. However, there is still a potential risk that meeting the requirements of the Conditions of Approval could affect the overall mine life.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| ES-7 |

| 1 | INTRODUCTION |

| | |

| 1.1 | TERMS OF REFERENCE |

GQM engaged Norwest Corporation (Norwest) in January 2007 to prepare a NI 43-101 compliant Technical Report to assess mineral reserves for the Project as part of an independent feasibility study based upon technical work and engineering designs completed to the end of 2007. The results of the Norwest study were disclosed in a press release on December 14, 2007. The NI 43-101 compliant Technical Report dated January 23, 2008 is available on SEDAR and on GQM’s website at www.goldenqueen.com.

Norwest has now updated the feasibility level study as per the detail provided in this report.

The geological model for the Project was developed by SRK Consulting (U.S.) Inc. and the mineral resources documented in a 43-101 Technical Report issued March 6, 2006. Norwest has used this model as a basis for pit optimization and the development of the mining plan in the feasibility study.

Detailed studies have been completed by GQM internally under the guidance of Lutz Klingmann, P.Eng., President of GQM. Norwest has incorporated the findings of many of the engineering and technical studies commissioned by GQM as these studies have been completed by qualified independent third parties. These studies are referenced in this feasibility report and a list of all references is included. Where revisions have been made to previous work they are noted (example: capital and operating cost updates).

A discussion of the applicable regulations, potential project impacts and the current status of the project regulatory review is included later in this chapter.

| 1.2 | SOURCES OF INFORMATION |

In-depth technical evaluations were carried out on the Project starting in the mid-1990’s. This work has dealt with all aspects of the Project ranging from geology and resource modeling through to mine operations, ore handling, leach pad operations, metals recovery and reclamation.

The majority of the work has been completed by independent third-party consultants and suppliers. Lutz Klingmann, P.Eng., President of GQM has been coordinating the Project development work since 2002 and has also contributed his technical expertise to the Project development process. Norwest has referenced the documents used in the relevant sections of this report and has also noted where input has been received from Mr. Klingmann.

Norwest has reviewed the reference documents used in the preparation of this feasibility study and has accepted them as providing a reasonable basis for feasibility level planning. Where revisions have been required for a specific document due to changes in the project development plan then these have been noted. In the majority of cases, revisions have been made to update capital or operating cost estimates for various project components.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 1-1 |

| 1.3 | REGULATORY CONDITIONS AND PROJECT STATUS |

The Project is subject to federal, State and county acts and regulations governing precious metal cyanide heap leach operations.

All key submissions required for an amended set of approvals and permits for the Project have now been submitted to the responsible regulatory authorities.

| | 1.3.1 | Land Use - Conditional Use Permits |

The environmental setting of the Project was documented in a number of baseline studies completed from 1990 onwards and in the final Environmental Impact Report (the EIR) and Environmental Impact Statement (the EIS) completed in 1997. The Kern County Board of Supervisors unanimously approved two Conditional Use Permits (CUPs) for the Project in September 1997 (i.e. CUP Case No. 41, Map No. 213 and CUP Case No. 22, Map No. 214). The Bureau of Land Management subsequently issued its Record of Decision approving the Plan of Operations under NEPA in November 1997. The company completed a number of studies and did significant work on site in 2005 and 2006 to document that the environmental setting for the Project has not changed since 1997.

The State of California introduced backfilling requirements for certain types of open pit, metal mines in December 2002. The company contended that these regulations did not apply to the Project under a grandfathering provision included in the regulation. The company therefore pursued both a favorable interpretation under the regulation and subsequently an amendment of the regulation with the State Mining and Geology Board (the Board) in 2006. These efforts were supported by Kern County officials. Both approaches were rejected by the Board and the decision was duly recorded by the Board in January 2007.

