| Forward-Looking Statements |  |

| | |

Caution WithRespect ToForward-LookingStatements:The information in this presentation includes certain “forward -looking statements” in accordance with United States and Canadian securities laws. All statements in this presentation, other than statements of historical fact, including, without limitation, the closing of the transactions contemplated under the Transaction Agreement and the JV Agreement; potential benefits of the Transaction to Golden Queen shareholders, the estimated proceeds from additional agreements to fund the joint venture and the projected cost to complete construction and development of the project; development and production parameters from the feasibility study; plans for and intentions with respect to capital requirements, construction and production timelines and other development activities on the Soledad Mountain Project; expectations related to management and operation of GQ California and future mining operations on the Soledad Mountain Project, are forward -looking statements. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

Important factors that could cause actual results to differ materially from statements in this presentation regarding our intentions include, without limitation, risks and uncertainties regarding: conditions required for the closing of the Transaction Agreement and the JV; the transfer of 50% of our interest in the Soledad Mountain Project; failure to fund our Top Up Contribution in accordance with the JV Agreement and related dilution in GQ California; required shareholder and regulatory approvals; the development and operation of the Soledad Mountain Project, including additional capital requirements for the Soledad Mountain Project, accidents, equipment breakdowns and non-compliance with environmental and permit requirements; and other risks and uncertainties disclosed in the section entitled "Risk Factors" contained in our Annual Report on Form 10-K for the year ended December 31, 2013. Investors are cautioned that forward -looking statements are not guarantees of future performance and, accordingly, investors should not put undue reliance on forward -looking statements. Any forward -looking statement made by us in this presentation is based only on information currently available to us and speaks only as of the date on which it is made.

Technical information in this presentation was reviewed and approved by H. Lutz Klingmann (P.Eng.), the Company's President and a Qualified Person as defined by National Instrument 43-101.

AdditionalInformation and Where to Find It

In connection with Golden Queen’s solicitation of proxies with regards to the meeting of shareholders of Golden Queen to be called with respect to the transaction, Golden Queen will file a proxy statement with the United States Securities and Exchange Commission (the “SEC”) in June 2014.

SHAREHOLDERS ARE ADVISED TO READ THE PROXY STATEMENT WHEN IT IS DISTRIBUTED TO SHAREHOLDERS BECAUSE IT WILL CONTAIN IMPORTANT INFORMATION.

Shareholders will be able to obtain a free-of-charge copy of the proxy statement (when available) and other relevant documents filed with the SEC from the SEC’s website at www.sec.gov. The proxy statement and other relevant documents will also be filed with certain Canadian securities regulators and available free-of-charge at www.sedar.com. Shareholders of Golden Queen will also be able to obtain a free-of-charge copy of the proxy statement and other relevant documents (when available) by directing a request by email to Brenda Dayton at bdayton@goldenqueen. com, by telephone to (604) 921-7570 or by mail to Golden Queen Mining Co. Ltd, 6411 Imperial Ave., West Vancouver, BC, Canada, V7W 2J5.

Golden Queen and its directors and executive officers will be participants in the solicitation of proxies from the shareholders of Golden Queen. Information about the directors and executive officers of Golden Queen, including their shareholdings in Golden Queen, is set forth in the proxy statement for Golden Queen’s 2014 Annual Meeting of Stockholders, which was filed with the SEC on April 30, 2014. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement regarding the proposed transaction when it becomes available.

The securities to be offered pursuant the Backstop Agreement, if any, have not been and, upon issuance, will not be registered under the United States Securities Act of 1933, as amended (the “1933 Act”) or any applicable securities laws of any state of the United States and may not be offered or sold absent such registration or an available exemption from such registration requirements. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval.

2

| Speakers on the Call Today |  |

| | |

Lutz Klingmann

President, Golden Queen Mining Co. Ltd.

Thomas Clay

Chairman, Golden Queen Mining Co. Ltd.

