- WPC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

W. P. Carey (WPC) 8-KConference on August 17TH

Filed: 17 Aug 04, 12:00am

The Wall Street Transcript’s

REIT Industry Conference

Tuesday, August 17, 2004

Harvard Club, New York City

W. P. Carey & Co. trades on the New York Stock Exchange under the ticker symbol WPC. Approximately

54% of its revenues are from management fees and 46% are from property holdings.

CPA® funds, which are advised by W. P. Carey, are created periodically as warranted by market opportunities.

The information contained in this presentation reflects CPA ®:1 through CPA ®:16 - Global. Subsequent

CPA ®funds will not own the same properties. There can be no guarantee that the performance of subsequent

CPA® funds will be similar to that of W. P. Carey or any prior CPA®portfolio.

Past performance does not assure future results.

The following presentation includes forward looking statements. Forward looking statements, which are based

on certain assumptions, describe future plans, strategies and expectations of WPC. Forward-looking statements

discuss matters that are not historical facts. Because they discuss future events or conditions, forward-looking

statements may include words such as "anticipate", "believe", "expect", "estimate", "intend", "could", "should",

"would", "may", or similar expressions. Do not unduly rely on forward looking statements. They give our

expectations about the future and are not guarantees, and speak only as of the date they are made. Such

statements involve known and unknown risks, uncertainties and other factors that may cause the actual results,

performance or achievement of W. P. Carey & Co. to be materially different from the results of operations or

plan expressed or implied by such forward looking statements. The risk factors are fully described in Item 1 of

the Annual Report on Form 10-K for the year ended December 31, 2003.