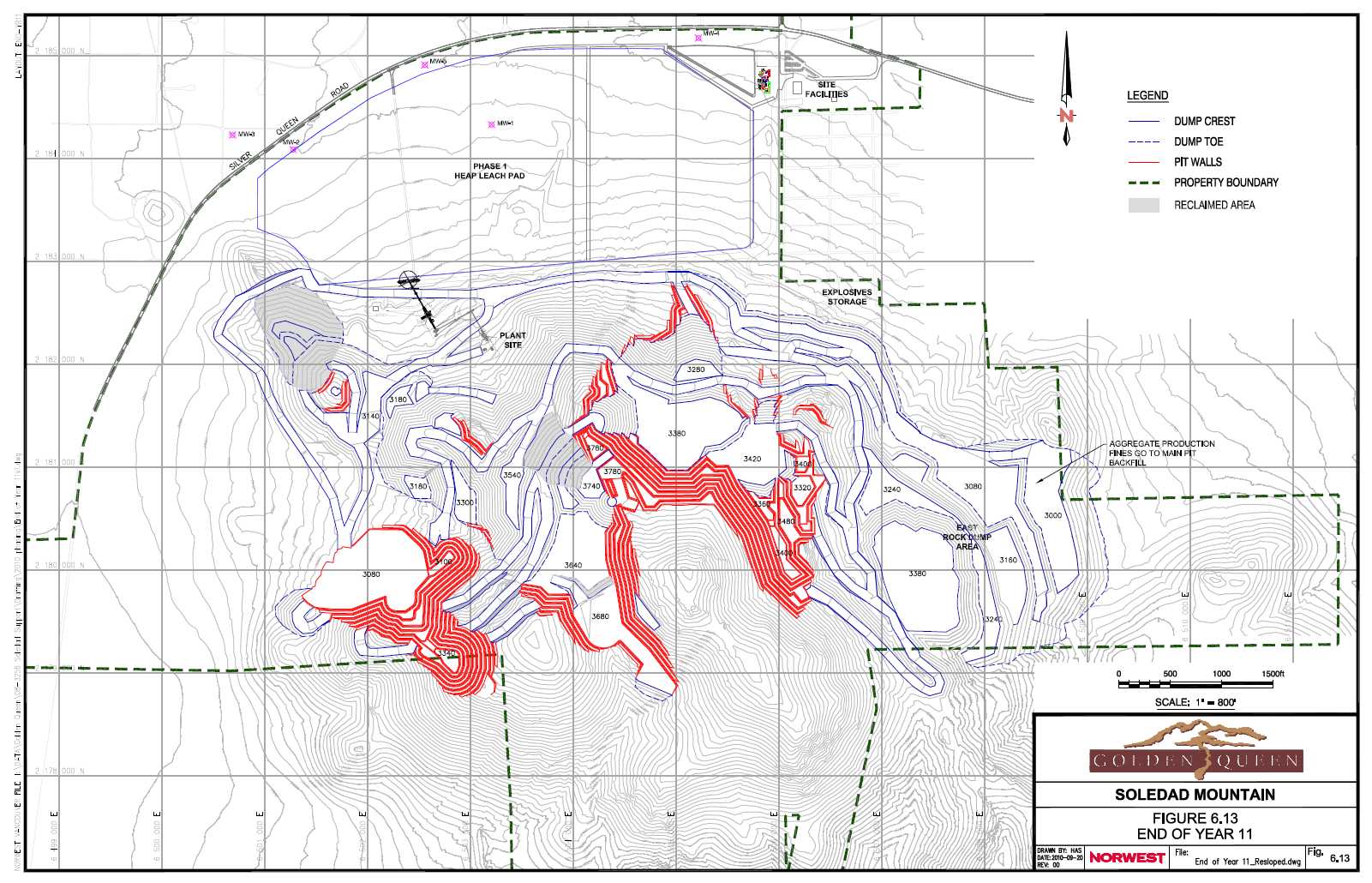

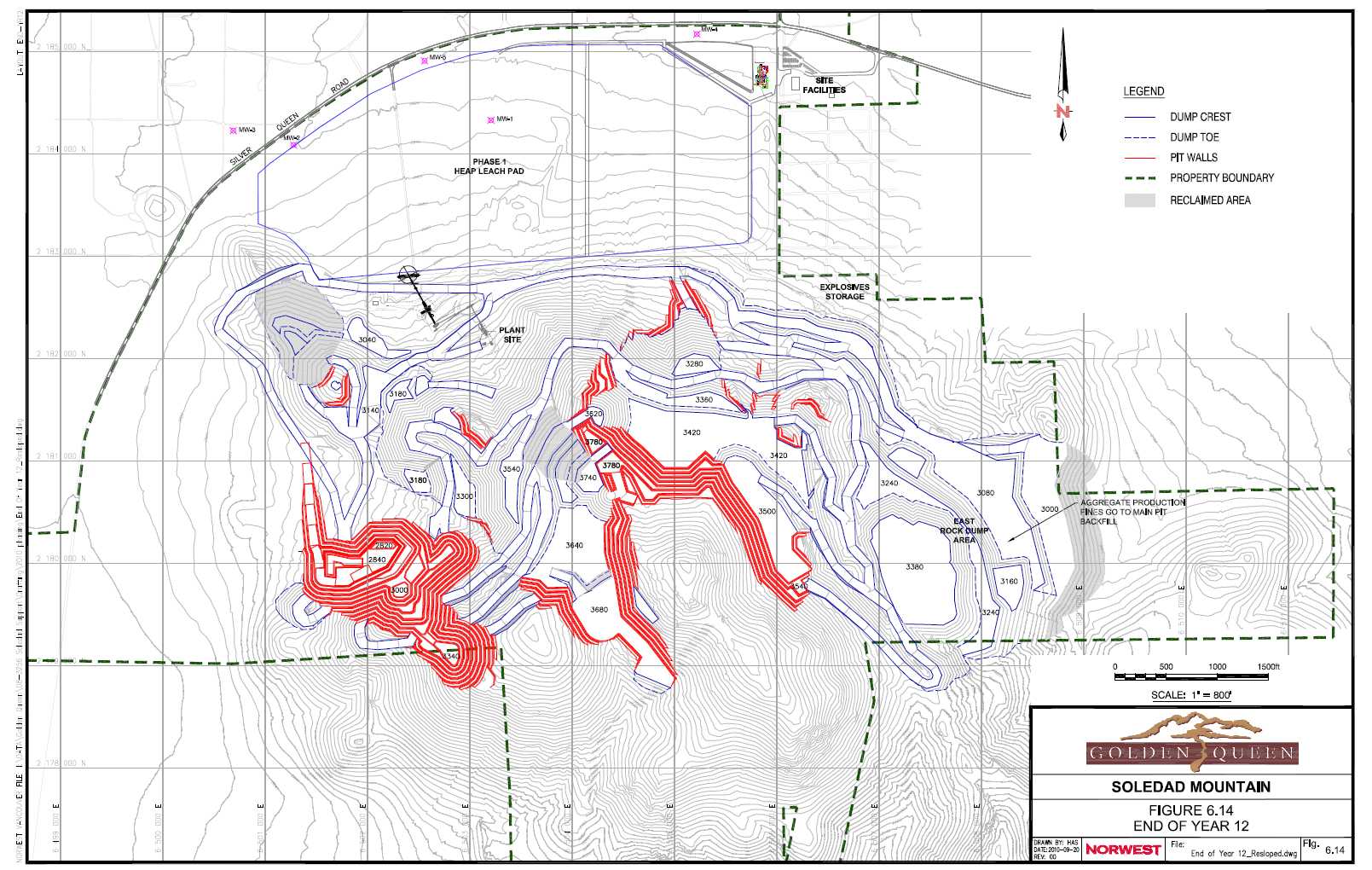

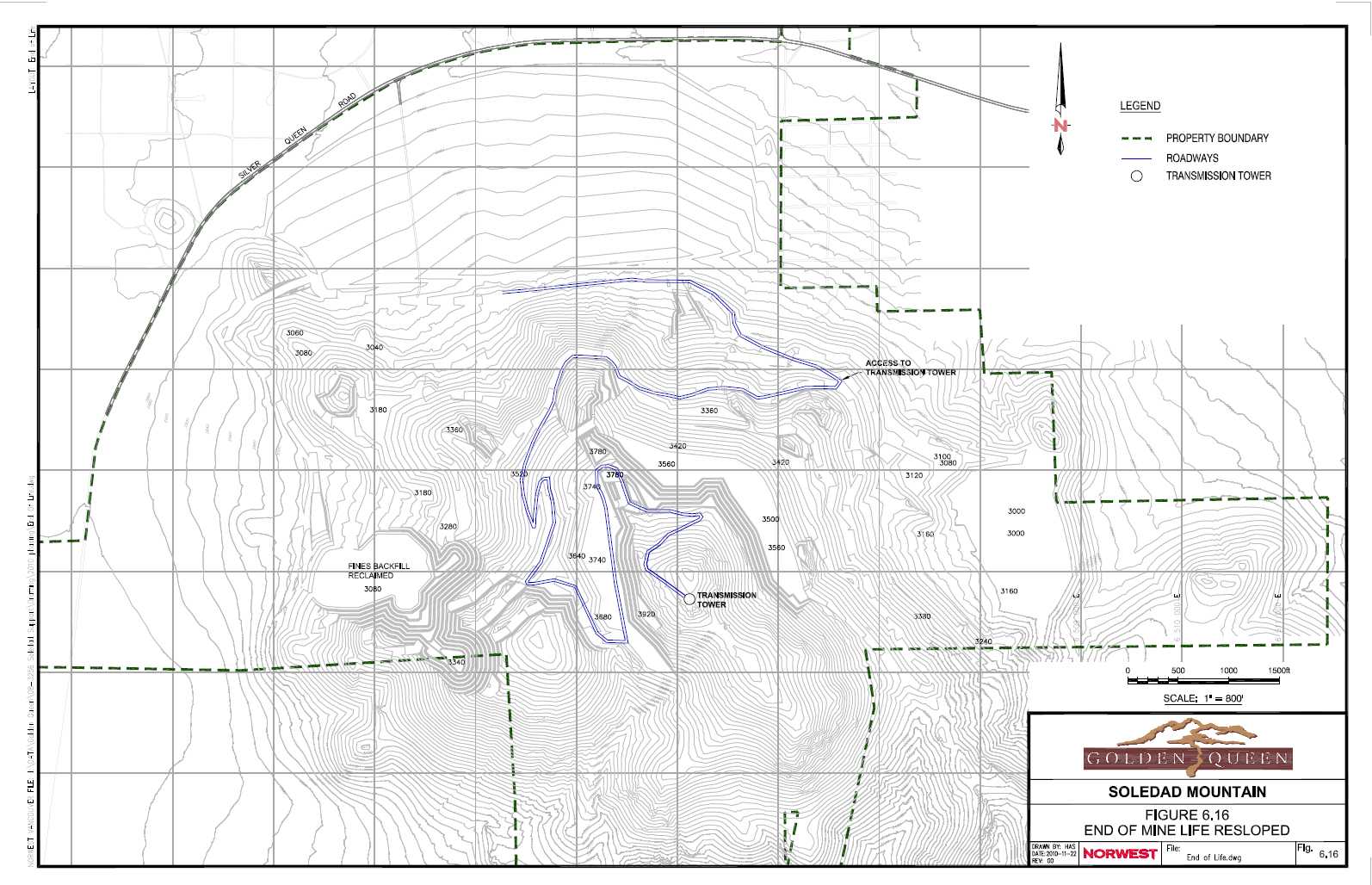

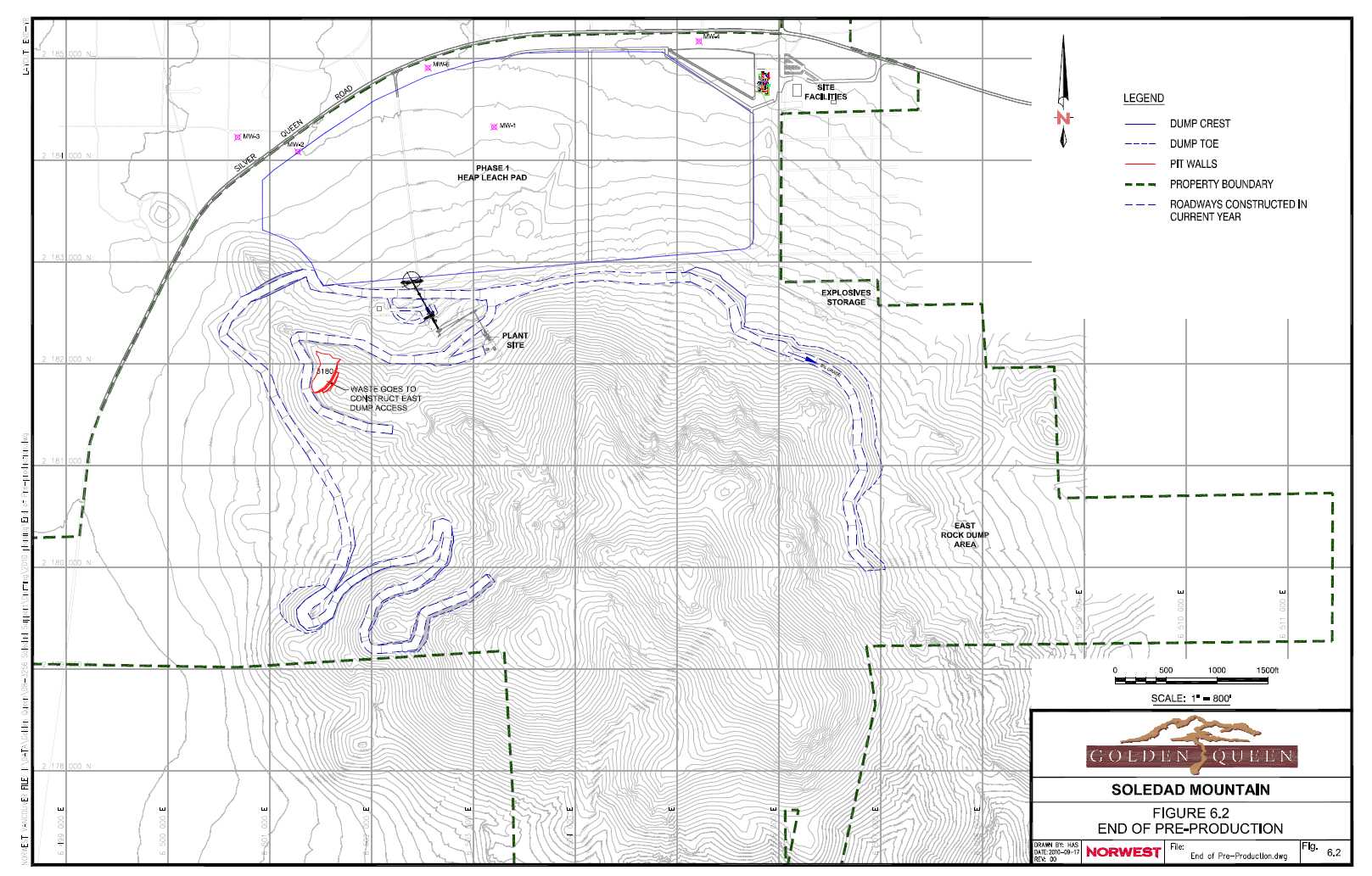

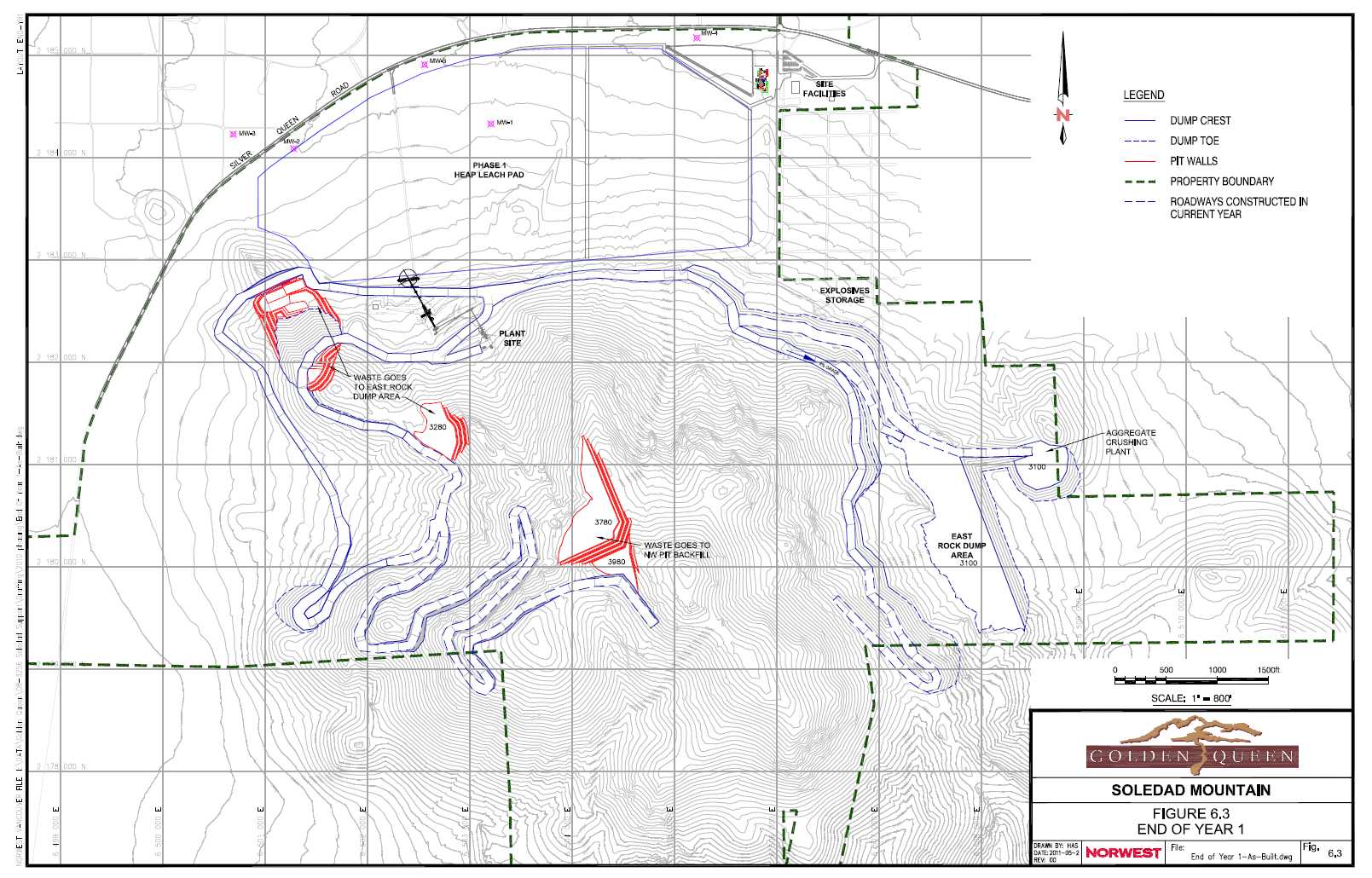

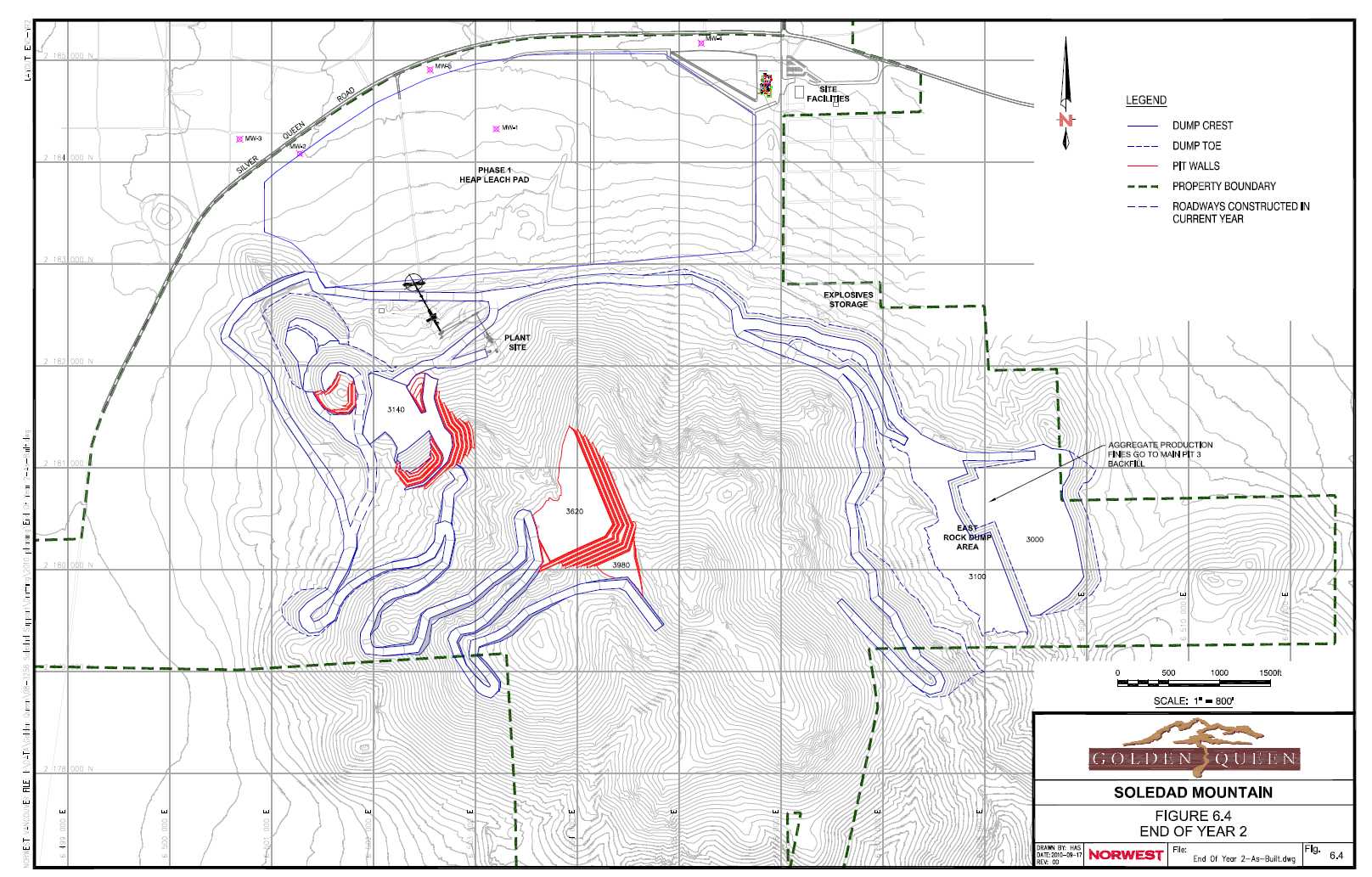

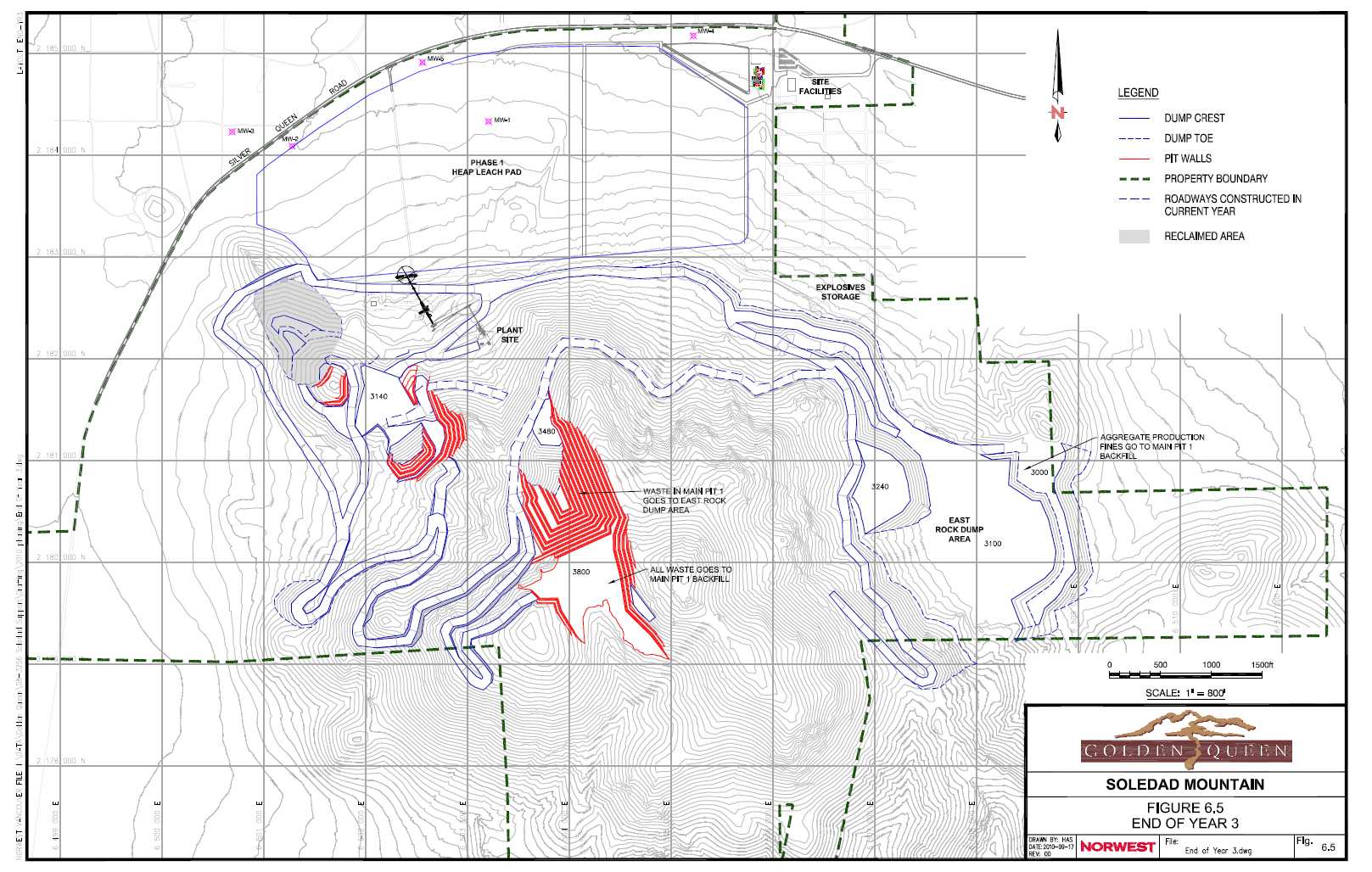

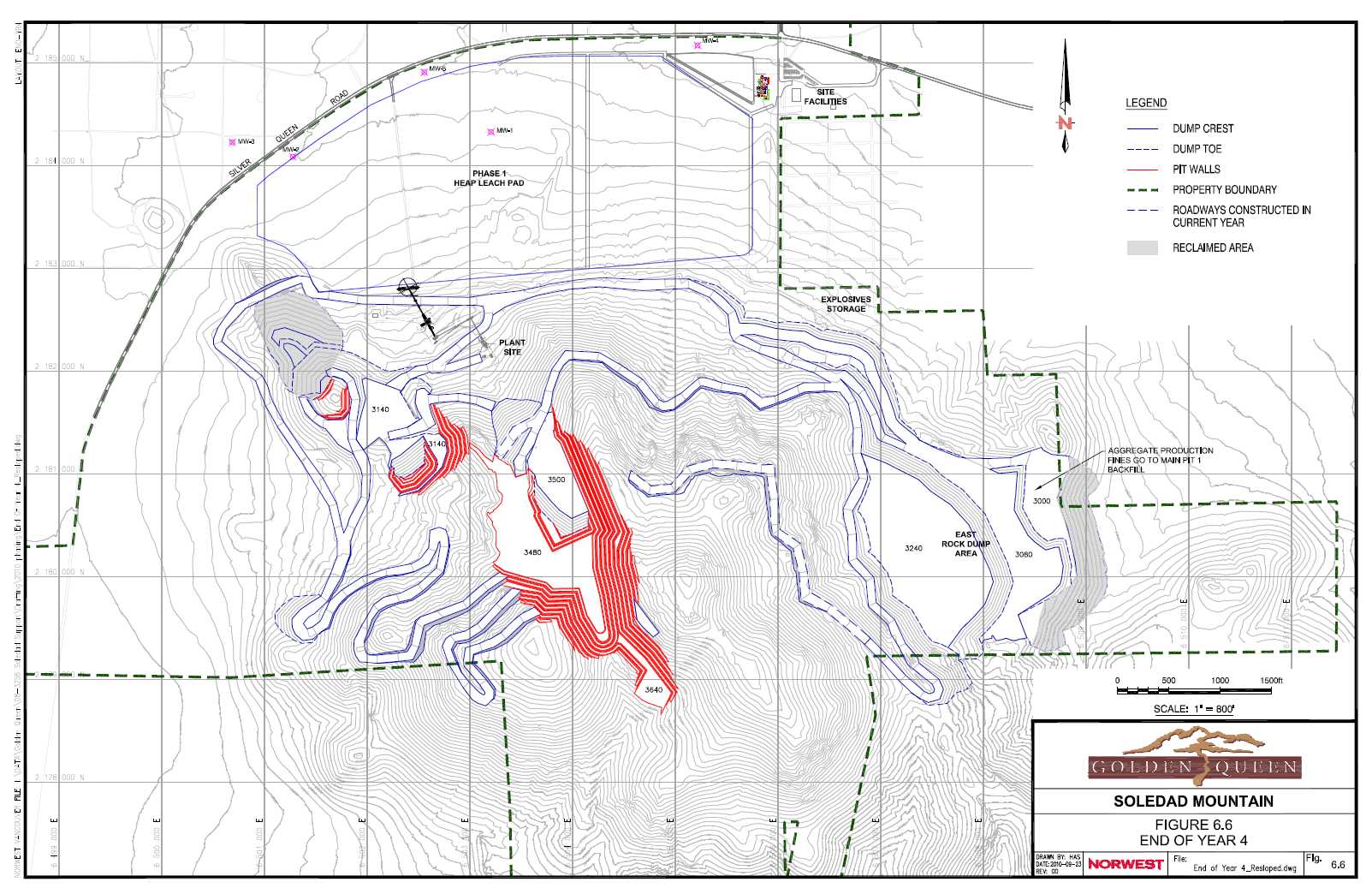

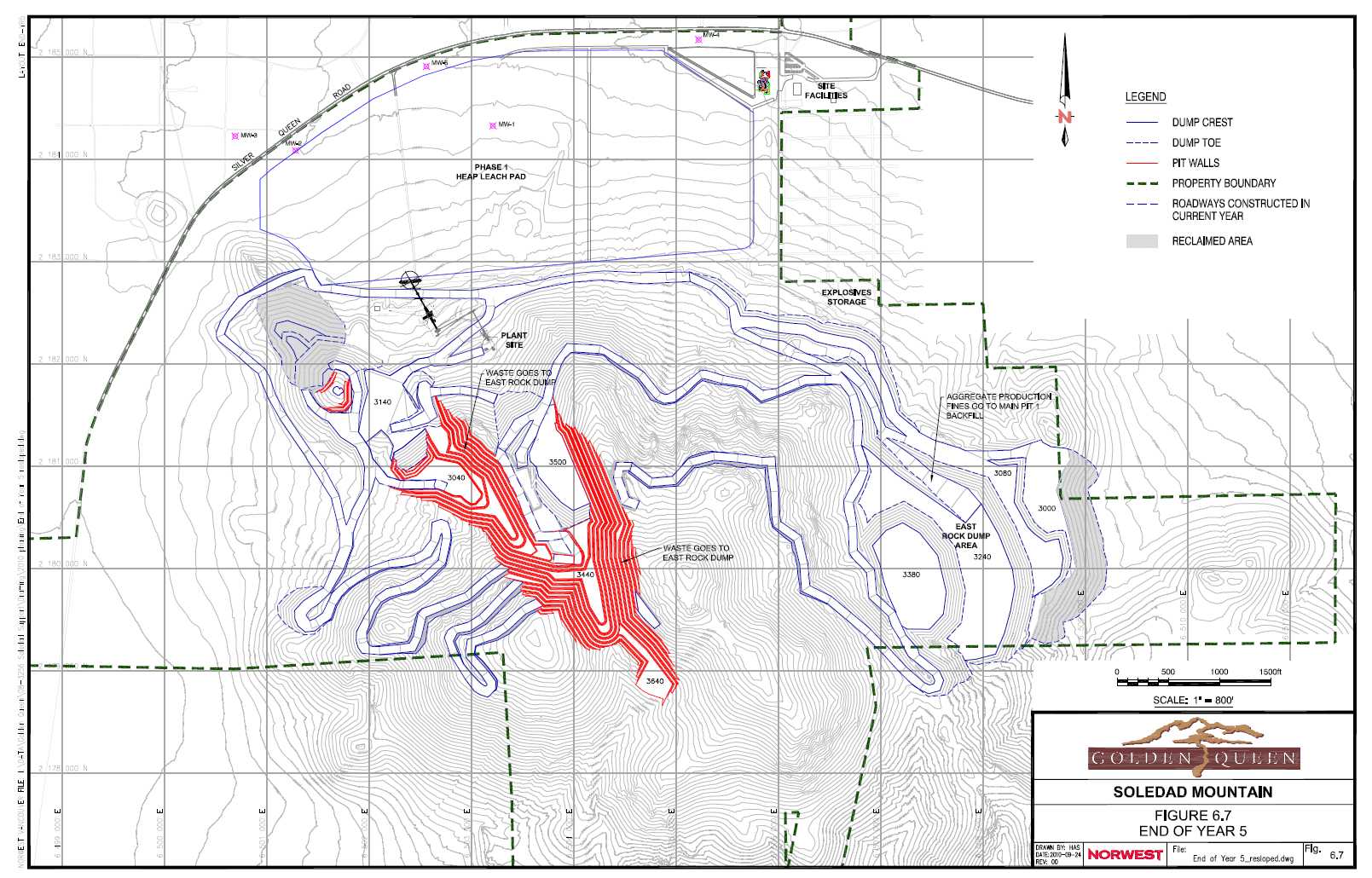

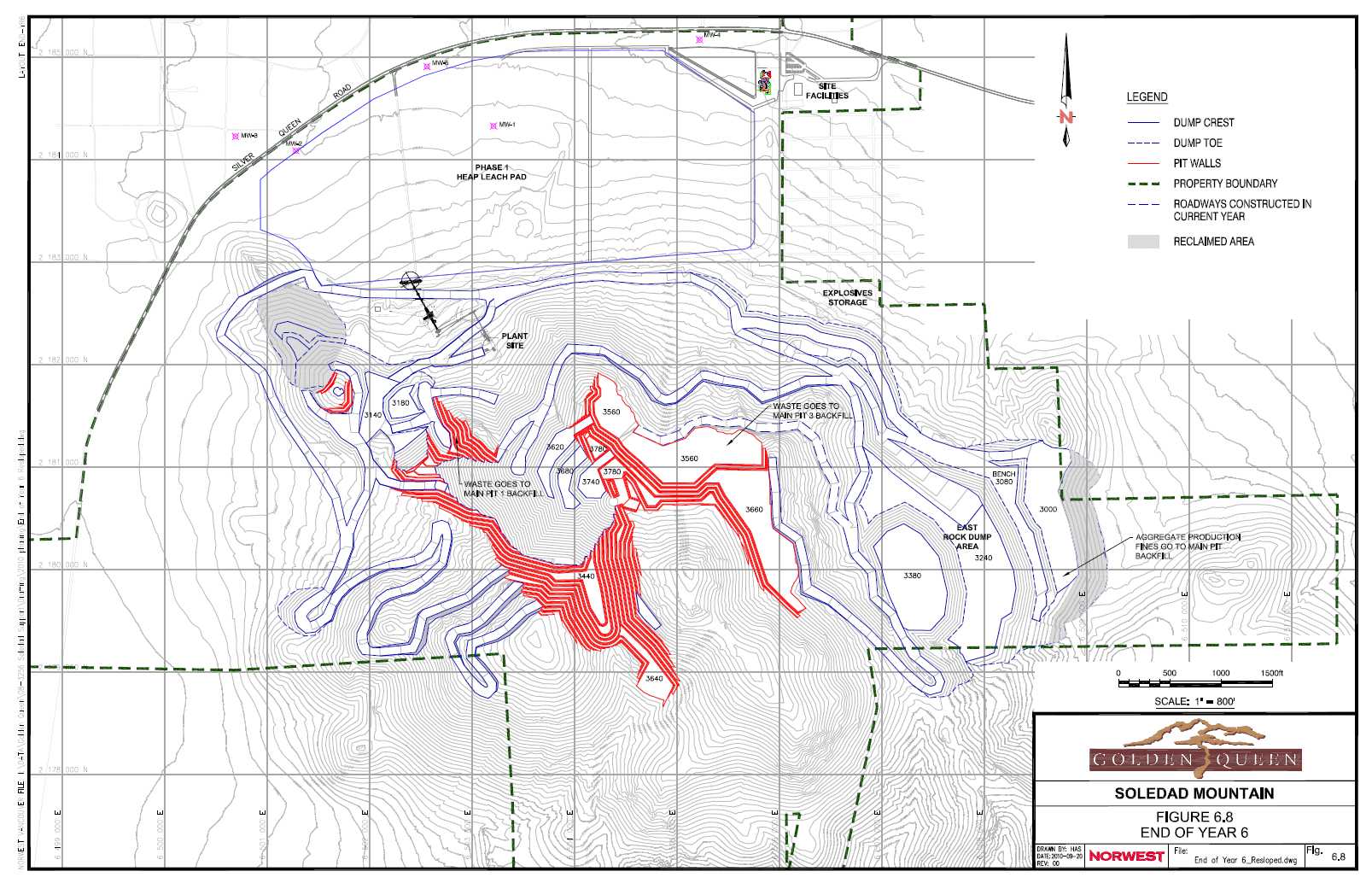

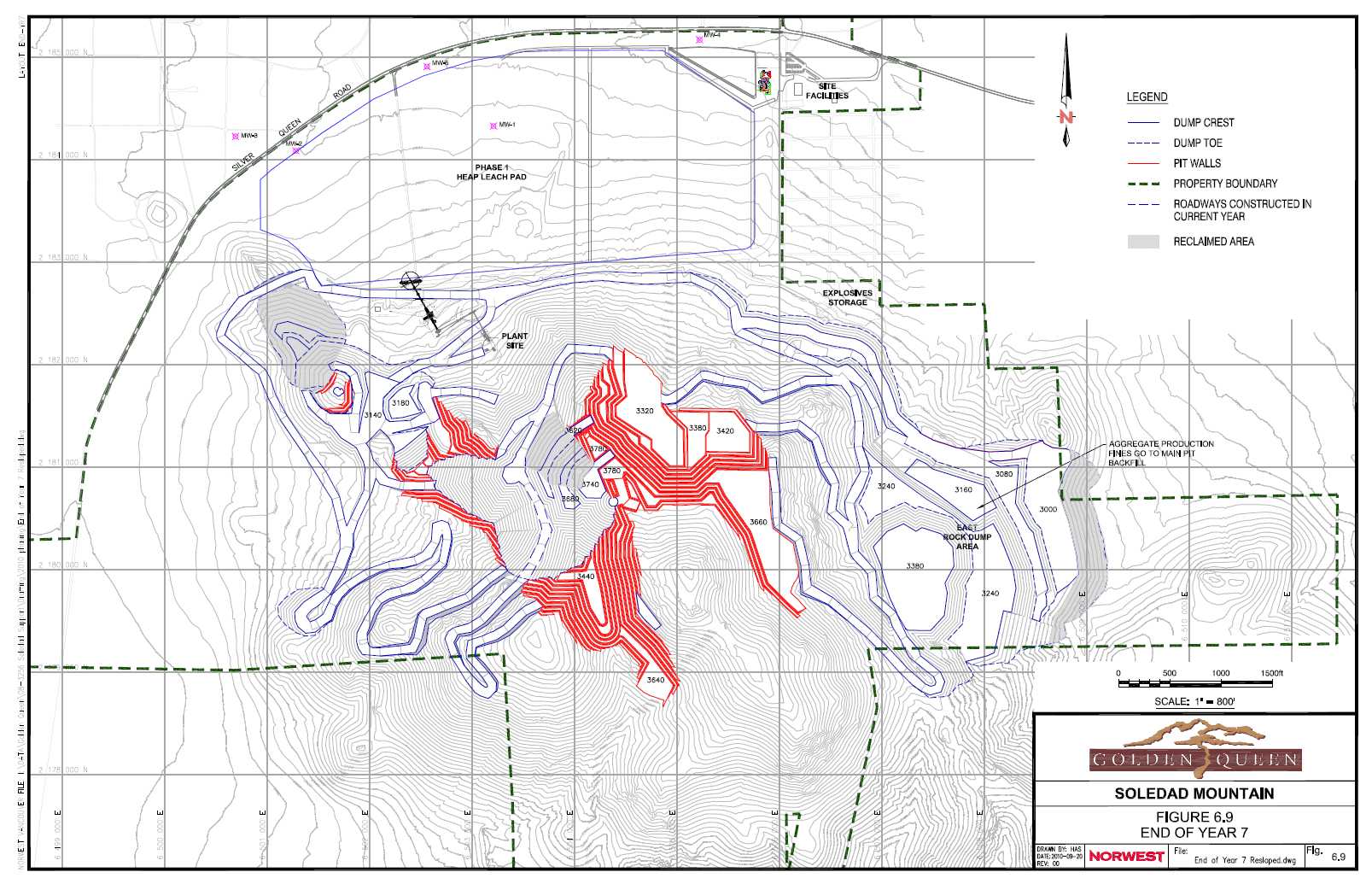

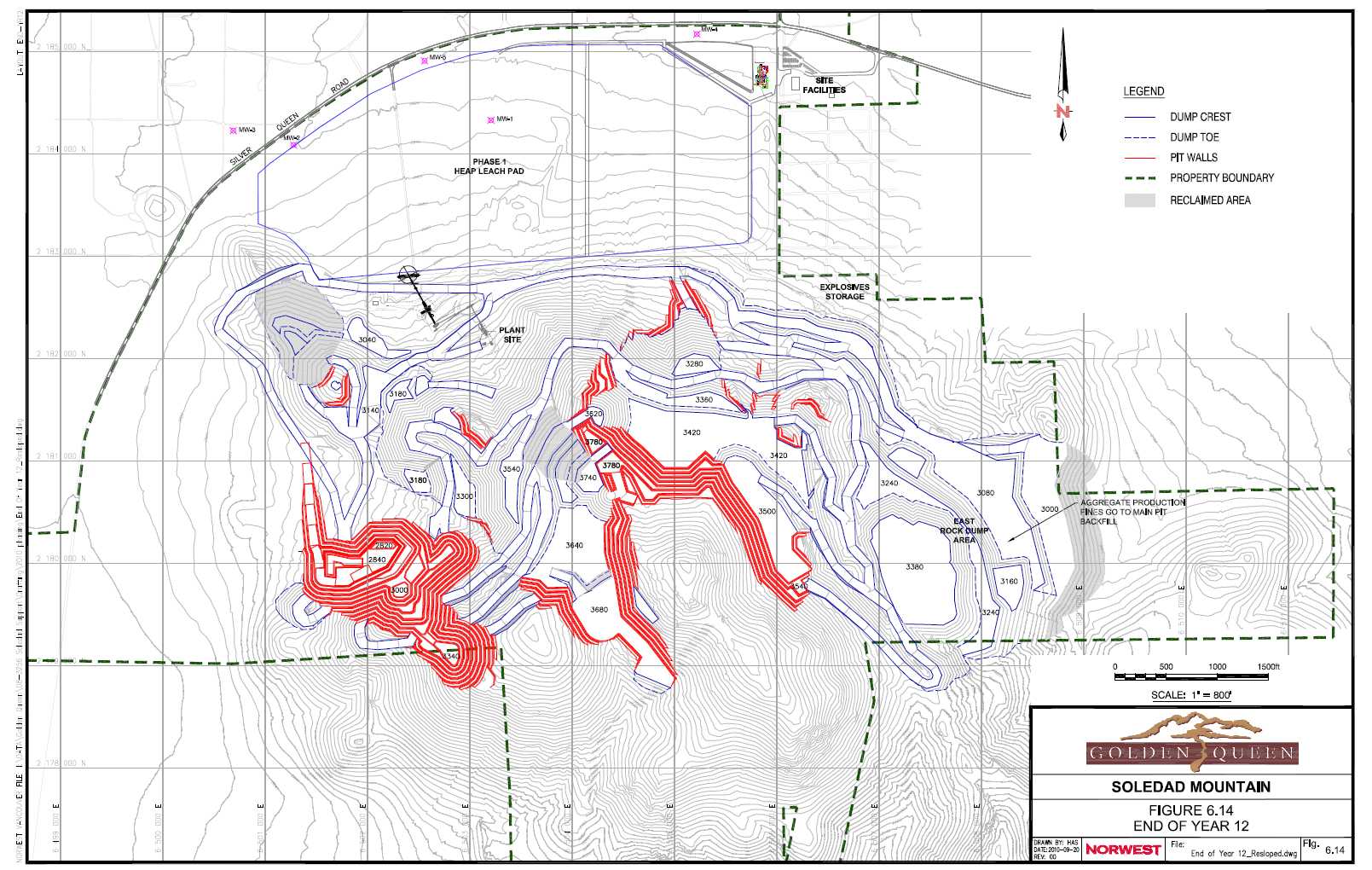

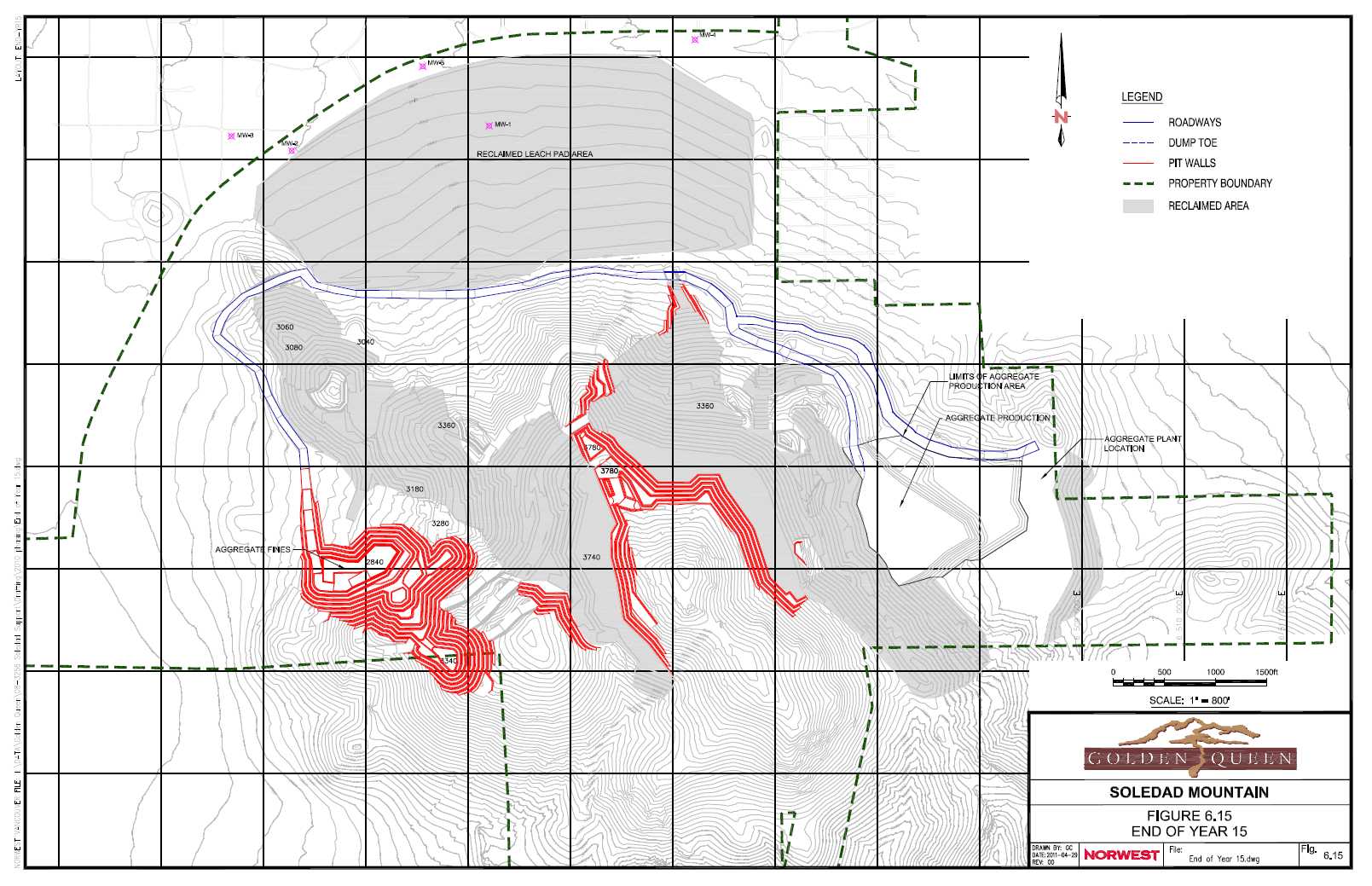

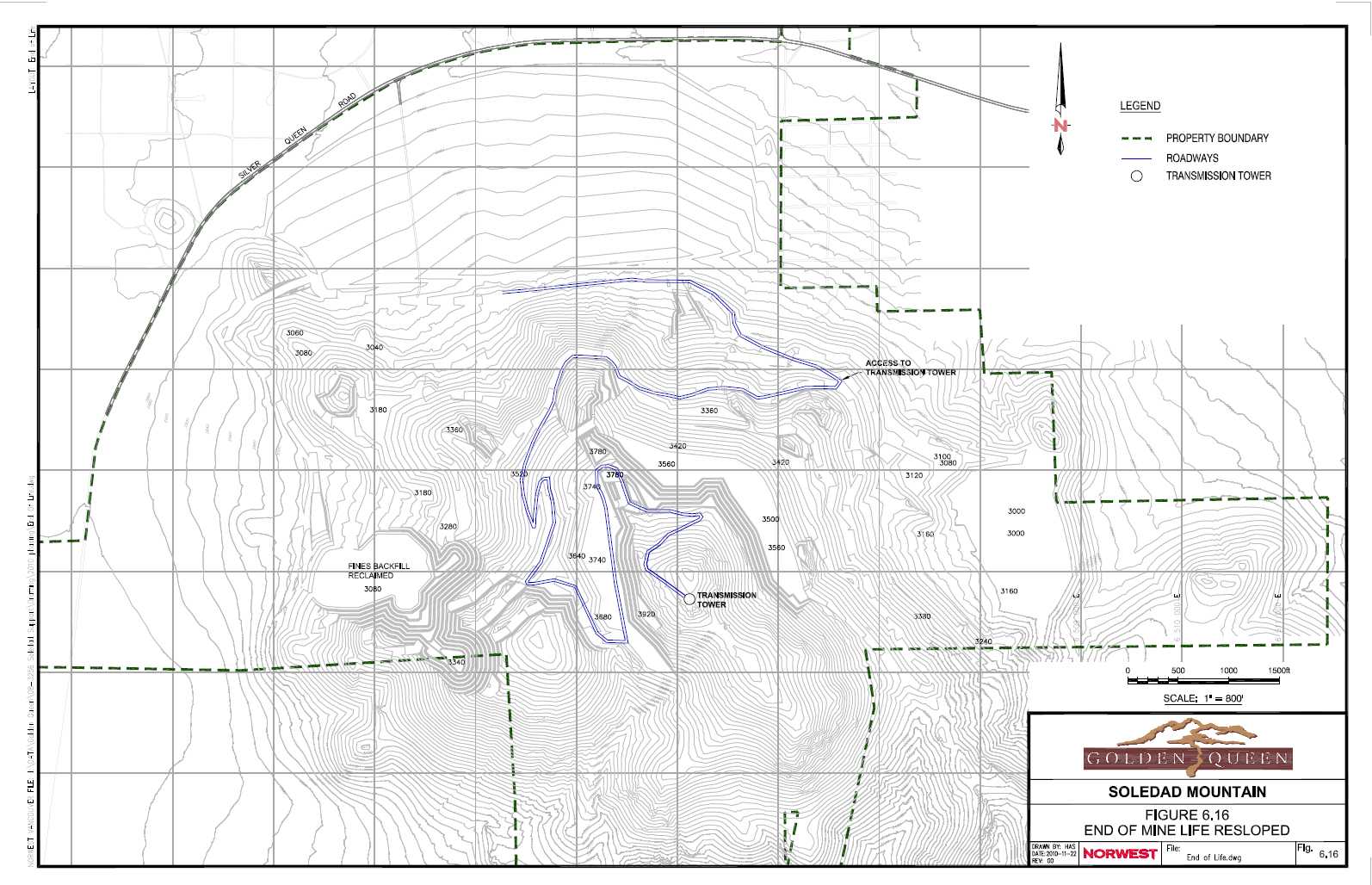

Norwest prepared a life-of-mine waste rock management plan and this plan incorporates sequential and partial backfilling of mined-out phases of the open pit with rehandle of waste at the end of the mine life to meet backfill requirements. This plan was included in an Application for a revised Surface Mining Reclamation Plan, which was submitted to the Kern County Planning & Community Development Department (the Planning Department) on April 9, 2007.

The Planning Department completed its review of the Application as set out in a letter dated July 24, 2007. The Planning Department noted that changes proposed for the Project constituted new information that required evaluation of potential impacts and mitigation in a supplemental EIR (SEIR).

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 1-2 |

The draft SEIR was completed and distributed in January 2010. The Kern County Planning Commission formally considered the Project at its regularly scheduled meeting in Bakersfield on April 8. At the meeting, the Commission, consisting of a panel of three commissioners, unanimously approved the Project. All appeals that were subsequently filed against the Commission’s decision have been withdrawn and the decision made by the Planning Commission is now final. The Planning Commission certified the SEIR, adopted a Mitigation Measures Monitoring Program and Conditions of Approval for the Project which define conditions and performance standards which the mining operation must meet. Record of the certification is available at GQM’s office in Vancouver and at the offices of the Kern County Planning Department in Bakersfield.

