- WPC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

W. P. Carey (WPC) DEF 14ADefinitive proxy

Filed: 9 Apr 20, 5:10pm

Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantþ | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

þ | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to § 240.14a-12 | |

| W. P. Carey Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

þ | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

(2) | Form, Schedule or Registration Statement No.: | |||

(3) | Filing Party: | |||

(4) | Date Filed: | |||

Notice of Annual Meeting of Stockholders |

April 9, 2020

| Date and Time |

| Thursday, June 11, 2020 1:30 p.m. |

Location* DLA Piper LLP (US) |

| 1251 Avenue of the Americas, 27th Floor New York, NY 10020 |

| Items of Business • Elect nine Directors for 2020; • Consider an advisory vote on executive compensation; • Consider an advisory vote on frequency of executive compensation vote; • Ratify the appointment of PricewaterhouseCoopers LLP as Independent Registered Public Accounting Firm for 2020; and • Transact such other business as may properly come before the meeting and any adjournment or postponement thereof. Only shareholders who owned stock at the close of business on April 1, 2020 are entitled to vote at the meeting. W. P. Carey Inc. mailed the attached Proxy Statement, proxy card and its Annual Report to shareholders on or about April 13, 2020. By Order of the Board of Directors

Susan C. Hyde Chief Administrative Officer and |

How to Vote | ||||||||||

| INTERNET | PHONE | IN PERSON | ||||||||

Whether or not you attend, it is important that your shares be represented and voted at the Annual Meeting. | ||||||||||

You may vote your shares by using the telephone or through the Internet, as described on the enclosed proxy card. You may also vote your shares by marking your votes on the enclosed proxy card, signing and dating it and mailing it in the business reply envelope provided. If you attend the Annual Meeting, you may withdraw your previously submitted proxy and vote in person. | ||||||||||

Additional questions are answered in the Users' Guide on page 61. | ||||||||||

Important Notice Regarding Availability of Proxy Materials For the 2020 Annual Meeting of Stockholders to Be Held on June 11, 2020: | ||||||||||

This Proxy Statement and the Annual Report to Shareholders are available atwww.proxyvote.com. | ||||||||||

Letter from Our Chairman and Chief Executive Officer |

| Dear Fellow Shareholders, | ||||

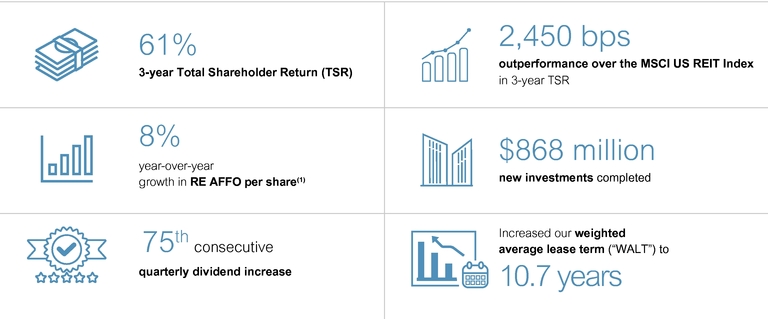

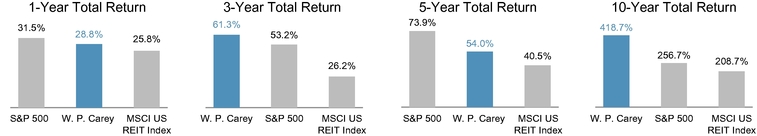

Jason E. Fox | On behalf of the W. P. Carey Board of Directors, we are pleased to present you with our 2020 Proxy Statement. We are proud of our achievements over the past year, most notably reaping the benefits of the merger with CPA:17—Global, which accelerated our commitment to simplify the company, improve the quality of our earnings and strengthen our balance sheet. During the year, we made accretive investments at healthy spreads to our cost of capital, further enhanced the quality of our portfolio and significantly reduced leverage. As long-term investors ourselves, we are pleased that, as of December 31, 2019, we provided our shareholders with a 3-year total return of 61% and outperformed the MSCI US REIT Index for the 1-, 3-, 5 and 10-year periods. With a focus on generating stable and growing income for shareholders over time, in 2019 our total dividends declared increased to $4.14 per share, with the fourth quarter declared dividend representing our 75th consecutive increase since going public in 1998. Our Board is responsible for the advancement of our business strategies and objectives and we believe our nominees share the skills and experience required for well-rounded oversight. Our directors are a diverse group of men and women with varying talents and viewpoints and importantly, deep experience across a range of industries. As our Board continues to evolve, we are committed to enhancing our diversity by increasing our female representation from 22% to 30% within the next 12 months. It is with mixed emotion that we announce that Ben Griswold, former Chairman of W. P. Carey and director since 2006, will not stand for re-election at our June shareholder meeting. Ben guided W. P. Carey through times of tremendous growth and change, and his wisdom and leadership resulted in the successful organization we are today. We are grateful for his many contributions and shall miss him greatly. When weInvest for the Long Run, our employees are at the core of that philosophy. Our employees continue to be our most valuable asset and as a Board, along with management, we spend considerable time focused on cultivating a culture that supports employee growth and wellness. We strive to make W. P. Carey a great place to work and to attract the best and brightest, enhancing the lives of our employees in and out of the office as they progress and grow with the company. Over the past year, we added new benefits to our already best-in class program, including financial support for adoption and surrogacy as one way reflect our commitment to a diverse and inclusive workforce. We are especially proud of our corporate responsibility initiatives, which lie at the very root of W. P. Carey and our core belief ofDoing Good While Doing Well. We are pleased to share more about our ongoing and expanding ESG efforts later in this proxy statement as well as in our Corporate Responsibility Report. We believe that investor outreach is an integral aspect of good governance, and we met with more than 250 of our equity and fixed income investors in 2019. We value your insight and input, and look forward to continuing a healthy dialogue as we move forward. The information contained in the following pages is, of course, intended to be a review of our performance and accomplishments over the past year. However, we would be remiss if we did not acknowledge that as we are going to press, we are in the midst of the COVID-19 pandemic, which is having a great toll on both the human and economic condition. We want to take this opportunity to wish all of our stakeholders—our shareholders, our tenants, our employees and all of the other constituents with whom we do business—health and safety during this unprecedented time. We value your investment in W. P. Carey, your input and your support. On behalf of the entire Board of Directors, we thank you for your confidence in us. | |||

| Christopher J. Niehaus Non-Executive Chairman Board of Directors | Jason E. Fox Chief Executive Officer Board of Directors | |||

Table of Contents |

Proxy Summary |

This summary highlights information contained in this proxy statement. The summary does not contain all of the information you should consider, and you should read the entire proxy statement carefully before voting.

2020 Annual Meeting of Stockholders |

Date and Time |

Thursday, June 11, 2020, 1:30 p.m.

Location |

DLA Piper LLP US, 1251 Avenue of the Americas, 27th Floor, New York, NY 10020

Voting |

Stockholders as of the record date, April 1, 2020, are entitled to vote; each share of common stock is entitled to one vote for each director nominee and one vote for each of the other proposals.

Voting Matters and Board Recommendations |

| Proposal | | Board Recommendation | Page | |||

|---|---|---|---|---|---|---|

| | | | | | | |

1 | Election of nine Directors named in this proxy statement for 2020 | FOR each Nominee | 5 | |||

| | | | | | | |

2 | Consideration of an advisory vote on executive compensation | FOR | 33 | |||

| | | | | | | |

3 | Consideration of an advisory vote on the frequency of executive compensation vote | FOR | 55 | |||

| | | | | | | |

4 | Ratification of the appointment of PricewaterhouseCoopers LLP as Independent Registered Public Accounting Firm for 2020 | FOR | 56 | |||

| | | | | | | |

Performance Highlights |

We are proud of our accomplishments over the past year, most notably reaping the benefits of the merger with CPA:17 – Global, enhancing our portfolio and strengthening our balance sheet. We take a long-term view with respect to both investing and our performance, and we were pleased to have executed well on behalf of our shareholders.

