SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. ______)

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to Rule 14a-12 |

GOLDEN QUEEN MINING CO. LTD.

(Name of Registrant as Specified In Its Charter)

Not Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | | No fee required |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | | |

| (2) | Aggregate number of securities to which transaction applies: |

| | | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| (4) | Proposed maximum aggregate value of transaction: |

| | | |

| (5) | Total fee paid: |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | | |

| (2) | Form, Schedule or Registration Statement No.: |

| | | |

| (3) | Filing Party: |

| | | |

| (4) | Date Filed: |

| | | |

NOTICE OF

ANNUAL GENERAL MEETING

OF SHAREHOLDERS

&

MANAGEMENT

INFORMATION CIRCULAR

GOLDEN QUEEN MINING CO. LTD.

MEETING TO BE HELD ON JUNE 11, 2018

CORPORATE OFFICE

2300 – 1066 West Hastings Street

Vancouver, BC V6E 3X2

Website:www.goldenqueen.com

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS TO BE HELD

AT 10:00 AM ON JUNE 11, 2018

NOTICE IS HEREBY GIVEN that the 2018 Annual General Meeting of Shareholders (the “Meeting”) of Golden Queen Mining Co. Ltd. (the “Company”) will be held at 10:00 AM (Pacific Standard Time) on Monday, June 11, 2018 at 2300 - 1066 West Hastings Street, Vancouver, BC, V6E 3X2, for the following purposes:

| 1. | To receive the financial statements of the Company for its financial year ended December 31, 2017 together with the report of the independent auditors thereon; |

| 2. | To set the number of directors at four (4) and to elect directors to serve until the next Annual General Meeting of Shareholders or until their respective successors are elected or appointed; |

| 3. | To re-appoint PricewaterhouseCoopers LLP as independent auditors of the Company for the financial year ending December 31, 2018, and to authorize the directors to fix the auditors’ remuneration; |

| 4. | To consider, and, if deemed appropriate, to pass, with or without variation, an ordinary resolution to approve all unallocated entitlements issuable under the Company’s Stock Option Plan; and |

| 5. | To transact any other business which may properly come before the Meeting, or any adjournment or postponement thereof. |

The specific details of the matters proposed to be put before the Meeting are set forth in the Management Information Circular accompanying and forming part of this Notice.

The board of directors has fixed April 18, 2018 as the record date for determining shareholders entitled to receive notice of, and to vote at, the Meeting or any adjournment or postponement thereof. Only shareholders of record at the close of business on that date will be entitled to receive notice of and to vote at the Meeting.

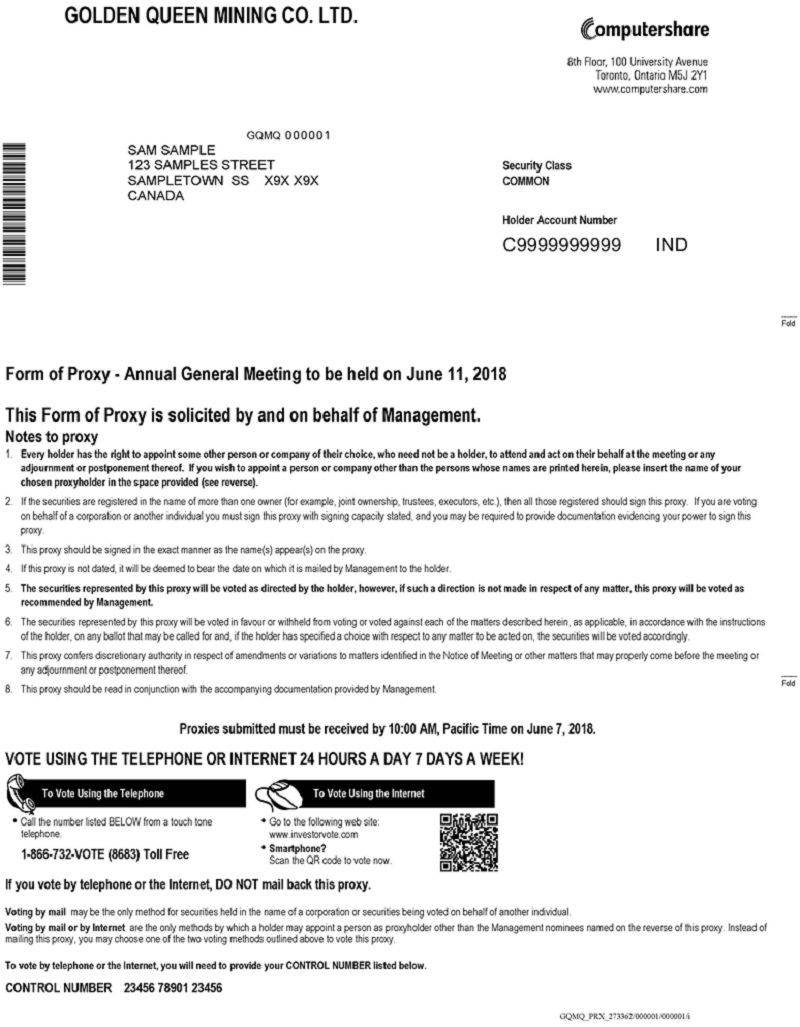

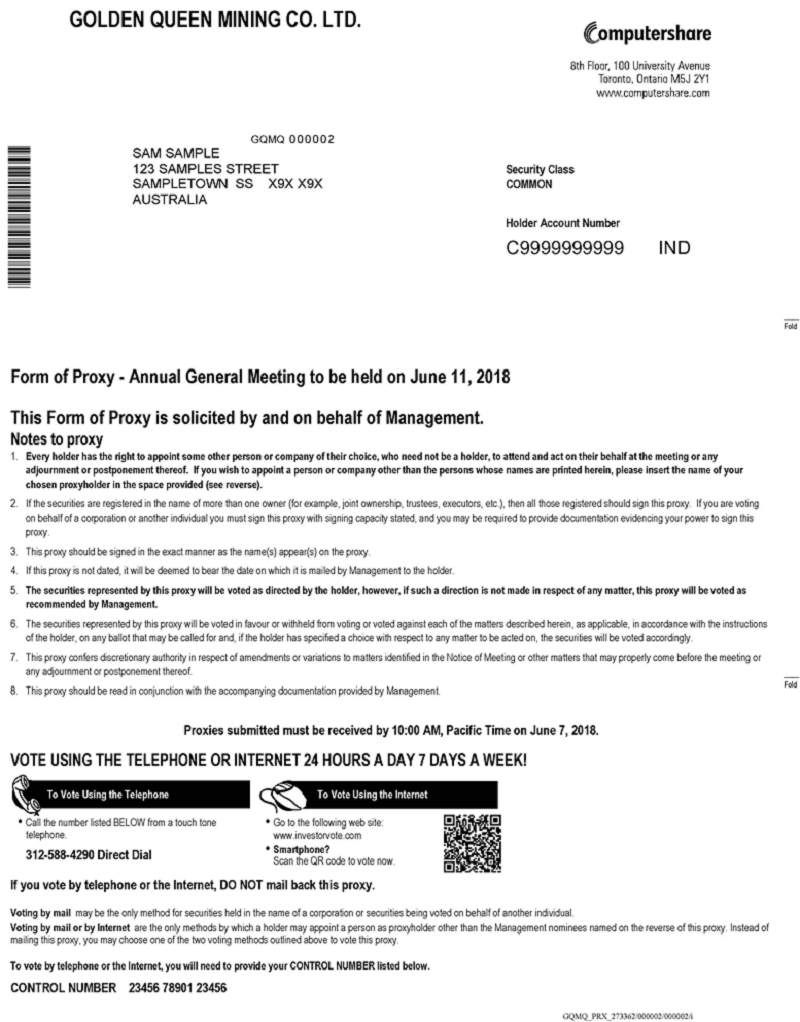

All shareholders are invited to attend the Meeting in person, but even if you expect to be present at the Meeting, you are requested to mark, sign, date and return the enclosed proxy card as promptly as possible in the envelope provided to ensure your representation.All proxies must be received by our transfer agent not less than 48 hours, excluding Saturdays, Sundays, and holidays,before the time of the Meeting in order to be counted. The address of our transfer agent is as follows: Computershare Trust Company of Canada, Proxy Dept., 100 University Ave., 8th Floor, Toronto, ON, M5J 2Y1. Shareholders of record attending the Meeting may vote in person even if they have previously voted by proxy.

Dated at Vancouver, British Columbia, this 25th day of April, 2018.

BY ORDER OF THE BOARD OF DIRECTORS

“Thomas M. Clay”

Thomas M. Clay, Chairman & Chief Executive Officer

Important Notice Regarding the Availability of Proxy Materials for

the Company’s Annual General Meeting of Shareholders on June 11, 2018.

The Golden Queen Mining Co. Ltd. Proxy Statement and 2017 Annual Report to Shareholders

are available online atwww.goldenqueen.com

GOLDEN QUEEN MINING CO. LTD.

2300 – 1066 West Hastings Street

Vancouver, BC V6E 3X2

PROXY STATEMENT

ANNUAL GENERAL MEETING OF SHAREHOLDERS

JUNE 11, 2018

In this Proxy Statement, all references to “$” are references to United States dollars and

all references to “C$” are references to Canadian dollars. As at April 18, 2018,

one Canadian dollar was equal to approximately $0.7914 in United States dollars.

INFORMATION REGARDING ORGANIZATION AND CONDUCT OF MEETING

The enclosed proxy is solicited by the Board of Directors (the “Board”) of Golden Queen Mining Co. Ltd., a British Columbia corporation (the “Company” or “Golden Queen”), for use at the Annual General Meeting of Shareholders (the “Meeting”) of Golden Queen to be held at 10:00 AM (Pacific Standard Time) on Monday, June 11, 2018, at 2300 - 1066 West Hastings Street, Vancouver, BC, V6E 3X2, and at any adjournment or postponement thereof.

In this Proxy Statement, “Registered Shareholders” means shareholders whose names appear on the records of the Company as the registered holders of shares. “Beneficial Shareholders” means shareholders who do not hold shares in their own name, as further explained under “Voting by Beneficial Shareholders” below.

