Enterprise Financial Services Corp 2022 Second Quarter Earnings Webcast Exhibit 99.2

Forward-Looking Statements Some of the information in this report may contain “forward-looking statements” within the meaning of and intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include projections based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company including, without limitation, plans, strategies and goals, and statements about the Company’s expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, yields and returns, loan diversification and credit management, shareholder value creation and the impact of the Company's integration of First Choice Bancorp ("First Choice") and other acquisitions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “pro forma” and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in the forward-looking statements and future results could differ materially from historical performance. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: the Company’s ability to efficiently integrate acquisitions, including the First Choice acquisition, into its operations, retain the customers of these businesses and grow the acquired operations, as well as credit risk, changes in the appraised valuation of real estate securing impaired loans, outcomes of litigation and other contingencies, exposure to general and local economic and market conditions, high unemployment rates, higher inflation and its impacts, U.S. fiscal debt, budget and tax matters, and any slowdown in global economic growth, risks associated with rapid increases or decreases in prevailing interest rates, consolidation in the banking industry, competition from banks and other financial institutions, the Company’s ability to attract and retain relationship officers and other key personnel, burdens imposed by federal and state regulation, changes in legislative or regulatory requirements, as well as current, pending or future legislation or regulation that could have a negative effect on our revenue and businesses, including rules and regulations relating to bank products and financial services, changes in accounting policies and practices or accounting standards, changes in the method of determining LIBOR and the phase out of LIBOR, natural disasters, terrorist activities, war and geopolitical matters (including the war in Ukraine and the imposition of additional sanctions and export controls in connection therewith), or pandemics, including the COVID-19 pandemic, and their effects on economic and business environments in which we operate, including the ongoing disruption to the financial market and other economic activity caused by the continuing COVID-19 pandemic, and those factors and risks referenced from time to time in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and the Company’s other filings with the SEC. The Company cautions that the preceding list is not exhaustive of all possible risk factors and other factors could also adversely affect the Company’s results. For any forward-looking statements made in this press release or in any documents, EFSC claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Annualized, pro forma, projected and estimated numbers in this document are used for illustrative purposes only, are not forecasts and may not reflect actual results. Readers are cautioned not to place undue reliance on any forward-looking statements. Except to the extent required by applicable law or regulation, EFSC disclaims any obligation to revise or publicly release any revision or update to any of the forward-looking statements included herein to reflect events or circumstances that occur after the date on which such statements were made. 2

Financial Highlights - 2Q22 Capital • Tangible Common Equity/Tangible Assets* 7.80%; Adjusted for PPP* 7.83% • Accumulated other comprehensive income declined $49.2 million primarily from a decrease in the fair value of the available-for-sale investment portfolio • Quarterly dividend of $0.22 per common share, increased 5% to $0.23 in third quarter 2022 • Quarterly preferred stock dividend of $12.50 per share ($0.3125 per depository share) • Repurchased 349,383 shares at an average price of $45.65 per share • Net Income $45.1 million; EPS $1.19 • PPNR* $58.4 million • ROAA 1.34%; PPNR ROAA* 1.73% • ROATCE* 17.44% Earnings *A Non-GAAP Measure, Refer to Appendix for Reconciliation. Loans & Deposits • Total Loans $9.3 billion • PPP Loans, $49.2 million, net of deferred fees • Loan/Deposits 84% • Total Deposits $11.1 billion • Noninterest-bearing Deposits/Total Deposits 43% Asset Quality • Nonperforming Assets/Assets 0.16% • Nonperforming Loans/Loans 0.21% • Allowance Coverage Ratio 1.52%; 1.69% adjusted for guaranteed loans including PPP 3

Areas of Focus Completed Expand Tax Credit Business, Geographically • Strategically Deploy $60 Million, New Markets Tax Credit Allocation Talent Acquisitions to Accelerate Higher Growth • Complementary California Associates • Practice Finance • Phoenix • Texas Continued Integration of California Market Ongoing Organic Loan and Deposit Growth Disciplined Loan and Deposit Pricing Maintain Strong Asset Quality Maintain a Strong Balance Sheet Opportunistic Talent Additions ü ü ü 4

$7,226 $9,117 $9,018 $9,056 $9,269 2Q21 3Q21 4Q21 1Q22 2Q22 In Millions 28% Total Loan Growth *Excludes First Choice PPP loans of $206 million included in acquisition total. First Choice $1,944 Total Loan Trends PPP* $233 PPP $134 PPP $272 PPP $397 PPP $49 5