Proxy Statement and Notice of 2020 Annual Meeting | 1

Proxy Summary |

Governance and Board Highlights |

Because we believe that a company's tone is set at the top, we are proud to report on our Corporate and Board-level governance provisions, many of which are recognized as best practices. Critical components of our governance profile include:

| | | |

|---|---|---|

| | | |

Director Independence and Compliance | • All directors, other than our CEO, are independent • There are no related-party transactions • Our Board reviews the independence of its members annually • Our Board is led by an Independent Chairman, separate from our CEO • All directors attended 75% or more of the Board and Board Committee meetings in 2019 • All directors are in compliance with our stock ownership guidelines (5x annual cash retainer) • There is a limitation on over-boarding by our directors | |

| | | |

Strong Shareholder Rights | • Shareholders have proxy access with a "3/3/20/20" market standard • We have irrevocably opted out of Maryland staggered board provisions; all directors elected annually • We have majority voting for directors • Shareholders can amend bylaws with a majority vote • We have no poison pill | |

| | | |

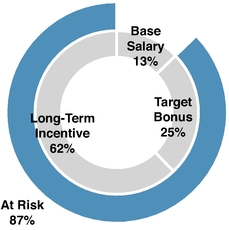

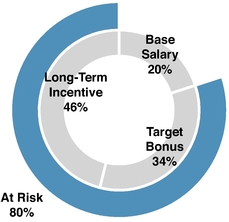

Our Approach to Compensation |

In 2019, we introduced an annual cash bonus plan for all employees designed to provide greater transparency. We design our compensation plans within a set of strong compensation governance provisions. These include:

| | | | | | | | | | | | | |

| What We Do | What We Don't Do | |||||||||||

| | | | | | | | | | | | | |

| ✓ | Deliver a significant percentage of annual compensation in the form of variable compensation tied to multi-year performance through our annual cash incentive plan | ✗ | Do not provide excise tax gross-ups | |||||||||

| | | | | | | | | | | | | |

| ✓ | Deliver half of the long-term incentive plan value at grant through PSUs measuring 3-year performance | ✗ | Do not have employment agreements | |||||||||

| | | | | | | | | | | | | |

| ✓ | Provide total compensation opportunities that approximate the market median | ✗ | Do not have executive perquisites | |||||||||

| | | | | | | | | | | | | |

| ✓ | Compare executive compensation levels and practices against a relevant peer group of similarly-sized REITs | ✗ | Do not have excessive severance benefits | |||||||||

| | | | | | | | | | | | | |

| ✓ | Engage an independent compensation consultant that reports directly to the Compensation Committee and provides no other services to the Company | ✗ | Do not allow current dividends to be paid on unearned PSUs or unvested RSUs. | |||||||||

| | | | | | | | | | | | | |

| ✓ | Require meaningful levels of stock ownership among our executive officers and non-employee directors | ✗ | Do not allow hedging or short sales of our securities, and have meaningful limits on pledging | |||||||||

| | | | | | | | | | | | | |

| ✓ | Maintain a clawback policy | ✗ | Do not provide enhanced retirement benefits or other supplemental executive retirement plans, known as SERPs | |||||||||

| | | | | | | | | | | | | |

| ✓ | Conduct annual compensation risk review | ✗ | Do not allow for any single-trigger cash severance benefits upon a change-in-control | |||||||||

| | | | | | | | | | | | | |

2 | Proxy Statement and Notice of 2020 Annual Meeting

| Proxy Summary |

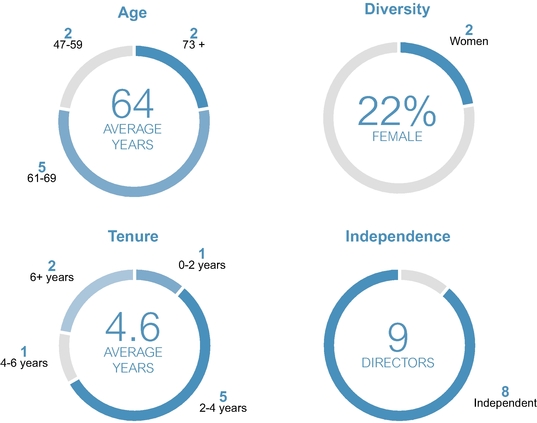

Director Nominees and Diversity |

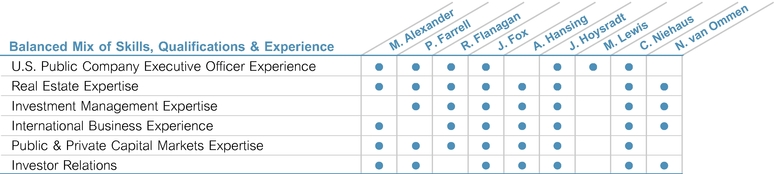

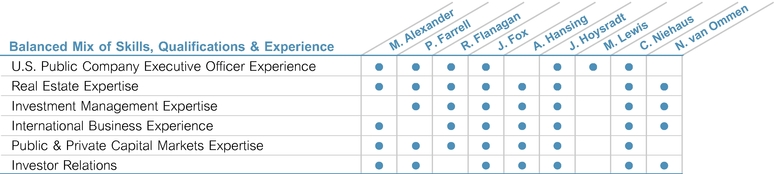

Our Board comprises our CEO and nine independent directors, one of whom is not standing for re-election, and benefits from a mix of tenured and newer directors, men and women, each with different backgrounds. We believe this diversity provides the varied viewpoints and robust discussion that result in better outcomes for our shareholders. Our Director Nominees are listed below:

| Committee Memberships | ||||||||||||||||||

| | | | | | | | | | | | | | | ��� | | | | |

| Name | Age | Director Since | Primary Occupation | Independent | Audit | Compensation | Executive | Investment | Nominating & Corporate Governance | |||||||||

| | | | | | | | | | | | | | | | | | | |

| Mark A. Alexander | 61 | 2016 | Managing Member, Landmark Property Group, LLC | ✓ | ||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Peter J. Farrell | 59 | 2016 | Partner and Co-founder CityInterests, LLC and PADC Realty Investors | ✓ | ||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Robert J. Flanagan | 63 | 2018 | President, Clark Enterprises, Inc. and Trustee, A. James & Alice B. Clark Foundation | ✓ | ||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Jason E. Fox | 47 | 2018 | Chief Executive Officer, W. P. Carey Inc. | |||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Axel K.A. Hansing | 77 | 2011 | Senior Partner, Coller Capital, Ltd. | ✓ | ||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Jean Hoysradt | 69 | 2014 | Former Chief Investment Officer, Mousse Partners Limited | ✓ | ||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Margaret G. Lewis | 65 | 2017 | Former President, HCA Capital Division | ✓ | ||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Christopher J. Niehaus Non-Executive Chairman of the Board | 61 | 2016 | Managing Partner, Member of the Global Investment Committees, BentallGreenOak | ✓ | ||||||||||||||

| | | | | | | | | | | | | | | | | | | |

| Nick J.M. van Ommen | 73 | 2011 | Former CEO, European Public Real Estate Association | ✓ | ||||||||||||||

| | | | | | | | | | | | | | | | | | | |

![]() Committee Chair

Committee Chair ![]() Financial Expert

Financial Expert

Skills |

Proxy Statement and Notice of 2020 Annual Meeting | 3

Proxy Summary |

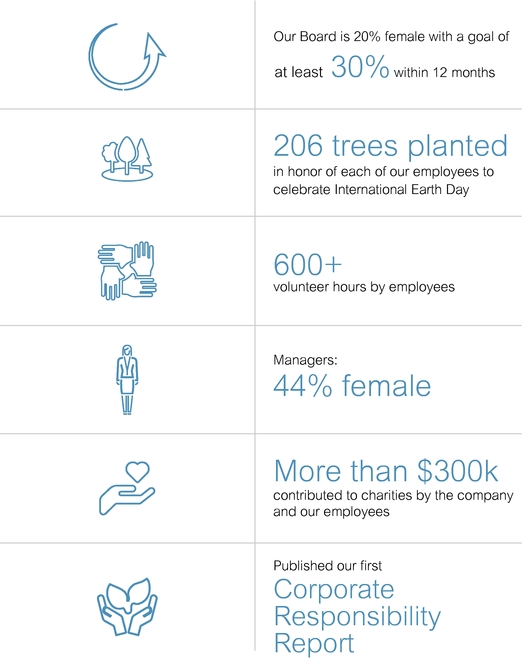

Environmental, Social and Governance Initiatives |

We are committed to our two core principles:Investing for the Long Run and Doing Good While Doing Well, which continue to guide the way we run our business and view the world. Our founder, Wm. Polk Carey, believed—as we do today—that our business by its very nature promotes prosperity and that our responsibility does not end there. He understood that good corporate citizenship was fundamental to good business and to creating long-term value for our investors. Today his vision and values live on through our corporate responsibility initiatives, focused on our environmental, social and governance objectives.