The Bureau of Land Management confirmed that its Record of Decision approving the Plan of Operations under NEPA in November 1997 remains valid.

| | 1.3.2 | Water Quality – Report of Waste Discharge and Waste Discharge Requirements |

The Lahontan Regional Water Quality Control Board (the Regional Board) is responsible for ensuring compliance with the federal Clean Water Act and California’s Porter-Cologne Water Quality Act.

The company submitted a Report of Waste Discharge (ROWD), prepared by WZI Inc., Bakersfield, to the Regional Board in June 1997. The Regional Board adopted Board Order No. 6-98-9 on March 5, 1998 at a meeting held in Lancaster and this set the Waste Discharge Requirements for the Project.

The company and its consulting engineers prepared and submitted a revised ROWD to the Regional Board on March 8, 2007. The revised ROWD was prepared at the request of the Regional Board to document changes in the layout and design of the heap leach facility plus other changes proposed for the Project.

The Regional Board unanimously approved Waste Discharge Requirements and a Monitoring and Reporting Program for the Project at a public hearing held in South Lake Tahoe on July 14, 2010 (reference Board Order No. R6V-2010-0031). The Board Order was subsequently signed by the Executive Officer of the Board and is now in effect.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 1-3 |

| | 1.3.3 | Air Quality – Authority to Construct and Permit to Operate |

GQM had obtained seven Authority to Construct permits dated March 16, 2002. These permits expired on March 16, 2004 and were not renewed due to changes anticipated in the Project.

A revised and updated Air Quality and Health Risk Assessment for the Project was completed and submitted to the Planning Department and the Eastern Kern Air Pollution Control District (EKAPCD) on July 21, 2009. All concerns about possible emissions were fully addressed in the SEIR. Feasible mitigation measures to reduce potential impacts from the Project to levels that are less than significant were recommended in the SEIR and included in the Mitigation Measures Monitoring Program or Conditions of Approval.