This Proxy Statement and the accompanying proxy card are being mailed to our shareholders on or about May 9, 2018. The Company is sending proxy-related materials directly to Registered Shareholders, as well as non-objecting Beneficial Shareholders under Canadian National Instrument 54-101 (“NI 54-101”). Management of the Company does not intend to pay for intermediaries to forward the proxy-related materials to objecting Beneficial Shareholders under NI 54-101. As a result, objecting Beneficial Shareholders will not receive the materials unless the objecting Beneficial Shareholder’s intermediary assumes the cost of delivery.

The cost of solicitation will be paid by the Company. The solicitation will be made primarily by mail. Proxies may also be solicited personally or by telephone by certain of the Company’s directors, officers and regular employees, who will not receive additional compensation therefore. In addition, the Company will reimburse brokerage firms, custodians, nominees and fiduciaries for their expenses in forwarding solicitation materials to non-objecting Beneficial Shareholders. The total cost of proxy solicitation including legal fees and expenses incurred in connection with the preparation of this Proxy Statement, is estimated to be $10,000.

Our administrative offices are located at 2300 – 1066 West Hastings Street, Vancouver, BC, V6E 3X2.

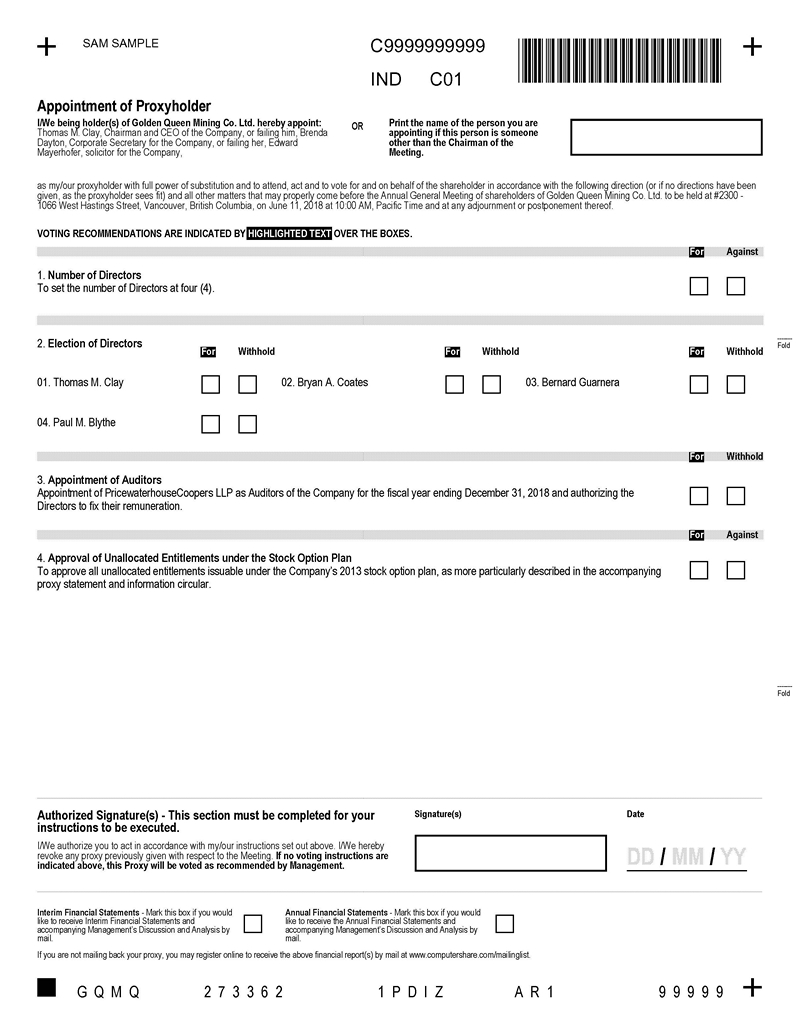

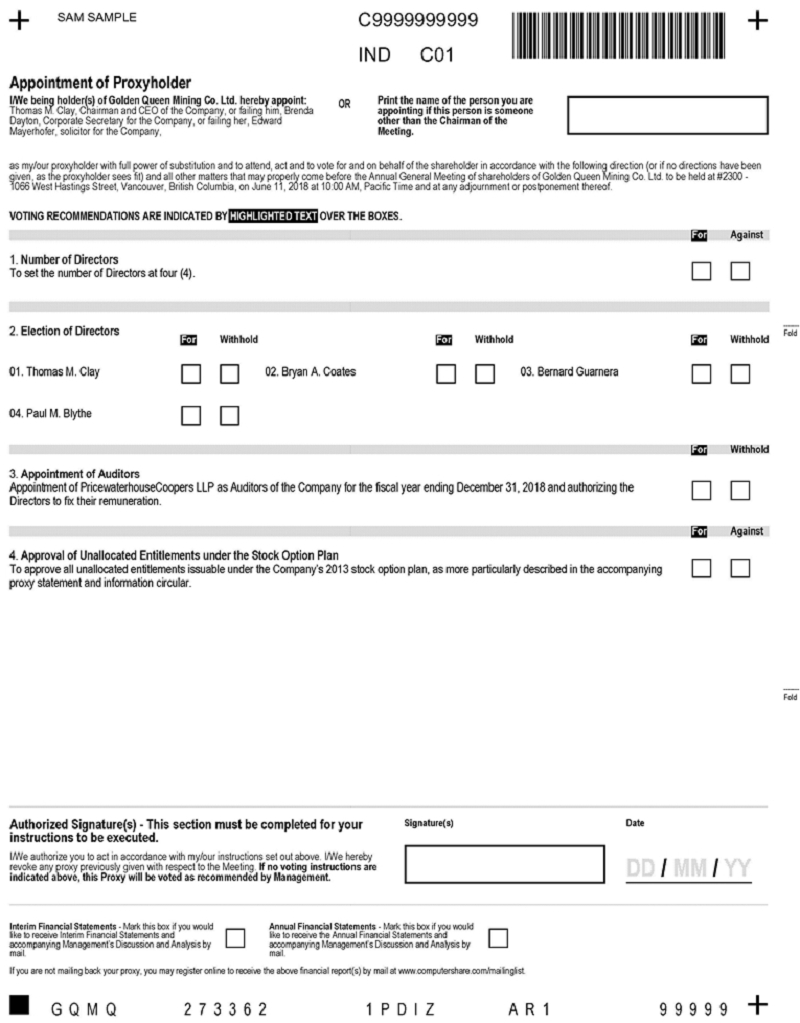

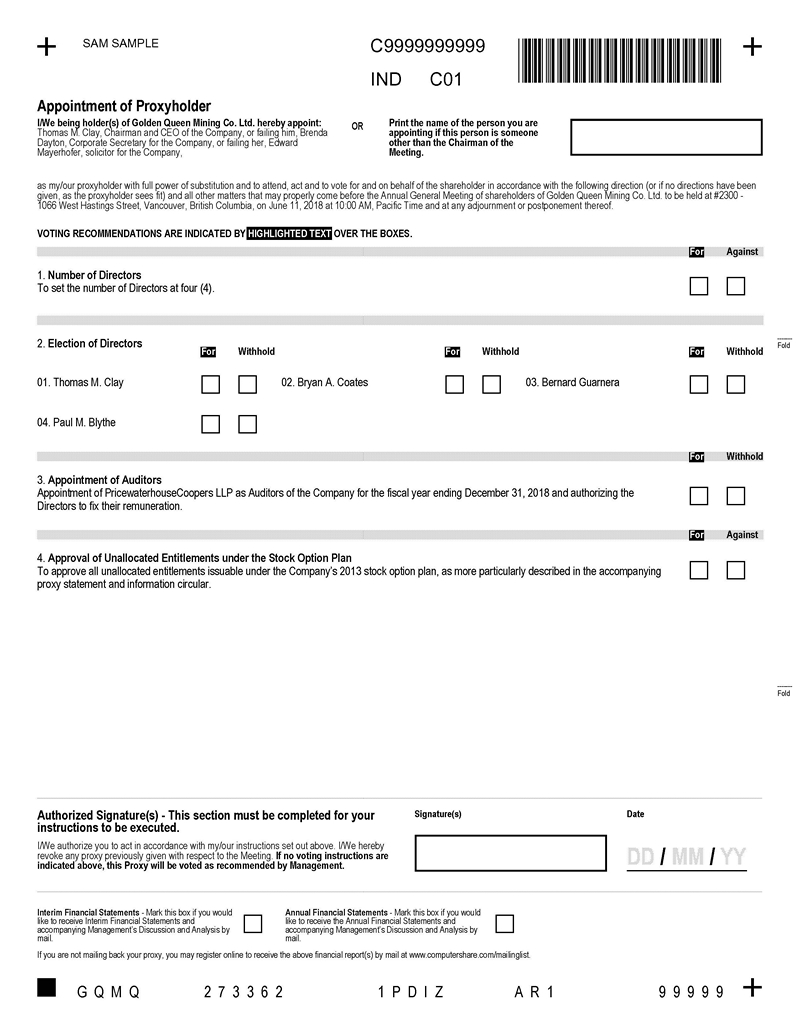

Appointment of Proxyholder

The persons named as proxyholder in the accompanying Proxy (“Proxy”) or Voting Instruction Form (“VIF”) were designated by the management of the Company (“Management Proxyholder”).A shareholder desiring to appoint some other person (“Alternate Proxyholder”) to represent him or her at the Meeting may do so by inserting such other person's name in the space indicated on the Proxy or VIF, or by completing another proper form of proxy. A person appointed as an Alternate Proxyholder need not be a shareholder of the Company.

Exercise of Discretion by Proxyholder

The proxyholder will vote for or against or withhold from voting the shares, as directed by a shareholder on the proxy, on any ballot that may be called for.In the absence of any such direction, the Management Proxyholder will vote in favour of matters described in the Proxy or VIF. In the absence of any direction as to how to vote the shares, an Alternate Proxyholder has discretion to vote them as he or she chooses.