Our 2019 highlights include:

4 | Proxy Statement and Notice of 2020 Annual Meeting

Proposal One:Election of Nine Directors |

We first ask that you vote for each of the current members of our Board of Directors standing for re-election. We lead with this vote because we, the Board of Directors, oversee W. P. Carey as stewards for all of our stakeholders, including you, our shareholders. |

We also lead with this vote because we are proud of all of the actions our Board took over the past year, including:

We believe these provisions and actions demonstrate our commitment to protecting your interests as shareholders. As we ask for your vote, we should note that our directors are elected annually, subject to a majority voting requirement, and are led by an independent Non-Executive Chairman separate from our Chief Executive Officer ("CEO"). Aside from our CEO, our Board members are independent, and all Directors are committed to enhancing shareholder value.

Mr. Benjamin E. Griswold, IV, a current Director, has decided not to stand for re-election at the Annual Meeting. The Board of Directors wishes to publicly thank him for his service on the Board and for his valuable contributions to the Company over the years.

Proxy Statement and Notice of 2020 Annual Meeting | 5

Proposal One:Election of Nine Directors |

| The Board recommends a voteFOR each of the nominees |

Nominees for the Board of Directors |

Our Board members are diverse in talents, experiences and backgrounds but share track records of successful management and oversight of public and private companies. The Board recommends a voteFOR each of the nominees set forth on the following pages so we can continue along the path we have been actively pursuing.

Unless otherwise specified, proxies will be voted FOR the election of the named nominees, each of whom was recommended by the Nominating and Corporate Governance Committee and approved by the Board. Assuming the presence of a quorum at the meeting of stockholders to be held on June 11, 2020 (the "Annual Meeting"), the affirmative vote of a majority of the votes cast for a nominee by the stockholders present, in person or by proxy, is required to elect each nominee.

6 | Proxy Statement and Notice of 2020 Annual Meeting

| Nominees for the Board of Directors |

| | | | | |

| Mark A. Alexander | CURRENTLY Managing Member | |||

Chair of the Director | | Mr. Alexander brings to the Board over 30 years of international business experience in operations, mergers & acquisitions and accounting. He has developed expertise in strategic planning, operational management, public & private capital markets, financial analysis, accounting and investor relations. Mr. Alexander's experience as a chief executive officer, certified public accountant, and public company board member make him qualified to be a W. P. Carey Board member and to be Chairman of the Audit Committee. | | Landmark Property Group, LLC: 2009 – Present PUBLIC BOARDS Kaydon Corp. (NYSE-listed): 2007 – 2013 PREVIOUSLY SVP, Corporate Development Senior Accountant & CPA EDUCATION |

| | | | | |

| | |||

| | | | | |

| Peter J. Farrell | CURRENTLY Partner and Co-founder | |||

Chair of the Director | | Mr. Farrell brings to the Board 38 years of experience in real estate investment, finance, leasing and development as well as public, private and international fund raising. His broad industry exposure and diverse skill set, along with his operating and board experience in the REIT industry, adds a valuable perspective to the W. P. Carey Board and provides a significant source of industry knowledge and expertise to the Company's committees on which he serves. | | CityInterests, LLC and PADC Realty Investors: 2004 – Present PREVIOUSLY PUBLIC BOARDS EDUCATION |

| | | | | |

Proxy Statement and Notice of 2020 Annual Meeting | 7

Nominees for the Board of Directors |

| | | | | |

| Robert J. Flanagan | CURRENTLY President | |||

Director | | Mr. Flanagan has served as President of Clark Enterprises, Inc. since 2015 and was its Executive Vice President from 1989 to 2015. At Clark Enterprises, Mr. Flanagan oversees the acquisition, management and development of new investment opportunities. As a result of these and other professional experiences, Mr. Flanagan has a deep understanding and knowledge of a broad variety of subject areas, including accounting, finance and capital structure; strategic planning and leadership of complex organizations; people management; board governance; and board practices of other entities. | | Clark Enterprises, Inc.: 2015 – Present PREVIOUSLY CURRENTLY PUBLIC BOARDS Martek Biosciences Corporation (NASDAQ-listed): PREVIOUSLY OTHER BOARDS Federal City Council, Svelte Medical Systems Vascular Therapies, Inc. EDUCATION MS in Taxation, American Certified Public Accountant |

| | | | | |

8 | Proxy Statement and Notice of 2020 Annual Meeting

| Nominees for the Board of Directors |

| | | | | |

| Jason E. Fox | CURRENTLY CEO | |||

Director | | Mr. Fox brings to the Board over 18 years of business and investment experience, having been responsible, most recently as Head of Global Investments, for sourcing, negotiating, and structuring acquisitions on behalf of W. P. Carey and the various programs it managed since joining the Company in 2002. He has a deep understanding of W. P. Carey's business and its investment strategies. Further, Mr. Fox's role as CEO and previous service as W. P. Carey's President, overseeing both the investment and asset management activities of the Company, make information and insight about the Company's business directly available to the Board in its deliberations. He also serves as a Trustee of the W. P. Carey Foundation. | | W. P. Carey Inc.: 2018 – Present PREVIOUSLY PUBLIC BOARDS Carey Watermark Investors 2 Incorporated ("CWI 2"): 2018 – Present Carey Watermark Investors Incorporated ("CWI 1"): 2018 – Present Corporate Property Associates 17 – Global Incorporated ("CPA:17 – Global"): 2018 EDUCATION MBA, Harvard Business School |

| | | | | |

| | |||

| | | | | |

| Axel K.A. Hansing | CURRENTLY Senior Partner | |||

Director | | Mr. Hansing brings to the Board over 45 years of experience in international corporate and investment banking, real estate financing, asset management, and private equity investing, both as a General and a Limited Partner. In his current role as Senior Partner at Coller Capital, Mr. Hansing is responsible for the origination, execution, and monitoring of investments. Prior to founding and serving as Chief Executive Officer of Hansing Associates, he served as Managing Director of Equitable Capital Management in London and New York, Head of the International Division of Bayerische Hypotheken—und Wechselbank AG (now part of UniCredit SpA) in Munich and New York and held roles with Merrill Lynch International Banking in Hong Kong and London as well as with Marine Midland Bank (now part of HSBC) in London and New York. | | Coller Capital, Ltd.: 2000 – Present PREVIOUSLY Managing Director EDUCATION Advanced Management Program, |

| | | | | |

Proxy Statement and Notice of 2020 Annual Meeting | 9

Nominees for the Board of Directors |

| | | | | |

| Jean Hoysradt | PUBLIC BOARDS The Swiss Helvetia Fund Inc. | |||

Director | | Ms. Hoysradt brings to the Board over 45 years of investment and financial expertise in real estate, debt and equity. Her former role as Chief Investment Officer of Mousse Partners, a prominent private family investment office, required both domestic and international business expertise. Prior to her position as head of the Investment Department and Treasury for New York Life Insurance Company, she held positions in investment banking and investment management at Manufacturers Hanover, First Boston and Equitable Life. Ms. Hoysradt served as director of the Duke University Management Company from August 2005 to August 2018, including acting as chair of its audit committee. She also served as a director of The Swiss Helvetia Fund (a closed end investment company) from July 2017 to September 2018. | | (NYSE-listed): Director: 2017 – 2018 PREVIOUSLY SVP and head of the EDUCATION MBA, Columbia University |

| | | | | |

| | |||

| | | | | |

| Margaret G. Lewis | PUBLIC BOARDS Flowers Foods (NYSE-listed): | |||

Chair of the Nominating and Corporate Governance Committee Director | | Ms. Lewis is the former president of Hospital Corporation of America's ("HCA's") Capital Division, which includes facilities in northern, central and southwestern Virginia, New Hampshire, Indiana and Kentucky. She began her career with HCA in 1978 and held several positions in nursing management and quality management before becoming chief nursing officer of HCA's Richmond Division in 1997. Ms. Lewis became chief operating officer of CJW Medical Center in 1998 and chief executive officer in 2001. She is a registered nurse and a fellow of the American College of Healthcare Executives. Ms. Lewis brings extensive leadership experience and management skills to the board. Her variety of senior management roles provides expertise in executive decision-making and strategic planning. | | Director: 2014 – Present Federal Reserve Bank of Richmond: Smithfield Foods (NYSE-listed): PREVIOUSLY EDUCATION BS in Nursing, Medical College of Virginia MBA, Averett University Fellow of the American College of |