Nine (plus one subsequently) applications for Authority to Construct permits were submitted to the EKAPCD on February 11, 2011 and EKACPD is processing the Authority To Construct permits.

The Authority to Construct permits would be converted to a Permit To Operate after construction has been completed and subject to inspection by the EKAPCD.

| | 1.3.4 | Reclamation and Reclamation Financial Assurance |

GQM has provided reclamation financial assurance in the form of an Irrevocable Standby Letter Of Credit backed by a Certificate Of Deposit with Union Bank of California in the amount of US$286,653.00. This is the current estimate for reclamation of historical disturbances on the property and this is reassessed annually.

GQM prepared detailed cost estimates for ongoing reclamation and reclamation at the end of the life of the mine and these cost estimates were included in the Application for a revised Surface Mining Reclamation Plan. GQM will provide the necessary financial assurance as required by the regulatory authorities. Cost estimates for site reclamation are included in the discussion of the project economics and operating costs.

A number of additional approvals and permits will be required as project development proceeds, as detailed below:

Newly implemented security requirements make contract blasting a preferred option and a contract blasting service will be used. The contractor will be required to obtain the necessary approvals and permits.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 1-4 |

Conditions GQM must meet both before the start of construction, during operations and after operations have ended are set out in the Mitigation Measures Monitoring Program and Conditions of Approval.

As noted in Section 1.3, the Project has been approved by the Kern County Planning Commission and the Kern Country Planning and Community Development Department. The Commission accepted the project plan subject to a number of Conditions of Approval. A number of these conditions specifically address issues related to reclamation of the property including backfilling and restoration to approximate pre-mining topography.

The mine plan presented in this document represents best efforts by Norwest to develop a mine plan which maximizes in-pit backfill while not unduly penalizing the Project’s economic viability. The pit shells used as a basis for this feasibility were selected based on consideration of both economic and waste volume considerations with the goal of developing pit configurations which balanced ore tonnage against waste quantities.

In order for the current mine plan to meet all the conditions laid out by the County, approximately 19 million tons of waste rock must be sold as aggregate and removed from site prior to final reclamation. In addition, all the leached residues must be either permitted to remain in place or be sold as aggregate. If this quantity cannot be sold, the necessity of handling this additional volume as part of the reclamation plan will affect the overall ore tonnage that can be mined at site. While no costs or revenues associated with aggregate production using this material, have been included in the Project economic analysis, removal of these materials is an integral component of the integrated mining and backfilling plan. If these quantities of material remain onsite, it will require revision of the mining plan in order to meet the backfill requirements which could reduce the life of the heap leach operation by up to 2 – 4 years.

Norwest has worked with GQM to develop a scenario which limits the effect of this on the mine life and GQM has had promising discussions with a local aggregate contractor regarding the saleability of the waste rock and leached residues into the regional market. However, there is still a potential risk that meeting the requirements of the Conditions of Approval could affect the overall mine life.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 1-5 |

| 2 | PROJECT OVERVIEW |

| | |

| 2.1 | PROJECT DESCRIPTION |

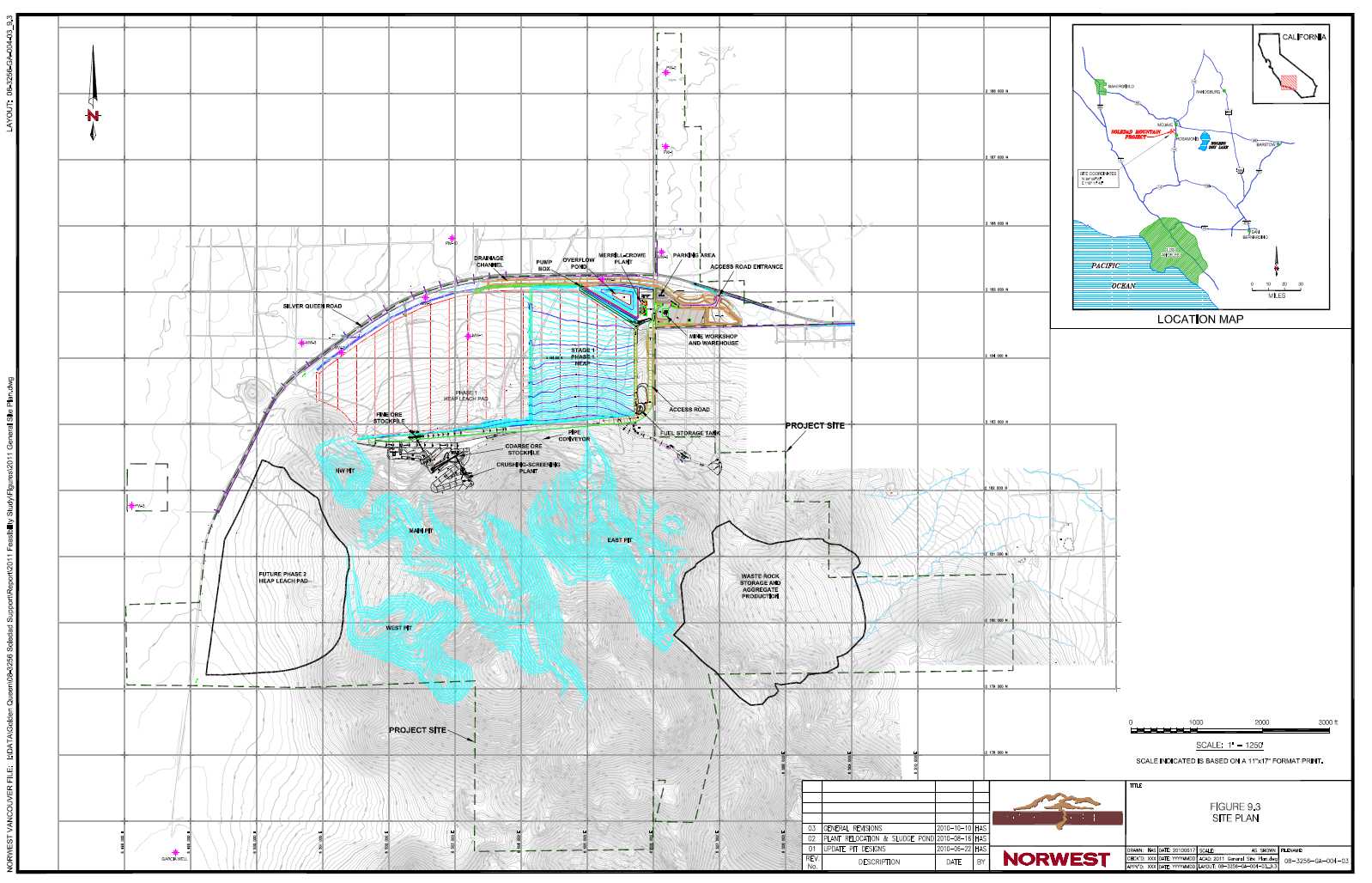

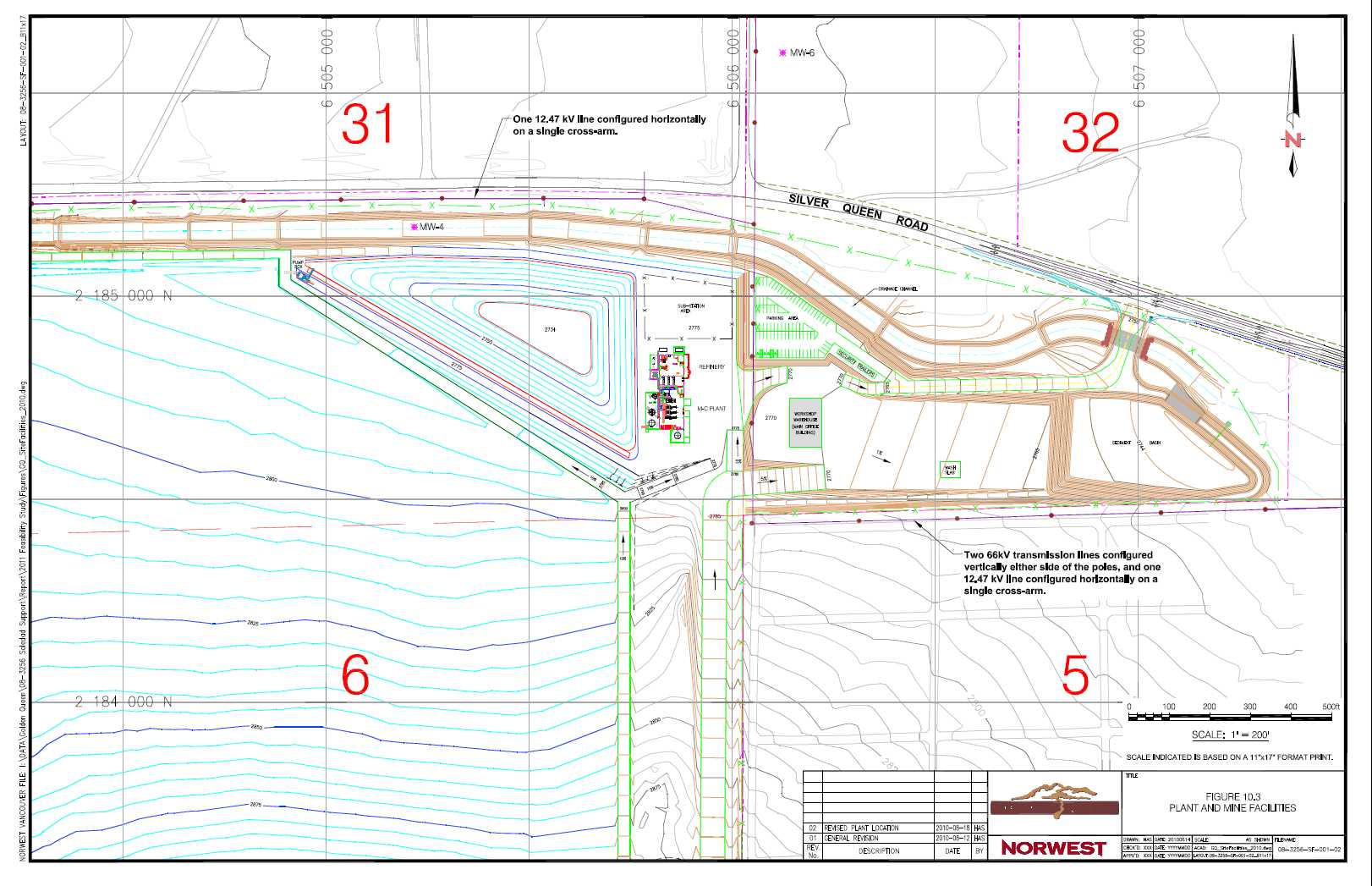

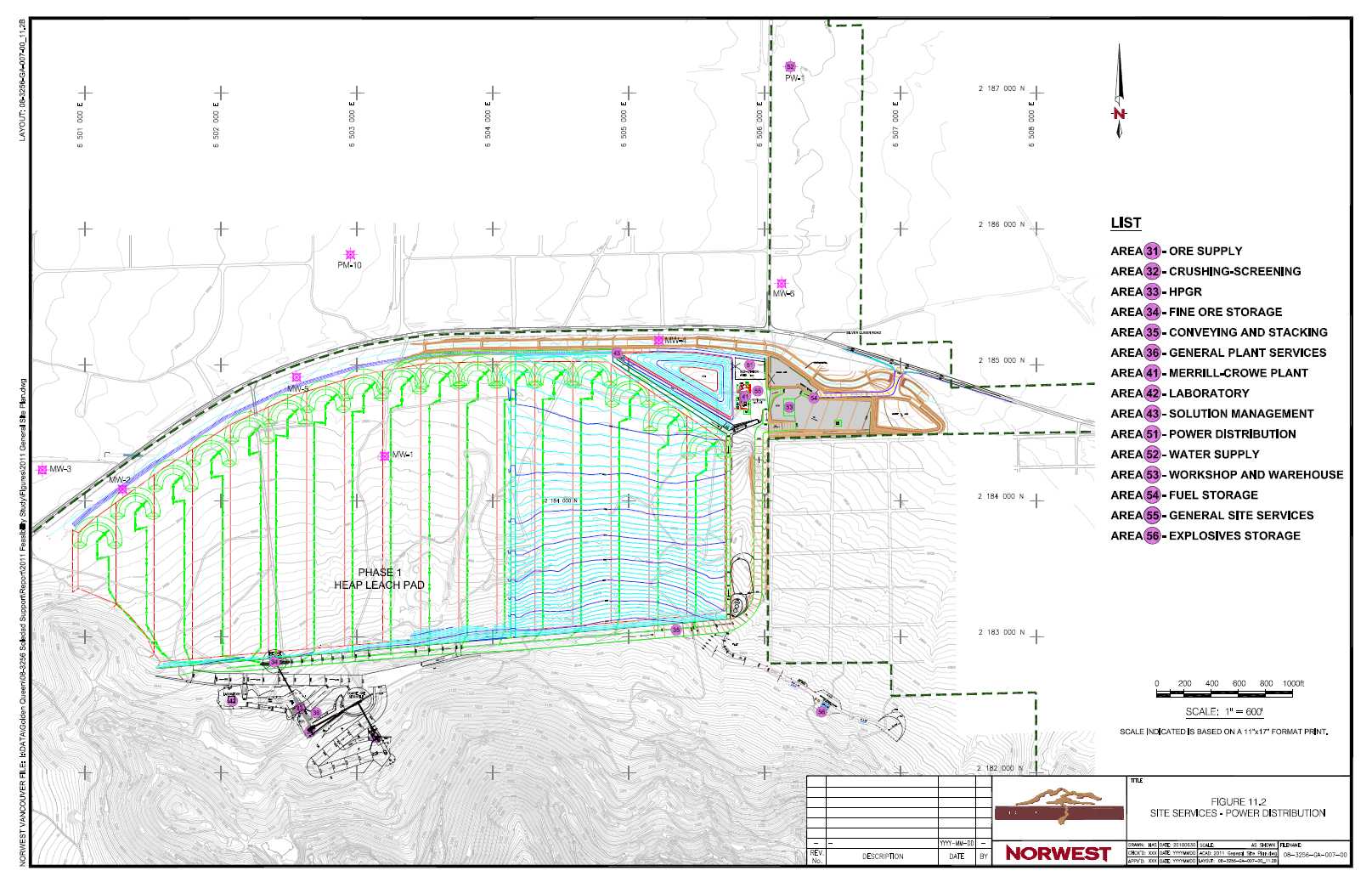

The Project is located in Kern County in southern California as shown in Figure 2.1. A general site layout is shown in Figure 2.2 showing details of the planned site layout including infrastructure, mining areas and the Phase 1 and potential future Phase 2 heap leach pads. The Project is located approximately 5 miles south of the town of Mojave. The metropolitan areas of Rosamond and Lancaster lie approximately 9 miles and 20 miles to the south respectively. Los Angeles is about 70 miles south of Mojave.

Access to site is from State Route 14 and Silver Queen Road, an existing paved County road. Mojave is a railroad hub for the Burlington Northern/Santa Fe and Union Pacific/Southern Pacific railroad lines. Services such as a hospital, ambulance, fire-protection, garbage and hazardous waste disposal, schools, motels and housing, shopping, airport and recreation are available in Mojave and its surroundings. Telephone service is available on site.

The Project is within the Mojave Mining District along with the former Cactus Gold Mine, Standard Hill Mine and Tropico Mine. These former operating mines are located within a radius of five miles of the Soledad Mountain site.

| 2.2 | SITE PHYSIOGRAPHY AND CLIMATE |

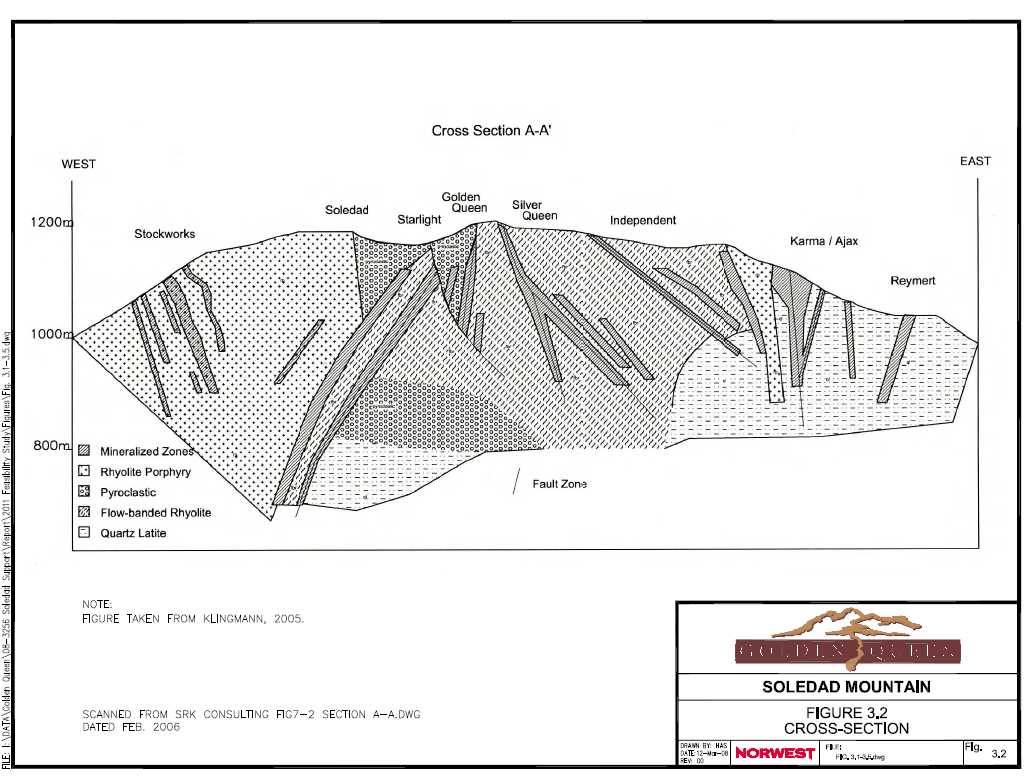

The Soledad Mountain gold-silver deposit is hosted in a volcanic sequence of rhyolite porphyries, quartz latites and bedded pyroclastics that form a large dome-shaped feature, called Soledad Mountain, along the margins of a collapsed caldera. The deposit is located on the central-northeast flank of Soledad Mountain. The mountain has a domal form that is a reflection of an original, dome-shaped volcanic center. Elevations range from 4,180ft at the highest point of Soledad Mountain to 2,840ft at the valley floor north of the mountain.

The Mojave region is generally characterized as arid, with a wet season from December through March. Rainfall events tend to be short lived and of high intensity. Mojave experiences high summer temperatures up to 113°F. The minimum temperature may reach 20°F. Maximum wind speed is 90mph with Exposure C for design purposes. Mean recorded annual rainfall is 6.14 inches with a mean maximum month of 1.11 inches.

GQM controls approximately 2,500 acres (1,000 hectares) of land in the area, consisting of private (fee land and patented lode mining claims and millsites) and federal lands (unpatented mining claims and millsites) administered by the BLM, collectively referred to as the Property. The total area required for the Project, which is surrounded by a Project boundary, is approximately 1,300 acres (500 hectares) in size. The actual area that will be disturbed by mining, waste rock disposal, the construction of the heap leach pads and the heap and the facilities will be approximately 912 acres (369 hectares) in size of which approximately 835 acres (338 hectares) will be reclaimed during and at the end of the mine life.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 2-1 |

The Property is located west of California State Highway 14 and largely south of Silver Queen Road in Kern County, California, and covers all of Section 6 and portions of Sections 5, 7 and 8 in Township 10 North (T10N), Range 12 West (R12W), portions of Sections 1 and 12 in T10N, R13W, portions of Section 18 in T9N, R12W, and portions of Section 32 in T11N, R12W, all from the San Bernardino Baseline and Meridian. The Project facilities will be located in Section 6 of T10N, R12W. Two water production wells have been drilled in Section 32, T11N, R12W, on land controlled by GQM. A third water production well was drilled in Section 1, T11N, R12W, on land controlled by GQM in 2008.