Loan Details - LTM 2Q22 2Q21 LTM Change First Choice Net Organic Change C&I $ 1,702 $ 1,116 $ 586 $ 328 $ 258 CRE Investor Owned 1,978 1,467 511 595 (84) CRE Owner Occupied 1,119 789 330 260 70 SBA loans* 1,284 1,011 273 155 118 Sponsor Finance* 647 464 183 — 183 Life Insurance Premium Financing* 688 564 124 — 124 Tax Credits* 551 423 128 — 128 Residential Real Estate 392 302 90 135 (45) Construction and Land Development 626 468 158 154 4 Other 233 225 8 31 (23) Subtotal $ 9,220 $ 6,829 $ 2,391 $ 1,658 $ 733 SBA PPP loans 49 397 (348) 33 (381) Total Loans $ 9,269 $ 7,226 $ 2,043 $ 1,691 $ 352 *Specialty loan category. In Millions 6

Loan Details - QTR 2Q22 1Q22 QTR Change C&I $ 1,702 $ 1,498 $ 204 CRE Investor Owned 1,978 1,983 (5) CRE Owner Occupied 1,119 1,138 (19) SBA loans* 1,284 1,250 34 Sponsor Finance* 647 641 6 Life Insurance Premium Financing* 688 636 52 Tax Credits* 551 518 33 Residential Real Estate 392 410 (18) Construction and Land Development 626 611 15 Other 233 237 (4) Subtotal $ 9,220 $ 8,922 $ 298 SBA PPP loans 49 134 (85) Total Loans $ 9,269 $ 9,056 $ 213 *Specialty loan category. In Millions 7

Total Loans By Business Unit Specialty Lending* $2,382 $2,981 $3,133 2Q21 1Q22 2Q22 In Millions St. Louis $2,106 $2,124 $2,207 2Q21 1Q22 2Q22 Southwest Region $480 $615 $658 2Q21 1Q22 2Q22 Kansas City $775 $806 $824 2Q21 1Q22 2Q22 New Mexico $595 $511 $488 2Q21 1Q22 2Q22 Note: Excludes PPP and Other loans Southern California** $266 $1,648 $1,677 2Q21 1Q22 2Q22 **1Q22 and 2Q22 include First Choice acquisition *1Q22 and 2Q22 include acquired First Choice SBA loans 8

Specialty Deposits 35.0% 22.4% 14.7% 2.7% 25.3% Community Associations $840 million in deposit accounts specifically designed to serve the needs of community associations. Property Management $539 million in deposits. Specializing in the compliance of Property Management Trust Accounts. Third-Party Escrow $353 million in deposits. Growing product line providing independent escrow services. Trust Services $64 million in deposit accounts. Providing services to nondepository trust companies. Specialty deposits of $2.4 billion represent 22% of total deposits. Includes high composition of noninterest-bearing deposits with a low cost of funds. Other $607 million in deposit accounts primarily related to Sponsor Finance and Life Insurance Premium Financing loans. 2Q21 3Q21 4Q21 1Q22 2Q22 Community Assoc Property Mgmt Third- Party Escrow Trust Services Other $— $250 $500 $750 In Millions 9

Earnings Per Share Trend - 2Q22 $1.23 $0.08 $(0.10) $(0.05) $0.01 $0.02 $1.19 1Q22 Operating Revenue Provision for Credit Losses Noninterest Expense Preferred Stock Dividends Change in Shares 2Q22 Change in EPS 10