| | | | | |

10 | Proxy Statement and Notice of 2020 Annual Meeting

| Nominees for the Board of Directors |

| | | | | |

| Christopher J. Niehaus | CURRENTLY Managing Partner, Member of the | |||

Non-Executive Chair of the Director | | Mr. Niehaus serves as the Managing Partner and a member of the global investment committees of BentallGreenOak, a global real estate investment management firm with $48 billion of assets under management. He brings to the Board over 37 years of experience in the real estate industry and a broad range and depth of experience in finance, real estate investment banking, portfolio management and private equity, as well as public, private and international fund raising and fund management. Mr. Niehaus spent 28 years at Morgan Stanley, where he helped build and run one of the leading global real estate banking, lending and investing businesses. His skill set and exposure to a variety of industries add valuable perspective to the W. P. Carey Board. Mr. Niehaus serves as a Trustee of the International Council of Shopping Centers and previously has served on the boards of private equity real estate companies in the U.S., Europe and Asia. | | Global Investment Committees BentallGreenOak: 2011 – Present PREVIOUSLY Co-Head of Global Real Estate EDUCATION MBA, Harvard University |

| | | | | |

Proxy Statement and Notice of 2020 Annual Meeting | 11

Nominees for the Board of Directors |

| | | | | |

| Nick J.M. van Ommen | PREVIOUSLY Chief Executive Officer | |||

Director | | Mr. van Ommen has served in various roles across the banking, venture capital, and asset management sectors through his career and brings to the Board over 36 years of financial and real estate experience, particularly in Europe. In the almost ten years that he served as CEO of the European Public Real Estate Association, Mr. van Ommen was responsible for promoting, developing and representing the European public real estate sector. In addition to his public boards, Mr. van Ommen currently serves on the supervisory boards and as chairman of the audit committees of Allianz Benelux SA, a private company that offers insurance products in Belgium, The Netherlands and Luxembourg, and of Allianz Netherlands Group NV, a life insurance company wholly owned by Allianz Benelux SA in Belgium. | | European Public Real Estate Association: 2000 – 2008 PUBLIC BOARDS IMMOFINANZ AG (Austria-listed VASTNED Retail (Belgium-listed Intervest Offices & Warehouses OTHER BOARDS Allianz Netherlands Group NV EDUCATION Fellow of the Royal Institute of |

| | | | | |

12 | Proxy Statement and Notice of 2020 Annual Meeting

| Nominees for the Board of Directors |

As described above, Mr. Benjamin E. Griswold, IV is not standing for re-election at the annual meeting. His biographical information is provided below.

| | | | | |

| Benjamin H. Griswold, IV | CURRENTLY Partner and Chairman, | |||

Director | | Mr. Griswold brings to the Board almost 50 years of experience in the investment business, first as an investment banker and then as an investment advisor. He has extensive experience with, and understanding of, capital markets as well as security analysis and valuation. His board experience and his past experience as a director of the New York Stock Exchange, give him a detailed understanding of corporate governance in general and audit, compensation, governance, and finance functions in particular. | | Brown Advisory, Inc.: 2005 – Present PREVIOUSLY PUBLIC BOARDS Stanley Black & Decker (NYSE-listed): New York Stock Exchange: 1993 – 1999 EDUCATION MBA, Harvard University |

| | | | | |

Proxy Statement and Notice of 2020 Annual Meeting | 13

Board Nominee Snapshot |

Our Board brings a strong mix of real estate expertise, international insights, and public company board and management experience. We believe our director nominees have the skills and experience necessary to fulfill the Board's responsibilities for strategic oversight, succession planning, risk management and other fiduciary duties as well as the breadth of knowledge and vision needed for the advancement of our business strategy and objectives. |

Skills |

14 | Proxy Statement and Notice of 2020 Annual Meeting

Committees of the Board of Directors |

Members of our Board of Directors serve on one or more of our Board's standing committees, which are our Compensation, Audit, and Nominating and Corporate Governance Committees. As required by the regulations of the SEC, the written charters for each of these standing committees can be viewed on our website, www.wpcarey.com, under the heading "Governance" in our "Investors" section. In addition to our standing committees, we have an Investment Committee and an Executive Committee. The table below reflects the membership of these committees as of the date of this Proxy Statement. From time to time, the Board may also establish certain ad hoc committees for specific purposes. |

Membership and Functions of the Committees of the Board

| | | |

Members Number of Meetings |

• setting compensation programs that apply generally to our employees; • reviewing compensation with respect to directors; • reviewing and making recommendations to the Board regarding the compensation structure for all current named executive officers ("NEOs") and other key employees, including salaries, cash incentive plans and equity-based plans; • reviewing goals and objectives relevant to our NEOs and key employees, evaluating their performance, and approving their compensation levels for both annual and long-term incentive awards; and • reviewing and approving the terms and conditions of stock grants. There were six regular meetings of the Compensation Committee held during 2019. | |

| | | |

Members Number of Meetings |

• assisting the Board in monitoring the integrity of the financial statements and management's report of internal controls over financial reporting of the Company, the compliance with legal and regulatory requirements, and the independence, qualifications, and performance of our internal audit function and Independent Registered Public Accounting Firm; • engaging an Independent Registered Public Accounting Firm, reviewing with the Independent Registered Public Accounting Firm the plans and results of the audit engagement, approving professional services provided by the Independent Registered Public Accounting Firm, and considering the range of audit and non-audit fees; • reviewing the internal audit charter and scope of the internal audit plan; and • reviewing and discussing the Company's internal controls with management, the internal auditors and the Independent Registered Public Accounting Firm and reviewing the results of the internal audit program. There were nine regular meetings of the Audit Committee held during 2019. | |

| | | |

Proxy Statement and Notice of 2020 Annual Meeting | 15

Committees of the Board of Directors |

| | | |

Members Number of Meetings |

• developing and implementing policies and practices relating to corporate governance, including monitoring implementation of our corporate governance policies; • oversight of the Company's ESG initiatives; • oversight of the Company's corporate culture; and • developing and reviewing background information of candidates for the Board of Directors, including those recommended by shareholders, and making recommendations to the Board regarding such candidates. There were four regular meetings of the Nominating and Corporate Governance Committee held during 2019. | |

| | | |

Members Number of Meetings |

• approving W. P. Carey's investments greater than $100 million to ensure that they satisfy our relevant investment criteria; • reviewing all of W. P. Carey's investments on a quarterly basis; and • reviewing and approving investments made on behalf of CPA:18 – Global and Carey European Student Housing Fund I, L.P. ("CESH"). There were five meetings of the Investment Committee held during 2019. | |

| | | |

16 | Proxy Statement and Notice of 2020 Annual Meeting

Board Governance |

Our directors each hold office until the next annual meeting of stockholders except in the event of death, resignation, or removal. If a nominee is unavailable for election, the Board may reduce its size or designate a substitute. If a substitute is designated, proxies voting on the original nominee will be cast with regard to the substituted nominee. Currently, the Board is unaware of any circumstances that would result in a nominee being unavailable.

Board Meetings and Director Attendance

There were six regular meetings of the Board held in 2019, and each director attended at least seventy-five percent of the aggregate of such meetings and of the meetings held during the year by the Committees of which he or she was a member. Under the Corporate Governance Guidelines adopted by our Board (the "Guidelines"), the directors are required to make every effort to attend each Board meeting and applicable Committee meetings, except in unavoidable circumstances. Although there is no specific policy regarding director attendance at meetings of stockholders, directors are invited and encouraged to attend. All of the current directors attended the Company's 2019 Annual Meeting. In addition to Board and Committee meetings, our directors also engage in informal group communications and discussions with the Non-Executive Chairman of the Board and the CEO, as well as with members of senior management regarding matters of interest.

Board Leadership Structure and Risk Oversight

Mr. Niehaus has served as Non-Executive Chairman of the Board since June 2019. The primary responsibility of the Non-Executive Chairman is to preside over meetings of the Board of Directors as well as to preside over periodic executive sessions of the Board in which the CEO and/or other members of management do not participate. The Chairman is also responsible, together with members of our senior management team, for establishing Board agendas and for working closely with our CEO on the overall direction of the Company to enhance long-term shareholder value. The Board believes that Mr. Niehaus is well-qualified to preside over both full and executive sessions of the Board and to fulfill the other duties of the Chairman, given the depth of his experience and his previous role as Vice Chairman of Morgan Stanley Real Estate.