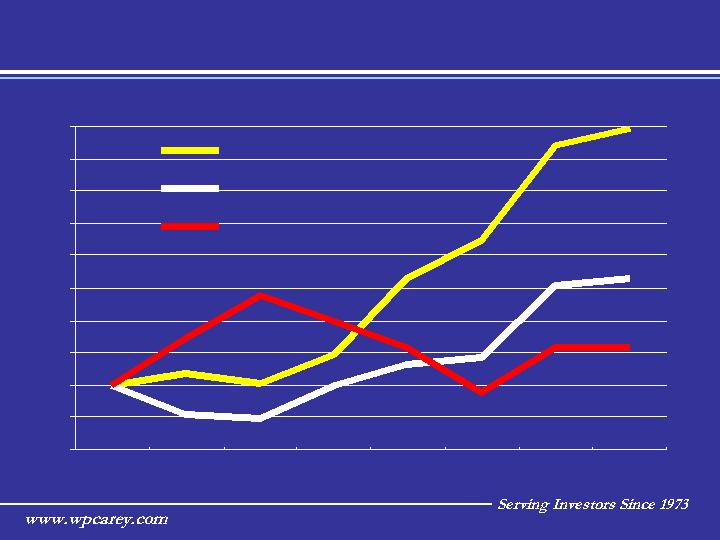

Returns Since NYSE Listing in 1998

Shareholder Returns

3

60

80

100

120

140

160

180

200

220

240

260

1/21/98

1998

1999

2000

2001

2002

2003

2004

YTD

WPC

NAREIT

S&P 500

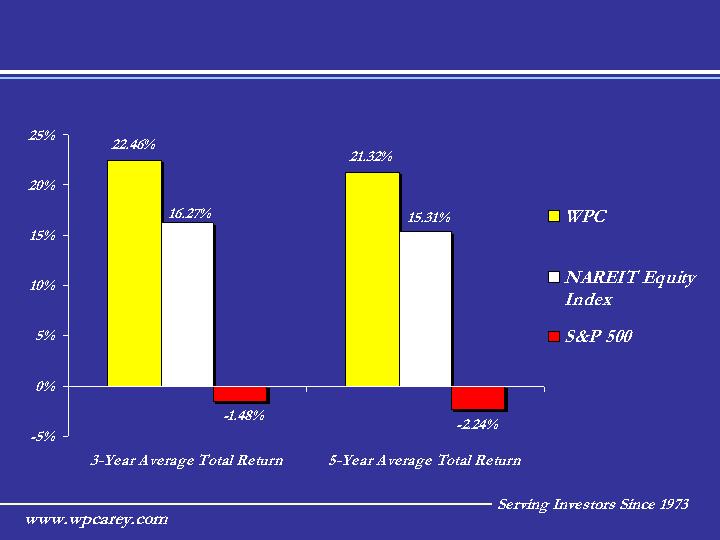

Comparative Total Returns

Shareholder Returns

4

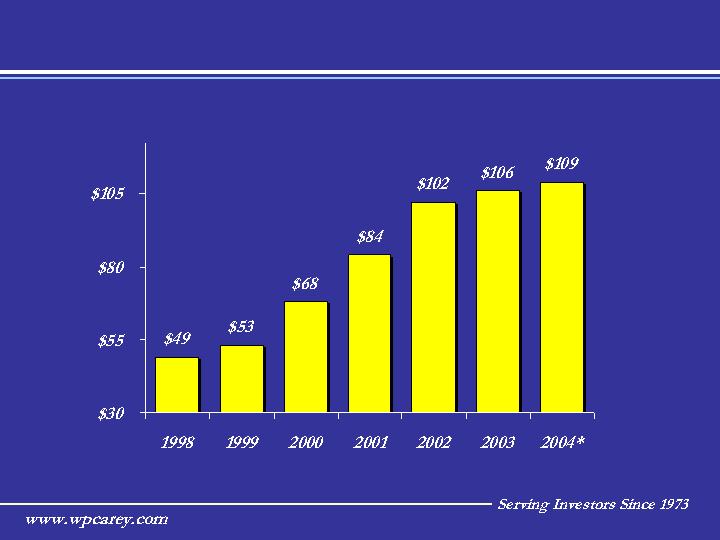

Since listing on the NYSE in 1998, Funds from Operations have grown at a 17% compound annual growth rate.

Growth in FFO

FFO Growth

($ in millions)

*Annualized 6-month FFO – Not a projection by the Company

5

Unique Business Model

W. P. Carey & Co. LLC

OWNS

MANAGES

Generates 54% of its revenue by

managing day-to-day operations

and new real estate investments.

$1.4 billion total

market capitalization

Generates 46% of its revenue

through rental income from its

owned assets.

$5.4 billion in net-leased

real estate

DIVERSIFIED STABLE

PORTFOLIO

CPA® REITS

6

W. P. Carey & Co. LLC

OWNS

MANAGES

Generates 46% of its revenue

through rental income from its

owned assets.

DIVERSIFIED STABLE

PORTFOLIO

Diversified Stable Portfolio

$1.4 billion total

market capitalization

7

Diversified Income

Diversified Stable Portfolio

1.4%

3.1%

2,393,255

AutoZone, Inc.

1.6%

3.4%

2,655,320

Orbital Sciences Corporation

1.6%

3.5%

2,709,076

Quebecor Printing USA

1.7%

3.7%

2,837,889

America West Holdings

1.7%

3.7%

2,888,424

Carrefour France, SA

1.7%

3.7%

2,922,348

Federal Express Corporation

2.1%

4.6%

3,535,408

Bouygues Telecom, S.A.