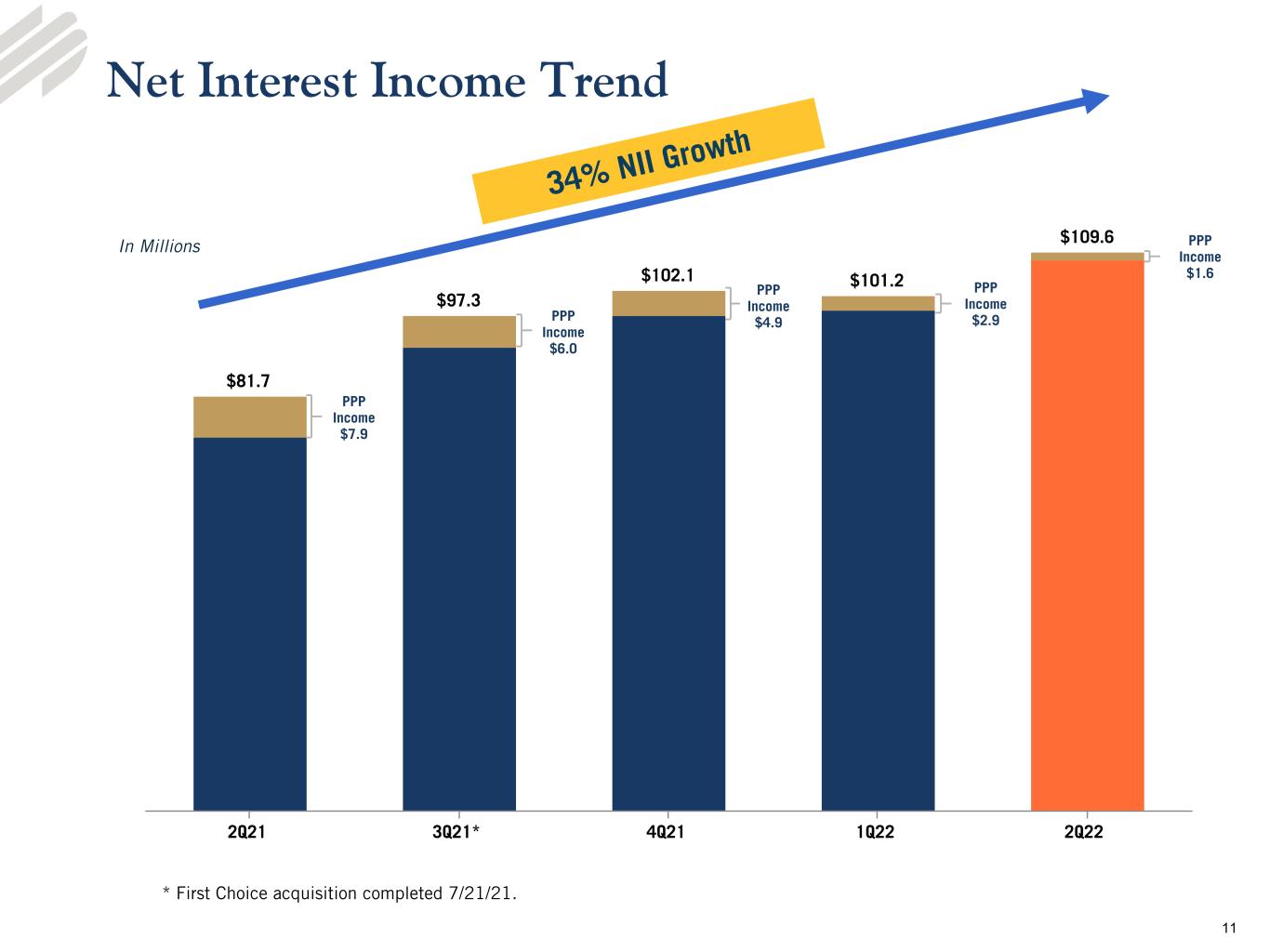

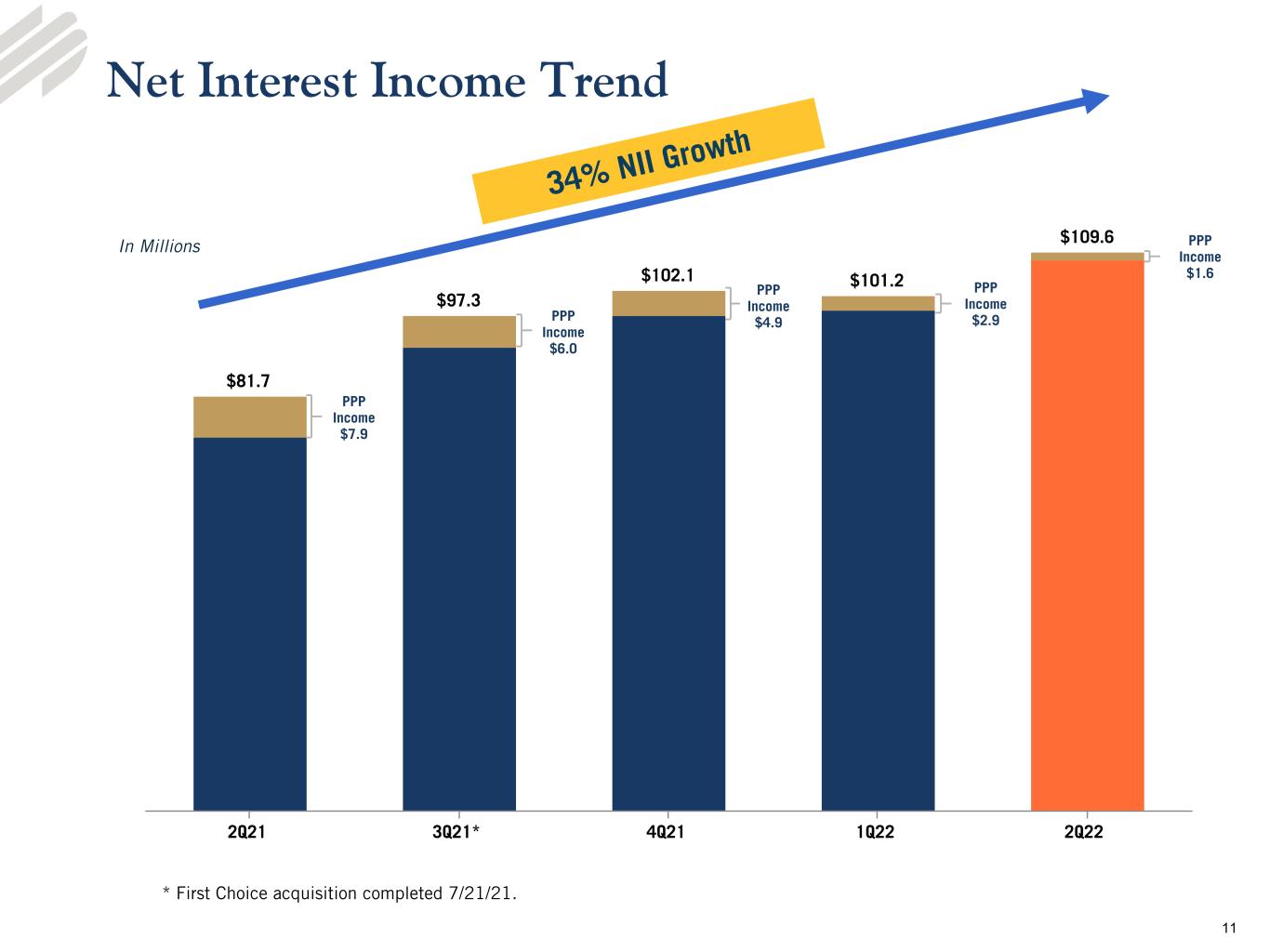

$81.7 $97.3 $102.1 $101.2 $109.6 2Q21 3Q21* 4Q21 1Q22 2Q22 Net Interest Income Trend In Millions 34% NII Growth PPP Income $2.9 PPP Income $1.6 PPP Income $7.9 PPP Income $6.0 * First Choice acquisition completed 7/21/21. PPP Income $4.9 11

Net Interest Margin 4.35% 4.32% 4.32% 4.34% 4.51% 2.46% 2.38% 2.30% 2.31% 2.51% 0.12% 0.15% 0.15% 0.19% 0.71% 3.70% 3.60% 3.50% 3.45% 3.76% Earning asset yield Interest-earning deposit yield Securities yield Loan yield 2Q21 3Q21 4Q21 1Q22 2Q22 0.18% 0.17% 0.17% 0.17% 0.24% 0.12% 0.11% 0.10% 0.10% 0.13% 0.37% 0.35% 0.31% 0.30% 0.37% Interest-bearing deposit rate Total cost of deposits Interest-bearing liabilities 2Q21 3Q21 4Q21 1Q22 2Q22 Components of Interest-bearing LiabilitiesComponents of Interest-earning Assets 3.46% 3.40% 3.32% 3.28% 3.55% 2Q21 3Q21 4Q21 1Q22 2Q22 1Q22 3.28 % Cash/Liquidity 0.14 % Loans 0.13 % Investments 0.02 % Deposits (0.02) % 2Q22 3.55 % Net Interest Margin Trend Net Interest Margin Bridge 12

Credit Trends for Loans 5 8 14 7 (1) 2Q21 3Q21 4Q21 1Q22 2Q22 $278 $111 $68 $176 $298 $(341) $(164) $(167) $(138) $(85) 38.9% 38.2% 39.9% 39.9% 43.9% Organic Loans PPP Loans Avg Line Draw % 2Q21 3Q21 4Q21 1Q22 2Q22 2Q22 1Q22 2Q21 NPAs/Assets 0.16% 0.17% 0.44% NPLs/Loans 0.21% 0.23% 0.58% ACL/NPLs 718.5% 657.9% 303.4% ACL/Loans** 1.69% 1.73% 2.09% Annualized Net Charge-offs (Recoveries) to Average Loans Period Ending Provision for Credit Losses $(2.7) $19.7 $(3.7) $(4.1) $0.7 2Q21 3Q21 4Q21 1Q22 2Q22 In Millions bps bps bps bps bps In Millions Loan Growth and Average Line of Credit Utilization* *Excludes acquisition of Seacoast for 4Q20 & First Choice for 3Q21 **Excludes guaranteed loans. *Excludes acquisition of First Choice for 3Q21 **Excludes guaranteed loans. 13