Our CEO, Mr. Fox, is also a member of the Board of Directors. The Board considers the CEO's participation to be important in order to make information and insight about the Company's business and its operations directly available to the directors in their deliberations.

Our Board of Directors has overall responsibility for risk oversight. The Board of Directors reviews and oversees our Enterprise Risk Management ("ERM") program, which is a company-wide initiative that involves our senior management and other personnel acting in an integrated effort to identify, assess and manage risks that may affect our ability to execute our corporate strategy and fulfill our business objectives. These activities involve the identification, prioritization and assessment of a broad range of risks, including operational, financial, strategic, and compliance risks, and the formulation of plans to manage these risks and mitigate their effects.

As part of our ERM program, management provides periodic updates to our Board of Directors with respect to risk appetite, key risks and discusses appropriate risk response strategies. Throughout the year, the Board, and the Committees to which it has delegated responsibility, dedicates a portion of their meetings to discuss specific risk topics in greater detail. Strategic and operational risks are presented and discussed in the context of the CEO's report on operations to the Board of Directors at regularly scheduled meetings and at presentations to the Board of Directors and its Committees by management. Additionally, at least annually, our Audit Committee discusses with management and the Director of Internal Audit our significant financial risk exposures, including cybersecurity risks, and steps that have been taken to monitor and control such exposures.

Our Compensation Committee reviews the risks related to our compensation policies and practices and assesses the impact to our risk profile, at least on an annual basis. Management, with the Compensation Committee, regularly reviews our compensation programs, including incentives that may create, and factors that may reduce, the likelihood of excessive risk taking in order to determine whether such programs present a significant risk to the Company.

Our Corporate Governance Guidelines establish rules regarding the independence of our directors. The Guidelines, which we believe meet or exceed the Listing Standards of the New York Stock Exchange (the "NYSE") and the rules of the SEC, include the Company's definition of Independent Director and can be found under the heading "Governance" in the "Investors" section of the W. P. Carey website, www.wpcarey.com. Pursuant to the Guidelines, the Board undertook its annual review of Director Independence in March 2020. During this review, the Board considered any transactions and relationships between each director and nominee, or any member of his

Proxy Statement and Notice of 2020 Annual Meeting | 17

Board Governance |

or her immediate family, and W. P. Carey and its subsidiaries and affiliates, including those reported under Certain Relationships and Related Transactions below. The Board also examined any transactions and relationships between each director and nominee or their affiliates and members of our senior management or their affiliates. As provided in the Guidelines, the purpose of this review was to determine whether any such relationships or transactions were inconsistent with a determination that the director is independent.

The NYSE also requires that the Board of Directors determine whether a director is "independent" for purposes of the NYSE Listing Standards. The Nominating and Corporate Governance Committee has asked each director and nominee to specify in writing the nature of any relevant relationships such individual may have with the Company, including, but not limited to, any relationships that would specifically preclude a finding of "independence" under those Listing Standards. Upon review of these disclosures, the Board has affirmatively determined that none of the directors or nominees noted as "independent" in this Proxy Statement has a material relationship with W. P. Carey that would interfere with his or her independence from the Company and its management.

As a result, the Board has affirmatively determined that director nominees Alexander, Farrell, Flanagan, Hansing, Hoysradt, Lewis, Niehaus and van Ommen, and director Griswold, a current director who is not seeking re-election at the Annual Meeting, are independent of the Company and its management under the standards set forth in the Guidelines, applicable federal laws, the rules of the SEC and the NYSE's Listing Standards and for the purpose of serving on the relevant Board committees, where applicable. Mr. Fox is not considered to be an independent director because of his current employment as CEO of W. P. Carey.

The Board has determined that none of the directors who currently serve on the Compensation, Audit or Nominating and Corporate Governance Committees, or who served at any time during 2019 on such committees, has or had a relationship to W. P. Carey that may interfere with his or her independence from W. P. Carey and its management, and therefore, as required by applicable regulations, all such directors were or are, as applicable, "independent" as defined in the NYSE Listing Standards and by the rules of the SEC.

The Board does not mandate director retirement at a specified age, but instead remains committed to actively refreshing the Board based on annual performance reviews

and an evaluation of the skills and experience necessary to fulfill the Board's responsibilities to shareholders. Our Board's goal is to have at least 30% of the directors be female within 12 months.

The Nominating and Corporate Governance Committee considers candidates for Board membership suggested by Board members, management, shareholders and outside advisors. A shareholder who wishes to recommend a prospective nominee for the Board should notify our Corporate Secretary or the Nominating and Corporate Governance Committee in writing with the information and in the time period required by our Bylaws, which is set forth in more detail in "Shareholder Proposals" and "Other Communications with the Board" in the Corporate Governance section of this Proxy Statement.

Once a candidate has been recommended to the Corporate Secretary or Nominating and Corporate Governance Committee, there are a number of actions undertaken to complete a full evaluation of the candidate, including the following:

Existing Board members are considered for nomination on an annual basis, by undertaking the following actions:

18 | Proxy Statement and Notice of 2020 Annual Meeting

| Board Governance |

In considering new candidates and existing Board members for nomination to the Board, this year the Nominating and Corporate Governance Committee and the Board evaluated the following:

Our Board feels confident that each of the nine individuals we have nominated has the experience and skill sets necessary to fulfill all Board and Committee responsibilities. We encourage you to review our Board accomplishments and biographies and to vote for all nine Board nominees.

We have what we believe to be the most prevalent proxy access model, the "3/3/20/20" structure. The following is a summary of the provisions related to our proxy access

bylaw and is qualified in its entirety by reference to a complete set of our Bylaws:

Shareholders' Eligibility to Nominate

Our Bylaws generally permit any shareholder or group of up to 20 shareholders who have maintained continuous qualifying ownership of at least 3% or more of our outstanding Common Stock for at least the previous 3 years to include a specified number of director nominees in the Company's proxy materials for our annual meeting of stockholders, as described below.

Number of Shareholder-Nominated Candidates

The maximum number of shareholder-nominated candidates will be equal to the greater of: (a) two candidates or (b) 20% of the directors in office at the time of nomination. If the 20% calculation does not result in a whole number, the maximum number of shareholder-nominated candidates would be the closest whole number below 20%. Shareholder-nominated candidates that the Board of Directors determines to include in the proxy materials as Board-nominated candidates will be counted against the 20% maximum.

Calculation of Qualifying Ownership

As more fully described in our Bylaws, a nominating shareholder will be considered to own only the shares for which the shareholder possesses the full voting and investment rights and the full economic interest (including the opportunity for profit and risk of loss). Under this provision, borrowed or hedged shares do not count as "owned" shares. A shareholder will be deemed to "own" shares that have been loaned by or on behalf of the shareholder to another person if the shareholder has the right to recall such loaned shares, undertakes to recall, and does recall such loaned shares prior to the record date for the annual meeting and maintains qualifying ownership of such loaned shares through the date of the meeting.

Procedure for Selecting Candidates in the Event the Number of Nominees Exceeds 20%

If the number of shareholder-nominated candidates exceeds 20% of the directors in office, each nominating shareholder will select one shareholder-nominated candidate, beginning with the nominating shareholder with the largest qualifying ownership and proceeding through the list of nominating shareholders in descending order of qualifying ownership until the permitted number of shareholder-nominated candidates is reached.

Proxy Statement and Notice of 2020 Annual Meeting | 19

Board Governance |

Nominating Procedure

In order to provide adequate time to assess shareholder-nominated candidates, requests to include shareholder-nominated candidates in proxy materials must be received no earlier than 150 days and no later than 120 days before the anniversary of the date that we mailed the proxy statement for the previous year's annual meeting of stockholders, which we expect to be no earlier than November 9, 2020 and no later than December 9, 2020.

Information Required of All Nominating Shareholders

As more fully described in our Bylaws, each shareholder seeking to include a director nominee in the proxy materials is required to provide certain information, including:

Nominating shareholders are also required to make certain representations and agreements, including with regard to:

Information Required of All Shareholder Nominees

Each shareholder nominee is required to provide the representations and agreements required of all nominees for election as director, including certain items noted in our Bylaws that we believe are consistent with current market practice.

Disqualification of Shareholder Nominees

A shareholder nominee would not be eligible for inclusion in the proxy statement under certain circumstances enumerated in our Bylaws, which we believe to be consistent with current market practice.

Supporting Statement

Nominating shareholders are permitted to include in the proxy statement a 500-word statement in support of their nominee(s). We may omit any information or statement that we believe would violate any applicable law or regulation.