GQM holds or controls via agreement 33 patented lode mining claims, 134 unpatented lode mining claims, 1 patented millsite, 12 unpatented millsites, 1 unpatented placer claim and 867 acres of fee land. A summary of the land held by GQM as part of the current permitted project area is shown in Table 2.1. As note above, additional land is held by GQM which may be incorporated into the project area in the future if required. Figure 2.3 shows the area listed in Table 2.1 and additional land claims done by GQM from 2006 to 2011.

TABLE 2.1

LAND STATUS

| Land Status | Acres | Hectares |

| Fee Land (Owned) | 702 | 284 |

| Unpatented Mining Claims | 266 | 108 |

| Patented Mining Claims | 353 | 143 |

| Fee Land (Purchases) | 6 | 2 |

| Fee Land (Leased) | 159 | 64 |

| Millsites | 74 | 30 |

| Total | 1,560 | 631 |

GQM holds or controls the properties under mining leases with 53 individual landholders, two groups of landholders and 2 incorporated entities. Contact information for the landholders is available on file at the GQM offices in Vancouver.

GQM believes that all the land required for the Project either has been secured under a mining lease or is held by GQM through ownership of the land in fee or via unpatented mining claims and millsites. GQM executed land purchases or entered into agreements from 1990 onwards, and is continuing to add to its land position in the area.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 2-2 |

GQM carried out an aerial survey of the Project area in 2004 and produced a topographic map with 5 ft contour intervals in the Project area using California State Plane Zone 5 coordinates.

A formal title review was done by Gresham Savage Nolan & Tilden, a firm with extensive experience in title matters. The report was dated September 6, 1996 and was updated to April 26, 1999.

A formal title review was again done by an independent landman, Sylvia Good, in May 2004.

GQM was formed in November 1985 to acquire Golden Queen Mining Co., Inc., a California corporation, which had secured, by agreement, a core group of claims on Soledad Mountain.

The reference to resources and reserves in this section are the historical terms used at the time and are not sufficiently defined to be classified by CIM categories in use today. The historical resource/reserve discussions in this section should not be relied upon. GQM is not treating them as current Mineral Resources or Mineral Reserves, and does not consider them to be NI 43-101 compliant resource estimates.

The first recorded mining activity in the Mojave Mining District occurred on March 8, 1894, when W.W. Bowers discovered gold on a promontory south of Mojave, then named Bowers' Hill and now known as Standard Hill. This soon led to the discovery of the Exposed Treasure vein on the same hill. Later that year gold was found on Tropico Hill, in the Rosamond Hills. Prospecting also started on Soledad Mountain and gold was found on the Queen Esther, Karma, Echo, Elephant and Gray Eagle properties.

The first mill was built at the Exposed Treasure Mine in 1901. This mill had 20 stamps and a cyanide plant. Construction of other mills followed rapidly - the Echo mill in 1902 with 10 stamps, the Queen Esther mill in 1903 and the Karma mill in 1904 with 20 stamps. Of these properties, the Exposed Treasure, with production equivalent to 3,260kg (105,000oz) of gold, was the largest; the Queen Esther, with production equivalent to 1,930kg (62,000oz) of gold, was second and the Karma third with production equivalent to 1,150kg (37,000oz) of gold. The last of these early mills was shut down in 1914 when the readily available ore was exhausted.

The district attracted brief attention eight years later with a find of rich ore on the Yellow Dog claim located on a small butte near Bowers' Hill, but interest soon waned as the deposit proved to be small.

The revival of the district is attributable in part to the Burton Brothers, who, as owners of the Tropico mine and mill, assisted lessors in the district by grub-staking prospectors and providing a mill for the treatment of lessees' ore. Lessees looking for a new area to work (George Holmes) found some float that led to the discovery of the Silver Queen vein system on Soledad Mountain in 1933. Claims were staked and exploration was done. The property was sold to a syndicate (Golden Queen Mining Co.) headed by Gold Fields America Development Co. (GFA) in January 1933.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 2-3 |

GFA did extensive exploration on the property in the next few years, which resulted in a large increase in ore reserves. The Golden Queen vein was also discovered at that time. During this period of exploration on the Golden Queen vein, an area south and west of the Golden Queen vein was also explored and a large vein was discovered on the Starlight claim. The Soledad Extension vein, west of the Starlight vein was also discovered. The Lodestar Mining Co. obtained control of this area.

GFA built a 273t/day (300ton/day) mill on the property and production started in October 1935. The mill was then expanded to 364t/day (400ton/day). Ore was extracted from the Silver Queen, Golden Queen, Soledad, Queen Esther and Karma veins plus ore was custom-milled from other properties in the area. Tailings from smaller, historical mining operations were also retreated. Production continued until the mine was closed by Order L-208 of the War Production Board in 1942. Although records are incomplete, it is estimated that 1.18million t (1.3million ton) of ore was mined and milled with average grades of 9.5g/t gold (0.277oz/ton) and 223g/t silver (6.5oz/ton) . The mine did not resume production after the war although some exploration and development work was done. GFA returned the property to its former owners in 1953 and the company was dissolved.

It is estimated that a total of 7,300t (8,030 tons) of ore was mined in the Project area by lessors in the early 1950s.

The only exploration of note between 1953 and 1985 was undertaken by Rosario Exploration. The company drilled eight or nine percussion holes in the area and did some underground sampling during the mid-1970s.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 2-4 |

Prior to the completion of the feasibility study, two evaluations of the geology of the Soledad Mountain area were carried out, the first by Mineral Resources Development, Inc. (MRDI) and the second, the NI 43-101 Technical Report, was carried out by SRK.

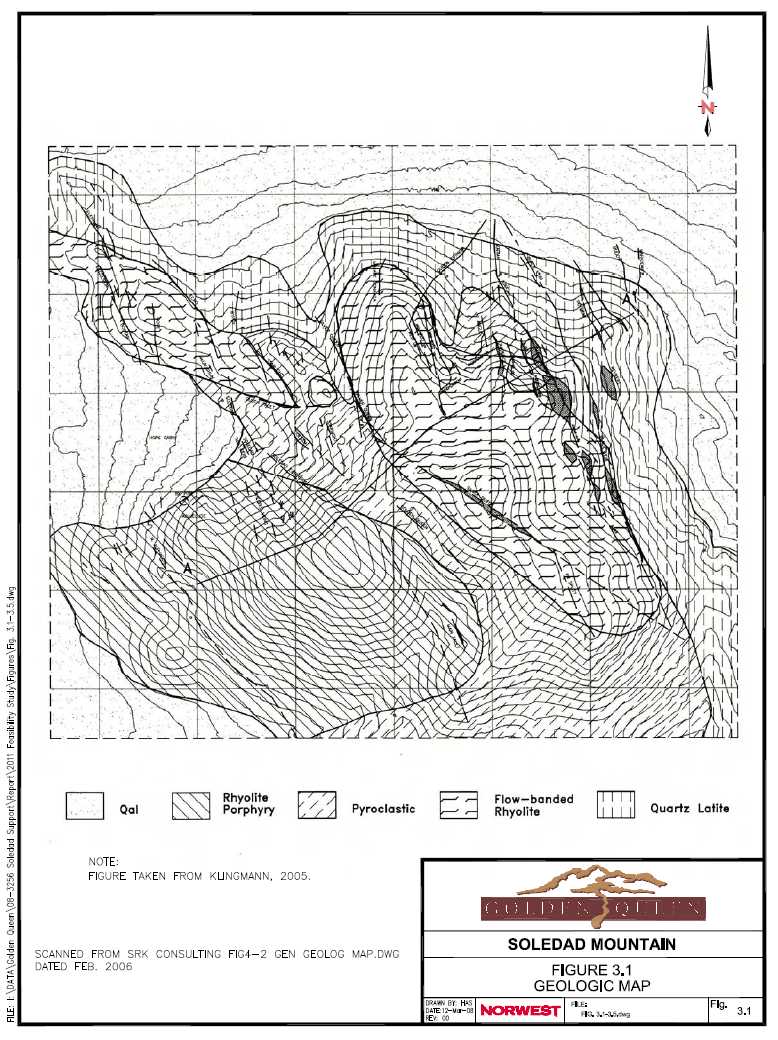

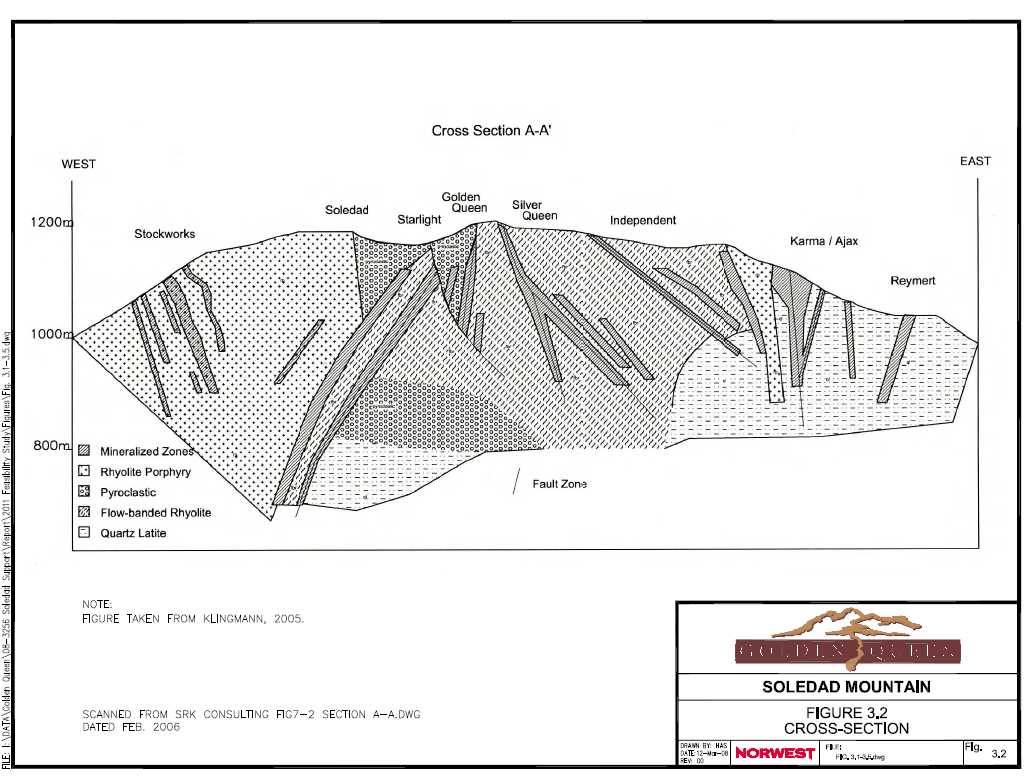

Soledad Mountain is located within the Mojave structural block, a triangular-shaped area bounded to the east by the northwest-trending San Andreas Fault and to the north by the northeast-trending, Garlock Fault. The Mojave block is broken into an orthogonal pattern of N50E to N60E and N40W to N50W fracture systems. These fracture zones likely developed as the result of Late Cretaceous compressional stresses that were present prior to formation of the Garlock and San Andreas Faults. Gold and silver mineralization at Soledad Mountain is hosted by northwest-trending, en-echelon faults and fracture systems. Cretaceous quartz monzonite forms the basement of stratigraphic sequences in the Mojave block. The quartz monzonite is overlain by Miocene-age, quartz latitic and rhyolitic volcanic rocks. Volcanic centers appear to have formed at intersections of the northeast and northwest-trending fracture systems. Major volcanic centers are present at Soledad Mountain, Willow Springs and Middle Buttes. These volcanic centers consist generally of initial, widespread sheet flows and pyroclastics of quartz latite, followed by restricted centers of rhyolitic flows and rhyolite porphyry intrusives. Rhyolitic flows and intrusives are elongated somewhat along northwest-trending vents and feeder zones. Gold deposits in the Mojave block include Soledad Mountain, Standard Hill, Cactus and Tropico. At Soldead Mountain gold mineralization occurs in low-sulfidation style, quartz-adularia veins and stockworks that strike northwest. Gold mineralization at Standard Hill, located 1 mile northeast of Soledad, consists of north to northwest-striking quartz veins in Cretaceous quartz monzonite and Tertiary, quartz latitic volcanic rocks. At the Cactus Gold Mine, 5 miles west of Soledad, gold occurs in northwest and northeast-striking quartz veins, breccias and irregular zones of silicification in quartz latite, rhyolitic flows and rhyolitic intrusive breccias.

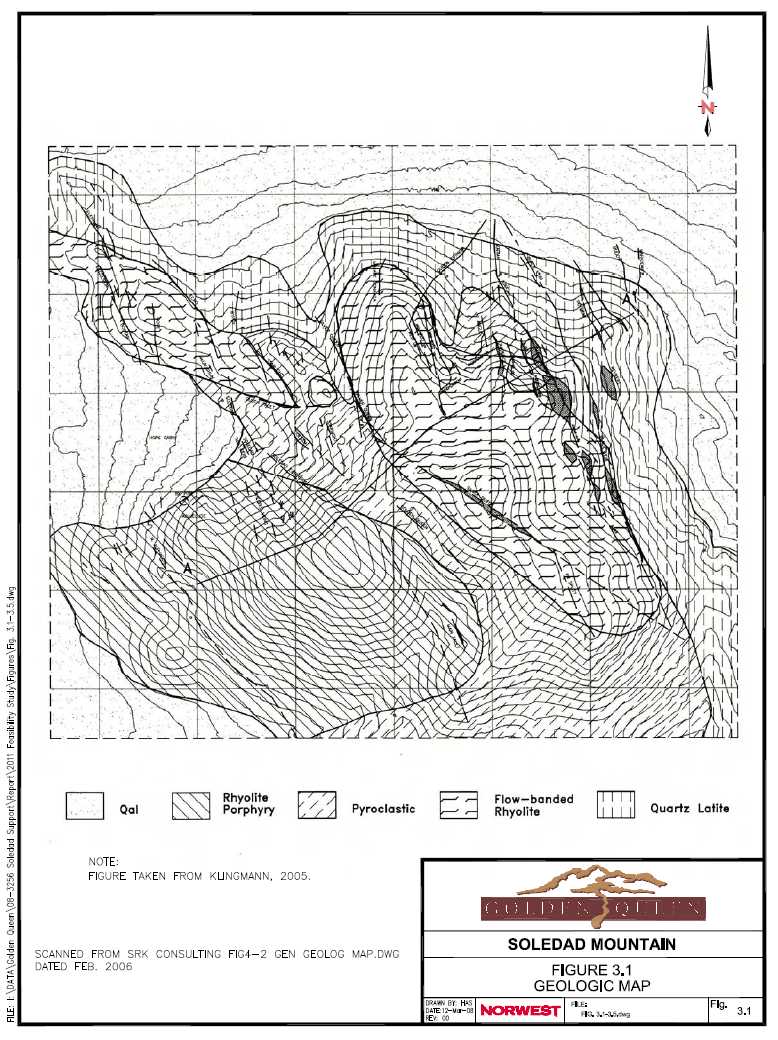

| 3.2 | LOCAL GEOLOGY |

| | |

| 3.2.1 | Lithology & Stratigraphy |

McCusker (1982) mapped Soledad Mountain in detail and defined the major stratigraphic and structural features of the volcanic complex present there. GQM has retained McCusker’s nomenclature without significant modification. Volcanics at Soledad Mountain comprise coalescing intrusive-extrusive domes, flows and pyroclastics. This volcanic center presumably overlies Cretaceous quartz monzonite, such as is exposed at the adjacent Standard Hill mine, although drillholes have not penetrated basement rocks at the deposit. Age dates of 21.5 Ma to 16.9 Ma have been obtained from the volcanic rocks, suggesting that the volcanic center formed over a relatively long period from early to middle Miocene age. The lower most volcanic unit penetrated in drilling is an early Miocene quartz latite flow that strikes northwest and dips at low angles to the northeast.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-1 |

|

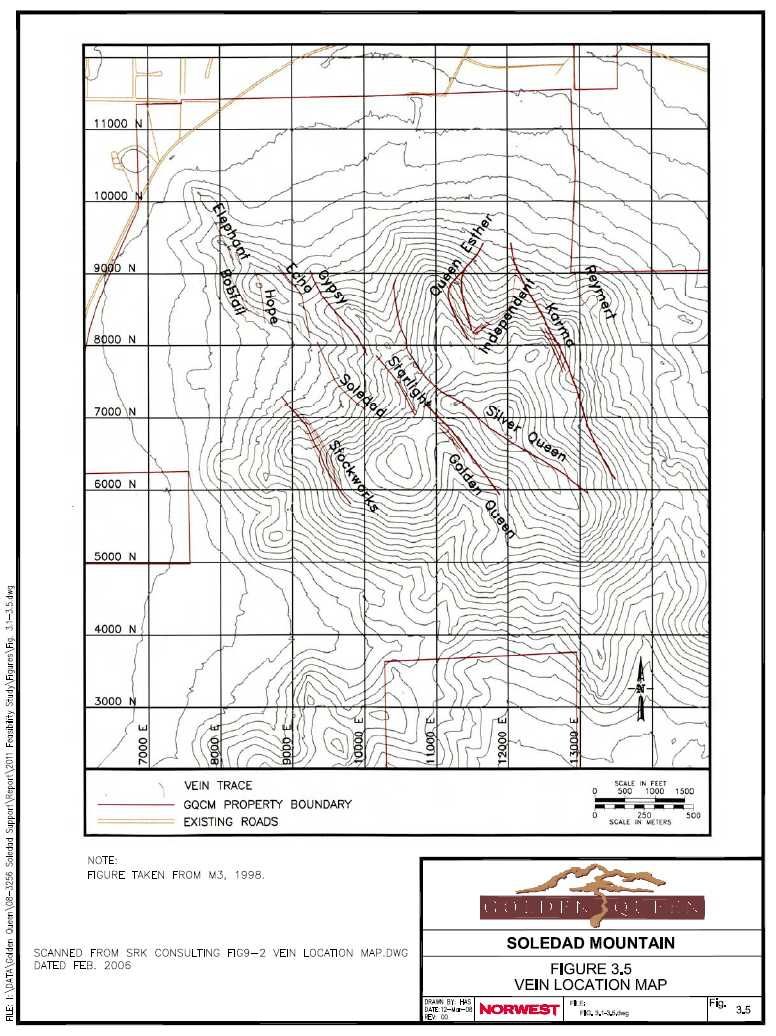

Overlying the quartz latite is a section of middle Miocene pyroclastics, (“lower pyroclastics”), comprising a vent-proximal sequence of coarse-grained volcanic debris, breccias and tuffs. Flow-banded rhyolites intrude and overly the lower pyroclastic unit. The rhyolites appear to have flowed out along a northwest-trending, high-angle vent coinciding generally with the center of the deposit and then northeastward away from the vent. Coarse-grained, pyroclastic breccias occur locally over the flow-banded rhyolites along the axis of the vents. These pyroclastic rocks likely represent laterally discontinuous zones of vent eruptions and collapse breccias that formed after the main pulse of rhyolite extrusion. The youngest volcanic unit is a massive, quartz-eye rhyolite porphyry of middle Miocene age. This unit is present over most of the southwest portion of the property. The rhyolite porphyry forms the core of the volcanic complex, intruding and displacing previous volcanic units south of the deposit center. Emplacement of the porphyry may have been controlled by a northwest fault that now coincides with the Soledad Extension Vein. GQM has classified volcanic lithologies into four units (Figure 3.1 and Figure 3.2): Quartz latite: present over most of the northeast portion of the deposit and in the subsurface of the center of the deposit; Pyroclastics: present in the subsurface of the north-central portion of the deposit beneath flow-banded rhyolite; Flow-banded rhyolite: present at the surface in the north-central portion of the deposit and, as an intrusive, extending deep into the center of the deposit; and rhyolite porphyry: present as a massive body extending from the surface to the bottom of drilling over most of the southwest portion of the deposit.