The enclosed Proxy or VIF confers discretionary authority upon the Proxyholder with respect to amendments or variations to matters identified in the attached Notice of Meeting and other matters which may properly come before the Meeting. At present, management of the Company knows of no such amendments, variations or other matters.

PROXY VOTING

Registered Shareholders

If you are a Registered Shareholder, you may wish to vote by proxy whether or not you attend the Meeting in person. Registered Shareholders electing to submit a proxy may do so by completing the enclosed Proxy and returning it to the Company’s transfer agent, Computershare Trust Company of Canada (“Computershare”), in accordance with the instructions on the Proxy. You should ensure that the Proxy is received by Computershare at least 48 hours (excluding Saturdays, Sundays and holidays) before the Meeting or the adjournment thereof at which the Proxy is to be used. The chairman of the Meeting may elect to exercise his discretion to accept proxies received after the due date.

Beneficial Shareholders

The following information is of significant importance to Beneficial Shareholders (shareholders who do not hold shares in their own name). Beneficial Shareholders should note that the only proxies that can be recognized and acted upon at the Meeting are those deposited by Registered Shareholders (those whose names appear on the records of the Company as the registered holders of shares).

If shares are listed in an account statement provided to a shareholder by a broker, then in almost all cases those shares will not be registered in the shareholder’s name on the records of the Company. Such shares will more likely be registered under the name of the shareholder's broker or an agent of that broker. In the United States, the vast majority of such shares are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depositary for many U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for The Canadian Depository for Securities Limited, which acts as nominee for many Canadian brokerage firms).

If you have consented to disclosure of your ownership information, you will receive a VIF from the Company (through Computershare). If you have declined to disclose your ownership information, you may receive a VIF from your Intermediary if they have assumed the cost of delivering the Proxy Statement and associated meeting materials. Every intermediary has its own mailing procedures and provides its own return instructions to clients. However, most intermediaries now delegate responsibility for obtaining voting instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”) in the United States and in Canada.

By returning the VIF in accordance with the instructions noted on it, a Beneficial Shareholder is able to instruct the Registered Shareholder (the intermediary) how to vote on behalf of the Beneficial Shareholder. VIFs, whether provided by the Company or by an intermediary, should be completed and returned in accordance with the specific instructions noted on the VIF. In either case, the purpose of this procedure is to permit Beneficial Shareholders to direct the voting of the shares which they beneficially own.

The VIF will name the same persons as named on the Company’s Proxy to represent you at the Meeting. Although as a Beneficial Shareholder you may not be recognized at the Meeting for the purposes of voting shares registered in the name of your intermediary, you, or a person designated by you (who need not be a shareholder), may attend the Meeting as proxyholder for your intermediary and vote your shares in that capacity. To exercise this right to attend the Meeting or appoint a proxyholder of your own choosing, you should insert the name of the desired representative in the blank space provided in the VIF. Alternatively, you may provide other written instructions requesting that you or your desired representative attend the Meeting as proxyholder for your intermediary. The completed VIF or other written instructions must then be returned in accordance with the instructions on the VIF.

If you receive a VIF from the Company or Broadridge, you cannot use it to vote shares directly at the Meeting. The VIF must be completed and returned in accordance with its instructions, well in advance of the Meeting in order to have the shares voted.

Revocation of Proxies

In addition to revocation in any other manner permitted by law, a Registered Shareholder who has given a Proxy may revoke it by:

| a) | Executing a Proxy bearing a later date or by executing a valid notice of revocation, either of the foregoing to be executed by the Registered Shareholder or the Registered Shareholder’s authorized attorney in writing, or, if the shareholder is a corporation, under its corporate seal by an officer or attorney duly authorized, and by delivering the Proxy bearing a later date to Computershare at any time up to and including the last business day that precedes the day of the Meeting or, if the Meeting is adjourned, the last business day that precedes any reconvening thereof, or to the chairman of the Meeting on the day of the Meeting or any reconvening thereof, or in any other manner provided by law, or |

| b) | Personally attending the meeting and voting the Registered Shareholders’ shares. |

A revocation of a Proxy will not affect a matter on which a vote is taken before the revocation.

Only Registered Shareholders have the right to revoke a Proxy. Beneficial Shareholders who wish to change their vote must, at least seven (7) days before the Meeting, arrange for their respective intermediaries to revoke the Proxy on their behalf.

VOTING PROCEDURE

A quorum for the transaction of business at the Meeting is one person present at the meeting representing in person or by proxy not less than 10% of the votes eligible to cast at such meeting. Broker non-votes occur when a person holding shares through a bank or brokerage account does not provide instructions as to how his or her shares should be voted and the bank or broker does not exercise discretion to vote those shares on a particular matter. Abstentions and broker non-votes will be included in determining the presence of a quorum at the Meeting. However, an abstention or broker non-vote will not have any effect on the outcome for the election of directors.

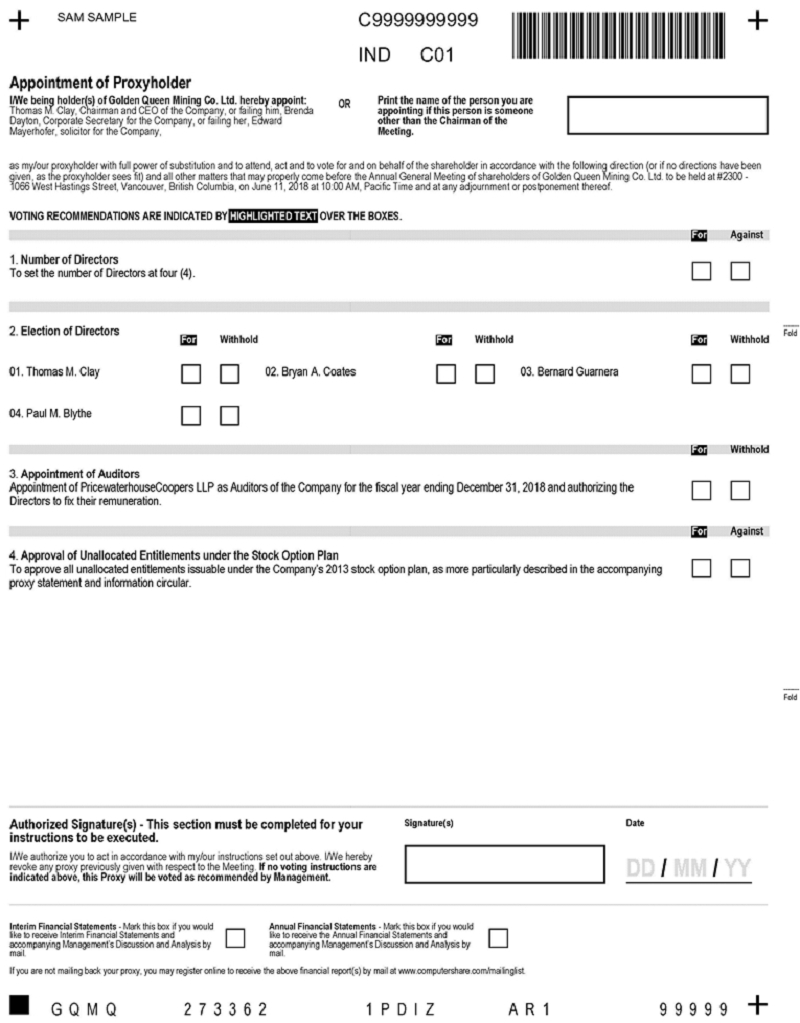

Shares for which Proxies are properly executed and returned will be voted at the Meeting in accordance with the directions noted thereon or, in the absence of directions, will be voted “FOR” fixing the number of directors at four (4), “FOR” the election of each of the nominees to the Board of Directors named on the following page, “FOR” the appointment of PricewaterhouseCoopers LLP as independent auditors of the Company for the fiscal year ending December 31, 2018, and to authorize the directors to fix the auditors’ remuneration, and “FOR” the approval of all unallocated entitlements under the Company’s Stock Option Plan. It is not expected that any matters other than those referred to in this Proxy Statement will be brought before the Meeting. If, however, other matters are properly presented, the persons named as proxies will vote in accordance with their discretion with respect to such matters.

To be effective, each matter which is submitted to a vote of shareholders, other than for the election of directors and the approval of auditors, must be approved by a majority of the votes cast by the shareholders voting in person or by proxy at the Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

On April 18, 2018 (the “Record Date”) there were 300,101,441 shares of our common stock (the “Common Stock”), issued and outstanding, each share carrying the right to one vote. Only shareholders of record at the close of business on the Record Date will be entitled to vote in person or by proxy at the Meeting or any adjournment thereof.