$139.2 $1.5 $(0.2) $140.5 ACL 1Q22 Portfolio Changes Net Recoveries ACL 2Q22 Allowance for Credit Losses for Loans In Millions • New loans and changes in composition of existing loans • Changes in risk ratings, past due status and reserves on individually evaluated loans • Changes in macroeconomic and qualitative factors 2Q22 In Millions Loans ACL ACL as a % of Loans Commercial and industrial $ 3,597 $ 66 1.83 % Commercial real estate 4,294 50 1.16 % Construction real estate 724 13 1.80 % Residential real estate 414 7 1.69 % Other 240 5 2.08 % Total $ 9,269 $ 141 1.52 % Reserves on sponsor finance, which is included in the categories above, represented $20.5 million. Total ACL percentage of loans excluding PPP and other government guaranteed loans was 1.69% Key Assumptions: • Reasonable and supportable forecast period is one year with a one year reversion period. • Forecast considers a weighted average of baseline, upside and downside scenarios. • Primary macroeconomic factors: ◦ Percentage change in GDP ◦ Unemployment ◦ Percentage change in Retail Sales ◦ Percentage change in CRE Index 14

Noninterest Income Trend Other Fee Income DetailFee Income In Millions $16.2 $17.6 $22.6 $18.6 $14.2 $2.5 $2.6 $2.7 $2.6 $2.5 $3.8 $4.5 $3.9 $4.2 $4.8 $3.0 $3.2 $3.2 $3.0 $3.5 $5.5 $4.0 $8.4 $6.2 $2.2 $1.4 $3.3 $4.4 $2.6 $1.2 16.5% 15.3% 18.1% 15.6% 11.5% Wealth Management Deposit Services Charge Card Services Other Tax Credit Income Fee income/Total income 2Q21 3Q21 4Q21 1Q22 2Q22 $5.5 $4.0 $8.4 $6.2 $2.2 $1.5 $1.3 $1.2 $0.6 $0.7 $0.5 $0.9 $0.3 $0.7 $0.2 $0.7 $0.7 $0.7 $1.0 $0.7 $1.2 $0.1 $0.1 $0.2 $5.0 $2.2 $2.0 $0.4 $0.6 $0.7 $0.5 $0.5 $0.3 Miscellaneous Servicing Fees BOLI Swap Fees CDE Private Equity Fund Distribution Mortgage 2Q21 3Q21 4Q21 1Q22 2Q22 $0.2 $0.2 15

Operating Expenses Trend Other Operating Expenses DetailOperating Expenses In Millions $52.4 $76.9 $63.7 $62.8 $65.4 $18.9 $20.6 $23.4 $22.4 $25.1 $3.5 $4.5 $4.5 $4.6 $4.3 $28.1 $33.7 $33.5 $35.8 $36.0 $1.9 $14.7 $2.3 $3.4 51.9% 51.3% 49.2% 52.4% 52.8% Other Occupancy Employee compensation and benefits Merger-related expenses Branch-closure expenses Core efficiency ratio* 2Q21 3Q21 4Q21 1Q22 2Q22 $18.9 $20.6 $23.4 $22.4 $25.1 $10.3 $11.4 $13.8 $12.9 $15.1 $2.9 $3.3 $3.2 $3.3 $3.1 $1.3 $0.9 $1.1 $1.2 $1.5 $1.4 $1.7 $1.8 $1.9 $1.6 $1.7 $1.8 $2.0 $1.7 $2.5 $1.3 $1.5 $1.5 $1.4 $1.3 Miscellaneous Data processing Professional fees FDIC and other insurance Loan, legal expenses Amortization expense 2Q21 3Q21 4Q21 1Q22 2Q22 16

Capital Tangible Common Equity/Tangible Assets* 8.32% 8.40% 8.13% 7.62% 7.80% 8.66% 8.71% 8.31% 7.70% 7.83% Tangible Common Equity/Tangible Assets Tangible Common Equity/Tangible Assets (excludes PPP loans) 2Q21 3Q21 4Q21 1Q22 2Q22 *A Non-GAAP Measure, Refer to Appendix for Reconciliation. Regulatory Capital 10.0% 14.9% 14.5% 14.7% 14.4% 14.2% 6.5% 11.1% 11.2% 11.3% 11.0% 10.9% CET1 Tier 1 Total Risk Based Capital Minimum "Well Capitalized" Ratio 2Q21 3Q21 4Q21 1Q22 2Q22 8.0% 12.3% 12.2% 13.0% 12.7% EFSC Capital Strategy: Low Cost - Highly Flexible High Capital Retention Rate – Strong earnings profile – Sustainable dividend profile Supporting Robust Asset Growth – Organic loan and deposit growth – High quality M&A to enhance commercial franchise and geographic diversification Maintain High Quality Capital Stack – Minimize WACC over time (preferred, sub debt, etc.) – Optimize capital levels T1 Common ~10%, Tier 1 ~12%, and Total Capital ~14% Maintain 8-9% TCE – Common stock repurchases – 349,383 repurchased at average price of $45.65 in 2Q22 – M&A deal structures – Drives ROATCE above peer levels TBV and Dividends per Share $26.85 $27.38 $28.28 $27.06 $26.63 $0.18 $0.19 $0.20 $0.21 $0.22 TBV/Share Dividends per Share 2Q21 3Q21 4Q21 1Q22 2Q22 12.5% 17