2.2%

4.8%

3,720,000

American Greetings Corporation

2.5%

5.4%

4,157,524

Detroit Diesel Corporation

2.6%

5.8%

$ 4,474,720

Dr Pepper/Seven Up Bottling

Percentage of

Total Revenue

Percentage of

Total Rent

Annual Rent

Top Ten Tenants/

Lease Guarantors

W. P. Carey & Co. LLC

OWNS

MANAGES

8

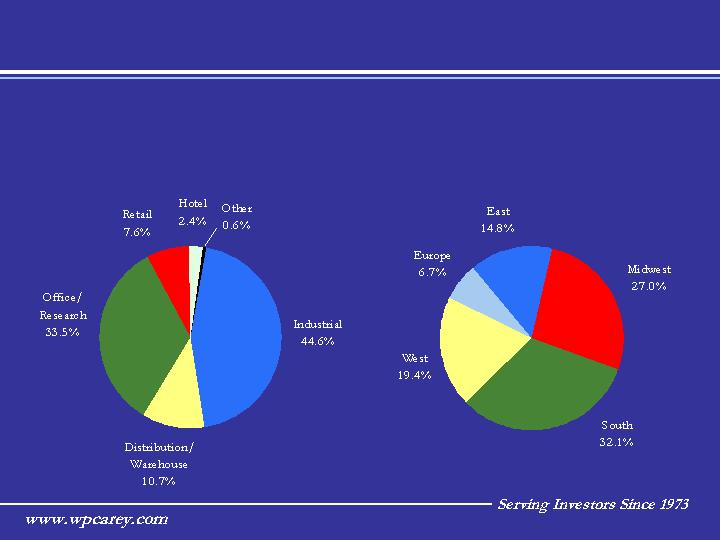

By Geographic Region

By Property Type

Portfolio Diversification

Note: Based on Annualized Rent

Diversified Stable Portfolio

9

Management/Advisory Business

W. P. Carey & Co. LLC

OWNS

MANAGES

Generates 54% of its revenue by

managing day-to-day operations

and new real estate investments.

$5.4 billion in net-leased

real estate

CPA® REITS

10

Approximately 24% of

commercial real estate is

owner-occupied,

representing over $1

trillion in investment

opportunity

Ownership of U.S. Commercial Real Estate*

*(Source: Jones Lang LaSalle)

Domestic Market Opportunity

11

Convergence of Two Major Trends

Investor

interest in

yield

investments

and stability

Corporations

desire to

outsource real

estate assets

W. P. Carey & Co. LLC

Management/Advisory Business

W. P. Carey & Co. LLC

OWNS

MANAGES

12

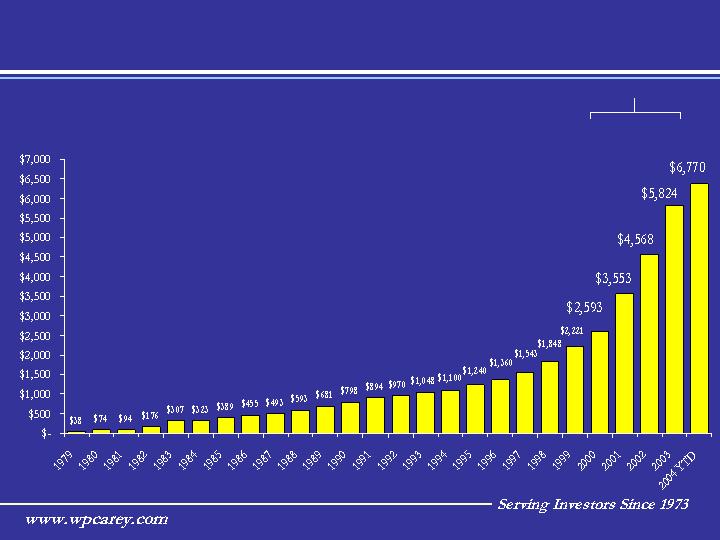

Investor interest in yield investments

Corporations desire to outsource real estate assets

($ in millions)

Growth in Assets Under Ownership and Management

W. P. Carey & Co. LLC

OWNS

MANAGES

Management/Advisory Business

Total assets under management and

ownership have grown at a compound

annual rate of 23% over the last 24 years

13

Investment Overview 2001 - 2004

Transaction Statistics

15

20

24

19

Number of Industries

17.8

19.5

16.7

19.6

Average Lease Term of

New Investments (years)

5

5

3

3

Number of Countries

$45,439

$24,993

$33,601

$19,753

Average Investment Size*

17

29

30

20

Number of Investments

$727,027

$724,788

$1,008,027

$395,064

Total Investment Volume*

2004 YTD

2003

2002

2001

* in thousands

W. P. Carey & Co. LLC

OWNS

MANAGES

14

Recent Acquisitions

15

Facility Type:

Self-Storage & Truck Rental Facilities

Purchase Price:

$312,445,000

Location:

78 locations throughout the U.S.