The groundwater water table is at about 2,580 ft above mean sea level. The boundary between oxidized and unoxidized mineralization is strongly controlled by the intensity of fracturing and mimics the geometry of veins and fault structures. The depth and degree of oxidation, as logged in RC and core holes, have not been modeled, and were not available for inspection. MRDI reported that mineralization in drill cores and in underground workings suggest that mineralization is oxidized at least to the depth of the present water table.

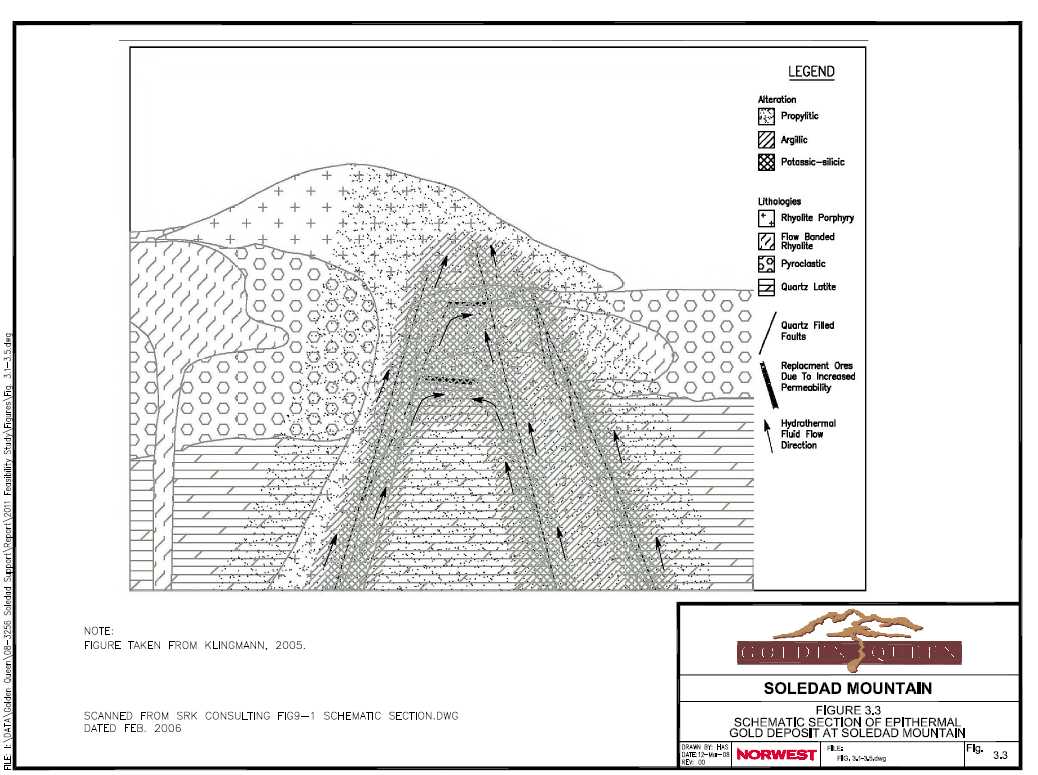

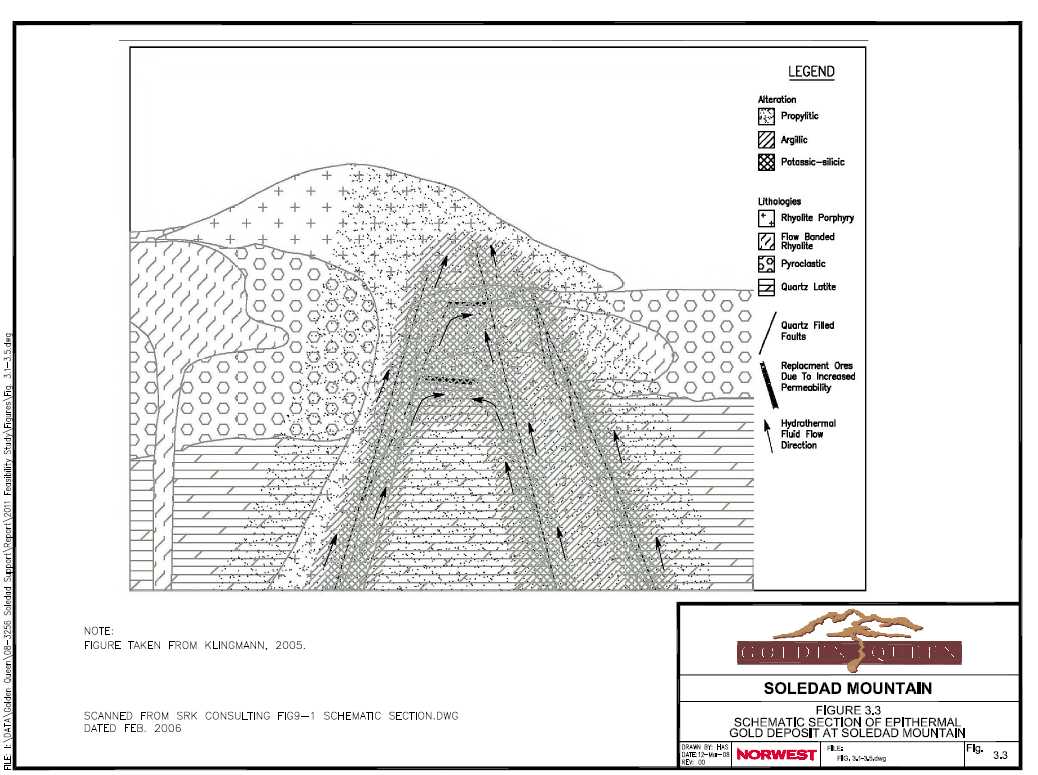

GQM interprets the deposition of precious metals to be related to a large epithermal, multiepisodic, fault/fissure vein system. Gold mineralization occurs in low-sulfidation style, quartz adularia veins and stockworks that strike northwest. Veins formed by the process of alteration of volcanic rocks by convecting groundwaters with the deposition of quartz and sericite-rich material in fault and fracture zones (Figure 3.3) . The total sulfide content is one percent or less. Vein “zones” consist of one or more central veins surrounded by either a stockwork or parallel zones of veinlets. High grade mineralization shoots form where dilational opening and cymoid loops develop, typically where the strike or dip of the fault changes, allowing solutions to undergo cooling, degasification by fluid mixing, boiling, pH changes of hydrothermal solutions, and decompression.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-2 |

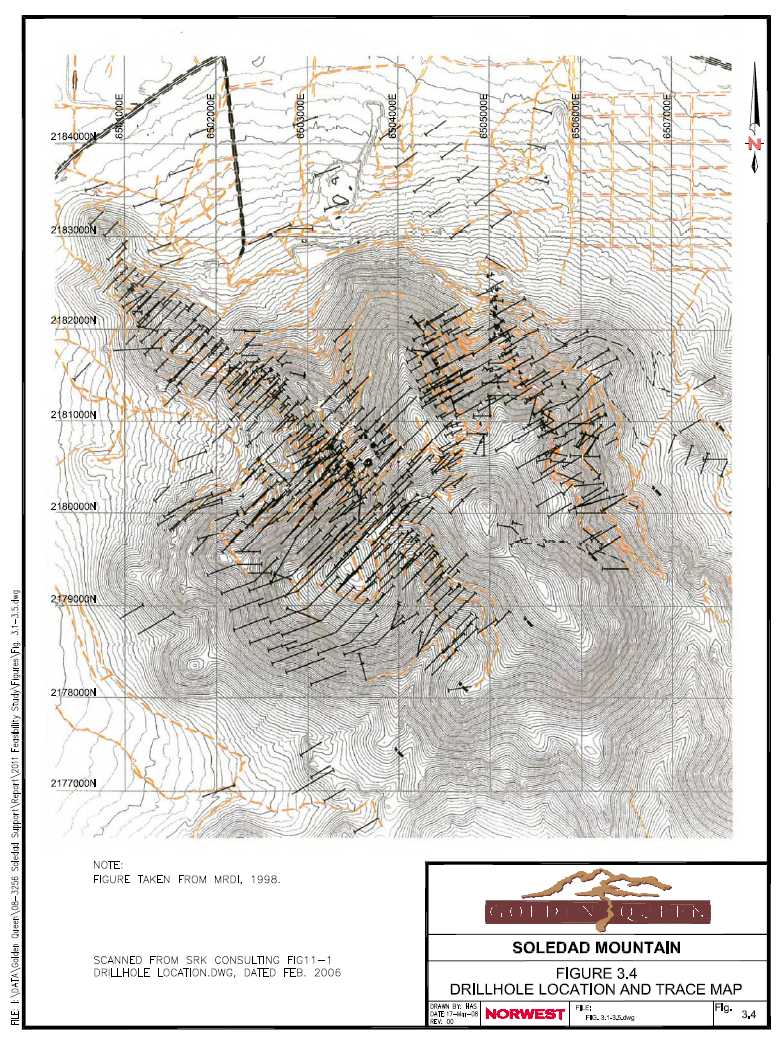

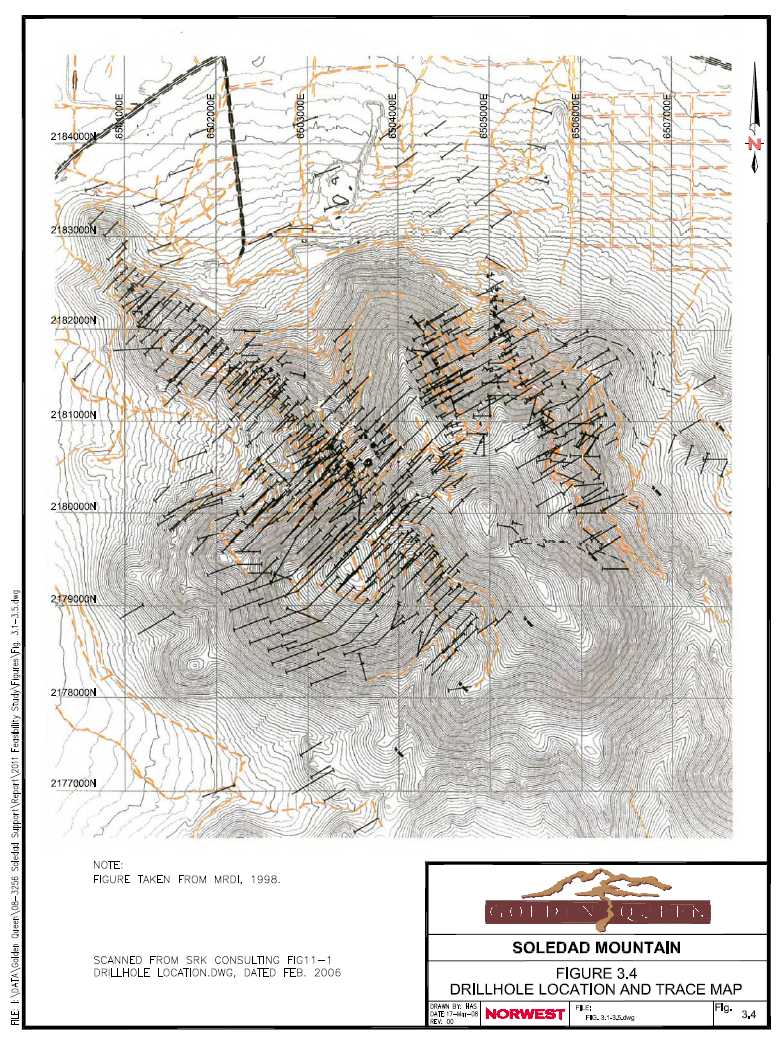

The resource model used as the basis of this feasibility study was based on 59 diamond drill holes, 663 reverse circulation (RC) drill holes and extensive sampling of the existing underground workings. Figure 3.4 shows the location of the drilling and cross cuts used in this resource model.

| | 3.3.1 | Drilling Methods |

| | | |

| | 3.3.1.1 | Sample Spacing |

Nominal spacing for surface drilling is about 100 ft along strike and 125 ft perpendicular to strike of known veins within the southwest one-half of the deposit (Sections oriented N45E). The drillhole spacing perpendicular to the strike of veins in the northeast half of the deposit (Sections oriented N60E) is about 200 ft. Drillholes are spaced from 200 ft to 500 ft apart outside of known veins. Both core holes and RC holes were positioned to intersect vein systems as close as possible to the perpendicular of vein strike and dip. Generally, drillholes intersect southwest-dipping veins at angles ranging from 45° to 70° and northeast-dipping veins at angles ranging from 45° to 90°. Deep intersections of southwest-dipping veins are at angles as low as 30°.

Underground channel samples were taken where cross-cuts were driven off the main vein zones by GFA and earlier operators. All accessible cross-cuts were channel sampled where previous GFA sampling had not been carried out. GQM has not used samples collected along the strike of the veins (along drifts). The spacing of cross-cuts varies, but they are normally 50 ft apart along the Silver Queen, Golden Queen and Starlight Veins and from 100 ft to 400 ft apart on other veins. With combined drillhole and cross-cut data, samples are spaced from 50 ft to 150 ft in the most important veins. This is adequate to define the continuity of the central portion of veins and surrounding low-grade material on 100 ft sections.

| | 3.3.1.2 | Reverse-Circulation Holes |

Drilling methods are described here from information compiled by Mine Research Associates (MRA). MRDI reports check this information where it was noted on drill logs stored in GQM’s files. MRDI reports that information on contractors and drill-rigs utilized for the first 332 RC holes drilled from 1985 to 1994 was not available. Since 1994, RC holes were drilled by Hackworth Drilling Company and P.C. Exploration Company using track-mounted MPDH 1000 drill-rigs. Drill bits ranging from 4.75 in to 5.5 in in diameter were used. Samples reportedly were collected at the drill rig at 5 ft intervals. According to GQM staff, drilling was carried out with water injection to reduce dust emissions. This required use of a rotating wet splitter. A “rig duplicate” sample was collected and left at the drill site. MRDI inspected five drill sites near the 200 Level portal and found that the plastic bags in which rig duplicates were stored had decayed, ruining the sample, or that samples had been destroyed during subsequent road work. As a result, very few rig duplicates are preserved in a condition that would permit check sampling. RC samples were not weighed at the time they were collected; therefore, sample recovery could not be evaluated. MRDI reports that RC drilling, logging and sampling methods did appear to meet industry standards.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-3 |

Information given here was obtained from MRA’s description contained in the M3 Feasibility Study of March, 1998. This information was checked during MRDI’s audit, where the information was available on drill logs.

Twelve surface diamond drillholes were drilled from 1985 to 1994 by several contractors. Information is not available concerning drill-rigs utilized. Since 1994, surface diamond drilling has been carried out by McFeron and Marcus Exploration, Inc., using a DMW-65 drill rig. All core is HQ (2.5 in diameter).

Underground core drilling was conducted, starting in 1994, by Boart Longyear Company using LM75 drillrigs. All core was HQ (2.5 in diameter). Core from holes drilled by GQM was inspected by MRDI in 2000 and SRK in 2005 at a storage warehouse at the mine site. Core boxes are in good condition and stored in a secure, well-organized fashion on wooden shelves. Core sampling techniques were examined by MRDI for holes DDH 97-1 and DDH 97-5. The core was either split mechanically or sawed. Three quarters of the core was collected for assaying, and one quarter was retained for reference. Core logs were reviewed for all 59 holes to check for poor recoveries through zones of mineralization. Recovery was not recorded for core holes 1-16. Only general comments regarding recovery were made for holes DDH 17-21 rather than recording actual measurements for each drill run. “100% recovery” was noted for most mineralized intervals except hole DDH 21, which experienced recoveries as low as 25% in mineralized intervals. The remainder of drill logs recorded measured recoveries for each cored interval. The number of mineralized intervals with poor core recovery is relatively small for the 43 core holes that have recovery information. MRDI reports that recovery appears to have been adequate to meet industry standards for holes 22 and onward. Records are substandard for the earliest 16 holes, however, and the impact of poor recovery in these holes cannot be assessed.

GQM has prepared a limited infill drilling program for 2011 with planned targets in the areas of the planned North-West and East pits. A total of 15 holes are proposed within the North-West open pit area with a total length of 1,500m (4,900ft). The North-West pit is the planned location of the first phase of mining. A total of 9 holes are proposed within the East pit area with a total length of 1,200m (3,900ft). The program will consist primarily of infill drilling with the objective of upgrading inferred resources to a level of assurance which will meet the criteria for classification as reserves. In addition, the drilling will test continuity of mineralization.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-4 |

| | 3.3.1.4 | Historical GFA Cross-cut Sampling |

MRDI reported inspecting sample channels cut across the Golden Queen Vein by GFA in the 1930s on the 200 Level. Channels are 6 inch wide and 1 inch deep and generally at least 5 ft long. The technique of sampling employed by GFA is unknown, but it appears that a 2 in by 6 in board was used as a guide and the channel was cut with hand chisels until the board fit neatly within the channel. Channels of this size should have produced a sample weighing about 33 lbs to 35 lbs per 5 ft sample length. Samples reportedly were assayed at the mill laboratory on site. Information on sample preparation and assay method is not available.

In 1997 and 1998, GQM carried out a program of re-sampling those cross-cuts that were channel-sampled by GFA, and a program of channel sampling other cross-cuts that either had not been previously sampled or where results for previous sampling were not available in a usable form. MRDI inspected GQM sample channels across the Golden Queen, Starlight and Footwall Veins on the 200 Level. GQM staff used a pneumatic hammer to cut horizontal channels from 2 to 3 inch wide and 5 feet long. An attempt was made to closely duplicate original channels cut by GFA, but this was not always possible because markings of the original channels did not survive or were illegible. In these cases, the locations of the original channels were relocated using map linens of sample locations and underground survey markers. Rock chips were collected on a canvas sheet. Samples weighing about 32 lbs were produced from GQM channels. All channels inspected were relatively consistent in width and depth. Additional channel samples were cut by GQM in 1999 to provide additional check information. MRDI reported that underground channel sampling by GFA and GQMC met industry standards.

| | 3.3.2 | Surveying |

| | | |

| | 3.3.2.1 | Drillhole Collar Surveys |

Drillhole collar locations were surveyed relative to the historical mine grid by DeWalt Corporation of Bakersfield, California. Surveys were carried out using either a Total Station Wild TC-1610 theodolite or Trimble 4000 SSI RTK Global Positioning System.

The accuracy of collar surveys for all drillholes was checked by MRDI by plotting drillhole collar elevations on a digital topographic map, (contour interval of 10 ft), and checking drill collar elevations against the topographic elevation. A total of 26 drillholes were found to have collar elevations greater than 10 ft above or below the topographic elevation. Local systematic errors, such as groups of drillholes with errors corresponding to the same direction in error relative to the topographic elevation, were found. Discrepancies in the horizontal location of collars range from 25 ft to as much as 100 ft. One group of 14 surface RC drillholes targeting the Queen Esther Vein had a systematic error in which drill collars were located from 20 ft to 5 ft southwest of the correct topographic elevation. MRDI informed GQM staff of the survey discrepancies and GQM made corrections to the database while MRDI was on site. The collar positions of GQ-88 and GQ-525 were checked in the field and were found to be reasonable relative to the portal of the 200 Level. The collar to GQ-19 could not be found and most likely was destroyed by later road work.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-5 |

Down-hole surveys were not performed for holes drilled prior to 1994. RC holes GQ-1 to GQ- 475 and core holes DDH-1 to DDH-16 were not surveyed. Diamond drillholes DDH-17 through DDH-42 and DDH 97-1 through DDH 97-10 were surveyed for dip and azimuth using a Baker Hughes/Inteq Magnetic Single Shot Survey Tool. RC holes GQ-475 through GQ-632 were surveyed for dip using a MD-Totco Special Operating Unit Deviation Tool. Inclined RC holes show a downward deviation of from 1.5° to 3° per 100ft. The lateral deviations in azimuth are unknown.