Manager, Auvergne, LLC

3

| Transaction Description |  |

| | |

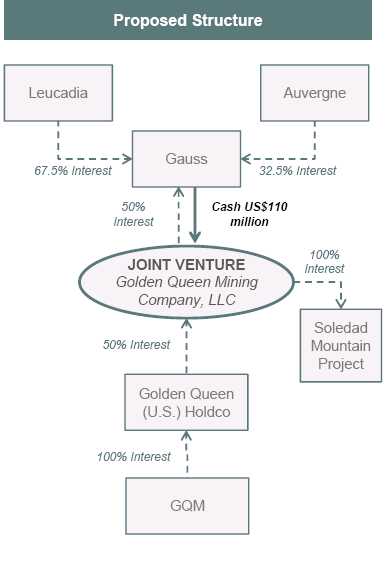

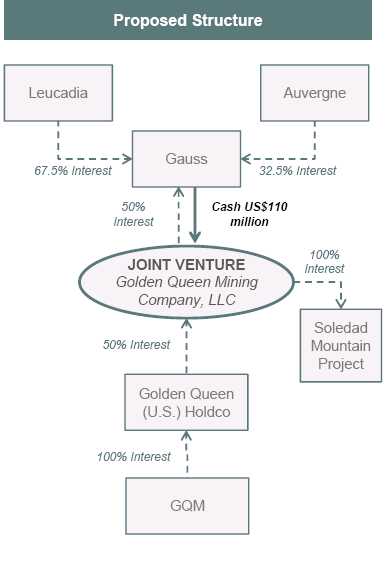

| • | Golden Queen Mining Co. Ltd. (“GQM”) to enter into a JV agreement with entities controlled by Leucadia National Corporation (“Leucadia”) (NYSE: LUK) and certain members of the Clay family (“Auvergne”) to jointly construct and operate the Soledad Mountain Project (the “Project”) |  |

| | |

| • | Pursuant to the terms of the JV agreement, GQM will convert its wholly- owned subsidiary that is developing the Soledad Mountain Project, Golden Queen Mining Company, Inc., into a California limited liability company (“GQ California”) |

| | |

| • | Gauss LLC, a joint venture to be owned 67.5% by Leucadia and 32.5% by Auvergne (“Gauss”), will acquire 50% of the membership interests of GQ California for US$110 million payable in cash to GQ California. GQM shareholders to retain a 50% interest in GQ California |

| | |

| • | GQM will have the option to contribute up to an additional US$25 million to the JV at which time Gauss will be required to match GQM’s investment |

| | |

| • | Upon closing of the transaction, GQM will enter into a support service agreement pursuant to which GQM will provide management services to GQ California |

| | |

| • | Golden Queen entered into a backstop guarantee agreement with the members of Gauss (the “Backstop Agreement”) whereby the Gauss members agreed to purchase, upon the terms set forth in the Backstop Agreement, any common shares which have not been acquired pursuant to the exercise of rights under the rights offering at a price per common share not to exceed US$1.10, up to a maximum amount of US$45 million in the aggregate |

| | |

| • | GQM will call a special meeting of its shareholders, which is expected to be held in August |

4

| Strategic Partners |  |

| | |

| |  | | |  |

| | Leucadia NationalCorporation | | | |

| | | | | |

| • | Diversified holding company engaged in a variety of businesses, including investment banking and capital markets, beef processing, asset management, manufacturing, energy and real estate | | • | Wholly owned entity of the Clay family, one of GQM’s longest and most supportive shareholders |

| | |

| • | Since the late 1980’s, the Clay family and associated entities have provided significant equity and debt capital to GQM to help fund the exploration and development of the Soledad Mountain Project |

| | | |

| • | Market capitalization of over US$9 billion and significant available liquidity | |

| | | |

| • | 36-year track record of acquiring and managing businesses and investments | | | |

| • | Thomas Clay, Manager of Auvergne, has served on the board of GQM since 2009 and has served as Chairman since 2013 |

| | | |

| • | History of successful investments in the mining sector | |

| | | |

| • | In 2013 merged with Jefferies Group, a global investment banking firm with operations in the U.S., Europe and Asia | |