Appendix Second Quarter 2022 Earnings Webcast

Use of Non-GAAP Financial Measures The Company’s accounting and reporting policies conform to generally accepted accounting principles in the United States (“GAAP”) and the prevailing practices in the banking industry. However, the Company provides other financial measures, such as tangible common equity, ROATCE, PPNR, PPNR return on average assets (“PPNR ROAA”), financial metrics adjusted for PPP impact, core efficiency ratio, and the tangible common equity ratio, in this presentation that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position, or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. The Company considers its tangible common equity, ROATCE, PPNR, PPNR ROAA, financial metrics adjusted for PPP impact, core efficency ratio and the tangible common equity ratio, collectively “core performance measures,” presented in this report and the included tables as important measures of financial performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the impact of certain non-comparable items, and the Company’s operating performance on an ongoing basis. Core performance measures include exclude certain other income and expense items, such as merger related expenses, facilities charges, and the gain or loss on sale of investment securities, the Company believes to be not indicative of or useful to measure the Company’s operating performance on an ongoing basis. The attached tables contain a reconciliation of these core performance measures to the GAAP measures. The Company believes that the tangible common equity ratio provides useful information to investors about the Company’s capital strength even though it is considered to be a non-GAAP financial measure and is not part of the regulatory capital requirements to which the Company is subject. The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and ratios, provide meaningful supplemental information regarding the Company’s performance and capital strength. The Company’s management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the Company’s operating results and related trends and when forecasting future periods. However, these non-GAAP measures and ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP. In the attached tables, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the financial measures for the periods indicated. 19

Reconciliation of Non-GAAP Financial Measures Quarter ended ($ in thousands) Jun 30, 2022 Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 SHAREHOLDERS’ EQUITY TO TANGIBLE COMMON EQUITY AND TOTAL ASSETS TO TANGIBLE ASSETS Shareholders’ equity $ 1,447,412 $ 1,473,177 $ 1,529,116 $ 1,439,635 $ 1,118,301 Less preferred stock 71,988 71,988 71,988 — — Less goodwill 365,164 365,164 365,164 365,415 260,567 Less intangible assets 19,528 20,855 22,286 23,777 20,358 Tangible common equity $ 990,732 $ 1,015,170 $ 1,069,678 $ 1,050,443 $ 837,376 Total assets $ 13,084,506 $ 13,706,769 $ 13,537,358 $ 12,888,016 $ 10,346,993 Less goodwill 365,164 365,164 365,164 365,415 260,567 Less intangible assets 19,528 20,855 22,286 23,777 20,358 Tangible assets $ 12,699,814 $ 13,320,750 $ 13,149,908 $ 12,498,824 $ 10,066,068 Tangible common equity to tangible assets 7.80 % 7.62 % 8.13 % 8.40 % 8.32 % 20

Reconciliation of Non-GAAP Financial Measures Quarter ended ($ in thousands) Jun 30, 2022 Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 CALCULATION OF PRE-PROVISION NET REVENUE Net interest income $ 109,613 $ 101,165 $ 102,060 $ 97,273 $ 81,738 Noninterest income 14,194 18,641 22,630 17,619 16,204 Less noninterest expense 65,424 62,800 63,694 76,885 52,456 Branch-closure expenses — — — 3,441 — Merger-related expenses — — 2,320 14,671 1,949 PPNR $ 58,383 $ 57,006 $ 56,119 $ 47,435 $ 40,671 Average assets $ 13,528,474 $ 13,614,003 $ 13,267,193 $ 12,334,558 $ 10,281,344 ROAA - GAAP net income 1.34 % 1.42 % 1.52 % 0.45 % 1.50 % PPNR ROAA - PPNR 1.73 % 1.70 % 1.89 % 1.81 % 1.85 % Quarter ended ($ in thousands) Jun 30, 2022 Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 IMPACT OF PAYCHECK PROTECTION PROGRAM Tangible assets - Non-GAAP (see reconciliation above) $ 12,699,814 $ 13,320,750 $ 13,149,908 $ 12,498,824 $ 10,066,068 PPP loans outstanding, net (49,175) (134,084) (271,958) (438,959) (396,660) Adjusted tangible assets - Non-GAAP $ 12,650,639 $ 13,186,666 $ 12,877,950 $ 12,059,865 $ 9,669,408 Tangible common equity Non - GAAP (see reconciliation above) $ 990,732 $ 1,015,170 $ 1,069,678 $ 1,050,443 $ 837,376 Tangible common equity to tangible assets 7.80 % 7.62 % 8.13 % 8.40 % 8.32 % Tangible common equity to tangible assets - adjusted tangible assets 7.83 % 7.70 % 8.31 % 8.71 % 8.66 % AVERAGE SHAREHOLDERS’ EQUITY AND AVERAGE TANGIBLE COMMON EQUITY Average shareholder’s equity $ 1,474,267 Less average preferred stock 71,988 Less average goodwill 365,164 Less average intangible assets 20,175 Average tangible common equity $ 1,016,940 Return on average tangible common equity 17.44 % 21