Shareholder Amendment of Bylaws

Our Board of Directors has the power to adopt, alter or repeal any provision of our Bylaws and to make new Bylaws. Our shareholders also have the power to alter or repeal any provision of our Bylaws and adopt new Bylaws with the approval of at least a majority of all votes entitled to be cast on the matter.

20 | Proxy Statement and Notice of 2020 Annual Meeting

Compensation of the Board of Directors |

Our non-executive directors are paid in two principal ways: an annual cash retainer and an annual restricted share award ("RSA"). For 2019, directors are paid an annual cash retainer of $100,000 and an RSA with a grant date value of $150,000. These Director RSAs are granted on or about July 1 of each year (although directors may receive a pro-rated RSA if they commence service after July 1). Director RSAs, which are scheduled to vest in full one year after the date of grant (or in the case of any pro-rated grants made during the year, on the same date as the annual grants for that year) and have voting rights, are granted under the W. P. Carey Inc. 2017 Share Incentive Plan ("2017 SIP"). Dividends are not paid currently on unvested Director RSAs granted under the 2017 SIP and instead accrue in cash and are distributed when the underlying award vests. The annual fees as of the date of this Proxy Statement paid to Directors for all positions held are set forth in the table below.

| Cash | | |||

|---|---|---|---|---|

| | | | | |

All Independent Directors | $ | 100,000 | ||

| | | | | |

Additional Fees(1): | ||||

Non-Executive Chairman | $ | 105,000 | ||

| | | | | |

Audit Committee Chair | $ | 20,000 | ||

| | | | | |

Compensation Committee Chair | $ | 17,500 | ||

| | | | | |

Nominating and Corporate Governance Chair | $ | 12,500 | ||

| | | | | |

Investment Committee Chair | $ | 7,500 | ||

| | | | | |

| Stock | | |

|---|---|---|

| | | |

| Form of payment: An RSA granted on or about July 1, with a grant date value of $150,000. | ||

| | | |

| Time of payment: Shares vest in full on the first anniversary of the grant. | ||

| | | |

Prior to July 1, 2019, the Non-Executive Chairman, the chair of the Compensation Committee and the chair of the Nominating and Corporate Governance Committee were paid annual cash retainers of $75,000, $15,000 and $10,000, respectively. | ||

Members of the Executive Committee do not receive additional compensation. | ||

Proxy Statement and Notice of 2020 Annual Meeting | 21

Compensation of the Board of Directors |

2019 DIRECTOR COMPENSATION TABLE

The following table sets forth information concerning the total compensation of the individuals who served as Non-Employee Directors during 2019, including service on all committees of the Board, as described above:

| Name | Fees Earned or Paid in Cash ($) | Stock Awards(1) ($) | Total(2) ($) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

Mark A. Alexander | 120,000 | 149,976 | 269,976 | |||||||

| | | | | | | | | | | |

Peter J. Farrell | 116,250 | 149,976 | 266,226 | |||||||

| | | | | | | | | | | |

Robert J. Flanagan | 100,000 | 149,976 | 249,976 | |||||||

| | | | | | | | | | | |

Benjamin H. Griswold, IV(3) | 137,500 | 149,976 | 287,476 | |||||||

| | | | | | | | | | | |

Axel K.A. Hansing | 100,000 | 149,976 | 249,976 | |||||||

| | | | | | | | | | | |

Jean Hoysradt | 100,000 | 149,976 | 249,976 | |||||||

| | | | | | | | | | | |

Margaret G. Lewis | 106,250 | 149,976 | 256,226 | |||||||

| | | | | | | | | | | |

Christopher J. Niehaus(4) | 186,250 | 149,976 | 336,226 | |||||||

| | | | | | | | | | | |

Nick J.M. van Ommen | 100,000 | 149,976 | 249,976 | |||||||

| | | | | | | | | | | |

22 | Proxy Statement and Notice of 2020 Annual Meeting

| Compensation of the Board of Directors |

DIRECTOR STOCK COMPENSATION TABLE

The following table reflects the Director RSAs, which were first granted in 2013, as well as any restricted stock units ("RSUs"), which were granted from 2008 until 2012 ("Director RSUs"), held by the individuals listed in the previous table, as of December 31, 2019, if any. Director RSUs were immediately vested when granted and pay current dividend equivalents but the payout of the underlying shares, on a one-for-one basis, was required to be deferred until the Director's service on the Board is complete.

| | Total RSU Awards (#) | Total RSA Awards (#) | |||||

|---|---|---|---|---|---|---|---|

| | | | | | | | |

Mark A. Alexander | — | 1,867 | |||||

| | | | | | | | |

Peter J. Farrell | — | 1,867 | |||||

| | | | | | | | |

Robert J. Flanagan | — | 1,867 | |||||

| | | | | | | | |

Benjamin H. Griswold, IV | 8,521 | 1,867 | |||||

| | | | | | | | |

Axel K.A. Hansing | 3,236 | 1,867 | |||||

| | | | | | | | |

Jean Hoysradt | — | 1,867 | |||||

| | | | | | | | |

Margaret G. Lewis | — | 1,867 | |||||

| | | | | | | | |

Christopher J. Niehaus | — | 1,867 | |||||

| | | | | | | | |

Nick J.M. van Ommen | 3,236 | 1,867 | |||||

| | | | | | | | |

Proxy Statement and Notice of 2020 Annual Meeting | 23

Corporate Governance |

We believe that a company's tone is set at the top and are proud to report on our Board-level governance provisions, many of which are recognized as best practices. Critical components of our governance profile include:

These governance provisions are supplemented by our Code of Business Conduct and Ethics and provisions governing related party transactions, which are important elements of our overall approach to governance and are described below.

Shareholder Proposals

The date by which shareholder proposals must be received by W. P. Carey for inclusion in proxy materials relating to our annual meeting to be held in 2021 (the "2021 Annual Meeting") is December 9, 2020, and any such proposals must meet the other requirements of Rule 14a-8 under the Exchange Act.

In order for proposals submitted outside of Rule 14a-8 to be considered at the 2021 Annual Meeting, shareholder proposals, including shareholder nominations for director,

must comply with the advance notice and eligibility requirements contained in the Bylaws. The Bylaws provide that shareholders are required to give advance notice to W. P. Carey of any business to be brought by a shareholder before an annual stockholders' meeting. For business to be properly brought before an annual meeting by a shareholder, the shareholder must give timely written notice thereof to the Secretary of W. P. Carey at the principal executive offices of the Company, W. P. Carey Inc., 50 Rockefeller Plaza, New York, NY 10020. In order to be timely, a shareholder's notice must be delivered not later than 5:00 p.m. Eastern Time on the 120th day prior to the first anniversary of the date of mailing of the notice for the preceding year's annual meeting of shareholders nor earlier than the 150th day prior to the first anniversary of such mailing. Therefore, any shareholder proposals, including nominations for directors, submitted outside of Rule 14a-8 to be voted on at the 2021 Annual Meeting must be received by W. P. Carey not earlier than November 9, 2020 and not later than December 9, 2020. However, in the event that the date of the 2021 Annual Meeting is advanced or delayed by more than 30 days from the anniversary date of the Annual Meeting, for notice by the shareholder to be timely it must be delivered not earlier than the 150th day prior to the date of such annual meeting date and not later than 5:00 p.m. Eastern Time on the later of the 120th day prior to the date of such annual meeting or the tenth day following the day on which public announcement of the date of such annual meeting is first made by W. P. Carey. Such proposals and nominations must be made in accordance with, and include the information required to be set forth by, the Bylaws. An untimely or incomplete proposal or nomination may be excluded from consideration at the 2021 Annual Meeting.

A copy of our Bylaws is available upon request. Such requests and any shareholder proposals should be sent to Susan C. Hyde, Corporate Secretary, W. P. Carey Inc., 50 Rockefeller Plaza, New York, NY 10020. These procedures apply to any matter that a shareholder wishes to raise at any annual meeting, including those matters raised other than pursuant to Rule 14a-8. A shareholder proposal that does not meet the requirements summarized above or listed in the Bylaws will be considered untimely, and any proxy solicited by W. P. Carey may confer discretionary authority to vote on such proposal.

Other Communications with the Board

We value your input. Shareholders and other interested persons who wish to send communications on any topic to the Board, the Non-Executive Chairman of the Board, or the Independent Directors as a group may do so by writing to the Non-Executive Chairman of the Board at the principal executive offices of W. P. Carey Inc.

