Enterprise Financial Services Corp 2024 Third Quarter Investor Presentation Exhibit 99.1

2 Forward-Looking Statements Some of the information in this report may contain “forward-looking statements” within the meaning of and intended to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include projections based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company including, without limitation, plans, strategies and goals, and statements about the Company’s expectations regarding revenue and asset growth, financial performance and profitability, loan and deposit growth, liquidity, yields and returns, loan diversification and credit management, shareholder value creation and the impact of acquisitions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “pro forma,” “pipeline” and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in the forward-looking statements and future results could differ materially from historical performance. They are neither statements of historical fact nor guarantees or assurances of future performance. While there is no assurance that any list of risks and uncertainties or risk factors is complete, important factors that could cause actual results to differ materially from those in the forward-looking statements include the following, without limitation: our ability to efficiently integrate acquisitions into our operations, retain the customers of these businesses and grow the acquired operations; credit risk; changes in the appraised valuation of real estate securing impaired loans; our ability to recover our investment in loans; fluctuations in the fair value of collateral underlying loans; outcomes of litigation and other contingencies; exposure to general and local economic and market conditions, including risk of recession, high unemployment rates, higher inflation and its impacts (including U.S. federal government measures to address higher inflation), U.S. fiscal debt, budget and tax matters, and any slowdown in global economic growth; risks associated with rapid increases or decreases in prevailing interest rates; changes in business prospects that could impact goodwill estimates and assumptions; consolidation within the banking industry; competition from banks and other financial institutions; the ability to attract and retain relationship officers and other key personnel; burdens imposed by federal and state regulation; changes in legislative or regulatory requirements, as well as current, pending or future legislation or regulation that could have a negative effect on our revenue and business, including rules and regulations relating to bank products and financial services; changes in accounting policies and practices or accounting standards; natural disasters; terrorist activities, war and geopolitical matters (including the war in Israel and potential for a broader regional conflict and the war in Ukraine and the imposition of additional sanctions and export controls in connection therewith), or pandemics, or other health emergencies and their effects on economic and business environments in which we operate, including the related disruption to the financial market and other economic activity; and other risks referenced from time to time in the Company’s filings with the Securities and Exchange Commission (the “SEC”), including in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and the Company’s other filings with the SEC. The Company cautions that the preceding list is not exhaustive of all possible risk factors and other factors could also adversely affect the Company’s results. For any forward-looking statements made in this press release or in any documents, EFSC claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Annualized, pro forma, projected and estimated numbers in this document are used for illustrative purposes only, are not forecasts and may not reflect actual results. Readers are cautioned not to place undue reliance on any forward-looking statements. Except to the extent required by applicable law or regulation, EFSC disclaims any obligation to revise or publicly release any revision or update to any of the forward-looking statements included herein to reflect events or circumstances that occur after the date on which such statements were made.

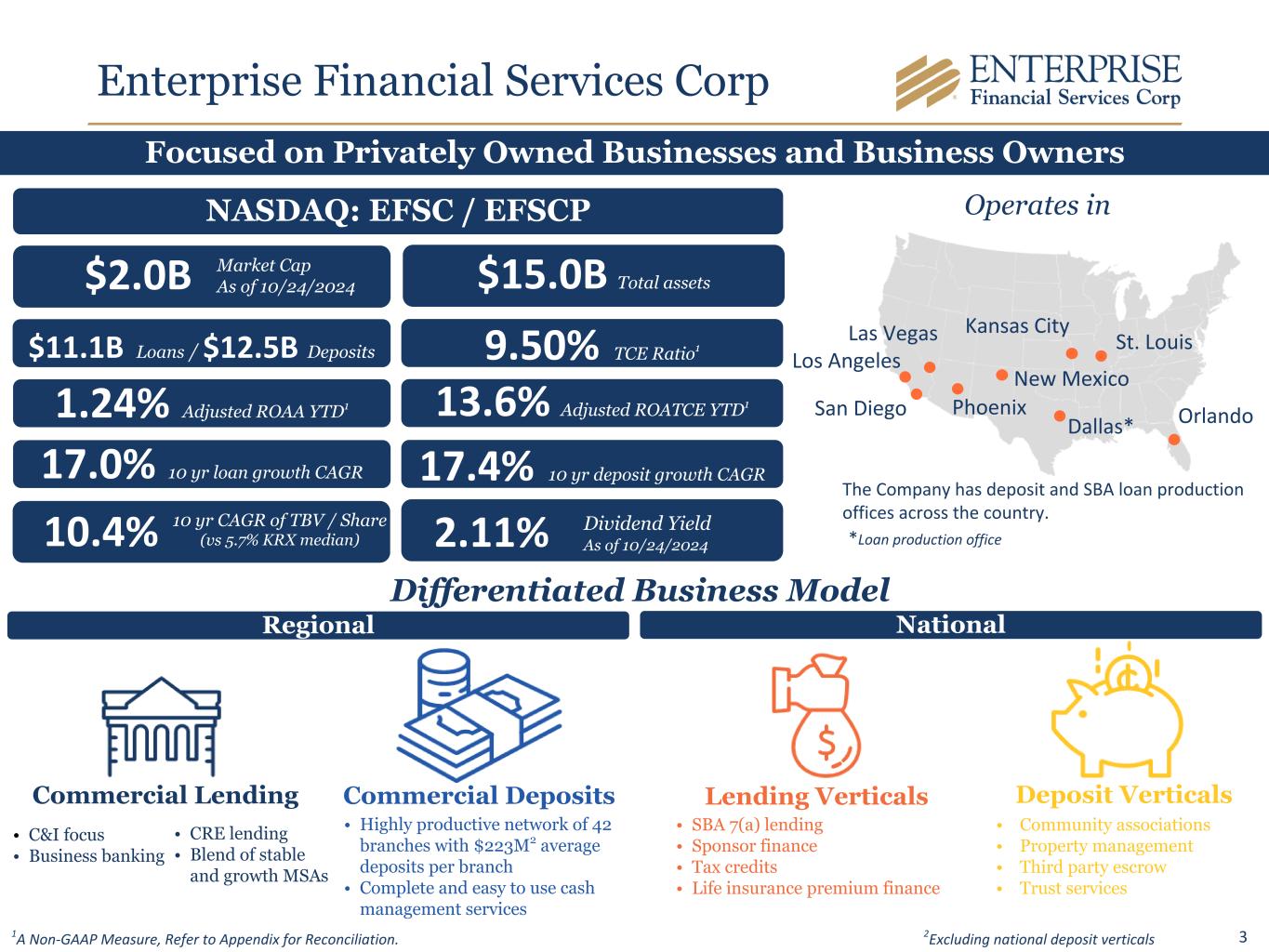

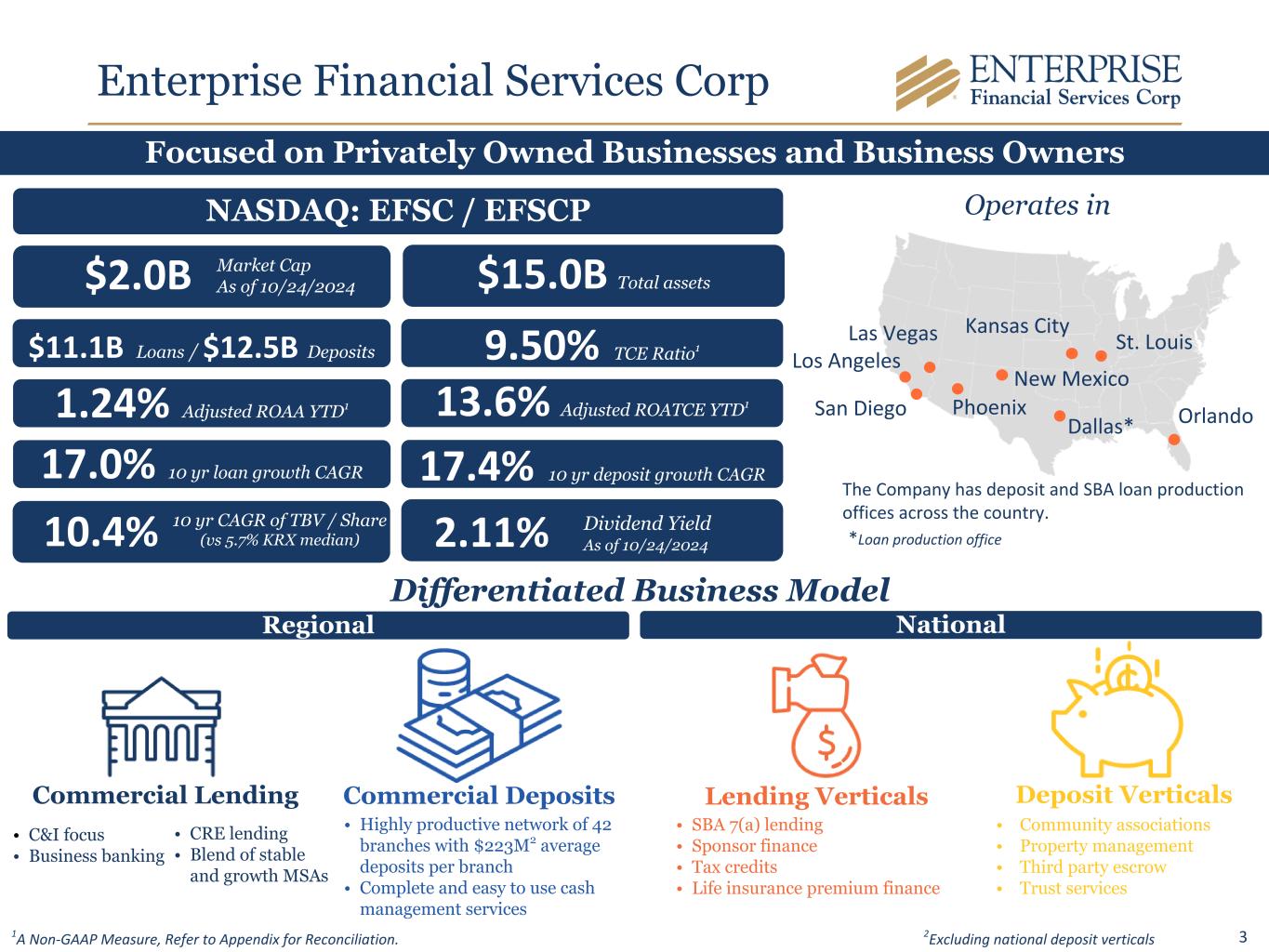

3 Enterprise Financial Services Corp Operates in St. Louis Kansas City Phoenix New Mexico Los Angeles Las Vegas The Company has deposit and SBA loan production offices across the country. San Diego Dallas* Orlando Focused on Privately Owned Businesses and Business Owners Commercial Lending Lending Verticals Deposit VerticalsCommercial Deposits • C&I focus • Business banking • CRE lending • Blend of stable and growth MSAs • SBA 7(a) lending • Sponsor finance • Tax credits • Life insurance premium finance • Community associations • Property management • Third party escrow • Trust services • Highly productive network of 42 branches with $223M2 average deposits per branch • Complete and easy to use cash management services NASDAQ: EFSC / EFSCP $2.0B r $15.0B Total assets $11.1B Loans / $12.5B Deposits 9.50% TCE Ratio1 1.24% Adjusted ROAA YTD1 13.6% Adjusted ROATCE YTD1 10.4% r 2.11% r Differentiated Business Model Market Cap As of 10/24/2024 1A Non-GAAP Measure, Refer to Appendix for Reconciliation. 10 yr CAGR of TBV / Share (vs 5.7% KRX median) Dividend Yield As of 10/24/2024 17.0% 10 yr loan growth CAGR 17.4% 10 yr deposit growth CAGR *Loan production office Regional National 2Excluding national deposit verticals

