- WPC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

W. P. Carey (WPC) 8-KFinancial statements and exhibits

Filed: 14 Apr 04, 12:00am

WPC Corporate Overview

New York Society of Security Analysts

14th Annual REIT Conference

April 14, 2004

Serving Investors Since 1973

© Copyright W. P. Carey & Co. LLC 2004

Table of Contents

2

Page

Corporate Overview

3-5

Market Opportunity

6

Unique Business Model

7-8

Diversified Stable Portfolio

9-11

Management/Advisory Business

12-17

W. P. Carey Fundamentals

18-26

Running the Business as Owners

27

Corporate Overview

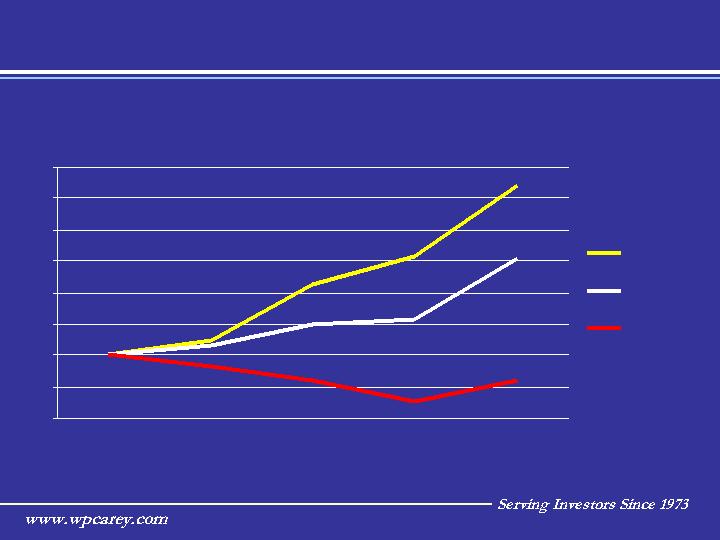

Returns Since W. P. Carey’s Merger in 2000

3

50

75

100

125

150

175

200

225

250

6/28/2000

2000

2001

2002

2003

WPC

NAREIT

S&P 500

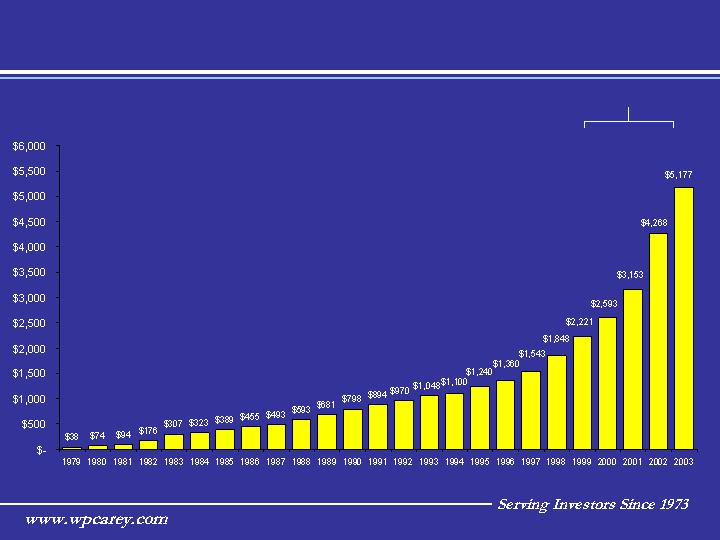

Since listing on the NYSE in 1998, funds from operations have grown at a 17% compound annual growth rate.

