Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are not strictly historical statements constitute forward-looking statements and may often, but not always, be identified by the use of such words such as “expects,” “believes,” “intends,” “anticipates,” “plans,” “estimates,” “guidance,” “target,” “potential,” “possible,” or “probable” or statements that certain actions, events or results “may,” “will,” “should,” or “could” be taken, occur or be achieved. The forward-looking statements include statements about the expected future reserves, production, financial position, business strategy, revenues, earnings, costs, capital expenditures and debt levels of the Company, and plans and objectives of management for future operations. Forward-looking statements are based on current expectations and assumptions and analyses made by Earthstone and its management in light of experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: further and substantial declines in oil, natural gas liquids or natural gas prices; risks relating to any unforeseen liabilities; the level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; impacts to financial statements as a result of impairment write- downs; risks related to levels of indebtedness and periodic redeterminations of the borrowing base under the Company’s credit agreement; Earthstone’s ability to generate sufficient cash flows from operations to meet the internally funded portion of its capital expenditures budget; Earthstone’s ability to obtain external capital to finance exploration and development operations and acquisitions; the ability to successfully complete any potential acquisitions and the risks related thereto; the impacts of hedging on results of operations; uninsured or underinsured losses resulting from oil and natural gas operations; Earthstone’s ability to replace oil and natural gas reserves; and any loss of senior management or key technical personnel. Earthstone’s 2018 Annual Report on Form 10-K, quarterly reports on Form 10-Q, recent current reports on Form 8-K and other Securities and Exchange Commission (“SEC”) filings discuss some of the important risk factors identified that may affect Earthstone’s business, results of operations, and financial condition. Earthstone undertakes no obligation to revise or update publicly any forward-looking statementsexceptasrequiredbylaw. This presentation contains Earthstone’s 2020 production, capital expenditure and operating expense guidance. The actual levels of production, capital expenditures and operating expenses may be higher or lower than these estimates due to, among other things, uncertainty in drilling schedules, changes in market demand and unanticipated delays in production. These estimates are based on numerous assumptions. All or any of these assumptions may not prove to be accurate, which could result in actual results differing materially from estimates. No assurance can be made that any new wells will produce in line with historical performance, or that existing wells will continue to produce in line with expectations. For additional discussion of the factors that may cause us not to achieve our production estimates, see Earthstone’s filings with the SEC, including its Form 10-K and any amendments thereto. We do not undertake any obligation to release publicly the results of any future revisions we may make to this prospective data or to update this prospective data to reflect events or circumstances after the date of this presentation. Therefore, you are cautioned not to place undue reliance on this information. 2