4 Economic View of Regional Markets State/Metro Population (in millions)2 Unemployment Rate2 Average Household Income (in thousands)2 Gross Product (in billions)2 1Q24 YTD FY2023 Midwest Total Loans1 / Total Deposits $3.2 billion / $6.2 billion Missouri 6.3 3.52% $160 $448 St. Louis 2.8 3.65% $191 $225 Kansas 3.0 2.92% $170 $234 Kansas City 2.3 3.25% $175 $178 Southwest Total Loans1 / Total Deposits $1.7 billion / $2.0 billion New Mexico 2.2 3.81% $145 $140 Albuquerque 0.9 3.60% $148 $61 Santa Fe 0.2 3.20% $184 $8 Arizona 7.6 3.41% $166 $549 Phoenix 5.2 3.05% $180 $409 Texas 31.4 3.99% $188 $2,695 Dallas 8.5 3.77% $208 $821 Nevada 3.3 5.15% $177 $260 Las Vegas 2.4 5.35% $171 $185 West Total Loans1 / Total Deposits $1.9 billion / $1.2 billion California 39.4 5.24% $247 $4,080 Los Angeles 13.0 4.97% $243 $1,475 San Diego 3.3 4.51% $233 $368 United States 342.0 4.00% $187 $29,017 1Excludes Other and Specialty loans 2For the period ended June 30, 2024 Geographic diversification in attractive markets with opportunity to expand market share in high growth, robust MSAs in California, Arizona, Nevada and Texas. Stable Markets Growth Markets

5 Executive Leadership Team JAMES B. LALLY 56, President & Chief Executive Officer, EFSC Enterprise Tenure – 20 years KEENE S. TURNER 45, SEVP, Chief Financial Officer, EFSC Enterprise Tenure – 11 years SCOTT R. GOODMAN 60, SEVP, President, Enterprise Bank & Trust Enterprise Tenure – 21 years DOUGLAS N. BAUCHE 54, SEVP, Chief Credit Officer, Enterprise Bank & Trust Enterprise Tenure – 24 years MARK G. PONDER 54, SEVP, Chief Administrative Officer, Enterprise Bank & Trust Enterprise Tenure – 12 years NICOLE M. IANNACONE 44, SEVP, Chief Legal Officer, Enterprise Bank & Trust Enterprise Tenure – 10 years BRIDGET HUFFMAN 42, SEVP, Chief Risk Officer, Enterprise Bank & Trust Enterprise Tenure – 13 years

6 EFSC Awards and Recognition Doing Well by Doing Good Award Promote community service, philanthropy and charitable giving to make a difference in the communities they service. Women in the Workplace Honoree Company policies, practices, development and data that show our commitment to supporting and advancing women in the workplace. “3+” Corporation Three or more women serving on our Board of Directors, an important step to achieving gender-balanced and diverse boards. 2023 Leader in Disability Inclusion Award Demonstrate values associated with being a leader in disability inclusion. Top-Performing Bank No. 22 in American Banker’s annual list of top-performing banks between $10-$50B in assets based on three-year average return on equity. Best Banks to Work For 2023 No. 52 in American Banker’s list of best banks to work for based on a combination of associate survey, plus a review of our policies and associate benefits.