5

| Potential Benefits to GQM Shareholders |  |

| | |

| • Recognition of thesignificant valueof GQM’s Soledad Mountain Project |

| •Strong partnershipwith long-term, credible partners |

| •Removes financing overhangand positions GQM to re-rate to producer multiples |

| •Sizeable investment allowsthe Project to advance through construction |

| •Low-risk, equity-based capital structurewith no hedging and no financial covenants. |

| •GQ California will have a strong balance sheetand financial flexibility |

| Long-term investors supporting GQM and the Soledad Mountain Project |

6

| Soledad Mountain Project |  |

| | |

| • | The Project is located in Kern County ~90 miles northeast of Los Angeles | |

| | | |

| • | Access to site is from State Route 14 and an existing paved County road |

| | | |

| • | Power line, water supply and railroad within ~1 mile from the Project |

| | | |

| • | Project located ~5 miles south of the town of Mojave |

| | – | Railroad hub for the Burlington Northern and Union Pacific railroad lines |

| | – | Municipal services include schools and fire services |

| | – | Skilled labour available locally |

| | | |

| • | The metropolitan areas of Lancaster and Palmdale lie just to the south |

Excellent infrastructure nearby:

paved road, power, water, railroad |

| • | Kern County’s economy strongly depends on natural resources |

| | | |

| | – | Kern County is the state's top oil-producing county and accounts for ~75%-80% of California’s oil production (California is the 3rd largest oil producing state in the U.S., behind Texas and North Dakota) |

| | | |

| | – | A collection of wind turbines to the west of the Project is one of the largest onshore wind energy projects in the world |

7

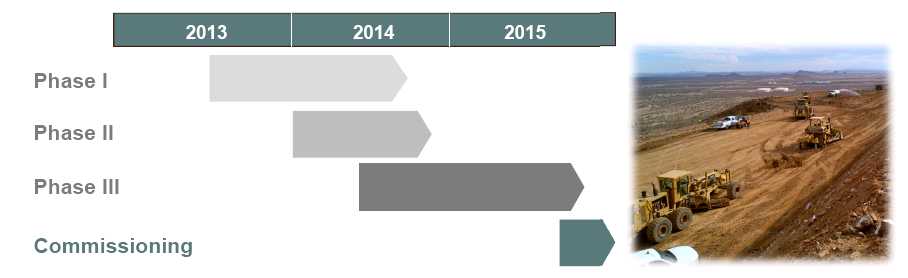

| Timeline to Production(1) |  |

| | |

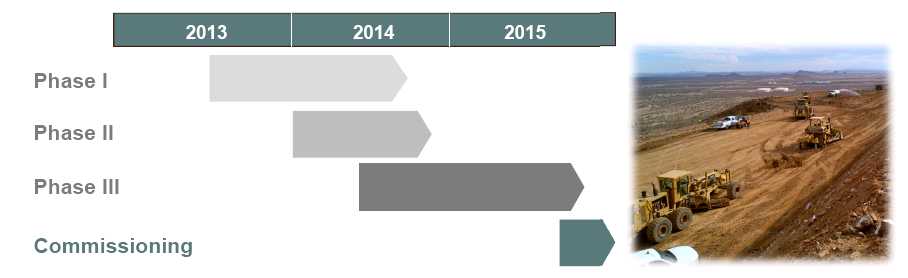

| Phase I | | Phase II | | Phase III |

| | | | | |

Start:Q3 2013

Key Items:

• Site grading, access roads

• Workshop-warehouse pad

excavation

• Site drainage system

• Engineering work

| | Start:Q1 2014

Key Items:

• Engineering work

• Construction of the Workshop-

warehouse

• Assay laboratory

• Commitment to the HPGR

• Water supply

• Commitment to power supply

• Staffing | | Start:Q2 2014

Key Items:

• Crushing-screening plant

• Merrill-Crowe plant

• Assay laboratory

• Water and power supply

• Conveying and stacking system

• Phase 1 heap leach pad

• Pre-production mining

• Staffing |

(1) | The projected timeline to production is based on various assumptions and is subject to various risks. See Cautionary statement on slide 2 in regards to forward looking statements and associated risks. |