Acquired by:

CPA® :14, CPA®:15, CPA® :16 - Global

U-Haul is the nation’s leading do-it-yourself moving company with a network

of over 14,000 locations in all 50 United States and 10 Canadian provinces.

The facilities are located in 69 cities in 24 states. All 78 locations contain a

truck rental facility, and all but one contains a self-storage facility. Under the

terms of the two separate bond-type net lease agreements the self-storage

facilities will be leased for an initial term of 20 years, while the truck rental

facilities will be leased for an initial term of 10 years.

16

Recent Acquisitions

Shaklee Corporation is a leading provider of premium quality, natural,

environmentally friendly nutrition, personal care, and household products as

well as state-of-the art air and water treatment systems.

The 124,000 square foot facility will be leased under a 20-year triple net

lease followed by two, ten-year renewal options. The transaction provided

acquisition financing to the private equity firm acquiring the Company.

Facility Type:

Corporate Headquarters

Purchase Price:

$32,461,000

Location:

Pleasanton, CA

Acquired by:

CPA® :15

Recent Acquisitions

17

Facility Type:

Manufacturing/Office

Purchase Price:

$16,690,000

Location:

Kahl am Main, Germany

Acquired by:

CPA® :15, CPA®:16 - Global

Actuant is a global manufacturer and marketer of a wide range of industrial

products and systems. The Actuant businesses are market leaders in highly

engineered position and motion control systems and branded hydraulic and

electrical tools.

The 305,700 square foot facility will be leased under a 17-year triple net

lease followed by two, five-year renewal options.

Recent Highlights

18

Launched CPA®:16 – Global in December 2003 and raised

$350 million program to date

Completed $727 million of investments on behalf of

CPA REITs in 2004 year-to-date

Assets under ownership and management surpasses

$6 billion

W. P. Carey proposed liquidity transaction for CIP ®

Carey Institutional Properties (CIP ®)’s

Proposed Liquidity Transaction Details

Management/Advisory Business

W. P. Carey & Co. LLC

OWNS

MANAGES

19

$13.90 NAV per share represents 39% increase in initial

principal value

Upon approval, including dividends received and capital

appreciation, CIP® shareholders have achieved an average

annual total return of 11.3%

CIP® shareholders have outperformed the

NCREIF Property Index by

450 basis points per year over the past 12 years.

* When returns are calculated using similar methodologies.

CPA® Program Track Record

Management/Advisory Business

W. P. Carey & Co. LLC

OWNS

MANAGES

Full-Cycle

Programs

Average

Annual

Return

= 12%

20

Fund

Date of

End Value

Cumulative

Average

Final Closing

Plus Distributions

Return

Annual Return

CPA® :1

6/12/79

$2,367

137%

7.3%

CPA® :2

9/23/80

$3,687

269%

15.3%

CPA® :3

5/13/82

$4,082

308%

19.4%

CPA® :4

6/16/83

$3,101

210%

14.3%

CPA® :5

12/21/83

$2,103

110%

7.9%

CPA® :6

2/13/85

$2,639

164%

12.7%

CPA® :7

9/17/87

$2,151

115%

10.8%

CPA® :8

11/21/88

$2,286

129%

13.8%

CPA® :9

4/30/90

$1,839

84%

10.4%

CPA® :10

7/17/91

$2,083

108%

9.0%

CIP®

12/19/91

$1,390

141%

11.3%

CPA® :12

5/12/94

$1,170

99%

9.8%

CPA® :14

4/3/98

$1,130

57%

9.1%

WPC Fundamentals

21

WPC Financial Results

(in thousands except per share amounts)