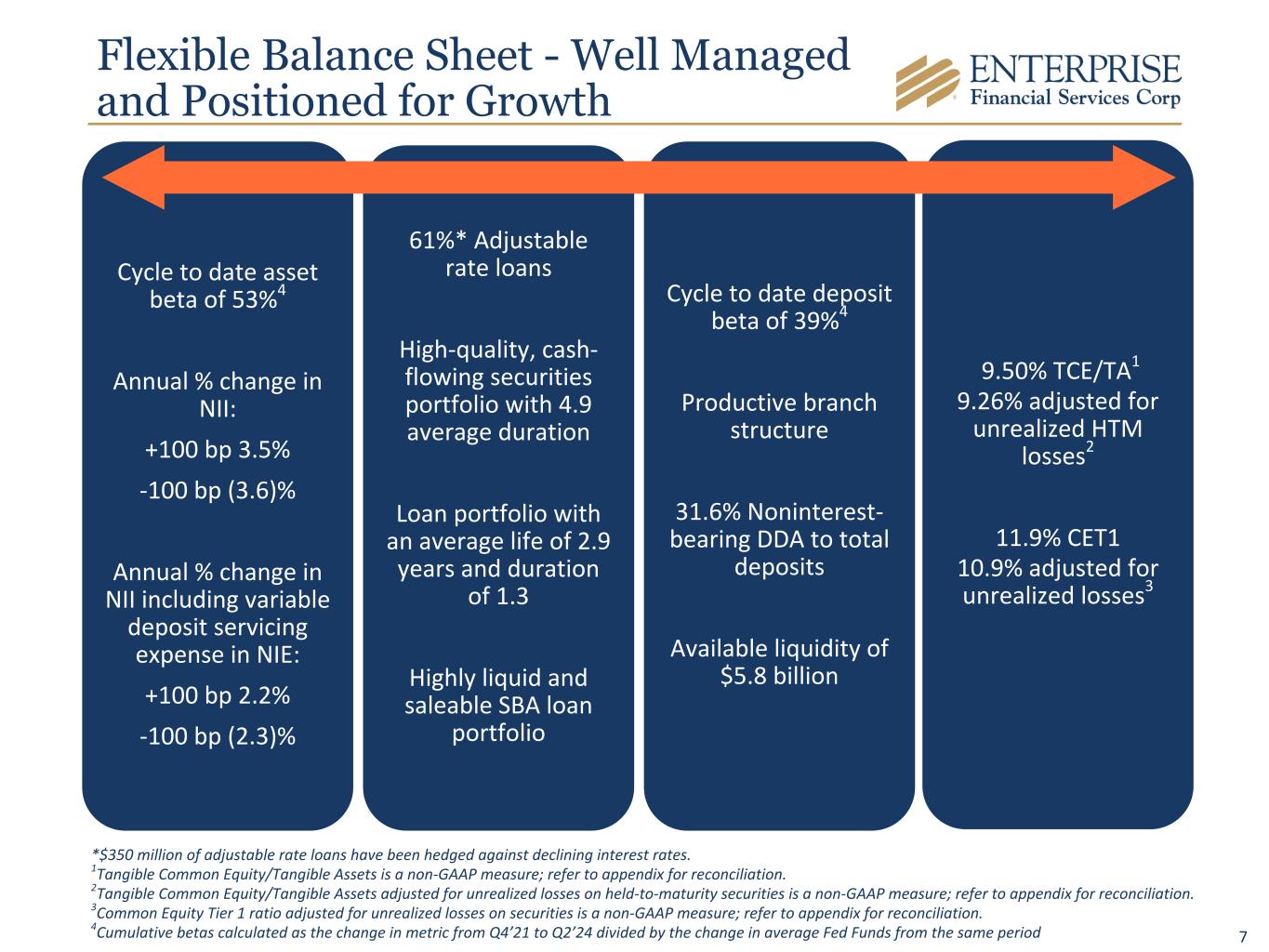

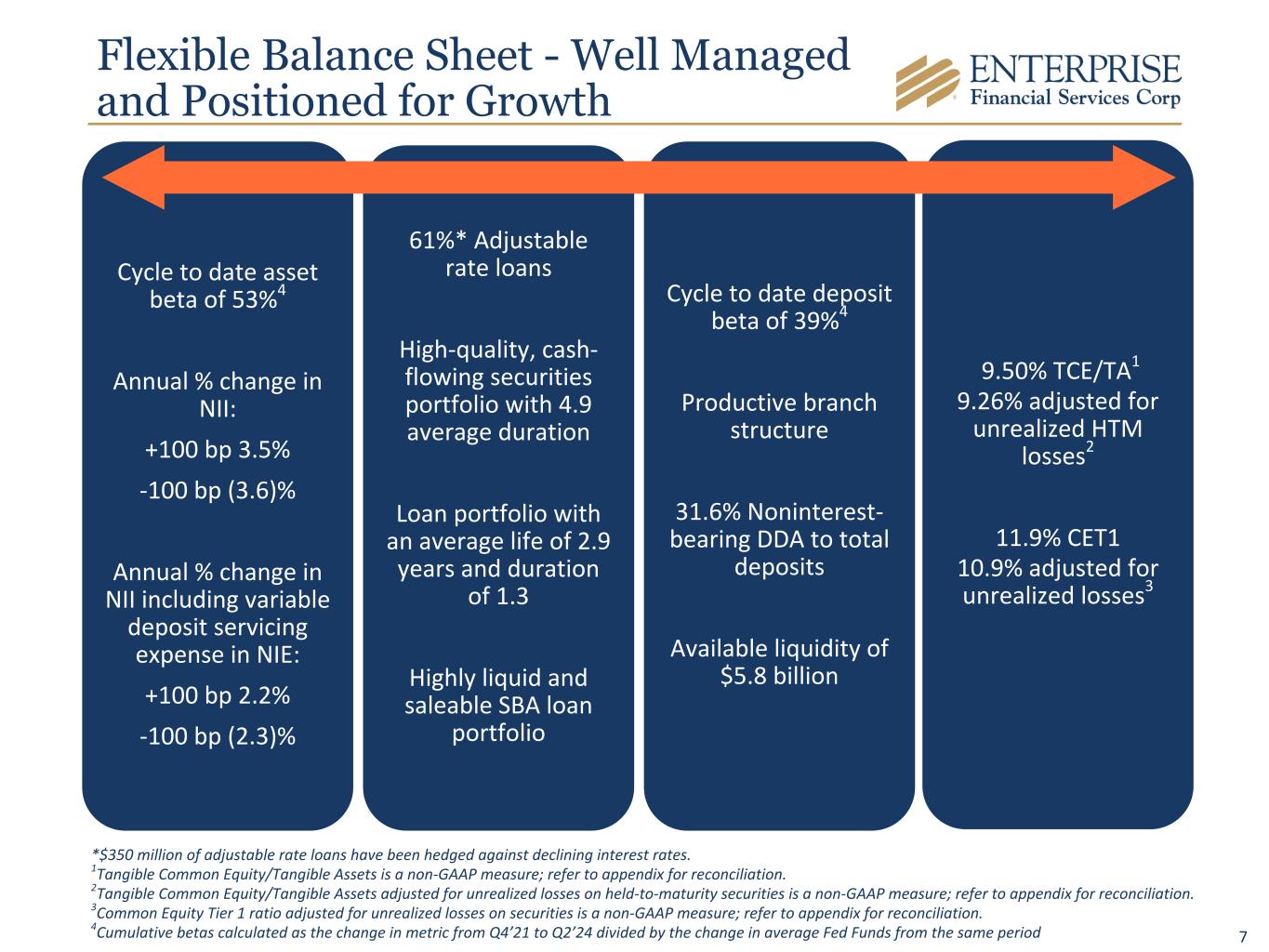

7 Cycle to date asset beta of 53%4 Annual % change in NII: +100 bp 3.5% -100 bp (3.6)% Annual % change in NII including variable deposit servicing expense in NIE: +100 bp 2.2% -100 bp (2.3)% 61%* Adjustable rate loans High-quality, cash- flowing securities portfolio with 4.9 average duration Loan portfolio with an average life of 2.9 years and duration of 1.3 Highly liquid and saleable SBA loan portfolio Cycle to date deposit beta of 39%4 Productive branch structure 31.6% Noninterest- bearing DDA to total deposits Available liquidity of $5.8 billion 9.50% TCE/TA1 9.26% adjusted for unrealized HTM losses2 11.9% CET1 10.9% adjusted for unrealized losses3 Flexible Balance Sheet - Well Managed and Positioned for Growth *$350 million of adjustable rate loans have been hedged against declining interest rates. 1Tangible Common Equity/Tangible Assets is a non-GAAP measure; refer to appendix for reconciliation. 2Tangible Common Equity/Tangible Assets adjusted for unrealized losses on held-to-maturity securities is a non-GAAP measure; refer to appendix for reconciliation. 3Common Equity Tier 1 ratio adjusted for unrealized losses on securities is a non-GAAP measure; refer to appendix for reconciliation. 4Cumulative betas calculated as the change in metric from Q4’21 to Q2’24 divided by the change in average Fed Funds from the same period

8 $2.4 $2.8 $3.2 $4.1 $4.4 $5.3 $7.2 $9.0 $9.7 $10.9 $11.1 $2.5 $2.8 $3.2 $4.2 $4.6 $5.8 $8.0 $11.3 $10.8 $12.2 $12.5 EFSC Loans Acquired Loans EFSC Deposits Acquired Deposits 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 3Q24 $ In Billions 17.4 % 10 yr D epo sit G row th C AGR 1 (11. 6% 1 exc ludi ng a cqu isiti ons and bro kere d CD s)17.0 % 10 yr L oan Gro wth CAG R1 (11. 0% 1 exc ludi ng a cqu isiti ons ) Loan and Deposit Trends 110 yr CAGR from 3Q14 - 3Q24

9 M&A Diversifies & Complements Organic Growth M&A Strategy Growth History $5.3 $5.6 $7.3 $9.8 $13.5 $13.1 $14.5 $4.4 $6.1 $8.5 $11.3 $0.9 $1.2 $1.3 $2.2 EFSC Assets Merger Contribution 2017 2018 2019 2020 2021 2022 2023 $ In Billions Strategically enhanced geographic diversification and product lines through select M&A transactions. These transactions provided: * Entry into vibrant and growing markets * Granular, low-cost deposit base in New Mexico and St. Louis (Trinity and JC Bankshares) * Deepened C&I focus in California market (First Choice) * National Deposit Vertical Platform (Seacoast) * National SBA Lending Platform (Seacoast)

10 Strengths vs KRX Peers1 3Q24 NIM 3.26% 3.50% 4.17% KRX Median KRX Top Quartile EFSC AOCI Adjusted 10-Year TBV CAGR 7.8% 9.5% 11.0% KRX Median KRX Top Quartile EFSC 10-Year TTM EPS CAGR 6.1% 9.0% 14.2% KRX Median KRX Top Quartile EFSC NIB Deposits 25.6% 29.3% 31.6% KRX Median KRX Top Quartile EFSC 3Q24 ROAA 1.09% 1.24% 1.36% KRX Median KRX Top Quartile EFSC 1 3Q24 results available as of October 25, 2024. All figures are as reported by S&P 2TTM - Trailing twelve months 4Q21 - 3Q24 NIM ∆ (bps) 35 58 85 KRX Median KRX Top Quartile EFSC TCE Ratio 8.50% 10.26% 9.50% KRX Median KRX Top Quartile EFSC 10-Year TBV CAGR 5.7% 7.9% 10.4% KRX Median KRX Top Quartile EFSC 2

11 Value Proposition EFSC Adding Shareholder Value Experience Performance Discipline • Tenured management team ◦ Average years of tenure: 16 years • Abundant industry experience ◦ Average years of industry experience: 23 years • Diversification across geographic regions and product lines • History of strong earnings: 55+ quarters of profitability • Top quartile net interest margin and ROAA ◦ 2023 NIM of 4.43% and ROAA of 1.41%1 vs peer top quartile of 3.53% and 1.22%, respectively • Strong capital foundation ◦ CET1 of 11.9% (10.9%1 including unrealized losses on investments) ◦ 1.43%1 ACL on loans (excluding guaranteed loans and including ACL on unfunded commitments) • Consistent credit culture ◦ NPL to loans of 0.26% and NPA to assets of 0.22% 1A Non-GAAP Measure, Refer to Appendix for Reconciliation. Strategy • Drive industry-leading service and differentiated financial performance • Empowered associates with effective technology solutions • Emphasis on commercial asset growth through specialty, business and commercial banking teams • Growth funded through retail banking, business services and deposit verticals

Financial Highlights

13 Financial Highlights - 3Q24* Capital • Tangible Common Equity/Tangible Assets** 9.50%, compared to 9.18% • Tangible Book Value Per Common Share** $37.26, compared to $35.02 • CET1 Ratio 11.9%, compared to 11.7% • Repurchased 195,114 shares at an average price of $49.73 • Quarterly common stock dividend of $0.27 per share in third quarter 2024 ($0.01 increase) • Quarterly preferred stock dividend of $12.50 per share ($0.3125 per depositary share) • Net Income $50.6 million, up $5.1 million; EPS $1.32 • Net Interest Income $143.5 million, up $2.9 million; NIM 4.17% • PPNR** $65.1 million, up $1.8 million • Adjusted ROAA** 1.32%, compared to 1.27%; PPNR ROAA** 1.74%, compared to 1.74% • Adjusted ROATCE** 14.16%, compared to 14.06% Earnings *Comparisons noted below are to the linked quarter unless otherwise noted. **A Non-GAAP Measure, Refer to Appendix for Reconciliation.

14 Financial Highlights, continued - 3Q24* *Comparisons noted below are to the linked quarter unless otherwise noted. **A Non-GAAP Measure, Refer to Appendix for Reconciliation. Loans & Deposits • Loans $11.1 billion, up $79.9 million • Loan/Deposit Ratio 89% • Deposits $12.5 billion, up $182.9 million or $196.9 million excluding brokered CDs • Noninterest-bearing Deposits/Total Deposits 32% Asset Quality • Nonperforming Loans/Loans 0.26% • Nonperforming Assets/Assets 0.22% • Allowance Coverage Ratio 1.26%; 1.38% adjusted for guaranteed loans** • Net Charge-offs $3.9 million

15 Total Loan Trends $7,225 $9,018 $9,737 $10,884 $11,080 90.5% 79.5% 89.9% 89.4% 88.9% Loans PPP Loans/Deposits 2020 2021 2022 2023 3Q24 $ In Millions PPP $272 PPP $699

16 Loan Details 3Q24 2Q24 3Q23 Qtr Change LTM Change C&I $ 2,145 $ 2,107 $ 2,020 $ 38 $ 125 CRE Investor Owned 2,347 2,309 2,260 38 87 CRE Owner Occupied 1,323 1,314 1,256 9 67 SBA loans* 1,273 1,269 1,309 4 (36) Sponsor Finance* 819 866 888 (47) (69) Life Insurance Premium Financing* 1,030 996 928 34 102 Tax Credits* 724 738 684 (14) 40 Residential Real Estate 346 340 365 6 (19) Construction and Land Development 797 792 640 5 157 Other 276 269 267 7 9 Total Loans $ 11,080 $ 11,000 $ 10,617 $ 80 $ 463 *Specialty loan category. $ In Millions

17 Loans By Region Specialty Lending $3,871 $3,959 $3,990 3Q23 2Q24 3Q24 $ In Millions Midwest $3,260 $3,279 $3,194 3Q23 2Q24 3Q24 Southwest $1,464 $1,649 $1,680 3Q23 2Q24 3Q24 Note: Excludes “Other” loans; Region Components: Midwest (St. Louis & Kansas City), Southwest (AZ, NM, Las Vegas, TX), West (Southern California) West $1,755 $1,844 $1,940 3Q23 2Q24 3Q24

18 Tax Credit Programs 6.5% Sponsor Finance 7.4% Life Insurance Premium Financing 9.3% SBA 11.5% Other 65.3% Focused Loan Growth Strategies Total Loans Lending verticals provide a competitive advantage, risk adjusted pricing and fee income opportunities. Tax Credit Programs $724 million in loans outstanding related to Federal, Historic, and Affordable Housing tax credits. $353 million in Federal & State New Market tax credits awarded to date. Sponsor Finance $819 million in M&A related loans outstanding, partnering with SBIC and PE firms. Life Insurance Premium Finance $1.0 billion in loans outstanding related to high net worth estate planning. SBA Loans $1.3 billion in loans outstanding in SBA 7(a) loans, including $905 million guaranteed.