To the knowledge of the directors and officers of the Company, no person or corporation beneficially owns directly or indirectly, or exercises control or direction over, more than 5% of the outstanding Common Stock as of April 18, 2018, except as described below:

| Name and Address | | Number of Voting Securities(1) | | | Nature of Ownership | | Percentage of Outstanding Voting Securities | |

Thomas M. Clay

| | | 125,325,870(2)(3) | | | Sole voting and investment control | | | 41.76 | % |

| Boulder, CO, USA | | | 7,839,005(4)(5) | | | Shared voting and investment control | | | 2.61 | % |

| | | | | | | | | | | |

Jonathan Clay

| | | 30,724,234(6) | | | Sole voting and investment control | | | 10.23 | % |

| West Palm Beach, FL, USA | | | 807,250(7) | | | Shared voting and investment control | | | 0.27 | % |

| [1] | The information relating to the above share ownership was obtained by the Company from insider reports and beneficial ownership reports on Schedule 13D filed with the SEC or available at www.sedi.ca, or from the shareholder, and includes direct and indirect holdings. |

| [2] | Includes (i) 6,658,116 shares of common stock (“Common Stock”) of Golden Queen held directly by Mr. Thomas M. Clay; (ii) 118,419,672 shares of Common Stock held by the Estate of Landon Thomas Clay (the “Estate”), for which Mr. Thomas M. Clay is the executor; and (iii) 248,082 shares of Common Stock held by LTC Corporation, for which Mr. Thomas M. Clay is President. Mr. Thomas M. Clay disclaims beneficial ownership of the shares of Common Stock held by the Estate and by LTC Corporation. |

| [3] | Excludes 457,500 shares of Common Stock that are issuable upon the exercise of outstanding, currently exercisable options of Golden Queen held directly by Mr. Thomas M. Clay. |

| [4] | Includes (i) 807,250 shares of Common Stock held by Arctic Coast Petroleums, Ltd. (“Arctic Coast”), for which Mr. Thomas M. Clay is a director; and (ii) 7,031,755 shares of Common Stock held by the Monadnock Charitable Annuity Lead Trust dated May 31, 1996 (the “Monadnock Trust”), for which East Hill Management Company, LLC (“East Hill”) is the investment manager and Mr. Thomas M. Clay is the sole manager of East Hill. |

| [5] | Excludes (i) 10,740,600 shares of Common Stock that are issuable upon the exercise of outstanding, currently exercisable warrants of Golden Queen held by the Landon T. Clay 2009 Irrevocable Trust u/a dated March 6, 2006 (the “LTC Trust”), for which Mr. Thomas M. Clay is a trustee; and (ii) 2,759,400 shares of Common Stock that are issuable upon the exercise of outstanding, currently exercisable warrants of Golden Queen held by the Clay Family 2009 Irrevocable Trust u/a dated April 14, 2009 (the “CF Trust” and, together with the LTC Trust, the “Trusts”), for which Mr. Thomas M. Clay is a trustee and has a residual beneficial interest. The CF Trust holds a 50% beneficial interest of the shares of Common Stock held by Arctic Coast, and Mr. Thomas M. Clay therefore disclaims beneficial ownership of 50% of the shares of Common Stock held by Arctic Coast. |

| | [6] | Includes (i) 26,855,821shares of Common Stock of Golden Queen held by EHT LLC and Mr. Jonathan Clay is a beneficiary; (ii) 3,683,413 shares of Common Stock held directly by Mr. Jonathan Clay; and (iii) 185,000 shares of Common Stock held by Milledge, LLC. |

| | [7] | Includes (i) 807,250 shares of Common Stock held by Arctic Coast Petroleums, Ltd., for which Mr. Jonathan Clay is a director. |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as disclosed herein, no Person has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in matters to be acted upon at the Meeting other than the election of directors and the appointment of auditors and as set out herein. For the purpose of this paragraph, “Person” shall include each person: (a) who has been a director, senior officer or insider of the Company at any time since the commencement of the Company’s last fiscal year; (b) who is a proposed nominee for election as a director of the Company; or (c) who is an associate or affiliate of a person included in subparagraphs (a) or (b).

MATTERS TO BE ACTED UPON AT MEETING

Proposal 1: Election of Directors

The Board proposes to fix the number of directors of the Company at four (4) and that the following four (4) nominees be elected as directors at the Meeting, each of whom will hold office until the expiration of their term or until his or her successor shall have been duly appointed or elected and qualified: Paul M. Blythe, Thomas M. Clay, Bryan A. Coates, and Bernard Guarnera.

Unless otherwise instructed, it is the intention of the persons named as proxies on the accompanying proxy card to vote shares represented by properly executed proxies for the election of such nominees. Although the Board anticipates that the four (4) nominees will be available to serve as directors of Golden Queen, if any of them should be unwilling or unable to serve, it is intended that the proxies will be voted for the election of such substitute nominee or nominees as may be designated by the Board.

The board of directors recommends a vote “FOR” THE ELECTION OF each nominee.

As part of its ongoing review of corporate governance policies, on March 5, 2014, the Board adopted a policy providing that in an uncontested election of directors, any nominee who receives a greater number of votes “withheld” than votes “for” will tender his or her resignation to the Chairman of the Board promptly following the shareholders’ meeting. The Board will consider the offer of resignation and will make a decision whether or not to accept it. In considering whether or not to accept the resignation, the Board will consider all relevant factors. The Board will be expected to accept the resignation except in situations where the considerations would warrant the applicable director continuing to serve on the Board. The Board will make its final decision and announce it in a press release within 90 days following the shareholders’ meeting. A director who tenders his or her resignation pursuant to this policy will not participate in any meeting of the Board at which the resignation is considered.

The following table sets out the names of the nominees, their positions and offices in the Company, principal occupations, the period of time that they have been directors of the Company, whether or not they are considered independent or non-independent, the number of shares of the Company which each beneficially owns or over which control or direction is exercised, Board/Committee membership and attendance, and other public board of directorships information:

Name, Present Office, Province/State & Country of Residence | | Present Principal Occupation or Employment[1] | | Security Holdings[2] |

PAUL M. BLYTHE | | |

Director Collingwood, ON, Canada | | Mr. Blythehas over 40 years experience in the mining industry including significant international experience in corporate management, project development, open pit and underground operations, mergers and acquisitions, and debt and equity financing. He was the founder and President of Quadra FNX Mining and previously worked for Westmin Resources Limited, Placer Dome Canada Limited, Lac Minerals Limited and BHP Billiton. It is the determination of the Board that Mr. Blythe’s technical expertise as well as his corporate development activities are an asset to the Company. Date first appointed as a Director:March 30, 2017 | | Common Shares: 1,580,000 Stock Options: 150,000 |

| | | | | |

| Independent | | Board/Committee

Memberships | | Attendance at

Meetings During 2017 | | Other Public

Board Directorships |

| Yes | | Board of Directors Audit Committee Compensation Committee Nominating Committee | | 3/3 (100%) 3/3 (100%) nil nil | | nil |

| | | | | | | |

| | | | | | | |

| THOMAS M. CLAY |

Director, Chairman of the Board and Chief Executive Officer Boulder, Colorado, USA | | Mr. Clay is the Manager of East Hill Management Company, LLC, Chairman of ThromboGenics NV, and a Director of The Clay Mathematics Institute.Mr. Clay represents the interests of certain significant shareholders of the Company, and as such, the Board believes that Mr. Clay is valuable as a member of the Board. Date first appointed as a Director:January 13, 2009 | | Common Shares: 133,164,875(3) Stock Options: 457,500(4) Warrants: 13,500,000(5) |

| | | | | | | |

| Independent | | Board/Committee

Memberships | | Attendance at

Meetings During 2017 | | Other Public

Board Directorships |

| No | | Board of Directors | | 4/4 (100%) | | ThromboGenics NV |

| BRYAN A. COATES |

Director Saint-Lambert, Quebec, Canada | | Mr. Coates currently serves as President of Osisko Gold Royalties since June 2014. Prior to that, he was the Vice President, Finance and Chief Financial Officer of Osisko Mining. He was responsible for all activities related to financing, financial reporting, marketing related to the gold industry, risk management and government relations. Mr. Coates has more than 30 years of progressive experience within the international and Canadian mining industry. Before joining Osisko, he was Chief Financial Officer of Iamgold (2006-2007), Cambior Inc. (2001-2006), and Cia Minera Antamina (1998-2001). He also acts as a Member of the Board of Directors of the Fédération des Chambres de Commerce du Quebec’s, as well as the chair of the Chamber's Mining Industry Committee. He is a member of the Chartered Professional Accountants of Ontario. It is the determination of the Board that Mr. Coates’ financial acumen in conjunction with his public company expertise is an asset to the Company. Date first appointed as a Director:January 28, 2013 | | Common Shares: 17,000 Stock Options: 382,500 Warrants: 8,500 |

| | | | | |

| Independent | | Board/Committee

Memberships | | Attendance at

Meetings During 2017 | | Other Public

Board Directorships |

| Yes | | Board of Directors Audit Committee Compensation Committee Nominating Committee | | 4/4 (100%) 4/4 (100%) nil nil | | Alio Gold Inc. Falco Resources Technosub |

| |

| |

BERNARD GUARNERA |

Director Las Vegas, Nevada, USA | | Mr. Guarnera has over 40 years of experience in the global mining industry and is President of Broadlands Mineral Advisory Services Ltd.. Mr. Guarnera was the former Chairman of the Board of Behre Dolbear Group Inc., a mining consulting firm founded in 1991. Mr. Guarnera is a registered professional engineer and a registered professional geologist. He serves as a director of the Colorado Mining Association and Northern Zinc, and is the president of Mining and Metallurgical Society of America. The Board believes that Mr. Guarnera’s technical expertise and his capital market experience make him a valuable member of the Board. Date first appointed as a Director:May 30, 2013 | | Common Shares: 25,000 Stock Options: 382,500 |

| | | | | |

| Independent | | Board/Committee

Memberships | | Attendance at

Meetings During 2017 | | Other Public

Board Directorships |

| Yes | | Board of Directors Audit Committee Compensation Committee Nominating Committee | | 3/4 (75%) 3/4 (75%) nil nil | | |

| [1] | The information as to principal occupation and business or employment has been furnished by the respective nominees. |

| [2] | Based upon information furnished to Golden Queen either by the directors and executive officers or from the insider reports and beneficial ownership reports filed with the SEC or available atwww.sedi.ca. These amounts include beneficial ownership of securities not currently outstanding but which are reserved for immediate issuance on exercise of options. |

| [3] | Includes (i) 6,658,116 shares of Common Stock of Golden Queen held directly by Mr. Thomas M. Clay; (ii) 118,419,672 shares of Common Stock held by the Estate of Landon Thomas Clay (the “Estate”), for which Mr. Thomas M. Clay is the executor; (iii) 248,082 shares of Common Stock held by LTC Corporation, for which Mr. Thomas M. Clay is President; (iv) 807,250 shares of Common Stock held by Arctic Coast Petroleums, Ltd. (“Arctic Coast”), for which Mr. Thomas M. Clay is a director; and (v) 7,031,755 shares of Common Stock held by the Monadnock Charitable Annuity Lead Trust dated May 31, 1996 (the “Monadnock Trust”), for which East Hill Management Company, LLC (“East Hill”) is the investment manager and Mr. Thomas M. Clay is the sole manager of East Hill. |

| [4] | Includes 457,500 shares of Common Stock that are issuable upon the exercise of outstanding, currently exercisable options of Golden Queen held directly by Mr. Thomas M. Clay. |

| [5] | Includes (i) 10,740,600 shares of Common Stock that are issuable upon the exercise of outstanding, currently exercisable warrants of Golden Queen held by the Landon T. Clay 2009 Irrevocable Trust u/a dated March 6, 2006 (the “LTC Trust”), for which Mr. Thomas M. Clay is a trustee; and (ii) 2,759,400 shares of Common Stock that are issuable upon the exercise of outstanding, currently exercisable warrants of Golden Queen held by the Clay Family 2009 Irrevocable Trust u/a dated April 14, 2009 (the “CF Trust” and, together with the LTC Trust, the “Trusts”), for which Mr. Thomas M. Clay is a trustee and has a residual beneficial interest. |

The Board seeks to ensure that it is composed of members whose particular experience, qualifications, attributes and skills, when taken together, will allow the Board to satisfy its oversight responsibilities effectively. The Board as a whole is responsible for identifying, screening and/or appointing persons to serve on the Board. In identifying Board candidates, it is the Board’s goals to identify persons whom it believes have appropriate expertise and experience to contribute to the oversight of a company of the Company’s nature while also allowing for other appropriate factors. The Board believes that the process in place to identify candidates and elect directors allows the most qualified candidates to be appointed independently.