Growth in FFO

Corporate Overview

($ in millions)

4

Corporate Overview

Leading Sale-Leaseback Investor

30 years as premier sale-leaseback investor

Expertise across many industries

Ability to underwrite extremely complex

transactions

5

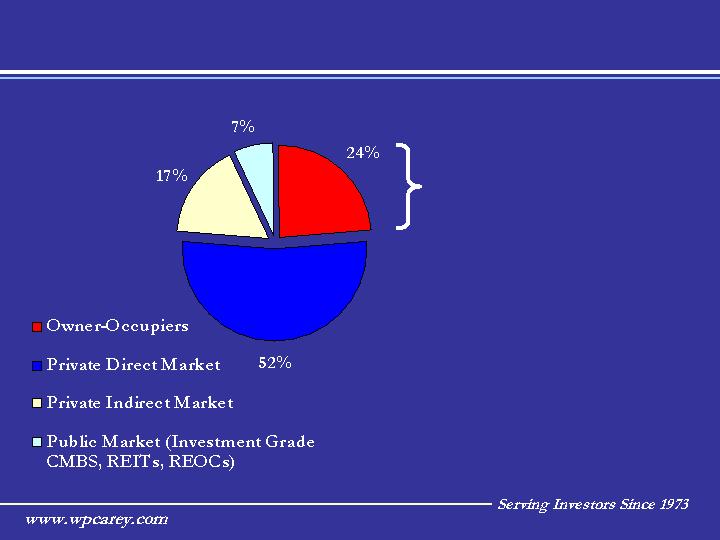

Approximately 24% of

commercial real estate is

owner-occupied,

representing over $1

trillion in investment

opportunity

Domestic Market Opportunity

Ownership of U.S. Commercial Real Estate*

*(Source: Jones Lang LaSalle)

6

Unique Business Model

W. P. Carey & Co. LLC

OWNS

MANAGES

Generates 54% of its revenue by

managing day-to-day operations

and new real estate investments

$800 million in

net-leased real estate

Generates 46% of its revenue

through rental income from its

owned assets.

$4.4 billion in net-leased

real estate

DIVERSIFIED STABLE

PORTFOLIO

CPA® REITS

7

Why a Limited Liability Company (LLC)?

Unique Business Model

LIMITED LIABILITY

COMPANY

OWNS

C Corp

Carey Asset Management

CURRENT

STRUCTURE

MANAGES

Taxation – More efficient than REIT or C-Corp. Minimizes corporate level

taxation

Operating flexibility – Less restrictive than a REIT on sources of revenue and

real estate business activity

The LLC structure provides W. P. Carey's management with the

flexibility it needs to implement the Company's unique business model

while providing its shareholders with the most efficient tax treatment.

8

W. P. Carey & Co. LLC

OWNS

MANAGES

$800 million in

net-leased real estate

Generates 46% of its revenue

through rental income from its

owned assets.