MRDI notes that the lack of down-hole surveys for more than 70% of the drillholes will contribute to errors in the predicted location of zones of mineralization. The drill paths of unsurveyed RC drillholes were adjusted by GQM to incorporate 2° of downward deviation per 100 ft of hole. MRDI reports that this correction has produced a more reasonable interpretation of the location of veins and vein zones, as confirmed by comparisons between the location of veins in RC holes, core holes and underground workings. MRDI states that the lack of down-hole surveys for RC holes should not materially affect resource estimation, given the average correction used and the fact that RC vein intercepts agree reasonably with the locations of veins as indicated by underground sampling and core drilling. Survey control for the location of drillholes and down-hole location of drill samples is adequate to support a feasibility study.

| | 3.3.2.3 | Underground Cross-cut Samples |

The positions of underground cross-cut samples were located by GQM by using historical transit surveys of underground workings. Portal elevations were corrected during surface surveying of drill sites if portal elevations on mine maps did not agree with GQM’s topographic map. The location of cross-cut samples was corrected by GQM if the elevations of those samples were tied to incorrect portal elevations. Monuments for RC drillholes GQ-525 and GQ- 88 were inspected by MRDI in the vicinity of the 200 Level adit. Monuments consist of handscribed, aluminum tags stapled to wood laths, which are set in a cement collar plug.

| | 3.3.2.4 | Topographic Database |

A new topographic database was produced in 2004. DeWalt Corporation, Bakersfield set the control points around the perimeter of the area. Foto Flight Surveys Ltd., Calgary did the aerial photography in July 2004. Triathlon scanned colour film, completed aerial triangulation, photogrammetric mapping and digital orthophotography. Project specifications are as follows:

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-6 |

| | • | Control points | 8 targeted and surveyed control points |

| | • | Photo scale | 1:16,000 |

| | • | Mapping scale | 1 inch = 200 ft |

| | • | Contour interval | 5 ft |

| | • | Projection | California State Plane Zone 5 |

| | • | Horizontal datum | NAD83 |

| | • | Vertical datum | NAV88 |

| | • | Units | Survey Feet |

| 3.4 | MINERALIZATION |

| | |

| 3.4.1 | Types of Mineralization |

At least 14 separate veins and related vein splits occur at Soledad Mountain. Veins generally strike N40W and dip at high angles either to the northeast or to the southwest. Mineralization consists of fine-grained pyrite, covellite, chalcocite, tetrahedrite, acanthite, native silver, pyrargyrite, polybasite, native gold and electrum within discrete quartz veins, veinlets, veinlet stockworks and irregular zones of silicification. Electrum is about 25% silver. Native gold is generally associated with siliceous gangue and occurs as particles with diameters ranging from less than 10 µm to as much as 150 µm. Gangue minerals include quartz, potassium feldspar, ferruginous kaolinitic clay, sericite, hematite, magnetite, geothite and limonite. Veins formed by the process of intense alteration of volcanic rocks and by deposition of quartz and sericite-rich material in fault and fracture zones (Figure 3.3) . The alteration is generally low in sulfur, with total sulfide content being 1% or less. Vein “zones” consist of one or more central veins surrounded by either a stockwork or parallel zones of veinlets. The effect is to have a core vein of 1 ft to 20 ft wide (with gold grades being generally greater than 0.1 oz/ton), surrounded by lower grade mineralization with widths ranging from 5 ft to 150 ft. The boundary between mineralized and non-mineralized material must be determined by assay.

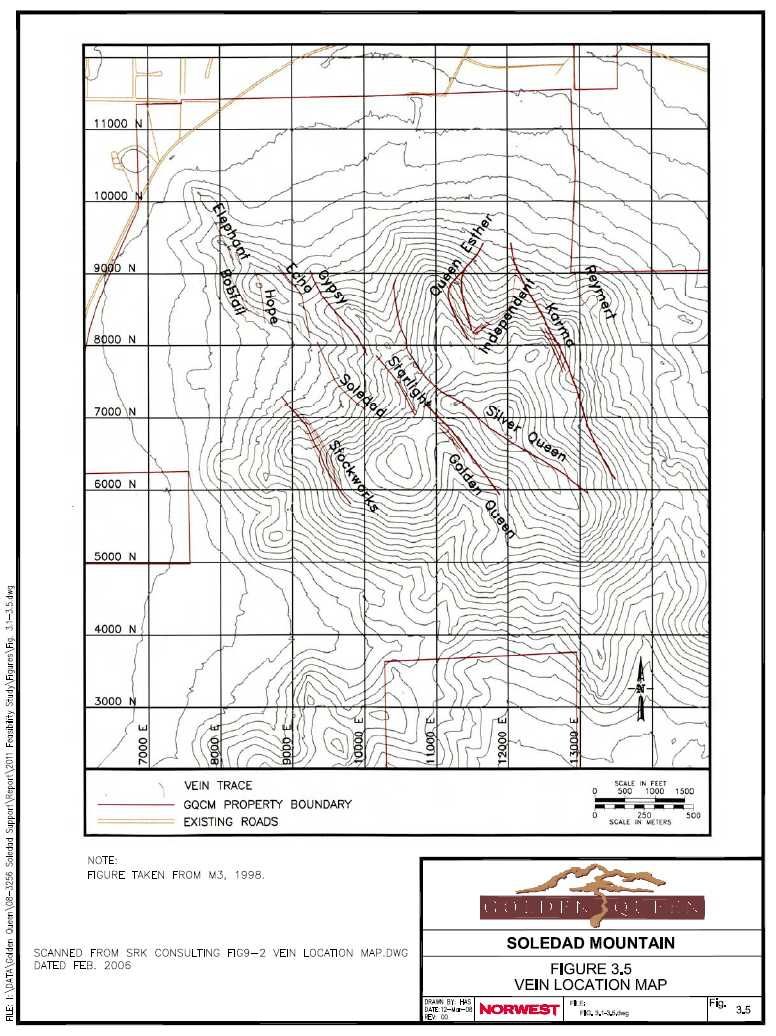

Important veins (Figure 3.5), from the northeast to southwest, are the Reymert, Karma, Independent, Queen Esther, Silver Queen, Golden Queen, Starlight, Gypsy, Echo, Soledad Extension, Hope, Elephant and Bobtail. Veins northeast of the Golden Queen Vein dip from 40° to 70° northeast. Veins south of the Golden Queen Vein dip about 70° southwest. A zone of “Flat Ore” is present between the Starlight and Silver Queen Vein. Flat Ore is a complex zone of veins and stockwork mineralization that is from 100 ft to 125 ft thick and nearly horizontal. It may have been produced by post-ore faulting of higher levels of the Starlight Vein. Separate, parallel or en-echelon vein systems are present over a total strike length of 6,000 ft trending northwest and a total width of 4,500 ft. Veins and zones are from 5 ft to 150 ft thick, 325 ft to 3,000 ft long and from 300 ft to 1,000 ft deep along dip. The horizontal distance between individual veins is from 50 ft to over 400 ft.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-7 |

| | 3.4.3 | Tenor & Silver to Gold Ratio |

Gold grades greater than 0.1 oz/ton appear to occur where veins exhibit multiple generations of quartz, adularia and sericite. Sheeted vein systems and stockwork veins decrease in grade laterally outward from core veins. Silver to gold ratios vary from 1:1 in shallow portions of veins in the south half of the deposit to greater than 35:1 at deeper levels (600 Level) in the north half of the deposit. A consulting geologist, working for GQM, studied spatial variations in silver to gold ratios throughout all of the vein systems (GQM internal report, April 1998). Silver to gold ratios were found to increase generally with depth from about 10:1 at the surface of the Golden Queen Vein (historical GFA 0 Level) to about 35:1 at the 600 Level in the same vein. The district average ranges from 15:1 to 18:1.

| 3.5 | MINERAL RESOURCE & MINERAL RESERVE ESTIMATES |

| | |

| | 3.5.1 | Overview |

An audit determined that deficiencies in both data and modeling approach noted by AMEC E & C Services Inc. in October 2005 had been corrected and that the recommendations made by MRDI in 2000 had been followed. Based on direct observations made by SRK during the site inspection, interviews with GQM personnel, examination of the GQM and MRDI reports, discussions with AMEC and the audit of the model and associated databases, SRK concluded:

Geologic Interpretation – The interpretation of structure and rock types is thorough and realistic.

Drilling – Core drilling and core logging meet industry standards. As reported by GQM and MRDI, RC drilling and logging appear to meet industry standards. Survey control for the location and down-hole location of drill samples appears adequate.

Drillhole spacing is adequate to define most of the veins.

Sampling Method, Approach, Preparation and Analysis – The underground channel sampling by GFA and GQM, inspected and checked by MRDI, was reported to meet industry standards. SRK finds the factors developed by MRDI to correct the historic GFA data to be reasonable. The reported assay precision is acceptable for grades greater than 0.008oz/ton Au.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-8 |

Data Verification - MRDI found errors during their check of the pre-1999 assay database; however, they found the database to be acceptable. SRK and AMEC found errors during checks of the 1999 drilling but found the data to be acceptable. Assays from twins of core holes, RC holes and underground cross-cuts show a reasonable correlation among different drilling and sampling methods.

Mineral Resource Estimate – The procedures developed by GQM, with assistance from MRDI, and employed by GQM and later AMEC, to construct the resource model, are acceptable. The grade zones developed by GQM are a very significant interpretation controlling the resource estimation process. MRDI pointed out in 1999 that the 0.008oz/ton AuEq cutoff grade is somewhat arbitrary in terms of the geology of the deposit, but is related to the operating mining cutoff at the time the interpretations were started. SRK agrees with MRDI that the cutoff is acceptable if the operating cutoff is above 0.008oz/ton AuEq. If the operating cutoff drops below this level, the low-grade mineralization (outside of the low-grade zone definition boundaries) is not represented in the model. SRK also agrees that if the operating cutoff is not sufficiently above the low grade zone definition cutoff, dilution (that may occur during mining) is not represented in the model. For the purpose of global resource estimation these zones are acceptable.

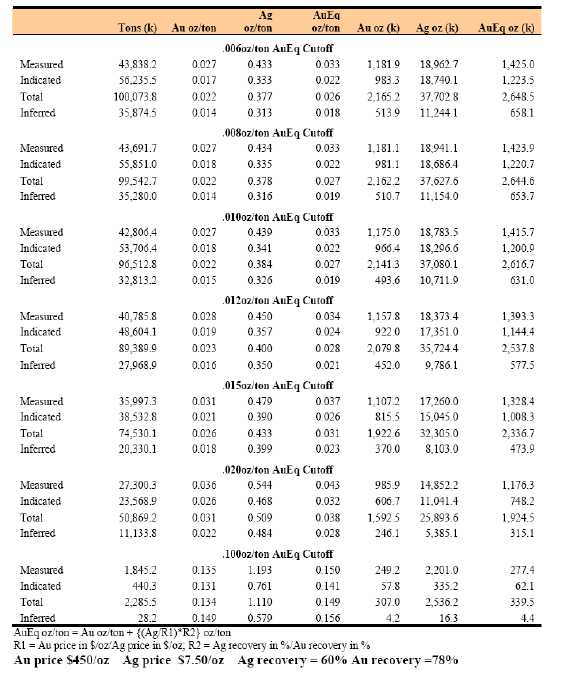

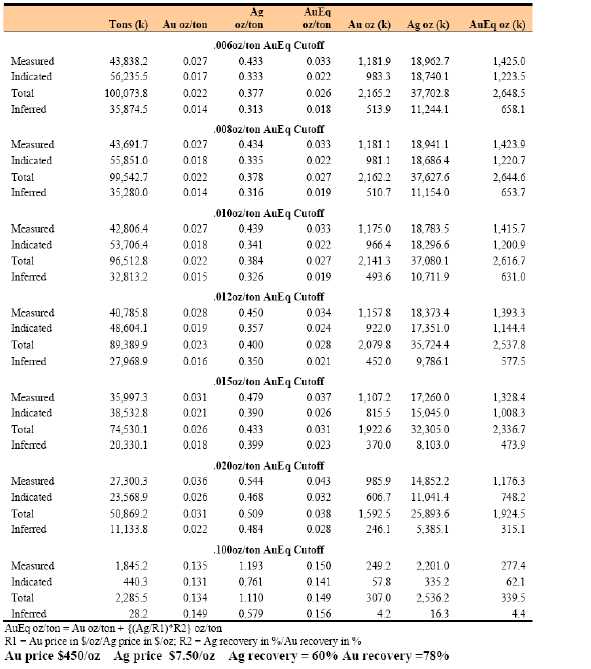

The confidence classification parameters developed by MRDI are reasonable but, as pointed out by MRDI, do not address uncertainty as to the location of the high and low grade boundaries. SRK confirms the model as acceptable for a global resource estimate. Table 3.1 shows the resources calculated from the 2006 model delivered by SRK February 3, 2006.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-9 |

TABLE 3.1

STATEMENT OF MINERAL RESOURCES, FEBRUARY 3, 2006

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-10 |

AMEC reconstructed a resource model in late 2005 using the procedures, parameters and geologic interpretations developed from 1998 to 2000. The model dimensions are shown in Table 3.2.

TABLE 3.2

AMEC BLOCK MODEL DIMENSIONS

Direction

| Minimum

(ft) | Maximum

(ft) | Block Size

(ft) | Number of

Blocks |

| EASTING | 5,500 | 15,500 | 20 | 500 |

| NORTHING | 2,500 | 12,500 | 20 | 500 |

| ELEVATION | 2,200 | 4,200 | 20 | 100 |

| | 3.5.3 | Assay Database & Capping |

MRDI recommended a gold grade cap of 1.0 oz/ton and a silver cap of 9.0 oz/ton in December 1999. These cap grades were selected based upon MRDI’s risk-adjusted metal reduction approach, which considers the risk associated with the very high-grade assays relative to the production rate. (Section 3.6.5 describes the analysis that was performed by MRDI which evaluated grade estimation confidence intervals, or risk, for quantities of material representing three months of production.) In 2000 MRDI recommended that, given the low coefficient of variation of 10 ft composited gold grades in the high-grade zone, capping was not required. This was subsequently re-evaluated. During the 2006 composite database construction, both gold and silver were capped by AMEC at 1.0 oz/ton and 9.0 oz/ton respectively. SRK agrees the capping of both assays to be appropriate as is the adjustment of the historical GFA underground assays. Adjusted value = 0.8571 x GFA value - ..0088 oz/ton Au.

| | 3.5.4 | Geologic Modeling |

| | | |

| | 3.5.4.1 | Rock Types |

The following rock types are stored in the model:

| | 1 = Pyroclastics | 13.9 ft3/ton |

| | | |

| | 2 = Quartz Latite | 13.9 ft3/ton |

| | | |

| | 3 = Rhyolite Porphyry | 13.9 ft3/ton |

| | | |

| | 4 = Flow-banded Rhyolite | 13.8 ft3/ton |

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-11 |

Rock types are used to assign specific volume values for resource tonnage calculation.

| | 3.5.4.2 | Grade Zoning & Envelope Construction |

Prior to modeling the gold and silver assays were combined to form gold equivalent values and composited in 10 ft lengths down-hole.

The formula used for calculation of the gold equivalent values is as follows:

AuEq (oz/ton) = Au (oz/ton) + Ag (oz/ton) x 0.0142

Note: The 0.0142 factor above is derived from an Au price of $325/oz, Ag price of $6.00/oz, Au recovery of 78% and Ag recovery of 60%.

AuEq oz/ton = Au (oz/ton) + {(Ag/R1)*R2} (oz/ton)

| | Where: | R1 = | Au price in $/oz |

| | | | Ag price in $/oz |

| | | | |

| | | R2 = | Ag recovery in % |

| | | | Au recovery in % |

| | | | |

| | | Au price $450/oz |

| | | Ag price $7.50/oz |

| | | Ag recovery = 60% Au recovery = 78% |

These composites were used as the basis of the interpretation of high-grade and low-grade zones on cross sections. The low-and high-grade zone interpretations were completed on 100 ft to 109 ft spaced vertical sections on two different grids. The sectional interpretations were translated to 20 ft bench plans, re-drawn, digitized and used to code the block model. Zones between 0.008 oz/ton AuEq and 0.100 oz/ton Au were classified as low-grade and zones above 0.100 oz/ton Au were classified as high-grade. This cutoff range is at a level at which there is reasonable continuity, as evidenced in underground workings. The minimum “width” of the high-grade zone is 10 ft, (based upon the 10 ft composite length), which equates to a smaller true horizontal width, depending upon the drillhole angle and dip of the veins. The low-grade zone has a minimum composite-length of 20 ft, (two 10 ft composites). Blocks with centroids falling within the outline of the low-grade zone were coded as low-grade. Subsequently the high-grade outlines were used to assign the percentage of high-grade to each block. During resource calculation the percentage of high and low-grade are used with their respective interpolated grades to calculate the whole block grade. Internal waste was weight-averaged into the entire width of the mineralized zone and the grade of the zone was reduced accordingly. Waste intervals in excess of 30 ft wide were drawn as separate blocks. The grade zones developed by GQM are a very significant interpretation controlling the resource estimation process. MRDI pointed out in 1999 that the 0.008 oz/ton AuEq cutoff grade is somewhat arbitrary in terms of the geology of the deposit, but is related to the operating mining cutoff at the time the interpretations were started. Norwest agrees with MRDI that the cutoff is acceptable if the operating cutoff is above 0.008 oz/ton AuEq. For the feasibility study the undiluted operating cutoff has been set at 0.008 oz/ton, and hence, for the purpose of this feasibility study these zones are acceptable.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-12 |

| | 3.5.4.3 | Structural Controls |

Grade zones were defined by a series of perimeters for high-grade, low-grade and waste. Low grade was then divided into four domains called “Szones” that are modeled separately. GQM grouped vein systems with similar strike and dips into four structural zones or Szones:

Low-grade zone strike N150W, Dip 75° SW; (Golden Queen, Starlight, Soledad, Stockworks, Hope).

Low-grade zone strike N150W, Dip 60° NE; (Queen Esther and Independent).

Low-grade zone strike N150W, Dip 60° NE; and (Silver Queen).

Low-grade zone strike N150W, Dip 75° NE. (Karma, Ajax, Black and Reymert).

Szone codes were assigned to both the model blocks and composited assays to be used to control the selection of kriging parameters during grade assignment for each block. In general SRK finds the structural zones definition to be reasonable.

| | 3.5.4.4 | Calculation of Whole Block Grades |

Outlines of underground workings were plotted on sections to calculate historical mining extraction. Where maps of workings were not available, the vein material was subtracted using the cutoff grade for 1930-1942 mining with mining dilution added. Percent of stope void from mining was assigned to the block model and used to adjust the whole block grade and volume. Where underground mining occurred it is assumed that the higher grade portion of the block would be mined first. SRK verified that the material assumed to be mined was removed from the model and that higher grade volumes were preferentially depleted.