The Company believes that each of the persons standing for election to the Board at the Meeting has the experience, qualifications, attributes and skills that, when taken as a whole, will enable the Board to satisfy its oversight responsibilities effectively.

The Board is responsible for overseeing management of the Company and determining the Company’s strategy and for determining whether or not a director is independent. In making this determination, the Board has adopted the definition of “independence” as set forth in NI 58-101 and NP 58-201 with the recommendation that a majority of the Board be considered “independent”. In applying this definition, the Board considers all relationships of the directors of the Company, including business, family and other relationships.

As at the date of this Proxy Statement, there are four (4) directors on the Board, Paul M. Blythe, Thomas M. Clay, Bryan A. Coates, and Bernard Guarnera. Of the four (4) directors, Paul M. Blythe, Bryan A. Coates, and Bernard Guarnera are considered independent. Thomas M. Clay, Chairman of the Board and Chief Executive Officer, is not considered independent. Following the Meeting, the Board, as proposed by management in this Proxy Statement, will consist of Paul M. Blythe, Thomas M. Clay, Bryan A. Coates, and Bernard Guarnera.

The Board does not have a policy regarding a Board members’ attendance at annual meetings of shareholders. Three (3) directors attended the Company’s 2017 annual meeting of shareholders.

Biographical Information Regarding Executive Officers

Thomas M. Clay - Chairman and Chief Executive Officer.Mr. Clay is the Vice President of East Hill Management Co., LLC and Director of the Clay Mathematics Institute and of Thrombogenics N.V. His business education was completed at Harvard College, Oxford University and Harvard Business School. Mr. Clay has served on the Board of Directors since 2009.

Robert C. Walish, Jr. – Chief Operating Officer.Mr. Walish is the President & Chief Executive Officer of Golden Queen Mining LLC and was most recently the General Manager of the SCM Franke Operation of KGHM International, formerly QuadraFNX, located in northern Chile, where he was responsible for mining, processing and administration of a four million pound per month open-pit copper mining, heap-leach and SX-EW operation. Prior to that and over the course of more than 30 years, Mr. Walish worked at mines in Guyana, Arizona, Alaska, South Carolina, Montana and Nevada. He received his Bachelor of Arts degree from the University of Colorado and his Master of Science degree from the University of Wisconsin.

Guy Le Bel - Chief Financial Officer. Mr. Le Belhas more than 30 years of international mining experience in strategic and financial planning. Until recently, he served as Vice President Evaluations for Capstone Mining Corp. and is a Director of Pembridge Resources, PLC and Westbourne Resources Limited. Previously, Mr. Le Bel was VP, Business Development at Quadra Mining Ltd., and prior to that held business advisory, strategy and planning, business valuation, and financial planning management roles at BHP Billiton Base Metals Ltd., Rio Algom Ltd. and Cambior Inc.

Brenda Dayton – Corporate Secretary. Ms. Dayton has served as Corporate Secretary for several mining companies on the NYSE, TSX and TSX Venture and her expertise includes governance, communications and investor relations. Prior to working with public companies, she worked in the financial industry in banking and insurance. She holds a Bachelor of Arts degree from the University of Calgary.

Proposal 2: Appointment of Independent Auditors

On March 31, 2016, Golden Queen appointed PricewaterhouseCoopers LLP (“PWC”) as its independent registered public accountant, subject to completion of its standard client acceptance procedures. The appointment of PWC was recommended by Golden Queen’s audit committee after considering proposals from several international public accounting firms, including BDO. As a result of PWC’s appointment, Golden Queen’s engagement of BDO Canada LLP, as its independent registered public accounting firm, was terminated.

Although the appointment of PWC is not required to be submitted to a vote of shareholders, the Board believes it is appropriate as a matter of policy to request that shareholders approve the appointment of the independent auditors for the fiscal year ending December 31, 2018, and the authorization of the directors to fix the auditors’ remuneration. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy at the Meeting and entitled to vote is required. In the event a majority of the votes cast at the meeting are not voted in favor of appointment, the adverse vote will be considered as a direction to the Board to select other independent auditors for the fiscal year ending December 31, 2018.

Section 10(A)(i) of the Exchange Act prohibits the Company’s independent auditors from performing audit services for the Company as well as any services not considered to be “audit services” unless such services are pre-approved by the Audit Committee of the Board, or unless the services meet certainde minimis standards.

Under the Company’s Audit Committee Charter, all non-audit services to be performed by the Company’s independent auditors must be approved in advance by the Audit Committee. All of the 2017 audit related fees, and tax fees were pre-approved by the Audit Committee.

See External Auditor Service Fees section for more information.

Representatives of PWC are expected to be present at the Meeting, will have the opportunity to make a statement if they desire to do so, and are expected to be available to respond to questions from Shareholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPOINTMENT OF PRICEWATERHOUSECOOPERS LLP AS GOLDEN QUEEN'S INDEPENDENT AUDITORS FOR THE FISCAL YEAR ENDING DECEMBER 31, 2018, AND THE AUTHORIZATION OF THE DIRECTORS TO FIX THEIR REMUNERATION.

Proposal 3: Approval of UNALLOCATED ENTITLEMENTS UNDER the Company’s Stock Option Plan

The rules of the Toronto Stock Exchange (the “TSX”) provide that every three years after the institution of a security-based compensation arrangement, all unallocated options, rights or other entitlements under such arrangement that does not have a fixed maximum number of securities issuable thereunder, must be approved by a majority of the issuer’s directors and by a majority of the issuer’s shareholders. An “evergreen plan” (being a plan that provides for the replenishment of the number of securities reserved when awards are exercised) does not, by definition, have a fixed maximum number of securities issuable thereunder, and is therefore subject to the requirement that shareholders approve unallocated entitlements every three years. Entitlements are considered to be “allocated” under a plan when they are granted to a participant and entitlements that remain available for grant under a plan are referred to as “unallocated”.

The Board adopted the 2013 stock option plan (the “Stock Option Plan” or the “Plan”) for the benefit of the Company’s Directors, executives, employees and consultants, and Shareholders approved the Stock Option Plan on May 30, 2013. The Board also adopted a house keeping amendment to the Plan on April 27, 2015 to clarify the procedure for fixing the earlier termination date of stock options. Shareholders approved all unallocated entitlements issuable under the Stock Option Plan on June 3, 2015.

The Stock Option Plan has been established to assist the Company in the recruitment and retention of highly qualified executives, employees and eligible consultants by providing a means to reward performance, to motivate participants to achieve important corporate and personal objectives and, to align the interests of participants with the long-term interests of Shareholders. At the Meeting, Shareholders will be asked to approve all unallocated entitlements under the Stock Option Plan. The Board has approved the unallocated options under the Stock Option Plan.

As at December 31, 2017, the Company had 111,148,680 Common Shares issued and outstanding and a maximum of 7,200,000 Common Shares were available for issuance under the Stock Option Plan as at such date. As at December 31, 2017, there were 1,955,002 options granted and outstanding under the Stock Option Plan (representing 1.76% of the Common Shares), leaving 5,244,998 Common Shares (representing 4.72% of the Common Shares) available for grant of further options. As of December 31, 2017, no stock options had been exercised under the Stock Option Plan since 2014.

Under TSX requirements, the Company must disclose the annual burn rate of the Stock Option Plan for each of the Company’s three most recently completed fiscal years. The annual burn rate of the Stock Option Plan is equal to 1.44% for the year ended December 31, 2017, 0.46% for the year ended December 31, 2016 and 0.57% for the year ended December 31, 2015.

The annual burn rate of the Stock Option Plan is calculated as the number of securities granted under the Stock Option Plan during the applicable fiscal year divided by the weighted average number of securities outstanding for the applicable fiscal year. The weighted average number of securities outstanding during the period is the number of securities outstanding at the beginning of the period, adjusted by the number of securities bought back or issued during the period multiplied by a time-weighting factor. The time-weighting factor is the number of days that the securities are outstanding as a proportion of the total number of days in the period; a reasonable approximation of the weighted average is adequate in many circumstances. The weighted average number of securities outstanding is calculated in accordance with the CPA Canada Handbook, as such may be amended or superseded from time to time.

At the Meeting, Shareholders will be asked to consider, and if thought appropriate, pass the following ordinary resolution approving the unallocated entitlements issuable pursuant to the Stock Option Plan:

RESOLVED THAT all unallocated entitlements under the Plan be approved, the Company have the ability to continue granting options under the Plan until June 11, 2021, which is the date that is three (3) years from the date of this Meeting at which shareholder approval is being sought, and any director of officer of the Company be authorized to do such things and to sign, execute and deliver all documents that such director and officer may, in their discretion, determined to be necessary in order to give full effect to the intent and purpose of this resolution.