8

| Construction Update |  |

| | |

| Construction progressing on budget |

9

| 2012 Feasibility Study(1) |  |

| | |

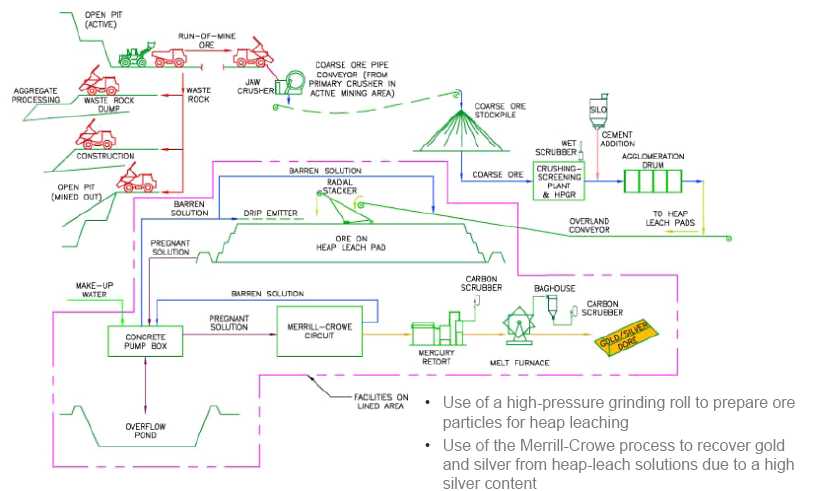

| Key Parameters (2) | | • | Project will use conventional open-pit mining methods and cyanide heap leach and Merrill-Crowe processes |

| Estimated Mine Life (Years) | 15 |

| Average Throughput (k short tons per year) | 4,710 |

| Strip Ratio (waste:ore) | 1.49:1 | | | |

| Au Recovery Rate (%) | 85.0% | • | In March 2014, released updated capital cost estimates as a result of the completion of detailed engineering and optimization studies |

| Ag Recovery Rate (%) | 52.5% | | | |

| Total Au Production (k oz) | 1,067.3 | | – | Total capital cost to build the project is now US$114 million, which includes a contingency of 15% |

| Total Ag Production (MM oz) | 12.0 |

| Average Annual Au Production (k oz) (Yr2 - Yr14) | 77 |

| Average Annual Ag Production (k oz) (Yr2 - Yr14) | 890 | | – | The total capital cost including $10.5mm in working capital and mobile mining equipment is now US$141 million |

| LOM Average Au Total Cash Costs (US$/oz)(3) | $257 |

| LOM Average Au Total Cash Costs + Sustaining Capex (US$/oz)(3) | $285 |

| LOM Average Au Total Cash Costs + Sustaining Capex + Estimated Taxes (US$/oz)(3) | $592 |

| Capex + 15% Contingency (US$MM) | $114 | | – | ~US$8 million has been spent to date (March 31, 2014) |

| Capex + 15% Contingency + mobile equipment + $10.5 working capital (US$MM) | $141 |

| LOM Sustaining Capex (US$ MM) | $30.6 | | | |

| (1) | Soledad Mountain Project Technical Report dated October 17, 2012, prepared by Norwest Corporation and AMEC E&C Services Inc. Available on SEDAR at www.sedar.com |

| | |

| (2) | The information is based on numerous assumptions and is subject to various risks. Please refer to the Forward-Looking Statements on slide 2. Further information on the assumptions is available in the Soledad Mountain Project NI 43-101 Technical Report dated October 17, 2012, and available on SEDAR at www.sedar.com |

| (3) | Net of silver credits and including royalties. Assumes silver price of US$27.65/oz. |