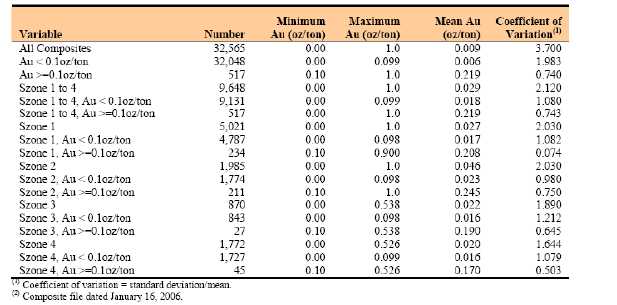

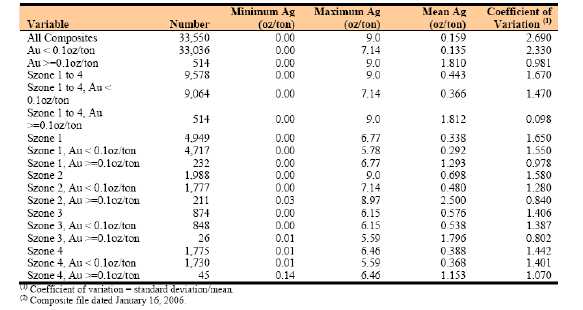

| | 3.5.4.5 | Summary Statistics on 10 ft Composites and Variography |

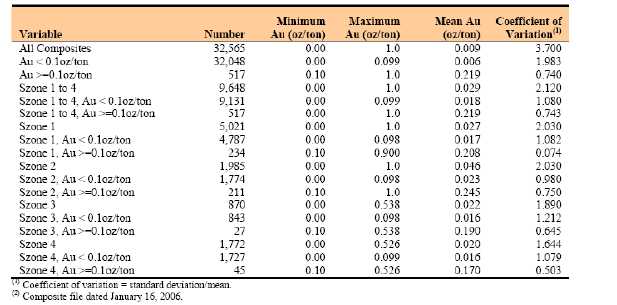

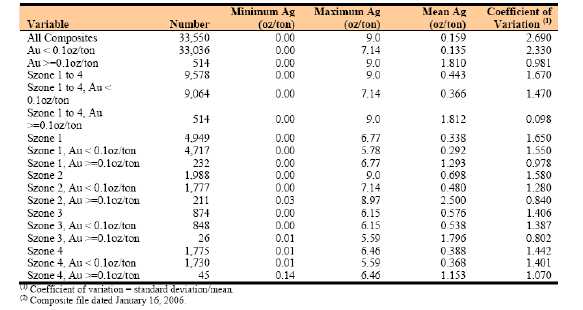

The following tables of summary statistics for gold and silver were produced by SRK using the composited database provided by AMEC on January 16, 2006. All adjustments to grades (capping, GFA adjustments, Billiton adjustments), were made to raw assays prior to compositing. Adjusted and unadjusted values are available in the database. SRK verified that the adjusted grades were used for composite creation and that the adjustments had been, in most cases, correctly made. Where there are discrepancies the errors were found to be on the conservative side. The use of the adjusted assays to form composites is reflected in the lower maximum values, means and coefficients of variation for both gold and silver than those reported by MRDI in May of 2000. The Szone, designated for each composite is the same as assigned in 2000.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-13 |

TABLE 3.3

GOLD COMPOSITE STATISTICS AND VARIOGRAPHY

TABLE 3.4

SILVER COMPOSITE STATISTICS AND VARIOGRAPHY

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-14 |

|

MRDI ran statistics and correlograms in December 1999. MRDI chose to run correlograms rather than traditional variograms because correlograms are more stable and show greater continuity with skewed populations (MRDI report, Appendix B). SRK checked these against correlograms created with the 2006 composite database and found no significant differences. While it is possible to model correlograms for each of the low-grade Szones (Au less than 0.1oz/ton) it is not possible to do so for the high-grade Szones because of the limited number of composites (617). A single model was developed for all high-grade Szones. For both the low and high-grade zones interpretable directional correlograms could not be achieved. Preferential directions of continuity of grade for Szones were defined by GQM’s geologic interpretation. Histogram and lognormal probability plots on 10 ft composites for gold and silver are included in the MRDI report, Appendix C. SRK recreated lognormal probability plots with the 2006 composite database but found no significant differences. The statistics show that the interpreted zones are based on an equivalent gold grade cutoff. There is no indication of a break in the distributions that would be indicative of multiple populations. The mean silver grade in the high gold grade zone is higher than in the low gold grade zone, but there is clearly a mixing of silver populations across this gold grade boundary.

| | 3.5.4.6 | Kriging Methodology |

The grade zone interpretation is critical to the kriging estimation runs. For gold, each low-grade zone and high-grade zone is estimated separately. Composites in the low-grade part of a Szone are used to estimate low-grade Szone blocks and vice versa. The grades were estimated with a series of passes, with the initial pass using an expanded search and low number of minimum composites in order that most of the blocks within the interpreted zones be estimated, (the blocks in these initial passes will be in the Inferred Resource category). Subsequent passes overwrote many of the blocks estimated in the initial passes so the initial passes had minimal effect. A similar approach was used to estimate silver grades. Multiple silver kriging runs were done for the low-grade gold Szones. Silver grades within the high-grade gold zone were estimated using the same kriging run and the same gold grade variogram and searching parameters. The variograms run on silver composites, where the gold grade is greater than 0.1oz/ton, are highly erratic, even more so than the gold variograms. The kriging parameters used are shown in Appendix B of the SRK report. GQM used ordinary kriging for estimating block grades. Very restricted estimation methods were used in order to provide block grade distributions that were not overly smoothed. Block grade estimates based on restricted estimation plans are very inaccurate on a local basis; however, over volumes needed for feasibility planning the estimates are sufficiently accurate and precise to be valid for planning. Blast hole grade control will insure that the predicted volumes of ore at the predicted grade are recovered.

| |

| GOLDEN QUEEN MINING CO. LTD. / 08-3256 |

| SOLEDAD MOUNTAIN FEASIBILITY STUDY |

| 3-15 |

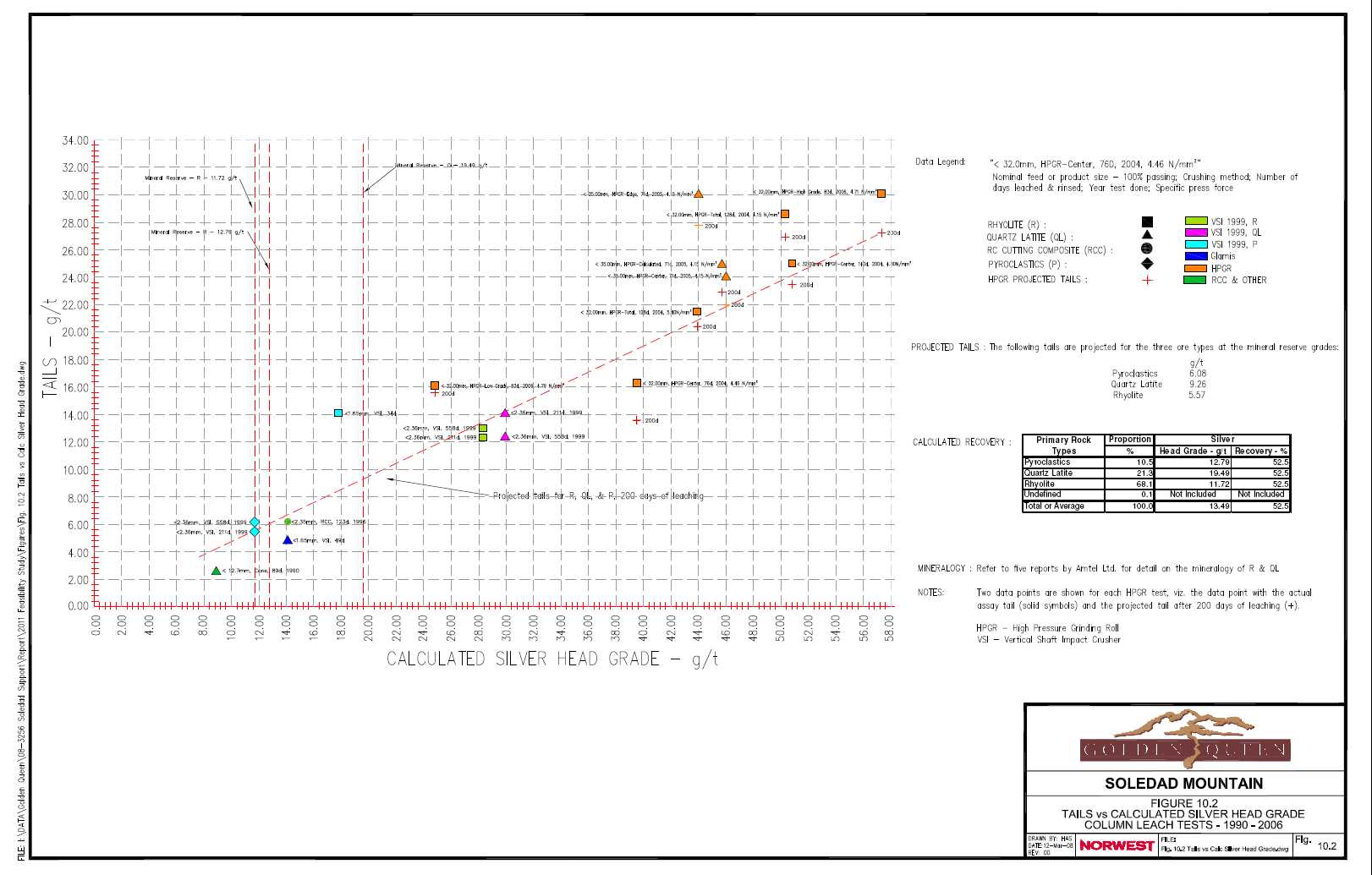

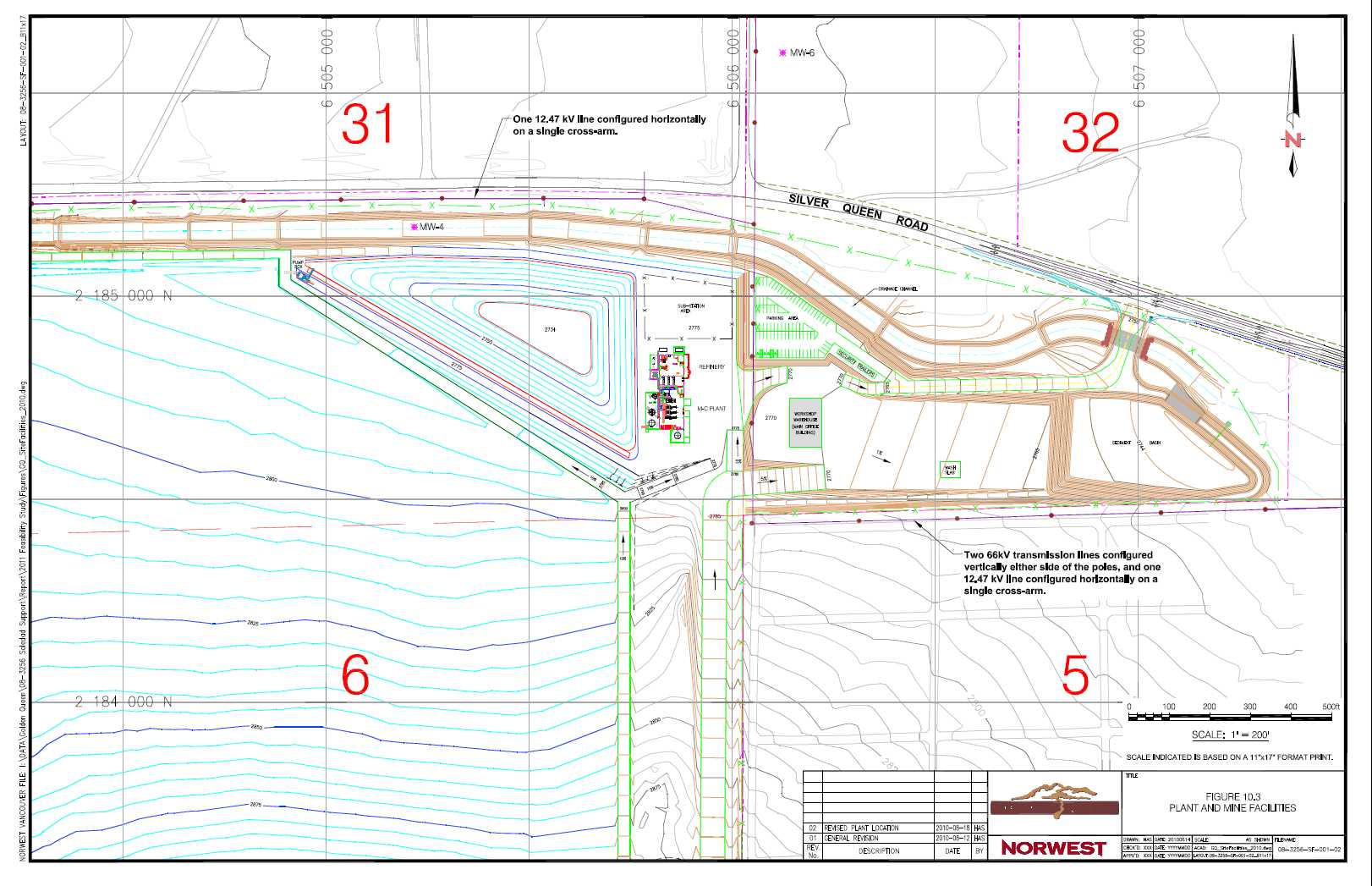

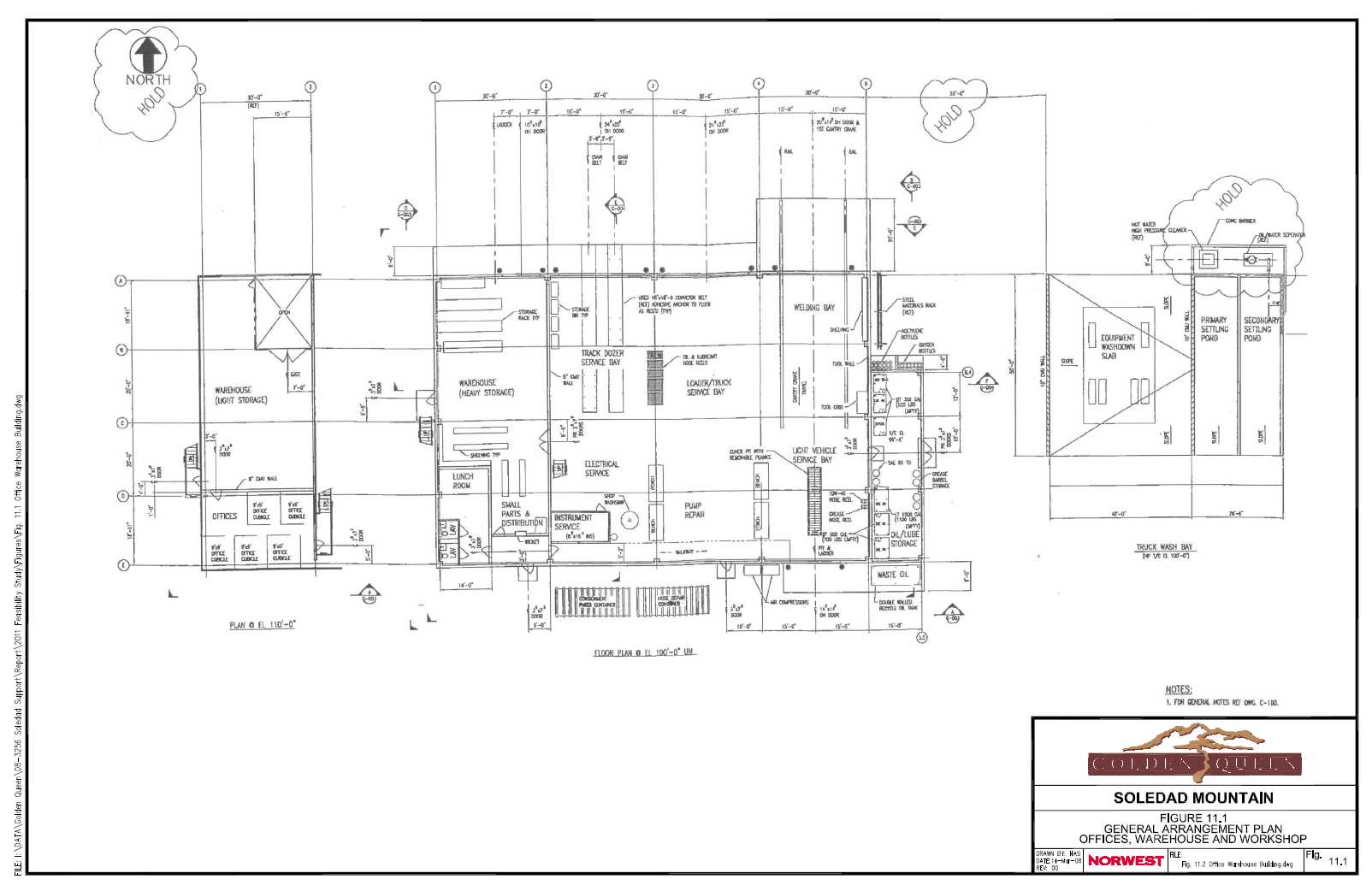

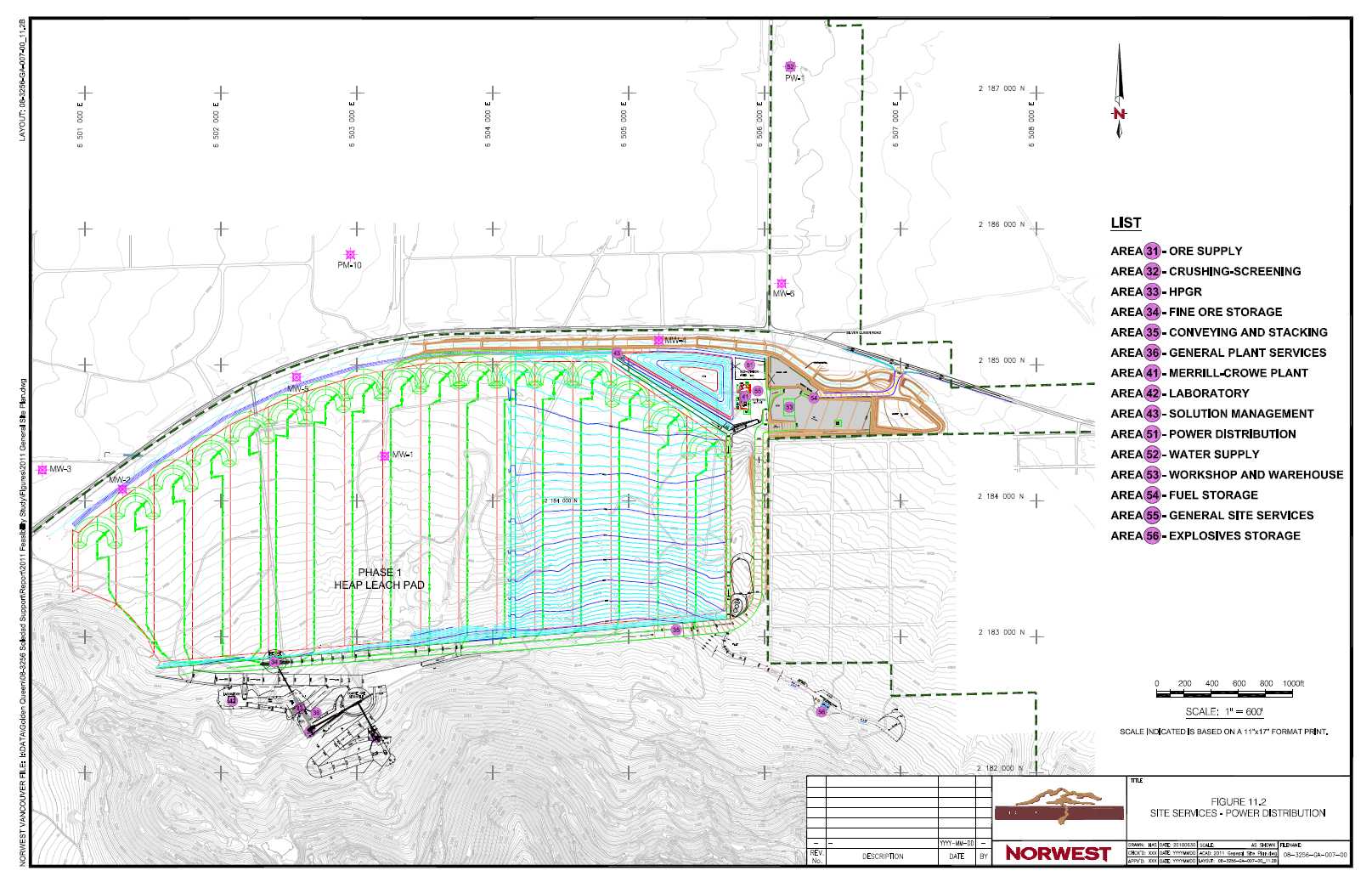

| | 3.5.5 | Resource Classification |