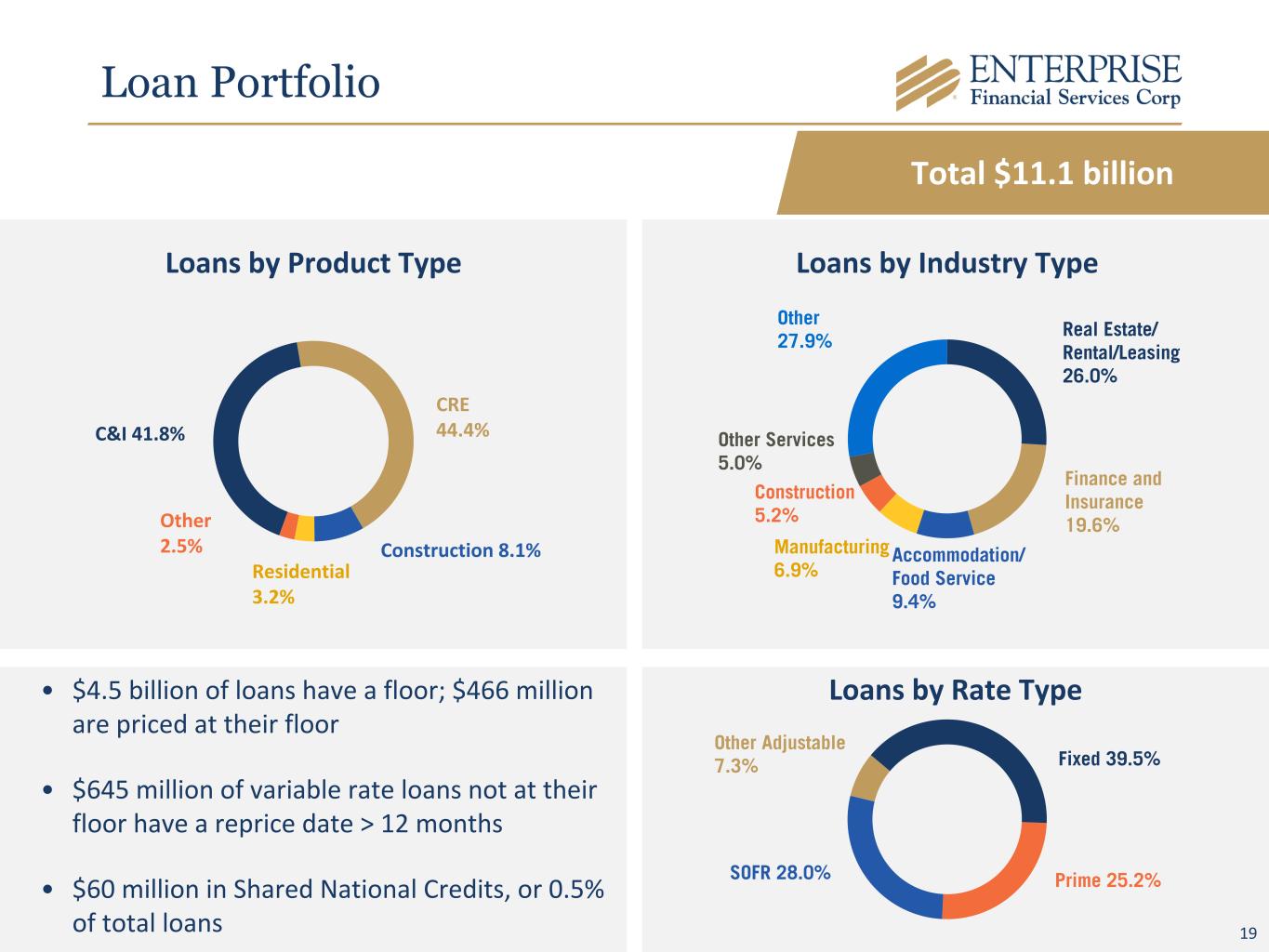

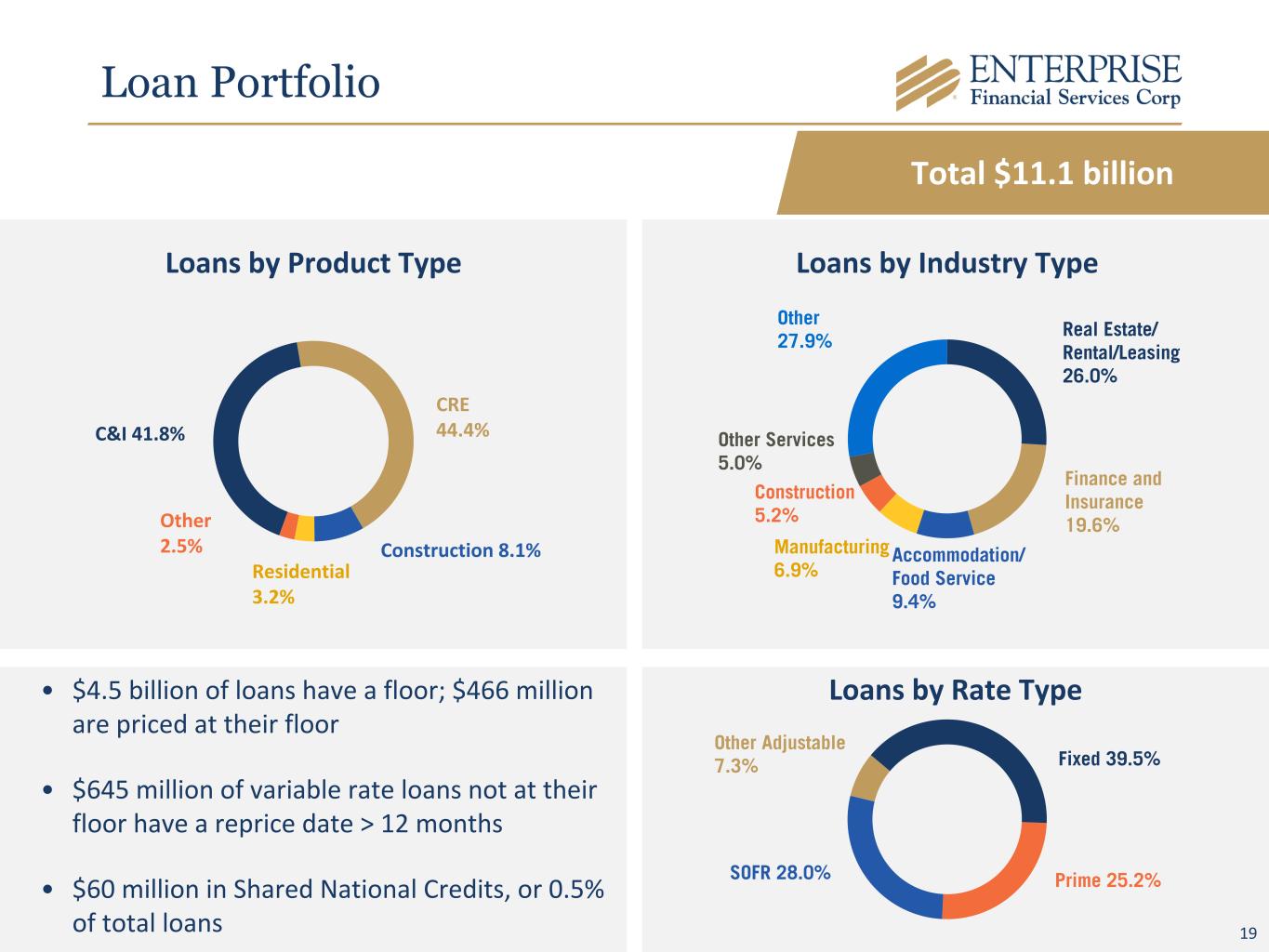

19 Loan Portfolio Total $11.1 billion C&I 41.8% CRE 44.4% Construction 8.1% Residential 3.2% Other 2.5% Loans by Product Type Real Estate/ Rental/Leasing 26.0% Finance and Insurance 19.6% Accommodation/ Food Service 9.4% Manufacturing 6.9% Construction 5.2% Other Services 5.0% Other 27.9% Loans by Industry Type Fixed 39.5% Prime 25.2%SOFR 28.0% Other Adjustable 7.3% Loans by Rate Type• $4.5 billion of loans have a floor; $466 million are priced at their floor • $645 million of variable rate loans not at their floor have a reprice date > 12 months • $60 million in Shared National Credits, or 0.5% of total loans 19