The Board has unanimously concluded that the approval of the unallocated entitlements under the Stock Option Plan is in the best interest of the Company and its Shareholders, and recommends that Shareholders voteIN FAVOR of the approval of the unallocated entitlements under the Stock Option Plan. The Company has been advised that the Directors and senior officers of the Company intend to vote all Common Shares held by them in favor of the approval of the unallocated entitlements under the Stock Option Plan.In the absence of a contrary instruction, the person(s) designated by management of the Company in the form of proxy intend to vote FOR the approval of the unallocated entitlements under the Stock Option Plan.

Summary of the Stock Option Plan

Set out below is a summary of the material terms of the Stock Option Plan.

| i) | the eligible participants under the Plan are directors, officers, employees and consultants of the Company; |

| ii) | the number of common shares reserved for issuance from time to time under the Plan is 7,200,000, which represents approximately 2.4% of the number of the current issued and outstanding shares of the Company; |

| iii) | if any stock option is exercised or expires or otherwise terminates for any reason, the number of common shares in respect of which the stock option is exercised or expired or terminated shall again be available for the purposes of the Plan; |

| iv) | the aggregate number of options awarded within any one (1) year period to insiders under the Plan or any previously established and outstanding stock option plans or grants, cannot exceed 10% of the issued shares of the Company (calculated at the time of award); or the aggregate number of shares reserved at any time for issuance to insiders upon the exercise of options awarded under the Plan or any previously established and outstanding stock option plans or grants, cannot exceed 10% of the issued shares of the Company (calculated at the time of award); |

| v) | the exercise price for securities under the Plan will be determined by the Board of Directors in its sole discretion as of the date of grant, and shall not be less than: |

| (a) | if the Company’s shares are not listed for trading on an exchange at the date of grant, the last price at which the Company’s shares were issued prior to the date of grant; or |

| (b) | if the Company’s shares are listed for trading on an exchange at the date of grant, the volume-weighted average price for the five (5) trading days immediately prior to the date of grant; |

| vi) | the value of a share for stock appreciation rights shall be determined, unless otherwise specified or permitted by applicable regulatory policies, based on the weighted average trading price per share for the five (5) trading days immediately preceding the date the notice is received by the Company on the Exchange; |

| vii) | a stock appreciation right granted pursuant to the Plan shall entitle the option holder to elect to surrender to the Company, unexercised, the option with which it is included, or any portion thereof, and to receive from the Company in exchange therefore that number of shares, disregarding fractions, having an aggregate value equal to the excess of the value of one share over the purchase price per share specified in such option, times the number of shares called for by the option, or portion thereof, which is so surrendered; |

| viii) | the Board of Directors may grant stock options to any director, officer or employee, together with a bonus consisting of a corresponding right to be paid, in cash, an amount equal to the exercise price of such stock options, subject to such provisos and restrictions as the Board may determine, and subject to any applicable approvals, if required. The options granted as part of the bonus shall be included in, and not in addition to, the maximum number of options which may be granted under the Plan from time to time; |

| ix) | all options granted pursuant to the Plan will be subject to such vesting requirements as may be prescribed by the Exchange, if applicable, or as may be imposed by the Board of Directors; |

| x) | the expiry date of an option shall be the date so fixed by the Board of Directors at the time the particular option is awarded, provided that such date shall not be later than the fifth anniversary of the date of grant of the option. If the expiry date of an option falls within a blackout period, then the expiry date of the option will be the date which is ten (10) business days after the expiry date of the blackout period. The ten (10) business day period may not be extended by the Board; |

| xi) | any options granted pursuant to the Plan will terminate on the date determined by the Board, such date not to exceed one (1) year of the date the option holder ceases to act as a director, officer, or employee of the Company or any of its affiliates, and one year of the date the option holder ceases to act as an employee engaged in investor relations activities, unless such cessation is on account of death. If such cessation is on account of death, the options terminate on the first anniversary of such cessation. If such cessation is on account of cause, or terminated by regulatory sanction or by reason of judicial order, the options terminate immediately. Options that have been cancelled or that have expired without having been exercised shall continue to be issuable under the Plan. The Plan also provides for adjustments to outstanding options in the event of any consolidation, subdivision, conversion or exchange of Company’s shares; |

| xii) | options may not be assigned or transferred; |

| xiii) | subject to subsection xiv) below, the Board may amend the Plan and the terms and conditions of any option thereafter to be granted without shareholder approval, unless shareholder approval is expressly required under any relevant law, rule or regulation, or the policies of the Exchange, including but not limited to the following types of amendments: |

| (a) | an amendment to the purchase price of any option, unless the amendment is a reduction in the purchase price of an option held by an insider; |

| (b) | an amendment to the date upon which an option may expire, unless the amendment extends the expiry of the option held by an insider; |

| (c) | an amendment to the vesting provisions of the Plan and any option granted under the Plan; |

| (d) | an addition to, deletion from or alteration of the Plan or an option that is necessary to comply with the applicable law or the requirements of any regulatory authority or the TSX; |

| (e) | any amendment of a “housekeeping” nature; |

| (f) | any amendment respecting the administration of the Plan; |

| (g) | any other amendment that does not require shareholder approval under the Plan; |

| xiv) | any substantive amendments to the Plan shall be subject to the Company first obtaining the approvals, if required, of: |

| (a) | the shareholders or disinterested shareholders, as the case may be, of the Company at general meetings where required by the rules and policies of the Exchange, or any stock exchange on which the Shares may then be listed for trading; and |

| (b) | the Exchange, or any stock exchange on which the shares may then be listed for trading; |

| xv) | there are no provisions in the Plan for direct financial assistance to be provided by the Company to participants under the Plan to facilitate the purchase of securities under the Plan, although the Plan does permit stock appreciation rights and bonuses to be issued together with options as described above; |

| xvi) | there are no entitlements under the Plan previously granted and subject to approval by security holders; |

| xvii) | any substantive amendments to the Plan shall be subject to the Company first obtaining the approvals, if required, of: |

| (a) | the shareholders or disinterested shareholders, as the case may be, of the Company at general meetings where required by the rules and policies of the Exchange, or any stock exchange on which the Shares may then be listed for trading; and |

| (b) | the Exchange, or any stock exchange on which the shares may then be listed for trading; |

| xviii) | there are no provisions in the Plan for direct financial assistance to be provided by the Company to participants under the Plan to facilitate the purchase of securities under the Plan, although the Plan does permit stock appreciation rights and bonuses to be issued together with options as described above; and |

| xix) | there are no entitlements under the Plan previously granted and subject to approval by security holders. |

A copy of the Stock Option Plan was filed on SEDAR at www.sedar.com on May 2, 2013 as a schedule to the Company’s Management Information Circular and on EDGAR at www.sec.gov on April 30, 2013 as a schedule to the Company’s Proxy Statement. Shareholders may request additional copies by (i) mail to: 2300 – 1066 West Hastings Street, Vancouver, BC V6E 3X2 or (ii) telephone to: (778) 373-1557.

DIRECTORS AND EXECUTIVE OFFICERS

The following table contains information regarding the members and nominees of the Board of Directors and the Executive of Golden Queen as of the Record Date:

| Name | | Age | | | Position | | Position Held Since |

| Thomas M. Clay | | | 33 | | | Director

Chairman

CEO | | January 13, 2009

May 30, 2013

August 10, 2015 |

| Bryan A. Coates | | | 59 | | | Director | | January 28, 2013 |

| Bernard Guarnera | | | 74 | | | Director | | May 30, 2013 |

Paul Blythe

Robert C. Walish, Jr. | | | 65 65 | | | Director

COO | | March 30, 2017

August 10, 2015 |

Guy Le Bel

Brenda Dayton | | | 59 50 | | | CFO

Corporate Secretary | | March 16, 2017

October 1, 2015 |

All of the officers identified above serve at the discretion of the Board and have consented to act as directors of the Company.

RELATIONSHIPS AMONG DIRECTORS OR EXECUTIVE OFFICERS

There are no family relationships among any of the existing directors or executive officers of Golden Queen.

SECURITY OWNERSHIP OF MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of April 18, 2018 by:

| (i) | each director of Golden Queen; |

| (ii) | each of the Named Executive Officers of Golden Queen; and |

| (iii) | all directors and executive officers as a group. |

Except as noted below, Golden Queen believes that the beneficial owners of the Common Stock listed below, based on information furnished by such owners, have sole voting and investment power with respect to such shares, except as noted in the footnote below the table.

Name and Address of

Beneficial Owner | | Shares

Beneficially Owned | | | Percentage of Shares

Beneficially Owned (on a partially diluted basis) | |

| | | | | | | |

THOMAS M. CLAY,Director, Chairman & Chief Executive Officer Providence, RI | | | 147,122,375[1][2] | | | | 46.85 | % |

| | | | | | | | | |

BRYAN A. COATES,Director Saint-Lambert, QC | | | 408,000[1][3] | | | | 0.12 | % |

| | | | | | | | | |

BERNARD GUARNERA,Director Las Vegas, NV | | | 407,500[1] | | | | 0.12 | % |

| | | | | | | | | |

GUY LE BEL,Former Director and Chief Financial Officer[4] Repentigny, QC | | | 962,501[1] | | | | 0.29 | % |

| | | | | | | | | |

PAUL M. BLYTHE,Director[5] Collingwood, ON | | | 1,730,000[1] | | | | 0.53 | % |

| | | | | | | | | |

ROBERT C. WALISH, JR.,Chief Operating Officer Mojave, CA | | | nil | | | | 0.0 | % |

| | | | | | | | | |

ANDRÉE ST-GERMAIN,Chief Financial Officer[6] Vancouver, BC | | | nil | | | | 0.0 | % |

| | | | | | | | | |

BRENDA DAYTON,Corporate Secretary Vancouver, BC | | | 220,000[1] | | | | 0.07 | % |

| | | | | | | | | |

| All officers and directors (8) persons | | | 150,850,376 | | | | 47.98 | % |

| [1] | These amounts include beneficial ownership of securities not currently outstanding but which are reserved for immediate issuance on exercise of options. In particular, these amounts include shares issuable upon exercise of options as follows: 457,500 shares issuable to Thomas M. Clay, 207,500 shares issuable to Bryan A. Coates, 632,502 shares issuable to Guy Le Bel, 150,000 shares issuable to Paul M. Blythe, 382,500 shares issuable to Bernard Guarnera, and 220,000 shares issuable to Brenda Dayton. |