22

12 Months Ended

12 Months Ended

12 Months Ended

12/31/01

12/31/02

12/31/03

Revenues:

Principal Revenues

$92,500

$86,670

$80,840

Management Revenues

$46,911

$84,255

$88,060

Expenses:

Interest Expense

$21,603

$16,134

$15,116

G&A Expense

$29,435

$42,592

$43,698

Net Income:

$35,761

$46,588

$62,878

Per Share

$1.02

$1.28

$1.65

WPC Capital Structure

(in thousands)

Effect of 25 b.p.

interest rate

= $.001 FFO

per Share

23

Market Capitalization (as of June 30, 2004):

W. P. Carey

Equity Market Capitalization

$1,151,783

Fixed Rate Debt Capitalization

$ 217,227

Variable Rate Debt Capitalization

$

30,536

Total Market Capitalization

$1,399,546

NAREIT

W. P. Carey

Equity Index

Equity % of Total Market Cap

82%

61%

Debt % of Total Market Cap

18%

39%

Recourse Debt % of Total Market Cap

1.2%

17%

Interest Coverage

7.9x

3.0x

Source: SEC Filings, SNL DataSource

FFO Multiple vs. REIT Peer Group

W. P. Carey Current Valuation

*Annualized 6-month FFO – Not a projection by the Company

24

Close

8/11/04

2004 Est. FFO

FFO Multiple

AMB Property

$34.95

$2.33

15.0

Alexandria Real Estate

$60.50

$4.48

13.5

Capital Automotive REIT

$29.42

$2.46

12.0

Commercial Net Lease Realty

$16.69

$1.40

11.9

Lexington Corp. Properties

$19.94

$1.74

11.5

Realty Income

$40.71

$3.05

13.3

Washington REIT

$28.68

$2.09

13.7

iSTAR Financial

$38.74

$3.47

11.2

ProLogis Trust

$34.27

$2.37

14.5

W. P. Carey & Co. LLC

$30.47

$2.82*

10.8

Peer Average

12.9

Earnings Multiple vs. Investment Manager Peer Group

W. P. Carey Current Valuation

25

Close

2003

8/11/04

Net Income

P/E Ratio

Alliance Capital

$32.80

$2.12

15.5

Franklin Resources

$48.76

$2.22

22.0

BlackRock

$62.29

$2.36

26.4

Eaton Vance

$36.38

$1.51

24.1

Federated Investors

$28.26

$1.82

15.5

Janus Capital Group

$13.15

$0.86

15.3

Legg Mason

$77.17

$3.99

19.3

T. Rowe Price

$46.08

$1.77

26.0

Gabelli Asset Mgmt

$39.14

$1.64

23.9

W.P. Stewart

$19.45

$0.96

20.3

Waddell & Reed

$19.36

$1.13

17.1

W. P. Carey & Co. LLC

$30.47

$1.65

18.5

Peer Average

20.5

W. P. Carey Current Valuation

Annualized

EBITDA

= $68,000,000

Annualized Funds from

Operations

= $52,000,000

OWNS

MANAGES

Average REIT Peer Group

P/2004 FFO Multiple

12.9x

Average Asset Manager Peer Group

P/2004 EBITDA Multiple

10x

WPC Market Cap at

Average Multiples

= $1,350,800,000

Vs.

Current Market Cap

= $1,176,000,000

26

Running the Business as Owners

13.90%

Fortune 500*

14.59%

Equity REIT Industry

7.50%

Peer Group

40.17%

W. P. Carey

Percentage of Management Ownership

as of 2004 Proxy Season

* As of 2003 Proxy Season

27

1-800 WP CAREY IR@wpcarey.com

28