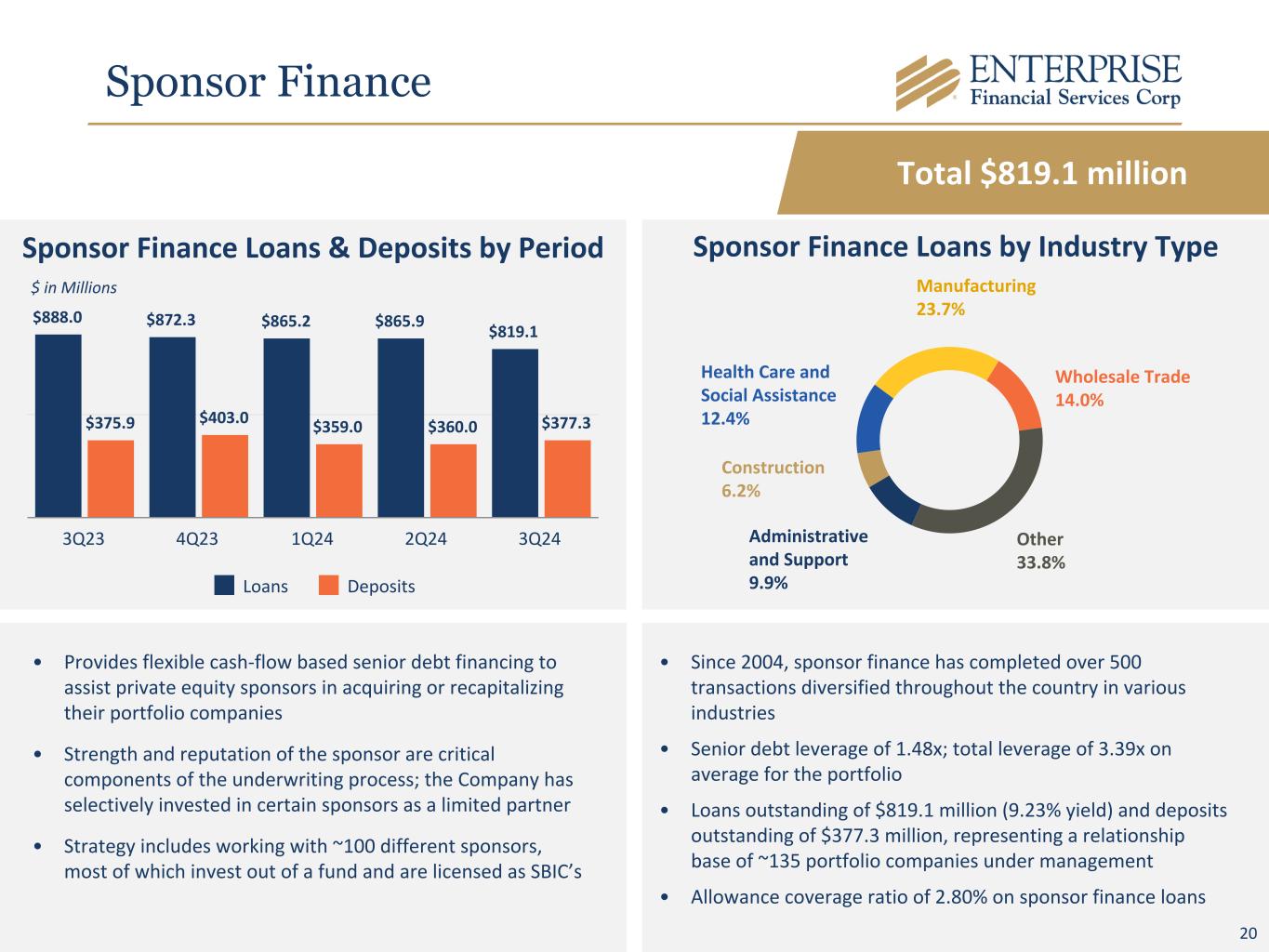

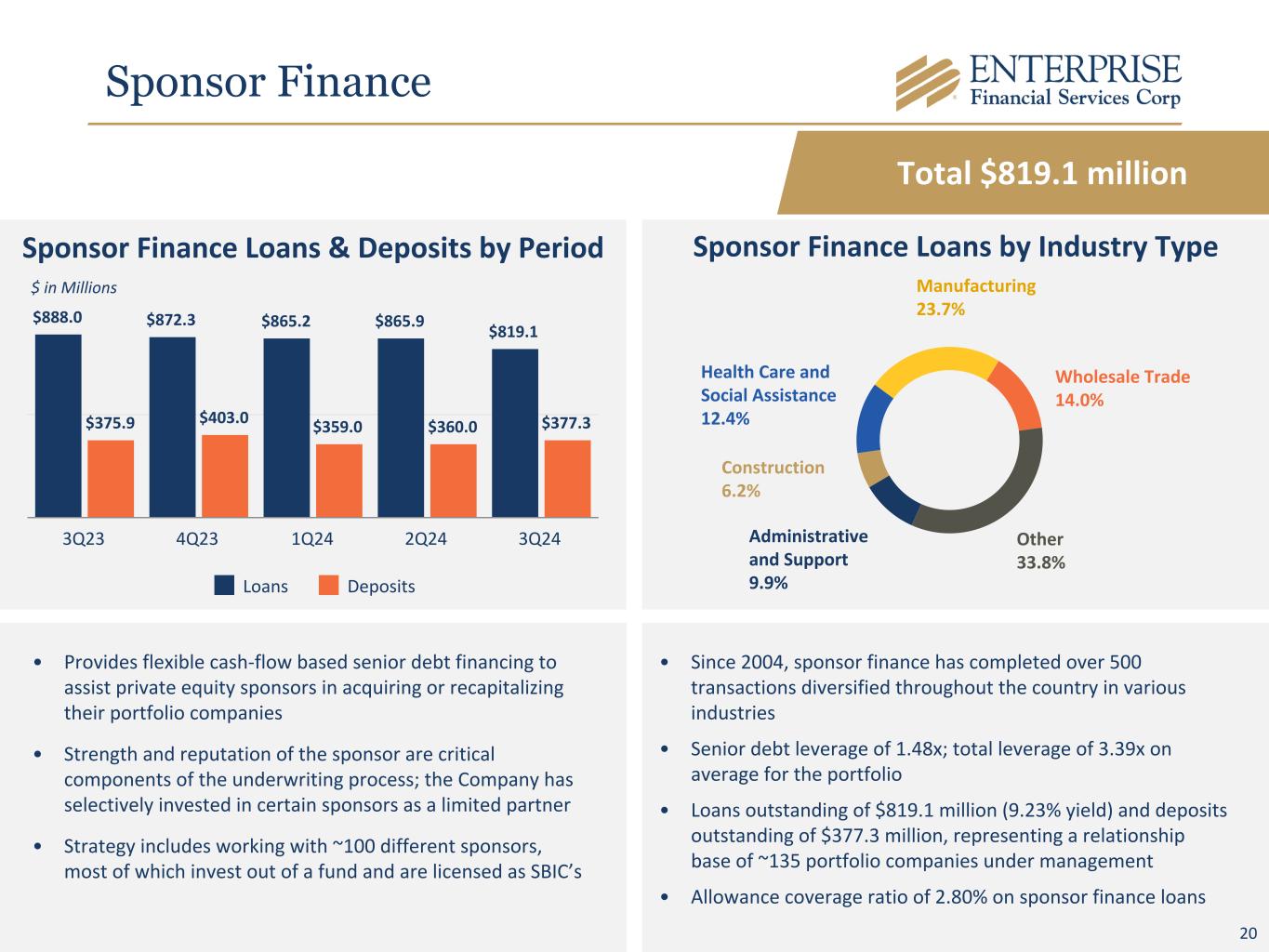

20 Sponsor Finance Administrative and Support 9.9% Construction 6.2% Health Care and Social Assistance 12.4% Manufacturing 23.7% Wholesale Trade 14.0% Other 33.8% Sponsor Finance Loans by Industry TypeSponsor Finance Loans & Deposits by Period $888.0 $872.3 $865.2 $865.9 $819.1 $375.9 $403.0 $359.0 $360.0 $377.3 Loans Deposits 3Q23 4Q23 1Q24 2Q24 3Q24 • Provides flexible cash-flow based senior debt financing to assist private equity sponsors in acquiring or recapitalizing their portfolio companies • Strength and reputation of the sponsor are critical components of the underwriting process; the Company has selectively invested in certain sponsors as a limited partner • Strategy includes working with ~100 different sponsors, most of which invest out of a fund and are licensed as SBIC’s $ in Millions • Since 2004, sponsor finance has completed over 500 transactions diversified throughout the country in various industries • Senior debt leverage of 1.48x; total leverage of 3.39x on average for the portfolio • Loans outstanding of $819.1 million (9.23% yield) and deposits outstanding of $377.3 million, representing a relationship base of ~135 portfolio companies under management • Allowance coverage ratio of 2.80% on sponsor finance loans Total $819.1 million 20

21 Office CRE (Non-owner Occupied) Total $503.1 million Midwest 46.9% Southwest 27.5% West 20.6% Specialty 5.0% Office CRE Loans by Location Real Estate/ Rental/Leasing 87.7% Health Care and Social Assistance 3.4% Other 8.9% Office CRE Loans by Industry Type Size Average Risk Rating Number of Loans Balance Average Balance > $10 Million 5.58 12 $ 187.5 $ 15.6 $5-10 Million 5.00 10 66.3 6.6 $2-5 Million 5.17 42 134.2 3.2 < $2 Million 5.30 202 115.1 0.6 Total 5.28 266 $ 503.1 $ 1.9 Office CRE Loans by Size $ In Millions • Average loan-to-origination value 52% • 71% of loans have recourse to owners • Average debt-service coverage ratio (DSCR) of 1.52x • Average market occupancy of 88%; average rents of $24 psf • 42% Class A, 54% Class B, 4% Class C • $11.5 million unfunded commitments • Limited near-term maturity risk: 10% mature in 2024, 90% maturing in 2025 and beyond 21

22 $139.5 $4.2 $(3.9) $139.8 ACL 2Q24 Portfolio Changes Net Charge-offs ACL 3Q24 Allowance for Credit Losses for Loans $ In Millions • New loans and changes in composition of existing loans • Changes in risk ratings, past due status and reserves on individually evaluated loans • Changes in macroeconomic and qualitative factors 3Q24 $ In Millions Loans ACL ACL as a % of Loans Commercial and industrial $ 4,628 $ 64 1.38 % Commercial real estate 4,915 56 1.14 % Construction real estate 896 10 1.12 % Residential real estate 355 6 1.69 % Other 286 4 1.40 % Total $ 11,080 $ 140 1.26 % Reserves on sponsor finance, agricultural, and investor office CRE loans, which are included in the categories above, represented $23.0 million, $5.1 million, and $11.7 million, respectively. Total ACL percentage of loans excluding government guaranteed loans was 1.38%*. Key Assumptions: • Reasonable and supportable forecast period is one year with a one year reversion period. • Forecast considers a weighted average of baseline, upside and downside scenarios. • Primary macroeconomic factors: ◦ Percentage change in GDP ◦ Unemployment ◦ Percentage change in Retail Sales ◦ Percentage change in CRE Index *A Non-GAAP Measure, Refer to Appendix for Reconciliation.