DIVERSIFIED STABLE

PORTFOLIO

Diversified Stable Portfolio

9

Diversified Income

5.0%

-

7.5%

0

2.5%

-

5.0%

2

2.5% or Less

95

10

MANAGES

OWNS

W. P. Carey & Co. LLC

Diversified Stable Portfolio

% of Total Revenues # of Tenants/Guarantors

Only two tenants represent more than 2.5% of W. P. Carey’s total revenues

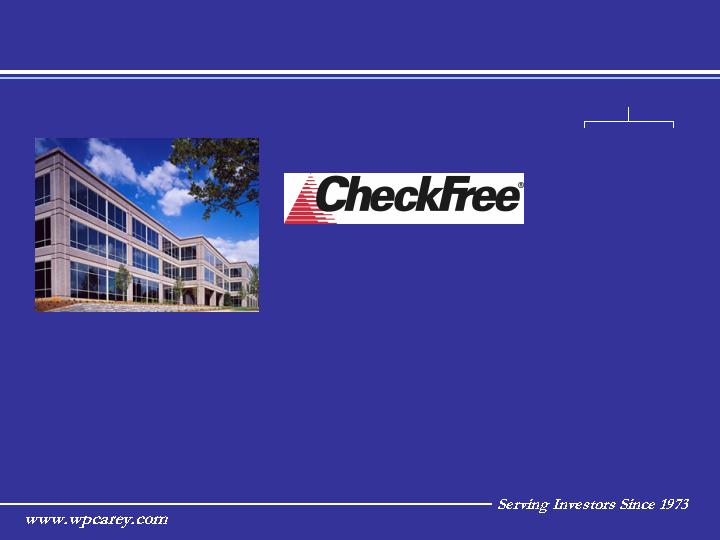

Diversified Stable Portfolio

Location: Norcross, GA

Purchase Price: $42 million

Lease Term: December 2015

Rent Escalation Provision: CPI Indexed

CheckFree Corporation

Corporate Office Headquarters Campus

11

MANAGES

OWNS

W. P. Carey & Co. LLC

Management/Advisory Business

W. P. Carey & Co. LLC

OWNS

MANAGES

Generates 54% of its revenue by

managing day-to-day operations

and new real estate investments.

$4.4 billion in net-leased

real estate

CPA® REITS

12

Institutional - Carey Institutional Properties (CIP®)

- Variety of pension fund clients

- Formerly exclusive CalPERS advisor for net lease asset class

Individual - Corporate Property Associates (CPA®) series

- More than 80,000 investors in CPA® funds

- Sold through relationships with UBS Financial Services, Inc., American

Express Financial Advisors, and 30 additional broker/dealers

Investment Attributes

- Yield

- Low volatility

- Preservation of capital

- Upside “kicker”

Management/Advisory Business

W. P. Carey & Co. LLC

OWNS

MANAGES

13

Unusually Valuable Franchise

Superior Performance

- All funds have met or exceeded investor expectations

- No full-term investor has lost money in any program

- Ten programs have gone full cycle to liquidity with average annual return of 12%

- Distributed 680 dividends with 89% of those larger than the preceding one

Structure

- Designed as closed-end funds

- CPA ®: 12, CPA®: 14 and CPA® : 15 were structured with redemption programs;

redemptions totaled less than 0.2% of assets in 2002

Management/Advisory Business

W. P. Carey & Co. LLC

OWNS

MANAGES

14

Convergence of Two Major Trends

Investor interest in yield investments

Corporations facing capital market constraints

Investor

interest in

yield

investments

and stability

Corporate

capital

constraints and

desire to shed

real estate

W. P. Carey & Co. LLC

Management/Advisory Business

W. P. Carey & Co. LLC

OWNS

MANAGES

15

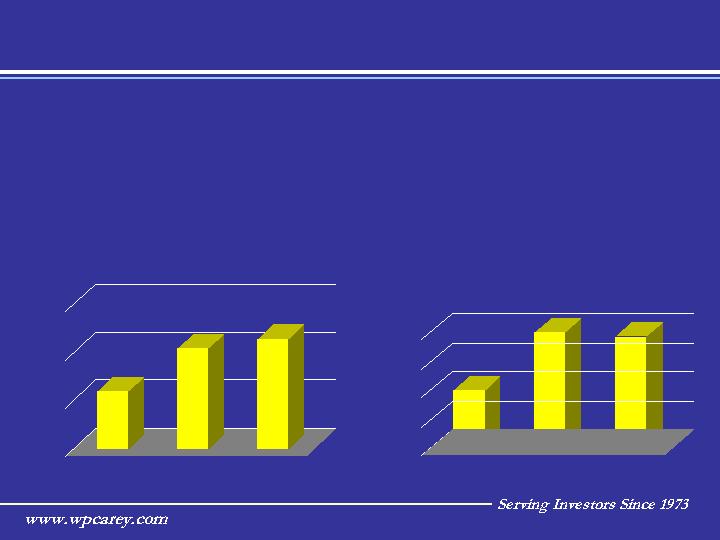

($ in millions)

Growth in Assets Under Ownership and Management

W. P. Carey & Co. LLC

OWNS

MANAGES

Total assets under management and ownership have grown at a compound annual rate of 23% over the last 24 years