24 | Proxy Statement and Notice of 2020 Annual Meeting

| Corporate Governance |

The Nominating and Corporate Governance Committee has approved a process for handling communications to the Board in which, absent unusual circumstances or as contemplated by Committee charters, and subject to any required assistance or advice from legal counsel, Ms. Hyde is responsible for monitoring communications and for providing copies or summaries of such communications to the directors as she considers appropriate. The Board will give appropriate attention to written communications that are submitted and will respond if and as appropriate.

Code of Ethics

It is important that all of our business activities reflect our commitment to a culture of honesty and accountability. Our Code of Business Conduct and Ethics, which we refer to in this Proxy Statement as the Code of Ethics, sets forth the standards of business conduct and ethics applicable to all of our employees, including our executive officers and directors. Our Code of Ethics is available on our website, www.wpcarey.com, under the heading "Governance" in the "Investors" section. We also intend to post amendments to or waivers from the Code of Ethics, to the extent applicable to our principal executive officer, principal financial officer and principal accounting officer, at this location on the website; however, no such amendments or waivers have been granted to date.

Compliance with Anti-Bribery, Foreign Corrupt Practices Act, and Office of Foreign Assets Control Requirements

It is our policy to comply with all applicable laws and adhere to the highest level of ethical conduct, including international anti-bribery laws, such as the U.S. Foreign Corrupt Practices Act, United Kingdom Bribery Act and similar laws in other jurisdictions. In that regard, we have adopted an Anti-Bribery and Foreign Corrupt Practices Act Policy that is posted on our employee portal and periodically distributed to appropriate personnel, and we ensure compliance with that policy by monitoring our activities abroad and through periodic employee training.

In addition, we have policies and procedures in place that promote and articulate our compliance with U.S. economic sanctions administered by the U.S. Department of Treasury, Office of Foreign Assets Control in all facets of our operations. We use a screening vendor with respect to all payments that we initiate. Our Economic Sanctions Compliance Policy is periodically distributed to appropriate personnel.

Other conflicts of interest, while not prohibited in all cases, may be harmful to W. P. Carey and therefore must be disclosed in accordance with the Code of Ethics. Our Chief Ethics Officer or, in his or her absence, our Chief Legal Officer, has primary authority and responsibility for the

administration of the Code of Ethics subject to the oversight of the Nominating and Corporate Governance Committee or, in the case of accounting, internal accounting controls or auditing matters, the Audit Committee.

Certain Relationships and Related Transactions

Policies and Procedures with Respect to Related Party Transactions

Our executive officers and directors are committed to upholding the highest legal and ethical conduct in fulfilling their responsibilities and recognize that related party transactions can present a heightened risk of potential or actual conflicts of interest. Employees, officers and directors have an obligation to act in the best interest of W. P. Carey and to put such interests at all times ahead of their own personal interests. In addition, all of our employees, officers and directors should seek to avoid any action or interest that conflicts with or gives the appearance of a conflict with the Company's interests. According to the Code of Ethics, a conflict of interest occurs when a person's private economic or other interest conflicts with, is reasonably expected to conflict with, or may give the appearance of conflicting with, any interest of W. P. Carey. The following conflicts of interest are prohibited, and each employee, officer and director must take all reasonable steps to detect, prevent, and eliminate such conflicts:

In general, a potential related party transaction would be reviewed by the Board. A permitted related party transaction must be considered to be in the best interests of W. P. Carey. If there are any potential related party transactions, all of the relevant material facts and the related person's interest in the transaction will be reviewed by the Board before approval is granted under the Company's policy.

Proxy Statement and Notice of 2020 Annual Meeting | 25

Corporate Governance |

Transactions with Managed Programs

Through wholly-owned subsidiaries, we earn revenue as the advisor to the programs that we manage, which as of the date of this Proxy Statement are CPA:18 – Global CWI 1, CWI 2 and CESH and, collectively, the "Managed Programs". We have also entered into certain transactions

with the Managed Programs, such as co-investments and loans. For more information regarding these transactions and the fees received by W. P. Carey from the Managed Programs, see Notes 3 and 4 to the consolidated financial statements in the 2019 Form 10-K.

26 | Proxy Statement and Notice of 2020 Annual Meeting

Corporate Responsibility Initiatives Supporting Environmental, Social and Governance Goals |

"By its nature, our work promotes jobs and prosperity. Doing Good While Doing Well means that when we are financing properties for companies, we are also helping the communities those companies serve. It is important to always ask, What is the impact of what we are doing? What is good for society? What is good for the country?" |

—Wm. Polk Carey, Founder, W. P. Carey Inc.

2001

We believe that good corporate governance includes being a good corporate citizen and that it is our responsibility to give back to our communities. Now, more than ever, our ability to recruit and retain top talent, to be welcomed in our communities, and to withstand whatever vicissitudes inevitably come our way depends on communicating and living our two core values:Investing for the Long Run andDoing Good While Doing Well.

In 2019, we published our inaugural Corporate Responsibility Report, which provides a comprehensive overview of our ESG initiatives. We continue to enhance our disclosure and maintain open channels of conversation with each of our stakeholder groups, including our employees, tenants and investors. We believe that frequent dialogue with our investors provides us with insights on the topics that are most important to them and accordingly, during 2019, we met with more than 250 equity and fixed income investors.

Our Environmental Practices |

Our commitment to sustainability is largely demonstrated by how we manage our day-to-day activities in our corporate offices. During the last year, we:

In Our Portfolio |

Substantially all of our properties are net leased to our tenants on a triple-net basis, whereby they are responsible for maintaining the buildings and are in control of their energy usage and environmental sustainability practices.

Over the last year, we have increased our outreach to our tenants regarding our sustainability initiatives and gathered information regarding their energy and water usage and waste management practices.

We have identified more than 20 properties in our portfolio that have green certifications, including LEED and BREEAM and recently entered into a lease for a solar roof on our logistics facility in the port of Rotterdam leased to Nippon, which will be the largest in the Netherlands once it is completed. We have other solar projects underway and continue to evaluate other opportunities across our portfolio.

Our Asset Management team is embarking on a Climate Change Risk Analysis, which we anticipate completing by the end of 2020. It is our goal to increase and enhance our disclosure on various ESG projects and initiatives in the coming year.

In evaluating new investments, we include an environmental assessment of the properties we underwrite as part of our analysis to understand sustainability practices and performance and to ensure the properties we acquire meet environmental standards. We are also in the process of implementing a new internal framework to our existing real estate portfolio, to allow us to better view our portfolio as a whole and identify opportunities for impact.

Proxy Statement and Notice of 2020 Annual Meeting | 27

Corporate Responsibility Initiatives Supporting Environmental, Social and Governance Goals |

Corporate Citizenship |

Wm. Polk Carey established the W. P. Carey Foundation in 1990 with a primary mission to support educational institutions and to promote business education, with the larger goal of improving America's competitiveness in the world. As a result of its support, thousands of young people around the country and abroad have seen increased educational opportunities.

As good stewards of our communities, W. P. Carey continues to support educational programs as well as hospitals, museums and other community organizations, and in 2019, together with our employees, donated more than $300,000 to community organizations. In addition, to continue Bill Carey's mission to encourage personal generosity, in the spirit of "Doing Good While Doing Well," the W. P. Carey Foundation supports the philanthropic activities of the W. P. Carey community by matching certain charitable contributions made by our employees and directors and in 2019 bestowed the inaugural "Carey the Torch" award on a W. P. Carey employee who made an exceptional impact on his community and society as a whole.

Carey Forward

Our Carey Forward program was established in 2012 shortly after the passing of Bill Carey and was inspired by his generosity. We have continued growing the Carey Forward program by demonstrating a sustained enthusiasm for building and fostering productive relationships between our company and our communities. The program is funded by the Company and encourages employees to become involved in philanthropic and charitable activities, devote their time and resources to meaningful causes and initiatives, and bring to philanthropic and community organizations the same level of skill and excellence they devote to their professional responsibilities. Although the organizations and activities we support can vary, our focus is often on youth development and education, hunger relief, healthcare, and arts and restoration. In 2019, our employees spent more than 600 hours volunteering in our communities.

Investing in our Employees |

When weInvest for the Long Run, our employees are at the core of that philosophy. We strive to make W. P. Carey a great place to work and to attract and surround ourselves with the best and brightest; we want to enhance their lives in and out of the office as they progress and grow with the company. We offer various levels of training including management training, executive training, skills training and "Respect in the Workforce" training, in addition to our

"Conversations at Carey" educational program. By engaging with our employees and investing in their careers through training and development, we are building a talented workforce capable of executing our business strategies.