23 Credit Trends for Loans 3Q24 YTD 2023 2022 2021 2020 NPLs/Loans 0.26 % 0.40 % 0.10 % 0.31 % 0.53 % NPAs/Assets 0.22 % 0.34 % 0.08 % 0.23 % 0.45 % Criticized & Classified Loans/Loans 4.87 % 4.06 % 4.09 % 5.52 % 6.42 % ACL/NPLs 492.6 % 308.2 % 1371.90 % 517.60 % 354.90 % ACL/Loans* 1.38 % 1.35 % 1.56 % 1.84 % 2.31 % Provision expense (benefit) $14.7 $36.6 $(0.6) $13.4 $65.4 NCO/Average loans 0.13 % 0.37 % 0.04 % 0.14 % 0.03 % *Excludes guaranteed loans. A Non-GAAP Measure, Refer to Appendix for Reconciliation. $ In Millions

24 Investment Portfolio Breakout AFS & HTM Securities Obligations of U.S. Government- sponsored enterprises 11% Obligations of states and political subdivisions 42% Agency mortgage- backed securities, 35% Corporate debt securities 6% U.S. Treasury bills 6% TOTAL $2.6 billion • Effective duration of 4.9 years balances the short 3-year duration of the loan portfolio • Cash flows next 12 months of approximately $434.5 million • 3.40% tax-equivalent yield • Municipal bond portfolio rated A or better • Laddered maturity and repayment structure for consistent cash flows Overview Total AFS (Fair Value) Total HTM (Fair Value) AFS Securities (Net Unrealized) HTM Securities (Net Unrealized) 3Q23 4Q23 1Q24 2Q24 3Q24 $— $800 $1,600 $2,400 $(320) $(160) $— $160 $ In Millions $53.9 $144.6 $69.8 $67.2 $241.4 5.60% 5.36% 5.21% 5.43% 4.97% Principal Cost Yield (TEQ) 3Q23 4Q23 1Q24 2Q24 3Q24 Investment Purchase Yield $ In Millions Investment Portfolio

25 EFSC Borrowing Capacity $5.1 $5.1 $5.3 $1.3 $1.2 $1.2 $2.6 $2.6 $2.6 $0.1 $0.1 $0.1 $1.1 $1.2 $1.4 42% 42% 43% FHLB borrowing capacity FRB borrowing capacity Fed Funds lines Unpledged securities Borrowing capacity/Deposits 1Q24 2Q24 3Q24 $ In Billions End of Period and Average Loans to Deposits 89% 89% 90% 90% 89%88% 88% 90% 89% 87% End of period Loans/Deposits Avg Loans/Avg Deposits 3Q23 4Q23 1Q24 2Q24 3Q24 • $1.2 billion available FHLB capacity • $2.6 billion available FRB capacity • $140.0 million in seven federal funds lines • $1.4 billion in unpledged investment securities • $426.4 million cash • $25.0 million available line of credit • Portfolio of saleable SBA loans • Investment portfolio/total assets of 18% • FHLB maximum credit capacity is 45% of assets $0.4 $0.4 $0.4 $0.3 $0.3 $0.4 $0.8 $1.2 $1.5 $1.8 Annual Cash Flows Cumulative Cash Flows 2024 2025 2026 2027 2028 Investment Portfolio Cash Flows* $ In Billions Strong Liquidity Profile *Trailing 12 months ending September 30 of each year Liquidity

26 34.0% 40.4% 42.9% 32.5% 31.6% 32% 33%11% 24% $7,985 $11,344 $10,829 $12,176 $12,465 0.32% 0.11% 0.27% 1.58% 2.18% Deposits Cost of deposits Noninterest bearing % 2020 2021 2022 2023 3Q24 CD Interest-Bearing Demand Accounts DDA MMA & Savings $ In Millions Total Deposits $12.5 billion 3Q24 Deposit Mix

27 Deposit Details 3Q24 2Q24 3Q23 Qtr Change LTM Change Noninterest-bearing demand accounts $ 3,934 $ 3,928 $ 3,852 $ 6 $ 82 Interest-bearing demand accounts 3,049 2,952 2,750 97 299 Money market accounts 3,568 3,474 3,211 94 357 Savings accounts 553 565 626 (12) (73) Certificates of deposit: Brokered 481 495 696 (14) (215) Customer 880 868 775 12 105 Total Deposits $ 12,465 $ 12,282 $ 11,910 $ 183 $ 555 Deposit Verticals (included in total deposits)** $ 3,093 $ 3,033 $ 2,693 $ 60 $ 400 $ In Millions * Total deposits excluding Deposit Verticals and brokered CDs increased $137 million from 2Q24 and increased $370 million from 3Q23 ** Note: prior period amounts have been reclassified among categories to conform to the current period presentation. Deposits related to specialty lending (i.e., Sponsor Finance and Life Insurance Premium Finance) are no longer included in Deposit Verticals. *

28 Deposits By Region Deposit Verticals** $2,693 $3,033 $3,093 3Q23 2Q24 3Q24 $ In Millions Midwest(*)** $6,098 $6,111 $6,205 3Q23 2Q24 3Q24 Southwest $1,802 $1,984 $1,971 3Q23 2Q24 3Q24 West* $1,317 $1,154 $1,196 3Q23 2Q24 3Q24 Note: Region Components: Midwest (St. Louis & Kansas City), Southwest (AZ, NM, Las Vegas, TX), West (Southern California) *Includes brokered balances ** Note, prior period amounts have been reclassified among categories to conform to the current period presentation. Deposits related to specialty lending (i.e., Sponsor Finance and Life Insurance Premium Finance) are no longer included in Deposit Verticals.

29 Differentiated Deposit Verticals 37.7% 36.8% 25.5% Community Associations $1.2 billion in deposit accounts specifically designed to serve the needs of community associations. Property Management $1.1 billion in deposits. Specializing in the compliance of Property Management Trust Accounts. Legal Industry and Escrow Services $791 million in deposits. Product lines providing services to independent escrow and non- depository trust companies. • $3.09 billion - 25% of total deposits • $3.24 billion - Average deposits for 3Q24 • $23.8 million - Related deposit costs in noninterest expense, resulting in an average deposit vertical cost of 2.92% in 3Q24 • $144.3 million - Average Deposits per Branch for FDIC Insured Banks with a deposit portfolio between $5-20B* • 21 - Number of traditional branches that would support the EFSC deposit vertical portfolio *Data Source: Deposit data as of June 30th, 2024, per the FDIC Summary of Deposits. 3Q23 4Q23 1Q24 2Q24 3Q24 Community Associations Property Management Legal Industry and Escrow Services $— $500 $1,000 $ In Millions

30 Core Funding Mix Commercial Business Banking Consumer $ In Millions 1At September 30, 2024 2Excludes insured accounts, collateralized accounts, accounts that qualify for pass-through insurance, reciprocal accounts, and affiliated accounts. Note: Brokered deposits were $0.7 billion at 3Q24 Deposit Verticals 3Q24 Net New/Closed Deposit Accounts COMMERCIAL BUSINESS BANKING CONSUMER DEPOSIT VERTICALS Total net average balance ($ in thousands) 3Q24 $ 91,386 $ 8,093 $ 14,866 $ 138,514 2Q24 $ 64,583 $ 13,825 $ 20,882 $ 131,394 1Q24 $ 81,742 $ 16,921 $ 3,986 $ 142,484 4Q23 $ 85,358 $ 18,529 $ 26,556 $ 214,189 Number of accounts 3Q24 56 (89) (57) 828 2Q24 (73) (60) 215 878 1Q24 (48) 31 759 2,260 4Q23 84 (77) 842 1,452 Total Portfolio Average Account Size & Cost of Funds Average account size ($ in thousands) 3Q24 $ 283 $ 71 $ 23 $ 111 Cost of funds 3Q241 2.45 % 1.25 % 1.83 % 1.11 % • Estimated uninsured deposits of $3.7 billion, or 30% of total deposits2 • ~80% of commercial deposits utilize Treasury Management services • ~90% of checking and savings accounts utilize online banking services • ~60% of commercial deposits have a lending relationship • ~155% of on- and off-balance sheet liquidity to estimated uninsured deposits Overview 30% 38% 30% 41% 32% 19% 4% 6% 30% 21% 17% 22% 4% 60% 3% 36% $4,453 $3,093$2,794$1,404

31 Capital Strategy EFSC Capital Strategy: Low Cost - Highly Flexible High Capital Retention Rate Supports Robust Asset Growth Maintain High Quality Capital Stack Maintain 8-9% TCE • Strong earnings profile • Sustainable dividend profile • Organic loan and deposit growth • High quality M&A to enhance commercial franchise and geographic diversification • Minimize WACC over time (preferred, sub debt, etc.) • Optimize capital levels CET1 ~10%, Tier 1 ~12%, and Total Capital ~14% • Common stock repurchases of 420,249 shares at an average price per share of $43.49 • M&A deal structures • Drives ROATCE above peer levels

32 Capital TBV* and Common Dividends per Share $25.48 $28.28 $28.67 $33.85 $37.26 $0.72 $0.75 $0.90 $1.00 $0.78 TBV/Share Dividends per Share 2020 2021 2022 2023 3Q24 YTD Return of Capital $35.1 $86.8 $66.5 $37.4 $47.6 $19.8 $26.2 $33.6 $37.4 $29.2 $15.3 $60.6 $32.9 $18.4 Common dividend payments Share repurchases 2020 2021 2022 2023 3Q24 YTD In Millions *TBV per Common Share is a Non-GAAP Measure. Refer to Appendix for Reconciliation.

33 Regulatory Capital 10.0% 14.0% 14.9% 14.7% 14.2% 14.2% 14.8% 6.5% 10.0% 10.9% 11.3% 11.1% 11.3% 11.9% 9.3% 10.1% 10.9% CET1 Tier 1 Total Risk Based Capital CET1 excluding unrealized losses* Minimum "Well Capitalized" Ratio Optimal Capital Levels 2020 2021 2022 2023 3Q24 8.0% 12.6% 12.7% 12.1% 13.0% 12.0% *CET1 excluding unrealized losses on securities (when applicable). This is a non-GAAP measure; refer to appendix for reconciliation. 13.2%

34 Net Interest Income Trend $ In Millions $270.0 $360.2 $473.9 $562.6 $421.7 3.56% 3.41% 3.89% 4.43% 4.17% 0.36% 0.08% 1.68% 5.03% 5.31% Net Interest Income Net Interest Margin Avg Federal Funds Rate 2020 2021 2022 2023 3Q24 YTD 2020 2021 2022 2023 3Q24 YTD Net Interest Income - FTE $ 273.2 $ 365.3 $ 480.9 $ 570.7 $ 427.9 Purchase Accounting Amortization/(Accretion) $ (10.3) $ (0.5) $ 0.8 $ 2.4 $ 0.8 Adjusted Net Interest Income - FTE $ 262.9 $ 364.8 $ 481.7 $ 573.1 $ 428.7 Net Interest Margin 3.56 % 3.41 % 3.89 % 4.43 % 4.17 % Purchase Accounting Amortization/(Accretion) (0.13) % — % 0.01 % 0.02 % 0.01 % Adjusted Net Interest Margin 3.43 % 3.41 % 3.90 % 4.45 % 4.18 %

35 Noninterest Income Trend $ In Millions $54.5 $67.7 $59.2 $68.7 $49.1 $17.0 $22.1 $16.7 $22.9 $17.4 $6.6 $8.0 $2.6 $9.2 $2.9 $11.7 $15.4 $18.3 $16.6 $13.6 $9.5 $11.9 $11.6 $10.0 $7.5 $9.7 $10.3 $10.0 $10.0 $7.7 16.8% 15.8% 11.1% 10.9% 10.4% Other Tax Credit Income Deposit Services Charge Card Services Wealth Management Noninterest income/Total income 2020 2021 2022 2023 3Q24 YTD

36 Noninterest Expense Trend $167.2 $245.9 $274.2 $348.2 $285.5 $57.2 $65.0 $78.5 $94.8 $71.7 $14.2 $31.1 $72.3 $65.8 $13.5 $16.3 $17.6 $16.5 $12.9 $92.3 $124.9 $147.0 $164.6 $135.1 $4.2 $22.1 $3.4 48.7% 49.7% 49.8% 53.4% 58.9% Other Deposit costs Occupancy Employee compensation and benefits Merger-related expenses Branch-closure expenses Core efficiency ratio* NIE / Average assets 2020 2021 2022 2023 3Q24 YTD 2.0% 2.1% 2.1% 2.5% 2.6% $ In Millions *A Non-GAAP Measure, Refer to Appendix for Reconciliation.

Appendix

38 ■ Selected by the Community Development Financial Institutions Fund (CDFI Fund) of the U.S. Department of the Treasury to receive $353 million of New Markets Tax Credits allocations since 2011. ■ In 2023, our portfolio included the financing of over $2.1 billion in small business, small farm and community development-qualified loans. ■ Enterprise University, which provides training courses, has helped more than 39,000 professionals. ■ The Company has been named a best bank to work for numerous times. ESG Highlights The 2023 Environmental, Social and Governance Report is available at https:// www.enterprisebank.com/about/corporate-responsibility. Our Framework Additional Policies We have a robust set of governance policies to guide the operation of our business in a socially responsible way. We not only operate in a highly regulated environment and seek to comply with the laws and regulations applicable to our businesses, but we also strive to operate with integrity and accountability consistent with our Guiding Principles. Our commitment to sustainability begins with the Board of Directors of Enterprise. As the governing body responsible for our general oversight and strategic direction, the Board establishes parameters to ensure that our interactions with society and the environment are considered in connection with all business activities. Governance Climate With the oversight of our Board and the Risk Committee, we are formulating processes for identifying, measuring and modeling the impact of climate-related risks and their potential significance to our ongoing business operations and long-term value. Community Involvement We are committed to managing our business and community relationships in ways that positively impact our associates, clients and the diverse communities where we live and work. We have a long-standing history of supporting our communities. Our Community Impact Report is available at enterprisebank.com/about/corporate-responsibility. Human Capital Several of our Guiding Principles focus on our associates and the communities in which they work and live. We focus on creating an inclusive and transparent culture that celebrates teamwork and recognizes associates at all levels. Our Results

39 Best-In-Class Technology Partnerships Client journey supported by a competitive digital product set. Customer surveys Salesforce integrated with core for 360 client view Client Portal Online Banking integrated with treasury products Integrations for APIs for HOA/PM Positive Pay (Check & ACH) TARGET ONBOARD SERVICE PROTECT GROW Weiland Account Analysis Successful Conversion to FIS Leading Core Solution 39

40 Use of Non-GAAP Financial Measures The Company’s accounting and reporting policies conform to generally accepted accounting principles in the United States (“GAAP”) and the prevailing practices in the banking industry. However, the Company provides additional financial measures, such as tangible common equity, PPNR, ROATCE, ROAA, PPNR return on average assets (“PPNR ROAA”), core efficiency ratio, allowance for coverage ratio adjusted for guaranteed loans, allowance for coverage ratio adjusted for guaranteed loans and unfunded commitments, common equity tier 1 ratio adjusted for unrealized losses, the tangible common equity ratio, and tangible book value per common share, in this release that are considered “non-GAAP financial measures.” Generally, a non-GAAP financial measure is a numerical measure of a company’s financial performance, financial position, or cash flows that exclude (or include) amounts that are included in (or excluded from) the most directly comparable measure calculated and presented in accordance with GAAP. The Company considers its tangible common equity, PPNR, ROATCE, ROAA, PPNR ROAA, core efficiency ratio, allowance for coverage ratio adjusted for guaranteed loans, allowance for coverage ratio adjusted for guaranteed loans and unfunded commitments, common equity tier 1 ratio adjusted for unrealized losses, the tangible common equity ratio, and tangible book value per common share, collectively “core performance measures,” presented in this earnings release and the included tables as important measures of financial performance, even though they are non-GAAP measures, as they provide supplemental information by which to evaluate the impact of certain non-comparable items, and the Company’s operating performance on an ongoing basis. Core performance measures exclude certain other income and expense items, such as the FDIC special assessment, core conversion expenses, merger-related expenses, facilities charges, the gain or loss on the sale of other real estate owned, and the gain or loss on sale of investment securities, that the Company believes to be not indicative of or useful to measure the Company’s operating performance on an ongoing basis. The attached tables contain a reconciliation of these core performance measures to the GAAP measures. The Company believes that the tangible common equity ratio provides useful information to investors about the Company’s capital strength even though it is considered to be a non-GAAP financial measure and is not part of the regulatory capital requirements to which the Company is subject. The Company believes these non-GAAP measures and ratios, when taken together with the corresponding GAAP measures and ratios, provide meaningful supplemental information regarding the Company’s performance and capital strength. The Company’s management uses, and believes that investors benefit from referring to, these non-GAAP measures and ratios in assessing the Company’s operating results and related trends and when forecasting future periods. However, these non-GAAP measures and ratios should be considered in addition to, and not as a substitute for or preferable to, ratios prepared in accordance with GAAP. In the attached tables, the Company has provided a reconciliation of, where applicable, the most comparable GAAP financial measures and ratios to the non-GAAP financial measures and ratios, or a reconciliation of the non-GAAP calculation of the financial measures for the periods indicated.

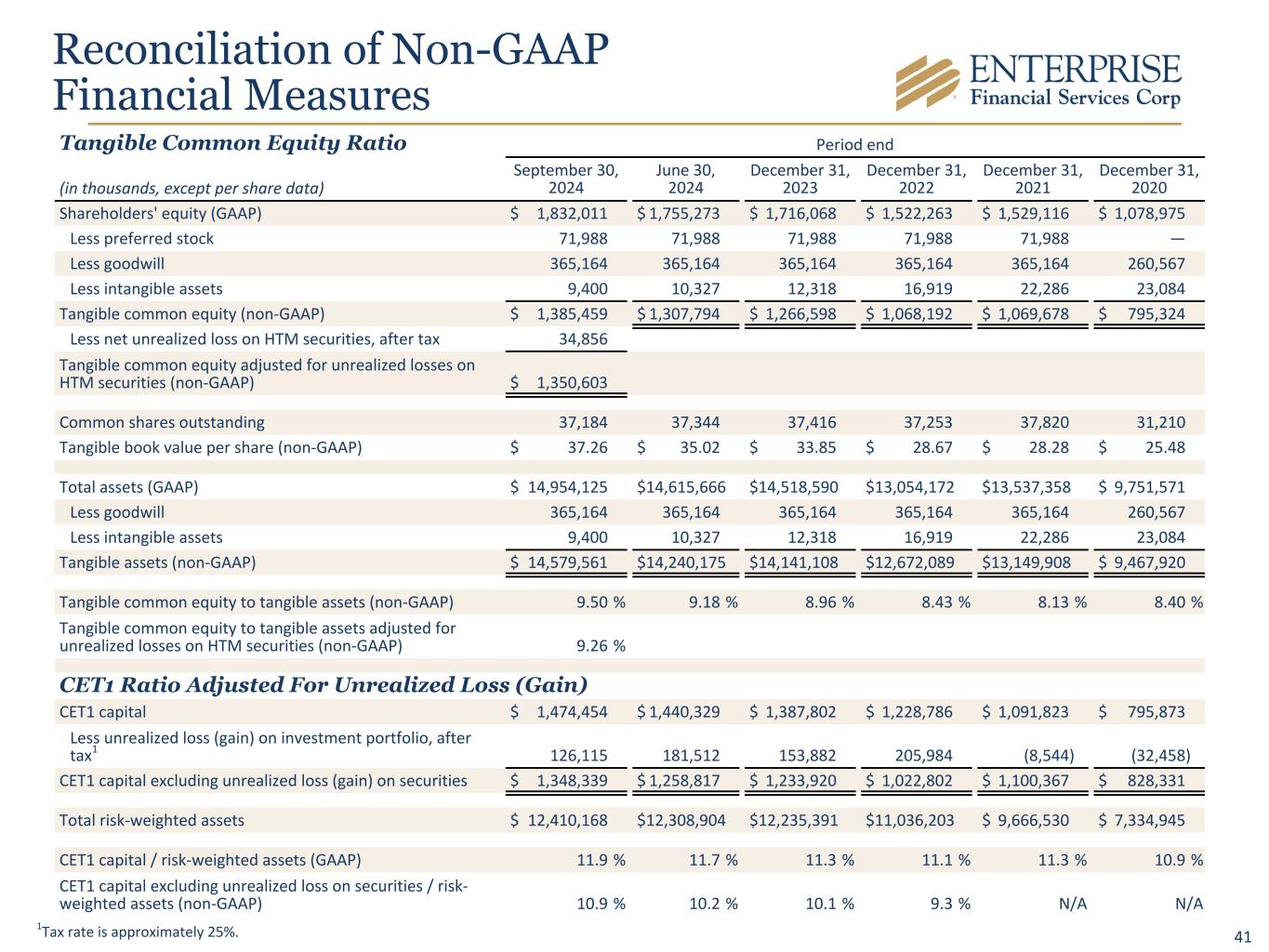

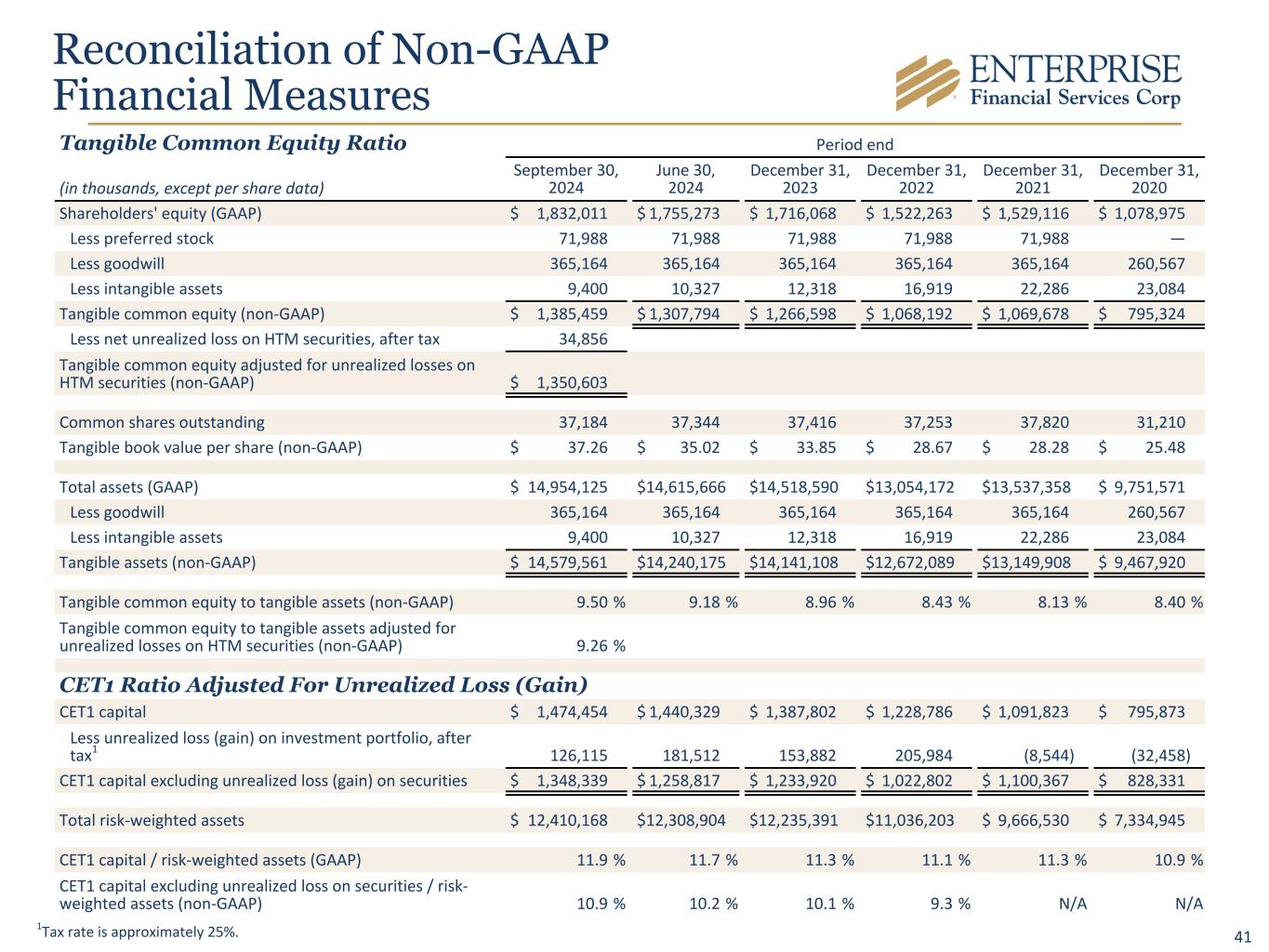

41 Reconciliation of Non-GAAP Financial Measures Tangible Common Equity Ratio Period end (in thousands, except per share data) September 30, 2024 June 30, 2024 December 31, 2023 December 31, 2022 December 31, 2021 December 31, 2020 Shareholders' equity (GAAP) $ 1,832,011 $ 1,755,273 $ 1,716,068 $ 1,522,263 $ 1,529,116 $ 1,078,975 Less preferred stock 71,988 71,988 71,988 71,988 71,988 — Less goodwill 365,164 365,164 365,164 365,164 365,164 260,567 Less intangible assets 9,400 10,327 12,318 16,919 22,286 23,084 Tangible common equity (non-GAAP) $ 1,385,459 $ 1,307,794 $ 1,266,598 $ 1,068,192 $ 1,069,678 $ 795,324 Less net unrealized loss on HTM securities, after tax 34,856 Tangible common equity adjusted for unrealized losses on HTM securities (non-GAAP) $ 1,350,603 Common shares outstanding 37,184 37,344 37,416 37,253 37,820 31,210 Tangible book value per share (non-GAAP) $ 37.26 $ 35.02 $ 33.85 $ 28.67 $ 28.28 $ 25.48 Total assets (GAAP) $ 14,954,125 $ 14,615,666 $ 14,518,590 $ 13,054,172 $ 13,537,358 $ 9,751,571 Less goodwill 365,164 365,164 365,164 365,164 365,164 260,567 Less intangible assets 9,400 10,327 12,318 16,919 22,286 23,084 Tangible assets (non-GAAP) $ 14,579,561 $ 14,240,175 $ 14,141,108 $ 12,672,089 $ 13,149,908 $ 9,467,920 Tangible common equity to tangible assets (non-GAAP) 9.50 % 9.18 % 8.96 % 8.43 % 8.13 % 8.40 % Tangible common equity to tangible assets adjusted for unrealized losses on HTM securities (non-GAAP) 9.26 % CET1 Ratio Adjusted For Unrealized Loss (Gain) CET1 capital $ 1,474,454 $ 1,440,329 $ 1,387,802 $ 1,228,786 $ 1,091,823 $ 795,873 Less unrealized loss (gain) on investment portfolio, after tax1 126,115 181,512 153,882 205,984 (8,544) (32,458) CET1 capital excluding unrealized loss (gain) on securities $ 1,348,339 $ 1,258,817 $ 1,233,920 $ 1,022,802 $ 1,100,367 $ 828,331 Total risk-weighted assets $ 12,410,168 $ 12,308,904 $ 12,235,391 $ 11,036,203 $ 9,666,530 $ 7,334,945 CET1 capital / risk-weighted assets (GAAP) 11.9 % 11.7 % 11.3 % 11.1 % 11.3 % 10.9 % CET1 capital excluding unrealized loss on securities / risk- weighted assets (non-GAAP) 10.9 % 10.2 % 10.1 % 9.3 % N/A N/A 1Tax rate is approximately 25%.

42 Allowance Coverage Ratio Adjusted for Guaranteed Loans Period end ($ in thousands) September 30, 2024 December 31, 2023 December 31, 2022 December 31, 2021 December 31, 2020 Loans (GAAP) $ 11,079,892 $ 10,884,118 $ 9,737,138 $ 9,017,642 $ 7,224,935 Less guaranteed loans, net 928,272 932,118 960,254 1,151,895 1,297,212 Adjusted loans (non-GAAP) $ 10,151,620 $ 9,952,000 $ 8,776,884 $ 7,865,747 $ 5,927,723 Allowance for credit losses on loans (GAAP) $ 139,778 $ 134,771 $ 136,932 $ 145,041 $ 136,671 Allowance for credit losses on unfunded commitments 5,692 Allowance for credit losses on loans including unfunded commitments $ 145,470 Allowance for credit losses on loans / total loans (GAAP) 1.26 % 1.24 % 1.41 % 1.61 % 1.89 % Allowance for credit losses on loans / adjusted loans (non-GAAP) 1.38 % 1.35 % 1.56 % 1.84 % 2.31 % Allowance for credit losses on loans including unfunded commitments / adjusted loans (non-GAAP) 1.43 % Reconciliation of Non-GAAP Financial Measures PPNR & PPNR ROAA Quarter ended ($ in thousands) September 30, 2024 June 30, 2024 Net interest income $ 143,469 $ 140,529 Noninterest income 21,420 15,494 Core conversion expense 1,375 1,250 Less gain on sale of other real estate owned 3,159 — Less noninterest expense 98,007 94,017 PPNR (non-GAAP) $ 65,098 $ 63,256 Average assets $ 14,849,455 $ 14,646,381 ROAA (GAAP) 1.36 % 1.25 % PPNR ROAA (non-GAAP) 1.74 % 1.74 %

43 Year-to-date Year ended ($ in thousands) September 30, 2024 December 31, 2023 December 31, 2022 December 31, 2021 December 31, 2020 Net interest income (GAAP) $ 421,726 $ 562,592 $ 473,903 $ 360,194 $ 270,001 Tax-equivalent adjustment 6,173 8,079 7,042 5,151 3,190 Less incremental accretion income — — — — 4,083 Net interest income - FTE (non-GAAP) 427,899 570,671 480,945 365,345 269,108 Noninterest income (GAAP) 49,072 68,725 59,162 67,743 54,503 Less gain on sale of investment securities — 601 — — 421 Less gain (loss) on sale of other real estate owned 3,157 187 (93) 884 — Less other non-core income — — — — 265 Core revenue (non-GAAP) $ 473,814 $ 638,608 $ 540,200 $ 432,204 $ 322,925 Noninterest expense (GAAP) $ 285,525 $ 348,186 $ 274,216 $ 245,919 $ 167,159 Less amortization on intangibles 2,918 4,601 5,367 5,691 5,673 Less FDIC special assessment 625 2,412 — — — Less core conversion expense 2,975 — — — — Less other expenses related to non-core acquired loans — — — — 57 Less branch closure expenses — — — 3,441 — Less merger-related expenses — — — 22,082 4,174 Core noninterest expense (non-GAAP) $ 279,007 $ 341,173 $ 268,849 $ 214,705 $ 157,255 Core efficiency ratio (non-GAAP) 58.9 % 53.4 % 49.8 % 49.7 % 48.7 % Reconciliation of Non-GAAP Financial Measures Core Efficiency Ratio

44 Reconciliation of Non-GAAP Financial Measures Quarter ended Year-to-date ($ in thousands) September 30, 2024 June 30, 2024 September 30, 2024 December 31, 2023 Average shareholder’s equity $ 1,804,369 $ 1,748,240 $ 1,763,917 $ 1,623,121 Less average preferred stock 71,988 71,988 71,988 71,988 Less average goodwill 365,164 365,164 365,164 365,164 Less average intangible assets 9,855 10,783 10,799 14,531 Average tangible common equity $ 1,357,362 $ 1,300,305 $ 1,315,966 $ 1,171,438 Net income (GAAP) $ 50,585 $ 45,446 $ 136,432 $ 194,059 FDIC special assessment (after tax) — — 470 1,814 Core conversion expense (after tax) 1,034 940 2,237 — Less gain on sale of investment securities (after tax) — — — 452 Less gain on sales of other real estate owned (after tax) 2,375 — 2,374 141 Net income adjusted (non-GAAP) $ 49,244 $ 46,386 $ 136,765 $ 195,280 Less preferred stock dividends 938 937 2,813 3,750 Net income available to common shareholders adjusted (non-GAAP) $ 48,306 $ 45,449 $ 133,952 $ 191,530 ROATCE (non-GAAP) 14.55 % 13.77 % 13.56 % 16.25 % Adjusted ROATCE (non-GAAP) 14.16 % 14.06 % 13.60 % 16.35 % Average assets $ 14,849,455 $ 14,646,381 $ 14,684,589 $ 13,805,236 Return on average assets (GAAP) 1.36 % 1.25 % 1.24 % 1.41 % Adjusted return on average assets (non-GAAP) 1.32 % 1.27 % 1.24 % 1.41 % Return on Average Tangible Common Equity (ROATCE) and Return on Average Assets (ROAA)