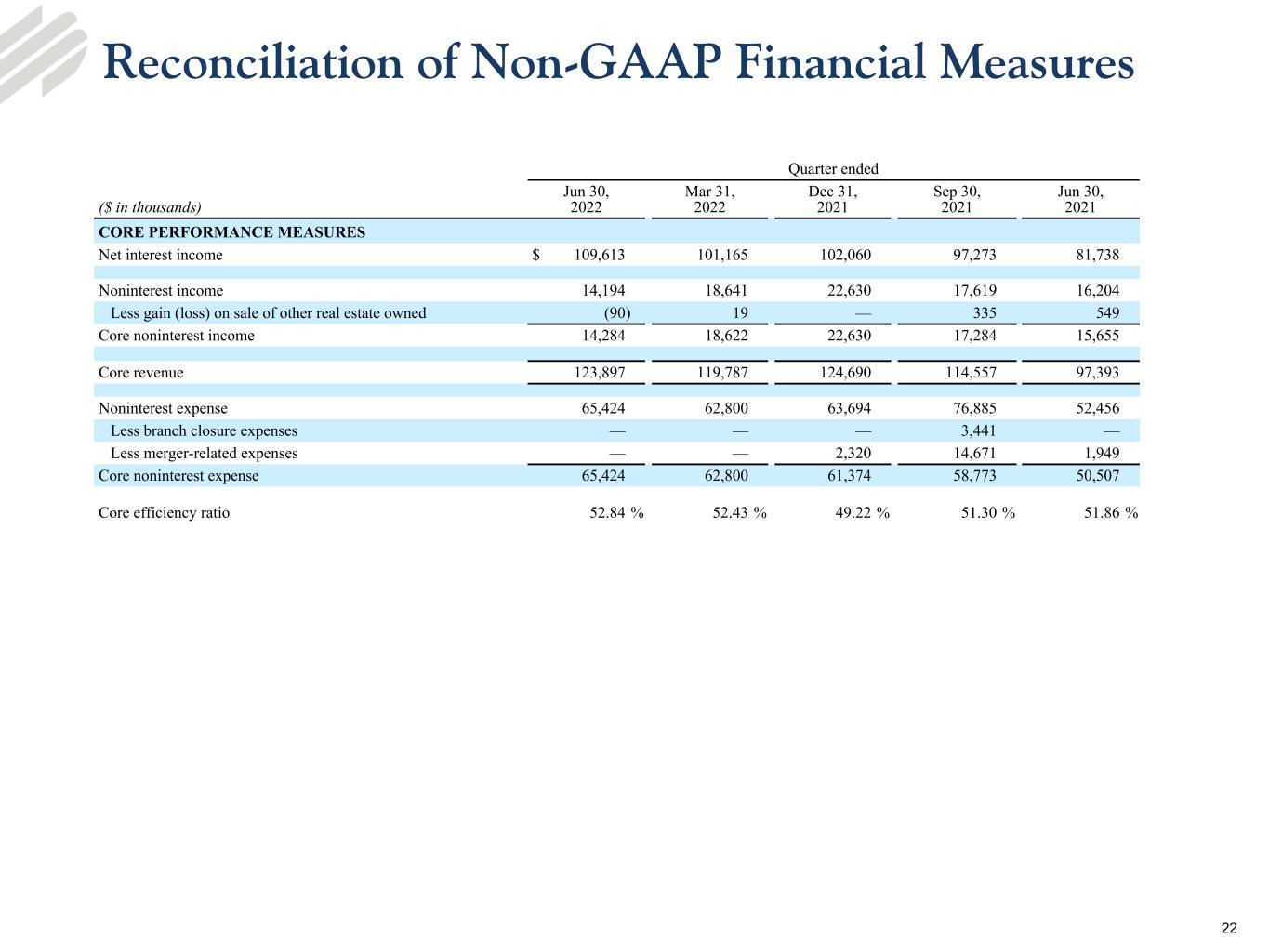

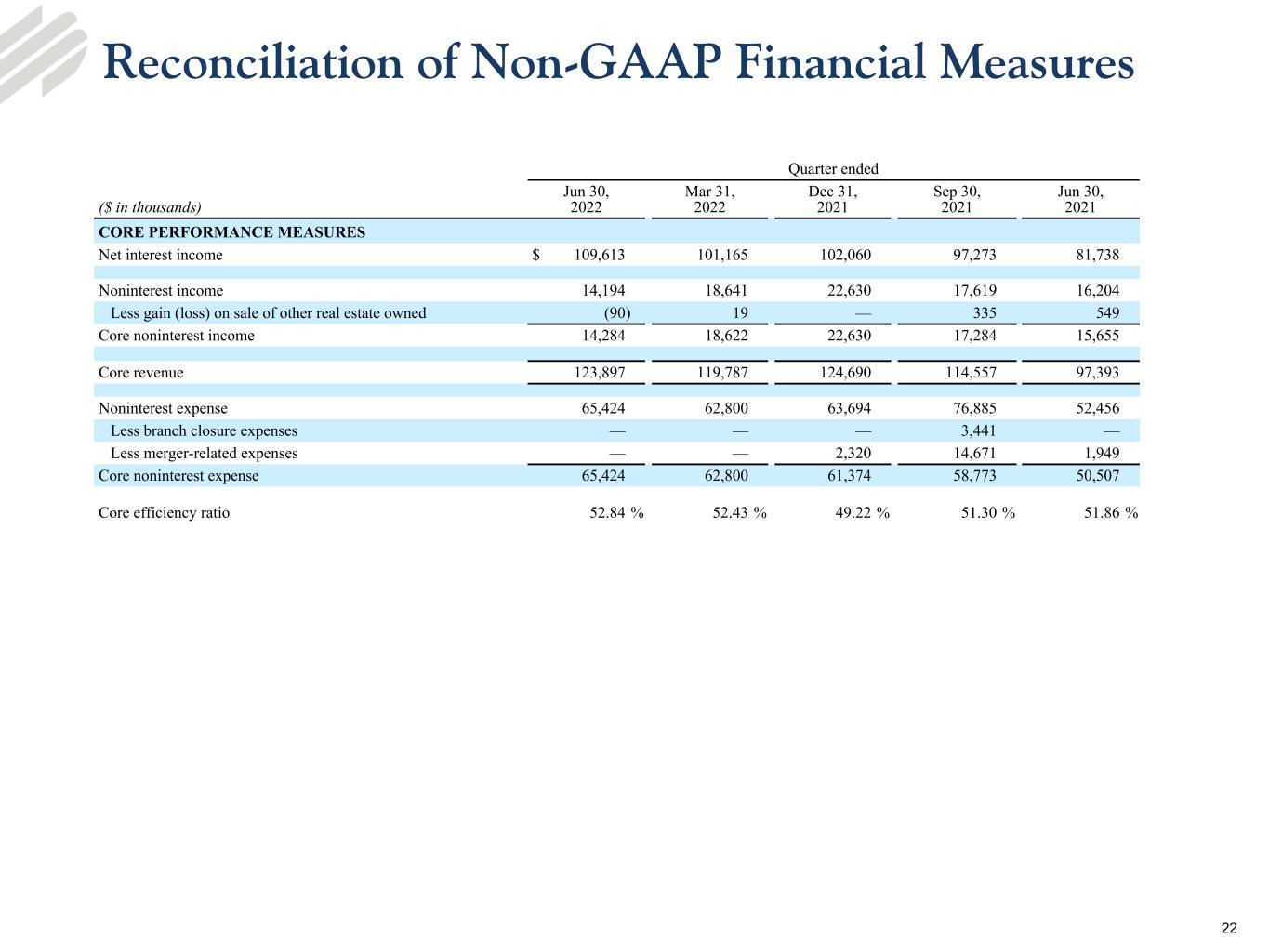

Reconciliation of Non-GAAP Financial Measures Quarter ended ($ in thousands) Jun 30, 2022 Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 CORE PERFORMANCE MEASURES Net interest income $ 109,613 101,165 102,060 97,273 81,738 Noninterest income 14,194 18,641 22,630 17,619 16,204 Less gain (loss) on sale of other real estate owned (90) 19 — 335 549 Core noninterest income 14,284 18,622 22,630 17,284 15,655 Core revenue 123,897 119,787 124,690 114,557 97,393 Noninterest expense 65,424 62,800 63,694 76,885 52,456 Less branch closure expenses — — — 3,441 — Less merger-related expenses — — 2,320 14,671 1,949 Core noninterest expense 65,424 62,800 61,374 58,773 50,507 Core efficiency ratio 52.84 % 52.43 % 49.22 % 51.30 % 51.86 % 22

Q & A Second Quarter 2022 Earnings Webcast