Diversity |

Diversity and inclusion is an organic part of who we are and is supported at all levels of the organization. W. P. Carey is an equal opportunity employer and considers qualified applicants regardless of race, color, religion, gender, sexual orientation, gender identity, gender expression, or national origin, age, disability, military or veteran status, genetic information or other statuses protected by applicable federal, state and local law. As of December 31, 2019, women represented 47% of our global workforce, 44% of our managers and 33% of our executive team. Women make up 22% of our Board nominees and we have committed to increase that to at least 30% within 12 months. In addition to gender diversity, our employees represent various backgrounds and speak more than 25 languages. Our offices, located in New York, Amsterdam, London and Dallas, attract a diverse workforce simply by virtue of their geographic locations. With an average age of 38, our employees currently range in age from 23 to 74.

As our company continues to grow, we want to ensure that all of our employees and their families feel supported and represented. Most recently, we introduced financial benefits to assist our employees with adoption and surrogacy expenses. We believe that our success over the long run has been the result of the diverse backgrounds and perspectives of our employees, as well as our directors.

Employee Wellness |

The health and wellness of our employees and their families are paramount and our comprehensive benefits package is designed to address the changing needs of employees and their dependents.

Health and Wellness

28 | Proxy Statement and Notice of 2020 Annual Meeting

| Corporate Responsibility Initiatives Supporting Environmental, Social and Governance Goals |

Our Carey Wellness program provides our employees with education and practical guidance on nutrition, stress management and general healthy living matters that they can apply both in and out of the office.

Financial

Proxy Statement and Notice of 2020 Annual Meeting | 29

Executive Officers |

We believe that our corporate governance creates a framework supportive of long-term sustainable performance. Our executive officers are critical to developing and executing the strategies that make us who we are, and in 2019 they continued to focus on identifying ways to generate value for our shareholders, and executed on a variety of important accomplishments during the year: |

30 | Proxy Statement and Notice of 2020 Annual Meeting

| Executive Officers |

Executive Officers

The Company's executive officers are determined by our Board of Directors. The executive officers as of the date of this Proxy Statement are as follows:

|

Mr. Fox became CEO on January 1, 2018 and has been an executive officer since 2015. Since he is also a Board member, his biography appears on page 9 in Proposal One: Election of Nine Directors. | |

|

Mr. Park became President of W. P. Carey in January 2018 and most recently served as Director of Strategy and Capital Markets since March 2016, after serving in various capacities since joining the Company as an investment analyst in 1987. During his tenure, he has spearheaded the transactions that have transformed the company, including consolidation and listing of CPA:1-9 as Carey Diversified LLC in 1998, its merger with W. P. Carey & Co. Inc. in 2000, liquidity transactions of CPA:10, CIP, CPA:12 and CPA:14, W. P. Carey's merger with CPA:15 and REIT conversion in 2012, W. P. Carey's merger with CPA:16 in 2014 and W. P. Carey's merger with CPA:17 – Global ("CPA:17 Merger") in October 2018. The Board designated him as an executive officer in March 2016. Mr. Park received a B.S. in Chemistry from the Massachusetts Institute of Technology and an M.B.A. in Finance from Stern School of Business at New York University. He also serves as a trustee of the W. P. Carey Foundation. | |

|

Ms. Sanzone was appointed Chief Financial Officer of W. P. Carey in January 2017, having served as Interim Chief Financial Officer since October 2016 and, prior to that, as Chief Accounting Officer since June 2015. She has been an executive officer since 2016. Ms. Sanzone also serves as Chief Financial Officer of CPA:18 – Global since December 2019, and from October 2016 to March 2017. She also served as Chief Financial Officer of CPA:17 – Global from October 2016 to March 2017, having previously served as Chief Accounting Officer since August 2015. In addition, Ms. Sanzone served as Chief Financial Officer of CWI 1 and CWI 2 from October 2016 to March 2017. Prior to joining the Company as Controller in April 2013, Ms. Sanzone worked from 2006 to 2013 at iStar Inc., a publicly-traded REIT, where she served in various capacities, including most recently as Corporate Controller. From 2004 to 2006, Ms. Sanzone served in various accounting and financial reporting roles at Bed Bath and Beyond, Inc., a publicly traded company. Ms. Sanzone also held various positions in the assurance and advisory services practice of Deloitte LLP from 1998 to 2004. Ms. Sanzone is a Certified Public Accountant licensed in the states of New York and New Jersey. She graduated magna cum laude with a B.S. in Accounting from Long Island University, C.W. Post (now LIU Post). |

Proxy Statement and Notice of 2020 Annual Meeting | 31

Executive Officers |

| Gino M. Sabatini,Managing Director and Head of Investments, Age 51 Mr. Sabatini has served as Head of Investments of W. P. Carey since December 2016 and oversees the sourcing, negotiating and structuring of investments in North America and Europe on behalf of W. P. Carey and CPA:18 – Global as well as CPA:17 – Global, through the date of its merger with W. P. Carey in October 2018. Mr. Sabatini joined the Company in 2000, serving in various capacities with increasing responsibilities in the Investment Department, including most recently as Head of U.S. Net Lease Investments, and he has been a Managing Director since 2009. The Board designated him as an executive officer in January 2018. Mr. Sabatini is a graduate of the University of Pennsylvania, where he was enrolled in the Management and Technology program. He received a B.Sc. in Mechanical Engineering from the University of Pennsylvania's Engineering School and a B.Sc. in Economics from the University of Pennsylvania's Wharton School. He earned his M.B.A. from Harvard Business School. | |

|

Mr. Gordon has served as Head of Asset Management of W. P. Carey since April 2017 and oversees asset management activity across all property types in North America and Europe on behalf of W. P. Carey and CPA:18 – Global as well as CPA:17 – Global, through the date of its merger with W. P. Carey in October 2018. Since joining the Company in 2006, Mr. Gordon has served in various capacities with increasing responsibilities in the Asset Management Department, including most recently as the head of the North American Asset Management team, and he has been a Managing Director since 2014. The Board designated him as an executive officer in January 2018. Mr. Gordon earned his B.A. in Economics from Johns Hopkins University, with a concentration in finance and management. He also graduated from Groton School in Groton, MA, and currently serves on the board of directors of The Hinckley Company, a privately held company that manufactures, services, and sells luxury sail and power boats. |

32 | Proxy Statement and Notice of 2020 Annual Meeting

Proposal Two:Advisory Vote on Executive Compensation |

The Board and the Compensation Committee, which is responsible for designing and administering W. P. Carey's executive compensation program, value the opinions expressed by shareholders in their vote on this proposal and will review and consider the outcome of the vote when making future decisions on executive compensation.

At our annual meeting of stockholders held on June 19, 2014, the Board recommended, and stockholders voted, to hold this advisory vote, known as a "Say-on-Pay" vote, every year, with which the Board agreed. Accordingly, and pursuant to SEC rules, in this Proposal Two, shareholders are being asked to vote on the following resolution:

RESOLVED, that the shareholders of W. P. Carey approve, on an advisory basis, the compensation of the company's Named Executive Officers, as disclosed pursuant to Item 402 of SEC Regulation S-K, including the Compensation Discussion and Analysis and the related compensation tables and narrative discussion in this Proxy Statement.

Our goal is to maintain an executive compensation program that fosters the short- and long-term goals of the company and its shareholders. We seek to accomplish this goal by motivating our senior leadership group to achieve a high level of financial performance. We believe that our executive compensation program is designed to align executive pay with performance and to motivate management to make sound financial decisions that increase the value of the company.

Assuming the presence of a quorum at the Annual Meeting, we will hold the next Say-on-Pay vote at the Annual Meeting, and the affirmative vote of a majority of the votes cast by the stockholders, in person or by proxy, is necessary for approval of Proposal Two. However, as an advisory vote, Proposal Two is not binding upon the Board, the Compensation Committee, or W. P. Carey.

| The Board recommends a voteFOR the approval, on an advisory basis, of the foregoing resolution approving the Company's executive compensation. |

Proxy Statement and Notice of 2020 Annual Meeting | 33

Executive Compensation |

Compensation Discussion and Analysis |

The following pages discuss the process and philosophy guiding compensation decisions for the following NEOs during 2019:

Compensation Principles

The Company's executive compensation programs have evolved in structure but follow three basic principles, first established by the Company's late Founder, Mr. Wm. Polk Carey: