1Q23 Earnings Presentation M a y 3 , 2 0 2 3 1 E x h i b i t 9 9 . 2

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are not strictly historical statements constitute forward-looking statements and may often, but not always, be identified by the use of words such as “expects,” “believes,” “intends,” “anticipates,” “plans,” “estimates,” “guidance,” “target,” “potential,” “possible,” or “probable” or statements that certain actions, events or results “may,” “will,” “should,” or “could” be taken, occur or be achieved. The forward-looking statements include statements about the expected benefits of Earthstone Energy, Inc. (“ESTE,” “Earthstone” or the “Company”) and its stockholders from Earthstone’s recent acquisitions of oil and gas properties, the expected future reserves, production, financial position, business strategy, revenues, earnings, free cash flow, costs, capital expenditures and debt levels of the Company, and plans and objectives of management for future operations. Forward-looking statements are based on current expectations and assumptions and analyses made by Earthstone and its management in light of experience and perception of historical trends, current conditions and expected future developments, as well as other factors appropriate under the circumstances. However, whether actual results and developments will conform to expectations is subject to a number of material risks and uncertainties, including but not limited to: Earthstone’s ability to successfully integrate the oil and gas properties it has recently acquired and achieve anticipated benefits from them; risks relating to any unforeseen liabilities of Earthstone or the oil and gas properties it has recently acquired; declines in oil, natural gas liquids or natural gas prices; developments in the Russia-Ukraine conflict; and future geopolitical events, the level of success in exploration, development and production activities; adverse weather conditions that may negatively impact development or production activities; the timing of exploration and development expenditures; inaccuracies of reserve estimates or assumptions underlying them; revisions to reserve estimates as a result of changes in commodity prices; impacts to financial statements as a result of impairment writedowns; risks related to national banking systems; our level of indebtedness and periodic redeterminations of the borrowing base under the Company’s credit facility; Earthstone’s ability to generate sufficient cash flows from operations to fund all or portions of its future capital expenditures budget or to support a shareholder return program; Earthstone’s ability to obtain external capital to finance exploration and development operations and acquisitions; the impacts of hedging on results of operations; uninsured or underinsured losses resulting from oil and natural gas operations; competition for assets, equipment, materials and qualified people; supply chain disruptions; constraints or downtime on midstream assets servicing Earthstone’s oil and gas production; Earthstone’s ability to replace oil and natural gas reserves; any loss of senior management or technical personnel; regulatory matters, including environmental regulations; oilfield service cost inflation; social, market and regulatory efforts to address climate change; cybersecurity risks, and the direct and indirect impact on most or all of the foregoing on the COVID-19 pandemic or future variants. Earthstone’s annual report on Form 10-K for the year ended December 31, 2022, quarterly reports on Form 10-Q, recent current reports on Form 8- K, and other Securities and Exchange Commission (“SEC”) filings discuss some of the important risk factors identified that may affect Earthstone’s business, results of operations, and financial condition. The forward-looking statements included in this presentation speak only as of the date of this presentation and Earthstone undertakes no obligation to revise or update publicly any forward-looking statements except as required by law. . This presentation contains estimates of Earthstone’s 2023 production, capital expenditures and expense guidance. The actual levels of production, capital expenditures and operating expenses may be higher or lower than these estimates due to, among other things, uncertainty in drilling schedules, oil and natural gas prices, changes in market demand for hydrocarbons and unanticipated delays in production and well completions. These estimates are based on numerous assumptions. All or any of these assumptions may not prove to be accurate, which could result in actual results differing materially from estimates. No assurance can be made that any new wells will produce in line with historical performance, or that existing wells will continue to produce in line with Earthstone’s expectations. Earthstone’s ability to fund its 2023 and future capital budgets is subject to numerous risks and uncertainties, including volatility in commodity prices and the potential for unanticipated production and completion delays and increases in costs associated with drilling, production and transportation. Use of Non-GAAP Information This presentation includes financial measures that are not in accordance with accounting principles generally accepted in the United States (“GAAP”) such as PV-10, free cash flow, Leverage, Net Debt, and Adjusted EBITDAX. Such non-GAAP measures are not alternatives to GAAP measures, and you should not consider these non-GAAP measures in isolation or as a substitute for analysis of our results as reported under GAAP. For additional disclosure regarding such non-GAAP measures, including reconciliations to their most directly comparable GAAP measure, please refer to the Appendix or to Earthstone’s press release for the quarter ended March 31, 2023. Cautionary Note on Reserves and Resource Estimates The SEC permits oil and gas companies, in their filings with the SEC, to disclose only proved, probable and possible reserves. Any reserve estimates provided in this presentation that are not specifically designated as being estimates of proved reserves may include estimated reserves or locations not necessarily calculated in accordance with, or contemplated by, the SEC’s latest reserve reporting guidelines. You are urged to consider closely the oil and gas disclosures in our 2022 Form 10-K and our other reports and filings with the SEC. Estimated ultimate recovery (“EUR”) is a measure that by its nature is more speculative than estimates of proved reserves prepared in accordance with SEC definitions and guidelines and is accordingly less certain. Industry and Market Data This presentation has been prepared by Earthstone and includes market data and other statistical information from third-party sources, including independent industry publications, government publications or other published independent sources. Although Earthstone believes these third-party sources are reliable as of their respective dates, Earthstone has not independently verified the accuracy or completeness of this information. Some data are also based on Earthstone’s good faith estimates, which are derived from its review of internal sources as well as the third-party sources described above. 2

Returns Focused Modest cash flow needed to maintain production levels, creates robust free cash flow generation1 Top Basins / Long Inventory Life Delaware Basin and Midland Basin asset base with ~10 years of high quality inventory life Earthstone’s Differentiating Factors 3 Strategic Consolidator Seven acquisitions since early 2021 increased production by >5x and improved cost and operating efficiencies Low Leverage Achieved LTM 1Q23 leverage of 0.8x² Shareholder Returns Earthstone provides opportunities to consider further shareholder returns Management Team Conservative Management Team with a Proven History of Value Creation Commitment & Focus “Do the right thing” commitment to stakeholders, employees and environment Note: See Appendix for footnotes.

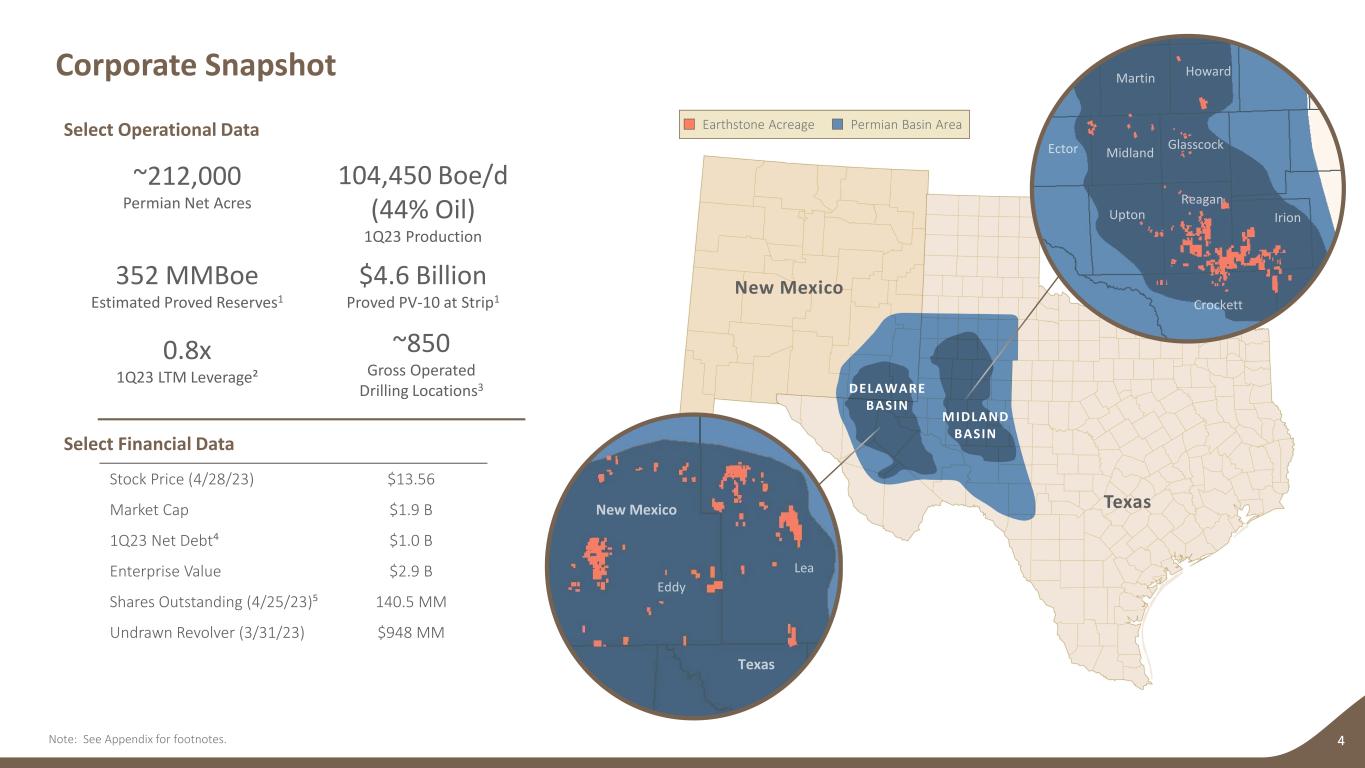

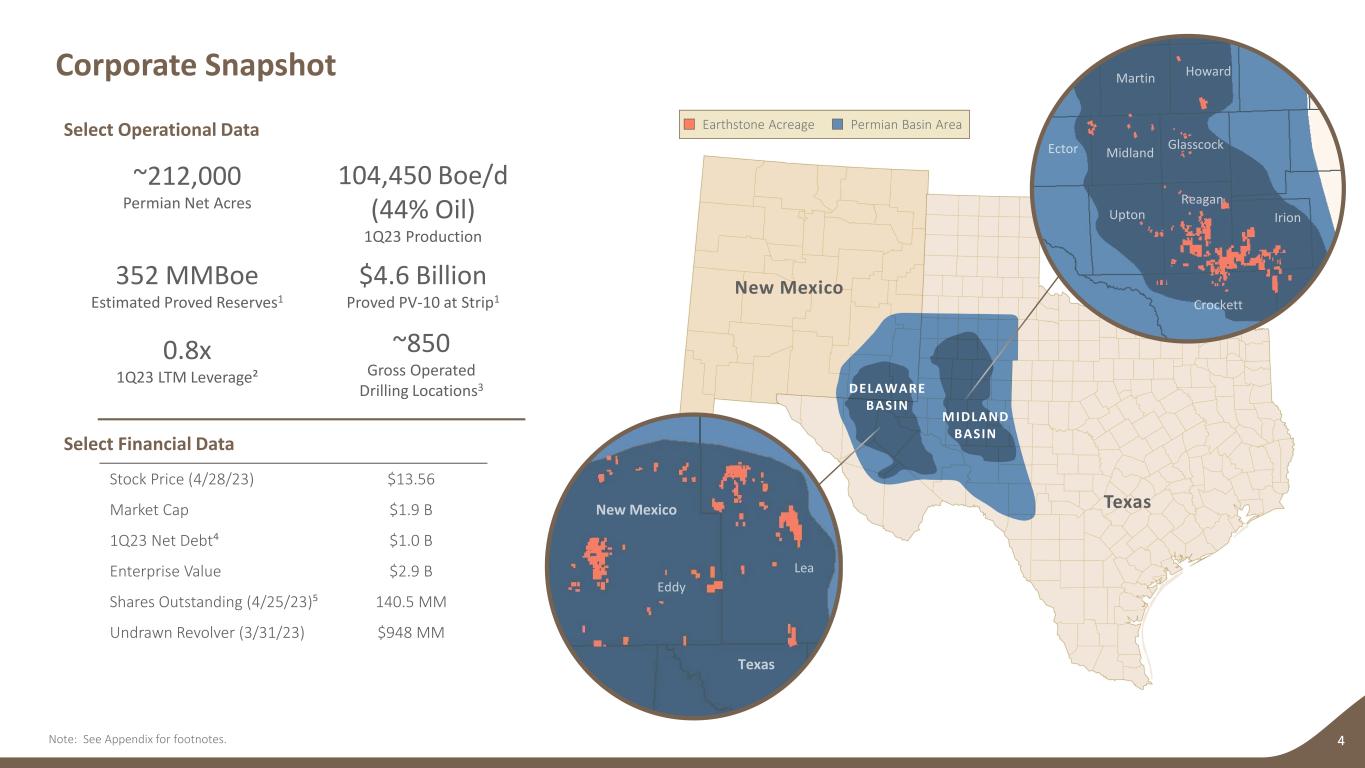

Texas New Mexico Corporate Snapshot 4Note: See Appendix for footnotes. Earthstone Acreage Permian Basin Area MIDLAND BASIN DELAWARE BASIN Select Operational Data 352 MMBoe Estimated Proved Reserves1 $4.6 Billion Proved PV-10 at Strip1 104,450 Boe/d (44% Oil) 1Q23 Production ~212,000 Permian Net Acres Select Financial Data 0.8x 1Q23 LTM Leverage² ~850 Gross Operated Drilling Locations3 Stock Price (4/28/23) $13.56 Market Cap $1.9 B 1Q23 Net Debt⁴ $1.0 B Enterprise Value $2.9 B Shares Outstanding (4/25/23)⁵ 140.5 MM Undrawn Revolver (3/31/23) $948 MM

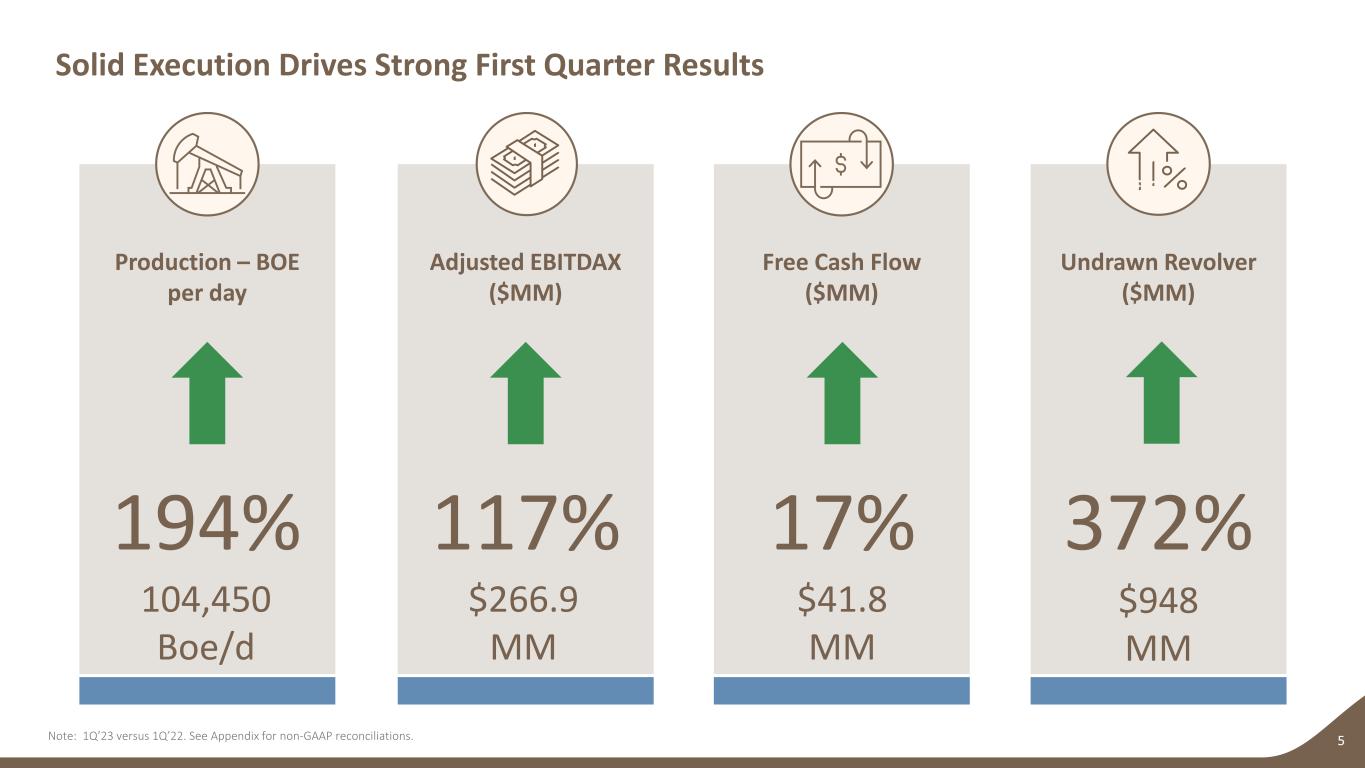

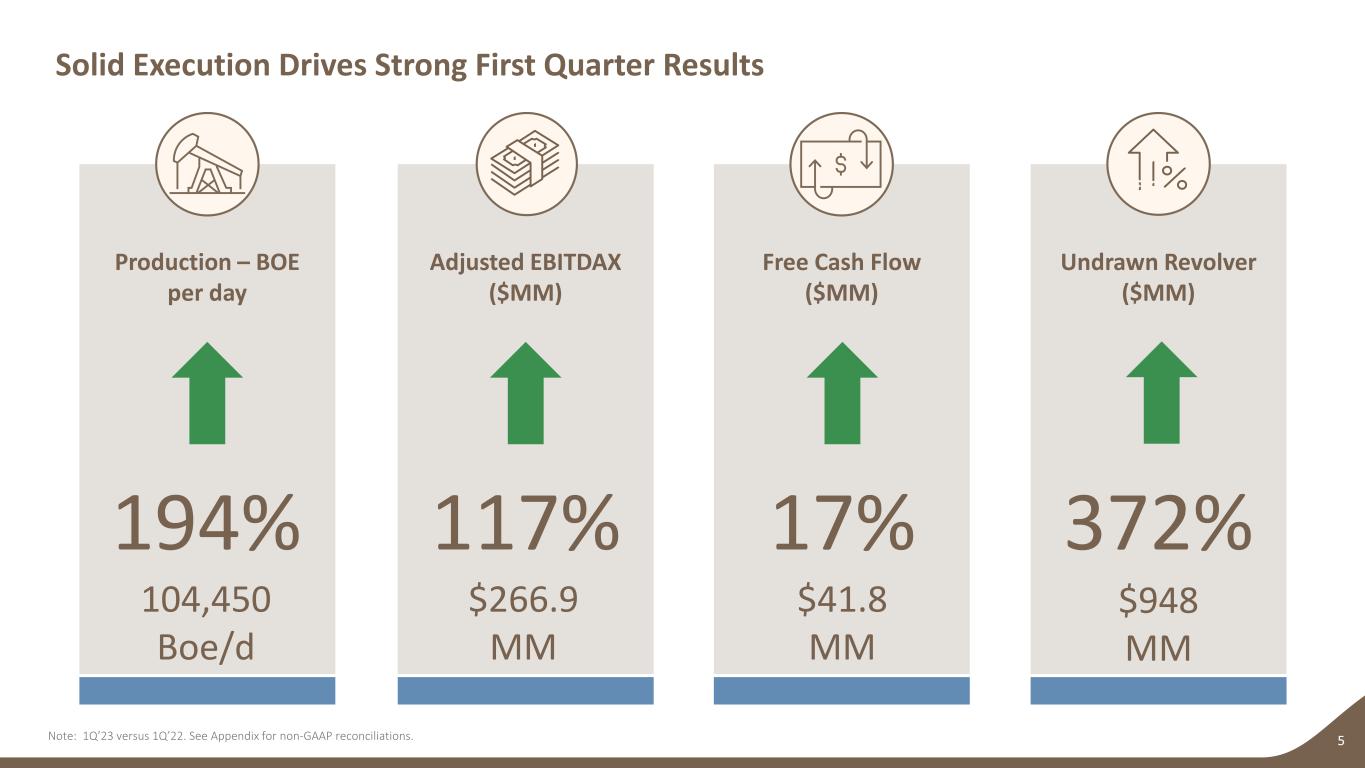

Solid Execution Drives Strong First Quarter Results 5Note: 1Q’23 versus 1Q’22. See Appendix for non-GAAP reconciliations. Production – BOE per day Adjusted EBITDAX ($MM) Free Cash Flow ($MM) Undrawn Revolver ($MM) 194% 117% 17% 372% 104,450 Boe/d $266.9 MM $41.8 MM $948 MM

1 Proven Permian Consolidator Invested over $2.0 Billion in 3 Significant Delaware and Midland Basin Acquisitions 2 Production Growth Strong well results and operational performance drove estimated production to more than 104,000 Boepd (45% oil) in 4Q22 3 Proved Reserves Growth Increased Proved Reserves volume by ~150%1 2022 Key Accomplishments 6 4 Shareholder Returns Repurchased ~2% of Outstanding Shares in 4Q22 5 Strong Balance Sheet Maintained Strong Balance Sheet with LTM Leverage of 0.8x2 6 Record Financial Results Adjusted EBITDAX of $1.1 billion; Free Cash Flow of over $500 million³ Significant step-change in 2022 positions Earthstone for substantial opportunities to enhance existing Permian asset base and generate shareholder value Note: See Appendix for footnotes.

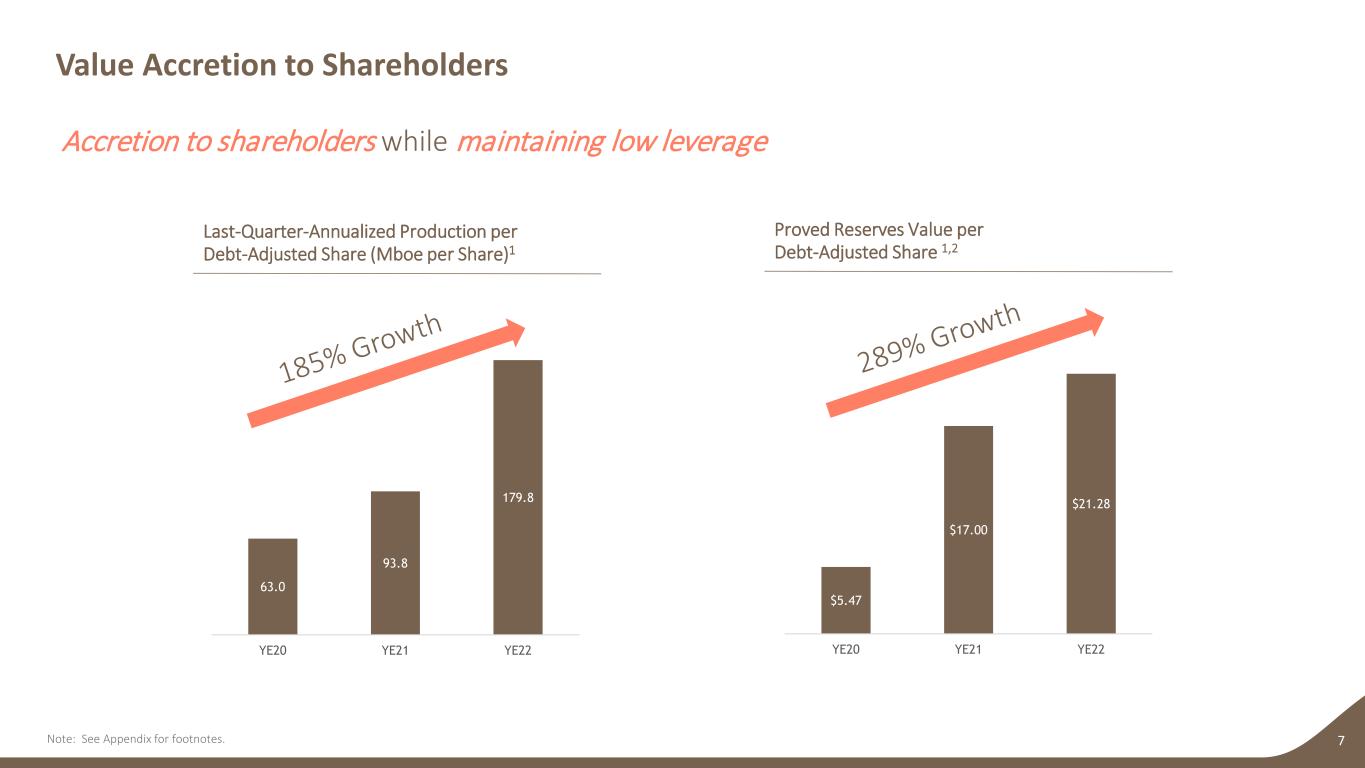

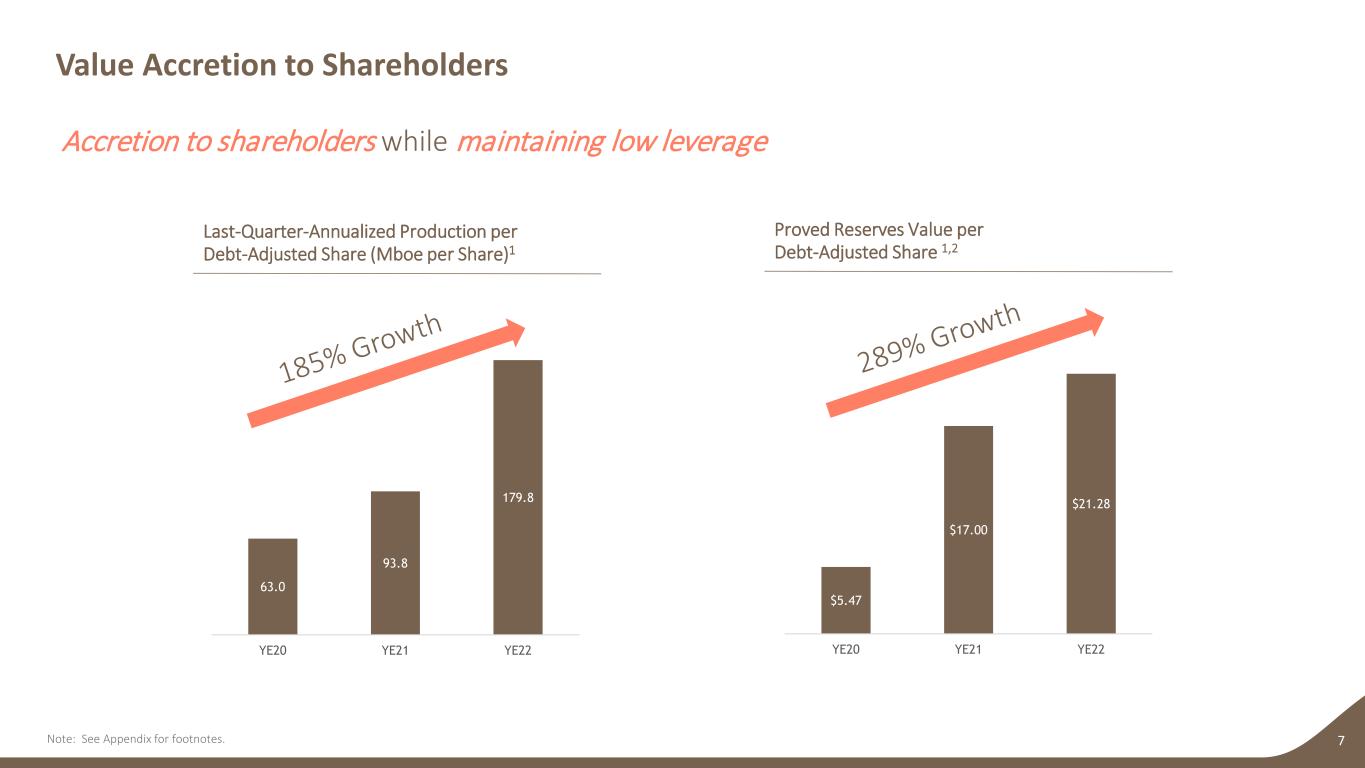

Value Accretion to Shareholders 7 Accretion to shareholders while maintaining low leverage $5.47 $17.00 $21.28 YE20 YE21 YE22 Proved Reserves Value per Debt-Adjusted Share 1,2 63.0 93.8 179.8 YE20 YE21 YE22 Last-Quarter-Annualized Production per Debt-Adjusted Share (Mboe per Share)1 Note: See Appendix for footnotes.

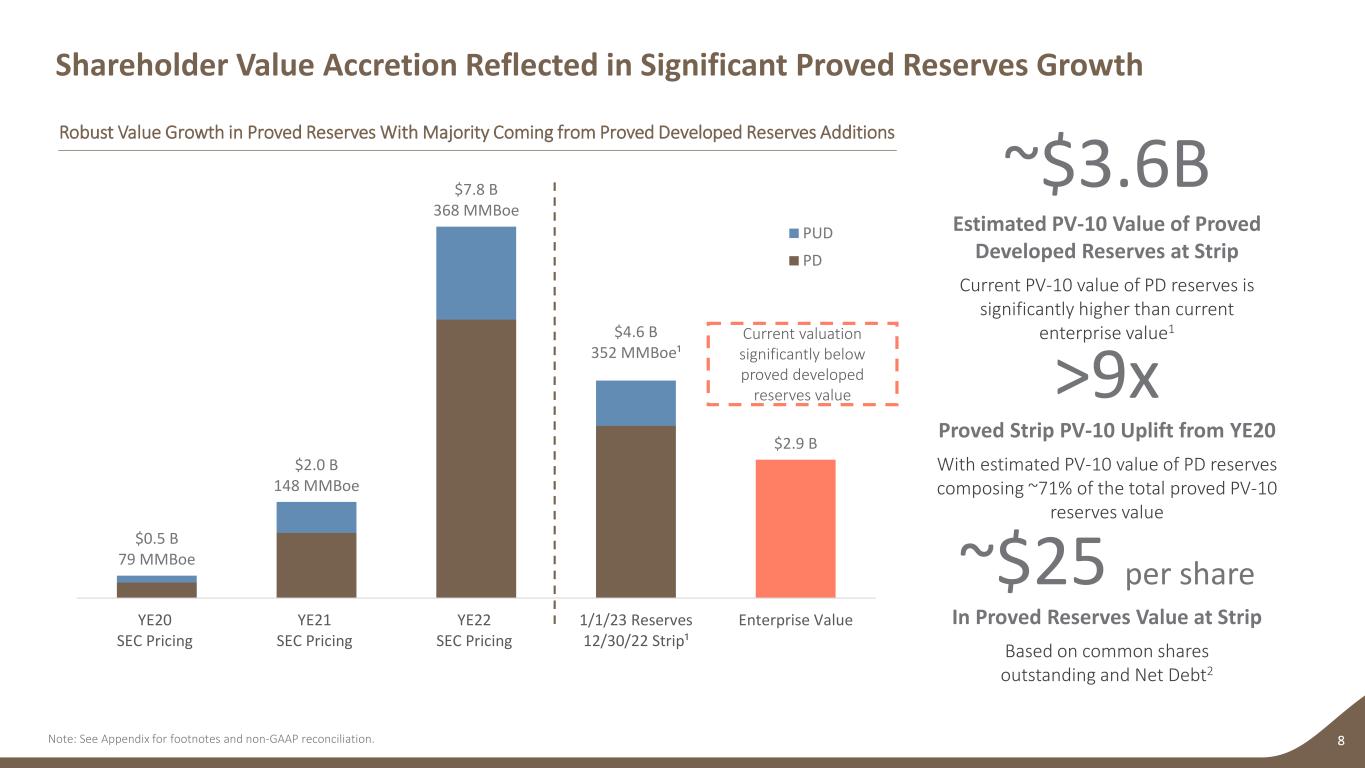

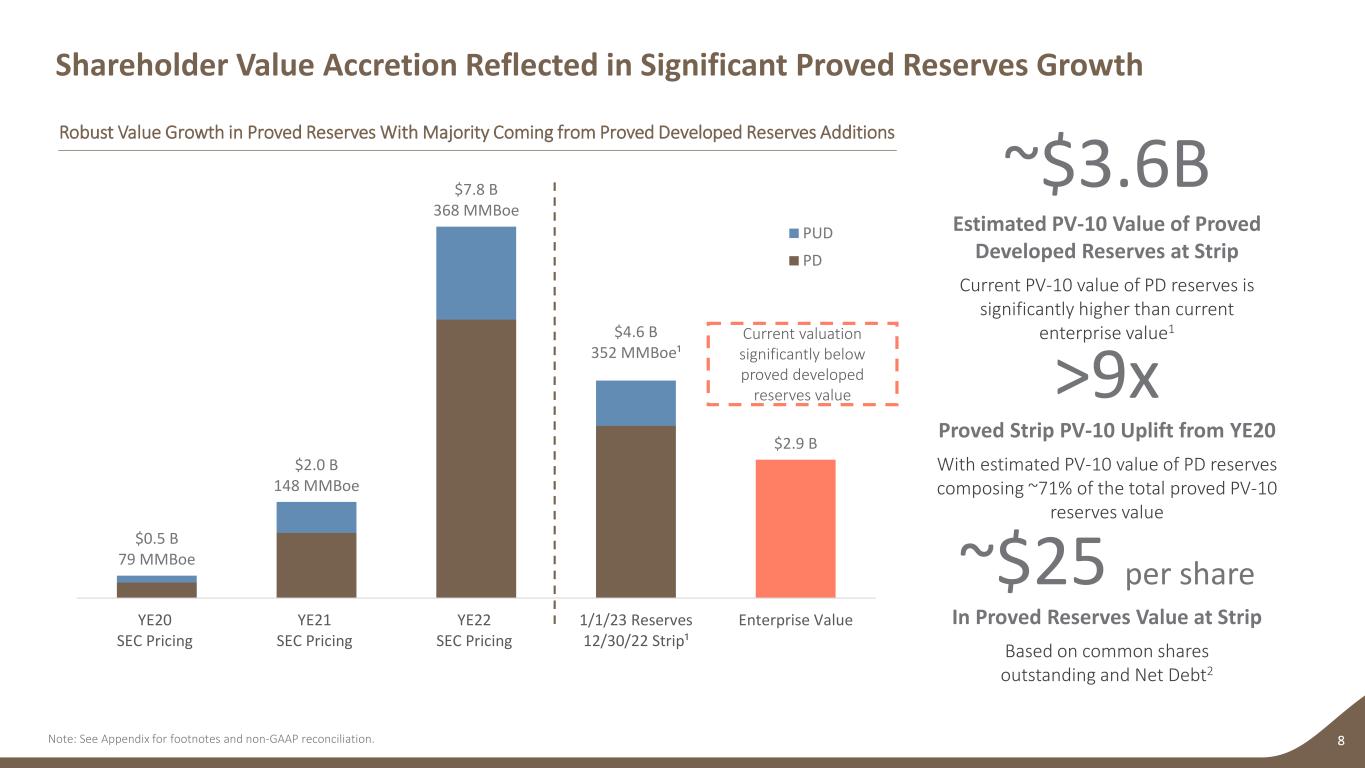

$0.5 B 79 MMBoe $2.0 B 148 MMBoe $7.8 B 368 MMBoe $4.6 B 352 MMBoe¹ $2.9 B YE20 SEC Pricing YE21 SEC Pricing YE22 SEC Pricing 1/1/23 Reserves 12/30/22 Strip¹ Enterprise Value PUD PD Shareholder Value Accretion Reflected in Significant Proved Reserves Growth 8 Proved Strip PV-10 Uplift from YE20 With estimated PV-10 value of PD reserves composing ~71% of the total proved PV-10 reserves value In Proved Reserves Value at Strip Based on common shares outstanding and Net Debt2 >9x ~$25 per share Estimated PV-10 Value of Proved Developed Reserves at Strip Current PV-10 value of PD reserves is significantly higher than current enterprise value1 ~$3.6B Robust Value Growth in Proved Reserves With Majority Coming from Proved Developed Reserves Additions Current valuation significantly below proved developed reserves value Note: See Appendix for footnotes and non-GAAP reconciliation.

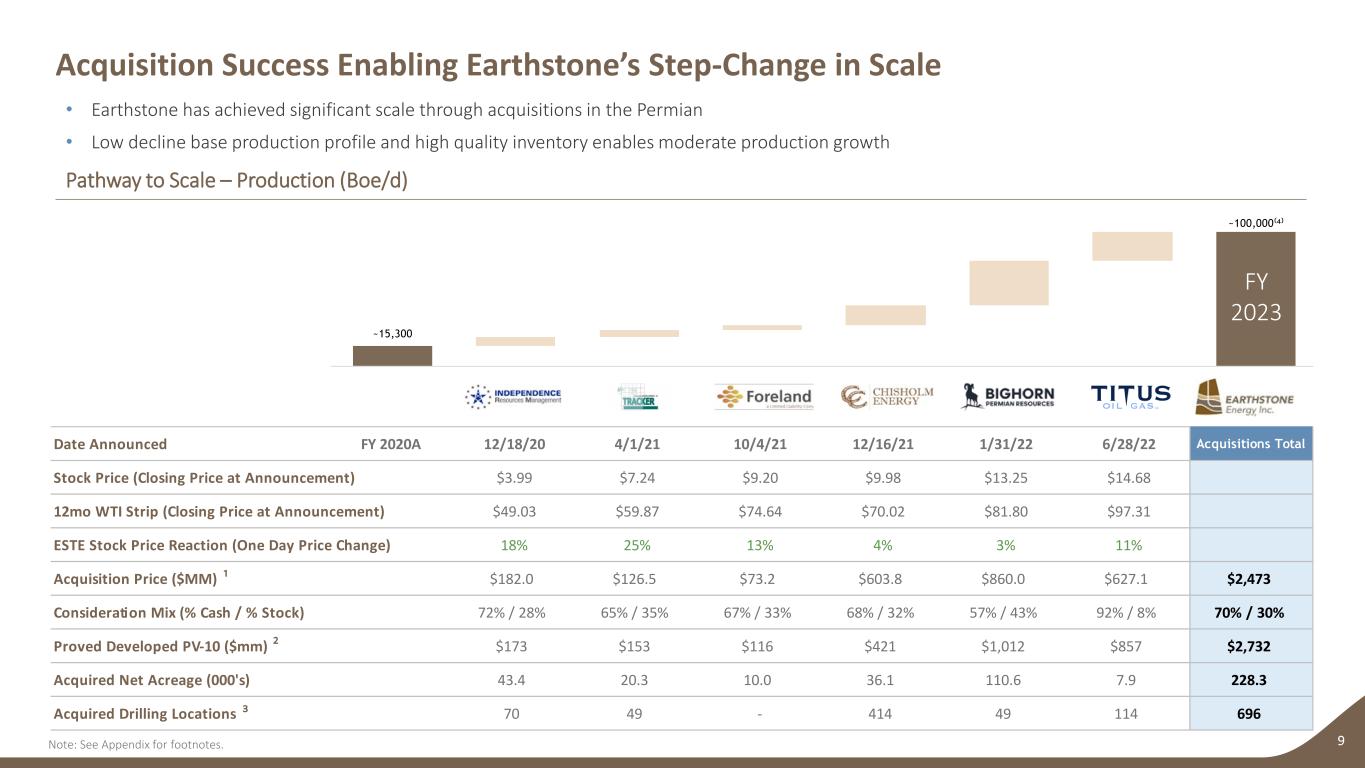

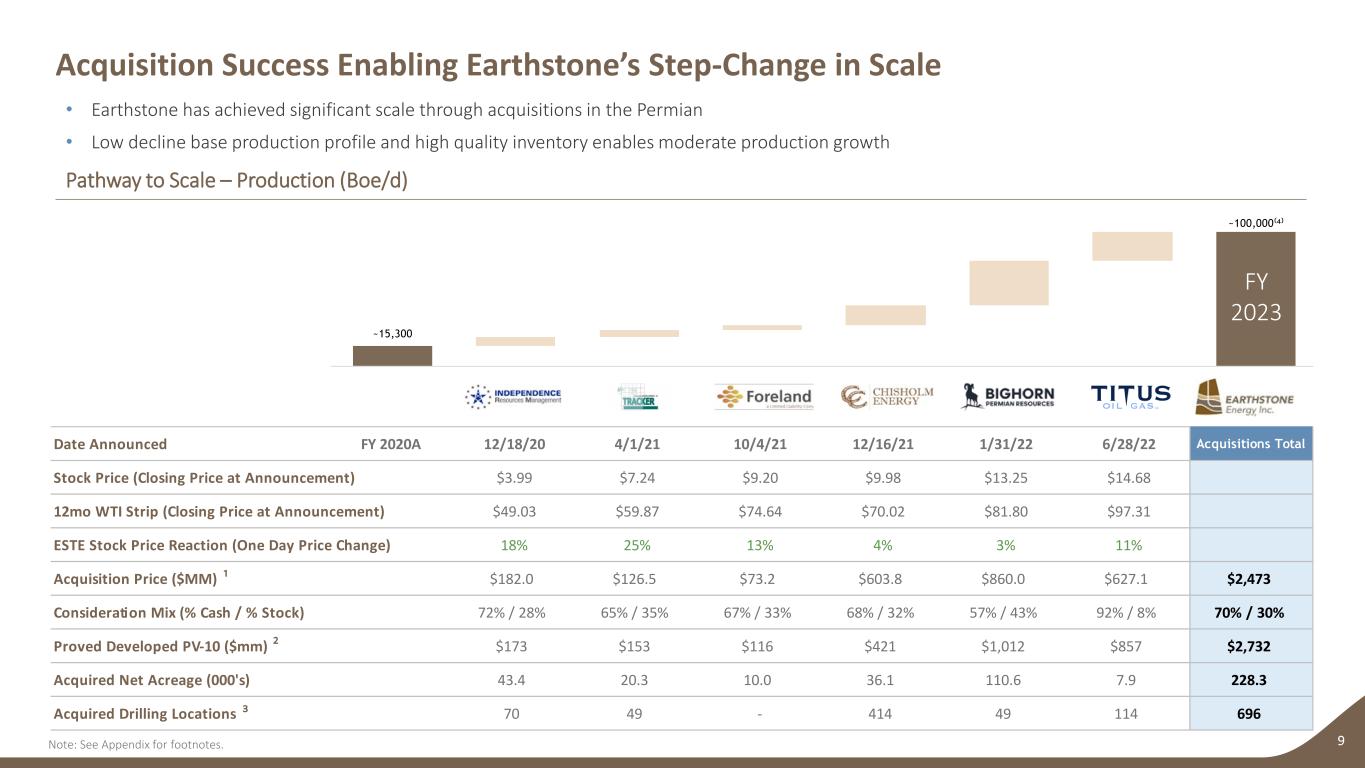

Acquisition Success Enabling Earthstone’s Step-Change in Scale • Earthstone has achieved significant scale through acquisitions in the Permian • Low decline base production profile and high quality inventory enables moderate production growth Note: See Appendix for footnotes. 9 FY 2023E Date Announced FY 2020A 12/18/20 4/1/21 10/4/21 12/16/21 1/31/22 6/28/22 Acquisitions Total Stock Price (Closing Price at Announcement) $3.99 $7.24 $9.20 $9.98 $13.25 $14.68 12mo WTI Strip (Closing Price at Announcement) $49.03 $59.87 $74.64 $70.02 $81.80 $97.31 ESTE Stock Price Reaction (One Day Price Change) 18% 25% 13% 4% 3% 11% Acquisition Price ($MM)(1) $182.0 $126.5 $73.2 $603.8 $860.0 $627.1 $2,473 Consideration Mix (% Cash / % Stock) 72% / 28% 65% / 35% 67% / 33% 68% / 32% 57% / 43% 92% / 8% 70% / 30% Proved Developed PV-10 ($mm) (2) $173 $153 $116 $421 $1,012 $857 $2,732 Acquired Net Acreage (000's) 43.4 20.3 10.0 36.1 110.6 7.9 228.3 Acquired Drilling Locations(3) 70 49 - 414 49 114 696 ~15,300 ~100,000⁽⁴⁾ ESTE… IRM Tracker Foreland Chisholm Bighorn Titus 4Q22E Pathway to Scale – Production (Boe/d) ¹ ² ³ FY 2023

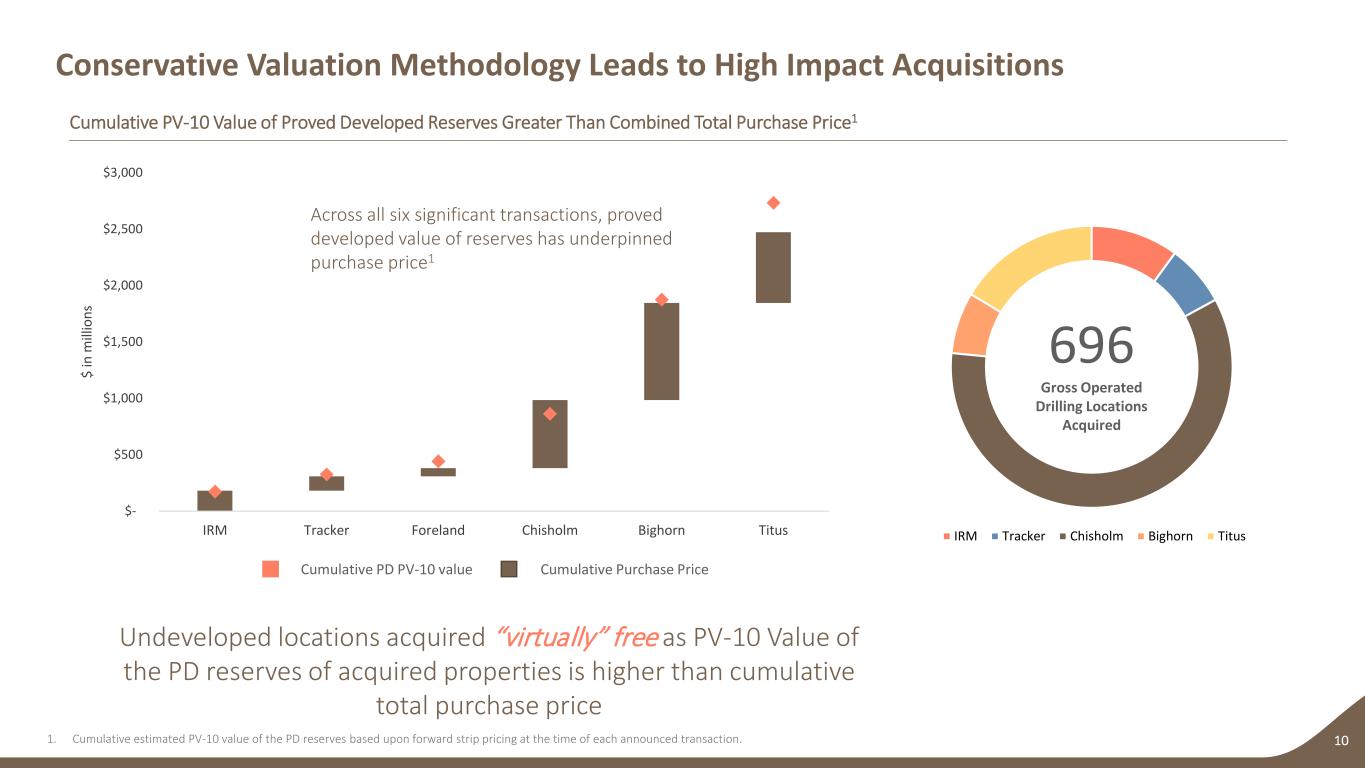

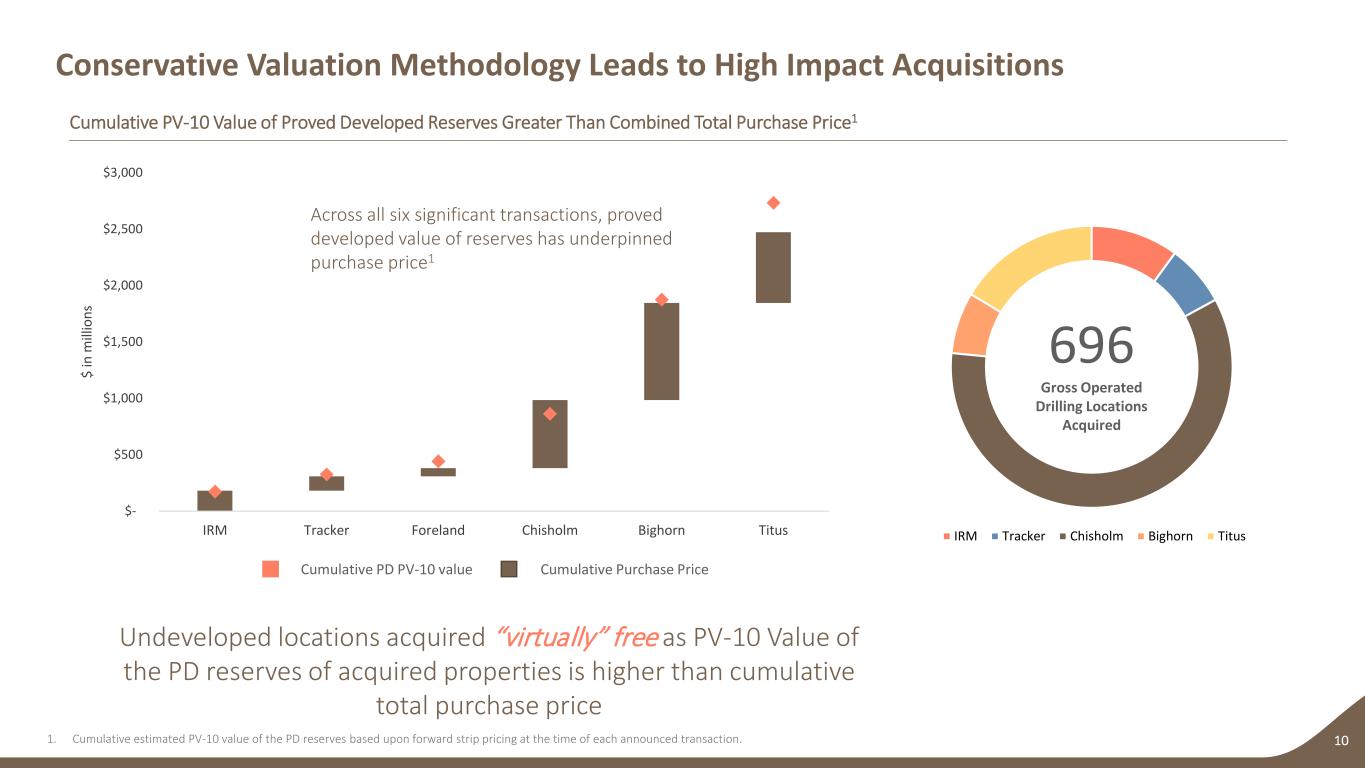

$- $500 $1,000 $1,500 $2,000 $2,500 $3,000 IRM Tracker Foreland Chisholm Bighorn Titus $ in m ill io ns Conservative Valuation Methodology Leads to High Impact Acquisitions 10 Cumulative PV-10 Value of Proved Developed Reserves Greater Than Combined Total Purchase Price1 1. Cumulative estimated PV-10 value of the PD reserves based upon forward strip pricing at the time of each announced transaction. Cumulative PD PV-10 value Cumulative Purchase Price IRM Tracker Chisholm Bighorn Titus 696 Gross Operated Drilling Locations Acquired Across all six significant transactions, proved developed value of reserves has underpinned purchase price1 Undeveloped locations acquired “virtually” free as PV-10 Value of the PD reserves of acquired properties is higher than cumulative total purchase price

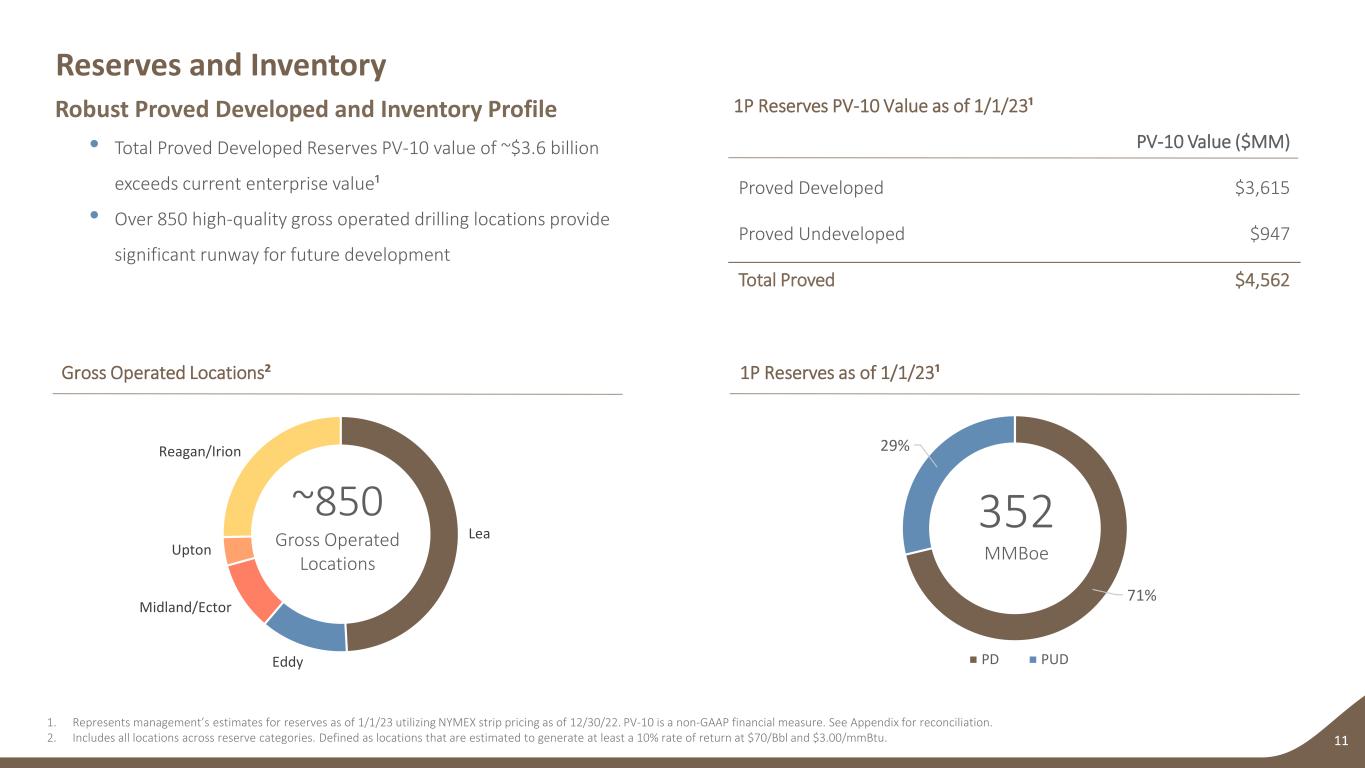

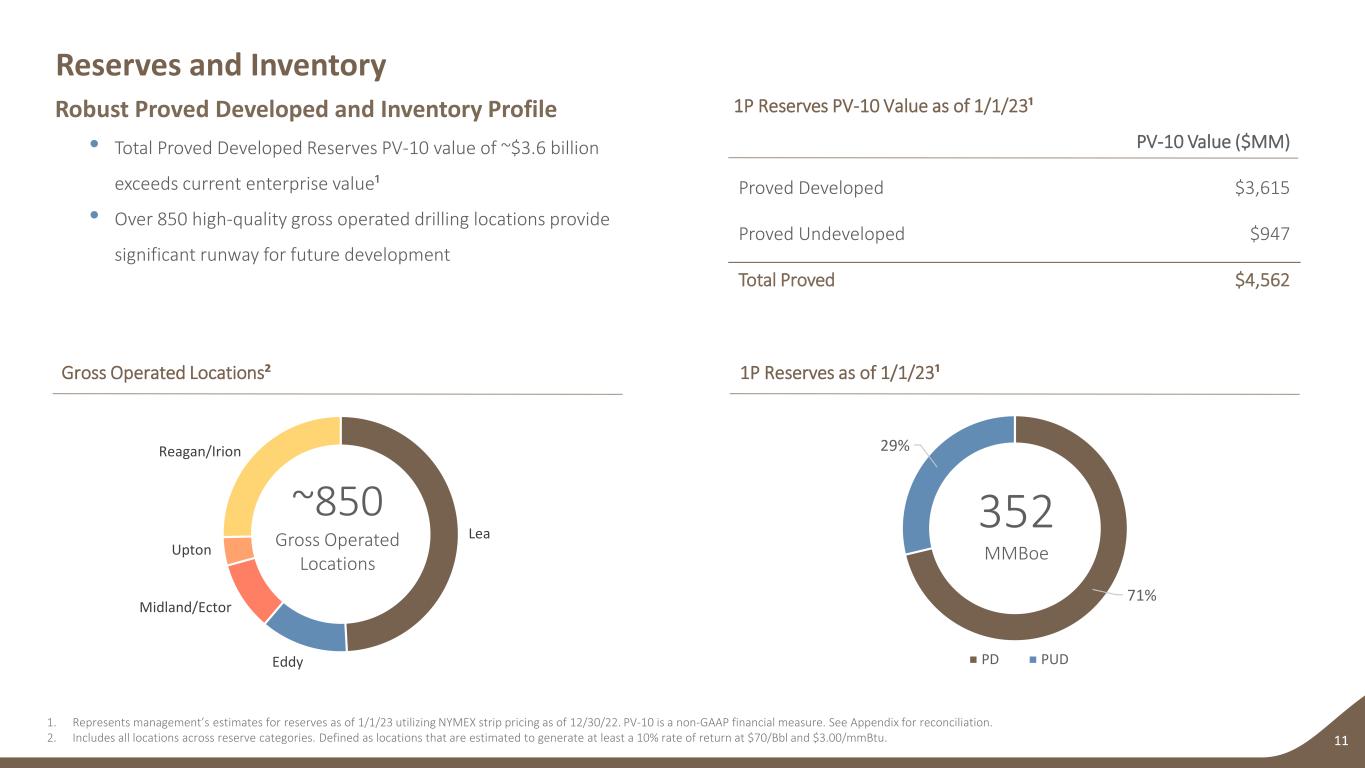

Robust Proved Developed and Inventory Profile 1P Reserves PV-10 Value as of 1/1/23¹ PV-10 Value ($MM) Proved Developed $3,615 Proved Undeveloped $947 Total Proved $4,562 • Total Proved Developed Reserves PV-10 value of ~$3.6 billion exceeds current enterprise value¹ • Over 850 high-quality gross operated drilling locations provide significant runway for future development Lea Eddy Midland/Ector Upton Reagan/Irion 1P Reserves as of 1/1/23¹ Reserves and Inventory 11 1. Represents management’s estimates for reserves as of 1/1/23 utilizing NYMEX strip pricing as of 12/30/22. PV-10 is a non-GAAP financial measure. See Appendix for reconciliation. 2. Includes all locations across reserve categories. Defined as locations that are estimated to generate at least a 10% rate of return at $70/Bbl and $3.00/mmBtu. 71% 29% PD PUD 352 MMBoe Gross Operated Locations² ~850 Gross Operated Locations

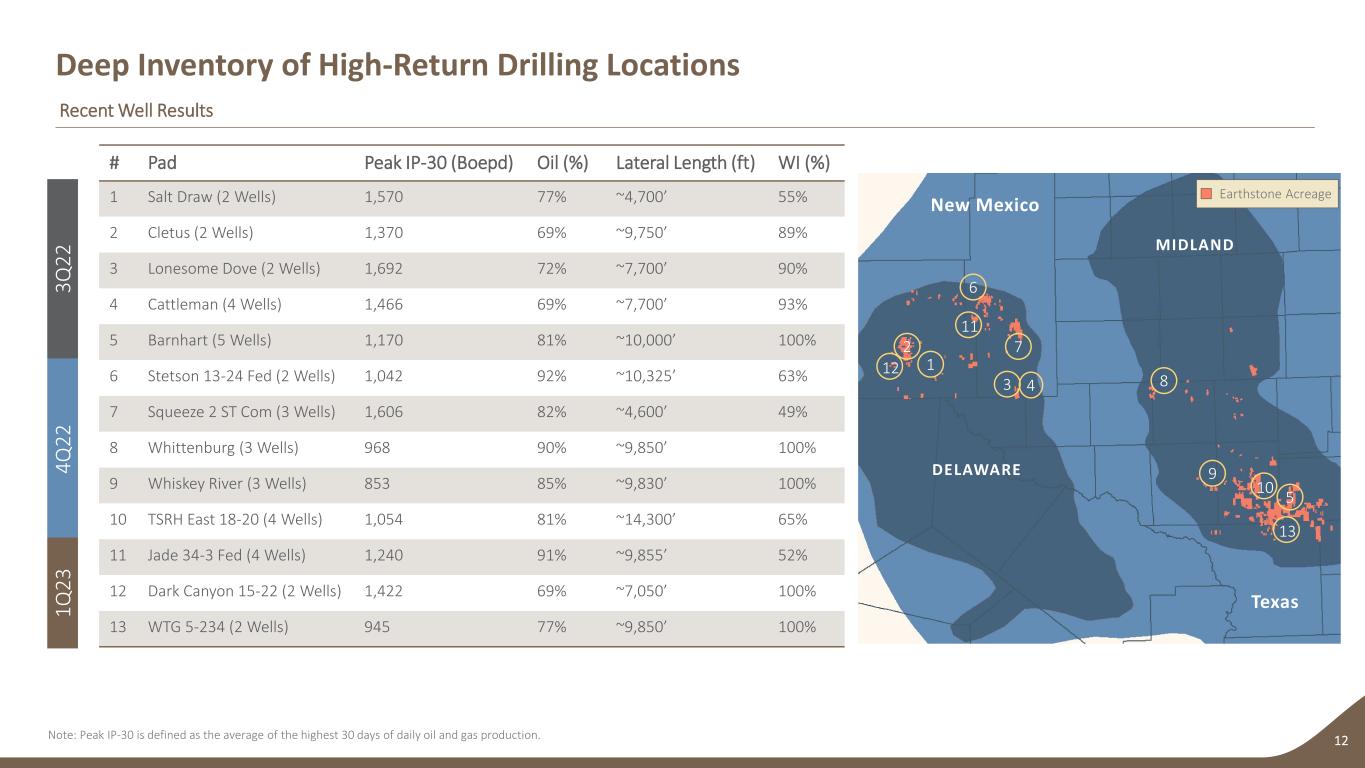

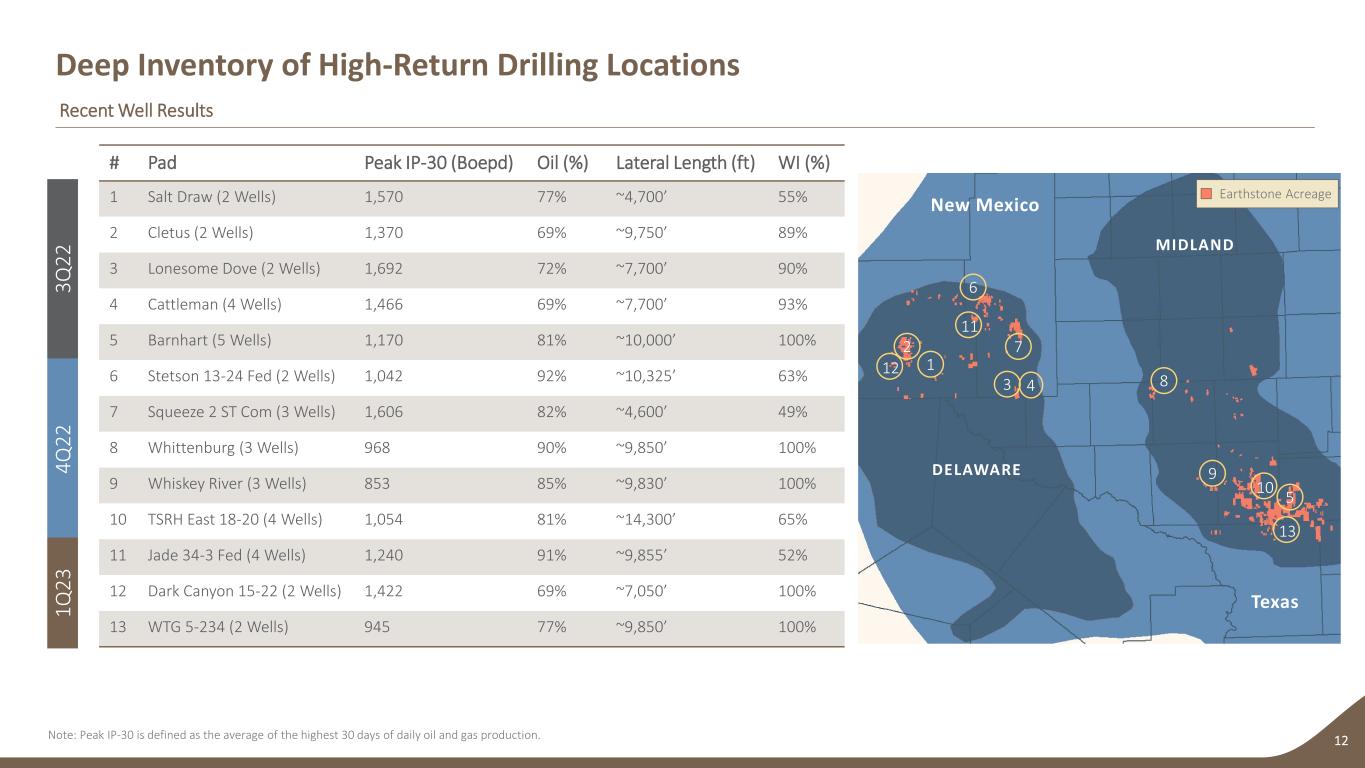

MIDLAND New Mexico Earthstone Acreage Texas Deep Inventory of High-Return Drilling Locations 12 Recent Well Results # Pad Peak IP-30 (Boepd) Oil (%) Lateral Length (ft) WI (%) 1 Salt Draw (2 Wells) 1,570 77% ~4,700’ 55% 2 Cletus (2 Wells) 1,370 69% ~9,750’ 89% 3 Lonesome Dove (2 Wells) 1,692 72% ~7,700’ 90% 4 Cattleman (4 Wells) 1,466 69% ~7,700’ 93% 5 Barnhart (5 Wells) 1,170 81% ~10,000’ 100% 6 Stetson 13-24 Fed (2 Wells) 1,042 92% ~10,325’ 63% 7 Squeeze 2 ST Com (3 Wells) 1,606 82% ~4,600’ 49% 8 Whittenburg (3 Wells) 968 90% ~9,850’ 100% 9 Whiskey River (3 Wells) 853 85% ~9,830’ 100% 10 TSRH East 18-20 (4 Wells) 1,054 81% ~14,300’ 65% 11 Jade 34-3 Fed (4 Wells) 1,240 91% ~9,855’ 52% 12 Dark Canyon 15-22 (2 Wells) 1,422 69% ~7,050’ 100% 13 WTG 5-234 (2 Wells) 945 77% ~9,850’ 100% 1 2 3 4 5 11 DELAWARE 6 7 8 9 10 12 13 3Q 22 4Q 22 1Q 23 Note: Peak IP-30 is defined as the average of the highest 30 days of daily oil and gas production.

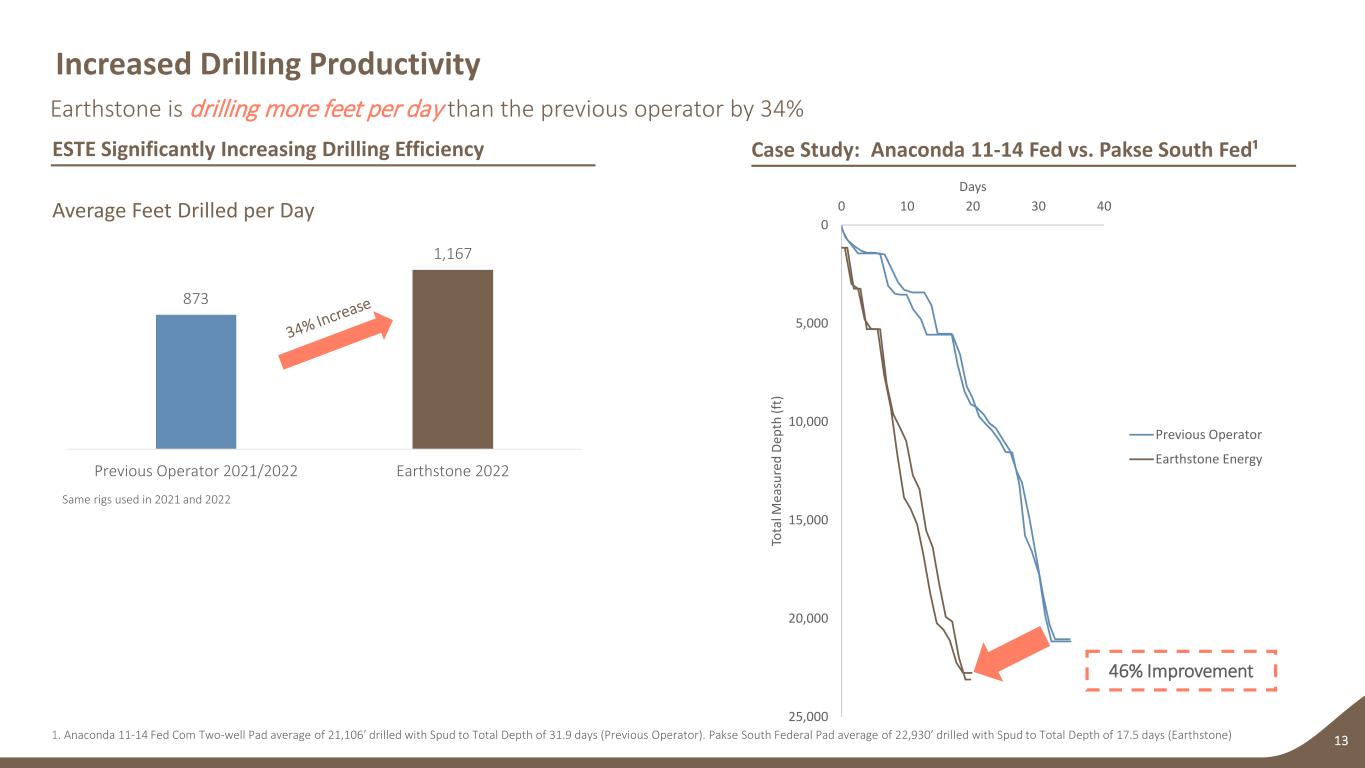

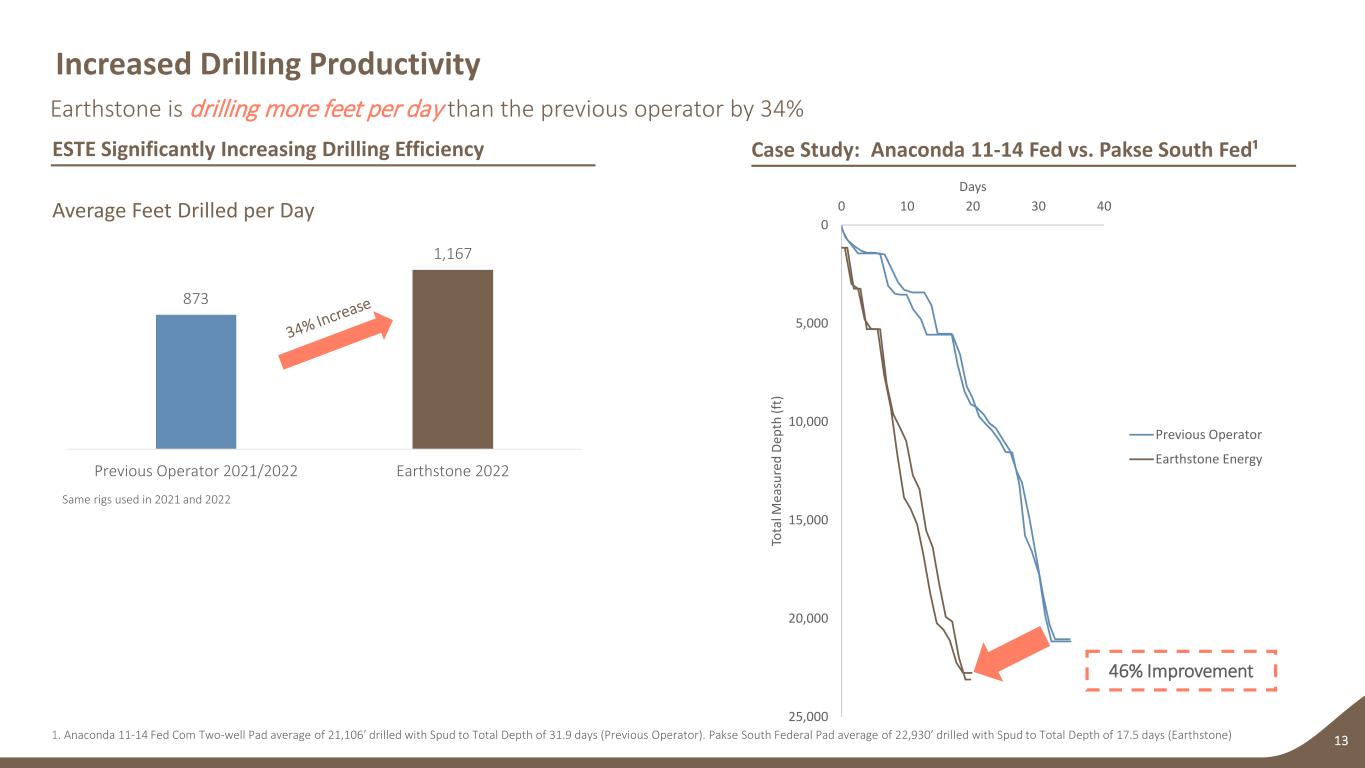

0 5,000 10,000 15,000 20,000 25,000 0 10 20 30 40 To ta l M ea su re d De pt h (ft ) Days Previous Operator Previous Operator Earthstone Energy Earthstone Energy Increased Drilling Productivity 13 Case Study: Anaconda 11-14 Fed vs. Pakse South Fed¹ ESTE Significantly Increasing Drilling Efficiency 873 1,167 Previous Operator 2021/2022 Earthstone 2022 Same rigs used in 2021 and 2022 Average Feet Drilled per Day Earthstone is drilling more feet per day than the previous operator by 34% 1. Anaconda 11-14 Fed Com Two-well Pad average of 21,106’ drilled with Spud to Total Depth of 31.9 days (Previous Operator). Pakse South Federal Pad average of 22,930’ drilled with Spud to Total Depth of 17.5 days (Earthstone) 46% Improvement

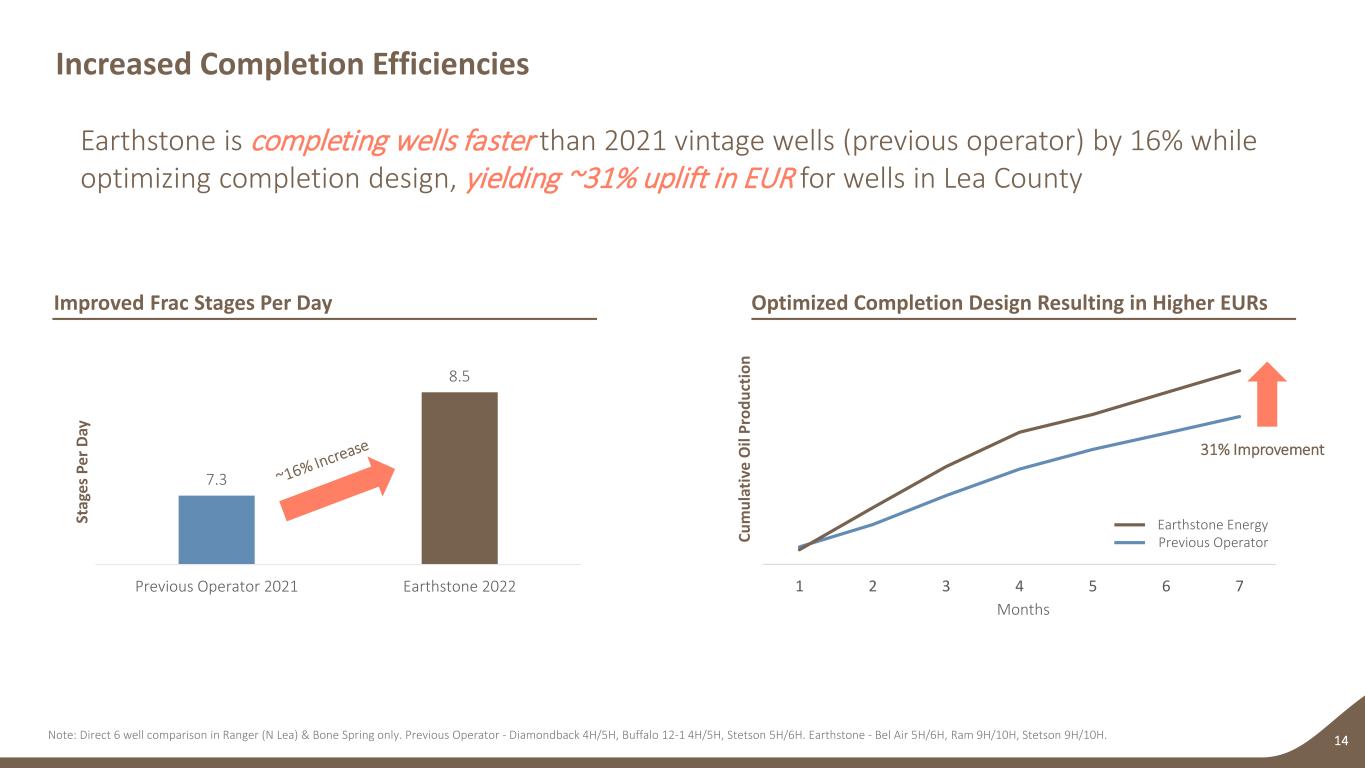

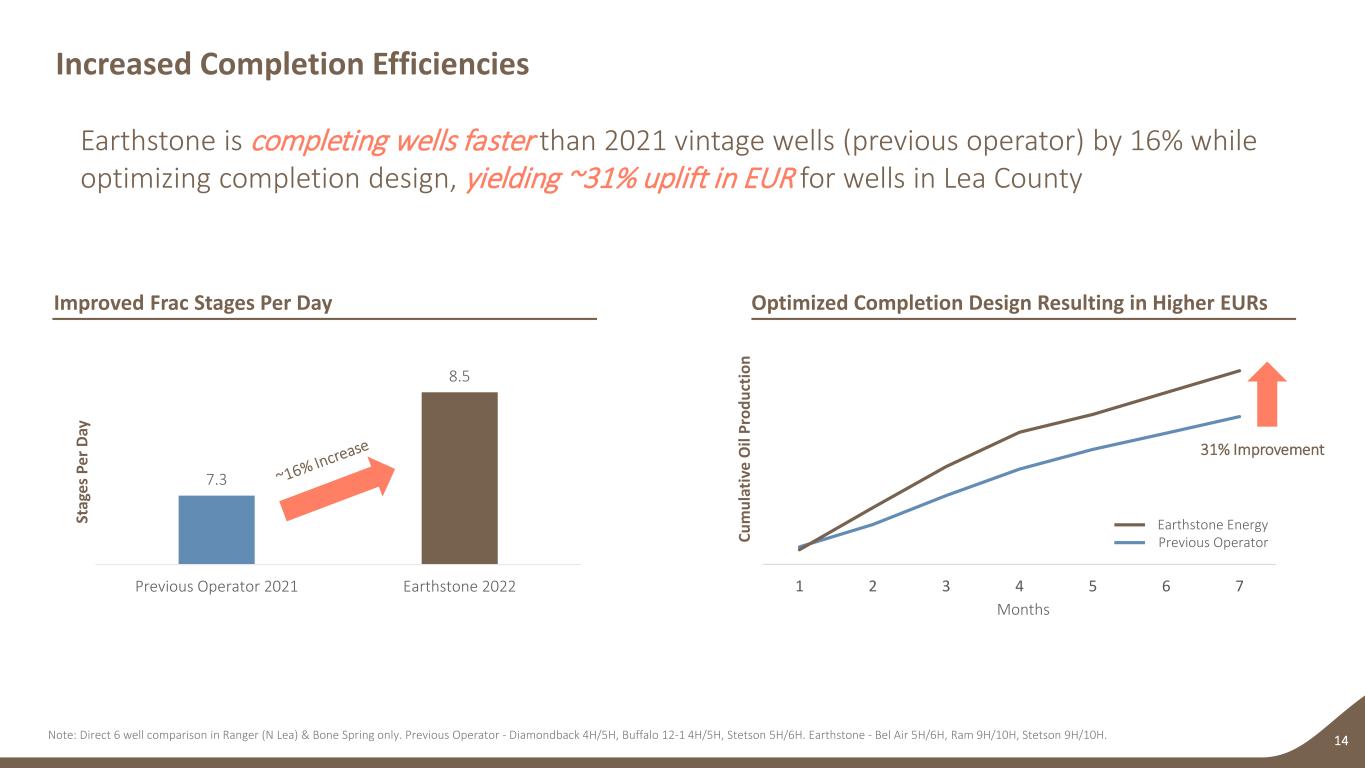

Increased Completion Efficiencies 14 Optimized Completion Design Resulting in Higher EURsImproved Frac Stages Per Day Earthstone is completing wells faster than 2021 vintage wells (previous operator) by 16% while optimizing completion design, yielding ~31% uplift in EUR for wells in Lea County 7.3 8.5 Previous Operator 2021 Earthstone 2022 St ag es P er D ay 1 2 3 4 5 6 7 31% Improvement Cu m ul at iv e O il Pr od uc tio n Months Previous Operator Earthstone EnergySt ag es P er D ay Note: Direct 6 well comparison in Ranger (N Lea) & Bone Spring only. Previous Operator - Diamondback 4H/5H, Buffalo 12-1 4H/5H, Stetson 5H/6H. Earthstone - Bel Air 5H/6H, Ram 9H/10H, Stetson 9H/10H.

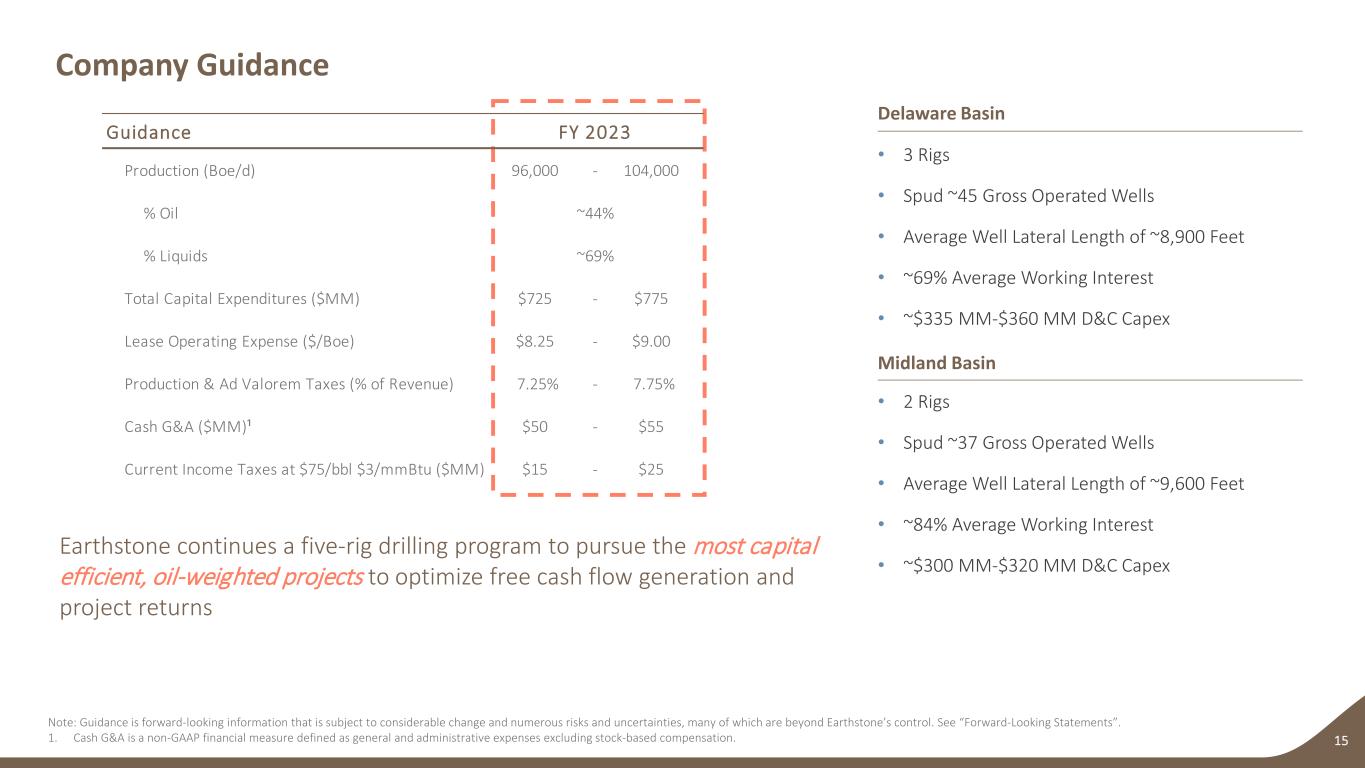

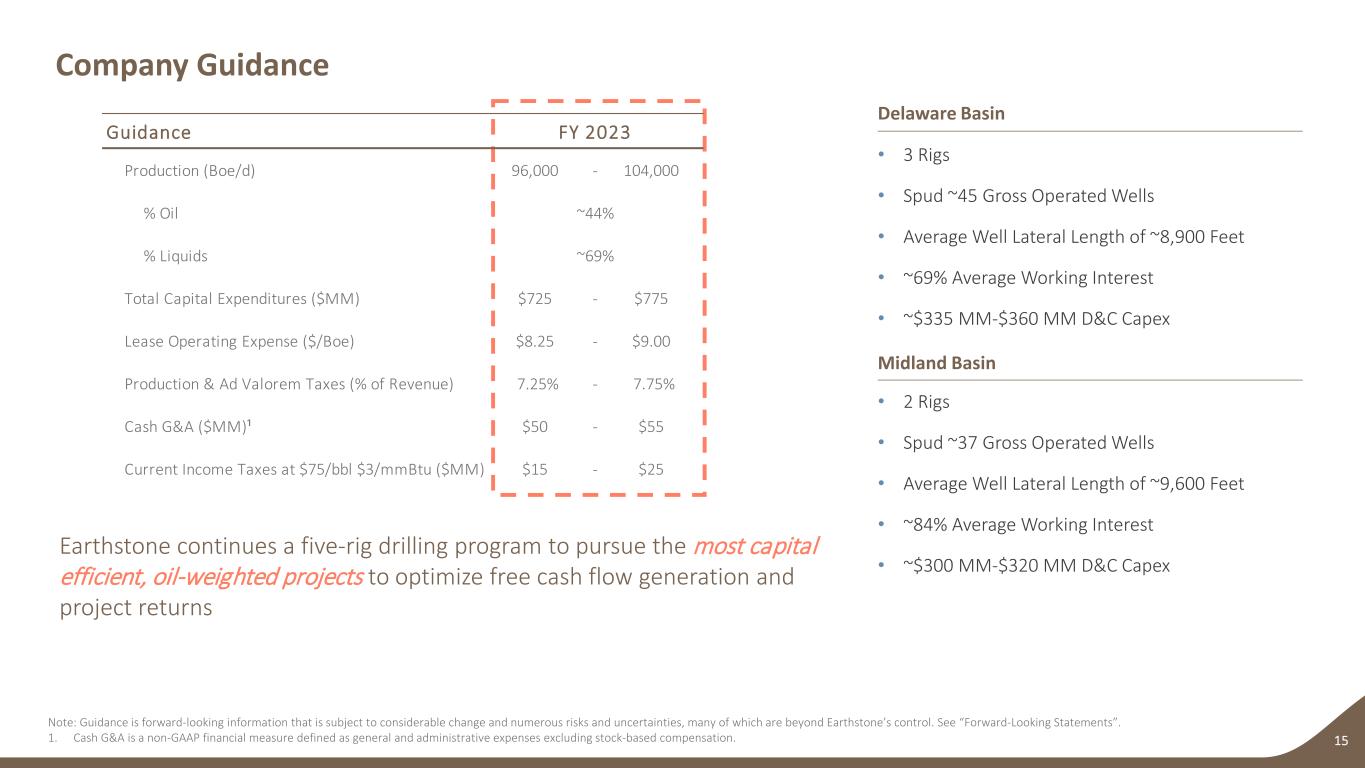

Company Guidance 15 Note: Guidance is forward-looking information that is subject to considerable change and numerous risks and uncertainties, many of which are beyond Earthstone’s control. See “Forward-Looking Statements”. 1. Cash G&A is a non-GAAP financial measure defined as general and administrative expenses excluding stock-based compensation. Midland Basin Delaware Basin • 2 Rigs • Spud ~37 Gross Operated Wells • Average Well Lateral Length of ~9,600 Feet • ~84% Average Working Interest • ~$300 MM-$320 MM D&C Capex • 3 Rigs • Spud ~45 Gross Operated Wells • Average Well Lateral Length of ~8,900 Feet • ~69% Average Working Interest • ~$335 MM-$360 MM D&C Capex Earthstone continues a five-rig drilling program to pursue the most capital efficient, oil-weighted projects to optimize free cash flow generation and project returns Guidance FY 2023 Production (Boe/d) 96,000 - 104,000 % Oil ~44% % Liquids ~69% Total Capital Expenditures ($MM) $725 - $775 Lease Operating Expense ($/Boe) $8.25 - $9.00 Production & Ad Valorem Taxes (% of Revenue) 7.25% - 7.75% Cash G&A ($MM)¹ $50 - $55 Current Income Taxes at $75/bbl $3/mmBtu ($MM) $15 - $25

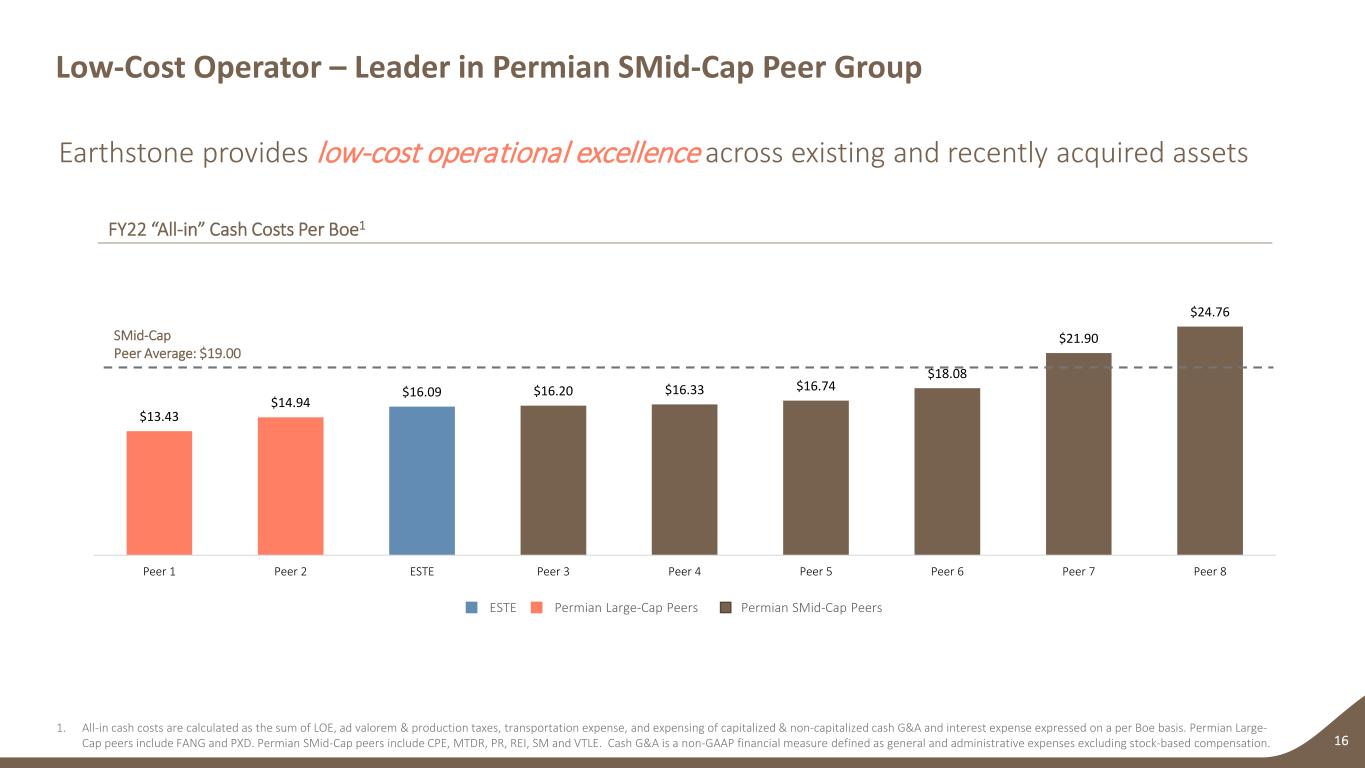

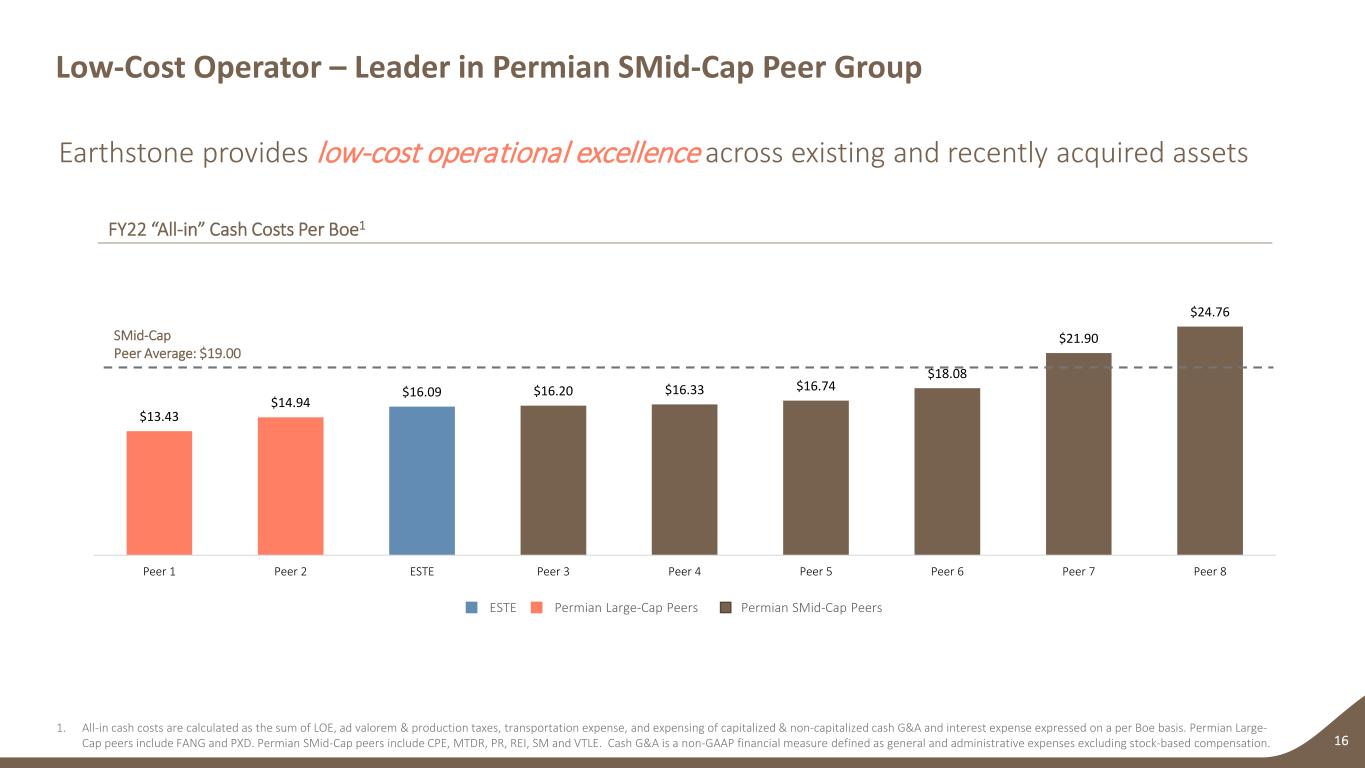

$13.43 $14.94 $16.09 $16.20 $16.33 $16.74 $18.08 $21.90 $24.76 Peer 1 Peer 2 ESTE Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Low-Cost Operator – Leader in Permian SMid-Cap Peer Group 16 Earthstone provides low-cost operational excellence across existing and recently acquired assets Permian Large-Cap Peers Permian SMid-Cap PeersESTE SMid-Cap Peer Average: $19.00 FY22 “All-in” Cash Costs Per Boe1 1. All-in cash costs are calculated as the sum of LOE, ad valorem & production taxes, transportation expense, and expensing of capitalized & non-capitalized cash G&A and interest expense expressed on a per Boe basis. Permian Large- Cap peers include FANG and PXD. Permian SMid-Cap peers include CPE, MTDR, PR, REI, SM and VTLE. Cash G&A is a non-GAAP financial measure defined as general and administrative expenses excluding stock-based compensation.

17.5x 16.8x 14.3x 14.0x 12.4x 12.1x 12.1x 9.5x 9.1x 5.8x Technology Real Estate Healthcare Consumer Staples Consumer Discretionary Utilities Industrials Materials Communications Energy The Energy Sector Offers an Attractive Value Opportunity 17Source : S&P 1500 analyst expectations sourced from FactSet and share prices as of 4/28/2023. Note: Free Cash Flow Yield is calculated by dividing Free Cash Flow by Market Capitalization. Enterprise Value to 2023E EBITDA 2023E Free Cash Flow Yield • Energy has the lowest EV / EBITDA multiples and the highest Free Cash Flow yield -1.4% 3.6% 4.0% 4.2% 4.7% 4.7% 5.2% 5.5% 5.6% 9.2% Utilities Technology Consumer Staples Consumer Discretionary Industrials Materials Healthcare Communications Real Estate Energy

2.5x 5.8x 5.0x 4.5x 3.4x 2.9x 2.7x 2.1x 5.5x 4.4x 3.2x 3.1x 3.1x 2.9x 2.8x ESTE Peer 1 Peer 2 Peer 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Peer 11 Peer 12 Peer 13 Peer 14 19% 8% 12% 7% 14% 15% 15% 15% 8% 9% 14% 15% 16% 16% 18% ESTE Peer 1 Peer 2 Peer 3 Peer 4 Peer 7 Peer 6 Peer 5 Peer 9 Peer 10 Peer 8 Peer 14 Peer 13 Peer 12 Peer 11 Earthstone Offers an Attractive Value Opportunity 18 Source: Company filings, press releases, Wall Street research, analyst expectations sourced from FactSet and share prices as of 4/28/23. Note: Free Cash Flow Yield is calculated by dividing Free Cash Flow by Market Capitalization. Future Adjusted EBITDAX and Free Cash Flow for Earthstone are forward-looking information that is subject to considerable change and numerous risks and uncertainties, many of which are beyond Earthstone’s control. See “Forward-Looking Statements”. Permian Large-Cap includes FANG and PXD. Permian SMid-Cap includes CPE, MTDR, PR, SM and VTLE. Non-Permian SMid Cap includes CHRD, CIVI, CRGY, MGY, NOG, PDCE and ROCC. Enterprise Value to 2023E EBITDAX 2023E Free Cash Flow Yield • ESTE has one of the lowest EV / EBITDAX multiples and the highest Free Cash Flow yield Permian SMid-CapPermian Large-Cap Non-Permian SMid-Cap Permian SMid-CapPermian Large-Cap Non-Permian SMid-Cap

$115 $320 $520 $452 $125 $330 $680 $948 $650 $250 $240 $650 $1,850 $1,650 YE20 YE21 YE22 Q1 23 Drawn RBL Debt Undrawn RBL Commitments Uncommitted Borrowing Base Availability Liquidity and Capital Structure Benefitting from Expanded Scale 19 Significant Liquidity Supports All Potential Capital Allocation Scenarios • Borrowing Base has grown from $240 MM at YE20 to $1.65 B driven primarily by high value reserves and production additions1 • $1.4 B of elected commitments under Credit Facility maturing in 2027 • 1Q23 facility utilization only ~32% of current $1.4 B of elected commitments • Robust estimated PV-10 value of PD reserves of ~$3.6 B with low corporate decline rate (~25%) support continued availability1 • $550 MM unsecured senior notes, 8% coupon, matures in 2027 (issued in April 2022) 1. Estimated PD reserves of ~$3.6 billion reflect the PV-10 value of proved developed reserves as of 1/1/23 utilizing NYMEX strip pricing as of 12/30/22. PV-10 is a non-GAAP financial measure. See Appendix for reconciliation. $948 MM undrawn as of 3/31/23

Highly Focused Environmental Stewardship – “Doing the Right Thing” 20 Key Environmental Priorities Focus on Responsible Operatorship Installation of Vapor Recovery Towers (“VRTs”) and Vapor Recovery Units (“VRUs”) with tank battery construction minimizes air emissions Percentage of oil production on pipelines increased from 58% in 2021 to 87% in 2022, reducing trucking and thus lowering CO2 emissions Greater than 95% of produced water is disposed of via pipelines, reducing trucking and thus lowering CO2 emissions Earthstone is an Environmental Partnership Program Participant Leak Detection & Repair (“LDAR”) program since 2019 to identify and remediate emissions Target Zero Flaring: Connect natural gas pipelines ahead of flowback and first production negates the need for flaring - Incorporating Earthstone’s practices and standards to reduce flaring on acquired assets Installation of air-operated pneumatic actuators at new facilities and retrofitting legacy facilities to reduce emissions Testing of continuous emissions monitoring systems with initial implementation in 2023 Upgrading existing facilities with low-pressure and high-pressure flare equipment to reduce emissions

Earthstone Presents A Compelling Investment Opportunity 21 Earthstone Management has consistently shown fundamental conservatism in assessing and executing a broader corporate strategy of value driven investment in high quality assets, operating cost leadership, and management of its balance sheet offering investors a reliable and predictable opportunity to invest in a growing operator. Greater Efficiency Achieved from Increased Critical Mass Robust Inventory in the Premier Shale Basins of the US Significant Free Cash Flow Generation with Low Reinvestment Needs Historically Low Leverage and Expect to Remain Below 1.0x Improving the Opportunity to Implement Meaningful Shareholder Returns Committed to Delivering for Stakeholders, Employees, and the Environment

Appendix 22

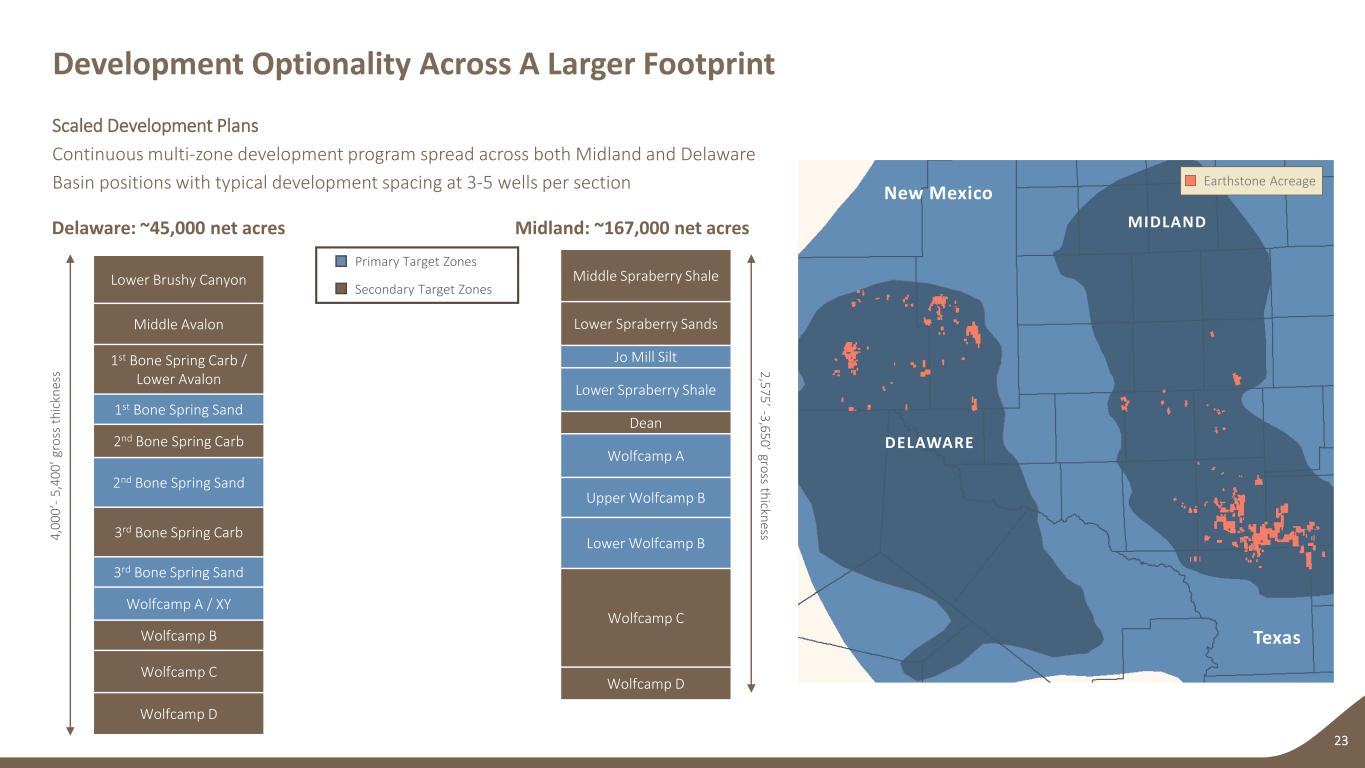

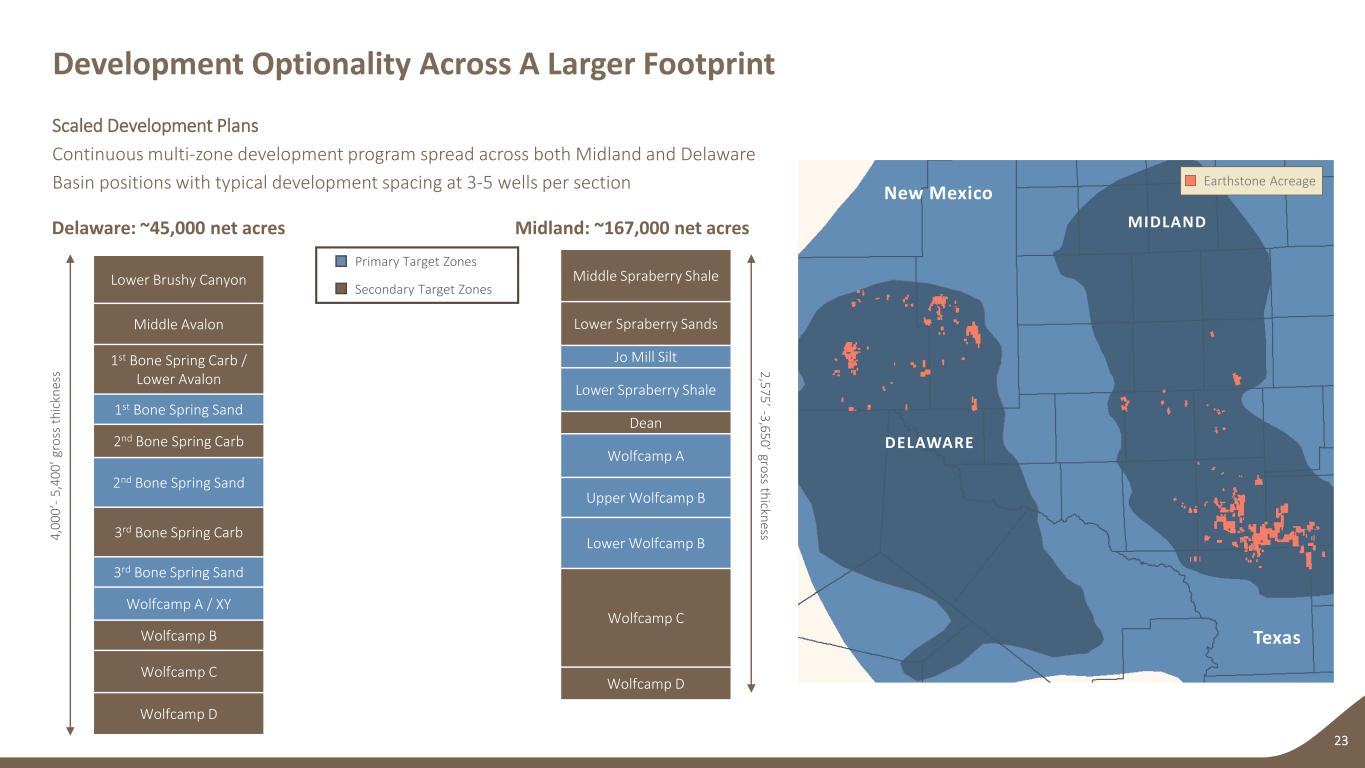

Development Optionality Across A Larger Footprint 23 Scaled Development Plans Continuous multi-zone development program spread across both Midland and Delaware Basin positions with typical development spacing at 3-5 wells per section Delaware: ~45,000 net acres Midland: ~167,000 net acres Lower Brushy Canyon Middle Avalon 1st Bone Spring Carb / Lower Avalon 1st Bone Spring Sand 2nd Bone Spring Carb 2nd Bone Spring Sand 3rd Bone Spring Carb 3rd Bone Spring Sand Wolfcamp A / XY Wolfcamp B Wolfcamp C Wolfcamp D 2,575’ -3,650’ gross thickness4, 00 0’ -5 ,4 00 ’ g ro ss th ic kn es s Secondary Target Zones Primary Target Zones MIDLAND New Mexico Middle Spraberry Shale Lower Spraberry Sands Jo Mill Silt Lower Spraberry Shale Dean Wolfcamp A Upper Wolfcamp B Lower Wolfcamp B Wolfcamp C Wolfcamp D Earthstone Acreage Texas DELAWARE

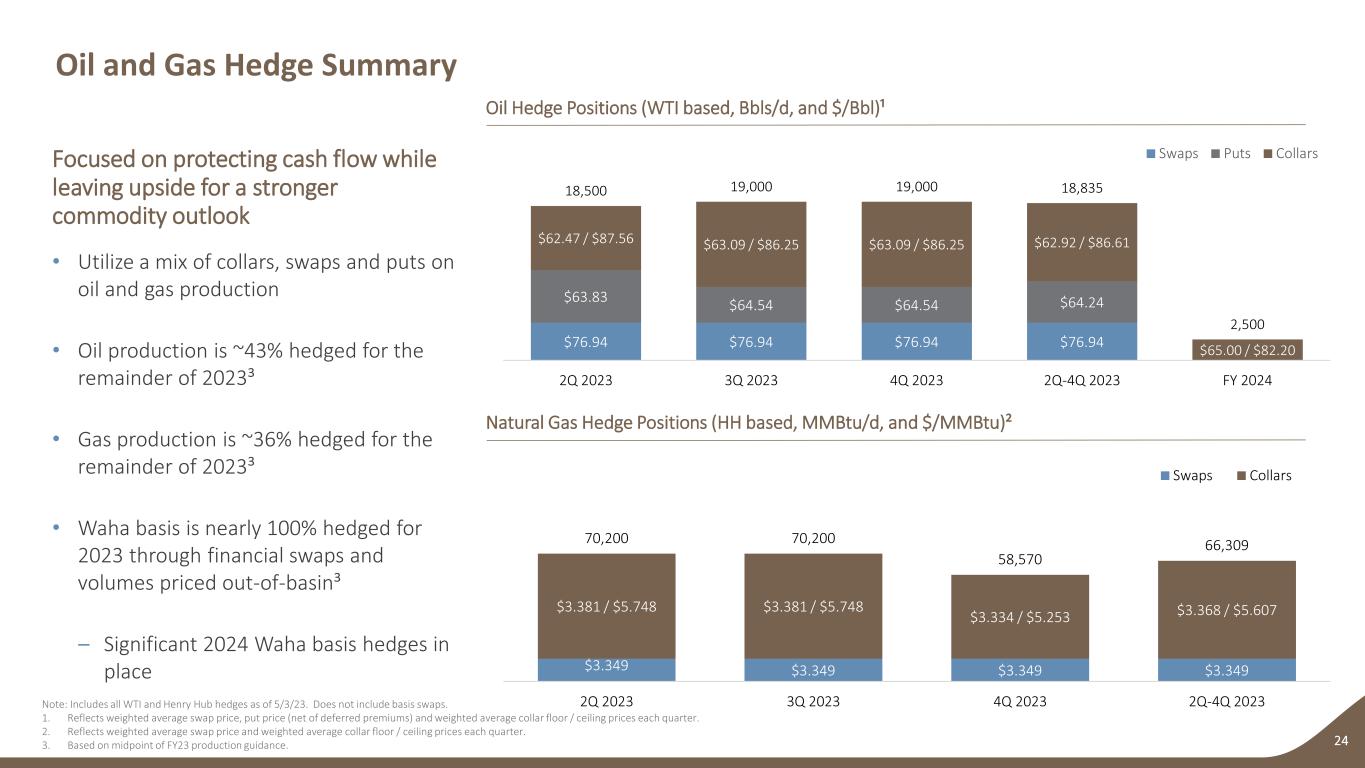

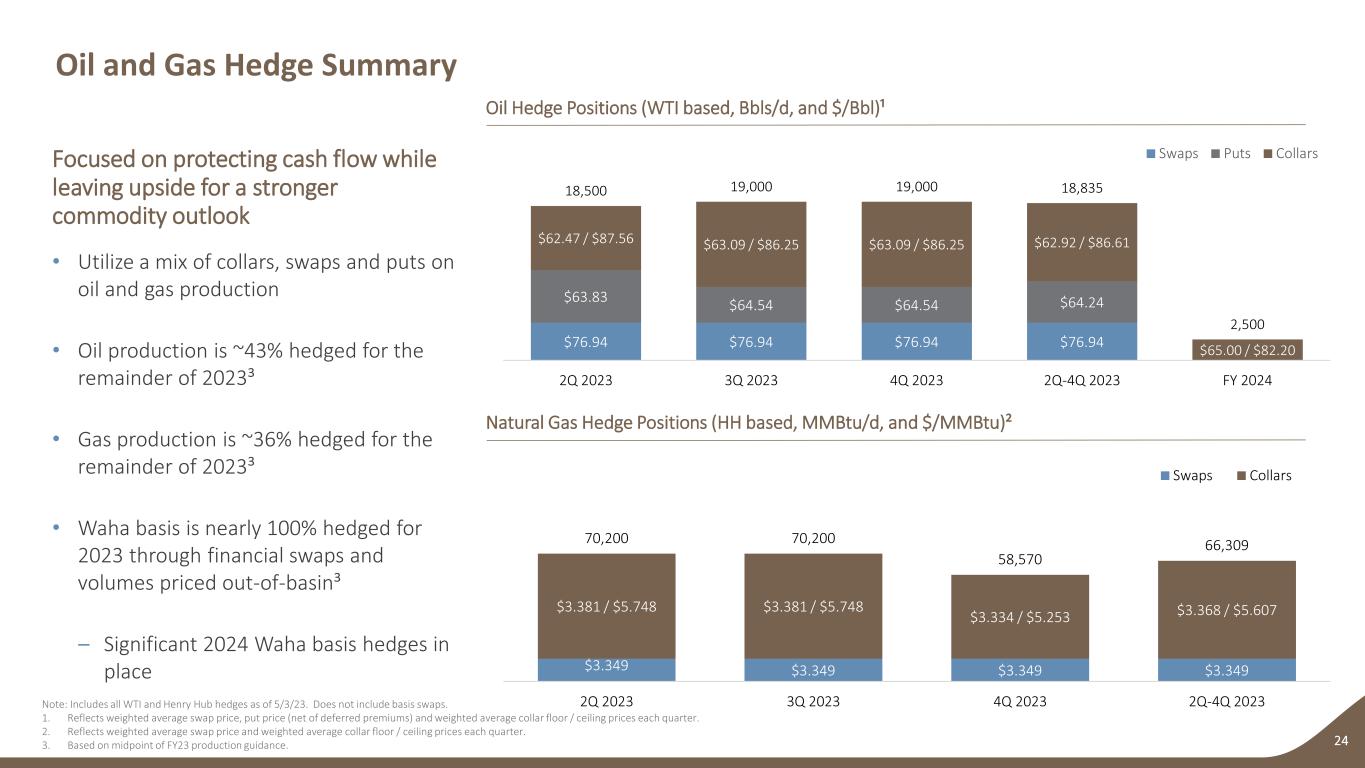

Oil and Gas Hedge Summary 24 Oil Hedge Positions (WTI based, Bbls/d, and $/Bbl)¹ Natural Gas Hedge Positions (HH based, MMBtu/d, and $/MMBtu)² Focused on protecting cash flow while leaving upside for a stronger commodity outlook • Utilize a mix of collars, swaps and puts on oil and gas production • Oil production is ~43% hedged for the remainder of 2023³ • Gas production is ~36% hedged for the remainder of 2023³ • Waha basis is nearly 100% hedged for 2023 through financial swaps and volumes priced out-of-basin³ – Significant 2024 Waha basis hedges in place Note: Includes all WTI and Henry Hub hedges as of 5/3/23. Does not include basis swaps. 1. Reflects weighted average swap price, put price (net of deferred premiums) and weighted average collar floor / ceiling prices each quarter. 2. Reflects weighted average swap price and weighted average collar floor / ceiling prices each quarter. 3. Based on midpoint of FY23 production guidance. $76.94 $76.94 $76.94 $76.94 $63.83 $64.54 $64.54 $64.24 $62.47 / $87.56 $63.09 / $86.25 $63.09 / $86.25 $62.92 / $86.61 $65.00 / $82.20 18,500 19,000 19,000 18,835 2,500 2Q 2023 3Q 2023 4Q 2023 2Q-4Q 2023 FY 2024 Swaps Puts Collars $3.349 $3.349 $3.349 $3.349 $3.381 / $5.748 $3.381 / $5.748 $3.334 / $5.253 $3.368 / $5.607 70,200 70,200 58,570 66,309 2Q 2023 3Q 2023 4Q 2023 2Q-4Q 2023 Swaps Collars

WTI Oil Hedges - Swaps HH Gas Hedges - Swaps Period Volume (Bbls) Volume (Bbls/d) $/Bbl Period Volume (MMBtu) Volume (MMBtu/d) $/MMBtu 2Q 2023 409,500 4,500 $76.94 2Q 2023 1,137,500 12,500 $3.35 3Q 2023 414,000 4,500 $76.94 3Q 2023 1,150,000 12,500 $3.35 4Q 2023 414,000 4,500 $76.94 4Q 2023 1,150,000 12,500 $3.35 2Q-4Q 2023 1,237,500 4,500 $76.94 2Q-4Q 2023 3,437,500 12,500 $3.35 WTI Oil Hedges - Collars HH Gas Hedges - Collars Period Volume (Bbls) Volume (Bbls/d) $/Bbl (Floor) $/Bbl (Ceiling) Period Volume (MMBtu) Volume (MMBtu/d) $/MMBtu (Floor) $/MMBtu (Ceiling) 2Q 2023 700,700 7,700 $62.47 $87.56 2Q 2023 5,250,700 57,700 $3.38 $5.75 3Q 2023 938,400 10,200 $63.09 $86.25 3Q 2023 5,308,400 57,700 $3.38 $5.75 4Q 2023 938,400 10,200 $63.09 $86.25 4Q 2023 4,238,400 46,070 $3.33 $5.25 2Q-4Q 2023 2,577,500 9,373 $62.92 $86.61 2Q-4Q 2023 14,797,500 53,809 $3.37 $5.61 FY 2024 915,000 2,500 $65.00 $82.20 WTI Midland Argus Crude Basis Swaps WAHA Differential Basis Swaps Period Volume (Bbls) Volume (Bbls/d) $/Bbl (Differential) Period Volume (MMBtu) Volume (MMBtu/d) $/MMBtu 2Q 2023 2,411,500 26,500 $0.91 2Q 2023 12,740,000 140,000 ($1.67) 3Q 2023 2,346,000 25,500 $0.92 3Q 2023 12,880,000 140,000 ($1.67) 4Q 2023 2,346,000 25,500 $0.92 4Q 2023 12,880,000 140,000 ($1.67) 2Q-4Q 2023 7,103,500 25,831 $0.92 2Q-4Q 2023 38,500,000 140,000 ($1.67) FY 2024 FY 2024 36,600,000 100,000 ($1.05) FY 2025 FY 2025 14,600,000 40,000 ($0.74) WTI Deferred Premium Puts Period Volume (Bbls) Volume (Bbls/d) $/Bbl (Strike Price) $/Bbl (Net of Premium) 2Q 2023 573,300 6,300 $69.21 $63.83 3Q 2023 395,600 4,300 $70.00 $64.54 4Q 2023 395,600 4,300 $70.00 $64.54 2Q-4Q 2023 1,364,500 4,962 $69.67 $64.24 Oil and Gas Hedge Positions 25Note: Hedgebook as of 5/3/23.

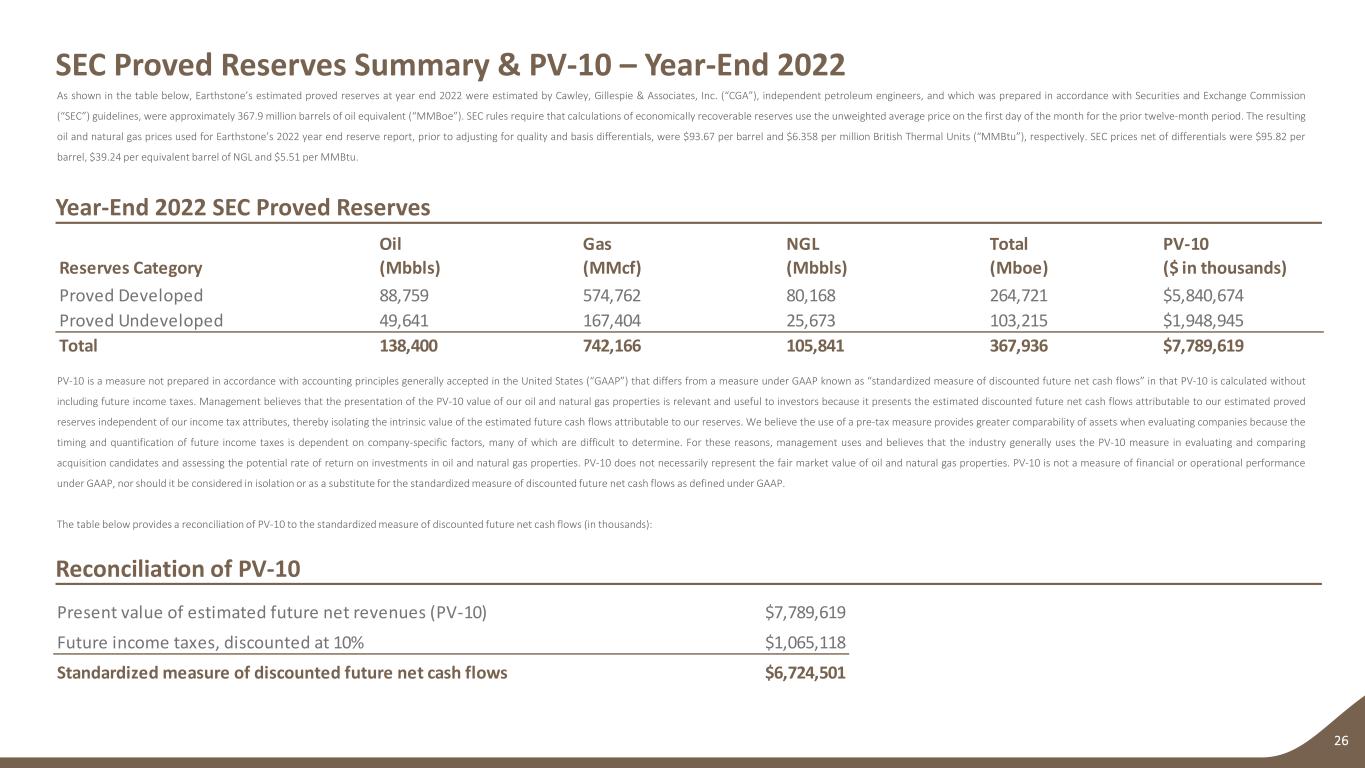

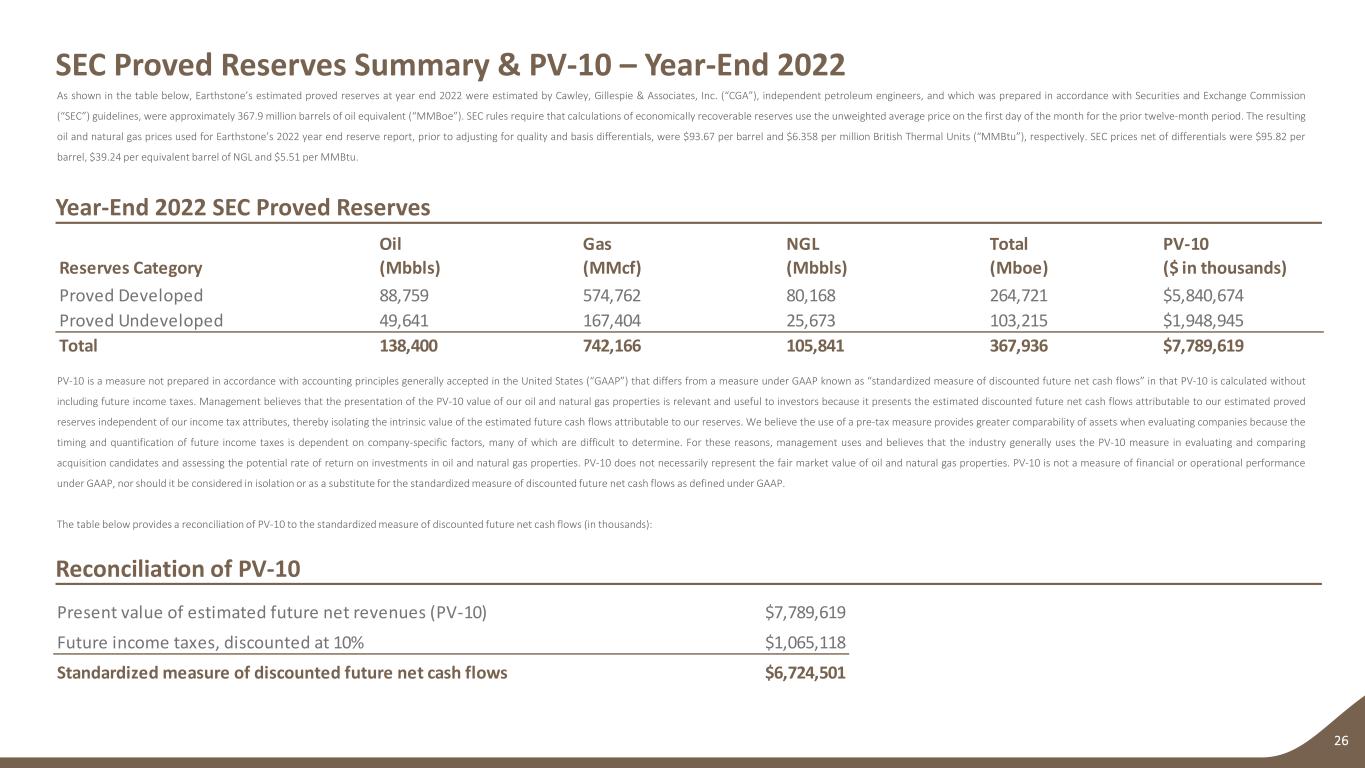

SEC Proved Reserves Summary & PV-10 – Year-End 2022 26 Year-End 2022 SEC Proved Reserves Reconciliation of PV-10 As shown in the table below, Earthstone’s estimated proved reserves at year end 2022 were estimated by Cawley, Gillespie & Associates, Inc. (“CGA”), independent petroleum engineers, and which was prepared in accordance with Securities and Exchange Commission (“SEC”) guidelines, were approximately 367.9 million barrels of oil equivalent (“MMBoe”). SEC rules require that calculations of economically recoverable reserves use the unweighted average price on the first day of the month for the prior twelve-month period. The resulting oil and natural gas prices used for Earthstone’s 2022 year end reserve report, prior to adjusting for quality and basis differentials, were $93.67 per barrel and $6.358 per million British Thermal Units (“MMBtu”), respectively. SEC prices net of differentials were $95.82 per barrel, $39.24 per equivalent barrel of NGL and $5.51 per MMBtu. PV-10 is a measure not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) that differs from a measure under GAAP known as “standardized measure of discounted future net cash flows” in that PV-10 is calculated without including future income taxes. Management believes that the presentation of the PV-10 value of our oil and natural gas properties is relevant and useful to investors because it presents the estimated discounted future net cash flows attributable to our estimated proved reserves independent of our income tax attributes, thereby isolating the intrinsic value of the estimated future cash flows attributable to our reserves. We believe the use of a pre-tax measure provides greater comparability of assets when evaluating companies because the timing and quantification of future income taxes is dependent on company-specific factors, many of which are difficult to determine. For these reasons, management uses and believes that the industry generally uses the PV-10 measure in evaluating and comparing acquisition candidates and assessing the potential rate of return on investments in oil and natural gas properties. PV-10 does not necessarily represent the fair market value of oil and natural gas properties. PV-10 is not a measure of financial or operational performance under GAAP, nor should it be considered in isolation or as a substitute for the standardized measure of discounted future net cash flows as defined under GAAP. The table below provides a reconciliation of PV-10 to the standardized measure of discounted future net cash flows (in thousands): Present value of estimated future net revenues (PV-10) $7,789,619 Future income taxes, discounted at 10% $1,065,118 Standardized measure of discounted future net cash flows $6,724,501 Oil Gas NGL Total PV-10 Reserves Category (Mbbls) (MMcf) (Mbbls) (Mboe) ($ in thousands) Proved Developed 88,759 574,762 80,168 264,721 $5,840,674 Proved Undeveloped 49,641 167,404 25,673 103,215 $1,948,945 Total 138,400 742,166 105,841 367,936 $7,789,619

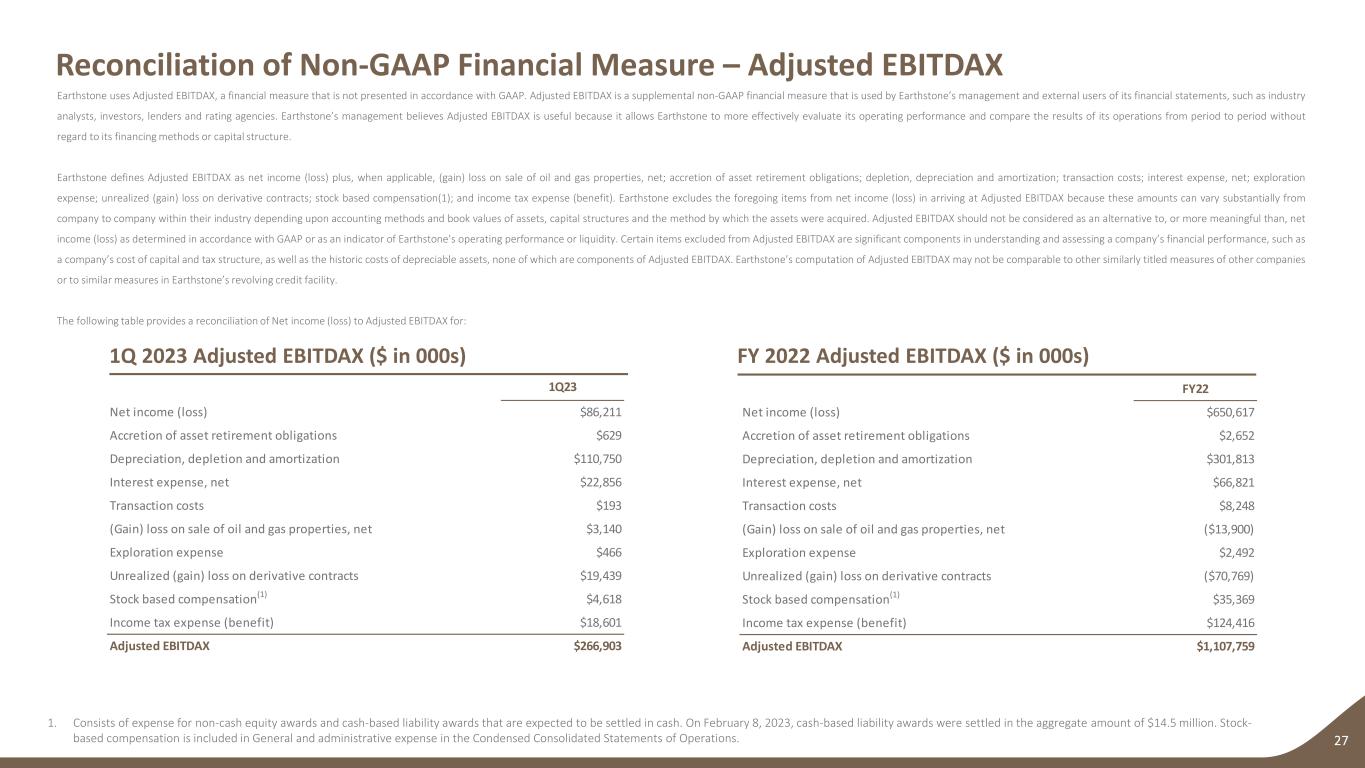

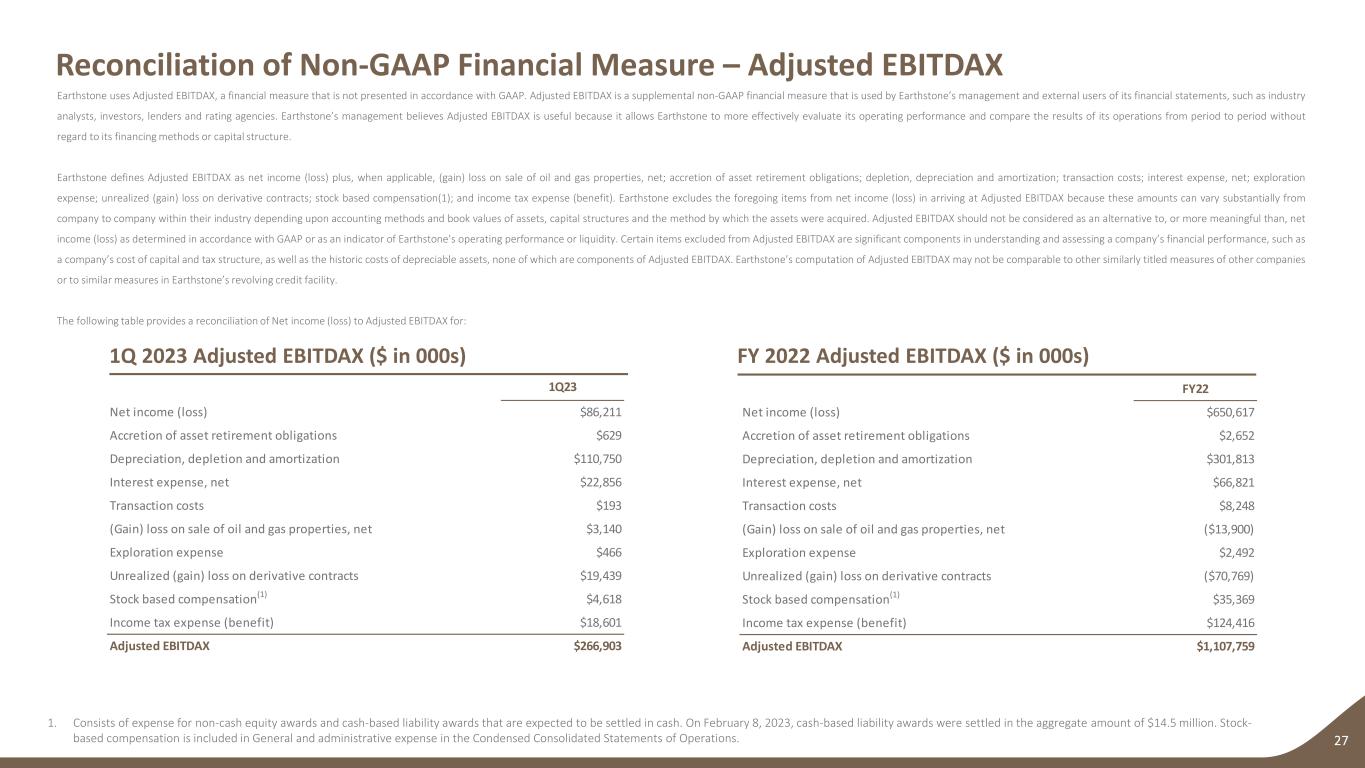

Reconciliation of Non-GAAP Financial Measure – Adjusted EBITDAX 27 1Q 2023 Adjusted EBITDAX ($ in 000s) 1. Consists of expense for non-cash equity awards and cash-based liability awards that are expected to be settled in cash. On February 8, 2023, cash-based liability awards were settled in the aggregate amount of $14.5 million. Stock- based compensation is included in General and administrative expense in the Condensed Consolidated Statements of Operations. Earthstone uses Adjusted EBITDAX, a financial measure that is not presented in accordance with GAAP. Adjusted EBITDAX is a supplemental non-GAAP financial measure that is used by Earthstone’s management and external users of its financial statements, such as industry analysts, investors, lenders and rating agencies. Earthstone’s management believes Adjusted EBITDAX is useful because it allows Earthstone to more effectively evaluate its operating performance and compare the results of its operations from period to period without regard to its financing methods or capital structure. Earthstone defines Adjusted EBITDAX as net income (loss) plus, when applicable, (gain) loss on sale of oil and gas properties, net; accretion of asset retirement obligations; depletion, depreciation and amortization; transaction costs; interest expense, net; exploration expense; unrealized (gain) loss on derivative contracts; stock based compensation(1); and income tax expense (benefit). Earthstone excludes the foregoing items from net income (loss) in arriving at Adjusted EBITDAX because these amounts can vary substantially from company to company within their industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDAX should not be considered as an alternative to, or more meaningful than, net income (loss) as determined in accordance with GAAP or as an indicator of Earthstone’s operating performance or liquidity. Certain items excluded from Adjusted EBITDAX are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDAX. Earthstone’s computation of Adjusted EBITDAX may not be comparable to other similarly titled measures of other companies or to similar measures in Earthstone’s revolving credit facility. The following table provides a reconciliation of Net income (loss) to Adjusted EBITDAX for: FY 2022 Adjusted EBITDAX ($ in 000s) FY22 Net income (loss) $650,617 Accretion of asset retirement obligations $2,652 Depreciation, depletion and amortization $301,813 Interest expense, net $66,821 Transaction costs $8,248 (Gain) loss on sale of oil and gas properties, net ($13,900) Exploration expense $2,492 Unrealized (gain) loss on derivative contracts ($70,769) Stock based compensation(1) $35,369 Income tax expense (benefit) $124,416 Adjusted EBITDAX $1,107,759 1Q23 Net income (loss) $86,211 Accretion of asset retirement obligations $629 Depreciation, depletion and amortization $110,750 Interest expense, net $22,856 Transaction costs $193 (Gain) loss on sale of oil and gas properties, net $3,140 Exploration expense $466 Unrealized (gain) loss on derivative contracts $19,439 Stock based compensation(1) $4,618 Income tax expense (benefit) $18,601 Adjusted EBITDAX $266,903

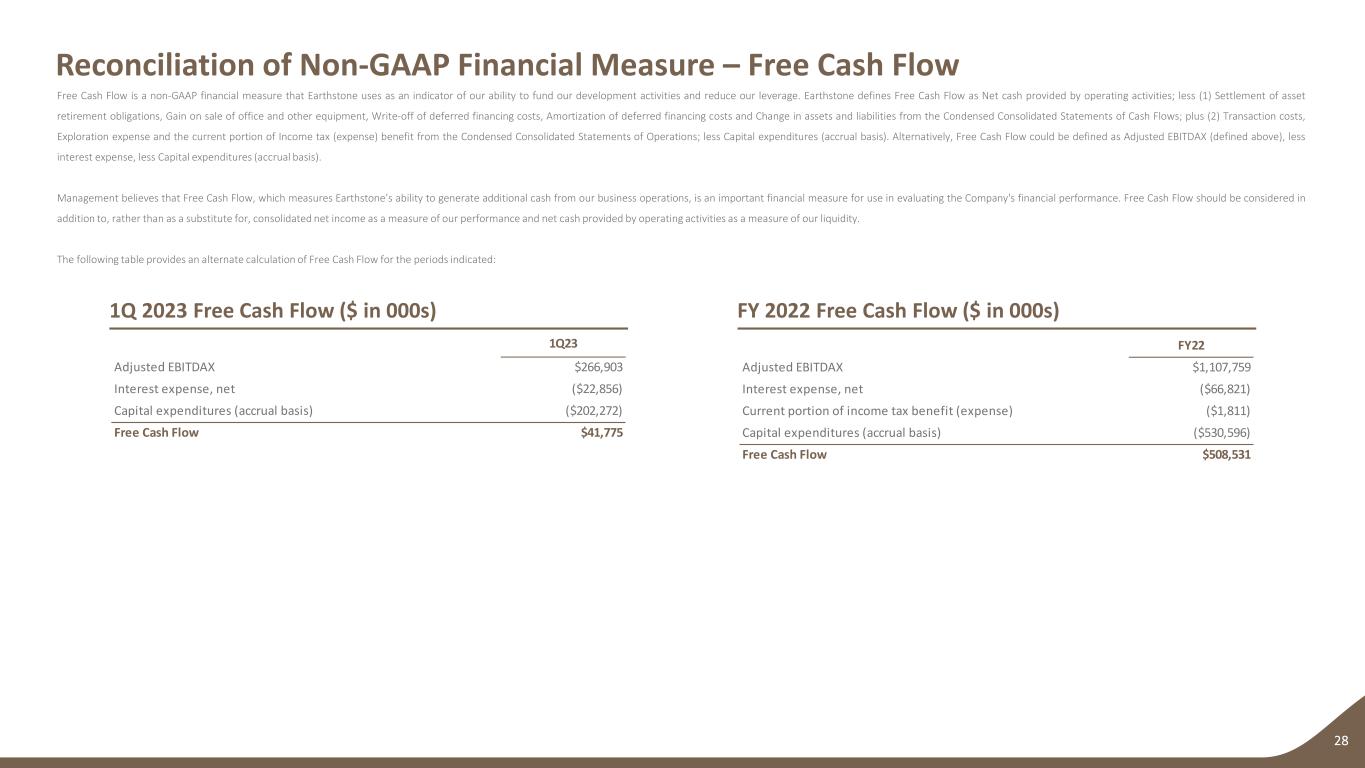

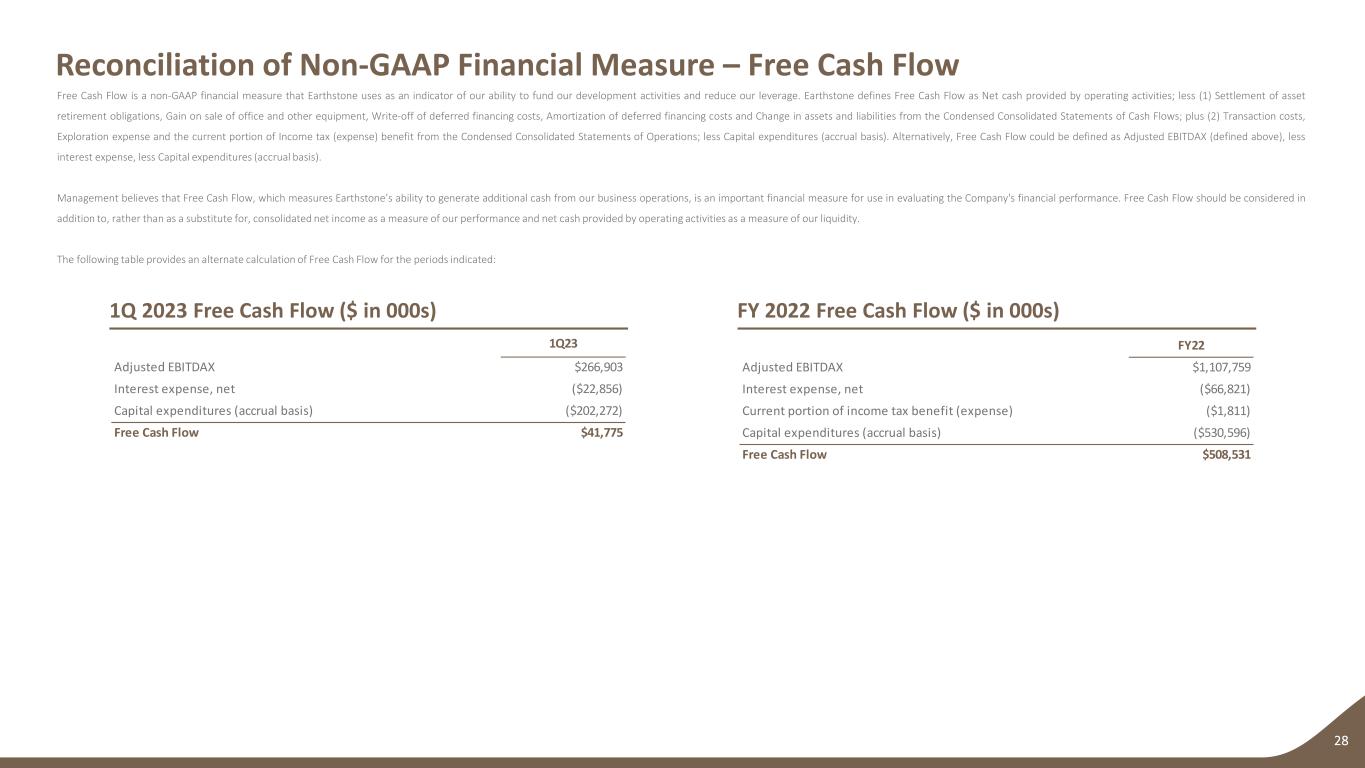

Reconciliation of Non-GAAP Financial Measure – Free Cash Flow 28 1Q 2023 Free Cash Flow ($ in 000s) Free Cash Flow is a non-GAAP financial measure that Earthstone uses as an indicator of our ability to fund our development activities and reduce our leverage. Earthstone defines Free Cash Flow as Net cash provided by operating activities; less (1) Settlement of asset retirement obligations, Gain on sale of office and other equipment, Write-off of deferred financing costs, Amortization of deferred financing costs and Change in assets and liabilities from the Condensed Consolidated Statements of Cash Flows; plus (2) Transaction costs, Exploration expense and the current portion of Income tax (expense) benefit from the Condensed Consolidated Statements of Operations; less Capital expenditures (accrual basis). Alternatively, Free Cash Flow could be defined as Adjusted EBITDAX (defined above), less interest expense, less Capital expenditures (accrual basis). Management believes that Free Cash Flow, which measures Earthstone’s ability to generate additional cash from our business operations, is an important financial measure for use in evaluating the Company's financial performance. Free Cash Flow should be considered in addition to, rather than as a substitute for, consolidated net income as a measure of our performance and net cash provided by operating activities as a measure of our liquidity. The following table provides an alternate calculation of Free Cash Flow for the periods indicated: FY 2022 Free Cash Flow ($ in 000s) FY22 Adjusted EBITDAX $1,107,759 Interest expense, net ($66,821) Current portion of income tax benefit (expense) ($1,811) Capital expenditures (accrual basis) ($530,596) Free Cash Flow $508,531 1Q23 Adjusted EBITDAX $266,903 Interest expense, net ($22,856) Capital expenditures (accrual basis) ($202,272) Free Cash Flow $41,775

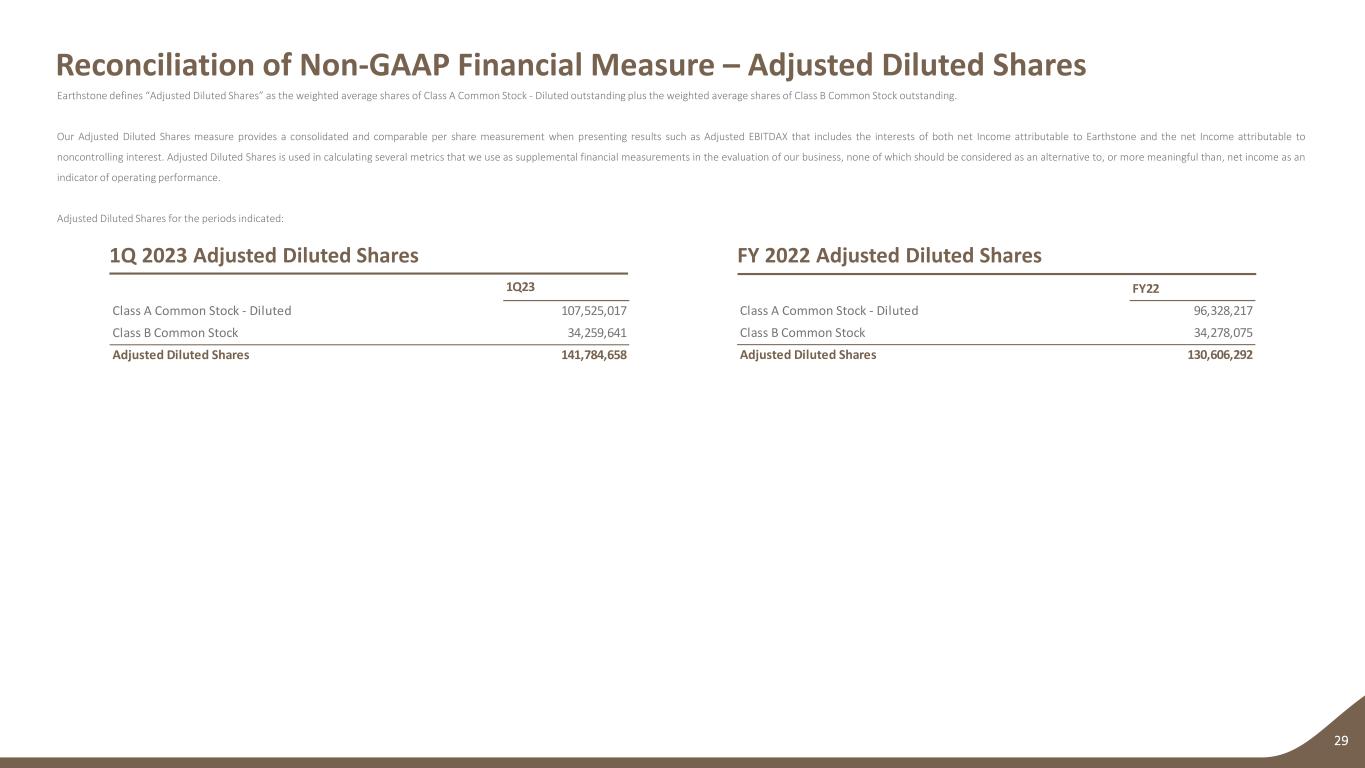

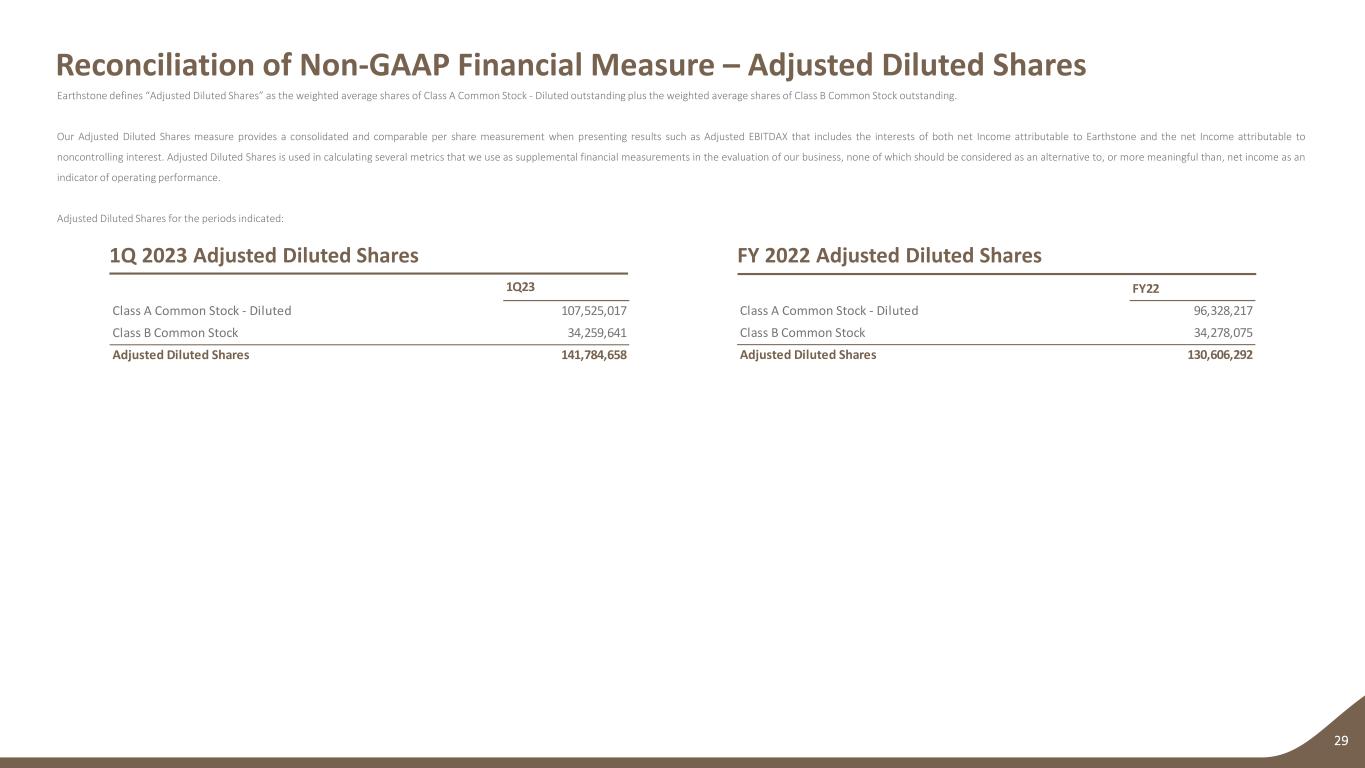

Reconciliation of Non-GAAP Financial Measure – Adjusted Diluted Shares 29 Earthstone defines “Adjusted Diluted Shares” as the weighted average shares of Class A Common Stock - Diluted outstanding plus the weighted average shares of Class B Common Stock outstanding. Our Adjusted Diluted Shares measure provides a consolidated and comparable per share measurement when presenting results such as Adjusted EBITDAX that includes the interests of both net Income attributable to Earthstone and the net Income attributable to noncontrolling interest. Adjusted Diluted Shares is used in calculating several metrics that we use as supplemental financial measurements in the evaluation of our business, none of which should be considered as an alternative to, or more meaningful than, net income as an indicator of operating performance. Adjusted Diluted Shares for the periods indicated: FY22 Class A Common Stock - Diluted 96,328,217 Class B Common Stock 34,278,075 Adjusted Diluted Shares 130,606,292 1Q 2023 Adjusted Diluted Shares FY 2022 Adjusted Diluted Shares 1Q23 Class A Common Stock - Diluted 107,525,017 Class B Common Stock 34,259,641 Adjusted Diluted Shares 141,784,658

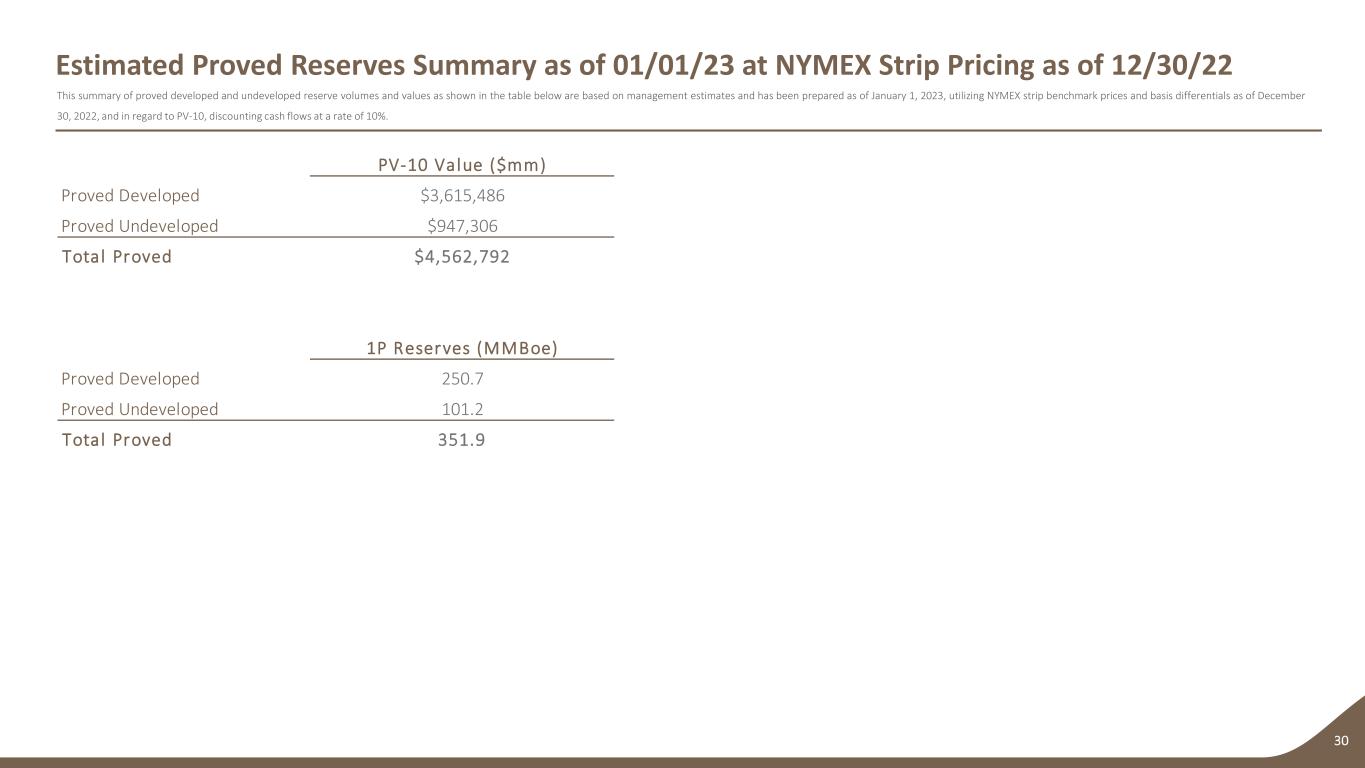

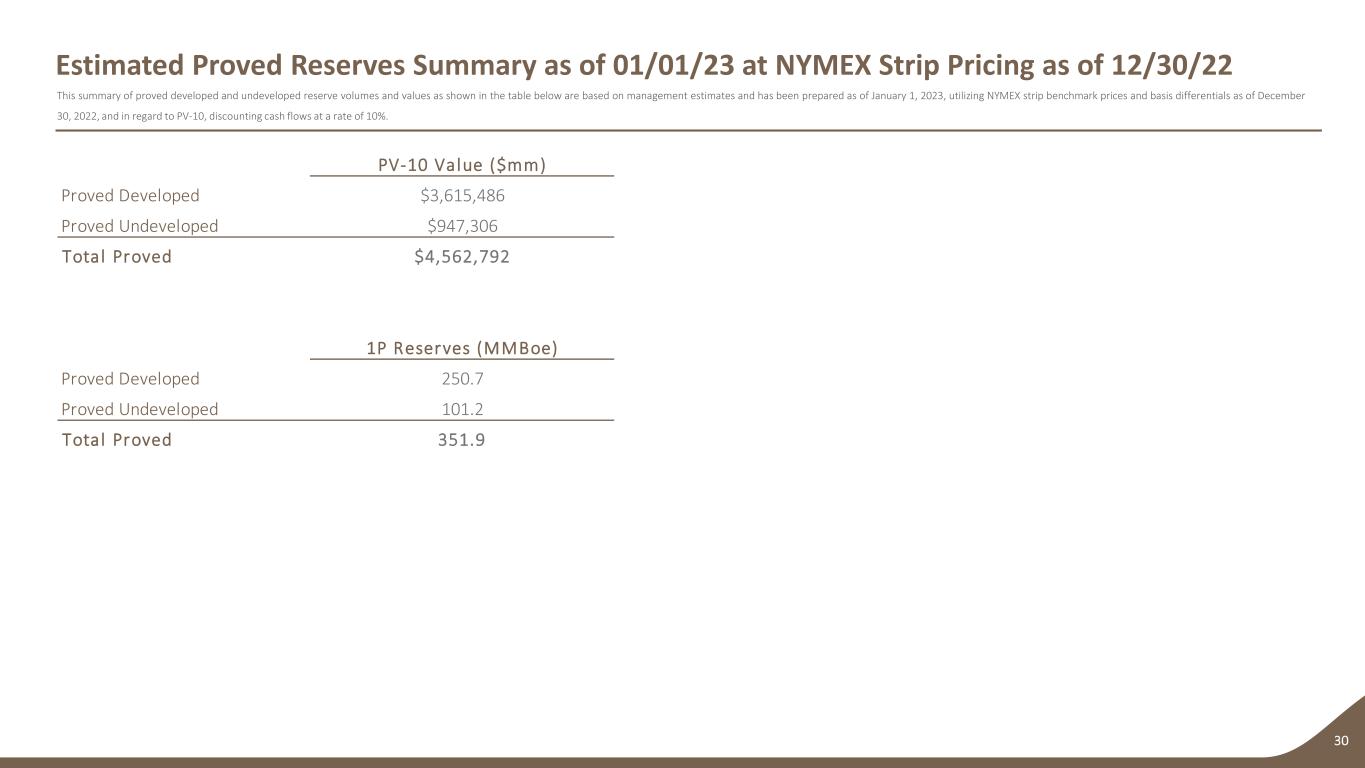

Estimated Proved Reserves Summary as of 01/01/23 at NYMEX Strip Pricing as of 12/30/22 30 This summary of proved developed and undeveloped reserve volumes and values as shown in the table below are based on management estimates and has been prepared as of January 1, 2023, utilizing NYMEX strip benchmark prices and basis differentials as of December 30, 2022, and in regard to PV-10, discounting cash flows at a rate of 10%. PV-10 Value ($mm) Proved Developed $3,615,486 Proved Undeveloped $947,306 Total Proved $4,562,792 1P Reserves (MMBoe) Proved Developed 250.7 Proved Undeveloped 101.2 Total Proved 351.9

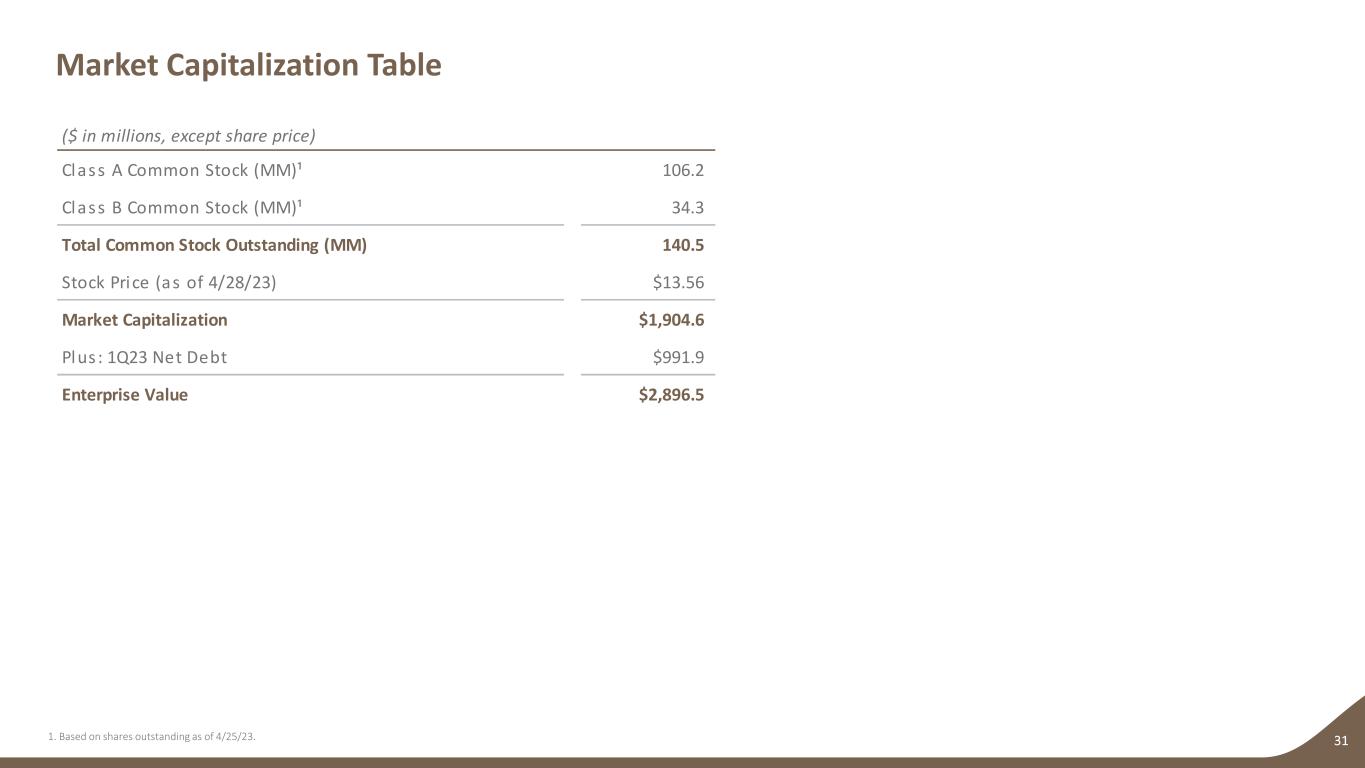

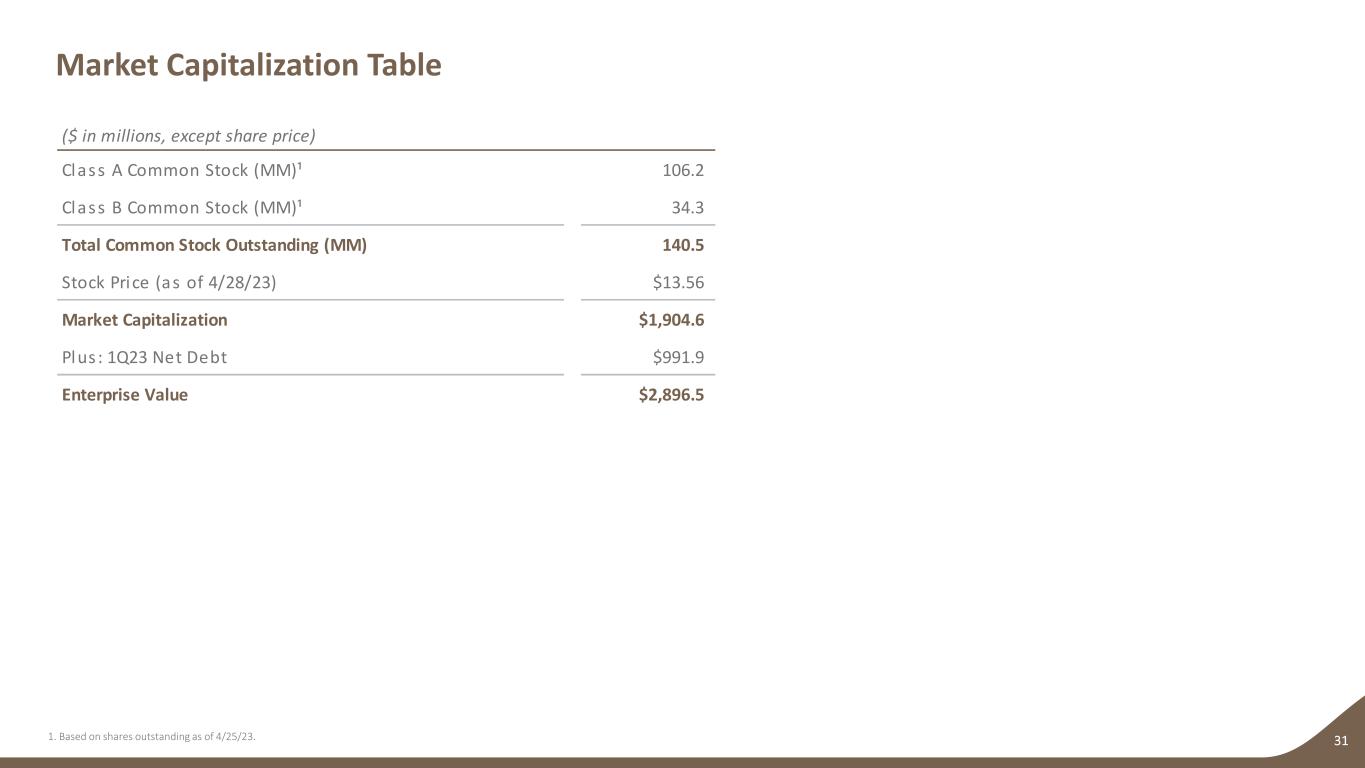

Market Capitalization Table 311. Based on shares outstanding as of 4/25/23. ($ in millions, except share price) Class A Common Stock (MM)¹ 106.2 Class B Common Stock (MM)¹ 34.3 Total Common Stock Outstanding (MM) 140.5 Stock Price (as of 4/28/23) $13.56 Market Capitalization $1,904.6 Plus : 1Q23 Net Debt $991.9 Enterprise Value $2,896.5

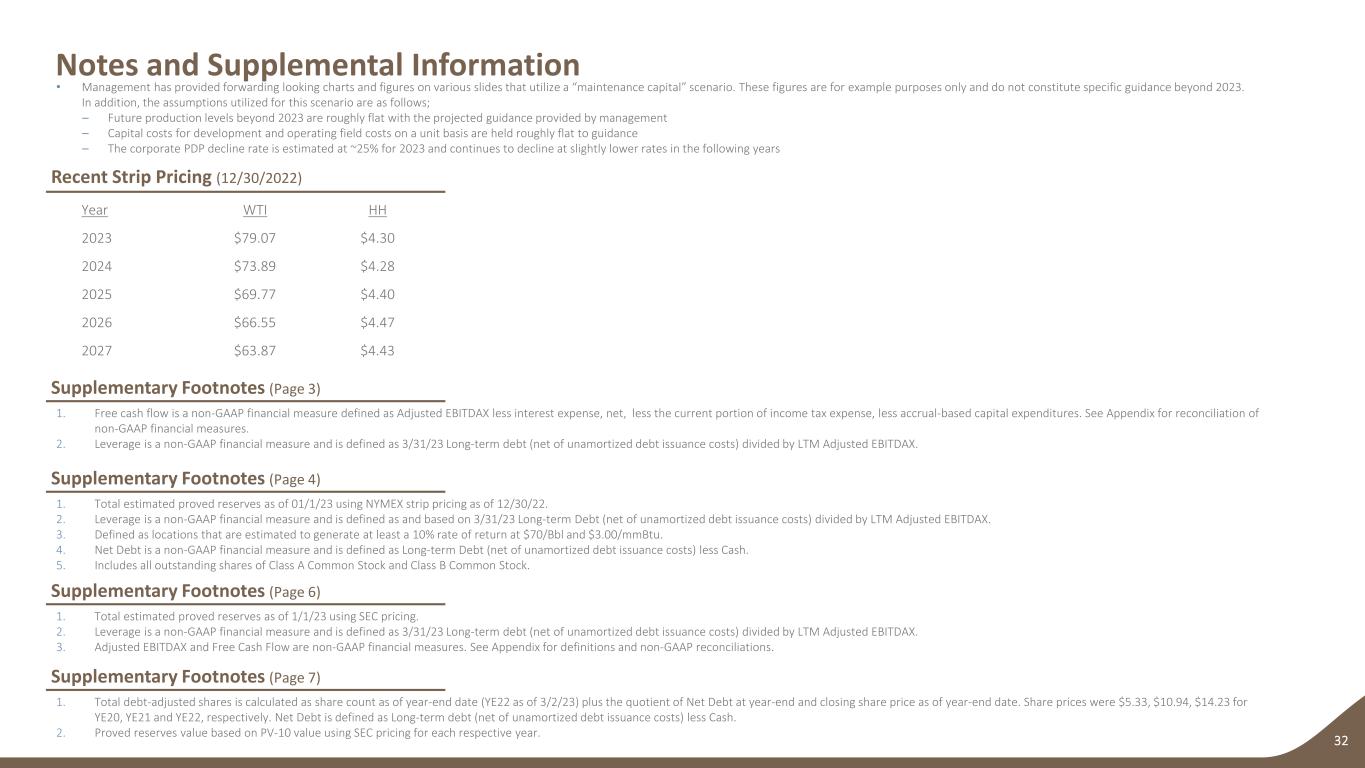

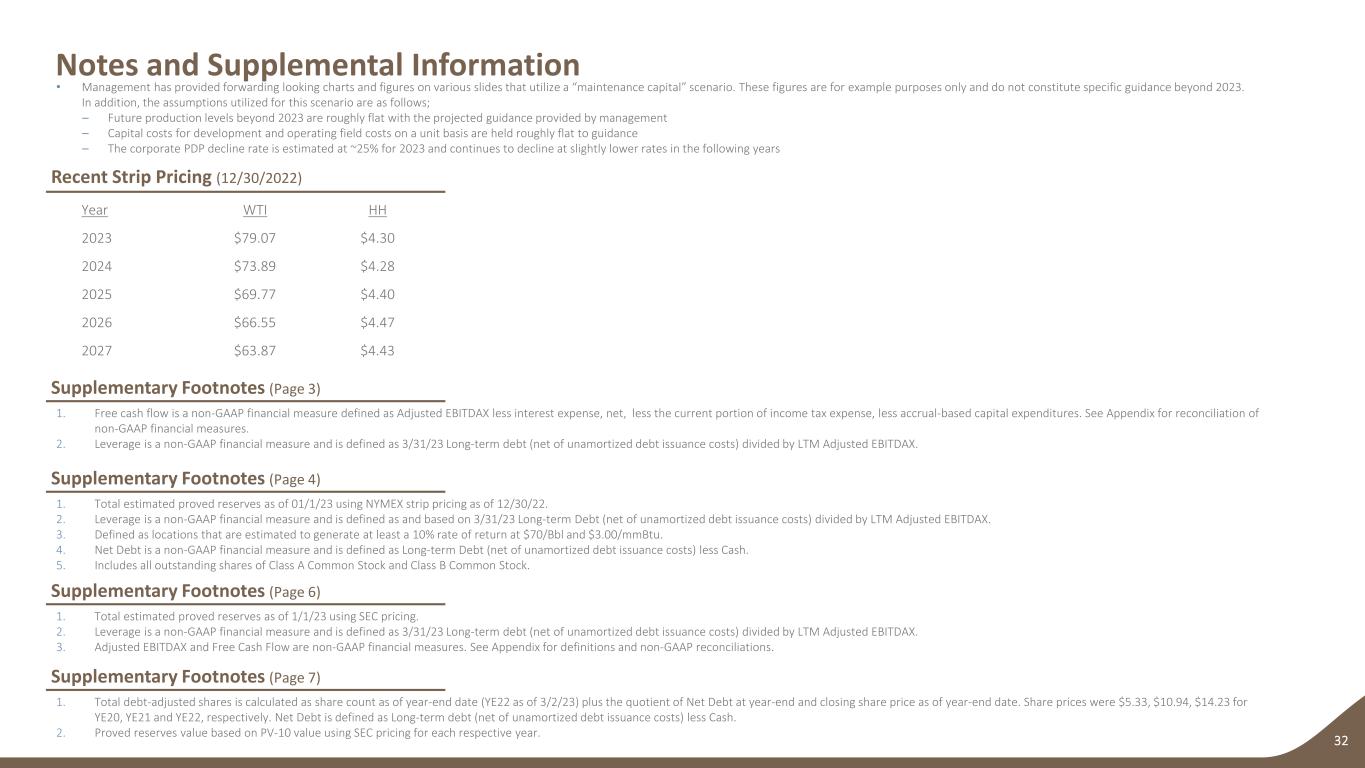

1. Free cash flow is a non-GAAP financial measure defined as Adjusted EBITDAX less interest expense, net, less the current portion of income tax expense, less accrual-based capital expenditures. See Appendix for reconciliation of non-GAAP financial measures. 2. Leverage is a non-GAAP financial measure and is defined as 3/31/23 Long-term debt (net of unamortized debt issuance costs) divided by LTM Adjusted EBITDAX. Notes and Supplemental Information 32 • Management has provided forwarding looking charts and figures on various slides that utilize a “maintenance capital” scenario. These figures are for example purposes only and do not constitute specific guidance beyond 2023. In addition, the assumptions utilized for this scenario are as follows; – Future production levels beyond 2023 are roughly flat with the projected guidance provided by management – Capital costs for development and operating field costs on a unit basis are held roughly flat to guidance – The corporate PDP decline rate is estimated at ~25% for 2023 and continues to decline at slightly lower rates in the following years Supplementary Footnotes (Page 3) Year WTI HH 2023 $79.07 $4.30 2024 $73.89 $4.28 2025 $69.77 $4.40 2026 $66.55 $4.47 2027 $63.87 $4.43 Recent Strip Pricing (12/30/2022) 1. Total estimated proved reserves as of 01/1/23 using NYMEX strip pricing as of 12/30/22. 2. Leverage is a non-GAAP financial measure and is defined as and based on 3/31/23 Long-term Debt (net of unamortized debt issuance costs) divided by LTM Adjusted EBITDAX. 3. Defined as locations that are estimated to generate at least a 10% rate of return at $70/Bbl and $3.00/mmBtu. 4. Net Debt is a non-GAAP financial measure and is defined as Long-term Debt (net of unamortized debt issuance costs) less Cash. 5. Includes all outstanding shares of Class A Common Stock and Class B Common Stock. Supplementary Footnotes (Page 4) 1. Total estimated proved reserves as of 1/1/23 using SEC pricing. 2. Leverage is a non-GAAP financial measure and is defined as 3/31/23 Long-term debt (net of unamortized debt issuance costs) divided by LTM Adjusted EBITDAX. 3. Adjusted EBITDAX and Free Cash Flow are non-GAAP financial measures. See Appendix for definitions and non-GAAP reconciliations. Supplementary Footnotes (Page 6) 1. Total debt-adjusted shares is calculated as share count as of year-end date (YE22 as of 3/2/23) plus the quotient of Net Debt at year-end and closing share price as of year-end date. Share prices were $5.33, $10.94, $14.23 for YE20, YE21 and YE22, respectively. Net Debt is defined as Long-term debt (net of unamortized debt issuance costs) less Cash. 2. Proved reserves value based on PV-10 value using SEC pricing for each respective year. Supplementary Footnotes (Page 7)

Notes and Supplemental Information, Continued 33 Supplementary Footnotes (Page 9) 1. IRM Acquisition price of $186MM based on $50.8MM of equity consideration (approximately 12.7MM Class A shares and ESTE share price of $3.99 on 12/16/20) and cash consideration of $135.2MM. Tracker Acquisition price of $126MM based on $44.2MM of equity consideration (approximately 6.2MM Class A shares and ESTE share price of $7.24 on 3/30/21) and cash consideration of $81.6MM. Includes assets from Tracker Resource Development III, LLC and from affiliates of Sequel Energy. Foreland Acquisition price of $73.2MM consisting of $49.2MM cash consideration and 2.6 MM Class A shares and ESTE share price of $9.20 on 9/30/21. Chisholm Acquisition price of $604MM based on $194MM of equity consideration (approximately 19.4MM Class A shares and ESTE share price of $9.98 on 12/15/21) and cash consideration of $410MM. Bighorn Acquisition price of $860MM based on equity consideration of $90MM (approximately 6.8MM Class A shares and ESTE share price of $13.25 on 1/28/22) and $770MM in cash ($280MM of cash raised via PIPE that was converted into 25.2MM shares of Class A Common Stock). Titus Acquisition price of $627MM based on equity consideration of $52MM (approximately 3.9MM Class A shares and ESTE share price of $13.51 on 6/24/22) and $575MM in cash. Cash consideration for all acquisitions as described above is prior to purchase price adjustments. 2. Based on ESTE estimates; PV-10 as of 7/1/21 based on NYMEX strip pricing as of 9/30/21 for Foreland, as of 11/1/21 based on NYMEX strip pricing as of 12/8/21 for Chisholm, as of 1/1/22 based on NYMEX strip pricing as of 1/18/22 for Bighorn, and as of 8/1/22 based on NYMEX strip prices as of 6/17/22 for Titus. 3. ESTE estimated gross operated drilling locations exceeding ESTE rate of return threshold based on 12/8/21 NYMEX strip pricing for Chisholm, 1/18/22 NYMEX strip pricing for Bighorn and on NYMEX strip pricing as of 6/17/22 for Titus. 4. Reflects midpoint of FY23 estimated production guidance. Supplementary Footnotes (Page 8) 1. Estimated PD reserves value of $3.6 billion as of 1/01/23 at NYMEX strip pricing as of 12/30/22. See Appendix for additional details. 2. Calculated as 1/1/23 estimated PV-10 value of proved reserves at NYMEX strip pricing as of 12/30/22 less Net Debt and divided by share count of ~140.5 million as of 4/25/23; Net Debt as of 3/31/23. Net Debt is defined as Long-term debt (net of unamortized debt issuance costs) less Cash.