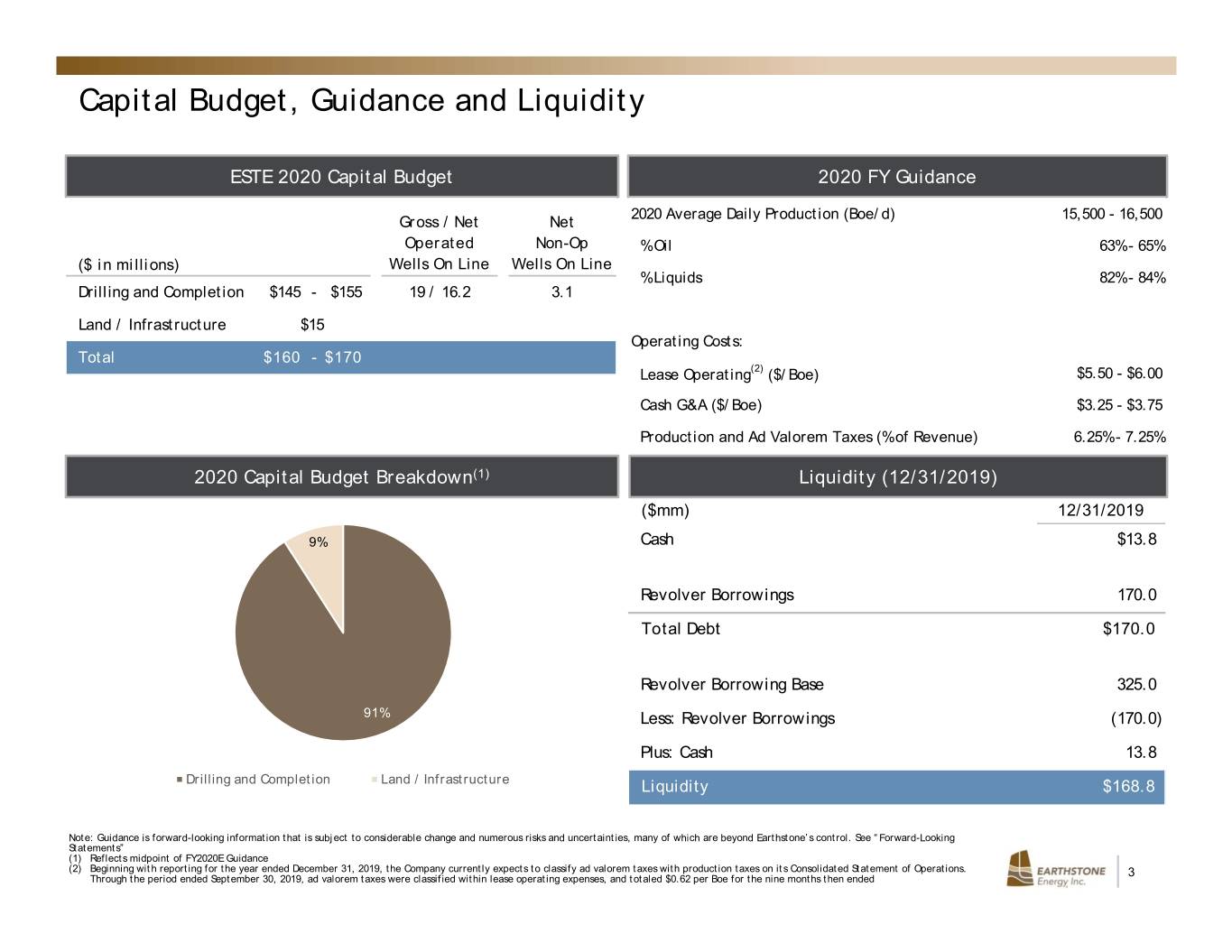

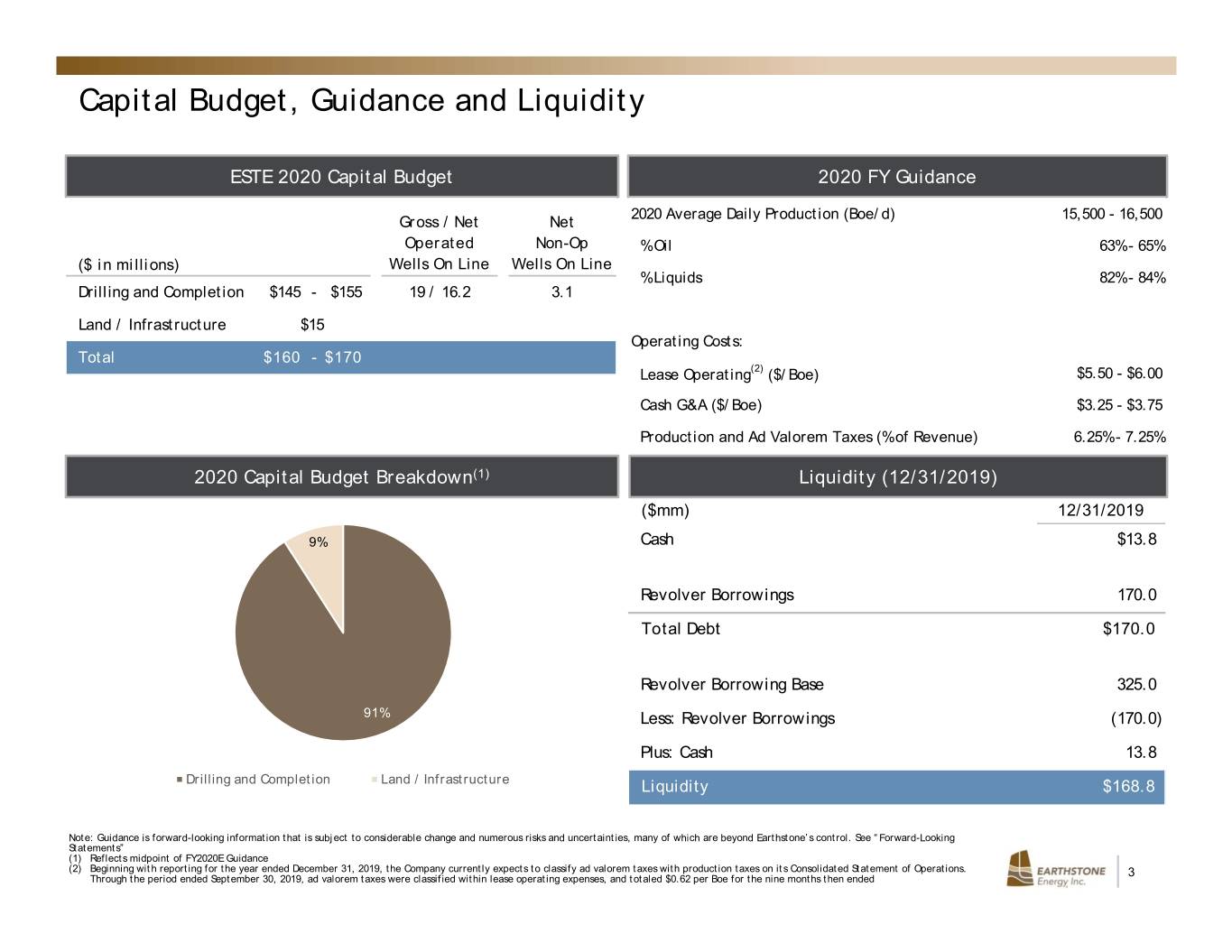

Capital Budget, Guidance and Liquidity ESTE 2020 Capital Budget 2020 FY Guidance 2020 Average Daily Production (Boe/d) 15,500 - 16,500 Gross / Net Net Operated Non-Op % Oil 63% - 65% ($ in millions) Wells On Line Wells On Line % Liquids 82% - 84% Drilling and Completion $145 - $155 19 / 16.2 3.1 Land / Infrastructure $15 Operating Costs: Total $160 - $170 Lease Operating(2) ($/Boe) $5.50 - $6.00 Cash G&A ($/Boe) $3.25 - $3.75 (2) Production and Ad Valorem Taxes (% of Revenue) 6.25% - 7.25% 2020 Capital Budget Breakdown(1) Liquidity (12/31/2019) ($mm) 12/31/2019 9% Cash $13.8 Revolver Borrowings 170.0 Total Debt $170.0 Revolver Borrowing Base 325.0 91% Less: Revolver Borrowings (170.0) Plus: Cash 13.8 Drilling and Completion Land / Infrastructure Liquidity $168.8 Note: Guidance is forward-looking information that is subject to considerable change and numerous risks and uncertainties, many of which are beyond Earthstone’s control. See “Forward-Looking Statements” (1) Reflects midpoint of FY2020E Guidance (2) Beginning with reporting for the year ended December 31, 2019, the Company currently expects to classify ad valorem taxes with production taxes on its Consolidated Statement of Operations. 3 Through the period ended September 30, 2019, ad valorem taxes were classified within lease operating expenses, and totaled $0.62 per Boe for the nine months then ended

Contact Information Mark Lumpkin, Jr. EVP, Chief Financial Officer Scott Thelander Vice President of Finance Corporate Offices Houston 1400 Woodloch Forest Drive | Suite 300 | The Woodlands, TX 77380 | (281) 298-4246 Midland 600 N. Marienfeld | Suite 1000 | Midland, TX 79701 | (432) 686-1100 Website www.earthstoneenergy.com 4