| [2] | Includes (i) 6,658,116 shares held directly by Mr. Thomas M. Clay; (ii) 118,419,672 shares held by the Estate of Landon Thomas Clay, for which Mr. Thomas M. Clay is the executor; (iii) 248,082 shares held by LTC Corporation, for which Mr. Thomas M. Clay is President; (iv) 7,031,755 shares held by Monadnock Charitable Lead Annuity Trust, for which East Hill Management Company, LLC (“East Hill”) is the investment manager and Mr. Thomas M. Clay is the sole manager of East Hill; (v) 807,250 shares held by Arctic Coast Petroleums, Ltd. , for which Mr. Thomas M. Clay is a director; ( vi) the shares issuable upon exercise of the 2,759,400 warrants held by the Clay Family 2009 Trust, for which Mr. Thomas M. Clay is a trustee and has a residual beneficial interest; and (vii) the shares issuable upon exercise of the 10,740,600 warrants held by Landon T. Clay 2009 Trust, for which Mr. Thomas M. Clay is a trustee. |

| [3] | Includes 8,500 shares issuable upon exercise of warrants. |

| [4] | Guy Le Bel assumed the role of Chief Financial Officer on March 16, 2017, and resigned as director on March 30, 2017. |

| [5] | Paul M. Blythe was appointed as a director of the Company on March 30, 2017. |

| [6] | Andrée St-Germain resigned from the Company on March 16, 2017. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires Golden Queen’s directors, executive officers and persons who own more than 10% of a registered class of Golden Queen’s securities to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of Golden Queen. Directors, executive officers and greater than 10% shareholders are required by SEC regulation to furnish Golden Queen with copies of all Section 16(a) reports they file.

To the Company’s knowledge, based solely on a review of Forms 3 and 4, as amended, furnished to it during its most recent fiscal year, and Form 5, as amended, furnished to it with respect to such year, other than as disclosed in this Proxy Statement, the Company believes that during the year ended December 31, 2017, its directors, executive officers and greater than 10% shareholders complied with all Section 16(a) filing requirements of the Securities Exchange Act of 1934.

DIRECTORS COMPENSATION

The following table sets out the compensation provided to the members of the Board during the Company’s year ended December 31, 2017:

| Name | | Fees

Earned or Paid in Cash ($) | | | Stock Awards ($) | | | Option Awards ($)(4) | | | Non-Equity Incentive Plan Compensation ($) | | | Change in Pension Value and Non-Qualified Deferred Compensation Earnings | | | All Other Compensation ($) | | | Total ($) | |

| Thomas M. Clay | | | 100,000 | | | | Nil | | | | 38,250 | | | | Nil | | | | N/A | | | | Nil | | | | 138,250 | |

| Bryan A. Coates | | | 35,000 | | | | Nil | | | | 22,950 | | | | Nil | | | | N/A | | | | Nil | | | | 57,950 | |

| Bernard Guarnera(1) | | | 35,000 | | | | Nil | | | | 22,950 | | | | Nil | | | | N/A | | | | Nil | | | | 57,950 | |

| Paul M. Blythe(2) | | | 26,250 | | | | Nil | | | | 22,950 | | | | Nil | | | | N/A | | | | Nil | | | | 49,200 | |

| Guy Le Bel(3) | | | 7,292 | | | | Nil | | | | Nil | | | | Nil | | | | N/A | | | | Nil | | | | 7,292 | |

| (1) | Director fees earned by Bernard Guarnera were paid to Broadlands Mineral Advisory Services Ltd., a company which he controls |

| (2) | Paul M. Blythe joined the Board of Directors on March 30, 2017 |

| (3) | Guy Le Bel resigned from the Board of Directors on March 30, 2017 |

| (4) | The fair value on October 20, 2017, the grant date was calculated using the Black-Scholes option pricing model, with the following assumptions – risk-free interest rate of 1.7%; dividend yield of $nil; expected volatility of 79.17%; expected life of 5 years. |

It is currently the policy of the Company to grant options to purchase Common Shares to its directors under the Company’s 2013 Stock Option Plan.

Other than as disclosed in this Proxy Statement and Management Information Circular, there are no other arrangements under which directors of the Company were compensated by the Company during the year ended December 31, 2017 for their services in their capacity as directors and, without limiting the generality of the foregoing, no additional amounts are payable under any standard arrangements for committee participation or special assignments, except that the Articles of the Company provide that the directors are entitled to be paid reasonable traveling, hotel and other expenses incurred by them in the performance of their duties as directors. The Company’s Articles also provide that if a director is called upon to perform any professional or other services for the Company that, in the opinion of the directors, is outside of the ordinary duties of a director, such director may be paid a remuneration to be fixed by the directors and such remuneration may be either in addition to or in substitution for any other remuneration that such director may be entitled to receive.

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth information concerning the total compensation of Golden Queen’s president and chief executive officer, chief financial officer, and the chief operating officer (the “Named Executive Officers”) during the last three completed fiscal years for services rendered to Golden Queen in all capacities.

Name and Principal Position | | | Year | | | | Salary ($) | | | | Bonus ($) | | | | Stock Awards ($) | | | | Option Awards ($)[1] | | | | Non-Equity Incentive Plan Compensation ($) | | | | Nonqualified Deferred Compensation Earnings ($) | | | | All Other Compensation ($) | | | | Total ($) | |

Thomas M. Clay[2] Chairman & CEO | | | 2017

2016 | | | | 100,000 33,333 | | | | Nil Nil | | | | Nil Nil | | | | 38,250 Nil | | | | Nil Nil | | | | Nil Nil | | | | Nil Nil | | | | 138,250 33,333 | |

| | | | 2015 | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | | | | Nil | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Robert C. Walish, Jr.[3] COO | | | 2017

2016

2015 | | | | 175,000 115,984 116,667 | | | | 87,500 75,000 51,065 | | | | Nil Nil Nil | | | | Nil Nil Nil | | | | Nil Nil Nil | | | | Nil Nil Nil | | | | Nil Nil Nil | | | | 262,500 226,065 191,667 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Guy Le Bel,[4]

CFO | | | 2017

2016

2015 | | | | 126,058 N/A N/A | | | | 19,785 N/A N/A | | | | Nil N/A N/A | | | | 216,851 N/A N/A | | | | Nil N/A N/A | | | | Nil N/A N/A | | | | Nil N/A N/A | | | | 362,694 N/A N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Andrée St-Germain[5] Former CFO | | | 2017

2016

2015 | | | | 37,216 133,572 135,817 | | | | 31,412 30,583 167,783 | | | | Nil Nil Nil | | | | Nil 15,195 141,181 | | | | Nil Nil Nil | | | | Nil Nil Nil | | | | Nil Nil Nil | | | | 68,628 179,350 444,781 | |

| [1] | The determination of the value of option awards is based upon the Black-Scholes Option pricing model, details and assumptions of which are set out in the Company’s consolidated financial statements for the fiscal years ended December 31, 2015, December 31, 2016 and December 31, 2017. |

| [2] | Thomas M. Clay was appointed the Chief Executive Officer on August 10, 2015. |

| [3] | Guy Le Bel assumed the role of Chief Financial Officer on March 16, 2017, and resigned as director on March 30, 2017. |

| [4] | Andrée St-Germain was appointed the Chief Financial Officer on September 18, 2013 and resigned on March 16, 2017. |

OPTION GRANTS DURING THE MOST RECENTLY COMPLETED FISCAL YEAR

The Board approves the issuance of stock options to our directors, officers, employees and consultants. Unless otherwise provided by the Board of Directors, all vested options are exercisable for a term of five (5) years from the date of grant. During the fiscal year ended December 31, 2017, there were 1,605,001 options granted to the Company’s directors, officers and employees.

OUTSTANDING EQUITY AWARDS AT THE MOST RECENTLY COMPLETED FISCAL YEAR

The following table sets forth the information concerning all option-based awards outstanding for each of Golden Queen’s Named Executive Officers as of December 31, 2017:

Name and Principal Position | | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | | Equity Incentive Plan Awards; Number of Securities Underlying Unexercised Unearned Options (#) | | | | Option Exercise Price ($) | | | Option Expiration Date |

Thomas M. Clay Chairman & CEO(1) | | | 107,500 100,000 250,000 | | | | 107,500 100,000 Nil | | | | Nil Nil 250,000 | | | | $0.58 $0.66 $0.29 | | | September 8, 2020

November 30, 2021

October 20, 2022 |

| | | | | | | | | | | | | | | | | | | |

Guy Le Bel CFO(2) | | | 50,000 107,500 75,000 400,002 249,999 | | | | 50,000 107,500 75,000 133,334 Nil | | | | Nil Nil Nil 266,668 249,999 | | | | $1.67 $0.58 $0.66 $0.65 $0.29 | | | September 4, 2018

September 8,2020

November 30, 2021

March 20, 2022

October 20, 2022 |

| [1] | Thomas M. Clay was appointed as Chief Executive Officer on August 10, 2015. |

| [2] | Guy Le Bel assumed the role of Chief Financial Officer on March 16, 2017 and resigned as director on March 30, 2017. |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets out information as of the end of the fiscal year ended December 31, 2017 with respect to compensation plans under which equity securities of the Company are authorized for issuance:

| Plan Category | | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights (a) | | | Weighted-Average Exercise Price of Outstanding Options. Warrants and Rights (b) | | | Number of Securities Remaining Available for Future Issuances Under Equity Compensation Plan [Excluding Securities Reflected in Column (a)] (c) | |

Equity Compensation

Plans Approved by

Security Holders | | | 50,000 150,000 430,000 365,000 400,002 1,204,999 | | | $ $ $ $ $ $ | 1.16 1.59 0.58 0.66 0.65 0.29 | | | | 4,599,999 | |

Equity Compensation

Plans Not Approved by

Security Holders | | | Nil | | | | Nil | | | | Nil | |

| Total: | | | 2,600,001 | | | $ | 0.54 | | | | 4,599,999 | |

AGGREGATED STOCK OPTION EXERCISES DURING THE MOST RECENTLY COMPLETED FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

There were no stock options exercised by the Named Executive Officers during the Company’s fiscal year ended December 31, 2017.