10

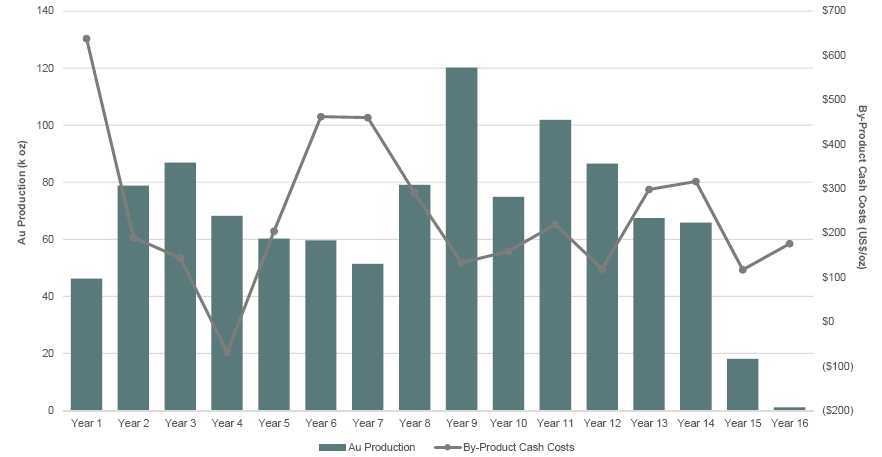

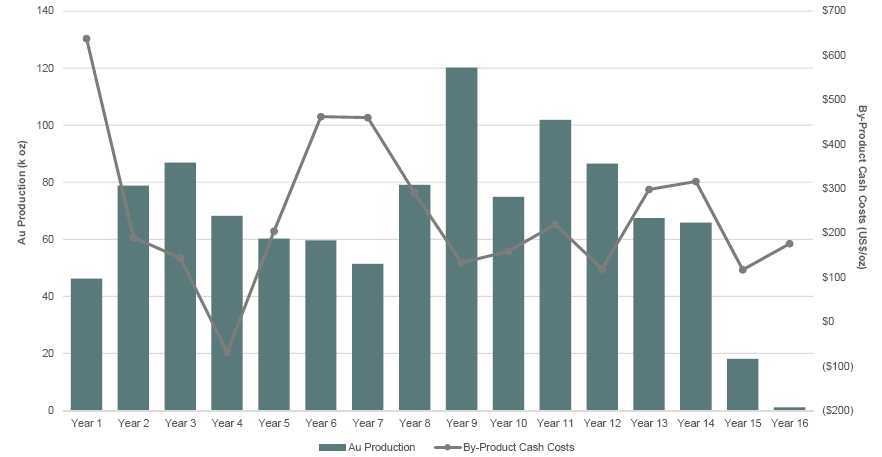

Robust Projected Production Profile with

First Quartile Cash Costs |  |

| | |

Productionand cash cost profile(100% basis)(1)

| (1) | The information is based on numerous assumptions and is subject to various risks. Please refer to the Forward-Looking Statements on slide 2. Further information on the assumptions is available in the Soledad Mountain Project NI 43-101 Technical Report dated October 17, 2012, and available on SEDAR at www.sedar.com |

11

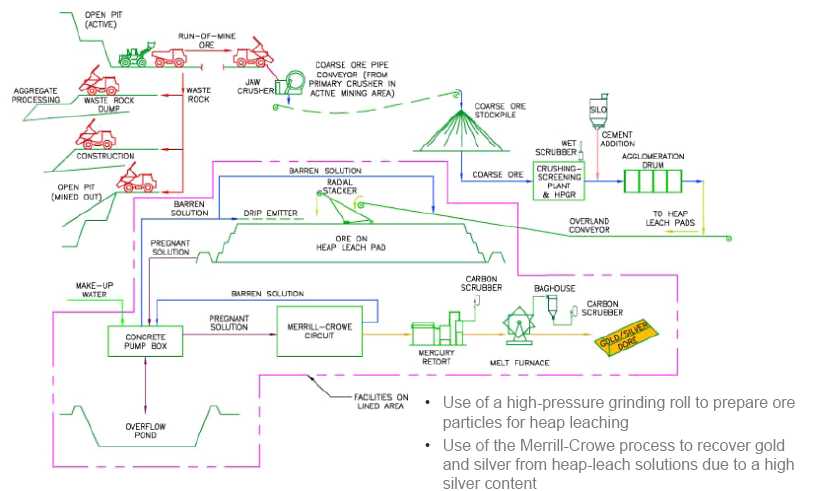

| Project Flowsheet(1) |  |

| | |

| A simple and proven process |

(1) | Soledad Mountain Project NI 43-101 Technical Report dated October 17, 2012, prepared by Norwest Corporation and AMEC E&C Services Inc. Available on SEDAR at www.sedar.com |

12

| Aggregate Sales |  |

| | |

The Company is actively pursuing a by-product aggregate business if and when the heap leach operation is in full production, based on the location of the Project in Southern California (proximity to major highways and railway lines)

The source of raw materials will be suitable quality waste rock specifically stockpiled for this purpose. The waste rock can be classified into a range of products such as riprap, crushed stone and sand with little further processing

Test work done in the 1990’s confirmed the suitability of waste rock as aggregate

The Company also plans to process and sell leached and rinsed residues from the heap leach operation for a range of uses to local and regional markets

No contributions from the sale of aggregate will be included in the cash flow projections until long term contracts for the sale of products have been secured

| The sale of aggregate has been approved for thirty years |

13