Management/Advisory Business

16

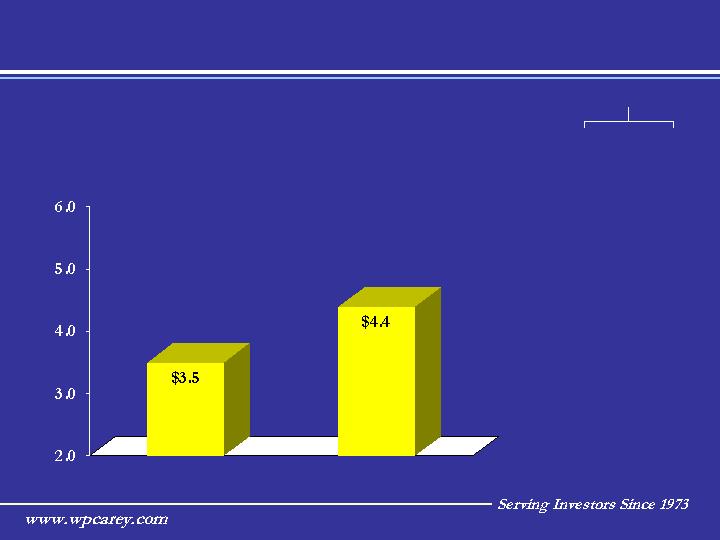

Assets Under Management Growth

Management/Advisory Business

($ in billions)

Year-Over-Year

Growth in

Assets Under

Management

26%

billion

billion

December 2002

December 2003

W. P. Carey & Co. LLC

OWNS

MANAGES

17

WPC Fundamentals

18

WPC Financial Results

(in thousands except per share amounts)

19

12 Months Ended

12 Months Ended

12 Months Ended

12/31/01

12/31/02

12/31/03

Revenues:

Principal Revenues

$92,500

$86,670

$80,840

Management Revenues

$46,911

$84,255

$88,060

Expenses:

Interest Expense

$21,603

$16,134

$15,116

G&A Expense

$29,435

$42,592

$43,698

Net Income:

$35,761

$46,588

$62,878

Per Share

$1.02

$1.28

$1.65

WPC Financial Results

(in thousands except per share amounts)

Funds from Operations

Funds from Operations

(in millions)

20

$84

$102

$106

$60

$80

$100

$120

2001

2002

2003

2003

2002

2001

$3.00

$2.80

$2.60

$2.40

$2.20

$2.00

$2.78

$2.81

$2.41

12 Months Ended

12 Months Ended

12 Months Ended

12/31/01

12/31/02

12/31/03

Funds From Operations:

$84,160

$102,013

$105,518

Per Share (Diluted)

$2.41

$2.81

$2.78

WPC Financial Results

(in thousands except per share amounts)

21

12 Months Ended

12 Months Ended

12 Months Ended

12/31/01

12/31/02

12/31/03

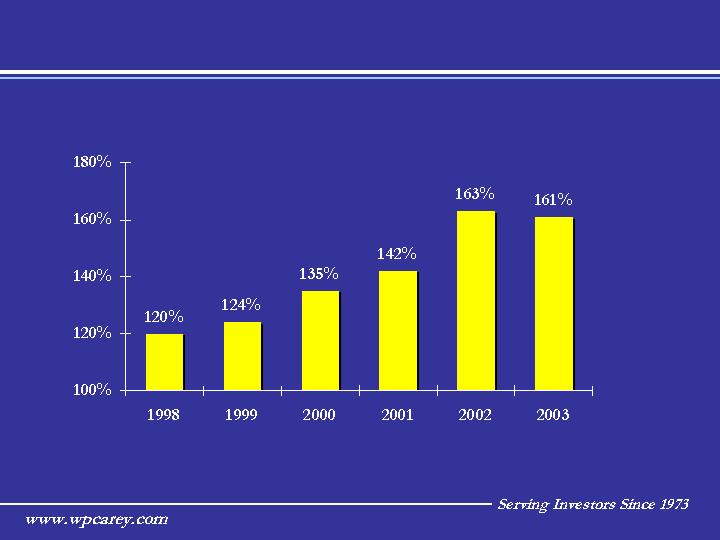

Per Share:

Funds From Operations

$2.41

$2.81

$2.79

Dividend

$1.704

$1.72

$1.73

Dividend Coverage

141%

163%

161%

Average Shares Outstanding

34,952

36,265

38,008

Balance Sheet:

Total Assets

$915,883

$893,524

$906,505

Non-Recourse Mortgage Payable $200,515

$186,049

$180,193

Notes Payable

$95,000

$49,000

$29,000

WPC Capital Structure

(in thousands except per share amounts)

22

Market Capitalization:

WPC

Equity Market Capitalization

$966,364

Debt Market Capitalization

$209,193

Total Market Capitalization

$1,175,557

WPC

NAREIT

Equity % of Total Market Cap

82%

61%

Debt % of Total Market Cap

18%

39%

Unsecured Debt % of Total Market Cap

2.5%

19%

Source: NAREIT, SEC Filings, SNL DataSource

WPC Conservative Approach

W. P. Carey & Co. and its affiliates continue to provide investors with a safe, steady flow

of income and have paid more than 680 consecutive dividends.

Dividend Coverage Since Listing

23

FFO Multiple vs. REIT Peer Group

W. P. Carey Current Valuation

24

Close

4/12/03

2003 FFO

FFO Multiple

AMB Property

$32.10

$2.13

15.1

Alexandria Real Estate

$57.75

$4.23

13.7

Capital Automotive REIT

$29.42

$2.40

12.3

Commercial Net Lease Rlty

$17.18

$1.46

11.8

Lexington Corp. Properties

$19.25

$1.82

10.6

Realty Income

$37.80

$2.92

12.9

Washington REIT

$27.57

$2.04

13.5

iSTAR Financial

$38.18

$3.25

11.7

ProLogis Trust

$30.75

$2.41

12.8

W. P. Carey & Co. LLC

$26.30

$2.78

9.5

Peer Average

12.7

Dividend Yield vs. REIT Peer Group

W. P. Carey Current Valuation

WPC is currently yielding over 240 basis points above the 10-Year Treasury while the

NAREIT Equity Index is yielding 150 basis points above the 10-Year Treasury

25

Close

4/12/03

FFO Multiple

Yield

Div. Coverage

AMB Property

$32.10

15.8

5.30%

129%

Alexandria Real Estate

$57.75

13.7

4.16%

198%

Capital Automotive REIT

$29.42

12.3

5.66%

146%

Commercial Net Lease Rlty

$17.18

11.8

7.45%

114%

Lexington Corp. Properties

$19.25

10.6

7.27%

136%

Realty Income

$37.80

12.9

6.39%

124%

Washington REIT

$27.57

13.5

5.40%

136%

iSTAR Financial

$38.18

11.7

7.44%

123%

ProLogis Trust

$30.75

12.8

4.75%

167%

W. P. Carey & Co. LLC

$26.30

9.5

6.63%

161%

Peer Average

5.98%

141%

FFO Multiple vs. Investment Manager Peer Group

W. P. Carey Current Valuation

26

Close

4/12/03

2003 Net Income

P/E Ratio

Alliance Capital

$36.93

$2.11

17.5

Franklin Resources

$57.06

$2.22

25.7

BlackRock

$63.90

$2.36

27.1

Eaton Vance

$39.21

$1.60

24.5

Federated Investors

$31.75

$1.83

17.3

Janus Capital Group

$16.70

$0.86

19.4

Legg Mason

$99.10

$3.57

27.8

T. Rowe Price

$53.90

$1.77

30.5

Gabelli Asset Mgmt

$40.50

$1.64

24.7

W.P. Stewart

$20.55

$0.96

21.4

Waddell & Reed

$24.52

$1.13

21.7

W. P. Carey & Co. LLC

$26.30

$1.65

15.9

Peer Average

23.4

Running the Business as Owners

13.90%

Fortune 500

16.71%

Equity REIT Industry

8.16%

Peer Group

39.70%

WPC

% of Management Ownership as of 2003 Proxy Season

27