TERMINATION OF EMPLOYMENT, CHANGE IN RESPONSIBILITIES AND EMPLOYMENT CONTRACTS

The Company has entered into consulting or employment contracts with each of the Named Executive Officers as follows:

The Company entered into an amended and restated employment contract on October 1, 2017 with Brenda Dayton who is employed as Corporate Secretary of the Company effective October 1, 2015. Her employment with the Company will continue without fixed term. Her position as officer of the Company will be renewed annually subject to the approval of the Board. Ms. Dayton is entitled to an annual salary of C$110,000, subject to periodic review in accordance with Company practice. Pursuant to the contract, if Ms. Dayton is terminated by the Company without cause or terminated by Ms. Dayton for good reason, within 12 months following a change of control, she will be entitled to receive a lump-sum severance payment equal to her gross annual salary and two (2) times her annual bonus. Ms. Dayton is also entitled to participate in the Company’s stock option plan.

The Company entered into an employment contract on March 16, 2017 with Guy Le Bel pursuant to which Mr. Le Bel assumed the role of Chief Financial Officer. Mr. Le Bel is entitled to an annual salary of C$175,000 and a one-time signing bonus of C$25,000. Thereafter, Mr. Le Bel may be paid bonuses at the sole discretion of the Board. Mr. Le Bel also received an initial grant of 400,002 stock options to purchase common shares of the Company for a period of 5 years. The stock options will vest as follows: 133,334 options at 12 months, 133,334 options at 24 months, and 133,334 options at 36 months. Mr. Le Bel is also entitled to participate in the Company’s stock option plan. If Mr. Le Bel is terminated by the Company without cause after the first six (6) months of his employment, he will be entitled to twelve (12) months base salary being C$175,000 and 100% of the last annual Target Bonus granted. In the event that the employment of Mr. Le Bel is terminated by the Company or its successor without cause, or is terminated by Mr. Le Bel for good reason, in either case within three (3) months following a change of control, he will be entitled to receive a lump-sum severance payment equal to twenty-four (24) months base salary, being C$350,000, and two (2) times his annual bonus.

REPORT OF CORPORATE GOVERNANCE

The Canadian Securities Administrators have adopted National Instrument 58-101Disclosure of Corporate Governance Practices (“NI 58-101”) and National Policy 58-201Corporate Governance Guidelines(“NP 58-201”) (the “Guidelines”), both of which came into force as of June 30, 2005 and effectively replaced the corporate governance guidelines and disclosure policies of the Exchange. NI 58-101 requires issuers such as the Company to disclose the corporate governance practices that they have adopted, while NP 58-201 provides guidance on corporate governance practices. In this regard, a brief description of the Company’s system of corporate governance, with reference to the items set out in NI 58-101 and NP 58-101 is set forth below.

The Board and management recognize that effective corporate governance is important to the direction and operation of the Company in a manner in which ultimately enhances shareholder value. As a result, the Company has developed and implemented, and continues to develop, implement and refine formal policies and procedures which reflect its ongoing commitment to good corporate governance. The Company believes that the corporate governance practices and procedures described below are appropriate for a company such as the Company.

Board of Directors

NP 58-201 recommends that boards of directors of reporting issuers be composed of a majority of independent directors. With three (3) of the four (4) current directors considered independent, the Board is currently composed of a majority of independent directors. Mr. Clay, in his role as CEO and the Chairman of the Board is not deemed independent. The Board holds regular meetings. Between the scheduled meetings, the Board meets as required. Management also communicates informally with directors on a regular basis, and solicits advice from directors on matters falling within their special knowledge or experience.

Chairman of the Board

Thomas M. Clay, a non-independent director, was appointed Chairman of the Board on June 10, 2014. Mr. Clay’s primary roles as Chairman are to chair all meetings of the Board and to manage the affairs of the Board, including ensuring the Board is organized properly, functions effectively and meets its obligations and responsibilities. The Chairman’s responsibilities include, among other things, ensuring effective relations and communications among Board members.

The Company does not have a chairman that is independent or a lead independent director. Given the size of the Board, the Board believes that the presence of three (3) independent directors out of the four (4) directors currently on the Board, each of whom sits on the Board’s committees, is sufficient independent oversight of the Chairman of the Board and Chief Executive Officer. The independent directors work well together in the current Board structure and the Board does not believe that selecting an independent chairman or a lead independent director would add significant benefits to the Board oversight role.

Director Meetings

The Board meets on a regular basis and holds additional meetings as considered appropriate to deal with the matters arising from developments in the business and affairs of the Company from time to time. During the fiscal year ended December 31, 2017, the Board held four (4) regular meetings, including an in-person Board meeting held on site. In addition to the business conducted at such meetings, various other matters were discussed by phone and approved by written resolution signed by all members of the Board.

The Company does not have a policy with regard to Board members’ attendance at annual meetings of Shareholders.

Board Mandate

The Board is responsible for the overall stewardship of the Company. The Board discharges this responsibility directly and through the delegation of specific responsibilities to committees of the Board. The Board works with management to establish goals and strategies for the Company, to identify principal risks, to select and assess senior management and to review significant operational and financial matters. The Board’s mandate is available on the Company’s website atwww.goldenqueen.com.

Position Descriptions

The Board has developed written position descriptions for the Chairman of the Board, the Directors of the Board, each chair of each board committee, and for the Chief Executive Officer of the Company, which are available on the Company’s website atwww.goldenqueen.com.

Orientation and Continuing Education

The Company provides new directors with an overview of their role as a member of the Board and its Committees, and the nature and operation of the Company’s business and affairs. New directors also have the opportunity to discuss the Company’s affairs with legal counsel and with the Company’s independent auditors. New directors are also provided with opportunities to visit the mine site in Mojave and are invited to have discussions with the Company’s operating personnel. In 2016, all of the directors visited the Soledad Mountain Project and had the opportunity to meet with local stakeholders and tour the project facilities.

The Company does not provide formal continuing education to its Board members, but does encourage them to communicate with management, independent auditors and consultants. Board members are also encouraged to participate in industry-related conferences, meetings and education events to maintain their skills and knowledge necessary to meet their obligations as directors of the Company.

Code of Business Conduct

The Board has adopted a Code of Business Conduct (the “Code”), which is distributed to officers, management and employees of the Company. To ensure and monitor compliance with the Code, the Board has adopted a Whistle-blower Policy. A request for a waiver of any provision of the Code can be made in writing to the Audit Committee, however, such waiver must be approved by the Board. During the recently completed fiscal year, there was no conduct by an officer, by management or an employee that constituted a departure from the Code. The Board has also adopted a Code of Ethics for Senior Financial Officers. The Company’s Code of Business Conduct and Code of Ethics for Senior Financial Officers are available on the Company’s website atwww.goldenqueen.com.

If a director or senior officer has a material interest in a transaction or agreement being considered by the Company, such individual is precluded from voting on the matter and the Board considers such matter without the individual present.

Assessments

Based upon the Company’s size, its current stage of development and the number of individuals on the Board, the Board considers a formal process for assessing the effectiveness and contribution of the Board as a whole, its committees or individual directors to be unnecessary at this time. The Board and its committees meet on numerous occasions during each year, each director having regular opportunity to assess the Board as a whole, its committees, and other directors in relation to assessment of the competencies and skills that the Board as a whole, its committees and directors should possess. The Board will continue to evaluate its own effectiveness and the effectiveness of its committees and individual directors in such manner.

Board Leadership Structure

The Board does not have an express policy regarding the separation of the roles of the Chairman of the Board and Chief Executive Officer, as the Board believes that it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. The Board has reviewed the Company’s current Board leadership structure. Thomas M. Clay has been the Company’s Chairman of the Board since May 2013 and assumed the role of Chief Executive Officer on August 10, 2015. In light of the composition of the Board, the Company’s size, the nature of the Company’s business, the regulatory framework under which the Company operates, the Company’s shareholder base, the Company’s peer group and other relevant factors, the Board believes that the current leadership structure is appropriate. Mr. Clay brings complimentary attributes to the Company’s business operations and strategic plans and generally are focused on somewhat different aspects of the Company’s operations.

The Company does not have a lead independent director. Given the size of the Board, the Board believes that the presence of three (3) independent directors out of the four (4) directors currently on the Board, each of whom sits on the Board’s committees, is sufficient independent oversight of the Chairman of the Board and Chief Executive Officer. The independent directors work well together in the current Board structure and the Board does not believe that selecting a lead independent director would add significant benefits to the Board oversight role.

Also, the Board does not have a formal policy with respect to the consideration of diversity when assessing directors and director candidates, but considers diversity as part of its overall assessment of the Board’s functions and needs.

Board’s Role in Risk Oversight

The understanding, identification and management of risk are essential elements for the successful management of the Company. Management is charged with the day-to-day management of the risks the Company faces. However, the Board, directly and indirectly through its committees, is actively involved in the oversight of the Company’s risk management policies. The Board is charged with overseeing enterprise risk management, generally, and with reviewing and discussing with management the Company’s major risk exposure (whether financial, operating or otherwise) and the steps management has taken to monitor, control and manage these exposures, including the Company’s risk assessment and risk management guidelines and policies. Additionally, the Compensation Committee oversees the Company’s compensation policies generally, in part to determine whether or not they create risks that are reasonably likely to have a material adverse effect on the Company.

Board Term Limits

The Company has not adopted term limits for the directors on the Board or other mechanisms of board renewal because the Company believes that the imposition of term limits for its directors may lead to the exclusion of potentially valuable members of the Board. While there is a benefit to adding new perspectives to the Board from time to time, there are also benefits to having continuity and directors having in-depth knowledge of the Company’s business. The Company’s Nominating Committee considers, among other factors, skills, experience, and tenure when identifying potential director nominees.

Gender Diversity